SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, For Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| x | | Soliciting Material Under Rule 14a-12 |

|

BLUE COAT SYSTEMS, INC. |

| (Name of Registrant as Specified In Its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | |

| | (1) | | Amount previously paid: |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | (4) | | Date Filed: |

| | | | |

The following information was presented to employees of Blue Coat Systems, Inc. on December 19, 2011:

|

Corporate All Hands Meeting Corporate All Hands Meeting Corporate All Hands Meeting Dec. 19, 2011 Dec. 19, 2011 Blue Coat Confidential – Internal Use Only |

|

2 Important Information for Blue Coat Shareholders Important Information for Blue Coat Important Information for Blue Coat Shareholders Shareholders Information Regarding the Solicitation of Proxies Information Regarding the Solicitation of Proxies In connection with the proposed transaction, Blue Coat will file a proxy statement and relevant documents concerning the proposed transaction with the SEC relating to the solicitation of proxies to vote at a special meeting of stockholders to be called to approve the proposed transaction. The definitive proxy statement will be mailed to the stockholders of the company in advance of the special meeting. Shareholders of Blue Coat are urged to read the proxy statement and other relevant materials when they become available because they will contain important information about Blue Coat and the proposed transaction. Shareholders may obtain a free copy of the proxy statement and any other relevant documents filed by Blue Coat with the SEC (when available) at the SEC's Web site at www.sec.gov. In addition, shareholders may obtain free copies of the documents filed with the SEC by Blue Coat by contacting Blue Coat Investor Relations by e-mail at jane.underwood@bluecoat.com or by phone at 408-541-3015. Blue Coat and its directors and certain executive officers may be deemed to be participants in the solicitation of proxies from Blue Coat shareholders in respect of the proposed transaction. Information about the directors and executive officers of Blue Coat and their respective interests in Blue Coat by security holdings or otherwise is set forth in its proxy statements and Annual Reports on Form 10-K, previously filed with the SEC. Investors may obtain additional information regarding the interest of the participants by reading the proxy statement regarding the acquisition when it becomes available. Each of these documents is, or will be, available for free at the SEC's Web site at www.sec.gov and at the Blue Coat Investor Relations Web site at: www.bluecoat.com/company/corporate-investor. © Blue Coat Systems, Inc. 2011. Blue Coat Confidential – Internal Use Only |

|

Introduction to Thoma Bravo Introduction to Thoma Introduction to Thoma Bravo Bravo Greg Clark, President & CEO Greg Clark, President & CEO Seth Boro, Partner, Thoma Bravo Seth Boro, Partner, Thoma Bravo Blue Coat Confidential – Internal Use Only |

|

CONFIDENTIAL About Thoma Bravo About Thoma Bravo Founded in 1980 (among the oldest private equity firms in the world) $2.5 billion of equity capital under management Latest fund: Thoma Bravo Fund IX, raised in April 2009 Strong and consistent track record: 30-year aggregate IRR of 35.6% & Technology IRR of 72.2% Recognized as the leading, most active technology private equity investor 60 technology acquisitions since 2002 representing $5.5+ billion in value Completed more security and infrastructure technology transactions than any other private equity investor • Security: Tripwire, SonicWALL, Entrust, LANDesk and Novell • Infrastructure: Attachmate, Vision, Embarcadero, Hyland, Flexera |

|

CONFIDENTIAL Thoma Bravo Technology Portfolio Thoma Bravo Technology Portfolio The Thoma Bravo technology team has: Led or co-led 19 tech buyouts with aggregate enterprise value of over $3.8 billion Closed 46 add-ons with aggregate enterprise value of $2.7 billion Constructed a portfolio of technology businesses which: • Has revenue and EBITDA in excess of $3.6 billion and $1.1 billion, respectively • Serves more than 300,000 customers • Employs approximately 14,000 people Created leaders in fourteen technology markets: Thoma Bravo is the most active private equity technology investor • Enterprise Content Management • Software Entitlement Mgmt & Installation • Property Tax and Appraisal Software • Retail & Consumer Goods • Fleet Routing & Scheduling • Distribution • High Availability • Higher Education • K-12 Education • Manufacturing • Network Security • Authentication & Identity Mgmt • Security Information & Event Mgmt • Desktop & Systems Management • Cross Platform Data Management |

|

CONFIDENTIAL Investment Criteria and Blue Coat Investment Criteria and Blue Coat Thoma Bravo analyzes 100+ deals per year, and generally makes 2 - 3 new investments Blue Coat represents the largest and most important investment in our firm’s history Blue Coat is a perfect fit for our criteria and approach Market leading franchise in Web Security and Network Acceleration Experienced management team, and highly talented employee base Strong industry fundamentals Core markets projected to grow between 10% - 20% Marquee customer base offering significant opportunity for further penetration Industry leading technology Gartner magic quadrant leader in all of its markets Tremendous platform for consolidation in fragmented markets Tremendous growth opportunity through market and product expansion Management and investor goals are 100% aligned Highly achievable plan to double the size of the business |

|

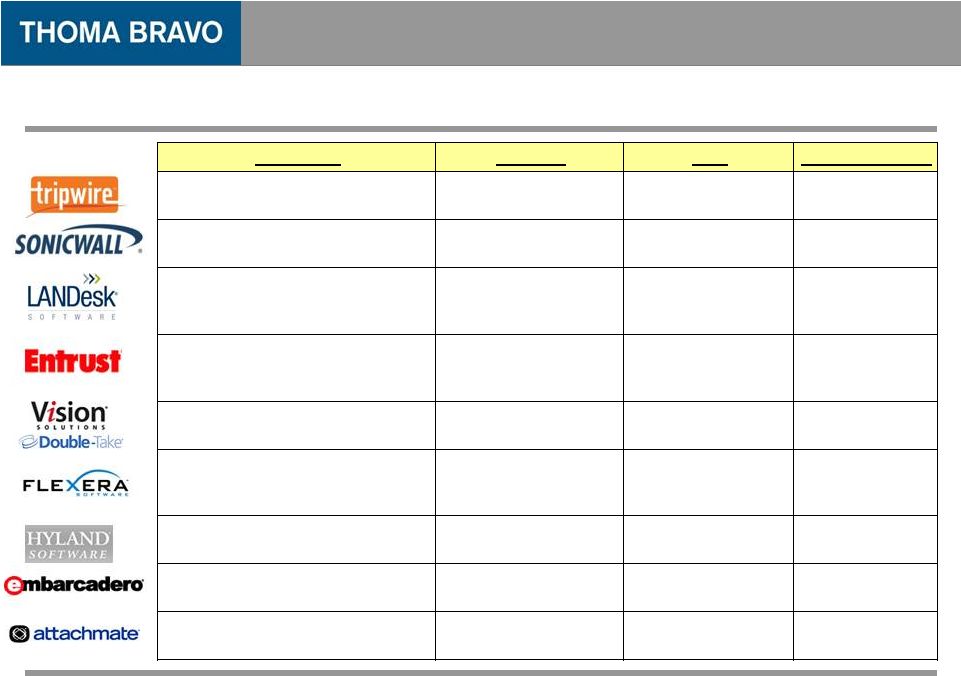

CONFIDENTIAL Infrastructure Portfolio Infrastructure Portfolio Leadership Footprint M&A Transaction Type #1 provider of file integrity monitoring and change audit solutions Over 6,000 customers; 50% of the Fortune 500 New investment MBO #1 provider of network security solutions to SMB Over 12,000 resellers; over 1MM customers New investment Take private #1 provider of endpoint systems management and IT service desk solutions 330 channel partners and 3,500 customers New Investment Divisional spinout #1 provider of authentication and identity management solutions Over 2,000 customers including 9 of the top 10 e-governments 2 deals in review, but none completed to date Take private #1 provider of high availability software Over 5,000 customers 1 large merger; 2 follow-on acquisitions Take private #1 provider of software entitlement management and installation solutions ~60,000 customers and 500mm desktops 3 follow-on acquisitions Divisional spinout #1 provider of SMB content management software 6,400 customers; strong franchise in healthcare 4 follow-on acquisitions Recapitalization #1 provider of cross platform database management tools 22,000 customers; 97 of the Fortune 100 2 follow-on acquisitions Take private #1 provider of host access and systems management software Over 40,000 customers on over 16mm desktops 3 large mergers; 1 follow-on acquisition Recapitalization |

|

CONFIDENTIAL Applications Portfolio Applications Portfolio Leadership Footprint M&A Transaction Type #1 software provider to the distribution industry 3,400 customers; 95,000 users; over $55bn in transactions / yr 7 follow-on acquisitions Take private #1 software solution provider to higher education Over 660 clients and nearly 4 million students served Zero MBO #1 software provider to SMB manufacturing industry 4,000 customers serving over 30 manufacturing verticals 9 follow-on acquisitions Management-backed consolidation #1 software solutions provider in 4 core verticals 15,000 customers representing 32,000 locations 2 follow-on acquisitions Management-backed consolidation #1 software vendor to retail and consumer goods verticals Over 5,500 customers; installments in over 60% of top 100 retailers 1 large merger with Manugistics PIPE #1 provider of property tax and appraisal software 1,400 customers representing 28mm parcels of land 6 follow-on acquisitions; strong acquisition pipeline Take private #1 provider of instructional technology solutions to K-12 education 2,362 customers, nearly 2 million students on flagship on-line product 1 follow-on acquisition Take private #1 provider of fleet routing and scheduling software 900 customers representing 3,300 locations New investment Divisional spinout |

|

CONFIDENTIAL Thoma Bravo Security Ecosystem Thoma Bravo Security Ecosystem SIEM IPS Firewall / VPN Endpoint Protection Secure Web Gateway Email User Provisioning / Identify Mgmt Market Size ($mm) 5-YR CAGR % Representative TB Investments $6,383 $3,029 $1,862 $1,799 $1,091 $1,498 $987 10% 4% 14% 10% 9% 12% 12% Total $16,649 10% Source: Market data per Gartner and Lazard research. Over the past 3 years Thoma Bravo has built a security portfolio that generates annual revenues of $1.1BN |

|

CONFIDENTIAL ` Portfolio Company Results Note: Does not include all companies in the current portfolio. ($MM) Company EBITDA at Close Add-On Acquisitions / EBITDA Growth Current EBITDA $42.4 $27.6 $70.0 $13.2 $16.8 $30.0 $8.2 $16.8 $25.0 $26.0 $14.0 $40.0 $93.0 $21.3 $114.3 $20.8 $42.2 $63.0 $5.6 $17.5 $23.1 $20.0 $386.0 $406.0 $8.5 $63.5 $72.0 $15.0 $8.5 $23.5 $30.0 $30.0 $60.0 $43.1 $29.9 $73.0 $12.6 $6.7 $19.3 $9.3 $1.7 $11.0 Total $347.7 $682.5 $1,030.2 |

|

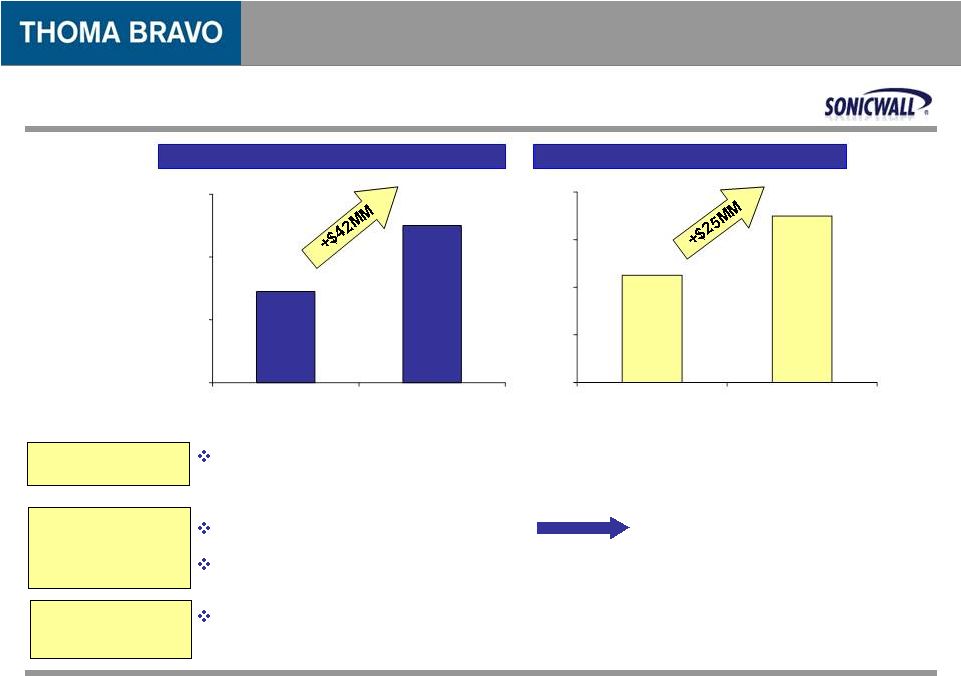

CONFIDENTIAL SonicWALL Case Study SonicWALL Case Study Back existing management to consolidate the Unified Threat Management network security market, improve operations and bolster organic growth EBITDA Margin: 20% before investment 27% through operating efficiencies Dramatically improved the company’s subscription services attach and renewal rates Leading independent provider of UTM network security with market leading SME position and a successful initial launch into the enterprise next generation firewall market Thesis Operational Improvement Results $218.0 $260.0 $160.0 $200.0 $240.0 $280.0 Pre-Investment 2011E $45.0 $70.0 $0.0 $20.0 $40.0 $60.0 $80.0 Pre-Investment 2011E Revenue EBITDA |

|

CONFIDENTIAL Flexera Software Case Study Flexera Software Case Study Back existing management to build a standalone company and consolidate Flexera’s market Organic growth from 0% to 24%; EBITDA margin expansion to 36% in 2011E 4 total: 2 substantial, highly strategic acquisitions to round out product portfolio and add $20mm in EBITDA 4.6x capital invested, 71% gross IRR, through a sale to a financial buyer Thesis Operational Improvement Acquisitions Results Revenue EBITDA $112.9 $166.0 $50.0 $75.0 $100.0 $125.0 $150.0 $175.0 Pre-Investment 2011E $32.2 $60.3 $0.0 $20.0 $40.0 $60.0 $80.0 Pre-Investment 2011E |

|

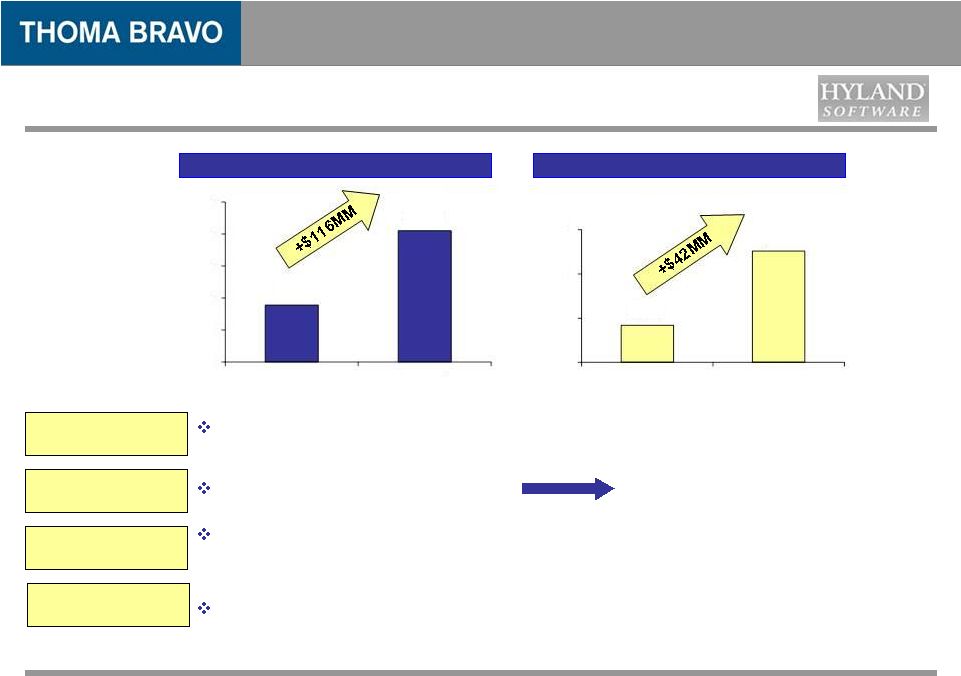

CONFIDENTIAL Hyland Software Case Study Hyland Software Case Study Back existing management to consolidate the enterprise content management software market, grow the direct business, and improve operating metrics EBITDA margin: 23% pre investment 33% for 2011E 5 acquisitions: $45MM revenue, $15MM PF EBITDA, $50MM Purchase Price, 3x Pro Forma, all funded with balance sheet cash and/or debt Leading independent provider of ECM software, 2010 license bookings growth of 38% Thesis Operational Improvement Acquisitions Results Revenue EBITDA $89.0 $205.0 $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 Pre-Investment 2011E $21.0 $63.0 $0.0 $25.0 $50.0 $75.0 Pre-Investment 2011E |

|

CONFIDENTIAL Vision Solutions Case Study Vision Solutions Case Study Back existing management to consolidate the High Availability software market, and significantly improve operations EBITDA Margin: <10% before investment 40% in 2011E 3 substantial: $130MM revenue, $50MM PF EBITDA, $260MM Purchase Price, 5x Pro Forma, all funded with cash and/or debt Leading independent provider of HA across all computing platforms Thesis Operational Improvement Acquisitions Results Revenue EBITDA Note: Fiscal year ending October 31. $36.2 $175.0 $0.0 $50.0 $100.0 $150.0 $200.0 Pre-Investment 2011E $3.0 $72.0 $0.0 $20.0 $40.0 $60.0 $80.0 Pre-Investment 2011E |

|

Blue Coat Confidential – Internal Use Only |

Important Information

Blue Coat Systems, Inc. (the “Company”) plans to file with the Securities and Exchange Commission (the “SEC”) and mail to its stockholders a proxy statement regarding the proposed acquisition of the Company by controlled affiliates of Thoma Bravo, LLC (“Thoma Bravo”). Investors and security holders are urged to read the proxy statement relating to such acquisition and any other relevant documents filed with the SEC when they become available because they will contain important information. Investors and security holders may obtain a free copy of the proxy statement and other documents that the Company files with the SEC (when available) from the SEC’s website at www.sec.gov and the Company’s website at www.bluecoat.com. In addition, the proxy statement and other documents filed by the Company with the SEC (when available) may be obtained from the Company free of charge by directing a request to Blue Coat Systems, Inc., Attn: Investor Relations, 420 North Mary Avenue, Sunnyvale, CA 94085, telephone: (408) 220-2200.

Certain Information Regarding Participants

The Company, its directors, executive officers and certain employees may be deemed to be participants in the solicitation of the Company’s security holders in connection with the proposed acquisition of the Company by Thoma Bravo. Security holders may obtain information regarding the names, affiliations and interests of such individuals in the Company’s Annual Report on Form 10-K for the fiscal year ended April 30, 2011, which was filed with the SEC on June 8, 2011, and its definitive proxy statement for the 2011 Annual Meeting of Stockholders, which was filed with the SEC on August 29, 2011. To the extent holdings of Company securities have changed since the amounts printed in the definitive proxy statement for the 2011 Annual Meeting, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 or Initial Statements of Beneficial Ownership on Form 3 filed with the SEC. Additional information regarding the interests of such individuals can also be obtained from the proxy statement relating to the proposed acquisition of the Company by Thoma Bravo when it is filed by the Company with the SEC. These documents (when available) may be obtained free of charge from the SEC’s website at www.sec.gov and the Company’s website at www.bluecoat.com.

Forward-looking Statements

Any statements in this document not relating to historical matters are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements relate to the Company’s future plans, objectives, expectations, intentions and financial performance and the assumptions that underlie these statements. These forward-looking statements include, but are not limited to, statements concerning the following: plans to develop and offer new products and services and enter new markets; expectations with respect to future market growth opportunities; changes in and expectations with respect to revenues, gross margins and income tax provisions; future operating expense levels and operating margins; the impact of quarterly fluctuations of revenue and operating results; the success of the Company’s business strategy and changes in the Company’s business model, management, organizational structure and operations; the impact of macroeconomic conditions on the Company’s business; the adequacy of the Company’s capital resources to fund operations

and growth; investments or potential investments in acquired businesses and technologies, as well as internally developed technologies; the effectiveness of the Company’s sales force, distribution channel, and marketing activities; the impact of recent changes in accounting standards; the parties’ ability to consummate the proposed acquisition of the Company by Thoma Bravo; and assumptions underlying any of the foregoing. In some cases, forward-looking statements are identified by the use of terminology such as “anticipate,” “expect,” “intend,” “plan,” “predict,” “believe,” “estimate,” “may,” “will,” “should,” “would,” “could,” “potential,” “continue,” “ongoing,” or negatives or derivatives of the foregoing, or other comparable terminology. The forward-looking statements contained in this document involve known and unknown risks, uncertainties and other factors that may cause industry and market trends, or the Company’s actual results, level of activity, performance or achievements, to be materially different from any future trends, results, level of activity, performance or achievements expressed or implied by these statements. For a detailed discussion of these risks, readers are referred to the Company’s filings with the SEC, including but not limited to, the information included in the Company’s Annual Report on Form 10-K for the fiscal year ended April 30, 2011, which outlines certain important risks regarding the Company’s forward-looking statements, as well as information included in subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. The Company undertakes no obligation to revise or update forward-looking statements to reflect new information or events or circumstances occurring after the date of this release, except as may be required by applicable law.