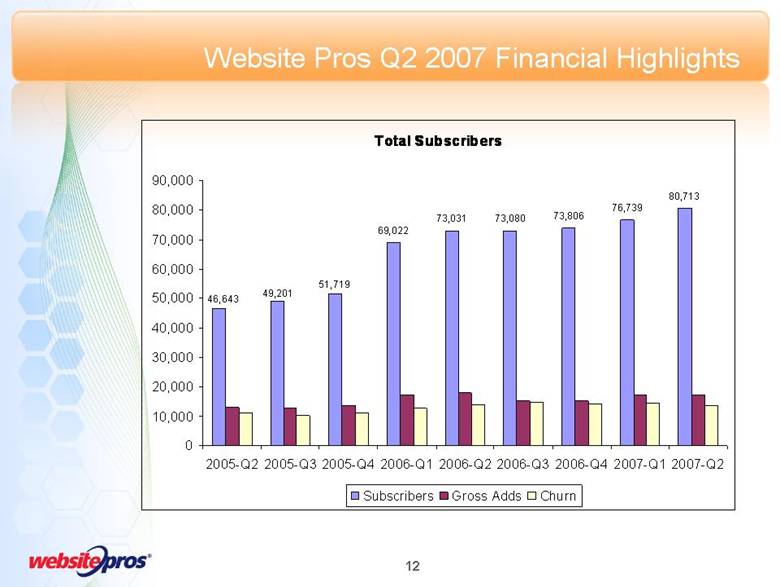

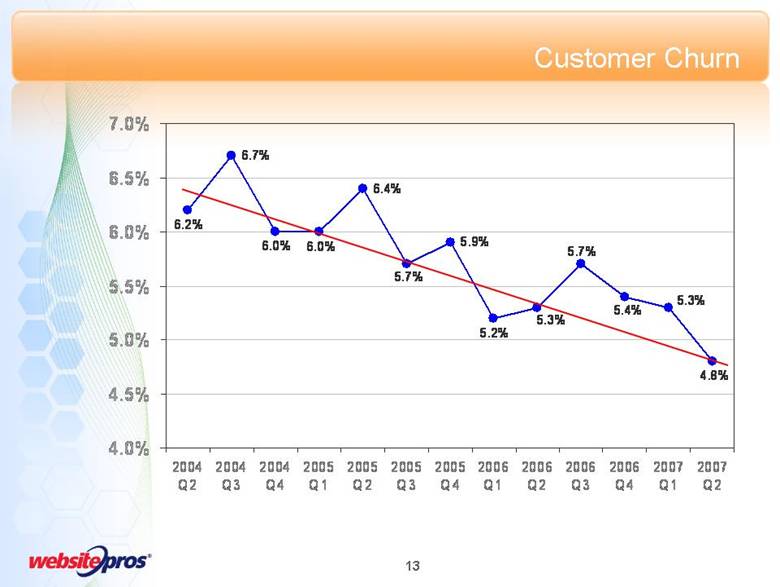

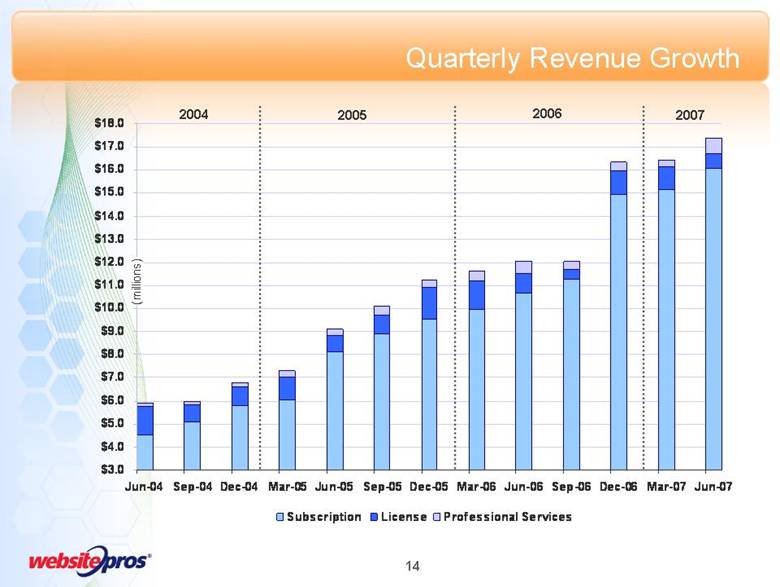

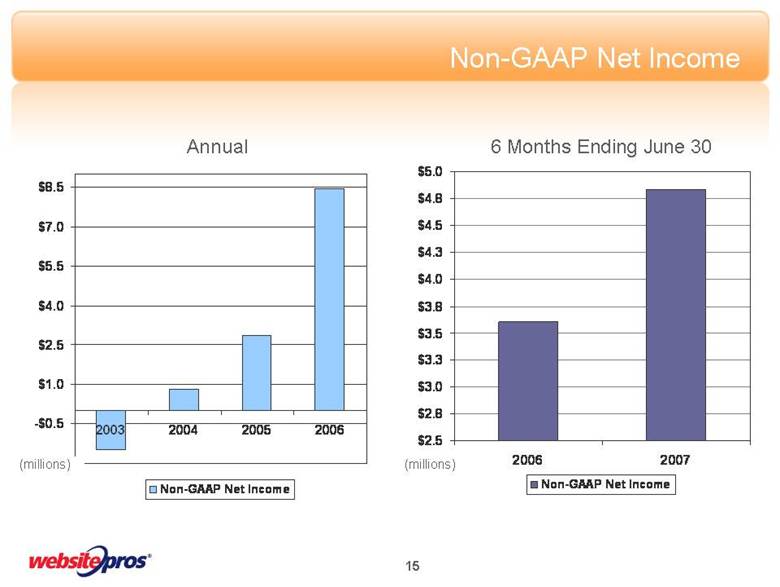

| Safe-Harbor Statement This presentation includes forward-looking statements, including those regarding the proposed acquisition of Web.com by Website Pros and the anticipated reach, capabilities and opportunities for the combined company, future products and services, expected benefits to merchants and other customers, market opportunities, expected customer base, and the anticipated closing of the transaction. These statements are based on certain assumptions and reflect our current expectations. Statements including words such as "anticipate," "propose," "estimate," "believe" or "expect" and statements in the future tense are forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause the actual results, performance or achievements to differ materially from any future results, performance, or achievements discussed or implied by such forward-looking statements. Some of the factors that could cause results to differ materially from the expectations expressed in these forward-looking statements include the following: the risk that the proposed transaction may not be completed in a timely manner, if at all; disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers; risks related to the successful offering of the combined company's products and services; the risk that the anticipated benefits of the merger may not be realized; and other risks that may impact Website Pros’ and Web.com’s businesses, some of which are discussed in the companies' reports filed with the Securities and Exchange Commission (the "SEC") under the caption "Risks That Could Affect Future Results" or "Risk Factors" and elsewhere, including, without limitation, each of Website Pros’ and Web.com’s 10-Ks for the year ended December 31, 2006 and 10-Q’s for the quarter ended March 31, 2007. Copies of Website Pros’ and Web.com’s filings with the SEC can be obtained on their websites, or at the SEC's website at www.sec.gov. You can also obtain Website Pros’ report through its website at http://www.websitepros.com and Web.com’s reports through its website at http://www.web.com . Any forward-looking statement is qualified by reference to these risks, uncertainties and factors. If any of these risks or uncertainties materializes, the acquisition may not be consummated, the potential benefits of the acquisition may not be realized, the operating results of Website Pros and Web.com could suffer, and actual results could differ materially from the expectations described in these forward-looking statements. Forward-looking statements speak only as of the date of the document in which they are made. These risks, uncertainties and factors are not exclusive, and Website Pros and Web.com undertake no obligation to publicly update or revise any forward-looking statements to reflect events or circumstances that may arise after the date of this presentation. Reconciliations of financial metrics Adjusted net income from continuing operations is a non-GAAP financial measure and is defined as net income from continuing operations excluding interest income or expense, provision for income taxes, depreciation, amortization of intangibles, stock-based compensation, and fair value adjustment to purchased deferred revenue. A reconciliation of this non-GAAP measure to the GAAP measure, net income, can be found in our earnings release dated August 1, 2007. Subscriber Acquisition Cost “SAC” is calculated as the cost of media spent during the period divided by gross subscriber addition during the period. Average Revenue Per User “ARPU” is calculated using the GAAP revenue for the quarter reported divided by the average number of subscribers for the period. Churn is calculated as the number of subscribers cancelled during the period divided by the sum of the number of subscribers at the beginning of the period and the gross number of subscribers added during the period. |