Not applicable.

Not applicable.

A. [Reserved]

B. Capitalization and indebtedness

Not applicable.

C. Reasons for the offer and use of proceeds

Not applicable.

D. Risk factors

Investing in our shares and ADSs involves a high degree of risk. Potential investors should carefully consider the risks described below and the other information contained in this annual report when evaluating an investment in our shares or ADSs. Our businesses, results of operations, cash flow, liquidity and financial condition could be materially harmed if any of these risks materializes and, as a result, the trading price of the shares or the ADSs could decline and investors could lose a substantial part or even all their investment.

We have included information in these risk factors concerning Brazil based on information that is publicly available. Other risks that we do not presently know about or deem as immaterial could also cause adverse effects on our businesses, operations, financial condition and results of operations.

Summary of risk factors

Risks relating to Ultrapar and its industries

- Petrobras is the main supplier of LPG and oil-based fuels in Brazil. Fuel and LPG distributors in Brazil, including Ipiranga and Ultragaz, have formal contracts with Petrobras for the supply of oil-derivatives. Any material delay or interruption in the supply of LPG or oil-based fuels from Petrobras would immediately affect Ultragaz’s or Ipiranga’s ability to provide LPG and oil-based fuels to their customers. In addition, Petrobras’ current pricing policy may have an adverse effect in our businesses;

- Intense competition is generally inherent to distribution markets, including the LPG and the fuel distribution markets, and may affect our operating margins. LPG and oil-based fuels also compete with alternative sources of energy, and are expected to compete with alternative sources of energy that may be developed in the future, which may adversely affect the markets in which we operate;

- Anticompetitive practices in the fuel distribution sector may distort market prices;

- Our businesses would be materially adversely affected if operations at our transportation and distribution facilities experienced significant events outside of our control;

- We may be adversely affected by changes to specific laws and regulations in our operating sectors;

- Any change in our senior management and any difficulty in retaining, attracting and replacing qualified personnel could affect our ability to grow and could have an adverse effect on our activities, financial condition and results of operations;

- Our level of indebtedness may require us to use a significant portion of our cash flow to service such indebtedness;

- Higher LPG, fuels and other raw material costs could increase cost of products sold and decrease gross margin, adversely affecting our total operating result. Our exposure to cost volatility and other events related to these products could have a material adverse effect on our businesses, financial condition, and results of operations;

- Our businesses may be materially and adversely affected by the outbreak of communicable diseases, other epidemics or pandemics;

- We are subject to extensive federal and state legislation and regulation by governmental agencies responsible for implementing environmental and health laws and policies in Brazil;

- Our businesses, financial condition and results of operations may be materially and adversely affected by a general economic downturn and by instability and volatility in the financial markets, including as a result of the conflict between Ukraine and Russia and the conflict involving Hamas and Israel;

- Our insurance coverage may be insufficient to cover losses that we might incur;

- The taxation system in Brazil may undergo significant changes, including as a result of the upcoming tax reform bill, potentially leading to material changes in taxation of our products and services that could adversely affect our results of operations and financial condition;

- The suspension, cancellation or non-renewal of certain tax benefits may adversely affect our results of operations;

- No single shareholder or group of shareholders holds more than 50% of our capital stock, which may increase the opportunity for alliances between shareholders and other events that may occur as a result thereof;

- As a result of acquisitions, Ultrapar has assumed and may assume in the future certain liabilities related to the businesses acquired or to be acquired. Additionally, Ultrapar has assumed and may assume certain risks associated with acquisitions and divestments, including regulatory risks;

- The founding family and part of our senior management, through their ownership interest in Ultra S.A. and Parth, own a significant portion of our shares and may influence the management, direction and policies of Ultrapar, including the outcome of any matter submitted to the vote of shareholders;

- Our status as a holding company may limit our ability to pay dividends on the shares and consequently, on the ADSs;

- Failure to comply with, obtain or renew the licenses and permits required for each of the sectors in which we operate may have a material adverse effect on us;

- Our governance and compliance processes may fail to prevent regulatory penalties and reputational harm;

- Information technology failures, including those that affect the privacy and security of personal data, as a result of cyber-attacks or other causes, could adversely affect our businesses and the market price of our shares and ADSs; and

- The production, storage and transportation of fuels, LPG, chemicals, corrosives and other liquid or gaseous bulk products are inherently hazardous.

Risks relating to Brazil

- The Brazilian government has exercised, and continues to exercise, significant influence over the Brazilian economy. Brazilian political and economic conditions, including ongoing political instability and perceptions of these conditions in the international markets, could adversely affect our businesses and the market price of our shares and ADSs;

- Inflation and certain governmental measures to curb inflation may contribute significantly to economic uncertainty in Brazil and could harm our businesses and the market value of the ADSs and our shares;

- Exchange rate instability may adversely affect our financial condition, results of operations and the market price of the ADSs and our shares;

- Economic and market conditions in other countries, including in the United States and emerging market countries, may materially and adversely affect the Brazilian economy and, therefore, our financial condition and the market price of the shares and ADSs;

- Holders of our ADSs may face difficulties in serving process on or enforcing judgments against us and other relevant persons;

- Due to concerns about the risks of climate change, a number of countries, including Brazil, have adopted or are considering adopting regulatory frameworks which could adversely affect our businesses, financial condition and results of operations;

- We may be adversely affected by the imposition and enforcement of more stringent environmental laws and regulations, including as a result of rising climate change concerns, that may result in increased costs of operation and compliance, as well as a decrease in demand for our products; and

- Floods, storms, windstorms, rise in sea levels and other climate change events could bring harm to our facilities, thus affecting our financial position and results of our operations.

Risks relating to our common shares and ADSs

- Asserting limited voting rights as a holder of ADSs may prove more difficult than for holders of our common shares;

- Holders of our shares or ADSs may not receive dividends;

- Holders of our shares may be unable to exercise preemptive rights with respect to the shares;

- If shareholders exchange ADSs for shares, they may lose certain foreign currency remittance and Brazilian tax advantages;

- Changes in Brazilian tax laws may have an adverse impact on the taxes applicable to a disposition of our ADSs;

- Substantial sales of our shares or our ADSs could cause the price of our shares or our ADSs to decrease; and

- There may be adverse U.S. federal income tax consequences to U.S. holders if we are or become a PFIC under the Code.

Risks relating to Ultrapar and its industries

Petrobras is the main supplier of LPG and oil-based fuels in Brazil. Fuel and LPG distributors in Brazil, including Ipiranga and Ultragaz, have formal contracts with Petrobras for the supply of oil-derivatives. Any material delay or interruption in the supply of LPG or oil-based fuels from Petrobras would immediately affect Ultragaz’s or Ipiranga’s ability to provide LPG and oil-based fuels to their customers. In addition, Petrobras’ current pricing policy may have an adverse effect in our businesses.

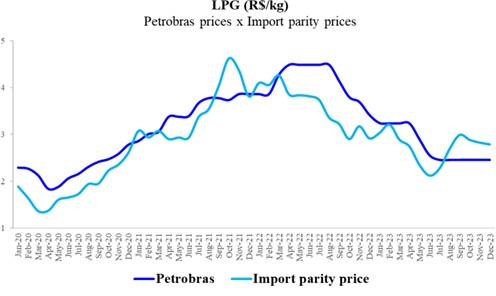

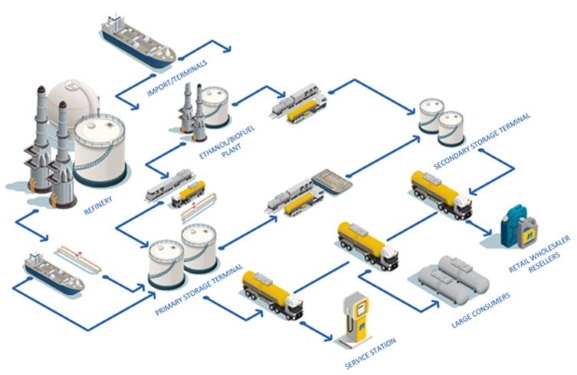

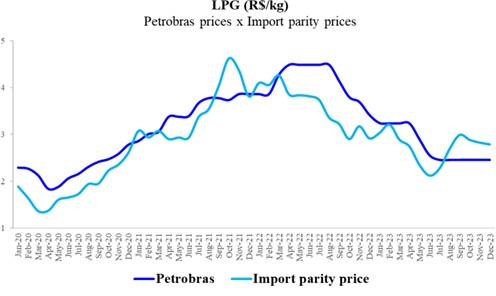

Prior to 1995, Petrobras held a constitutional monopoly for producing and importing petroleum products in Brazil. Although this constitutional monopoly was formally terminated pursuant to an amendment to the Brazilian constitution enacted in 1995, Petrobras effectively remains the main provider of LPG and oil-based fuels in Brazil. In 2023, 83% of all the LPG purchased by Ultragaz was supplied by Petrobras and 17% was supplied by other companies. With respect to fuel distribution, Petrobras also supplied the majority of Ipiranga and other distributors’ oil-based fuel requirements in 2023, supplying 76% of all diesel and 74% of all gasoline in the market, according to ANP data.

Significant interruptions or delays of LPG and oil-based fuel supply from Petrobras could occur in the future. Any interruption in the supply of LPG or oil-based fuels from Petrobras would immediately affect Ultragaz or Ipiranga’s respective ability to provide LPG or oil-based fuels to its customers, and material delays in the supply could also impact our operations.

Additionally, Petrobras announced in 2021 that it would cease to guarantee the supply of fuels to the Brazilian market and informed distributors that a portion of their fuel purchase orders would not be fully met. As a result, fuel distribution companies, including Ipiranga, have been required to purchase part of their fuels needs from other local refineries or in the international market.

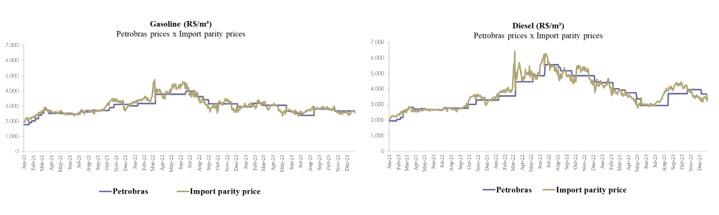

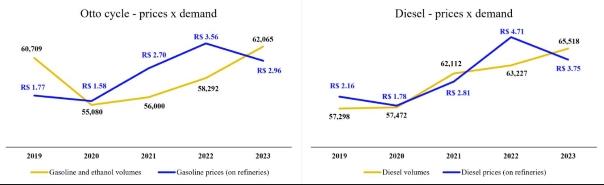

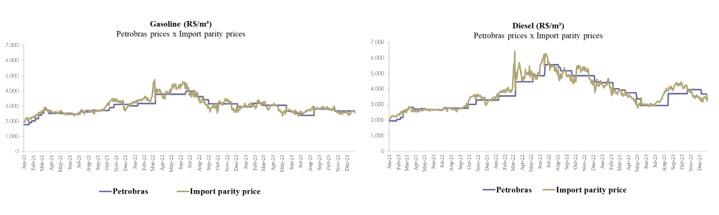

In May 2023, Petrobras announced a new commercial strategy for setting diesel and gasoline prices, thus replacing its pricing policy in which the import parity prices were the sole reference for selling fuels to distributors in the Brazilian market. The new pricing model not only considers the international market dynamics, but also takes into account national pricing references such as the customer alternative cost and the marginal value for Petrobras. If the prices at which these products are imported or bought from other companies are materially different from those charged by Petrobras, the fuel market supply dynamics could be materially affected, thus, our operating margins, market share, financial condition and results of our operations may be adversely affected. Moreover, if we are not able to obtain an adequate volume of LPG or oil-based fuels at competitive prices or pass on the increase in costs to our customers, our operating margins, market share, financial condition and results of our operations may be adversely affected.

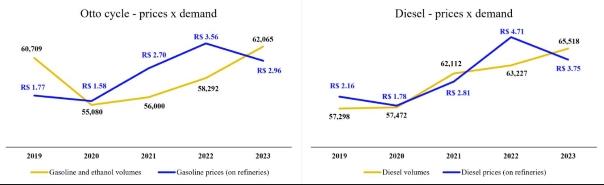

Intense competition is generally inherent to distribution markets, including the LPG and the fuel distribution markets, and may affect our operating margins. LPG and oil-based fuels also compete with alternative sources of energy, and are expected to compete with alternative sources of energy that may be developed in the future, which may adversely affect the markets in which we operate.

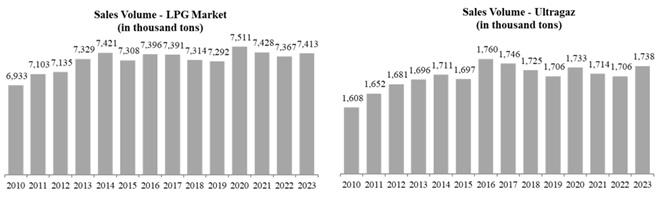

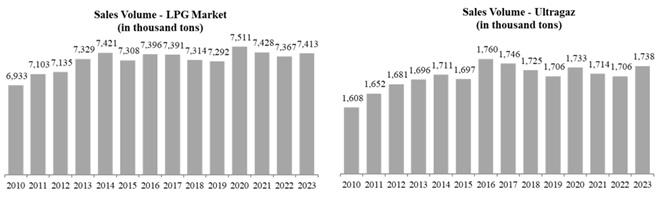

The Brazilian LPG market is very competitive in all segments — residential, commercial, and industrial. Intense competition in the LPG distribution market could lead to lower sales volumes, lower selling prices and increased marketing expenses, which may have a material adverse effect on our operating margins. See “Item 4.B. Information on the Company—Business overview——Industry and regulatory overview—A. Distribution of LPG—Ultragaz—Competition.”

LPG competes with alternative sources of energy, such as natural gas, wood, diesel, fuel oil and electricity. Natural gas is currently the main source of energy that we compete with, mainly for large industrial consumers. Changes in relative prices, investments in natural gas infrastructure grid or the development of alternative sources of energy in the future may adversely affect the LPG market and consequently our business, financial results, and results of operations.

The Brazilian fuel distribution market is highly competitive as well, in both retail and wholesale segments, with companies with significant resources participating in it. Furthermore, small, local and regional distributors have increased their market share in recent years. Intense competition in the fuel distribution market could lead to lower sales volumes, lower selling prices and increased marketing expenses, which may have a material adverse effect on our operating margins. See “Item 4.B. Information on the Company—Business overview—Industry and regulatory overview—C. Fuel distribution—Ipiranga—Competition.”

Moreover, oil-based fuels face competition from a variety of renewable alternatives, such as biofuels and electric vehicles. The share of renewable energy sources in the global energy matrix is steadily increasing and a growing number of countries, including Brazil, are discussing and adopting public policies to encourage the marketing of these fuels. We are unable to foresee the timing and pace or even which renewable sources of energy will be developed or adopted, and may not be able to timely adapt our business model or remain competitive with them, which could impact our financial condition and results of operations.

Anticompetitive practices in the fuel distribution sector may distort market prices.

In the recent past, anticompetitive practices have been one of the main problems affecting fuel distributors in Brazil, including Ipiranga. Generally, these practices have involved a combination of tax evasion and fuel adulteration, such as the dilution of gasoline by mixing solvents, adding anhydrous ethanol in an amount greater than that permitted by applicable law, or adding biodiesel in an amount smaller than that required by applicable law.

Taxes constitute a significant portion of the cost of fuels sold in Brazil. For this reason, tax evasion by some fuel distributors has been prevalent, allowing them to lower the prices they charge compared to large distributors, such as Ipiranga. As the final prices for the products sold by distributors, including Ipiranga, are calculated based on, among other factors, the amount of taxes levied on the purchase and sale of these fuels, anticompetitive practices such as tax evasion may reduce Ipiranga’s sales volume and could have a material adverse effect on our operating margins. Should there be any increase in the taxes levied on fuels, tax evasion may increase, resulting in a greater distortion of the prices of fuels sold and further adversely affecting our results of operations.

Furthermore, the fuel distribution sector has been under scrutiny by Brazilian authorities, including CADE and public prosecutors, as there have been allegations of cartels involving price arrangements and certain other antitrust practices within the sector. The outcome of these ongoing investigations and administrative and judicial proceedings may have an adverse impact on the Company’s businesses and results. For example, as of December 31, 2023, Ipiranga had two administrative proceedings filed by CADE, both of which were classified by outside legal counsel to have a remote risk of loss.

Our businesses would be materially adversely affected if operations at our transportation and distribution facilities experienced significant events outside of our control.

The distribution of LPG and fuels is subject to inherent risks, including interruptions or disturbances in the distribution system which may be caused by accidents or force majeure events. Our operations are dependent upon the uninterrupted operation of our terminals, storage and distribution facilities and various means of transportation. We are also dependent upon the uninterrupted operation of certain facilities owned or operated by our suppliers. Operations at our facilities and at the facilities owned or operated by our suppliers could be partially or completely shut down, temporarily or permanently, as the result of any number of circumstances that are not within our control, such as:

- Catastrophic events, including hurricanes and floods;

- Social and economic conflicts, terrorist events and wars, such as the ongoing conflict between Russia and Ukraine and the conflict involving Hamas and Israel;

- Epidemics and pandemics;

- Environmental matters (including environmental licensing processes or environmental incidents, contamination, and others);

- Labor difficulties (including work stoppages, strikes and other events); and

- Disruptions in our means of transportation, affecting the supply of our products.

Any significant interruption at these facilities or inability to transport products to or from these facilities or to our customers for any reason could subject us to liability in judicial, administrative, or other proceedings, including for disruptions caused by events outside of our control, which could materially affect our businesses and results.

Our businesses are also subject to stoppages and blockades of highways and other public roads, such as the Brazilian truck drivers’ strike in May 2018, when truck drivers started a nationwide strike demanding the reduction in taxes levied on diesel and changes to the fuel prices policy adopted by Petrobras. The stoppages and blockages of highways and other public roads may impact our businesses and financial results.

We may be adversely affected by changes to specific laws and regulations in our operating sectors.

We are subject to extensive federal, state and local legislation and regulation by government agencies and sector associations in the industries we operate. Rules related to quality of products, product storage, staff working hours, among others, may become more stringent or be amended overtime, and require new investments or the increase in expenses so our operations are in compliance with the applicable rules. Changes in specific laws and regulations in the sectors we operate may adversely affect the conditions under which we operate in ways that could have a materially negative effect on our businesses and our results.

Any change in our senior management and any difficulty in retaining, attracting and replacing qualified personnel could affect our ability to grow and could have an adverse effect on our activities, financial condition and results of operations.

Our success depends, in part, on the efforts and skills of our senior management and key personnel. The loss or failure to retain one or more of our key personnel could adversely affect our businesses. Our success also depends, in part, on our continuous ability to identify, hire, attract, train, develop and retain other highly qualified employees. Competition for these employees can be intense and we may not be able to attract and retain them. If we are unable to attract or retain qualified professionals to manage and expand our operations, we may not be able to conduct our businesses and, as a result, our operating and financial results may be adversely affected.

Our level of indebtedness may require us to use a significant portion of our cash flow to service such indebtedness.

As of December 31, 2023, our consolidated Gross Debt was R$11,768.0 million and our net cash provided by operating activities from continuing operations totaled R$3,849.8 million. The level and composition of our indebtedness could have significant consequences for us, including requiring a portion of our cash flow from operations to be committed to the payment of principal and interest on our indebtedness, thereby reducing the available cash to finance our working capital and investment in growth opportunities. In addition, any increase in our level of indebtedness or leverage could negatively impact our credit rating, making it more difficult to refinance our indebtedness in the future.

Higher LPG, fuels and other raw material costs could increase cost of products sold and decrease gross margin, adversely affecting our total operating result. Our exposure to cost volatility and other events related to these products could have a material adverse effect on our businesses, financial condition, and results of operations.

LPG, fuels and the main raw materials used in the distribution of our main products are subject to substantial price fluctuations. Such fluctuations could have a material adverse effect on our businesses, financial condition, and results of operations. The prices of LPG, fuels and other raw materials are influenced by several factors over which we have little or no control, including, but not limited to weather, agricultural production, international and national political and economic conditions, transportation and processing costs, regulations and government policies, and the relationship between world supply and demand. In addition, we may not be able to pass through to our customers, in due course, increases in LPG, fuels and other raw material costs and other operating costs related to the distribution of our products, which could decrease our profit margin and cause a material adverse effect in our activities, financial condition, and operating results.

Our businesses may be materially and adversely affected by the outbreak of communicable diseases, other epidemics or pandemics.

Historically, some regional or global epidemics and outbreaks, such as the one caused by the Zika virus, the one caused by the Ebola virus, the H5N5 virus (popularly known as avian flu), the foot-and-mouth disease, the H1N1 virus (influenza A, popularly known as swine flu), the Middle East Respiratory Syndrome (MERS), the Severe Acute Respiratory Syndrome (SARS) and the coronavirus (COVID-19) have affected certain sectors of the economy in countries where these diseases have spread. Policies designed to prevent or delay the spread of such communicable diseases, such as the restriction on circulation of people and/or the operations of certain sectors of the economy, might negatively affect business and economic sentiment, causing significant volatility in global capital and commodity markets and thus affecting the outlook of the economy of Brazil and other countries, directly impacting our businesses, operations and financial condition.

A global pandemic can also precipitate or exacerbate the other risks described in this annual report, which in turn could further materially and adversely affect our businesses, financial condition, results of operations, cash flows, prospects and the market price of our securities, including in ways not currently known or considered by us to present material risks.

We are subject to extensive federal and state legislation and regulation by governmental agencies responsible for implementing environmental and health laws and policies in Brazil.

Our subsidiaries must obtain permits for its industrial facilities from the appropriate environmental agencies, which may create additional regulations for our operations by prescribing specific environmental standards in their operating licenses.

Changes in these laws and regulations, or in their enforcement, may adversely affect the Company by increasing its compliance and operating costs. Furthermore, additional new laws and regulations, as well as more stringent interpretation of existing laws and regulations, may require additional investments for the Company to maintain its operations in compliance with legislation, which could increase costs and adversely affect results.

In addition to regulatory issues, our environmental risks are mainly related to the use of water (especially in areas of water scarcity), the generation and disposal of waste and the contamination of soil and water.

In our operations, water is mainly used in emergencies involving fires. Our operations also generate waste, such as contaminated waste, civil construction waste, and others. Finally, soil and water contamination can occur due to leaks from products stored and transported by our businesses. The occurrence of such events could result in fines, loss of operating licenses and reputational harm, consequently affecting our results and financial position.

Our businesses, financial condition and results of operations may be materially and adversely affected by a general economic downturn and by instability and volatility in the financial markets, including as a result of the conflict between Ukraine and Russia and the conflict involving Hamas and Israel.

The turmoil of the global financial markets and the scarcity of credit in the past led to lack of consumer confidence, increased market volatility and widespread reduction of business activity. An economic downturn could materially and adversely affect the liquidity, businesses and/or financial conditions of our customers, which could in turn result in decreased demand for our products, increased delinquencies in our accounts receivable and limited liquidity of our shares and ADSs.

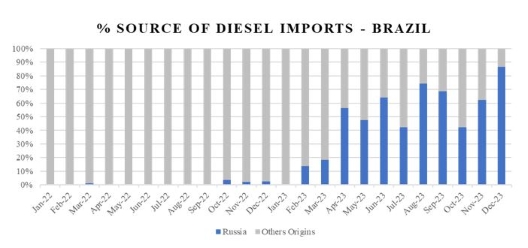

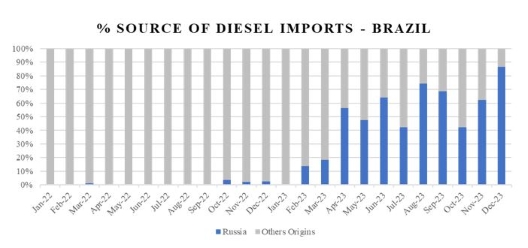

Global markets have recently experienced volatility and disruption following the escalation of geopolitical tensions, the start of a military conflict between Russia and Ukraine and the armed conflict involving Hamas and Israel. Any hostilities, terrorist activities, political instability or violence as a result of these conflicts could lead to market disruptions, sanctions and volatility, which, depending on the scale the conflicts take, could adversely affect our businesses and results of operations.

Moreover, an eventual new global financial crisis could have a negative impact on our cost of borrowing and on our ability to obtain future borrowings. The disruptions in the financial markets could also lead to a reduction in available trade credit, due to counterparties’ liquidity concerns. If we experience a decrease in demand for our products or an increase in delinquencies in our accounts receivable, or if we are unable to obtain borrowings our businesses, financial condition and results of operations could be materially adversely affected.

Our insurance coverage may be insufficient to cover losses that we might incur.

The specialized distribution and retail, as well as the operations of logistics of oil, LPG and fuels involve substantial risks of property damage and personal injury and may result in material costs and liabilities. Although we maintain insurance policies, the occurrence of losses or other liabilities that are not covered by insurance or that exceed the limits of our insurance coverage could result in significant unexpected additional costs.

The taxation system in Brazil may undergo significant changes, including as a result of the upcoming tax reform bill, potentially leading to material changes in taxation of our products and services that could adversely affect our results of operations and financial condition.

Taxation in Brazil is complex, with a myriad of regulations, exemptions, and amendments, that make it challenging for businesses to navigate and anticipate their tax obligations.

Even though the Brazilian tax reform bill is expected to result in positive changes in the taxation system of the country, it also introduces significant risks while it is not fully in force. As the reform aims to consolidate and modify existing federal, state, and municipal tax regimes and structures, it introduces uncertainties that may significantly impact our results of operations and financial condition.

The reform may lead to changes in tax rates for fuels and LPG. Any increase in tax rates could elevate the cost of goods sold, thereby reducing profitability if we could not timely pass these adjustments on to consumers. On the other hand, a decrease in tax rates might positively impact margins, but could also lead to intensified competition as other market players might adjust their own pricing strategies.

We also expect significant resources and time would be required to ensure compliance with the new tax regulations, thus increasing compliance costs arising from the need for additional staff training, IT system updates, and engagement with tax advisors. Failure to comply with the revised tax regulations could also result in penalties, fines, or legal actions, further impacting our financial condition.

The suspension, cancellation or non-renewal of certain tax benefits may adversely affect our results of operations.

Currently, we are entitled to tax benefits providing for income tax reduction for our activities in the Northeast region of Brazil, subject to certain conditions. Conversely, if the corresponding tax authorities understand that we have not complied with any of the tax benefit requirements or if the current tax programs from which we benefit are modified, suspended, canceled, not renewed or renewed under terms that are substantially less favorable than expected, we may become liable for the payment of related taxes at the full tax rates and our results of operations may be adversely affected. Income tax exemptions amounted to R$109.0 million, R$93.4 million and R$47.1 million for the years ended December 31, 2023, 2022 and 2021, respectively. See “Item 4.B. Information on the Company—Business overview—Industry and regulatory overview—A. Distribution of LPG—Ultragaz—Income tax exemption status” and “Item 4.B. Information on the Company—Business overview—Industry and regulatory overview—B. Storage services for liquid bulk —Ultracargo—Income tax exemption status.”

No single shareholder or group of shareholders holds more than 50% of our capital stock, which may increase the opportunity for alliances between shareholders and other events that may occur as a result thereof.

In the event a controlling group is formed and decides to exercise its influence over our Company, we may be subject to unexpected changes in our corporate governance and strategies, including the replacement of key executive officers and board members. Any unexpected change in our management team, business policy or strategy, any dispute between our shareholders, or any attempt to acquire control of our Company may have an adverse impact on us. The term of office of our current Board of Directors, the members of which were elected at the Annual and Extraordinary General Shareholders’ Meeting held on April 19, 2023, will expire in the Annual General Shareholders’ Meeting to be held in 2025. Consequently, a new composition of the Board of Directors might be elected by our shareholders.

As a result of acquisitions, Ultrapar has assumed and may assume in the future certain liabilities related to the businesses acquired or to be acquired. Additionally, Ultrapar has assumed and may assume certain risks associated with acquisitions and divestments, including regulatory risks.

Ultrapar is subject to risks relating to acquisitions and divestments that it enters into from time to time. Such risks include the assumption of liabilities of an acquired business or a refusal by the relevant regulatory bodies, including CADE, to approve the relevant transaction.

Ultrapar may acquire new businesses in the future and, as a result, it may be subject to additional liabilities, obligations and risks. See “Item 4.A. Information on the Company—History and development of the Company” for more information in connection with these acquisitions. These liabilities may cause Ultrapar to be required to make payments (including indemnifications and payments in respect of future claims in judicial and arbitral proceedings), incur charges or take other actions that may adversely affect our financial position, results of operations and the price of our shares.

For example, the sale of Oxiteno to Indorama was closed on April 1, 2022, and the sale of Extrafarma to Pague Menos was closed on August 1, 2022. Thus, these two companies ceased to be consolidated as subsidiaries of Ultrapar, and we no longer control their management or operations. However, under the applicable sale agreements, we will remain liable for certain previously existing financial obligations, legal liabilities or other known and unknown contingent liabilities or risks associated with Oxiteno and Extrafarma that may, if materialized, adversely affect our businesses, operations and/or results. In addition, as of December 31, 2023, the payment installment due by Pague Menos amounted to R$182.7 million, as adjusted by DI + 0.5% p.a. since August 1, 2022, to be paid on August 1, 2024. If Pague Menos fails to make this payment, we would be adversely affected. As of December 31, 2023, payment installments due by Indorama amounted to US$150.0 million, which were settled on April 1, 2024.

Our management is unable to predict whether and when any new acquisitions or strategic alliances will occur or the likelihood that any particular transaction will be completed on favorable terms and conditions. Our ability to expand our business through acquisitions or alliances depends on many factors, including its ability to identify acquisition opportunities or access capital markets on acceptable terms. Even if we are able to identify opportunities and obtain the resources necessary to do so, financing these acquisitions could result in an overcommitment on our part. Acquisitions, particularly those involving sizeable enterprises, may bring managerial and operational challenges, including the diversion of management’s attention from existing operations and difficulties in integrating operations and personnel. Any material failure by us in integrating new businesses or in managing any new alliances may adversely affect our business and financial performance.

On March 24, 2024, the Company signed, through a subsidiary, a share purchase and sale instrument for the acquisition of 128,369,488 shares of Hidrovias. The closing of the transaction is subject to certain conditions precedent, including the approval of CADE. We may not be successful in obtaining required approvals on a timely basis or at all. For more information, see “Item 4.A. Information on the Company—History and development of the Company—Recent developments.”

The founding family and part of our senior management, through their ownership interest in Ultra S.A. and Parth, own a significant portion of our shares and may influence the management, direction and policies of Ultrapar, including the outcome of any matter submitted to the vote of shareholders.

Although there is no controlling shareholder of Ultrapar, the founding family and part of our senior management, through their ownership interest in Ultra S.A. and Parth, beneficially own a significative portion of our outstanding common stock. On August 18, 2020, Ultra S.A. and Parth entered into the 2020 Shareholders’ Agreement to include Pátria in its capacity as Ultra S.A.’s shareholder then holding a 20% stake in Ultra S.A.’s capital stock. On September 28, 2021, Ultra S.A. informed the Company that Mr. Marcos Marinho Lutz, Vice-Chairman of the Board of Directors and Chief Executive Officer of Ultrapar, had become a shareholder of Ultra S.A., holding 2.4% of its capital stock, and also had become a consenting intervening party of the 2020 Shareholders’ Agreement. A total of 35.5% of the Company’s capital stock is bound by the 2020 Shareholder’s Agreement as of December 31, 2023. Accordingly, these shareholders, acting together through Ultra S.A. and Parth, may exercise significant influence over all matters requiring shareholder approval, including the election of our directors. See “Item 4.A. Information on the Company—History and development of the Company”, “Item 7.A. Major shareholders and related party transactions—Major shareholders—Shareholders’ Agreements” and “Exhibit 2.9—Shareholders’ Agreement dated August 18, 2020.”

Our status as a holding company may limit our ability to pay dividends on the shares and consequently, on the ADSs.

As a holding company, we have no significant operating assets other than the ownership of shares of our subsidiaries. Substantially all of our operating income comes from our subsidiaries, and therefore we depend on the distribution of dividends or interest on shareholders’ equity from our subsidiaries. Consequently, our ability to pay dividends depends solely upon our dividends and other cash flows from our subsidiaries.

Failure to comply with, obtain or renew the licenses and permits required for each of the sectors in which we operate may have a material adverse effect on us.

The Company’s subsidiaries are in a constant process of obtaining or renewing the required permits to operate. Our subsidiaries must obtain and maintain such licenses and permits from different public bodies for the continuity of their activities. If the Company’s subsidiaries are unable to obtain or renew all licenses and permits necessary to conduct their businesses and operations, the absence of such licenses could materially and adversely affect the Company’s businesses, financial condition, and results of operations.

Our governance and compliance processes may fail to prevent regulatory penalties and reputational harm.

Our governance and compliance processes, which include reviewing internal controls over financial reporting, may not prevent future violations of applicable legal, anti-corruption, antitrust and conflicts of interest laws and regulations, accounting or governance standards. We may be subject to legal and regulatory violations and to breaches of our Code of Ethics, anti-corruption policies and commercial conduct protocols, and to instances of fraudulent behavior, corrupt, anticompetitive and unethical practices and dishonesty by our employees, contractors or other agents. In the recent past, anticompetitive practices have been one of the main problems affecting fuels and LPG distributors in Brazil, including Ipiranga and Ultragaz. There are allegations of cartels involved in price fixing in the fuel distribution and LPG sectors, and CADE has been targeting players of these sectors in different regions of Brazil. CADE has been actively investigating these sectors and a negative outcome of the ongoing investigations, administrative proceedings and lawsuits could have a material adverse effect on Ipiranga and Ultragaz. Our failure to comply with applicable laws and other standards could subject us to, among others, litigation, investigations, expenses, fines, loss of operating licenses and reputational harm. For more information about ongoing proceedings, see “Item 8.A. Financial information—Consolidated statements and other financial information—Legal proceedings.”

In addition, our management is responsible for establishing and maintaining adequate internal controls over financial reporting as defined under the Exchange Act. During our assessment of our internal controls over financial reporting as of December 31, 2023, we identified a material weakness. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of annual or interim financial statements will not be prevented or detected on a timely basis. For more information, see “Item 15. Controls and Procedures”. If our efforts to remedy any identified inconsistencies and/or weaknesses are not sufficient, we could continue to experience material weaknesses in our internal controls in future periods which could result in a material misstatement in our consolidated financial statements.

Information technology failures, including those that affect the privacy and security of personal data, as a result of cyber-attacks or other causes, could adversely affect our businesses and the market price of our shares and ADSs.

We increasingly rely on information technology systems to process, transmit, and store electronic information. A significant portion of the communication between our personnel, customers, and suppliers depends on information technology. In addition, our billing systems relies heavily on technology infrastructure. As with all large systems, our information systems may be vulnerable to a variety of interruptions, due to events beyond our control including, but not limited to, natural disasters, telecommunications failures, computer viruses, hacker attacks, human errors or other security issues.

We depend on information technology to enable us to operate efficiently and interface with customers, as well as to maintain in-house management and control. We also collect and store personal information that customers provide to purchase products or services.

In addition, the concentration of processes in shared services centers means that any technology disruption could impact a large portion of our businesses within the regions we serve. Any transition of processes to, from or within shared services centers, as well as other transformational projects, could lead to businesses’ disruptions. If we do not allocate and effectively manage the resources necessary to build and sustain a proper technology infrastructure, we could be subject to transaction errors, processing inefficiencies, loss of customers, operations disruptions, or the loss of or damage to intellectual property caused by security breaches. As with all information technology systems, our system could also be breached by outside parties with the purpose of extracting information, corrupting information, or disrupting businesses’ processes.

In Brazil, we are subject to laws and regulations regarding data protection and privacy, including Brazilian Law No. 13,709/18 (Brazilian General Data Protection Law) or LGPD, which came into force on September 18, 2020. Inspired by the General Data Protection Regulation of the European Union, LGPD sets forth a comprehensive set of rules on how companies, organizations and public authorities should collect, use, process and store personal data when carrying out their activities.

LGPD sets out a legal framework for the processing of personal data and provides for the rights of data holders, the legal bases applicable to the protection of personal data, the requirements for obtaining consent, the obligations and requirements related to data breaches, requirements for international data transfers, among others. LGPD also created the Autoridade Nacional de Proteção de Dados (National Data Protection Authority), or ANPD, responsible for enforcing the law. Most provisions of the LGPD entered into effect on September 18, 2020, while the provisions relating to administrative sanctions came into effect on August 1, 2021. On October 29, 2021, the Regulation on Supervision and Sanctioning Procedures approved by the ANPD was published, which governs, among other things, how the administrative sanctions provided for in the LGPD should be applied.

LGPD requires mandatory breach notification in case of relevant risk or damage to data holders and authorizes regulatory investigations that could lead to fines and other sanctions in case of non-compliance. As of the date of this annual report, we are not aware of any ongoing regulatory investigations affecting us. However, we cannot assure that we will not be subject to any such investigations and any resulting sanctions in the future, should any breaches take place.

LGPD, as well as any other changes to existing personal data protection laws, may subject us to, among other measures, additional costs and expenses, which would require costly changes to our businesses practices and security systems, policies, procedures and practices.

Our protections may be compromised as a result of third-party security breaches, burglaries, cyberattack, errors by employees or employees of third-party vendors, contractors, misappropriation of data by employees, vendors or unaffiliated third parties, or other irregularities that may result in persons obtaining unauthorized access to company data or otherwise disrupting our businesses.

For example, on January 11, 2021, an unauthorized party disrupted access to our IT systems, which caused a temporary interruption to our operations and resulted in the theft of certain proprietary data. On January 14, 2021, we began restoring the systems that were affected by this incident and all critical information systems have been fully operational since February 2021. No material impacts were incurred by the Company as a result of this event.

Furthermore, due to the lack of effective controls and procedures in the process of monitoring activities carried out by Company personnel with restrictive access to and authority over our IT systems management and controls operations, which could have affected the source data and logic of certain reports that were used to execute automated and manual controls, which depend on information generated by such IT applications, our management has identified a control deficiency that represents a material weakness in our internal control over financial reporting as of December 31, 2023. For more information, see “Item 15. Controls and Procedures”.

As of the date of this annual report, the Company does not carry insurance against cyber incidents. Therefore, similar interruptions, data breaches or any noncompliance with LGPD could have an adverse effect on our businesses, reputation, results of operations, cash flows or financial condition, or result in proceedings or actions against us, including the imposition of fines.

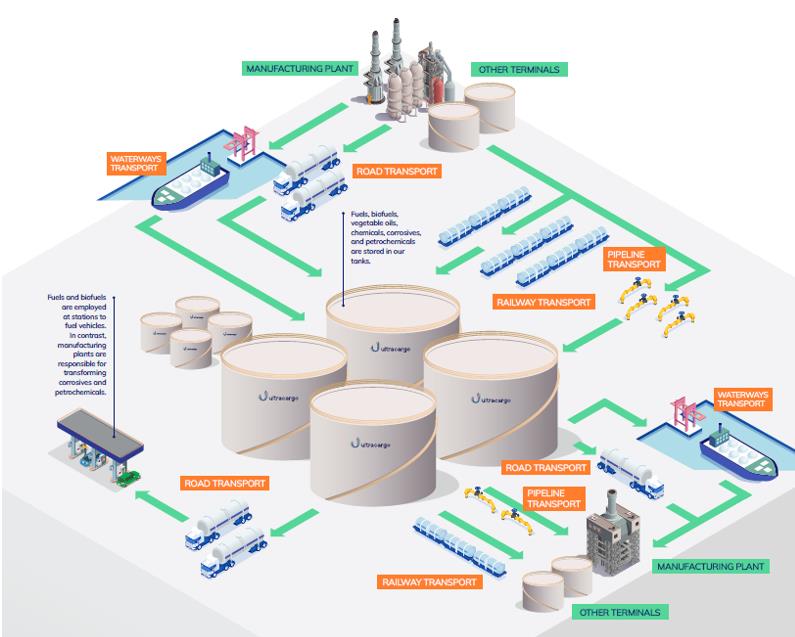

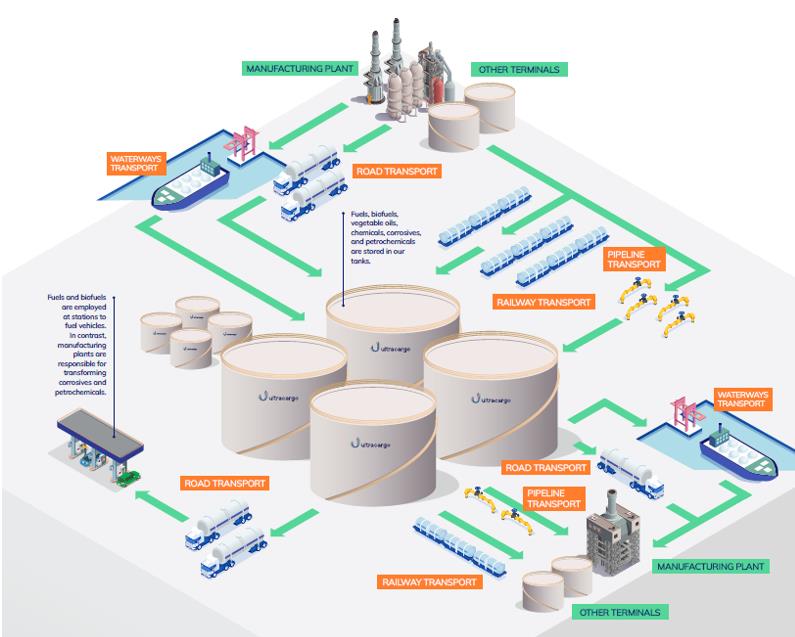

The production, storage and transportation of fuels, LPG, chemicals, corrosives and other liquid or gaseous bulk products are inherently hazardous.

The operations performed by Ultrapar’s businesses involve safety and other operational risks, including the handling, production, storage and transportation of highly flammable, explosive and toxic materials. These risks can result in bodily injury or death, damage to or destruction of facilities or equipment, and environmental damage. A sufficiently large accident at one of the service stations or storage facilities could force temporary suspension of activities at the site, resulting in significant remediation costs, lost revenues, and contingent liabilities. In addition, insurance coverage may not be available in a timely manner or may be insufficient to cover all losses or any loss at all. Equipment breakdowns, natural disasters and delays in obtaining imported products or spare parts or equipment could also affect the production process and, consequently, the results of operations and our reputation.

Risks relating to Brazil

The Brazilian government has exercised, and continues to exercise, significant influence over the Brazilian economy. Brazilian political and economic conditions, including ongoing political instability and perceptions of these conditions in the international markets, could adversely affect our businesses and the market price of our shares and ADSs.

The Brazilian government frequently intervenes in the Brazilian economy and occasionally makes substantial changes in policy and regulations. The Brazilian government’s actions to influence the course of Brazil’s economy, control inflation and to implement other policies and regulations have involved increases in interest rates, changes in tax policies, price and wage controls, currency devaluations, capital controls, fiscal adjustments, and limits on imports and exports, among other measures. Our businesses, financial condition and results of operations may be adversely affected by changes in policy or regulations involving or affecting tariffs, exchange controls and other matters, as well as factors such as:

- Currency fluctuations;

- Inflation;

- Interest rates;

- Exchange rate policies;

- Liquidity available in the domestic capital, credit and financial markets;

- Oil and gas sector regulations, including price policies;

- The impact of epidemics and pandemics;

- Price instability;

- Social and political instability;

- Energy and water shortages and rationing;

- Liquidity of domestic capital and lending markets;

- Fiscal policy;

- Overturning of final judicial rulings on tax cases; and

- Other political, economic, social, trade and diplomatic developments in or affecting Brazil.

Uncertainty over whether the Brazilian government may implement changes in policy, including with respect to the oil and gas industry, or regulation affecting these or other factors in the future may contribute to economic uncertainty in Brazil and to heightened volatility in the Brazilian securities markets and securities issued abroad by Brazilian issuers, as well as heightened volatility in the Real. These and other future developments in the Brazilian economy or government policies may adversely affect us and our businesses as well as our results of operations and may adversely affect the trading price of our ADSs and shares. Furthermore, the Brazilian government may enact new regulations that may adversely affect our businesses and us.

Uncertainty regarding whether the Brazilian government will implement policy and regulatory changes may be compounded by political instability. Political crises have affected and continue to affect the confidence of investors and the general public and have historically resulted in economic deceleration and heightened volatility in the securities issued by Brazilian companies. Additionally, political instability in Brazil has been growing in recent years, which has contributed to a decline in market confidence in the Brazilian economy as well as to a deteriorating political environment.

Furthermore, in recent years some of Brazil’s leading politicians were targets of inquiries involving corruption, misconduct of public management, as well as the potential misuse of government funds. The potential outcome of these and other inquiries, as well as potential new inquiries involving Brazilian politicians that may arise are uncertain, but they had, and still may have a negative impact on the general perception of the Brazilian economy and consequently have adversely affected and may continue to affect our businesses, financial condition, and results of operations, as well as the market price of our common shares.

Ultimately, we cannot predict the scope, nature and impact of any policy changes or reforms (or reversals thereof) that the government will implement, which could result in further political and economic instability and negatively impact the regulatory framework in which we operate, which in turn could adversely affect our businesses, financial condition and operating results.

In addition, there is no guarantee that the president will be successful in executing his campaign promises or passing certain reforms fully or at all. Likewise, we cannot predict how the president’s administration may impact the overall stability, growth prospects and economic and political health of the country. A failure by the Brazilian government to implement reforms may result in diminished confidence in the Brazilian government’s budgetary condition and fiscal stance, which could result in downgrades of Brazil’s sovereign foreign credit rating by credit rating agencies and the rise of risk premium, negatively impacting Brazil’s economy, and leading to further depreciation of the Real and an increase in inflation and interest rates, adversely affecting our businesses, financial condition and results of operations.

Inflation and certain governmental measures to curb inflation may contribute significantly to economic uncertainty in Brazil and could harm our businesses and the market value of the ADSs and our shares.

Brazil has experienced significantly high rates of inflation in the past, while the Brazilian economy has been characterized by frequent and occasionally extensive interventions by the Brazilian government. The Brazilian government’s past measures to control inflation included maintaining a tight monetary policy with high interest rates, wage and price controls, exchange controls, restrictions on imports, and others. High inflation, actions to combat inflation and public speculation about possible future measures has led and may lead to significant negative impacts on the Brazilian economy and heightened volatility in the securities markets. According to the IGP-M, an inflation index, the Brazilian general price inflation rate was -3.2% in 2023, 5.5% in 2022 and 17.8% in 2021. According to the IPCA, an inflation index to which the Brazilian government’s inflation targets are linked, inflation in Brazil was 4.6% in 2023, 5.8% in 2022 and 10.1% in 2021. Brazil may experience high levels of inflation in the future.

Since our operating expenses are substantially in Reais, any inflationary pressure could materially affect our operating margins. Furthermore, high inflation or higher interest rates could materially affect our cost of debt and our ability to finance our operations, which may adversely affect the results of our operations and net income.

In addition, high levels of inflation may also adversely affect the Brazilian economy, which would reduce consumption of goods and, as a result, affect our financial condition, operations and profits. Any deterioration in our financial performance would also likely lead to a decline in the market price of our common shares and ADSs.

Exchange rate instability may adversely affect our financial condition, results of operations and the market price of the ADSs and our shares.

A significant portion of the products that we distribute, including LPG and fuels, have prices linked to commodity prices denominated in U.S. dollars. Therefore, we are exposed to foreign exchange rate risks that could adversely affect our businesses, financial condition and results of operations, as well as our capacity to service our debt. See “Item 11. Quantitative and Qualitative Disclosures about Market Risk.”

In 2021, the Real depreciated 7% against the U.S. dollar, mainly due to the slow recovery of Brazil from the economic downturn, the increase in global inflation and fiscal risks in the country. In 2022, the reopening of the economy after the restrictions imposed by the coronavirus pandemic in 2021, added to the stimulus packages, the evolution of public accounts and financial support policies for the population contributed to the improvement of the economy’s performance and resulted in the appreciation of 7% of the Real against the U.S. dollar. In 2023, the Real appreciated 7% against the U.S. dollar, mainly due to the reduction of fiscal uncertainties in Brazil and the record trade balance in the period.

There are no guarantees that the exchange rate between the Real and the U.S. dollar will stabilize at current levels, and the Real and the U.S. dollar exchange rate may be adversely impacted by the economic and fiscal scenario. Although we have contracted hedging instruments with respect to part of our existing U.S. dollar debt obligations, in order to reduce our exposure to fluctuations in the U.S. dollar/Real exchange rate, we cannot guarantee that such instruments will be adequate to fully protect us against further devaluation of the Real and, as a result, we could experience monetary losses in the future. See “Item 11. Quantitative and Qualitative Disclosures about Market Risk” for information about our foreign exchange risk hedging policy.

Depreciations of the Real relative to the U.S. dollar can create additional inflationary pressures in Brazil that may negatively affect us. Depreciations generally curtail access to foreign financial markets and may prompt government intervention, including recessionary governmental policies. Depreciations also reduce the U.S. dollar value of distributions and dividends on the ADSs and the U.S. dollar equivalent of the market price of our shares and, as a result, the ADSs. On the other hand, appreciation of the Real against the U.S. dollar may lead to a deterioration of the country’s current account and the balance of payments, as well as to a dampening of export-driven growth.

Economic and market conditions in other countries, including in the United States and emerging market countries, may materially and adversely affect the Brazilian economy and, therefore, our financial condition and the market price of the shares and ADSs.

The market for securities issued by Brazilian companies is influenced by economic and market conditions in Brazil, and to varying degrees, market conditions in other countries, including the United States, other Latin American and emerging market countries. Although economic conditions are different in each country, the reaction of investors to developments in one country may cause the capital markets in other countries to fluctuate. Developments or conditions in other countries, including the United States and other emerging market countries, have at times significantly affected the availability of credit in the Brazilian economy and resulted in considerable outflows of funds and declines in the amount of foreign currency invested in Brazil, as well as limited access to international capital markets. These uncertainties may materially and adversely affect our ability to borrow funds at an acceptable interest rate or to raise equity capital when and if we should have such a need, and the market value of our securities. In addition, we continue to be exposed to disruptions and volatility in the global financial markets because of their effects on the financial and economic environment, particularly in Brazil, such as a slowdown in the economy, an increase in the unemployment rate, a decrease in the purchasing power of consumers and the lack of credit availability.

Disruption or volatility in the global financial markets, including as a result of the military conflict in Ukraine, the Gaza Strip or any other geopolitical tensions, could further increase negative effects on the financial and economic environment in Brazil, which could have a material adverse effect on our businesses, results of operations and financial condition.

Holders of our ADSs may face difficulties in serving process on or enforcing judgments against us and other relevant persons.

We are a company incorporated under the laws of Brazil. All members of our Board of Directors, executive officers and experts named in this annual report are residents of Brazil or have their business address in Brazil. All or a substantial part of the assets pertaining to these individuals and to Ultrapar are located outside the United States. As a result, it is possible that investors may not be able to effect service of process upon these individuals or us in the United States or other jurisdictions outside Brazil or enforce judgments against us or these other persons obtained in the United States or other jurisdictions outside Brazil, including for civil liability based upon United States federal securities laws or otherwise. In addition, because judgments of United States courts for civil liabilities based upon the United States federal securities laws may only be enforced in Brazil if certain conditions are met, holders may face greater difficulties in protecting their interests in the case of actions against us or our Board of Directors or executive officers than would shareholders of a United States corporation.

Due to concerns about the risks of climate change, a number of countries, including Brazil, have adopted or are considering adopting regulatory frameworks which could adversely affect our businesses, financial condition and results of operations.

New laws and regulatory frameworks adopted by countries in response to concerns about climate change include the adoption of cap and trading carbon market system, taxes on carbon emissions, increased efficiency standards, bans on vehicles running on oil-based fuels, and incentives or requirements for the use of renewable energy. Such requirements can reduce the demand for hydrocarbon fuels at different rates and levels in each of the regions where our customers are located, as well as lead to a replacement of their demand with lower carbon sources. In addition, many governments are offering tax benefits and providing other subsidies and guidelines to make alternative energy sources more competitive with oil and gas, which may discourage the sale of certain products supplied by the Company’s subsidiaries.

Governments around the world have been encouraging the development of new technologies and companies have also been promoting research to reduce the cost and increase the scale of production of alternative energy sources, which could reduce demand for the Company’s products. In addition, current regulations on GHG, or regulations that may eventually be approved, could substantially increase the Company’s compliance costs.

Furthermore, discussions about carbon pricing, whether by emissions trading or taxation, are gaining momentum in Brazil. As a company engaged in the energy, mobility and logistics infrastructure sectors, we could be included in Brazil's future regulated carbon market. We cannot predict the scope, nature and impact of any policy changes or reforms related to the carbon market, given that there are many uncertainties throughout its structuring, which could result in higher costs, lower operational margins and, in turn, could adversely affect our businesses, financial condition and operating results.

We may be adversely affected by the imposition and enforcement of more stringent environmental laws and regulations, including as a result of rising climate change concerns, that may result in increased costs of operation and compliance, as well as a decrease in demand for our products.

In December 2016, the Ministry of Mines and Energy (MME), seeking to fulfill the commitments made at the 2014 United Nations Climate Change Conference (COP 21), launched RenovaBio, a program aimed at reducing carbon emissions and encouraging the production of biofuels in Brazil, such as ethanol, biodiesel, biogas and aviation biofuel. Under this program, biofuel producers and importers duly certified by the ANP issue CBios based on their sales and purchase invoices, while fossil fuel distributors receive annual decarbonization targets based on the proportion of fossil fuels they sell, which can only be met by purchasing CBios.

CBios are traded freely on B3, and their prices are set by market supply and demand, which can be influenced, among other factors, by unexpected regulatory changes, such as the postponement of the CBios purchase targets announced by the Brazilian government in July 2022. Since CBios prices can be highly volatile and targets increase annually, we cannot predict whether we will be able to successfully pass through our costs with CBios to customers, which could adversely affect our operations, market share, financial condition, and results. The possible unavailability of CBios or our inability to meet these targets may result in administrative penalties and the blocking of operating licenses. In addition, the Brazilian government is reviewing RenovaBio’s guidelines, and we cannot predict how these possible changes may affect us.

If we do not invest in research and development of new, less carbon-intensive solutions and adapt our operating structure to operate with cleaner energy sources, we may incur higher compliance and operating costs, which may have an adverse effect on our competitiveness and revenues.

In addition, if we violate environmental laws and regulations, we may face reputational damage with consumers, our business customers, investors, the communities in which we operate and other stakeholders, which could adversely affect our access to capital, revenues, and ability to obtain the necessary licenses to conduct our operations.

Floods, storms, windstorms, rise in sea levels and other climate change events could bring harm to our facilities, thus affecting our financial position and results of our operations.

Floods, storms, windstorms and other climate effects can cause production stoppages, interrupt supply chains, and damage physical structures. The rise in sea levels is also a risk to our operations since our businesses have assets in coastal regions and ports.

Risks relating to our common shares and ADSs

Asserting limited voting rights as a holder of ADSs may prove more difficult than for holders of our common shares.

Under the Brazilian Corporate Law, only shareholders registered as such in our corporate books may attend shareholders’ meetings. All common shares underlying the ADSs are registered in the name of the depositary bank. A holder of ADSs, accordingly, is not entitled to attend shareholders’ meetings. A holder of ADSs is entitled to instruct the depositary bank as to how to exercise the voting rights of its common shares underlying the ADSs in accordance with procedures provided for in the Deposit Agreement, but a holder of ADSs will not be able to vote directly at a shareholders’ meeting or appoint a proxy to do so. In addition, a holder of ADSs may not have sufficient or reasonable time to provide such voting instructions to the depositary bank in accordance with the mechanisms set forth in the Deposit Agreement and custody agreement, and the depositary bank will not be held liable for failure to deliver any voting instructions to such holders.

Holders of our shares or ADSs may not receive dividends.

Under the Brazilian Corporate Law and our Bylaws, unless otherwise proposed by the Board of Directors and approved by the voting shareholders at our Annual General Shareholders’ Meeting, we must pay our shareholders a mandatory distribution equal to at least 25% of our adjusted net income, after the allocation of 5% of the net income to the legal reserve. However, our net income may be used to increase our capital stock, to set off losses and/or be otherwise retained in accordance with the Brazilian Corporate Law and may not be available for the payment of dividends, including in the form of interest on shareholders’ equity. Therefore, whether investors receive a dividend or not depends on the amount of the mandatory distribution, if any, and whether the Board of Directors and the voting shareholders exercise their discretion to suspend these payments. See “Item 8.A. Financial information—Consolidated statements and other financial information—Dividends and distribution policy—Dividend policy” for a more detailed discussion of mandatory distributions.

Holders of our shares may be unable to exercise preemptive rights with respect to the shares.

In the event that we issue new shares pursuant to a capital increase or offer rights to purchase our shares, shareholders would have preemptive rights to subscribe for the newly issued shares or rights, as the case may be, corresponding to their respective interest in our share capital, allowing them to maintain their existing shareholder percentage.

However, our Bylaws establish that the Board of Directors may exclude preemptive rights to the current shareholders or reduce the time our shareholders have to exercise their rights, in the case of an offering of new shares to be sold on a registered stock exchange or otherwise through a public offering.

The holders of our shares or ADSs may be unable to exercise their preemptive rights in relation to the shares represented by the ADSs, unless we file a registration statement for the offering of rights or shares with the SEC pursuant to the United States Securities Act or an exemption from the registration requirements applies. We are not obliged to file registration statements in order to facilitate the exercise of preemptive rights and, therefore, we cannot assure ADS holders that such a registration statement will be filed. As a result, the equity interest of such holders in our Company may be diluted. If the rights or shares, as the case may be, are not registered as required, the depositary will try to sell the preemptive rights held by holder of the ADSs and investors will have the right to the net sale value, if any. However, the preemptive rights will expire without compensation to investors should the depositary not succeed in selling them.

If shareholders exchange ADSs for shares, they may lose certain foreign currency remittance and Brazilian tax advantages.

The ADSs benefit from the depositary’s certificate of foreign capital registration, which permits the depositary to convert dividends and other distributions with respect to the shares into foreign currency and remit the proceeds abroad. In order to surrender ADSs for the purpose of withdrawing the shares represented thereby, investors are required to comply with National Monetary Council (“CMN”) Resolution 4,373 of September 29, 2014 (“CMN Resolution 4,373”), which requires, among other things, that investors appoint a legal representative in Brazil. If the investors fail to comply with CMN Resolution 4,373, or the legal representative appointed by the investors fails to comply with CMN Resolution 4,373 or to take action when required to do so, it could affect the investors’ ability to receive dividends or distributions relating to our shares or the return of their capital in a timely manner. Investors that are registered as CMN Resolution 4,373 investors may buy and sell their shares on the Brazilian stock exchanges without obtaining separate certificates of registration. If investors do not qualify under CMN Resolution 4,373, they will generally be subject to less favorable tax treatment on distributions with respect to the shares. The depositary’s certificate of registration or any certificate of foreign capital registration obtained by the investor may be affected by future legislative or regulatory changes, and additional Brazilian law restrictions applicable to their investment in the ADSs may be imposed in the future. For a more complete description of Brazilian tax regulations, see “Item 10.E. Additional information—Taxation—Brazilian tax considerations.”

Changes in Brazilian tax laws may have an adverse impact on the taxes applicable to a disposition of our ADSs.

According to Article 26 of Brazilian Law No. 10,833/03, if a holder not deemed to be domiciled in Brazil for Brazilian tax and regulatory purposes, or a non-Brazilian holder, disposes of assets located in Brazil, the transaction will be subject to taxation in Brazil, even if such disposition occurs outside Brazil or if such disposition is made to another non-Brazilian holder. A disposition of our ADSs involves the disposal of a non-Brazilian asset, which in principle should not be subject to taxation in Brazil. Nevertheless, in the event that the disposal of assets located in Brazil is interpreted to include a disposal of our ADSs, this tax law could result in the imposition of the withholding income tax on a disposal of our ADSs between non-residents of Brazil. See “Item 10.E. Additional information—Taxation—Brazilian tax considerations—Taxation of gains.”

Substantial sales of our shares or our ADSs could cause the price of our shares or our ADSs to decrease.

The shareholders of Ultra S.A. and Parth, which together owned 33.5% of our outstanding shares (excluding shared held in treasury) as of April 2, 2024 have the right to exchange their shares of Ultra S.A. and Parth for shares of Ultrapar and freely trade them in the market as more fully described under “Item 7.A. Major shareholders and related party transactions—Major shareholders—Shareholders’ Agreements.” Other shareholders, who may freely sell their respective shares, hold a substantial portion of our remaining shares. A sale of a significant number of shares could negatively affect the market value of the shares and ADSs. The market price of our shares and the ADSs could drop significantly if the holders of shares or the ADSs sell them or the market perceives that they intend to sell them.

There may be adverse U.S. federal income tax consequences to U.S. holders if we are or become a PFIC under the Code.

If we were characterized as a PFIC, in any year during which a U.S. holder holds our shares or ADSs, certain adverse U.S. federal tax income consequences could apply to that person. Based on the manner in which we currently operate our businesses, the projected composition of our income and valuation of our assets, and the current interpretation of the PFIC rules, including the Commodity Exception, we do not believe that we were a PFIC in 2023 and we do not expect to be a PFIC in the foreseeable future. However, because PFIC classification is a factual determination made annually and is subject to change and differing interpretations, there can be no assurance that we will not be considered a PFIC for the current taxable year or any subsequent taxable year. U.S. holders should carefully read “Item 10.E. Additional information—Taxation—U.S. federal income tax considerations” for a description of the PFIC rules and consult their tax advisors regarding the likelihood and consequences of us being treated as a PFIC for U.S. federal income tax purposes.

A. History and development of the Company

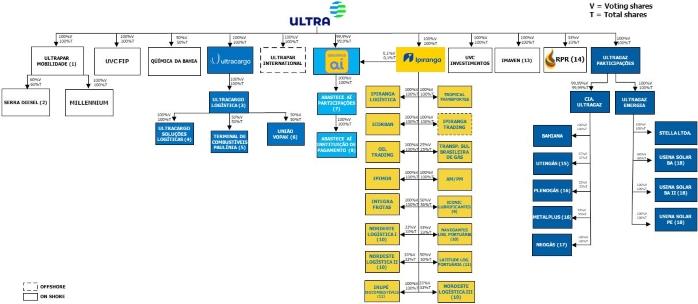

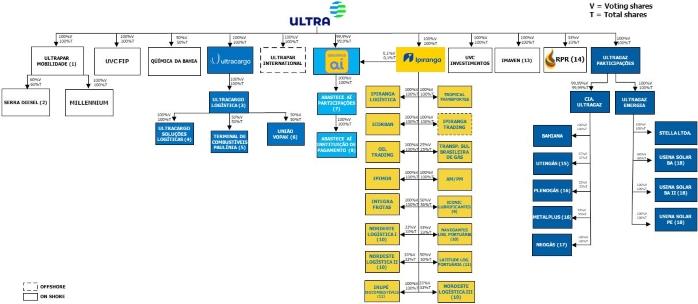

We were incorporated on December 20, 1953, with our origins going back to 1937, when Ernesto Igel founded Ultragaz and pioneered the use of LPG as cooking gas in Brazil, using bottles acquired from Companhia Zeppelin. The gas stove began to replace the traditional wood stove, which dominated Brazilian kitchens at the time. Since then, Ultrapar has become one of the largest business groups in Brazil. As of December 31, 2023, Ultrapar owned three main businesses: Ipiranga, Ultragaz and Ultracargo.

On December 31, 2021, our former wholly owned subsidiaries, Oxiteno and Extrafarma, were classified as assets and liabilities held for sale and discontinued operations, due to the signing of a share purchase agreement with Indorama in August 2021 and with Pague Menos in May 2021, respectively. The sales of Oxiteno and Extrafarma were closed on April 1, 2022 and on August 1, 2022, respectively and, as a result, these companies are no longer part of Ultrapar’s business portfolio as of these dates.

Ultrapar Participações S.A. is a listed corporation incorporated under the laws of Brazil. Our main executive office is located at Brigadeiro Luis Antônio Avenue, 1343, 9th Floor, 01317-910, São Paulo, SP, Brazil. Our telephone number is +55 (11) 3177 7014. Our internet website address is http://ultra.com.br and our investor relations internet website address is http://ri.ultra.com.br. Unless expressly incorporated by reference into this annual report, including the exhibits and schedules filed herewith, the contents of our website are not incorporated by reference into this annual report. Our agent for service of process in the United States is C.T. Corporation System, located at 28 Liberty Street, New York, NY 10005.

In addition, SEC maintains an internet website that contains reports, proxy and information statements, and other information regarding Ultrapar electronically filed within the SEC. The address of the SEC’s website is www.sec.gov.

Below we describe our main continuing and discontinued operations. In 2022, Ultrapar has ceased to present abastece aí as a separate segment, due to the small relevance of this business relative to the overall results of the Company.

A.1. Continuing operations

Ultragaz

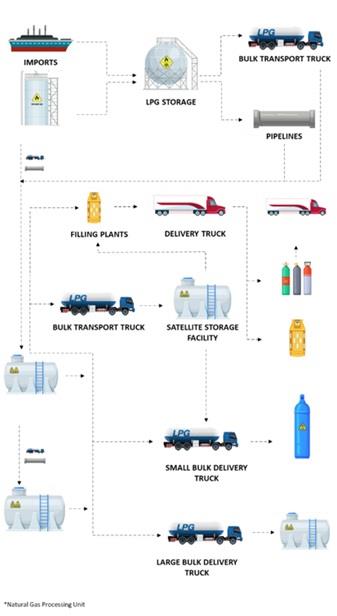

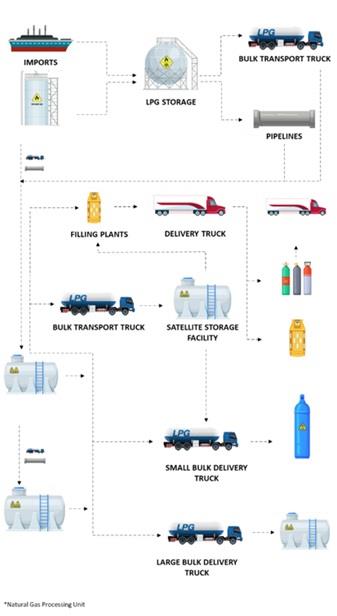

When Ultragaz began its operations, it served only the Southeast region of Brazil. Currently, Ultragaz operates nationwide in the distribution of both bottled and bulk LPG, including the most highly populated states in Brazil, such as São Paulo, Minas Gerais and Bahia, and may sell bottled LPG through independent dealers. Bulk LPG is served through Ultragaz own infrastructure.

In 1995, Ultragaz introduced its own bob-tail trucks system to process small bulk distribution to residential, commercial and industrial segments, and started the process of geographical expansion through the construction of new LPG filling and satellite plants.

In 2003, Ultragaz acquired Shell Gás, Royal Dutch Shell plc’s LPG operations in Brazil. With this acquisition, Ultragaz became the Brazilian market leader in LPG, with a 24% share of the Brazilian market on that date. In 2011, Ultragaz acquired Repsol’s LPG distribution business in Brazil.

In the past few years, Ultragaz undertook a comprehensive review of its business strategy, leveraging itself in its innovative roots and using its experience, knowledge and reliability of its processes, products and services to create and offer energy solutions that meet its clients’ needs. This strategy shift was illustrated through the redefinition of Ultragaz’s business motto, making it broader, more inspirational and suitable to the Company’s goals. Ultragaz’s new motto is: “we use our energy to change people’s lives.”

On September 12, 2022, Ultragaz signed an agreement for the acquisition of all shares of Stella, a technology platform founded in 2019 that connects renewable electricity generators and customers through distributed generation, and the transaction closed on October 1, 2022. Ultragaz acquired Stella for a minimum amount of R$63.0 million, and an initial payment of R$7.6 million. The remaining amount of the purchase price is expected to be settled in 2027, subject mainly to performance metrics of the acquired company. Stella has been part of UVC’s portfolio (Ultrapar's Corporate Venture Capital fund) since 2021. This acquisition marked Ultragaz's entry into the electricity segment, in line with its strategy of expanding the offering of energy solutions to its customers, leveraging on its capillarity, commercial strength, the Ultragaz brand and its extensive base of industrial and residential customers.