CONSOLIDATED FINANCIAL STATEMENTS MARINA PALMS, LLC AND SUBSIDIARIES (A DELAWARE LIMITED LIABILITY COMPANY) FOR THE YEARS ENDED DECEMBER 31, 2017, 2016 AND 2015

Contents PAGE Independent Auditor’s Report Consolidated Financial Statements: Balance Sheets 1 Statements of Income 2 Statements of Members’ Capital 3 Statements of Cash Flows 4 Notes to Consolidated Financial Statements 5-8

www.gprco-cpa.com 4770 Biscayne Blvd., Suite 400 Miami, FL 33137 Telephone: 305-868-3600 Facsimile: 305-864-6740 7777 Glades Road, Suite 204 Boca Raton, FL 33434 Telephone: 561-392-9059 Facsimile: 561-372-7957 Gerson, Preston, Klein, Lips, Eisenberg & Gelber, P.A. C E R T I F I E D P U B L I C A C C O U N T A N T S INDEPENDENT AUDITOR’S REPORT To the Members Marina Palms, LLC and Subsidiaries We have audited the accompanying consolidated financial statements of Marina Palms, LLC and Subsidiaries (a Delaware Limited Liability Company), which comprise the consolidated balance sheets as of December 31, 2017 and 2016, and the related consolidated statements of income, members’ capital, and cash flows for each of the three years in the period ended December 31, 2017, and the related notes to the consolidated financial statements. Management’s Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. Auditor’s Responsibility Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditor's judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity's preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity's internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Opinion In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Marina Palms, LLC and Subsidiaries as of December 31, 2017 and 2016, and the results of their consolidated operations and their consolidated cash flows for each of the three years in the period ended December 31, 2017, in accordance with accounting principles generally accepted in the United States of America. Miami, Florida February 9, 2018

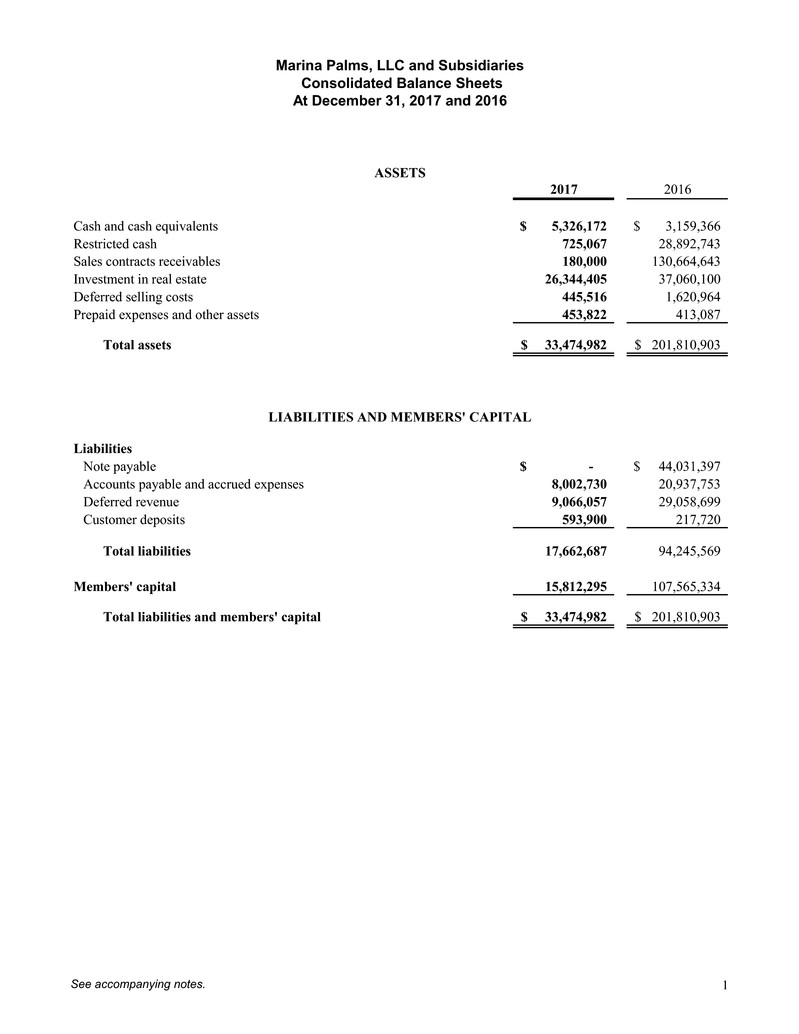

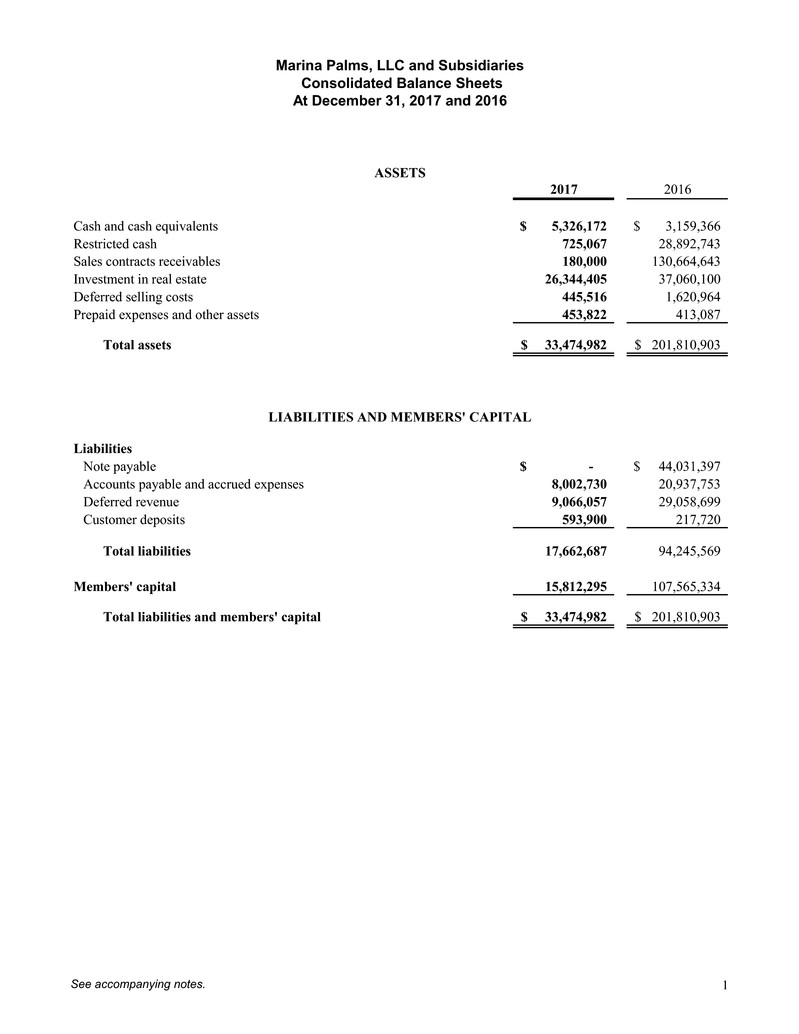

Marina Palms, LLC and Subsidiaries Consolidated Balance Sheets At December 31, 2017 and 2016 ASSETS 2017 2016 Cash and cash equivalents 5,326,172$ 3,159,366$ Restricted cash 725,067 28,892,743 Sales contracts receivables 180,000 130,664,643 Investment in real estate 26,344,405 37,060,100 Deferred selling costs 445,516 1,620,964 Prepaid expenses and other assets 453,822 413,087 Total assets 33,474,982$ 201,810,903$ LIABILITIES AND MEMBERS' CAPITAL Liabilities Note payable -$ 44,031,397$ Accounts payable and accrued expenses 8,002,730 20,937,753 Deferred revenue 9,066,057 29,058,699 Customer deposits 593,900 217,720 Total liabilities 17,662,687 94,245,569 Members' capital 15,812,295 107,565,334 Total liabilities and members' capital 33,474,982$ 201,810,903$ 1See accompanying notes.

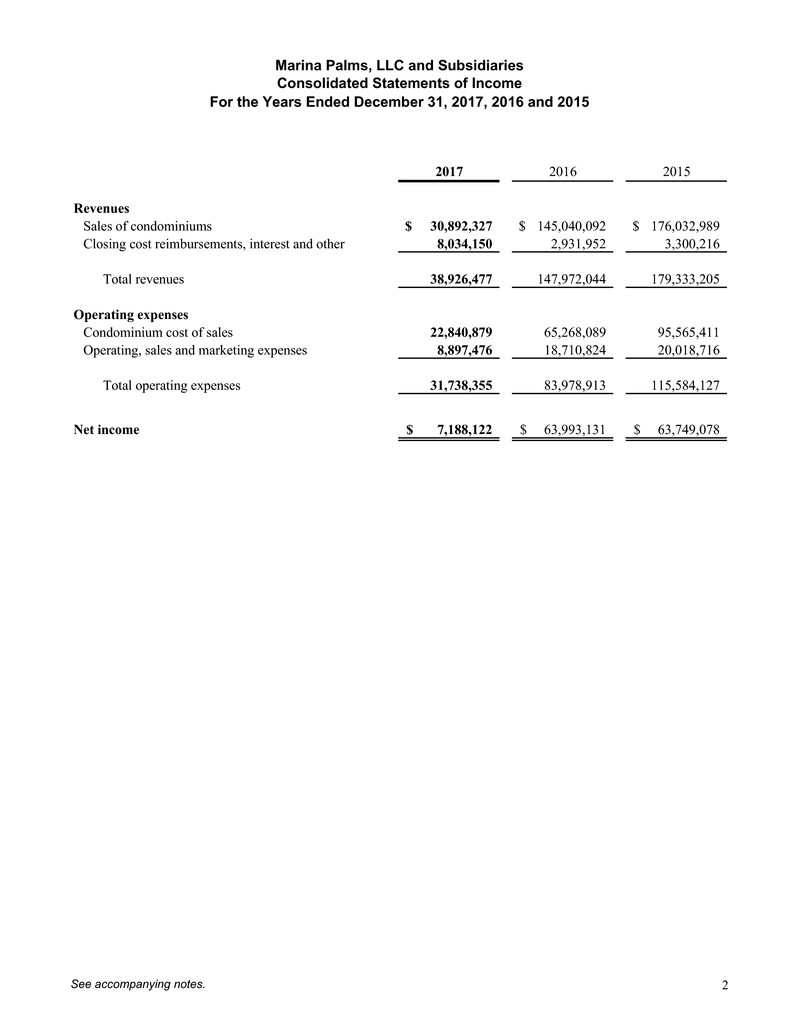

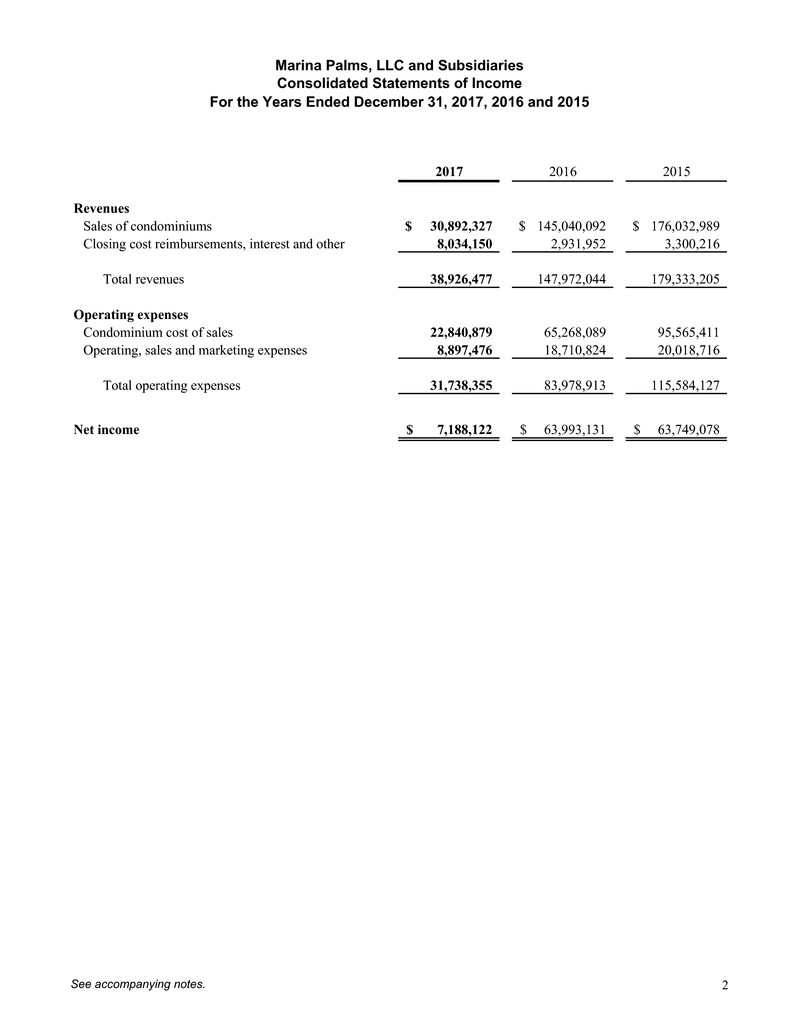

2017 2016 2015 Revenues Sales of condominiums 30,892,327$ 145,040,092$ 176,032,989$ Closing cost reimbursements, interest and other 8,034,150 2,931,952 3,300,216 Total revenues 38,926,477 147,972,044 179,333,205 Operating expenses Condominium cost of sales 22,840,879 65,268,089 95,565,411 Operating, sales and marketing expenses 8,897,476 18,710,824 20,018,716 Total operating expenses 31,738,355 83,978,913 115,584,127 Net income 7,188,122$ 63,993,131$ 63,749,078$ Marina Palms, LLC and Subsidiaries Consolidated Statements of Income For the Years Ended December 31, 2017, 2016 and 2015 2See accompanying notes.

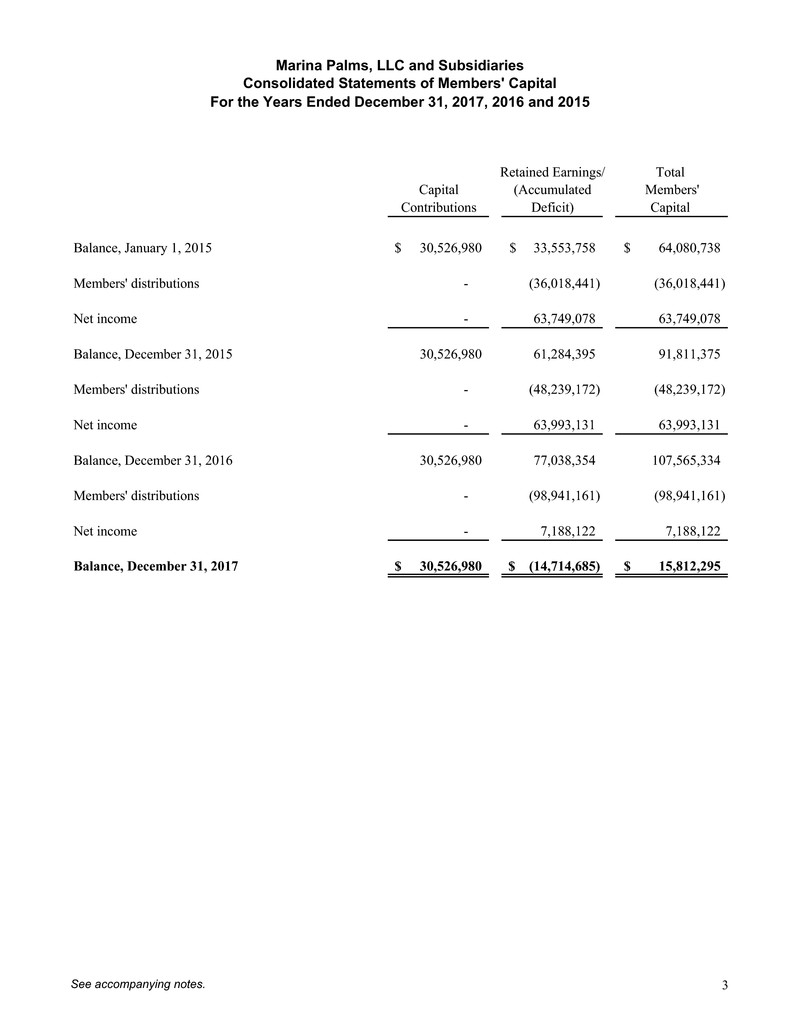

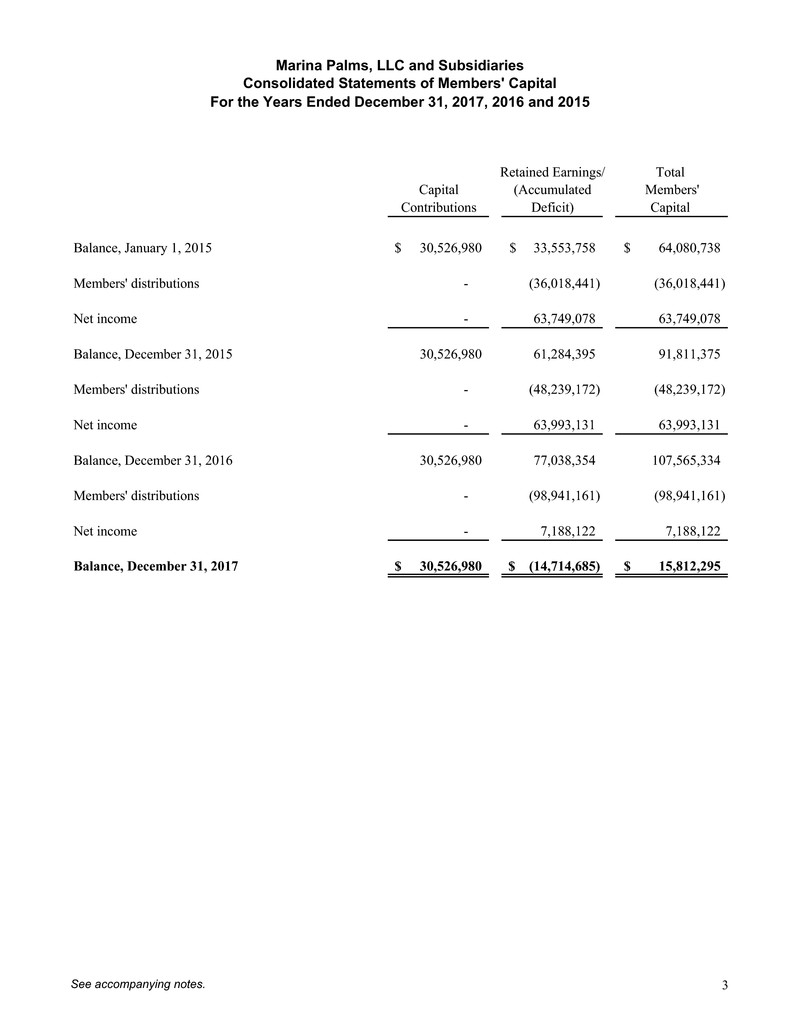

Marina Palms, LLC and Subsidiaries Consolidated Statements of Members' Capital Retained Earnings/ Total Capital (Accumulated Members' Contributions Deficit) Capital Balance, January 1, 2015 30,526,980$ 33,553,758$ 64,080,738$ Members' distributions - (36,018,441) (36,018,441) Net income - 63,749,078 63,749,078 Balance, December 31, 2015 30,526,980 61,284,395 91,811,375 Members' distributions - (48,239,172) (48,239,172) Net income - 63,993,131 63,993,131 Balance, December 31, 2016 30,526,980 77,038,354 107,565,334 Members' distributions - (98,941,161) (98,941,161) Net income - 7,188,122 7,188,122 Balance, December 31, 2017 30,526,980$ (14,714,685)$ 15,812,295$ For the Years Ended December 31, 2017, 2016 and 2015 3See accompanying notes.

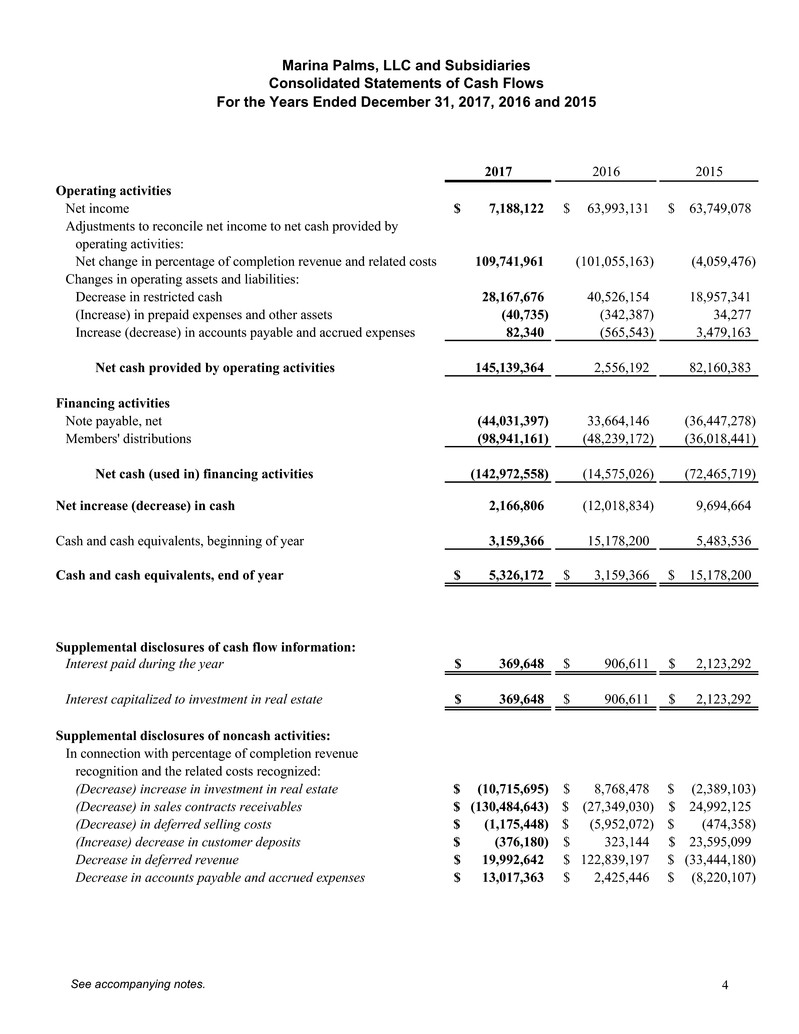

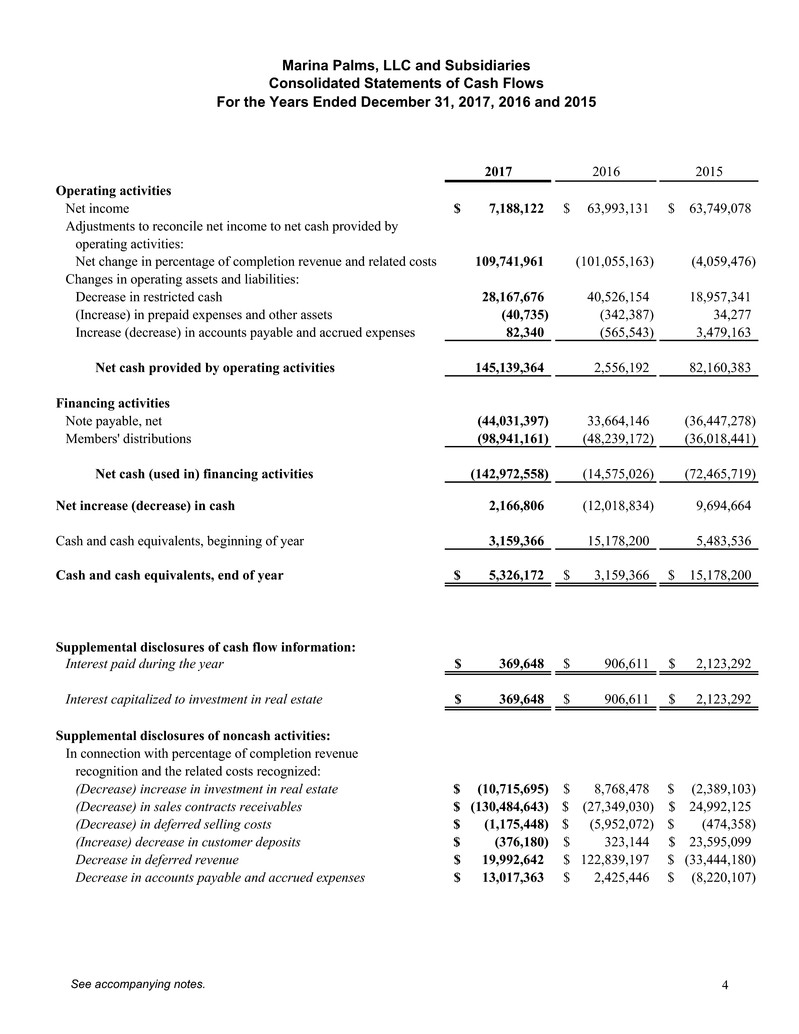

2017 2016 2015 Operating activities Net income 7,188,122$ 63,993,131$ 63,749,078$ Adjustments to reconcile net income to net cash provided by operating activities: Net change in percentage of completion revenue and related costs 109,741,961 (101,055,163) (4,059,476) Changes in operating assets and liabilities: Decrease in restricted cash 28,167,676 40,526,154 18,957,341 (Increase) in prepaid expenses and other assets (40,735) (342,387) 34,277 Increase (decrease) in accounts payable and accrued expenses 82,340 (565,543) 3,479,163 Net cash provided by operating activities 145,139,364 2,556,192 82,160,383 Financing activities Note payable, net (44,031,397) 33,664,146 (36,447,278) Members' distributions (98,941,161) (48,239,172) (36,018,441) Net cash (used in) financing activities (142,972,558) (14,575,026) (72,465,719) Net increase (decrease) in cash 2,166,806 (12,018,834) 9,694,664 Cash and cash equivalents, beginning of year 3,159,366 15,178,200 5,483,536 Cash and cash equivalents, end of year 5,326,172$ 3,159,366$ 15,178,200$ Supplemental disclosures of cash flow information: Interest paid during the year 369,648$ 906,611$ 2,123,292$ Interest capitalized to investment in real estate 369,648$ 906,611$ 2,123,292$ Supplemental disclosures of noncash activities: In connection with percentage of completion revenue recognition and the related costs recognized: (Decrease) increase in investment in real estate (10,715,695)$ 8,768,478$ (2,389,103)$ (Decrease) in sales contracts receivables (130,484,643)$ (27,349,030)$ 24,992,125$ (Decrease) in deferred selling costs (1,175,448)$ (5,952,072)$ (474,358)$ (Increase) decrease in customer deposits (376,180)$ 323,144$ 23,595,099$ Decrease in deferred revenue 19,992,642$ 122,839,197$ (33,444,180)$ Decrease in accounts payable and accrued expenses 13,017,363$ 2,425,446$ (8,220,107)$ Marina Palms, LLC and Subsidiaries Consolidated Statements of Cash Flows For the Years Ended December 31, 2017, 2016 and 2015 4See accompanying notes.

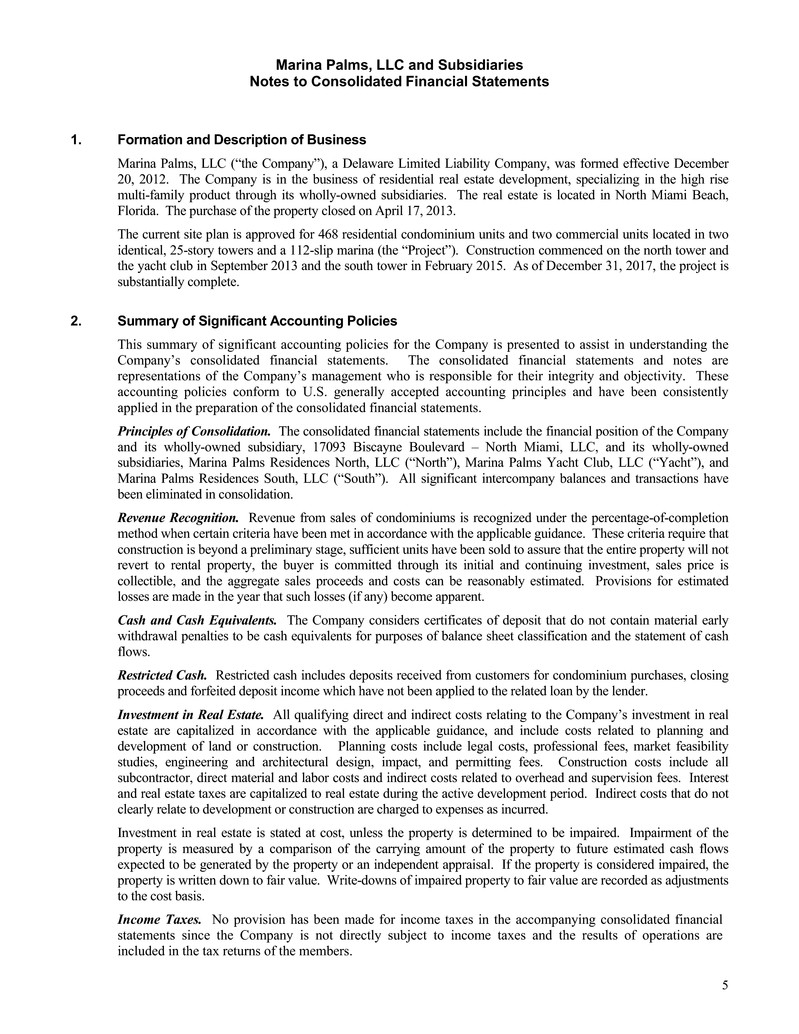

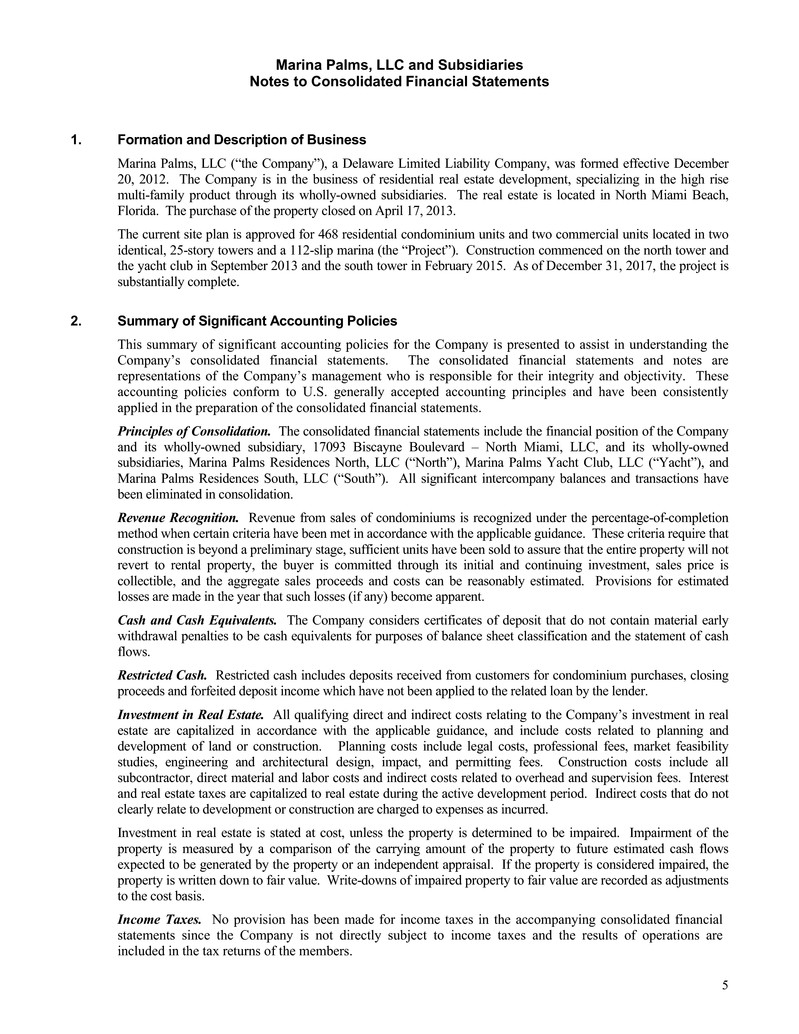

Marina Palms, LLC and Subsidiaries Notes to Consolidated Financial Statements 1. Formation and Description of Business Marina Palms, LLC (“the Company”), a Delaware Limited Liability Company, was formed effective December 20, 2012. The Company is in the business of residential real estate development, specializing in the high rise multi-family product through its wholly-owned subsidiaries. The real estate is located in North Miami Beach, Florida. The purchase of the property closed on April 17, 2013. The current site plan is approved for 468 residential condominium units and two commercial units located in two identical, 25-story towers and a 112-slip marina (the “Project”). Construction commenced on the north tower and the yacht club in September 2013 and the south tower in February 2015. As of December 31, 2017, the project is substantially complete. 2. Summary of Significant Accounting Policies This summary of significant accounting policies for the Company is presented to assist in understanding the Company’s consolidated financial statements. The consolidated financial statements and notes are representations of the Company’s management who is responsible for their integrity and objectivity. These accounting policies conform to U.S. generally accepted accounting principles and have been consistently applied in the preparation of the consolidated financial statements. Principles of Consolidation. The consolidated financial statements include the financial position of the Company and its wholly-owned subsidiary, 17093 Biscayne Boulevard – North Miami, LLC, and its wholly-owned subsidiaries, Marina Palms Residences North, LLC (“North”), Marina Palms Yacht Club, LLC (“Yacht”), and Marina Palms Residences South, LLC (“South”). All significant intercompany balances and transactions have been eliminated in consolidation. Revenue Recognition. Revenue from sales of condominiums is recognized under the percentage-of-completion method when certain criteria have been met in accordance with the applicable guidance. These criteria require that construction is beyond a preliminary stage, sufficient units have been sold to assure that the entire property will not revert to rental property, the buyer is committed through its initial and continuing investment, sales price is collectible, and the aggregate sales proceeds and costs can be reasonably estimated. Provisions for estimated losses are made in the year that such losses (if any) become apparent. Cash and Cash Equivalents. The Company considers certificates of deposit that do not contain material early withdrawal penalties to be cash equivalents for purposes of balance sheet classification and the statement of cash flows. Restricted Cash. Restricted cash includes deposits received from customers for condominium purchases, closing proceeds and forfeited deposit income which have not been applied to the related loan by the lender. Investment in Real Estate. All qualifying direct and indirect costs relating to the Company’s investment in real estate are capitalized in accordance with the applicable guidance, and include costs related to planning and development of land or construction. Planning costs include legal costs, professional fees, market feasibility studies, engineering and architectural design, impact, and permitting fees. Construction costs include all subcontractor, direct material and labor costs and indirect costs related to overhead and supervision fees. Interest and real estate taxes are capitalized to real estate during the active development period. Indirect costs that do not clearly relate to development or construction are charged to expenses as incurred. Investment in real estate is stated at cost, unless the property is determined to be impaired. Impairment of the property is measured by a comparison of the carrying amount of the property to future estimated cash flows expected to be generated by the property or an independent appraisal. If the property is considered impaired, the property is written down to fair value. Write-downs of impaired property to fair value are recorded as adjustments to the cost basis. Income Taxes. No provision has been made for income taxes in the accompanying consolidated financial statements since the Company is not directly subject to income taxes and the results of operations are included in the tax returns of the members. 5

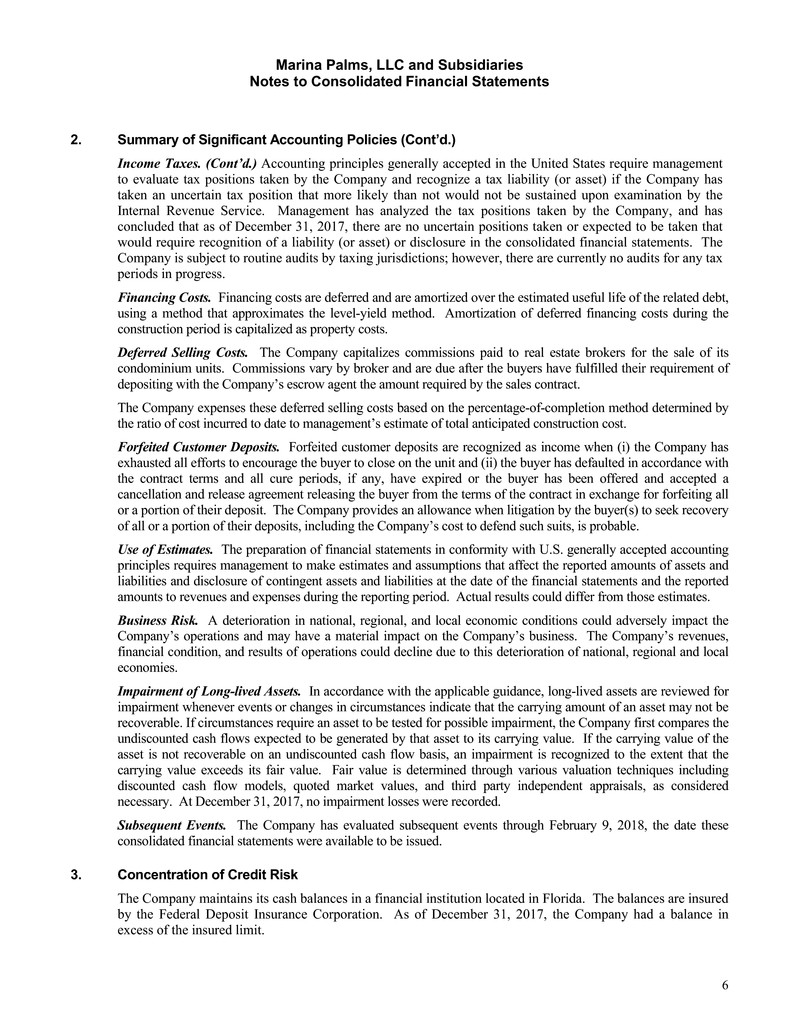

Marina Palms, LLC and Subsidiaries Notes to Consolidated Financial Statements 2. Summary of Significant Accounting Policies (Cont’d.) Income Taxes. (Cont’d.) Accounting principles generally accepted in the United States require management to evaluate tax positions taken by the Company and recognize a tax liability (or asset) if the Company has taken an uncertain tax position that more likely than not would not be sustained upon examination by the Internal Revenue Service. Management has analyzed the tax positions taken by the Company, and has concluded that as of December 31, 2017, there are no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the consolidated financial statements. The Company is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. Financing Costs. Financing costs are deferred and are amortized over the estimated useful life of the related debt, using a method that approximates the level-yield method. Amortization of deferred financing costs during the construction period is capitalized as property costs. Deferred Selling Costs. The Company capitalizes commissions paid to real estate brokers for the sale of its condominium units. Commissions vary by broker and are due after the buyers have fulfilled their requirement of depositing with the Company’s escrow agent the amount required by the sales contract. The Company expenses these deferred selling costs based on the percentage-of-completion method determined by the ratio of cost incurred to date to management’s estimate of total anticipated construction cost. Forfeited Customer Deposits. Forfeited customer deposits are recognized as income when (i) the Company has exhausted all efforts to encourage the buyer to close on the unit and (ii) the buyer has defaulted in accordance with the contract terms and all cure periods, if any, have expired or the buyer has been offered and accepted a cancellation and release agreement releasing the buyer from the terms of the contract in exchange for forfeiting all or a portion of their deposit. The Company provides an allowance when litigation by the buyer(s) to seek recovery of all or a portion of their deposits, including the Company’s cost to defend such suits, is probable. Use of Estimates. The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts to revenues and expenses during the reporting period. Actual results could differ from those estimates. Business Risk. A deterioration in national, regional, and local economic conditions could adversely impact the Company’s operations and may have a material impact on the Company’s business. The Company’s revenues, financial condition, and results of operations could decline due to this deterioration of national, regional and local economies. Impairment of Long-lived Assets. In accordance with the applicable guidance, long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. If circumstances require an asset to be tested for possible impairment, the Company first compares the undiscounted cash flows expected to be generated by that asset to its carrying value. If the carrying value of the asset is not recoverable on an undiscounted cash flow basis, an impairment is recognized to the extent that the carrying value exceeds its fair value. Fair value is determined through various valuation techniques including discounted cash flow models, quoted market values, and third party independent appraisals, as considered necessary. At December 31, 2017, no impairment losses were recorded. Subsequent Events. The Company has evaluated subsequent events through February 9, 2018, the date these consolidated financial statements were available to be issued. 3. Concentration of Credit Risk The Company maintains its cash balances in a financial institution located in Florida. The balances are insured by the Federal Deposit Insurance Corporation. As of December 31, 2017, the Company had a balance in excess of the insured limit. 6

Marina Palms, LLC and Subsidiaries Notes to Consolidated Financial Statements 4. Notes Payable On February 25, 2015, Yacht and South closed on an $87 million construction loan agreement with a bank. The loan had an initial maturity date of August 25, 2017, bore interest at a variable rate, and was guaranteed by a shareholder of one of the owners of the Company. The loan was collateralized by the assets of Yacht and South. The loan was satisfied and cancelled as of December 31, 2017. Interest on this note were $369,648, $906,611 and $2,123,292 for the years ended December 31, 2017, 2016 and 2015, respectively, and was capitalized to investment in real estate. 5. Fair Value Measurements (a) Fair Value of Financial Instruments The following methods and assumptions were used to estimate the fair value of the Company’s financial instruments at December 31, 2017 and 2016: • The carrying value of cash and cash equivalents, restricted cash, sales contracts receivables, deferred selling costs, prepaid expenses and other assets, accounts payable and accrued expenses, deferred revenue and customer deposits approximate fair value due to the short maturity of these instruments. • The carrying value of the note payable approximates its fair value due to the interest rate being reset to the market rate on a periodic basis. The fair value estimates are made at a specific point in time, based on relevant market information and information about the financial instruments. These estimates are subjective in nature and involve uncertainties and matters of significant judgment and, therefore, cannot be determined with precision. Changes in assumptions could significantly affect the estimates. (b) Fair Value Hierarchy The Company applies the provisions of the applicable guidance, for fair value measurements of financial assets and financial liabilities and for fair value measurements of nonfinancial items that are recognized or disclosed at fair value in the statements of financial position on a recurring basis. The applicable guidance defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The applicable guidance also establishes a framework for measuring fair value and expands disclosures about fair value measurements. The applicable guidance establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (level 1 measurements) and the lowest priority to measurements involving significant unobservable inputs (level 3 measurements). The three levels of the fair value hierarchy under the applicable guidance are described below: Level 1 Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets that the Company has the ability to access at the measurement date. Level 2 Inputs to the valuation methodology include: a) Quoted prices for similar assets or liabilities in active markets; b) Quoted prices for identical or similar assets or liabilities in inactive markets; c) Inputs other than quoted prices that are observable for the asset or liability; d) Inputs that are derived principally from or corroborated by observable market data by correlation or other means. If the asset or liability has a specified (contractual) term, the level 2 input must be observable for substantially the full term of the asset or liability. Level 3 Inputs to the valuation methodology are unobservable and significant to the fair value measurement. 7

Marina Palms, LLC and Subsidiaries Notes to Consolidated Financial Statements 5. Fair Value Measurements (Cont’d.) (b) Fair Value Hierarchy (Cont’d.) The level in the fair value hierarchy within which a fair value measurement in its entirety falls is based on the lowest level of input that is significant to the fair value measurement in its entirety. The Company does not have any financial assets and financial liabilities that are measured at fair value on a recurring basis as of December 31, 2017 and 2016. The consolidated financial statements as of December 31, 2017 and 2016 do not include any significant nonrecurring fair value measurements relating to assets or liabilities for which the Company had adopted the provisions of the applicable guidance. The Company values its investment in real estate at fair value on a nonrecurring basis if it is determined that an impairment has occurred. Such fair value measurements use significant other observable inputs and significant unobservable inputs and are classified as Level 2 or Level 3 as determined appropriate. No impairments have been recorded on this property. 6. Preferred Membership Interest The Company had a preferred membership interest of $10,000,000 which was contributed on September 15, 2014. The preferred return rate was 15%. The preferred membership interest and preferred return was paid in full as of December 18, 2015. The preferred return was $-, $- and $1,610,542 during the years ended December 31, 2017, 2016 and 2015, respectively. 8