UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest reported) May 30, 2006

BREK ENERGY CORPORATION |

| (Exact name of registrant as specified in its chapter) |

Nevada | 000-27753 | 98-0206979 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

Third Floor, 346 Kensington High Street, London, United Kingdom | W14 8NS |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code 1-866-472-7987

| |

| (Former name or former address, if changed since last report) |

INFORMATION TO BE INCLUDED IN REPORT

Item 1.01. Entry into a Material Definitive Agreement.

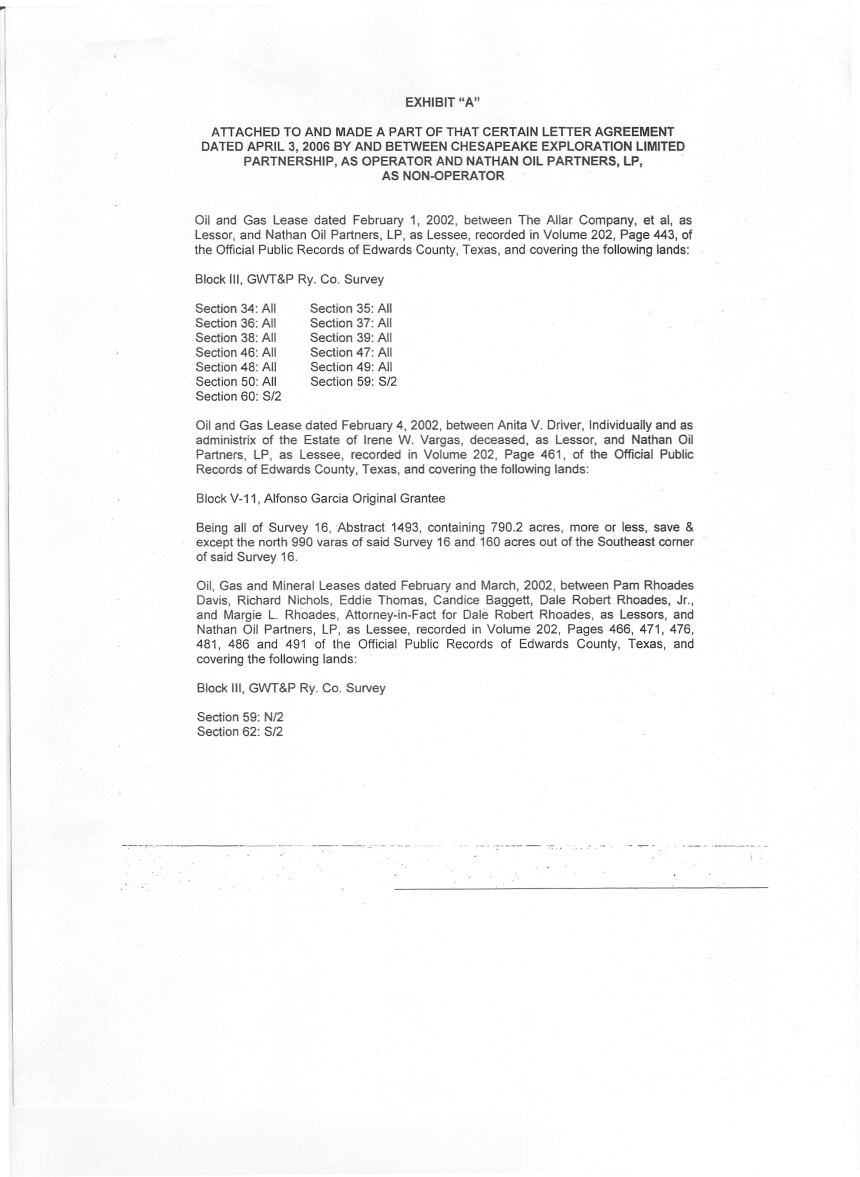

On May 8, 2006, Brek Energy-controlled Vallenar Energy Corp., through its operating company Nathan Oil Partners LP, has signed a letter agreement with Chesapeake Exploration Limited Partnership (the “operator”) for the development of oil and gas properties on the Rocksprings Prospect in Edwards County, Texas (the “Letter Agreement”). Pursuant to the terms of the Letter Agreement, Nathan Oil agreed to assign a 100% interest in the Rocksprings oil and gas properties that are below a depth of 1,500 feet (the “Lease” or the “Leases”) to allow for exploration. The operator can earn a 75% working interest in the wells and production in exchange for drilling until it has completed a well capable of producing hydrocarbons in commercial quantities. When the operator has completed the first 10 wells and recovered 100% of the costs to drill the wells (“payout”), Nathan Oil can back in for a 25% working interest in the wells. On future wells, Nathan Oil can either participate from the outset to earn a 25% working interest, or back in after payout to earn a 6.25% working interest.

The operator will conduct a 3-D seismic survey over an area that will include coverage of the Leases. The operator will bear the entire cost of the 3-D seismic survey and will provide Nathan Oil with interpretive data that relates to the acreage covered by the Leases, including data related the shallow zone on the initial well drilled on the Rocksprings oil and gas properties.

Also, immediately upon the successful completion of a well capable of producing natural gas in commercial quantities, the operator will begin the process of building or procuring a pipeline to transport natural gas to market.

If, for any reason, any of the Leases expire before being developed, the operator will make every reasonable effort to acquire a new Lease, or an extension of the Leases, which extension will be subject to the terms and conditions of the Letter Agreement. If the operator fails to drill an initial well on the Leases before any Lease expires, and is unable to acquire a new Lease or extend the existing Lease, the operator will pay Nathan Oil $500,000 in liquidated damages.

If the operator does not propose a well and commence operations for the drilling of that well within 60 days from the expiration of a Lease, Nathan Oil will have the right to propose and/or drill a well. The operator will have 15 days from the receipt of Nathan Oil’s proposal to elect to participate in the proposed well.

See Exhibit 10.8 - Letter Agreement for more details.

Item 7.01. Regulation FD Disclosure.

Limitation on Incorporation by Reference: In accordance with general instruction B.2 of Form 8-K, the information in this report, including Exhibit 10.8, is furnished under Item 9 and pursuant to Regulation FD, and will not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, or incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as will be expressly set forth by specific reference in such filing. This report will not be deemed a determination or an admission as to the materiality of any information in the report that is required to be disclosed solely by Regulation FD.

The information contained in Exhibit 10.8 is incorporated herein by reference.

Item 8.01. Other Events.

On May 8, 2006, Nathan Oil Partners LP agreed to and accepted the terms and conditions of the Letter Agreement. A press release regarding the Letter Agreement was issued on May 12, 2006. A copy of this press release is attached as Exhibit 99.1 and hereby incorporated by reference.

Item 9. Financial Statements and Exhibits.

Exhibit | Description | |

| 10.8 | Letter Agreement dated April 3, 2006 between Chesapeake Exploration Limited Partnership and Nathan Oil Partners LP | Included |

| 99.1 | Press release dated May 12, 2006 announcing the Letter Agreement with Chesapeake Exploration Limited Partnership | Included |

| | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Brek Energy Corporation has caused this report to be signed on its behalf by the undersigned duly authorized person.

BREK ENERGY CORPORATION

By:/s/ Richard N. Jeffs

Dated: May 30, 2006

Richard N. Jeffs - CEO & President

Exhibit 10.8

Exhibit 99.1

Nathan Oil Partners and Chesapeake Exploration Limited Partnership reach agreement on natural gas prospect in Edwards County, Texas

Reno, Nevada: May 12, 2006. Brek Energy Corporation (Other OTC: BREK). We are pleased to announce that Brek Energy-controlled Vallenar Energy Corporation, through its operating company Nathan Oil Partners LP, has signed an agreement with Chesapeake Exploration Limited Partnership on the Rocksprings Prospect in Edwards County, Texas. Nathan Oil has agreed to assign all of its interest in the leases below a depth of 1,500 feet to allow Chesapeake the opportunity to explore for oil and natural gas on the property. The assignment is subject to Nathan Oil’s right to a 25% working interest in every well that Chesapeake drills on the property. Chesapeake will earn their interest in the leases when they have successfully completed a well capable of producing hydrocarbons in commercial quantities.

Chesapeake will drill the first ten wells bearing all of the costs. When they have recovered 100% of the costs from production, Nathan Oil will back-in with a 25% working interest in the wells. At this point, Nathan may participate with a 25% working interest in all future wells drilled, or may back in after payout for a 6.5% working interest in lieu of non-consent penalties.

Chesapeake will conduct a 3-D seismic survey over an area that includes the acreage covered by the leases, bearing the entire cost and expense. Chesapeake will process, transport and market the natural gas produced from any commercial wells on the leases, and will immediately begin to build or procure a pipeline to transport the natural gas to market.

“The recent Ellenburger natural gas discovery wells on leases adjacent to the Vallenar’s Rocksprings Prospect shifted the focus from heavy oil to natural gas,” said Rick Jeffs, Brek Energy’s CEO. “Given the competitive drilling and well completion environment in the oil and gas industry, Vallenar is fortunate to have this opportunity to work with Chesapeake, with its considerable experience and success in the oil and gas industry. As for the heavy oil, in the initial well, Chesapeake will provide an array of logs and sidewall cores in the shallow oil zone covered by Nathan leases but not part of the leases assigned under the Chesapeake agreement.”

About Brek Energy Corporation

Brek Energy Corporation is an exploration and development company with interests in non-conventional oil and gas resources in the US Rocky Mountains, Texas and California. The company is focusing on its 17,115 net acres within the Gasco Energy-operated Riverbend Project in the Uinta Basin, Utah. Brek Energy had proved reserves at year-end 2005 of approximately 5.8 Bcfe, 97% of which was natural gas and 30% were proved developed. For further information on the company and its properties, please visit www.brekenergy.com.

About Vallenar Energy Corporation.

Vallenar Energy Corp. is an oil & gas company with interest in the Rocksprings Prospect in Edwards County, Texas. Vallenar’s objectives are to explore and develop the hydrocarbons on its 8,865 net acres of oil & gas properties.

Certain statements contained above are "forward-looking" statements (as defined in the Private Securities Litigation Reform Act of 1995). Because these statements include significant risks and uncertainties, actual results may differ materially from those expressed or implied by the forward-looking statements. For a discussion of some of these risks and uncertainties, please refer to the company's SEC filings, which contain additional discussion about those risk factors, which could cause actual results to differ from management's expectations. Brek Energy expressly disclaims any obligation to update these forward-looking statements.

FOR FURTHER INFORMATION PLEASE CONTACT:

Peter Forward

Corporate Communications

Toll Free: (866) 472-7987

information@brekenergy.com

www.brekenergy.com