UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09945

Natixis Funds Trust IV

(Exact name of Registrant as specified in charter)

888 Boylston Street, Suite 800 Boston, Massachusetts 02199-8197

(Address of principal executive offices) (Zip code)

Susan McWhan Tobin, Esq.

Natixis Distribution, LLC

888 Boylston Street, Suite 800

Boston, Massachusetts 02199-8197

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2139

Date of fiscal year end: January 31

Date of reporting period: July 31, 2024

Item 1. Reports to Stockholders.

| | (a) | The Registrant’s Tailored Shareholder Reports transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 are as follows: |

AEW Global Focused Real Estate Fund

Semi-annual Shareholder Report - July 31, 2024

This semi-annual shareholder report contains important information about AEW Global Focused Real Estate Fund for the period of February 1, 2024 to July 31, 2024. You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at 800-225-5478 or by contacting your financial intermediary directly.

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Class A | $60 | 1.16% |

| Footnote | Description |

Footnote† | Annualized |

- Total Net Assets$35,778,938

- # of Portfolio Holdings (including overnight repurchase agreements)59

- Portfolio Turnover Rate26%

- Total Advisory Fees Paid (after waiver/reimbursement)$0

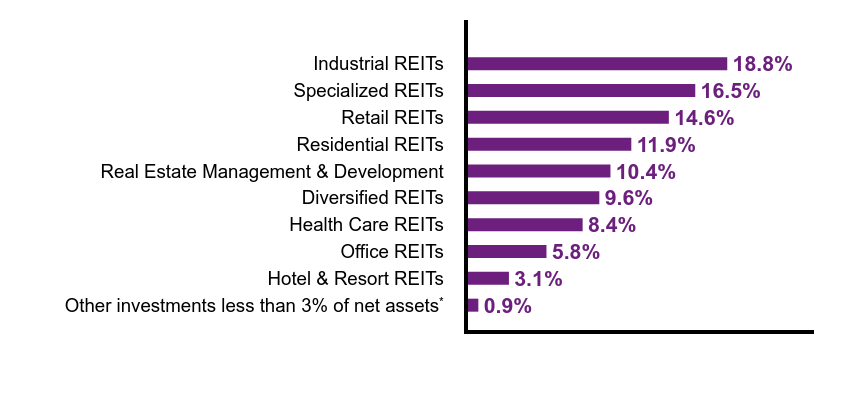

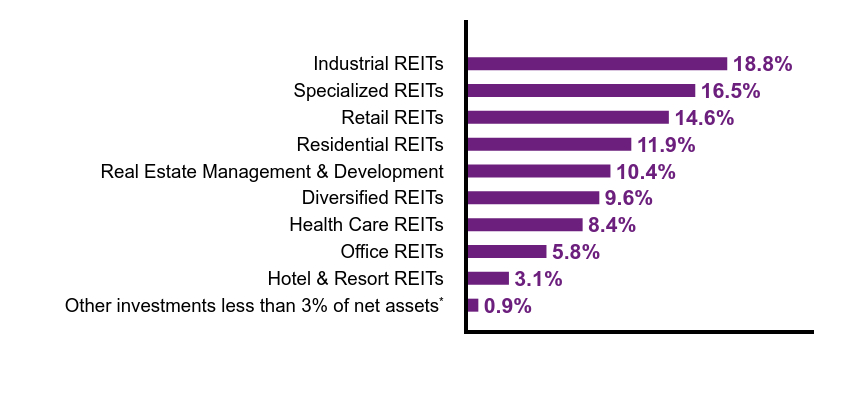

What did the Fund invest in? (% of Net Assets)

| Value | Value |

|---|

Other investments less than 3% of net assetsFootnote Reference* | 0.9% |

| Hotel & Resort REITs | 3.1% |

| Office REITs | 5.8% |

| Health Care REITs | 8.4% |

| Diversified REITs | 9.6% |

| Real Estate Management & Development | 10.4% |

| Residential REITs | 11.9% |

| Retail REITs | 14.6% |

| Specialized REITs | 16.5% |

| Industrial REITs | 18.8% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities |

| Prologis, Inc. | 7.2% |

| Welltower, Inc. | 6.4% |

| Equinix, Inc. | 5.0% |

| AvalonBay Communities, Inc. | 4.4% |

| Regency Centers Corp. | 4.3% |

| Realty Income Corp. | 4.1% |

| UDR, Inc. | 3.9% |

| Extra Space Storage, Inc. | 3.7% |

| Broadstone Net Lease, Inc. | 3.4% |

| Simon Property Group, Inc. | 3.1% |

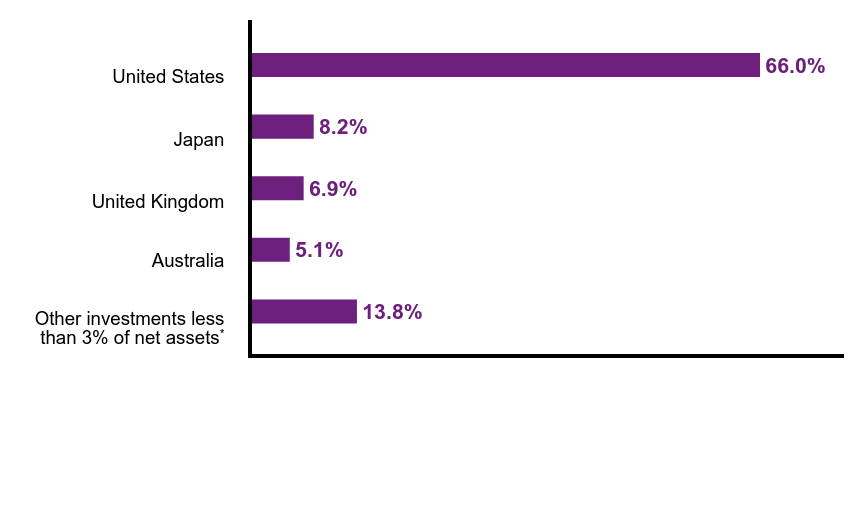

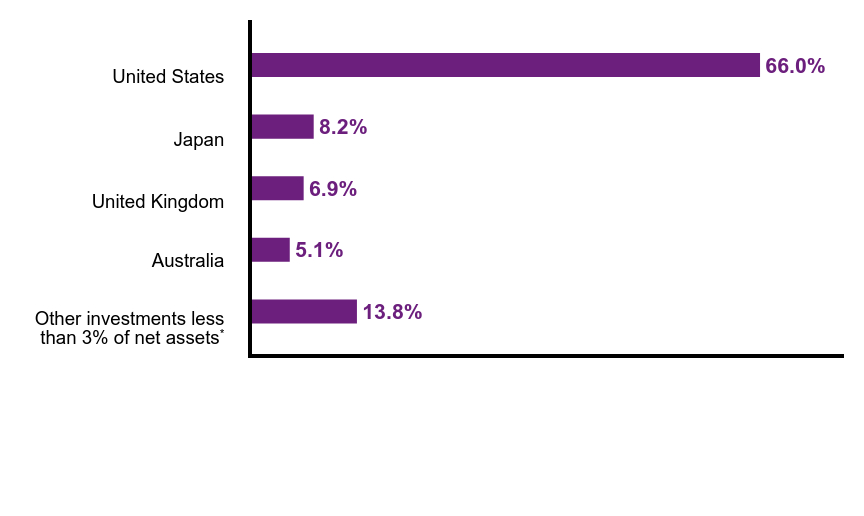

| Value | Value |

|---|

Other investments less than 3% of net assetsFootnote Reference* | 13.8% |

| Australia | 5.1% |

| United Kingdom | 6.9% |

| Japan | 8.2% |

| United States | 66.0% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities |

There were no material fund changes during the period.

There were no changes in or disagreements with Accountants during the period.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, scan the QR code or visit im.natixis.com/funddocuments

Phone: 800-225-5478

Email: secretaryofthefunds@natixis.com

AEW Global Focused Real Estate Fund

Semi-annual Shareholder Report

July 31, 2024

AEW Global Focused Real Estate Fund

Semi-annual Shareholder Report - July 31, 2024

This semi-annual shareholder report contains important information about AEW Global Focused Real Estate Fund for the period of February 1, 2024 to July 31, 2024. You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at 800-225-5478 or by contacting your financial intermediary directly.

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Class C | $98 | 1.91% |

| Footnote | Description |

Footnote† | Annualized |

- Total Net Assets$35,778,938

- # of Portfolio Holdings (including overnight repurchase agreements)59

- Portfolio Turnover Rate26%

- Total Advisory Fees Paid (after waiver/reimbursement)$0

What did the Fund invest in? (% of Net Assets)

| Value | Value |

|---|

Other investments less than 3% of net assetsFootnote Reference* | 0.9% |

| Hotel & Resort REITs | 3.1% |

| Office REITs | 5.8% |

| Health Care REITs | 8.4% |

| Diversified REITs | 9.6% |

| Real Estate Management & Development | 10.4% |

| Residential REITs | 11.9% |

| Retail REITs | 14.6% |

| Specialized REITs | 16.5% |

| Industrial REITs | 18.8% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities |

| Prologis, Inc. | 7.2% |

| Welltower, Inc. | 6.4% |

| Equinix, Inc. | 5.0% |

| AvalonBay Communities, Inc. | 4.4% |

| Regency Centers Corp. | 4.3% |

| Realty Income Corp. | 4.1% |

| UDR, Inc. | 3.9% |

| Extra Space Storage, Inc. | 3.7% |

| Broadstone Net Lease, Inc. | 3.4% |

| Simon Property Group, Inc. | 3.1% |

| Value | Value |

|---|

Other investments less than 3% of net assetsFootnote Reference* | 13.8% |

| Australia | 5.1% |

| United Kingdom | 6.9% |

| Japan | 8.2% |

| United States | 66.0% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities |

There were no material fund changes during the period.

There were no changes in or disagreements with Accountants during the period.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, scan the QR code or visit im.natixis.com/funddocuments

Phone: 800-225-5478

Email: secretaryofthefunds@natixis.com

AEW Global Focused Real Estate Fund

Semi-annual Shareholder Report

July 31, 2024

AEW Global Focused Real Estate Fund

Semi-annual Shareholder Report - July 31, 2024

This semi-annual shareholder report contains important information about AEW Global Focused Real Estate Fund for the period of February 1, 2024 to July 31, 2024. You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at 800-225-5478 or by contacting your financial intermediary directly.

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Class N | $44 | 0.86% |

| Footnote | Description |

Footnote† | Annualized |

- Total Net Assets$35,778,938

- # of Portfolio Holdings (including overnight repurchase agreements)59

- Portfolio Turnover Rate26%

- Total Advisory Fees Paid (after waiver/reimbursement)$0

What did the Fund invest in? (% of Net Assets)

| Value | Value |

|---|

Other investments less than 3% of net assetsFootnote Reference* | 0.9% |

| Hotel & Resort REITs | 3.1% |

| Office REITs | 5.8% |

| Health Care REITs | 8.4% |

| Diversified REITs | 9.6% |

| Real Estate Management & Development | 10.4% |

| Residential REITs | 11.9% |

| Retail REITs | 14.6% |

| Specialized REITs | 16.5% |

| Industrial REITs | 18.8% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities |

| Prologis, Inc. | 7.2% |

| Welltower, Inc. | 6.4% |

| Equinix, Inc. | 5.0% |

| AvalonBay Communities, Inc. | 4.4% |

| Regency Centers Corp. | 4.3% |

| Realty Income Corp. | 4.1% |

| UDR, Inc. | 3.9% |

| Extra Space Storage, Inc. | 3.7% |

| Broadstone Net Lease, Inc. | 3.4% |

| Simon Property Group, Inc. | 3.1% |

| Value | Value |

|---|

Other investments less than 3% of net assetsFootnote Reference* | 13.8% |

| Australia | 5.1% |

| United Kingdom | 6.9% |

| Japan | 8.2% |

| United States | 66.0% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities |

There were no material fund changes during the period.

There were no changes in or disagreements with Accountants during the period.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, scan the QR code or visit im.natixis.com/funddocuments

Phone: 800-225-5478

Email: secretaryofthefunds@natixis.com

AEW Global Focused Real Estate Fund

Semi-annual Shareholder Report

July 31, 2024

AEW Global Focused Real Estate Fund

Semi-annual Shareholder Report - July 31, 2024

This semi-annual shareholder report contains important information about AEW Global Focused Real Estate Fund for the period of February 1, 2024 to July 31, 2024. You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at 800-225-5478 or by contacting your financial intermediary directly.

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Class Y | $47 | 0.91% |

| Footnote | Description |

Footnote† | Annualized |

- Total Net Assets$35,778,938

- # of Portfolio Holdings (including overnight repurchase agreements)59

- Portfolio Turnover Rate26%

- Total Advisory Fees Paid (after waiver/reimbursement)$0

What did the Fund invest in? (% of Net Assets)

| Value | Value |

|---|

Other investments less than 3% of net assetsFootnote Reference* | 0.9% |

| Hotel & Resort REITs | 3.1% |

| Office REITs | 5.8% |

| Health Care REITs | 8.4% |

| Diversified REITs | 9.6% |

| Real Estate Management & Development | 10.4% |

| Residential REITs | 11.9% |

| Retail REITs | 14.6% |

| Specialized REITs | 16.5% |

| Industrial REITs | 18.8% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities |

| Prologis, Inc. | 7.2% |

| Welltower, Inc. | 6.4% |

| Equinix, Inc. | 5.0% |

| AvalonBay Communities, Inc. | 4.4% |

| Regency Centers Corp. | 4.3% |

| Realty Income Corp. | 4.1% |

| UDR, Inc. | 3.9% |

| Extra Space Storage, Inc. | 3.7% |

| Broadstone Net Lease, Inc. | 3.4% |

| Simon Property Group, Inc. | 3.1% |

| Value | Value |

|---|

Other investments less than 3% of net assetsFootnote Reference* | 13.8% |

| Australia | 5.1% |

| United Kingdom | 6.9% |

| Japan | 8.2% |

| United States | 66.0% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities |

There were no material fund changes during the period.

There were no changes in or disagreements with Accountants during the period.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, scan the QR code or visit im.natixis.com/funddocuments

Phone: 800-225-5478

Email: secretaryofthefunds@natixis.com

AEW Global Focused Real Estate Fund

Semi-annual Shareholder Report

July 31, 2024

Natixis Target Retirement 2015 Fund

Semi-annual Shareholder Report - July 31, 2024

This semi-annual shareholder report contains important information about Natixis Target Retirement 2015 Fund for the period of February 1, 2024 to July 31, 2024. You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at 800-225-5478 or by contacting your financial intermediary directly. This report describes changes to the Fund that occurred during the reporting period.

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Class N | $11 | 0.22% |

| Footnote | Description |

Footnote† | Annualized |

Costs do not include the expenses of the underlying funds in which the Fund invests.

- Total Net Assets$5,817,619

- # of Portfolio Holdings (including overnight repurchase agreements)574

- Portfolio Turnover Rate12%

- Total Advisory Fees Paid (after waiver/reimbursement)$0

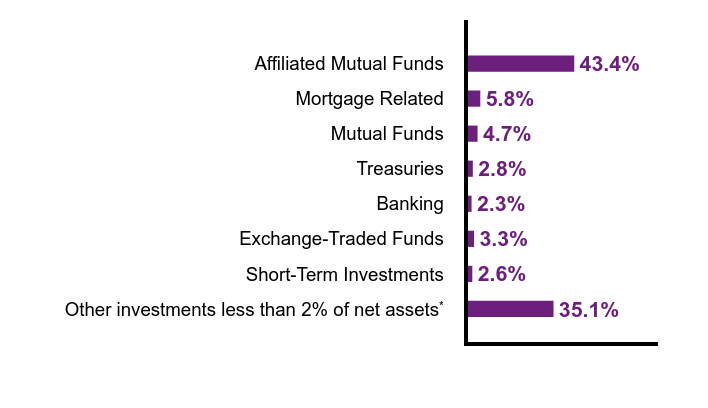

What did the Fund invest in? (% of Net Assets)

| Value | Value |

|---|

Other investments less than 2% of net assetsFootnote Reference* | 35.1% |

| Short-Term Investments | 2.6% |

| Exchange-Traded Funds | 3.3% |

| Banking | 2.3% |

| Treasuries | 2.8% |

| Mutual Funds | 4.7% |

| Mortgage Related | 5.8% |

| Affiliated Mutual Funds | 43.4% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities |

| Equity | 36.6% |

| | AIA International Developed Markets Equity ESG Segment | 3.3% |

| | AIA U.S. Large Cap Core ESG Segment | 4.8% |

| | AIA U.S. Large Cap Value ESG Segment | 3.2% |

| | AIA U.S. Small/Mid Cap ESG Segment | 5.1% |

| | Harris Associates Large Cap Value Segment | 6.2% |

| | Loomis Sayles All Cap Growth Segment | 6.0% |

| | Mirova International Sustainable Equity Fund | 3.3% |

| | WCM Focused Emerging Markets Fund | 1.4% |

| | WCM Focused International Growth Fund | 3.3% |

| Fixed Income | 61.4% |

| | Loomis Sayles Core Fixed Income Segment | 21.5% |

| | Loomis Sayles Inflation Protected Securities Fund | 16.8% |

| | Loomis Sayles Limited Term Government and Agency Fund | 12.0% |

| | Mirova Global Green Bond Fund | 11.1% |

| Cash | 2.0% |

| Total | | 100.0% |

Effective July 1, 2024, the Fund had the following material changes, which were reported in a supplement to the Fund's prospectus. For more information, you may review the Fund's prospectus at im.natixis.com/funddocuments or upon request at 800-225-5478 or through your financial intermediary.

Name Change: The Fund's name was changed to Natixis Target Retirement 2015 Fund from Natixis Sustainable Future 2015 Fund.

Expenses: The expense limit as a percentage of average daily net assets was reduced to 0.44% from 0.50%.

There were no changes in or disagreements with Accountants during the period.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, scan the QR code or visit im.natixis.com/funddocuments

Phone: 800-225-5478

Email: secretaryofthefunds@natixis.com

Natixis Target Retirement 2015 Fund

Semi-annual Shareholder Report

July 31, 2024

Natixis Target Retirement 2020 Fund

Semi-annual Shareholder Report - July 31, 2024

This semi-annual shareholder report contains important information about Natixis Target Retirement 2020 Fund for the period of February 1, 2024 to July 31, 2024. You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at 800-225-5478 or by contacting your financial intermediary directly. This report describes changes to the Fund that occurred during the reporting period.

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Class N | $12 | 0.24% |

| Footnote | Description |

Footnote† | Annualized |

Costs do not include the expenses of the underlying funds in which the Fund invests.

- Total Net Assets$5,848,626

- # of Portfolio Holdings (including overnight repurchase agreements)585

- Portfolio Turnover Rate25%

- Total Advisory Fees Paid (after waiver/reimbursement)$0

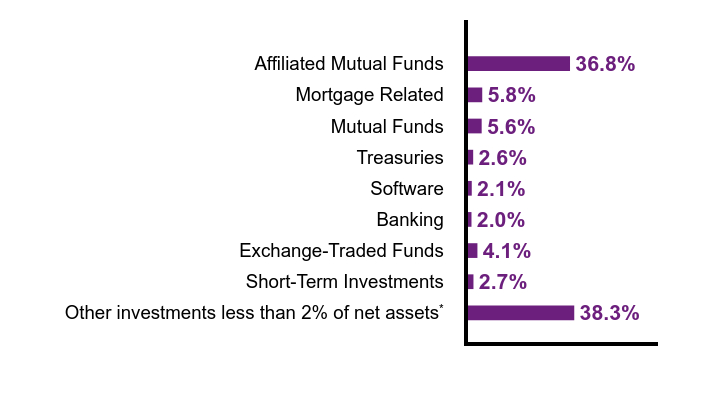

What did the Fund invest in? (% of Net Assets)

| Value | Value |

|---|

Other investments less than 2% of net assetsFootnote Reference* | 38.3% |

| Short-Term Investments | 2.7% |

| Exchange-Traded Funds | 4.1% |

| Banking | 2.0% |

| Software | 2.1% |

| Treasuries | 2.6% |

| Mutual Funds | 5.6% |

| Mortgage Related | 5.8% |

| Affiliated Mutual Funds | 36.8% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities |

| Equity | 45.6% |

| | AIA International Developed Markets Equity ESG Segment | 4.1% |

| | AIA U.S. Large Cap Core ESG Segment | 6.1% |

| | AIA U.S. Large Cap Value ESG Segment | 4.0% |

| | AIA U.S. Small/Mid Cap ESG Segment | 6.5% |

| | Harris Associates Large Cap Value Segment | 7.8% |

| | Loomis Sayles All Cap Growth Segment | 7.4% |

| | Mirova International Sustainable Equity Fund | 4.1% |

| | WCM Focused Emerging Markets Fund | 1.5% |

| | WCM Focused International Growth Fund | 4.1% |

| Fixed Income | 52.4% |

| | Loomis Sayles Core Fixed Income Segment | 19.9% |

| | Loomis Sayles Inflation Protected Securities Fund | 12.3% |

| | Loomis Sayles Limited Term Government and Agency Fund | 10.2% |

| | Mirova Global Green Bond Fund | 10.0% |

| Cash | 2.0% |

| Total | | 100.0% |

Effective July 1, 2024, the Fund had the following material changes, which were reported in a supplement to the Fund's prospectus. For more information, you may review the Fund's prospectus at im.natixis.com/funddocuments or upon request at 800-225-5478 or through your financial intermediary.

Name Change: The Fund's name was changed to Natixis Target Retirement 2020 Fund from Natixis Sustainable Future 2020 Fund.

Expenses: The expense limit as a percentage of average daily net assets was reduced to 0.44% from 0.50%.

There were no changes in or disagreements with Accountants during the period.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, scan the QR code or visit im.natixis.com/funddocuments

Phone: 800-225-5478

Email: secretaryofthefunds@natixis.com

Natixis Target Retirement 2020 Fund

Semi-annual Shareholder Report

July 31, 2024

Natixis Target Retirement 2025 Fund

Semi-annual Shareholder Report - July 31, 2024

This semi-annual shareholder report contains important information about Natixis Target Retirement 2025 Fund for the period of February 1, 2024 to July 31, 2024. You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at 800-225-5478 or by contacting your financial intermediary directly. This report describes changes to the Fund that occurred during the reporting period.

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Class N | $12 | 0.24% |

| Footnote | Description |

Footnote† | Annualized |

Costs do not include the expenses of the underlying funds in which the Fund invests.

- Total Net Assets$10,255,580

- # of Portfolio Holdings (including overnight repurchase agreements)580

- Portfolio Turnover Rate18%

- Total Advisory Fees Paid (after waiver/reimbursement)$0

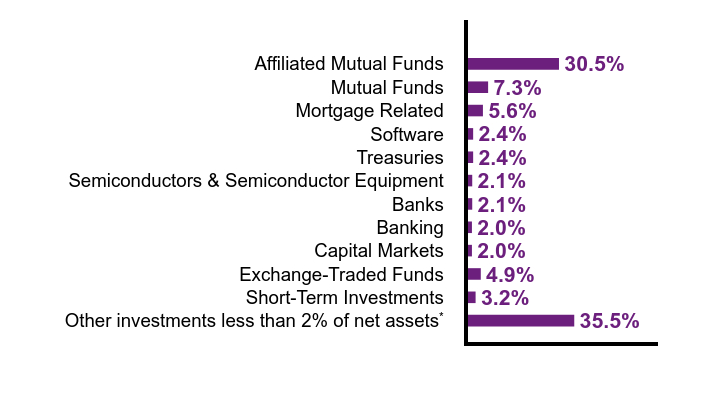

What did the Fund invest in? (% of Net Assets)

| Value | Value |

|---|

Other investments less than 2% of net assetsFootnote Reference* | 35.5% |

| Short-Term Investments | 3.2% |

| Exchange-Traded Funds | 4.9% |

| Capital Markets | 2.0% |

| Banking | 2.0% |

| Banks | 2.1% |

| Semiconductors & Semiconductor Equipment | 2.1% |

| Treasuries | 2.4% |

| Software | 2.4% |

| Mortgage Related | 5.6% |

| Mutual Funds | 7.3% |

| Affiliated Mutual Funds | 30.5% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities |

| Equity | 51.6% |

| | AIA International Developed Markets Equity ESG Segment | 5.1% |

| | AIA U.S. Large Cap Core ESG Segment | 7.1% |

| | AIA U.S. Large Cap Value ESG Segment | 4.3% |

| | AIA U.S. Small/Mid Cap ESG Segment | 4.7% |

| | Harris Associates Large Cap Value Segment | 9.1% |

| | Loomis Sayles All Cap Growth Segment | 8.7% |

| | Mirova International Sustainable Equity Fund | 5.0% |

| | WCM Focused Emerging Markets Fund | 2.5% |

| | WCM Focused International Growth Fund | 5.1% |

| Fixed Income | 46.3% |

| | Loomis Sayles Core Fixed Income Segment | 19.9% |

| | Loomis Sayles Inflation Protected Securities Fund | 7.5% |

| | Loomis Sayles Limited Term Government and Agency Fund | 9.1% |

| | Mirova Global Green Bond Fund | 9.8% |

| Cash | 2.1% |

| Total | | 100.0% |

Effective July 1, 2024, the Fund had the following material changes, which were reported in a supplement to the Fund's prospectus. For more information, you may review the Fund's prospectus at im.natixis.com/funddocuments or upon request at 800-225-5478 or through your financial intermediary.

Name Change: The Fund's name was changed to Natixis Target Retirement 2025 Fund from Natixis Sustainable Future 2025 Fund.

Expenses: The expense limit as a percentage of average daily net assets was reduced to 0.45% from 0.51%.

There were no changes in or disagreements with Accountants during the period.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, scan the QR code or visit im.natixis.com/funddocuments

Phone: 800-225-5478

Email: secretaryofthefunds@natixis.com

Natixis Target Retirement 2025 Fund

Semi-annual Shareholder Report

July 31, 2024

Natixis Target Retirement 2030 Fund

Semi-annual Shareholder Report - July 31, 2024

This semi-annual shareholder report contains important information about Natixis Target Retirement 2030 Fund for the period of February 1, 2024 to July 31, 2024. You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at 800-225-5478 or by contacting your financial intermediary directly. This report describes changes to the Fund that occurred during the reporting period.

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Class N | $12 | 0.24% |

| Footnote | Description |

Footnote† | Annualized |

Costs do not include the expenses of the underlying funds in which the Fund invests.

- Total Net Assets$21,041,817

- # of Portfolio Holdings (including overnight repurchase agreements)590

- Portfolio Turnover Rate11%

- Total Advisory Fees Paid (after waiver/reimbursement)$0

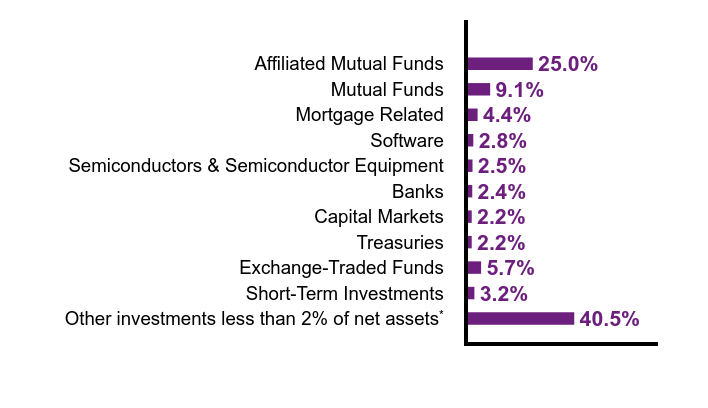

What did the Fund invest in? (% of Net Assets)

| Value | Value |

|---|

Other investments less than 2% of net assetsFootnote Reference* | 40.5% |

| Short-Term Investments | 3.2% |

| Exchange-Traded Funds | 5.7% |

| Treasuries | 2.2% |

| Capital Markets | 2.2% |

| Banks | 2.4% |

| Semiconductors & Semiconductor Equipment | 2.5% |

| Software | 2.8% |

| Mortgage Related | 4.4% |

| Mutual Funds | 9.1% |

| Affiliated Mutual Funds | 25.0% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities |

| Equity | 61.7% |

| | AIA International Developed Markets Equity ESG Segment | 5.6% |

| | AIA U.S. Large Cap Core ESG Segment | 8.0% |

| | AIA U.S. Large Cap Value ESG Segment | 5.1% |

| | AIA U.S. Small/Mid Cap ESG Segment | 8.3% |

| | Harris Associates Large Cap Value Segment | 10.0% |

| | Loomis Sayles All Cap Growth Segment | 9.9% |

| | Mirova International Sustainable Equity Fund | 5.7% |

| | WCM Focused Emerging Markets Fund | 3.4% |

| | WCM Focused International Growth Fund | 5.7% |

| Fixed Income | 36.4% |

| | Loomis Sayles Core Fixed Income Segment | 17.1% |

| | Loomis Sayles Inflation Protected Securities Fund | 5.1% |

| | Loomis Sayles Limited Term Government and Agency Fund | 6.1% |

| | Mirova Global Green Bond Fund | 8.1% |

| Cash | 1.9% |

| Total | | 100.0% |

Effective July 1, 2024, the Fund had the following material changes, which were reported in a supplement to the Fund's prospectus. For more information, you may review the Fund's prospectus at im.natixis.com/funddocuments or upon request at 800-225-5478 or through your financial intermediary.

Name Change: The Fund's name was changed to Natixis Target Retirement 2030 Fund from Natixis Sustainable Future 2030 Fund.

Expenses: The expense limit as a percentage of average daily net assets was reduced to 0.46% from 0.52%.

There were no changes in or disagreements with Accountants during the period.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, scan the QR code or visit im.natixis.com/funddocuments

Phone: 800-225-5478

Email: secretaryofthefunds@natixis.com

Natixis Target Retirement 2030 Fund

Semi-annual Shareholder Report

July 31, 2024

Natixis Target Retirement 2035 Fund

Semi-annual Shareholder Report - July 31, 2024

This semi-annual shareholder report contains important information about Natixis Target Retirement 2035 Fund for the period of February 1, 2024 to July 31, 2024. You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at 800-225-5478 or by contacting your financial intermediary directly. This report describes changes to the Fund that occurred during the reporting period.

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Class N | $13 | 0.26% |

| Footnote | Description |

Footnote† | Annualized |

Costs do not include the expenses of the underlying funds in which the Fund invests.

- Total Net Assets$21,858,097

- # of Portfolio Holdings (including overnight repurchase agreements)590

- Portfolio Turnover Rate11%

- Total Advisory Fees Paid (after waiver/reimbursement)$0

What did the Fund invest in? (% of Net Assets)

| Value | Value |

|---|

Other investments less than 2% of net assetsFootnote Reference* | 40.0% |

| Short-Term Investments | 3.2% |

| Exchange-Traded Funds | 6.4% |

| Interactive Media & Services | 2.2% |

| Oil, Gas & Consumable Fuels | 2.2% |

| Capital Markets | 2.6% |

| Banks | 2.8% |

| Semiconductors & Semiconductor Equipment | 2.9% |

| Software | 3.2% |

| Mortgage Related | 3.3% |

| Mutual Funds | 9.9% |

| Affiliated Mutual Funds | 21.3% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities |

| Equity | 70.5% |

| | AIA International Developed Markets Equity ESG Segment | 6.4% |

| | AIA U.S. Large Cap Core ESG Segment | 9.2% |

| | AIA U.S. Large Cap Value ESG Segment | 6.0% |

| | AIA U.S. Small/Mid Cap ESG Segment | 9.6% |

| | Harris Associates Large Cap Value Segment | 11.6% |

| | Loomis Sayles All Cap Growth Segment | 11.4% |

| | Mirova International Sustainable Equity Fund | 6.5% |

| | WCM Focused Emerging Markets Fund | 3.4% |

| | WCM Focused International Growth Fund | 6.4% |

| Fixed Income | 27.5% |

| | Loomis Sayles Core Fixed Income Segment | 12.7% |

| | Loomis Sayles Inflation Protected Securities Fund | 4.5% |

| | Loomis Sayles Limited Term Government and Agency Fund | 4.7% |

| | Mirova Global Green Bond Fund | 5.6% |

| Cash | 2.0% |

| Total | | 100.0% |

Effective July 1, 2024, the Fund had the following material changes, which were reported in a supplement to the Fund's prospectus. For more information, you may review the Fund's prospectus at im.natixis.com/funddocuments or upon request at 800-225-5478 or through your financial intermediary.

Name Change: The Fund's name was changed to Natixis Target Retirement 2035 Fund from Natixis Sustainable Future 2035 Fund.

Expenses: The expense limit as a percentage of average daily net assets was reduced to 0.47% from 0.53%.

There were no changes in or disagreements with Accountants during the period.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, scan the QR code or visit im.natixis.com/funddocuments

Phone: 800-225-5478

Email: secretaryofthefunds@natixis.com

Natixis Target Retirement 2035 Fund

Semi-annual Shareholder Report

July 31, 2024

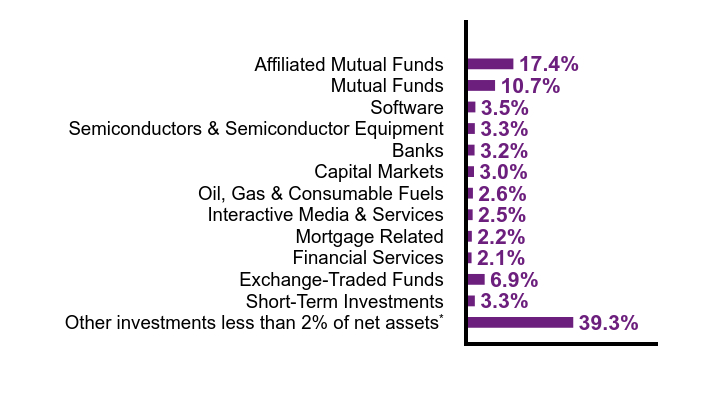

Natixis Target Retirement 2040 Fund

Semi-annual Shareholder Report - July 31, 2024

This semi-annual shareholder report contains important information about Natixis Target Retirement 2040 Fund for the period of February 1, 2024 to July 31, 2024. You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at 800-225-5478 or by contacting your financial intermediary directly. This report describes changes to the Fund that occurred during the reporting period.

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Class N | $14 | 0.27% |

| Footnote | Description |

Footnote† | Annualized |

Costs do not include the expenses of the underlying funds in which the Fund invests.

- Total Net Assets$25,538,637

- # of Portfolio Holdings (including overnight repurchase agreements)590

- Portfolio Turnover Rate10%

- Total Advisory Fees Paid (after waiver/reimbursement)$0

What did the Fund invest in? (% of Net Assets)

| Value | Value |

|---|

Other investments less than 2% of net assetsFootnote Reference* | 39.3% |

| Short-Term Investments | 3.3% |

| Exchange-Traded Funds | 6.9% |

| Financial Services | 2.1% |

| Mortgage Related | 2.2% |

| Interactive Media & Services | 2.5% |

| Oil, Gas & Consumable Fuels | 2.6% |

| Capital Markets | 3.0% |

| Banks | 3.2% |

| Semiconductors & Semiconductor Equipment | 3.3% |

| Software | 3.5% |

| Mutual Funds | 10.7% |

| Affiliated Mutual Funds | 17.4% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities |

| Equity | 79.1% |

| | AIA International Developed Markets Equity ESG Segment | 6.9% |

| | AIA U.S. Large Cap Core ESG Segment | 10.4% |

| | AIA U.S. Large Cap Value ESG Segment | 6.9% |

| | AIA U.S. Small/Mid Cap ESG Segment | 11.2% |

| | Harris Associates Large Cap Value Segment | 13.5% |

| | Loomis Sayles All Cap Growth Segment | 12.6% |

| | Mirova International Sustainable Equity Fund | 6.9% |

| | WCM Focused Emerging Markets Fund | 3.8% |

| | WCM Focused International Growth Fund | 6.9% |

| Fixed Income | 18.9% |

| | Loomis Sayles Core Fixed Income Segment | 8.5% |

| | Loomis Sayles Inflation Protected Securities Fund | 3.5% |

| | Loomis Sayles Limited Term Government and Agency Fund | 2.8% |

| | Mirova Global Green Bond Fund | 4.1% |

| Cash | 2.0% |

| Total | | 100.0% |

Effective July 1, 2024, the Fund had the following material changes, which were reported in a supplement to the Fund's prospectus. For more information, you may review the Fund's prospectus at im.natixis.com/funddocuments or upon request at 800-225-5478 or through your financial intermediary.

Name Change: The Fund's name was changed to Natixis Target Retirement 2040 Fund from Natixis Sustainable Future 2040 Fund.

Expenses: The expense limit as a percentage of average daily net assets was reduced to 0.48% from 0.54%.

There were no changes in or disagreements with Accountants during the period.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, scan the QR code or visit im.natixis.com/funddocuments

Phone: 800-225-5478

Email: secretaryofthefunds@natixis.com

Natixis Target Retirement 2040 Fund

Semi-annual Shareholder Report

July 31, 2024

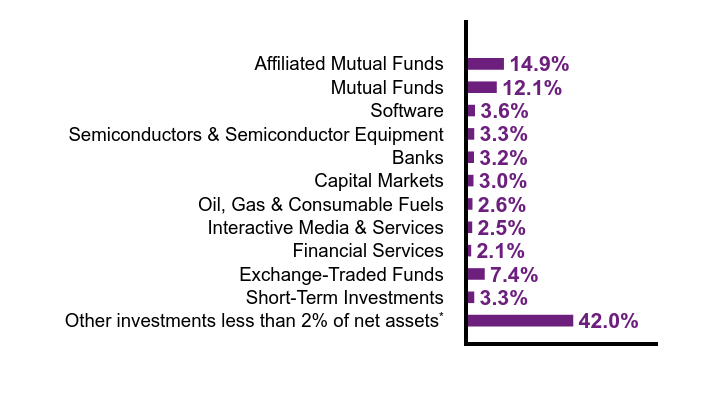

Natixis Target Retirement 2045 Fund

Semi-annual Shareholder Report - July 31, 2024

This semi-annual shareholder report contains important information about Natixis Target Retirement 2045 Fund for the period of February 1, 2024 to July 31, 2024. You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at 800-225-5478 or by contacting your financial intermediary directly. This report describes changes to the Fund that occurred during the reporting period.

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Class N | $13 | 0.25% |

| Footnote | Description |

Footnote† | Annualized |

Costs do not include the expenses of the underlying funds in which the Fund invests.

- Total Net Assets$24,955,200

- # of Portfolio Holdings (including overnight repurchase agreements)586

- Portfolio Turnover Rate9%

- Total Advisory Fees Paid (after waiver/reimbursement)$0

What did the Fund invest in? (% of Net Assets)

| Value | Value |

|---|

Other investments less than 2% of net assetsFootnote Reference* | 42.0% |

| Short-Term Investments | 3.3% |

| Exchange-Traded Funds | 7.4% |

| Financial Services | 2.1% |

| Interactive Media & Services | 2.5% |

| Oil, Gas & Consumable Fuels | 2.6% |

| Capital Markets | 3.0% |

| Banks | 3.2% |

| Semiconductors & Semiconductor Equipment | 3.3% |

| Software | 3.6% |

| Mutual Funds | 12.1% |

| Affiliated Mutual Funds | 14.9% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities |

| Equity | 85.7% |

| | AIA International Developed Markets Equity ESG Segment | 7.9% |

| | AIA U.S. Large Cap Core ESG Segment | 10.9% |

| | AIA U.S. Large Cap Value ESG Segment | 7.2% |

| | AIA U.S. Small/Mid Cap ESG Segment | 11.7% |

| | Harris Associates Large Cap Value Segment | 14.1% |

| | Loomis Sayles All Cap Growth Segment | 13.3% |

| | Mirova International Sustainable Equity Fund | 7.9% |

| | WCM Focused Emerging Markets Fund | 4.8% |

| | WCM Focused International Growth Fund | 7.9% |

| Fixed Income | 12.3% |

| | Loomis Sayles Core Fixed Income Segment | 4.6% |

| | Loomis Sayles Inflation Protected Securities Fund | 2.5% |

| | Loomis Sayles Limited Term Government and Agency Fund | 1.7% |

| | Mirova Global Green Bond Fund | 3.5% |

| Cash | 2.0% |

| Total | | 100.0% |

Effective July 1, 2024, the Fund had the following material changes, which were reported in a supplement to the Fund's prospectus. For more information, you may review the Fund's prospectus at im.natixis.com/funddocuments or upon request at 800-225-5478 or through your financial intermediary.

Name Change: The Fund's name was changed to Natixis Target Retirement 2045 Fund from Natixis Sustainable Future 2045 Fund.

Expenses: The expense limit as a percentage of average daily net assets was reduced to 0.48% from 0.54%.

There were no changes in or disagreements with Accountants during the period.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, scan the QR code or visit im.natixis.com/funddocuments

Phone: 800-225-5478

Email: secretaryofthefunds@natixis.com

Natixis Target Retirement 2045 Fund

Semi-annual Shareholder Report

July 31, 2024

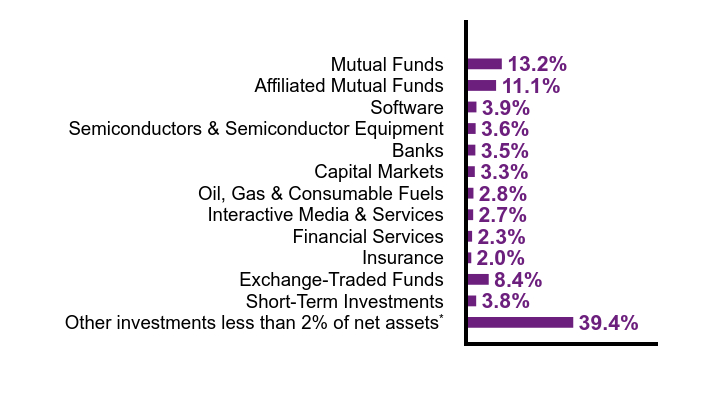

Natixis Target Retirement 2050 Fund

Semi-annual Shareholder Report - July 31, 2024

This semi-annual shareholder report contains important information about Natixis Target Retirement 2050 Fund for the period of February 1, 2024 to July 31, 2024. You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at 800-225-5478 or by contacting your financial intermediary directly. This report describes changes to the Fund that occurred during the reporting period.

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Class N | $14 | 0.27% |

| Footnote | Description |

Footnote† | Annualized |

Costs do not include the expenses of the underlying funds in which the Fund invests.

- Total Net Assets$24,719,983

- # of Portfolio Holdings (including overnight repurchase agreements)591

- Portfolio Turnover Rate8%

- Total Advisory Fees Paid (after waiver/reimbursement)$0

What did the Fund invest in? (% of Net Assets)

| Value | Value |

|---|

Other investments less than 2% of net assetsFootnote Reference* | 39.4% |

| Short-Term Investments | 3.8% |

| Exchange-Traded Funds | 8.4% |

| Insurance | 2.0% |

| Financial Services | 2.3% |

| Interactive Media & Services | 2.7% |

| Oil, Gas & Consumable Fuels | 2.8% |

| Capital Markets | 3.3% |

| Banks | 3.5% |

| Semiconductors & Semiconductor Equipment | 3.6% |

| Software | 3.9% |

| Affiliated Mutual Funds | 11.1% |

| Mutual Funds | 13.2% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities |

| Equity | 89.8% |

| | AIA International Developed Markets Equity ESG Segment | 8.4% |

| | AIA U.S. Large Cap Core ESG Segment | 11.4% |

| | AIA U.S. Large Cap Value ESG Segment | 7.6% |

| | AIA U.S. Small/Mid Cap ESG Segment | 12.3% |

| | Harris Associates Large Cap Value Segment | 14.7% |

| | Loomis Sayles All Cap Growth Segment | 13.9% |

| | Mirova International Sustainable Equity Fund | 8.4% |

| | WCM Focused Emerging Markets Fund | 4.8% |

| | WCM Focused International Growth Fund | 8.3% |

| Fixed Income | 8.2% |

| | Loomis Sayles Core Fixed Income Segment | 5.5% |

| | Loomis Sayles Inflation Protected Securities Fund | 1.1% |

| | Mirova Global Green Bond Fund | 1.6% |

| Cash | 2.0% |

| Total | | 100.0% |

Effective July 1, 2024, the Fund had the following material changes, which were reported in a supplement to the Fund's prospectus. For more information, you may review the Fund's prospectus at im.natixis.com/funddocuments or upon request at 800-225-5478 or through your financial intermediary.

Name Change: The Fund's name was changed to Natixis Target Retirement 2050 Fund from Natixis Sustainable Future 2050 Fund.

Expenses: The expense limit as a percentage of average daily net assets was reduced to 0.49% from 0.55%.

There were no changes in or disagreements with Accountants during the period.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, scan the QR code or visit im.natixis.com/funddocuments

Phone: 800-225-5478

Email: secretaryofthefunds@natixis.com

Natixis Target Retirement 2050 Fund

Semi-annual Shareholder Report

July 31, 2024

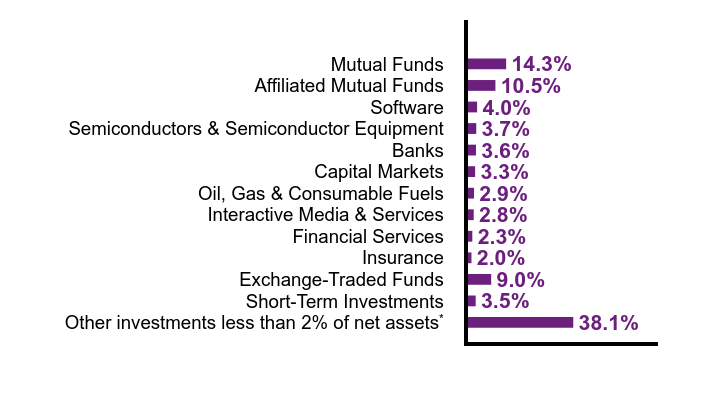

Natixis Target Retirement 2055 Fund

Semi-annual Shareholder Report - July 31, 2024

This semi-annual shareholder report contains important information about Natixis Target Retirement 2055 Fund for the period of February 1, 2024 to July 31, 2024. You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at 800-225-5478 or by contacting your financial intermediary directly. This report describes changes to the Fund that occurred during the reporting period.

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Class N | $14 | 0.26% |

| Footnote | Description |

Footnote† | Annualized |

Costs do not include the expenses of the underlying funds in which the Fund invests.

- Total Net Assets$19,799,524

- # of Portfolio Holdings (including overnight repurchase agreements)581

- Portfolio Turnover Rate10%

- Total Advisory Fees Paid (after waiver/reimbursement)$0

What did the Fund invest in? (% of Net Assets)

| Value | Value |

|---|

Other investments less than 2% of net assetsFootnote Reference* | 38.1% |

| Short-Term Investments | 3.5% |

| Exchange-Traded Funds | 9.0% |

| Insurance | 2.0% |

| Financial Services | 2.3% |

| Interactive Media & Services | 2.8% |

| Oil, Gas & Consumable Fuels | 2.9% |

| Capital Markets | 3.3% |

| Banks | 3.6% |

| Semiconductors & Semiconductor Equipment | 3.7% |

| Software | 4.0% |

| Affiliated Mutual Funds | 10.5% |

| Mutual Funds | 14.3% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities |

| Equity | 92.4% |

| | AIA International Developed Markets Equity ESG Segment | 8.9% |

| | AIA U.S. Large Cap Core ESG Segment | 11.6% |

| | AIA U.S. Large Cap Value ESG Segment | 7.6% |

| | AIA U.S. Small/Mid Cap ESG Segment | 12.3% |

| | Harris Associates Large Cap Value Segment | 14.8% |

| | Loomis Sayles All Cap Growth Segment | 14.1% |

| | Mirova International Sustainable Equity Fund | 8.9% |

| | WCM Focused Emerging Markets Fund | 5.3% |

| | WCM Focused International Growth Fund | 8.9% |

| Fixed Income | 5.7% |

| | Loomis Sayles Core Fixed Income Segment | 4.1% |

| | Loomis Sayles Inflation Protected Securities Fund | 0.1% |

| | Mirova Global Green Bond Fund | 1.5% |

| Cash | 1.9% |

| Total | | 100.0% |

Effective July 1, 2024, the Fund had the following material changes, which were reported in a supplement to the Fund's prospectus. For more information, you may review the Fund's prospectus at im.natixis.com/funddocuments or upon request at 800-225-5478 or through your financial intermediary.

Name Change: The Fund's name was changed to Natixis Target Retirement 2055 Fund from Natixis Sustainable Future 2055 Fund.

Expenses: The expense limit as a percentage of average daily net assets was reduced to 0.49% from 0.55%.

There were no changes in or disagreements with Accountants during the period.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, scan the QR code or visit im.natixis.com/funddocuments

Phone: 800-225-5478

Email: secretaryofthefunds@natixis.com

Natixis Target Retirement 2055 Fund

Semi-annual Shareholder Report

July 31, 2024

Natixis Target Retirement 2060 Fund

Semi-annual Shareholder Report - July 31, 2024

This semi-annual shareholder report contains important information about Natixis Target Retirement 2060 Fund for the period of February 1, 2024 to July 31, 2024. You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at 800-225-5478 or by contacting your financial intermediary directly. This report describes changes to the Fund that occurred during the reporting period.

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Class N | $14 | 0.26% |

| Footnote | Description |

Footnote† | Annualized |

Costs do not include the expenses of the underlying funds in which the Fund invests.

- Total Net Assets$16,389,934

- # of Portfolio Holdings (including overnight repurchase agreements)583

- Portfolio Turnover Rate8%

- Total Advisory Fees Paid (after waiver/reimbursement)$0

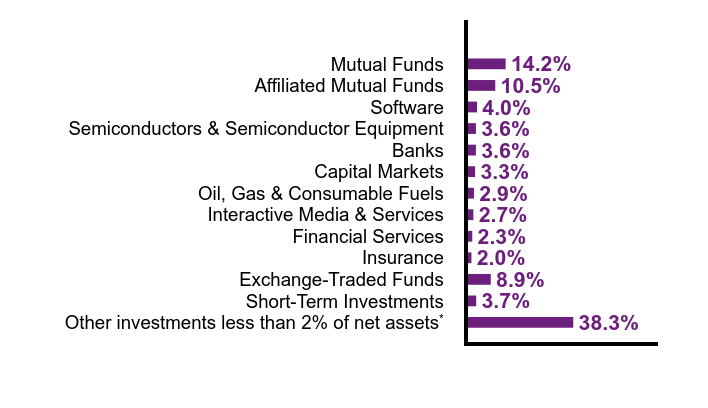

What did the Fund invest in? (% of Net Assets)

| Value | Value |

|---|

Other investments less than 2% of net assetsFootnote Reference* | 38.3% |

| Short-Term Investments | 3.7% |

| Exchange-Traded Funds | 8.9% |

| Insurance | 2.0% |

| Financial Services | 2.3% |

| Interactive Media & Services | 2.7% |

| Oil, Gas & Consumable Fuels | 2.9% |

| Capital Markets | 3.3% |

| Banks | 3.6% |

| Semiconductors & Semiconductor Equipment | 3.6% |

| Software | 4.0% |

| Affiliated Mutual Funds | 10.5% |

| Mutual Funds | 14.2% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities |

| Equity | 92.5% |

| | AIA International Developed Markets Equity ESG Segment | 8.9% |

| | AIA U.S. Large Cap Core ESG Segment | 11.5% |

| | AIA U.S. Large Cap Value ESG Segment | 7.7% |

| | AIA U.S. Small/Mid Cap ESG Segment | 12.3% |

| | Harris Associates Large Cap Value Segment | 14.9% |

| | Loomis Sayles All Cap Growth Segment | 14.1% |

| | Mirova International Sustainable Equity Fund | 8.9% |

| | WCM Focused Emerging Markets Fund | 5.3% |

| | WCM Focused International Growth Fund | 8.9% |

| Fixed Income | 5.5% |

| | Loomis Sayles Core Fixed Income Segment | 4.0% |

| | Mirova Global Green Bond Fund | 1.5% |

| Cash | 2.0% |

| Total | | 100.0% |

Effective July 1, 2024, the Fund had the following material changes, which were reported in a supplement to the Fund's prospectus. For more information, you may review the Fund's prospectus at im.natixis.com/funddocuments or upon request at 800-225-5478 or through your financial intermediary.

Name Change: The Fund's name was changed to Natixis Target Retirement 2060 Fund from Natixis Sustainable Future 2060 Fund.

Expenses: The expense limit as a percentage of average daily net assets was reduced to 0.49% from 0.55%.

There were no changes in or disagreements with Accountants during the period.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, scan the QR code or visit im.natixis.com/funddocuments

Phone: 800-225-5478

Email: secretaryofthefunds@natixis.com

Natixis Target Retirement 2060 Fund

Semi-annual Shareholder Report

July 31, 2024

Natixis Target Retirement 2065 Fund

Semi-annual Shareholder Report - July 31, 2024

This semi-annual shareholder report contains important information about Natixis Target Retirement 2065 Fund for the period of February 1, 2024 to July 31, 2024. You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at 800-225-5478 or by contacting your financial intermediary directly. This report describes changes to the Fund that occurred during the reporting period.

What were the fund costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Class N | $14 | 0.27% |

| Footnote | Description |

Footnote† | Annualized |

Costs do not include the expenses of the underlying funds in which the Fund invests.

- Total Net Assets$3,802,211

- # of Portfolio Holdings (including overnight repurchase agreements)534

- Portfolio Turnover Rate9%

- Total Advisory Fees Paid (after waiver/reimbursement)$0

What did the Fund invest in? (% of Net Assets)

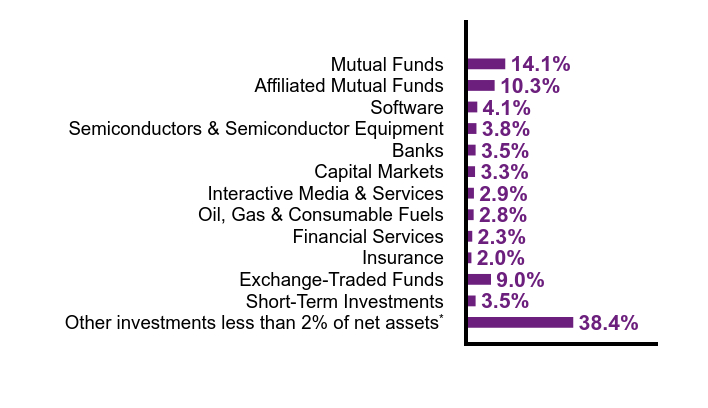

| Value | Value |

|---|

Other investments less than 2% of net assetsFootnote Reference* | 38.4% |

| Short-Term Investments | 3.5% |

| Exchange-Traded Funds | 9.0% |

| Insurance | 2.0% |

| Financial Services | 2.3% |

| Oil, Gas & Consumable Fuels | 2.8% |

| Interactive Media & Services | 2.9% |

| Capital Markets | 3.3% |

| Banks | 3.5% |

| Semiconductors & Semiconductor Equipment | 3.8% |

| Software | 4.1% |

| Affiliated Mutual Funds | 10.3% |

| Mutual Funds | 14.1% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities |

| Equity | 92.6% |

| | AIA International Developed Markets Equity ESG Segment | 8.9% |

| | AIA U.S. Large Cap Core ESG Segment | 11.7% |

| | AIA U.S. Large Cap Value ESG Segment | 7.6% |

| | AIA U.S. Small/Mid Cap ESG Segment | 12.3% |

| | Harris Associates Large Cap Value Segment | 14.8% |

| | Loomis Sayles All Cap Growth Segment | 14.5% |

| | Mirova International Sustainable Equity Fund | 8.8% |

| | WCM Focused Emerging Markets Fund | 5.2% |

| | WCM Focused International Growth Fund | 8.8% |

| Fixed Income | 5.4% |

| | Loomis Sayles Core Fixed Income Segment | 4.0% |

| | Mirova Global Green Bond Fund | 1.4% |

| Cash | 2.0% |

| Total | | 100.0% |

Effective July 1, 2024, the Fund had the following material changes, which were reported in a supplement to the Fund's prospectus. For more information, you may review the Fund's prospectus at im.natixis.com/funddocuments or upon request at 800-225-5478 or through your financial intermediary.

Name Change: The Fund's name was changed to Natixis Target Retirement 2065 Fund from Natixis Sustainable Future 2065 Fund.

Expenses: The expense limit as a percentage of average daily net assets was reduced to 0.49% from 0.55%.

There were no changes in or disagreements with Accountants during the period.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, scan the QR code or visit im.natixis.com/funddocuments

Phone: 800-225-5478

Email: secretaryofthefunds@natixis.com

Natixis Target Retirement 2065 Fund

Semi-annual Shareholder Report

July 31, 2024

Item 2. Code of Ethics.

Not applicable.

Item 3. Audit Committee Financial Expert.

Not applicable.

Item 4. Principal Accountant Fees and Services.

Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Schedule of Investments.

The Schedule of Investments are incorporated by reference as part of the Financial Statements and Other Important Information for Open-End Management Investment Companies filed as Item 7 herewith.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

The Registrant’s Financial Statements and Other Important Information are as follows:

Semi-annual Financial Statements and Other Important Information

AEW Global Focused Real Estate Fund |

Portfolio of Investments – as of July 31, 2024 (Unaudited)AEW Global Focused Real Estate Fund

| | |

Common Stocks — 99.6% of Net Assets |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

| |

| Dream Industrial Real Estate Investment Trust | |

| |

| | |

| | |

| | |

| Unibail-Rodamco-Westfield(a) | |

| | |

| |

| | |

| | |

| | |

| |

| | |

| | |

| Sun Hung Kai Properties Ltd. | |

| Wharf Real Estate Investment Co. Ltd. | |

| | |

| |

| | |

| Invincible Investment Corp. | |

| Japan Real Estate Investment Corp. | |

| KDX Realty Investment Corp. | |

| | |

| Nippon Accommodations Fund, Inc. | |

| Sumitomo Realty & Development Co. Ltd. | |

| | |

| |

| | |

| |

| Cromwell European Real Estate Investment Trust | |

| Digital Core REIT Management Pte. Ltd. | |

| Mapletree Logistics Trust | |

| | |

| | |

| |

| Merlin Properties SOCIMI SA | |

| |

| Fastighets AB Balder, Class B(a) | |

| |

| | |

| | |

| Great Portland Estates PLC | |

| | |

| | |

| | |

| | |

| United Kingdom — continued |

| | |

| | |

| | |

| |

| American Homes 4 Rent, Class A | |

| | |

| AvalonBay Communities, Inc. | |

| Broadstone Net Lease, Inc. | |

| | |

| Digital Realty Trust, Inc. | |

| | |

| Essential Properties Realty Trust, Inc. | |

| Extra Space Storage, Inc. | |

| Healthpeak Properties, Inc. | |

| | |

| | |

| | |

| | |

| | |

| Ryman Hospitality Properties, Inc. | |

| Simon Property Group, Inc. | |

| | |

| | |

| | |

| Total Common Stocks

(Identified Cost $31,510,058) | |

| | |

Short-Term Investments — 0.9% |

| Tri-Party Repurchase Agreement with Fixed Income Clearing Corporation, dated 7/31/2024 at 3.500% to be repurchased at $333,046 on 8/01/2024 collateralized by $340,100 U.S. Treasury Note, 4.250% due 12/31/2025 valued at $339,719 including accrued interest (Note 2 of Notes to Financial Statements)

(Identified Cost $333,014) | |

| Total Investments — 100.5%

(Identified Cost $31,843,072) | |

| Other assets less liabilities — (0.5)% | |

| | |

| See Note 2 of Notes to Financial Statements. |

| Non-income producing security. |

| Japan Real Estate Investment Trust |

| Real Estate Investment Trusts |

See accompanying notes to financial statements.

Portfolio of Investments – as of July 31, 2024 (Unaudited)AEW Global Focused Real Estate Fund (continued) Industry Summary at July 31, 2024 (Unaudited)

| |

| |

| |

| |

Real Estate Management & Development | |

| |

| |

| |

| |

| |

| |

| |

Other assets less liabilities | |

| |

Currency Exposure Summary at July 31, 2024 (Unaudited)

| |

| |

| |

| |

| |

| |

| |

| |

Other assets less liabilities | |

| |

See accompanying notes to financial statements.

Statement of Assets and Liabilities

July 31, 2024 (Unaudited)

| |

| |

Net unrealized appreciation | |

| |

| |

Receivable for Fund shares sold | |

Receivable for securities sold | |

Dividends and interest receivable | |

| |

| |

| |

| |

Payable for securities purchased | |

Payable for Fund shares redeemed | |

Management fees payable (Note 5) | |

Deferred Trustees’ fees (Note 5) | |

Administrative fees payable (Note 5) | |

Payable to distributor (Note 5d) | |

Audit and tax services fees payable | |

Other accounts payable and accrued expenses | |

| |

COMMITMENTS AND CONTINGENCIES(a) | |

| |

| |

| |

| |

| |

COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE: | |

| |

| |

Shares of beneficial interest | |

Net asset value and redemption price per share | |

Offering price per share (100/94.25 of net asset value) (Note 1) | |

Class C shares: (redemption price per share is equal to net asset value less any applicable contingent deferred sales charge) (Note 1) | |

| |

Shares of beneficial interest | |

Net asset value and offering price per share | |

| |

| |

Shares of beneficial interest | |

Net asset value, offering and redemption price per share | |

| |

| |

Shares of beneficial interest | |

Net asset value, offering and redemption price per share | |

| As disclosed in the Notes to Financial Statements, if applicable. |

See accompanying notes to financial statements.

For the Six Months Ended July 31, 2024 (Unaudited)

| |

| |

| |

Less net foreign taxes withheld | |

| |

| |

| |

Service and distribution fees (Note 5) | |

Administrative fees (Note 5) | |

Trustees' fees and expenses (Note 5) | |

Transfer agent fees and expenses (Notes 5, 6 and 7) | |

Audit and tax services fees | |

Custodian fees and expenses | |

Interest expense (Note 10) | |

| |

| |

Shareholder reporting expenses | |

| |

| |

Less waiver and/or expense reimbursement (Note 5) | |

Less expense offset (Note 7) | |

| |

| |

Net realized and unrealized gain (loss) on Investments and Foreign currency transactions | |

Net realized gain (loss) on: | |

| |

Foreign currency transactions (Note 2c) | |

Net change in unrealized appreciation (depreciation) on: | |

| |

Foreign currency translations (Note 2c) | |

Net realized and unrealized gain on Investments and Foreign currency transactions | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | |

See accompanying notes to financial statements.

Statement of Changes in Net Assets

| Six Months Ended

July 31,2024

(Unaudited) | Year Ended

January 31,2024 |

| | |

| | |

Net realized gain (loss) on investments and foreign currency transactions | | |

Net change in unrealized appreciation on investments and foreign currency translations | | |

Net increase (decrease) in net assets resulting from operations | | |

FROM DISTRIBUTIONS TO SHAREHOLDERS: | | |

| | |

| | |

| | |

| | |

| | |

NET DECREASE IN NET ASSETS

FROM CAPITAL SHARES TRANSACTIONS

(Note 12) | | |

Net decrease in net assets | | |

| | |

| | |

| | |

See accompanying notes to financial statements.

For a share outstanding throughout each period.

| |

| Six Months

Ended

July 31,

2024

(Unaudited) | Year Ended

January 31,

2024 | Year Ended

January 31,

2023 | Year Ended

January 31,

2022 | Year Ended

January 31,

2021 | Year Ended

January 31,

2020 |

Net asset value, beginning of the period | | | | | | |

INCOME (LOSS) FROM INVESTMENT OPERATIONS: | | | | | | |

| | | | | | |

Net realized and unrealized gain (loss) | | | | | | |

Total from Investment Operations | | | | | | |

| | | | | | |

| | | | | | |

Net realized capital gains | | | | | | |

| | | | | | |

Net asset value, end of the period | | | | | | |

| | | | | | |

RATIOS TO AVERAGE NET ASSETS: | | | | | | |

Net assets, end of the period (000's) | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Per share net investment income has been calculated using the average shares outstanding during the period. |

| Includes a non-recurring dividend. Without this dividend, net investment income per share would have been $0.17, total return would have been 22.99% and the ratio of net investment income to average net assets would have been 1.14%. |

| A sales charge for Class A shares is not reflected in total return calculations. |

| Had certain expenses not been waived/reimbursed during the period, total returns would have been lower. |

| Periods less than one year are not annualized. |

| The investment adviser agreed to waive its fees and/or reimburse a portion of the Fund’s expenses during the period. Without this waiver/reimbursement, expenses would have been higher. |

| Computed on an annualized basis for periods less than one year. |

| Includes transfer agent fees and expenses before expense offset and interest expense. Without these expenses the ratio of net expenses would have been 1.15% and the ratio of gross expenses would have been 1.98%. |

| Includes interest expense. Without this expense the ratio of net expenses would have been 1.15% and the ratio of gross expenses would have been 1.57%. |

| Effective June 1, 2019, the expense limit decreased from 1.25% to 1.15%. |

See accompanying notes to financial statements.

Financial Highlights (continued)

For a share outstanding throughout each period.

| |

| Six Months

Ended

July 31,

2024

(Unaudited) | Year Ended

January 31,

2024 | Year Ended

January 31,

2023 | Year Ended

January 31,

2022 | Year Ended

January 31,

2021 | Year Ended

January 31,

2020 |

Net asset value, beginning of the period | | | | | | |

INCOME (LOSS) FROM INVESTMENT OPERATIONS: | | | | | | |

| | | | | | |

Net realized and unrealized gain (loss) | | | | | | |

Total from Investment Operations | | | | | | |

| | | | | | |

| | | | | | |

Net realized capital gains | | | | | | |

| | | | | | |

Net asset value, end of the period | | | | | | |

| | | | | | |

RATIOS TO AVERAGE NET ASSETS: | | | | | | |

Net assets, end of the period (000's) | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Per share net investment income has been calculated using the average shares outstanding during the period. |

| Includes a non-recurring dividend. Without this dividend, net investment income per share would have been $0.07, total return would have been 21.99% and the ratio of net investment income to average net assets would have been 0.51%. |

| A contingent deferred sales charge for Class C shares is not reflected in total return calculations. |

| Had certain expenses not been waived/reimbursed during the period, total returns would have been lower. |

| Periods less than one year are not annualized. |

| The investment adviser agreed to waive its fees and/or reimburse a portion of the Fund’s expenses during the period. Without this waiver/reimbursement, expenses would have been higher. |

| Computed on an annualized basis for periods less than one year. |

| Includes transfer agent fees and expenses before expense offset and interest expense. Without these expenses the ratio of net expenses would have been 1.90% and the ratio of gross expenses would have been 2.72%. |

| Includes interest expense. Without this expense the ratio of net expenses would have been 1.90% and the ratio of gross expenses would have been 2.32%. |

| Effective June 1, 2019, the expense limit decreased from 2.00% to 1.90%. |

See accompanying notes to financial statements.

Financial Highlights (continued)

For a share outstanding throughout each period.

| |

| Six Months

Ended

July 31,

2024

(Unaudited) | Year Ended

January 31,

2024 | Year Ended

January 31,

2023 | Year Ended

January 31,

2022 | Year Ended

January 31,

2021 | Year Ended

January 31,

2020 |

Net asset value, beginning of the period | | | | | | |

INCOME (LOSS) FROM INVESTMENT OPERATIONS: | | | | | | |

| | | | | | |

Net realized and unrealized gain (loss) | | | | | | |

Total from Investment Operations | | | | | | |

| | | | | | |

| | | | | | |

Net realized capital gains | | | | | | |

| | | | | | |

Net asset value, end of the period | | | | | | |

| | | | | | |

RATIOS TO AVERAGE NET ASSETS: | | | | | | |

Net assets, end of the period (000's) | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Per share net investment income has been calculated using the average shares outstanding during the period. |

| Includes a non-recurring dividend. Without this dividend, net investment income per share would have been $0.19, total return would have been 23.30% and the ratio of net investment income to average net assets would have been 1.43%. |

| Had certain expenses not been waived/reimbursed during the period, total returns would have been lower. |

| Periods less than one year are not annualized. |

| The investment adviser agreed to waive its fees and/or reimburse a portion of the Fund’s expenses during the period. Without this waiver/reimbursement, expenses would have been higher. |

| Computed on an annualized basis for periods less than one year. |

| Includes interest expense. Without this expense the ratio of net expenses would have been 0.85% and the ratio of gross expenses would have been 1.58%. |

| Includes interest expense. Without this expense the ratio of net expenses would have been 0.85% and the ratio of gross expenses would have been 1.23%. |

| Effective June 1, 2019, the expense limit decreased from 0.95% to 0.85%. |

See accompanying notes to financial statements.

Financial Highlights (continued)

For a share outstanding throughout each period.

| |

| Six Months

Ended

July 31,

2024

(Unaudited) | Year Ended

January 31,

2024 | Year Ended

January 31,

2023 | Year Ended

January 31,

2022 | Year Ended

January 31,

2021 | Year Ended

January 31,

2020 |

Net asset value, beginning of the period | | | | | | |

INCOME (LOSS) FROM INVESTMENT OPERATIONS: | | | | | | |

| | | | | | |

Net realized and unrealized gain (loss) | | | | | | |

Total from Investment Operations | | | | | | |

| | | | | | |

| | | | | | |

Net realized capital gains | | | | | | |

| | | | | | |

Net asset value, end of the period | | | | | | |

| | | | | | |

RATIOS TO AVERAGE NET ASSETS: | | | | | | |

Net assets, end of the period (000's) | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Per share net investment income has been calculated using the average shares outstanding during the period. |

| Includes a non-recurring dividend. Without this dividend, net investment income per share would have been $0.17, total return would have been 23.22% and the ratio of net investment income to average net assets would have been 1.27%. |

| Had certain expenses not been waived/reimbursed during the period, total returns would have been lower. |

| Periods less than one year are not annualized. |

| The investment adviser agreed to waive its fees and/or reimburse a portion of the Fund’s expenses during the period. Without this waiver/reimbursement, expenses would have been higher. |

| Computed on an annualized basis for periods less than one year. |

| Includes interest expense. Without this expense the ratio of net expenses would have been 0.90% and the ratio of gross expenses would have been 1.72%. |

| Includes interest expense. Without this expense the ratio of net expenses would have been 0.90% and the ratio of gross expenses would have been 1.32%. |

| Effective June 1, 2019, the expense limit decreased from 1.00% to 0.90%. |

See accompanying notes to financial statements.

Notes to Financial Statements

July 31, 2024 (Unaudited)

1.Organization. Natixis Funds Trust IV (the “Trust”) is organized as a Massachusetts business trust. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Declaration of Trust permits the Board of Trustees to authorize the issuance of an unlimited number of shares of the Trust in multiple series. The financial statements for certain funds of the Trust are presented in separate reports. Information presented in this report pertains to AEW Global Focused Real Estate Fund (the “Fund”).

The Fund is a diversified investment company.

The Fund offers Class A, Class C, Class N and Class Y shares.

Class A shares are sold with a maximum front-end sales charge of 5.75%. Class C shares do not pay a front-end sales charge, pay higher Rule 12b-1 fees than Class A shares for eight years (at which point they automatically convert to Class A shares) (prior to May 1, 2021, Class C shares automatically converted to Class A shares after ten years) and may be subject to a contingent deferred sales charge (“CDSC”) of 1.00% if those shares are redeemed within one year of acquisition, except for reinvested distributions. Class N and Class Y shares do not pay a front-end sales charge, a CDSC or Rule 12b-1 fees. Class N shares are offered with an initial minimum investment of $1,000,000. Class Y shares are offered with an initial minimum investment of $100,000. Certain categories of investors are exempted from the minimum investment amounts for Class N and Class Y as outlined in the Fund’s prospectus.

Most expenses can be directly attributed to a Fund. Expenses which cannot be directly attributed to a Fund are generally apportioned based on the relative net assets of each of the Funds in Natixis Funds Trust I, Natixis Funds Trust II, Natixis Funds Trust IV and Gateway Trust (“Natixis Funds Trusts”), Loomis Sayles Funds I and Loomis Sayles Funds II (“Loomis Sayles Funds Trusts”) and Natixis ETF Trust and Natixis ETF Trust II (“Natixis ETF Trusts”). Expenses of the Fund are borne pro rata by the holders of each class of shares, except that each class bears expenses unique to that class (such as the Rule 12b-1 fees applicable to Class A and Class C), and transfer agent fees are borne collectively for Class A, Class C and Class Y and individually for Class N. In addition, each class votes as a class only with respect to its own Rule 12b-1 Plan. Shares of each class would receive their pro rata share of the net assets of the Fund if the Fund were liquidated. The Trustees approve separate distributions from net investment income on each class of shares.

2.Significant Accounting Policies. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The Fund’s financial statements follow the accounting and reporting guidelines provided for investment companies and are prepared in accordance with accounting principles generally accepted in the United States of America which require the use of management estimates that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates. Management has evaluated the events and transactions subsequent to period-end through the date the financial statements were issued and has determined that there were no material events that would require disclosure in the Fund’s financial statements.

a. Valuation. Registered investment companies are required to value portfolio investments using an unadjusted, readily available market quotation. Each Fund obtains readily available market quotations from independent pricing services. Fund investments for which readily available market quotations are not available are priced at fair value pursuant to the Funds’ Valuation Procedures. The Board of Trustees has approved a valuation designee who is subject to the Board’s oversight.

Unadjusted readily available market quotations that are utilized for exchange traded equity securities (including shares of closed-end investment companies and exchange-traded funds) include the last sale price quoted on the exchange where the security is traded most extensively. Shares of open-end investment companies are valued at net asset value ("NAV") per share.

Exchange traded equity securities for which there is no reported sale during the day are fair valued at the closing bid quotation as reported by an independent pricing service. Unlisted equity securities (except unlisted preferred equity securities) are fair valued at the last sale price quoted in the market where they are traded most extensively or, if there is no reported sale during the day, the closing bid quotation as reported by an independent pricing service. If there is no last sale price or closing bid quotation available, unlisted equity securities will be fair valued using evaluated bids furnished by an independent pricing service, if available.

Debt securities and unlisted preferred equity securities are fair valued based on evaluated bids furnished to the Fund by an independent pricing service or bid prices obtained from broker-dealers. Broker-dealer bid prices may be used to fair value debt and unlisted equities where an independent pricing service is unable to price an investment or where an independent pricing service does not provide a reliable price for the investment.

The Fund may also fair value investments in other circumstances such as when extraordinary events occur after the close of a foreign market, but prior to the close of the New York Stock Exchange. This may include situations relating to a single issuer (such as a declaration of bankruptcy or a delisting of the issuer’s security from the primary market on which it has traded) as well as events affecting the securities markets in general (such as market disruptions or closings and significant fluctuations in U.S. and/or foreign markets). When fair valuing a Fund’s investments, the valuation designee may, among other things, use modeling tools or other

Notes to Financial Statements (continued)

July 31, 2024 (Unaudited)

processes that may take into account factors such as issuer specific information, or other related market activity and/or information that occurred after the close of the foreign market but before the time the Fund’s NAV is calculated. Fair valuation by the Fund’s valuation designee may require subjective determinations about the value of the investment, and fair values used to determine a Fund’s NAV may differ from quoted or published prices, or from prices that are used by others, for the same investments. In addition, the use of fair value pricing may not always result in adjustments to the prices of investments held by a Fund.

b. Investment Transactions and Related Investment Income. Investment transactions are accounted for on a trade date plus one day basis for daily NAV calculation. However, for financial reporting purposes, investment transactions are reported on the trade date. Dividend income (including income reinvested) and foreign withholding tax, if applicable, is recorded on the ex-dividend date, or in the case of certain foreign securities, as soon as the Fund is notified, and interest income is recorded on an accrual basis. Distributions received from investments in securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments or as a realized gain, respectively. The calendar year-end amounts of ordinary income, capital gains, and return of capital included in dividends received from the Fund’s investments in real estate investment trusts (“REITs") are reported to the Fund after the end of the calendar year; accordingly, the Fund estimates these amounts for accounting purposes until the characterization of REIT distributions is reported to the Fund after the end of the calendar year. Estimates for the period from February 1 through July 31, 2024 are included in the Statement of Operations. Estimates are based on the most recent REIT distribution information available. Interest income is increased by the accretion of discount and decreased by the amortization of premium, if applicable. In determining net gain or loss on securities sold, the cost of securities has been determined on an identified cost basis. Investment income, non-class-specific expenses and realized and unrealized gains and losses are allocated on a pro rata basis to each class based on the relative net assets of each class to the total net assets of the Fund.

c. Foreign Currency Translation. The books and records of the Fund are maintained in U.S. dollars. The values of securities, currencies and other assets and liabilities denominated in currencies other than U.S. dollars, if any, are translated into U.S. dollars based upon foreign exchange rates prevailing at the end of the period. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars on the respective dates of such transactions.