At an in-person meeting held on April 17, 2012, the Boards reviewed materials relating to their consideration of the Agreements. As a result of the discussions that occurred during the April 17, 2012 meeting, and as a culmination of each Board’s year-long deliberative process, the Boards presented BlackRock with questions and requests for additional information. BlackRock responded to these requests with additional written information in advance of the May 15–16, 2012 Board meeting.

At an in-person meeting held on May 15–16, 2012, (a) the Board of the Master LLC, including all the Independent Board Members, unanimously approved the continuation of (i) the Master LLC Advisory Agreement between the Manager and the Master LLC with respect to each Master Portfolio and (ii) the Master LLC Sub-Advisory Agreement between the Manager and the Sub-Advisor with respect to each Master Portfolio; and (b) the Board of the Corporation, including all the Independent Board Members, unanimously approved the continuation of (i) the Core Plus Fund Advisory Agreement between the Manager and the Corporation on behalf of Core Plus Fund and (ii) the Core Plus Fund Sub-Advisory Agreement between the Manager and the Sub-Advisor with respect to Core Plus Fund, each for a one-year term ending June 30, 2013. The Board Members of the Corporation, including the Independent Board Members, also considered the continuation of the Master LLC Agreements and found these Agreements to be satisfactory. In approving the continuation of the Agreements, each Board considered, with respect to the applicable Master Portfolio and/or Fund: (a) the nature, extent and quality of the services provided by BlackRock; (b) the investment performance of the Master Portfolio and/or Fund and BlackRock; (c) the advisory fee and the cost of the services and profits to be realized by BlackRock and its affiliates from their relationship with the Master Portfolio and/or Fund; (d) economies of scale; (e) fall-out benefits to BlackRock as a result of its relationship with the Master Portfolio and/or Fund; and (f) other factors deemed relevant by the Board Members.

Each Board also considered other matters it deemed important to the approval process, as pertinent, such as payments made to BlackRock or its affiliates relating to the distribution of the applicable Fund’s shares and securities lending, services related to the valuation and pricing of portfolio holdings of the applicable Master Portfolio or Fund, direct and indirect benefits to BlackRock and its affiliates from their relationship with the applicable Master Portfolios and/or Funds and advice from independent legal counsel with respect to the review process and materials submitted for the Board’s review. The Boards noted the willingness of BlackRock personnel to engage in open, candid discussions with the Boards. The Boards did not identify any particular information as controlling, and each Board Member may have attributed different weights to the various items considered.

The Boards considered, among other factors, the number, education and experience of BlackRock’s investment personnel generally and, as applicable, the portfolio management team of each Master Portfolio and/or Core Plus Fund, investments by portfolio managers in the funds they manage, BlackRock’s portfolio trading capabilities, BlackRock’s use of technology, BlackRock’s commitment to compliance, BlackRock’s credit analysis capabilities, BlackRock’s risk analysis and oversight capabilities and BlackRock’s approach to training and retaining portfolio managers and other research, advisory and management personnel. The Boards engaged in a review, as applicable, of BlackRock’s compensation structure with respect to the portfolio management team of each Master Portfolio and/or Core Plus Fund and BlackRock’s ability to attract and retain high-quality talent and create performance incentives.

In addition to advisory services, the Boards considered the quality of the administrative and non-investment advisory services provided to each Master Portfolio and Fund. BlackRock and its affiliates provide each Master Portfolio and Fund with certain administrative, shareholder and other services (in addition to any such services provided to the Master Portfolio and Fund by third parties) and officers and other personnel as are necessary for the operations of the Master Portfolio and the Fund. In particular, BlackRock and its affiliates provide each Master Portfolio and Fund with the following administrative services, including, among others: (i) preparing disclosure documents, such as the prospectus, the statement of additional information and periodic shareholder reports; (ii) assisting with daily accounting and pricing; (iii) overseeing and coordinating the activities of other service providers; (iv) organizing Board meetings and preparing the materials for such Board meetings; (v) providing legal and compliance support; and (vi) performing other administrative functions necessary for the operation of the Master Portfolio and the Fund, such as tax reporting, fulfilling regulatory filing requirements and call center services. The Boards reviewed the structure and duties of BlackRock’s fund administration, accounting, legal and compliance departments and considered BlackRock’s policies and procedures for assuring compliance with applicable laws and regulations.

|

|

Disclosure of Investment Advisory Agreement and Sub-Advisory Agreement (continued) |

B. The Investment Performance of each Master Portfolio, each Fund and BlackRock: Each Board, including the Independent Board Members, also reviewed and considered the performance history of each Master Portfolio and/or Fund, as applicable. The Boards noted that each Master Portfolio’s investment results correspond directly to the investment results of the applicable Feeder Fund. In preparation for the April 17, 2012 meeting, the Boards worked with their independent legal counsel, BlackRock and Lipper to develop a template for, and were provided with, reports independently prepared by Lipper, which included a comprehensive analysis of each Fund’s performance. The Boards also reviewed a narrative and statistical analysis of the Lipper data that was prepared by BlackRock, which analyzed various factors that affect Lipper’s rankings. In connection with their review, the Boards received and reviewed information regarding the investment performance of each applicable Fund as compared to funds in such Fund’s applicable Lipper category. The Boards were provided with a description of the methodology used by Lipper to select peer funds and periodically meet with Lipper representatives to review their methodology. Each Board and the Board’s Performance Oversight and Contract Committee regularly review, and meet with the management of each Master Portfolio and/or Core Plus Fund, as applicable, to discuss the performance of the Master Portfolios and/or Funds throughout the year.

The Board of the Corporation noted that, in general, Core Plus Fund performed better than its Peers in that the Fund’s performance was at or above the median of its Lipper Performance Universe in two of the one-year, three-year and since-inception periods reported.

The Boards noted that, in general, Growth Fund performed better than its Peers in that the Fund’s performance was at or above the median of its Lipper Performance Universe in two of the one-, three- and five-year periods reported.

The Boards noted that Core Fund performed below the median of its Lipper Performance Universe in the three- and five-year periods reported, but that the Fund performed at or above the median of its Lipper Performance Universe in the one-year period reported. The Boards and BlackRock reviewed and discussed the reasons for the Fund’s underperformance during the three- and five-year periods compared with its Peers. BlackRock informed the Boards that, among other things, stock selection within information technology and industrials was the greatest detractor from performance over the three- and five-year periods.

The Boards noted that Value Fund performed below the median of its Lipper Performance Universe in the three- and five-year periods reported, but that the Fund performed at or above the median of its Lipper Performance Universe in the one-year period reported. The Boards and BlackRock reviewed and discussed the reasons for the Fund’s underperformance during the three- and five-year periods compared with its Peers. BlackRock informed the Boards that, among other things, stock selection within the financial sector was the largest detractor over the three-year period, while stock selection within the utilities sector was the largest detractor from performance over the five-year period.

The Boards and BlackRock discussed BlackRock’s strategy for improving the performance of Master Large Cap Core Portfolio/Core Fund and Master Large Cap Value Portfolio/Value Fund and BlackRock’s commitment to providing the resources necessary to assist the portfolio managers of these Master Portfolios and to improve these Master Portfolios’/Funds’ performance.

C. Consideration of the Advisory/Management Fees and the Cost of the Services and Profits to be Realized by BlackRock and its Affiliates from their Relationship with each Master Portfolio and Fund: Each Board, including the Independent Board Members, reviewed, as applicable, the contractual management fee rate of each Master Portfolio/Feeder Fund and/or Core Plus Fund compared with the other funds in the Fund’s Lipper category. Each board also compared, as applicable, each Fund’s total expense ratio, as well as the actual management fee rate of each Master Portfolio/Feeder Fund and Core Plus Fund, to those of other funds in the Fund’s Lipper category. The Board considered the services provided and the fees charged by BlackRock to other types of clients with similar investment mandates, including separately managed institutional accounts.

The Boards received and reviewed statements relating to BlackRock’s financial condition and profitability with respect to the services it provided each Master Portfolio and Fund. The Boards were also provided with a profitability analysis that detailed the revenues earned and the expenses incurred by BlackRock for services provided to the Master Portfolios and the Funds. The Boards reviewed BlackRock’s profitability with respect to each Master Portfolio and Fund, as applicable, and other funds the Board currently oversees for the year ended December 31, 2011 compared to available aggregate profitability data provided for the years ended December 31, 2010 and December 31, 2009. The Boards reviewed BlackRock’s profitability with respect to other fund complexes managed by the Manager and/or its affiliates. The Boards reviewed BlackRock’s assumptions and methodology of allocating expenses in the profitability analysis, noting the inherent limitations in allocating costs among various advisory products. The Boards recognized that profitability may be affected by numerous factors including, among other things, fee waivers and expense reimbursements by the Manager, the types of funds managed, expense allocations and business mix, and the difficulty of comparing profitability as a result of those factors.

The Boards noted that, in general, individual fund or product line profitability of other advisors is not publicly available. The Boards considered BlackRock’s operating margin, in general, compared to the operating margin for leading investment management firms whose operations include advising open-end funds, among other product types. In addition, the Boards considered, among other things, certain third party data comparing BlackRock’s operating margin with that of other publicly-traded asset management firms. The Boards considered the differences between BlackRock and these other firms, including the contribution of technology at BlackRock, BlackRock’s expense management and the relative product mix.

In addition, the Boards considered the cost of the services provided to each Master Portfolio and Fund by BlackRock, and BlackRock’s and its affiliates’ profits relating to the management and distribution of each Master Portfolio and Fund and the other funds advised by BlackRock and its affiliates. As part of their analysis, the Boards reviewed BlackRock’s methodology in allocating its costs to the management of the Master Portfolios and the Funds. The Boards also considered whether BlackRock has the financial resources necessary to attract and retain high quality investment management personnel to perform its obligations under the Agreements and to continue to provide the high quality of services that is expected by the Boards.

The Boards noted that Master Large Cap Growth Portfolio’s/Growth Fund’s contractual management fee ratio (a combination of the advisory fee and the administration fee, if any) was above the median contractual management fee ratio paid by the Fund’s Peers, in each case before taking into account any expense reimbursements or fee waivers. The Boards also noted,

| | |

| | |

76 | BLACKROCK LARGE CAP SERIES FUNDS, INC. | SEPTEMBER 30, 2012 |

|

|

Disclosure of Investment Advisory Agreement and Sub-Advisory Agreement (concluded) |

however, that Master Large Cap Growth Portfolio’s/Growth Fund’s contractual management fee ratio was reasonable relative to the median contractual management fee ratio paid by the Fund’s Peers.

The Boards noted that the contractual management fee ratio (a combination of the advisory fee and the administration fee, if any) of each of Master Large Cap Core Portfolio/Core Fund and Master Large Cap Value Portfolio/Value Fund was above the median contractual management fee ratio paid by the corresponding Fund’s Peers, in each case before taking into account any expense reimbursements or fee waivers. The Boards also noted, however, that each Fund’s actual total expense ratio, after giving effect to any expense reimbursements or fee waivers by BlackRock, was reasonable relative to the median actual total expense ratio paid by the Fund’s Peers, after giving effect to any expense reimbursements or fee waivers.

The Board of the Corporation noted that Core Plus Fund’s contractual management fee ratio (a combination of the advisory fee and the administration fee, if any) was above the median contractual management fee ratio paid by the Fund’s Peers, in each case before taking into account any expense reimbursements or fee waivers.

The Boards also noted, as applicable, that each Master Portfolio and Core Plus Fund has an advisory fee arrangement that includes breakpoints that adjust the fee rate downward as the size of the Master Portfolio or Core Plus Fund increases above certain contractually specified levels.

The Boards further noted that BlackRock has (i) with respect to Core Fund, contractually agreed to waive fees and/or reimburse expenses in order to limit, to a specified amount, the total operating expenses of Core Fund as a percentage of the Fund’s average daily net assets on a class-by-class basis, as applicable and (ii) with respect to Core Plus Fund, voluntarily agreed to waive fees and/or reimburse expenses in order to limit, to a specified amount, the total operating expenses of Core Plus Fund as a percentage of the Fund’s average daily net assets on a class-by-class basis, as applicable. With respect to Value Fund, the Boards noted that after discussions between the Boards, including the Independent Board Members, and BlackRock, the Boards and BlackRock agreed to a voluntary administration fee reduction effective June 1, 2012.

D. Economies of Scale: Each Board, including the Independent Board Members, considered, as applicable, the extent to which economies of scale might be realized as the assets of each Master Portfolio and Fund increase, as well as the existence of expense caps. The Boards also considered the extent to which each Master Portfolio and Fund benefit from such economies and whether there should be changes in the advisory fee rate or structure in order to enable each Master Portfolio and Fund to participate in these economies of scale, for example through the use of revised breakpoints in the advisory fee based upon the asset level of the Master Portfolio or Core Plus Fund, as applicable. In their consideration, the Board Members took into account the existence of expense caps and further considered the continuation and/or implementation, as applicable, of such caps.

E. Other Factors Deemed Relevant by the Board Members: Each Board, including the Independent Board Members, also took into account other ancillary or “fall-out” benefits that BlackRock or its affiliates may derive from their respective relationships with the Master Portfolios and the Funds, both tangible and intangible, such as BlackRock’s ability to leverage its investment professionals who manage other portfolios and risk management personnel, an increase in BlackRock’s profile in the investment advisory community, and the engagement of BlackRock’s affiliates as service providers to the Master Portfolios and the Funds, including for administrative, distribution, securities lending and cash management services. The Boards also considered BlackRock’s overall operations and its efforts to expand the scale of, and improve the quality of, its operations. The Boards also noted that BlackRock may use and benefit from third party research obtained by soft dollars generated by certain registered fund transactions to assist in managing all or a number of its other client accounts. The Boards further noted that they had considered the investment by BlackRock’s funds in ETFs without any offset against the management fees payable by the funds to BlackRock.

In connection with their consideration of the pertinent Agreements, the Boards also received information regarding BlackRock’s brokerage and soft dollar practices. The Boards received reports from BlackRock which included information on brokerage commissions and trade execution practices throughout the year.

The Boards noted the competitive nature of the open-end fund marketplace, and that shareholders are able to redeem their Fund shares if they believe that the applicable Fund’s and/or Master Portfolio’s fees and expenses are too high or if they are dissatisfied with the performance of the Fund.

Conclusion

The Board of the Master LLC, including all the Independent Board Members, unanimously approved the continuation of the Master LLC Advisory Agreement between the Manager and the Master LLC, with respect to each Master Portfolio, for a one-year term ending June 30, 2013 and the Master LLC Sub-Advisory Agreement between the Manager and the Sub-Advisor, with respect to each Master Portfolio, for a one-year term ending June 30, 2013. Based upon its evaluation of all of the aforementioned factors in their totality, the Board of the Master LLC, including the Independent Board Members, was satisfied that the terms of the Master LLC Agreements were fair and reasonable and in the best interest of each Master Portfolio and its shareholders. The Board of the Corporation, including the Independent Board Members, also considered the continuation of the Master LLC Agreements with respect to each Master Portfolio and found the Agreements to be satisfactory.

The Board of the Corporation, including all the Independent Board Members, unanimously approved the continuation of the Core Plus Fund Advisory Agreement between the Manager and the Corporation on behalf of Core Plus Fund, for a one-year term ending June 30, 2013 and the Core Plus Fund Sub-Advisory Agreement between the Manager and the Sub-Advisor with respect to Core Plus Fund, for a one-year term ending June 30, 2013. Based upon its evaluation of all of the aforementioned factors in their totality, the Board of the Corporation, including the Independent Board Members, was satisfied that the terms of the Core Plus Fund Agreements were fair and reasonable and in the best interest of Core Plus Fund and its shareholders.

In arriving at its decision to approve the applicable Agreements, each Board did not identify any single factor or group of factors as all-important or controlling, but considered all factors together, and different Board Members may have attributed different weights to the various factors considered. The Independent Board Members were also assisted by the advice of independent legal counsel in making this determination. The contractual fee arrangements for each Master Portfolio and Core Plus Fund reflect the results of several years of review by the Board Members and predecessor Board Members, and discussions between such Board Members (and predecessor Board Members) and BlackRock. As a result, the Board Members’ conclusions may be based in part on their consideration of these arrangements in prior years.

| | | |

| | | |

| BLACKROCK LARGE CAP SERIES FUNDS, INC. | SEPTEMBER 30, 2012 | 77 |

| | | | | | | | | | |

Name, Address

and Year of Birth | | Position(s)

Held with

Corporation/

Master LLC | | Length

of Time

Served as

a Director2 | | Principal Occupation(s) During Past Five Years | | Number of BlackRock-

Advised Registered

Investment Companies

(“RICs”) Consisting of

Investment Portfolios

(“Portfolios”) Overseen | | Public

Directorships |

Independent Directors1 | | | | | | | | |

Ronald W. Forbes

55 East 52nd Street

New York, NY 10055

1940 | | Co-Chairman of the Board and Director | | Since

2007 | | Professor Emeritus of Finance, School of Business, State University of New York at Albany since 2000. | | 33 RICs consisting of 102 Portfolios | | None |

Rodney D. Johnson

55 East 52nd Street

New York, NY 10055

1941 | | Co-Chairman of the Board and Director | | Since

2007 | | President, Fairmount Capital Advisors, Inc. since 1987; Member of the Archdiocesan Investment Committee of the Archdiocese of Philadelphia since 2004; Director, The Committee of Seventy (civic) since 2006; Director, Fox Chase Cancer Center 2004 to 2011. | | 33 RICs consisting of 102 Portfolios | | None |

David O. Beim

55 East 52nd Street

New York, NY 10055

1940 | | Director | | Since

2007 | | Professor of Professional Practice at the Columbia University Graduate School of Business since 1991; Trustee, Phillips Exeter Academy since 2002; Chairman, Wave Hill, Inc. (public garden and cultural center) from 1990 to 2006. | | 33 RICs consisting of 102 Portfolios | | None |

Dr. Matina S. Horner

55 East 52nd Street

New York, NY 10055

1939 | | Director | | Since

2007 | | Executive Vice President of Teachers Insurance and Annuity Association and College Retirement Equities Fund from 1989 to 2003. | | 33 RICs consisting of 102 Portfolios | | NSTAR (electric and gas utility) |

Herbert I. London

55 East 52nd Street

New York, NY 10055

1939 | | Director | | Since

19993

and

20074 | | Professor Emeritus, New York University since 2005; John M. Olin Professor of Humanities, New York University from 1993 to 2005 and Professor thereof from 1980 to 2005; President Emeritus, Hudson Institute (policy research organization) since 2011, President thereof from 1997 to 2011 and Trustee since 1980; Chairman of the Board of Trustees for Grantham University since 2006; Director, InnoCentive, Inc. (strategic solutions company) since 2005; Director, Cerego, LLC (software development and design) since 2005; Director, Cybersettle (dispute resolution technology) since 2009. | | 33 RICs consisting of 102 Portfolios | | AIMS Worldwide, Inc. (marketing) |

Ian A. MacKinnon

55 East 52nd Street

New York, NY 10055

1948 | | Director | | Since

2012 | | Director, Kennett Capital, Inc. (investments) since 2006; Director, Free Library of Philadelphia from 1999 to 2008. | | 33 RICs consisting of 102 Portfolios | | None |

Cynthia A. Montgomery

55 East 52nd Street

New York, NY 10055

1952 | | Director | | Since

2007 | | Professor, Harvard Business School since 1989; Director, McLean Hospital since 2005; Director, Harvard Business School Publishing from 2005 to 2010. | | 33 RICs consisting of 102 Portfolios | | Newell Rubbermaid, Inc. (manufacturing) |

Joseph P. Platt

55 East 52nd Street

New York, NY 10055

1947 | | Director | | Since

2007 | | Director, The West Penn Allegheny Health System (a not-for-profit health system) since 2008; Director, Jones and Brown (Canadian insurance broker) since 1998; General Partner, Thorn Partners, LP (private investments) since 1998; Director, WQED Multi-Media (public broadcasting not-for-profit) since 2001; Partner, Amarna Corporation, LLC (private investment company) from 2002 to 2008. | | 33 RICs consisting of 102 Portfolios | | Greenlight Capital Re, Ltd. (reinsurance company) |

Robert C. Robb, Jr.

55 East 52nd Street

New York, NY 10055

1945 | | Director | | Since

2007 | | Partner, Lewis, Eckert, Robb and Company (management and financial consulting firm) since 1981. | | 33 RICs consisting of 102 Portfolios | | None |

| | |

| | |

78 | BLACKROCK LARGE CAP SERIES FUNDS, INC. | SEPTEMBER 30, 2012 |

|

|

Officers and Directors (continued) |

| | | | | | | | | | |

Name, Address

and Year of Birth | | Position(s)

Held with

Corporation/

Master LLC | | Length

of Time

Served as

a Director2 | | Principal Occupation(s) During Past Five Years | | Number of BlackRock-

Advised Registered

Investment Companies

(“RICs”) Consisting of

Investment Portfolios

(“Portfolios”) Overseen | | Public

Directorships |

Independent Directors1 (concluded) |

Toby Rosenblatt

55 East 52nd Street

New York, NY 10055

1938 | | Director | | Since

2007 | | President, Founders Investments Ltd. (private investments) since 1999; Director, Forward Management, LLC since 2007; Director, College Access Foundation of California (philanthropic foundation) since 2009; Director, A.P. Pharma, Inc. (specialty pharmaceuticals) from 1983 to 2011; Director, The James Irvine Foundation (philanthropic foundation) from 1998 to 2008. | | 33 RICs consisting of 102 Portfolios | | None |

Kenneth L. Urish

55 East 52nd Street

New York, NY 10055

1951 | | Director | | Since

2007 | | Managing Partner, Urish Popeck & Co., LLC (certified public accountants and consultants) since 1976; Chairman Elect of the Professional Ethics Committee of the Pennsylvania Institute of Certified Public Accountants and Committee Member thereof since 2007; Member of External Advisory Board, The Pennsylvania State University Accounting Department since 2001; Trustee, The Holy Family Institute from 2001 to 2010; President and Trustee, Pittsburgh Catholic Publishing Associates from 2003 to 2008; Director, Inter-Tel from 2006 to 2007. | | 33 RICs consisting of 102 Portfolios | | None |

Frederick W. Winter

55 East 52nd Street

New York, NY 10055

1945 | | Director | | Since

2007 | | Professor and Dean Emeritus of the Joseph M. Katz School of Business, University of Pittsburgh since 2005 and Dean thereof from 1997 to 2005; Director, Alkon Corporation (pneumatics) since 1992; Director, Tippman Sports (recreation) since 2005; Director, Indotronix International (IT services) from 2004 to 2008. | | 33 RICs consisting of 102 Portfolios | | None |

| | |

| 1 | Directors serve until their resignation, removal or death, or until December 31 of the year in which they turn 72. The Board has approved extensions in terms of Directors who turn 72 prior to December 31, 2013. |

| | |

| 2 | Date shown is the earliest date a person has served for the Corporation/Master LLC covered by this annual report. Following the combination of Merrill Lynch Investment Managers, L.P. (“MLIM”) and BlackRock, Inc. (“BlackRock”) in September 2006, the various legacy MLIM and legacy BlackRock Fund boards were realigned and consolidated into three new Fund boards in 2007. As a result, although the chart shows certain Directors as joining the Corporation’s/Master LLC’s board in 2007, each Director first became a member of the board of other legacy MLIM or legacy BlackRock Funds as follows: David O. Beim, 1998; Ronald W. Forbes, 1977; Dr. Matina S. Horner, 2004; Rodney D. Johnson, 1995; Herbert I. London, 1987; Cynthia A. Montgomery, 1994; Joseph P. Platt, 1999; Robert C. Robb, Jr., 1998; Toby Rosenblatt, 2005; Kenneth L. Urish, 1999; and Frederick W. Winter, 1999. |

| | |

| 3 | For BlackRock Large Cap Core Fund, BlackRock Large Cap Growth Fund, BlackRock Large Cap Value Fund and the Master LLC. |

| | |

| 4 | For BlackRock Large Cap Core Plus Fund. |

| | | | | | | | | | |

Interested Directors5 |

Paul L. Audet

55 East 52nd Street

New York, NY 10055

1953 | | Director | | Since

2011 | | Senior Managing Director of BlackRock and Head of U.S. Mutual Funds since 2011; Chair of the U.S. Mutual Funds Committee reporting to the Global Executive Committee since 2011; Head of BlackRock’s Real Estate business from 2008 to 2011; Member of BlackRock’s Global Operating and Corporate Risk Management Committees and of the BlackRock Alternative Investors Executive Committee and Investment Committee for the Private Equity Fund of Funds business since 2008; Head of BlackRock’s Global Cash Management business from 2005 to 2010; Acting Chief Financial Officer of BlackRock from 2007 to 2008; Chief Financial Officer of BlackRock from 1998 to 2005. | | 160 RICs consisting of 278 Portfolios | | None |

Henry Gabbay

55 East 52nd Street

New York, NY 10055

1947 | | Director | | Since

2007 | | Consultant, BlackRock from 2007 to 2008; Managing Director, BlackRock from 1989 to 2007; Chief Administrative Officer, BlackRock Advisors, LLC from 1998 to 2007; President of BlackRock Funds and BlackRock Bond Allocation Target Shares from 2005 to 2007 and Treasurer of certain closed-end funds in the BlackRock fund complex from 1989 to 2006. | | 160 RICs consisting of 278 Portfolios | | None |

| | |

| 5 | Mr. Audet is an “interested person,” as defined in the 1940 Act, of the Corporation/Master LLC based on his position with BlackRock and its affiliates. Mr. Gabbay is an “interested person” of the Corporation/Master LLC based on his former positions with BlackRock and its affiliates as well as his ownership of BlackRock and The PNC Financial Services Group, Inc. securities. Mr. Audet and Mr. Gabbay are also Directors of the BlackRock registered closed-end funds and Directors of other BlackRock registered open-end funds. Directors serve until their resignation, removal or death, or until December 31 of the year in which they turn 72. |

| | | |

| | | |

| BLACKROCK LARGE CAP SERIES FUNDS, INC. | SEPTEMBER 30, 2012 | 79 |

|

|

Officers and Directors (concluded) |

| | | | | | |

Name, Address

and Year of Birth | | Position(s)

Held with

Corporation/

Master LLC | | Length

of Time

Served | | Principal Occupation(s) During Past Five Years |

Officers1 | | | | | | |

John M. Perlowski

55 East 52nd Street

New York, NY 10055

1964 | | President and Chief Executive Officer | | Since

2010 | | Managing Director of BlackRock since 2009; Global Head of BlackRock Fund Administration since 2009; Managing Director and Chief Operating Officer of the Global Product Group at Goldman Sachs Asset Management, L.P. from 2003 to 2009; Treasurer of Goldman Sachs Mutual Funds from 2003 to 2009 and Senior Vice President thereof from 2007 to 2009; Director of Goldman Sachs Offshore Funds from 2002 to 2009; Director of Family Resource Network (charitable foundation) since 2009. |

Brendan Kyne

55 East 52nd Street

New York, NY 10055

1977 | | Vice President | | Since

2009 | | Managing Director of BlackRock since 2010; Director of BlackRock from 2008 to 2009; Head of Product Development and Management for BlackRock’s U.S. Retail Group since 2009 and Co-head thereof from 2007 to 2009; Vice President of BlackRock from 2005 to 2008. |

Neal Andrews

55 East 52nd Street

New York, NY 10055

1966 | | Chief Financial Officer | | Since

2007 | | Managing Director of BlackRock since 2006; Senior Vice President and Line of Business Head of Fund Accounting and Administration at PNC Global Investment Servicing (U.S.) Inc. from 1992 to 2006. |

Jay Fife

55 East 52nd Street

New York, NY 10055

1966 | | Treasurer | | Since

2007 | | Managing Director of BlackRock since 2007; Director of BlackRock in 2006; Assistant Treasurer of the MLIM and Fund Asset Management, L.P. advised funds from 2005 to 2006; Director of MLIM Fund Services Group from 2001 to 2006. |

Brian Kindelan

55 East 52nd Street

New York, NY 10055

1959 | | Chief Compliance Officer and Anti-Money Laundering Officer | | Since

2007 | | Chief Compliance Officer of the BlackRock-advised funds since 2007; Managing Director and Senior Counsel of BlackRock since 2005. |

Benjamin Archibald

55 East 52nd Street

New York, NY 10055

1975 | | Secretary | | Since

2012 | | Director of BlackRock since 2010; Assistant Secretary to the funds from 2010 to 2012; General Counsel and Chief Operating Officer of Uhuru Capital Management from 2009 to 2010; Executive Director and Counsel of Goldman Sachs Asset Management from 2005 to 2009. |

| | |

| 1 | Officers of the Corporation/Master LLC serve at the pleasure of the Board. |

| Further information about the Corporation’s Officers and Directors is available in the Corporation’s Statement of Additional Information, which can be obtained without charge by calling (800) 441-7762. |

|

Investment Advisor |

BlackRock Advisors, LLC |

Wilmington, DE 19809 |

|

Sub-Advisor |

BlackRock Investment |

Management, LLC |

Princeton, NJ 08540 |

|

Custodian |

Brown Brothers Harriman & Co. |

Boston, MA 02109 |

|

Transfer Agent |

BNY Mellon Investment |

Servicing (US) Inc. |

Wilmington, DE 19809 |

|

Accounting Agent |

State Street Bank and |

Trust Company |

Boston, MA 02110 |

|

Distributor |

BlackRock Investments, LLC |

New York, NY 10022 |

|

Legal Counsel |

Sidley Austin LLP |

New York, NY 10019 |

|

Independent Registered Public Accounting Firm |

Deloitte & Touche LLP |

Boston, MA 02116 |

|

Address of the Corporation |

100 Bellevue Parkway |

Wilmington, DE 19809 |

|

Effective May 15, 2012, Ian A. MacKinnon became a Director of the Corporation and Master LLC. |

|

Effective May 16, 2012, Ira P. Shapiro resigned as Secretary of the Corporation and Master LLC, and Benjamin Archibald became Secretary of the Corporation and Master LLC. |

|

| | |

| | |

80 | BLACKROCK LARGE CAP SERIES FUNDS, INC. | SEPTEMBER 30, 2012 |

Electronic Delivery

Electronic copies of most financial reports and prospectuses are available on the Funds’ website or shareholders can sign up for e-mail notifications of quarterly statements, annual and semi-annual reports and prospectuses by enrolling in the Funds’ electronic delivery program.

To enroll:

Shareholders Who Hold Accounts with Investment Advisors, Banks or Brokerages:

Please contact your financial advisor. Please note that not all investment advisors, banks or brokerages may offer this service.

Shareholders Who Hold Accounts Directly with BlackRock:

1) Access the BlackRock website at http://www.blackrock.com/edelivery

2) Select “eDelivery” under the “More Information” section

3) Log into your account

Householding

The Funds will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Funds at (800) 441-7762.

Availability of Quarterly Schedule of Investments

The Corporation/Master LLC file their complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Corporation’s/Master LLC’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on how to access documents on the SEC’s website without charge may be obtained by calling (800) SEC-0330. The Corporation’s/Master LLC’s Forms N-Q may also be obtained upon request and without charge by calling (800) 441-7762.

Availability of Proxy Voting Policies and Procedures

A description of the policies and procedures that the Corporation/ Master LLC use to determine how to vote proxies relating to portfolio securities is available (1) without charge, upon request, by calling (800) 441-7762; (2) at http://www.blackrock.com; and (3) on the SEC’s website at http://www.sec.gov.

Availability of Proxy Voting Record

Information about how the Corporation/Master LLC voted proxies relating to securities held in the Corporation’s/Master LLC’s portfolios during the most recent 12-month period ended June 30 is available upon request and without charge (1) at http://www.blackrock.com or by calling (800) 441-7762 and (2) on the SEC’s website at http://www.sec.gov.

| | | |

|

| BLACKROCK LARGE CAP SERIES FUNDS, INC. | SEPTEMBER 30, 2012 | 81 |

|

|

Additional Information (concluded) |

Account Information

Call us at (800) 441-7762 from 8:00 AM to 6:00 PM EST on any business day to get information about your account balances, recent transactions and share prices. You can also reach us on the Web at http://www.blackrock.com/funds.

Automatic Investment Plans

Investor Class shareholders who want to invest regularly can arrange to have $50 or more automatically deducted from their checking or savings account and invested in any of the BlackRock funds.

Systematic Withdrawal Plans

Investor Class shareholders can establish a systematic withdrawal plan and receive periodic payments of $50 or more from their BlackRock funds, as long as their account balance is at least $10,000.

Retirement Plans

Shareholders may make investments in conjunction with Traditional, Rollover, Roth, Coverdell, Simple IRAs, SEP IRAs and 403(b) Plans.

|

BlackRock Privacy Principles |

BlackRock is committed to maintaining the privacy of its current and former fund investors and individual clients (collectively, “Clients”) and to safeguarding their non-public personal information. The following information is provided to help you understand what personal information BlackRock collects, how we protect that information and why in certain cases we share such information with select parties.

If you are located in a jurisdiction where specific laws, rules or regulations require BlackRock to provide you with additional or different privacy-related rights beyond what is set forth below, then BlackRock will comply with those specific laws, rules or regulations.

BlackRock obtains or verifies personal non-public information from and about you from different sources, including the following: (i) information we receive from you or, if applicable, your financial intermediary, on applications, forms or other documents; (ii) information about your transactions with us, our affiliates, or others; (iii) information we receive from a consumer reporting agency; and (iv) from visits to our websites.

BlackRock does not sell or disclose to non-affiliated third parties any non-public personal information about its Clients, except as permitted by law or as is necessary to respond to regulatory requests or to service Client accounts. These non-affiliated third parties are required to protect the confidentiality and security of this information and to use it only for its intended purpose.

We may share information with our affiliates to service your account or to provide you with information about other BlackRock products or services that may be of interest to you. In addition, BlackRock restricts access to non-public personal information about its Clients to those BlackRock employees with a legitimate business need for the information. BlackRock maintains physical, electronic and procedural safeguards that are designed to protect the non-public personal information of its Clients, including procedures relating to the proper storage and disposal of such information.

| | | |

|

82 | BLACKROCK LARGE CAP SERIES FUNDS, INC. | SEPTEMBER 30, 2012 | |

|

|

A World-Class Mutual Fund Family |

BlackRock offers a diverse lineup of open-end mutual funds crossing all investment styles and managed by experts in equity, fixed income and tax-exempt investing.

|

Equity Funds |

|

BlackRock ACWI ex-US Index Fund |

BlackRock All-Cap Energy & Resources Portfolio |

BlackRock Balanced Capital Fund† |

BlackRock Basic Value Fund |

BlackRock Capital Appreciation Fund |

BlackRock China Fund |

BlackRock Commodity Strategies Fund |

BlackRock Emerging Markets Fund |

BlackRock Emerging Markets Long/Short Equity Fund |

BlackRock Energy & Resources Portfolio |

BlackRock Equity Dividend Fund |

BlackRock EuroFund |

BlackRock Flexible Equity Fund |

BlackRock Focus Growth Fund |

BlackRock Global Allocation Fund† |

BlackRock Global Dividend Income Portfolio |

BlackRock Global Opportunities Portfolio |

BlackRock Global SmallCap Fund |

BlackRock Health Sciences Opportunities Portfolio |

BlackRock Index Equity Portfolio |

BlackRock India Fund |

BlackRock International Fund |

BlackRock International Index Fund |

BlackRock International Opportunities Portfolio |

BlackRock Large Cap Core Fund |

BlackRock Large Cap Core Plus Fund |

BlackRock Large Cap Growth Fund |

BlackRock Large Cap Value Fund |

BlackRock Latin America Fund |

BlackRock Long-Horizon Equity Fund |

BlackRock Managed Volatility Portfolio† |

BlackRock Mid-Cap Growth Equity Portfolio |

BlackRock Mid Cap Value Opportunities Fund |

BlackRock Natural Resources Trust |

BlackRock Pacific Fund |

BlackRock Real Estate Securities Fund |

BlackRock Russell 1000 Index Fund |

BlackRock Science & Technology Opportunities Portfolio |

BlackRock Small Cap Growth Equity Portfolio |

BlackRock Small Cap Growth Fund II |

BlackRock Small Cap Index Fund |

BlackRock S&P 500 Index Fund |

BlackRock S&P 500 Stock Fund |

BlackRock U.S. Opportunities Portfolio |

BlackRock Value Opportunities Fund |

BlackRock World Gold Fund |

|

|

Taxable Fixed Income Funds |

|

BlackRock Bond Index Fund |

BlackRock Core Bond Portfolio |

BlackRock CoreAlpha Bond Fund |

BlackRock Emerging Market Local Debt Portfolio |

BlackRock Floating Rate Income Portfolio |

BlackRock Global Long/Short Credit Fund |

BlackRock GNMA Portfolio |

BlackRock High Yield Bond Portfolio |

BlackRock Inflation Protected Bond Portfolio |

BlackRock International Bond Portfolio |

BlackRock Long Duration Bond Portfolio |

BlackRock Low Duration Bond Portfolio |

BlackRock Multi-Asset Income Portfolio† |

BlackRock Secured Credit Portfolio |

BlackRock Strategic Income Opportunities Portfolio |

BlackRock Total Return Fund |

BlackRock US Government Bond Portfolio |

BlackRock US Mortgage Portfolio |

BlackRock World Income Fund |

|

|

Municipal Fixed Income Funds |

|

BlackRock California Municipal Bond Fund |

BlackRock High Yield Municipal Fund |

BlackRock Intermediate Municipal Fund |

BlackRock National Municipal Fund |

BlackRock New Jersey Municipal Bond Fund |

BlackRock New York Municipal Bond Fund |

BlackRock Pennsylvania Municipal Bond Fund |

BlackRock Short-Term Municipal Fund |

|

|

Target Risk & Target Date Funds† |

|

BlackRock Prepared Portfolios |

Conservative Prepared Portfolio |

Moderate Prepared Portfolio |

Growth Prepared Portfolio |

Aggressive Growth Prepared Portfolio |

|

LifePath Active Portfolios |

2015 |

2020 |

2025 |

2030 |

2035 |

2040 |

2045 |

2050 |

|

LifePath Portfolios |

Retirement |

2020 |

2025 |

2030 |

2035 |

2040 |

2045 |

2050 |

2055 |

|

LifePath Index Portfolios |

Retirement |

2020 |

2025 |

2030 |

2035 |

2040 |

2045 |

2050 |

2055 |

BlackRock mutual funds are currently distributed by BlackRock Investments, LLC. You should consider the investment objectives, risks, charges and expenses of the funds under consideration carefully before investing. Each fund’s prospectus contains this and other information and is available at www.blackrock.com or by calling (800) 441-7762 or from your financial advisor. The prospectus should be read carefully before investing.

| | | |

| | | |

| BLACKROCK LARGE CAP SERIES FUNDS, INC. | SEPTEMBER 30, 2012 | 83 |

These reports are not authorized for use as an offer of sale or a solicitation of an offer to buy shares of the Funds unless accompanied or preceded by the Funds’ current prospectus. Past performance results shown in these reports should not be considered a representation of future performance. Investment returns and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Statements and other information herein are as dated and are subject to change.

| |

|

#CAPSERIESCP-9/12-AR |

|

| |

| September 30, 2012 |

Annual Report

BlackRock Large Cap Series Funds, Inc.

|

• BlackRock Large Cap Core Retirement Portfolio

|

• BlackRock Large Cap Growth Retirement Portfolio

|

• BlackRock Large Cap Value Retirement Portfolio |

|

Not FDIC Insured §No Bank Guarantee §May Lose Value |

| | | |

| | | |

2 | BLACKROCK LARGE CAP SERIES FUNDS, INC. | SEPTEMBER 30, 2012 | |

Late in the summer of 2011, financial markets were upended by sovereign debt turmoil in the United States and Europe as well as growing concerns about the future of the global economy. Investor confidence had crumbled. However, the fourth quarter of 2011 brought improving economic data and more concerted efforts among European leaders toward stemming the region’s debt crisis, gradually drawing investors back to the markets. Improving sentiment carried over into early 2012 as investors felt some relief from the world’s financial woes. Volatility abated and risk assets (including stocks, commodities and high yield bonds) moved boldly higher through the first two months of 2012, while climbing Treasury yields pressured higher-quality fixed income assets.

Markets reversed course in the spring when Europe’s debt problems boiled over once again. High levels of volatility returned as political instability in Greece threatened the country’s membership in the eurozone. Spain faced severe deficit issues while the nation’s banks clamored for liquidity. Yields on Spanish and Italian government debt rose to levels deemed unsustainable. European leaders conferred and debated vehemently over the need for fiscal integration among the 17 nations comprising the euro currency bloc as a means to resolve the crisis for the long term.

Alongside the drama in Europe, investors were discouraged by gloomy economic reports from various parts of the world. A slowdown in China, a key powerhouse for global growth, became particularly worrisome. In the United States, disappointing jobs reports dealt a crushing blow to investor sentiment. Risk assets sold off in the second quarter as investors again retreated to safe haven assets.

Despite ongoing concerns about the health of the global economy and the debt crisis in Europe, most asset classes enjoyed a robust summer rally powered mainly by expectations for policy stimulus from central banks in Europe and the United States. Although global economic data continued to be mixed, the spate of downside surprises seen in the second quarter had receded and, outside of Europe, the risk of recession largely subsided. Additionally, in response to growing debt pressures, the European Central Bank allayed investors’ fears by stating its conviction to hold the eurozone together. Early in September, the European Central Bank announced a plan to purchase sovereign debt in the eurozone’s most troubled nations. Later that month, the US Federal Reserve announced its long-awaited — and surprisingly aggressive — stimulus program, committing to purchase $40 billion of agency mortgage-backed securities per month until the US economy exhibits enough strength to sustain real growth and improving labor market conditions. These central bank actions boosted risk assets globally as investors increased their risk appetites in their search for higher returns.

All asset classes performed well for the 12-month period ended September 30, 2012, with particularly strong returns from US stocks and high yield bonds. For the six-month period ended September 30, 2012, fixed income investments outperformed equities. US Treasury bonds posted exceptional gains by historical standards and outperformed investment-grade corporate bonds and tax-exempt municipals. High yield bonds also generated solid returns. US stocks finished the six-month period with modest gains, while international and emerging market stocks lagged other asset classes amid ongoing uncertainty. Near-zero short term interest rates continued to keep yields on money market securities near their all-time lows.

The financial world is more uncertain than ever, but there are new avenues of opportunity — new ways to invest and new markets in which to invest. We believe it’s our responsibility to help investors adapt to today’s new world of investing and build the portfolios these times require. We encourage you to visit www.blackrock.com/newworld for more information.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

“The financial world is more uncertain than ever, but there are new avenues of opportunity.”

|

Rob Kapito |

President, BlackRock Advisors, LLC |

|

|

Total Returns as of September 30, 2012 |

| | | | | | | |

| | 6-month | | 12-month | |

US large cap equities

(S&P 500® Index) | | 3.43 | % | | 30.20 | % | |

US small cap equities

(Russell 2000® Index) | | 1.60 | | | 31.91 | | |

International equities

(MSCI Europe, Australasia,

Far East Index) | | (0.70 | ) | | 13.75 | | |

Emerging market

equities (MSCI Emerging

Markets Index) | | (1.84 | ) | | 16.93 | | |

3-month Treasury bill

(BofA Merrill Lynch

3-Month US Treasury

Bill Index) | | 0.06 | | | 0.07 | | |

US Treasury securities

(BofA Merrill Lynch 10-

Year US Treasury Index) | | 6.78 | | | 5.66 | | |

US investment grade

bonds (Barclays US

Aggregate Bond Index) | | 3.68 | | | 5.16 | | |

Tax-exempt municipal

bonds (S&P Municipal

Bond Index) | | 4.50 | | | 8.84 | | |

US high yield bonds

(Barclays US Corporate

High Yield 2% Issuer

Capped Index) | | 6.40 | | | 19.35 | | |

| | | | | | | |

Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. |

| | | |

| | | |

| THIS PAGE NOT PART OF YOUR FUND REPORT | | 3 |

| |

| |

Fund Summary as of September 30, 2012 | BlackRock Large Cap Core Retirement Portfolio |

| |

| |

Investment Objective |

|

BlackRock Large Cap Core Retirement Portfolio’s (the “Fund”) investment objective is to seek long-term capital growth. In other words, the Fund tries to choose investments that will increase in value. |

|

|

Portfolio Management Commentary |

|

How did the Fund perform? |

| | |

• | For the 12-month period ended September 30, 2012, the Fund, through its investment in Master Large Cap Core Portfolio (the “Portfolio”), generated a positive double-digit return, but underperformed its benchmark, the Russell 1000® Index. |

| | |

What factors influenced performance? |

|

• | Stock selection in the information technology (“IT”) sector was the leading contributor to the Fund’s positive performance during the period. In the internet software & services industry, the Portfolio’s position in Google, Inc. delivered a strong return as higher click-through rates and pricing stabilization helped drive robust revenue growth for the company. Shares of AOL, Inc. also surged as the company began returning patent proceeds to shareholders via stock repurchases while continuing to transform its business model to focus on internet advertising. In the semiconductor space, a bias toward names with exposure to hard disk drives proved beneficial, with consolidation in the semiconductor equipment arena boosting returns for select holdings as well. In materials, the Portfolio’s positioning in the chemicals industry had a positive impact on performance. Specifically, the Portfolio was overweight in CF Industries Holdings, Inc., a key fertilizer holding, which experienced soaring profit margins due to lower input costs (i.e., natural gas) coupled with increasing demand and rising prices for its nitrogen-based crop nutrients. Portfolio holdings of select commodity chemical producers also benefited from lower natural gas prices during the period. |

| |

• | The largest detractor from performance relative to the benchmark index came from the industrials sector, where the Portfolio’s underweight to the machinery industry hindered returns. Machinery stocks are highly sensitive to economic growth and thus surged early in the reporting period. Stock selection in telecommunication services also had a negative impact on relative returns as the Portfolio preferred wireless holdings, which underperformed over the period amid continued competitive pressures, especially within the prepaid space. |

| | |

Describe recent portfolio activity. |

|

• | During the 12-month period, the Portfolio significantly increased exposure to the financials sector, and also added to energy and industrials. The Portfolio reduced its allocations to IT, health care and materials. |

| | |

Describe portfolio positioning at period end. |

|

• | Portfolio management continues to believe equities offer good value, especially relative to bonds. Company margins remain high in an environment marked by slow economic growth. Going forward, the companies best able to differentiate themselves will likely have the following characteristics: strong free cash flow, the ability to sustain or even improve their margins, and/or the ability to grow their business. Portfolio management does not believe any one group or sector has a monopoly on these characteristics and, as such, is looking across the market to identify stock-specific investments to emphasize the view within the portfolio. Relative to the Russell 1000® Index, the Portfolio ended the period with its largest sector overweight in health care, followed by energy and consumer discretionary, and its most significant underweights in consumer staples and industrials. |

| | |

| | The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results. |

| | | |

| | | |

4 | BLACKROCK LARGE CAP SERIES FUNDS, INC. | SEPTEMBER 30, 2012 | |

|

|

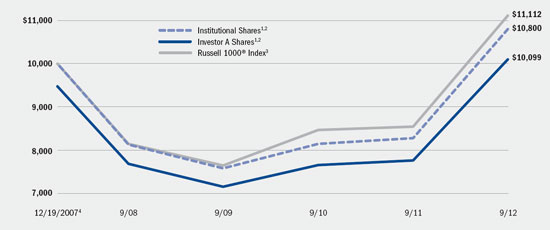

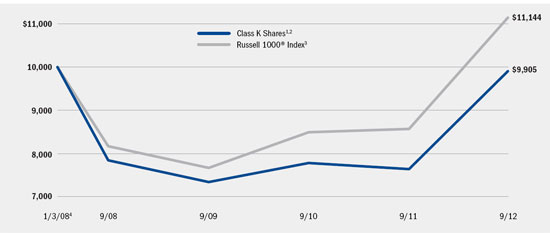

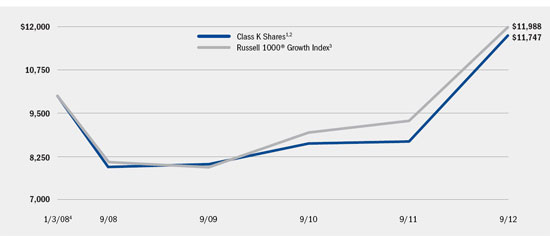

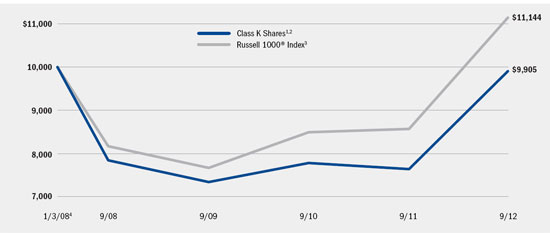

BlackRock Large Cap Core Retirement Portfolio |

|

Total Return Based on a $10,000 Investment |

| | |

| |

|

| | |

| 1 | Assuming transaction costs and other operating expenses, including administration fees, if any. |

| | |

| 2 | The Fund invests all of its assets in the Portfolio, a series of Master Large Cap Series LLC. The Portfolio invests at least 80% of its assets in equity securities of large cap companies located in the United States that the investment advisor selects from among those that are, at the time of purchase, included in the Russell 1000® Index. |

| | |

| 3 | This unmanaged broad-based index measures the performance of the 1,000 largest companies in the Russell 3000® Index, which represents approximately 90% of the total market capitalization of the Russell 3000® Index. |

| | |

| 4 | Commencement of operations. |

|

Performance Summary for the Period Ended September 30, 2012 |

| | | | | | | | | | |

| | 6-Month

Total Returns | | Average Annual Total Returns5 | |

| | | 1 Year | | Since Inception6 | |

Class K | | 1.38 | % | | 29.67 | % | | (0.20 | )% | |

Russell 1000® Index | | 2.99 | | | 30.06 | | | 2.31 | | |

| | |

| 5 | See “About Fund Performance” on page 10 for a detailed description of the share class, including any related sales charges and fees. |

| | |

| 6 | The Fund commenced operations on January 3, 2008.

Past performance is not indicative of future results. |

| | | | | | | | | | | | | | | | | | | | | | |

| | Actual | | Hypothetical8 | | | |

| | Beginning

Account Value

April 1, 2012 | | Ending

Account Value

September 30, 2012 | | Expenses Paid

During the Period7 | | Beginning

Account Value

April 1, 2012 | | Ending

Account Value

September 30, 2012 | | Expenses Paid

During the Period7 | | Annualized

Expense Ratio | |

Class K | | | $1,000.00 | | | $1,013.80 | | | $2.42 | | | $1,000.00 | | | $1,022.60 | | | $2.43 | | | 0.48% | |

| | |

| 7 | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period shown). Because the Fund invests significantly in the Portfolio, the expense example reflects the net expenses of both the Fund and the Portfolio in which it invests. |

| | |

| 8 | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 366.

See “Disclosure of Expenses” on page 10 for further information on how expenses were calculated. |

| | | |

| | | |

| BLACKROCK LARGE CAP SERIES FUNDS, INC. | SEPTEMBER 30, 2012 | 5 |

| |

| |

Fund Summary as of September 30, 2012 | BlackRock Large Cap Growth Retirement Portfolio |

BlackRock Large Cap Growth Retirement Portfolio’s (the “Fund”) investment objective is to seek long-term capital growth. In other words, the Fund tries to choose investments that will increase in value.

|

Portfolio Management Commentary |

| |

How did the Fund perform? |

|

• | For the 12-month period ended September 30, 2012, the Fund, through its investment in Master Large Cap Growth Portfolio (the “Portfolio”), outperformed its benchmark, the Russell 1000® Growth Index. |

| |

What factors influenced performance? |

|

• | The Fund’s outperformance was attributable to the Portfolio’s stock selection across several sectors. In materials, the Portfolio’s positioning in the chemicals industry had a positive impact on performance. Specifically, the Portfolio was overweight in CF Industries Holdings, Inc., a key fertilizer holding, which experienced soaring profit margins due to lower input costs (i.e., natural gas) coupled with increasing demand and rising prices for its nitrogen-based crop nutrients. Portfolio holdings of select commodity chemical producers also benefited from lower natural gas prices during the period. In the IT sector, a bias toward semiconductor names with exposure to hard disk drives proved beneficial, as did the avoidance of Intel Corp., which lagged during the period. In the internet software & services industry, the Portfolio’s position in Google, Inc. delivered a strong return as higher click-through rates and pricing stabilization helped drive robust revenue growth. In consumer discretionary, strength was especially notable among the Portfolio’s travel-related holdings, which outperformed on earnings results that handily beat very low expectations, as well as very strong forward hotel bookings in the United States and abroad (including Europe). An overweight to media names also aided relative results, as did favorable selection in the hotels, restaurants & leisure industry. |

| |

• | Detracting from performance relative to the benchmark index was positioning in the industrials sector, where the Portfolio’s underweight to the machinery industry hindered returns. Machinery stocks are highly sensitive to economic growth and thus surged early in the reporting period. Stock selection in telecommunication services also had a negative impact on relative returns as the Portfolio preferred wireless holdings, which underperformed over the period amid continued competitive pressures, especially within the prepaid space. |

| |

Describe recent portfolio activity. |

|

• | During the 12-month period, the Portfolio significantly increased its weightings in the industrials and consumer staples sectors and reduced allocations to health care, IT and consumer discretionary. |

| |

Describe portfolio positioning at period end. |

| |

• | Portfolio management continues to believe equities offer good value, especially relative to bonds. Company margins remain high in an environment marked by slow economic growth. Going forward, the companies best able to differentiate themselves will likely have the following characteristics: strong free cash flow, the ability to sustain or even improve their margins, and/or the ability to grow their business. Portfolio management does not believe any one group or sector has a monopoly on these characteristics and, as such, is looking across the market to identify stock-specific investments to emphasize the view within the portfolio. Relative to the Russell 1000® Growth Index, the Portfolio ended the period with its largest sector overweights in energy and health care, and its most significant underweights in consumer discretionary, financials and IT. |

| |

| The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results. |

| | |

| | |

6 | BLACKROCK LARGE CAP SERIES FUNDS, INC. | SEPTEMBER 30, 2012 |

|

|

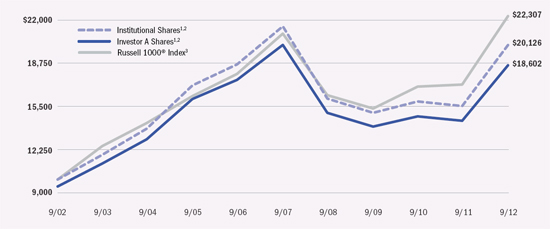

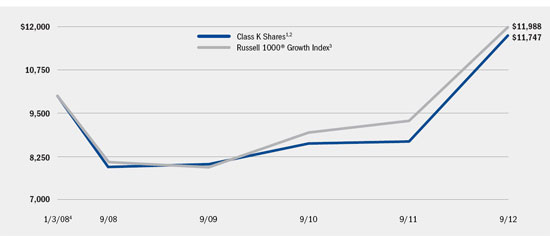

BlackRock Large Cap Growth Retirement Portfolio |

|

Total Return Based on a $10,000 Investment |

| | |

| |

|

| | |

| 1 | Assuming transaction costs and other operating expenses, including administration fees, if any. |

| | |

| 2 | The Fund invests all of its assets in the Portfolio, a series of Master Large Cap Series LLC. The Portfolio invests at least 80% of its assets in equity securities of large cap companies located in the United States that the investment advisor selects from among those that are, at the time of purchase, included in the Russell 1000® Growth Index. |

| | |

| 3 | This unmanaged broad-based index is a subset of the Russell 1000® Index consisting of those Russell 1000® securities with a greater-than-average growth orientation. |

| | |

| 4 | Commencement of operations. |

|

Performance Summary for the Period Ended September 30, 2012 |

| | | | | | | | | | |

| | | | Average Annual Total Returns5 | |

| | 6-Month

Total Returns | | 1 Year | | Since Inception6 | |

Class K | | 2.08 | % | | 35.29 | % | | 3.45 | % | |

Russell 1000® Growth Index | | 1.84 | | | 29.19 | | | 3.90 | | |

| | |

| 5 | See “About Fund Performance” on page 10 for a detailed description of the share class, including any related sales charges and fees. |

| | |

| 6 | The Fund commenced operations on January 3, 2008.

Past performance is not indicative of future results. |

| | | | | | | | | | | | | | | | | | | | | | |

| | Actual | | Hypothetical8 | | | | |

| | Beginning

Account Value

April 1, 2012 | | Ending

Account Value

September 30, 2012 | | Expenses Paid

During the Period7 | | Beginning

Account Value

April 1, 2012 | | Ending

Account Value

September 30, 2012 | | Expenses Paid

During the Period7 | | Annualized

Expense Ratio | |

Class K | | | $1,000.00 | | | $1,020.00 | | | $3.23 | | | $1,000.00 | | | $1,021.80 | | | $3.23 | | | 0.64% | |

| | |

| 7 | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period shown). Because the Fund invests significantly in the Portfolio, the expense example reflects the net expenses of both the Fund and the Portfolio in which it invests. |

| | |

| 8 | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 366.

See “Disclosure of Expenses” on page 10 for further information on how expenses were calculated. |

| | | |

| | | |

| BLACKROCK LARGE CAP SERIES FUNDS, INC. | SEPTEMBER 30, 2012 | 7 |

| |

| |

Fund Summary as of September 30, 2012 | BlackRock Large Cap Value Retirement Portfolio |

BlackRock Large Cap Value Retirement Portfolio’s (the “Fund”) investment objective is to seek long-term capital growth. In other words, the Fund tries to choose investments that will increase in value.

|

Portfolio Management Commentary |

| |

How did the Fund perform? |

|

• | For the 12-month period ended September 30, 2012, the Fund, through its investment in Master Large Cap Value Portfolio (the “Portfolio”), generated a positive double-digit return, but underperformed its benchmark, the Russell 1000® Value Index. |

| |

What factors influenced performance? |

|

• | The Portfolio’s positioning within materials was the leading contributor to the Fund’s positive performance during the period. Specifically, the Portfolio was overweight in CF Industries Holdings, Inc., a key fertilizer holding, which experienced soaring profit margins due to lower input costs (i.e., natural gas) coupled with increasing demand and rising prices for its nitrogen-based crop nutrients. Portfolio holdings of select commodity chemical producers also benefited from lower natural gas prices during the period. An overall sector underweight in utilities also proved beneficial, especially with respect to traditional regulated utilities. Utilities trailed other sectors over the period as investors moved out of the defensive group to take advantage of the broader market turnaround. |

| |

• | The largest detractor from performance relative to the benchmark index was stock selection in the consumer discretionary sector, with underperformance concentrated in education services providers and consumer electronics retailers. Ongoing weakness in new student enrollments hampered the results of education services providers, as changes to company business models in response to regulatory pressures drove increased competition for higher quality students. The Portfolio’s holdings in consumer electronics retailers lagged on product cycle weakness and competitive pressures. Core business segments such as televisions and gaming are in secular decline, while at the same time, big-ticket purchases are increasingly moving online. This toxic combination has hurt pricing and margins for companies in the industry. Elsewhere, an underweight allocation to the financials sector hurt relative returns, especially in commercial banks. The sector surged during the reporting period as investor confidence improved, spurring demand for higher-risk investments. In addition, the Portfolio was overexposed to select life insurers that struggled amid the sharp declines in interest rates and concerns about underwriting quality. Stock selection in telecommunication services also had a negative impact on relative returns as the Portfolio preferred wireless holdings, which underperformed over the period amid continued competitive pressures, especially within the prepaid space. |

| |

Describe recent portfolio activity. |

| |

• | During the 12-month period, the Portfolio significantly increased exposure to the financials and energy sectors, while also adding to industrials. The Portfolio reduced its weightings in information technology, health care, materials and consumer staples. |

| |

Describe portfolio positioning at period end. |

| |

• | Portfolio management continues to believe equities offer good value, especially relative to bonds. Company margins remain high in an environment marked by slow economic growth. Going forward, the companies best able to differentiate themselves will likely have the following characteristics: strong free cash flow, the ability to sustain or even improve their margins, and/or the ability to grow their business. Portfolio management does not believe any one group or sector has a monopoly on these characteristics and, as such, is looking across the market to identify stock-specific investments to emphasize the view within the portfolio. Relative to the Russell 1000® Value Index, the Portfolio ended the period with its largest sector overweights in health care and consumer discretionary, and its most significant underweights in utilities and consumer staples. |

| |

| The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results. |

| | |

| | |

8 | BLACKROCK LARGE CAP SERIES FUNDS, INC. | SEPTEMBER 30, 2012 |

|

|

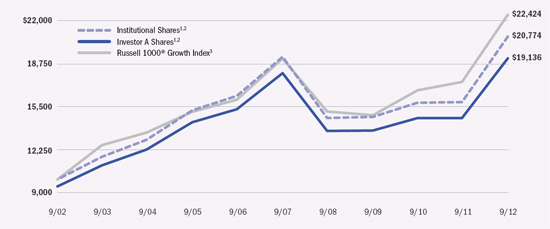

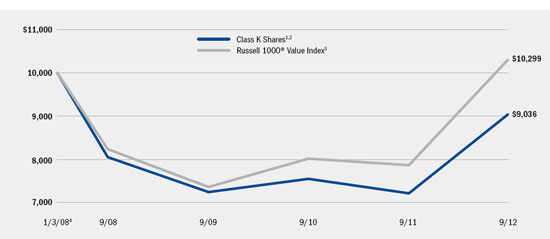

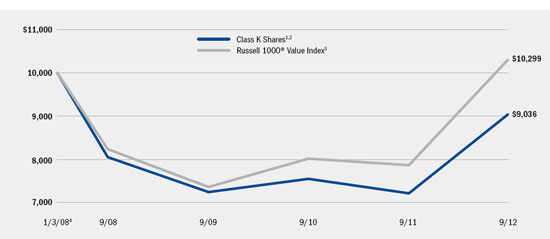

BlackRock Large Cap Value Retirement Portfolio |

|

Total Return Based on a $10,000 Investment |

| | |

| |

|

| | |

| 1 | Assuming transaction costs and other operating expenses, including administration fees, if any. |

| | |

| 2 | The Fund invests all of its assets in the Portfolio, a series of Master Large Cap Series LLC. The Portfolio invests at least 80% of its assets in equity securities of large cap companies located in the United States that the investment advisor selects from among those that are, at the time of purchase, included in the Russell 1000® Value Index. |

| | |

| 3 | This unmanaged broad-based index is a subset of the Russell 1000® Index consisting of those Russell 1000® securities with lower price/book ratios and lower forecasted growth values. |

| | |

| 4 | Commencement of operations. |

|

Performance Summary for the Period Ended September 30, 2012 |

| | | | | | | | | | |

| | 6-Month

Total Returns | | Average Annual Total Returns5 | |

| | | 1 Year | | Since Inception6 | |

Class K | | (0.99 | )% | | 25.23 | % | | (2.11 | )% | |

Russell 1000® Value Index | | 4.16 | | | 30.92 | | | 0.62 | | |

| | |

| 5 | See “About Fund Performance” on page 10 for a detailed description of the share class, including any related sales charges and fees. |

| | |

| 6 | The Fund commenced operations on January 3, 2008.

Past performance is not indicative of future results. |

| | | | | | | | | | | | | | | | | | | | | | |

| | Actual | | Hypothetical8 | | | | |

| | Beginning

Account Value

April 1, 2012 | | Ending

Account Value

September 30, 2012 | | Expenses Paid

During the Period7 | | Beginning

Account Value

April 1, 2012 | | Ending

Account Value

September 30, 2012 | | Expenses Paid

During the Period7 | | Annualized

Expense Ratio | |

Class K | | | $1,000.00 | | | $990.10 | | | $2.64 | | | $1,000.00 | | | $1,022.30 | | | $2.68 | | | 0.53% | |

| | |

| 7 | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period shown). Because the Fund invests significantly in the Portfolio, the expense example reflects the net expenses of both the Fund and the Portfolio in which it invests. |

| | |

| 8 | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 366.

See “Disclosure of Expenses” on page 10 for further information on how expenses were calculated. |

| | | |

| | | |

| BLACKROCK LARGE CAP SERIES FUNDS, INC. | SEPTEMBER 30, 2012 | 9 |

| |

| |

About Fund Performance | BlackRock Large Cap Series Funds, Inc. |

| |

• | Class K Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to eligible investors. |

| |

| Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Refer to www.blackrock.com/funds to obtain performance data current to the most recent month end. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Figures shown in each of the performance tables on the previous pages assume reinvestment of all dividends and capital gain distributions, if any, at net asset value (“NAV”) on the ex-dividend date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The Funds’ administrator waived and/or reimbursed a portion of each of the Fund’s expenses. Without such waiver and/or reimbursement, the Funds’ performance would have been lower. The administrator is under no obligation to waive and/or reimburse or continue waiving and/or reimbursing its fees. |

Shareholders of these Funds may incur the following charges: (a) expenses related to transactions, including sales charges and exchange fees; and (b) operating expenses, including administration fees, service and distribution fees, including 12b-1 fees, and other Fund expenses. The expense examples shown on the previous pages (which are based on a hypothetical investment of $1,000 invested on April 1, 2012 and held through September 30, 2012) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense examples provide information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund under the heading entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in other funds’ shareholder reports.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges or exchange fees, if any. Therefore, the hypothetical examples are useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

|

|

Derivative Financial Instruments |