UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF

THE SECURITIES EXCHANGE ACT OF 1934 (AMENDMENT NO. )

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

| Check the appropriate box: |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

| Web.com Group, Inc. |

(Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | |

| | (4) | |

WEB.COM GROUP, INC.

12808 Gran Bay Parkway West Jacksonville, Florida 32258

NOTICE OF 2009 ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 6, 2009

Dear Stockholder:

You are cordially invited to attend the 2009 Annual Meeting of Stockholders of WEB.COM GROUP, INC., a Delaware corporation (the “Company”). The meeting will be held on May 6, 2009 at 10:30 a.m. local time, at the Company’s offices located at 12808 Gran Bay Parkway West, Jacksonville, Florida 32258 for the following purposes:

| 1. | To elect two directors to hold office until the 2012 Annual Meeting of Stockholders. |

| 2. | To ratify the selection of Ernst & Young LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2009. |

| 3. | To conduct any other business properly brought before the meeting. |

These items of business are more fully described in the Proxy Statement accompanying this Notice.

The record date for the annual meeting is March 20, 2009. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

By Order of the Board of Directors Matthew P. McClure Secretary |

Jacksonville, Florida

April 6, 2009

You are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the enclosed proxy, or vote over the telephone or the Internet as instructed in these materials, as promptly as possible in order to ensure your representation at the meeting. A return envelope (which is postage prepaid if mailed in the United States) is enclosed for your convenience. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

WEB.COM GROUP, INC.

12808 Gran Bay Parkway West

Jacksonville, Florida 32258

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

May 6, 2009

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why am I receiving these materials?

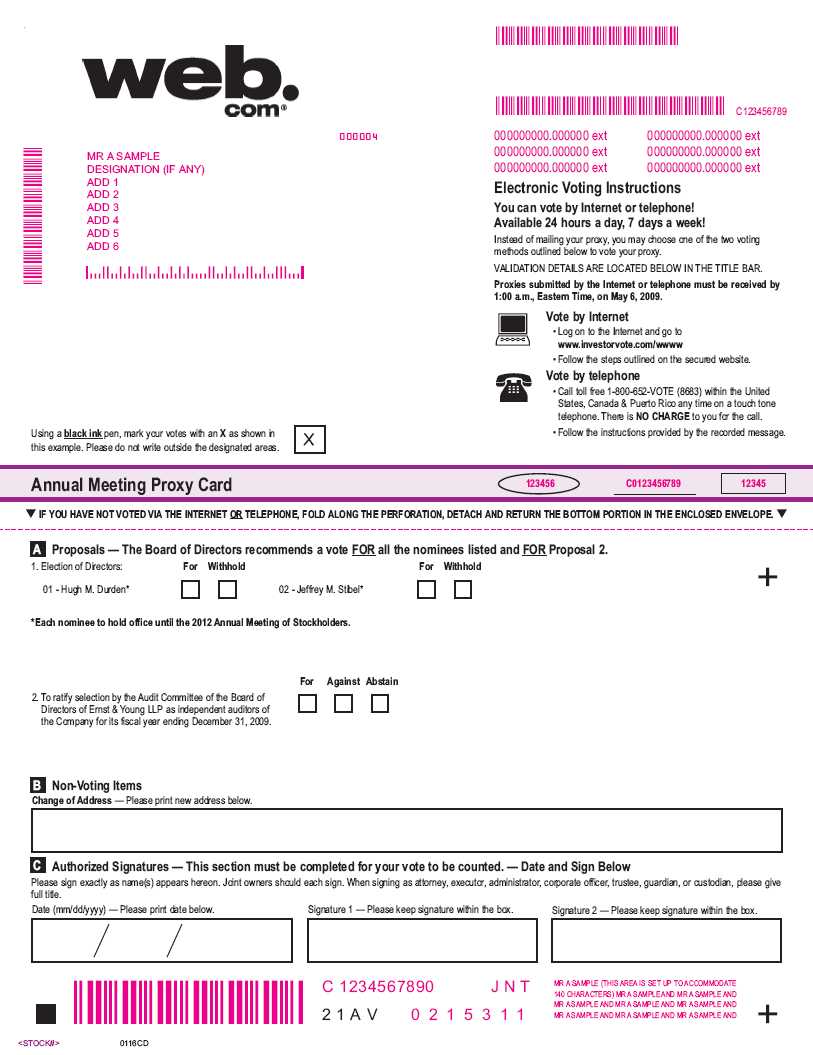

We sent you this proxy statement and the enclosed proxy card because the Board of Directors of WEB.COM GROUP, INC. (sometimes referred to as the “Company” or “Web.com”) is soliciting your proxy to vote at the 2009 Annual Meeting of Stockholders. You are invited to attend this annual meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or follow the instructions below to submit your proxy over the telephone or on the Internet.

The Company intends to mail this proxy statement and accompanying proxy card on or about April 6, 2009 to all stockholders of record entitled to vote at the annual meeting.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on March 20, 2009 will be entitled to vote at the annual meeting. On this record date, there were 26,371,125 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on March 20, 2009 your shares were registered directly in your name with the Company’s transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card or vote by proxy over the telephone or on the Internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on March 20, 2009 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are two matters scheduled for a vote:

• Election of two directors; and

• Ratification of Ernst & Young LLP as the independent registered public accounting firm of the Companyfor its fiscal year ending December 31, 2009.

How do I vote?

You may either vote “For” all the nominees to the Board of Directors or you may “Withhold” your vote for any nominee you specify. You may vote “For” or “Against,” or abstain from voting with respect to, the ratification of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal year ending December 31, 2009. The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the annual meeting, vote by proxy using the enclosed proxy card, vote by proxy over the telephone, or vote by proxy on the Internet. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person if you have already voted by proxy.

| | • | To vote in person, come to the annual meeting and we will give you a ballot when you arrive. |

| | • | To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct. |

| | • | To vote over the telephone, dial toll-free 1-800-652-VOTE (8683) using a touch-tone phone and follow the recorded instructions. You will be asked to provide your holder account number and proxy access number from the enclosed proxy card. Your vote must be received by 1:00 a.m. Eastern time on May 6, 2009 to be counted. |

| | • | To vote on the Internet, go to www.investorvote.com to complete an electronic proxy card. You will be asked to provide your holder account number and proxy access number from the enclosed proxy card. Your vote must be received by 1:00 a.m. Eastern time on May 6, 2009 to be counted. |

| | Beneficial Owner: Shares Registered in the Name of Broker or Bank |

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from Web.com. Simply complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may vote by telephone or over the Internet as instructed by your broker or bank. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

How many votes do I have?

You have one vote for each share of common stock you own as of the close of business on March 20, 2009.

What if I return a proxy card but do not make specific choices?

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted “For” the election of all two nominees and “For” the ratification of Ernst & Young LLP as the independent registered public accounting firm for the fiscal year ending December 31, 2009. If any other matter is properly presented at the meeting, your proxy (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

The Company will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, the Company’s directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. The Company may also reimburse brokerage firms, banks, and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of three ways:

• You may submit another properly completed proxy card with a later date.

• You may send a written notice that you are revoking your proxy to Web.com’s Secretary at 12808 Gran Bay Parkway West, Jacksonville, Florida 32258.

• You may attend the annual meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy.

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by November 6, 2009 to the Secretary of Web.com at 12808 Gran Bay Parkway West, Jacksonville, Florida 32258.

A stockholder nomination for director or a proposal that will not be included in next year’s proxy materials, but that a stockholder intends to present in person at next year’s annual meeting, must comply with the notice, information and consent provisions contained in the Company’s Bylaws. In part, the Bylaws provide that to timely submit a proposal or nominate a director you must do so by submitting the proposal or nomination in writing, to the Company’s Secretary at the Company’s principal executive offices no later than the close of business on February 5, 2010 (90 days prior to the first anniversary of the 2009 Annual Meeting Date) nor earlier than the close of business on January 6, 2010 (120 days prior to the first anniversary of the 2009 Annual Meeting date). In the event that the Company sets an annual meeting date for 2010 that is not within 30 days before or after the anniversary of the 2009 Annual Meeting date, notice by the stockholder must be received no later than the close of business on the 120th day prior to the 2010 Annual Meeting and not later than the close of business on the later of the 90th day prior to the 2009 Annual Meeting or the 10th day following the day on which public announcement of the date of the 2010 Annual Meeting is first made. The Company’s Bylaws contain additional requirements to properly submit a proposal or nominate a director. If you plan to submit a proposal or nominate a director, please review the Company’s Bylaws carefully. You may obtain a copy of the Company’s Bylaws by mailing a request in writing to the Secretary of Web.com at 12808 Gran Bay Parkway West, Jacksonville, Florida 32258.

How are votes counted?

Votes will be counted by the inspector of elections appointed for the meeting, who will separately count “For” and “Withhold” and, with respect to proposals other than the election of directors, “Against” votes, abstentions and broker non-votes. Abstentions will be counted towards the vote total for each proposal and will have the same effect as “Against” votes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

If your shares are held by your broker as your nominee (that is, in “street name”), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. Discretionary items are proposals considered routine under the rules of the New York Stock Exchange (“NYSE”) on which your broker may vote shares held in street name in the absence of your voting instructions. On non-discretionary items for which you do not give your broker instructions, the shares will be treated as broker non-votes.

How many votes are needed to approve each proposal?

| | • | For the election of directors, the two nominees receiving the most “For” votes (among votes properly cast in person or by proxy) will be elected. Only votes “For” or “Withheld” will affect the outcome. |

| | • | To be approved, Proposal 2—Ratification of Ernst & Young LLP as independent registered public accounting firm for the Company for its fiscal year ending December 31, 2009 must receive a “For” vote from the majority of shares present and entitled to vote either in person or by proxy. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if a majority of the shares outstanding on the record date are represented by stockholders present at the meeting or by proxy. On the record date, there were 26,371,125 shares outstanding and entitled to vote. Thus at least 13,185,562 shares must be represented by stockholders present at the meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, either the chairman of the meeting or a majority of the votes present at the meeting may adjourn the meeting to another date.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. Final voting results will be published in the Company’s quarterly report on Form 10-Q for the second quarter of 2009.

How can I access the proxy statement and annual report?

A copy of the Company’s 2009 Proxy Statement and Annual Report is available without charge at http://www.vfnotice.com/web.com/ or by mail upon written request to: Secretary, Web.com Group, Inc., 12808 Gran Bay Parkway West, Jacksonville, Florida 32258.

PROPOSAL 1

ELECTION OF DIRECTORS

Web.com’s Board of Directors is divided into three classes. Each class consists, as nearly as possible, of one-third of the total number of directors, and each class has a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class shall serve for the remainder of the full term of that class, and until the director’s successor is elected and qualified or until the director’s death, resignation or removal. This includes vacancies created by an increase in the number of directors.

As of April 6, 2009, the Board of Directors has seven members. There are two directors in the class whose term of office expires in 2009. Mr. Durden, an outside director, was appointed to the Board of Directors in January 2006. Mr. Stibel was appointed to the Board of Directors in September 2007, in connection with the Company’s acquisition of Web.com, Inc. If elected at the annual meeting, each of these nominees would serve until the 2012 annual meeting and until his successor is elected and has qualified, or until the director’s death, resignation or removal.

It is the Company’s policy to encourage directors and nominees for director to attend the annual meeting, and four directors attended the Company’s 2008 Annual Meeting.

The following is a brief biography of the nominees for election at the 2009 Annual Meeting and each director whose term will continue after the annual meeting.

NOMINEES FOR ELECTION FOR A THREE-YEAR TERM EXPIRING AT THE 2012 ANNUAL MEETING

Hugh M. Durden, age 66, has served as a member of the Company’s Board of Directors since January 2006. Mr. Durden is currently Chairman of the Alfred I. DuPont Testamentary Trust, and Chairman of the Board of Directors of the St. Joe Company, a NYSE listed real estate development company, since 2000. He is also Chairman of the Investment Committee for the EARTH University Endowment Trust. From January 1994 until December 2000, Mr. Durden served as President of Wachovia Corporate Services, and Executive Vice President of Wachovia Corporation, a banking corporation. Mr. Durden holds a B.A. degree from Princeton University and an M.B.A. from the Freeman School of Business at Tulane University.

Jeffrey M. Stibel, age 35, has served as a member of the Company’s Board of Directors since September 30, 2007, when he also assumed the role of President. From August 2005 until joining the Company, Mr. Stibel was the President and Chief Executive Officer of Interland and Web.com, Inc. and a member of its board of directors. From August 2000 to August 2005, Mr. Stibel was part of the founding management team at United Online, Inc., a NASDAQ listed company. Mr. Stibel currently serves on the board of directors for Autobytel, a NASDAQ listed company and several private companies, including The Search Agency, an Internet company, and EdgeCast Networks, Inc., an Internet company. He also serves on the Board of Brown University’s Entrepreneurship Program and Tufts University’s Gordon Center for Leadership. Mr. Stibel received a Master’s degree from Brown University and studied business and brain science at MIT’s Sloan School of Management and at Brown University, where he was a Brain and Behavior Fellow.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF EACH NAMED NOMINEE.

DIRECTORS CONTINUING IN OFFICE UNTIL THE 2010 ANNUAL MEETING

Julius Genachowski, age 46, has served as a member of the Company’s Board of Directors since January 2006. He is co-founder of LaunchBox Digital, an investment firm, co-founder and managing director of Rock Creek Ventures, a venture capital firm, and a special advisor at General Atlantic. From 1997 until 2005, Mr. Genachowski served in senior executive positions at IAC/InterActiveCorp, a NASDAQ listed e-commerce and media company. His positions at IAC included Chief of Business Operations, General Counsel and member of the Office of the Chairman. Prior to joining IAC, Mr. Genachowski served as Chief Counsel to the Chairman of the Federal Communications Commission. Prior to joining the FCC, he served as a law clerk to U.S. Supreme Court Justice David H. Souter and, before that, to retired U.S. Supreme Court Justice William J. Brennan, Jr., and to Chief Judge Abner J. Mikva of the U.S. Court of Appeals for the D.C. Circuit. He has served as an aide to U.S. Senator (then Representative) Charles E. Schumer, and to the House Iran-Contra Committee. Mr. Genachowski holds a B.A. degree from Columbia University and a J.D. degree from Harvard Law School.

Robert S. McCoy, Jr., age 70, has served as a member of the Company’s Board of Directors since March 2007. Since November 2003, Mr. McCoy has been a director of Krispy Kreme Doughnuts, Inc., a NYSE listed food company, and is currently the Chairman of its Audit and a member of its Governance Committee. Mr. McCoy has been a director of MedCath Corporation since October 2003 and is currently the Chairman of its Audit and Governance and Nominating Committee, and a member of its Compensation Committee. Mr. McCoy retired in September 2003 as Vice Chairman and Chief Financial Officer of Wachovia Corporation, a diversified financial services company, where he had been a senior executive officer since 1991.

DIRECTORS CONTINUING IN OFFICE UNTIL THE 2011 ANNUAL MEETING

David L. Brown, age 55, has served as the Company’s Chief Executive Officer since August 2000; as President of the Company from August 1999 to March 2000 and again from August 2000 to September 2007; and as a director since August 1999. From March 2000 until August 2000, Mr. Brown was employed by Atlantic Partners Group, a private equity firm. Prior to joining the Company, Mr. Brown was the founder of Atlantic Teleservices, a technology services company, and served as its Chief Executive Officer from 1997 until its acquisition by the Company in August 1999. Mr. Brown holds a B.A. degree from Harvard University.

Timothy I. Maudlin, age 58, has served as a member of the Company’s Board of Directors since February 2002 and was appointed Lead Director in January 2007. Mr. Maudlin served as a managing partner of Medical Innovation Partners, a venture capital firm from 1989 through 2007 and President of its management company from 1985. He has served as a director of Sucampo Pharmaceuticals, Inc., a NASDAQ listed pharmaceutical company since September 2006, and is currently a member of its Audit Committee and its Nominating and Corporate Governance Committee. Mr. Maudlin also serves on the board of directors of five private companies. Beginning in 1984 until June 2006, Mr. Maudlin served on the Board of Directors of Curative Health Services, Inc., a biopharmaceutical company, and from February 2005 until June 2006, Mr. Maudlin served as its Chairman. In March 2006, Curative filed a voluntary petition for bankruptcy under Chapter 11 and in June 2006, it emerged from bankruptcy. He is a certified public accountant and holds a B.A. degree from St. Olaf College and a Masters in Management degree from Kellogg School of Management at Northwestern University.

Alex Kazerani, age 36, has served as a member of the Company’s Board of Directors since September 2007. From August 2005 until joining the Company’s Board of Directors, Mr. Kazerani served on Web.com’s, Inc. board of directors. Mr. Kazerani is currently Chief Executive Officer of EdgeCast Networks Inc., where he has served since August 2006. Prior to co-founding EdgeCast, he was the Chairman and Chief Executive Officer of KnowledgeBase.net, a hosted enterprise knowledge management company with many Fortune 1000 customers, which he started in 2001. Mr. Kazerani earned a B.A. degree in International Relations and Economics from Tufts University.

INDEPENDENCE OF THE BOARD OF DIRECTORS

As required under The NASDAQ Global Market (“Nasdaq”) listing standards, a majority of the members of a listed company’s Board of Directors must qualify as “independent,” as affirmatively determined by the Board of Directors. The Board consults with the Company’s counsel to ensure that the Board’s determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of Nasdaq, as in effect from time to time.

Consistent with these considerations, after review of all relevant transactions or relationships between each director, or any of his or her family members, and the Company, its senior management and its independent registered public accounting firm, the Board affirmatively has determined that the following directors are independent directors within the meaning of the applicable Nasdaq listing standards: Mr. Durden, Mr. Genachowski, Mr. Kazerani, Mr. Maudlin, and Mr. McCoy. In making this determination, the Board found that none of the independent directors or nominees for director has a material or other disqualifying relationship with the Company. Mr. Brown, the Chief Executive Officer of the Company, and Mr. Stibel, the President of the Company, are not independent directors.

INFORMATION REGARDING THE BOARD OF DIRECTORS AND ITS COMMITTEES

On January 25, 2007, the Board of Directors documented the governance practices followed by the Company by adopting Corporate Governance Principles to assure that the Board will have the necessary authority and practices in place to review and evaluate the Company’s business operations as needed and to make decisions that are independent of the Company’s management. The principles are also intended to align the interests of directors and management with those of the Company’s stockholders. The Corporate Governance Principles set forth the practices the Board will follow with respect to board composition and selection, board meetings and involvement of senior management, Chief Executive Officer performance evaluation and succession planning, and board committees and compensation. The Corporate Governance Principles were adopted by the Board to, among other things, reflect changes to the Nasdaq listing standards and Securities and Exchange Commission rules adopted to implement provisions of the Sarbanes-Oxley Act of 2002. The Corporate Governance Principles, as well as the charters for each committee of the Board, may be viewed at http://ir.web.com/documents.cfm.

As required under applicable Nasdaq listing standards, in the fiscal year ended December 31, 2008, the Company’s independent directors met 7 times in regularly scheduled executive sessions at which only independent directors were present. Mr. Maudlin, Lead Director and chairman of the Audit Committee, presided over the executive sessions. Persons interested in communicating with the independent directors with their concerns or issues may address correspondence to a particular director, or to the independent directors generally, in care of Web.com at 12808 Gran Bay Parkway West, Jacksonville, Florida 32258. If no particular director is named, letters will be forwarded, depending on the subject matter, to the Chairman of the Audit, Compensation, or Nominating and Corporate Governance Committee.

The Board has three committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The following table provides the current membership and the meeting information for the fiscal year ended December 31, 2008 for each of the Board committees:

| Name | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee |

| Hugh M. Durden | x | | x* |

| Julius Genachowski | x | x* | x |

| Alex Kazerani | | | x |

| Timothy I. Maudlin | x* | x | |

| Robert S. McCoy, Jr. | x | x | |

| Total meetings in fiscal year 2008 | 7 | 9 | 1 |

* Committee Chairperson.

Below is a description of each committee of the Board of Directors. The Board of Directors has determined that each member of each committee meets the applicable rules and regulations regarding “independence” and that each member is free of any relationship that would interfere with his or her individual exercise of independent judgment with regard to the Company.

AUDIT COMMITTEE

The Audit Committee of the Board of Directors oversees the Company’s corporate accounting and financial reporting process. For this purpose, the Audit Committee performs several functions. The Audit Committee evaluates the performance of and assesses the qualifications of the independent registered public accounting firm; determines and approves the engagement of the independent registered public accounting firm; determines whether to retain or terminate the existing independent registered public accounting firm or to appoint and engage a new independent registered public accounting firm; reviews and approves the retention of the independent registered public accounting firm to perform any proposed permissible non-audit services; monitors the rotation of partners of the independent registered public accounting firm on the Company’s audit engagement team as required by law; confers with management and the independent registered public accounting firm regarding the effectiveness of internal controls over financial reporting; establishes procedures, as required under applicable law, for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters; and meets to review the company’s annual audited financial statements and quarterly financial statements with management and the independent auditor, including reviewing the Company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operation” set forth in the Company’s quarterly reports on Form 10-Q and annual report on Form 10-K. In the fiscal year ended December 31, 2008, the Audit Committee met four times in executive session with the Company’s independent auditor.

The Audit Committee charter can be found on the Company’s corporate website at http://ir.web.com/documents.cfm. The Board of Directors annually reviews the Nasdaq listing standards definition of independence for Audit Committee members and has determined that all members of the Company’s Audit Committee are independent (as required by Rule 4350(d)(2)(A)(i) and (ii) of the Nasdaq listing standards). The Board of Directors has determined that Mr. Maudlin qualifies as an “audit committee financial expert,” as defined in applicable SEC rules. The Board made a qualitative assessment of Mr. Maudlin’s level of knowledge and experience based on a number of factors, including his formal education and experience as an audit manager with Arthur Andersen and as a chief financial officer.

COMPENSATION COMMITTEE

The Compensation Committee of the Board of Directors reviews and approves the overall compensation policies, plans and programs for the Company. The Compensation Committee reviews and approves corporate performance goals and objectives relevant to the compensation of the Company’s independent directors, executive officers and other senior management; determines and approves the compensation and other terms of employment of the Company’s Chief Executive Officer; reviews and approves the compensation and other terms of employment of the other executive officers; administers the Company’s stock option and purchase plans, pension and profit sharing plans, stock bonus plans, deferred compensation plans and other similar programs; and reviews succession planning for executive positions. Commencing this year, the Compensation Committee also began to review with management the Company’s Compensation Discussion and Analysis and to consider whether to recommend that it be included in proxy statements and other filings. The Compensation Committee charter can be found on the Company’s corporate website at http://ir.web.com/documents.cfm. All members of the Company’s Compensation Committee are independent (as independence is currently defined in Rule 4200(a)(15) of the Nasdaq listing standards).

The Compensation Committee meets regularly in executive session. In addition, various members of management and other employees as well as outside advisors or consultants are invited by the Compensation Committee to make presentations, provide financial or other background information or advice or otherwise participate in Compensation Committee meetings. The Chief Executive Officer may not participate in or be present during any deliberations or determinations of the Compensation Committee regarding his compensation or individual performance objectives. The charter of the Compensation Committee grants the Compensation Committee full access to all books, records, facilities and personnel of the Company, as well as authority to obtain, at the expense of the Company, advice and assistance from internal and external legal, accounting or other advisors and consultants and other external resources that the Compensation Committee considers necessary or appropriate in the performance of its duties. In particular, the Compensation Committee has the authority to retain compensation consultants to assist in its evaluation of executive and director compensation, including the sole authority to approve the consultant’s reasonable fees and other retention terms. During 2008, the Compensation Committee met six times in executive session.

In connection with setting executive compensation for fiscal 2008, the Compensation Committee engaged the PRM Consulting Group (“PRM”), an independent compensation consulting firm, to evaluate the Company’s existing compensation strategy and practices in supporting and reinforcing the Company’s long-term strategic goals and to assist in refining the Company’s compensation strategy. As part of its engagement, PRM developed a comparative group of companies and performed analyses of competitive performance and compensation levels for that group.

Under its charter, the Compensation Committee may form and delegate authority to subcommittees as appropriate, including, but not limited to, a subcommittee composed of one or more members of the Board to grant stock awards under the Company’s equity incentive plans to persons who are not (a) “Covered Employees” under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”); (b) individuals with respect to whom the Company wishes to comply with Section 162(m) of the Code or (c) then subject to Section 16 of the Exchange Act. Prior to October 26, 2006, the Compensation Committee had delegated authority to the Chief Executive Officer to grant options under the Company’s 2005 Equity Incentive Plan in amounts not exceeding 5,000 shares per grant. In 2006, the Chief Executive Officer exercised this authority to grant options covering a total of 36,400 shares. On October 26, 2006, in order to implement best practices regarding equity grants the Compensation Committee withdrew this authority and determined that the Compensation Committee would act on all awards under the 2005 Equity Incentive Plan, at its regularly scheduled meetings.

Historically, the Compensation Committee has made most significant adjustments to annual compensation, determined bonus and equity awards and established new performance objectives at one or more meetings held during the first quarter of the year. However, the Compensation Committee also considers matters related to individual compensation as necessary throughout the year. For executives other than the Chief Executive Officer, the Compensation Committee solicits and considers evaluations and recommendations submitted to the Compensation Committee by the Chief Executive Officer. In the case of the Chief Executive Officer, the evaluation of his performance is conducted by the Compensation Committee, which determines any adjustments to his compensation as well as awards to be granted. For all executives and directors, as part of its deliberations, the Compensation Committee may review and consider materials such as financial reports and projections, operational data, tax and accounting information, tally sheets that set forth the total compensation that may become payable to executives in various hypothetical scenarios, executive and director stock ownership information, company stock performance data, analyses of historical executive compensation levels and current Company-wide compensation levels, and recommendations of the Compensation Committee’s independent compensation consultant, including analyses of executive and director compensation paid at other companies identified by the compensation consulting firm.

The specific determinations with respect to executive compensation for fiscal 2009 are described in greater detail in the Compensation Discussion and Analysis section of this Proxy Statement.

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE

The Nominating and Corporate Governance Committee of the Board of Directors is responsible for identifying, reviewing and evaluating candidates to serve as directors of the Company, reviewing and evaluating incumbent directors, recommending to the Board for selection candidates for election to the Board of Directors, making recommendations to the Board regarding the membership of the committees of the Board, assessing the performance of the Board and developing a set of corporate governance principles for the Company. The Nominating and Corporate Governance Committee charter can be found on the Company’s corporate at http://ir.web.com/documents.cfm. All members of the Nominating and Corporate Governance Committee are independent (as independence is currently defined in Rule 4200(a)(15) of the Nasdaq listing standards).

The Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including being able to read and understand basic financial statements, being over 21 years of age and having the highest personal integrity and ethics. The Nominating and Corporate Governance Committee also intends to consider such factors as possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of the Company, demonstrated excellence in his or her field, having the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of the Company’s stockholders. However, the Nominating and Corporate Governance Committee retains the right to modify these qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition of the Board, the operating requirements of the Company and the long-term interests of stockholders. In conducting this assessment, the Nominating and Corporate Governance Committee considers diversity, age, skills, and such other factors as it deems appropriate given the current needs of the Board and the Company, to maintain a balance of knowledge, experience and capability. During 2008, the Nominating Committee met one time in executive session.

In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee reviews such directors’ overall service to the Company during their term, including the number of meetings attended, level of participation, quality of performance, and any other relationships and transactions that might impair such directors’ independence. In the case of new director candidates, the Nominating and Corporate Governance Committee also determines whether the nominee must be independent for Nasdaq purposes, which determination is based upon applicable Nasdaq listing standards, applicable SEC rules and regulations and the advice of counsel, if necessary. The Nominating and Corporate Governance Committee then uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. The Nominating and Corporate Governance Committee meets to discuss and consider such candidates’ qualifications and then selects a nominee for recommendation to the Board by majority vote. To date, the Nominating and Corporate Governance Committee has not paid a fee to any third party to assist in the process of identifying or evaluating director candidates. To date, the Nominating and Corporate Governance Committee has not rejected a timely director nominee from a stockholder or stockholders holding more than 5% of the Company’s voting stock.

At this time, the Nominating and Corporate Governance Committee does not consider director candidates recommended by stockholders. The Nominating and Corporate Governance Committee believes that it is in the best position to identify, review, evaluate and select qualified candidates for Board membership, based on the comprehensive criteria for Board membership approved by the Board.

COMPENSATION OF DIRECTORS

The Company pays a quarterly retainer to its directors as follows:

Position | | Quarterly Retainer ($) |

| Non-Employee, Non-Chair Board Member | | 4,000 |

| Audit Committee Chair | | 5,000 |

| Compensation Committee Chair | | 4,500 |

| Nominating and Corporate Governance Committee Chair | | 4,250 |

The Company pays per meeting fees of $1,500 for Tier I meetings and $750 for Tier II meetings. The determination of Tier I and II meetings is at the discretion of the Chairman of the Board of Directors and is primarily based on the items to be reviewed and/or acted at the meeting. The members of the Board of Directors are also eligible for reimbursement for their expenses incurred in attending Board and committee meetings in accordance with Company policy.

Based on the data provided by of PRM, in October 2008, the Company began compensating Mr. Maudlin for his services as Lead Director, with an additional fee of $8,000 per year, starting with the fourth quarter in 2008.

During 2008, each non-employee director of the Company also received stock option grants under the 2005 Non-Employee Directors’ Stock Option Plan (the “2005 Directors Plan”). Only non-employee directors of the Company are eligible to receive options under the 2005 Directors Plan. Options granted under the 2005 Directors Plan are intended by the Company not to qualify as incentive stock options under the Internal Revenue Code.

During the last completed fiscal year, the Company granted under the 2005 Directors Plan 4,250 shares of restricted stock to each non-employee director, and the following options to purchase 10,500 shares of common stock to Mr. Durden, Chairman of the Nominating and Corporate Governance Committee; options to purchase 11,500 shares of common stock to Mr. Genachowski, Chairman of the Compensation Committee; options to purchase 8,500 shares of common stock to Mr. Kazerani; options to purchase 13,500 shares of common stock to Mr. Maudlin, Chairman of the Audit Committee; and options to purchase 8,500 shares of common stock to Mr. McCoy, in each case, immediately following the 2008 Annual Meeting of Stockholders, at an exercise price per share of $8.74, the fair market value of such shares on the date of grant. The shares subject to such options vest in a series of 12 successive monthly installments measured from the date of grant, and the shares of restricted stock vest on the first anniversary of the date of grant. As of March 20, 2009 no options had been exercised under the 2005 Directors Plan. Also, in October 2008 and upon the data provided by PRM, Mr. Maudlin, for his services as Lead Director, was granted an additional grant of 375 shares of restricted stock, and an additional option to purchase 1,000 of common stock pursuant to the 2008 Equity Incentive Plan.

The following table provides information for fiscal 2008 compensation for non-employee directors who served during fiscal 2008:

| Name | Fees Earned or Paid in Cash | Stock Awards(1) | Option Awards(1) | Total |

| | | | | |

Hugh M. Durden (2) | $81,237.50 $82,987.50 $50,496.40 $90,987.50 $79,487.50 | $ 36,644 $ 36,444 $ 78,155 $ 36,644 $ 36,644 | $129,108 $132,937 $ 54,683 $128,807 $ 95,991 | $246,989.50 $252,568.50 $183,334.40 $256,438.50 $212,122.50 |

Julius Genachowski (3) |

Alex Kazerani (4) |

Timothy I. Maudlin (5) |

Robert S. McCoy, Jr. (6) |

| (1) | The amounts shown reflect the dollar amount recognized for financial statement reporting purposes for the fiscal year ended December 31, 2008, in accordance with FAS 123(R) and thus includes amounts from awards granted prior to 2007. Assumptions used in the calculation of this | amount are included in Footnote 11 to the Company’s audited financial statements for the fiscal year ended December 31, 2008, included in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 6, 2009. |

| (2) | Includes an option to purchase 40,000 shares of common stock granted on January 17, 2006 with a grant date fair value (as calculated under FAS 123R for financial reporting purposes) of $88,897; an option to purchase 10,500 shares of common stock granted on May 8, 2007 with a grant date fair value (as calculated under FAS 123R for financial reporting purposes) of $31,154; an option to purchase 10,500 shares of common stock granted on May 13, 2008 with a grant date fair value (as calculated under FAS 123R for financial reporting purposes) of $36,519; 4,250 shares of restricted common stock granted on May 8, 2007 with a grant date fair value (as calculated under FAS 123R for financial reporting purposes) of $23,978; and 4,250 shares of restricted common stock granted on May 13, 2008 with a grant fair value (as calculated under FAS 123R for financial reporting purposes) of $37,145. As of December 31, 2008, Mr. Durden had options outstanding to purchase 65,512 shares of common stock. |

| (3) | Includes an option to purchase 40,000 shares of common stock granted on January 17, 2006 with a grant date fair value (as calculated under FAS 123R for financial reporting purposes) of $88,897; an option to purchase 11,500 shares of common stock granted on May 8, 2007 with a grant date fair value (as calculated under FAS 123R for financial reporting purposes) of $34,124; an option to purchase 11,500 shares of common stock granted on May 13, 2008 with a grant date fair value (as calculated under FAS 123R for financial reporting purposes) of $39,997; 4,250 shares of restricted common stock granted on May 8, 2007 with a grant date fair value (as calculated under FAS 123R for financial reporting purposes) of $23,978; and 4,250 shares of restricted common stock granted on May 13, 2008 with a grant fair value (as calculated under FAS 123R for financial reporting purposes) of $37,145. As of December 31, 2008, Mr. Genachowski had options outstanding to purchase 67,096 shares of common stock. |

| (4) | Includes an option to purchase 25,000 shares of common stock granted on September 30, 2007 with a grant date fair value (as calculated under FAS 123R for financial reporting purposes) of $11,092; an option to purchase 8,500 shares of common stock granted on May 13, 2008 with a grant date fair value (as calculated under FAS 123R for financial reporting purposes) of $29,563; 12,500 shares of restricted common stock granted on September 30, 2007 with a grant date fair value (as calculated under FAS 123R for financial reporting purposes) of $10,986; and 4,250 shares of restricted common stock granted on May 13, 2008 with a grant date fair value (as calculated under FAS 123R for financial reporting purposes) of $37,145. As of December 31, 2008, Mr. Kazerani had options outstanding to purchase 15,374 shares of common stock. |

| (5) | Includes an option to purchase 40,000 shares of common stock granted on November 7, 2005 with a grant date fair value (as calculated under FAS 123R for financial reporting purposes) of $90,340; an option to purchase 13,500 shares of common stock granted on May 8, 2007 with a grant date fair value (as calculated under FAS 123R for financial reporting purposes) of $40,057; an option to purchase 13,500 shares of common stock granted on May 13, 2008 with a grant date fair value (as calculated under FAS 123R for financial reporting purposes) of $46,953; 4,250 shares of restricted common stock granted on May 8, 2007 with a grant date fair value (as calculated under FAS 123R for financial reporting purposes) of $23,978; 4,250 shares of restricted common stock granted on May 13, 2008 with a grant date fair value (as calculated under FAS 123R for financial reporting purposes) of $37,145; 1,000 shares of common stock granted on October 30, 2008 with a grant date fair value (as calculated under FAS 123R for financial reporting purposes) of $2,112; and 375 shares of restricted stock granted on October 30, 2008 with a grant date fair value (as calculated under FAS 123R for financial reporting purposes) of $551. As of December 31, 2008, Mr. Maudlin had options outstanding to purchase 61,374 shares of common stock. |

| (6) | Includes an option to purchase 40,000 shares of common stock granted on March 28, 2007 with a grant date fair value (as calculated under FAS 123R for financial reporting purposes) of $48,087; an option to purchase 8,500 shares of common stock granted on May 8, 2007 with a grant date fair value (as calculated under FAS 123R for financial reporting purposes) of $25,221; an option to purchase 8,500 shares of common stock granted on May 13, 2008 with a grant date fair value (as calculated under FAS 123R for financial reporting purposes) of $29,563; 4,250 shares of restricted common stock granted on May 8, 2007 with a grant date fair value (as calculated under FAS 123R for financial reporting purposes) of $23,978; and 4,250 shares of restricted common stock granted on May 13, 2008 with a grant date fair value (as calculated under FAS 123R for financial reporting purposes) of $37,145. As of December 31, 2008, Mr. McCoy had options outstanding to purchase 36,791 shares of common stock. |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

From January 1, 2008, through December 31, 2008, the Compensation Committee consisted of Messrs. Genachowski (Chair), Maudlin and McCoy. No member of the Compensation Committee is an officer or employee of the Company, and none of the Company’s executive officers serve as a member of a compensation committee of any entity that has one or more executive officers serving as a member of the Company’s Compensation Committee. Each of the Company’s directors holds Web.com’s securities as set forth under the heading “Security Ownership of Certain Beneficial Owners and Management.”

MEETINGS OF THE BOARD OF DIRECTORS

The Board of Directors met nine times during the last fiscal year. Each incumbent Board member attended 75% or more of the aggregate of the meetings of the Board and of the committees on which he served, held during the period for which he was a director or committee member, respectively.

STOCKHOLDER COMMUNICATIONS WITH THE BOARD OF DIRECTORS

The Company’s Board has adopted a formal process by which stockholders may communicate with the Board or any of its directors. Stockholders who wish to communicate with the Board may do so by sending written communications addressed to the Secretary of Web.com at 12808 Gran Bay Parkway West, Jacksonville, Florida 32258. All communications will be compiled by the Secretary of the Company and submitted to the Board or the individual directors on a periodic basis. These communications will be reviewed by one or more employees of the Company designated by the Board, who will determine whether they should be presented to the Board. The purpose of this screening is to allow the Board to avoid having to consider irrelevant or inappropriate communications (such as advertisements, solicitations and communications not requiring Board consideration). The screening procedures have been approved by a majority of the independent directors of the Board. All communications directed to the Audit Committee in accordance with the Company’s whistleblower Policy that relates to questionable accounting or auditing matters involving the Company will be promptly and directly forwarded to the Audit Committee.

CODE OF ETHICS

The Company has adopted the Web.com Group, Inc. Code of Conduct that applies to all officers, directors and employees. The Code of Conduct is available on the Company’s website at http://ir.web.com/documents.cfm. If the Company makes any substantive amendments to the Code of Conduct or grants any waiver from a provision of the Code of Conduct to any executive officer or director, the Company will promptly disclose the nature of the amendment or waiver on its website.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The following report of the Audit Committee shall not constitute “soliciting material,” shall not be deemed “filed” with the SEC and is not to be incorporated by reference into any of other the Company’s filing under the Securities Act or the Exchange Act, except to the extent the Company specifically incorporates this report by reference therein.

Communications with Management and Independent Registered Public Accounting Firm

The Audit Committee has reviewed and discussed the Company’s audited financial statements with management. In addition, the Audit Committee has discussed with Ernst & Young LLP, the Company’s independent registered public accounting firm, the matters required to be discussed by Statement of Auditing Standards No. 114, “Communications with Audit Committees,” which includes, among other items, matters related to the conduct of the audit of the Company’s financial statements. The Audit Committee has also received written disclosures and the letter from Ernst & Young LLP required by the Public Company Accounting Oversight Board Rule No. 1, which relates to Ernst & Young LLP’s independence from the Company and its related entities, and has discussed their independence from the Company, including whether Ernst & Young LLP’s provision of non-audit services was compatible with that independence.

Committee Member Independence and Financial Expert

From January 1, 2008 until August 11, 2008, the Audit Committee was comprised of Messrs. Maudlin (Chair), Durden and McCoy, and was comprised of Messrs. Maudlin (Chair), Durden, Genachowski, and McCoy from August 11, 2008 to December 31, 2008, all of whom satisfy the independence criteria of the Nasdaq listing standards for serving on an audit committee. SEC regulations require the Company to disclose whether its Board has determined that a director qualifying as a “financial expert” serves on the Company’s Audit Committee, and the Board of Directors has determined that Mr. Maudlin qualifies as a “financial expert” within the meaning of such regulations.

Recommendation Regarding Financial Statements

Based on the review and discussions referred to above, the Audit Committee recommended to the Board that the Company’s audited financial statements for the fiscal year ended December 31, 2008, be included in its Annual Report on Form 10-K for the fiscal year ended December 31, 2008.

AUDIT COMMITTEE Timothy I. Maudlin, Chair Hugh M. Durden Julius Genachowski Robert S. McCoy, Jr. |

PROPOSAL 2

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has selected Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2009 and has further directed that management submit the selection of the independent registered public accounting firm for ratification by the stockholders at the annual meeting. Ernst & Young LLP has audited the Company’s financial statements since 2002. Representatives of Ernst & Young LLP are expected to be present at the annual meeting at which they will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither the Company’s Bylaws nor other governing documents or law require stockholder ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm. However, the Audit Committee of the Board is submitting the selection of Ernst & Young LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee of the Board will reconsider whether to retain Ernst & Young LLP as the Company’s independent registered public accounting firm. Even if the selection is ratified, the Audit Committee of the Board in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting will be required to ratify the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm. Abstentions will be counted toward the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

The following table represents aggregate fees billed to the Company for fiscal years ended December 31, 2007 and December 31, 2008, by Ernst & Young LLP, the Company’s principal accountant (all fees described below were approved by the Audit Committee):

| | Fiscal Year Ended |

| | |

| | | |

| | (in thousands $) |

Audit Fees (1) | 775 | 814 |

Audit-related Fees(2) | — | 25 |

Tax Fees (3) | 79 | 178 |

| All Other Fees | 2 | 2 |

(1) The 2007 amount includes audit fees associated with the acquisition of Web.com, Inc.

| | (2) | Consists of fees pertaining to audit related matters for the acquisition of Web.com, Inc. |

| | (3) | Consists of fees pertaining to tax consultations in connection with the acquisition of Web.com, Inc. in 2007. The 2008 and 2007 amounts also include fees for tax compliance services. |

PRE-APPROVAL POLICIES AND PROCEDURES

The Audit Committee pre-approves all audit and non-audit services rendered by the Company’s independent registered accounting firm, Ernst & Young LLP. While the Audit Committee Charter permits the Audit Committee to delegate pre-approval authority to one or more individuals, as well as to pre-approve defined categories of services, the Audit Committee has not yet done so. To date, all pre-approval has been given as part of the Audit Committee’s approval of the scope of the engagement of the independent auditor or on an individual explicit case-by-case basis before the independent auditor is engaged to provide each service.

The Audit Committee has determined that the rendering of the services other than audit services by Ernst & Young LLP is compatible with maintaining the principal accountant’s independence.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 2.

The following table sets forth certain information regarding the ownership of the Company’s common stock as of March 20, 2009 by: (i) each director; (ii) each of the executive officers named in the Summary Compensation Table; (iii) all executive officers and directors of the Company as a group; and (iv) all those known by the Company to be beneficial owners of more than five percent of its common stock.

| | | Beneficial Ownership(1) |

Beneficial Owner | | Number of Shares | | Percent of Total |

| | | | | |

| Five Percent Stockholders: | | | | |

William Blair Capital Management LLC 222 West Adams Chicago, IL 60606 | | 2,667,079 | | 10.1% |

| | | | | |

NorthPoint Capital LLC 101 W. Big Beaver, Suite 745 Troy, MI 48084 | | 2,006,116 | | 7.6% |

| | | | | |

Barclays Global Investments NA 400 Howard Street San Francisco, CA 94105 | | 1,382,056 | | 5.2% |

| | | | | |

S Square Technology LLC 515 Madison Avenue New York NY 10022 | | 1,346,178 | | 5.1% |

| | | | | |

| Directors and Executive Officers: | | | | |

David L. Brown (2) | | 2,084,717 | | 7.4% |

Jeffrey M. Stibel (3) | | 1,757,442 | | 6.4% |

Kevin M. Carney (4) | | 448,517 | | 1.7% |

Hugh M. Durden (5) | | 79,500 | | * |

Julius Genachowski (6) | | 81,500 | | * |

Alex Kazerani (7) | | 54,420 | | * |

Timothy I. Maudlin (8) | | 248,528 | | * |

Robert S. McCoy, Jr. (9) | | 53,277 | | * |

All executive officers and directors as a group (8 persons) (10) | | 4,807,901 | | 16.0% |

* Less than one percent.

| (1) | This table is based upon information supplied by officers, directors and stockholders and Schedules 13D, 13F and 13G filed with the Securities and Exchange Commission (the “SEC”). Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, the Company believes that each of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Applicable percentages are based on 26,371,125 shares outstanding on March 20, 2009, adjusted as required by rules promulgated by the SEC. |

| (2) | Includes 36,414 shares held by Atlantic Teleservices, L.P. (“Atlantic Teleservices”), 68 shares held by Mr. Brown’s wife, 68 shares held by Mr. Brown’s son and 1,704,041 shares issuable upon the exercise of options exercisable within 60 days after March 20, 2009. Mr. Brown is a member of CIMC Atlantic II, LLC, which is the general partner of Atlantic Teleservices. Mr. Brown shares voting and investment power with respect to these shares with Alton G. Keel, Jr. |

| (3) | Includes 9,834 shares held by a trust and 1,282,810 shares issuable upon the exercise of options exercisable within 60 days after March 20, 2009. |

| (4) | Includes 327,212 shares issuable upon the exercise of options exercisable within 60 days after March 20, 2009. |

| (5) | Includes 71,000 shares issuable upon the exercise of options exercisable within 60 days after March 20, 2009. |

| (6) | Includes 73,000 shares issuable upon the exercise of options exercisable within 60 days after March 20, 2009. |

| (7) | Includes 21,694 shares issuable upon the exercise of options exercisable within 60 days after March 20, 2009. |

| (8) | Includes 57,122 shares held by Mr. Maudlin’s wife, Janice K. Maudlin and 82,166 shares issuable upon the exercise of options exercisable within 60 days after March 20, 2009. |

| (9) | Includes 44,777 shares issuable upon the exercise of options exercisable within 60 days after March 20, 2009. |

| (10) | Includes 3,728,005 shares issuable upon exercise of options exercisable within 60 days after March 20, 2009. See footnotes 1 through 9 above. |

The following table sets forth certain information about the Company’s executive officers, including their ages as of March 20, 2009.

| Name | | Age | | Position |

| David L. Brown | | 55 | | Chairman and Chief Executive Officer |

| Jeffrey M. Stibel | | 35 | | Director and President |

| Kevin M. Carney | | 45 | | Chief Financial Officer |

David L. Brown has served as the Company’s Chief Executive Officer since August 2000; as President of the Company from August 1999 to March 2000 and again from August 2000 to September 2007; and as a director since August 1999. From March 2000 until August 2000, Mr. Brown was employed by Atlantic Partners Group, a private equity firm. Prior to joining the Company, Mr. Brown was the founder of Atlantic Teleservices, a technology services company, and served as its Chief Executive Officer from 1997 until its acquisition by the Company in August 1999. Mr. Brown holds a B.A. degree from Harvard University.

Jeffrey M. Stibel has served as a member of the Company’s Board of Directors since September 30, 2007, when he also assumed the role of President. From August 2005 until joining the Company, Mr. Stibel was the President and Chief Executive Officer of Interland and Web.com, Inc. and a member of its board of directors. From August 2000 to August 2005, Mr. Stibel was part of the founding management team at United Online, Inc., a NASDAQ listed marketing technology company currently owned by ValueClick. Mr. Stibel currently serves on the board of directors for Autobytel, a Nasdaq listed company and several private companies, including The Search Agency, an Internet company, and EdgeCast Networks, Inc., an Internet company. He also serves on the Board of Brown University’s Entrepreneurship Program and Tufts University’s Gordon Center for Leadership. Mr. Stibel received a Master’s degree from Brown University and studied business and brain science at MIT’s Sloan School of Management and at Brown University, where he was a Brain and Behavior Fellow.

Kevin M. Carney has served as the Company’s Chief Financial Officer since January 2002. Mr. Carney served as director of finance from September 2000 until January 2002 and from August 1999 until June 2000. Mr. Carney was employed by Atlantic Partners Group, a private equity firm, from June 2000 until September 2000. Prior to joining us, Mr. Carney served as the chief financial officer of Atlantic Teleservices, a technology services company, from June 1998 until its acquisition by us in August 1999. Mr. Carney is a certified public accountant and holds a B.S. in accounting and finance from Boston College.

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

The Board of Directors has delegated the power and authority to review, modify and approve compensation policies and practices and to administer the Company’s equity plans to the Compensation Committee. The Compensation Committee annually evaluates and establishes the compensation policies for the Chief Executive Officer and other named executive officers. Messrs. Genachowski (Chairman), Maudlin and McCoy comprise the Compensation Committee and are non-employees and independent within the meaning of Rule 4200(a) (15) of the Nasdaq listing standards and are outside directors for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”).

Compensation Philosophy and Objectives

The Compensation Committee believes that compensation of the Company’s executive officers should:

| | • | provide a means for Web.com to attract, retain and reward high-quality executives who will contribute to the long-term success of the Company; |

| | • | inspire executive officers, including the Company’s Chief Executive Officer, to achieve the Company’s business objectives; and |

| | • | align the financial interests of the executive officers with those of the stockholders. |

The Compensation Committee’s approach regarding base salaries for executives is conservative, with the goal of maintaining base salaries at or somewhat below the median for our selected group of Web services companies of comparable size (discussed below) and giving greater weight in total compensation in target bonus and potential gains related to equity. The Company believes significant equity-based incentives for executives help ensure that the executives are motivated over the long-term to respond to the Company’s business challenges and opportunities as owners and not just as employees.

In connection with setting executive compensation for fiscal 2008, the Compensation Committee engaged PRM to evaluate the Company’s existing compensation strategy and practices in supporting and reinforcing the Company’s long-term strategic goals and to assist in refining the compensation strategy. PRM developed comparison compensation data stemming from its review of peer group companies, which was presented to the Compensation Committee for its consideration.

Although the Compensation Committee has been delegated the responsibility for compensation matters, it may, at its discretion and in accordance with the philosophy of making all information available to the Board, present matters to the entire Board of Directors for approval. Therefore, the Compensation Committee presented to the Board its recommendations for the 2008 compensation for executive officers based, in part, on the information provided to it by PRM with a request for approval by the Board. The Board of Directors approved the 2008 compensation for executive officers, as presented to it.

Compensation Benchmarking

In order to compare the Company’s compensation approach with market practices, in 2008 the Compensation Committee reviewed compensation data compiled by PRM, which was drawn from individual company proxy filings with respect to the Company’s peer group and published surveys from Watson Wyatt, Top Management Survey, Mercer, and Culpepper. In determining the peer group, PRM and the Company’s Chief Executive Officer, Chief Legal Officer, Senior Vice President of Investment Relations, and the Senior Vice President of Human Resources, recommended, and the Compensation Committee approved, a list of companies which compete for talent within the Company’s labor markets. The peer group consisted of Internet software and services companies with similar revenue to that anticipated by the Company in 2008 and similar historical revenue growth rates. For fiscal year 2008, the compensation peer group consisted of the following 21 companies, referred to below as the peer group companies:

| 24/7 Real Media, Inc. | Interwoven, Inc. | Sina Corp. |

| Concur Technologies, Inc. | Kenexa Corp. | Sonicwall, Inc. |

| Cybersource Corp. | Knot, Inc. | Stellent, Inc. |

| Dealertrack Holdings, Inc. | Marchex, Inc. | Taleo Corp. |

| Digital Insight, Inc. | Online Resources Corp. | Ultimate Software Group, Inc. |

| Digital River, Inc. | Perficient, Inc. | WebMD, Inc. |

| Internap Network Services Corp. | Rightnow Technologies, Inc. | Websense, Inc. |

In general, we strive to position salaries near the 50th percentile of these peer group companies. The Company’s total cash and equity compensation is targeted near the 75th percentile of these peer group companies for on-target performance.

Elements of Compensation

The Compensation Committee uses two types of compensation to achieve its overall compensation objectives: annual compensation and long-term compensation. Annual compensation is comprised of base salary and variable cash compensation, while long-term compensation is generally comprised of stock options and restricted stock.

Annual Compensation

Base Salary. The Compensation Committee recognizes the importance of maintaining base cash compensation levels that are competitive (that is, at the median) with our peer group of companies, that is, the companies with which Web.com competes for talent. Each spring, the Compensation Committee reviews annual salaries for all of the Company’s named executive officers. In addition to considering the peer group data, the Compensation Committee also considers, subjectively, past performance and expected future contributions of the individual executive.

Variable Compensation. In addition to earning a base salary, named executive officers are eligible to receive additional cash compensation through variable bonuses. The variable bonuses are intended to motivate executives to achieve company-wide operating and strategic objectives, and work at the highest levels of their individual abilities. Potential payment levels are expressed as a percentage of base salary, which percentage is set annually by the Compensation Committee for that year. Payouts of bonuses, which generally are made in the first quarter of the following year, are based upon the Compensation Committee’s review of both Company and individual performance, including but not limited, to the extent to which Company operating goals are met. The Compensation Committee may modify these goals at any time during the year and pay bonuses to the executive officers even if the performance goals are not met in recognition of the officer’s efforts throughout the year. The combination of annual salary and target variable compensation is targeted to bring the participant’s total cash compensation to levels that are at or near the 75th percentile of the peer group. In June 2008, the Compensation Committee established the target cash bonuses (the “Cash Incentive Bonuses”) for each named executive officer. Additionally, on June 17, 2008, the Compensation Committee established corporate performance goals for 2008 that it would consider in determining the amount, if any, of any Cash Incentive Bonus that ultimately would be paid to named executive officers for performance in 2008. These goals consisted of the Company’s achievement of certain levels of non-GAAP earnings per share and revenue (the “Company Goals”). The amount of a Cash Incentive Bonus for a named executive officer for performance in 2008 would also be based on the Committee’s evaluation in its sole discretion, of that named executive officer’s performance in 2008 with consideration being given to achievement of the Company Goals. However, the Compensation Committee considers individual and corporate performance in a subjective manner and without reliance on specific formulas. The Compensation Committee did not assign a particular weight to, or ascribe a specific dollar value to, any one of the corporate goals or individual performance achievements. Instead, the Compensation Committee comes to a general, subjective conclusion as to whether the corporate goals were met and whether the executive has performed his duties in a satisfactory manner. In sum, the amount of variable compensation that is actually earned by our named executives is a subjective, entirely discretionary determination, made by the Compensation Committee without the use of pre-determined formulas based on levels of individual or corporate performance. The Company Goals can be modified or adjusted to reflect business acquisitions or dispositions by the Company.

The Cash Incentive Bonus for performance in 2008 for each named executive officer, expressed as a percentage of such named executive officer’s annual base salary, was as follows:

| Name | Title | Target Bonus%(1) |

| | | |

| David L. Brown | Chairman & CEO | 90% |

| Jeffrey Stibel | President | 75% |

| Kevin Carney | Chief Financial Officer | 65% |

________________ (1) Expressed as a percentage of base salary. |

The Company failed to achieve the Company Goals, and notwithstanding the officer’s individual performance in 2008, the Compensation Committee determined, based in part on the recommendations of the named executive officers that they not be paid a bonus, not to award bonuses to named executive officers for performance in 2008, in light of the volatility in the Internet software and services industry, including unexpected events that affected objective measures of corporate performance, the Compensation Committee believed that maintaining discretion to evaluate the Company's and the executive’s performance at the close of the year based on the totality of the circumstances, and to award or fail to award bonus compensation without reliance on rote calculations under set formulas, was appropriate in responsibly discharging its duties.

Long-Term Compensation

Equity Compensation. Equity compensation, which the Compensation Committee considers to be long term compensation, is an integral component of the Company’s efforts to attract and retain exceptional executives, senior management and employees. The Compensation Committee believes that properly structured equity compensation aligns the long-term interests of stockholders and employees by creating a strong, direct link between employee compensation and stock appreciation. While equity compensation is an important part of the overall compensation policy, the Compensation Committee is sensitive to the concerns of the Company’s stockholders regarding the potentially dilutive impact of stock option grants and other equity compensation awarded to employees. Equity grants are determined, therefore, by taking into account each executive officer’s performance and responsibility level, a comparison with comparable awards to individuals in similar positions in the industry, each executive officer’s current level of equity participation, the dilutive impact of the potential grant, and the Company’s operating performance. However, the Compensation Committee does not strictly adhere to these factors in all cases and may vary grants made to each executive officer as the particular circumstances warrant. Exercise prices for options are set at the fair market value of the Company’s common stock on the date of grant.