Exhibit 99.2

PORTAGE BIOTECH INC.

THREE AND SIX MONTHS ENDED SEPTEMBER 30, 2023

MANAGEMENT’S DISCUSSION AND ANALYSIS

Prepared as of November 28, 2023

TABLE OF CONTENTS

Management Discussion and Analysis

The following discussion and analysis by management of the financial condition and financial results for Portage Biotech Inc. for the three and six months ended September 30, 2023, should be read in conjunction with the unaudited condensed consolidated interim financial statements for the three and six months ended September 30, 2023, together with the related Management’s Discussion and Analysis and audited consolidated financial statements for the year ended March 31, 2023, and the annual report on Form 20-F (“Annual Report”) for the year ended March 31, 2023.

Forward-Looking Statements

This document includes “forward-looking statements.” All statements, other than statements of historical facts, included herein or incorporated by reference herein, including without limitation, statements regarding our business strategy, plans and objectives of management for future operations and those statements preceded by, followed by or that otherwise include the words “believe,” “expects,” “anticipates,” “intends,” “estimates,” “will,” “may,” “should,” “could,” “targets,” “projects,” “predicts,” “plans,” “potential,” or “continue,” or similar expressions or variations on such expressions are forward-looking statements. We can give no assurances that such forward-looking statements will prove to be correct.

Each forward-looking statement reflects our current view of future events and is subject to risks, uncertainties and other factors that could cause actual results to differ materially from any results expressed or implied by our forward-looking statements.

Risks and uncertainties include, but are not limited to:

| · | our need for financing and our estimates regarding our capital requirements and future revenues and profitability; |

| · | our plans and ability to develop and commercialize product candidates and the timing of these development programs; |

| · | clinical development of our product candidates, including the timing for availability and release of results of current and future clinical trials; |

| · | our expectations regarding regulatory communications, submissions or approvals; |

| · | the potential functionality, capabilities, benefits and risks of our product candidates as compared to others; |

| · | our maintenance and establishment of intellectual property rights in our product candidates; |

| · | our estimates of the size of the potential markets for our product candidates; and |

| · | our selection and licensing of product candidates. |

Our business focus is that of being primarily a pharmaceutical development business subject to all of the risks of a pharmaceutical development business. We do not anticipate directly engaging in the commercialization of the product candidates we develop.

These statements are based on assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments based on the focus of our business activities on biotechnology, as well as other factors we believe are appropriate in particular circumstances. However, whether actual results and developments will meet our expectations and predictions depends on a number of risks and uncertainties, which could cause actual results to differ materially from our expectations, including the risks set forth in “Item 3 - Key Information - Risk Factors” in our Annual Report on Form 20-F for the year ended March 31, 2023.

Consequently, all of the forward-looking statements made in this Management’s Discussion and Analysis are qualified by these cautionary statements. We cannot assure you that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected effect on us or our business or operations.

Unless the context indicates otherwise the terms “Portage Biotech Inc.,” “the Company,” “our Company,” “Portage,” “we,” “us” or “our” are used interchangeably in this Management’s Discussion and Analysis and mean Portage Biotech Inc. and its subsidiaries. Capitalized terms used but not defined herein have the meaning ascribed to such terms in our unaudited condensed consolidated interim financial statements for the three and six months ended September 30, 2023.

Nature of Operations and Overview

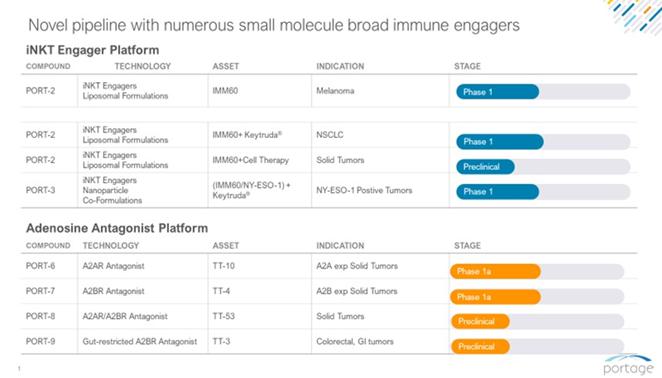

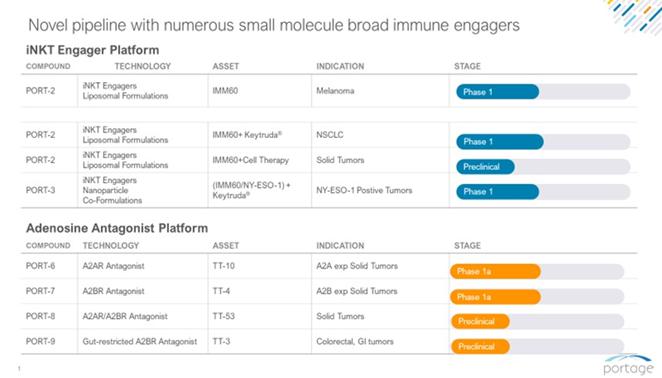

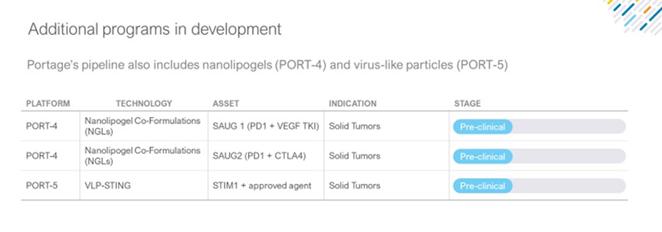

We are a clinical stage immune-oncology company advancing treatments we believe will be first-in-class therapies that target known checkpoint resistance pathways to improve long-term treatment response and quality of life in patients with invasive cancers. Our access to next-generation technologies coupled with a deep understanding of biological mechanisms enables the identification of clinical therapies and product development strategies that accelerate these medicines through the translational pipeline. We currently are working on 9 immuno-oncology assets, of which five are pre-clinical and four of which are clinical stage. This excludes backup compounds. In our pipeline, PORT-3 has been paused as we await more data. Additionally, PORT-7 is in Phase 1a from an Investigational New Drug (“IND”) perspective, though we have not commenced dosing patients, which we expect to commence in the first half of calendar year 2024, based upon available liquidity. We source, nurture and develop the creation of early- to mid-stage treatments that we believe will be first-in-class therapies for a variety of cancers, by funding, implementing viable, cost effective product development strategies, clinical counsel/trial design, shared services, financial and project management to enable efficient, turnkey execution of commercially informed development plans. Our drug development pipeline portfolio encompasses product candidates or technologies based on biology addressing known resistance pathways/mechanisms of current checkpoint inhibitors with established scientific rationales, including intratumoral delivery, nanoparticles, liposomes, aptamers, and virus-like particles.

The Portage Approach

Our mission is to advance and grow a portfolio of innovative, early-stage oncology assets based on the latest scientific breakthroughs focused on overcoming immune resistance and expanding the addressable patient population. Given these foundations, we manage capital allocation and risk as much as we oversee drug development. By focusing our efforts on translational medicine and pipeline diversification, we seek to mitigate overall exposure to many of the inherent risks of drug development.

Our approach is guided by the following core elements:

| · | Portfolio diversification to mitigate risk and maximize optionality; |

| · | Capital allocation based on risk-adjusted potential, including staged funding to pre-specified scientific and clinical results; |

| · | Virtual infrastructure and key external relationships to maintain a lean operating base; |

| · | Internal development capabilities complemented by external business development; |

| · | Rigorous asset selection for broad targets with disciplined ongoing evaluation; |

| · | Focus on translational medicine and therapeutic candidates with single agent activity; |

| · | Conduct randomized trials early and test non-overlapping mechanisms of action; and |

| · | Improve potential outcomes for patients with invasive cancers. |

Our execution is achieved, in part, through our internal core team and our large network of experts, contract labs and academic partners.

Our Science Strategy

Our goal is to develop immuno-oncology therapeutics that will dramatically improve the standard-of-care for patients with cancer. The key elements of our scientific strategy are to:

| · | Build a pipeline of differentiated oncology therapeutic candidates that are diversified by mechanism, broad targets, therapeutic approach, modality, stage of development, leading to a variety of deal types that can be executed with partners; |

| · | Expand our pipeline through research collaborations, business development and internally designed programs; |

| · | Continue to advance and evolve our pipeline with a goal of advancing one therapeutic candidate into the clinic and one program into IND-enabling studies each year; and |

| · | Evaluate strategic opportunities to accelerate development timelines and maximize the value of our portfolio. |

Our Pipeline

We have built a pipeline of immuno-oncology therapeutic candidates and programs that are diversified by mechanism, therapeutic approach, modality and stage of development. On an ongoing basis, we rigorously assess each of our programs using internally defined success criteria to justify continued investment and determine proper capital allocation. When certain programs do not meet our de-risking criteria for advancement, we look to monetize or terminate those programs and preserve our capital and resources to invest in programs with greater potential. As a result, our pipeline will continue to be dynamic.

The charts below set forth, as of November 28, 2023, the current state of our immuno-oncology therapeutic product candidates and programs. The chart contains forward-looking information and projections based on management’s current estimates. The chart information is based on and subject to many assumptions, as determined by management and not verified by any independent third party, which may change or may not occur as modeled. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Before you make an investment decision regarding us, you should make your own analysis of forward-looking statements and our projections about candidate and program development and results. PORT-3 has been paused as we await more data. Additionally, PORT-7 is in Phase 1a from an IND perspective, though we have not commenced dosing patients, which we expect to commence in the first half of calendar year 2024, based upon available liquidity.

Our Business Model

We are a development organization that is structured to facilitate flexibility in financing and ease of partnering, licensing, and merger/acquisition of individual assets and or technology platforms. The intellectual property (“IP”) for each platform is held in separate private entities. Our employees and consultants work across the pipeline of assets and we believe that this can (i) enhance operational efficiency, (ii) maintain an optimal cost structure, (iii) attract leading collaborators, and (iv) promote asset flexibility, as further described below.

| · | Enhance operational efficiency: We allocate resources while empowering managers to make program-level decisions in order to increase productivity and speed. We believe this model enables a flexible organizational structure that can achieve scale through the addition of programs without increasing burdensome bureaucracy or redundant infrastructure. |

| · | Maintain an optimal cost structure: We have a relatively small number of employees and have partnered with a number of service providers to leverage their infrastructure and expertise as needed instead of embarking on capital-intensive lab, manufacturing, and equipment expenditures. By reducing overhead costs, we believe we can increase the likelihood that we can generate a return on invested capital. |

| · | Attract leading collaborators and licensors: Our pipeline is comprised of therapies we believe will be first-in-class therapies for a variety of cancers sourced via our extensive industry contacts and relationships (including academia and pharmaceutical industry executives). On preclinical programs/technology, we initially established development structures enabling us to keep licensors economically incentivized at the program level. We believe that our experienced drug development leadership team and approach to resource allocation differentiate us from other potential licensees. |

| · | Leverage the commoditized checkpoint marketplace and explore the potential to further enhance long-term clinical benefits for patients with cancer and also expand the eligible population to include those who do not currently receive anti-PD-1 therapy: Presently there are multiple approved checkpoint therapeutics that lack differentiation, resulting in a competitive market dynamic, which will favor combination therapy. There is substantial opportunity for potential expansion in the PD-1 market with our iNKT engagers and adenosine antagonists. Studies show that 70-80% of patients do not respond or have a limited response to existing monotherapies, such as PD-1 checkpoint inhibitors. We see potential for our unique approach of using iNKT engagers and adenosine antagonists to initiate an immune response in tumors that have become refractory to checkpoint therapy or to increase the number of front-line patients achieving more durable responses. Combinations can improve this but often come at the cost of significant additional toxicity. The market is saturated with 14 approved PD-1 antibodies, and every major pharmaceutical company competes in this space. One illustrative example of potentially expanding eligible patients is with iNKT engagers upregulating expression of PD-L1. Patient populations that are typically not good candidates for PD-1 antibodies due to their lack or low expression of PD-L1 may be able to utilize iNKTs to sensitize tumors to PD-1 agents. Extending the use of PD-1 antibodies represents a significant potential upside for one of these companies competing for market share, should they choose to partner with Portage. |

| · | Promote asset flexibility: Our structure is designed to maximize flexibility and cost efficiency. This allows us to efficiently pursue various subsidiary-level transactions, such as stock or asset sales, licensing transactions, strategic partnerships and/or co-development arrangements. It also provides us with the flexibility to terminate programs with minimal costs if results do not meet our de-risking criteria for advancement. |

We are a BVI business company incorporated under the BVI Business Companies Act (Revised Edition 2020, as amended) with our registered office located at Clarence Thomas Building, P.O. Box 4649, Road Town, Tortola, British Virgin Islands, VG1110. Our U.S. agent, Portage Development Services Inc. (“PDS”), is located at 61 Wilton Road, Westport, CT 06880.

We currently are a foreign private issuer under the United States Securities and Exchange Commission (“SEC”) rules. We are also a reporting issuer under the securities legislation of the provinces of Ontario and British Columbia. Our ordinary shares were listed on the Canadian Securities Exchange (“CSE”) under the symbol “PBT.U”. On February 25, 2021, our ordinary shares began trading on the Nasdaq Capital Market under the symbol “PRTG”. As the principal market for our ordinary shares is Nasdaq, we voluntarily delisted from the CSE on April 23, 2021.

Summary of Results

The following table summarizes financial information for the quarter ended September 30, 2023, and the preceding eight quarters (all amounts in 000’US$ except net loss per share, which are actual amounts).

| | Sept. 30, | | June 30, | | Mar. 31, | | Dec. 31, | | Sept. 30 | | June 30, | | Mar. 31, | | Dec. 31, | | Sept. 30, |

| Quarter ended | | 2023 | | 2023 | | 2023 | | 2022 | | 2022 | | 2022 | | 2022 | | 2021 | | 2021 |

| | | |

| Net loss attributable to owners of the Company | | | (5,158 | ) | | | (5,919 | ) | | | (94,448 | ) | | | (7,485 | ) | | | (949 | ) | | | (1,729 | ) | | | (7,317 | ) | | | (3,512 | ) | | | (2,975 | ) |

| Comprehensive loss attributable to the owners of the Company | | | (6,458 | ) | | | (4,150 | ) | | | (95,714 | ) | | | (11,502 | ) | | | (949 | ) | | | (1,729 | ) | | | (7,317 | ) | | | (3,512 | ) | | | (2,975 | ) |

| Working capital (1) to (5) | | | 3,131 | | | | 8,254 | | | | 11,811 | | | | 13,110 | | | | 15,737 | | | | 21,138 | | | | 24,049 | | | | 25,639 | | | | 27,301 | |

| Equity attributable to owners of the Company | | | 67,661 | | | | 73,307 | | | | 76,045 | | | | 168,945 | | | | 178,434 | | | | 120,682 | | | | 121,205 | | | | 125,789 | | | | 127,140 | |

| Net loss per share - Basic | | | (0.29 | ) | | | (0.33 | ) | | | (5.45 | ) | | | (0.44 | ) | | | (0.06 | ) | | | (0.13 | ) | | | (0.55 | ) | | | (0.26 | ) | | | (0.22 | ) |

| Net loss per share - Diluted | | | (0.29 | ) | | | (0.33 | ) | | | (5.45 | ) | | | (0.44 | ) | | | (0.06 | ) | | | (0.13 | ) | | | (0.55 | ) | | | (0.26 | ) | | | (0.22 | ) |

| (1) | September 30, 2022 working capital is net of warrant liability of $8 settleable on a non-cash basis. |

| (2) | June 30, 2022 working capital is net of warrant liability of $32 settleable on a non-cash basis. |

| (3) | March 31, 2022 working capital is net of warrant liability of $33 settleable on a non-cash basis. |

| (4) | December 31, 2021 working capital is net of warrant liability of $159 settleable on a non-cash basis. |

| (5) | September 30, 2021 working capital is net of warrant liability of $535 settleable on a non-cash basis. |

Number of Ordinary Shares

The following table summarizes the number of our ordinary shares issued and outstanding at September 30, 2023 and November 28, 2023:

| As of, | | September 30, 2023 | | November 28, 2023 |

| Shares issued and outstanding (a) (b) (c) | | | 17,808,225 | | | | 19,778,225 | |

| (a) | This amount excludes an aggregate of 243,000 restricted stock units granted to our executive chairman and an employee on January 13, 2021, which vested immediately on the date of grant and are subject to certain restrictions for the settlement and delivery of the ordinary shares underlying the restricted stock units and 135,740 restricted stock units granted to employees (one of whom is also a director) on January 19, 2022, which vested immediately on the date of grant and are subject to certain restrictions for the settlement and delivery of the ordinary shares underlying the restricted stock units. |

| (b) | The September 30, 2023 amount includes 6,834 shares earned for services rendered from July 1, 2023 to August 31, 2023, accrued at September 30, 2023 for financial statement purposes and issued in November 2023. |

| (c) | The November 28, 2023 amount includes 1,970,000 ordinary shares issued pursuant to a Registered Direct Offering, which closed on October 3, 2023, and excludes 1,187,895 Pre-Funded Warrants to purchase up to 1,187,895 ordinary shares. |

Business Environment – Risk Factors

Please refer to the Annual Report on Form 20-F for the fiscal year ended March 31, 2023 (“Fiscal 2023”) for detailed information as the economic and industry factors that are substantially unchanged as of the date hereof.

Our Programs and Technology – Recent Developments

Invariant Natural Killer T-cells (iNKT cells) Platform

iNKT cells play an important role in anti-tumor immune responses and are a distinct class of T lymphocyte displaying a limited diversity of T-cell receptors. They recognize lipid antigens on the surface of tumor cells and produce large amounts of cytokines within hours of stimulation without the need for clonal expansion. Furthermore, iNKT cells activate multiple immune system components, including dendritic cells (“DC”), T-cells and B-cells and stimulate an antigen-specific expansion of these cells. Our operating subsidiary, iOx Therapeutics Ltd. (“iOx”), holds an exclusive license (with the right to sub-license) from the Ludwig Institute for Cancer Research (the "Ludwig Institute") to use, research, develop and commercialize iNKT cell engagers, for the treatment of various forms of human disease, including cancer, under the Ludwig Institute’s intellectual property and know-how.

PORT-2 (IMM60)

PORT-2 is an iNKT cell engager formulated in a liposome with a six-member carbon head structure that has been shown to activate both human and murine iNKT cells, resulting in DC maturation and the priming of Ag-specific T and B cells.

In animal models, PORT-2 enhanced the frequency of tumor specific immune responses. iNKT cells are unique lymphocytes defined by their co-expression of surface markers associated with NK cells along with a T-cell antigen receptor. They recognize amphipathic ligands such as glycolipids or phospholipids presented in the context of the non-polymorphic, MHC class I-like molecule CD1d. Activated iNKT cells rapidly produce IFN-gamma and IL-4 and induce DC maturation and IL-12 production.

In August 2021, we dosed the first patient in the IMP-MEL PORT-2 clinical trial, a Phase 1/2 dose escalation and randomized expansion trial. The PORT-2 trial is expected to enroll up to 88 patients with melanoma or non-small cell lung carcinoma (“NSCLC”) in order to evaluate safety and efficacy. In November 2022, we announced that we had entered into a clinical trial collaboration with Merck to evaluate PORT-2 in combination with pembrolizumab for patients with NSCLC. Under the terms of the collaboration, Merck will supply pembrolizumab for our Phase 1/2 trial of PORT-2 in patients with NSCLC and melanoma.

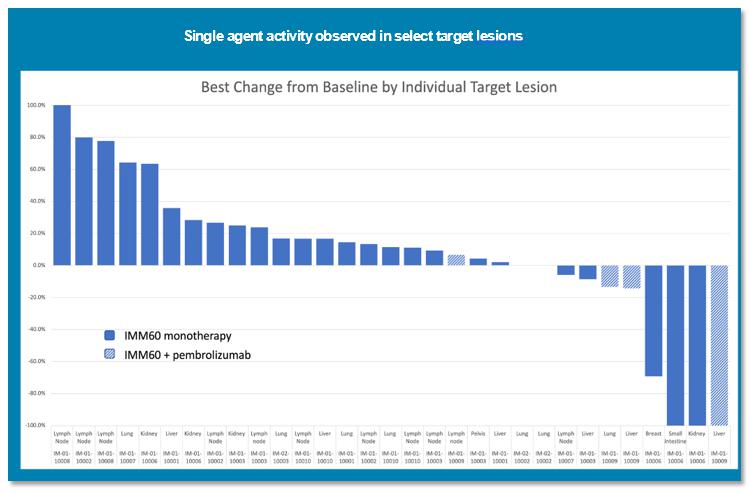

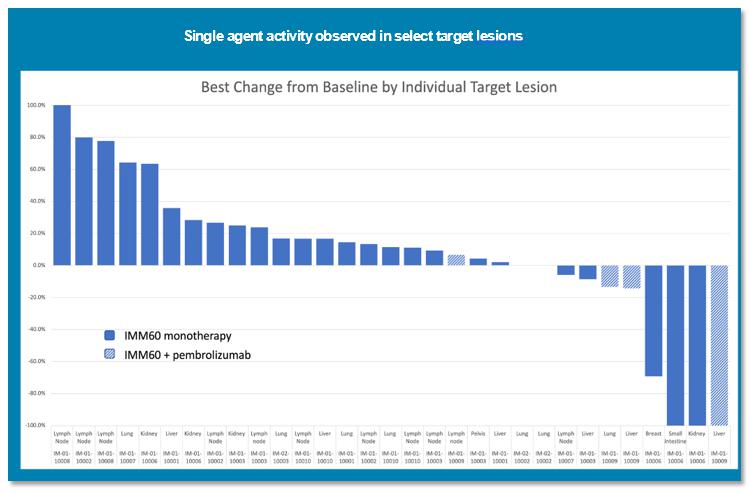

Preliminary Phase 1 data from the IMP-MEL PORT-2 clinical trial, presented at the Society for Immunotherapy of Cancer in November 2023, suggests PORT-2 was well tolerated when administered as a monotherapy, with no related severe or serious adverse events. All possibly related adverse events were mild to moderate and did not limit dosing. Given the very clean safety profile observed in the clinical trials to date, the clinical protocol for the IMP-MEL PORT-2 clinical trial was amended to include a higher Phase 1 dose level as our near-term focus is defining the recommended Phase 2 dose. The combination safety cohort with pembrolizumab is being conducted in parallel with the ongoing high dose monotherapy cohort. As of November 2023, two patients have received the combination with pembrolizumab, and no related severe or serious adverse events were reported. The adverse event profile was consistent with pembrolizumab. Previously reported biomarker data confirmed the mechanism of action (i.e., both activation of the innate and adaptive arms of the immune system). The following figure illustrates the different lesion responses. Although these are preliminary results, several lesions showed shrinkage, and the responses in liver metastases were encouraging.

We are encouraged by the growing patient data set that supports proof of concept for using an iNKT engager in cancer treatment. Preliminary Phase 1 data suggests that PORT-2 has a favorable safety and tolerability profile as a monotherapy at all doses tested to date (as noted above), has demonstrated evidence of single agent activity, and biomarkers confirm mechanistic potential of PORT-2 to activate both the adaptive and innate immune systems.

To accelerate development, we have transitioned sponsorship and have expanded the PORT-2 trial beyond the U.K. while addressing COVID-19 headwinds. The clinical trial agreement has been transferred from the University of Oxford to us through our iOx subsidiary and the trial is being converted to a program sponsored by iOx as we bring on sites in the U.S. Should there be delays in recruiting patients, this could result in increasing overall costs of program administration and ultimately, slow down the completion of the trial and achievement of results.

Given the safety data shown at the highest planned doses, the trial protocol is being amended to escalate patient dosing to include one additional higher dose to identify the recommended Phase 2 dose, and we anticipate the Phase 2 portion of the trial to commence in the first half of calendar 2024.

PORT-3 (IMM65)

PORT-3 is a poly(lactide-co-glycolide) (“PLGA”)-nanoparticle formulation of PORT-2 (IMM60) combined with a NY-ESO-1 peptide vaccine. Biodegradable PLGA-nanoparticles function as a delivery platform for immunomodulators and tumor antigens to induce a specific anti-tumor immune response. PLGA has minimal (systemic) toxicity and is used in various drug-carrying platforms as an encapsulating agent. Furthermore, co-formulating an iNKT engager with a peptide vaccine in a particle has shown to be approximately five times more potent in killing cancer cells and generating an antigen-specific CD8 T-cell response than giving the two agents individually.

NY-ESO-1 is a cancer-testis antigen expressed during embryogenesis and in the testis, an immune privileged site. Furthermore, NY-ESO-1 expression is observed in several advanced cancers: Lung (2-32%), melanoma (40%), bladder (32-35%), prostate (38%), ovarian (30%), esophageal (24-33%), and gastric cancers (8-12%). Clinical trials have shown the safety and tolerability of Good Manufacturing Practices-grade NY-ESO-1 peptides in patients with cancer.

The first patient was dosed in 2021 and patients continue to enroll in the PRECIOUS Phase 1 trial of PORT-3 in patients with solid tumors. The Phase 1 portion of the trial is expected to enroll 15 patients. The trial was having difficulty identifying tumors that expressed NY-ESO-1, so the trial protocol was amended to include all solid tumors regardless of expression to facilitate assessment of safety. This platform is designed to demonstrate proof of concept. The combination of NY-ESO-1 and IMM-60 is being evaluated to determine its ability to prime and boost an anti-tumor immune response. Our patent position extends to other known tumor antigens, and we are prepared to rapidly launch other assets into the clinic if we see strong activity of this formulation. Preliminary safety data for repeat dosing of PORT-3 in the PRECIOUS Phase 1 trial shows a favorable safety profile. The investigator trial has paused while we await more data. It is our understanding that the investigators with who we work with have continued to explore next generation targeted nanoparticles.

Adenosine Receptor Antagonist Platform

A critical mechanism of cancer immune evasion is the generation of high levels of immunosuppressive adenosine within the tumor microenvironment (“TME”). Research suggests that the TME has significantly elevated concentrations of extracellular adenosine. Engagement with adenosine receptors A2A and A2B triggers a dampening effect on the immune response, suppressing effector cell function and stabilizing immunosuppressive regulatory cells. Over-expression of the A2A and A2B receptors leads to a poor prognosis in multiple cancers, including prostate cancer, colorectal cancer and lung adenocarcinoma, driven by a reduced ability to generate an immune response against the tumor.

These findings have made A2A and A2B high-priority targets for immunotherapeutic intervention. We are advancing four adenosine antagonists that we believe to be first-in-class, which together represent a broad suite of adenosine-targeting approaches and are expected to enable a comprehensive exploration of how targeting the adenosine pathway could potentially improve response in multiple cancer and non-cancer indications. By modulating the adenosine pathway in four different ways, we expect to determine the optimal approach to maximize the impact of the mechanism of action on different tumors.

We have designed the ADPORT-601 clinical trial to evaluate the activity and safety of PORT-6 and PORT-7 alone and in combination. This trial will adapt over time and also include safety cohorts for these two agents with other immune activating agents including others from our internal pipeline. Depending on the data, it can be expanded to evaluate either agent as monotherapy or a randomized comparison of either agent plus standard of care versus standard of care alone.

PORT-6 (TT-10)

PORT-6 is an adenosine receptor type 2A (“A2A”) antagonist being studied for the treatment of A2A expressing solid tumors. We believe PORT-6 is more potent, more durable and more selective than other clinical stage A2A agents.

The ADPORT-601 portion of the Phase 1a trial for PORT-6, dosed its first patient in June 2023. We have fully enrolled the lowest dose cohort, and have activated six sites in the U.S. to complete the Phase 1 including: MD Anderson Cancer Center, UC San Francisco, University of Southern California, Thomas Jefferson University, Virginia Cancer Specialists and Sarah Canon Research Institute.

PORT-7 (TT-4)

PORT-7 is an adenosine receptor type 2B (“A2B”) antagonist that we expect to study for the treatment of solid tumors. PORT-7 has a very selective profile that focuses on A2B. PORT-7 is in Phase 1a from an IND perspective, though we have not commenced dosing patients, which we expect to commence in the first half of calendar year 2024, based upon available liquidity.

PORT-8 (TT-53)

PORT-8 is a dual antagonist of adenosine receptors 2A and 2B (A2A/A2B) that we expect to study for the treatment of solid tumors. We have the ability to combine these two adenosine receptors to titrate the levels of A2A and A2B or has the ability to give the dual antagonist (PORT-08). The PORT-8 program is a pre-clinical stage program.

PORT-9 (TT-3)

PORT-9 is an A2B antagonist to treat colorectal and gastrointestinal cancers. The PORT-9 program is a pre-clinical stage program.

In connection with the adenosine programs, we will focus on solid tumor types with high adenosine expression of receptors A2A and A2B and enrich for patients that have high adenosine expression and therefore have potential to benefit most from treatment.

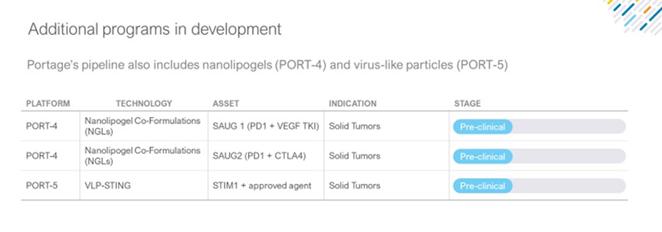

Other Programs and Investee Programs in Development

We are focused on delivering clinical data with the iNKT and adenosine programs and prioritizing the allocation of financial resources to these programs. Developmental work continues on some of the other developmental assets, through collaborations such as that with the U.S. National Cancer Institute (“NCI”) and other academic groups, as further described below. These developmental assets may be re-evaluated at a future point depending on market conditions, ongoing data, funding priorities and status.

Amphiphilic platform

DfuseRx SM, identifies combinations of anti-cancer agents with amphiphilic diffuse enhancers that can passively enter into cancer cells. These novel formulations with unique IP can be directly injected into any solid tumors, and the payloads will diffuse across the membrane and disperse throughout the tumor, while sparing healthy cells. Once inside the cells, the technology is diluted away and the payloads are stuck inside the cells. The payloads are able to disperse to areas of the tumor that do not have blood supply and hence oral or IV drugs will not reach.

PORT-1 (INT230-6)

Intensity Therapeutics, Inc., (“Intensity”), which we have an investment in, is developing INT230-6 (“PORT-1”) as a fixed dose formulation of cisplatin, vinblastine and a penetration enhancer. In animal models, the drug has shown efficacy in the majority of the animals, by a combination of direct killing of the cancer cells, and also a CD4 and CD8 T-cell response. Interim safety and survival data from the Phase 1/2 IT-01 trial exploring the safety and efficacy of PORT-1 in patients with refractory or metastatic cancers presented at ASCO Annual Meeting in 2021 demonstrated that both PORT-1 monotherapy and combination therapy with immune checkpoint drugs are well-tolerated. Intensity completed enrollment of the Phase 1/2 IT-01 trial in June 2022 and finalized the clinical study report in September 2023. The mechanism of action includes direct tumor-killing effects, as well as responses generated in non-injected tumors (abscopal responses) resulting from antigen presentation and immune activation. The specific rapid local killing in the normal three-dimensional environment inside the body we believe is critical for robust antigen presentation and immune activation. Animal studies also showed synergy when combined with checkpoint inhibition. PORT-1 has shown proof of concept in humans in that the vast majority of the drug has been shown to stay in the tumor, and a dose equivalent to three times the approved dose of the cytotoxic agent was well tolerated without the typical chemotherapy side effects. The most common adverse event related to the treatment was pain at the injection site. As a result, PORT-1 is being studied in nine Phase 2 trials including seven clinical collaborations with the two largest immuno-oncology drug manufacturers, Bristol Myers Squibb and Merck, in combination with their respective checkpoints in high unmet need medical types (including pancreatic, gall bladder, sarcoma, non-microsatellite unstable colorectal).

Intensity has also launched a randomized Phase 2 trial of PORT-1 for the treatment in early stage breast cancer for patients who are ineligible or chose not to have presurgical chemotherapy (compared to no treatment, which is the standard of care) (the “INVINCIBLE Trial”) and has expanded its collaboration efforts with the INVINCIBLE Trial, conducted by the Ottawa Hospital and the Ontario Institute for Cancer Research. The INVINCIBLE Trial suggests that one treatment with PORT-1, can result in near complete necrosis of breast tumors greater than 3 cm with an influx of key immune cells to process the dying tumor. Intensity presented clinical data from the PORT-1 INVINCIBLE Trial at the ASCO Annual Meeting in June 2023, which demonstrated significant necrosis of presurgical breast cancer tumors in the majority of patients injected with PORT-1 in the window period from diagnosis to surgery and a pathway enrichment analysis that demonstrated changes in T-cell activation, lymphocyte activation and inflammatory response from the INVINCIBLE Trial.

On September 7, 2023, Intensity announced that the FDA’s Office of Orphan Products Development granted orphan-drug designation for the treatment of soft tissue sarcoma to the three active moieties comprising PORT-1.

On July 5, 2023, Intensity completed an initial public offering (“IPO”) of its common stock selling 3,900,000 shares at a price of $5.00 per share generating net proceeds of approximately $16.2 million. In connection with the offering, Intensity’s common stock began trading on Nasdaq on June 30, 2023, under the ticker symbol “INTS.” We received an additional 2,659 shares in connection with the offering pursuant to certain anti-dilution rights. Intensity sold its overallotment shares totaling 585,000 shares, which closed on July 7, 2023. As of the date of this report, we own approximately 4.7% of the issued and outstanding shares of Intensity.

PORT-4, Nanolipogel (“NLG”) co-formulation Platform

Scientists are interested in novel ways to deliver multiple signals to the immune system in order to better activate an anti-tumor response. We have been impressed with a platform from Yale University that allows different types of agents to be packaged together and will concentrate them in tumors. We have licensed the platform for delivery of DNA aptamers and certain aptamer-small molecule-based combination products. In order to have multiple proprietary agents with known mechanisms of action, we have licensed rights to create DNA aptamers for immune-oncology targets and the first one developed is a proprietary PD1 aptamer, which has been placed in the NLG formulation. Early testing has shown the formulation properly modulates PD1 signaling in vitro similar to a PD1 antibody I. In non-clinical, in vivo experiments, the NLG-PD1 performed favorably compared to a mouse PD1 antibody. The current level of funding is expected to support exploration of multiple PD1 based co-formulations with small molecules and other DNA aptamers. We have conducted further research with the technology licensed from Yale University to co-deliver a PD1 blocking signal with a small molecule vascular endothelial growth factor inhibitor.

As of September 30, 2023, we owned approximately 70% of the outstanding shares of Saugatuck Therapeutics, Ltd., the subsidiary on which the PORT-4 platform is managed.

PORT-5, STING Agonist Platform

Proprietary immune priming and boosting technology (using a STING agonist delivered in a virus-like particle) has shown proof of concept in animal models and Stimunity S.A. (“Stimunity”) is beginning to progress its lead asset towards the clinic. This platform offers multiple ways to target immune stimulation towards the cancer, as well as to co-deliver multiple signals in a single product. The PORT-5 STING platform provides distinct advantages over chemical intratumoral approaches by offering a potent immune priming and boosting pathway within a virus-like particle to enable convenient systemic administration and traffic to the correct targets. This technology preferentially targets dendritic cells, which is differentiated from other chemical STING approaches. Stimunity is progressing this project towards clinical trials as well as developing next generation compounds. To that end, Stimunity has received grant funding to study this technology with any COVID-19 vaccine to evaluate if it is possible to boost the immune response for immunocompromised or elderly patients. During April 2022, the American Association for Cancer Research showcased PORT-5 preclinical data at a late-breaking session that shows that one or more targeted immunotherapy agents could be packaged within a virus-like particle to increase potency, while enabling a selective immune activation. Advancing the program to an IND for PORT-5 is subject to Stimunity securing additional financing.

As of September 30, 2023, we owned approximately 44% of the outstanding shares of Stimunity, the subsidiary on which the PORT-5 platform is managed.

Early-Stage Research and Development Collaborations

We continue to evaluate and test new antibody targets. Our interest here lies in the suppressive tumor microenvironment, and how we can down regulate or remove MDSC, TAMs, Tregs and other signals that impede the immune response from clearing cancer cells.

| · | We are collaborating with Dr. Robert Negrin and his team at Stanford University in an IST study to evaluate the use of PORT-2 with iNKT cell therapies in animals. This work will evaluate if an engager co-administered with expanded or transformed iNKT cells can further activate the transplanted and endogenous cells inside the patient. The Stanford collaboration will also study the impact iNKT engagers have on driving an adaptive immune response and correcting the suppressive tumor microenvironment. |

| · | We have entered into a Cooperative Research and Development Agreement (“CRADA”) with the NCI. We and NCI will advance preclinical and potential clinical development of STING agonists and anti-RAGE agents for cancer vaccines. We and NCI will develop agents to enhance the efficacy of proprietary cancer vaccines and mouse model cancer vaccines developed by NCI. After the acquisition of Tarus Therapeutics, LLC (“Tarus”), we amended the CRADA to include exploration of the different adenosine compounds. |

Three Months Ended September 30, 2023 Compared to the Three Months Ended September 30, 2022

(All Amounts in 000’$)

Results of Operations

The following details major expenses for the three months ended September 30, 2023, compared to the three months ended September 30, 2022:

| Three months ended September 30, | | 2023 | | 2022 |

| | | In 000’$ | | In 000’$ |

| Operating expenses | | $ | (5,930 | ) | | $ | (3,653 | ) |

| Change in fair value of deferred purchase price payable - Tarus and deferred obligation - iOx milestone | | | (113 | ) | | | 70 | |

| Share of loss in associate accounted for using equity method | | | (40 | ) | | | (56 | ) |

| Change in fair value of warrant liability | | | - | | | | 24 | |

| Depreciation expense | | | (15 | ) | | | - | |

| Foreign exchange transaction loss | | | (17 | ) | | | (58 | ) |

| Interest income, net | | | 43 | | | | 35 | |

| Loss before benefit for income taxes | | | (6,072 | ) | | | (3,638 | ) |

| Income tax benefit | | | 907 | | | | 2,553 | |

| Net loss | | | (5,165 | ) | | | (1,085 | ) |

| Other comprehensive income (loss) | | | | | | | | |

| Net unrealized gain on investments | | | (1,300 | ) | | | - | |

| Total comprehensive loss for period | | $ | (6,465 | ) | | $ | (1,085 | ) |

| | | | | | | | | |

| Comprehensive loss attributable to: | | | | | | | | |

| Owners of the Company | | $ | (6,458 | ) | | $ | (949 | ) |

| Non-controlling interest | | | (7 | ) | | | (136 | ) |

| Total comprehensive loss for period | | $ | (6,465 | ) | | $ | (1,085 | ) |

Results of Operations for the Three Months Ended September 30, 2023 Compared to the Three Months Ended September 30, 2022

We incurred a net loss of approximately $5.2 million and total comprehensive loss of approximately $6.5 million during the three months ended September 30, 2023 (the “Fiscal 2024 Quarter”), compared to a net loss and total comprehensive loss of approximately $1.1 million during the three months ended September 30, 2022 (the “Fiscal 2023 Quarter”), an increase in net loss of $4.1 million and an increase in total comprehensive loss of $5.4 million, quarter-over-quarter.

The components of the change in net loss and total comprehensive loss are as follows:

| · | Operating expenses, which include R&D and general and administrative (“G&A”) expenses, were $5.9 million in the Fiscal 2024 Quarter, compared to $3.6 million in the Fiscal 2023 Quarter, an increase of $2.3 million, which is discussed more fully below. |

| · | Our other items of income and expense were substantially non-cash in nature and aggregated approximately $0.142 million net loss in the Fiscal 2024 Quarter, compared to approximately $0.015 million net income in the Fiscal 2023 Quarter, a change in other items of income and expense of approximately $0.157 million, quarter-over-quarter. The primary reason for the quarter-over-quarter difference in other items of income and expense were (a) the non-cash loss from the change (increase) in fair value of the deferred purchase price payable to the former Tarus shareholders and (b) the deferred obligation - iOx milestone, partially offset by the decrease in our foreign exchange transaction loss in the Fiscal 2024 Quarter, compared to the Fiscal 2023 Quarter. |

| · | Additionally, we reflected a non-cash net deferred income tax benefit of $0.9 million in the Fiscal 2024 Quarter, compared to a net deferred income tax benefit of $2.6 million in the Fiscal 2023 Quarter. For the Fiscal 2024 Quarter, we recognized a decrease in net deferred tax liability of $0.3 million to reflect the effect of the change in exchange rates on the liability during the period and the recognition $0.6 million of current period losses in the U.K. The Fiscal 2023 Quarter includes the foreign currency effect on deferred tax liability balance settleable in British pound sterling of $2.2 million and the recognition of current period losses in the U.K. of $0.3 million as well as the rate change effect of $0.1 million. |

Operating Expenses

Total operating expenses are comprised of the following:

| Three months ended September 30, | | 2023 | | 2022 |

| | | In 000’$ | | In 000’$ |

| Research and development | | $ | 4,237 | | | $ | 1,565 | |

| General and administrative expenses | | | 1,693 | | | | 2,088 | |

| Total operating expenses | | $ | 5,930 | | | $ | 3,653 | |

Research and Development Costs

R&D costs are comprised of the following:

| Three months ended September 30, | | 2023 | | 2022 |

| | | In 000’$ | | In 000’$ |

| Research and development - Clinical | | $ | 1,962 | | | $ | 150 | |

| Manufacturing-related costs | | | 968 | | | | 2 | |

| Share-based compensation expense | | | 394 | | | | 660 | |

| Payroll-related expenses | | | 367 | | | | 499 | |

| Consulting fees | | | 247 | | | | 100 | |

| Research and development services and storage | | | 148 | | | | 123 | |

| Licensing fees | | | 120 | | | | - | |

| Research and development – CRADA | | | 31 | | | | 31 | |

| Total research and development costs | | $ | 4,237 | | | $ | 1,565 | |

R&D costs increased by approximately $2.7 million, or approximately 180%, from approximately $1.5 million in the Fiscal 2023 Quarter, to approximately $4.2 million in the Fiscal 2024 Quarter. The increase was primarily attributable to an overall increase in expenditures for our CRO-related costs of $1.3 million in the Fiscal 2024 Quarter, from $0.1 million in the Fiscal 2023 Quarter to $1.4 million in the Fiscal 2024 Quarter and other clinical costs incurred in the Fiscal 2024 Quarter of $0.6 million. We incurred manufacturing-related costs of $1.0 million related to the development of the drugs for the iNKT and adenosine clinical trials; there were de minimis manufacturing-related costs in the prior year period. Payroll-related expenses decreased by 0.1 million due to the recovery of certain personnel costs collected from Intensity for services rendered; the increases in salaries effectuated January 2023 was offset by the fact that no bonus was accrued for in the Fiscal 2024 Quarter. Non-cash share-based compensation expense aggregated $0.4 million in the Fiscal 2024 Quarter (allocated equally to each of the adenosine and iNKT programs), as compared to approximately $0.7 million in the Fiscal 2023 Quarter. The decrease in non-cash stock-based compensation expense is due to the continued vesting of options granted in prior years, as well as recent grants having a lower grant date fair value. We incurred an increase in consulting fees of $0.1 million to reflect the increase in activity period-over-period. Finally, the Fiscal 2024 Quarter reflects $0.1 million in licensing fees paid to the licensor of certain intellectual property utilized in the iNKT clinical trial, which commenced per agreement in the 2024 fiscal year.

General and Administrative Expenses

Key components of G&A expenses are the following:

| Three months ended September 30, | | 2023 | | 2022 |

| | | In 000’$ | | In 000’$ |

| Professional fees | | $ | 762 | | | $ | 767 | |

| Share-based compensation expense | | | 348 | | | | 565 | |

| Payroll-related expenses | | | 223 | | | | 255 | |

| D&O insurance | | | 175 | | | | 312 | |

| Office and general expenses | | | 99 | | | | 65 | |

| Directors fees | | | 83 | | | | 83 | |

| Consulting fees | | | 3 | | | | 41 | |

| Total general and administrative expenses | | $ | 1,693 | | | $ | 2,088 | |

G&A expenses decreased by approximately $0.4 million, or approximately 19%, from approximately $2.1 million in the Fiscal 2023 Quarter, to approximately $1.7 million in the Fiscal 2024 Quarter. Non-cash share-based compensation expense decreased by $0.2 million attributable to the vesting of certain stock options granted in prior years and lower fair value associated with more recent grants. Insurance expense decreased by $0.1 million due to the decrease in the D&O premium year-over-year resulting from changes in the insurance markets.

Six Months Ended September 30, 2023 Compared to the Six Months Ended September 30, 2022

(All Amounts in 000’$)

Results of Operations

The following details major expenses for the six months ended September 30, 2023, compared to the six months ended September 30, 2022:

| Six months ended September 30, | | 2023 | | 2022 |

| | | In 000’$ | | In 000’$ |

| Operating expenses | | $ | (10,927 | ) | | $ | (7,740 | ) |

| Change in fair value of deferred purchase price payable - Tarus and deferred obligation - iOx milestone | | | (1,224 | ) | | | 70 | |

| Share of loss in associate accounted for using equity method | | | (90 | ) | | | (116 | ) |

| Change in fair value of warrant liability | | | - | | | | 25 | |

| Depreciation expense | | | (26 | ) | | | - | |

| Foreign exchange transaction gain (loss) | | | 1 | | | | (110 | ) |

| Interest income, net | | | 123 | | | | 56 | |

| Loss before benefit for income taxes | | | (12,143 | ) | | | (7,815 | ) |

| Income tax benefit | | | 1,052 | | | | 5,105 | |

| Net loss | | | (11,091 | ) | | | (2,710 | ) |

| Other comprehensive income (loss) | | | | | | | | |

| Net unrealized gain on investments | | | 469 | | | | - | |

| Total comprehensive loss for period | | $ | (10,622 | ) | | $ | (2,710 | ) |

| | | | | | | | | |

| Comprehensive loss attributable to: | | | | | | | | |

| Owners of the Company | | $ | (10,608 | ) | | $ | (2,678 | ) |

| Non-controlling interest | | | (14 | ) | | | (32 | ) |

| Total comprehensive loss for period | | $ | (10,622 | ) | | $ | (2,710 | ) |

Results of Operations for the Six Months Ended September 30, 2023 Compared to the Six Months Ended September 30, 2022

We incurred a net loss of approximately $11.1 million and total comprehensive loss of approximately $10.6 million during the six months ended September 30, 2023 (the “Fiscal 2024 Six Months”), which include approximately $1.7 million of non-cash expenses, net, compared to a net loss and total comprehensive loss of approximately $2.7 million during the six months ended September 30, 2022 (the “Fiscal 2023 Six Months”), an increase in net loss of $8.4 million and an increase in total comprehensive loss of $7.9 million, period-over-period.

The components of the change in net loss and total comprehensive loss are as follows:

| · | Operating expenses, which include R&D and G&A expenses, were $10.9 million in the Fiscal 2024 Six Months, compared to $7.7 million in the Fiscal 2023 Six Months, an increase of $3.2 million, which is discussed more fully below. |

| · | Our other items of income and expense were substantially non-cash in nature and aggregated approximately $1.216 million net loss in the Fiscal 2024 Six Months, compared to approximately $0.075 million net loss in the Fiscal 2023 Six Months, a change in other items of income and expense of approximately $1.141 million, period-over-period. The primary reason for the period-over-period difference in other items of income and expense were (a) the non-cash loss from the change (increase) in fair value of the deferred purchase price payable to the former Tarus shareholders and (b) the deferred obligation - iOx milestone totaling $1.224 million, partially offset by the increase in our net interest income from investments in short-term investments in the Fiscal 2024 Six Months. |

| · | Additionally, we reflected a non-cash net deferred income tax benefit of $1.1 million in the Fiscal 2024 Six Months, compared to a non-cash net deferred income tax benefit of $5.1 million in the Fiscal 2023 Six Months. For the Fiscal 2024 Six Months, we recognized a decrease in net deferred tax liability of $0.1 million to reflect the effect of the change in exchange rates on the liability during the period and the recognition $1.0 million of current period losses in the U.K. The Fiscal 2023 Six Months includes the foreign currency effect on deferred tax liability balance settleable in British pound sterling of $4.3 million and the recognition of current period losses in the U.K. of $0.6 million, as well as the rate change effect of $0.2 million. |

Operating Expenses

Total operating expenses are comprised of the following:

| Six months ended September 30, | | 2023 | | 2022 |

| | | In 000’$ | | In 000’$ |

| Research and development | | $ | 7,865 | | | $ | 3,441 | |

| General and administrative expenses | | | 3,062 | | | | 4,299 | |

| Total operating expenses | | $ | 10,927 | | | $ | 7,740 | |

Research and Development Costs

R&D costs are comprised of the following:

| Six months ended September 30, | | 2023 | | 2022 |

| | | In 000’$ | | In 000’$ |

| Research and development – Clinical | | $ | 2,985 | | | $ | 792 | |

| Manufacturing-related costs | | | 1,715 | | | | 26 | |

| Payroll-related expenses | | | 847 | | | | 905 | |

| Share-based compensation expense | | | 817 | | | | 1,211 | |

| Contractual milestone | | | 500 | | | | - | |

| Consulting fees | | | 460 | | | | 124 | |

| Research and development services and storage | | | 238 | | | | 243 | |

| Licensing fees | | | 232 | | | | - | |

| Research and development – CRADA | | | 63 | | | | 100 | |

| Legal regarding patents’ registration | | | 8 | | | | 40 | |

| Total research and development costs | | $ | 7,865 | | | $ | 3,441 | |

R&D costs increased by approximately $4.5 million, or approximately 132%, from approximately $3.4 million in the Fiscal 2023 Six Months, to approximately $7.9 million in the Fiscal 2024 Six Months. The increase was primarily attributable to clinical trial costs (principally CRO-related), which increased from $0.8 million in the Fiscal 2023 Six Months to $3.0 million in the Fiscal 2024 Six Months, or approximately $2.2 million as activities ramped up throughout the period. We incurred manufacturing-related costs of $1.7 million related to the development of the drugs for the iNKT and adenosine clinical trials; there were de minimis related costs in the prior year period. Payroll-related expenses were consistent period over period; the increases in salaries effectuated January 2023 was offset by the fact that no bonus was accrued for in the Fiscal 2024 Six Months. Non-cash share-based compensation expense aggregated $0.8 million in the Fiscal 2024 Six Months (allocated equally to each of the adenosine and iNKT programs), as compared to approximately $1.2 million in the Fiscal 2023 Six Months. The decrease in non-cash stock-based compensation expense is due to the continued vesting of options granted in prior years, as well as recent grants having a lower grant date fair value. In the Fiscal 2024 Six Months, we incurred a milestone payment of $0.5 million for dosing our first adenosine patients, an increase in consulting fees of approximately $0.3 million to reflect the increase in activity period over period and, finally, $0.2 million in licensing fees paid to the licensor of certain intellectual property utilized in the iNKT clinical trial, which commenced per agreement in the 2024 fiscal year.

General and Administrative Expenses

Key components of G&A expenses are the following:

| Six months ended September 30, | | 2023 | | 2022 |

| | | In 000’$ | | In 000’$ |

| Professional fees | | $ | 1,232 | | | $ | 1,670 | |

| Share-based compensation expense | | | 695 | | | | 1,189 | |

| Payroll-related expenses | | | 447 | | | | 506 | |

| D&O insurance | | | 350 | | | | 619 | |

| Office and general expenses | | | 168 | | | | 116 | |

| Directors fees | | | 165 | | | | 158 | |

| Consulting fees | | | 5 | | | | 41 | |

| Total general and administrative expenses | | $ | 3,062 | | | $ | 4,299 | |

G&A expenses decreased by approximately $1.2 million, or approximately 28%, from approximately $4.3 million in the Fiscal 2023 Six Months, to approximately $3.1 million in the Fiscal 2024 Six Months. Professional fees decreased by $0.4 million, primarily attributable to legal fees associated with the Tarus acquisition in the Fiscal 2023 Six Months. Additionally, non-cash share-based compensation expense decreased by $0.5 million attributable to the vesting of certain stock options granted in prior years and lower fair value associated with more recent grants. Insurance expense decreased by $0.3 million due to the decrease in the D&O premium year-over-year resulting from changes in the insurance markets. Finally, payroll-related expenses in total were similar in the Fiscal 2024 Six Months, compared to the Fiscal 2023 Six Months; the increase in annual salaries effectuated in January 2023 was slightly more than offset by the fact that no bonus was accrued for in the Fiscal 2024 Six Months.

Liquidity and Capital Resources

Capital Resources

We filed a registration statement with the SEC under which we may sell ordinary shares, debt securities, warrants and units in one or more offerings from time to time, which became effective on March 8, 2021. In connection with the registration statement, we have filed with the SEC:

| · | a base prospectus, which covers the offering, issuance and sale by us of up to $200,000,000 in the aggregate of the securities identified above from time to time in one or more offerings; |

| · | a prospectus supplement, which covers the offer, issuance and sale by us in an “at-the-market” (“ATM”) offering program of up to a maximum aggregate offering price of $50,000,000 of our ordinary shares that may be issued and sold from time to time under a Controlled Equity Offering Sales Agreement, dated February 24, 2021 (the “Sales Agreement”), with Cantor Fitzgerald & Co., the sales agent; |

| · | a prospectus supplement dated June 24, 2021, for the offer, issuance and sale by us of 1,150,000 ordinary shares for gross proceeds of approximately $26.5 million in a firm commitment underwritten public offering with Cantor Fitzgerald; |

| · | a prospectus supplement dated August 19, 2022, for the resale of up to $30,000,000 in ordinary shares that we may sell from time to time to Lincoln and an additional 94,508 shares that were issued to Lincoln; and |

| · | a prospectus supplement dated September 29, 2023 for the offer, issuance and sale by us in a registered direct public offering through H.C. Wainwright & Co., the placement agent, of (i) 1,970,000 ordinary shares at a purchase price of $1.90 per share and (ii) pre-funded warrants (the “Pre-Funded Warrants”) to purchase up to 1,187,895 ordinary shares, at a purchase price of $1.899 per Pre-Funded Warrant (the “Pre-Funded Warrant Shares”), for aggregate gross proceeds of approximately $6 million. Each Pre-Funded Warrant is exercisable for one ordinary share at an exercise price of $0.001 per share, is immediately exercisable, and will expire when exercised in full (the “2023 Equity Financing”). |

The Sales Agreement permits us to sell in an ATM program up to $50,000,000 of ordinary shares from time to time, the amount of which is included in the $200,000,000 of securities that may be offered, issued and sold by us under the base prospectus. The sales under the prospectus will be deemed to be made pursuant to an ATM program as defined in Rule 415(a)(4) promulgated under the Securities Act. Upon termination of the Sales Agreement, any portion of the $50,000,000 included in the Sales Agreement prospectus that is not sold pursuant to the Sales Agreement will be available for sale in other offerings pursuant to the base prospectus.

On June 24, 2021, we completed the sale of 1,150,000 ordinary shares, including the underwriters’ option, at a price of $23.00 per share, which generated gross proceeds of approximately $26.5 million and net proceeds of approximately $25.0 million, and was settled June 28, 2021.

On July 6, 2022 (the “Signing Date”), we entered into a Purchase Agreement (the “Committed Purchase Agreement”) with Lincoln, pursuant to which we may require Lincoln to purchase our ordinary shares having an aggregate value of up to $30 million over a period of 36 months. Pursuant to the Committed Purchase Agreement, Lincoln will be obligated to purchase the ordinary shares in three different scenarios as described below.

Regular Purchase – At any time after the Closing Date (as defined below) and provided that the closing sale price of the ordinary shares is not less than $0.25 per share, from time to time on any business day selected by us (the “Purchase Date”), we shall have the right, but not the obligation, to require Lincoln to purchase up to 30,000 ordinary shares at the Purchase Price (as defined below) per purchase notice (each such purchase, a “Regular Purchase”). Lincoln’s committed obligation under each Regular Purchase shall not exceed $1,500,000; provided, that the parties may mutually agree at any time to increase the dollar amount of any Regular Purchase on any Purchase Date above and beyond the forgoing amounts that Lincoln is committed to purchase. The purchase price for Regular Purchases (the “Purchase Price”) shall be equal to the lesser of: (i) the lowest sale price of the ordinary shares during the Purchase Date, and (ii) the average of the three (3) lowest closing sale prices of the ordinary shares during the ten (10) business days prior to the Purchase Date. We shall have the right to submit a Regular Purchase notice to Lincoln as often as every business day. “Closing Date” shall mean the date that customary conditions to closing have been satisfied, including that our shelf registration statement for the ordinary shares to be issued pursuant to the Committed Purchase Agreement is effective and available for use and any listing application and/or exchange approvals, to the extent applicable, have been approved.

| · | Accelerated Purchase – In addition to Regular Purchases and provided that we have directed a Regular Purchase in full, we in our sole discretion may require Lincoln on each Purchase Date to purchase on the following business day (“Accelerated Purchase Date”) up to the lesser of (i) three (3) times the number of ordinary shares purchased pursuant to such Regular Purchase, and (ii) 25% of the trading volume on the Accelerated Purchase Date at a purchase price equal to the lesser of 97% of (i) the closing sale price on the Accelerated Purchase Date, and (ii) the Accelerated Purchase Date’s volume weighted average price (the “Accelerated Purchase Price”). The parties may mutually agree to increase the number of ordinary shares sold to Lincoln on any Accelerated Purchase Date at the Accelerated Purchase Price. We shall have the right in our sole discretion to set a minimum price threshold for each Accelerated Purchase in the notice provided with respect to such Accelerated Purchase and we may direct multiple Accelerated Purchases in a day; provided, that delivery of ordinary shares has been completed with respect to any prior Regular Purchases and Accelerated Purchases Lincoln has purchased. |

| · | Tranche Purchase – In addition to Regular Purchases and Accelerated Purchases and provided that the closing price of the ordinary shares is not below $0.25, at any time beginning five (5) business days from the Closing Date, we shall have the option to require Lincoln to purchase up to $3,000,000 in separate purchases of up to $1,000,000 of ordinary shares for each purchase (the “Tranche Purchases”, and with Regular Purchases and Accelerated Purchases, the “Committed Purchases”). The purchase price for each Tranche Purchase shall be equal to 90% of the Purchase Price. We may deliver notice to Lincoln for a Tranche Purchase so long as at least twenty (20) business days have passed since any Tranche Purchase was completed. |

Upon execution of the Committed Purchase Agreement, we issued to Lincoln 94,508 ordinary shares, representing a 3% commitment fee. We have the right to terminate the Committed Purchase Agreement for any reason, effective upon one (1) business day prior written notice to Lincoln. Lincoln has no right to terminate the Committed Purchase Agreement.

Committed Purchases shall be suspended if any of the following occur: (i) the shelf registration statement is not available for the sale of all of the ordinary shares issued pursuant to the Committed Purchase Agreement for ten (10) consecutive trading days or for a total of thirty (30) trading days out of the preceding 365 days; (ii) the ordinary shares cease to be DTC authorized and participating in the D.W.A.C./F.A.S.T. systems; (iii) suspension of the ordinary shares from trading for one (1) trading day; (iv) any breach of the representations and warranties or covenants contained in any related agreements with Lincoln which has or which could have a material adverse effect on us, Lincoln or the value of the ordinary shares, subject to reasonable cure periods to be agreed upon for curable breaches of covenants; (v) if we are listed on a national exchange or market (excluding the OTC Markets, OTC Bulletin Board or comparable market), at any time prior to shareholder approval of the Committed Purchase Agreement more than 19.99% of our aggregate ordinary shares, determined as of the Signing Date, would be issuable to Lincoln in violation of the principal securities exchange or market rules; (vi) if the ordinary shares cease to be eligible for trading on the Nasdaq Capital Market, our principal market, and is not immediately thereafter trading on the Nasdaq Global Select Market, the Nasdaq Global Market, the NYSE, the NYSE American, or the OTC Markets; or (vii) our insolvency or our participation or threatened participation in insolvency or bankruptcy proceedings by or against us. The Committed Purchases may resume following the resolution of any of the forgoing events.

The Committed Purchase Agreement does not impose any financial or business covenants on us and there are no limitations on the use of proceeds received by us from Lincoln. We may raise capital from other sources in our sole discretion; provided, however, that we shall not enter into any similar agreement for the issuance of variable priced equity-like securities until the three-year anniversary of the Signing Date, excluding, however, an ATM transaction with a registered broker-dealer, which includes any sales under the Sales Agreement with Cantor Fitzgerald.

In connection with the Committed Purchase Agreement, we and Lincoln entered into a Registration Rights Agreement (the “Registration Rights Agreement”), dated July 6, 2022. Pursuant to the Registration Rights Agreement, we agreed, within the time required under Rule 424(b) under the Securities Act, to file with the SEC an initial prospectus supplement to our shelf registration statement pursuant to Rule 424(b) for the purpose of registering for resale the ordinary shares to be issued to Lincoln under the Committed Purchase Agreement. All reasonable expenses of ours incurred through the registration of the ordinary shares under the Committed Purchase Agreement shall be paid by us.

From October 2022 through March 31, 2023, we sold 166,145 ordinary shares under the ATM program, generating net proceeds of approximately $0.9 million. Separately, between October 2022 and March 31, 2023, we sold 480,000 ordinary shares to Lincoln under the Committed Purchase Agreement for net proceeds totaling approximately $2.0 million. Finally, from April 1, 2023 through September 30, 2023, we sold 186,604 ordinary shares under the ATM program, generating net proceeds of approximately $0.7 million.

On March 1, 2023, Tarus entered into a clinical service agreement with a third-party service provider. The term of the agreement is through the earlier of August 14, 2025 or the completion of provision of services and the payment of contractual obligations. The agreement provides for budgeted costs totaling approximately $12.1 million.

In connection with the 2023 Equity Financing, on September 29, 2023, we entered into a securities purchase agreement (the “Purchase Agreement”) with an institutional and accredited investor in connection with a registered direct offering as described above (the “Registered Direct Offering”) and a concurrent private placement (the “Private Placement,” and together with the Registered Direct Offering, the “Offerings”). The Offerings closed on October 3, 2023.

Pursuant to the Purchase Agreement, in the Registered Direct Offering, we sold (i) 1,970,000 ordinary shares, at a purchase price of $1.90 per share and (ii) Pre-Funded Warrants to purchase up to 1,187,895 Pre-Funded Warrant Shares. Each Pre-Funded Warrant is exercisable for one ordinary share at an exercise price of $0.001 per share, is immediately exercisable, and will expire when exercised in full.

In the Private Placement, we issued to such institutional and accredited investor unregistered warrants to purchase up to 3,157,895 ordinary shares (the “Series A Warrants”), unregistered warrants to purchase up to 3,157,895 ordinary shares (the “Series B Warrants”), and unregistered warrants to purchase up to 3,157,895 ordinary shares (the “Series C Warrants,” together with the Series A Warrants and the Series B Warrants, the “Private Warrants”), together exercisable for an aggregate of up to 9,473,685 ordinary shares (the “Private Warrant Shares”). Pursuant to the terms of the Purchase Agreement, for each ordinary share and Pre-Funded Warrant issued in the Registered Direct Offering, an accompanying Series A Warrant, Series B Warrant and Series C Warrant were issued to such institutional and accredited investor. Each Series A Warrant is exercisable for one Private Warrant Share at an exercise price of $1.90 per share, is immediately exercisable and will expire 18 months from the date of issuance. Each Series B Warrant is exercisable for one Private Warrant Share at an exercise price of $2.26 per share, is immediately exercisable and will expire three years from the date of issuance. Each Series C Warrant is exercisable for one Private Warrant Share at an exercise price of $2.26 per share, is immediately exercisable and will expire five years from the date of issuance. The net proceeds to us from the Offerings were approximately $5.3 million, after deducting placement agent’s fees and estimated offering expenses.

Pursuant to an engagement letter, dated as of August 26, 2023, between us and H.C. Wainwright & Co., LLC (the “Placement Agent”), we paid the Placement Agent a total cash fee equal to 6.0% of the aggregate gross proceeds received in the Offerings, or $0.36 million. We also agreed to pay the Placement Agent in connection with the Offerings a management fee equal to 1.0% of the aggregate gross proceeds raised in the Offerings ($0.06 million), $75,000 for non-accountable expenses and $15,950 for clearing fees. In addition, we agreed to issue to the Placement Agent, or its designees, warrants to purchase up to 157,895 ordinary shares (the “Placement Agent Warrants,” and together with the Pre-Funded Warrants and the Private Warrants, the “Warrants”), which represents 5.0% of the aggregate number of ordinary shares and Pre-Funded Warrants sold in the Registered Direct Offering. The Placement Agent Warrants have substantially the same terms as the Private Warrants, except that the Placement Agent Warrants have an exercise price equal to $2.375, or 125% of the offering price per ordinary share sold in the Registered Direct Offering, and will be exercisable for five years from the commencement of the sales pursuant to the Offerings.

Access to the Committed Purchase Agreement with Lincoln is generally limited based on, among other things, our Nasdaq trading volume. Furthermore, under General Instruction I.B.5 to Form F-3 (the “Baby Shelf Rule”), the amount of funds we can raise through primary public offerings of securities in any 12-month period using our registration statement on Form F-3 is limited to one-third of the aggregate market value of the ordinary shares held by our non-affiliates, which limitation may change over time based on our stock price, number of ordinary shares outstanding and the percentage of ordinary shares held by non-affiliates. We are therefore limited by the Baby Shelf Rule as of the filing of this Form 6-K, until such time as our non-affiliate public float exceeds $75 million.

We are prohibited from issuing or entering into any agreement to issue ordinary shares (or ordinary share equivalents) involving a variable rate transaction, including pursuant to the Committed Purchase Agreement with Lincoln, the Sales Agreement for the ATM program and any other equity line of credit or at-the-market facility, for a period commencing on September 29, 2023 and expiring on April 3, 2024.

Going Concern

The accompanying condensed consolidated interim financial statements for the three and six months ended September 30, 2023 have been prepared on a basis that assumes that we will continue as a going concern and that contemplates the continuity of operations, the realization of assets and the satisfaction of liabilities and commitments in the normal course of business. Accordingly, the accompanying condensed consolidated interim financial statements for the three and six months ended September 30, 2023 do not include any adjustments relating to the recoverability and classification of recorded asset amounts or amounts of liabilities that might result from the outcome of this uncertainty.

As of September 30, 2023, we had cash and cash equivalents of approximately $3.4 million and total current liabilities of approximately $3.1 million. For the six months ended September 30, 2023, we are reporting a net loss of approximately $11.1 million and cash used in operating activities of approximately $7.7 million. As of October 31, 2023, we had approximately $7.2 million of cash and cash equivalents on hand.

Our cash and cash equivalents balance is decreasing from operations and we will not generate positive cash flows from operations for the fiscal year ending March 31, 2024.

We have and may continue to delay, scale-back, or eliminate certain of our activities and other aspects of our operations until such time as we are successful in securing additional funding. We are exploring various dilutive and non-dilutive sources of funding, including equity and debt financings, strategic alliances, business development and other sources. Our future success is dependent upon our ability to obtain additional funding. There can be no assurance, however, that we will be successful in obtaining such funding in sufficient amounts, on terms acceptable to us, or at all. As of the date of this filing, we currently anticipate that current cash and cash equivalents, excluding any potential proceeds from our ATM program and Committed Purchase Agreement with Lincoln, will be sufficient to meet our anticipated cash requirements through the end of March 2024. Access to our Committed Purchase Agreement with Lincoln is generally limited based on, among other things, our trading volume. Furthermore, under the Baby Shelf Rule, the amount of funds we can raise through primary public offerings of securities in any 12-month period using our registration statement on Form F-3 is limited to one-third of the aggregate market value of the ordinary shares held by our non-affiliates, which limitation may change over time based on our stock price, number of ordinary shares outstanding and the percentage of ordinary shares held by non-affiliates. We therefore are limited by the Baby Shelf Rule as of the filing of this Form 6-K, until such time as our non-affiliate public float exceeds $75 million. These factors raise significant doubt about our ability to continue as a going concern within one year after the date that the financial statements are issued.

We have incurred significant operating losses since inception and expect to continue to incur significant operating losses for the foreseeable future and may never become profitable. The losses result primarily from our conduct of research and development activities.

We historically have funded our operations principally from proceeds from issuances of equity and debt securities. We will require significant additional capital to make the investments we need to execute our longer-term business plan. Our ability to successfully raise sufficient funds through the sale of debt or equity securities when needed is subject to many risks and uncertainties and, future equity issuances would result in dilution to existing stockholders and any future debt securities may contain covenants that limit our operations or ability to enter into certain transactions.

Cash Flows From Operating Activities

During the Fiscal 2024 Six Months, we used cash of approximately $7.7 million to fund operating activities, compared to approximately $4.7 million used during the Fiscal 2023 Six Months. Operations in both the Fiscal 2024 Six Months and the Fiscal 2023 Six Months were funded by cash raised from the ATM program, the public offering in June 2021 and the ordinary shares issued to Lincoln under the Committed Purchase Agreement, described above under “Capital Resources.”

Our continuing operations are dependent upon any one of:

| 1. | the development and identification of economically recoverable therapeutic solutions; |

| 2. | the ability of us to obtain the necessary financing to complete the research and development; or |

| 3. | the future profitable production, or proceeds, from the disposition of intellectual property. |

We have incurred significant operating losses since inception due to significant R&D spending and corporate overhead, and we expect to continue to incur significant operating losses for the foreseeable future and may never become profitable. As of September 30, 2023, we had cash and cash equivalents of approximately $3.4 million, working capital of approximately $3.1 million (including prepaid expenses of $2.4 million) and an accumulated deficit of approximately $170.7 million. We have funded our operations primarily from proceeds from the sale of equity and debt securities. We will require significant additional capital to make the investments that we need to execute our longer-term business plan. Our ability to successfully raise sufficient funds through the sale of debt or equity securities when needed is subject to many risks and uncertainties and, even if it were successful, future equity issuances would result in dilution to our existing stockholders and any future debt securities may contain covenants that limit our operations or ability to enter into certain transactions.

Cash Flows From Investing Activities

During the Fiscal 2024 Six Months, there were no cash flows from investing activities. During the Fiscal 2023 Six Months, we used cash of $0.6 million to fund investing activities.

Cash Flows From Financing Activities

During the Fiscal 2024 Six Months, we generated net cash of $0.6 million from financing activities. During the Fiscal 2023 Six Months, we used cash of $3.0 million to fund financing activities.

From April 1, 2023 through September 30, 2023, we sold 186,604 ordinary shares under the ATM program, generating net proceeds of approximately $0.7 million. Additionally, the Fiscal 2024 Six Months reflects the scheduled repayment of the lease liability.

Key Contractual Obligations