October 6, 2011

Ms. Kathleen Collins

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, DC 20549

| Re: | Intersections Inc. |

| | |

| | Form 10-K for the Year Ended December 31, 2010 |

| | Filed March 16, 2011 |

| | |

| | Form 10-Q for Fiscal Quarter Ended June 30, 2011 |

| | Filed August 9, 2011 |

| | |

| | File No. 000-50580 |

Dear Ms. Collins:

We have reviewed the comment letter dated September 7, 2011 from the Commission’s Staff related to the above-mentioned filings by Intersections Inc. (the “Company”). With respect to each of the items in that letter, the Company’s response to the Staff’s comments is set forth below with each response below numbered to correspond to the numbered comment in the Staff’s letter. To assist in your review, we have included the text of the Staff’s comments below in italicized type. As explained below, in accordance with the Staff’s request, where applicable, the Company will undertake to include revised disclosures responsive to the Staff’s comments in the Company’s future filings, beginning with the Company’s quarterly report on Form 10-Q for the quarter ending September 30, 2011, which is required to be filed on or before November 9, 2011.

General

| 1. | We note that on March 16, 2011, May 5, 2011 and August 9, 2011 you posted your earnings releases on your website. Please tell us how you considered filing these earnings releases under Item 2.02. |

Company Response: On March 16, 2011, May 10, 2011 and August 9, 2011 the Company issued its earnings releases and then posted the releases on its website subsequent to filing its Form 10-K for the year ended December 31, 2010 and its Form 10-Qs for the fiscal quarters ended March 31, 2011 and June 30, 2011. Accordingly, the Company does not believe that it is required to file these earnings releases under Item 2.02 of Form 8-K as the earnings releases did not contain any “material nonpublic information” regarding any previously completed fiscal period. All of the material information contained in the respective earnings releases was previously made public by virtue of the prior filing of the Form 10-K/Form 10-Qs with the Commission by EDGAR. The Company believes this is consistent with Instruction 4 of Item 2.02, which provides that Item 2.02 of Form 8-K does not apply in the case of a disclosure that is made in a Form 10-K or Form 10-Q.

Form 10-K for the Fiscal Year Ended December 31, 2010

Report of Independent Registered Public Accounting Firm, page F-1

| 2. | Please amend your filing to include a report properly signed by your independent registered public accounting firm pursuant to Rule 2-02(a) of Regulation S-X. |

Company Response: In response to the Staff’s comments, the Company inadvertently omitted the signature of the independent registered public accounting firm from the audit opinion on its filing. The Company had the signed opinion at the time of filing and has attached a copy of this opinion to this response letter. The Company respectfully requests not to have to amend the filing to include the properly signed report, and will make sure to include the signature of the independent registered public accounting firm in future filings, beginning with the year ended December 31, 2011 Form 10-K.

Notes to Consolidated Financial Statements

Note 2. Basis of Presentation and Summary of Significant Accounting Policies

Basis of Presentation and Consolidation, page F-6

| 3. | We note you recorded a cumulative out-of-period adjustment during the three months ended September 30, 2010. Please tell us what this adjustment relates to and tell us the period(s) in which these amounts should have been recorded. In addition, explain further how you considered both the quantitative and qualitative factors outlined in SAB 99 as well as any other qualitative factors considered in concluding that these adjustments were not material to any of the impacted periods. |

Company Response: The Company respectfully acknowledges the Staff’s comment and supplementally advises the Staff that it considered the guidance in SAB 99 in reaching its determination that the revenue adjustment of $1.3 million was immaterial to its financial statements.

As the result of an oversight in the Company’s billing process for one of its indirect marketing arrangements, pricing adjustments for memberships greater than 24 months were not properly applied. Therefore, beginning in January 2009, the billing process did not properly age memberships greater than 24 months. This resulted in overbillings of revenue for the period from January 2009 until June 2010 of approximately $1.3 million as follows:

| Quarter Ended | Revenue Amount (in thousands) |

| 1Q 2009 | $68 |

| 2Q 2009 | $164 |

| 3Q 2009 | $220 |

| 4Q 2009 | $254 |

| YTD 2009 | $706 |

| | |

| 1Q 2010 | $300 |

| 2Q 2010 | $344 |

| TOTAL | $1,350 |

In the third quarter of 2010, Intersections recorded a reduction to revenue of approximately $1.3 million to correct this error. Intersections recorded the adjustment as a pre-tax reduction to revenue on the consolidated income statement and an accrued liability on the consolidated balance sheet.

The Company also corrected the billing query to ensure correct application of the contract terms going forward, reviewed other material contracts for similar time-based pricing terms (and found none), and reviewed controls in general related to this incident.

Statement of Financial Accounting Concepts No. 2 states the concept of materiality as:

The omission or misstatement of an item in a financial report is material if, in the light of surrounding circumstances, the magnitude of the item is such that it is probable that the judgment of a reasonable person relying upon the report would have been changed or influenced by the inclusion or correction of the item.

Further, the SEC Advisory Committee on Improvements to Financial Reporting issued a progress report in February 2008, where they provided recommendations regarding the assessment of the materiality of errors to financial statements and the correction of financial statements for errors. The report discusses and proposes reinforcing the following concepts:

| · | Those who evaluate the materiality of an error should make the decision based upon the perspective of a “reasonable investor.” |

| · | Materiality should be judged based on how an error affects the “total mix” of information available to a reasonable investor. |

| · | Just as qualitative factors may lead to a conclusion that a quantitatively small error is immaterial, qualitative factors also may lead to a conclusion that a quantitatively large error is not material. The evaluation of errors should be on a “sliding scale.” |

Reasonable Investor

The Company has defined a “reasonable investor” as an individual who regularly uses and understands financial statements, key industry metrics and utilizes trend analysis to make investment decisions. The Company has determined that reasonable investors include shareholders and/or potential shareholders, debt holders and/or credit agencies, analysts, regulators (SEC, IRS), employees and management, competitors, legal claimants and strategic partners.

Total Mix

Materiality is a highly subjective matter, and professional judgment is required to evaluate whether a particular error is material. When looking at how an error affects the total mix of information available, the analysis should not focus on whether an item is “quantitatively material” or, separately, whether it is “qualitatively material.” Materiality analyses should weigh both quantitative and qualitative factors in light of the relevant facts and circumstances from the perspective of the intended users. Thus, as the Company considers the quantitative and qualitative factors in determining if an error is material, bright lines are not really useful in making materiality judgments.

Sliding Scale

There should be a “sliding scale” for evaluating errors. On this scale, the higher the quantitative significance of an error, the stronger the qualitative factors must be to result in a judgment that the error is not material. Conversely, the lower the quantitative significance of an error, the stronger the qualitative factors must be to result in a judgment that the error is material. Qualitative factors not only can increase, but also can decrease, the importance of an error to the reasonable investor.

Quantitative Assessment

The quantitative element of the assessment addresses the size of the misstatement in numerical and percentage terms. Current practice is evolving to include quantitative GAAP measures other than traditional measures like Net Income (before and after tax), or EPS into materiality analyses in order to provide a holistic approach to determining what is material. The Company considered these traditional measures as well as other alternative measures. See attached Appendix A for its quantitative assessment and trend analysis. Based on the analysis, the following is a written summary of the quantitative analysis performed by the Company:

Evaluation of 2009 Financial Statements - As noted below, the quantitative analysis was performed using the results as originally reported, which would have been the results that were publicly available at the time of the filing of the 3rd quarter 10Q . Subsequent to the filing of the 3rd quarter 10Q for 2010, the 2009 results were recast in the 2010 10K to reflect discontinued operations. See the Company’s overall analysis and conclusion that the adjustments were not material to the recast 2009 financial statements below:

| · | The Company did note that the error represented 6.3% of pre-tax income and 3.9% of net loss for 2009 as originally reported; however, it did not deem this percentage to be material to the users of the financial statements. Please note that the Company has two net loss line items in the statement of operations, “Net Loss” as well as ”Net Loss Attributable to Intersections,” due to a noncontrolling interest held by a third party. The above Net Loss effect was calculated using the higher consolidated net loss amount of approximately $(10,733) thousand resulting in a 3.9% effect on Net Loss. |

| · | The error did not cause a swing from net loss to net income or net income to net loss for any previously reported financial statements. |

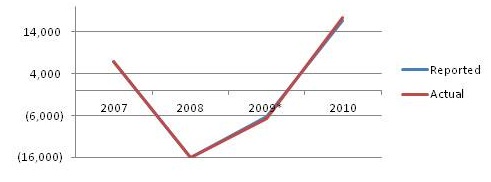

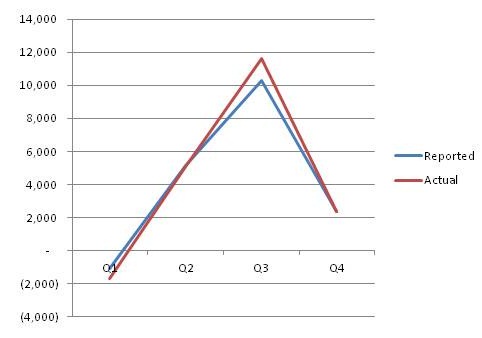

| · | The error would not change the trend in earnings for the Company year over year. As shown in the attached trend analysis, the graph shows that there is very little change in the trends with and without the adjustment for the error. |

| · | The effect on basic and diluted EPS is 6.4% and 6.4%, respectively, for 2009. As stated, this would just be an additional loss per share not a change between loss and income per share. The additional loss per share for basic and diluted EPS would only be $(0.02), and the Company did not deem this amount to be material to the users of the financial statements. |

| · | The balance sheet effects are immaterial to the financial statement line items and captions. |

| · | The error only affects offsetting amounts in net income and accounts payable in the operating section of the statement of cash flows, thus the total operating, investing and financing sections of the statement of cash flows would not be affected if the adjustment had been made. |

Evaluation of 2010 Quarterly and Projected Annual Results

| · | Per ASC 270-10-45-16, the Company evaluated the quarterly errors in 2010 using the projected annual results for 2010 and considered trends as detailed in the attached schedule. The errors as of the first and second quarters in 2010 are not quantitatively material in consideration of annual projected 2010 results. The Company would like to note that actual Net Income for 2010 exceeded the projected Net Income for 2010 by 21%. The error does not significantly impact any significant financial statement metrics, including the error as a percentage of Net Income (was less than a 10% impact to any line item for the third quarter and forecasted year-end). Based on the attached Appendix A, the Company has the ability to correct the accumulation of the errors in the 3rd quarter of 2010 without materially misstating the 3rd quarter results or any trends in quarterly results. |

| · | The Company also considered the quarterly trends and considered the error as it relates to both 2010 and 2009 quarters and concluded that the error in historical periods and the correction of the accumulation of the error would not significantly alter the trends. |

Overall Factors

| · | The impact on the working capital ratio, the indicator of a Company’s ability for current assets to cover current liabilities, is not material. |

| · | There is no other significant impact on any other financial statement ratios. |

| · | The error was not intentional and did not affect compliance with any laws or regulations. |

Qualitative Assessment

The Company did not identify any attributes of the adjustment that would make it qualitatively material to a user of the financial statements. Per SAB 99, the attributes considered include:

| · | Whether the misstatement arises from an item capable of precise measurement or whether it arises from an estimate and, if so, the degree of imprecision inherent in the estimate; |

| o | The misstatement arose from an error in the calculation of amounts for services that was billed to a client in an indirect marketing arrangement. The calculation error was due to an oversight in the billing process and did not arise from an estimate or any imprecision inherent in that estimate. |

| · | Whether the misstatement masks a change in earnings or other trends; |

| o | The impact to each of the prior periods did not impact trends or mask a change in earnings (see attached trend analysis). The Company was at a Net Loss in 2009 and the errors do not change the loss to income but would generate a larger loss. The error in the historical quarters and the correction of the error out of period in the third quarter of 2010 would not reasonably change any conclusions on the trend in earnings. |

| · | Whether the misstatement hides a failure to meet analysts’ consensus expectations for the enterprise; |

| o | As no analysts are currently publishing estimates regarding the Company, the exclusion of the proposed adjustment did not impact whether the Company met or missed analysts’ consensus expectations. In addition, the Company historically has provided little forward-looking guidance to set expectations and therefore, this item is not applicable. In investor communications, the Company focuses on revenue and also discusses adjusted EBITDA (adjusted represents EBITDA before share based compensation and prior to non-cash impairment charges). The error had no impact on meeting estimates for 2009 (as there are no estimates) and had a very insignificant impact on these amounts. As stated above, the impact on net loss was an increase to the loss. In consideration of these items for 2009, the error is not considered to negatively impact the information published by the Company. |

| · | Whether the misstatement changes a loss into income and vice versa; |

| o | Please reference the Company’s supplemental quantitative analysis for an assessment of the impact to prior and current year revenue, operating income (loss), pretax book income (loss) and net income (loss). In summary, the correction of the error would not change net loss into income or vice versa. |

| · | Whether the misstatement concerns a segment or other portion of the registrant’s business that has been identified as playing a significant role in the registrant’s operations or profitability; |

| o | The error affecting the consolidated financial statements only affects one segment, the Consumer Products and Services segment, which accounts for 99.3% of revenue. The adjustment was not material to the segment in which the adjustment was made and had a very small effect on the earnings trend. |

| · | Whether the misstatement affects the registrant’s compliance with loan covenants or other contractual requirements; |

| o | The Company considered the impact to the calculation of its loan covenants and determined there was no material impact to them. The adjustment would not have resulted in any change in or failing of the loan covenants or increases in the applicable interest rate as a result of material changes to its financial covenant ratios. The Company is not aware of any regulations that it would be out of compliance with as a result of correcting the error. |

| · | Whether the misstatement has the effect of increasing management’s compensation – for example, by satisfying requirements for the award of bonuses or other forms of incentive compensation; or |

| o | The Company’s Compensation Committee bases its evaluation of annual cash and equity incentive compensation (such as granting of stock options or restricted stock units) on an annual predetermined value pool amount which is based on several factors from the prior year, including the Company’s financial and operating results, individual performance and scope of responsibility, competitive market pay information and practices and internal equity. Cash bonuses or other compensation above the value pool amount are granted solely in the discretion of the Company’s Compensation Committee, and historically, not based on satisfaction of specific targets or requirements. Due to the nature of the compensation plan and various criteria utilized by the Compensation Committee to make any compensation decisions, the Company does not believe this adjustment to be material to that analysis. In addition, the Company did not pay bonuses in 2009 to senior management; therefore, the unrecorded adjustments in the prior year would not have affected management’s compensation. |

| · | Whether the misstatement involves concealment of an unlawful transaction. |

| o | The exclusion of the adjustment did not conceal an unlawful transaction and is not applicable. The error was identified by the Company. Additionally, the Company disclosed the error to the customer/client and paid the amounts owed. The customer/client did not and has not indicated that there will be any disagreement on the amount owed to them and there is no contractual breach that would result in any additional material liability. In addition, the Company went through every contract that it has with that customer/client and noted no other discrepancies between the contracts and the amounts billed. |

Evaluation of Effect of Discontinued Operations

As noted above, subsequent to the filing of the 3rd quarter 10Q for 2010, the 2009 results were recast in the 2010 10K to reflect discontinued operations. The Company reviewed both the quantitative and the qualitative analysis above after adjusting for the effects of the discontinued operations and concluded that the adjustment noted above continued to be immaterial to the recast 2009 financial statements. Although the Company acknowledges that the percentage impact of the errors are large, this is the result of nearly break-even operating results for the reported period. As was suggested by Todd Hardiman, the associate chief accountant in the SEC’s Division of Corporation Finance at the 2007 AICPA conference, and Mark Mahar, former associate chief accountant in the SEC’s Office of the Chief Accountant at the 2008 AICPA conference, it is possible for quantitatively large errors to be immaterial after robust consideration of what the financial statement users consider relevant Large percentages against small dollar amounts generally do not provide the reader useful information. Rather they tend to focus on the dollar amounts of the errors rather than percentages and also consider the nature of the errors. From a qualitative perspective, all the facts above remained the same except in the first quarter of 2010, the adjustment would change the slight income from continuing operations, as recast for discontinued operations, to a slight loss. However, based on the fact that these amounts are negligible, the Company does not believe that it is material to the users of the financial statements, especially given that the total net loss remains a net loss.

The Company respectfully acknowledges the Staff’s comment and advises the Staff that it considered the guidance in SAB 99 in reaching its determination that the revenue adjustment of $1.3 million was immaterial to its financial statements as originally reported. The error identified has been recorded in the 2010 financial statements and the error was disclosed. The Company does not believe the adjustment would change any decisions related to the Company of any reasonable person relying on the report. Based upon the evaluation of all relevant quantitative factors as provided in Appendix A and qualitative factors included above, the Company concluded its 2009 financial statements were not materially misstated either individually or in the aggregate and restatement of the prior year financial statements to correct the error is not considered necessary. In addition, the impact on the projected 2010 financial statements and the impact on the first, second and third quarter 2010 financial statements from the out-of-period corrections of the error was not material on both a pre-tax and after-tax basis.

Note 18. Commitments and Contingencies

Legal proceedings, page F-30

| 4. | We note your discussions in both your Form 10-K and subsequent Forms 10-Q regarding the various class action complaints filed against the company. Please clarify for us whether there are any probable and reasonably estimable losses related to these contingencies. Further if there is at least a reasonable possibility that a loss may have been incurred, in your next periodic filing, either disclose an estimate (or, if true, state that the estimate is immaterial in lieu of providing quantified amounts) of the additional loss or range of loss, or state that such an estimate cannot be made. Please refer to ASC 450-20-50. |

If you conclude that you cannot estimate the reasonably possible additional loss or range of loss, please supplementally: (1) explain to us the procedures you undertake on a quarterly basis to attempt to develop a range of reasonably possible loss for disclosure and (2) for each material matter, what specific factors are causing the inability ot estimate and when you expect those factors to be alleviated. We recognize that there are a number of uncertainties and potential outcomes associated with loss contingencies. Nonetheless, an effort should be made to develop estimates for purpose of disclosure, including determining which of the potential outcomes are reasonably possible and what the reasonably possible range of losses would be for those reasonably possible outcomes.

You may provide your disclosures on an aggregated basis. Please include your proposed disclosures in your response.

Company Response: As a part of the process of preparing the financial statements and related disclosures for each reporting period, the Company’s management discusses each unresolved class action case with in-house counsel and, when necessary, with outside counsel to assess the likelihood of an unfavorable outcome and whether the disclosure of the cases is required. At the time of the preparation of the 10-K and subsequent Forms 10-Q, the Company believed, and continues to believe, that no loss in these matters is probable and that it was and remains unable to determine a range of possible loss for any of the legal proceedings. The factors causing an inability to estimate a range of possible loss in each case include the procedural status of the case and the lack of sufficient information at this stage of the case regarding the claims made and the potentially relevant facts. The Company continually monitors developments in its litigation proceedings and, as noted above, considers its disclosure obligations under ASC 450 in connection with each Form 10-Q and 10-K filing. Accordingly, as warranted by changes to facts and circumstances, the Company will revise these disclosures in future filings.

The Company will add the following additional disclosure to its future filings in which it does not provide a range of possible loss:

Based on currently available information, management does not believe it is has sufficient information to provide a range of possible loss for these proceedings. Management periodically analyzes currently available information and will provide a range of possible loss when it believes that sufficient information is available.

Note 21. Stockholders’ Equity

Stock Options, page f-33

| 5. | We note from your disclosures on page F-13 that you use the simplified method to estimate the expected term in your option valuation model. Please tell us whether information is available from other sources to make more refined estimates of the expected term. If so, explain further why you continue to use the simplified method or tell us when management expects that sufficient information will be available such that use of the simplified method will no longer be necessary. We refer you to Question 6 of the SAB Topic 14.D.2. |

Company Response: Under ASC 718 Compensation – Stock Compensation, the term for which an option is expected to be outstanding is a key factor in measuring its fair value and related compensation cost. Question 6 of the SAB Topic 14.D.2, sets forth the “simplified” method of estimating the expected term of “plain vanilla” share options. SAB 107, as amended by SAB 110, permits entities, under certain circumstances, to continue to use the simplified method if the entity believes its historical exercise experience does not provide a reasonable basis with which to estimate expected term.

Within SAB 110, the Staff provides the following examples of situations in which it may be appropriate to use the simplified method:

| · | A company does not have sufficient historical exercise data to provide a reasonable basis upon which to estimate expected term due to the limited period of time its equity shares have been publicly traded. |

| · | A company significantly changes the terms of its share option grants or the types of employees that receive share options grants such that its historical exercise data may no longer provide a reasonable basis upon which to estimate expected term. |

| · | A company has or expects to have significant structural changes in its business such that its historical exercise data may no longer provide a reasonable basis upon which to estimate expected term. |

While the Company has been publicly traded since April 2004, it does not believe that its historical experience provided a reasonable basis with which to estimate expected term (see additional explanation below) prior to April 2011. However, as a result of an increase in option exercise activity since April 2011, the Company believes it has now accumulated sufficient exercise activity and expects to derive the expected term from historical experience with future significant grants.

| · | The Company has historically limited the population of employees who are granted stock options since 2006 to senior management (which includes Vice Presidents, Senior Vice Presidents, Executive Vice Presidents and the CEO) and members of the Board of Directors. As of December 31, 2010, only 5% of options granted subsequent to 2006 had been exercised. |

| · | As of December 31, 2010, a review of all options exercised over the life of the Company’s stock option plans (since 1999) further show that 61% of all exercises were completed by two executive officers. Those specific stock options exercised were granted prior to the Company’s initial public offering in April 2004, and substantially all of these stock options had an exercise price significantly lower than the average market price of the Company’s stock since its initial public offering. |

| · | Although seven years have passed since the Company’s initial public offering, due to vesting terms and the historical market price of the stock, there have only been short periods of time when the market price of the Company’s stock exceeded the exercise price of vested outstanding awards. For example, at December 31, 2010, the Company had 1.1 million exercisable non-qualified stock options outstanding with an average exercise price of $8.03 and 261 thousand exercisable incentive stock options with an average exercise price of $11.42. However, for the period from January 1, 2006 through December 31, 2010 the average share price was $7.32, with a high of $11.30 and a low of $1.84. |

The Company believes that this historical experience does not provide a reasonable basis with which to estimate the expected term. The Company further considered that the expected term may be estimated using industry averages or available academic research. However, the Company was not able to obtain adequate or underlying support and documentation, specific to its industry or from comparable companies, to be used as a proxy in the Company’s calculation of an estimated expected term.

Subsequent to the filing on March 16, 2011, of the Form 10-K for the year ended December 31, 2010, the Company recognized both an increase in option exercise activity and an increase in the Company’s market price to a range of $11.99 through $21.97. From April 1, 2011 through August 31, 2011, approximately 1.6 million stock options have been exercised. Of this amount, approximately 56% of the exercises were completed by employees other than the Chief Executive Officer. The Company historically has made one material grant of stock options on an annual basis, which generally occurs in the first four months of the year. In 2011, substantially all of the exercise activity mentioned above occurred subsequent to the only material grant by the Company in April 2011. With this available information, the Company, therefore, in the Form 10-Q for the fiscal quarter ended June 30, 2011, modified its disclosure to include the italicized sentence:

Expected Term. The expected term of options granted during the three and six months ended June 30, 2011 and 2010 was determined under the simplified calculation ((vesting term + original contractual term)/2). For the majority of grants valued during the three and six months ended June 30, 2011 and 2010, the options had graded vesting over 4 years (equal vesting of options annually) and the contractual term was 10 years. We will continue to review our estimate in the future.

The Company expects that it will be able to derive its expected term from historical experience in future grants. In consideration of your comment, the Company recognizes that it would be useful to expand its disclosure in future filings to be more descriptive as to the reasons historical experience does not provide a reasonable basis for estimation and expectations going forward. Set forth below is the additional disclosure that the Company would propose to include in future filings, beginning with the Company’s Form 10-Q for the nine months ended September 30, 2011. To assist in your review, the Company has included the text of the proposed language below in italicized type:

Expected Term. The expected term of options granted during the three and six months ended June 30, 2011 and 2010 was determined under the simplified calculation ((vesting term + original contractual term)/2). For the majority of grants valued during the three and six months ended June 30, 2011 and 2010, the options had graded vesting over 4 years (equal vesting of options annually) and the contractual term was 10 years. Historically, based on the applicable provisions of U.S. GAAP and other relevant guidance, we do not believe we have had sufficient historical experience to provide a reasonable basis with which to estimate the expected term and determined the use of the simplified method to be the most appropriate method. Beginning with the next significant option grant, we believe that we have accumulated sufficient exercise activity and we expect to derive our expected term from historical experience.

| | Form 10-Q for Fiscal Quarter Ended June 30, 2011 |

| | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| 6. | We note your non-GAAP measures of customer revenue and marketing and commissions associated with customer revenue, which you indicate normalizes the effect of changes in the mix of indirect and direct marketing arrangements. Please clarify for us, and expand your disclosures in future filings, to further explain this metric and its usefulness to investors. In this regard, it is unclear what the adjustments of “other revenue” and “other commissions paid” relate to and why this information would be beneficial to investors. We refer you to Item 10(e) of Regulations S-K. |

Company Response: Client arrangements are distinguished from one another by the allocation between the Company and the client of the economic risk and reward of the marketing campaigns. Generally, the Company has three types of client arrangements (as further described in the Company’s SEC filings), although arrangements with particular clients may contain unique characteristics.

| · | Direct marketing arrangements: Under direct marketing arrangements, the Company bears most of the new subscriber marketing costs and pays the client a commission for revenue derived from subscribers. These commissions could be payable upfront in a lump sum on a per subscriber basis for the subscriber’s enrollment, periodically over the life of a subscriber, or through a combination of both. Revenue is recognized on a gross basis under these arrangements. |

| · | Indirect marketing arrangements: Under indirect marketing arrangements, the client bears the marketing expense and pays the Company a service fee or percentage of the revenue. Because the subscriber acquisition cost is borne by the client under these arrangements, the Company’s revenue per subscriber is typically lower than that under direct marketing arrangements. Revenue is generally recognized on a net basis under these arrangements. |

| · | Shared marketing arrangements: Under shared marketing arrangements, marketing expenses are shared by both parties in various proportions, and the Company may pay a commission to or receive a service fee from the client. Revenue generally is split relative to the investment made by both parties. |

The Company’s mix of direct and indirect marketing arrangements change over time based on new or amended contractual arrangements with the clients, as disclosed in the MD&A section of the Company’s Forms 10-K and 10-Q.

Subscription revenue, net of marketing and commissions associated with customer revenue, is a non-GAAP financial measure that the Company believes is important to investors and one that the Company utilizes in managing the business as it normalizes the effect of the changes in the mix of indirect and direct marketing arrangements. The Company provides this metric to illustrate and allow comparability of the trend in subscription revenue, which comprises the majority of the business, from period to period. The Company believes this metric and trending, along with the ongoing disclosure of the changes in the mix of direct and indirect marketing arrangements, is beneficial to the investor. In response to the Staff’s comment, Other Revenue is revenue generated by the Company for its services on a transactional basis and which do not retain the characteristics of a subscription based product. Other Revenue primarily consists of revenue from the Corporate Brand Protection and Bail Bonds Industry Solutions segment, as well as transactional type services. Other Commissions primarily consists of commissions that the Company may pay to the referring organization on transactional based revenue. Although the Company believes these amounts to be immaterial to the disclosure, it is necessary to illustrate these amounts as a reconciling item to the respective consolidated revenue and commission amounts.

As a result of the Company’s divestiture of its second largest operating segment in July 2010 (which is presented as discontinued operations in its financial statements), the remaining segments and transactional lines of business are immaterial to the financial statements and overall operations of the consolidated entity, and the Company has placed less emphasis on this disclosure. Therefore, the Company proposes to discontinue this particular disclosure in future filings, beginning with the Form 10-Q for the nine months ended September 30, 2011.

* * * * *

In connection with the above, we hereby acknowledge that:

1. Intersections is responsible for the adequacy and accuracy of the disclosure in the filings;

| 2. | Staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filings; and |

| 3. | Intersections may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

If, after review hereof, you should have additional questions or should need any additional information, please contact the undersigned at (direct) 703-488-3042.

Very truly yours,

/s/ John G. Scanlon

John G. Scanlon

Chief Financial Officer

cc: Melissa Kindelan, Staff Accountant

Todd Lenson, Stroock & Stroock & Lavan

Marc Bjorkman, Audit Partner