UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended May 31, 2008

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________ to ______________

Commission file number: 0-27587

ARKADOS GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware | | 22-3586087 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

| | | |

| 220 Old New Brunswick Road, Piscataway, NJ | | 08854 |

| (Address of principal executive offices) | | Zip code |

| | | |

| | | |

| Issuer's telephone number: (732) 465-9300 | | |

| | | |

| | | |

| Securities registered under Section 12(b) of the Exchange Act: |

| | | |

| Title of each class | | Name of each exchange on which registered |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Securities registered under Section 12(g) of the Exchange Act: |

Common Stock, $.0001 par value

(Title of class)

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

o Yes x No

Indicate by a check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer. (See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act). (Check one):

Large accelerated filer o Non-Accelerated filer o | Accelerated filer o Smaller reporting company x |

Indicate by check mark wither the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates1 computed by reference to the price at which the common equity was last sold on September 11, 2008 was $ 4,326,233.

The number of shares of common stock outstanding as of the latest practicable date, September 12, 2008, was 30,535,147.

_______________

(1) The information provided shall in no way be construed as an admission that any person whose holdings are excluded from the figure is not an affiliate or that any person whose holdings are included is an affiliate and any such admission is hereby disclaimed.

FISCAL 2008 FORM 10-K

INDEX

| Item | Page |

| | |

| PART I | |

| | |

| ITEM 1: Business | 4 |

| ITEM 1A: Risk Factors | 22 |

| ITEM 1B: Unresolved Staff Comments | 33 |

| ITEM 2: Properties | 34 |

| ITEM 3: Legal Proceedings | 34 |

| ITEM 4: Submission of Matters to a Vote of Security Holders | 34 |

| | |

| | |

| PART II | |

| | |

| ITEM 5: Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 35 |

| ITEM 6: Selected Financial Data | 37 |

| ITEM 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations | 38 |

| ITEM 7A:Quantitative and Qualitative Disclosures About Market Risk | 42 |

| ITEM 8: Financial Statements and Supplementary Data | 42 |

| ITEM 9: Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 44 |

| ITEM 9A:Controls and Procedures | 44 |

| ITEM 9B: Other Information | 45 |

| | |

| | |

| PART III | |

| | |

| ITEM 10: Directors, Executive Officers and Corporate Governance | 46 |

| ITEM 11: Executive Compensation | 46 |

| ITEM 12: Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 46 |

| ITEM 13: Certain Relationships and Related Transactions, and Director Independence | 46 |

| ITEM 14: Principal Accountant Fees and Services | 46 |

| | |

| | |

| PART IV | |

| | |

| ITEM 15: Exhibits and Financial Statement Schedules | 47 |

| | |

| Signatures | 55 |

As used in this Annual Report on Form 10-K, the terms “we”, “our” or “us” mean Arkados Group, Inc., a Delaware corporation and its consolidated subsidiaries, unless the context indicates otherwise.

NOTE RE: FORWARD LOOKING INFORMATION

All statements in this annual report on Form 10-K that are not historical are forward-looking statements, including statements regarding our “expectations,” “beliefs,” “hopes,” “intentions,” “strategies,” or the like. Such statements are based on management’s current expectations and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those set forth or implied by any forward looking statements. Some of these risks are detailed in Part I, Item 1A “Risk Factors” and elsewhere in this report. We caution investors that there can be no assurance that actual results or business conditions will not differ materially from those projected or suggested in such forward-looking statements as a result of various factors, including, but not limited to, the risk factors discussed in this Annual Report on Form 10-K. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or any change in events, conditions, or circumstances on which any such statements are based.

This Annual Report on Form 10-K contains registered and unregistered trademarks of Arkados Group, Inc and its subsidiaries and other companies, as indicated. Unless otherwise clear from the context or noted in this Annual Report, marks identified by “®” and “™” are registered marks and trademarks of Arkados Group, Inc. or its subsidiaries. All other trademarks and service marks are the property of their respective owners. iPod® is a registered trademark of Apple Computer, Inc. HomePlug® is a registered trademark of the HomePlug Powerline Alliance, of which Arkados is a member.

General

The registrant, Arkados Group, Inc., was incorporated in the State of Delaware in 1998.

We are principally engaged in developing and marketing technology and solutions enabling broadband communication, multimedia, and networking over standard household electrical lines. We conduct these activities principally through Arkados, Inc., which is a wholly owned subsidiary. In September 2006, we changed our corporate name from CDKnet.com, Inc., to its current form to align our corporate identity with the “Arkados” brand developed by our subsidiary. Our Arkados subsidiary is a member of the HomePlug Powerline Alliance, an independent trade organization which has developed global specifications for high-speed powerline communications.

Our executive offices are located at 220 Old New Brunswick Road, Piscataway, NJ 08854. We can be reached at our principal offices by telephone at (732) 465-9300. Arkados maintains a website at www.arkados.com.

Except for the documents on our website that are expressly incorporated by reference into this report, the information contained on our website is not incorporated by reference into this report and should not be considered to be a part of this report. This includes the website referred to in the paragraph above, as well as other websites that we refer to elsewhere in this report. All of these website addresses are included in this document as inactive textual references only.

Available Information

We file annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and all other reports, and amendments to these reports, required of public companies with the SEC. The public may read and copy the materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website at http://www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. Copies of our fiscal 2008 Form 10-K may also be obtained without charge by mailing a request to us at 220 Old New Brunswick Road, Piscataway, NJ 08854 or by calling us at (732) 465-9300.

Overview

Arkados provides hardware/software engines for a wide variety of products that enable high-speed digital transmission of music, movies, video, voice, and broadband data over the existing infrastructure of electrical power lines.

By combining our system-on-chip (SoC) semiconductors with software and hardware platform designs, our solutions address diverse target markets in a number of growing market categories.

Significant recent developments include our beginning the transition from development stage company by generating $855,676 of revenue in the fiscal year ended May 31, 2008, obtaining a second extension of convertible subordinated notes (now due June 30, 2009), obtaining a limited waiver of anti-dilution rights held the holders of secured convertible notes to facilitate equity financing, and the addition of Harris Cohen to our board of directors.

We have designed our turnkey solutions to be used inside products for both consumers and industry. For example, consumer products can use Arkados solutions as part of a connected home entertainment and computing network, while industry can implement Arkados solutions as a part of a utility company’s “smart grid” and “green energy” solutions.

We are a “fabless” semiconductor company, meaning we design semiconductors without the capital requirements of owning and operating a fabrication facility. Our semiconductors are made from our designs by independent fabricators. We offer value to our customers by providing hardware and software as a complete design solution that allows them to

build devices that will distribute audio, video, voice, and data content throughout the whole house, building, or “smart-grid” infrastructure.

Arkados Products

Our highly integrated semiconductors provide the internet or network connections over existing electric lines for new consumer electronic products (such as stereo systems, television sets, intercoms and personal iPods®). Our solutions can also be used for bridging legacy products with newer home networking and broadband communications technologies.

Arkados’ solutions offer a completely different approach than our competitors. Our solutions incorporate a processor and multiple interfaces into the same chip that houses HomePlug communication technology, as well as, provide application level software that runs on the chip, We believe this “system-on-a-chip” approach provides a more cost-effective and more flexible strategy to bring products to market for our customers.

Customer-focused Product Approach

While a major component of our solutions is the ability for communication over power lines, our SoC and software provides the foundation for the full realization of a customer’s products. Our unique approach in designing our SoCs and software allows our customers great flexibility in building products, while also shortening their time-to-market and reducing their costs. For our direct customers, using Arkados solutions means they can bring sophisticated and full-featured products to market faster at a lower overall development cost by using a single standards-based platform: Arkados’ versatile and programmable ArkTIC® platform.

Arkados’ chip and software architecture was developed based upon specifications from the HomePlug Powerline Alliance standard and, unlike products from its competitors, our solutions will be extensible and scalable to HomePlug AV technology and further to IEEE1901 standards. This product strategy allows Arkados’ customers to easily port their applications to higher speed architectures.

Excellent User Experience

Products that use our semiconductors are easy-to-install and easy-to-use since they create connectivity through the existing electrical outlets and electrical wires. For the end user, products that use Arkados solutions connect to each other by simply plugging in, while also being reliable and secure. Arkados solutions leverage the benefits of standard powerline communications technologies that are used worldwide for in-building consumer electronics and home-based systems, and to-the-home Broadband Powerline (“BPL”) and Smart Grid applications.

Arkados recently added to its product line by offering a license to an implementation of the 802.15.3b Wireless Multimedia MAC. The license is available to any developer interested in jumpstarting their development process, and bringing digital home multimedia products to market more quickly.

Technology

Arkados is committed to building standards based solutions. Currently, Arkados’ SoC are based on the specifications developed by the HomePlug Powerline Alliance and TIA-1113 standards. In the future, Arkados plans to support IEEE P1901 and ITU G.hn standards when they become available. Arkados has been active in standards development since 2000.

System-on-Chip Semiconductors

Arkados has a number of design wins that employ our first SoC, the Arkados AI-1100, which we started marketing in Fiscal 2007. The device supports applications such as whole-house music streaming, whole-house internet access, and can be used in IPTV set-top boxes designed to decode and display standard definition video content -- from sources as varied as surveillance cameras and YouTube -- on regular TVs throughout the home. This turnkey solution fetures a programmable MAC and an on-chip ARM 9 application processor. Its fully HomePlug 1.0 compliant MAC/PHY and Arkados extensions and software provide increased performance and future proofing.

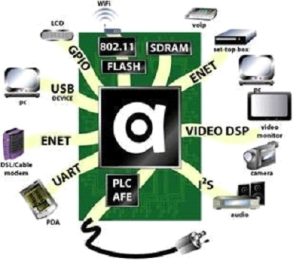

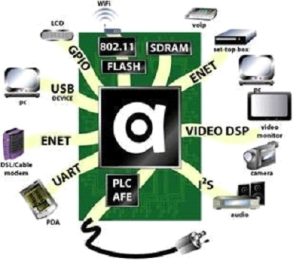

The AI-1100 chip offers a single-chip integration of HomePlug 1.0.1 powerline technology, ARM 926-JES CPU operating at 160 MHz, dual Ethernet interfaces, I 2S Audio Interface, and a wide variety of other interfaces designed to support connected home applications. Furthermore, the programmable nature of our implementation allows ODMs/OEMs to extend the functionality of these products and HomePlug technology.

Our next generation SoC, the AI-2100, will be backwards compatible with our current chip and it will feature an enhanced embedded Quality of Service (QoS) engine which supports video flows for low jitter, lip synch and low latency delivery. Arkados’ architecture also features a programmable, flexible MAC which may be configured for unique applications or field upgradeable. In addition, the architecture results in a reduced bill of materials (BOM), allowing the production of fully featured products at a lower cost.

Software

Today’s digital products are incomplete without an array of software components that enable both device-to-device communications and robust product features. Arkados services our customers by providing a host of software components that run directly on our chips, further eliminating development time for our customers. These software components include application-level features (such as our Direct-to-Speaker™ multi-channel audio synchronization, networking and internet, online gaming, etc.) embedded application support software (audio compression/decompression, internet radio support, GUI support, video drivers, etc.), Quality of Service engine, traffic management, and TCP/IP components.

Market Opportunities

Arkados solutions contribute to several large markets each of which is global, broad, and deep. The retail consumer electronics market, the whole-home custom installation market, the smart grid market, and the subscription services market combine to form a very broad potential base for Arkados solutions.

The following is a brief compendium of publically available quotes that echo our beliefs in the strength of Arkados’ target markets:

| · | Retail Consumer Electronics for the Digital Home Market |

| o | ABI Research: “Total network-enabled consumer electronics and media devices shipments are expected to grow from 92 million in 2007 to nearly 460 million by 2012, exceeding the 368 million network-enabled home gateways, routers, network adapters and home network storage products shipped the same year.” (10/18/2007) |

| o | ABI Research: “Networked Home Audio Market to Hit $7.2 Billion by 2012” (4/17/2007) |

| o | Multimedia Intelligence as quoted by EETimes magazine: “By 2012, as consumer electronics manufacturers and operators gradually add IP connectivity across a broad array of equipment,” the analyst forecasts “the market for the resulting network interface semiconductors growing to nearly $2.5 billion.” They continue, “With more than 60 million IP-enabled consumer electronics devices shipped into the market in 2007, the semiconductors underlying that connectivity already represent more than $560 million in annual revenues. The total includes the media-access control (MAC), physical interface (PHY) and related support chips.” (7/2007) |

| o | iSuppli: “the worldwide home networking silicon total available market is expected to grow from $1.1 billion in 2007 to $3.1 billion in 2011, representing a compounded annual growth rate of approximately 29%.” (7/2007) |

| · | Smart-Grid and Utility Applications Market |

| o | From EDN Magazine: “in the electric industry alone, 500 million meters worldwide could be replaced over the next 10 years, resulting in semiconductor sales of at least $7.5 billion, according to Mark Buccini, director of strategic marketing for Texas Instruments’ microcontroller products.” And continues to say “a large number of those will be connected to a home area network, and that home network will have at least one device that can talk to the meter,” and that “the communications piece is as much as three times as big [as the $7.5B market for meters].” (6/24/2008) |

| o | Techno Systems Research predicts a 106.4% CAGR for SmartGrid/Broadband Powerline markets from 2005-2011. (12/2007) |

| · | Subscription and “over the top” Services |

| | Many services currently available, from remotely-monitored security, to piped-in music, to health monitoring systems require costly professional installation for communication and distribution. With the addition of a broadband pipe to the house, and the use of an in-home distribution method such as Arkados solutions provide, over-the-top (OTT) this type of solution allows the content owners to deliver the content directly to consumers. |

| o | The Diffusion Group: “TDG found that 40% of broadband users are watching at least an hour of video per week on the Internet. More surprising is that 30% of those are watching 25% or more of their TV online. Imagine what will happen when tens of millions of households are capable of watching broadband video on their big-screen, high-dollar, high-definition TVs and home theater systems.” (5/2008) |

| o | Harbor Research: “The ability to monitor, repair and control equipment remotely over the Internet….. has changed the concept of service for manufacturers in key industries around the world…..These new services represent a multi-billion dollar opportunity. Market growth is also extremely strong.”(3/2006) |

The Growing Digital Home: Networked Consumer Electronics

As broadband access to the home is becoming ubiquitous, home networking and connectivity demands for digital home applications continues to grow – extending the internet, and the services that travel on it, to every corner of the house.

The promise of sending digital communications over common power lines is now being realized, and Arkados’ products serve several large and growing markets: retail consumer electronic products, whole-house audio installations, smart-grid utility company applications, broadband-over-powerline internet access, and the distribution of internet-based services.

The Arkados AI-1100 is the first HomePlug 1.0 compliant system-on-chip targeted for the retail consumer electronics market. Coupled with software to create full turnkey solutions for its customers, the Arkados AI-1100 has already received a number of design wins, and is the engine behind the creation of reasonably-priced multi-room audio and video distribution products for the retail consumer market. Products coming to market soon will feature iPod® docking stations and powered speakers that can be placed anywhere in the home, with no additional wiring needed.

As a subset of this market, the whole-house audio market category has been particularly active. Arkados’ solutions offer a way to create retail audio systems with features and functionality heretofore available only in multi-thousand dollar custom audio installations. Arkados’ customers include Devolo AG, Channel Vision, IOGEAR, Gigafast, Tatung, and Zinwell. Higher product volumes are expected to be realized in fiscal 2009 and customers move their products from development into the marketplace.

In addition providing the connectivity engine for these retail consumer products, Arkados provides solutions for custom and self installation high-end consumer systems. These high-end custom audio systems, which address the existing home market (expanding from their primary market target of newly constructed homes), can feature as many as 8 separate audio zones and can process a wide range of sources of audio content which can be streamed from any digital or legacy analog source. Russound, a leading custom multi-room audio distribution system manufacturer, has selected the AI-1100 for use in its iBridge Power Dock. Arkados has received initial volume commitments and NRE’s (Non-Recurring Engineering) valued over $1.2 million from customers in this area, of which over $641,000 has been recognized through May 31, 2008. Arkados’ chips can also power cameras, video endpoints, and sensors for other installed home systems, such as for surveillance systems.

Smart Energy and Utility Company Applications

Another large potential market for Arkados’ solutions relates to energy conservation, the “green” applications that help utility companies and their customers save both money and energy. For example, “Smart Grid” applications (Green Energy, demand response, energy efficiency and grid modernization – i.e., reduction of carbon emissions) and home/building automation, such as controlling air conditioner thermostats remotely, represent large and attractive opportunities given today’s surging energy costs. Arkados has design wins at MainNet (which has the largest installed base of business power line solutions in the world) and Corporate Systems Engineering, with significant volumes already committed.

Services

An additional immediate potential market for the Arkados platform is for subscription music services. Its software and chips enable the distribution of Internet music services (e.g., Rhapsody, Yahoo! Music, AOL Music, Shoutcast services). The Company is actively working on reference designs and business strategies to address this rapidly developing market.

Corporate Background

On May 24, 2004, we filed a merger certificate completing the acquisition of Miletos, Inc., a previously unaffiliated Delaware corporation (the “Merger”). The consideration for this Merger was 16,090,577 restricted shares of our common stock and the assumption of certain liabilities of Miletos’ predecessor and former controlling equity holders. The merger was completed according to the terms of an Agreement and Plan of Merger dated as of May 7, 2004. Miletos merged into a wholly owned subsidiary we formed for the merger which then changed its name to “Arkados, Inc.”.

Simultaneously with the merger, we completed a private placement of 883,334 shares of our common stock for aggregate proceeds of $1,060,000, of which approximately $950,000 were subscriptions for cash, $50,000 (41,667 shares) was for outstanding debt of Arkados, and $59,800 (49,834 shares) was in lieu of consulting fees. The sale was made to 10 accredited investors (“Investors”) directly by us without any general solicitation or broker. The offering is claimed to be exempt from registration pursuant to Section 4(2) under the Securities Act of 1933, as amended. In addition, we settled liabilities relating to outstanding convertible notes and payables for 700,000 common shares.

Prior to the Merger, on March 23, 2004, Miletos acquired the assets and business of Enikia, LLC, a Delaware limited liability company at a public foreclosure sale, including the intellectual property upon which Arkados’ development efforts are based. Miletos was formed in February 2004, by control affiliates of Enikia. These control affiliates were both secured creditors of Enikia and holders of the controlling equity interest in Enikia. They contributed a secured promissory note to Miletos in the initial principal amount of $9,221,000, dated June 1, 2002. The promissory note also represents obligations to the lender for additional advances to Enikia by the control group which brought the aggregate principal due at the time of foreclosure to approximately $11,100,000. At the foreclosure sale, Miletos forgave $4,000,000 of the secured obligation in exchange for substantially all of the assets of Enikia. The merger has been treated as a reorganization of Arkados, Inc. via a reverse merger with Arkados Group, Inc. The assets acquired at the foreclosure sale and certain liabilities assumed by Arkados Group, Inc. have been recorded as historical cost.

On March 3, 2007 we completed the merger of Arkados Wireless Technologies, Inc., our wholly owned subsidiary (“Merger Sub”) with Aster Wireless, Inc. a Delaware corporation (“Aster”) pursuant to an Agreement and Plan of Merger dated February 13, 2007 by and among Merger Sub and Arkados Group, Inc. In this merger, we acquired synergistic talent and technology which has helped improve the reliability and quality of audio streaming in our current generation chipset and we believe will help deliver our next-generation chips to market more quickly, with richer capabilities. This will translate to a better competitive position in the marketplace. The technology enhances the reliable distribution of multimedia content, potentially over multiple distribution media, and is designed to be embedded in new consumer electronics products and accessories for audio, video distribution, set-top boxes and other multimedia entertainment appliances.

Dependence on Financing Activities

Although we have started to generate revenue during the past two years, we continue to be dependent on outside sources of financing to continue the development of our semiconductors and software, and to further support sales. During fiscal 2008, we completed a series of debt financings in the aggregate principal amount of $855,000; we also issued notes in the amount of $125,000 which were converted into equity in August 2008. Andreas Typaldos, our Chairman and one other Director loaned the Company $177,700.

From June 1, 2008 to August 31, 2008, we received approximately $649,000 which was converted into equity in August 2008. In addition, we received an additional $20,000 which represents borrowings from related parties.

We have sought and will continue to seek various sources of financing but there are no binding commitments from anyone to provide us with financing. In addition, there is $11,383,261 principal amount of 6% Secured Convertible Debentures due June 28, 2009 (initially due December 28, 2008) issued during the period from December 2004 to August 31, 2008 outstanding, which has been an impediment to obtaining equity financing . The documents were amended in January 2007 to eliminate the requirement that the holders of 60.1% of the outstanding principal amount consent to our issuance of shares, debt or fixed convertible securities to finance our operations, continue to contain a full “ratchet down” provision which has a dilutive effect, which is triggered by future financing at an effective price lower than the conversion and warrant exercise price.

In July 2008, we reached an agreement with the holders of the Secured Debentures which extended the due date to June 28, 2009 (which may be further extended if we raise equity financing of more than $2 million before maturity), capitalizing interest until the Secured Debentures are due and waiving the ratchet down anti-dilution adjustment for certain equity financings completed before October 31, 2008. In exchange for these amendments the Company will exchange:

| · | new debentures for 25% of the outstanding principal amount of Secured Debentures ($2,845,815.25) having identical rights as the Secured Debentures, except that the conversion price is $0.25 rather than $0.85 and |

| · | new warrants for 25% of the existing warrants held by the holders of the Secured Debentures (2,332,131), identical to the warrants surrendered, except that the warrant exercise price is $0.25 rather than $0.85 and the new warrants are only exercisable for cash until December 1, 2008. |

On August 7, 2008, we issued 1,690.080 units (each consisting of two shares of our common stock and one warrant) to 18 accredited investors for aggregate consideration of $845,038.47. Of this consideration $762,593.66 was cash or cash advances made to us after April 15, 2008 and the balance was in exchange for prior obligations for borrowed money and other accounts payable. The warrants are exercisable until June 30. 2013 and entitle the holder to acquire one additional share of our common stock for $0.25 per share.

While a substantial portion of the net proceeds of these financing activities was initially used to repay pre-existing debt, all of the proceeds during the fiscal year 2008 were used to support Arkados’ operations. There is no assurance that the holders of the Secured Debentures will continue to provide additional funds to us, that future equity financing will be available or that future financing will not be impeded by the anti-dilution provisions of the documents. Our ability to continue our operations depends on our ability to obtain financing. If adequate funds are not available on acceptable terms, we may not be able to retain existing and/or attract new employees, support product development and fabrication, take advantage of market opportunities, develop or enhance new products, pursue acquisitions that would complement our existing product offerings or enhance our technical capabilities to develop new products or execute our business strategy.

Industry Background

Music, movies, and a wide range of communication services are experiencing a fundamental shift. The distribution of content to products, and in some cases the products themselves, is transitioning from traditional methods. Digital content is requires a new digital distribution model.

Arkados’ Standards-based Solutions

Arkados’ solutions directly address this opportunity by enabling electrical power sockets to be turned into high-speed network ports, thereby providing a high-speed pathway through which digital information can travel both inside a home, and to the home. We believe that this shift creates demand for new products, and new products will require new types of semiconductors that incorporate digital technologies, supporting such functions as communication and media rendering.

Our ArkTIC® family of turnkey hardware and software solutions is designed to address these requirements. In particular, Arkados has implemented a method that uses power lines as a pathway for digital information, allowing end users to truly achieve “plug-and-play” simplicity without the hassles of custom-installed networks, or the dropouts, unreliable coverage and security issues of wireless solutions.

Standards-compliance Creates Market and Product Confidence

Members of the Arkados team have been active in establishing standards for the powerline communications industry since the year 2000. Standards are important in many industries. For example, wireless standards have brought about a ubiquitous, interoperable and affordable standard for portable data communication.

Standards are important for a number of reasons, but especially when both consumers and service providers may be installing different pieces of the ecosystem – as in the powerline communications industry.

Members of the Arkados team participated in the creation of the HomePlug Powerline Alliance, an independent industry

association. The Alliance’s mission is to enable and promote rapid availability, adoption and implementation of cost effective, interoperable and standards-based home powerline networks and products. Formed in 2000, the Alliance developed the HomePlug 1.0 specification that unified product vendors in support of a single powerline solution for home networking. Later, in 2008, the technology of the HomePlug 1.0 specification was adapted by the Telecommunication Industry Association as TIA-1113 standard. In 2005, the Alliance ratified HomePlug AV specification that is going to enable 200Mbps class communication over power lines.

In-Stat believes that HomePlug AV will be a potentially important technology for multimedia networking, as the technology could provide a home network backbone. Arkados has worked in significant ways to develop the HomePlug specifications including HomePlug 1.0 and HomePlug AV for in-home technologies, HomePlug BPL for broadband over powerline, and HomePlug Command &Control (C&C) for low-speed command and control applications.

Arkados is a Contributing Member of the HomePlug alliance. Members of the Arkados team hold leadership positions in the Alliance and in several HomePlug working groups. Oleg Logvinov, our president and CEO, serves as the Chief Strategy Officer of the HomePlug Alliance. Mr. Logvinov is also a past president of the Alliance, having been succeeded by Matthew Theall of Intel. Additionally, Jim Reeber, our Director of Marketing has served as Chair of Marketing Working Group since 2003, and Grant Ogata, our Executive Vice President of Worldwide Operations, served as the Chairman of HomePlug Command and Control Working Group and was instrumental in spearheading the alliance’s efforts to develop a specification for a low-cost command and control technology in his role as the working group chair.

The HomePlug technology now dominates the marketplace. Market analyst In-Stat forecasted that by 2010, the technology based on HomePlug specifications will hold 85% of the worldwide market for powerline communications. The HomePlug Powerline Alliance has brought together both personal computer and consumer electronics companies on a global scale. Membership in the Alliance has grown to include nearly 70 industry-leading companies. HomePlug Sponsor companies include Cisco; Comcast; GE Energy., part of General Electric Co.; Intel Corporation; LG Electronics; Motorola; Sharp Laboratories of America; and Texas Instruments Incorporated (TI). Besides Arkados, contributor members include Corporate Systems Engineering; Gigle Semiconductor; Intellon Corporation; SPiDCOM Technologies; and YiTran Communications.

Arkados is also a member of the IEEE P1901 group that is focused on the development of powerline communication Physical Layer (PHY) and Media Access Control (MAC) specifications. Working with the HomePlug Powerline Alliance, the Arkados team has contributed to the development of a number of specifications that were contributed to standards organizations, such as the Telecommunications Industry Association.

The Strategy behind Arkados Solutions

We are a fabless semiconductor company that develops comprehensive platform solutions, including system-on-chip (SoC) semiconductors, and firmware and software for manufacturers of networked multimedia appliances and feature-rich networking devices. Our platform solutions are designed to enable a systems-based approach to networking and will allow our customers to build products that are simple and intuitive to install, and easy to operate with intuitive and customizable user interfaces.

We believe that many of our customers plan to produce not just one standalone device, but they will introduce many system components that work together. An example is the audio market; our customers would not just introduce a dock for an MP3 player, but would also produce a variety of speakers, control units, CD players, adapters, boom-box style rendering points, etc. Our solutions enable greater versatility and value that allows our customers to create each of those components, sometimes with only a single hardware design.

The primary goal of our solutions is to enable our customers’ plan to develop and sell end-user systems. Our customers require a lower Bill of Materials (their cost for manufacturing a product), and better ways to produce a variety of components for end-user systems more quickly. We call our solutions “turnkey” because they enable our customers to create entire lines of products without dedicating their resources to long product development cycles, or extensive software design.

Our customers are also aware of our strategy to support a seamless transition to higher-speed technologies as they become available. This promotes long life-span of their development effort, and creates significant re-use of their software components.

Inside our SoC, we have included a powerful processor that allows applications to be run directly on-chip. Multiple vertical applications can be built by loading different firmware. This feature can broaden product offerings, and extend the product lifecycle. The Arkados implementation of HomePlug technology offers programmability that enables OEMs to extend the functionality of their products and produce a variety of products from a single design.

Key elements of our solution are as follows:

| Comprehensive platform solutions. |

| | Our platform solutions consist of an integrated package of hardware, firmware and software designed to enable our customers to develop differentiated products in a cost-effective manner with short time-to-market. In addition to a high-performance SoC, we plan to provide our customers with customizable, high functionality firmware and software development kits to allow them to rapidly develop and differentiate their products. As a result, we would be able to reduce our customers’ investment in costly and time-consuming internal firmware and software development for their products, and from having to source different firmware and software for their end products from multiple suppliers. |

| · | Customizable firmware and software. |

| | Our firmware, which is sold as a bundled solution with our SoCs, includes a real-time operating system and a set of application specific modules that support a wide range of functions including Web-based management, audio distribution, traffic classifications, etc. Our software platform includes a comprehensive suite of components, such as device link libraries and drivers, tools, sample code and documentation to create applications that would allow a wide range of networking devices and networked multimedia appliances. |

| Targeted, high-performance SoCs. |

| | Our SoC solutions are specifically designed for the powerline communication market. They are driven by function-specific blocks that allow simultaneous execution of complex operations, such as transmission of data over power lines and MPEG audio decoding and playback. Our SoCs support most major peripheral connection protocols, including USB, Ethernet, Infrared, I2S, and a number of specialized and general purpose interfaces. This support enables connectivity to a variety of playback, display and content creation devices including cameras, PCs, televisions and car and home audio systems. |

In contrast, competitors that do not provide comprehensive platform solutions such as ours may be able to produce a greater variety of customized ICs to more specifically address the particular requirements of an OEM. In addition, solutions which do not include customizable firmware and software like ours may allow OEMs to take advantage of a wider range of third-party developers. While, these alternative solutions may be lower in cost for simple data networking devices in comparison to our platform solutions, our solution will be more cost effective and has higher reliability and performance for multi-media networking including distributing audio and video throughout the home and outputting to existing consumer electronic products.

Key Strategic Elements

Provided we are able to continue to finance our operations, our objective is to be the leading supplier of comprehensive platform solutions for high-performance and feature-rich networked multimedia appliances and networking devices.

Key elements of our strategy are:

| · | Maintain a full platform solution approach with industry-leading SoCs, firmware and software. |

| | | We plan to continue to commit the resources of each of our hardware, firmware and software teams to drive innovation so that our solutions are at the forefront of the networked multimedia appliances and networking devices industries and capture a leading market share. We intend to continue to devote resources to increase the performance and functionality of our SoCs and expand the features and capabilities of our firmware and software. This enables great flexibility and value for our customers as they take products to consumer and enterprise markets. |

| · | Maintain our focus on feature-rich networked multimedia appliances and networking devices. |

| | | We intend to build on our experience as a platform provider by continuing to focus primarily on customers that produce feature-rich networked multimedia appliances and networking devices. In addition, we intend to continue to work closely with manufacturers of other media rendering components to ensure that our platform solutions interface with their current and future technology components for optimal performance their end products. |

| · | Maintain our focus on the integration of powerline and audio rendering functions to secure the leadership position in networked multimedia appliances and networking devices. |

| | | We believe that the networked audio markets will continue to represent the largest near-term volume opportunity for networked multimedia appliance and networking device manufacturers. We intend to continue to focus on advancing functionality and promoting our solutions to win designs in this large and growing market. By including these options in our platform, we create a foundation that enables our customers to incorporate new features more quickly. |

| · | Enable new growth markets, such as photo- and video-enabled networked multimedia appliances. |

| | | We intend to build on our existing expertise to be the leading provider of comprehensive platform solutions in new markets. We intend to continue to invest our research and development efforts and engineering resources to develop new platforms and products and to strengthen our technological expertise. One example is our reference design that employs both our solutions as well as Blackfin® Processors by Analog Devices to provide a cost- effective platform for a variety of video applications based on powerline distribution. We believe that our focus in this area creates optimized solutions for our customers and increases the revenue potential for companies throughout the value chain. |

| · | Expand our customer base while securing additional design wins with existing customers. |

| | | We plan to be the leading supplier of new designs to our existing customers, and to secure a high market share with new customers entering this market. We intend to continue the expansion of our customer base by marketing our platform solutions to additional manufacturers of consumer devices. Further, we intend to broaden our reach within our existing customer base into their adjacent product lines that can utilize technologies that we intend to implement in the near future. By providing key hardware and software components to our customers, we believe we can deliver better value and features to our customers, while reducing design and manufacturing costs. |

| | Create business arrangements with companies to better serve our common OEM customers. |

| | | We plan to go to market together with a number of companies who target specific areas of the marketplace. Since certain companies pursue many of the same customers who approve the products destined for the end-user, we plan to take advantage of this communality and together create solutions and offer even greater turnkey value. This approach offers OEM customers an easier point-of-contact and allows them to take advantage of efficiencies we have already built with our partners. |

Our Products

We design and develop and are marketing highly integrated SoC semiconductors that are designed to cater to the markets for powerline communications. Our chip designs offer flexible solutions through programmability and remote firmware upgrades. Our customers have responded very favorably to our platform offerings which we call ArkTIC®, which is an acronym for the Arkados Total Integration Concept.

Solutions from our ArkTIC® family of converged multimedia and networking solutions targets data-, audio-, photo-, and video-enabled networked multimedia appliances and networking devices.

The ArkTIC® family is a portfolio of turnkey hardware and software solutions that enable OEMs and ODMs to quickly develop digitally networked consumer electronic products with a competitive cost structure to address this rapidly developing market. Among other networking interfaces, the first member of the ArkTIC® family will supports a powerline communication interface based on the HomePlug Powerline Specification 1.0.1.

We started marketing our AI-1100 system-on-chip in Fiscal 2007. It is designed to be embedded into various consumer electronics and multimedia networking devices and deliver high-speed Internet/Networking connectivity and multimedia over the power lines in a home. The AI-1100 chip offers a single-chip integration of HomePlug 1.0.1 powerline technology, an ARM 926-JES CPU operating at 160 MHz, dual Ethernet interfaces, an I2S Audio Interface, and a wide variety of other interfaces designed to support connected home applications. Furthermore, the programmable nature of our implementation allows ODMs/OEMs to extend the functionality of these products and HomePlug technology.

ArkTIC™ AI-1100 system-on-chip features:

· Based on HomePlug 1.0 Specification - PHY/MAC sub-system is designed to allow for compliance with the HomePlug specification - Arkados extensions for increased performance and future-proofing - Programmable MAC functions for full flexibility · ARM926 Processor - 16k instruction cache & 4k data cache - Memory Management Unit - Embedded Trace Macrocell (ETM9) · SDRAM Controller - Supports external parts up to 256Mb · SRAM Controller/Expansion Bus Interface - Supports external boot Flash or external SRAM and acts as a general-purpose interface bus for external logic · Ethernet controllers - Standard MII port (802.3u) - or - PHY Emulation Port (PEP) MII (emulates Ethernet PHY) · Video/Audio DSP Interface · USB 1.1 Device · Serial I/O Controllers · I2S for direct connection to audio DAC · IrDA - 6550d compatible UART · GPIO Controller · JTAG / Debug Interface · 0.18μ CMOS, 1.8V core, 3.3v I/O |  |

Our AI-1100 is the first in a series of devices built around existing and emerging HomePlug Powerline Alliance networking specifications. This device supports the HomePlug 1.0.1 specification along with a variety of multimedia applications. Our Direct to Speaker™ Internet Radio Reference Design (AI1100-DTS-INTR) and our Direct-to-Speaker™ MFi iPod Dock have received HomePlug 1.0 certification. Furthermore, the programmable nature of the Arkados implementation allows OEMs to extend the functionality of the HomePlug technology. Future devices will include, among other enhancements, the implementation of new HomePlug standards, such as HomePlug AV and HomePlug BPL, as they become available.

We have modularized a core Orthogonal Frequency Division Multiplexing (OFDM) and communication platform to rapidly develop customized solutions for each powerline market. This enables efficient reuse and repurposing of technology blocks, which can be used to create many specific solutions.

We also provide consulting, software, and applications support, thereby facilitating system integration in an effort to reduce our customers’ time-to-market and our customers’ development costs.

In the in-home networking portion of the market, we expect to deliver solutions for both computer-centric and entertainment-centric applications by combining both networking blocks and blocks that are capable of supporting end-user applications for consumer electronics products inside our chips. Our chips are designed to offer a high degree of programmability and may become an attractive solution for a diverse range of home-networking products that merge traditional consumer electronic functions with network-centric features.

In another portion of the market, we expect to deliver highly integrated circuits that combine both networking blocks and blocks that are capable of supporting communications applications in demand from businesses such as hotels, office parks, shopping plazas, apartment buildings, etc. This is sometimes referred to as the multi-dwelling/multi-tenant unit (MDU/MTU) or the “commercial” market. Downloadable firmware management capabilities make this an attractive solution for remote management and service applications.

In the Smart-Grid and Utility Applications portion of the market we expect to deliver highly integrated circuits that combine both networking blocks and blocks that are capable of supporting the communications applications that in demand from service providers and utility companies. This portion includes the “green power” applications that help utility companies to conserve energy and better manage their network, such as Automated Meter Reading, Peak Shaving, and a host of other applications that provide a variety of benefits and cost-saving measures. Downloadable firmware management capabilities would make this an attractive solution for remote management and service applications.

The application of Arkados solutions

Listed below are examples of the products that can be built based on the Arkados semiconductors by ODMs and OEMs. Our customers have already developed some of these products and either have or will be bringing them to market.

| | · | CONSUMER ELECTRONICS - Devices that bridge current devices and content with existing and new consumer electronic products throughout the home. Enjoy music from iPod, internet, or PC throughout the whole house - Watch video downloaded from the internet on your big screen TV, view all digital photos stored on your PC on a digital photo frame or share new photos with loved ones via the internet by displaying them directly on a digital photo frame located thousands of miles away. This is a growing market that includes audio & video devices with embedded powerline technology. We expect this market to grow over the next few years as more video and audio products are released with networking technologies built-in. Televisions, stereos, powered speakers, receivers, DVD and CD players, digital picture frames, home intercom systems, and other products are targeted applications for powerline networking technology. Internet streaming content and home content servers should greatly increase the demand for HomePlug 1.0 and AV products. In particular, our solutions offer advanced features such as synchronized whole-house audio which, combined with its new ease of installation, may significantly broaden the marketplace for such applications. |

| | | |

| | · | NETWORK HARDWARE - New types of routers, switches, gateways, network attached storage, surveillance cameras, and other devices that offer various types of services to the SOHO (Small Office Home Office) network. |

| | · | INTERNET TELEPHONY - As companies like Vonage, Comcast, Verizon and other service providers begin to roll-out new voice services to the home, an easy-to-use and reliable home network is needed. VoIP (Voice-over-IP) phones are currently produced by several vendors and we expect to see such products with HomePlug technology embedded into them. |

| | · | HOME SECURITY - Many companies have created home security cameras that are networked through various means. Early market entrants GigaFast, ST&T, and Asoka have already created powerline networked security cameras with embedded web servers that allow direct access to the camera’s feed. |

| | · | SMART GRID – Many utility companies may implement applications that could provide benefits such as saving money due to automated operation, the ability to predict maintenance issues, implementing a self-healing grid architecture, reducing power outages, and making better use of their assets; managing the grid more intelligently to prevent blackouts and power disruptions; recovering more quickly after a power disruption; increasing security; implementing real-time monitoring of the state of the network, and managing a response; managing the quality of the power (to deliver differentiated services for businesses with sensitive electronics and computers); implementing “green power” programs that allow consumers to manage their electricity use and costs; and integrating control systems, power electronics, and distributed resources. |

By developing solutions to facilitate our customers’ rapid development of full-featured next-generation products at reasonable prices, we position our company as a builder of bridges. Our solutions are designed to bridge entertainment and internet content to devices around the home, and to bridge between communications technologies, such as WiFi and powerline, Ethernet and powerline, and even to-the-home and in-the-home powerline technologies. We believe the growth of digital technologies will increase beyond computing until a large percentage of devices in the home seamlessly connect to some form of digital content or communications.

Many of our existing and potential customers are also currently in a specific marketplace that is being affected by digital convergence and networking technologies. We believe traditional networking companies are moving into traditional consumer electronics areas, while the reverse is happening to consumer electronics companies. Arkados provides platform solutions that allow those companies to enter the new market space with ease and speed.

We continue to gain considerable traction with our customers. We and our customers have publicly displayed a wide variety of potential products that include whole-house audio solutions (including music player docking stations, audio bridges, powered speakers, computer drivers for whole-house networked distribution of sound, and internet radio), and whole-house video distribution systems (including Internet-based TV adapters, surveillance systems, and digital picture frames).

Our solutions have been shown in a number of public venues, including the 2007 and 2008 International Consumer Electronics Show, Microsoft’s WinHEC 2007, and other conferences. Our prototypes or products have been publicly announced and/or demonstrated by Analog Devices, Channel Vision, devolo AG, GigaFast, GoodWay, Meiloon, PAC Electronics, Russound, Tatung, Zinwell, and Zylux. Many of these companies are suppliers to top tier brands in the market place. Several of these relationships, among others, have progressed into sales of chips, software development services, and related revenue.

Arkados received a major award from G4 Television for its HomePlug system-on-chip and software solution. While more than 20,000 products were introduced at the 2008 Consumer Electronics Show, only fifteen received G4’s CES 2008 “Best of the Best” product award. Arkados won the award on the strength of its embedded solution powering the IOGEAR Powerline Stereo Audio System consisting of an iPod® dock that is used as an audio source to distribute synchronized music to up to four different receivers. This creates whole-house music at a fraction of the cost of dedicated installed systems

We have also been involved with our customers in projects related to Smart Grid applications.

We have experienced the beginning of semiconductor sales. While most of our revenue has come from design and development agreements, we expect that such agreements will lead to volume orders, but we cannot assure you that they

will. We are targeting the sale of our powerline connectivity products to a broad range of communications, computing and consumer electronics ODMs/OEMs, but we have not yet derived significant product revenue from these ODMs/OEMs due to lengthy development cycle to develop and produce finished products. We are working closely with many of the leading communications, digital entertainment and consumer electronics companies some of which may result in design wins and orders for our integrated circuits. There are multiple OEMs that are sampling and testing our AI-1100 SoC chips, and one has announced a product incorporating our chip, but factors such as design issues, compatibility issues and manufacturing errors could delay the functioning of the products and prevent us from making sales. As is evidenced by the HomePlug certification of several of our reference designs for an Internet Radio and for a whole-house connected iPod dock, we are focused on delivering a wide array of reference designs that can help guide our customers through the product-to-market cycle.

Strategic Relationships

In July 2004, Arkados entered into a five-year Silicon Product Development and Product Collaboration Agreement with GDA Technologies, Inc., under which GDA assists Arkados in translating Arkados chip designs into a mask that can be used by a semiconductor foundry to manufacture Arkados designed integrated circuits in a cost effective manner. We paid GDA $175,000 under the agreement in Fiscal 2007 and will pay GDA 20% of production costs as compensation for production management services. In addition, we issued 150,000 shares of our restricted common stock to GDA for nominal consideration.

We have also entered into go-to-market strategies with a number of ODMs and other technology companies. Since many companies in this space target the same customer base as we do, we plan to collaborate to create solutions and offer even greater turnkey value for OEMs. We have announced relationships and strategies with several companies, including GigaFast and Tatung. Tatung Corporation, a multi-billion dollar product design and manufacturing company, and Arkados are developing whole-house digital media solutions that can distribute music and video from a multitude of sources such as an iPod®, music and video stored on computers, any internet radio station, and music and video download services to existing stereo systems, televisions, and speakers throughout the house.

Manufacturing

We have developed strategic alliances to implement our fabless manufacturing strategy. This is designed to allow us to concentrate on our design strengths, minimize fixed costs and capital expenditures, access advanced manufacturing facilities, and provide flexibility on sourcing multiple leading-edge technologies. We contract with third parties for all of our wafer fabrication and assembly, as well as for a portion of our design and testing.

Our manufacturing process is designed as follows. After wafer fabrication by the foundry, third-party assembly vendors package the wafer die. The finished products are then sent for testing, either to third-party testers or to our internal test facility, before shipment to our customers. We expect to qualify each product, participate in process and package development, define and control the manufacturing process at our suppliers where possible and practicable, develop or participate in the development of test programs, and perform production testing of products in accordance with our quality management system. If possible, we plan to use multiple foundries, assembly houses, and test houses. At present, we are using foundries in Japan owned by Fujitsu and we also use third parties to aid in our test and qualification process. Our efforts to develop multiple sources of supply have been hindered by our lack of adequate working capital.

Patents, Licenses and Trademarks

Our patent portfolio reflects our innovative development efforts and our forecasts of how we envision the market will evolve. We have been awarded 11 U.S. Patents, which we believe is an indicator that we have developed a good understanding regarding key industry developments. We believe our patents not only help us to safeguard our intellectual property, but will help us to position our company as a leader in this space. We believe that some of our recently awarded patents are integral to the implementation of powerline communication networks, which may create value in our company given the global market for this technology and the vast number of potential players in the marketplace.

We rely on trade secret, patent, copyright, and trademark laws to protect our intellectual property in our products and technology. We intend to continue this practice in the future. In addition to our issued U.S. patents, we have over 30 pending U.S. patent applications, and various corresponding international patents and applications.

To complement our own research and development efforts, we have also licensed, and expect to continue to license, from third parties a variety of intellectual property and technologies important to our business.

Although we have not received any notification from third parties that we are infringing any of their intellectual property, there may be third party patents or other intellectual property that we are infringing. If that were the case, third parties could assert infringement claims against us or seek an injunction on the sale of any of our products in the future. If such infringement were found to exist, we may attempt to acquire the requisite licenses or rights to use such technology or intellectual property. However, we cannot assure you that such licenses or rights could be obtained on favorable terms or at all.

Research and Development

We have focused on R&D since our inception. Our company has placed extraordinary value on the work done by our engineering staff, and we continue to create new software solutions, technology implementations, system-on-chip semiconductors, and the creation and development of intellectual property, that focus on helping our customers to get full-featured connected products to market quickly and at a lower cost. We protect our innovations with diligent patent and trademark programs.

We concentrate our research and development efforts on the design and development of new products for each of our principal markets. At this point, 12 of our 16 employees are dedicated to research and development. Research and development expenditures were $1,987,313, $1,920,892, and $1,395,257 in the years ended May 31, 2008, 2007 and 2006, respectively.

Our 2007 acquisition of Aster Wireless, near Rochester, NY strengthened our intellectual property pool and added three R&D employees to those that currently work in New Jersey. The intellectual property that was developed by Aster through years of R&D under the guidance of industry giants such as Kodak® has allowed us to introduce new products complementary to our existing product offerings. An example is our offering of a license to an implementation of the 802.15.3b Wireless Multimedia MAC, which is available to any developer interested in jumpstarting their development process, and bringing digital home multimedia products to market more quickly. With these developments, Arkados continues to offer a best-in-class platform for media-centric applications that demand reliable delivery of time-sensitive data.

We also fund certain research activities focused on other emerging product opportunities. Our future success is highly dependent upon our ability to develop complex new products, to transfer new products to volume production in a timely fashion, to introduce them to the marketplace ahead of the competition, to maintain competitive features, and to have them selected for design into products of leading systems manufacturers.

Our future success may also depend on assisting our customers with integration of our components into their new products, including providing support from the concept stage through design, launch, and production ramp. In this new converged marketplace, we believe the role of the traditional semiconductor provider is changing, and we have positioned ourselves as a platform provider that becomes an integral part of our customer’s product development process. We believe that our focus on application related features and software may contribute to our success.

Intellectual Property Portfolio

We focus on developing patents that have direct application to growth and strength in our business. Key patent areas include power line communications and wireless communications technology and applications. Examples include methods for increasing resistance to noise, allowing more robust transmissions, maximizing throughput, and several product-level applications such as adaptors and connectivity devices. We believe our patent portfolio will provide a competitive edge in the areas of the technology based on such new standards such as IEEE1901 and upcoming ITU G.hn standards.

Our IP Portfolio continues to grow. We diligently protect our inventions with US and International patents. Currently, we have been issued 11 patents by the United States Patent & Trademark Office, and have 25 pending applications. We also prosecute our valuable IP on an international basis, and currently have 18 Pending International Applications.

We have registered trademarks for Arkados® and ArkTIC®, and have two other trademark applications pending.

As a member of the HomePlug Alliance, we are obligated to license Necessary Patent Claims (intellectual property rights without the use of which products cannot conform to the HomePlug specifications) to any member of the alliance (including competitors) on a reasonable and non-discriminatory basis (known as RaND) as defined in the alliance’s Sponsor Agreement and Contributor Agreement. Under our license and development agreements, we retain title to our patents, patent applications and other licensed technology, and to any improvements that we develop.

To complement our own research and development efforts, we have also licensed, and expect to continue to license, from third parties a variety of intellectual property and technologies important to our business.

Although we have not received any notification from third parties that we are infringing any of their intellectual property, there may be third party patents or other intellectual property that we are infringing. If that were the case, third parties could assert infringement claims against us or seek an injunction on the sale of any of our products in the future. If such infringement were found to exist, we may attempt to acquire the requisite licenses or rights to use such technology or intellectual property. However, we cannot assure you that such licenses or rights could be obtained on favorable terms or at all.

Competition

Arkados faces intense competition as a solution provider, a technology developer of standards-based powerline technologies, as well as from other technologies also focused on our target markets. Our overarching value remains in our ability to develop SoC/software solutions that help our customers to create full-featured products that are cost-effective and can be brought to market quickly.

Differentiation of Arkados Solutions

Some manufacturers have attempted to add HomePlug-based chips to their existing products. This “bolt-on” approach often leads to products that are functional; however, the end product can be very expensive with decreased margins.

Arkados’ solutions offer a completely different approach. By incorporating a processor and multiple interfaces into the same chip that houses HomePlug communication technology, and by providing application level software that runs on the chip, Arkados presents a more cost-effective and more flexible strategy to bring products to market.

Building on the architecture of the HomePlug 1.0 chip that offered a wide range of advantages over the competition, Arkados is developing a HomePlug AV System-on-Chip to provide an even greater range of differentiation and advantages.

Business Environment

Markets for our products are highly competitive and we expect that competition will continue to increase. We compete with other semiconductor suppliers that offer standard semiconductors, application-specific integrated circuits, and fully customized integrated circuits, including embedded software, chip, and board-level products.

Our competitive strategy has been to provide cost-effective integrated products bundled with software that is designed to support a turnkey approach for a variety of applications. We believe this approach, coupled with the benefits of powerline communications technology, allows us to effectively compete due the following aspects:

| · | Due to embedded HomePlug standard technology, we believe our product performance includes unique features such as whole-house connectivity, high throughput, ease of setup, and Quality-of-service mechanisms that preserve a positive end-user experience |

| · | Due to the integration of our system-on-chip and firmware solutions, we believe our potential customers will benefit from quicker time-to-market, a competitive bill-of-materials cost, an enhanced feature set, and lower development costs |

| · | Due to our reliance on international technology standards, we believe our solutions are able comply with regulatory requirements on a global basis |

We face competition both from established players that are beginning to focus on powerline networking technology, as well as recent entrants in the field. Some of these competitors create solutions that are compliant with HomePlug Alliance

specifications, while other competitors’ products are based on proprietary technologies. Immediate key competitors in the HomePlug powerline networking portion include Afa Technologies, Conexant Systems Inc., Intellon Corporation, and Maxim Integrated Products Inc. DS2 and Panasonic build ICs that are incompatible with the HomePlug standard.

We expect to face additional competition from new entrants in each of our markets, which may include both large domestic and international integrated circuit manufacturers and smaller, emerging companies. Many of our competitors have substantially greater financial, engineering, manufacturing, marketing, technical, distribution and other resources, broader product lines, greater intellectual property rights, and longer relationships with customers than we have.

In addition, there are organizations worldwide may attempt to create technology standards that compete with the industry specifications established by the HomePlug Powerline Alliance. These include the Institute of Electrical and Electronics Engineers (IEEE) and the International Telecommunication Union (ITU) which may adopt standards different from, and incompatible with, the technology inside our products. We also participate in these standards efforts. Other industry organizations promote powerline communications, such as the Universal Powerline Association, the Consumer Electronics Powerline Communication Alliance (CEPCA) and the High Definition Powerline Communications (HD-PLC) Alliance. They have also established technology or coexistence specifications that may conflict with the HomePlug specifications.

As a provider of powerline home connectivity integrated circuits, we face additional competition from other home connectivity technologies such as twisted pair cable, coaxial cable and wireless media. Despite the broad array of different technologies deployed to date, we believe those technologies that do not require new wires such as HomePNA, MoCA, 802.11 and other wireless alternatives, will provide the competition to powerline solutions.

Sales and Marketing

We expect to sell our products worldwide using the following channels:

| | · | Sales and marketing partnerships with established companies. |

| | These relationships generally help to establish the presence in specific regions and access customers through already developed relationships. The benefits of using this channel are numerous, among them are added credibility, reduction of upfront sales and marketing expenses, acceleration of volume sales through incumbency of the customer base, and local customer support and account management. |

| | · | Advanced development partnerships with strategic customers. |

| | The benefits of using this channel include the creation of product focus, reduction of upfront sales and marketing expenses, acceleration of sales volumes through early commitments, and creation of incremental development revenues. |

| | · | Network of distributors that can support our customers worldwide. |

| | We have an agreement with Jedcom, a distributor in Taiwan. Under the terms of this agreement Jedcom would provide us with distribution, sales and marketing, and field application engineering support in Taiwan and certain regions of China. |

We expect to develop our sales force to include a network of direct sales regions. We expect to establish international sales offices and develop relationships with appropriate organizations located worldwide. We expect to supplement our direct sales force with sales representative organizations and distributors. The scope and development of our sales and marketing organization will depend, among other things, on the amount of capital available to us and when products are ready for testing.

Our marketing consists of various programs that help create awareness and promote the benefits of our various solutions, the worth of the company, and the value of our technology to our target industries. Much of the marketing is handled through press releases, website, involvement in trade shows and conferences, press interview opportunities, placed articles, newsletters, white papers, and through interpersonal relationships developed through numerous methods. We have at times hired agencies to assist with specialized functions.

Regulatory Environment

Our customers’ products, which contain our solutions for powerline communications technology must adhere to regulations about transmission power, permissible frequencies of operation and electromagnetic interference (EMI) for both U.S. and foreign governments. In some countries, certification tests must be performed to ensure a vendor’s products comply with the regulations. While it is our customers who are responsible to obtain certifications, we need to ensure international regulations are adhered to.

The Federal Communications Commission (FCC) administers regulations in the United States. Our solutions are unlicensed devices in the U.S.A. and receive no regulatory protection from interference from other devices and may not cause any harmful interference to licensed devices. Those who operate unlicensed devices must stop using a device when the FCC declares that the device is causing harmful interference. Products using our solutions over power lines both inside and outside the home are FCC-regulated and must comply with radiated emission limits and various other technical standards.

Outside of the United States, the International Electrotechnical Commission, International Special Committee on Radio Interference (IEC/CISPR) is the primary authority. IEC member states import IEC/CISPR standards into their own national laws either in whole or in part. Powerline communications regulations are based upon specific country requirements. In some countries, regulations may limit the use of powerline communications in certain circumstances or to certain power levels or frequency bands.

Before products can be sold, most countries require electronic products to comply with safety testing or to be certified. While it is our customers who are responsible to obtain certifications, we need to ensure international regulations are adhered to.

Regulations and their enforcement and interpretation varies between countries. Regulatory change or certification methodologies may require a redesign of products containing our solutions. At its most severe, regulatory changes could terminate the use of products already in the marketplace.

Backlog

We expect sales outside of strategic partnership agreements to be made primarily pursuant to standard short-term purchase orders for delivery of standard products. We expect the quantity actually ordered by the customer, as well as the shipment schedules, to be frequently revised, without significant penalty, to reflect changes in the customer’s needs. As a result, we believe that in the future, our backlog at any given time should not be used as a meaningful indicator of future revenues.

As of May 31, 2008, we had a backlog of approximately $235,000 of orders we believe are firm.

Employees