SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14D-9

Solicitation/Recommendation Statement Under Section 14(d)(4)

of the Securities Exchange Act of 1934

CAMINUS CORPORATION

(Name of Subject Company)

Caminus Corporation

(Name of Person(s) Filing Statement)

Common Stock,

Par Value $0.01 Per Share

(Title of Class of Securities)

133766 10 5

(CUSIP Number of Class of Securities)

William P. Lyons

President and Chief Executive Officer

Caminus Corporation

825 Third Avenue

New York, New York 10022

Tel: (212) 515-3600

(Name, Address and Telephone Number of Person Authorized to Receive

Notices and Communications on Behalf of the Person(s) Filing Statement)

Copy to:

Anthony T. Iler, Esq.

Irell & Manella LLP

1800 Avenue of the Stars, Suite 900

Los Angeles, California 90067

Tel: (310) 277-1010

¨ Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

Item 1. Subject Company Information.

The name of the subject company to which this Solicitation/Recommendation Statement on Schedule 14D-9 (this “Statement”) relates is Caminus Corporation, a Delaware corporation (the “Company”). The address of the principal executive offices of the Company is 825 Third Avenue, New York, New York 10022. The telephone number of the principal executive offices of the Company is (212) 515-3600.

The title of the class of securities to which this Statement relates is the common stock, par value $0.01 per share, of the Company (the “Common Stock”). As of January 19, 2003, there were 16,782,306 shares of Common Stock outstanding.

Item 2. Identity and Background of Filing Person.

The name, address and telephone number of the Company, which is the person filing this Statement and is also the subject company, are set forth in Item 1 above.

This Statement relates to the tender offer by Rapid Resources Inc., a Delaware corporation (“Purchaser”) and a wholly owned subsidiary of SunGard Data Systems Inc., a Delaware corporation (“Parent”), disclosed in a Tender Offer Statement on Schedule TO filed by Purchaser and Parent (as amended from time to time, the “Schedule TO”) with the Securities and Exchange Commission (the “SEC”) on January 29, 2003, to purchase all of the outstanding shares of Common Stock at a purchase price of $9.00 per share, in cash, without interest thereon (the “Offer Price”), upon the terms and subject to the conditions set forth in the Offer to Purchase, dated January 29, 2003 (the “Offer to Purchase”), and in the related Letter of Transmittal (the “Letter of Transmittal,” which, together with the Offer to Purchase, as they may be amended and supplemented from time to time, constitute the “Offer”). Copies of the Offer to Purchase and the Letter of Transmittal are filed as Exhibits (a)(1)(A) and (a)(1)(B) hereto, respectively, and are incorporated herein by reference. Copies of the Offer to Purchase and the Letter of Transmittal are being furnished to Company stockholders concurrently with this Statement.

The Offer is being made pursuant to the Agreement and Plan of Merger, dated January 20, 2003, by and among Parent, Purchaser and the Company (the “Merger Agreement”). The Merger Agreement, among other things, provides that, subject to the satisfaction or waiver of certain conditions, following the consummation of the Offer and in accordance with the relevant provisions of the Delaware General Corporation Law (the “DGCL”), Purchaser will be merged with and into the Company (the “Merger”). Following the effective time of the Merger (the “Effective Time”), the Company will continue as the surviving corporation (the “Surviving Corporation”) and a wholly owned subsidiary of Parent.

In the Merger, each share of Common Stock outstanding at the Effective Time (other than shares of Common Stock held by Parent, Purchaser or any other wholly owned subsidiary of Parent, the Company, or any wholly owned subsidiary of the Company, which will be cancelled, and other than the shares of Common Stock, if any, held by holders of Common Stock who have properly demanded and perfected their appraisal rights under Section 262 of the DGCL) will, by virtue of the Merger and without any action on the part of the holders of Common Stock, be converted into the right to receive the Offer Price, or any greater amount per share of Common Stock paid pursuant to the Offer, without interest. The Merger Agreement is more fully described in Section 12 “Purpose of the Offer; Plans for Caminus; The Merger Agreement; The Tender and Voting Agreement” of the Offer to Purchase, which is filed herewith as Exhibit (a)(1)(A) and is incorporated herein by reference.

The following directors, executive officers, and affiliated stockholders have entered into a Tender and Voting Agreement, dated January 20, 2003 (the “Tender Agreement”), with Parent and Purchaser, pursuant to which they have agreed, in their capacity as stockholders, to tender all of their shares of Common Stock, with certain limited exceptions, as well as any additional shares of Common Stock which they may acquire (pursuant to stock options or otherwise), with certain limited exceptions, to Purchaser in the Offer: OCM Principal Opportunities Fund, L.P., ZAK Associates, Inc., Brian J. Scanlan and Cynthia Chang, jointly, Cynthia Chang,

2

Brian J. Scanlan, William P. Lyons, Joseph P. Dwyer, John A. Andrus, RIT Capital Partners plc, GFI Two LLC, OW Richards and CMJ Spottiswoode Accumulation and Maintenance Trust and Clare M.J. Spottiswoode. As of January 20, 2003, such directors, executive officers and affiliated stockholders held in the aggregate, including shares issuable upon exercise of stock options, 5,099,416 shares of Common Stock, which represented approximately 28% of the outstanding shares of Common Stock on a fully diluted basis. Such directors, executive officers and affiliated stockholders also agreed to grant Parent a proxy with respect to the voting of their shares of Common Stock, upon the terms set forth in the Tender Agreement. The Tender Agreement is more fully described in Section 12 “Purpose of the Offer; Plans for Caminus; The Merger Agreement; The Tender and Voting Agreement” of the Offer to Purchase, which is filed herewith as Exhibit (a)(1)(A) and is incorporated herein by reference.

Copies of the Merger Agreement and the Tender Agreement are filed herewith as Exhibits (e)(1) and (e)(2), respectively, and are incorporated herein by reference. A copy of the joint press release issued by the Company and Parent on January 21, 2003 is filed herewith as Exhibit (a)(1)(H) and is incorporated herein by reference.

Purchaser has not conducted any activities since its organization, other than those related to the acquisition. As set forth in the Schedule TO, the principal executive offices of Parent and Purchaser are located at 1285 Drummers Lane, Suite 300, Wayne, Pennsylvania 19087. The telephone number of Parent and Purchaser at that address is (610) 341-8700.

Item 3. Past Contacts, Transactions, Negotiations and Agreements.

General

Certain contracts, agreements, arrangements or understandings between the Company or its affiliates and certain of its directors and executive officers and between the Company and Parent and Purchaser are described in the Information Statement pursuant to Section 14(f) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Rule 14f-1 thereunder (the “Information Statement”) that is attached as Annex A to this Statement and is incorporated herein by reference.

Except as set forth in this Item 3 or in the Information Statement or as incorporated by reference herein, to the knowledge of the Company, as of the date hereof, there are no material agreements, arrangements or understandings and no actual or potential conflicts of interest between the Company or its affiliates and (i) the Company or its executive officers, directors or affiliates or (ii) Parent, Purchaser or their respective executive officers, directors or affiliates.

Interests of Executive Officers, Directors and Affiliates

Employment Agreements with Executive Officers, Directors and Affiliates

The Company has entered into employment agreements with certain of its executive officers. The Merger Agreement provides that the Company will make commercially reasonable efforts to obtain and deliver to Parent the resignation of certain directors of the Company and its subsidiaries and such officers of the Company and its subsidiaries as Parent requests, except that, as more fully described in Section 12 “Purpose of the Offer; Plans for Caminus; The Merger Agreement; The Tender and Voting Agreement” of the Offer to Purchase, which is filed herewith as Exhibit (a)(1)(A) and is incorporated herein by reference, and in the Information Statement, which discussion is incorporated herein by reference, under certain circumstances up to two of the Company’s current non-employee directors will remain on the Company’s Board of Directors through the Effective Time.

Severance Arrangements with Executive Officers

The Company has entered into employment and/or management retention agreements with William P. Lyons, its President and Chief Executive Officer, Joseph P. Dwyer, its Chief Financial Officer, and

3

John A. Andrus, its Chief Operating Officer, that provide for certain severance payments that may be triggered by the Merger, which are discussed in more detail in the Information Statement, which discussion is incorporated herein by reference.

Confidentiality Agreement

On November 6, 2002, Parent and the Company entered into a confidentiality agreement in connection with Parent’s evaluation of the Company and the Company’s provision of certain information to Parent (the “Confidentiality Agreement”). The Confidentiality Agreement is filed herewith as Exhibit (e)(3) and is incorporated herein by reference.

Effect of the Transaction on Stock Option Plans

The transactions contemplated by the Merger Agreement will cause each option to purchase shares of Common Stock, whether granted under the Company’s 1998 Stock Incentive Plan, 1999 Employee Stock Purchase Plan, 1999 Stock Incentive Plan, 2001 Non-Officer Employee Stock Incentive Plan or otherwise issued or granted (including non-plan grants, a “Company Option”), to be fully accelerated in accordance with their terms. The Merger Agreement provides that each such Company Option will be canceled by virtue of the Merger in exchange for a cash payment in the amount, if any, by which the Offer Price exceeds the exercise price per share of such Company Option, multiplied by the number of shares of Common Stock subject to such Company Option.

Except for certain commitments to issue options pursuant to the Company’s Tender Offer Statement on Schedule TO filed with the SEC on October 28, 2002, as amended (the “Option Tender Offer”), all stock option plans established by the Company or any of its subsidiaries, and any other plan, program or arrangement providing for the issuance or grant of any other interest in the capital stock of the Company, will terminate as of the Effective Time.

The Merger Agreement also provides that, as of the Effective Time, the Surviving Corporation will continue to be bound by the Company’s commitment to issue options pursuant to the Option Tender Offer. The options issued pursuant to the Option Tender Offer (the “Assumed Options”) will be options to purchase shares of Parent common stock, $0.01 par value per share (“Parent Common Stock”). In furtherance of the foregoing, (i) the number of shares of Parent Common Stock purchasable upon exercise of such Assumed Options shall be calculated in accordance with the ratio set forth in the Merger Agreement, and (ii) the per share exercise price under each such Assumed Option shall be the closing sale price of a share of Parent Common Stock reported on the New York Stock Exchange on the day on which the Assumed Options are granted pursuant to the Option Tender Offer, and rounding up to the nearest cent. To be eligible to receive Assumed Options, a potential recipient must be employed by Parent or the Surviving Corporation at the time of issuance.

The Merger Agreement also provides that Parent must take all corporate action necessary to reserve for issuance a sufficient number of shares of Parent Common Stock for delivery upon exercise of the Assumed Options. Parent must file with the SEC a registration statement on Form S-8 or on another appropriate form, reasonably promptly following the Effective Time, with respect to Parent Common Stock subject to the Assumed Options and must use commercially reasonable efforts to maintain the effectiveness of the registration statement for so long as the Assumed Options remain outstanding and exercisable.

Effect of the Transaction on Employee Benefit Plans

The Merger Agreement provides that all employees of the Company and its subsidiaries who continue employment with Parent, Purchaser, or any subsidiary of Purchaser after the Effective Time (“Continuing Employees”) will be eligible to continue to participate in health or welfare benefit plans provided by the Surviving Corporation. The Merger Agreement also provides that Parent or Purchaser can terminate any such

4

health or welfare benefit plan at any time (including as of the Effective Time). If these health or welfare benefit plans are terminated, then the employees will be immediately eligible to participate in Parent’s health and welfare plans to substantially the same extent as similarly situated employees of Parent.

The Merger Agreement also provides that immediately after the Effective Time, the Continuing Employees will be entitled to participate in a 401(k) plan sponsored, maintained or contributed to by Parent or its subsidiaries. Each Continuing Employee’s period of service and compensation history with the Company and its subsidiaries will be counted in determining eligibility for, and the amount and vesting of, benefits under Parent’s health and welfare plans, including the 401(k) plan. Each Continuing Employee who participates in one of these plans will participate without regard to any waiting period or any condition or exclusion based on pre-existing conditions, medical history, claims experience, evidence of insurability, or genetic factors, and will receive full credit for any co-payments or deductible payments, or account balances under any cafeteria or flexible spending plan made before the Effective Time. In the event that any Continuing Employee receives an “eligible rollover distribution” (within the meaning of Section 402(c)(4) of the Internal Revenue Code) from a 401(k) plan of the Company, Parent will cause a Parent 401(k) plan to accept a direct rollover of such eligible rollover distribution (including, but not limited to, any portion of such eligible rollover distribution comprised of the outstanding balance of a loan from the Company 401(k) plan).

The Merger Agreement provides that, unless Parent provides written notice otherwise, the Company will terminate any 401(k) plan of the Company, effective as of the day immediately prior to and contingent upon the Company becoming a member of the same Controlled Group of Corporations (as such term is defined in Section 414(b) of the Internal Revenue Code) as Parent.

Indemnification and Insurance

The Company’s bylaws and certificate of incorporation provide that certain of the directors and officers of the Company (the “Indemnified Persons”) have rights to indemnification existing in their favor. The Merger Agreement provides that, for the acts and omissions of the Indemnified Persons occurring prior to the Effective Time, these indemnification rights will survive the Merger and will be observed by the Surviving Corporation to the fullest extent available under Delaware law for a period of six years from the Effective Time.

The Merger Agreement provides that Purchaser will maintain in effect, for the benefit of the Indemnified Persons with respect to their acts and omissions occurring prior to the Effective Time, a “tail” policy of directors’ and officers’ liability insurance (the “Tail Policy”) covering the period of time from the Effective Time until up to the sixth anniversary of the Effective Time, providing comparable coverage to the existing directors’ and officers’ liability insurance policy maintained by the Company. The maximum aggregate premium to purchase the Tail Policy will be $3.0 million, and, in the event the aggregate premium for the Tail Policy exceeds $3.0 million, Purchaser will be entitled to alter the terms of the coverage and/or period of the coverage under the Tail Policy to such terms of coverage and/or period of time that can be obtained for an aggregate premium equal to $3.0 million.

The Merger Agreement provides that proper provisions will be made so that the successors and assigns of Parent assume the indemnification and insurance obligations described above in the event Parent or any of its successors or assigns (i) consolidates with or merges into any other person and shall not be the continuing or surviving corporation of such consolidation or merger, or (ii) transfers or conveys all or substantially all of its properties and assets to any person.

Representation on the Board

The Merger Agreement sets forth certain agreements between the Company and Parent regarding the election by Parent of directors to the Company’s board of directors (the “Board”) upon acceptance of shares for payment pursuant to the Offer. These agreements are described in the Information Statement, which description is incorporated herein by reference.

5

Merger Agreement

A summary of the Merger Agreement and a description of the conditions of the Offer are contained in Section 12 “Purpose of the Offer; Plans for Caminus; The Merger Agreement; The Tender and Voting Agreement” and Section 13 “Certain Conditions to the Offer” of the Offer to Purchase, which is filed herewith as Exhibit (a)(1)(A) and is incorporated herein by reference. Such summary and description are qualified in their entirety by reference to the Merger Agreement, which is filed herewith as Exhibit (e)(1) and is incorporated herein by reference.

Tender Agreement

A summary of the Tender Agreement is contained in Section 12 “Purpose of the Offer; Plans for Caminus; The Merger Agreement; The Tender and Voting Agreement” of the Offer to Purchase, which is filed herewith as Exhibit (a)(1)(A) and is incorporated herein by reference. Such summary is qualified in its entirety by reference to the Tender Agreement, which is filed herewith as Exhibit (e)(2) and is incorporated herein by reference.

Item 4. The Solicitation or Recommendation.

Recommendation of the Board

On January 18, 2003, at a meeting of the Board at which all directors were present, the Board unanimously determined that the Merger Agreement and the transactions contemplated thereby, including the Offer and the Merger, are fair to and in the best interests of the stockholders of the Company, approved and adopted the Merger Agreement and the transactions contemplated thereby, including the Offer and the Merger, in accordance with the DGCL and declared that the Merger Agreement is advisable.Accordingly, the Board unanimously recommends that the stockholders of the Company accept the Offer and tender their shares of Common Stock to Purchaser and adopt the Merger Agreement if required under applicable law.

A letter to the stockholders of the Company communicating the Board’s recommendation is filed herewith as Exhibit (a)(2) and is incorporated herein by reference.

Background

Prior to September 20, 2002, representatives of Parent periodically contacted representatives of the company to discuss potential business relationships or transactions between the companies.

On September 20, 2002, Cristóbal Conde, president and chief executive officer of Parent, and Lawrence Gilson, chairman of the Company, met for the first time to discuss Parent’s preliminary interest in a possible acquisition of the Company. Mr. Conde and Mr. Gilson discussed a possible transaction in only general terms, and no indicative price in such transaction was discussed.

On September 26, 2002, Mr. Conde indicated in a conversation with Mr. Gilson that, based upon publicly available information, Parent considered the valuation of the Company to be approximately $7.00 per share. Mr. Gilson responded that it did not appear that Parent in deriving its valuation was factoring appropriately, among other things, the consensus of stock analysts with respect to the Company’s expected revenue for 2002 nor its recently announced stock buy-back program.

Based upon a re-examination of the Company from publicly available information, Mr. Conde in a conversation with Mr. Gilson on October 10, 2002 indicated that Parent had revised its valuation of the Company and considered its revised valuation of the Company to be in the range of $8.50 to $9.00 per share.

On November 6, 2002, Parent executed a confidentiality agreement with the Company.

On November 8, 2002, the Company retained Banc of America Securities LLC (“BAS”) to provide an opinion to the Company’s board of directors as to the fairness, from a financial point of view, of the consideration proposed to be received pursuant to a transaction with Parent, if the Company contemplated a sale transaction with Parent.

6

On November 12 and 13, 2002, representatives of Parent met with representatives of the Company to conduct preliminary due diligence, which included a review of the Company’s products and services, its operating results for 2002 and financial plan for 2003, as well as perceived potential synergies between the two companies.

On November 15, 2002, representatives of Parent met with representatives of the Company to conduct technical due diligence.

On November 22, 2002, representatives of Parent met with representatives of the Company to propose an acquisition of the shares of the Company for $7.00 per share in cash, subject to a number of conditions and contingencies, including the completion of a satisfactory due diligence investigation of the Company. During this meeting, representatives of the Company indicated that Parent should be willing to pay $9.50 to $10.00 per share to acquire the Company.

On November 25, 2002, representatives of Parent met again with representatives of the Company to review additional financial information and discuss potential cost synergies that could result from the combination.

Between November 25, 2002 and December 9, 2002, representatives of Parent and the Company had further discussions concerning Parent’s proposal and the valuation of the Company and potential cost synergies that could be achieved from a combination of the two companies. On December 9, 2002, the parties agreed to pursue negotiation of the proposed transaction, including a definitive agreement, at a price of $9.00 per share in cash.

On December 12, 2002, representatives of Parent and the Company and their respective legal advisors met to discuss and negotiate aspects of the proposed transaction. Later during that same day, the board of directors of Parent approved the acquisition of the Company subject to satisfactory negotiation of the Merger Agreement and satisfactory completion of a comprehensive due diligence review of the Company.

Between December 15, 2002 and January 15, 2003, representatives of Parent and its legal and accounting advisors conducted extensive due diligence on the Company’s business, including conducting meetings with the Company’s management and reviewing financial and legal documents provided by the Company. Also during this time, legal and financial representatives of Parent and the Company and their respective advisors discussed and negotiated on many occasions all aspects of the proposed merger and the definitive agreement therefor. These negotiations covered all aspects of the transaction, including, among other things: the representations and warranties made by the parties; the restrictions on the conduct of the Company’s business following execution and delivery of the Merger Agreement; the conditions to completion of the Offer and the Merger; the provisions regarding termination; the amount, triggers and payment of the termination fee and the consequences of termination; and the delivery and terms of the Tender Agreement.

In meetings held on December 8, 12 and 22 of 2002, the board of directors of the Company reviewed the status of the proposed transaction. At the December 22, 2002 meeting, the board of directors received a preliminary presentation from BAS as to the fairness, from a financial point of view, to the stockholders of the Company, other than the stockholders who were to be parties to the Tender Agreement, of the consideration proposed to be received by such stockholders in connection with the proposed Offer and Merger.

On January 17, 2003, the board of directors of Parent approved the Merger Agreement in the form presented.

On January 18, 2003, the board of directors of the Company held a meeting to discuss the status of Parent’s acquisition proposal. During this meeting there was a full briefing by management, BAS made a presentation and rendered an opinion to the board of directors, to the effect that the consideration proposed to be received by the Company’s stockholders in the proposed Offer and Merger, other than stockholders who were to be parties to the Tender Agreement, is fair, from a financial point of view, to such stockholders, and the Company’s legal advisors rendered a full report to the Company’s board of directors. After further discussion of the proposed transaction and the board’s fiduciary responsibilities to the Company’s stockholders, the board unanimously approved the Merger Agreement and the other transaction documents, subject to finalization of all remaining details to management’s satisfaction.

7

Following such approvals, on January 20, 2003, the Merger Agreement was executed by Parent and the Company and the Tender Agreement was executed by the stockholders named therein and Parent.

On January 21, 2003, Parent and the Company, before the opening of trading on the New York Stock Exchange and Nasdaq, issued a joint press release announcing the transaction.

Reasons for the Recommendation of the Board

In approving the Merger Agreement and the transactions contemplated thereby, including the Offer and the Merger (the “Transaction”), and recommending that all holders of Common Stock accept the Offer and tender their shares of Common Stock pursuant to the Offer, the Board considered a number of factors, including:

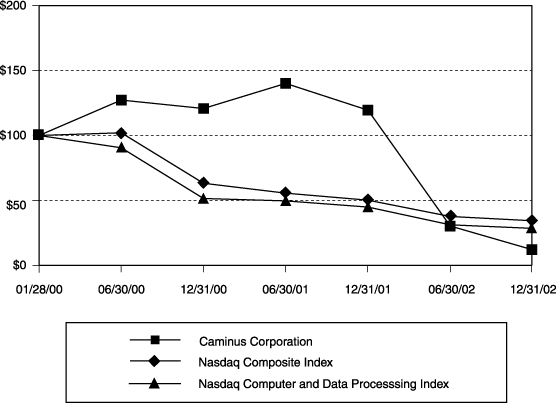

1. Historical and Recent Trading Activity. The Board considered the relationship of the Offer Price to the recent and historical market prices and trading activity of shares of Common Stock. As part of this, the Board considered that the Offer Price represents (a) a premium of 252.9% over the last sale price of the Common Stock reported by The Nasdaq National Market on January 10, 2003, (b) a premium of 248.7% over the average sale price of shares of Common Stock reported by The Nasdaq National Market for the one month period prior to January 10, 2003, (c) a premium of 284.4% over the average sale price of shares of Common Stock reported by The Nasdaq National Market for the three month period prior to January 10, 2003, and (d) a premium of 303.1% over the average sale price of shares of Common Stock reported by The Nasdaq National Market for the six month period prior to January 10, 2003. The Board considered these periods the most relevant to demonstrate the recent performance of shares of Common Stock.

2. Company Operating and Financial Condition. The Board considered the current and historical financial condition and results of operations of the Company, as well as the prospects and strategic objectives of the Company, including the risks involved in achieving those prospects and objectives as an independent entity, and the current and expected conditions in the industry in which the Company operates. In addition, the Board considered the likely adverse effect that the Company’s small market capitalization, limited trading volume and diminishing attention from research analysts has had and may in the future have on the trading markets for, and the value of, shares of Common Stock.

3. Strategic Alternatives. The Board reviewed trends in the industry in which the Company operates and the strategic alternatives available to the Company, including the Company’s alternative to remain an independent public company, the possibility of its acquisitions of or its acquisition by other companies in its industry or complementary industries, as well as the risks and uncertainties associated with each such alternative. The Board considered comparable transactions as well as other possible alternatives to the Transaction involving third parties, the likelihood of consummation of such comparable and alternative transactions, and the risks associated with each of them.

4. Terms and Conditions of the Merger Agreement. The Board considered the terms and conditions of the Transaction, including the amount of consideration to be received by the Company’s stockholders, the parties’ representations, warranties and covenants, conditions to their respective obligations and the ability of Parent and Purchaser to terminate the Offer and the Merger.

5. No Financing Contingency. The Board considered that neither the Offer nor the Merger is subject to any financing condition.

6. Financing Representation. The Board considered Parent’s and Purchaser’s representation in the Merger Agreement that Purchaser has sufficient liquid cash funds available to satisfy Purchaser’s obligation to complete the Offer and the Merger.

7. Consents. The Board considered that there are no material third party consents required to consummate the Merger.

8. Indicia of Stockholder Support. The Board considered the willingness of certain stockholders to enter into the Tender Agreement and tender their shares of Common Stock pursuant to the Offer.

8

9. Timing of Completion. The Board considered the anticipated timing of the Transaction, including the structure of the Transaction as a cash tender offer for all of the outstanding shares of Common Stock. The Board considered that the cash tender offer afforded the stockholders the opportunity to obtain cash for all of their shares of Common Stock at the earliest possible time.

10. Certainty of Value. The Board considered the form of consideration to be paid to holders of Common Stock in the Offer and the Merger, and the certainty of value of such cash consideration compared to stock or other possible forms of consideration. Volatility in the market prices of shares quoted on The Nasdaq National Market and in stock markets generally have increased the uncertainties in valuing any non-cash consideration. The Board was aware that the consideration received by holders of Common Stock in the Offer and Merger would be taxable to such holders for income tax purposes.

11. Negotiated Price. The Board considered that, in its judgment, based on the extended arm’s-length negotiations with Parent and Purchaser, that the Offer Price represented the highest price that Purchaser would be willing to pay in acquiring the Company.

12. Fairness Opinion of BAS. The Board considered presentations from BAS and the opinion of BAS to the Board that, as of January 18, 2003 and based on and subject to the matters stated in such opinion, the $9.00 in cash per share proposed to be received by holders of Common Stock in the Offer and the Merger (other than holders who are party to the Tender Agreement) is fair from a financial point of view to such holders. For purposes of rendering its fairness opinion, BAS’s analysis included a review of certain financial statements and other business, financial and operating data of the Company, trading multiples for selected publicly traded companies, valuation multiples in selected acquisitions, an analysis of premiums paid in selected transactions and other matters referred to in that opinion. A copy of the opinion of BAS that was delivered to the Board setting forth the assumptions made, procedures followed, matters considered and limits on the review undertaken by BAS in arriving at its opinion, is attached hereto as Annex B and is incorporated herein. BAS’s opinion, addressed to the Board, relates only to the fairness, from a financial point of view, of the $9.00 in cash per share to be received by stockholders who are not a party to the Tender Agreement, and does not constitute an opinion or recommendation to any stockholder as to whether or not such stockholder should tender shares in the Offer, how a stockholder should vote at the stockholders’ meeting, if any, held in connection with the Merger, or as to any other matters relating to the Offer or the Merger. Stockholders are urged to read this opinion in its entirety. The Board was aware of and considered that certain fees described in Item 5 below become payable to BAS upon the consummation of the Transaction.

13. Alternative Transactions. The Board considered that the Merger Agreement permits the Company to (1) consider an unsolicited acquisition proposal under certain circumstances and (2) recommend any such proposal that is superior to the Offer and the Merger, if, among other things, (a) the Board determines in good faith that the acquisition proposal is more favorable to the Company’s stockholders (based on factors the Board deems relevant, including the additional time necessary to consummate the competing acquisition proposal and the financial advice of the Company’s financial advisors that the value of the consideration is superior in the competing acquisition proposal), (b) financing, to the extent required, is (based on the opinion of the Company’s financial advisors) reasonably capable of being obtained, (c) after consultation with the Company’s legal advisors, the Board determines the failure to take any such action would be a breach of the board’s fiduciary duties, (d) the Company gives Parent three business days notice, and (e) the Company pays Parent a termination fee in the amount of $4.0 million, plus expenses not to exceed $500,000. The Board considered the possible effect of these provisions of the Merger Agreement on third parties who might be interested in exploring an acquisition of the Company.

14. The Company’s Future Prospects. The Board considered that all holders of shares of Common Stock (except for Parent and Purchaser) whose shares are purchased in the Offer will not participate in the Company’s future growth. Because of the risks and uncertainties associated with the Company’s future prospects, the Board concluded that this detriment was not reasonably quantifiable. The Board also concluded that obtaining a substantial cash premium for shares of Common Stock now was preferable to affording the stockholders a speculative potential future return.

9

15. Parent’s Interest in the Sector. The Board considered that Parent is in a particularly advantageous position to take advantage of the opportunity represented by a purchase of the Company, and as a result to pay a substantial premium relative to historical and recent trading prices for shares of Common Stock. Parent sells non- energy specific software products and services to some of the same customers as the Company, but does not currently participate materially in the energy transaction and risk management software business. As a result the Board considered that Parent is likely to realize substantially greater synergies from an acquisition of the Company than other potential acquirors, enabling Parent to pay a higher price for the Company.

16. Potential Conflicts of Interest. The Board considered that the interests of certain persons, including Company executives, in the Merger may be different from those of the stockholders (see Item 3 above in this Statement).

The Board also considered a number of uncertainties and risks in its deliberations concerning the Transaction:

1. The circumstances under the Merger Agreement in which the termination fee of $4.0 million becomes payable by the Company, and the circumstances under the Merger Agreement in which the Company is required to reimburse Parent’s expenses incurred in connection with the Merger Agreement, up to $500,000.

2. The fact that under the terms of the Merger Agreement, between the execution of the Merger Agreement and the Effective Time, the Company is required to obtain Parent’s consent before it can take specified actions.

3. The conditions to Purchaser’s and Parent’s obligations to purchase Common Stock in the Offer, and the possibility that such conditions might not be satisfied, including expiration or termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”).

4. The possibility that, although the Offer gives stockholders the opportunity to realize a premium over the price at which shares of Common Stock traded prior to the public announcement of the Offer and the Merger, the price or value of shares of Common Stock may increase in the future if the Company were to remain an independent company, and that Company stockholders would not benefit from those future increases.

5. The tax effects to Company stockholders of the Offer and the Merger.

The Board believed that these risks were outweighed by the potential benefits of the Offer and the Merger.

In view of the variety of factors considered in connection with its evaluation of the Merger Agreement, the Board found it impracticable to, and did not, quantify, rank or otherwise assign relative weights to the factors considered or determine that any factor was of particular importance in reaching its determination that the Merger Agreement and the transactions contemplated thereby are advisable to, and in the best interests of, the Company’s stockholders. Rather, the decision of each Board member was based upon his or her own judgment, in light of the totality of the information presented and considered, of the overall effect of the Merger Agreement and the transactions contemplated thereby, including the Offer and the Merger, on the Company’s stockholders. After weighing all of these considerations, the Board unanimously approved the Merger Agreement and the transactions contemplated thereby and recommends that the holders of shares of Common Stock tender such shares in the Offer and adopt the Merger Agreement if required under applicable law.

Intent to Tender

To the knowledge of the Company, after reasonable inquiry, each executive officer and director of the Company who owns shares of Common Stock currently intends, subject to contractual obligations and compliance with applicable law, including Section 16(b) of the Exchange Act, to tender all outstanding shares of Common Stock held of record or beneficially owned by such person to Purchaser in the Offer. Certain directors, executive officers, and affiliated stockholders who hold approximately 28% of the outstanding shares of

10

Common Stock, calculated on a fully diluted basis, as of January 19, 2003, have entered into the Tender Agreement pursuant to which they have agreed, in their capacity as stockholders, to tender all of their shares of Common Stock, with certain limited exceptions, as well as any additional shares of Common Stock which they may acquire (pursuant to stock options or otherwise), with certain limited exceptions, to Purchaser in the Offer. See Item 2 above.

Item 5. Person/Assets, Retained, Employed, Compensated or Used.

The Company retained BAS to render an opinion to the Board as to the fairness, from a financial point of view, of the consideration proposed to be received pursuant to a transaction with Parent. Pursuant to the terms of BAS’s engagement, the Company has agreed to pay BAS a fee of $800,000, payable on the earlier to occur of the date of closing of the Transaction or the date of termination of the Merger Agreement. The Company has also agreed to reimburse BAS for reasonable expenses (including reasonable fees and expenses of legal counsel), up to $17,500, and to indemnify BAS and related parties against certain liabilities arising out its engagement. In the ordinary course of its business, BAS and its affiliates may actively trade the debt and equity securities of the Company and Parent for its or its affiliates own account or for the accounts of customers and, accordingly, it or its affiliates may at any time hold long or short positions in such securities. Bank of America, N.A., an affiliate of BAS, is a lender under Parent’s senior credit facility and has received fees for the rendering of such services.

Neither the Company nor any person acting on its behalf currently intends to employ, retain or compensate any person to make solicitations or recommendations to stockholders on its behalf concerning the Offer.

Item 6. Interest in Securities of the Subject Company.

No transactions in shares of Common Stock have been effected during the past 60 days by the Company or any of its subsidiaries or, to the best of the Company’s knowledge, by any executive officer, director or affiliate of the Company, except as follows:

| | 1. | | 275,212 shares of Common Stock have been released from escrow to the Company in connection with the Company’s acquisition of Altra Software Services, Inc. in November 2001; and |

| | 2. | | In January 2003, Ms. Spottiswoode transferred an aggregate of 7,500 shares to two of her adult children. |

Item 7. Purposes of the Transaction and Plans or Proposals.

Except as set forth in this Statement or the Offer to Purchase, to the Company’s knowledge, no negotiation is being undertaken or engaged in by the Company that relates to or would result in:

| | • | | a tender offer for or other acquisition of the Company’s securities by the Company, any subsidiary of the Company, or any other person; |

| | • | | any extraordinary transaction, such as a merger, reorganization or liquidation, involving the Company or any subsidiary of the Company; |

| | • | | any purchase, sale or transfer of a material amount of assets of the Company or any subsidiary of the Company; or |

| | • | | any material change in the present dividend rate or policy, or indebtedness or capitalization of the Company. |

Except as set forth in this Statement or the Offer to Purchase, there are no transactions, resolutions of the Board, agreements in principle, or signed contracts in response to the Offer that relate to one or more of the events referred to in this Item 7.

11

Item 8. Additional Information.

Section 14(f) Information Statement

The Information Statement attached as Annex A hereto is being furnished in connection with the possible designation by Parent, pursuant to the Merger Agreement, of certain persons to be appointed to the Board other than at a meeting of the Company’s stockholders, and such information is incorporated herein by reference.

In addition, the information contained in the Offer to Purchase is incorporated herein by reference.

Anti-Takeover Statute

Because the Company is a Delaware corporation, the provisions of Section 203 of the Delaware General Corporation Law (the “DGCL”) by their terms apply to the approval of the Offer and the Merger. The description of these provisions and their applicability to the approval of the Offer and the Merger is contained in Section 14 “Certain Legal Matters” of the Offer to Purchase, which is filed herewith as Exhibit (a)(1)(A) and is incorporated herein by reference. At its meeting held on January 18, 2003, the Board approved the Merger Agreement and the transactions contemplated thereby, which approval rendered Section 203 of the DGCL inapplicable to the Merger Agreement and the transactions contemplated thereby, including the Offer and the Merger.

Appraisal Rights

For a description of the appraisal rights applicable to the Merger (such rights not being applicable to the Offer), see Section 12 “Purpose of the Offer; Plans for Caminus; The Merger Agreement; The Tender and Voting Agreement” of the Offer to Purchase, which is filed herewith as Exhibit (a)(1)(A) and is incorporated herein by reference.

Merger Provisions

Under Section 253 of the DGCL, if Purchaser acquires, pursuant to the Offer or otherwise, at least 90% of the outstanding shares of Common Stock, Purchaser will be able to effect the Merger after consummation of the Offer without a vote of the Company’s stockholders. However, if Purchaser does not acquire at least 90% of the outstanding shares of Common Stock pursuant to the Offer or otherwise, a vote or the written consent of the Company’s stockholders is required under Delaware law, and a significantly longer period of time will be required to effect the Merger.

Regulatory Approvals

Under the provisions of the HSR Act applicable to the Offer, the purchase of shares of Common Stock in the Offer may be consummated after the expiration or termination of the applicable waiting period following the filing by Purchaser of a Notification and Report Form with respect to the Offer, unless Purchaser receives a request for additional information or documentary material from the Antitrust Division of the Department of Justice or the Federal Trade Commission. The description of this regulatory approval process is contained in Section 14 “Certain Legal Matters” of the Offer to Purchase, which is filed herewith as Exhibit (a)(1)(A) and is incorporated herein by reference.

12

Item 9. Exhibits.

The following Exhibits are filed herewith:

Exhibit No.

| | Description

|

|

| (a)(1)(A) | | Offer to Purchase dated January 29, 2003*+ |

| (a)(1)(B) | | Letter of Transmittal*+ |

| (a)(1)(C) | | Form of Notice of Guaranteed Delivery*+ |

| (a)(1)(D) | | Form of Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees*+ |

| (a)(1)(E) | | Form of Letter to Client for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees*+ |

| (a)(1)(F) | | Guidelines for Certification of Taxpayer Identification Number on Substitute Form W-9*+ |

| (a)(1)(G) | | Summary Advertisement as published in the New York Times, National Edition on January 29, 2003* |

| (a)(1)(H) | | Joint Press Release issued by the Company and Parent on January 21, 2003** |

| (a)(2) | | Letter to Stockholders from William P. Lyons, President and Chief Executive Officer of the Company, dated January 29, 2003+ |

| (a)(5) | | Opinion of Banc of America Securities LLC, dated January 18, 2003 (included as Annex B to this Statement) |

| (e)(1) | | Agreement and Plan of Merger, dated January 20, 2003, among Parent, Purchaser and the Company** |

| (e)(2) | | Tender and Voting Agreement* |

| (e)(3) | | Confidentiality Agreement* |

| (e)(4) | | Information Statement pursuant to Section 14(f) of the Securities Exchange Act of 1934, as amended, and Rule 14f-1 thereunder (included as Annex A to this Statement) |

| (g) | | None |

| * | | Incorporated by reference to Schedule TO filed by Parent on January 29, 2003 |

| ** | | Incorporated by reference to the Form 8-K filed by the Company on January 21, 2003 |

| + | | Included in copies mailed to the Company’s stockholders |

13

Signature

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| Dated: January 29, 2003 | | | | CAMINUS CORPORATION |

|

| | | | | | | By: | | /s/ William P. Lyons

|

| | | | | | | | | Name: William P. Lyons Title: President and Chief Executive Officer |

14

ANNEX A

CAMINUS CORPORATION

825 Third Avenue

28th Floor

New York, New York 10022

INFORMATION STATEMENT PURSUANT TO SECTION 14(f) OF

THE SECURITIES EXCHANGE ACT OF 1934 AND RULE 14f-1 THEREUNDER

This Information Statement (this “Information Statement”) is being mailed on or about January 29, 2003 as part of the Solicitation/Recommendation Statement on Schedule 14D-9 (the “Statement”) of Caminus Corporation, a Delaware corporation (the “Company”). You are receiving this Information Statement in connection with the possible election of persons designated by SunGard Data Systems Inc., a Delaware corporation (“Parent”), to a majority of the seats on the Board of Directors of the Company (the “Board of Directors” or the “Board”). On January 20, 2003, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Parent and Rapid Resources Inc. a Delaware corporation and a wholly owned subsidiary of Parent (“Purchaser”), pursuant to which Purchaser is required to commence a tender offer to purchase all outstanding shares of common stock, $0.01 par value per share, of the Company (the “Common Stock”) at a price of $9.00 per share, in cash, without interest thereon (the “Offer Price”), upon the terms and subject to the conditions set forth in the Offer to Purchase, dated January 29, 2003 (the “Offer to Purchase”), and in the related Letter of Transmittal (the “Letter of Transmittal,” which, collectively with the Offer to Purchase, as they may be amended and supplemented from time to time, constitute the “Offer”). Copies of the Offer to Purchase and the Letter of Transmittal are being furnished to stockholders of the Company concurrently with the Statement and are filed as Exhibits (a)(1)(A) and (a)(1)(B), respectively, to the Statement.

The Merger Agreement provides that, subject to the satisfaction or waiver of certain conditions, following the consummation of the Offer and in accordance with the Delaware General Corporation Law (the “DGCL”), Purchaser will be merged with and into the Company (the “Merger”). Following the effective time of the Merger (the “Effective Time”), the Company will continue as the surviving corporation and a wholly owned subsidiary of Parent. At the Effective Time, by virtue of the Merger and without any action on the part of the holders of Common Stock, each share of Common Stock then outstanding will be converted into the right to receive the Offer Price or any greater amount per share of Common Stock paid pursuant to the Offer (the “Merger Consideration”), without interest, except for (i) shares of Common Stock that are owned by (a) the Company or any wholly owned subsidiary of the Company (or held in the Company’s treasury) and (b) Parent, Purchaser, or any other wholly owned subsidiary of Parent, and (ii) to the extent that Section 262 of the DGCL becomes applicable to the Merger, shares of Common Stock held, as of the Effective Time, by stockholders of the Company who have, as of the Effective Time, preserved appraisal rights under Section 262 of the DGCL (unless such appraisal rights are not perfected or the holders of such shares of Common Stock otherwise lose their appraisal rights with respect to such shares of Common Stock, in which case such shares of Common Stock will be converted into the Merger Consideration upon the later of the Effective Time and the time that such appraisal rights fail to perfect or are otherwise lost).

The Offer, the Merger and the Merger Agreement are more fully described in the Statement to which this Information Statement is attached as Annex A, which was filed by the Company with the Securities and Exchange Commission (“SEC”) on January 29, 2003, and which is being mailed to stockholders of the Company along with this Information Statement.

This Information Statement is being mailed to you in accordance with Section 14(f) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Rule 14f-1 promulgated thereunder. The information set forth herein supplements certain information set forth in the Statement. Information set forth herein related to Parent, Purchaser or Parent Designees (as defined below) has been provided by Parent. You are

A-1

urged to read this Information Statement carefully. You are not, however, required to take any action in connection with the matters set forth herein.

Pursuant to the Merger Agreement, Purchaser commenced the Offer on January 29, 2003. The Offer is currently scheduled to expire at 12:00 midnight, New York City time, on February 26, 2003, unless extended by Purchaser or the Company in accordance with the Merger Agreement and the Exchange Act and the rules promulgated thereunder.

GENERAL

The Common Stock is the only class of equity securities of the Company outstanding that is entitled to vote at a meeting of the stockholders of the Company. Each share of Common Stock is entitled to one vote. As of January 19, 2003, there were 16,782,306 shares of Common Stock outstanding.

DESIGNATION OF DIRECTORS BY PARENT

The Merger Agreement provides that, effective upon the acceptance for payment of any shares of Common Stock pursuant to the Offer, Parent will be entitled to designate the number of directors (“Parent Designees”), rounded up to the next whole number, on the Board that equals the product of (i) the total number of directors on the Board (giving effect to the election of any additional directors) and (ii) a fraction whose numerator is the aggregate number of shares of Common Stock then beneficially owned by Parent or Purchaser (including shares of Common Stock accepted for payment pursuant to the Offer), and whose denominator is the total number of shares of Common Stock then outstanding. The Company will take all commercially reasonable actions necessary to cause Parent Designees to be elected or appointed to the Board, including increasing the number of directors and seeking and accepting resignations of incumbent directors. To the extent requested by Parent, the Company will use all commercially reasonable efforts to cause individuals designated by Parent to constitute the number of members, rounded up to the next whole number, on (i) each committee of the Board and (ii) each board of directors of each subsidiary of the Company (and each committee thereof) that represents the same percentage as Parent Designees represent on the Board.

The Merger Agreement also provides that, notwithstanding the foregoing, Parent, Purchaser and the Company will use their respective commercially reasonable efforts to cause at least two of the members of the Board, at all times prior to the Effective Time, to be individuals who were directors of the Company and were not officers or employees of the Company or any of its subsidiaries as of the date of the Merger Agreement (“Continuing Directors”). If at any time prior to the Effective Time there is only one Continuing Director in office, the Board will cause a person who is not an officer or employee of the Company or any of its subsidiaries to be designated by the remaining Continuing Director to fill such vacancy (and such person will be deemed a Continuing Director). If at any time prior to the Effective Time no Continuing Directors remain in office, the other directors of the Company then in office will use reasonable efforts to designate two persons to fill such vacancies who are not officers, employees or affiliates of the Company, the Company’s subsidiaries, Parent or Purchaser, or any of their respective affiliates (and such persons will be deemed Continuing Directors).

After the election or appointment of Parent Designees to the Board and until the Effective Time, the approval of a majority of the Continuing Directors, or if there is only one, of a Continuing Director, will be required to authorize (and such authorization will constitute the authorization of the Board and no other action on the part of the Company, including any action by any other director of the Company, will be required to authorize) any (i) termination of the Merger Agreement by the Company, (ii) amendment of the Merger Agreement requiring action by the Board, (iii) extension of time for performance of any obligation or action under the Merger Agreement by Parent or Purchaser requiring the consent of the Company, (iv) waiver of compliance by the Company of any of the agreements or conditions contained in the Merger Agreement for the

A-2

benefit of the Company or its stockholders, (v) required or permitted consent or action by the Board under the Merger Agreement and (vi) other action of the Company under the Merger Agreement that adversely affects the holders of shares of Common Stock (other than Parent or Purchaser). If for any reason there are no Continuing Directors and the Company has used commercially reasonable efforts to appoint Continuing Directors but has been unable after a reasonable period of time to find suitable candidates willing to serve, such actions may be effected by majority vote of the entire Board.

As of the date of this Information Statement, no determination has been made as to which directors of the Company will serve as Continuing Directors.

As of the date of this Information Statement, Parent has not determined who will be Parent Designees. However, Parent Designees will be selected from among the persons listed in Schedule I attached hereto. Schedule I also includes certain information with respect to each such person. Each of the persons listed in Schedule I has consented to serve as a director of the Company if appointed or elected. None of such persons currently is a director of, or holds any positions with, the Company. Parent and Purchaser have advised the Company that none of the persons listed on Schedule I or any of their affiliates (i) beneficially owns any equity securities of the Company or rights to acquire any such securities or (ii) except as disclosed in Section 9 “Certain Information concerning the Purchaser and SunGard,” of the Offer to Purchase, which is filed as exhibit (a)(1)(A) to the Statement and is incorporated herein by reference, has been involved in any transaction with the Company or any of its directors, executive officers or affiliates that is required to be disclosed pursuant to the rules and regulations of the SEC, other than with respect to transactions among Parent, Purchaser and the Company that have been described in the Schedule TO filed by Parent and Purchaser with the SEC on January 29, 2003 or the Statement. In addition, none of the persons listed in Schedule I has a familial relationship with any of the current directors or executive officers of the Company.

It is expected that Parent Designees will assume office promptly following the purchase by Purchaser of the shares of Common Stock pursuant to the terms of the Offer, which purchase cannot be earlier than February 27, 2003, and, that upon assuming office, Parent Designees together with the Continuing Directors will thereafter constitute the entire Board.

CURRENT DIRECTORS AND EXECUTIVE OFFICERS OF THE COMPANY

Directors

The Board of Directors is divided into three classes, with the members of each class serving for a staggered three-year term. At each annual meeting of stockholders of the Company, a class of directors will be elected for a three-year term to succeed the directors of the same class whose terms are then expiring. The terms of the Class I directors expire upon the election and qualification of successor directors at the annual meeting of stockholders to be held in 2003. The terms of the Class II directors expire upon the election and qualification of successor directors at the annual meeting of stockholders to be held in 2004. The terms of the Class III directors expire upon the election and qualification of successor directors at the annual meeting of stockholders to be held in 2005.

The Board of Directors currently consists of three Class I directors (Anthony H. Bloom, Richard K. Landers and Clare M.J. Spottiswoode), two Class II directors (Lawrence D. Gilson and Brian J. Scanlan) and two Class III directors (Christopher S. Brothers and William P. Lyons). As of the date hereof, there are two vacancies on the Board, one with respect to Class I and one with respect to Class II. Information regarding the current directors of the Company is set forth below.

Anthony H. Bloom, 63, has served as a director of the Company since May 1998. Mr. Bloom is an international investor now based in London. Prior to his relocation to London in July 1988, he lived in South Africa, where he was the chairman and chief executive of The Premier Group, a multi-billion dollar

A-3

conglomerate involved in agribusiness, retail and consumer products, and a member of the boards of directors of Barclays Bank, Liberty Life Assurance and South African Breweries. After moving to the United Kingdom in 1988, he served as a member of the board of directors of RIT Capital Partners plc (“RIT”), a publicly traded, London-based investment company chaired by Lord Rothschild, and as Deputy Chairman of Sketchley plc. Mr. Bloom presently provides investment advice to RIT and is chairman of Cine-UK Ltd. Mr. Bloom is also a director of each of Cherokee International Corporation, Power Measurement, Inc., Rio Narcea Gold Mines Ltd., Xantrex Technology, Inc., Afri-Can Marine Minerals Corp. and Rockridge Consolidated Ltd.

Christopher S. Brothers, 37, has served as a director of the Company since May 1998. Mr. Brothers is a managing director of Oaktree Capital Management, LLC (“Oaktree”), a registered investment adviser under the Investment Advisers Act of 1940. Prior to joining Oaktree in 1996, Mr. Brothers worked at the New York headquarters of Salomon Brothers Inc, an investment bank, where he served as a vice president in the mergers and acquisitions group. Prior to 1992, Mr. Brothers was a manager in the valuation services group of PricewaterhouseCoopers LLP, an accounting firm. Mr. Brothers serves on the boards of directors of each of APW Ltd., Cherokee International Corporation, National Mobile Television, Inc., Power Measurement, Inc. and Xantrex Technology, Inc.

Lawrence D. Gilson, 54, has served as chairman of the Board of Directors since May 1998. Mr. Gilson is Chairman of GFI Energy Ventures LLC (together with its affiliated entities, “GFI”) and founded this and all other GFI affiliated entities since 1995. GFI Energy Ventures LLC is a fund manager with an exclusive energy focus. He previously founded and was president of Venture Associates, a leading energy industry consulting firm, from 1985 to 1995. When he and his partners sold Venture Associates to Arthur Andersen LLP in a two-stage transaction in 1990 and 1992, Mr. Gilson also became worldwide head of Arthur Andersen’s utility consulting practice. Prior to founding Venture Associates, Mr. Gilson served as a member of the White House staff from 1977 through 1979 and then as vice president for corporate development and government affairs of Amtrak, a passenger rail company, from 1979 to 1983. He is also board chair of Power Measurement, Inc.

Richard K. Landers, 55, has served as a director of the Company since May 1998. Mr. Landers is a principal of GFI Energy Ventures LLC and a founder of each GFI affiliated entity established since 1995. From 1986 to 1995, he was a partner of Venture Associates and of Arthur Andersen LLP following that firm’s acquisition of Venture Associates. From 1979 to 1986, Mr. Landers held senior planning strategy positions in Los Angeles and Washington, D.C. with Southern California Gas Company and its holding company, Pacific Enterprises. Before joining Southern California Gas, Mr. Landers served as a foreign service officer in the U.S. State Department with special responsibilities for international energy matters. He is also a director of each of LODESTAR Corporation and RealEnergy, Inc.

William P. Lyons, 58, has served as president, chief executive officer, and a director of the Company since July 2002. From January 2001 to July 2002, Mr. Lyons served as president and chief executive officer of NeuVis Software Inc., an enterprise software company focused on selling Rapid Application Development platforms to leading global companies. From February 1998 to January 2001, he served as president and chief executive officer of Finjan Software, Inc., an Israeli-based internet security company. From April 1992 to July 1997, Mr. Lyons served as president and chief executive officer of ParcPlace-Digitalk, Inc., the largest object-oriented software company at that time. From October 1988 to November 1991, Mr. Lyons served in a number of positions at Ashton-Tate Corporation, a PC database provider, ultimately becoming its chairman and chief executive officer. During his tenure at IBM from 1969 to 1988, he served in numerous sales and marketing positions, as well as in the office of the chairman, and rose to lead product management and marketing for all of IBM’s PC hardware and software products. Mr. Lyons also is a director of FileNET Corporation.

Brian J. Scanlan, 40, has served as the Company’s executive vice president, future products since July 2001 and as a director since May 1998. From November 2000 to July 2001, Mr. Scanlan served as executive vice president and chief technology officer of the Company. Mr. Scanlan served as the Company’s senior vice president and chief technology officer from January 1999 to November 2000. From May 1998 to December

A-4

1998, Mr. Scanlan served as president of Zai*Net Software, L.P., and, from 1987 to May 1998, he served as president of Zai*Net Software, Inc., a software firm and the Company’s predecessor.

Clare M.J. Spottiswoode, 49, has served as a director of the Company since December 2000. From April 1999 to April 2000, Ms. Spottiswoode was a partner of PA Consulting Group, a management, systems and technology consulting firm. From November 1998 to March 1999, she served as senior vice president of Azurix, a global water services company. From 1993 to 1998, Ms. Spottiswoode served as director general of Gas Supply, the United Kingdom’s gas regulator. In 1984, she founded, and until 1990 was chairman and chief executive of, Spottiswoode and Spottiswoode, a microcomputer software company targeted at the financial and corporate sectors. Ms. Spottiswoode serves as chairman of the board of each of Economatters, H2GO and Homebill and as a director of each of Advanced Technology Ltd., British Energy and Gerard Energy Ventures. Ms. Spottiswoode was made a commander of the British Empire in 1999.

Executive Officers

Each executive officer of the Company serves at the discretion of the Board and holds office until his or her successor is elected and qualified or until his or her earlier resignation or removal. There are no familial relationships among any of the directors or executive officers of the Company. Information regarding the current executive officers of the Company is set forth below.

William P. Lyons, See “Current Directors and Executive Officers of the Company—Directors.”

Joseph P. Dwyer, 47, has served as the Company’s executive vice president and chief financial officer since July 2001. He has served as the Company’s assistant secretary and treasurer since April 2001. From April 2001 to July 2001, Mr. Dwyer served as the Company’s senior vice president and chief financial officer. From June 2000 to April 2001, Mr. Dwyer served as executive vice president and chief financial officer of ACTV, Inc., a digital media company. From January 1990 to June 2000, he served as senior vice president, finance, of Winstar Communications, Inc., a global broadband services company, and, from January 1988 to January 1990, he was chief financial officer of Legal Software Solutions, a software development firm.

Brian J. Scanlan, See “Current Directors and Executive Officers of the Company—Directors.”

John A. Andrus, 48, has served as the Company’s executive vice president and chief operating officer since December 2001. From January 2001 to December 2001, Mr. Andrus served as the Company’s executive vice president, North American operations, and, from April 1999 to January 2001, he served as the Company’s senior vice president, North American sales. From April 1997 to March 1999, Mr. Andrus served as vice president, sales and marketing at JGI, a privately held provider of enterprise software and supply chain solutions. From November 1992 to April 1997, Mr. Andrus served in various roles, including vice president, North American sales and operations, at Marcam Corporation, an international provider of enterprise applications and services.

A-5

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of January 19, 2003, certain information concerning the beneficial ownership of shares of Common Stock by: (i) each person who is known by the Company to beneficially own more than 5% of the outstanding shares of Common Stock, (ii) each director of the Company, (iii) the Chief Executive Officer and the three other most highly compensated executive officers who were serving as executive officers on January 19, 2003 (the “Named Executive Officers”), and (iv) all directors and executive officers of the Company as a group. Such information is based upon information provided to the Company by such persons or set forth in their filings with the SEC.

Name and Address of Beneficial Owner

| | Amount and Nature of Beneficial Ownership(1)

| | Percent of Class(2)

|

OCM Principal Opportunities Fund, L.P.(3) c/o Oaktree Capital Management, LLC 333 South Grand Avenue, 28th Floor Los Angeles, CA 90071 | | 2,514,979 | | 15% |

|

Christopher S. Brothers(3) c/o Oaktree Capital Management, LLC 333 South Grand Avenue, 28th Floor Los Angeles, CA 90071 | | 2,514,979 | | 15% |

|

Credit Suisse Asset Management, LLC(4) 466 Lexington Avenue 12th Floor New York, New York, 10017 | | 1,660,500 | | 9.9% |

|

Brian J. Scanlan(5)(6) c/o Caminus Corporation 825 Third Avenue, 28th Floor New York, NY 10022 | | 1,020,068 | | 6.0% |

|

ZAK Associates, Inc.(6) c/o Caminus Corporation 825 Third Avenue, 28th Floor New York, NY 10022 | | 946,375 | | 5.6% |

|

| Anthony H. Bloom(7) | | 474,118 | | 2.8% |

|

| Lawrence D. Gilson(8)(9) | | 431,196 | | 2.6% |

|

| Richard K. Landers(8)(9) | | 431,196 | | 2.6% |

|

| John A. Andrus(10) | | 31,649 | | 0.2% |

|

| Clare M. J. Spottiswoode(11) | | 18,720 | | 0.1% |

|

| William P. Lyons | | 49,500 | | 0.3% |

|

| Joseph P. Dwyer | | 3,000 | | * |

|

| All directors and executive officers as a group (9 persons)(12) | | 4,543,230 | | 26.9% |

| (1) | | The inclusion herein of any shares of Common Stock deemed beneficially owned does not constitute an admission of beneficial ownership of those shares. Unless otherwise indicated, each person listed above has sole voting and investment power with respect to the shares listed. For purposes of this table, each person is deemed to beneficially own any shares subject to stock options, warrants or other securities convertible into Common Stock, held by such person that are currently exercisable or convertible, or exercisable or convertible within 60 days after January 19, 2003. |

A-6

| (2) | | Number of shares deemed outstanding includes 16,782,306 shares issued and outstanding as of January 19, 2003, plus any shares subject to stock options, warrants or other securities convertible into Common Stock, held by the referenced beneficial owner(s). |

| (3) | | Includes 2,509,473 shares of Common Stock held by OCM Principal Opportunities Fund, L.P. (the “Fund”). Oaktree, a registered investment adviser under the Investment Advisers Act of 1940, has voting and dispositive power over the shares held by the Fund as general partner of the Fund. Christopher S. Brothers is a managing director of Oaktree. Although Oaktree may be deemed to beneficially own such shares for purposes of Section 13 of the Exchange Act, Oaktree disclaims beneficial ownership of such shares except to the extent of its pecuniary interest therein. To the extent that Mr. Brothers participates in the process to vote or dispose of such shares, he may be deemed under certain circumstances for purposes of Section 13 of the Exchange Act to be the beneficial owner of such shares of Common Stock. Mr. Brothers disclaims beneficial ownership of such shares, except to the extent of any pecuniary interest therein. Also includes 5,506 shares of Common Stock issuable upon the exercise of an option granted to Mr. Brothers as a director of the Company. Any proceeds from the sale of shares issuable upon exercise of the stock option are for the benefit of the Fund. Each of Oaktree and Mr. Brothers disclaims beneficial ownership of the shares issuable upon exercise of such stock option, except to the extent of any pecuniary interest therein. |

| (4) | | Beneficial ownership data as of September 30, 2002, based on information contained in a Form 13F filed with the SEC on November 14, 2002. |

| (5) | | Includes 946,375 shares of Common Stock held by ZAK Associates, Inc., which is an entity that is directly owned by Brian J. Scanlan and Cynthia Chang. Mr. Scanlan and Ms. Chang are husband and wife and share voting and dispositive power over the shares of Common Stock owned by ZAK Associates, Inc. Also includes 20,208 shares that are owned jointly by Mr. Scanlan and Ms. Chang, 7,652 shares that are owned by Ms. Chang and 45,833 shares of Common Stock issuable upon the exercise of an option granted to Mr. Scanlan as a director of the Company. |

| (6) | | Includes 149,900 shares of Common Stock pledged by ZAK Associates, Inc. to an affiliate of Banc of America Securities LLC to secure a forward sale contract that matures on February 28, 2005. |

| (7) | | Includes 468,612 shares of Common Stock held by RIT. Anthony H. Bloom, a former director of RIT, provides investment advice to RIT and may be deemed to beneficially own the shares held by RIT. Mr. Bloom disclaims beneficial ownership of such shares, except to the extent of any pecuniary interest therein. Also includes 5,506 shares of Common Stock issuable upon the exercise of stock options. |

| (8) | | Includes 11,012 shares of Common Stock issuable upon the exercise of stock options, of which 5,506 are issuable upon the exercise of options granted to Lawrence D. Gilson as a director and 5,506 shares are issuable upon the exercise of options granted to Richard K. Landers as a director. Any proceeds from the sale of shares issuable upon the exercise of options granted to Messrs. Gilson and Landers are for the benefit of GFI. Each of Messrs. Gilson and Landers disclaims beneficial ownership of the shares issuable upon the exercise of such stock options, except to the extent of any pecuniary interest therein. |

| (9) | | Includes 420,184 shares owned by GFI Two LLC. GFI has pledged (a) 150,000 of such shares to an affiliate of Banc of America Securities LLC to secure a forward sale contract that matures on June 20, 2003 and (b) 112,400 of such shares to an affiliate of Banc of America Securities LLC to secure a forward sale contract that matures on February 28, 2005. Lawrence D. Gilson is Chairman of GFI, and Richard K. Landers is a principal of GFI. To the extent that Messrs. Gilson and Landers participate in the process to vote or dispose of such shares, Messrs. Gilson and Landers may be deemed to beneficially own the shares held by GFI. Each of Messrs. Gilson and Landers disclaims beneficial ownership of such shares, except to the extent of his direct pecuniary interest therein. |

| (10) | | Includes 29,701 shares of Common Stock issuable upon the exercise of stock options. |

| (11) | | Includes 3,720 shares of Common Stock issuable upon the exercise of stock options and 7,500 shares of Common Stock held by Ms. Spottiswoode’s adult children, with respect to which Ms. Spottiswoode possesses voting rights. |

| (12) | | Includes an aggregate of 101,278 shares of Common Stock issuable upon the exercise of stock options. |

A-7

MEETINGS AND COMPENSATION OF DIRECTORS

The Board of Directors met eleven times during 2002. Each director attended at least 75% of the aggregate of the number of Board meetings and the number of meetings held by all committees on which he or she then served.

The Company reimburses directors for reasonable out-of-pocket expenses incurred in attending meetings of the Board of Directors and any meetings of its committees. Each non-employee director (except for the Chairman of the Board) is paid $1,500 for attendance at each meeting of the Board of Directors or for each telephonic meeting of the Board of Directors in which he or she participates. The Chairman of the Board is paid $2,400 for attendance at each such meeting. Each non-employee director is further entitled to $750 for each meeting of a committee of the Board attended by the director that is held on a day other than the day of any meeting of the full Board of Directors, except that a committee chairman receives per-meeting fees of $1,500. Non-employee directors also receive an annual retainer fee of $15,000, except for the Chairman of the Board, who receives an annual retainer fee of $24,000. Other directors are not entitled to compensation in their capacities as directors. The Company may, in its discretion, grant stock options and other equity awards to its non-employee directors from time to time under its stock plans.

BOARD COMPOSITION AND COMMITTEES

Audit Committee

The Audit Committee of the Board of Directors is composed of three members and acts under a written charter adopted and approved on May 2, 2000. The members of the Audit Committee are Anthony H. Bloom, Christopher S. Brothers (Chair) and Richard K. Landers. Each of the members of the Audit Committee is independent, as defined by the Audit Committee charter and the rules of the Nasdaq Stock Market, with the exception of Richard K. Landers. Mr. Landers is a principal of GFI, which received a $1,300,000 fee from the Company in February 2000 in connection with the provision of strategic advice, as well as financial, tax and general administrative services, to the Company. However, the Board of Directors determined at its meeting in May 2001, that, based upon his financial experience and background, including his tenure at GFI, Venture Associates and Arthur Andersen LLP, Mr. Landers’ membership on the Audit Committee is required by the best interests of the Company and its stockholders. The Audit Committee met five times during 2002.