INTRODUCTION

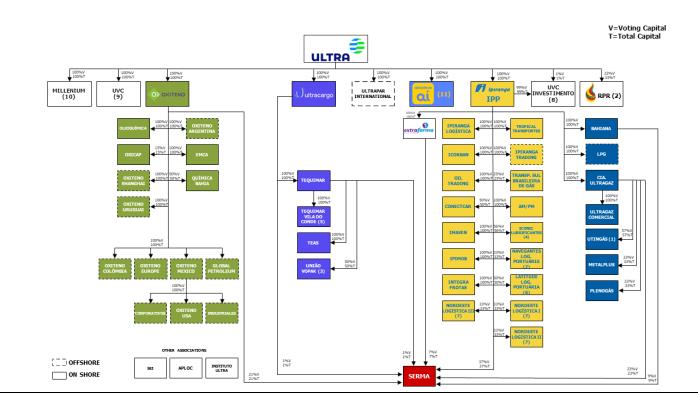

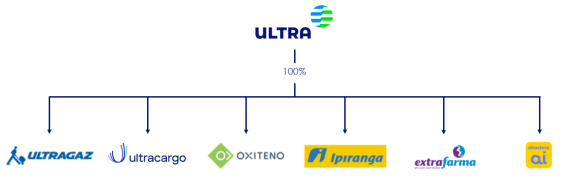

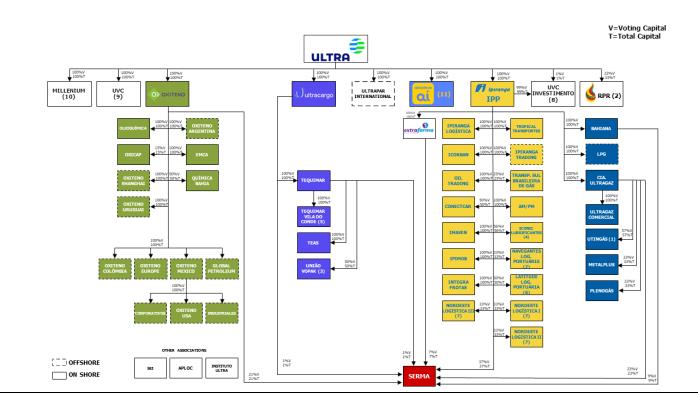

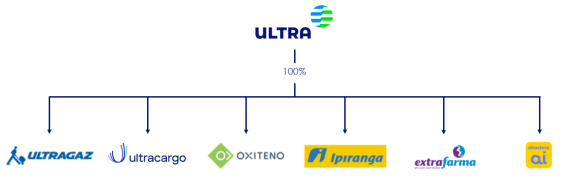

Ultrapar is a Brazilian company with its origins in 1937, when Ernesto Igel founded Ultragaz. Since then, Ultrapar has grown and expanded to new markets, becoming one of the largest corporate groups in Brazil. As of the date of this annual report, Ultrapar owns the following main businesses: Ipiranga, Ultragaz and Ultracargo (oil & gas downstream segment), Oxiteno (specialty chemicals), Extrafarma (retail pharmacy) and abastece aí (digital payments).

Since 1999, Ultrapar’s shares are traded under an ADR Level III program on the New York Stock Exchange – NYSE, and on the São Paulo Stock Exchange, B3 S.A. Since 2011, the Company’s shares have been listed on B3’s Novo Mercado segment.

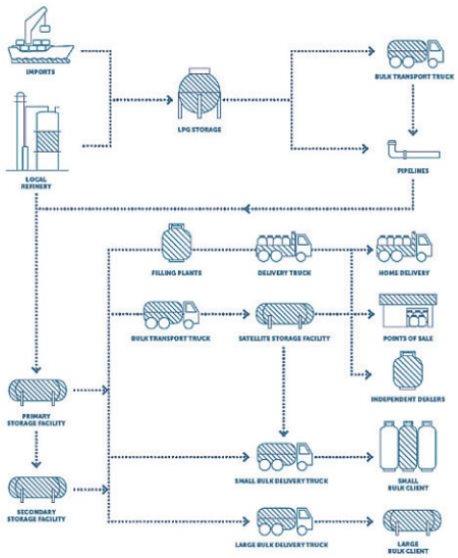

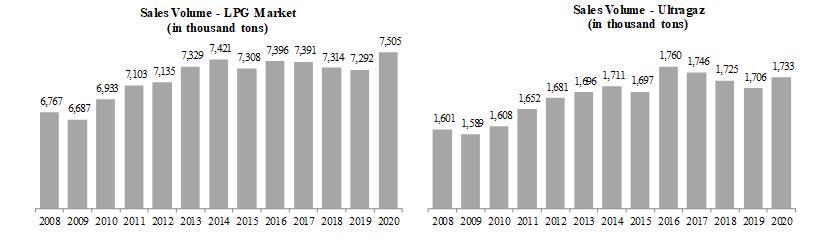

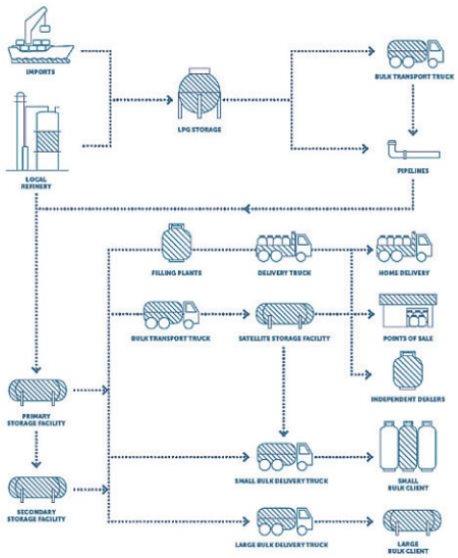

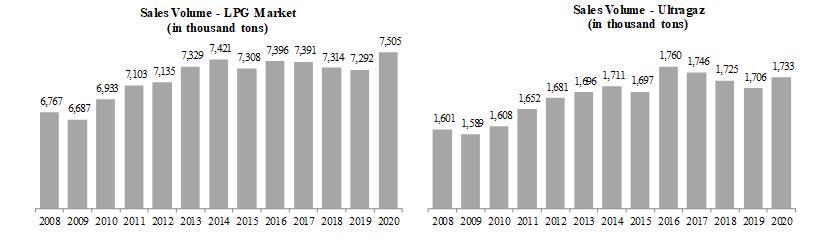

· As of December 31, 2020, Ultragaz was the leader in LPG distribution in Brazil, one of the largest markets worldwide. Ultragaz had a 23.1% market share in 2020 according to ANP and was one of the largest independent LPG distributors in the world in terms of volume sold. See “Item 4.B. Information on the Company—Business Overview—Distribution of Liquefied Petroleum Gas—Ultragaz—Competition”. As of December 31, 2020, we delivered LPG to an estimated 11 million households through a network of approximately 5.1 thousand independent retailers in the bottled segment and to approximately 58 thousand customers in the bulk segment. In 2020, Ultragaz’s total LPG volume sold was 1.7 million tons.

· Ultracargo is the largest private company in the liquid bulk storage industry in Brazil, with six terminals and storage capacity of 838 thousand cubic meters as of December 31, 2020, providing it with leading positions in the main ports in Brazil.

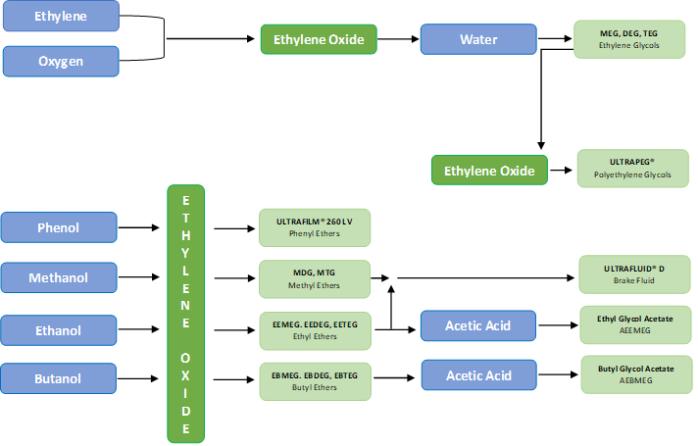

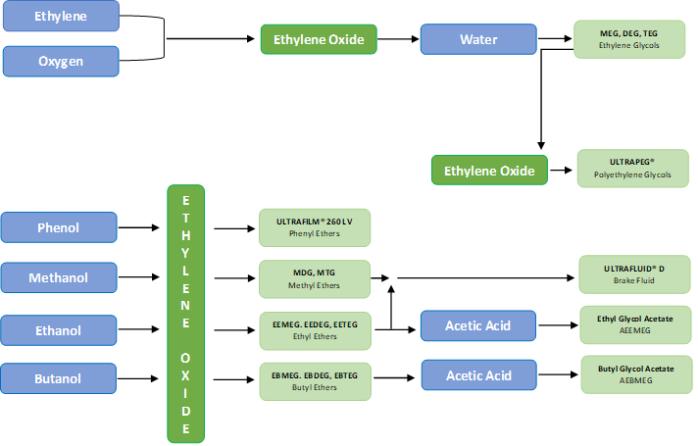

· Oxiteno is a major producer of specialty chemicals and one of the largest producers of ethylene oxide and its main derivatives in Latin America, according to IHS Chemical. Oxiteno has eleven industrial units: six in Brazil, three in Mexico, one in the United States, and one in Uruguay, commercial offices in Argentina, Belgium, China and Colombia, and research and development centers in Brazil, Mexico, the United States, and China. For the year ended December 31, 2020, Oxiteno sold 753 thousand tons of chemical products.

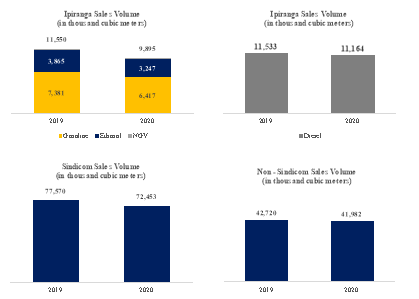

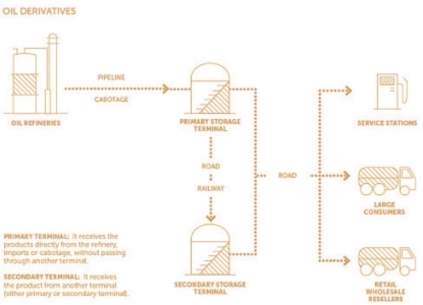

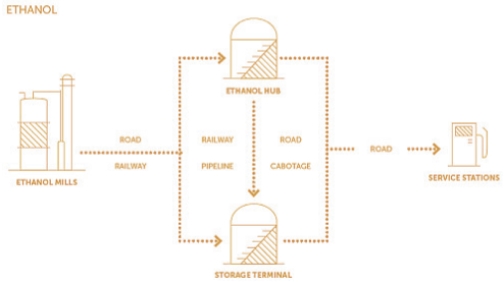

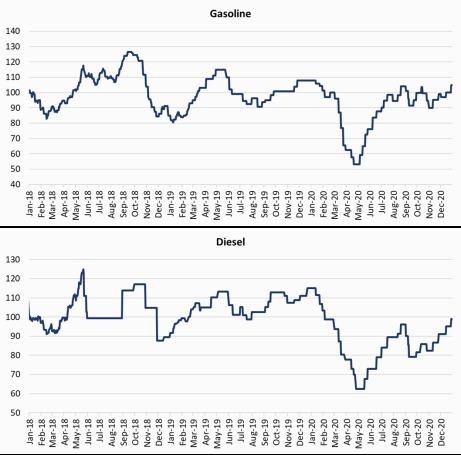

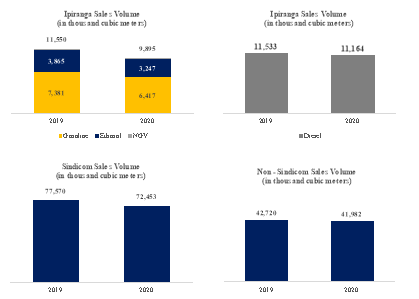

· Ipiranga is one of the largest fuel distributors in Brazil, with a network of 7,107 service stations and 18.5% market share in 2020 according to ANP. In addition to the service stations, Ipiranga has 1,804 AmPm convenience stores. See “Item 4.B. Information on the Company—Business Overview—Fuel Distribution—Ipiranga—Competition”.

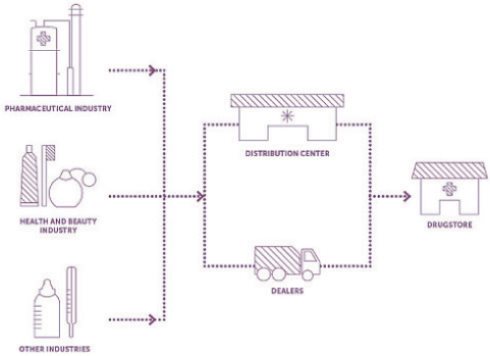

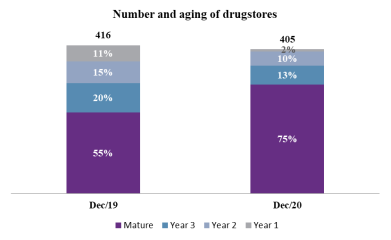

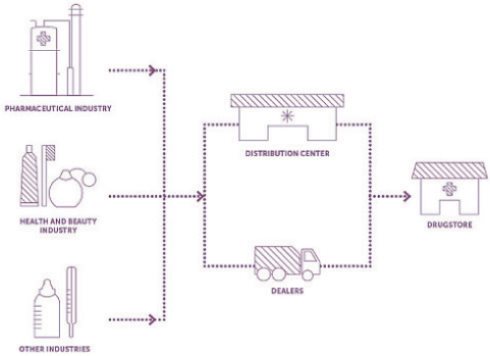

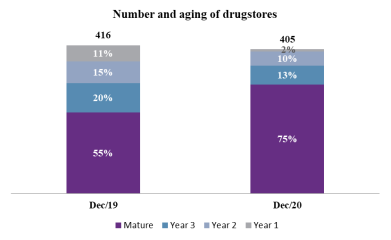

· Extrafarma is the seventh largest drugstore chain in Brazil, according to ABRAFARMA, with 405 drugstores and 3 distribution centers as of December 31, 2020.

· abastece aí is a digital payments company created in 2020 to leverage the benefits of the Km de Vantagens (Km of Advantages Loyalty Program) and the abastece aí (“fill up here”) app. It is a digital ecosystem pursuant to which discounts and cashback are offered to clients, mainly car and truck drivers. More than 2.3 million abastece aí digital accounts were created in 2020.

References in this annual report to “Ultrapar”, “Ultra Group”, “we”, “our”, “us” and “the Company” are to Ultrapar Participações S.A. and its consolidated subsidiaries (unless the context otherwise requires). In addition, all references in this annual report to:

· “abastece aí” are to Ultrapar’s subsidiaries that operate in the digital payment segment;

· “ABIQUIM” are to Associação Brasileira da Indústria Química, the Brazilian association of chemical industries;

· “ABRAFARMA” are to Associação Brasileira de Redes de Farmácias e Drogarias, the Brazilian association of pharmacy and drugstore chains;

· “ABTL” are to Associação Brasileira de Terminais de Líquidos, the Brazilian association of liquid bulk terminal operators;

· “ADSs” are to our American Depositary Shares, each representing (i) one common share, with respect to any period on or after August 17, 2011; or (ii) one non-voting preferred share, with respect to any period prior to August 17, 2011;

· “AmPm” are to Ipiranga’s convenience stores franchise network that operate under the brand AmPm, managed by AmPm Comestíveis Ltda.;

· “ANFAVEA” are to Associação Nacional dos Fabricantes de Veículos Automotores, the Brazilian association of vehicle producers;

· “ANP” are to the Agência Nacional do Petróleo, Gás Natural e Biocombustíveis, the Brazilian oil, natural gas and biofuels regulatory agency;

· “ANVISA” are to the Agência Nacional de Vigilância Sanitária, the Brazilian health surveillance agency;

· “ARLA” are to Automotive Liquid Reducing Agent;

· “B3” are to the B3 S.A.—Brasil, Bolsa, Balcão, the São Paulo Stock Exchange;

· “Braskem” are to Braskem S.A.;

· “Brazil” are to the Federative Republic of Brazil;

· “Brazilian Corporate Law” are to Law No. 6,404 enacted in December 1976, as amended by Law No. 9,457 enacted in May 1997, by Law No. 10,303 enacted in October 2001, by Law No. 11,638 enacted in December 2007, by Law No. 11,941 enacted in May 2009, by Law No. 12,431 enacted in June 2011, by Law No. 12,810 enacted in May 2013, by Law No. 13,129 enacted in May 2015, by Law No. 13,818 enacted in April 2019, by Law No. 13,874 enacted in September 2019, and by Law No. 14,030 enacted in July 2020;

· “Brazilian GAAP” are accounting practices adopted in Brazil that comprise the Brazilian Corporate Law and the Pronouncements, Guidelines and Interpretations issued by the Accounting Pronouncements Committee (“CPC”) and approved by the Federal Accounting Council (“CFC”) and the Brazilian Securities and Exchange Commission (“CVM”);

· “Brazilian government” are to the federal government of the Federative Republic of Brazil;

· “CADE” are to Conselho Administrativo de Defesa Econômica, the Brazilian Antitrust Authority;

· “Canamex” are to the chemical business formerly owned by the Berci Group, a company that was acquired by Oxiteno in 2003, currently Oxiteno Mexico;

· “CBL” are to Chevron Brasil Ltda. (currently IPP), a former subsidiary of Chevron that, together with Galena, held Texaco;

· “CBLSA” are to Chevron Brasil Lubrificantes S.A., now called Iconic;

· “CBPI” are to Companhia Brasileira de Petróleo Ipiranga, a company that was merged into IPP in November 2009;

· “Central Bank” are to the Banco Central do Brasil, the Brazilian central bank;

· “Chevron” are to Chevron Latin America Marketing LLC and Chevron Amazonas LLC;

· “Cia. Ultragaz” are to Companhia Ultragaz S.A.;

· “Code” are to the U.S. Internal Revenue Code of 1986, as amended;

· “Commodity Exception” are to gains derived from “qualified active sales” of commodities and “qualified hedging transactions” involving commodities, within the meaning of the applicable U.S. Treasury regulations;

· “CONAMA” are to Conselho Nacional do Meio Ambiente – the National Council of the Environment;

· “ConectCar” are to ConectCar Soluções de Mobilidade Eletrônica S.A., a joint-venture initially formed by Ipiranga and OTP (Odebrecht Transport S.A.), which started its operations in 2012. In 2016, Redecard S.A. acquired OTP’s interest in ConectCar;

· “Conversion” are to the conversion of all preferred shares issued by the company into common shares, at a ratio of 1 (one) preferred share for 1 (one) common share, as approved at the extraordinary general shareholders’ meeting and the special preferred shareholders’ meeting, both held on June 28, 2011;

· “CVM” are to Comissão de Valores Mobiliários, the Securities and Exchange Commission of Brazil;

· “Deposit Agreement” are to the Deposit Agreement between Ultrapar Participações S.A. and the Bank of New York Mellon, dated September 16, 1999, and all subsequent amendments thereto;

· “DI” are to the Brazilian money market interest rate (Certificados de Depósito Interbancário);

· “DNP” are to Distribuidora Nacional de Petróleo Ltda., a company that was acquired by Ipiranga in 2010 and was merged into IPP in 2011;

· “DPPI” are to Distribuidora de Produtos de Petróleo Ipiranga S.A., a company that was merged into CBPI in 2008;

· “EMCA” are to Empresa Carioca de Produtos Químicos S.A.;

· “Extrafarma” are to Imifarma Produtos Farmacêuticos e Cosméticos S.A.;

· “Extrafarma Transaction” are to the exchange of shares of Extrafarma for Ultrapar’s shares on January 31, 2014, as described in “Item 4.A. Information on the Company—History and Development of the Company—Extrafarma”;

· “FGTS” are to Fundo de Garantia do Tempo de Serviço, the Brazilian government severance indemnity fund;

· “Galena” are to Sociedade Anônima de Óleo Galena Signal, a former subsidiary of Chevron that, together with CBL, held Texaco;

· “IAS” are to International Accounting Standards;

· “IASB” are to International Accounting Standards Board;

· “Iconic” are to Iconic Lubrificantes S.A., formerly CBLSA, an association formed by Ipiranga and Chevron, which started its operations in 2017;

· “IFRS” are to International Financial Reporting Standards, as issued by IASB;

· “IGP-M” are to General Index of Market Prices of Brazilian inflation (Índice Geral de Preços – Mercado), calculated by the Getulio Vargas Foundation;

· “IpiLubs” are to Ipiranga Lubrificantes S.A., a company that was merged into CBLSA in November 2018;

· “Ipiranga” are to Ultrapar’s subsidiaries that operate in the fuel distribution business and related activities;

· “Ipiranga Group” are to RPR, DPPI, CBPI, Ipiranga Química S.A. (“IQ”), Ipiranga Petroquímica S.A. (“IPQ”), Companhia Petroquímica do Sul S.A. (“Copesul”) and their respective subsidiaries prior to their sale to Ultrapar, Petrobras and Braskem;

· “Ipiranga Group SPA” are to the Share Purchase Agreement entered into and among Ultrapar, with the consent of Petrobras and Braskem, and the Key Shareholders on March 18, 2007;

· “Ipiranga Group Transaction Agreements” are to agreements related to the acquisition of Ipiranga Group by Ultrapar, Petrobras and Braskem. Each Ipiranga Group Transaction Agreement is incorporated by reference to Exhibits 2.5, 2.6, 2.7, 4.4, 4.5, 4.6 and 4.7 to Form 20-F of Ultrapar Participações S.A. filed on June 7, 2007;

· “IPP” are to Ipiranga Produtos de Petróleo S.A., formerly CBL;

· “IQVIA”, are to the merger of Quintiles and IMS Health, Inc.;

· “IRS” are to U.S. Internal Revenue Service;

· “Key Shareholders” are to Ipiranga Group’s former controlling shareholders prior to the closing of the Ipiranga Group SPA;

· “KMV” are to Km de Vantagens (Km of Advantages Program) loyalty program;

· “Latin America” are to countries in America other than the United States and Canada;

· “Liquigás” are to Liquigás Distribuidora S.A.;

· “LPG” are to liquefied petroleum gas;

· “LPG International” are to LPG International Inc.;

· “NAFTA” are to North American Free Trade Agreement, formed by the United States, Canada and Mexico. A revised version of NAFTA has been agreed to by all three countries for approval under a new name, the United States Mexico Canada Agreement, or USMCA, and is awaiting legislative approval before it comes into force;

· “Northern Distribution Business” are to former CBPI’s fuel and lubricant distribution businesses located in the North, Northeast and Midwest regions of Brazil;

· “Novo Mercado” are to Novo Mercado listing segment of B3;

· “NYSE” are to the New York Stock Exchange;

· “Oleoquímica” are to Oleoquímica Indústria e Comércio de Produtos Químicos Ltda.;

· “Oxiteno” are to Oxiteno S.A. – Indústria e Comércio, our wholly-owned subsidiary and its subsidiaries that produce ethylene oxide and its principal derivatives, fatty alcohols and other specialty chemicals;

· “Oxiteno Andina” are to the business of Oxiteno that was carried out in Venezuela until October 2019. In October 2019, Oxiteno Andina was sold to a buyer in Venezuela;

· “Oxiteno Mexico” are to the business of Oxiteno carried out in Mexico;

· “Oxiteno Nordeste” are to Oxiteno Nordeste S.A. Indústria e Comércio, which was merged into Oxiteno in December 2019;

· “Oxiteno Uruguay” are to the business of Oxiteno carried out in Uruguay;

· “Oxiteno USA” are to the business of Oxiteno carried out in the United States;

· “Parth” are to Parth do Brasil Participações Ltda., an investment company controlled by Mrs. Daisy Igel’s family and owner of 8% of Ultrapar’s capital stock;

· “Pátria” are to Pátria Private Equity VI FIP Multiestratégia, an investment company, an indirect shareholder of Ultrapar;

· “Petrobras” are to Petrobras – Petróleo Brasileiro S.A.;

· “Petrochemical Business” are to IQ, IPQ and IPQ’s stake in Copesul;

· “PFIC” are to passive foreign investment company;

· “PIS and COFINS taxes” are to Programa de Integração Social (Integration Program Taxes) and Contribuição para o Financiamento da Securidade Social (Contribution for the Financing of Social Security Taxes), respectively;

· “Real”, “Reais” or “R$” are to Brazilian Reais, the official currency of Brazil;

· “Refap” are to the Alberto Pasqualini refinery;

· “Repsol” are to Repsol Gás Brasil S.A., a company that was acquired by Ultragaz in 2011 and was merged into Cia. Ultragaz in 2012;

· “RPR” are to Refinaria de Petróleo Riograndense S.A. (formerly Refinaria de Petróleo Ipiranga S.A.), a joint-venture owned by Petrobras, Braskem and Ultrapar;

· “SEC” are to the U.S. Securities and Exchange Commission;

· “Securities Act” are to the U.S. Securities Act of 1933, as amended;

· “Selic” are to the Brazilian base interest rate;

· “Serma” are to Associação dos Usuários de Equipamentos de Processamento de Dados e Serviços Correlatos, our wholly owned company, responsible for providing IT services to Ultrapar and its subsidiaries;

· “Share Exchange” are to the exchanges of RPR’s, DPPI’s and CBPI’s preferred shares and any remaining common shares for Ultrapar’s preferred shares in connection with the acquisition of Ipiranga Group;

· “Sindicom” are to the Brazilian association of fuel distributors;

· “Sindigás” are to the Brazilian association of LPG distributors;

· “Southern Distribution Business” are to Ipiranga Group’s fuel and lubricant distribution businesses located in the South and Southeast regions of Brazil and their related activities;

· “STF” are to Supremo Tribunal Federal, the Brazilian Supreme Federal Court;

· “SUDENE” are to Superintendência do Desenvolvimento do Nordeste, the development agency of the Northeast of Brazil;

· “TEAS” are to TEAS – Terminal Exportador de Álcool de Santos Ltda., a company acquired by Ultracargo in March 2018;

· “Temmar” are to Terminal Marítimo do Maranhão S.A., a company that was acquired by Ultracargo in 2012 and was merged into Tequimar in 2013;

· “Tequimar” are to Terminal Químico de Aratu S.A., Ultracargo’s subsidiary that operates in the liquid bulk storage segment;

· “Texaco” are to the Texaco-branded fuel marketing business in Brazil, previously carried-out by CBL and Galena, companies that were acquired by Ipiranga in 2009;

· “Tropical” are to Tropical Transportes Ipiranga Ltda.;

· “TRR” are to Retail Wholesale Resellers, specialized resellers in the fuel distribution;

· “Ultra S.A.” are to Ultra S.A. Participações, a holding company owned by members of the founding family and senior management of Ultrapar. Ultra S.A. is the largest shareholder of Ultrapar, holding 25% of its total capital stock;

· “Ultracargo” are to Ultracargo Operações Logísticas e Participações Ltda., our wholly owned subsidiary and its subsidiaries that provide storage, handling and logistics services for liquid bulk cargo;

· “Ultragaz” are to Ultrapar’s subsidiaries that operate in the distribution of LPG;

· “Ultrapar International” are to Ultrapar International S.A.;

· “União Terminais” are to União Terminais e Armazéns Gerais Ltda., a company that was merged into Tequimar in 2008;

· “União Vopak” are to União Vopak Armazéns Gerais Ltda., a joint-venture in which Ultracargo has a 50% stake;

· “Unipar” are to União das Indústrias Petroquímicas S.A.;

· “U.S. Holder” has the meaning given in “Item 10. Additional Information—E. Taxation—U.S. Federal Income Tax Considerations”;

· “US$”, “dollar”, “dollars” or “U.S. dollars” are to the United States dollar; and

· “2018 Shareholders’ Agreement” has the meaning given in “Item 4.A. Information on the Company—History and Development of the Company—Corporate Events”, “Item 7.A. Major Shareholders and Related Party Transactions—Major Shareholders” and “Item 10.C. Additional Information—Material Contracts”.

· “2020 Shareholders’ Agreement” has the meaning given in “Item 4.A. Information on the Company—History and Development of the Company—Corporate Events”, “Item 7.A. Major Shareholders and Related Party Transactions—Major Shareholders” and “Item 10.C. Additional Information—Material Contracts”.

Unless otherwise specified, data related to (i) the Brazilian petrochemical industry included in this annual report were obtained from ABIQUIM, (ii) the LPG business were obtained from Sindigás and ANP, (iii) the fuel distribution business were obtained from Sindicom and ANP, (iv) the liquid bulk storage industry were obtained from ABTL, and (v) the retail pharmacy business were obtained from ABRAFARMA and IQVIA.

PRESENTATION OF FINANCIAL INFORMATION

Our audited consolidated financial statements included in Item 18 were prepared in accordance with IFRS as issued by the IASB and include our consolidated Statements of Financial Position, as of December 31, 2020 and 2019 and the related Statements of Profit or Loss, Statements of Comprehensive Income, Statements of Changes in Equity and Statements of Cash Flows for the years ended December 31, 2020, 2019 and 2018, as well as notes thereto.

There are no IFRS standards, amendments or interpretations adopted by us, as issued by IASB, which became effective in 2020 and which had a material impact on the measurement and on the financial statements.

The following standards became effective on January 1, 2019:

(i) IFRS 16—Leases: IFRS 16 establishes principles for the recognition, measurement, presentation and disclosure of leases and requires lessees to account for all leases under a single on-balance sheet model similar to the accounting for finance leases under IAS 17. IFRS 16—Leases replaced the previous lease accounting requirements and introduced significant changes in the accounting, removing the distinction between operating and finance leases under IAS 17—Leases and related interpretations, and requires a lessee to recognize a right-of-use asset and a lease liability at lease commencement date. The impact to the consolidated financial statements is demonstrated in the recognition of right-of-use assets and lease liabilities in the balance sheet.

Accordingly, leases entered into by the Company and its subsidiaries, identified and effective at the date of transition and with maturities of more than 12 months, were accounted in the consolidated financial statements as follows:

· recognition of right-of-use assets and lease liabilities in financial position, initially measured at the present value of future lease payments; and

· recognition of amortization expenses of right-of-use assets and interest expenses on the lease payable in the financial result in the statements of profits or loss.

The Company selected as transition method the modified retrospective approach, with the cumulative effect of initial application of this new pronouncement recorded as an adjustment to the opening balance of equity and without restatement of comparative periods.

(ii) IFRIC 23—Uncertainty Over Income Tax Treatments: IFRIC 23 clarifies how to apply the recognition and measurement requirements in IAS 12 – when there is uncertainty over income tax treatments. In such circumstance, an entity shall recognize and measure its current or deferred tax asset or liability applying the requirements in IAS 12 based on taxable profit (tax loss), tax bases, unused tax losses, unused tax credits and tax rates, applying this interpretation.

The adoption of IFRIC 23 by the Company did not have a significant impact on the Company’s consolidated financial statements, since all the procedures adopted for the determination and collection of income taxes by the Company and its subsidiaries are supported by the legislation and precedents from administrative and judicial courts.

The following standards became effective on January 1, 2018:

(i) IFRS 9—Financial instrument classification and measurement that includes new requirements for the classification and measurement of financial assets and liabilities, derecognition requirements, new impairment methodology for financial instruments, and new hedge accounting guidance.

(ii) IFRS 15—Revenue from contracts with customers, which establishes the principles of nature, amount, timing and uncertainty of revenue and cash flow arising from a contract with a customer.

The financial information presented in this annual report should be read in conjunction with our consolidated financial statements.

Segment information for our businesses is presented on an unconsolidated basis. See note 32 to our consolidated financial statements for further information on segment information. Consequently, intercompany transactions have not been eliminated in segment information, and such information may differ from consolidated financial information provided elsewhere in this annual report. See “Item 7.B. Major Shareholders and Related Party Transactions—Related Party Transactions” for more information on intercompany transactions.

Certain figures included in this annual report have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables and charts may not be an arithmetic aggregation of the figures that precede them.

On April 28, 2021, the exchange rate for Reais into U.S. dollars was 5.400 to US$1.00, based on the commercial selling rate as reported by the Central Bank. The commercial selling rate was R$5.197 to US$1.00 on December 31, 2020, R$4.031 to US$1.00 on December 31, 2019, and R$3.875 to US$1.00 on December 31, 2018. The Real/dollar exchange rate fluctuates widely, and the current commercial selling rate may not be indicative of future exchange rates. See “Item 3.A. Key Information—Selected Consolidated Financial Data—Exchange Rates” for information regarding exchange rates for the Brazilian currency. Solely for the convenience of the reader, we have translated some amounts included in “Item 3.A. Key Information—Selected Consolidated Financial Data” and elsewhere in this annual report from Reais into U.S. dollars using the commercial selling rate as reported by the Central Bank on December 31, 2020 of R$5.197 to US$1.00. These translations should not be considered representations that any such amounts have been, could have been or could be converted into U.S. dollars at that or at any other exchange rate. Such translations should not be construed as representations that the Real amounts represent or have been or could be converted into U.S. dollars as of that or any other date.

Market share and economic information

All market share information, unless otherwise specified, related to (i) the LPG business was obtained from ANP, (ii) the fuel distribution business was obtained from Sindicom and ANP, (iii) the liquid bulk storage industry was obtained from ABTL and (iv) the retail pharmacy business was obtained from ABRAFARMA and IQVIA. Unless otherwise specified, all macroeconomic data are obtained from the Instituto Brasileiro de Geografia e Estatística—IBGE, Fundação Getulio Vargas—FGV and the Central Bank. Although we do not have any reason to believe any of this information is inaccurate in any material respect, we have not independently verified any such information.

FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements within the meaning of Section 27A of the Securities Act subject to risks and uncertainties, including our estimates, plans, forecasts and expectations regarding future events, strategies and projections. Forward-looking statements speak only as of the date they were made, and we undertake no obligation to update publicly or revise any forward-looking statements after we distribute this annual report because of new information, future events and other factors. Words such as “believe”, “expect”, “may”, “will”, “plan”, “strategy”, “prospect”, “foresee”, “estimate”, “project”, “anticipate”, “can”, “intend” and similar words are intended to identify forward-looking statements. We have made forward-looking statements with respect to, among other things, our:

· strategy for marketing and operational expansion;

· capital expenditures forecasts; and

· development of additional sources of revenue.

The risks and uncertainties described above include, but are not limited to:

· general business, economic and political conditions, including the price of crude oil and other commodities, refining margins and prevailing foreign exchange rates and the effect of such conditions on the economies of Brazil and other Latin American countries;

· risks beyond our control, including geopolitical crises, natural disasters, epidemics or pandemics (such as the ongoing outbreak of coronavirus, or COVID-19, its developments and the vaccination roll-out in the markets we have business, suppliers or customers), cyber-attacks, acts of terrorism or other catastrophic events, including the economic, financial and business impacts of such events;

· competition;

· ability to produce and deliver products on a timely basis;

· ability to anticipate trends in the LPG, fuels, chemicals, logistics and retail pharmacy industries, including changes in capacity and industry price movements;

· changes in official regulations;

· receipt of official authorizations and licenses;

· political, economic and social events in Brazil and the other countries in which we have operations;

· access to sources of financing and our level of indebtedness;

· ability to integrate acquisitions;

· regulatory issues relating to acquisitions;

· instability and volatility in the financial markets;

· availability of tax benefits; and

· other factors contained in this annual report under “Item 3.D. Key Information—Risk Factors”.

Forward-looking statements involve risks and uncertainties and are not a guarantee of future results. Considering the risks and uncertainties described above, the forward-looking events and circumstances discussed in this annual report might not occur and our future results may differ materially from those expressed in or suggested by these forward-looking statements.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected Consolidated Financial Data

We have selected the following consolidated financial data from our audited consolidated financial statements, for the years indicated. You should read our selected consolidated financial data in conjunction with “Item 5. Operating and Financial Review and Prospects” and our audited consolidated financial statements and notes thereto included in this annual report. Our consolidated financial statements are prepared in Reais and in accordance with IFRS. The consolidated Statements of Financial Position as of December 31, 2020 and 2019 and the consolidated Statements of Profit or Loss and Statements of Cash Flows as of and for the years ended December 31, 2020, 2019 and 2018 are derived from our audited consolidated financial statements included in this annual report. See “Presentation of Financial Information” and “Item 5.A. Operating and Financial Review and Prospects — Operating Results — Critical accounting policies and estimates”. The following table presents our selected financial information in accordance with IFRS at the dates and for each of the periods indicated.

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| Years Ended December 31, |

|

|

| 2020(1) |

|

| 2020 |

|

| 2019 |

|

| 2018 |

|

| 2017 |

|

| 2016 |

|

|

| (in millions, except per share data) |

|

Statements of Profit or Loss data: |

| US$ |

|

| R$ |

|

| R$ |

|

| R$ |

|

| R$ |

|

| R$ |

|

Net revenue from sales and services |

| 15,633.2 |

|

| 81,241.1 |

|

| 89,298.0 |

|

| 90,698.0 |

|

| 79,230.0 |

|

| 76,740.0 |

|

Cost of products and services sold |

| (14,553.1 | ) |

| (75,628.2 | ) |

| (83,187.1 | ) |

| (84,537.4 | ) |

| (72,431.5 | ) |

| (70,196.9 | ) |

Gross profit |

| 1,080.1 |

|

| 5,612.9 |

|

| 6,110.9 |

|

| 6,160.6 |

|

| 6,798.5 |

|

| 6,543.1 |

|

Operating income (expenses) |

| |

|

Selling and marketing |

| (493.0 | ) |

| (2,561.8 | ) |

| (2,640.4 | ) |

| (2,670.9 | ) |

| (2,486.4 | ) |

| (2,220.2 | ) |

General and administrative |

| (295.7 | ) |

| (1,536.6 | ) |

| (1,726.3 | ) |

| (1,625.8 | ) |

| (1,576.5 | ) |

| (1,445.9 | ) |

Gain (loss) on disposal of property, plant and equipment and intangibles |

| 14.7 |

|

| 76.1 |

|

| (30.0 | ) |

| (22.1 | ) |

| (2.2 | ) |

| (6.1 | ) |

Other operating income, net |

| 42.6 |

|

| 221.4 |

|

| 179.6 |

|

| 57.5 |

|

| 59.4 |

|

| 199.0 |

|

Impairment of assets. |

| —

|

|

| — |

|

| (593.3 | ) |

| — |

|

| — |

|

| — |

|

Financial result, net |

| (51.8 | ) |

| (269.4 | ) |

| (506.9 | ) |

| (113.5 | ) |

| (474.3 | ) |

| (842.6 | ) |

Share of profit (loss) of joint-ventures and associates. |

| (8.4 | ) |

| (43.6 | ) |

| (12.1 | ) |

| (14.8 | ) |

| 20.7 |

|

| 7.5 |

|

Income before income and social contribution taxes | | 288.5 |

|

| 1,499.1 |

|

| 781.6 |

|

| 1,771.0 |

|

| 2,339.1 |

|

| 2,234.8 |

|

Income and social contribution taxes |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

Current |

| (126.9 | ) |

| (659.3 | ) |

| (476.1 | ) |

| (476.3 | ) |

| (922.5 | ) |

| (800.5 | ) |

Deferred |

| 16.9 |

|

| 87.9 |

|

| 97.5 |

|

| (162.4 | ) |

| 109.2 |

|

| 112.5 |

|

|

| (109.9 | ) |

| (571.4 | ) |

| (378.6 | ) |

| (638.7 | ) |

| (813.3 | ) |

| (688.0 | ) |

Net income for the year |

| 178.5 |

|

| 927.7 |

|

| 402.9 |

|

| 1,132.3 |

|

| 1,525.9 |

|

| 1,546.8 |

|

Net income for the year attributable to: |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

Shareholders of the Company |

| 171.9 |

|

| 893.4 |

|

| 373.5 |

|

| 1,150.4 |

|

| 1,526.5 |

|

| 1,537.8 |

|

Non-controlling interests in subsidiaries |

| 6.6 |

|

| 34.3 |

|

| 29.4 |

|

| (18.1 | ) |

| (0.6 | ) |

| 9.0 |

|

Earnings per share(2) |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

Basic |

| 0.16 |

|

| 0.82 |

|

| 0.34 |

|

| 1.06 |

|

| 1.41 |

|

| 1.42 |

|

Diluted |

| 0.16 |

|

| 0.82 |

|

| 0.34 |

|

| 1.05 |

|

| 1.40 |

|

| 1.41 |

|

Dividends per share(3) |

| 0.08 |

|

| 0.44 |

|

| 0.44 |

|

| 0.63 |

|

| 0.88 |

|

| 0.84 |

|

| (1) |

| The figures in Reais for December 31, 2020 have been converted into U.S. dollars using the exchange rate of US$1.00 = R$5.1967, which is the commercial rate reported by the Central Bank on that date. This information is presented solely for the convenience of the reader. You should not interpret the currency conversions in this annual report as a statement that the amounts in Reais currently represent such values in U.S. dollars. Additionally, you should not interpret such conversions as statements that the amounts in Reais have been, could have been or could be converted into U.S. dollars at this or any other foreign exchange rates. See “Item 3.A. Key Information—Selected Consolidated Financial Data—Exchange Rates”.

|

| (2) |

| Earnings per share are calculated based on the net income attributable to Ultrapar’s shareholders and the weighted average shares outstanding during each of the years presented. For each of the years presented, the earnings per share was adjusted retrospectively due to the approval of the stock split on April 10, 2019 and the implementation of the stock split on April 24, 2019. The number of shares used in the earnings per share calculation has not been retrospectively adjusted to reflect the issuance of 2,108,542, 86,978 and 70,939 new common shares that occurred in February 2020, August 2020 and February 2021, respectively, as a result of the partial exercise of the subscription warrants issued to the former Extrafarma shareholders. See “Item 4.A. Information on the Company—History and Development of the Company—Corporate Events” and note 31 to our consolidated financial statements for further information on earnings per share.

|

| (3) |

| For each of the years presented, dividends per share take into account the stock split approved on April 10, 2019 and implemented on April 24, 2019. The number of shares used in the dividends per share calculation has not been retrospectively adjusted to reflect the issuance of 2,108,542, 86,978 and 70,939 new common shares that occurred in February 2020, August 2020 and February 2021, respectively, as a result of the partial exercise of the subscription warrants issued to the former Extrafarma shareholders. |

The following table presents other financial data information at the dates and for each of the periods indicated.

|

| Years Ended December 31, |

|

|

| 2020(1) |

|

| 2020 |

|

| 2019 |

|

| 2018 |

|

| 2017 |

|

| 2016 |

|

|

| (in millions, except share data) |

|

Other financial data |

| US$ |

|

| R$ |

|

| R$ |

|

| R$ |

|

| R$ |

|

| R$ |

|

Net cash provided by operating activities |

| 603.9 |

|

| 3,138.1 |

|

| 2,924.9 |

|

| 2,889.0 |

|

| 1,739.0 |

|

| 1,988.9 |

|

Net cash used in investing activities |

| (411.1 | ) |

| (2,136.4 | ) |

| (1,835.3 | ) |

| (3,177.6 | ) |

| (1,371.8 | ) |

| (1,324.0 | ) |

Net cash provided by (used in) financing activities |

| (114.0 | ) |

| (592.3 | ) |

| (2,922.2 | ) |

| (801.0 | ) |

| 340.3 |

|

| 928.4 |

|

Depreciation and amortization(2) |

| 180.7 |

|

| 938.8 |

|

| 844.6 |

|

| 812.5 |

|

| 704.5 |

|

| 628.2 |

|

Amortization of contractual assets with customers – exclusive rights (Ipiranga and Ultragaz)(3) |

| 55.7 |

|

| 289.4 |

|

| 355.2 |

|

| 371.8 |

|

| 463.0 |

|

| 463.5 |

|

Amortization of right-of-use assets(4) |

| 63.2 |

|

| 328.3 |

|

| 300.1 |

|

| — |

|

| — |

|

| — |

|

Net income |

| 178.5 |

|

| 927.7 |

|

| 402.9 |

|

| 1,132.3 |

|

| 1,525.9 |

|

| 1,546.8 |

|

Adjusted EBITDA(5) |

| 669.4 |

|

| 3,478.5 |

|

| 2,800.3 |

|

| 3,068.9 |

|

| 3,981.0 |

|

| 4,169.0 |

|

Gross debt(6) |

| (3,343.7 | ) |

| (17,376.2 | ) |

| (14,392.7 | ) |

| (15,206.1 | ) |

| (13,590.6 | ) |

| (11,417.1 | ) |

Net debt(6) |

| (1,674.9 | ) |

| (8,704.1 | ) |

| (8,680.6 | ) |

| (8,211.7 | ) |

| (7,220.7 | ) |

| (5,715.3 | ) |

Number of common shares (in thousands)(7) |

| 1,115,005.7 |

|

| 1,115,005.7 |

|

| 1,112,810.2 |

|

| 1,112,810.2 |

|

| 1,112,810.2 |

|

| 1,112,810.2 |

|

(1) The figures in Reais for December 31, 2020 have been converted into U.S. dollars using the exchange rate of US$1.00 = R$5.1967, which is the commercial rate reported by the Central Bank on that date. This information is presented solely for the convenience of the reader. You should not interpret the currency conversions in this annual report as a statement that the amounts in Reais currently represent such values in U.S. dollars. Additionally, you should not interpret such conversions as statements that the amounts in Reais have been, could have been or could be converted into U.S. dollars at this or any other foreign exchange rates. See “Item 3.A. Key Information—Selected Consolidated Financial Data—Exchange Rates”.

(2) Represents depreciation and amortization expenses included in cost of products and services sold and in selling, marketing, general and administrative expenses.

(3) Represents amortization of contractual assets with customers – exclusive rights (Ipiranga and Ultragaz) recorded as a reduction of revenue in accordance with IFRS 15. See “Presentation of Financial Information. See notes 2.a, 2.f and 11 to our consolidated financial statements for further information.

(4) Represents amortization of right-of-use assets included in selling, marketing, general and administrative expenses. See “Presentation of Financial Information”. See notes 2.h and 13 to our consolidated financial statements for further information.

(5) The purpose of including Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization adjusted for cash flow hedge from bonds and amortization of contractual assets with customers—exclusive rights) information is to provide a measure used by management for internal assessment of our operating results, and because part of our employee profit sharing plan is linked directly or indirectly to Adjusted EBITDA performance. It is also a financial indicator widely used by investors and analysts to measure our ability to generate cash from operations and our operating performance. We also calculate Adjusted EBITDA in connection with covenants related to some of our financing, as described in note 16 to our consolidated financial statements. We believe Adjusted EBITDA allows a better understanding not only of our financial performance but also of our capacity of meeting the payment of interest and principal from our debt and of obtaining resources for our investments and working capital. Our definition of Adjusted EBITDA may differ from, and, therefore, may not be comparable with similarly titled measures used by other companies, thereby limiting its usefulness as a comparative measure. Because Adjusted EBITDA excludes net financial expense (income), income and social contribution taxes, depreciation and amortization and also excludes cash flow hedge from bonds and amortization of contractual assets with customers—exclusive rights, it provides an indicator of general economic performance that is not affected by debt restructurings, fluctuations in interest rates or changes in income and social contribution taxes, depreciation and amortization. Adjusted EBITDA is not measure of financial performance under IFRS and should not be considered in isolation, or as substitute for net income, as measure of operating performance, as substitute for cash flows from operations or as measure of liquidity. Adjusted EBITDA has material limitations that impair its value as a measure of a company’s overall profitability since it does not address certain ongoing costs of our businesses that could significantly affect profitability such as financial expense (income), income and social contribution taxes, depreciation and amortization and also excludes cash flow hedge from bonds and amortization of contractual assets with customers—exclusive rights.

(6) Gross debt and net debt are included in this annual report in order to provide the reader with information relating to our overall indebtedness and financial position. Net debt is not a measure of financial performance or liquidity under IFRS. In managing our businesses, we rely on net debt as a means of assessing our financial condition. We believe that this type of measurement is useful for comparing our financial condition from period to period and making related management decisions. Net debt is also used in connection with covenants related to some of our financings.

(7) The number of shares corresponds to all of shares issued by the Company, including those held in treasury. These numbers have been retrospectively adjusted to reflect the stock split that was approved on April 10, 2019 and implemented on April 24, 2019, but have not been retrospectively adjusted to reflect the issuance of 2,108,542, 86,978 and 70,939 new common shares that occurred in February 2020, August 2020 and February 2021, respectively, as a result of the partial exercise of the subscription warrants issued to the former Extrafarma shareholders.

The tables below provide a reconciliation of net income and operating income before financial income (expenses) and share of profit (loss) of joint-ventures and associates to EBITDA and Adjusted EBITDA for Ultrapar and a reconciliation of operating income before financial income (expenses) and share of profit (loss) of joint-ventures and associates to Adjusted EBITDA for Ipiranga, Oxiteno and Ultragaz segments and to EBITDA for Ultracargo, Extrafarma and abastece aí segments for the years ended December 31, 2020, 2019, 2018, 2017 and 2016.

| Ultrapar |

|

| Reconciliation of net income to EBITDA and Adjusted EBITDA |

|

| Years ended December 31, |

|

| 2020 |

| 2019 |

| 2018 |

| 2017 |

| 2016 |

|

| (in millions of Reais) |

|

Net income | 927.7 |

| 402.9 |

| 1,132.3 |

| 1,525.9 |

| 1,546.8 |

|

Net financial expenses | 269.4 |

| 506.9 |

| 113.5 |

| 474.3 |

| 842.6 |

|

Income and social contribution taxes | 571.4 |

| 378.6 |

| 638.7 |

| 813.3 |

| 688.0 |

|

Depreciation and amortization | 938.8 |

| 844.6 |

| 812.5 |

| 704.5 |

| 628.2 |

|

Amortization of right-of-use assets | 328.3 |

| 300.1 |

| — |

| — |

| — |

|

EBITDA(1) | 3,035.6 |

| 2,433.1 |

| 2,697.1 |

| 3,518.0 |

| 3,705.5 |

|

Adjustments | |

| |

| |

| |

| |

|

Cash flow hedge from bonds (Oxiteno)(2) | 153.5 |

| 11.9 |

| — |

| — |

| — |

|

Amortization of contractual assets with customers—exclusive rights (Ipiranga and Ultragaz) | 289.4 |

| 355.2 |

| 371.8 |

| 463.0 |

| 463.5 |

|

Adjusted EBITDA(1) | 3,478.5 |

| 2,800.3 |

| 3,068.9 |

| 3,981.0 |

| 4,169.0 |

|

| Ultrapar |

|

| Reconciliation of operating income to Adjusted EBITDA |

|

| Years ended December 31, |

|

| 2020 |

|

| 2019 |

|

| 2018 |

|

| 2017 |

| 2016 |

|

| (in millions of Reais) |

|

| Operating income before financial income (expenses) and share of profit (loss) of joint-ventures and associates | 1,812.1 |

|

| 1,300.6 |

|

| 1,899.4 |

|

| 2,792.7 |

| 3,069.9 |

|

Depreciation and amortization | 938.8 |

|

| 844.6 |

|

| 812.5 |

|

| 704.5 |

| 628.2 |

|

Amortization of right-of-use assets | 328.3 |

|

| 300.1 |

|

| — |

|

| — |

| — |

|

Share of profit (loss) of joint-ventures and associates | (43.6 | ) |

| (12.1 | ) |

| (14.8 | ) |

| 20.7 |

| 7.5 |

|

EBITDA(1) | 3.035.6 |

|

| 2,433.1 |

|

| 2,697.1 |

|

| 3,518.0 |

| 3,705.5 |

|

Adjustments | |

|

| |

|

| |

|

| |

| |

|

Cash flow hedge from bonds (Oxiteno)(2) | 153.5 |

|

| 11.9 |

|

| �� — |

|

| — |

| — |

|

Amortization of contractual assets with customers—exclusive rights (Ipiranga and Ultragaz) | 289.4 |

|

| 355.2 |

|

| 371.8 |

|

| 463.0 |

| 463.5 |

|

Adjusted EBITDA(1) | 3,478.5 |

|

| 2,800.3 |

|

| 3,068.9 |

|

| 3,981.0 |

| 4,169.0 |

|

| Ultragaz |

|

| Reconciliation of operating income to Adjusted EBITDA |

|

| Years ended December 31, |

|

| 2020 |

|

| 2019 |

|

| 2018 |

| 2017(3) |

| 2016(3) |

|

| (in millions of Reais) |

|

| Operating income before financial income (expenses) and share of profit (loss) of associates | 494.2 |

|

| 369.0 |

|

| 52.6 |

| 255.9 |

| 267.3 |

|

Depreciation and amortization | 192.2 |

|

| 186.2 |

|

| 222.5 |

| 182.8 |

| 158.2 |

|

Amortization of right-of-use assets | 41.0 |

|

| 31.3 |

|

| — |

| — |

| — |

|

Share of profit (loss) of associates | (0.1 | ) |

| (0.0 | ) |

| 0.0 |

| 1.2 |

| (0.0 | ) |

EBITDA(1) | 727.4 |

|

| 586.5 |

|

| 275.1 |

| 440.0 |

| 425.4 |

|

Adjustments | |

|

| |

|

| |

|

|

| |

|

Amortization of contractual assets with customers – exclusive rights | 1.6 |

|

| 0.2 |

|

| — |

| — |

| — |

|

Adjusted EBITDA(1) | 729.1 |

|

| 586.7 |

|

| 275.1 |

| 440.0 |

| 425.4 |

|

| |

| |

| |

| |

| |

|

| Ultracargo |

|

| Reconciliation of operating income to EBITDA |

|

| Years ended December 31, |

|

| 2020 |

| 2019

|

| 2018 |

| 2017(3) |

| 2016(3) |

|

| (in millions of Reais) |

|

Operating income (expenses) before financial income (expenses) and share of profit (loss) of joint-ventures and associates | 251.8 |

| 83.2 |

| 129.5 |

| 75.0 |

| 127.7 |

|

Depreciation and amortization | 65.8 |

| 59.6 |

| 52.4 |

| 47.7 |

| 43.4 |

|

Amortization of right-of-use assets | 19.5 |

| 20.7 |

| — |

| — |

| — |

|

Share of profit (loss) of joint-ventures and associates | 0.4 |

| 1.4 |

| 1.3 |

| 1.6 |

| (0.0 | ) |

EBITDA(1) | 337.5 |

| 164.8 |

| 183.3 |

| 124.3 |

| 171.1 |

|

| Oxiteno |

|

| Reconciliation of operating income to Adjusted EBITDA |

|

| Years ended December 31, |

|

| 2020 |

| 2019 |

|

| 2018 |

| 2017(3) |

| 2016(3) |

|

| (in millions of Reais) |

|

Operating income before financial income (expenses) and share of profit (loss) of associates | 355.9 |

| (12.8 | ) |

| 471.9 |

| 141.4 |

| 311.5 |

|

Depreciation and amortization | 260.8 |

| 212.3 |

|

| 167.4 |

| 153.1 |

| 149.7 |

|

Amortization of right-of-use assets | 14.3 |

| 9.7 |

|

| — |

| — |

| — |

|

Share of profit (loss) of associates | 0.4 |

| 0.5 |

|

| 0.9 |

| 1.4 |

| 1.0 |

|

EBITDA(1) | 631.3 |

| 209.7 |

|

| 640.2 |

| 295.9 |

| 462.2 |

|

Adjustments | |

| |

|

| |

| |

| |

|

Cash flow hedge from bonds(2) | 153.5 |

| 11.9 |

|

| — |

| — |

| — |

|

Adjusted EBITDA(1) | 784.8 |

| 221.6 |

|

| 640.2 |

| 295.9 |

| 462.2 |

|

| |

|

| |

| |

| |

| |

|

| Ipiranga |

|

| Reconciliation of operating income to Adjusted EBITDA |

|

| Years ended December 31, |

|

| 2020 |

|

| 2019 |

| 2018 |

| 2017(3) |

| 2016(3) |

|

| (in millions of Reais) |

|

Operating income before financial income (expenses) and share of profit (loss) of associates | 915.4 |

|

| 1,674.4 |

| 1,461.5 |

| 2,357.1 |

| 2,364.0 |

|

Depreciation and amortization | 314.5 |

|

| 290.7 |

| 283.4 |

| 245.4 |

| 220.3 |

|

Amortization of right-of-use assets | 177.0 |

|

| 164.5 |

| — |

| — |

| — |

|

Share of profit (loss) of associates | (0.9 | ) |

| 1.8 |

| 0.6 |

| 1.2 |

| 1.2 |

|

EBITDA(1) | 1,406.1 |

|

| 2,131.5 |

| 1,745.5 |

| 2,603.8 |

| 2,585.5 |

|

Adjustment | |

|

| |

| |

| |

| |

|

Amortization of contractual assets with customers – exclusive rights | 287.8 |

|

| 355.1 |

| 371.8 |

| 463.0 |

| 463.5 |

|

Adjusted EBITDA(1) | 1,693.9 |

|

| 2,486.6 |

| 2,117.3 |

| 3,066.8 |

| 3,049.0 |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| Extrafarma |

|

| Reconciliation of operating income to EBITDA |

|

| Years ended December 31, |

|

| 2020 |

|

| 2019 |

|

| 2018 |

|

| 2017(3) |

|

| 2016(3) |

|

| (in millions of Reais) |

|

Operating income (expenses) before financial income (expenses) | (69.7 | ) |

| (720.3 | ) |

| (113.8 | ) |

| (37.7 | ) |

| (3.8 | ) |

Depreciation and amortization | 82.5 |

|

| 80.6 |

|

| 71.6 |

|

| 60.8 |

|

| 42.7 |

|

Amortization of right-of-use assets | 71.4 |

|

| 73.8 |

|

| — |

|

| — |

|

| — |

|

EBITDA(1) | 84.2 |

|

| (565.9 | ) |

| (42.2 | ) |

| 23.1 |

|

| 38.8 |

|

| abastece aí |

|

| Reconciliation of operating income to EBITDA |

|

| Years ended December 31, |

|

| 2020 |

|

| 2019 |

| 2018 |

| 2017 |

| 2016 |

|

| (in millions of Reais) |

|

Operating income (expenses) before financial income (expenses) | (29.0 | ) |

| — |

| — |

| — |

| — |

|

Depreciation and amortization | 4.1 |

|

| — |

| — |

| — |

| — |

|

Amortization of right-of-use assets | — |

|

| — |

| — |

| — |

| — |

|

EBITDA(1) | (24.9 | ) |

| — |

| — |

| — |

| — |

|

(1) See footnote 5 under “Item 3.A. Key Information—Selected Consolidated Financial Data” for a more complete discussion of EBITDA and Adjusted EBITDA and its reconciliation to information in our consolidated financial statements.

(2) Cash flow hedge from bonds adjustment relates to the hedge accounting designation in 2016, whose object of protection was firm commitments and highly probable future export sales generated by Oxiteno and its subsidiaries. When a future sale of exported products occurs, it is recorded in the income statement at the exchange rate of the initial designation of the hedge (R$/US$3.2270).

(3) The results of 2016 and 2017 have not been retrospectively adjusted to reflect the segregation of the Holding expenses. For more information, see “Item 5.A. Operating and Financial Review and prospects – Operating results – Summary of the changes due to the segregation of the Holding expenses”.

The reconciliation of Adjusted EBITDA to cash flows from operating activities for the years ended December 31, 2020, 2019, 2018, 2017 and 2016 is presented in the table below:

| 2020 |

|

| 2019 |

|

| 2018 |

|

| 2017 |

|

| 2016 |

|

| (in millions of Reais) |

|

Net income for the year | 927.7 |

|

| 402.9 |

|

| 1,132.3 |

|

| 1,525.9 |

|

| 1,546.8 |

|

Adjustments to reconcile net income to Adjusted EBITDA: | |

|

| |

|

| |

|

| |

|

| |

|

Depreciation and amortization | 938.8 |

|

| 844.6 |

|

| 812.5 |

|

| 704.5 |

|

| 628.2 |

|

Amortization of right-of-use assets | 328.3 |

|

| 300.1 |

|

| — |

|

| — |

|

| — |

|

Amortization of contractual assets with customers—exclusive rights | 289.4 |

|

| 355.2 |

|

| 371.8 |

|

| 463.0 |

|

| 463.5 |

|

Financial result, net | 269.4 |

|

| 506.9 |

|

| 113.5 |

|

| 474.3 |

|

| 842.6 |

|

Cash flow hedge from bonds (Oxiteno) | 153.5 |

|

| 11.9 |

|

| — |

|

| — |

|

| — |

|

Income and social contribution taxes | 571.4 |

|

| 378.6 |

|

| 638.7 |

|

| 813.3 |

|

| 688.0 |

|

Adjusted EBITDA(1) | 3,478.5 |

|

| 2,800.3 |

|

| 3,068.9 |

|

| 3,981.0 |

|

| 4,169.0 |

|

Adjustments to reconcile Adjusted EBITDA to cash provided by operating activities: | |

|

| |

|

| |

|

| |

|

| |

|

Financial result that affected the cash flow from operating activities | 482.1 |

|

| 729.9 |

|

| 913.0 |

|

| 380.4 |

|

| (78.8 | ) |

Current income and social contribution taxes | (659.3 | ) |

| (476.1 | ) |

| (476.3 | ) |

| (922.5 | ) |

| (800.5 | ) |

PIS and COFINS credits on depreciation | 15.7 |

|

| 14.9 |

|

| 15.7 |

|

| 13.1 |

|

| 12.6 |

|

Assets retirement obligation | — |

|

| — |

|

| — |

|

| — |

|

| — |

|

Impairment of assets | — |

|

| 593.3 |

|

| — |

|

| — |

|

| — |

|

Provision of decarbonization - CBIO | 124.3 |

|

| — |

|

| — |

|

| — |

|

| — |

|

Provision for tax, civil and labor risks | 18.8 |

|

| 6.6 |

|

| 48.8 |

|

| (40,5 | ) |

| 108,5 |

|

Others | (31.6 | ) |

| 92.1 |

|

| 109.3 |

|

| 129.0 |

|

| 85.9 |

|

(Increase) decrease in current assets | |

|

| |

|

| |

|

| |

|

| |

|

Trade receivables and reseller financing | 209.5 |

|

| 361.6 |

|

| (355.9 | ) |

| (725.2 | ) |

| (372.9 | ) |

Inventories | (125.0 | ) |

| (357.6 | ) |

| 168.7 |

|

| (606.5 | ) |

| (267.5 | ) |

Recoverable taxes | 36.7 |

|

| (550.8 | ) |

| (11.5 | ) |

| (334.2 | ) |

| 87.0 |

|

Dividends received from subsidiaries and joint-ventures | 4.8 |

|

| 4.1 |

|

| 42.4 |

|

| 29.4 |

|

| 7.9 |

|

Insurance and other receivables | (20.2 | ) |

| 21.7 |

|

| (14.5 | ) |

| 358.7 |

|

| (309.7 | ) |

Prepaid expenses | (74.6 | ) |

| (15.5 | ) |

| (37.5 | ) |

| (23.0 | ) |

| (40.0 | ) |

Increase (decrease) in current liabilities | |

|

| |

|

| |

|

| |

|

| |

|

Trade payables | 1,147.5 |

|

| (31.6 | ) |

| 576.2 |

|

| 412.4 |

|

| 249.1 |

|

Salaries and related charges | 63.0 |

|

| (22.6 | ) |

| 40.1 |

|

| 7.1 |

|

| (41.6 | ) |

Taxes payable | 16.1 |

|

| 1.9 |

|

| 46.5 |

|

| 33.1 |

|

| 4.0 |

|

Income and social contribution taxes | 347.2 |

|

| 250.5 |

|

| 166.5 |

|

| 783.7 |

|

| 567.3 |

|

Post-employment benefits | (1.9 | ) |

| (16.7 | ) |

| 15.6 |

|

| 5.1 |

|

| 11.2 |

|

Insurance and other payables | 0.3 |

|

| 66.8 |

|

| (59.2 | ) |

| (49.4 | ) |

| 54.0 |

|

Deferred revenue | (9.3 | ) |

| 1.1 |

|

| 8.2 |

|

| (3.9 | ) |

| (2.1 | ) |

(Increase) decrease in non-current assets | |

|

| |

|

| |

|

| |

|

| |

|

Trade receivables and reseller financing | (73.0 | ) |

| 11.4 |

|

| (99.6 | ) |

| (102.9 | ) |

| (74.8 | ) |

Recoverable taxes | (863.7 | ) |

| (19.5 | ) |

| (539.5 | ) |

| (130.2 | ) |

| (47.2 | ) |

Escrow deposits | (28.4 | ) |

| (39.9 | ) |

| (58.8 | ) |

| (39.8 | ) |

| (37.9 | ) |

Other receivables | (27.8 | ) |

| (0.8 | ) |

| 6.4 |

|

| (4.4 | ) |

| 13.8 |

|

Prepaid expenses | 15.0 |

|

| (4.4 | ) |

| (58.7 | ) |

| (116.7 | ) |

| (65.8 | ) |

Increase (decrease) in non-current liabilities | |

|

| |

|

| |

|

| |

|

| |

|

Post-employment benefits | 12.1 |

|

| (15.4 | ) |

| (8.5 | ) |

| (0.8 | ) |

| (7.7 | ) |

Provision for tax, civil and labor risks | — |

|

| — |

|

| — |

|

| — |

|

| — |

|

Other payables | (49.3 | ) |

| 27.7 |

|

| (4.4 | ) |

| 88.0 |

|

| (19.3 | ) |

Deferred revenue | — |

|

| (11.9 | ) |

| (1.0 | ) |

| 0.4 |

|

| 1.5 |

|

CBIO acquisition | (125.3 | ) |

| — |

|

| — |

|

| — |

|

| — |

|

Payments of contractual assets with customers—exclusive rights | (356.0 | ) |

| (330.1 | ) |

| (390.2 | ) |

| (529.7 | ) |

| (514.3 | ) |

Payments of provision for tax, civil and labor risks | (45.4 | ) |

| (25.1 | ) |

| (23.7 | ) |

| (15,9 | ) |

| (58,7 | ) |

Income and social contribution taxes paid | (342.7 | ) |

| (141.2 | ) |

| (197.9 | ) |

| (836.8 | ) |

| (644.2 | ) |

Net cash provided by operating activities | 3,138.1 |

|

| 2,924.9 |

|

| 2,889.0 |

|

| 1,739.0 |

|

| 1,988.9 |

|

(1) See footnote 5 under “Item 3.A. Key Information—Selected Consolidated Financial Data” for a more complete discussion of EBITDA and Adjusted EBITDA and its reconciliation to information in our consolidated financial statements.

The table below provides a reconciliation of our consolidated statement of financial position data to the net debt positions shown in the table:

| |

|

| |

|

| |

|

| |

|

| |

|

| Ultrapar |

|

| As of December 31, |

|

| 2020 |

|

| 2019 |

|

| 2018 |

|

| 2017 |

|

| 2016 |

|

| (in millions of Reais) |

|

Current loans and hedging instruments | (2,306.0 | ) |

| (867.9 | ) |

| (2,010.3 | ) |

| (1,822.5 | ) |

| (1,824.0 | ) |

Current debentures | (949.9 | ) |

| (249.6 | ) |

| (263.7 | ) |

| (1,681.2 | ) |

| (651.6 | ) |

Non-current loans and hedging instruments | (8,526.1 | ) |

| (6,907.1 | ) |

| (6,530.6 | ) |

| (6,159.4 | ) |

| (6,846.2 | ) |

Non-current debentures | (5,594.2 | ) |

| (6,368.2 | ) |

| (6,401.5 | ) |

| (3,927.6 | ) |

| (2,095.3 | ) |

Gross debt position | (17,376.2 | ) |

| (14,392.7 | ) |

| (15,206.1 | ) |

| (13,590.6 | ) |

| (11,417.1 | ) |

Cash and cash equivalents | 2,661.5 |

|

| 2,115.4 |

|

| 3,939.0 |

|

| 5,002.0 |

|

| 4,274.2 |

|

Current financial investments | 5,033.3 |

|

| 3,090.2 |

|

| 2,853.1 |

|

| 1,283.5 |

|

| 1,412.6 |

|

Non-current financial investments | 977.4 |

|

| 506.5 |

|

| 202.3 |

|

| 84.4 |

|

| 15.1 |

|

Net debt (excluding leases payable) | (8,704.1 | ) |

| (8,680.6 | ) |

| (8,211.7 | ) |

| (7,220.7 | ) |

| (5,715.3 | ) |

Leases payable | (1,833.3 | ) |

| (1,588.7 | ) |

| — |

|

| — |

|

| — |

|

Net debt | (10,537.3 | ) |

| (10,269.3 | ) |

| — |

|

| — |

|

| — |

|

The following tables present our consolidated statements of financial position in accordance with IFRS as of the dates indicated.

|

| |

| |

| |

| |

| |

| |

|

|

| As of December 31, |

|

|

| 2020(1) |

| 2020 |

| 2019 |

| 2018 |

| 2017 |

| 2016 |

|

|

| (in millions) |

|

Consolidated Statements of Financial Position Data: |

| US$ |

| R$ |

| R$ |

| R$ |

| R$ |

| R$ |

|

Current assets |

| |

| |

| |

| |

| |

| |

|

Cash and cash equivalents |

| 512.2 |

| 2,661.5 |

| 2,115.4 |

| 3,939.0 |

| 5,002.0 |

| 4,274.2 |

|

Financial investments and hedging instruments |

| 968.5 |

| 5,033.3 |

| 3,090.2 |

| 2,853.1 |

| 1,283.5 |

| 1,412.6 |

|

Trade receivables |

| 638.7 |

| 3,318.9 |

| 3,635.8 |

| 4,069.3 |

| 3,861.3 |

| 3,177.1 |

|

Reseller financing |

| 105.7 |

| 549.1 |

| 436.2 |

| 367.3 |

| 286.6 |

| 211.1 |

|

Inventories |

| 740.1 |

| 3,846.2 |

| 3,715.6 |

| 3,354.5 |

| 3,513.7 |

| 2,781.4 |

|

Recoverable taxes |

| 201.1 |

| 1,044.9 |

| 1,122.3 |

| 639.7 |

| 665.0 |

| 382.4 |

|

Recoverable income and social contribution taxes |

| 70.4 |

| 366.1 |

| 325.3 |

| 257.2 |

| 216.6 |

| 159.4 |

|

Other receivables |

| 11.2 |

| 58.1 |

| 40.4 |

| 59.6 |

| 55.2 |

| 395.9 |

|

Prepaid expenses |

| 25.4 |

| 132.1 |

| 111.4 |

| 187.6 |

| 150.0 |

| 123.9 |

|

Contractual assets with customers – exclusive rights |

| 92.2 |

| 478.9 |

| 465.5 |

| 484.5 |

| 456.2 |

| 448.3 |

|

Total current assets |

| 3,365.4 |

| 17,489.1 |

| 15,058.1 |

| 16,211.7 |

| 15,490.1 |

| 13,366.1 |

|

Non-current assets |

| |

| |

| |

| |

| |

| |

|

Financial investments and hedging instruments |

| 188.1 |

| 977.4 |

| 506.5 |

| 202.3 |

| 84.4 |

| 15.1 |

|

Trade receivables |

| 13.9 |

| 72.2 |

| 53.7 |

| 81.6 |

| 46.3 |

| 49.6 |

|

Reseller financing |

| 80.7 |

| 419.3 |

| 364.7 |

| 348.3 |

| 283.7 |

| 177.5 |

|

Related parties |

| 0.5 |

| 2.8 |

| 0.5 |

| 0.5 |

| 0.5 |

| 0.5 |

|

Deferred income and social contribution taxes |

| 187.6 |

| 974.7 |

| 653.7 |

| 514.2 |

| 614.1 |

| 459.6 |

|

Recoverable taxes, net |

| 283.8 |

| 1,474.8 |

| 767.4 |

| 747.2 |

| 234.7 |

| 146.8 |

|

Recoverable income and social contribution taxes |

| 50.3 |

| 261.2 |

| 104.9 |

| 105.6 |

| 78.5 |

| 35.9 |

|

Escrow deposits |

| 182.8 |

| 949.8 |

| 921.4 |

| 881.5 |

| 822.7 |

| 778.8 |

|

Indemnity asset – business combination |

| 39.3 |

| 204.4 |

| 193.5 |

| 194.7 |

| 202.4 |

| — |

|

Other receivables |

| 3.9 |

| 20.2 |

| 3.4 |

| 1.4 |

| 7.9 |

| 2.7 |

|

Prepaid expenses |

| 13.6 |

| 70.5 |

| 69.2 |

| 399.1 |

| 346.9 |

| 222.5 |

|

Contractual assets with customers – exclusive rights |

| 236.2 |

| 1,227.4 |

| 1,000.5 |

| 1,034.0 |

| 1,046.1 |

| 989.8 |

|

|

| 1,280.6 |

| 6,654.8 |

| 4,639.5 |

| 4,510.4 |

| 3,768.2 |

| 2,878.6 |

|

|

| |

| |

| |

| |

| |

| |

|

|

| As of December 31, |

|

|

| 2020(1) |

| 2020 |

| 2019 |

| 2018 |

| 2017 |

| 2016 |

|

|

| (in millions) |

|

|

| US$ |

| R$ |

| R$ |

| R$ |

| R$ |

| R$ |

|

Investments |

| |

| |

| |

| |

| |

| |

|

In joint-ventures |

| 26.8 |

| 139.1 |

| 153.1 |

| 102.0 |

| 122.1 |

| 116.1 |

|

In associates |

| 4.9 |

| 25.6 |

| 25.8 |

| 24.3 |

| 25.3 |

| 22.7 |

|

Other |

| 0.5 |

| 2.8 |

| 2.8 |

| 2.8 |

| 2.8 |

| 2.8 |

|

Right to use assets |

| 413.8 |

| 2,150.3 |

| 1,980.9 |

| — |

| — |

| — |

|

Property, plant and equipment, net |

| 1,540.6 |

| 8,005.9 |

| 7,572.8 |

| 7,278.9 |

| 6,637.8 |

| 5,796.4 |

|

Intangible assets, net |

| 343.0 |

| 1,782.7 |

| 1,762.6 |

| 2,369.4 |

| 2,238.0 |

| 1,891.6 |

|

|

| 2,329.6 |

| 12,106.3 |

| 11,497.9 |

| 9,777.3 |

| 9,026.1 |

| 7,829.7 |

|

Total non-current assets |

| 3,610.2 |

| 18,761.1 |

| 16,137.4 |

| 14,287.7 |

| 12,794.2 |

| 10,708.4 |

|

TOTAL ASSETS |

| 6,975.6 |

| 36,250.2 |

| 31,195.5 |

| 30,499.4 |

| 28,284.3 |

| 24,074.5 |

|

|

| |

| |

| |

| |

| |

| |

|

|

| As of December 31, |

|

|

| 2020(1) |

| 2020 |

| 2019 |

| 2018 |

| 2017 |

| 2016 |

|

|

| (in millions) |

|

Consolidated Statements of Financial Position Data: |

| US$ |

| R$ |

| R$ |

| R$ |

| R$ |

| R$ |

|

Current liabilities |

| |

| |

| |

| |

| |

| |

|

Loans and hedging instruments |

| 443.7 |

| 2,306.0 |

| 867.9 |

| 2,007.4 |

| 1,819.8 |

| 1,821.4 |

|

Debentures |

| 182.8 |

| 949.9 |

| 249.6 |

| 263.7 |

| 1,681.2 |

| 651.6 |

|

Leases payable |

| 50.1 |

| 260.2 |

| 206.4 |

| 2.8 |

| 2.7 |

| 2.6 |

|

Trade payables |

| 777.5 |

| 4,040.7 |

| 2,700.1 |

| 2,731.7 |

| 2,155.5 |

| 1,709.7 |

|

Salaries and related charges |

| 90.2 |

| 468.6 |

| 405.6 |

| 428.2 |

| 388.1 |

| 362.7 |

|

Taxes payable |

| 55.0 |

| 286.0 |

| 269.9 |

| 268.0 |

| 221.5 |

| 168.4 |

|

Dividends payable |

| 85.1 |

| 442.1 |

| 16.7 |

| 284.0 |

| 338.8 |

| 320.9 |

|

Income and social contribution taxes payable |

| 32.6 |

| 169.3 |

| 164.8 |

| 55.5 |

| 86.8 |

| 140.0 |

|

Post-employment benefits |

| 5.2 |

| 27.1 |

| 29.0 |

| 45.7 |

| 30.1 |

| 24.9 |

|

Provision for asset retirement obligation |

| 0.8 |

| 4.3 |

| 3.8 |

| 4.4 |

| 4.8 |

| 4.6 |

|

Provision for tax, civil and labor risks |

| 8.4 |

| 43.7 |

| 40.5 |

| 77.8 |

| 64.6 |

| 52.7 |

|

Other payables |

| 43.2 |

| 224.7 |

| 213.3 |

| 141.0 |

| 197.4 |

| 202.6 |

|

Deferred revenue |

| 3.5 |

| 18.3 |

| 27.6 |

| 26.6 |

| 18.4 |

| 22.3 |

|

Total current liabilities |

| 1,778.2 |

| 9,240.8 |

| 5,195.1 |

| 6,336.8 |

| 7,009.7 |

| 5,484.3 |

|

Non-current liabilities |

| |

| |

| |

| |

| |

| |

|

Loans and hedging instruments |

| 1,640.7 |

| 8,526.1 |

| 6,907.1 |

| 6,487.4 |

| 6,113.5 |

| 6,800.1 |

|

Debentures |

| 1,076.5 |

| 5,594.2 |

| 6,368.2 |

| 6,401.5 |

| 3,927.6 |

| 2,095.3 |

|

Leases payable |

| 302.7 |

| 1,573.1 |

| 1,382.3 |

| 43.2 |

| 45.8 |

| 46.1 |

|

Related parties |

| 0.7 |

| 3.7 |

| 3.9 |

| 4.1 |

| 4.2 |

| 4.3 |

|

Deferred income and social contribution taxes |

| 2.5 |

| 12.7 |

| 7.5 |

| 9.3 |

| 83.6 |

| 7.6 |

|

Provision for tax, civil and labor risks |

| 164.4 |

| 854.4 |

| 884.1 |

| 865.2 |

| 861.2 |

| 727.1 |

|

Post-employment benefits |

| 49.6 |

| 257.6 |

| 243.9 |

| 204.2 |

| 207.5 |

| 119.8 |

|

Provision for assets retirement obligation |

| 9.5 |

| 49.2 |

| 47.4 |

| 50.3 |

| 60.0 |

| 73.0 |

|

Subscription warrants – indemnification |

| 16.6 |

| 86.4 |

| 130.7 |

| 123.1 |

| 171.5 |

| 153.4 |

|

Other payables |

| 27.2 |

| 141.6 |

| 190.1 |

| 162.4 |

| 162.8 |

| 74.9 |

|

Deferred revenue |

| — |

| —

|

| — |

| 11.9 |

| 12.9 |

| 12.5 |

|

Total non-current liabilities |

| 3,290.4 |

| 17,099.1 |

| 16,165.2 |

| 14,362.6 |

| 11,650.6 |

| 10,114.2 |

|

TOTAL LIABILITIES |

| 5,068.6 |

| 26,339.9 |

| 21,360.3 |

| 20,699.4 |

| 18,660.3 |

| 15,598.5 |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| As of December 31, |

|

| 2020(1) |

|

| 2020 |

|

| 2019 |

|

| 2018 |

|

| 2017 |

|

| 2016 |

|

| (in millions) |

|

| US$ |

|

| R$ |

|

| R$ |

|

| R$ |

|

| R$ |

|

| R$ |

|

Equity | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

Share capital | 995.2 |

|

| 5,171.8 |

|

| 5,171.8 |

|

| 5,171.8 |

|

| 5,171.8 |

|

| 3,838.7 |

|

Equity instrument granted | 4.3 |

|

| 22.4 |

|

| 12.0 |

|

| 4.3 |

|

| 0.5 |

|

| — |

|

Capital reserve | 114.3 |

|

| 594.0 |

|

| 542.4 |

|

| 542.4 |

|

| 549.8 |

|

| 552.0 |

|

Treasury shares | (94.1 | ) |

| (489.1 | ) |

| (485.4 | ) |

| (485.4 | ) |

| (482.3 | ) |

| (483.9 | ) |

Revaluation reserve on subsidiaries | 0.8 |

|

| 4.3 |

|

| 4.5 |

|

| 4.7 |

|

| 4.9 |

|

| 5.3 |

|

Profit reserves | 848.3 |

|

| 4,408.3 |

|

| 3,995.4 |

|

| 4,099.1 |

|

| 3,629.9 |

|

| 4,384.0 |

|

Additional dividends to the minimum mandatory dividends | 10.7 |

|

| 55.4 |

|

| 261.5 |

|

| 109.4 |

|

| 163.7 |

|

| 165.5 |

|

Valuation adjustments | (89.5 | ) |

| (465.0 | ) |

| (146.3 | ) |

| (64.0 | ) |

| 154.8 |

|

| (24.0 | ) |

Cumulative translation adjustments | 44.6 |

|

| 231.6 |

|

| 102.4 |

|

| 65.9 |

|

| 53.1 |

|

| 7.5 |

|

Equity attributable to: | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

Shareholders of the Company | 1,834.6 |

|

| 9,533.7 |

|

| 9,458.3 |

|

| 9,448.1 |

|

| 9,246.2 |

|

| 8,445.2 |

|

Non-controlling interest in subsidiaries | 72.5 |

|

| 376.5 |

|

| 376.9 |

|

| 351.9 |

|

| 377.8 |

|

| 30.9 |

|

TOTAL EQUITY | 1,907.0 |

|

| 9,910.3 |

|

| 9,835.2 |

|

| 9,800.0 |

|

| 9,624.0 |

|

| 8,476.1 |

|

TOTAL LIABILITIES AND EQUITY | 6,975.6 |

|

| 36,250.2 |

|

| 31,195.5 |

|

| 30,499.4 |

|

| 28,284.3 |

|

| 24,074.5 |

|

(1) The figures in Reais for December 31, 2020 have been converted into dollars using the exchange rate of US$1.00 = R$5.1967, which is the commercial rate reported by the Central Bank on that date. This information is presented solely for the convenience of the reader. You should not interpret the currency conversions in this annual report as a statement that the amounts in Reais currently represent such values in U.S. dollars. Additionally, you should not interpret such conversions as statements that the amounts in Reais have been, could have been or could be converted into U.S. dollars at this or any other foreign exchange rates. See “Item 3.A. Key Information—Selected Consolidated Financial Data—Exchange Rates”.

Exchange Rates