Exhibit 99.1

25

YEAR

EVEREST

25 YEARS PUBLIC, NEARLY SO YEARS OF HISTORY

ANNIVERSARY

Investor Day

June 23, 2021

Cautionary Note On Forward-looking Statements This presentation contains forward-looking statements within the meaning of the U.S. federal securities laws. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in the U.S. Federal securities laws. These statements reflect management's current expectations based on assumptions we believe are reasonable, but are not guarantees of performance. The forward-looking statements contained in this document involve risks and uncertainties that could cause actual results to differ materially from those contained in forward-looking statements made on behalf of the Company. These risks and uncertainties include, but are not limited to, the impact of general economic conditions and conditions affecting the insurance and reinsurance industry, the adequacy of our reserves, our ability to assess underwriting risk, trends in rates for property and casualty insurance and reinsurance, competition, investment market and investment income fluctuations, trends in insured and paid losses, catastrophes, pandemic, regulatory and legal uncertainties and other factors described in our latest Annual Report on Form 10-K. Except as required by law, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. EVEREST RE GROUP, LTD.

2

Today's Agenda

OPENING

Jon Levenson Head of Investor Relations

CHAIRMAN'S REMARKS

Joseph Taranto Chairman, Board of Directors

INTRODUCTION & STRATEGIC OVERVIEW

Juan C. Andrade President and Chief Executive Officer

FINANCIAL OVERVIEW

Mark Kociancic Group Chief Financial Officer

GROUP RISK

Jim Williamson Group Chief Operating Officer and Head of Reinsurance

Q&A SESSION #1

Juan C. Andrade, Mark Kociancic and Jim Williamson

15-MINUTE BREAK

EVEREST INSURANCE®

Mike Karmilowicz President and CEO of the Everest Insurance® Division

Mike Mulray Chief Operating Officer, Everest Insurance®

EVEREST REINSURANCE

Jim Williamson Group Chief Operating Officer and Head of Reinsurance

Chris Downey Chief Underwriting Officer, Everest Reinsurance

INVESTMENTS

Seth Vance Chief Investment Officer

SUMMARY THOUGHTS

Juan C. Andrade President and Chief Executive Officer

Q&A SESSION #2

Everest Management Team

EVEREST RE GROUP, LTD.

3

Introduction

& Strategic

Overview

EVEREST RE GROUP, LTD.

4

Everest's Investment Thesis

BUILDING ON STRENGTH

OPERATIONAL EXCELLENCE

SCALABLE GLOBAL FRANCHISES EVEREST

DISCIPLINED UNDERWRITING

FINANCIAL POWER

SEASONED LEADERSHIP TEAM

EVEREST RE GROUP, LTD.

5

Our Guiding Principles

1. Our objective is to deliver leading financial performance

2. We are an underwriting company whose core competency is the assessment, underwriting, pricing and management of risk

3. We are committed to building a broadly diversified company built upon competitive advantage

and opportunistic responses to market dislocations 4. We are focused on an investment strategy that optimizes risk, return, liquidity and asset/liability management, providing support for and balance to our underwriting risk

5. We are committed to an efficient cost base, a flat, responsive, and entrepreneurial organization, and the relentless pursuit of continuous operational excellence

6. Our plans are based on organic growth, but we will continuously assess opportunities to accelerate our strategy through acquisitions and partnerships

7. We are committed to investing in our people, culture, and building on ESG best practices in everything we do. We hold ourselves to the highest ethical standards

EVEREST RE GROUP, LTD.

6

Forging a New Path Forward

Building on a 50-year legacy

Operating from aposition of strength

Top Tier Management Team

Operational Excellence

Margin Expansion

Enhanced Investment Performance

Effective Capital Management

Global and Diverse Talent and Culture

EVEREST RE GROUP, LTD.

7

Delivering For Our Stakeholders

Building on

Strength

Accelerating profitable insurance growth / Capitalizing on leading global reinsurance franchise

Path forward is

Clear

Defined strategic priorities

Delivering superior

Results

Attractive shareholder returns

EVEREST RE GROUP, LTD.

8

A Unique Global Platform

STRONG GROSS WRITTEN PREMIUM GROWTH

EVEREST: A MARKET LEADER

$10.5

$9.1

$8.5

Growth company with competitive advantage in key markets

$7.2

$3.2

$6.0

$2.3

$2.8

$2.1

$1.8

Broadly diversified income streams

$6.2

$6.4

$7.3

$4.2

$5.1

Strong underlying underwriting performance with

reduced volatility

2016

2017

2018

2019

2020

Reinsurance

Insurance

Low expense base

ROBUST FINANCIAL METRICS

Nimble, entrepreneurial and responsive

BALANCE SHEET

(12/31/20)

$9.7B

14.1%

$25.5B

Strong cash flow

GAAP EQUITY

LT DEBT TO

CAPITAL(1)

INVESTMENT

PORTFOLIO

Growing, highly liquid, strong credit quality

investments

A+

A+

A1

FINANCIAL

STRENGTH

RATINGS

Robust, scalable 3rd party capital capabilities

A.M. Best

S&P Global

Moody's Investors

Service

STABLE OUTLOOK

(1) Excludes FHLB debt

EVEREST RE GROUP, LTD.

9

Everest Re: Our Divisions

POSITIONING

Everest Reinsurance Division

Everest Insurance® Division

· Entrepreneurial and responsive problem solvers

2020 GROSS WRITTEN PREMIUM BUSINESS MIX

2020 GROSS WRITTEN PREMIUM BUSINESS MIX

9%

Property Pro Rata

12%

16%

Accident & Health

· Rigorous centralized business controls and risk management allow for active portfolio oversight

13%

Property Non-Cat XOL

33%

Specialty Casualty

Property Cat XOL

$7.3B

$3.2 B

Prof Liab / Other Specialty

19%

Casualty Pro Rata

31%

· Think Globally, trade locally with 24 offices in 10 countries

21%

Property / Short Tail

Casualty XOL

7%

Financial Lines

Workers' Comp

17%

22%

· Preferred partner to our customers

KEY OPERATING STATISTICS

KEY OPERATING STATISTICS

· 11% GWP CAGR (5-Years)

· 16% GWP CAGR (5-Years)

· 85.2% attritional combined ratio* (2020)

· 94.2% attritional combined ratio* (2020)

* Attritional combined ratio excludes catastrophe losses, reinstatement premiums, prior year development and COVID-19 pandemic impact.

EVEREST RE GROUP, LTD.

10

Everest Leadership: Extensive Global Industry Experience

Mike Karmilowicz

EVP and President & CEO of Insurance

Mike Mulray

Chief Operating Officer of Insurance

Chris Downey

CUO of Reinsurance

Gail Van Beveren

EP and Chief Human Resources

Officer

Sanjoy Mukherjee

EVP and General Counsel, CCO and Secretary

.

Terry Walker

Chief Information Officer

Anne Rocco

Group Chief Transformation and Shared Services Leader

Seth Vance

Chief Investment Officer

Don Mango

Chief Risk Officer and Chief Actuary

Jim Williamson

EVP and Chief Operating Officer

Mark Kociancic

EVP and Chief Financial Officer

Juan C. Andrade

President and Chief Executive Officer

EVEREST RE GROUP, LTD.

11

Strategic Building Blocks

BUILDING OUR FRANCHISES

· Grow the Specialty P&C Insurance Platform with Expanded Margins

· Capitalize on and Grow Leading P&C Reinsurance Franchise

· Sharpen Investment Strategy

CONTINUOUS PURSUIT OF OPERATIONAL

EXCELLENCE

· Focused Underwriting Discipline

· Dynamic Capital Allocation

· Scalable Operating Model

WINNING BEHAVIORS

· Focus on People, Talent and Culture

· Promoting Diversity, Equity and Inclusion

· Pursue ESG Excellence

EVEREST RE GROUP, LTD.

12

Building Our Franchises

Insurance

· Fully Embed Data Analytics Across

· Improve Claims Outcomes

· Enhance Distribution

· Expand Global Footprint

· Scalable Operating Model

Reinsurance

· Continue Local Execution Supported by Strong Core

· Targeted Diversification Globally and by Product

· Grow Alternative Capital

Investments

· Maintain Portfolio Diversification

· Optimize Total Return Strategy

· Invest with ESG Mindset

FRANCHISE

STRATEGY BENEFITS

· Accelerate profitable top line growth in attractive markets

· Attain target Combined Ratios in the low 90s

· Enhance sustainability and diversification

· Optimize risk-adjusted returns with a capital efficient investment portfolio

EVEREST RE GROUP, LTD.

13

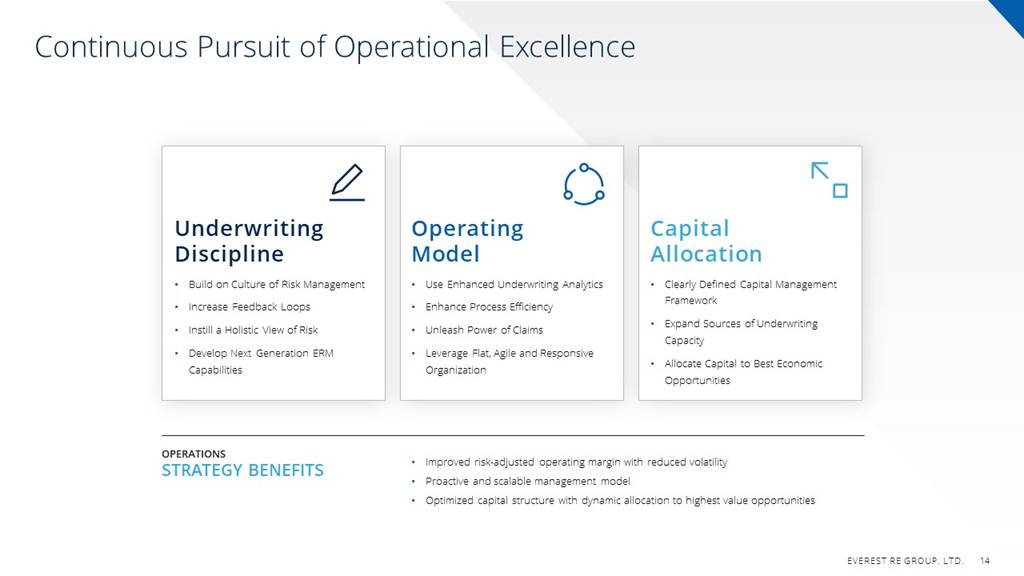

Continuous Pursuit of Operational Excellence

Underwriting Discipline

· Build on Culture of Risk Management

· Increase Feedback Loops

· Instill a Holistic View of Risk

· Develop Next Generation ERM Capabilities

Operating Model

· Use Enhanced Underwriting Analytics

· Enhance Process Efficiency

· Unleash Power of Claims

· Leverage Flat, Agile and Responsive Organization

Capital Allocation

· Clearly Defined Capital Management Framework

· Expand Sources of Underwriting Capacity

· Allocate Capital to Best Economic Opportunities

OPERATIONS

STRATEGY BENEFITS

· Improved risk-adjusted operating margin with reduced volatility

· Proactive and scalable management model

· Optimized capital structure with dynamic allocation to highest value opportunities

EVEREST RE GROUP, LTD.

14

Winning Behaviors

People, Talent and Culture

· Invest in our People and in new Talent Across Organization

Promoting Diversity, Equity and Inclusion

· Commitment to an inclusive organization

Pursue ESG Excellence

· Focus on Environmental Impact / Climate Change

· Best-in-class Governance

Reinforcing Our Culture

Consistently Recognized by Business Insurance as a "Best Place to Work"

TALENT

EXECUTION

EFFICIENCY

THOUGHTFUL ASSUMPTION OF RISK

HUMILITY

LEADERSHIP

COLLABORATION

DIVERSITY, EQUITY AND INCLUSION

EVEREST RE GROUP, LTD.

15

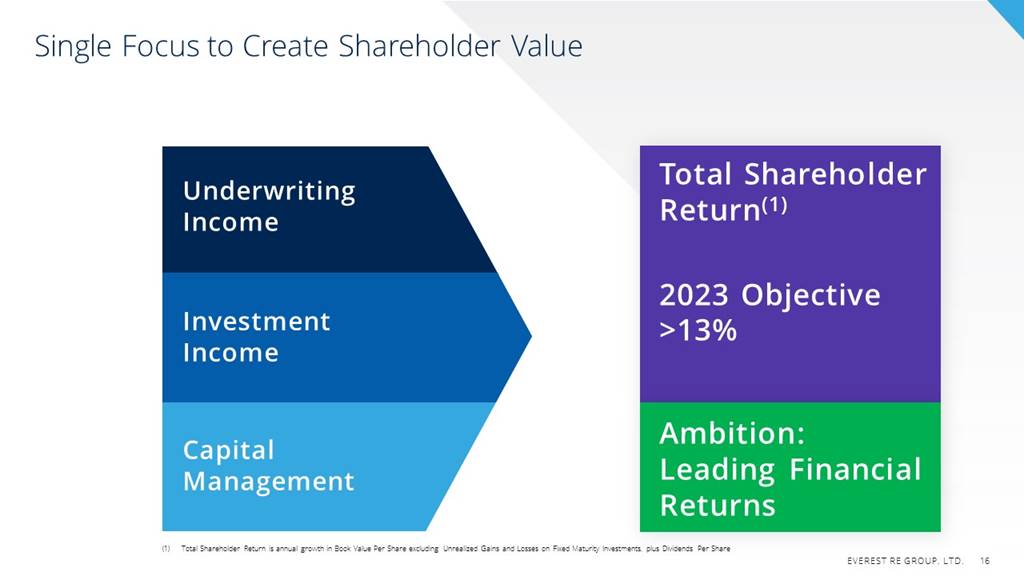

Single Focus to Create Shareholder Value

Underwriting Income

Investment Income

Capital Management

Total Shareholder Return(1)

2023 Objective > 13%

Ambition: Leading Financial Returns

(1)Total Shareholder Return is annual growth in Book Value Per Share excluding Unrealized Gains and Losses on Fixed Maturity Investments, plus Dividends Per Share

EVEREST RE GROUP, LTD.

16

Clear Strategic Direction to Drive Exceptional Outcomes

Seasoned management team forging a new path forward

Building on strengths to accelerate the growth of our franchises

Focusing on continuous operational excellence to drive margin expansion

Investing in our people and the communities we serve

Relentlessly pursuing financial performance: >13% Total Shareholder col Return 2023 Target; Ambition for leading financial returns

EVEREST RE GROUP, LTD.

17

Group

Finance

Overview

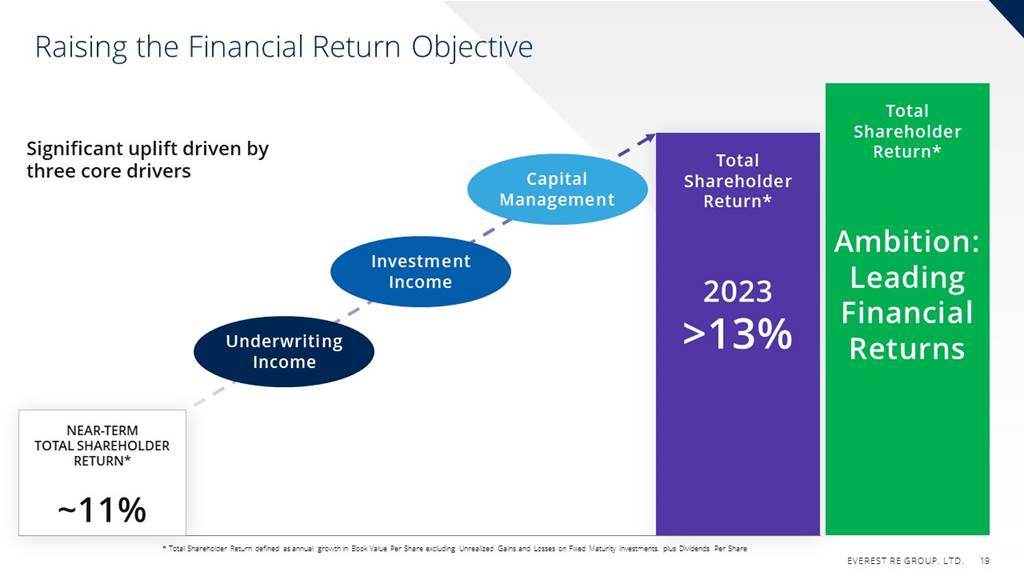

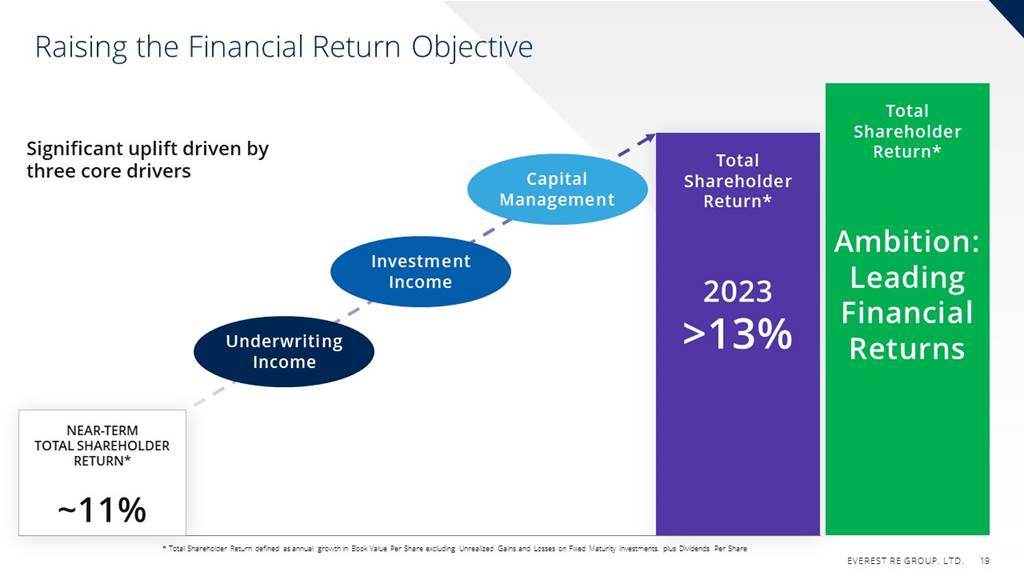

Raising the Financial Return Objective

Significant uplift driven by three core drivers

NEAR-TERM TOTAL SHAREHOLDER RETURN*

~11%

Underwriting Income

Investment Income

Capital Management

Total Shareholder Return*

2023

> 13%

Total Shareholder Return*

Ambition: Leading Financial Returns

Underwriting Income

* Total Shareholder Return defined as annual growth in Book Value Per Share excluding Unrealized Gains and Losses on Fixed Maturity Investments, plus Dividends Per Share

EVEREST RE GROUP, LTD.

19

3-Year (2021 – 2023) Strategic Plan Financial Target Assumptions

GWP Growth Rate

Key Ratios

Underwriting Income

2023

Group: 10 - 15% CAGR

• 91% - 93% CR (Group and Divisions)

.

Reinsurance: 8 - 12% CAGR

6 - 7% Cat load (included in CR)

Insurance: 18-22% CAGR

~6% Group general expense ratio

Total Shareholder Return*

Investment Mix

Return on Inv Assets

Investment Income

2.75% - 3.25%

Increasing Alternative Fixed

Income, Public & Private Equity

>13%

Capital Structure

Capital Return

Capital

Management

• A+ Financial Strength Rating(1)

• Commitment to proactive capital management

15 -20% LT Debt Leverage Ratio

* Total Shareholder Return defined as annual growth in Book Value Per Share excluding Unrealized Gains and Losses on Fixed Maturity Investments, plus Dividends Per Share

(1) Moderately-high risk profile

EVEREST RE GROUP, LTD.

20

Delivering Financial Performance: Underwriting Income

Premium Growth & Scale

· Strong gross written premium growth creates operating leverage

· Scalable platforms

Technology Enhancements

· Investment in data & analytics

· Improved claims outcomes

· Transitioning manual processes to automated solutions

Underwriting and Portfolio Optimization

· Thoughtful cycle management

· Dynamic portfolio Management

· Margin expansion

· Expense discipline

EVEREST RE GROUP, LTD.

21

Delivering Financial Performance: Investment Income

Core Portfolio Strategy

· Assets backing reserves

· High quality and liquid with matched duration while maximizing yield

Total Return Strategy

· Assets backing capital

· Enhanced investment returns with larger allocation to Alternative Fixed Income, Public & Private Equity

EVEREST RE GROUP, LTD.

22

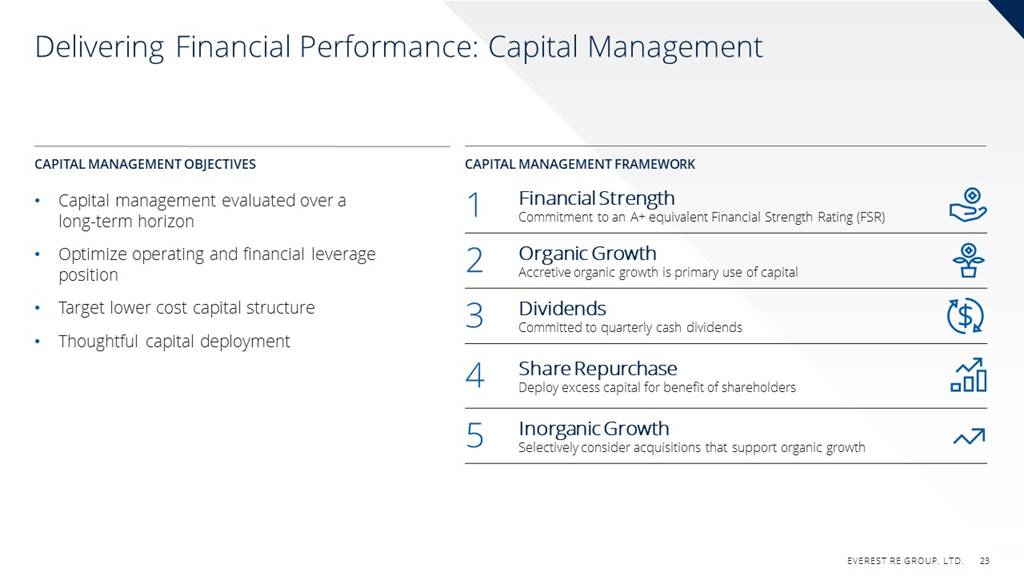

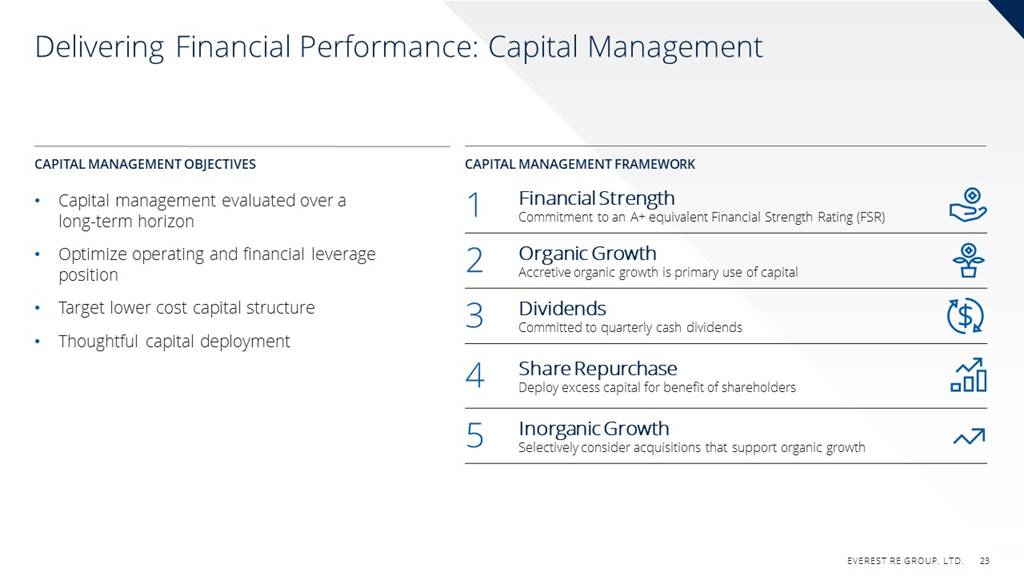

Delivering Financial Performance: Capital Management

CAPITAL MANAGEMENT OBJECTIVES

CAPITAL MANAGEMENT FRAMEWORK

· Capital management evaluated over a long-term horizon

1 Financial Strength

Commitment to an A+ equivalent Financial Strength Rating (FSR)

.

· Optimize operating and financial leverage position

2 Organic Growth

Accretive organic growth is primary use of capital

· Target lower cost capital structure

3 Dividends

Committed to quarterly cash dividends

· Thoughtful capital deployment

4 Share Repurchase

Deploy excess capital for benefit of shareholders

5 Inorganic Growth

Selectively consider acquisitions that support organic growth

EVEREST RE GROUP, LTD.

23

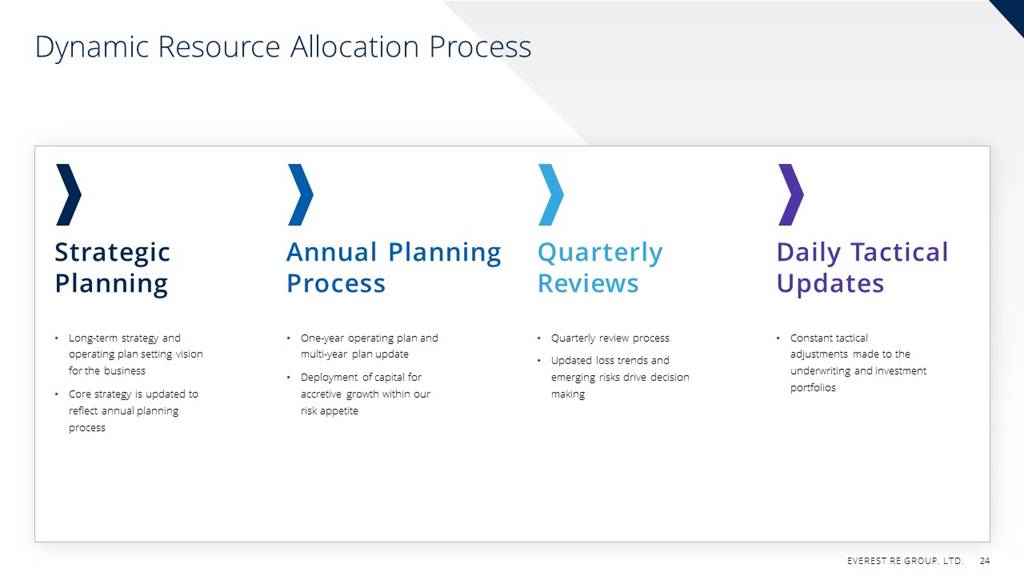

Dynamic Resource Allocation Process

Strategic Planning

· Long-term strategy and operating plan setting vision for the business

· Core strategy is updated to reflect annual planning process

Annual Planning Process

· One-year operating plan and multi-year plan update

· Deployment of capital for accretive growth within our risk appetite

Quarterly Reviews

· Quarterly review process

· Updated loss trends and emerging risks drive decision making

Daily Tactical Updates

· Constant tactical adjustments made to the underwriting and investment portfolios

EVEREST RE GROUP, LTD.

24

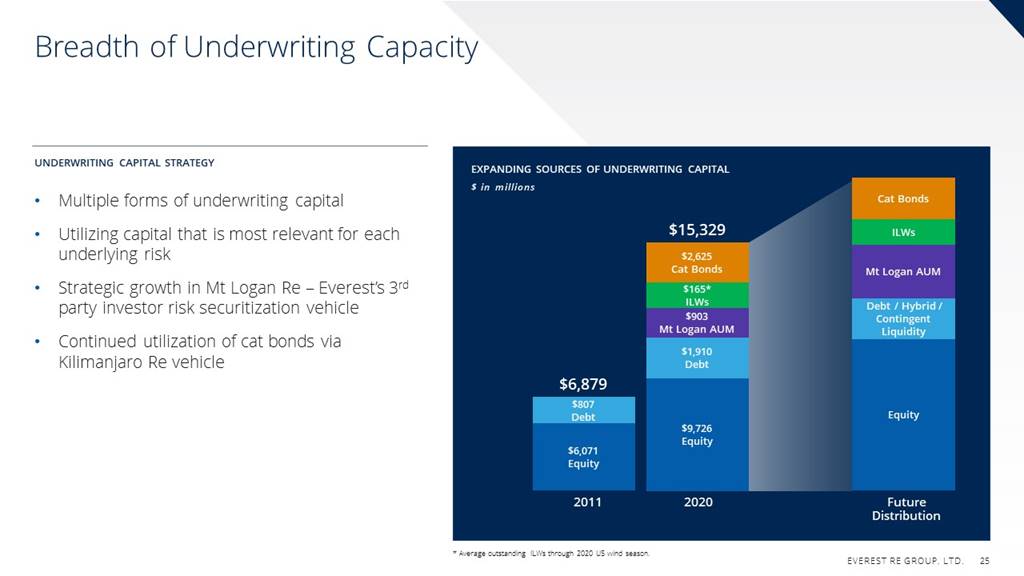

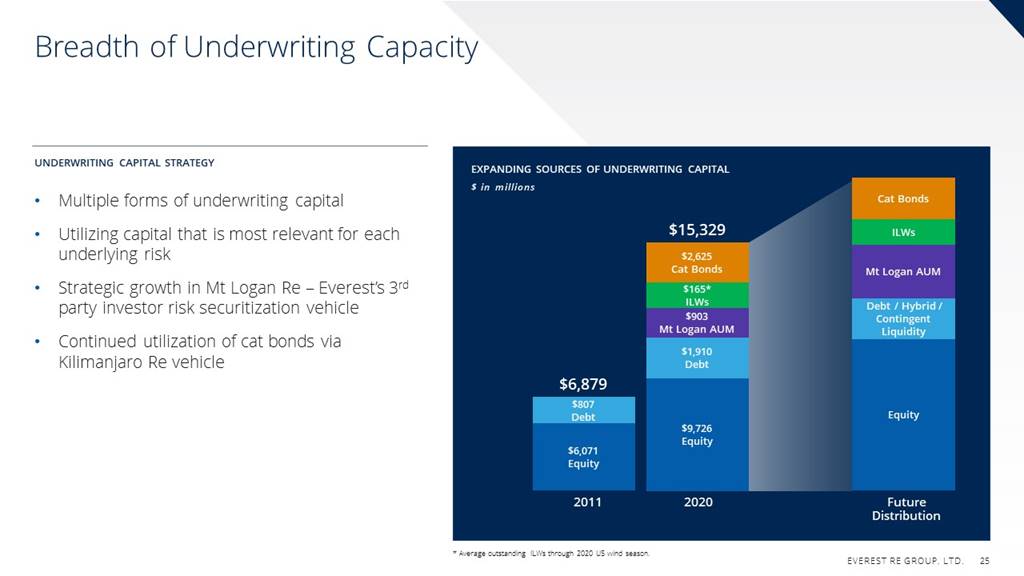

Breadth of Underwriting Capacity

UNDERWRITING CAPITAL STRATEGY

EXPANDING SOURCES OF UNDERWRITING CAPITAL

$ in millions

· Multiple forms of underwriting capital

Cat Bonds

$15,329

ILWs

· Utilizing capital that is most relevant for each underlying risk

$2,625

Cat Bonds

Mt Logan AUM

· Strategic growth in Mt Logan Re - Everest's 3rd party investor risk securitization vehicle

$165*

ILWs

$903

Mt Logan AUM

Debt / Hybrid /

Contingent

Liquidity

· Continued utilization of cat bonds via Kilimanjaro Re vehicle

$1,910

Debt

$6,879

$807

Debt

Equity

$9,726

Equity

$6,071

Equity

2011

2020

Future

Distribution

* Average outstanding ILWs through 2020 US wind season.

EVEREST RE GROUP, LTD.

25

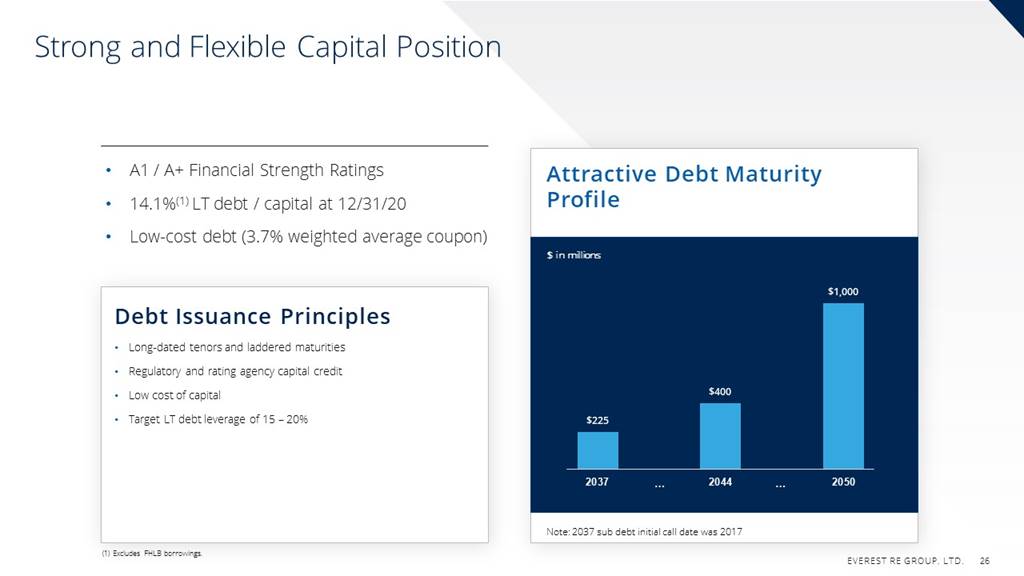

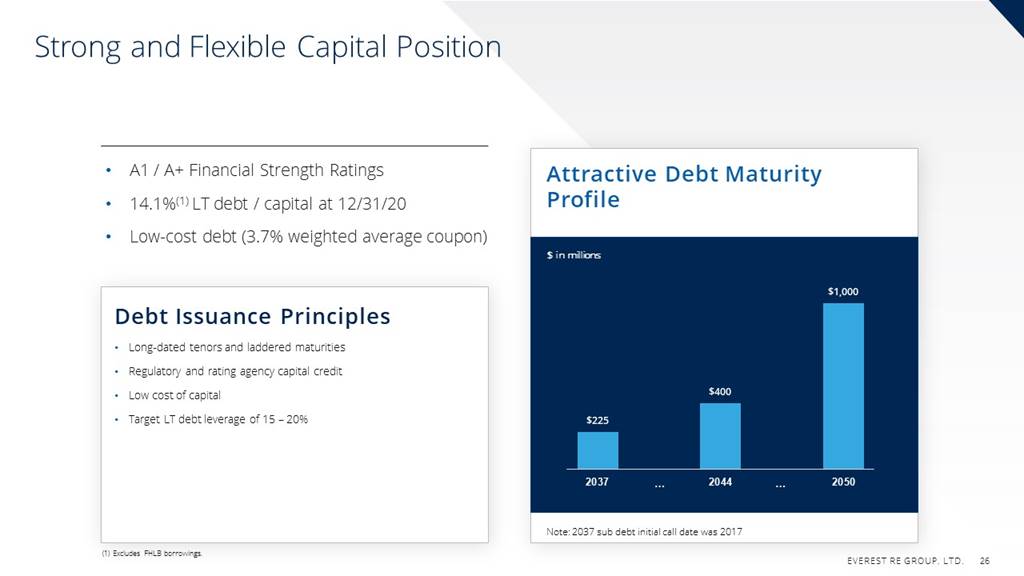

Strong and Flexible Capital Position

· A1 / A+ Financial Strength Ratings

Attractive Debt Maturity

Profile

· 14.1%(1) LT debt / capital at 12/31/20

· Low-cost debt (3.7% weighted average coupon)

$ in millions

$1,000

Debt Issuance Principles

.

· Long-dated tenors and laddered maturities

· Regulatory and rating agency capital credit

· Low cost of capital

· Target LT debt leverage of 15 - 20%

$400

$225

2037

2044

2050

Note: 2037 sub debt initial call date was 2017

(1) Excludes FHLB borrowings.

EVEREST RE GROUP, LTD.

26

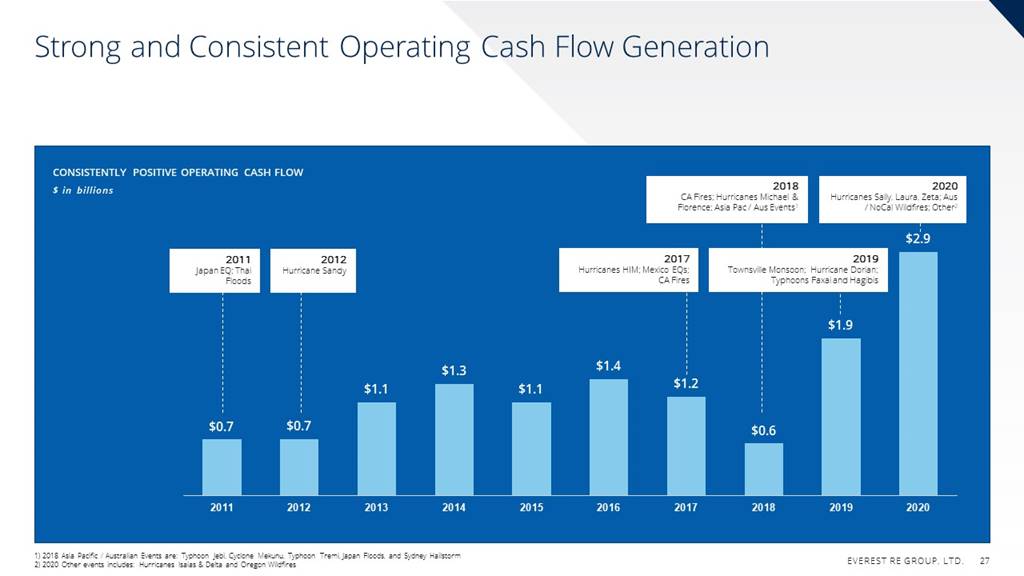

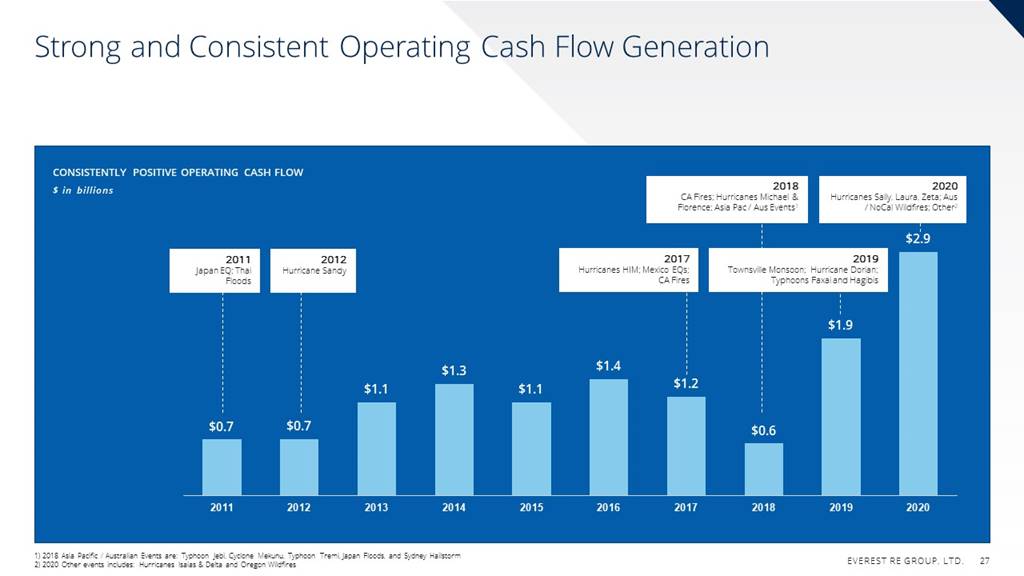

Strong and Consistent Operating Cash Flow Generation

CONSISTENTLY POSITIVE OPERATING CASH FLOW

$ in billions

2018 CA Fires; Hurricanes Michael & Florence; Asia Pac/Aus Events

2020 Hurricanes Sally, Laura, Zeta; Aus /NoCal Wildfires; Other2

$2.9

2011 Japan EQ; Thai Floods

2012 Hurricane Sandy

2017 Hurricanes HIM; Mexico EQS; CA Fires

2019 Townsville Monsoon; Hurricane Dorian; Typhoons Faxai and Hagibis

$1.9

$1.3

$1.4

$1.2

$1.1

$1.1

$0.7

$0.7

$0.6

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

1) 2018 Asia Pacific / Australian Events are: Typhoon jebi, Cyclone Mekunu, Typhoon Tremi Japan Floods, and Sydney Hailstorm

2) 2020 Other events includes: Hurricanes Isaias & Delta and Oregon Wildfires

EVEREST RE GROUP, LTD.

27

Prudent Liquidity Management

STRONG LIQUIDITY PROFILE

· U.S. platform minimizes collateral requirements

•

$1.6B FHLB*

Facility

· Strong operating cash flows

.

· Conservative PML's

Liquidity Facility

· Quality reinsurance with significant available collateral

· Low debt leverage

Everest's Liquidity Paradigm

· Readily marketable investment securities

Fixed Income Assets

Investment Income

· $1.6B Federal Home Loan Bank (FHLB) credit facility

Cash & Short-term Assets

Underwriting Income

Liquid Assets

Operating Cash Flows

* Federal Home Loan Bank (FHLB)

EVEREST RE GROUP, LTD.

28

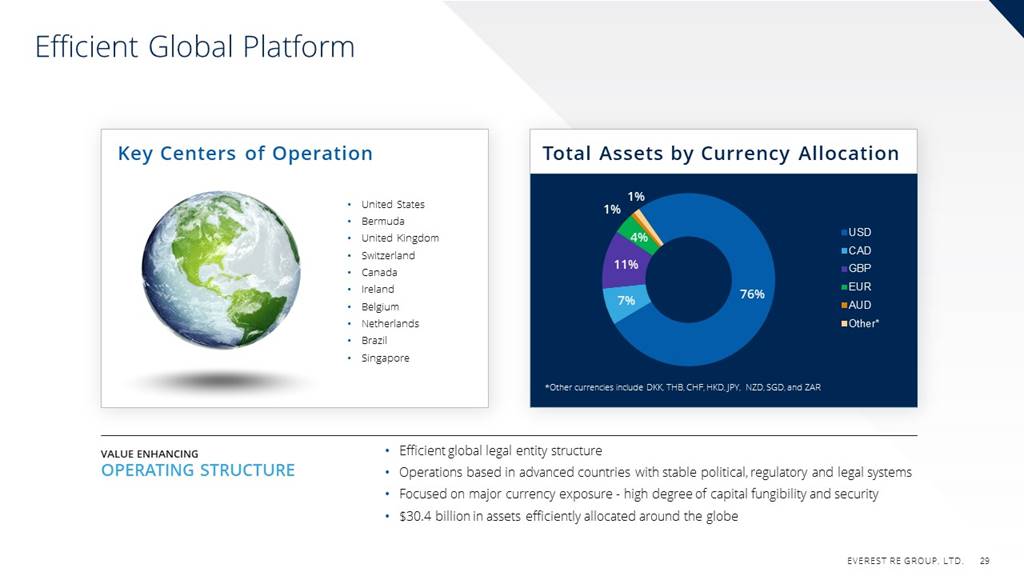

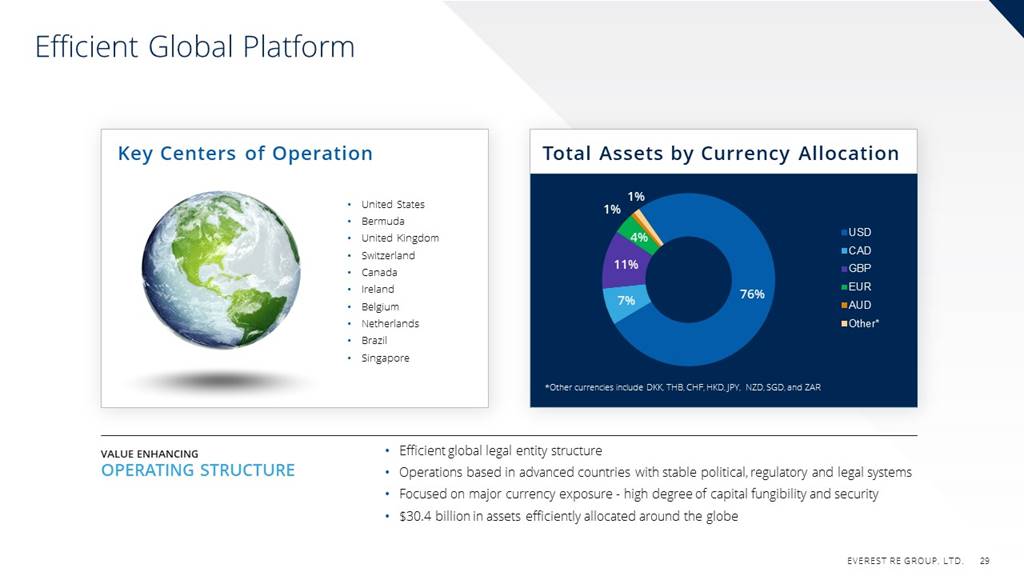

Efficient Global Platform

Key Centers of Operation

Total Assets by Currency Allocation

· United States

1%

1%

· Bermuda

USD

· United Kingdom

4%

· Switzerland

CAD

11%

· Canada

GBP

· Ireland

EUR

76%

7%

.

· Belgium

I AUD

O

· Netherlands

Other*

· Brazil

· Singapore

*Other currencies include DKK, THB, CHF, HKD JPY, NZD, SGD, and ZAR

VALUE ENHANCING

OPERATING STRUCTURE

•

· Efficient global legal entity structure

· Operations based in advanced countries with stable political, regulatory and legal systems

· Focused on major currency exposure - high degree of capital fungibility and security

· $30.4 billion in assets efficiently allocated around the globe

.

EVEREST RE GROUP, LTD.

29

Financial Strategy Supports Shareholder Value Creation

2023 Total Shareholder Return target >13%; Ambition for leading financial returns

10 - 15% gross written premium CAGR

Low 90's combined ratio assumption

Enhancing investment returns with greater focus on Alternative FI / PE

Capital structure evolution will improve shareholder returns

EVEREST RE GROUP, LTD.

30

Group Risk

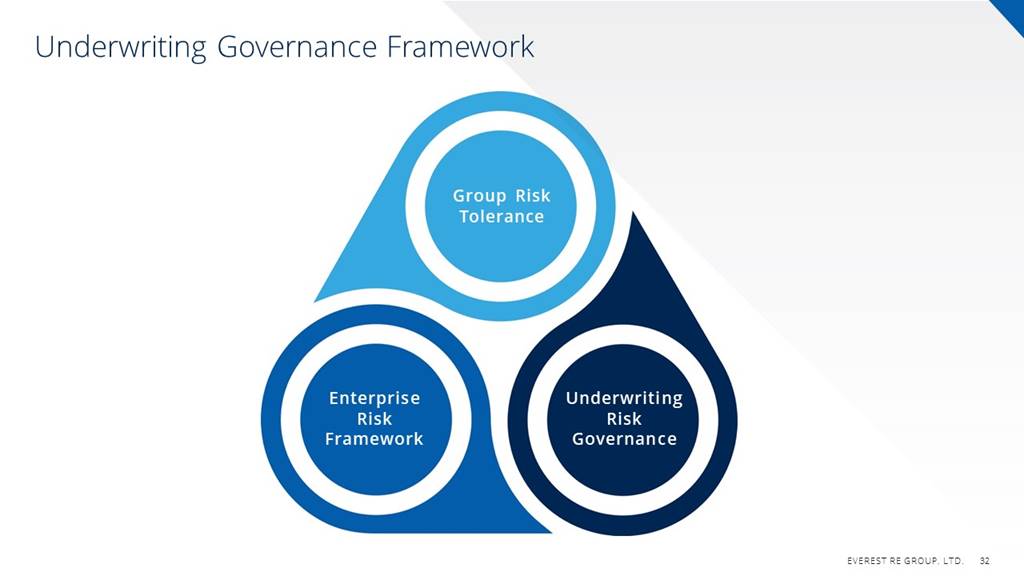

Underwriting Governance Framework

Group Risk Tolerance

Enterprise Risk Framework

Underwriting Risk Governance

EVEREST RE GROUP. LTD.

32

Transforming Everest's Risk Profile

ENTERPRISE RISK STRATEGY

Risk Profile Managed to Superior Risk / Reward Economics

· Increased expected earnings despite significant reduction in risk profile

2017

· Go-forward appetite defined by clear trading range

· Strong market conditions mean a nimble deployment of additional capacity

2016

2018

2015

Reducing Risk: PML Management

Earnings at Risk

AFTER TAX 1:100 PML AS A % OF GROUP EQUITY*

2014

11.4%

2019

9.1%

7.7%

6.7%

2021

5.9%

5.2%

2020

2017

2021

Capital at Risk

illustrative purposes

SE U.S., Wind Cal, EQ Texas, Wind

* Calculated as the 1:100 PML as of January 1 of the respective year, divided by Everest's shareholders' equity of the preceding December 31.

EVEREST RE GROUP, LTD.

33

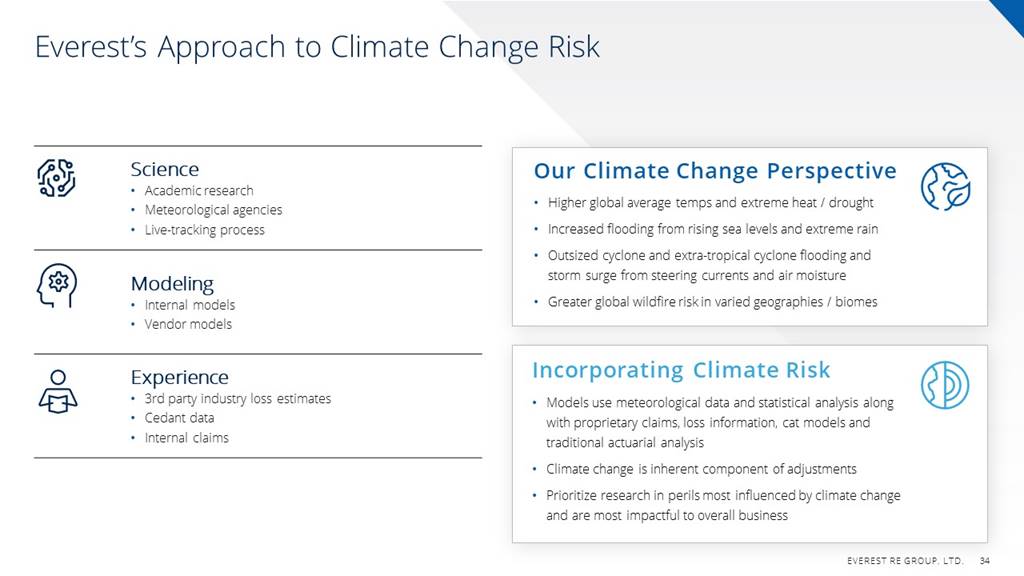

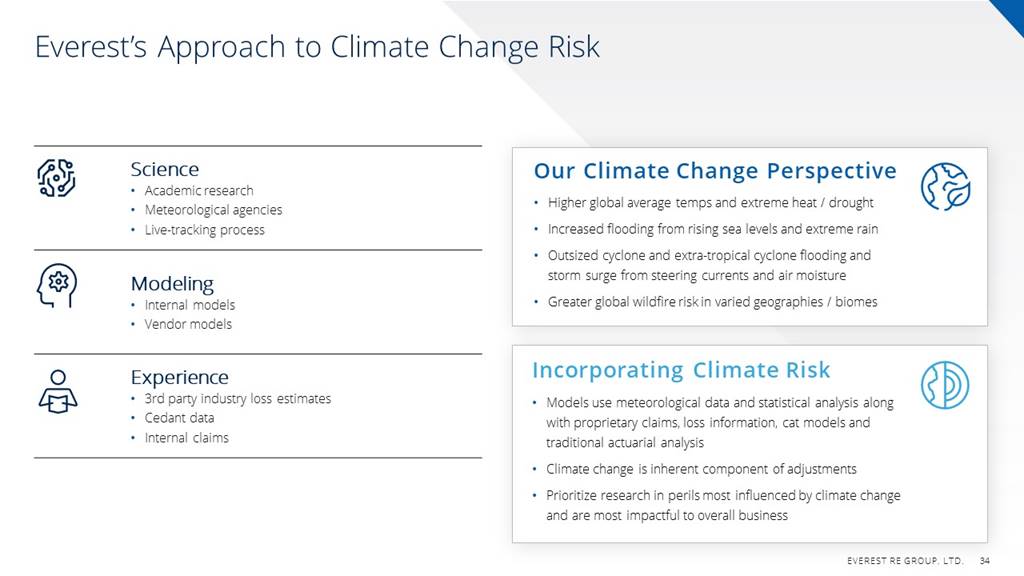

Everest's Approach to Climate Change Risk

Science

· Academic research

· Meteorological agencies

· Live-tracking process

Modeling

· Internal models

· Vendor models

Experience

· 3rd party industry loss estimates

· Cedant data

· Internal claims

Our Climate Change Perspective

· Higher global average temps and extreme heat / drought

· Increased flooding from rising sea levels and extreme rain

· Outsized cyclone and extra-tropical cyclone flooding and storm surge from steering currents and air moisture

· Greater global wildfire risk in varied geographies / biomes

Incorporating Climate Risk

· Models use meteorological data and statistical analysis along with proprietary claims, loss information, cat models and traditional actuarial analysis

· Climate change is inherent component of adjustments

· Prioritize research in perils most influenced by climate change and are most impactful to overall business

EVEREST RE GROUP, LTD.

34

Governance Process to Effectively Manage Risk

Pervasive culture of rigorous risk analysis

Clear, observed appetites for all lines of business

Reduced volatility and increasing underwriting income

Robust risk management feedback loops and metrics

EVEREST RE GROUP, LTD.

35

Q&A

Everest

Insurance

z

Our Mission

To be a World-Class Specialty Diversified Global Insurance Company

EVEREST RE GROUP, LTD.

38

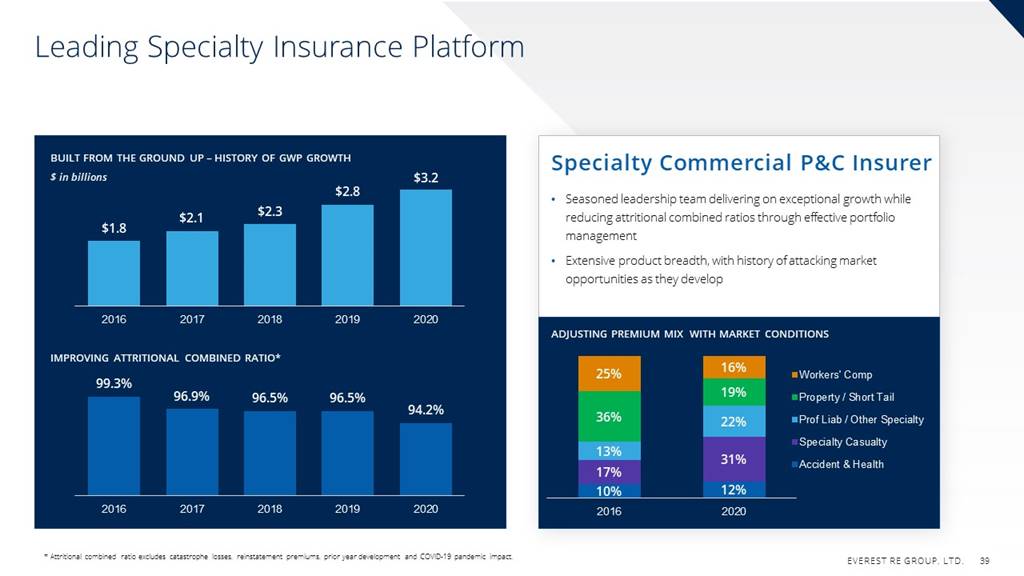

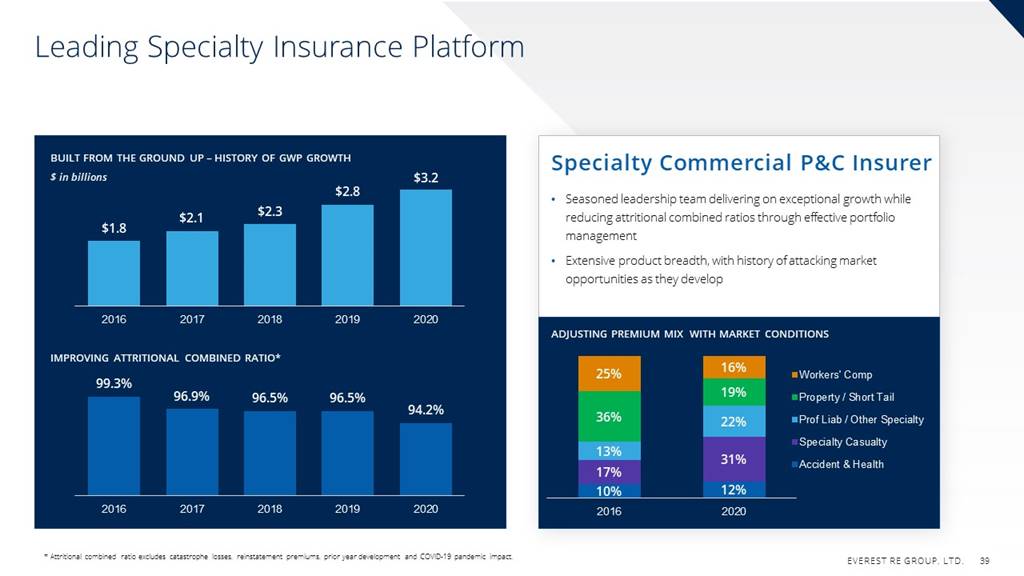

Leading Specialty Insurance Platform

BUILT FROM THE GROUND UP - HISTORY OF GWP GROWTH

Specialty Commercial P&C Insurer

$ in billions

$3.2

$2.8

$2.3

· Seasoned leadership team delivering on exceptional growth while reducing attritional combined ratios through effective portfolio management

$2.1

$1.8

1

.

· Extensive product breadth, with history of attacking market opportunities as they develop

2016

2017

2018

2019

2020

ADJUSTING PREMIUM MIX WITH MARKET CONDITIONS

IMPROVING ATTRITIONAL COMBINED RATIO*

16%

25%

Workers' Comp

99.3%

96.9%

19%

96.5%

96.5%

Property / Short Tail

94.2%

36%

22%

Prof Liab/ Other Specialty

Specialty Casualty

13%

31%

Accident & Health

17%

10%

12%

2016

2017

2018

2019

2020

2016

2020

* Attritional combined ratio excludes catastrophe losses, reinstatement premiums, prior year development and COVID-19 pandemic impact.

EVEREST RE GROUP, LTD.

39

Positioned For Opportunity

Deliver top tier results through the cycle

Deliver underwriting profitability with Combined Ratios in the low 90s

Scale enterprise through continued investment in automation, shared services, data, and claims

EVEREST RE GROUP, LTD.

40

A Value Proposition that Attracts and Retains Clients

Collaborative Culture

A Culture rooted in collaboration, Execution, Thoughtful Assumption of Risk, Leadership, and Humility, that values and prioritizes Diversity, Equity & Inclusion

Innovation and Solutions Focus

Expertise and innovation in all that we do with deep domain knowledge in Underwriting, Claims, and Loss Control to solve problems and exceed customer expectations

Responsive and Nimble

Nimble approach, solving complex problems in a responsive, intimate way

Customer Service Oriented

Easy to work with, flat and agile organization structure enables decision-makers to solve problems quickly

Financial Strength

Financial Strength and Stability with the Capacity to consistently bring solutions to the table

EVEREST RE GROUP, LTD.

41

Industry Leading Management Team

EXECUTIVE LEADERSHIP

MIKE KARMILOWICZ

President & CEO

MIKE MULRAY

Chief Operating Officer

DANA LODGE

Chief Financial Officer

PATRICIA MCMAHON

Chief Claims Officer

MARCUS COOPER

Senior Vice President Head of North American Distribution, Insurance

OWEN WILLIAMS

Senior Vice President, ETS Global Business Systems

GLOBAL LEADERSHIP

VINCENT VANDENDAEL

CEO Everest Global Markets

LINDA RYAN

CEO Everest Insurance (Ireland), DAC

NEIL LIGHTBOWN

CUO, Everest Global Markets and Active Underwriter, Syndicate 2786

DARIN SCANZANO

CEO Everest Insurance Company of Canada

KYLE ADAMS

Head of Bermuda Insurance

CAMERON VOGT

Global Head of Actuarial Pricing & Modeling

SEGMENT LEADERSHIP

DAVID SANDLER

President Risk Management Group

CONNIE GERMANO

President Specialty Casualty

BRIAN DRUM

Senior Vice President, Head of Everest Underwriting Partners

ERIK NIKODEM

Senior Vice President, Global Head of Property

ROB CLARK

Senior Vice President, Head of Everest Specialty Underwriters

LOU MONTEAGUDO

Senior Vice President, Head of Accident & Health

EVEREST RE GROUP, LTD.

42

Building on a Track Record of success

Relevance

Diversification

Growth

Profitability & Margin

Improvement

Disciplined

Product

Launches

Shifting

Business

Mix

Accelerating

GWP

Growth

Improved

Attritional

Combined Ratio

17 segments launched since 2016

Shift away from heavy Workers' Comp exposure to diversified mix

Reduction in attritional CR as mix / diversification earn in portfolio through cycle management

15.5% GWP CAGR; accelerating as market conditions improved

45% of GWP in 2020 from new offerings

27% → 11% Monoline Guaranteed Cost Workers Comp as % of Portfolio (2016 - 2020)

$1.8B → $3.2B GWP(2016 - 2020)

5.1% Attritional CR Improvement (2016 - 2020)

EVEREST RE GROUP, LTD.

43

Massive Market Opportunity

Property & Casualty Market

Opportunity Size*

$820 BILLION

0.4%

Estimated size of Global insurance market*

Everest's estimated

share of the global

insurance market*

Insurance

Opportunity

While Everest's relevance has continued to grow based on share of global commercial insurance premium placed, significant runway remains.

*Source of Global Premium: $798 Billion in 2019 from Finaccount; SwissRe Institute estimate of 2.7% Premium YOY growth in 2020

EVEREST RE GROUP, LTD.

44

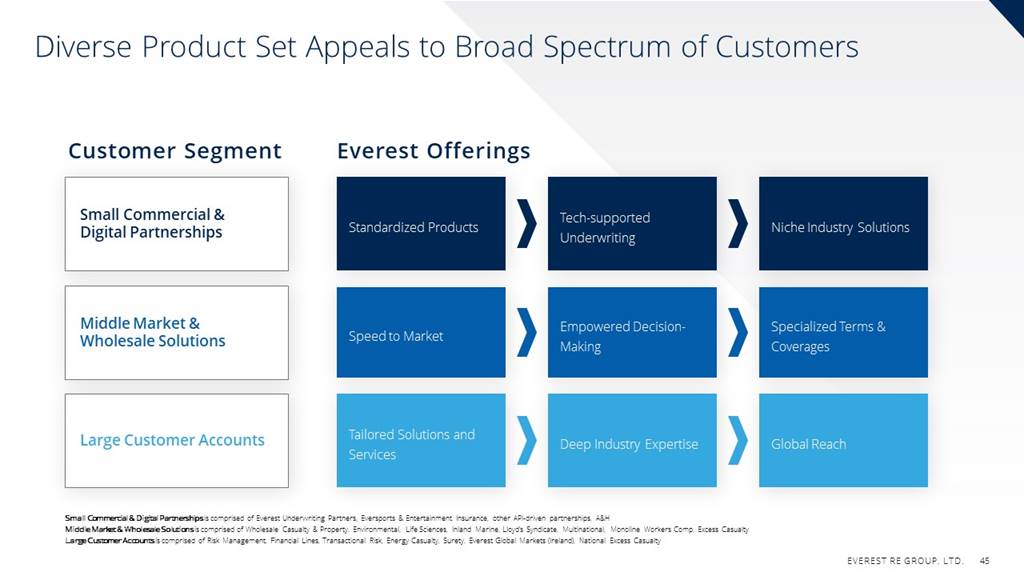

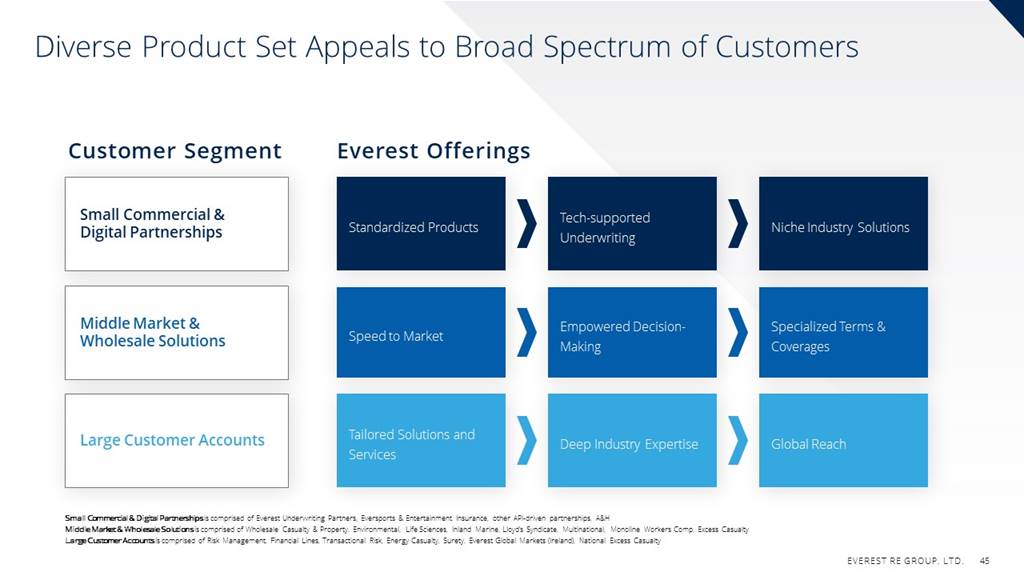

Diverse Product Set Appeals to Broad Spectrum of Customers

Customer Segment

Everest Offerings

Small Commercial & Digital Partnerships

Standardized Products

Tech-supported Underwriting

Niche Industry Solutions

Middle Market & Wholesale Solutions

Speed to Market

Empowered Decision- Making

Specialized Terms & Coverages

Tailored Solutions and Services

Large Customer Accounts

Deep Industry Expertise

Global Reach

Small Commercial & Digital Partnerships is comprised of Everest Underwriting Partners, Eversports & Entertainment Insurance, other API-driven partnerships, A&H Middle Market & Wholesale Solutions is comprised of Wholesale Casualty & Property, Environmental, Life Sciences, Inland Marine, Lloyd's Syndicate, Multinational, Monoline Workers Comp, Excess Casualty

Large Customer Accounts is comprised of Risk Management, Financial Lines, Transactional Risk, Energy Casualty, Surety, Everest Global Markets (Ireland), National Excess Casualty

EVEREST RE GROUP, LTD.

45

Diversifying and Deepening the Distribution Landscape

STRATEGIC RESPONSES TO EMERGING TRENDS

Trend

Strategy

Consolidation

Ongoing mergers & acquisition in the wholesale & retail space

· Enterprise level engagement

· Intimate specialization

· Deepen partnerships

.

Segmentation

Increased delineation between wholesaler & retailers

· Dedicated and distinct resources and expertise

· Alignment with industry verticals and capabilities

Digitization

Necessary capability going forward

· Online digital trading platforms

· API connectivity

EVEREST RE GROUP, LTD.

46

Scale Creates Margin Opportunity

Operating leverage

Portfolio management flexibility

Focused investment in technology

Skilled Cycle Management

Low 90s Combined Ratio

EVEREST RE GROUP, LTD.

47

Positioned to Deliver

Differentiated Value Proposition grounded in Strong Culture

Right Leadership, Right Vision

Size of Global Market Opportunity

Focused Strategy, Aligned Capabilities

Delivering Top Tier Performance

EVEREST RE GROUP, LTD.

48

Everest

Reinsurance

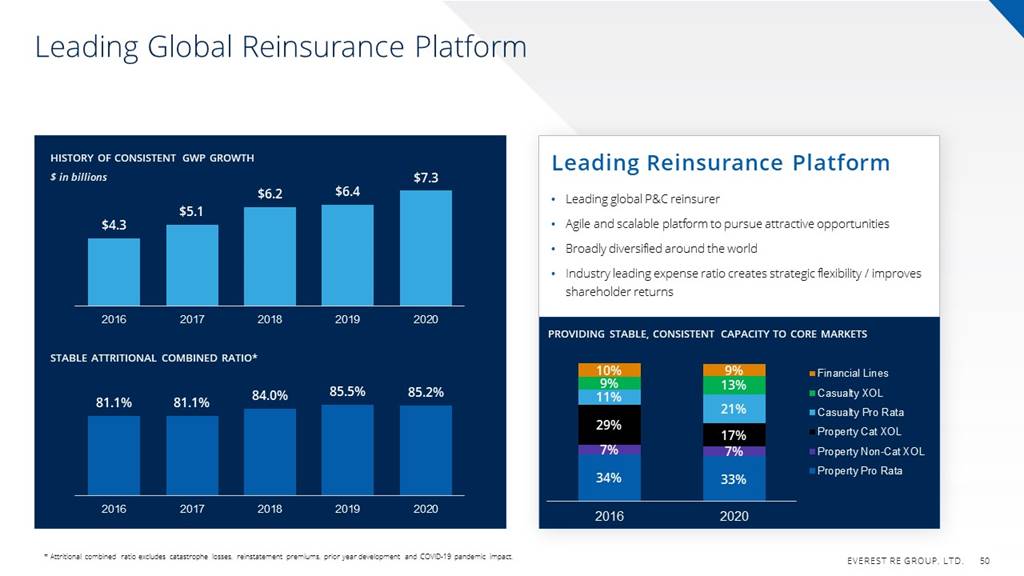

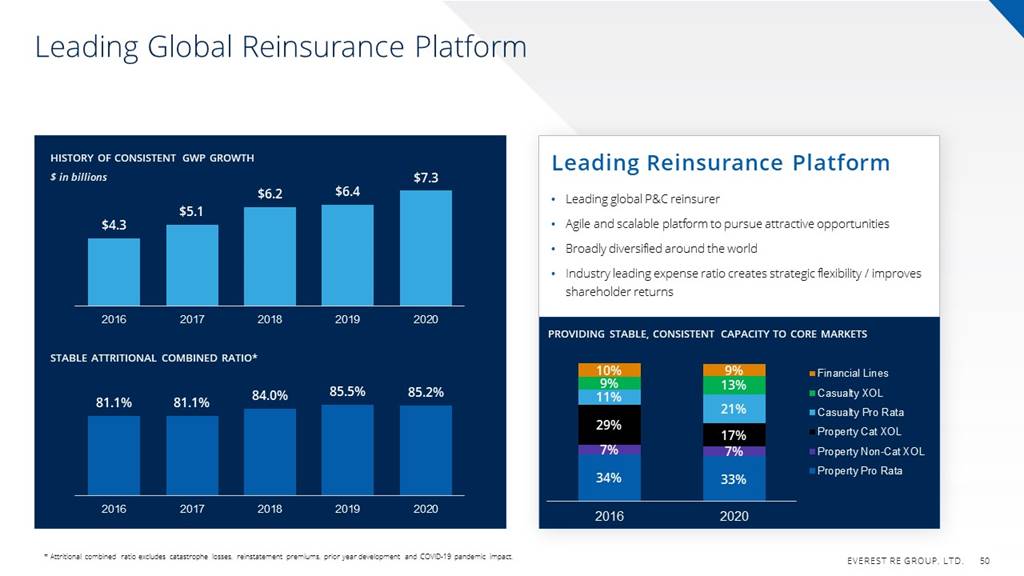

Leading Global Reinsurance Platform

HISTORY OF CONSISTENT GWP GROWTH

Leading Reinsurance Platform

$ in billions

$7.3

$6.2

$6.4

· Leading global P&C reinsurer

$5.1

$4.3

· Agile and scalable platform to pursue attractive opportunities

I

· Broadly diversified around the world

· Industry leading expense ratio creates strategic flexibility / improves shareholder returns

2016

2017

2018

2019

2020

PROVIDING STABLE, CONSISTENT CAPACITY TO CORE MARKETS

STABLE ATTRITIONAL COMBINED RATIO*

Financial Lines

10%

9%

11%

9%

13%

84.0%

85.5%

85.2%

Casualty XOL

81.1%

81.1%

21%

Casualty Pro Rata

29%

17%

Property Cat XOL

7%

7%

Property Non-Cat XOL

Property Pro Rata

34%

33%

2016

2017

2018

2019

2020

2016

2020

* Attritional combined ratio excludes catastrophe losses, reinstatement premiums, prior year development and COVID-19 pandemic impact.

EVEREST RE GROUP, LTD.

50

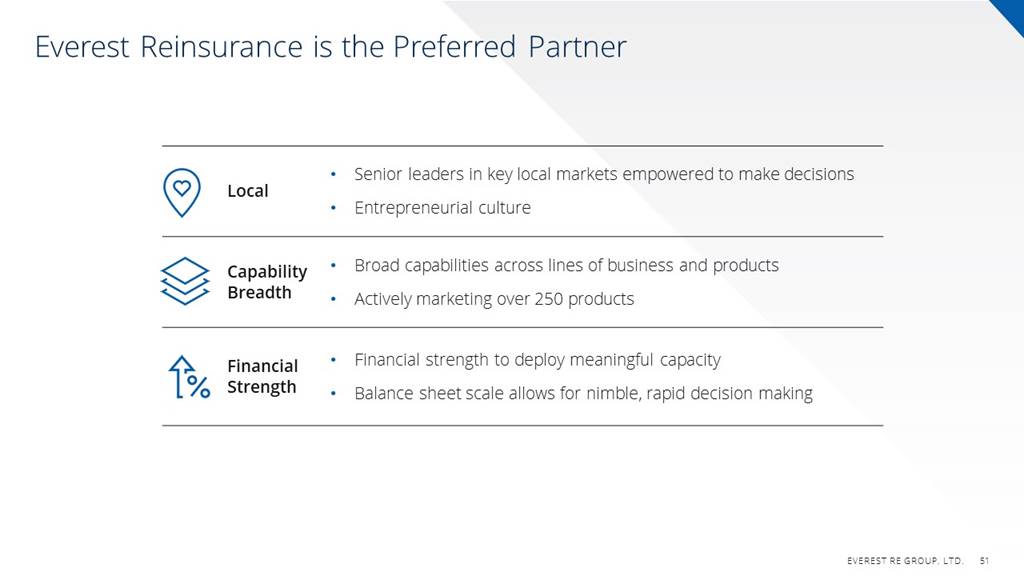

Everest Reinsurance is the Preferred Partner

Local

· Senior leaders in key local markets empowered to make decisions

· Entrepreneurial culture

Capability Breadth

· Broad capabilities across lines of business and products

· Actively marketing over 250 products

Financial Strength

· Financial strength to deploy meaningful capacity

· Balance sheet scale allows for nimble, rapid decision making

EVEREST RE GROUP, LTD.

51

Industry Leading Reinsurance Management Team

EXPERIENCED GLOBAL LEADERSHIP TEAM

Marty Scherzer

SVP Head of Structured Solutions

Russ Lewis

SVP & Chief Agent, Canada

Paul Tester

SVP & CUO London

Artur Klinger

Managing Director, Continental Europe

Dennis Alba

SVP U.S. Casualty & Surety

Ron Diaz

EVP International Reinsurance

Chuck Volker

SVP

Treaty Property & Manne

Melissa Ford

SVP Middle East Africa

Nitin Talwalkar

SVP Asia / Australia

Ike Barbatsoulis

SVP Chief Claims Officer

Lou Monteagudo

SVP Head of Acadent & Health

Sharry Tibbitt

SVP and Deputy CuO of Reinsurance

Jim Williamson

EVP, Group Coo and Head of Reinsurance

Chris Downey

SVP and CuO of Reinsurance

Peter Bell

SVP and Deputy Managing Director, Bermuda

David Whiting

President /

CUO Mt. Logan Re

EVEREST RE GROUP, LTD.

52

Local Leaders Drive Superior Execution

LOCAL STRATEGY IN ACTION

Think Globally, Trade Locally

· Offices in all key global reinsurance centers – local decision makers empowered to transact

· Ceding clients in 115 countries

· Dynamically allocating capital across markets

52%

United States

48%

International

2020 GWP Distribution

Note: countries with an Everest ceding client highlighted in blue.

EVEREST RE GROUP, LTD.

53

Existing Product Capabilities Supports Reinsurance Strategy

FLEXIBLE PRODUCTS TO HELP COMPANIES AND COMMUNITIES GET BACK TO NORMAL AFTER LOSS

Reinsurance Strategy Drivers

Growth in Favorable Markets

Aviation

Liability

Marine

Technology, Data and Analytics

3rd Party Capital

Natural Catastrophes

Professional Liabilities

Residential and Commercial Housing

EVEREST RE GROUP, LTD.

54

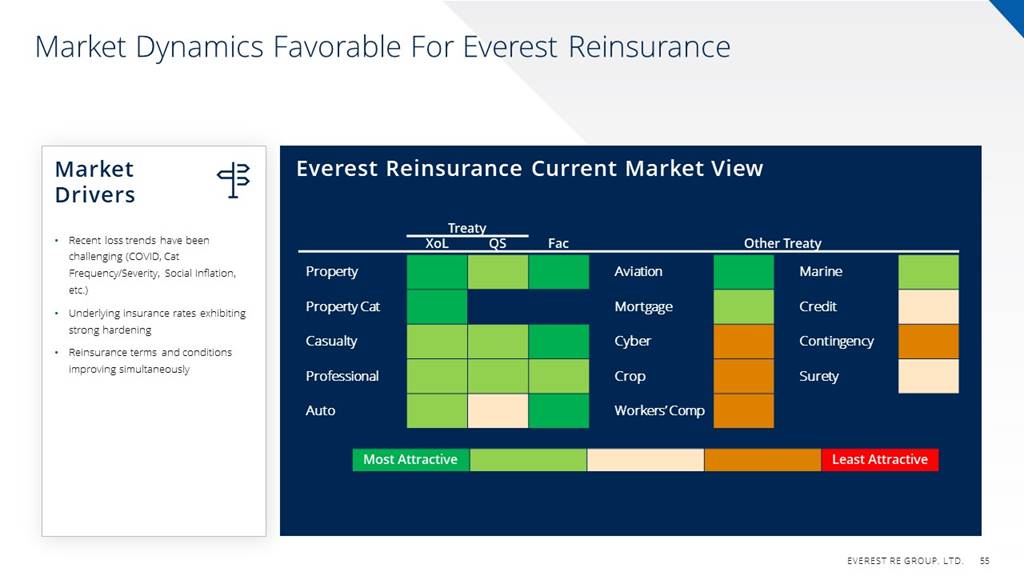

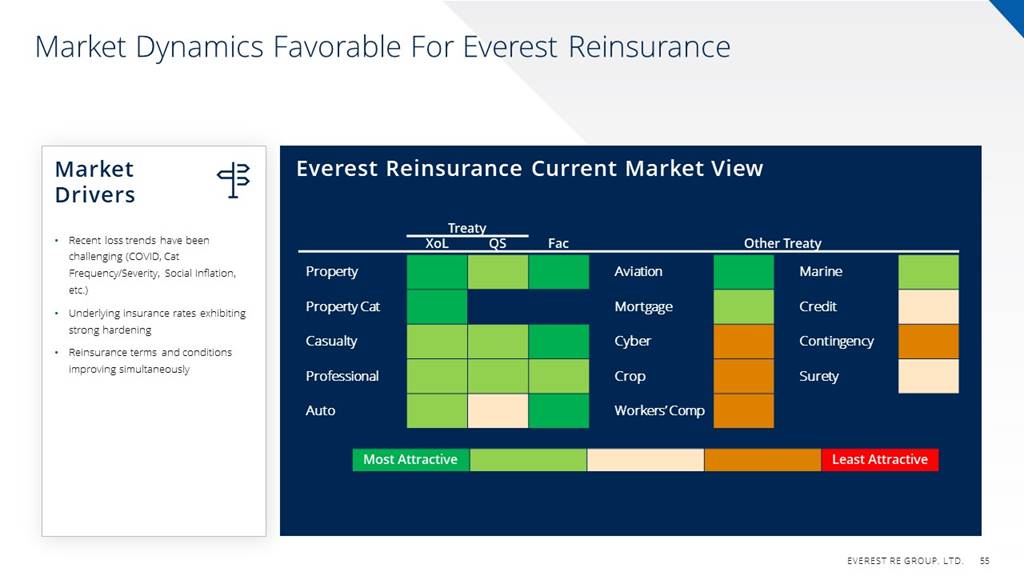

Market Dynamics Favorable For Everest Reinsurance

Everest Reinsurance Current Market View

Market Drivers

Recent loss trends have been challenging (COVID, Cat Frequency/Severity, Social Inflation, etc.)

Treaty

XOL

QS

Fac

Other Treaty

Property

Aviation

Marine

Property Cat

Mortgage

Credit

.

· Underlying insurance rates exhibiting strong hardening

Casualty

Cyber

Contingency

· Reinsurance terms and conditions improving simultaneously

Professional

Crop

Surety

Auto

Workers' Comp

Most Attractive

Least Attractive

EVEREST RE GROUP, LTD.

55

Partnership with Capital Markets Investors

Leading ILS Manager

Leading Issuer of Cat Bonds

KILIMANJARO RE

LADDERED CAT BOND ISSUANCE STRATEGY

· Mt Logan investors are strategically aligned with Everest: win/win lose/lose relationship

Mt. Logan Re.

· Largest global sponsor of cat bonds

•

Flexibility to grow

Efficient capacity for Everest's

global underwriting franchise

$2.3B in-forcell) limit; staggered term over 4-5

years - creates portfolio of hedging over time

$2.3B

2026

Index-based, annual aggregate coverage

Enhances client relationships and

improves terms

2021

2025

2025

7-Year

2019

2024

Track Record

2023

2018

2022

Nearly $1B

2017

2022

Assets Under

Management

Issuance

Current

Maturity

Date

Outstanding(1

Date

1. As of June 1, 2021

EVEREST RE GROUP, LTD.

56

Technology Augmenting Competitive Position and Margins

RECOGNIZED TECHNOLOGY LEADER

1 Core Systems

Build on core systems strategy

CIO

100

2. Enhanced Automation

Focus on analytics, automation and customer experience

CAT PRICING TEAM WIN

AWARD WINNER

3 Focus on Innovation

Data analytics enables data-driven decisions

2019

4. Process Reengineering

Leverage artificial intelligence, machine learning and robotic process automation

NOVARICA

5 Improved Analytics

NN

Digital reinsurance workbench to improve return on underwriter

(IMPACT

AWARDS

REINSURANCE

AUTOMATION PLATFORM

2020

EVEREST RE GROUP, LTD.

57

Build on Industry Leading Position to Enhance Underwriting Profit

Ongoing Portfolio Management

Focus on Accretive Growth

Nimble UW Cycle Management

Sustain Volatility Management

Best-in-Class Expense Ratio

Low 90s Combined Ratio

EVEREST RE GROUP, LTD.

58

Everest: A Leading Global Reinsurer

Preferred global trading partner for brokers and ceding clients

Industry leading talent, bench strength and product expertise

Trade globally in local markets while maintaining strong group controls

Product capabilities enable outperformance in all market conditions

Clear strategy to achieve growth & enhance margins

EVEREST RE GROUP, LTD.

59

Investments

Investment Portfolio Guiding Principles

ENGINES OF EARNINGS POWER

REINSURANCE

PRIVESTIMENTO

INSURANCE

1 Portfolio Diversification

2 High Degree of Liquidity

3 Strong Credit Quality

4 Match Asset / Liability Duration

5 Dual Strategy Approach: Stable Income and Total Return

6 Optimize Risk-Adjusted Return and Capital Efficiency

EVEREST RE GROUP, LTD.

61

Everest's Responsible ESG Investing

2019

· Signatory to United Nations' Principles for Responsible Investment (UN-PRI)

· Restrict future purchase of bonds issued by companies that derive >= 25% of revenue from coal*

2020

· 79% of total assets and 94% of fixed income assets managed by other UN-PRI signatories

2021 and Beyond

· Include ESG factors when making investment decisions

· Enhance portfolio reporting and analytics

· Integrate ESG standards to investments and underwriting

· Prioritize UN-PRI membership in selecting asset managers

* 0.29% exposure to companies that derive >= 25% of their revenue from coal. Prohibiting new purchases of companies that derive >=25% of their revenue from coal

EVEREST RE GROUP, LTD.

62

One Portfolio: Two Investment Strategies

Core Portfolio Strategy

STABILITY AND LIQUIDITY

· Investment grade assets cover reserves

· Match asset / liability duration

· High degree of liquidity

· Solid credit quality

· Consistent stable income

Total Return Strategy

ENHANCED PERFORMANCE

· Maximize risk adjusted returns

· Ensure capital efficiency

· Achieve efficient frontier portfolio

· Long-term investment horizon

$25.5B Investment Portfolio

Note: Investment portfolio as of December 31, 2020

EVEREST RE GROUP, LTD.

63

Asset Allocation Strategy

STRATEGIC ASSET ALLOCATION WITHIN RISK TOLERANCE

1.

Target

4Q 2020

Min

Max

Asset Allocation Strategic

Direction

Cash

4%

2%

10%

SHIFT IN PORTFOLIO CONSTRUCTION

Fixed Income

84%

70%

90%

Reduction in Corporate Bonds by 3-4% allocation

Short-term

5%

0%

10%

Commensurate increase in Private Equity and Alternative Fixed Income

(i.e. middle market loans, private debt and structured products)

Government Related

12%

10%

25%

Corporate Bonds

42%

35%

55%

PHILOSOPHY

Agency

9%

5%

15%

.

Asset / Liability duration matching

Securitized

14%

10%

20%

Retain strong credit quality and liquidity

Municipals

2%

0%

10%

Improve capital efficiency

Public Equity

5%

0%

10%

Private Equity / Credit

7%

5%

15%

Expected

2.75% - 3.25%

1.

Securitized includes: CLOS, ABS, CMBS and Non-agency RMBS

Return on invested Assets

EVEREST RE GROUP, LTD.

64

Investment Portfolio Provides Exceptional Liquidity

INVESTMENT PORTFOLIO LIQUIDITY PROFILE: 4Q 2020

Private Equity

Credit

Cash

Short-term

Multiple Sources of Cash

Generation

7%

4%

5%

Agency

Diversification is a key tenet of the investment portfolio

construction

Corporate

Bonds

Less Liquid

9%

7%

Highly Liquid

30%

Substantial portfolio liquidity part of Everest's overall

liquidity paradigm

Government

Related

12%

-$2B Cash & Short-term Investments

42%

~12-13% of existing fixed portfolio

naturally liquidates annually due to maturities

2%

Municipals

and calls

Liquid

63%

5%

Public

Equity

Operating cash flows and portfolio liquidity create

opportunity to continuously maximize yield using strategic

14%

asset allocation

Securitized

EVEREST RE GROUP, LTD.

65

Enhancing Yield Utilizing Alternative Fixed Income

Enhanced Yield Opportunities

· Alt Fl portfolio not matched against reserves providing more latitude for targeted risk-adjusted return maximization

· Floating rate product reduces duration while also providing some inflation protection

· Well understood set of targeted products with attractive risk / return dynamics:

Alt El Portfolio Design Changes

· Portfolio regularly adjusted to maximize risk adjusted return on allocated capital

· Increased focus on rated investment alternatives to optimize return on capital

☐ CLOs and rated middle market loan structures exhibit attractive risk-adjusted returns

☐ Shifting away from lower credit quality EMD

· Targeting -200 bps yield pickup with consistent duration and credit quality metrics of investment grade bonds

CLO

LOANS

PRIVATE IG

DIRECT CREDIT

EMERGING MARKET DEBT

HIGH YIELD

EVEREST RE GROUP, LTD.

66

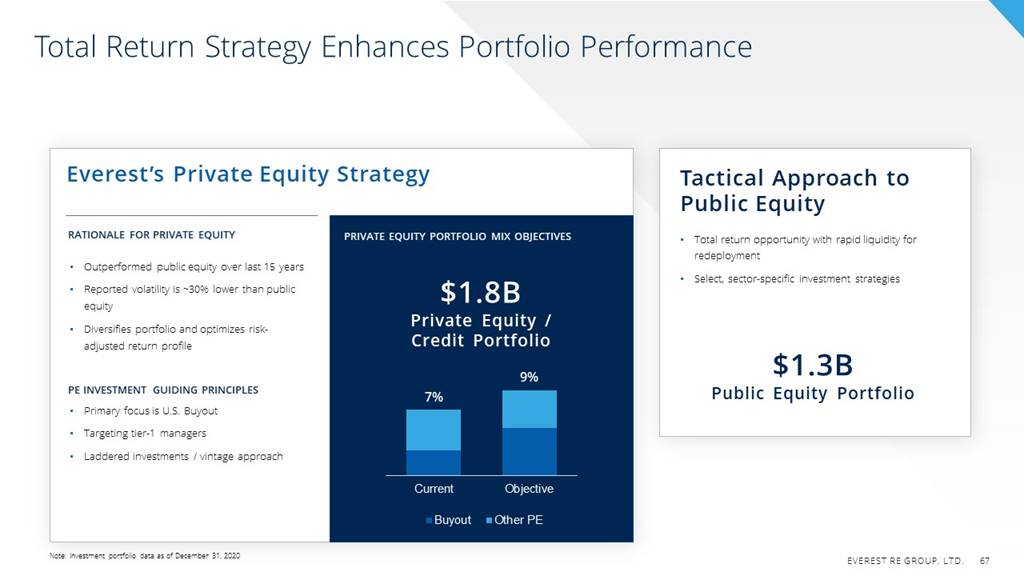

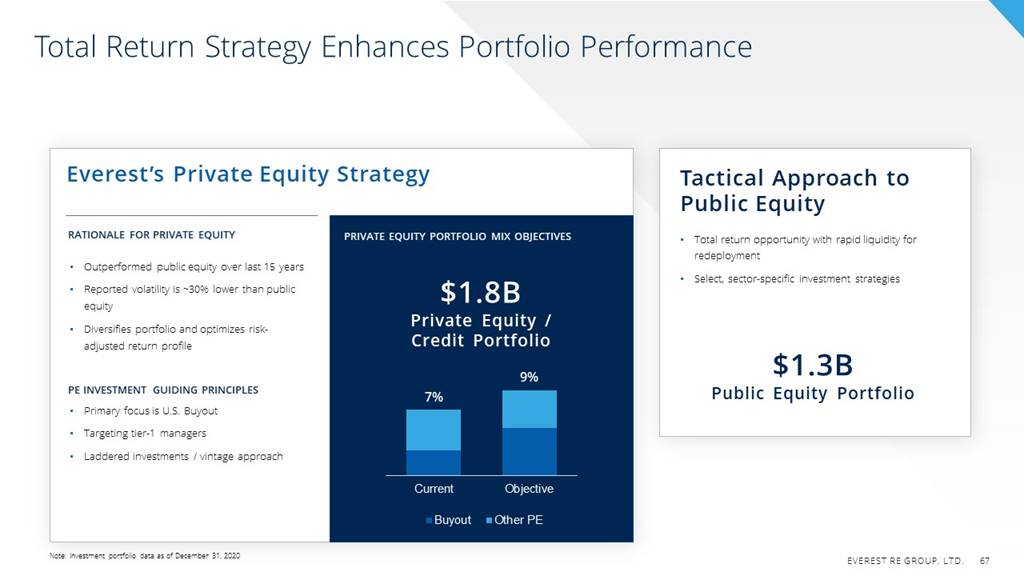

Total Return Strategy Enhances Portfolio Performance

Everest's Private Equity Strategy

Tactical Approach to

Public Equity

RATIONALE FOR PRIVATE EQUITY

PRIVATE EQUITY PORTFOLIO MIX OBJECTIVES

Total return opportunity with rapid liquidity for

redeployment

.

· Outperformed public equity over last 15 years

· Select, sector-specific investment strategies

· Reported volatility is -30% lower than public equity

$1.8B

Private Equity /

Credit Portfolio

· Diversifies portfolio and optimizes risk- adjusted return profile

9%

$1.3B

Public Equity Portfolio

PE INVESTMENT GUIDING PRINCIPLES

7%

Primary focus is U.S. Buyout

Targeting tier-1 managers

Laddered investments / vintage approach

Current

Objective

Buyout

Other PE

Note: Investment portfolio data as of December 31, 2020

EVEREST RE GROUP, LTD.

67

Investments: A Core Earnings Engine

Single portfolio with two strategies: Core and Total Return

Continued focus on responsible investing

Core strategy provides liquidity, stability and current income

Shift towards PE will improve performance

Investment performance is key to Everest's shareholder returns

EVEREST RE GROUP, LTD.

68

Investing in

Everest

Investing In Everest

Everest is a growing leading global reinsurance and insurance franchise

Seasoned leadership team in place forging a new path forward

Broadly diversified earnings power: Reinsurance, Insurance and Investments

Franchises are well positioned to drive growth and expand margins with reduced volatility

Strategic plan 2023 target of >13% Total Shareholder Return; Ambition for leading financial performance

EVEREST RE GROUP, LTD.

70

Q&A

EVEREST YEAR

Thank you for joining Everest's 2021 Investor Day

Appendix

Reference Information

2020/21 ESG Rankings

NYSE: RE

Outstanding Debt: L+2.385% Sub Notes due 2037

Environmental: 6

4.868% Sr Notes due 2044

ISS

*

Social: 5

MSCI

BB

3.500% Sr Notes due 2050

Governance: 4

FINANCIAL

STRENGTH

RATINGS

A+

A+

A1

(SAM

44th percentile

SUSTAINALYTICS

Low Risk

#23 of 290

insurers ranked

A.M. Best

S&P Global

Moody's Investors

Service

STABLE OUTLOOK

* AS of May 2021. Score of 1 is best.

Definitions / Notes

Glossary of Terms

BVPS: Book Value per Share

ILS: Insurance-linked Securities

Total Shareholder Return: annual growth in Book Value per Share, excluding Unrealized

Gains and Losses on Fixed Maturity Investments, plus Dividends per Share

CLO: Collateralized Loan Obligation

ILW: Industry Loss Warranty

Attritional Combined Ratio: Calendar year combined ratio excluding catastrophe losses,

reinstatement premiums, prior year development and COVID-19 pandemic impacts.

.

CR: Combined Ratio

.

PML: Probable Maximum Loss

.

DPS: Dividend per Share

.

Private IG: Private Investment Grade Debt

EMD: Emerging Market Debt

QS: Quota Share

Note: Asset allocations (both percentages and dollar amounts) have been adjusted

relative to GAAP financial presentation to reflect underlying asset risk profile rather than

legal entity structure of holding where relevant.

.

Fac: Facultative Risk

XOL: Excess of Loss

EVEREST RE GROUP, LTD.

73