- UGP Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Ultrapar Participações (UGP) 6-KCurrent report (foreign)

Filed: 11 Aug 21, 9:06pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K |

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 Or 15d-16 Of

The Securities Exchange Act Of 1934

For the month of August 2021

Commission File Number: 001-14950

ULTRAPAR HOLDINGS INC.

(Translation of Registrant’s Name into English)

Brigadeiro Luis Antonio Avenue, 1343, 9th floor

São Paulo, SP, Brazil 01317-910

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ____X____ Form 40-F ________

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ________ No ____X____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ________ No ____X____

ULTRAPAR HOLDINGS INC.

TABLE OF CONTENTS

|

(Convenience Translation into English from the Original Previously Issued in Portuguese)

Ultrapar Participações S.A.

Interim Financial Information as of and the Six-month Period Ended June 30, 2021 and Report on Review of Interim Financial Information

KPMG Auditores Independentes |

|

Ultrapar Participações S.A. and Subsidiaries

Parent’s Separate and Consolidated

Interim Financial Information

As of and the Six-month Period Ended June 30, 2021

(Convenience Translation into English from the Original Previously Issued in Portuguese)

information - ITR |

|

To the Shareholders, Directors and Management of Ultrapar Participações S.A. São Paulo, SP |

Introduction |

We have reviewed the accompanying individual and consolidated interim financial information of Ultrapar Participações S.A. (“Company”), comprised in the Quarterly Financial Information - ITR Form for the quarter ended June 30, 2021, which comprise the statements of financial position as of June 30, 2021, and related statements of income, comprehensive income for the three and six-month period then ended and changes in shareholders’ equity and cash flows for the six-month period then ended, including the explanatory notes. The Company’s Management is responsible for the preparation of the interim financial information in accordance with Technical Pronouncement CPC 21 (R1) Interim Financial Information and with International Standard IAS 34 – Interim Financial Reporting, issued by the International Accounting Standards Board - IASB, such as for the presentation of these information in a manner consistent with the standards issued by the Brazilian Securities and Exchange Commission, applicable to the preparation of the Quarterly Financial Information - ITR. Our responsibility is to express a conclusion on these interim financial information based on our review. |

Scope of the review |

Our review was conducted in accordance with the Brazilian and international Review Standards of interim information (NBC TR 2410 - Review of Interim Financial Information Performed by the Independent Auditor of the Entity and ISRE 2410 - Review of Interim Financial Information Performed by the Independent Auditor of the Entity, respectively). A review of interim information consists of making inquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with the auditing standards and consequently does not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion. |

Conclusion on the individual and consolidated interim financial information |

Based on our review, nothing has come to our attention that causes us to believe that the individual and consolidated interim financial information included in the quarterly information referred to above was not prepared, in all material respects, in accordance with CPC 21 (R1) and IAS 34, issued by the Accounting Committee and by IASB applicable to the preparation of Quarterly Financial Information – ITR and presented in accordance with the standards issued by the Brazilian Securities and Exchange Commission - CVM. |

Other matters - Interim statements of value added |

The individual and consolidated interim statements of value added (DVA) for the six-month period ended June 30, 2021, prepared under the responsibility of the Company's management, and presented as supplementary information for the purposes of IAS 34, were submitted to the same review procedures followed together with the review of the Company's interim financial information. In order to form our conclusion, we evaluated whether these statements are reconciled to the interim financial information and to the accounting records, as applicable, and whether their form and content are in accordance with the criteria set on Technical Pronouncement CPC 09 - Statement of Value Added. Based on our review, nothing has come to our attention that causes us to believe that the accompanying statements of value added are not prepared, in all material respects, according to the criteria defined in this Standard and consistently in accordance with the individual and consolidated interim financial information taken as a whole. |

São Paulo, August 11, 2021

KPMG Auditores Independentes |

Ultrapar Participações S.A. and Subsidiaries

As of June 30, 2021 and December 31, 2020

(In thousands of Brazilian Reais)

|

| Parent |

| Consolidated | ||||

| Note | 06/30/2021 |

| 12/31/2020 |

| 06/30/2021 |

| 12/31/2020 |

Assets |

|

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

|

Cash and cash equivalents | 4.a | 3,705 |

| 948,649 |

| 2,860,287 |

| 2,661,494 |

Financial investments and hedging instruments | 4.b | 214,302 |

| 88,100 |

| 3,355,993 |

| 5,033,258 |

Trade receivables | 5.a | - |

| - |

| 3,819,996 |

| 3,318,927 |

Reseller financing | 5.b | - |

| - |

| 543,152 |

| 549,129 |

Inventories | 6 | - |

| - |

| 4,888,796 |

| 3,846,196 |

Recoverable taxes | 7.a | 486 |

| 154 |

| 1,069,766 |

| 1,044,850 |

Recoverable income and social contribution taxes | 7.b | 37,858 |

| 47,913 |

| 353,374 |

| 366,080 |

Dividends receivable |

| 213 |

| 150,301 |

| 1,029 |

| 1,152 |

Other receivables |

| 84,924 |

| 58,300 |

| 114,903 |

| 56,955 |

Prepaid expenses | 10 | 10,215 |

| 3,684 |

| 159,755 |

| 132,122 |

Contractual assets with customers – exclusive rights | 11 | - |

| - |

| 514,410 |

| 478,908 |

Total current assets |

| 351,703 |

| 1,297,101 |

| 17,681,461 |

| 17,489,071 |

Non-current assets |

|

|

|

|

|

|

|

|

Financial investments and hedging instruments | 4.b | - |

| - |

| 762,460 |

| 977,408 |

Trade receivables | 5.a | - |

| - |

| 66,792 |

| 72,195 |

Reseller financing | 5.b | - |

| - |

| 434,023 |

| 419,255 |

Related parties | 8.a | 402,790 |

| 753,459 |

| 22,229 |

| 2,824 |

Deferred income and social contribution taxes | 9.a | 62,358 |

| 64,993 |

| 1,081,597 |

| 974,711 |

Recoverable taxes | 7.a | - |

| - |

| 1,463,750 |

| 1,474,808 |

Recoverable income and social contribution taxes | 7.b | 39,445 |

| 39,446 |

| 193,423 |

| 261,205 |

Escrow deposits | 22.a | 2 |

| 2 |

| 862,669 |

| 949,796 |

Indemnification asset – business combination | 22.c | - |

| - |

| 123,522 |

| 204,439 |

Other receivables |

| - |

| - |

| 22,554 |

| 20,238 |

Prepaid expenses | 10 | 2,802 |

| 3,888 |

| 66,757 |

| 70,507 |

Contractual assets with customers – exclusive rights | 11 | - |

| - |

| 1,297,184 |

| 1,227,423 |

Total long term assets |

| 507,397 |

| 861,788 |

| 6,396,960 |

| 6,654,809 |

Investments |

|

|

|

|

|

|

|

|

In subsidiaries | 12.a | 10,456,648 |

| 10,530,177 |

| - |

| - |

In joint ventures | 12.a; 12.b | - |

| - |

| 146,480 |

| 139,100 |

In associates | 12.c | - |

| - |

| 25,863 |

| 25,588 |

Others |

| - |

| - |

| 2,793 |

| 2,793 |

|

| 10,456,648 |

| 10,530,177 |

| 175,136 |

| 167,481 |

Right-of-use assets | 13 | 34,463 |

| 35,062 |

| 2,057,477 |

| 2,150,286 |

Property, plant, and equipment | 14 | 23,962 |

| 14,328 |

| 8,030,896 |

| 8,005,860 |

Intangible assets | 15 | 253,383 |

| 254,242 |

| 1,631,249 |

| 1,782,655 |

Total non-current assets |

| 11,275,853 |

| 11,695,597 |

| 18,291,718 |

| 18,761,091 |

Total assets |

| 11,627,556 |

| 12,992,698 |

| 35,973,179 |

| 36,250,162 |

The accompanying notes are an integral part of the interim financial information.

Ultrapar Participações S.A. and Subsidiaries

Statements of Financial Position

As of June 30, 2021 and December 31, 2020

(In thousands of Brazilian Reais)

|

| Parent |

| Consolidated | ||||

| Note | 06/30/2021 |

| 12/31/2020 |

| 06/30/2021 |

| 12/31/2020 |

Liabilities |

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

Loans, financing and hedge derivative financial instruments | 16 | - |

| 1,038,499 |

| 1,548,657 |

| 2,306,036 |

Debentures | 16.f | 16,396 |

| 9,996 |

| 1,480,638 |

| 949,908 |

Trade payables | 17.a | 25,935 |

| 16,870 |

| 3,058,389 |

| 2,745,019 |

Trade payables – reverse factoring | 17.b | - |

| - |

| 2,434,210 |

| 1,295,633 |

Salaries and related charges | 18 | 32,528 |

| 42,400 |

| 434,217 |

| 468,630 |

Taxes payable | 19 | 741 |

| 812 |

| 288,776 |

| 286,014 |

Dividends payable | 25.h | 9,940 |

| 439,094 |

| 12,124 |

| 442,133 |

Income and social contribution taxes payable |

| - |

| 4,264 |

| 207,360 |

| 169,317 |

Post-employment benefits | 20.b | - |

| - |

| 27,173 |

| 27,077 |

Provision for asset retirement obligation | 21 | - |

| - |

| 4,426 |

| 4,267 |

Provision for tax, civil, and labor risks | 22.a | - |

| - |

| 42,209 |

| 43,660 |

Leases payable | 13 | 5,307 |

| 4,688 |

| 286,617 |

| 260,189 |

Other payables |

| 15,207 |

| 10,157 |

| 226,483 |

| 224,676 |

Deferred revenue | 23 | - |

| - |

| 1,777 |

| 18,282 |

Total current liabilities |

| 106,054 |

| 1,566,780 |

| 10,053,056 |

| 9,240,841 |

Non-current liabilities |

|

|

|

|

|

|

|

|

Loans, financing and hedge derivative financial instruments | 16 | - |

| - |

| 7,698,625 |

| 8,526,064 |

Debentures | 16.f | 1,724,489 |

| 1,724,117 |

| 5,377,711 |

| 5,594,208 |

Related parties | 8.a | 4,804 |

| 5,272 |

| 3,582 |

| 3,711 |

Deferred income and social contribution taxes | 9.a | - |

| - |

| 11,328 |

| 12,732 |

Post-employment benefits | 20.b | 2,725 |

| 2,527 |

| 259,952 |

| 257,647 |

Provision for asset retirement obligation | 21 | - |

| - |

| 49,815 |

| 49,168 |

Provision for tax, civil, and labor risks | 22.a; 22.c | 280 |

| 280 |

| 768,592 |

| 854,385 |

Leases payable | 13 | 32,513 |

| 33,246 |

| 1,509,101 |

| 1,573,099 |

Subscription warrants – indemnification | 24 | 65,645 |

| 86,439 |

| 65,645 |

| 86,439 |

Provision for short-term liabilities of subsidiaries and joint venture | 12.a; 12.b | 20,608 |

| 35,794 |

| 782 |

| 2,096 |

Other payables |

| 5,697 |

| 4,497 |

| 126,173 |

| 139,507 |

Total non-current liabilities |

| 1,856,761 |

| 1,892,172 |

| 15,871,306 |

| 17,099,056 |

Equity |

|

|

|

|

|

|

|

|

Share capital | 25.a; 25.f | 5,171,752 |

| 5,171,752 |

| 5,171,752 |

| 5,171,752 |

Equity instrument granted | 25.b | 29,954 |

| 22,404 |

| 29,954 |

| 22,404 |

Capital reserve | 25.d | 595,420 |

| 594,049 |

| 595,420 |

| 594,049 |

Treasury shares | 25.c | (489,068) |

| (489,068) |

| (489,068) |

| (489,068) |

Revaluation reserve on subsidiaries | 25.e | 4,245 |

| 4,337 |

| 4,245 |

| 4,337 |

Profit reserves | 25.f | 4,408,275 |

| 4,408,275 |

| 4,408,275 |

| 4,408,275 |

Retained earnings |

| 108,529 |

| - |

| 108,529 |

| - |

Valuation adjustments | 25.g.1 | (358,523) |

| (464,990) |

| (358,523) |

| (464,990) |

Cumulative translation adjustments | 25.g.2 | 194,157 |

| 231,596 |

| 194,157 |

| 231,596 |

Additional dividends to the minimum mandatory dividends | 25.h | - |

| 55,391 |

| - |

| 55,391 |

Equity attributable to: |

|

|

|

|

|

|

|

|

Shareholders of the Company |

| 9,664,741 |

| 9,533,746 |

| 9,664,741 |

| 9,533,746 |

Non-controlling interests in subsidiaries |

| - |

| - |

| 384,076 |

| 376,519 |

Total equity |

| 9,664,741 |

| 9,533,746 |

| 10,048,817 |

| 9,910,265 |

Total liabilities and equity |

| 11,627,556 |

| 12,992,698 |

| 35,973,179 |

| 36,250,162 |

The accompanying notes are an integral part of the interim financial information.

Ultrapar Participações S.A. and Subsidiaries

For the six-month period ended June 30, 2021 and 2020

(In thousands of Brazilian Reais, except earnings per share)

|

| Parent |

| Consolidated | ||||

| Note | 06/30/2021 |

| 06/30/2020 |

| 06/30/2021 |

| 06/30/2020 |

Net revenue from sales and services | 26 | - |

| - |

| 52,476,338 |

| 37,263,372 |

Cost of products and services sold | 27 | - |

| - |

| (49,264,664) |

| (34,802,194) |

Gross profit |

| - |

| - |

| 3,211,674 |

| 2,461,178 |

|

|

|

|

|

|

|

|

|

Operating income (expenses) |

|

|

|

|

|

|

|

|

Selling and marketing | 27 | - |

| - |

| (1,365,116) |

| (1,196,737) |

Expected reversion (losses) on doubtful accounts |

| - |

| - |

| 6,340 |

| (56,516) |

General and administrative | 27 | (12,119) |

| - |

| (941,836) |

| (703,121) |

Gain (loss) on disposal of property, plant and equipment and intangibles | 28 | 2 |

| - |

| 40,148 |

| 20,910 |

Impairment | 3.c.1; 28 | - |

| - |

| (394,675) |

| - |

Other operating income | 29 | - |

| 2,178 |

| 228,698 |

| 228,296 |

Other operating expenses | 29 | (19) |

| (1,622) |

| (162,794) |

| (68,142) |

|

|

|

|

|

|

|

|

|

Operating income (loss) before finance income (expenses) and share of profit (loss) of subsidiaries, joint ventures and associates |

| (12,136) |

| 556 |

| 622,439 |

| 685,868 |

Share of profit (loss) of subsidiaries, joint ventures and associates | 12 | 122,334 |

| 218,142 |

| (10,941) |

| (25,698) |

Operating income before finance income (expenses) and income and social contribution taxes |

| 110,198 |

| 218,698 |

| 611,498 |

| 660,170 |

Finance income | 30 | 34,558 |

| 31,769 |

| 212,146 |

| 235,164 |

Finance expenses | 30 | (41,038) |

| (51,633) |

| (548,582) |

| (483,122) |

Financial result, net | 30 | (6,480) |

| (19,864) |

| (336,436) |

| (247,958) |

Profit before income and social contribution taxes |

| 103,718 |

| 198,834 |

| 275,062 |

| 412,212 |

Income and social contribution taxes |

|

|

|

|

|

|

|

|

Current | 9.b; 9.c | - |

| (170) |

| (329,775) |

| (219,632) |

Deferred | 9.b | (2,635) |

| 3,261 |

| 173,900 |

| 26,314 |

|

| (2,635) |

| 3,091 |

| (155,875) |

| (193,318) |

Profit for the period |

| 101,083 |

| 201,925 |

| 119,187 |

| 218,894 |

Income attributable to: |

|

|

|

|

|

|

|

|

Shareholders of the Company |

| 101,083 |

| 201,925 |

| 101,083 |

| 201,925 |

Non-controlling interests in subsidiaries |

| - |

| - |

| 18,104 |

| 16,969 |

Earnings per share (based on weighted average number of shares outstanding) – R$ |

|

|

|

|

|

|

|

|

Basic | 31 | 0.0929 |

| 0.1856 |

| 0.0929 |

| 0.1856 |

Diluted | 31 | 0.0924 |

| 0.1845 |

| 0.0924 |

| 0.1845 |

The accompanying notes are an integral part of the interim financial information.

Ultrapar Participações S.A. and Subsidiaries

Statements of Profit or Loss

For the three-month period ended June 30, 2021 and 2020

(In thousands of Brazilian Reais, except earnings per share)

|

| Parent |

| Consolidated | ||||

| Note | 06/30/2021 |

| 06/30/2020 |

| 06/30/2021 |

| 06/30/2020 |

Net revenue from sales and services | 26 | - |

| - |

| 28,526,054 |

| 15,876,234 |

Cost of products and services sold | 27 | - |

| - |

| (27,030,286) |

| (14,825,003) |

Gross profit |

| - |

| - |

| 1,495,768 |

| 1,051,231 |

|

|

|

|

|

|

|

|

|

Operating income (expenses) |

|

|

|

|

|

|

|

|

Selling and marketing | 27 | - |

| - |

| (710,543) |

| (582,106) |

Expected reversion (losses) on doubtful accounts |

| - |

| - |

| 10,280 |

| (26,241) |

General and administrative | 27 | (12,119) |

| - |

| (473,146) |

| (293,240) |

Gain (loss) on disposal of property, plant and equipment and intangibles | 28 | 1 |

| - |

| 32,072 |

| 13,972 |

Impairment | 3.c.1; 28 | - |

| - |

| (394,675) |

| - |

Other operating income | 29 | - |

| 2,178 |

| 176,096 |

| 68,723 |

Other operating expenses | 29 | 2,995 |

| (1,377) |

| (97,767) |

| (32,508) |

|

|

|

|

|

|

|

|

|

Operating income (loss) before finance income (expenses) and share of profit (loss) of subsidiaries, joint ventures and associates |

| (9,123) |

| 801 |

| 38,085 |

| 199,831 |

Share of profit (loss) of subsidiaries, joint ventures and associates | 12 | (21,719) |

| 63,293 |

| 1,281 |

| (13,270) |

Operating income (loss) before finance income (expenses) and income and social contribution taxes |

| (30,842) |

| 64,094 |

| 39,366 |

| 186,561 |

Finance income | 30 | 16,159 |

| (2,365) |

| 150,578 |

| 53,113 |

Finance expenses | 30 | (16,596) |

| (30,580) |

| (153,333) |

| (133,441) |

Financial result, net | 30 | (437) |

| (32,945) |

| (2,755) |

| (80,328) |

Profit (loss) before income and social contribution taxes |

| (31,279) |

| 31,149 |

| 36,611 |

| 106,233 |

Income and social contribution taxes |

|

|

|

|

|

|

|

|

Current | 9.b; 9.c | - |

| - |

| (223,321) |

| (111,343) |

Deferred | 9.b | 199 |

| 9,917 |

| 168,467 |

| 55,138 |

|

| 199 |

| 9,917 |

| (54,854) |

| (56,205) |

Profit (loss) for the period |

| (31,080) |

| 41,066 |

| (18,243) |

| 50,028 |

Income attributable to: |

|

|

|

|

|

|

|

|

Shareholders of the Company |

| (31,080) |

| 41,066 |

| (31,080) |

| 41,066 |

Non-controlling interests in subsidiaries |

| - |

| - |

| 12,837 |

| 8,962 |

Earnings (loss) per share (based on weighted average number of shares outstanding) – R$ |

|

|

|

|

|

|

|

|

Basic | 31 | (0.0286) |

| 0.0377 |

| (0.0286) |

| 0.0377 |

Diluted | 31 | (0.0284) |

| 0.0375 |

| (0.0284) |

| 0.0375 |

The accompanying notes are an integral part of the interim financial information.

Ultrapar Participações S.A. and Subsidiaries

For the six-month period ended June 30, 2021 and 2020

(In thousands of Brazilian Reais)

|

| Parent |

| Consolidated | ||||

| Note | 06/30/2021 |

| 06/30/2020 |

| 06/30/2021 |

| 06/30/2020 |

Net income for the period |

| 101,083 |

| 201,925 |

| 119,187 |

| 218,894 |

Items that are subsequently reclassified to profit or loss: |

|

|

|

|

|

|

|

|

Fair value adjustments of financial instruments, net | 25.g.1 | (120) |

| 432 |

| (120) |

| 432 |

Fair value adjustments of financial instruments of subsidiaries, net | 25.g.1 | 107,364 |

| (476,773) |

| 107,371 |

| (476,773) |

Fair value adjustments of financial instruments of joint ventures, net | 25.g.1 | (1,338) |

| 1,861 |

| (1,338) |

| 1,861 |

Cumulative translation adjustments and hedge of net investments in foreign operations, net | 25.g.2 | (37,439) |

| 136,122 |

| (37,439) |

| 136,122 |

Items that are not subsequently reclassified to profit or loss: |

|

|

|

|

|

|

|

|

Income and social contribution taxes on actuarial losses of post-employment benefits | 25.g.1 | 561 |

| - |

| 561 |

| - |

Total comprehensive income for the period |

| 170,111 |

| (136,433) |

| 188,222 |

| (119,464) |

Total comprehensive income for the period attributable to shareholders of the Company |

| 170,111 |

| (136,433) |

| 170,111 |

| (136,433) |

Total comprehensive income for the period attributable to non-controlling interest in subsidiaries |

| - |

| - |

| 18,111 |

| 16,969 |

The accompanying notes are an integral part of the interim financial information.

Ultrapar Participações S.A. and Subsidiaries

Statements of Comprehensive Income

For the three-month period ended June 30, 2021 and 2020

(In thousands of Brazilian Reais)

|

| Parent |

| Consolidated | ||||

| Note | 06/30/2021 |

| 06/30/2020 |

| 06/30/2021 |

| 06/30/2020 |

Net income for the period |

| (31,080) |

| 41,066 |

| (18,243) |

| 50,028 |

Items that are subsequently reclassified to profit or loss: |

|

|

|

|

|

|

|

|

Fair value adjustments of financial instruments, net | 25.g.1 | (3) |

| 430 |

| (3) |

| 430 |

Fair value adjustments of financial instruments of subsidiaries, net | 25.g.1 | 228,621 |

| (56,739) |

| 228,628 |

| (56,739) |

Fair value adjustments of financial instruments of joint ventures, net | 25.g.1 | (2,786) |

| (640) |

| (2,786) |

| (640) |

Cumulative translation adjustments and hedge of net investments in foreign operations, net | 25.g.2 | (125,287) |

| 14,248 |

| (125,287) |

| 14,248 |

Items that are not subsequently reclassified to profit or loss: |

|

|

|

|

|

|

|

|

Income and social contribution taxes on actuarial losses of post-employment benefits | 25.g.1 | 561 |

| - |

| 561 |

| - |

Total comprehensive income for the period |

| 70,026 |

| (1,635) |

| 82,870 |

| 7,327 |

Total comprehensive income for the period attributable to shareholders of the Company |

| 70,026 |

| (1,635) |

| 70,026 |

| (1,635) |

Total comprehensive income for the period attributable to non-controlling interest in subsidiaries |

| - |

| - |

| 12,844 |

| 8,962 |

The accompanying notes are an integral part of the interim financial information.

Ultrapar Participações S.A. and Subsidiaries

For the six-month period ended June 30, 2021 and 2020

(In thousands of Brazilian Reais, except dividends per share)

|

|

|

|

|

|

|

|

|

|

|

|

| Profit reserve |

|

|

|

|

|

|

|

|

| Equity attributable to: |

|

| ||||

| Note |

| Share capital |

| Equity instrument granted |

| Capital reserve |

| Treasury shares |

| Revaluation reserve on subsidiaries |

| Legal reserve |

| Investments statutory reserve |

| Valuation adjustments |

| Cumulative translation adjustments |

| Retained earnings |

| Additional dividends to the minimum mandatory dividends |

| Shareholders of the Company |

| Non-controlling interests in subsidiaries |

| Consolidated equity |

Balance as of December 31, 2020 |

|

| 5,171,752 |

| 22,404 |

| 594,049 |

| (489,068) |

| 4,337 |

| 750,010 |

| 3,658,265 |

| (464,990) |

| 231,596 |

| - |

| 55,391 |

| 9,533,746 |

| 376,519 |

| 9,910,265 |

Net income for the period |

|

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| 101,083 |

| - |

| 101,083 |

| 18,104 |

| 119,187 |

Other comprehensive income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair value adjustments of available for financial instruments, net of income taxes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company | 25.g.1 |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| (120) |

| - |

| - |

| - |

| (120) |

| - |

| (120) |

Subsidiaries | 12.a; 25.g.1 |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| 107,364 |

| - |

| - |

| - |

| 107,364 |

| 7 |

| 107,371 |

Joint ventures | 12.a; 25.g.1 |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| (1,338) |

| - |

| - |

| - |

| (1,338) |

| - |

| (1,338) |

Income and social contribution taxes on actuarial losses of post-employment benefits | 12.a; 25.g.1 |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| 561 |

| - |

| - |

| - |

| 561 |

| - |

| 561 |

Currency translation of foreign subsidiaries and the effect of net investments hedge, net of income taxes | 12.a; 25.g.2 |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| (37,439) |

| - |

| - |

| (37,439) |

| - |

| (37,439) |

Total comprehensive income for the period |

|

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| 106,467 |

| (37,439) |

| 101,083 |

| - |

| 170,111 |

| 18,111 |

| 188,222 |

Issuance of shares related to the subscription warrants - indemnification - Extrafarma acquisition | 25.d |

| - |

| - |

| 1,371 |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| 1,371 |

| - |

| 1,371 |

Equity instrument granted | 25.b |

| - |

| 2,965 |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| 2,965 |

| - |

| 2,965 |

Equity instrument granted of subsidiaries | 12.a; 25.b |

| - |

| 4,585 |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| 4,585 |

| - |

| 4,585 |

Income and social contribution taxes on realization of revaluation reserve of subsidiaries | 25.e |

| - |

| - |

| - |

| - |

| (92) |

| - |

| - |

| - |

| - |

| 92 |

| - |

| - |

| - |

| - |

Prescribed dividends |

|

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| 7,137 |

| - |

| 7,137 |

| - |

| 7,137 |

Gains due to the payments fixed dividends to preferred shares of subsidiaries |

|

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| 138 |

| - |

| 138 |

| (138) |

| - |

Shareholder transaction – changes of investments |

|

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| 79 |

| - |

| 79 |

| (79) |

| - |

Dividends attributable to non-controlling interests |

|

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| (10,337) |

| (10,337) |

Approval of additional dividends by the Shareholders’ Meeting | 25.h |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| (55,391) |

| (55,391) |

| - |

| (55,391) |

Balance as of June 30, 2021 |

|

| 5,171,752 |

| 29,954 |

| 595,420 |

| (489,068) |

| 4,245 |

| 750,010 |

| 3,658,265 |

| (358,523) |

| 194,157 |

| 108,529 |

| - |

| 9,664,741 |

| 384,076 |

| 10,048,817 |

The accompanying notes are an integral part of the interim financial information.

Ultrapar Participações S.A. and Subsidiaries

Statements of Changes in Equity

For the six-month period ended June 30, 2021 and 2020

(In thousands of Brazilian Reais, except dividends per share)

|

|

|

|

|

|

|

|

|

|

|

|

| Profit reserve |

|

|

|

|

|

|

|

|

| Equity attributable to: |

|

| ||||

| Note |

| Share capital |

| Equity instrument granted |

| Capital reserve |

| Treasury shares |

| Revaluation reserve on subsidiaries |

| Legal reserve |

| Investments statutory reserve |

| Valuation adjustments |

| Cumulative translation adjustments |

| Retained earnings |

| Additional dividends to the minimum mandatory dividends |

| Shareholders of the Company |

| Non-controlling interests in subsidiaries |

| Consolidated equity |

Balance as of December 31, 2019 |

|

| 5,171,752 |

| 11,970 |

| 542,400 |

| (485,383) |

| 4,522 |

| 705,341 |

| 3,290,073 |

| (146,317) |

| 102,427 |

| - |

| 261,470 |

| 9,458,255 |

| 376,920 |

| 9,835,175 |

Net income for the period |

|

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| 201,925 |

| - |

| 201,925 |

| 16,969 |

| 218,894 |

Other comprehensive income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair value adjustments of available for financial instruments, net of income taxes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company | 25.g.1 |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| 432 |

| - |

| - |

| - |

| 432 |

| - |

| 432 |

Subsidiaries and joint ventures | 12.a; 25.g.1 |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| (474,912) |

| - |

| - |

| - |

| (474,912) |

| - |

| (474,912) |

Currency translation of foreign subsidiaries, including the effect of net investments hedge | 25.g.2 |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| 136,122 |

| - |

| - |

| 136,122 |

| - |

| 136,122 |

Total comprehensive income for the period |

|

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| (474,480) |

| 136,122 |

| 201,925 |

| - |

| (136,433) |

| 16,969 |

| (119,464) |

Issuance of shares related to the subscription warrants - indemnification - Extrafarma acquisition | 25.d |

| - |

| - |

| 53,072 |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| 53,072 |

| - |

| 53,072 |

Equity instrument granted | 25.b |

| - |

| 2,189 |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| 2,189 |

| - |

| 2,189 |

Equity instrument granted of subsidiaries | 12.a; 25.b |

| - |

| 1,281 |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| 1,281 |

| - |

| 1,281 |

Income and social contribution taxes on realization of revaluation reserve of subsidiaries | 25.e |

| - |

| - |

| - |

| - |

| (93) |

| - |

| - |

| - |

| - |

| 93 |

| - |

| - |

| - |

| - |

Loss due to the payments fixed dividends to preferred shares |

|

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| (516) |

| - |

| (516) |

| 516 |

| - |

Shareholder transaction – changes of investments |

|

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| 41 |

| - |

| 41 |

| (41) |

| - |

Dividends attributable to non-controlling interests |

|

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| (2,790) |

| (2,790) |

Approval of additional dividends by the Shareholders’ Meeting | 25.h |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| (261,470) |

| (261,470) |

| - |

| (261,470) |

Balance as of June 30, 2020 |

|

| 5,171,752 |

| 15,440 |

| 595,472 |

| (485,383) |

| 4,429 |

| 705,341 |

| 3,290,073 |

| (620,797) |

| 238,549 |

| 201,543 |

| - |

| 9,116,419 |

| 391,574 |

| 9,507,993 |

The accompanying notes are an integral part of the interim financial information.

Ultrapar Participações S.A. and Subsidiaries

For the six-month period ended June 30, 2021 and 2020

(In thousands of Brazilian Reais)

|

| Parent |

| Consolidated | ||||

| Note | 06/30/2021 |

| 06/30/2020 |

| 06/30/2021 |

| 06/30/2020 |

Cash flows from operating activities |

|

|

|

|

|

|

|

|

Profit for the period |

| 101,083 |

| 201,925 |

| 119,187 |

| 218,894 |

Adjustments to reconcile net income to cash provided by operating activities |

|

|

|

|

|

|

|

|

Share of loss (profit) of subsidiaries, joint ventures and associates | 12 | (122,334) |

| (218,142) |

| 10,941 |

| 25,698 |

Amortization of contractual assets with customers – exclusive rights | 11 | - |

| - |

| 128,879 |

| 150,854 |

Amortization of right-of-use assets | 13.a | 2,984 |

| 1,854 |

| 175,346 |

| 158,628 |

Depreciation and amortization | 14; 15 | 3,030 |

| 971 |

| 493,054 |

| 458,512 |

PIS and COFINS credits on depreciation | 14; 15 | - |

| - |

| 8,805 |

| 8,794 |

Interest and foreign exchange rate variations |

| 8,778 |

| 36,030 |

| 613,578 |

| 614,526 |

Deferred income and social contribution taxes | 9.b | 2,635 |

| (3,261) |

| (173,900) |

| (26,314) |

Current income and social contribution taxes | 9.b | - |

| 170 |

| 329,775 |

| 219,632 |

Loss on disposal of property, plant, and equipment and intangibles | 28 | (2) |

| - |

| (40,148) |

| (20,910) |

Impairment | 3.c.1; 28 | - |

| - |

| 394,675 |

| - |

Expected losses on doubtful accounts | 5 | - |

| - |

| (6,340) |

| 56,516 |

Provision for losses in inventories | 6 | - |

| - |

| (3,371) |

| (1,800) |

Provision for post-employment benefits | 20.b | 198 |

| 913 |

| 2,626 |

| (2,896) |

Equity instrument granted | 8.c | 2,965 |

| 2,191 |

| 7,550 |

| 3,471 |

Provision of decarbonization – CBIO | 29 | - |

| - |

| 64,920 |

| - |

Provision for tax, civil, and labor risks | 22.a | - |

| (119) |

| (71,543) |

| (6,420) |

Other provisions and adjustments |

| 1,371 |

| (219) |

| 5,312 |

| (2,214) |

|

| 708 |

| 22,313 |

| 2,059,346 |

| 1,854,971 |

(Increase) decrease in current assets |

|

|

|

|

|

|

|

|

Trade receivables and reseller financing | 5 | - |

| (200) |

| (480,955) |

| 517,590 |

Inventories | 6 | - |

| - |

| (1,035,716) |

| 752,595 |

Recoverable taxes | 7 | 5,458 |

| (3,700) |

| (187,259) |

| (268,978) |

Dividends received from subsidiaries and joint ventures |

| 479,726 |

| 219,442 |

| 124 |

| 4,718 |

Other receivables |

| (26,625) |

| (21,543) |

| (57,948) |

| (49,815) |

Prepaid expenses | 10 | (6,531) |

| (2,783) |

| (55,598) |

| (74,316) |

Increase (decrease) in current liabilities |

|

|

|

|

|

|

|

|

Trade payables | 17 | 9,065 |

| 3,755 |

| 1,293,640 |

| (218,037) |

Salaries and related charges | 18 | (9,872) |

| 28,196 |

| (34,413) |

| 33,433 |

Taxes payable | 19 | (70) |

| 557 |

| 2,762 |

| (39,041) |

Post-employment benefits | 20.b | - |

| - |

| 96 |

| 777 |

Other payables |

| 4,583 |

| 1,686 |

| (8,199) |

| 20,082 |

Deferred revenue | 23 | - |

| - |

| (16,505) |

| (1,243) |

(Increase) decrease in non-current assets |

|

|

|

|

|

|

|

|

Trade receivables and reseller financing | 5 | - |

| - |

| (9,365) |

| (52,271) |

Recoverable taxes | 7 | 2 |

| - |

| (79,433) |

| (276,826) |

Escrow deposits |

| - |

| 15 |

| 87,127 |

| (28,302) |

Other receivables |

| - |

| - |

| 78,602 |

| 184 |

Prepaid expenses | 10 | 1,086 |

| (1,732) |

| 10,439 |

| (14,578) |

The accompanying notes are an integral part of the interim financial information.

Ultrapar Participações S.A. and Subsidiaries

Statements of Cash Flows – Indirect Method

For the six-month period ended June 30, 2021 and 2020

(In thousands of Brazilian Reais)

|

| Parent |

| Consolidated | ||||

|

| 06/30/2021 |

| 06/30/2020 |

| 06/30/2021 |

| 06/30/2020 |

Increase (decrease) in non-current liabilities |

|

|

|

|

|

|

|

|

Post-employment benefits | 20.b | - |

| 5,602 |

| (321) |

| 6,044 |

Other payables |

| 732 |

| 4,415 |

| (13,318) |

| (40,167) |

Acquisition of CBIO | 15 | - |

| - |

| (59,019) |

| - |

Payments of contractual assets with customers – exclusive rights | 11 | - |

| - |

| (83,632) |

| (236,579) |

Payments of contingencies | 22.a | - |

| - |

| (15,700) |

| (29,351) |

Income and social contribution taxes paid |

| - |

| - |

| (116,683) |

| (58,139) |

Net cash provided by operating activities |

| 458,262 |

| 256,023 |

| 1,278,072 |

| 1,802,751 |

Cash flows from investing activities |

|

|

|

|

|

|

|

|

Financial investments, net of redemptions | 4.b | (116,065) |

| 42,728 |

| 1,638,130 |

| 312,119 |

Acquisition of property, plant, and equipment | 14 | (11,741) |

| (5,595) |

| (571,714) |

| (354,487) |

Acquisition of intangible assets | 15 | (64) |

| (10,023) |

| (96,850) |

| (78,607) |

Capital increase in subsidiary | 12.a | (75,011) |

| (3,559) |

| - |

| - |

Capital increase in joint ventures | 12.b | - |

| - |

| (22,000) |

| (10,000) |

Related parties | 8.a | 350,669 |

| - |

| (19,405) |

| - |

Proceeds from disposal of property, plant, and equipment and intangibles | 28 | - |

| - |

| 71,931 |

| 49,447 |

Net cash provided by (used in) investing activities |

| 147,788 |

| 23,551 |

| 1,000,092 |

| (81,528) |

Cash flows from financing activities |

|

|

|

|

|

|

|

|

Loans and debentures |

|

|

|

|

|

|

|

|

Proceeds | 16 | - |

| 994,996 |

| 493,594 |

| 1,611,155 |

Repayments | 16 | (1,000,000) |

| - |

| (1,518,163) |

| (984,871) |

Interest paid | 16 | (69,923) |

| (43,083) |

| (352,645) |

| (336,187) |

Payments of lease |

|

|

|

|

|

|

|

|

Principal | 13 | (4,030) |

| (2,229) |

| (211,406) |

| (167,045) |

Interest paid | 13 | (101) |

| (92) |

| (6,653) |

| (5,228) |

Dividends paid | 25.h | (477,408) |

| (260,004) |

| (488,600) |

| (263,059) |

Related parties | 8.a | 468 |

| 3,690 |

| (129) |

| (48) |

Net cash provided by (used in) in financing activities |

| (1,550,994) |

| 693,278 |

| (2,084,002) |

| (145,283) |

Effect of exchange rate changes on cash and cash equivalents in foreign currency |

| - |

| - |

| 4,631 |

| 113,872 |

Increase (decrease) in cash and cash equivalents |

| (944,944) |

| 972,852 |

| 198,793 |

| 1,689,812 |

Cash and cash equivalents at the beginning of the year | 4.a | 948,649 |

| 42,580 |

| 2,661,494 |

| 2,115,379 |

Cash and cash equivalents at the end of the year | 4.a | 3,705 |

| 1,015,432 |

| 2,860,287 |

| 3,805,191 |

Transactions without cash effect: |

|

|

|

|

|

|

|

|

Addition on right-of-use assets and leases payable | 13.a | 2,486 |

| 32,719 |

| 133,813 |

| 293,685 |

Addition on contractual assets with customers – exclusive rights | 11 | - |

| - |

| 158,306 |

| 56,260 |

Reversion fund – private pension | 10; 20.a | - |

| - |

| 3,706 |

| 47,088 |

Issuance of shares related to the subscription warrants – indemnification – Extrafarma acquisition | 25.d | 1,371 |

| 53,072 |

| 1,371 |

| 53,072 |

The accompanying notes are an integral part of the interim financial information.

Ultrapar Participações S.A. and Subsidiaries

For the six-month period ended June 30, 2021 and 2020

(In thousands of Brazilian Reais, except percentages)

|

| Parent |

| Consolidated | ||||||||||||

| Note | 06/30/2021 |

| % |

| 06/30/2020 |

| % |

| 06/30/2021 |

| % |

| 06/30/2020 |

| % |

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross revenue from sales and services, except rents and royalties | 26 | - |

|

|

| - |

|

|

| 55,395,887 |

|

|

| 40,044,517 |

|

|

Rebates, discounts, and returns | 26 | - |

|

|

| - |

|

|

| (675,209) |

|

|

| (753,010) |

|

|

Expected reversion (losses) on doubtful accounts | 5 | - |

|

|

| - |

|

|

| 6,340 |

|

|

| (56,516) |

|

|

Amortization of contractual assets with customers – exclusive rights | 11 | - |

|

|

| - |

|

|

| (128,879) |

|

|

| (150,854) |

|

|

Provision for loss on disposal of property, plant, and equipment and intangibles and other operating income, net | 28; 29 | - |

|

|

| - |

|

|

| 106,052 |

|

|

| 64,759 |

|

|

|

| - |

|

|

| - |

|

|

| 54,704,191 |

|

|

| 39,148,896 |

|

|

Materials purchased from third parties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Raw materials used |

| - |

|

|

| - |

|

|

| (3,527,831) |

|

|

| (2,731,931) |

|

|

Cost of goods, products, and services sold |

| - |

|

|

| - |

|

|

| (46,093,574) |

|

|

| (32,142,487) |

|

|

Third-party materials, energy, services, and others |

| 73,804 |

|

|

| 79,685 |

|

|

| (1,445,601) |

|

|

| (1,157,296) |

|

|

Impairment | 3.c.1; 28 | - |

|

|

| - |

|

|

| (394,675) |

|

|

| - |

|

|

Provision for losses of assets |

| - |

|

|

| - |

|

|

| (20,173) |

|

|

| (19,808) |

|

|

|

| 73,804 |

|

|

| 79,685 |

|

|

| (51,481,854) |

|

|

| (36,051,522) |

|

|

Gross value added |

| 73,804 |

|

|

| 79,685 |

|

|

| 3,222,337 |

|

|

| 3,097,374 |

|

|

Deductions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization | 13.a; 14; 15 | (6,014) |

|

|

| (2,825) |

|

|

| (668,400) |

|

|

| (617,140) |

|

|

PIS and COFINS credits on depreciation | 14; 15 | - |

|

|

| - |

|

|

| (8,805) |

|

|

| (8,794) |

|

|

|

| (6,014) |

|

|

| (2,825) |

|

|

| (677,205) |

|

|

| (625,934) |

|

|

Net value added by the Company |

| 67,790 |

|

|

| 76,860 |

|

|

| 2,545,132 |

|

|

| 2,471,440 |

|

|

Value added received in transfer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share of profit (loss) of subsidiaries, joint ventures, and associates | 12 | 122,334 |

|

|

| 218,142 |

|

|

| (10,941) |

|

|

| (25,698) |

|

|

Rents and royalties | 26 | - |

|

|

| - |

|

|

| 57,137 |

|

|

| 57,226 |

|

|

Financial income | 30 | 34,558 |

|

|

| 31,769 |

|

|

| 212,146 |

|

|

| 235,164 |

|

|

|

| 156,892 |

|

|

| 249,911 |

|

|

| 258,342 |

|

|

| 266,692 |

|

|

Total value added available for distribution |

| 224,682 |

|

|

| 326,771 |

|

|

| 2,803,474 |

|

|

| 2,738,132 |

|

|

Distribution of value added |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Labor and benefits |

| 65,984 |

| 29 |

| 61,447 |

| 19 |

| 1,032,861 |

| 37 |

| 932,672 |

| 34 |

Taxes, fees, and contributions |

| 14,968 |

| 7 |

| 7,826 |

| 2 |

| 1,206,638 |

| 43 |

| 1,184,221 |

| 43 |

Financial expenses and rents |

| 42,647 |

| 19 |

| 55,573 |

| 17 |

| 444,788 |

| 16 |

| 402,345 |

| 15 |

Retained earnings |

| 101,083 |

| 45 |

| 201,925 |

| 62 |

| 119,187 |

| 4 |

| 218,894 |

| 8 |

Value added distributed |

| 224,682 |

| 100 |

| 326,771 |

| 100 |

| 2,803,474 |

| 100 |

| 2,738,132 |

| 100 |

The accompanying notes are an integral part of the interim financial information.

Ultrapar Participações S.A. and Subsidiaries

Notes to the Parent’s Separate and Consolidated Interim Financial Information

(In thousands of Brazilian Reais, unless otherwise stated)

Ultrapar Participações S.A. (“Ultrapar” or “Company”) is a publicly-traded company headquartered at the Brigadeiro Luis Antônio Avenue, 1343 in the city of São Paulo – SP, Brazil, listed on B3 S.A. – Brasil, Bolsa, Balcão (“B3”), in the Novo Mercado listing segment under the ticker “UGPA3” and on the New York Stock Exchange (“NYSE”) in the form of level III American Depositary Receipts (“ADRs”) under the ticker “UGP”.

The Company engages in the investment of its own capital in services, commercial, and industrial activities, through the subscription or acquisition of shares of other companies. Through its subsidiaries, it operates in the segments of liquefied petroleum gas – LPG distribution (“Ultragaz”), fuel distribution and related businesses (“Ipiranga”), production and marketing of chemicals (“Oxiteno”), and storage services for liquid bulk (“Ultracargo”), retail distribution of pharmaceutical, hygiene, beauty, and skincare products (“Extrafarma”) and digital payments segment (“Abastece aí”). The information about segments are disclosed in Note 32.

a. Clarifications on the impacts of COVID-19

The World Health Organization (“WHO”) declared a coronavirus pandemic (COVID-19) on March 11, 2020. To contain a spread of the virus in Brazil, the Ministry of Health (“MH”) and the state and municipal governments announced several actions to reduce the agglomeration and movement of people, including the closing of commerce, parks and common areas. In this context, the Company created a Crisis Committee to keep up with it and monitor the main risks and adopt preventive and emergency measures to reduce the pandemic effects.

Since the beginning of the coronavirus pandemic, the Company and its subsidiaries acted in numerous initiatives to ensure the safety and security of its employees and the stability and continuity of its operations and partners, the financial solidity of the Company. All the activities of the companies controlled by the Company are classified as essential in the context of the measures adopted to face the pandemic.

The Company and its subsidiaries quickly adopted the work at home (expressed by home office) for the administrative public, with all the necessary support for the operational continuity. In addition to basic safety concerns with employees, companies implemented several initiatives aimed at welfare, such as virtual meetings, psychological support and concern for ergonomics, following the principle of valuing people.

The emergency measures and speed in answer to the first effects of the crisis, as well as initiatives to support the supply chain, were effective to keep the activities of the subsidiaries in operation, ensuring the delivery of essential services to the population and preserving the health and security of employees and partners.

Uncertainty remains uncertain to what extent the financial information, after June 30, 2021, may be affected by the commercial, operational and financial impacts of the pandemic, because it will depend on its duration and the impacts on economic activities, as well as government, business in response to the crisis. In this context, some financial risk assessments, projections and impairment tests, in connection with the preparation of these financial statements, may be impacted by the pandemic, and may adversely affect the financial position of the Company and its subsidiaries.

Ultrapar Participações S.A. and Subsidiaries

Notes to the Parent’s Separate and Consolidated Interim Financial Information

(In thousands of Brazilian Reais, unless otherwise stated)

Operational impacts

The implemented measures of social isolation, restrictions on the movement of people and the operation of certain businesses due to COVID-19 pandemic continued to impact economic activity in Brazil in this second quarter of 2021. With respect the operations of the Company and its subsidiaries, the main effects were felt by Ipiranga, due to the impact on the Otto Cycle volume as result of mobility restrictions, and at Extrafarma as reflection of the lower flow of people in the mall stores.

Main risks and associated measures

Credit risk - The actions taken by the Company and its subsidiaries throughout 2020 softened the impacts of the pandemic on Ipiranga’s clients' financial condition and, consequently, mitigated its potential effects on Ipiranga's default rates, that remained at the same levels as 2020. The effects of expected losses on doubtful accounts of quarter ended June 30, 2021 are disclosed in Notes 5 and 33.d.

Risk of realization of deferred tax assets - the Company and its subsidiaries realized technical feasibility study of the constitution and realization of deferred tax credits, considering the current projections approved by the Board of Directors for each business segment and did not identify the need for write-offs for the period ended on June 30, 2021.

Risks in financial instruments - the increase in volatility in financial markets may impact financial results according to sensitivity analyzes presented in Note 33.

Liquidity risk – The Company and its subsidiaries presented variations in their net debt position compatible with the results and the seasonality of their businesses.

The management of the Company and its subsidiaries continue maintaining discipline in control of costs and expenses to preserve cash in all business and selectivity in the allocation of capital without compromising sustainable business growth.

b. Clarifications on the cyber incident

According communication sent to the market on January 12, 2021 and January 25, 2021, the Company suffered on January 11, 2021 a cyber incident of type ransomware in its information technology environment.

As a precautionary measure, the Company interrupted its systems, affecting for a short period of time, the operations of its subsidiaries. Immediately, all security and control measures were adopted to remedy the situation and as of January 14, 2021 the operational systems of the Company and its subsidiaries began to be gradually restored, with caution and security, according with the priority and relevance of each affected process. Since January 25, 2021, as communicated to the market on that date, all the critical information systems of the Company and its subsidiaries are in full operation.

The Company has a specific insurance policy for cyber incidents (see Note 34.b), which has already been duly activated.

Ultrapar Participações S.A. and Subsidiaries

Notes to the Parent’s Separate and Consolidated Interim Financial Information

(In thousands of Brazilian Reais, unless otherwise stated)

The parent’s separate and consolidated interim financial information (“interim financial information”) were prepared in accordance with the International Accounting Standard (“IAS”) 34 – Interim Financial Reporting issued by the International Accounting Standards Board (“IASB”) and the in accordance with the pronouncement CPC 21 (R1) issued by the Accounting Pronouncements Committee (“CPC”) and approved by the Brazilian Securities and Exchange Commission (“CVM”).

All relevant specific information of the interim financial information, and only this information, were presented and correspond to that used by the Company’s and its subsidiaries’ Management.

The presentation currency of the Company’s interim financial information is the Brazilian Real, which is the Company’s functional currency.

The Company and its subsidiaries applied the accounting policies described below in a consistent manner for all years presented in these interim financial information.

a. Recognition of revenue

Revenue of sales and services rendered is measured at the value of the consideration that the Company's subsidiaries expect to be entitled to, net of sales returns, discounts, amortization of contractual assets with customers and other deductions, if applicable, being recognized as the entity fulfills its performance obligation and freight mode of delivery. At Ipiranga, the revenue from sales of fuels and lubricants is recognized when the products are delivered to gas stations and to large consumers. At Ultragaz, revenue from sales of LPG is recognized when the products are delivered to customers at home, to independent dealers and to industrial and commercial customers. At Extrafarma, the revenue from sales of pharmaceuticals is recognized when the products are delivered to end user customers in own drugstores and when the products are delivered to independent resellers. At Oxiteno, the revenue from sales of chemical products is recognized when the products are delivered to industrial customers. At Ultracargo, the revenue provided from storage services is recognized as services are performed. At Abastece aí, the revenue provided from storage services of digital payments is recognized as services are performed. The breakdowns of revenues from sales and services are shown in Notes 26 and 32.

Amortization of contractual assets with customers for the exclusive rights in Ipiranga’s reseller service stations and the bonuses paid in performance obligation sales are recognized in the income statement as a deduction of the revenue from sale according to the conditions established in the agreements which is reviewed as per the changes occurred in the agreements (see Notes 2.f and 11).

The am/pm franchising upfront fee is deferred and recognized in profit or loss as the entity fulfills each performance obligation throughout the terms of the agreements with the franchisees. For more information, see Note 23.a.

Deferred revenue from loyalty program is recognized in the income statement when the points are redeemed, on which occasion the costs incurred are also recognized in profit or loss. Deferred revenue of unredeemed points is also recognized in profit or loss when points expire. For more information, see Note 23.b.

Ultrapar Participações S.A. and Subsidiaries

Notes to the Parent’s Separate and Consolidated Interim Financial Information

(In thousands of Brazilian Reais, unless otherwise stated)

Costs of products sold and services provided include goods (mainly fuels, lubricants, LPG, and pharmaceutical products), raw materials (chemicals and petrochemicals) and production, distribution, storage, and fulfillment costs.

Exchange variations and the results of derivative finance instruments are presented in the statement of profit and loss on financial expenses.

Research and development expenses are recognized in the statements of profit or loss in general and administrative expenses and amounted to R$ 33,382 for the six-month period ended June 30, 2021 (R$ 28,773 for the six-month period ended June 30, 2020).

b. Cash and cash equivalents

Includes cash, banks deposits, and short-term up to 90 days of maturity, highly liquid investments that are readily convertible into a known amount of cash and are subject to an insignificant risk of change in value. For further information on cash and cash equivalents of the Company and its subsidiaries, see Note 4.a.

c. Financial assets

The Company and its subsidiaries evaluated the classification and measurement of financial assets based on its business model of financial assets as follows:

Ultrapar Participações S.A. and Subsidiaries

Notes to the Parent’s Separate and Consolidated Interim Financial Information

(In thousands of Brazilian Reais, unless otherwise stated)

The Company and its subsidiaries use financial instruments for hedging purposes, applying the concepts described below:

For further information on financial instruments, see Note 33.

Ultrapar Participações S.A. and Subsidiaries

Notes to the Parent’s Separate and Consolidated Interim Financial Information

(In thousands of Brazilian Reais, unless otherwise stated)

d. Trade receivables and reseller financing

Trade receivables are recognized at the amount invoiced to the counterparty that the Company subsidiaries are entitled (see Notes 5.a and 33.d.3). The expected losses on doubtful accounts consider the expected losses for the next 12 months take into account the deterioration or improvement of the customers’ credit quality, considering the customers’ characteristics in each business segment. The amount of the expected credit losses is deemed by management to be sufficient to cover any loss on realization of trade receivables.

Reseller financing is provided at subsidized rate for renovation and upgrading of service stations, purchase of products and development of the automotive fuels and lubricants distribution market (see Notes 5.b and 33.d.3). The terms of reseller financing range between 12 and 60 months, with an average term of 40 months. The minimum and maximum subsisted interest rates are 0% per month and 1% per month respectively. These financing are remeasured at a market rate for working capital loans and the remeasurement adjustment between the market rate and the rate subsidized is recognized as a reduction to the reseller’s revenue at the beginning of the contract. Throughout the contract, the interest appropriated by the market rate is recognized to the financial result.

e. Inventories

Inventories are stated at the lower of acquisition cost or net realizable value (see Note 6). The cost value of inventory is measured using the weighted average cost and includes the costs of acquisition and processing directly and indirectly related to the units produced based on the normal capacity of production. Estimates of net realizable value are based on the average selling prices at the end of the reporting period, net of applicable direct selling expenses. Subsequent events related to the fluctuation of prices and costs are also considered, if relevant. If net realizable values are below inventory costs, a provision corresponding to this difference is recognized. Provisions are also made for obsolescence of products, materials, or supplies that (i) do not meet its subsidiaries’ specifications, (ii) have exceeded their expiration date, or (iii) are considered slow-moving inventory. This classification is made by management with the support of its industrial and operations teams.

f. Contractual assets with customers – exclusive rights

Exclusive rights disbursements as provided in Ipiranga’s agreements with reseller service stations and major consumers are recognized as contractual assets when paid and amortized according to the conditions established in the agreements (see Note 2.a and 11).

Ultrapar Participações S.A. and Subsidiaries

Notes to the Parent’s Separate and Consolidated Interim Financial Information

(In thousands of Brazilian Reais, unless otherwise stated)

g. Investments

Investments in subsidiaries are accounted for under the equity method of accounting in the interim financial information of the parent’s separate company (see Notes 3.b and 12.a). A subsidiary is an investee in which the investor is entitled to variable returns on investment and has the ability to interfere in its financial and operational activities. Usually the equity interest in a subsidiary is more than 50%.

Investments in associates and joint ventures are accounted for under the equity method of accounting in the interim financial information (see Note 12 items b and c). An associate is an investment, in which an investor has significant influence, that is, has the power to participate in the financial and operating decisions of the investee but does not exercise control. A joint venture is an investment in which the shareholders have the right to net assets on behalf of a joint control. Joint control is the agreement, which establish that decisions about the relevant activities of the investee require the consent from the parties that share control.

Other investments are stated at acquisition cost less provision for losses, unless the loss is considered temporary.

h. Right-of-use assets and leases payable

The Company and its subsidiaries recognized in the financial position, a right-of-use assets and the respective lease liabilities initially measured at the present value of future lease payments, considering the related contract costs (see Note 13). The amortization expenses of right-of-use assets is recognized in statement of profit or loss over the lease contract term. When the right-of-use asset is used in the construction of the property, plant, and equipment (“PP&E”), its amortization is capitalized until the asset under construction is completed. The liability is increased for interest and decreased by lease payments made. The interests are recognized in the statement of profit or loss using the effective interest rate method. The remeasurement of assets and liabilities based on the contractual index is recognized in the financial position, not having an effect in the result. In case of cancellation of the contract, the assets and respective liabilities are written off to the result, considering, if it is the case, any penalties provided in contractual clauses. The Company and its subsidiaries have no intention in purchasing the underlying asset. The Company and its subsidiaries periodically review the existence of an indication that the right-of-use assets may be impaired (see Note 2.u).

Right-of-use assets include amounts related to area port leases grants (see Note 34.c).

The Company and its subsidiaries apply the recognition exemptions to short-term leases of 12 months or less and lease contracts of low amount assets. In these cases, the recognition of the lease expense in the statements of profit or loss is on a straight-line basis.

Ultrapar Participações S.A. and Subsidiaries

Notes to the Parent’s Separate and Consolidated Interim Financial Information

(In thousands of Brazilian Reais, unless otherwise stated)

i. Property, plant, and equipment

PP&E is recognized at acquisition or construction cost, including capitalization of right-of-use assets amortization and financial charges incurred on PP&E under construction, as well as qualifying maintenance costs resulting from scheduled plant outages and estimated costs to remove, to decommission, or to restore assets (see Notes 2.n and 21), less accumulated depreciation and, when applicable, less provision for losses (see Note 14).

Depreciation is calculated using the straight-line method, over the periods mentioned in Note 14, taking into account the estimated useful lives of the assets, which are reviewed annually.

Leases hold improvements are depreciated over the shorter of the lease contract term and useful life of the property.

j. Intangible assets

Intangible assets include assets acquired by the Company and its subsidiaries from third parties, and are recognized according to the criteria below:

The Company and its subsidiaries have not recognized intangible assets that were generated internally. The Company and its subsidiaries have goodwill and brands acquired in business combinations, which are evaluated as intangible assets with indefinite useful life (see Note 15 items a and e).

k. Other assets

Other assets are stated at the lower of cost and realizable value, including, if applicable, interest earned, monetary changes and changes in exchange rates incurred, less the provisions for losses and, if applicable, adjusted to present value.

Ultrapar Participações S.A. and Subsidiaries

Notes to the Parent’s Separate and Consolidated Interim Financial Information

(In thousands of Brazilian Reais, unless otherwise stated)

l. Financial liabilities

The financial liabilities include trade payables, other payables, financing, loans, debentures, leases payable and derivative financial instruments. Financial liabilities are classified as “financial liabilities at fair value through profit or loss” or “financial liabilities at amortized cost”. The financial liabilities at fair value through profit or loss refer to derivative financial instruments, subscription warrants - indemnification, and financial liabilities designated as hedged items in a fair value hedge relationship upon initial recognition (see Note 2.c – Fair Value Hedge). The financial liabilities at amortized cost are stated at the initial transaction amount plus related charges and net of amortization and transaction costs. The charges are recognized in the statement of profit or loss using the effective interest rate method.

Transaction costs incurred and directly attributable to the activities necessary for contracting loans or for issuing bonds, as well as premiums and discounts upon issuance of debentures and other debt, are allocated to the instrument and amortized in the statement of profit or loss taking into its term, using the effective interest rate method (see Note 16.h).

m. Income and social contribution taxes on income

Current and deferred income tax (“IRPJ”) and social contribution on net income tax (“CSLL”) are calculated based on their current rates. For the calculation of current IRPJ, the value of tax incentives is also considered. At the end of the fiscal year the portion of the profit corresponding to these investment grants is allocated to the constitution of a tax incentive reserve in subsidiaries shareholders' equity, and is excluded from the dividend calculation base and subsequently capitalized. Taxes are recognized based on the rates of IRPJ and CSLL provided for by the laws enacted on the last day of the interim financial information. The current rates in Brazil are 25% for IRPJ and 9% for CSLL. For further information about recognition and realization of IRPJ and CSLL see Note 9.

For purposes of disclosure deferred tax assets were offset against the deferred tax liability IRPJ and CSLL, in the same taxable entity and the same tax authority.

n. Provision for asset retirement obligation – fuel tanks

The subsidiary Ipiranga has the legal obligation to remove the underground fuel tanks located at Ipiranga-branded service stations after a certain period. The estimated cost of the obligation to remove these fuel tanks is recognized as a liability when the tanks are installed. The estimated cost is recognized in PP&E and depreciated over the respective useful lives of the asset. The amounts recognized as a liability accrue inflation effect using the Amplified Consumer Price Index (“IPCA”) until the tank is removed (see Note 21). The estimated removal cost is reviewed and updated annually or when there is significant change in its amount and change in the estimated costs are recognized in statements of profit or loss when they become known.

o. Provisions for tax, civil, and labor risks

A provision for tax, civil and labor risks is recognized for quantifiable risks, when the chance of loss is more-likely-than-not in the opinion of management and internal and external legal counsel, and the amounts are recognized based on the evaluation of the outcomes of the legal proceedings (see Note 22).

Ultrapar Participações S.A. and Subsidiaries

Notes to the Parent’s Separate and Consolidated Interim Financial Information

(In thousands of Brazilian Reais, unless otherwise stated)

p. Post-employment benefits

Post-employment benefits granted and to be granted to employees, retirees, and pensioners are based on an actuarial calculation prepared by an independent actuary and reviewed by management, using the projected unit credit method (see Note 20.b). The actuarial gains and losses are recognized in equity in cumulative other comprehensive income in the “Valuation adjustments”.

q. Other liabilities

Other liabilities are stated at known or measurable amounts and changes in exchange rates incurred. When applicable, other liabilities are recognized at present value, based on interest rates that reflect the term, currency, and risk of each transaction.

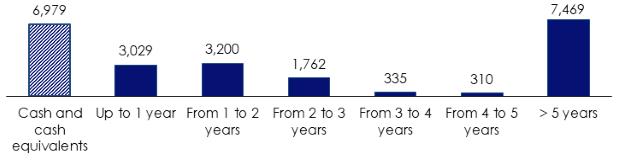

r. Foreign currency transactions