Washington, D.C. 20549

the Securities Exchange Act of 1934 (Amendment No. ___)

WORKSTREAM INC.

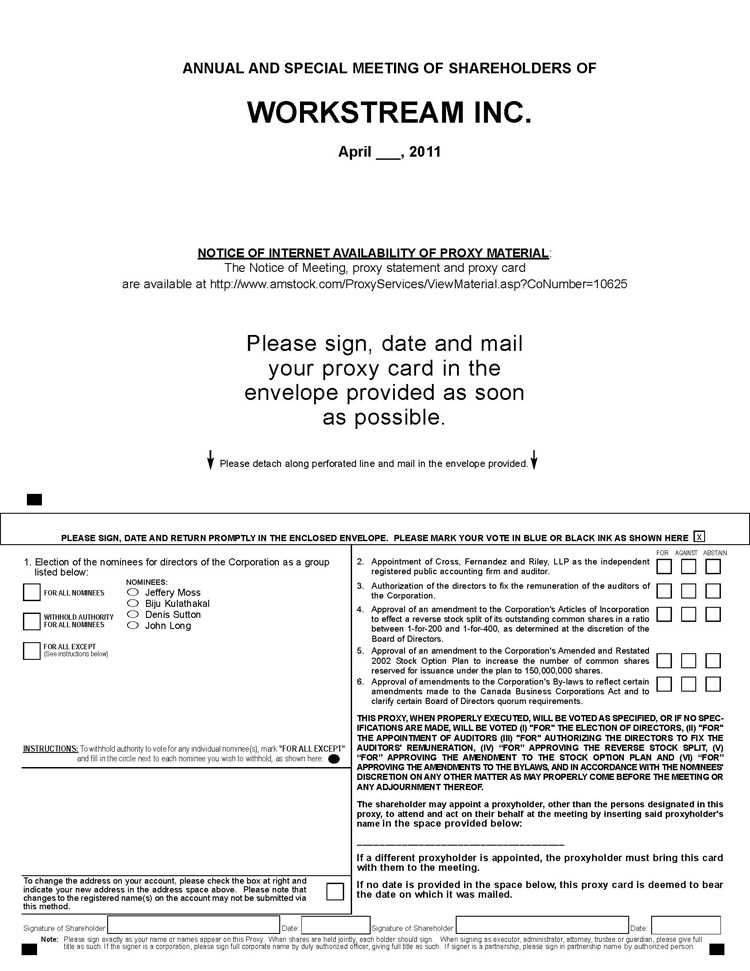

NOTE: IF YOU ARE UNABLE TO ATTEND THE MEETING IN PERSON, PLEASE COMPLETE AND RETURN THE ENCLOSED FORM OF PROXY. A POSTAGE PAID ADDRESSED ENVELOPE HAS BEEN ENCLOSED.

WORKSTREAM INC.

485 N. Keller Road

The Notice of Meeting, this document and the Form of Proxy will be mailed commencing on or about March ___, 2011 to shareholders of record as of the close of business on March 18, 2011, the record date for the Meeting.

INFORMATION ON VOTING

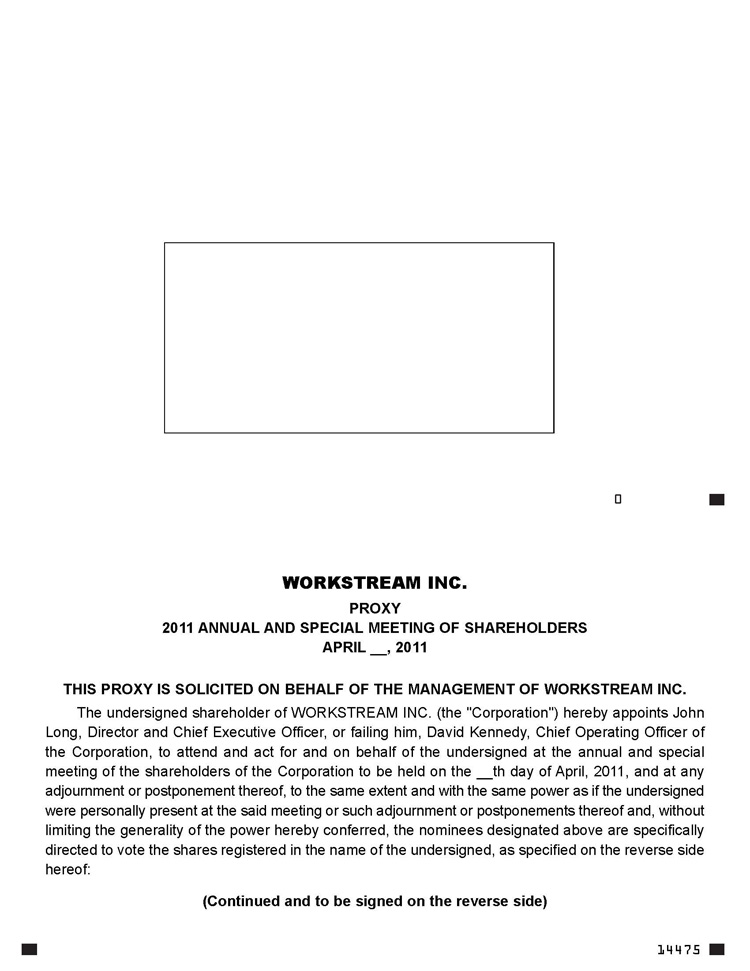

APPOINTMENT OF PROXIES

The persons named in the enclosed Form of Proxy are our directors and officers. A shareholder desiring to appoint some other person to represent him/her at the Meeting may do so by inserting such person’s name in the blank space provided in the Form of Proxy or by completing another form of proxy and in either case delivering the completed proxy to American Stock Transfer & Trust Company, 59 Maiden Lane, New York, New York 10038, Attention: Proxy Department, not later than the day preceding the Meeting or by depositing it with the Chairman of the Meeting prior to the commencement of the Meeting. It is the responsibility of the shareholder appointing some other person to represent him/her to inform such person that he/she has been so appointed. The proxy must be executed by the shareholder or his/her attorney autho rized in writing or, if the shareholder is a corporation, by an officer or attorney thereof, duly authorized.

REVOCABILITY OF PROXIES

A shareholder executing the enclosed Form of Proxy has the right to revoke it under subsection 148(4) of the Canadian Business Corporation Act. A shareholder may revoke a proxy by depositing an instrument in writing executed by him/her or by his/her attorney authorized in writing at our executive offices at 485 N. Keller Road, Suite 500, Maitland, Florida 32751 at any time up to and including the last business day preceding the day of the Meeting, or any adjournment or adjournments thereof, at which the proxy is to be used, or with the Chairman of the

Meeting on the day of the Meeting or any adjournment or adjournments thereof or in any other manner permitted by law.

VOTING BY PROXY

For the purpose of voting by proxy, proxies marked as “WITHHOLD/ABSTAIN” will be treated as present for the purpose of determining a quorum but will not be counted as having been voted in respect of any matter to which the instruction to “WITHHOLD/ABSTAIN” is indicated.

Your common shares may not be registered in your name but in the name of an intermediary (which is usually a bank, trust company, securities dealer or broker, or a clearing agency in which an intermediary participates). If your common shares are registered in the name of an intermediary, you are a non-registered shareholder.

We have distributed copies of this document to intermediaries for distribution to non-registered shareholders. Unless you have waived your rights to receive these materials, intermediaries are required to deliver them to you as a non-registered shareholder of Workstream and to seek your instructions as to how to vote your common shares. Proxies returned by intermediaries as “non-votes” because the intermediary has not received instructions from the non-registered shareholder with respect to the voting of certain shares or, under applicable stock exchange or other rules, the intermediary does not have the discretion to vote those shares on one or more of the matters that come before the meeting, will be treated as not entitled to vote on any such matter and will not be counted as having been voted in respect of a ny such matter. Common shares represented by such broker “non-votes” will, however, be counted in determining whether there is a quorum.

On any ballot that may be called for regarding the matters listed in the Notice of Meeting and in the Form of Proxy, the common shares of Workstream will be voted or withheld from voting in accordance with the instructions of the shareholder indicated on the Form of Proxy by marking an “X” in the boxes provided for that purpose on the Form of Proxy. In the absence of such instructions the common shares will be voted: (i) “FOR” the election of directors; (ii) “FOR” the appointment of auditors; (iii) “FOR” authorizing the directors to fix the auditors’ remuneration; (iv) “FOR” the reverse stock split; (v) “FOR” the authorization to amend the stock option plan; and (vi) “FOR” amendments to the By-laws, in each case, as referred to in this Proxy Circular and Proxy Statement.

EXERCISE OF DISCRETION BY PROXIES

If any amendments or variations to matters identified in the Notice of Meeting are proposed at the Meeting or if any other matters properly come before the Meeting, the enclosed Form of Proxy confers discretionary authority to vote on such amendments or variations or such other matters according to the best judgment of the person voting the proxy at the Meeting. Management knows of no matters to come before the Meeting other than the matters referred to in the Notice of Meeting.

AUTHORIZED CAPITAL, VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

We are authorized to issue an unlimited number of common shares, an unlimited number of Class A Preferred Shares and an unlimited number of Series A Convertible Preferred Shares. Our shareholders of record as at the close of business on March 18, 2011, the record date, are entitled to receive notice of, and vote at, the Meeting. As of that date, 988,702,590 common shares were issued and outstanding and entitled to vote. As of March 18, 2011, there are no Class A Preferred Shares or Series A Convertible Preferred Shares outstanding. The holders of the common shares are entitled to one vote at any meeting of our shareholders for each common share held.

The presence at the Meeting, in person or by proxy, of the holders of at least 33-1/3% of the outstanding common shares entitled to be voted at the Meeting constitutes a quorum for the transaction of business at the Meeting.

Unless otherwise indicated, all references in this document to dollar amounts are to U.S. dollars.

Security Ownership of Principal Shareholders

Security Ownership of Certain Beneficial Owners

The following table sets forth as of February 7, 2011 certain information with respect to the beneficial ownership of each person whom we knew or, based on the filing of a Schedule 13G, believe to be the beneficial owner of more than 5% of our common shares.

Name and Address of Beneficial Owner | Common Shares Number of Shares (1) | Percent |

| | | |

CCM Master Qualified Fund, Ltd. 1 North Wacker Drive, Suite 4350 Chicago, IL 60606 (2) | 383,233,209 | 38.8% |

Magnetar Capital Master Fund, Ltd (3) 1603 Orrington Ave. Evanston, IL 60201 | 190,158,979 | 19.2% |

Talkot Fund, L.P. Thomas B. Akin IRA 2400 Bridgeway, Suite 300 Sausalito, CA 94965 | 102,386,649(4) | 10.4% |

| (1) | With respect to each shareholder, the number of shares includes any shares issuable upon exercise of warrants held by such shareholder that are or will become exercisable within 60 days of September 1, 2010. |

| (2) | Coghill Capital Management, LLC serves as investment adviser to CCM Master Qualified Fund, Ltd. In such capacity, Coghill Capital Management exercises voting and investment power over the common shares held for the account of CCM Master Qualified Fund. Clint D. Coghill is the managing member of Coghill Capital Management. The amount beneficially owned excludes common shares issuable upon exercise of warrants held for the account of CCM Master Qualified Fund. The terms of the warrants contain a blocker provision under which the holder thereof does not have the right to exercise the warrant to the extent that, if exercisable by the holder, the holder thereof or any of its affiliates would beneficially own in excess of 9.99% of the common shares of Workstream. As a result, such warrants are not currently exercisable. |

| (3) | Magnetar Capital Partners LP serves as the sole member and parent holding company of Magnetar Financial LLC. Magnetar Financial serves as investment adviser to Magnetar Capital Master Fund. In such capacity, Magnetar Financial exercises voting and investment power over the common shares held for the account of Magnetar Capital Master Fund. Supernova Management LLC is the general partner of Magnetar Capital Partners. The manager of Supernova Management is Alec N. Litowitz. The foregoing excludes 2,500,000 common shares issuable upon exercise of a warrant held for the account of Magnetar Capital Master Fund. The terms of the warrant contain a blocker provision under which the holder thereof does not have the right to exercise the warrant to the extent (but only to the extent) that, if exercisable by the holder, the holder thereof or any of its affiliates would beneficially own in excess of 9.99% of the common shares. As a result of application of such blocker, the warrant is not currently exercisable, and the common shares issuable upon exercise of the warrant have not been included in the calculations of beneficial ownership of the Magnetar Capital Master Fund or the aggregate number of outstanding common shares. Without such blocker, Magnetar Capital Master Fund would be deemed to beneficially own 192,658,979 common shares, which would represent beneficial ownership of approximately 23.4% of the common shares, based on the common shares issued and outstanding as of August 13, 2010. |

| (4) | Consists of 62,797,932 common shares beneficially owned by Talkot Fund, L.P. and 39,588,717 common shares beneficially owned by Thomas B. Akin IRA. Thomas Akin is the Managing General Partner of the Talkot Fund and has voting and dispositive control over the common shares held by the Thomas B. Akin IRA. |

Change in Control

On August 13, 2010, we entered into separate Exchange and Share Purchase Agreements with each of the holders of our senior secured promissory notes (each of which is listed above in the table under the heading “Security Ownership of Certain Beneficial Owners”) pursuant to which, among other things, such holders exchanged their existing senior secured non-convertible notes and senior secured convertible notes, in the aggregate principal amount, together with accrued but unpaid interest and penalties, of $22,356,665, for a total of 682,852,374 of our common shares and we issued an aggregate 37,936,243 additional common shares to certain of such holders in connection with a private placement pursuant to which we raised $750,000 from such holders. The result of such transactions was that such holders held approximat ely 88% of our common shares immediately following consummation of the transactions.

Security Ownership of Management

The following table sets forth as of February 7, 2011 the beneficial ownership of our common shares by (i) each current director, each of whom is also a nominee for election to the Board of Directors, (ii) each person who served as our principal executive officer (“PEO”) during our fiscal year ended May 31, 2010, (iii) the most highly compensated executive officer other than the PEO who was serving as executive officer as of May 31, 2010 (the individuals in (ii) and (iii) are collectively referred to as the “Named Executive Officers”) and (iv) all the directors and executive officers as a group.

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership(1) | Percent of Class |

| | | |

| Jeffrey Moss | 1,017,735 | * |

| Biju Kulathakal | 1,017,735 | * |

| Denis Sutton | 1,017,735 | * |

John Long(2) | 26,002,613 | 2.6% |

Steve Purello(3) | 100,900 | * |

Michael Mullarkey(4) | 11,157,112 | 1.1% |

Jerome Kelliher(5) | -- | -- |

| All current executive officers and directors as a group (6 persons) | 50,849,828 | 5.1% |

| (1) | With respect to each beneficial owner, the number of shares includes any shares issuable upon exercise of options or RSU’s held by such beneficial owner that are or will become exercisable within 60 days of February 7, 2011. Unless otherwise noted, each beneficial owner has sole voting and investment power over the shares that he owns. Each of these persons may be contacted at our Company address. |

| (2) | Mr. Long became our Chief Executive Officer on August 13, 2010. |

| (3) | Mr. Purello served as our President and Chief Executive Officer from February 2008 until his resignation in October 2009. |

| (4) | Mr. Mullarkey served as our President and Chief Executive Officer from October 2009 until he was replaced by Mr. Long on August 13, 2010. Mr. Mullarkey subsequently resigned as our Executive Vice President, Sales and Marketing effective August 24, 2010. |

| (5) | Mr. Kelliher served as our Chief Financial Officer until his resignation on June 4, 2010. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our executive officers, directors and persons who beneficially own more than 10% of a registered class of our equity securities, to file initial reports of ownership and reports of changes in ownership with the Securities and Exchange Commission (“SEC”). Officers, directors and greater than 10% beneficial owners are required by SEC regulation to furnish us with copies of all Section 16(a) forms they file. To our knowledge, based solely on a review of the copies of such reports furnished to us and written representations that no other reports were required during the year ended May 31, 2010, all Section 16(a) filing requirements applicable to our officers, directors and greater than 10% beneficial owners were complied with.

PROPOSAL 1 - ELECTION OF DIRECTORS

At the Meeting, Shareholders will be asked to approve the election of directors, as a group, by resolution, which requires that a majority of the votes cast at the Meeting be voted “FOR” the resolution for the election of nominees as a group. Unless a contrary choice is specified, proxies solicited by management will be voted “FOR” the nominees for director set forth below.

At the Meeting, four directors are to be elected to the Board of Directors. All of the nominees currently serve as members of the Board of Directors and are standing for re-election. The term of office of each of the current directors is due to expire immediately prior to the election of directors at the Meeting. There are three vacancies on the Board of Directors that will not be filled at the Meeting. We are in the process of identifying suitable individuals to fill these vacancies. Once we have identified these individuals, we expect to fill such vacancies as prescribed in our bylaws.

We do not know of any reason why any of the nominees would not accept the nomination. However, if any nominee does not accept the nomination, the persons’ named in the attached Proxy will vote for the substitute nominee that the board recommends.

Set forth below is more detailed information regarding each of the nominees.

Recommendation and Vote Required

In order to be effective, the election of a director must be approved by a majority of votes cast by our shareholders who vote in respect of such resolution.

THE BOARD OF DIRECTORS RECOMMENDS VOTING “FOR” THE NOMINEES FOR DIRECTOR SET FORTH BELOW.

Name | Age | Director Since | Position |

| Jeffrey Moss | 36 | 2010 | Chairman of the Board of Directors (1)(2)(3) |

| John Long | 55 | 2010 | Director, Chief Executive Officer and Acting Chief Financial Officer |

| Biju Kulathakal | 34 | 2010 | Director (1)(2)(3) |

| Denis Sutton | 56 | 2010 | Director (1)(2)(3) |

| (1) | Member of the Audit Committee of the Board of Directors. |

| (2) | Member of the Compensation Committee of the Board of Directors. |

| (3) | Member of the Nominating Committee of the Board of Directors. |

Jeffrey Moss became Chairman of our Board of Directors on August 14, 2010. Since May 2010, Mr. Moss has served as Chief of Enterprise Growth for Educational Testing Service, Inc., an educational measurement and researching organization. Prior to joining ETS, from May 2004 until March 2010, Mr. Moss was a principal of Sterling Partners, L.P., a private equity firm. Mr. Moss is a resident of Illinois

John Long became our Chief Executive Officer and a member of our Board of Directors on August 13, 2010. Mr. Long is also currently serving as our Acting Chief Financial Officer. Immediately prior to joining us, Mr. Long was, and he continues to be, a principal in Yardley Capital Advisors, LLC, a private equity investment company. From October 2008 until May 2010, Mr. Long served as Chief Executive Officer of Excelus HR, Inc. From July 2003 until June 2007, Mr. Long served as Chief Executive Officer of First Advantage Corporation, a diversified business services company. Mr. Long is a resident of Florida.

Biju Kulathakal became a member of our Board of Directors on August 14, 2010. Since 2008 Mr Kulathakal has been Chairman and CEO of Trading Block Holdings, Inc. a retail broker dealer in Chicago, IL. From 2003 to 2009 he was an investor and partner at GetAMovie which was later sold to McDonalds and is now RedBox. Redbox is one of the largest movie rental companies in the United States and the fastest growing in terms of revenue. From 1999 he was a founder of Enterprise Logic Systems, which is a software development firm that specialized in the financial services and trading industry. He is a founder and board member of the Vidya Foundation. He has previously served on the board of the Beck Foundation, Chicago Charter School foundation, Civitas School s, Leap Learning Systems and the Heartland Institute. Biju received a BS in Aerospace Engineering from Illinois Institute of Technology Mr. Kulathakal is a resident of Illinois.

Denis E. Sutton became a member of our Board of Directors on August 13, 2010. Since March 2007, Mr Sutton has been Executive Vice President, Human Resources of IMRIS Inc., a biomedical imaging equipment developer. From March 2005 until March 2007, Mr. Sutton served as Senior Vice President, Human Resources of MTS Allstream Inc., a telecommunications company. Mr. Sutton is a resident of Manitoba, Canada.

Executive Officer Information

David Kennedy became our Chief Operating Officer on August 13, 2010. Immediately prior to joining us, Mr. Kennedy was, and he continues to be, a principal in Yardley Capital Advisors, LLC. From October 2008 until May 2010, Mr. Kennedy served as Chief Operating Officer of Excelus HR, Inc. From July 2003 until June 2007, Mr. Kennedy served as Executive Vice President, Operations, of First Advantage Corporation. From January 2003 until February 2006, Mr. Kennedy served as President of First Advantage’s Background Verification group.

Ezra Schneier became our Corporate Development Officer on August 13, 2010. Immediately prior to joining us, Mr. Schneier was, and he continues to be, a principal in Yardley Capital Advisors, LLC. From October 2008 until May 2010, Mr. Schneier served as Vice President of Corporate Development of Excelus HR, Inc. From July 2003 until June 2007, Mr. Schneier served as Vice President of Corporate Development for First Advantage Corporation.

Meetings and Committees of the Board of Directors

Our Board is not subject to any independence requirements. However, our Board has reviewed the independence of its directors under the requirements set forth by the NASDAQ Stock Market. Based on such review, each of our directors other than Mr. Long qualifies as “independent” in accordance with the published listing requirements of NASDAQ. As provided by the NASDAQ rules, the Board has made a subjective determination as to each independent director that no relationships exists which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, the directors reviewed and discussed information provided by the directors with regard to each director’s business and personal activities as they may relate to us and our management.

During the year ended May 31, 2010 (“fiscal 2010”), the Board of Directors held 19 meetings. None of our incumbent directors was a director during fiscal 2010, so none of our incumbent directors attended any meetings of the Board of Directors during fiscal year 2010. Each of our directors during fiscal 2010 attended more than 75% of the total number of meetings of the Board and meetings held by all committees of the Board on which he served during fiscal 2010.

The Board has established an Audit Committee, a Compensation Committee and a Nominating Committee.

The Audit Committee is comprised of three non-employee directors: Messrs. Moss (Chairman), Kulathakal and Sutton. The Board has determined that all members of the Audit Committee are “independent” as that term is currently defined in Rule 4200(a)(15) of the listing standards of the NASD and Rule 10A-3(b)(1) of the Securities Exchange Act of 1934. The Audit Committee does not currently have an “audit committee financial expert.” All of the members of our Board of Directors were recently appointed and are very knowledgeable about the industry in which we do business and about capital raising, on which we are currently focused as we seek to implement our new management team’s business strategy. We expect the Board will be expanded in the near future, at which time we expect to add one or more members to the Board who would be deemed to be “audit committee financial experts.” The Audit Committee recommends to the Board the annual engagement of a firm of independent accountants and reviews with the independent accountants the scope and results of audits, internal accounting controls and audit practices and professional services rendered to us by such independent accountants. The Audit Committee held 5 meetings during fiscal year 2010. The Board has adopted a written charter for the Audit Committee. A copy of the Audit Committee charter may be found on our website at www.workstreaminc.com.

The Compensation Committee is comprised of our three non-employee directors Messrs. Moss (Chairman), Kulathakal and Sutton, each of which is deemed “independent” as described above. The Compensation Committee makes recommendations to the Board on the compensation of the Chief Executive Officer, President and Chief Financial Officer and administers our stock option plan. The Compensation Committee held two meetings during fiscal year 2010. The Board expects to adopt a charter for the Compensation Committee shortly. A copy of the Compensation Committee charter will be posted on our website at www.workstreaminc.com a fter it is adopted.

The Nominating Committee is comprised of our three non-employee directors: Messrs. Moss (Chairman), Kulathakal and Sutton. The Nominating Committee is responsible for recommending candidates for nomination and election to our Board of Directors and, when appropriate, reviewing the requisite skills and characteristics required of individual Board members in the context of the current composition of the Board, including such factors as business experience, diversity, personal skills in technology, finance, marketing, financial reporting and other areas that are expected to contribute to an effective Board. The Committee also considers candidates recommended by shareholders. The names and biographies of any such proposed nominees should be sent to Workstream Inc., 485 N. Kell er Road, Suite 500, Maitland, Florida 32751, Attention: David Kennedy. The Nominating Committee held two meetings during fiscal year 2010. The Board expects to adopt a Nominating Committee Charter shortly, a copy of which will be posted to our website at www.workstreaminc.com after it is adopted.

Shareholder Communications with Directors

The Board of Directors welcomes communication from our Shareholders. Any Shareholder may communicate with either the Board as a whole or with any individual director by sending a written communication to our Chief Executive Officer at our executive office located at 485 N. Keller Road, Suite 500, Maitland, Florida 32751. All such communications sent to the Chief Executive Officer will be forwarded to the Board, as a whole, or to the individual director to whom such communication was addressed.

We encourage, but do not require, the members of the Board to attend the annual meeting of Shareholders. Messrs. Mullarkey and Gerrior (each, directors at the time of our last shareholders’ meeting) attended our last Annual and Special Meeting of Shareholders.

Compensation of Directors for Fiscal Year 2010

For fiscal year 2010, all directors were entitled to reimbursement of their reasonable out-of-pocket expenses incurred in attending Board and committee meetings. In November 2008 as part of the corporate cost cutting efforts, the Board resolved to reduce the Board Fees to $3,000 per month, payable monthly, and resolved that no member of the Board would be entitled to receive any additional compensation other than the Board Fee in connection with his service as a member of any of the Audit Committee, Compensation Committee or Nominating Committee of the Board. Each director was eligible to participate in our 2002 Amended and Restated Stock Option Plan and receive 40,000 restricted stock units and option grants each year.

The following table sets forth total compensation paid to the directors for their services during fiscal year 2010:

Director Compensation Table—Fiscal 2010

| | Fees Earned or | Option | RSU | All Other | |

| | Paid in Cash | Awards | Awards | Compensation | Total |

| Name | ($) | ($)(1) | ($)(2) | ($) | ($) |

| Thomas Danis | 30,000 | 6,505(1) | 14,933(2) | -- | 51,438 |

| Michael Gerrior | 33,000 | 6,505(1) | 14,933(2) | -- | 54,438 |

| Mitchell Tuchman | 24,000 | 6,505(1) | 14,933(2) | -- | 45,438 |

| Michael Mullarkey | 36,000 | 6,505(1) | 14,933(2) | -- | 57,438 |

| (1) | As of May 31, 2010, the director held options to acquire 100,000 common shares, of which 53,334 were fully vested and exercisable at exercise prices ranging from $0.34 to $1.32. We recorded non-cash stock based compensation expense of $6,505 in accordance with ASC718 related to these options during fiscal 2010. |

| (2) | The director received 13,333 vested restricted stock units in April 2010 at a market value of $1,067. The director was granted 40,000 restricted stock units in June 2009. The director had 46,666 unvested RSUs outstanding as of May 31, 2010. We recorded non-cash stock based compensation expense of $14,933 in accordance with ASC718 related to the vesting of RSU awards during fiscal 2010. |

In connection with the consummation of the transactions contemplated by the Exchange Agreements on August 13, 2010, Thomas Danis and Mitch Tuchman resigned as members of our Board of Directors. The Board of Directors appointed in their place Denis Sutton and John Long. Effective as of August 14, 2010, Michael Mullarkey and Michael Gerrior resigned as members of the Board of Directors and Jeffrey Moss (Chairman) and Biju Kulathakal were appointed in their place. Upon their appointment to the new Board of Directors, each new member other than Mr. Long was granted 265,000 RSUs and options to purchase 1,350,000 common shares pursuant to the terms of our 2002 Amended and Restated Stock Option Plan with an exercise price equal to the value weighted average price of our common shares for the twenty trading fo llowing August 13, 2010. The RSUs and options are exercisable on the one year anniversary of the date of their grant. In addition, each non-employee director will be entitled to receive a cash Board Fee equal to $3,000 per calendar month (or $36,000 per year), payable on a quarterly basis within 10 days of the end of each such quarter. For the first quarter of fiscal year 2011, the Board fees were paid in common shares instead of cash per the agreement of the Board of Directors. Additionally, the Board fees for each subsequent fiscal quarter will be paid in common shares instead of cash unless we successfully raise at least $500,000 in new capital.

Company Employee Code of Conduct

The Board has adopted a Code of Conduct that applies to our directors, officers and employees, including our principal executive, financial and accounting officers and persons performing similar functions. The Code of Conduct will be made available, without charge, upon written request made to David Kennedy at our executive offices located at 485 N. Keller Road, Suite 500, Maitland, Florida 32751. In addition, the Code of Conduct is also available on our website at www.workstreaminc.com.

Approval of Transactions with Related Persons

We review all transactions involving us in which any of our directors, director nominees, significant Shareholders and executive officers and their immediate family members are participants to determine whether such person has a direct or indirect material interest in the transaction. All directors, director nominees and executive officers must notify us of any proposed transaction involving us in which such person has a direct or indirect material interest. Such proposed transaction is then reviewed by either the Board as a whole or the Audit Committee, which determines whether or not to approve the transaction. After such review, the reviewing body approves the transaction only if it determines that the transaction is in, or not inconsistent with, the best interests of the company and its Shareholder s.

Board Leadership Structure and Role in Risk Oversight

The Board of Directors has risk oversight responsibility for Workstream and administers this responsibility directly. The Board of Directors oversees our risk management process through regular discussions of our risks with senior management both during and outside of regularly scheduled Board of Directors meetings. In addition, the Board of Directors administers our risk management process with respect to risks relating to our accounting and financial controls. Separate individuals serve as the Chairman of our Board of Directors and our Chief Executive Officer. While our Board of Directors does not have an affirmative policy with regard to the separation of the offices of Chairman of the Board and Chief Executive Officer, it has determined that such a separation is prudent and appropriate. Thus, the c urrent leadership structure separates these two offices.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth the cash compensation as well as certain other compensation earned during the last two fiscal years by our Named Executive Officers.

| Name and Principal Position | | Year | | Salary ($) | | Bonus ($) | | Restricted Stock Awards ($)(1) | | Option Awards ($)(1) | | Non-Equity Incentive Plan Compensation ($) | | All Other Compensation ($) | | Total ($) | |

Steve Purello, Former President & Chief Executive Officer (2) | | 2010 2009 | | 92,308 250,000 | | -- -- | | -- -- | | 60 22,030 | | -- -- | | 162,591(3) 10,365(3) | | 254,899 260,265 | |

| | | | | | | | | | | | | | | | | | |

Michael Mullarkey, Former President & Chief Executive Officer (4) | | 2010 2009 | | 189,073 -- | | 100,000 39,500 | | 14,955 482 | | 7,252 5,213 | | -- -- | | 89,917(5) 261,360(5) | | 378,990 300,860 | |

| | | | | | | | | | | | | | | | | | |

Jerome Kelliher, Former Chief Financial Officer (6) | | 2010 | | 70,770 | | 6,667 | | 2,500 | | 4,778 | | -- | | 2,039 | | 79,476 | |

| | | | | | | | | | | | | | | | | | |

| (1) | Represents the compensation expense incurred by us in the respective fiscal year in connection with the grants of restricted common stock or stock options, as applicable, calculated in accordance with ASC718. See Note 1 of Notes to Consolidated Financial Statements in our Form 10-K filed on September 13, 2010 for additional information, including valuation assumptions used in calculating the fair value of the award. |

| (2) | Mr. Purello served as our President and Chief Executive Officer from February 2008 until his resignation in October 2009. Mr. Purello received an annual salary of $250,000 at the time of his resignation. |

| (3) | Other compensation includes severance and amount of health care benefits paid by the Company on behalf of Mr. Purello. Severance totaled $150,639 and health insurance was $11,952 in fiscal year 2010. Fiscal year 2009 Other Compensation was comprised only of health insurance. |

| (4) | Mr. Mullarkey served as our Chief Executive Officer and President from October 2009 until August 13, 2010. Mr. Mullarkey also served as our Executive Chairman until August 13, 2010. Mr. Mullarkey also served as our Acting Chief Financial officer from January 2009 until December 2009, at which time we hired Jerome Kelliher as our Chief Financial Officer. In his capacity as Acting Chief Financial Officer, Mr. Mullarkey received $1,000 per day, plus expenses, for the time spent working in such capacity. At the time of his termination as Chief Executive Officer and President, Mr. Mullarkey received an annual salary of $312,000. The $39,500 in bonuses for fiscal year 2009 was a bonus paid for consulting work provided by Mr. Mullarkey. |

| (5) | Other compensation is comprised of earnings related to service as Chairman of the Board of Directors ($36,000), consulting fees from periods before he was hired as our CEO ($36,500) and health insurance ($17,417). During fiscal year 2009, Mr. Mullarkey earned $44,250 and $217,110 for service as Chairman of the Board of Directors and consulting fees, respectively. |

| (6) | Mr. Kelliher served as our Chief Financial Officer from December 2009 until his resignation in June 2010. At the time of his resignation, Mr. Kelliher received an annual salary of $160,000. Mr. Kelliher received no severance in connection with his resignation. Mr. Kelliher’s other compensation is comprised entirely of health insurance. |

The following table sets forth certain information concerning equity awards for our Named Executive Officers at May 31, 2010.

Outstanding Equity Awards At Fiscal Year-End—2010

| Option Awards |

| Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | Option Exercise Price ($/Sh) | Option Expiration Date |

| Steve Purello | -- | -- | -- | -- | -- |

| | | | | | |

| Michael Mullarkey | 13,334 | -- | -- | 1.29 | 03/01/12(1) |

| | 13,334 | 6,666 | -- | 0.69 | 11/15/12(1) |

| | -- | 40,000 | -- | 0.34 | 06/08/14(1) |

| | | | | | |

| Jerome Kelliher | -- | 160,000 | -- | 0.30 | 12/07/14(2) |

| (1) | Option to purchase 13,334 shares of common stock vested equally over three years from the grant date of March 1, 2007. Option to purchase 20,000 shares of common stock vested equally over three years from the grant date of November 15, 2007. Option to purchase 40,000 shares of common stock vested equally over three years from the grate date of June 8, 2009. |

| (2) | Option to purchase 160,000 shares of common stock vested equally over three years from the grant date of December 7, 2009 |

| Stock Awards |

| | Number of Shares or Units of Stock that have not Vested (#) | | Market Value of Share or Units of Stock that have not Vested ($)(1) | | Equity Incentive Plan Awards: Number of Unearned Shares, Units or other Rights that have not Vested (#) | | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or other Rights that have not Vested |

| Steve Purello | -- | | -- | | -- | | -- |

| | | | | | | | |

| Michael Mullarkey | 6,666(2) 40,000(2) | | 533 3,200 | | -- -- | | -- -- |

| | | | | | | | |

| Jerome Kelliher | 50,000(3) | | 4,000 | | -- | | -- |

| | | | | | | | |

| (1) | The market value per restricted stock unit is calculated by multiplying the number of shares of restricted stock that have not vested by the closing stock price of $0.08 per share as quoted on the OTCBB on May 28, 2010. |

| (2) | Original grant of 20,000 restricted stock units vested equally over three years from the grant date of November 15, 2007. Original grant of 40,000 restricted stock units vested equally over three years from the grant date of June 8, 2009. |

| (3) | Original grant of 50,000 restricted stock units vested equally over three years from the grant date of December 7, 2009. |

Employment Contracts, Termination of Employment and Change-in-Control Arrangements

In connection with the exchange and private placement transactions that were consummated on August 13, 2010, we entered into employment agreements with a new management team consisting of John Long, David Kennedy and Ezra Schneier. We also entered into an employment agreement with Michael Mullarkey, our former Chairman of the Board, Chief Executive Officer and President. Mr. Mullarkey subsequently resigned effective as of August 25, 2010. Below is a summary of the employment agreements with our new management team.

John Long, Chief Executive Officer. Pursuant to the terms of Mr. Long’s employment agreement, Mr. Long will earn an initial base salary of $250,000. Upon entering into the employment agreement, Mr. Long received 20,348,798 Restricted Stock Units (“RSUs”) and options to purchase 10,174,399 common shares exercisable at a price of $0.01977 per share. Such RSUs and options vest in equal quarterly installments beginning on the three month anniversary of the date of grant; provided, however, that upon a “change of control” (as defined in the employment agreement), all unvested RSUs and options shall automatically vest. Due to the fact that we do not have any additional shares eligible for issuance under our stoc k option plan, subsequent to entering into the employment agreement we agreed to issue Mr. Long restricted common shares in lieu of the options and RSUs to which he was entitled upon vesting. Mr. Long is also eligible to receive an annual bonus for each fiscal year of up 100% of his base salary based on achieving certain goals, which are to be mutually agreed upon, including a prorated bonus for the fiscal year ending May 31, 2011. Such bonus will be payable in cash unless the Board of Directors or the Compensation Committee of the Board determines, in its sole discretion to pay up to, but not more than, 50% of such bonus in fully vested RSUs. In the event that Mr. Long is terminated without “cause” or resigns for “good reason” (as such terms are defined in the employment agreement), Mr. Long will be entitled to severance equal to his then current salary for a period of six months following the date of termination, certain benefits for such six-month p eriod and a prorated bonus for the year in which he is terminated.

David Kennedy, Chief Operating Officer. Mr. Kennedy will earn an initial base salary of $125,000. Upon entering into the employment agreement, Mr. Kennedy received 10,174,399 RSUs and options to purchase 5,087,200 common shares exercisable at a price of $0.01977 per share. Such RSUs and options vest in equal quarterly installments beginning on the three month anniversary of the date of grant; provided, however, that upon a “change of control” (as defined in the employment agreement), all unvested RSUs and options shall automatically vest. Due to the fact that we do not have any additional shares eligible for issuance under our stock option plan, subsequent to entering into the employment agreement we agreed to issue Mr. Ken nedy restricted common shares in lieu of the options and RSUs to which he was entitled upon vesting. Mr. Kennedy is also eligible to receive an annual bonus for each fiscal year of up 100% of his base salary based on achieving certain goals, which are to be mutually agreed upon, including a prorated bonus for the fiscal year ending May 31, 2011. Such bonus will be payable in cash unless the Board of Directors or the Compensation Committee of the Board determines, in its sole discretion to pay up to, but not more than, 50% of such bonus in fully vested RSUs. In the event that Mr. Kennedy is terminated without “cause” or resigns for “good reason” (as such terms are defined in the employment agreement), Mr. Kennedy will be entitled to severance equal to his then current salary for a period of six months following the date of termination, certain benefits for such six-month period and a prorated bonus for the year in which he is terminated.

Ezra Schneier, Corporate Development Officer. Mr. Schneier will earn an initial base salary of $125,000. Upon entering into the employment agreement, Mr. Schneier received 10,174,399 RSUs and options to purchase 5,087,200 common shares exercisable at a price of $0.01977 per share. Such RSUs and options vest in equal quarterly installments beginning on the three month anniversary of the date of grant; provided, however, that upon a “change of control” (as defined in the employment agreement), all unvested RSUs and options shall automatically vest. Due to the fact that we do not have any additional shares eligible for issuance under our stock option plan, subsequent to entering into the employment agreement we agreed to issue Mr. Schneier restricted common shares in lieu of the options and RSUs to which he was entitled upon vesting. Mr. Schneier is also eligible to receive an annual bonus for each fiscal year of up 100% of his base salary based on achieving certain goals, which are to be mutually agreed upon, including a prorated bonus for the fiscal year ending May 31, 2011. Such bonus will be payable in cash unless the Board of Directors or the Compensation Committee of the Board determines, in its sole discretion to pay up to, but not more than, 50% of such bonus in fully vested RSUs. In the event that Mr. Schneier is terminated without “cause” or resigns for “good reason” (as such terms are defined in the employment agreement), Mr. Schneier will be entitled to severance equal to his then current salary for a period of six months following the date of termination, certain benefits for such six-month period and a prorated bonus for the year in which he is terminated.

Report of the Audit Committee

The Audit Committee reviews our financial reporting process on behalf of the Board of Directors. The Audit Committee is comprised solely of independent directors meeting the requirements of applicable Securities and Exchange Commission and NASDAQ rules. Management has the primary responsibility for the financial statements and the reporting process. Our independent auditors are responsible for expressing an opinion on the conformity of our audited financial statements to accounting principles generally accepted in the United States.

In this context, the Audit Committee has reviewed and discussed with management and the independent auditors the audited financial statements. The Committee has reviewed and discussed with management and the independent auditors its audited financial statements as of and for the year ended May 31, 2010, as well as the representations of management regarding the Company’s internal control over financial reporting. The Committee discussed with the Company’s independent auditors the overall scope and plans for their audit, and met with the independent auditors, with and without management present, to discuss the results of their examinations. The Committee also discussed with the Company’s independent auditors, with and without management present, their evaluation of the Company’s internal accounting controls, management’s representations regarding internal control over financial reporting, and the overall quality of Company’s financial reporting. The Audit Committee has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees). In addition, the Audit Committee has received from the independent auditors the written disclosures covered under the letter from independent auditors, required by Independent Standards Board No. 1 (Independent Discussions with Audit Committees), and has discussed with the auditors their independence from the Company and its management. Finally, the Audit Committee has considered whether the provision of non-audit services by the independent auditors is compatible with maintaining the auditors’ independence.

Based on the reviews and the discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in Workstream’s Annual Report on Form 10-K for the year ended May 31, 2010, for filing with the Securities and Exchange Commission.

As described below, we are seeking Shareholder approval to appoint Cross, Fernandez and Riley, LLP, as our independent auditors for fiscal year 2011, subject to Shareholder ratification of such appointment.

Submitted by the Audit Committee:

Jeffrey Moss (Chairman)

Biju Kulathakal

Denis Sutton

Fees Paid to Auditors

As part of its duties, the Audit Committee has also considered whether the provision of services other than audit services by the independent auditors to us is compatible with maintaining the auditors’ independence. The fees for all services provided by our independent auditors to us during fiscal year 2010 and fiscal year 2009 were as follows:

| | | Fiscal Year 2010 | | | Fiscal Year 2009 | |

| Audit Fees | | $ | 195,000 | | | $ | 222,183 | |

| Audit Related Fees | | | -- | | | $ | 31,200 | |

| Tax Fees | | $ | 40,000 | | | $ | 40,000 | |

| All Other Fees | | | -- | | | | -- | |

Audit Fees

Audit fees consist of those fees incurred in connection with statutory and regulatory filings or engagements and fees necessary to perform an audit or review in accordance with Generally Accepted Auditing Standards. These fees also include charges for accounting research in connection with the audit and audit committee and shareholder meeting attendance. Audit fees related to fiscal year 2010 and fiscal year 2009 services billed by Cross, Fernandez and Riley, LLP were $195,000 and $160,428, respectively. Audit fees related to fiscal year 2009 services billed by McGladrey & Pullen, LLP, our former principal accountants, were $61,755.

Audit-Related Fees

Audit-related fees consist of the fees for reviewing registration statements, due diligence procedures and research and consultation on proposed transactions.

Tax Fees

Tax fees relate to tax consultation and compliance services, and additional tax research. All of these fees were pre-approved by the Audit Committee.

The Audit Committee has considered the services provided by Cross, Fernandez and Riley and McGladrey & Pullen as disclosed above in the captions “audit related fees” and has concluded that such services are compatible with the independence of Cross, Fernandez and Riley and McGladrey & Pullen as our current and former principal accountants, respectively.

Audit Committee Pre-Approval Policies and Procedures

Section 10A(i)(1) of the Exchange Act and related Securities and Exchange Commission rules require that all auditing and permissible non-audit services to be performed by our principal accountants be approved in advance by the Audit Committee of the Board of Directors. Pursuant to Section 10A(i)(3) of the Exchange Act and related Securities and Exchange Commission rules, the Audit Committee has established procedures by which the Chairman of the Audit Committee may pre-approve such services provided that the pre-approval is detailed as to the particular service or category of services to be rendered and the Chairman reports the details of the services to the full Audit Committee at its next regularly scheduled meeting.

PROPOSAL 2 - APPOINTMENT OF AUDITORS

On March 5, 2009, we engaged Cross, Fernandez and Riley, LLP, an independent member of the BDO Seidman LLP Alliance network of firms, to be our independent registered public accounting firm as approved by our Board of Directors, on the advice of its Audit Committee. During fiscal years 2009 and 2010 and the subsequent interim period, we have not consulted with Cross, Fernandez and Riley with respect to any of the matters or reportable events set forth in Item 304(a)(2) of Regulation S-K.

Upon recommendation of the Audit Committee, the Board of Directors proposes to appoint Cross, Fernandez and Riley as our auditors, to hold such position until the close of the next annual meeting of Shareholders. If the Shareholders do not ratify this appointment by the affirmative vote of a majority of the votes present or represented by proxy at the Meeting, other independent public accountants will be considered by the Board of Directors upon recommendation of the Audit Committee.

Since it was hired on March 5, 2009, there have been (1) no disagreements between us and Cross, Fernandez and Riley on any matters of accounting principle or practices, financial statement disclosure, or auditing scope or procedures and (2) no reportable events within the meaning set forth in Item 304(a)(1)(v) of Regulation S-K. Cross, Fernandez and Riley has not issued any reports that contained any adverse opinion or a disclaimer of opinion or were qualified or modified as to uncertainty, audit scope or accounting principles, except for a going concern qualification expressing substantial doubt about our ability to continue as a going concern in our Annual Report on 10-K for fis cal year 2009.

A representative of Cross, Fernandez and Riley is expected to be at the Meeting. Such representative will have the opportunity to make a statement and will be available to respond to appropriate questions.

Recommendation and Vote Required

The affirmative vote of a majority of votes present or represented by proxy at the Meeting is required to ratify the appointment of Cross, Fernandez and Riley as our auditors. Unless a contrary choice is specified, proxies solicited by Management will be voted “FOR” ratification of the appointment of Cross, Fernandez and Riley as our auditors.

THE BOARD OF DIRECTORS RECOMMENDS VOTING “FOR” THE APPOINTMENT OF CROSS, FERNANDEZ AND RILEY, LLP AS AUDITORS OF WORKSTREAM.

PROPOSAL 3 - AUTHORIZATION TO FIX THE REMUNERATION OF AUDITORS

In the past, our directors have negotiated with our auditors on an arms-length basis in determining the fees to be paid to the auditors in connection with the provision of audit services. Such fees have been based upon the complexity of the matters in question and the time incurred by the auditors.

Recommendation and Vote Required

The affirmative vote of a majority of votes present or represented by proxy at the Meeting is required to authorize the directors to fix the remuneration of the auditors. Unless a contrary choice is specified, proxies solicited by Management will be voted “FOR” the authorization of the directors to fix the remuneration of the auditors.

THE BOARD OF DIRECTORS RECOMMENDS VOTING “FOR” THE AUTHORIZATION OF THE DIRECTORS TO FIX THE REMUNERATION OF THE AUDITORS.

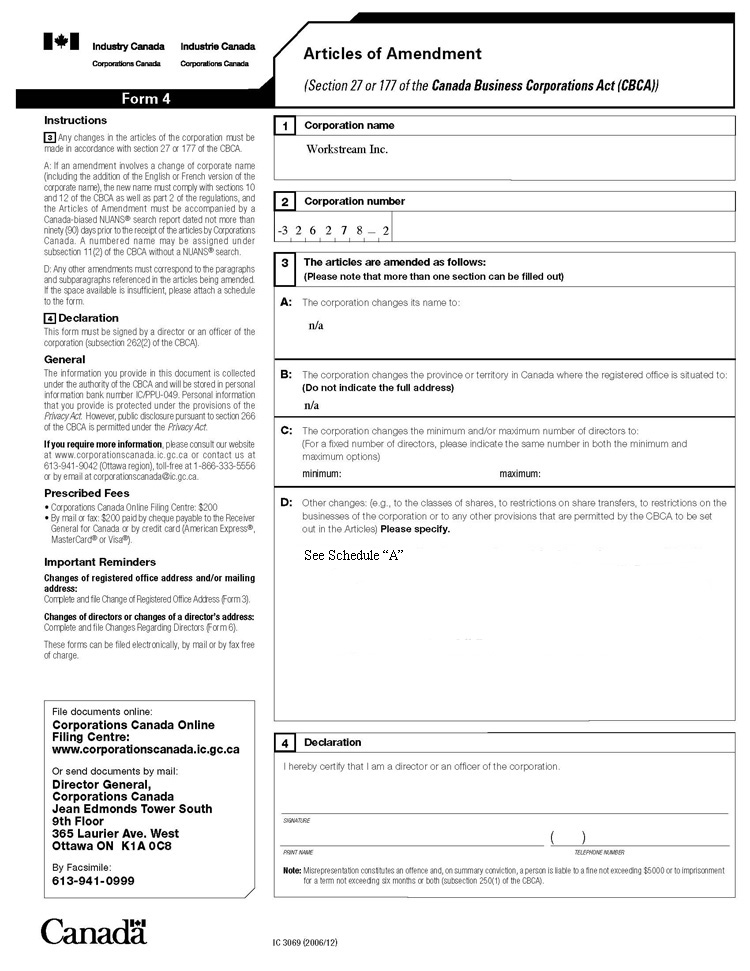

PROPOSAL 4 - REVERSE STOCK SPLIT AMENDMENT

At the Annual and Special Meeting, you will be asked to approve an amendment to our Articles of Incorporation, in substantially the form attached hereto as Appendix A, in order to effect a reverse stock split of our common shares. If our shareholders approve the amendment, our Board of Directors will have the authority, in its sole discretion, to file such amendment.

Background

Our Board of Directors has approved and our management is hereby soliciting shareholder approval of a reverse stock split of our outstanding common shares in a ratio between 1-for-200 and 1-for-400, as determined at the discretion of our Board of Directors. Our Board of Directors believes that approval of a range of reverse split ratios, rather than approval of a specific reverse split ratio, provides the Board of Directors with maximum flexibility to achieve the purposes of the reverse stock split, which are discussed below. If the shareholders approve the reverse stock split amendment, our Board of Directors will have the authority, in its sole discretion, and without further action on the part of the shareholders, to effect the approved reverse stock split by filing an amendment with Industry Canada at any time after the approval of the reverse stock split amendment.

Our Board of Directors has determined that the reverse stock split is in the best interests of Workstream and its shareholders. However, our Board of Directors reserves the right, notwithstanding shareholder approval, and without further action by the shareholders, to decide not to proceed with the filing of the reverse stock split amendment, if, at any time prior to the filing of the reverse stock split amendment, it determines, in its sole discretion, that the reverse stock split is no longer in the best interests of Workstream and its shareholders. By approving the reverse stock split amendment, our shareholders will be authorizing our Board of Directors to implement the reverse stock split at any time on or before November 30, 2011 or to abandon the reverse stock split at any time prior to implementation.

Purpose of the Reverse Stock Split

We believe the reverse stock split will broaden the appeal of our common shares to institutional investors and brokers and will also cause the number of our outstanding shares to be more in line with other similarly sized companies.

The Board of Directors believes that by reducing the number of common shares outstanding through the reverse stock split, and thereby proportionately increasing the per share price of our common shares, our common shares may be more appealing to institutional investors and institutional funds. Due to the trading volatility often associated with low-priced stocks, many brokerage firms and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. The Board of Directors believes that the anticipated higher market price resulting from the reverse stock split would enable institutional investors and brokerage firms with policies and practices such as those described above to inves t in our common shares. Also, because the brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher priced stocks, the current low share price of our common shares can result in individual shareholders paying transaction costs (commissions, markups or markdowns) that are a higher percentage of their total share value than would be the case if the price of our common shares was substantially higher. This factor is also believed to limit the willingness of institutions to purchase our common shares. The Board of Directors also believes that our shareholders may benefit from a higher priced stock as it could improve liquidity as a result of an increased interest from institutional investors and investment funds and lower trading costs.

Our Board of Directors intends to effect the reverse stock split only if it believes that a decrease in the number of shares outstanding is likely to make our stock more attractive to potential investors. However, even if our Board effects the reverse stock split, there can be no assurance of either an immediate or a sustainable increase in the per share trading price of our common shares.

Our Board of Directors is recommending that you empower the Board of Directors to effectuate, in the Board of Directors’ discretion, the reverse stock split within the above ratios to reduce the number of our outstanding shares to a more appropriate level and increase our share price.

Implementation and Effective Date of the Reverse Stock Split

If our shareholders approve this proposal, and the Board of Directors elects to effect the reverse stock split, we will file the Articles of Amendment included as Appendix A to this proxy statement (as completed to reflect the reverse stock split ratio as determined by the Board of Directors, in its discretion, within the range described above). The Articles of Amendment will become effective when it is filed with Industry Canada or such later time as is set forth in the Articles of Amendment. However, even if the reverse stock split is approved by our shareholders, our Board of Directors has discretion to decline to carry out the reverse stock split if it determines that the reverse stock split is no longer in the best interests of Workstream and our shareholders.

Risks Associated with the reverse stock split

The reverse stock split may not increase the price of our common shares. Although the Board expects that a reverse stock split will result in an increase in the price of our common shares, the effect of a reverse stock split cannot be predicted with certainty. Other factors, including but not limited to our financial results, market conditions, the incurrence of indebtedness, loss of key members of management, adverse legal actions against us and the market’s perception of our business, may adversely affect the stock price. As a result, there can be no assurance that the reverse stock split, if completed, will result in the intended benefits described above, that the stock price will increase following the reverse stock split or that the stock price will not decrease in the future.

The reverse stock split may decrease the trading market for our common shares. Because the reverse stock split will reduce the number of our common shares available in the public market, the trading market for the common shares may be harmed, particularly if the stock price does not increase as a result of the reverse stock split.

In addition, the reverse stock split may result in some of our shareholders owning “odd lots” of fewer than 100 common shares. Odd lot shares may be more difficult to sell, and brokerage commissions and other costs of transactions in odd lots are generally somewhat higher than the costs of transactions in “round lots” of even multiples of 100 shares.

Exchange of Stock Certificates and Payment for Fractional Shares

If the reverse stock split amendment is approved by our shareholders and our Board of Directors continues to believe that the reverse stock split is in the best interests of Workstream and its shareholders, the exchange of our common shares will occur at the effective time of the reverse stock split amendment without any further action on the part of our shareholders and without regard to the date that any shareholder physically surrenders the shareholder’s certificates representing pre-split shares of common shares for certificates representing post-split shares.

In the event that the number of shares of post-split common shares for any shareholder includes a fraction, we will pay that shareholder, in lieu of issuing fractional shares, a cash amount (without interest) equal to the fair market value of such fraction of a share which would otherwise result from the reverse stock split, based upon the average of the closing bid prices of our common shares on the OTCBB during each of the five trading days preceding the effective date of the reverse stock split amendment. This cash payment represents merely a mechanical rounding off of the fractions in the exchange, and is not a separately bargained-for consideration. No fractional shares will be issued on the exercise of outstanding warrants and options except as otherwise expressly specified in the documents governing such warrants and options.

Shortly after the effective date of the reverse stock split, each holder of an outstanding certificate representing our common shares will receive from American Stock Transfer & Trust Company, LLC, our transfer agent, instructions for the surrender of the certificate to the exchange agent. The instructions will include a form of transmittal letter to be completed and sent to the exchange agent. As soon as practicable after the surrender to the exchange agent of any certificate that prior to the reverse stock split represented common shares, together with a

duly executed transmittal letter and any other documents the exchange agent may specify, the exchange agent will deliver to the person in whose name such certificate had been issued certificates registered in the name of such person representing the number of full common shares into which the common shares previously represented by the surrendered certificate will have been reclassified and a check for any amounts to be paid in cash in lieu of any fractional share. Until surrendered as contemplated herein, each certificate that immediately prior to the reverse stock split represented common shares will be deemed at and after the effective date of the foregoing to represent the number of full common shares contemplated by the preceding sentence. Each certificate representing common shares issued in connection with the reverse stock split will continue to bear any legends restricting the transfer of such shares that were borne by the surrendered certificates representing the common shares. SHAREHOLDERS SHOULD NOT SEND THEIR SHARE CERTIFICATES UNTIL THEY RECEIVE A TRANSMITTAL FORM.

Effects of the Reverse Stock Split

If approved and effected, the reverse stock split would have the following effects:

| | · | common shares owned by a shareholder before the reverse stock split would be exchanged for a lesser number of common shares based on the ratio determined by the Board of Directors; |

| | · | proportionate adjustments would be made to the number of common shares underlying restricted stock and unit awards; and |

| | · | based on the reverse stock split ratio, proportionate adjustments will be made to the per share exercise price and the number of common shares issuable upon the exercise of all outstanding options and warrants entitling the holders thereof to purchase common shares, which will result in approximately the same aggregate price being required to be paid for such options or warrants upon exercise of such options or warrants immediately preceding the reverse stock split. However, the number of shares authorized for issuance pursuant to our outstanding stock option plan will not be affected. |

The following table shows certain effects of the reverse stock split if it were effected as of February 7, 2011.

| | Prior to reverse stock split | Post minimum reverse stock split of 1-for-200 | Post maximum reverse stock split of 1-for-400 |

| Common Shares Outstanding | 988,702,590 | 4,943,512 | 2,471,756 |

| Common Shares Issuable on exercise of options and warrants and the issuance of RSUs | 71,717,548 | 358,587 | 179,293 |

If approved and effected, the reverse stock split will be effected simultaneously for all of our common shares and the ratio will be the same for all of our common shares. The reverse stock split will affect all of our shareholders uniformly. The reverse stock split will not change the terms of our common shares. Our common shares will have the same voting rights and rights to dividends and distributions and will be identical in all other respects after the reverse stock split. No shareholder’s percentage ownership of common shares will be altered except for the effect of the elimination of fractional shares.

Number of Shareholders; Exchange Act Registration

We are subject to the periodic reporting and other requirements of the Securities Exchange Act of 1934. Certain holders of our common shares may no longer hold any whole common shares following the reverse stock split. These holders, to whom we will pay a cash amount in lieu of issuing fractional shares, will cease to be shareholders of Workstream. Notwithstanding the fact that the total number of record holders of our common shares would be reduced by a reverse stock split, the purpose of the proposed stock split is not to reduce the number of record holders. The reverse stock split is not part of a contemplated “going private” transaction under Rule 13e-3 of the Exchange Act, and we will continue to be subject to the periodic reporting requirements of the Exchange Act.

Appraisal Rights and Dissenter’s Rights

No appraisal or dissenter’s rights are available under Canadian law to shareholders who dissent from the reverse stock split amendment. There may exist other rights or actions under Canadian law or federal securities laws for Shareholders who can demonstrate that they have been damaged by the reverse stock split. Such causes of action are generally based on alleged breaches of directors’ fiduciary responsibility or the adequacy of corporate disclosure.

U.S. Income Tax Consequences

The following is a general summary of certain U.S. federal income tax consequences of the reverse stock split that may be relevant to shareholders. This summary is based upon the provisions of the Internal Revenue Code of 1986, as amended, Treasury regulations promulgated thereunder, published administrative rulings and judicial decisions as of the date hereof, all of which may change, possibly with retroactive effect, resulting in U.S. federal income tax consequences that may differ from those discussed below. This summary does not purport to be complete and does not address all aspects of federal income taxation that may be relevant to shareholders in light of their particular circumstances or to shareholders that may be subject to special tax rules, including, without limitation shareholders subject to the alternative minimum tax, banks or other financial institutions, insurance companies, regulated investment companies, mutual funds, partnerships or other pass-through entities, real estate investment trusts, personal holding companies, foreign entities, nonresident alien individuals, broker-dealers, traders in securities, or tax-exempt entities. In addition, this summary does not address the tax consequences arising under the laws of any foreign, state or local jurisdiction and U.S. federal tax consequences other than federal income taxation. Further, this summary assumes that the old shares of common stock were, and the new shares of common stock received in the reverse stock split will be, held as a “capital asset” (generally, property held for investment), as that term is defined in the Code.

We have not sought, and will not seek, an opinion of counsel or a ruling from the Internal Revenue Service regarding the U.S. income tax consequences of the reverse stock split and there can be no assurance the IRS will not challenge the statements and conclusions set forth below or that a court would not sustain any such challenge. EACH SHAREHOLDER SHOULD CONSULT SUCH SHAREHOLDER’S TAX ADVISOR WITH RESPECT TO THE PARTICULAR TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT TO SUCH SHAREHOLDER.

We believe that the reverse stock split should constitute a “recapitalization” for U.S. federal income tax purposes. As a result, a shareholder generally should not recognize gain or loss upon the reverse stock split, except with respect to cash received in lieu of a fractional share of the common shares, as described below. A shareholder’s aggregate tax basis in the common shares received pursuant to the reverse stock split should equal the aggregate tax basis of the common shares (excluding any portion of such basis that is allocated to any fractional share), and such shareholder’s holding period (i.e., acquired date) in the common shares received should include the holding period in the common shares surrendered. Treasury regulati ons promulgated under the Code provide detailed rules for allocating the tax basis and holding period of the common shares surrendered to the common shares received pursuant to the reverse stock split. If you acquired your common shares on different dates and at different prices, you should consult your tax advisors regarding the allocation of the tax basis and holding period of such shares.

A shareholder who receives cash in lieu of a fractional common share pursuant to the reverse stock split generally should recognize capital gain or loss in an amount equal to the difference between the amount of cash received and the holder’s tax basis in the common shares surrendered that is allocated to such fractional share of the common share. Such capital gain or loss should be long-term capital gain or loss if the holder’s holding period for the common shares surrendered exceeded one year at the effective time of the reverse stock split.

Canadian Income Tax Consequences

Shareholders should not have any Canadian tax consequences as a result of the reverse stock split. Pursuant to the Canadian Income Tax Act, when a common share of ours is cancelled through a reverse stock split, this may be viewed as a disposition under the Income Tax Act. Notwithstanding that a reverse stock split that cancels the original shares may be a disposition under the definition of "disposition" under the Income Tax Act, the reverse stock split should still be viewed as a non-taxable event. Each shareholder should consult their tax advisor as to the reporting requirements of the reverse stock split.

Accounting Effects of the reverse stock split

Following the effective date of the reverse stock split, the par value of the common shares will remain at no par value per share. The number of outstanding common shares and the number of common shares upon exercise or conversion of options, warrants and convertible securities will be reduced by the reverse stock split ratio, taking into account such additional decrease resulting from our repurchase of fractional shares that otherwise would result from the reverse stock split. If the reverse stock split is effected, all share and per share information in our financial statements will be restated to reflect the reverse stock split for all periods presented in our future filings, after the effective date of the amendment, with the Securities and Exchange Commission. Total shareholders’ equity will remain unchanged.

Recommendation and Vote Required

Approval of the reverse stock split amendment will require the affirmative vote of the holders of two-thirds of our common shares represented in person or by proxy and entitled to vote at the meeting.

THE BOARD OF DIRECTORS RECOMMENDS VOTING “FOR” THE REVERSE STOCK SPLIT AMENDMENT.

PROPOSAL 5 - AUTHORIZATION TO AMEND STOCK OPTION PLAN

The Board of Directors has adopted, subject to shareholder approval, an amendment to our Amended and Restated 2002 Stock Option Plan to increase the number of common shares reserved for issuance under the plan from 11,000,000 to 150,000,000 shares. In the event that the shareholders approve and the Board of Directors effects the reverse stock split described under Proposal 4, the number of common shares reserved for issuance under the plan will, by its term, be reduced by the reverse stock split ratio provided for in the Articles of Amendment to be filed by the Company. In such case, the number of common shares reserved for issuance under the plan will be reduced from 150,000,000 to anywhere from 750,000 to 375,000, depending on the final reverse stock split ratio.

The Board believes that increasing the number of common shares reserved for issuance under the plan is necessary to insure that a sufficient reserve of common shares remains available for issuance to allow us to continue to utilize equity incentives to attract and retain the services of key individuals essential to our long-term growth and financial success. We rely on equity incentives in the form of stock option grants and restricted stock unit awards in order to attract and retain key employees and believe that such equity incentives are necessary for us to remain competitive in the marketplace for executive talent and other key employees. As of February 7, 2011, there is no existing reserve of common shares remaining under the plan, and we currently have agreements to issue additional options and restricted s tock units to certain of our employees in excess of the number of shares reserved under the plan. Accordingly, we are currently unable to issue stock options or grant restricted stock unit awards to existing or prospective employees. As a result of our August 2010 exchange transaction, pursuant to which, among other things, we issued 746,079,445 of our common shares to our senior secured note holders and new investors, and subsequent private placements, we have 988,702,590 issued and outstanding common shares. In determining the appropriate number of shares to reserve under the plan, our Board of Directors considered the number of shares currently issued and outstanding and the future needs of the company in trying to attract and retain the services of key individuals to our strategic plan. If this proposal is approved, a total of an additional 78,282,452 common shares will be available for future issuances under the plan, not giving effect to a potential reverse s tock split.

Summary of the Plan

The following is a summary of the principal features of the plan, and does not purport to be a complete description of the plan. Any shareholder who wishes to obtain a copy of the actual plan may do so upon written request to 485 N. Keller Road, Suite 500, Maitland, Florida 32751, Attention: David Kennedy.

• Eligibility. All of our full-time employees, officers, directors and consultants are eligible to participate in the plan and receive options and share grants. As of February 7, 2011, there were approximately 85 eligible participants.

• Number of Shares. The aggregate maximum number of shares that may be issued under the plan will be 150,000,000 if the amendment is approved, subject to adjustment upon the occurrence of any subdivision, redivision, consolidation, or other similar change affecting the shares. If any shares subject to any option, grant or award are forfeited, or an option, grant or award is terminated without issuance of shares, the shares subject to such option, grant or award will again be available under the plan.

• Administration of the Plan. The plan is administered by the Audit Committee of the Board of Directors. The Audit Committee has the authority to make such adjustments, not inconsistent with the terms of the plan, to the terms of currently outstanding options and share grants as it shall deem appropriate in order to achieve reasonable comparability or other equitable relationship between: (i) outstanding employee awards or the right or obligation to make future awards in connection with the acquisition of another business or another corporation or business entity; and (ii) the options and share grants as so adjusted. The Audit Committee also has the au thority to determine the individuals to whom options and share grants should be granted and the number and terms of such options and share grants to be granted.

• Restricted Share Grants and Restricted Share Unit Grants ("share grants"). We may issue shares or award units (one share for each unit) that are issued or awarded subject to certain restrictions on their sale by the participant as determined by our Audit Committee (including, without limitation, any limitation on the right to vote the shares or the right to receive any dividend or other right or property), which restrictions may lapse separately or in combination at such time or times in such instalments or otherwise, as our Audit Committee may deem appropriate.

• Forfeiture of Share Grants. Any share grants that have not yet vested in a participant shall be terminated as of the termination of the participant's employment with us.

• Options. Options granted under the plan may be either incentive stock options (ISOs) or non-qualified stock options. ISOs are intended to qualify as “incentive stock options” within the meaning of Section 422 of the Internal Revenue Code. If the options are granted to a U.S. employee, the Audit Committee will designate the options granted under the plan as ISOs or non-qualified stock options.

• Exercise Price. The exercise price of an option granted under the plan is determined by the Audit Committee, but in any event the option price shall not be lower than the fair market value of a share on the date the option is granted. The exercise price must be at least 110% of the fair market value of our shares on the date an ISO is granted if the recipient owns shares possessing more than 10% of the total voting power of our shares.

• Termination of Options. All options terminate on the earliest of: (a) the expiration of the term specified in the option, which may not exceed five years from the date of grant, unless the Audit Committee specifies otherwise; (b) the lesser of the balance of the term of such options or 60 days from the date an optionee's employment or service with us or our affiliates terminates for any reason other than disability, death or retirement; or (c) the lesser of the balance of the term of such options or 180 days from the date an optionee's employment or service with us or our affiliates terminates by reason of disability, death or retirement. The Audit Committee, in its discretion, may provide for additional limitations on the terms of any option.

• Transfers. No option or share grant awarded under the plan may be assigned or transferred, except by will or the laws of descent and distribution.

• Payment. An optionee may pay for shares covered by an option in cash, certified check, bank draft, money order or by such other mode of payment as the Audit Committee may approve.

• Provisions Relating to a Change of Control. Unless otherwise determined by the Board of Directors, upon the occurrence of a change of control, all options and share grants become immediately vested and exercisable in full, provided that optionees are not required to exercise their options if the exercise price is greater than the price per share of the offer received in connection with the change of control. A change of control will occur upon approval by a majority of the shareholders of an offer to acquire greater than fifty percent of the combined voting power of our outstanding securities or an offer to acquire us through the purchase of all of our assets, by amalgamation or otherwise.