UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-02405, 811-09739 and 811-21434

Name of Fund: BlackRock Balanced Capital Fund, Inc., Master Advantage Large Cap Core Portfolio of Master Large Cap Series LLC and Master Total Return Portfolio of Master Bond LLC

| Fund Address: | | 100 Bellevue Parkway, Wilmington, DE 19809 |

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Balanced Capital Fund, Inc., Master Advantage Large Cap Core Portfolio of Master Large Cap Series LLC and Master Total Return Portfolio of Master Bond LLC, 55 East 52nd Street, New York, NY 10055

Registrants’ telephone number, including area code: (800) 441-7762

Date of fiscal year end: 09/30/2020

Date of reporting period: 09/30/2020

Item 1 – Report to Stockholders

| | |

| | SEPTEMBER 30, 2020 |

BlackRock Balanced Capital Fund, Inc.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from BlackRock or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect to receive all future reports in paper free of charge. If you hold accounts directly with BlackRock, you can call (800) 441-7762 to inform BlackRock that you wish to continue receiving paper copies of your shareholder reports. If you hold accounts through a financial intermediary, you can follow the instructions included with this disclosure, if applicable, or contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Please note that not all financial intermediaries may offer this service. Your election to receive reports in paper will apply to all funds advised by BlackRock Advisors, LLC, BlackRock Fund Advisors or their affiliates, or all funds held with your financial intermediary, as applicable.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive electronic delivery of shareholder reports and other communications by: (i) accessing the BlackRock website at blackrock.com/edelivery and logging into your accounts, if you hold accounts directly with BlackRock, or (ii) contacting your financial intermediary, if you hold accounts through a financial intermediary. Please note that not all financial intermediaries may offer this service.

|

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

The Markets in Review

Dear Shareholder,

The last 12 months have been a time of sudden change in global financial markets, as a long period of growth and positive returns was interrupted in early 2020 by the emergence and spread of the coronavirus. For the first part of the reporting period, U.S. equities and bonds both delivered impressive returns, despite fears and doubts about the economy that were ultimately laid to rest with unprecedented monetary stimulus and a sluggish yet resolute performance from the U.S. economy. But as the threat from the coronavirus became more apparent throughout February and March 2020, leading countries around the world took economically disruptive countermeasures, causing equity prices to fall sharply. While markets have since recovered some of these losses as countries around the world begin reopening, there is still significant uncertainty surrounding the long-term impact of the pandemic on the global economy.

Returns for most securities were robust for the first part of the reporting period, as investors began to realize that the U.S. economy was maintaining the modest yet steady growth that had characterized this economic cycle. However, once stay-at-home orders and closures of non-essential businesses became widespread, many workers were laid off and unemployment claims spiked. With large portions of the global economy on hold, all types of international equities ended the 12-month reporting period with negative performance, while in the United States large-capitalization stocks, which investors saw as more resilient than smaller companies, delivered solid returns.

The performance of different types of fixed-income securities diverged substantially due to a reduced investor appetite for risk. Treasuries benefited from the risk-off environment, and posted healthy returns, as the 10-year U.S. Treasury yield (which is inversely related to bond prices) fell to an all-time low. Investment-grade corporate bonds also delivered a solid return, while high-yield corporate returns were muted due to credit concerns.

The U.S. Federal Reserve (the “Fed”) reduced interest rates three times in 2019, to support slowing economic growth. After the coronavirus outbreak, the Fed instituted two emergency rate cuts, pushing short-term interest rates close to zero. To stabilize credit markets, the Fed also announced a new bond-buying program, as did several other central banks around the world, including the European Central Bank and the Bank of Japan.

Looking ahead, while coronavirus-related disruption is certain to hurt worldwide economic growth, the global expansion is likely to continue once the impact of the outbreak subsides. We are encouraged by the strong coordinated monetary and fiscal response that is underway, both in the United States and abroad. However, there remains a risk that policy fatigue and recent improvements in economic indicators could lead lawmakers to retreat from needed stimulus measures too soon.

Overall, we favor a neutral stance toward risk, given the uncertainty surrounding the path to recovery. Among equities, we see an advantage in U.S. stocks compared to other developed markets, given the diversity of the U.S. economy and the impressive scope of monetary and fiscal stimulus. In bonds, the swift action taken by the world’s central banks means there are attractive opportunities in credit, and we expect credit spreads to narrow as markets stabilize. Both U.S. Treasuries and sustainable investments can help provide portfolio resilience, and the disruption created by the coronavirus appears to be accelerating the shift toward sustainable investments.

In this environment, our view is that investors need to think globally, extend their scope across a broad array of asset classes, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | | | | | |

| Total Returns as of September 30, 2020 | |

| | | |

| | | 6-Month | | | 12-Month | |

| | |

U.S. large cap equities

(S&P 500® Index) | | | 31.31% | | | | 15.15% | |

| | |

U.S. small cap equities

(Russell 2000® Index) | | | 31.60 | | | | 0.39 | |

| | |

International equities

(MSCI Europe, Australasia, Far East Index) | | | 20.39 | | | | 0.49 | |

| | |

Emerging market equities (MSCI Emerging Markets Index) | | | 29.37 | | | | 10.54 | |

| | |

3-month Treasury bills

(ICE BofA 3-Month U.S. Treasury Bill Index) | | | 0.06 | | | | 1.10 | |

| | |

U.S. Treasury securities

(ICE BofA 10-Year U.S. Treasury Index) | | | 0.71 | | | | 10.74 | |

| | |

U.S. investment grade bonds (Bloomberg Barclays U.S. Aggregate Bond Index) | | | 3.53 | | | | 6.98 | |

| | |

Tax-exempt municipal bonds (S&P Municipal Bond Index) | | | 3.78 | | | | 3.85 | |

| | |

U.S. high yield bonds

(Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index) | | | 15.18 | | | | 3.20 | |

|

Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |

| | |

| 2 | | T H I S P A G E I S N O T P A R T O F Y O U R F U N D R E P O R T |

Table of Contents

| | |

| Fund Summary as of September 30, 2020 | | BlackRock Balanced Capital Fund, Inc. |

Investment Objective

BlackRock Balanced Capital Fund, Inc.’s (the “Fund”) investment objective is to seek the highest total investment return through a fully managed investment policy utilizing equity, debt (including money market) and convertible securities.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended September 30, 2020, through its investments in Master Advantage Large Cap Core Portfolio of Master Large Cap Series LLC (the “equity allocation” or the “Master Advantage Large Cap Core Portfolio”) and Master Total Return Portfolio of Master Bond LLC (the “fixed income allocation” or the “Master Total Return Portfolio”) (collectively, the “Master Portfolios”), the Fund underperformed the blended reference benchmark (60% Russell 1000® Index/40% Bloomberg Barclays U.S. Aggregate Bond Index). The Fund outperformed the fixed income portion of the benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index, but it underperformed the equity portion of the benchmark, the Russell 1000® Index.

What factors influenced performance?

The Fund combines top-down macroeconomic views and bottom-up security selection from Master Advantage Large Cap Core Portfolio and Master Total Return Portfolio.

An overweight in equities and an underweight in fixed-income detracted from returns in the first quarter of 2020, which hurt the Fund’s relative performance over the full 12 months. Higher-risk assets sold off in February and March due to concerns about the impact COVID-19 would have on the global economy, while bonds rallied.

Master Advantage Large Cap Core Portfolio underperformed the equity benchmark, largely due to relative weakness in the third calendar quarter of 2020. During this time, previously winning positions that had been boosted by post-coronavirus themes began to lag. For example, an overweight in the communications equipment industry—which was driven by an insight that evaluates remote work trends—hurt results as several notable employers made forward-looking comments regarding their desire for employees to return to office. Additionally, certain macro-thematic insights struggled amid the evolving market backdrop. Specifically, a style-timing insight focused on momentum detracted. On the positive side, various insights that capture trends for stocks using higher-frequency alternative data contributed. An insight that uses brand sentiment measures and mobile app usage to determine how companies are navigating fast-changing consumer habits and the emergence from lockdown was also additive.

In Master Total Return Portfolio, an overweight in U.S. municipal bonds—which lagged due to the effects of COVID-19 on the finances of state and local governments—detracted from performance. Conversely, Master Total Return Portfolio’s duration positioning and its overweights in investment-grade corporates, agency mortgage-backed securities (MBS) and emerging market debt contributed positively. (Duration is a measure of interest-rate sensitivity.)

The investment adviser used derivatives as a means to manage risk and/or take outright views on equities, interest rates, credit risk and/or the foreign exchange markets. The use of derivatives, which was limited overall, was a slight detractor from Fund performance. The Fund held an elevated exposure to cash as collateral for its derivatives positions. The cash position did not have any material impact on Fund performance.

Describe recent portfolio activity.

The Fund entered the year with a modest overweight in equities and an underweight in fixed-income. In early February, as the investment adviser’s conviction on the macroeconomic outlook improved, the Fund’s pro-cyclical positioning was increased by raising the extent of the overweight in equities and underweight in bonds. As the COVID-19 outbreak spread beyond China and equity markets sold off, the investment adviser took the opportunity to increase the overweight in U.S. equities and move the underweight in bonds to neutral. Later in the period, the investment adviser reduced the magnitude of the overweight in U.S. equities and added a tactical overweight in bonds. The Fund subsequently moved to a neutral allocation in bonds, where it finished the period.

Master Advantage Large Cap Core Portfolio maintained a balanced allocation of risk across all major return drivers, while adding several new stock-selection insights to the portfolio. Given the dynamism of the current environment, the investment adviser instituted enhanced signal constructs to identify trends emerging from COVID-19, such as “work from home” and vaccine development. Additionally, the investment adviser added the insight designed to capture consumer brand sentiment.

Within Master Total Return Portfolio, the investment adviser reduced the allocation to investment-grade corporates in late 2019 due to valuation concerns, and it rotated the proceeds into agency mortgage-backed securities. As investors moved into cash in the first quarter of 2020, liquidity became a major issue across the fixed-income market. Given the magnitude of the economic shock, Master Total Return Portfolio moved to an overweight on the front end of the yield curve. Master Total Return Portfolio also added to its positions in the three- to five-year range, as well as 15 years and above. In the second half of the period, the Master Total Return Portfolio shifted to a small underweight in duration versus the benchmark, as U.S. yields fell to historically low levels. (Prices and yields move in opposite directions.) The investment adviser also added to Master Total Return Portfolio’s overweight positions in emerging market debt, European sovereign bonds and non-agency residential mortgages, while reducing the weighting in agency mortgage-backed securities.

Describe portfolio positioning at period end.

The investment adviser believes central banks will continue to take actions that are likely to be supportive for risk assets. Therefore, it is expected that interest rates will remain at historically low levels for a sustained period, which should provide an ongoing tailwind for equities.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 4 | | 2 0 2 0 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

| Fund Summary as of September 30, 2020 (continued) | | BlackRock Balanced Capital Fund, Inc. |

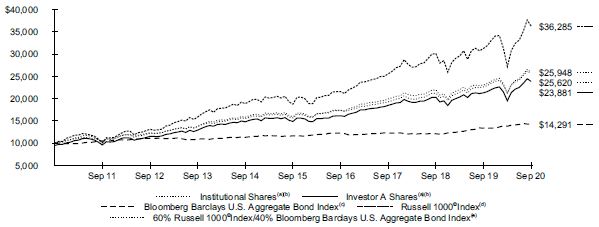

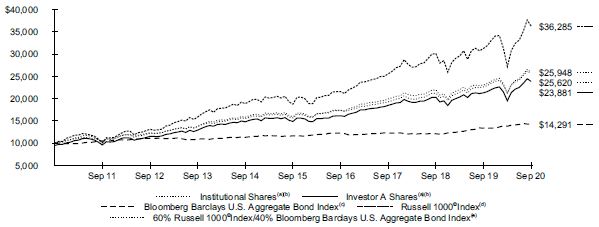

TOTAL RETURN BASED ON $10,000 INVESTMENT

| | (a) | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory and administration fees. Institutional Shares do not have a sales charge. | |

| | (b) | The Fund invests in equity securities (including common stock, preferred stock, securities convertible into common stock, or securities or other instruments whose price is linked to the value of common stock) and fixed-income securities (including debt securities, convertible securities and short term securities). | |

| | (c) | A widely recognized unmanaged market-weighted index, comprised of investment-grade corporate bonds rated BBB or better, mortgages and U.S. Treasury and U.S. Government agency issues with at least one year to maturity. | |

| | (d) | An index that measures the performance of the large cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index and includes approximately 1,000 of the largest securities based on a combination of their market capitalization and current index membership. The index represents approximately 92% of the total market capitalization of the Russell 3000® Index. | |

| | (e) | A customized weighted index comprised of the returns of the Russell 1000® Index (60%) and Bloomberg Barclays U.S. Aggregate Bond Index (40%). | |

Performance Summary for the Period Ended September 30, 2020

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns(a) | |

| | | | |

| | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | | | | | |

| | | 6-Month Total Returns | | | Without Sales Charge | | | With Sales Charge | | | Without Sales Charge | | | With Sales Charge | | | Without Sales Charge | | | With Sales Charge | |

| | | | | | | |

Institutional | | | 22.54 | % | | | 12.35 | % | | | N/A | | | | 10.23 | % | | | N/A | | | | 10.00 | % | | | N/A | |

Investor A | | | 22.39 | | | | 12.08 | | | | 6.20 | % | | | 9.92 | | | | 8.74 | % | | | 9.68 | | | | 9.10 | % |

Investor C | | | 21.94 | | | | 11.20 | | | | 10.20 | | | | 9.09 | | | | 9.09 | | | | 8.84 | | | | 8.84 | |

Class K | | | 22.57 | | | | 12.42 | | | | N/A | | | | 10.27 | | | | N/A | | | | 10.02 | | | | N/A | |

Class R | | | 22.12 | | | | 11.67 | | | | N/A | | | | 9.53 | | | | N/A | | | | 9.29 | | | | N/A | |

60% Russell 1000® Index/40% Bloomberg

Barclays U.S. Aggregate Bond Index | | | 20.85 | | | | 13.06 | | | | N/A | | | | 10.35 | | | | N/A | | | | 9.86 | | | | N/A | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | 3.53 | | | | 6.98 | | | | N/A | | | | 4.18 | | | | N/A | | | | 3.64 | | | | N/A | |

Russell 1000® Index | | | 33.36 | | | | 16.01 | | | | N/A | | | | 14.09 | | | | N/A | | | | 13.76 | | | | N/A | |

| | (a) | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 7 for a detailed description of share classes, including any related sales charges and fees, and how performance was calculated for certain share classes. | |

N/A - Not applicable as share class and index do not have a sales charge.

Past performance is not an indication of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

| | |

| Fund Summary as of September 30, 2020 (continued) | | BlackRock Balanced Capital Fund, Inc. |

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | Hypothetical(a) | | | | |

| | | | | | | |

| | |

| Beginning

Account Value (04/01/20) |

| |

| Ending

Account Value (09/30/20) |

| |

| Expenses

Paid During the Period |

(b) | |

| Beginning

Account Value (04/01/20) |

| |

| Ending

Account Value (09/30/20) |

| |

| Expenses

Paid During the Period |

(b) | |

| Annualized

Expense Ratio |

|

Institutional | | | $ 1,000.00 | | | | $ 1,225.40 | | | | $ 2.92 | | | | $ 1,000.00 | | | | $ 1,022.38 | | | | $ 2.65 | | | | 0.52 | % |

Investor A | | | 1,000.00 | | | | 1,223.90 | | | | 4.37 | | | | 1,000.00 | | | | 1,021.07 | | | | 3.97 | | | | 0.79 | |

Investor C | | | 1,000.00 | | | | 1,219.40 | | | | 8.58 | | | | 1,000.00 | | | | 1,017.27 | | | | 7.80 | | | | 1.55 | |

Class K | | | 1,000.00 | | | | 1,225.70 | | | | 2.67 | | | | 1,000.00 | | | | 1,022.60 | | | | 2.43 | | | | 0.48 | |

Class R | | | 1,000.00 | | | | 1,221.20 | | | | 6.39 | | | | 1,000.00 | | | | 1,019.25 | | | | 5.81 | | | | 1.15 | |

| | (a) | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 366. | |

| | (b) | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period shown). Because the Fund invests all of its assets in the Master Portfolios the expense example reflects the net expenses of both the Fund and the Master Portfolios in which it invests. | |

See “Disclosure of Expenses” on page 7 for further information on how expenses were calculated.

Portfolio Information

| | | | |

PORTFOLIO COMPOSITION | |

| | |

| Asset Type | | Percent of Total Investments | |

| |

Equity Funds | | | 52 | % |

Fixed-Income Funds | | | 32 | |

Short-Term Securities | | | 16 | |

| | |

| 6 | | 2 0 2 0 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

About Fund Performance

Institutional and Class K Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors. Class K Shares performance shown prior to the Class K Shares inception date of January 25, 2018 is that of Institutional Shares. The performance of the Fund’s Class K Shares would be substantially similar to Institutional Shares because Class K Shares and Institutional Shares invest in the same portfolio of securities and performance would only differ to the extent that Class K Shares and Institutional Shares have different expenses. The actual returns of Class K Shares would have been higher than those of the Institutional Shares because Class K Shares have lower expenses than the Institutional Shares.

Investor A Shares are subject to a maximum initial sales charge (front-end load) of 5.25% and a service fee of 0.25% per year (but no distribution fee). Certain redemptions of these shares may be subject to a contingent deferred sales charge (“CDSC”) where no initial sales charge was paid at the time of purchase. These shares are generally available through financial intermediaries.

Investor C Shares are subject to a 1.00% CDSC if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares are generally available through financial intermediaries. These shares automatically convert to Investor A Shares after approximately ten years. Effective November 23, 2020, the automatic conversion feature will be modified to reduce the conversion period from ten years to eight years.

Class R Shares are not subject to any sales charge. These shares are subject to a distribution fee of 0.25% per year and a service fee of 0.25% per year. These shares are available only to certain employer-sponsored retirement plans.

Past performance is not an indication of future results. Financial markets have experienced extreme volatility and trading in many instruments has been disrupted. These circumstances may continue for an extended period of time, and may continue to affect adversely the value and liquidity of the fund’s investments. As a result, current performance may be lower or higher than the performance data quoted. Refer to blackrock.com to obtain performance data current to the most recent month-end. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Figures shown in the performance tables on the previous page assume reinvestment of all distributions, if any, at net asset value (“NAV”) on the ex-dividend date or payable date, as applicable. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Distributions paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

BlackRock Advisors, LLC (the “Manager”), the Fund’s investment adviser, has contractually and/or voluntarily agreed to waive and/or reimburse a portion of the Fund’s expenses. Without such waiver and/or reimbursement, the Fund’s performance would have been lower. With respect to the Fund’s voluntary waivers, if any, the Manager is under no obligation to waive and/or reimburse or to continue waiving and/or reimbursing its fees and such voluntary waivers may be reduced or discontinued at any time. With respect to the Fund’s contractual waivers, if any, the Manager is under no obligation to continue waiving and/or reimbursing its fees after the applicable termination date of such agreement. See the Notes to Financial Statements for additional information on waivers and/or reimbursements.

Disclosure of Expenses

Shareholders of the Fund may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including administration fees, service and distribution fees, including 12b-1 fees, acquired fund fees and expenses, and other fund expenses. The expense example shown on the previous page (which is based on a hypothetical investment of $1,000 invested on April 1, 2020 and held through September 30, 2020) is intended to assist shareholders both in calculating expenses based on an investment in the Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense example provides information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their share class under the heading entitled “Expenses Paid During the Period.”

The expense example also provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in the Fund and other funds, compare the 5% hypothetical example with the 5% hypothetical examples that appear in shareholder reports of other funds.

The expenses shown in the expense example are intended to highlight shareholders’ ongoing costs only and do not reflect transactional expenses, such as sales charges, if any. Therefore, the hypothetical example is useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

Derivative Financial Instruments

The Fund and/or the Master Portfolios may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market, and/or other assets without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the instrument. The Fund’s and/or Master Portfolios’ successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation the Fund and/or the Master Portfolios can realize on an investment and/or may result in lower distributions paid to shareholders. The Fund’s and/or the Master Portfolios’ investments in these instruments, if any, are discussed in detail in the Fund’s and the Master Portfolios’ Notes to Financial Statements.

| | |

A B O U T F U N D P E R F O R M A N C E | | 7 |

| | |

Schedule of Investments September 30, 2020 | | BlackRock Balanced Capital Fund, Inc. (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Shares/

Investment

Value | | | Value | |

| | |

Investment Companies(a) | | | | | | | | |

| | |

| Equity Funds — 51.0% | | | | | | |

Master Advantage Large Cap Core Portfolio of Master Large Cap Series LLC | | $ | 755,769,919 | | | $ | 755,769,919 | |

| | | | | | | | |

| | |

| Fixed-Income Funds — 32.0% | | | | | | |

iShares Core U.S. Aggregate Bond ETF | | | 473,739 | | | | 55,929,627 | |

Master Total Return Portfolio of Master Bond LLC | | $ | 417,698,909 | | | | 417,698,909 | |

| | | | | | | | |

| | |

| | | | | | | 473,628,536 | |

| | | | | | | | |

| |

Total Long-Term Investments — 83.0%

(Cost: $1,087,840,281) | | | | 1,229,398,455 | |

| | | | | | | | |

| | |

| | | Shares | | | | |

| | |

Short-Term Securities(a)(b) | | | | | | | | |

| | |

| Money Market Funds — 16.3% | | | | | | |

BlackRock Liquidity Funds, T-Fund, Institutional Class, 0.02% | | | 242,046,920 | | | | 242,046,920 | |

| | | | | | | | |

| | |

Total Short-Term Securities — 16.3%

(Cost: $242,046,920) | | | | | | | 242,046,920 | |

| | | | | | | | |

| | |

Total Investments — 99.3%

(Cost: $1,329,887,201) | | | | | | | 1,471,445,375 | |

| | |

Other Assets Less Liabilities — 0.7% | | | | | | | 10,207,635 | |

| | | | | | | | |

| | |

Net Assets — 100.0% | | | | | | $ | 1,481,653,010 | |

| | | | | | | | |

| (a) | Affiliate of the Fund. |

| (b) | Annualized 7-day yield as of period end. |

Affiliates

Investments in issuers considered to be affiliate(s) of the Fund during the year ended September 30, 2020 for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | |

| | | Affiliated Issuer | | Value at 09/30/19 | | | Purchases at Cost | | | Proceeds from Sale | | | Net Realized Gain (Loss) | | | Change in Unrealized Appreciation (Depreciation) | | | Value at 09/30/20 | | | Shares/ Investment Value Held at 09/30/20 | | | Income

(Expense) | | | Capital Gain Distributions from Underlying Funds | | | | |

| | | | | | | |

| | | | | | | | | | | | |

| | BlackRock Liquidity Funds, T-Fund, Institutional Class | | $ | 159,700,160 | | | $ | 82,346,760 | (a) | | | $ — | | | $ | — | | | $ | — | | | $ | 242,046,920 | | | | 242,046,920 | | | $ | 1,358,331 | | | | | | | $ | 367 | | | | | |

| | iShares Core U.S. Aggregate Bond ETF | | | 37,092,486 | | | | 16,971,213 | | | | — | | | | — | | | | 1,865,928 | | | | 55,929,627 | | | | 473,739 | | | | 1,058,081 | | | | | | | | — | | | | | |

| | Master Advantage Large Cap Core Portfolio of Master Large Cap Series LLC | | | 651,543,880 | | | | 9,151,949 | (a)(b) | | | — | | | | 24,470,032 | | | | 70,604,058 | | | | 755,769,919 | | | $ | 755,769,919 | | | | 9,151,948 | | | | | | | | — | | | | | |

| | Master Total Return Portfolio of Master Bond LLC | | | 387,033,377 | | | | 10,861,524 | (a)(b) | | | — | | | | 20,234,215 | | | | (430,207 | ) | | | 417,698,909 | | | $ | 417,698,909 | | | | 10,861,521 | | | | | | | | — | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | $ | 44,704,247 | | | $ | 72,039,779 | | | $ | 1,471,445,375 | | | | | | | $ | 22,429,881 | | | | | | | $ | 367 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (a) | Represents net shares/investment value purchased (sold). | |

| | (b) | Inclusive of income, expense, realized and unrealized gains and losses allocated from the Master Portfolio. | |

| | |

| 8 | | 2 0 2 0 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

Schedule of Investments (continued) September 30, 2020 | | BlackRock Balanced Capital Fund, Inc. |

Derivative Financial Instruments Outstanding as of Period End

Futures Contracts

| | | | | | | | | | | | | | | | | | | | |

| |

| | | | |

| Description | | Number of Contracts | | | Expiration Date | | | Notional Amount (000) | | | Value/ Unrealized Appreciation (Depreciation) | |

| |

Long Contracts | | | | | | | | | | | | | | | | | | | | |

E-Mini S&P 500 Index | | | 922 | | | | 12/18/20 | | | $ | 154,527 | | | | | | | $ | 843,516 | |

U.S. Treasury Notes (10 Year) | | | 704 | | | | 12/21/20 | | | | 98,230 | | | | | | | | 59,123 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | 902,639 | |

| | | | | | | | | | | | | | | | | | | | |

Derivative Financial Instruments Categorized by Risk Exposure

As of period end, the fair values of derivative financial instruments located in the Statement of Assets and Liabilities were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | | | | | | |

| | | Commodity

Contracts | | | Credit

Contracts | | | Equity Contracts | | | Foreign

Currency

Exchange

Contracts | | | Interest Rate Contracts | | | Other

Contracts | | | | | | Total | |

| |

| | | | | | | | | | | | | | |

Assets — Derivative Financial Instruments | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Futures contracts | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Unrealized appreciation(a) | | | | | | $ | — | | | | | | | $ | — | | | | | | | $ | 843,516 | | | | | | | $ | — | | | | | | | $ | 59,123 | | | | | | | $ | — | | | | | | | $ | 902,639 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (a) | Net cumulative unrealized appreciation (depreciation) on futures contracts, if any, are reported in the Schedule of Investments. In the Statement of Assets and Liabilities, only current day’s variation margin is reported in receivables or payables and the net cumulative unrealized appreciation (depreciation) is included in accumulated earnings (loss). | |

For the year ended September 30, 2020, the effect of derivative financial instruments in the Statement of Operations was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | | | | | |

| | | Commodity Contracts | | | Credit Contracts | | | Equity Contracts | | | Foreign Currency Exchange Contracts | | | Interest Rate Contracts | | | Other Contracts | | | Total | |

| |

| | | | | | | | | | | | | | |

Net Realized Gain (Loss) from | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Futures contracts | | | | | | $ | — | | | | | �� | | $ | — | | | | | | | $ | 18,908,100 | | | | | | | $ | — | | | | | | | $ | (2,802,052 | ) | | | | | | $ | — | | | | | | | $ | 16,106,048 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Net Change in Unrealized Appreciation (Depreciation) on | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Futures contracts | | | | | | $ | — | | | | | | | $ | — | | | | | | | $ | 1,974,684 | | | | | | | $ | — | | | | | | | $ | 239,637 | | | | | | | $ | — | | | | | | | $ | 2,214,321 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Average Quarterly Balances of Outstanding Derivative Financial Instruments

| | | | |

| |

| |

Futures contracts | | | | |

Average notional value of contracts — long | | $ | 194,033,633 | |

Average notional value of contracts — short | | $ | 3,451,469 | |

| |

For more information about the Fund’s investment risks regarding derivative financial instruments, refer to the Notes to Financial Statements.

Fair Value Hierarchy as of Period End

Various inputs are used in determining the fair value of financial instruments. For description of the input levels and information about the Fund’s policy regarding valuation of financial instruments, refer to the Notes to Financial Statements.

| | |

S C H E D U L E O F I N V E S T M E N T S | | 9 |

| | |

Schedule of Investments (continued) September 30, 2020 | | BlackRock Balanced Capital Fund, Inc. |

The following tables summarize the Fund’s investments and derivative financial instruments categorized in the disclosure hierarchy. The breakdown of the Fund’s investments into major categories is disclosed in the Schedule of Investments above.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | | | | Total | |

| |

| | | | | | | |

Assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investments | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Long-Term Investments | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investment Companies(a) | | $ | 55,929,627 | | | | | | | $ | — | | | | | | | $ | — | | | | | | | $ | 55,929,627 | |

Short-Term Securities | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Money Market Funds | | | 242,046,920 | | | | | | | | — | | | | | | | | — | | | | | | | | 242,046,920 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 297,976,547 | | | | | | | $ | — | | | | | | | $ | — | | | | | | | | 297,976,547 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investments Valued at NAV(b) | | | | | | | | | | | | | | | | | | | | | | | | | | | 1,173,468,828 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | $ | 1,471,445,375 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Derivative Financial Instruments(c) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Equity Contracts | | $ | 843,516 | | | | | | | $ | — | | | | | | | $ | — | | | | | | | $ | 843,516 | |

Interest Rate Contracts | | | 59,123 | | | | | | | | — | | | | | | | | — | | | | | | | | 59,123 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 902,639 | | | | | | | $ | — | | | | | | | $ | — | | | | | | | $ | 902,639 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (a) | See above Schedule of Investments for values in each industry. | |

| | (b) | Certain investments of the Fund were fair valued using NAV per share as no quoted market value is available and therefore have been excluded from the fair value hierarchy. | |

| | (c) | Derivative financial instruments are futures contracts. Futures contracts are valued at the unrealized appreciation (depreciation) on the instrument. | |

| | |

| 10 | | 2 0 2 0 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Statement of Assets and Liabilities

September 30, 2020

| | | | |

| | BlackRock Balanced Capital Fund, Inc. | |

| |

ASSETS | | | | |

Investments at value — affiliated(a) | | $ | 1,471,445,375 | |

Cash pledged for futures contracts | | | 9,422,991 | |

Receivables: | | | | |

Capital shares sold | | | 2,447,967 | |

Dividends — affiliated | | | 9,498 | |

Variation margin on futures contracts | | | 710,499 | |

Prepaid expenses | | | 56,324 | |

| | | | |

| |

Total assets | | | 1,484,092,654 | |

| | | | |

| |

LIABILITIES | | | | |

Payables: | | | | |

Capital shares redeemed | | | 1,321,952 | |

Investment advisory fees | | | 197,387 | |

Officer’s fees | | | 3,137 | |

Other accrued expenses | | | 174,044 | |

Other affiliate fees | | | 38,234 | |

Service and distribution fees | | | 258,788 | |

Transfer agent fees | | | 237,424 | |

Variation margin on futures contracts | | | 208,678 | |

| | | | |

| |

Total liabilities | | | 2,439,644 | |

| | | | |

| |

NET ASSETS | | $ | 1,481,653,010 | |

| | | | |

| |

NET ASSETS CONSIST OF | | | | |

Paid-in capital | | $ | 1,267,557,912 | |

Accumulated earnings | | | 214,095,098 | |

| | | | |

| |

NET ASSETS | | $ | 1,481,653,010 | |

| | | | |

(a) Investments at cost — affiliated | | $ | 1,329,887,201 | |

| | |

F I N A N C I A L S T A T E M E N T S | | 11 |

Statement of Assets and Liabilities (continued)

September 30, 2020

| | | | |

| | | BlackRock Balanced Capital Fund, Inc. | |

NET ASSET VALUE | | | | |

| |

| Institutional | | | |

Net assets | | $ | 568,976,645 | |

| | | | |

Shares outstanding | | | 22,858,039 | |

| | | | |

Net asset value | | $ | 24.89 | |

| | | | |

Shares authorized | | | 400 million | |

| | | | |

Par value | | $ | 0.10 | |

| | | | |

| |

| Investor A | | | |

Net assets | | $ | 737,707,910 | |

| | | | |

Shares outstanding | | | 29,774,484 | |

| | | | |

Net asset value | | $ | 24.78 | |

| | | | |

Shares authorized | | | 200 million | |

| | | | |

Par value | | $ | 0.10 | |

| | | | |

| |

| Investor C | | | |

Net assets | | $ | 126,159,165 | |

| | | | |

Shares outstanding | | | 5,965,275 | |

| | | | |

Net asset value | | $ | 21.15 | |

| | | | |

Shares authorized | | | 200 million | |

| | | | |

Par value | | $ | 0.10 | |

| | | | |

| |

| Class K | | | |

Net assets | | $ | 36,969,786 | |

| | | | |

Shares outstanding | | | 1,485,229 | |

| | | | |

Net asset value | | $ | 24.89 | |

| | | | |

Shares authorized | | | 2 billion | |

| | | | |

Par value | | $ | 0.10 | |

| | | | |

| |

| Class R | | | |

Net assets | | $ | 11,839,504 | |

| | | | |

Shares outstanding | | | 524,085 | |

| | | | |

Net asset value | | $ | 22.59 | |

| | | | |

Shares authorized | | | 500 million | |

| | | | |

Par value | | $ | 0.10 | |

| | | | |

See notes to financial statements.

| | |

| 12 | | 2 0 2 0 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Statement of Operations

Year Ended September 30, 2020

| | | | | | | | |

| | | BlackRock Balanced Capital Fund, Inc. | |

| | |

INVESTMENT INCOME | | | | | | | | |

Dividends — affiliated | | | | | | $ | 2,416,412 | |

Other income | | | | | | | 36,029 | |

Net investment income allocated from the affiliated Master Portfolios: | | | | | | | | |

Dividends — unaffiliated | | | | | | | 12,044,867 | |

Dividends — affiliated | | | | | | | 275,412 | |

Interest — unaffiliated | | | | | | | 10,881,633 | |

Securities lending income — affiliated — net | | | | | | | 49,850 | |

Foreign taxes withheld | | | | | | | (43,127 | ) |

Expenses | | | | | | | (3,294,416 | ) |

Fees waived | | | | | | | 99,250 | |

| | | | | | | | |

| | |

Total investment income | | | | | | | 22,465,910 | |

| | | | | | | | |

| | |

FUND EXPENSES | | | | | | | | |

Investment advisory | | | | | | | 5,583,850 | |

Service and distribution — class specific | | | | | | | 2,964,388 | |

Transfer agent — class specific | | | | | | | 1,162,903 | |

Registration | | | | | | | 140,016 | |

Professional | | | | | | | 129,213 | |

Printing and postage | | | | | | | 126,894 | |

Officer | | | | | | | 21,123 | |

Accounting services | | | | | | | 7,020 | |

Miscellaneous | | | | | | | 25,206 | |

| | | | | | | | |

| | |

Total expenses | | | | | | | 10,160,613 | |

Less: | | | | | | | | |

Fees waived and/or reimbursed by the Manager | | | | | | | (3,389,075 | ) |

| | | | | | | | |

| | |

Total expenses after fees waived and/or reimbursed | | | | | | | 6,771,538 | |

| | | | | | | | |

| | |

Net investment income | | | | | | | 15,694,372 | |

| | | | | | | | |

| | |

REALIZED AND UNREALIZED GAIN (LOSS) | | | | | | | | |

Net realized gain (loss) from: | | | | | | | | |

Capital gain distributions from investment companies — affiliated | | | | | | | 367 | |

Futures contracts | | | | | | | 16,106,048 | |

Net realized gain from investments, capital gain distributions received from affiliated investment companies, foreign currency transactions, forward foreign currency exchange contracts, futures contracts, options written and swaps allocated from the affiliated Master Portfolios | | | | | | | 44,704,247 | |

| | | | | | | | |

| | |

| | | | | | | 60,810,662 | |

| | | | | | | | |

Net change in unrealized appreciation (depreciation) on: | | | | | | | | |

Investments — affiliated | | | | | | | 1,865,928 | |

Futures contracts | | | | | | | 2,214,321 | |

Net change in unrealized appreciation (depreciation) on investments, foreign currency translations, forward foreign currency exchange contracts, futures contracts, options written, swaps and unfunded floating rate loan interests allocated from the affiliated Master Portfolios | | | | | | | 70,173,851 | |

| | | | | | | | |

| | |

| | | | | | | 74,254,100 | |

| | | | | | | | |

| | |

Total net realized and unrealized gain | | | | | | | 135,064,762 | |

| | | | | | | | |

| | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | | | | $ | 150,759,134 | |

| | | | | | | | |

See notes to financial statements.

| | |

F I N A N C I A L S T A T E M E N T S | | 13 |

Statements of Changes in Net Assets

| | | | | | | | | | | | | | |

| | | BlackRock Balanced Capital Fund, Inc. | |

| |

| | | Year Ended September 30, | |

| | | | | | 2020 | | | | | 2019 | |

| | | | |

INCREASE (DECREASE) IN NET ASSETS | | | | | | | | | | | | | | |

| | | | |

OPERATIONS | | | | | | | | | | | | | | |

Net investment income | | | | | | $ | 15,694,372 | | | | | $ | 21,044,212 | |

Net realized gain | | | | | | | 60,810,662 | | | | | | 46,959,493 | |

Net change in unrealized appreciation (depreciation) | | | | | | | 74,254,100 | | | | | | (8,594,187 | ) |

| | | | | | | | | | | | | | |

| | | | |

Net increase in net assets resulting from operations | | | | | | | 150,759,134 | | | | | | 59,409,518 | |

| | | | | | | | | | | | | | |

| | | | |

DISTRIBUTIONS TO SHAREHOLDERS(a) | | | | | | | | | | | | | | |

Institutional | | | | | | | (25,614,887 | ) | | | | | (30,083,390 | ) |

Investor A | | | | | | | (30,893,014 | ) | | | | | (35,699,715 | ) |

Investor C | | | | | | | (6,569,740 | ) | | | | | (7,198,305 | ) |

Class K | | | | | | | (1,604,803 | ) | | | | | (754,289 | ) |

Class R | | | | | | | (602,475 | ) | | | | | (973,829 | ) |

| | | | | | | | | | | | | | |

| | | | |

Decrease in net assets resulting from distributions to shareholders | | | | | | | (65,284,919 | ) | | | | | (74,709,528 | ) |

| | | | | | | | | | | | | | |

| | | | |

CAPITAL SHARE TRANSACTIONS | | | | | | | | | | | | | | |

Net increase in net assets derived from capital share transactions | | | | | | | 153,847,508 | | | | | | 175,017,391 | |

| | | | | | | | | | | | | | |

| | | | |

NET ASSETS | | | | | | | | | | | | | | |

Total increase in net assets | | | | | | | 239,321,723 | | | | | | 159,717,381 | |

Beginning of year | | | | | | | 1,242,331,287 | | | | | | 1,082,613,906 | |

| | | | | | | | | | | | | | |

| | | | |

End of year | | | | | | $ | 1,481,653,010 | | | | | $ | 1,242,331,287 | |

| | | | | | | | | | | | | | |

| (a) | Distributions for annual periods determined in accordance with U.S. federal income tax regulations. |

See notes to financial statements.

| | |

| 14 | | 2 0 2 0 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Financial Highlights

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | BlackRock Balanced Capital Fund, Inc. | |

| |

| | | Institutional | |

| |

| | | Year Ended September 30, | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| | | | | |

Net asset value, beginning of year | | $ | 23.32 | | | $ | 23.95 | | | $ | 26.09 | | | $ | 23.86 | | | $ | 23.09 | |

| | | | | | | | | | | | | | | | | | | | |

Net investment income(a) | | | 0.33 | | | | 0.48 | | | | 0.47 | | | | 0.41 | | | | 0.38 | |

Net realized and unrealized gain | | | 2.47 | | | | 0.52 | | | | 1.89 | | | | 3.01 | | | | 1.64 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net increase from investment operations | | | 2.80 | | | | 1.00 | | | | 2.36 | | | | 3.42 | | | | 2.02 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Distributions(b) | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (0.37 | ) | | | (0.41 | ) | | | (0.47 | ) | | | (0.40 | ) | | | (0.41 | ) |

From net realized gain | | | (0.86 | ) | | | (1.22 | ) | | | (4.03 | ) | | | (0.79 | ) | | | (0.84 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total distributions | | | (1.23 | ) | | | (1.63 | ) | | | (4.50 | ) | | | (1.19 | ) | | | (1.25 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, end of year | | $ | 24.89 | | | $ | 23.32 | | | $ | 23.95 | | | $ | 26.09 | | | $ | 23.86 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Return(c) | | | | | | | | | | | | | | | | | | | | |

Based on net asset value | | | 12.35 | % | | | 5.16 | % | | | 10.14 | % | | | 14.83 | %(d) | | | 8.93 | %(d) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Ratios to Average Net Assets(e) | | | | | | | | | | | | | | | | | | | | |

Total expenses(f) | | | 0.78 | %(g) | | | 0.80 | % | | | 0.91 | % | | | 0.93 | % | | | 0.94 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total expenses after fees waived and/or reimbursed(f) | | | 0.52 | %(g) | | | 0.53 | % | | | 0.62 | % | | | 0.62 | % | | | 0.63 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income(f) | | | 1.42 | %(g) | | | 2.11 | % | | | 1.97 | % | | | 1.67 | % | | | 1.64 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 568,977 | | | $ | 488,105 | | | $ | 427,511 | | | $ | 395,850 | | | $ | 348,430 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Portfolio turnover rate of the Fund(h) | | | — | % | | | 4 | % | | | 140 | % | | | 109 | % | | | — | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Portfolio turnover rate of the Master Total Return Portfolio(i) | | | 556 | % | | | 574 | % | | | 734 | % | | | 806 | % | | | 841 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Portfolio turnover rate of the Master Advantage Large Cap Core Portfolio | | | 99 | % | | | 151 | % | | | 148 | % | | | 130 | % | | | 39 | % |

| | | | | | | | | | | | | | | | | | | | |

| (a) | Based on average shares outstanding. |

| (b) | Distributions for annual periods determined in accordance with U.S. federal income tax regulations. |

| (c) | Where applicable, assumes the reinvestment of distributions. |

| (d) | Includes proceeds received from a settlement of litigation, which had no impact on the Fund’s total return. |

| (e) | Includes the Fund’s share of the Master Portfolios’ allocated expenses and/or net investment income. |

| (f) | Excludes expenses incurred indirectly as a result of investments in underlying funds as follows: |

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended September 30, | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

Investments in underlying funds | | | 0.03 | % | | | 0.02 | % | | | 0.01 | % | | | 0.01 | % | | | — | % |

| | | | | | | | | | | | | | | | | | | | |

| (g) | Includes the Fund’s share of the Master Portfolios’ allocated fees waived of 0.01%. |

| (h) | Excludes transactions in the Master Portfolios. |

| (i) | Includes mortgage dollar roll transactions (“MDRs”). Additional information regarding portfolio turnover rate is as follows: |

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended September 30, | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

Portfolio turnover rate (excluding MDRs) | | | 274 | % | | | 241 | % | | | 350 | % | | | 540 | % | | | 598 | % |

| | | | | | | | | | | | | | | | | | | | |

See notes to financial statements.

| | |

F I N A N C I A L H I G H L I G H T S | | 15 |

Financial Highlights (continued)

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | BlackRock Balanced Capital Fund, Inc. (continued) | |

| |

| | | Investor A | |

| |

| | | Year Ended September 30, | |

| | | | | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| | | | | |

Net asset value, beginning of year | | $ | 23.22 | | | $ | 23.86 | | | $ | 26.00 | | | $ | 23.78 | | | $ | 23.03 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income(a) | | | 0.27 | | | | 0.41 | | | | 0.40 | | | | 0.34 | | | | 0.31 | |

Net realized and unrealized gain | | | 2.46 | | | | 0.52 | | | | 1.89 | | | | 3.01 | | | | 1.62 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net increase from investment operations | | | 2.73 | | | | 0.93 | | | | 2.29 | | | | 3.35 | | | | 1.93 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Distributions(b) | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (0.31 | ) | | | (0.35 | ) | | | (0.40 | ) | | | (0.34 | ) | | | (0.34 | ) |

From net realized gain | | | (0.86 | ) | | | (1.22 | ) | | | (4.03 | ) | | | (0.79 | ) | | | (0.84 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total distributions | | | (1.17 | ) | | | (1.57 | ) | | | (4.43 | ) | | | (1.13 | ) | | | (1.18 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, end of year | | $ | 24.78 | | | $ | 23.22 | | | $ | 23.86 | | | $ | 26.00 | | | $ | 23.78 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Return(c) | | | | | | | | | | | | | | | | | | | | |

Based on net asset value | | | 12.08 | % | | | 4.84 | % | | | 9.86 | % | | | 14.52 | %(d) | | | 8.57 | %(d) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Ratios to Average Net Assets(e) | | | | | | | | | | | | | | | | | | | | |

Total expenses(f) | | | 1.04 | %(g) | | | 1.07 | %(g) | | | 1.20 | %(h) | | | 1.21 | %(h) | | | 1.22 | %(h) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total expenses after fees waived and/or reimbursed(f) | | | 0.79 | %(g) | | | 0.80 | %(g) | | | 0.91 | %(h) | | | 0.90 | %(h) | | | 0.91 | %(h) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income(f) | | | 1.15 | %(g) | | | 1.83 | %(g) | | | 1.68 | %(h) | | | 1.38 | %(h) | | | 1.35 | %(h) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 737,708 | | | $ | 594,909 | | | $ | 528,701 | | | $ | 535,542 | | | $ | 491,889 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Portfolio turnover rate of the Fund(i) | | | — | % | | | 4 | % | | | 140 | % | | | 109 | % | | | — | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Portfolio turnover rate of the Master Total Return Portfolio(j) | | | 556 | % | | | 574 | % | | | 734 | % | | | 806 | % | | | 841 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Portfolio turnover rate of the Master Advantage Large Cap Core Portfolio | | | 99 | % | | | 151 | % | | | 148 | % | | | 130 | % | | | 39 | % |

| | | | | | | | | | | | | | | | | | | | |

| (a) | Based on average shares outstanding. |

| (b) | Distributions for annual periods determined in accordance with U.S. federal income tax regulations. |

| (c) | Where applicable, assumes the reinvestment of distributions. |

| (d) | Includes proceeds received from a settlement of litigation, which had no impact on the Fund’s total return. |

| (e) | Includes the Fund’s share of the Master Portfolios’ allocated expenses and/or net investment income. |

| (f) | Excludes expenses incurred indirectly as a result of investments in underlying funds as follows: |

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended September 30, | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| | | | | |

Investments in underlying funds | | | 0.03 | % | | | 0.02 | % | | | 0.01 | % | | | 0.01 | % | | | — | % |

| | | | | | | | | | | | | | | | | | | | |

| (g) | Includes the Fund’s share of the Master Portfolios’ allocated fees waived of 0.01%. |

| (h) | Includes the Fund’s share of the Master Portfolios’ allocated fees waived of less than 0.01%. |

| (i) | Excludes transactions in the Master Portfolios. |

| (j) | Includes MDRs. Additional information regarding portfolio turnover rate is as follows: |

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended September 30, | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| | | | | |

Portfolio turnover rate (excluding MDRs) | | | 274 | % | | | 241 | % | | | 350 | % | | | 540 | % | | | 598 | % |

| | | | | | | | | | | | | | | | | | | | |

See notes to financial statements.

| | |

| 16 | | 2 0 2 0 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Financial Highlights (continued)

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | BlackRock Balanced Capital Fund, Inc. (continued) | |

| |

| | | Investor C | |

| |

| | | Year Ended September 30, | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| | | | | |

Net asset value, beginning of year | | $ | 20.00 | | | $ | 20.79 | | | $ | 23.21 | | | $ | 21.34 | | | $ | 20.80 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income(a) | | | 0.08 | | | | 0.21 | | | | 0.19 | | | | 0.14 | | | | 0.12 | |

Net realized and unrealized gain | | | 2.10 | | | | 0.43 | | | | 1.67 | | | | 2.68 | | | | 1.47 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net increase from investment operations | | | 2.18 | | | | 0.64 | | | | 1.86 | | | | 2.82 | | | | 1.59 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Distributions(b) | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (0.17 | ) | | | (0.21 | ) | | | (0.25 | ) | | | (0.16 | ) | | | (0.21 | ) |

From net realized gain | | | (0.86 | ) | | | (1.22 | ) | | | (4.03 | ) | | | (0.79 | ) | | | (0.84 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total distributions | | | (1.03 | ) | | | (1.43 | ) | | | (4.28 | ) | | | (0.95 | ) | | | (1.05 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, end of year | | $ | 21.15 | | | $ | 20.00 | | | $ | 20.79 | | | $ | 23.21 | | | $ | 21.34 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Return(c) | | | | | | | | | | | | | | | | | | | | |

Based on net asset value | | | 11.20 | % | | | 4.09 | % | | | 9.03 | % | | | 13.62 | %(d) | | | 7.78 | %(d) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Ratios to Average Net Assets(e) | | | | | | | | | | | | | | | | | | | | |

Total expenses(f) | | | 1.80 | %(g) | | | 1.83 | % | | | 1.95 | % | | | 1.97 | % | | | 1.98 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total expenses after fees waived and/or reimbursed(f) | | | 1.55 | %(g) | | | 1.56 | % | | | 1.66 | % | | | 1.66 | % | | | 1.67 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income(f) | | | 0.41 | %(g) | | | 1.07 | % | | | 0.93 | % | | | 0.63 | % | | | 0.60 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 126,159 | | | $ | 125,584 | | | $ | 103,756 | | | $ | 104,113 | | | $ | 117,651 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Portfolio turnover rate of the Fund(h) | | | — | % | | | 4 | % | | | 140 | % | | | 109 | % | | | — | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Portfolio turnover rate of the Master Total Return Portfolio(i) | | | 556 | % | | | 574 | % | | | 734 | % | | | 806 | % | | | 841 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Portfolio turnover rate of the Master Advantage Large Cap Core Portfolio | | | 99 | % | | | 151 | % | | | 148 | % | | | 130 | % | | | 39 | % |

| | | | | | | | | | | | | | | | | | | | |

| (a) | Based on average shares outstanding. |

| (b) | Distributions for annual periods determined in accordance with U.S. federal income tax regulations. |

| (c) | Where applicable, assumes the reinvestment of distributions. |

| (d) | Includes proceeds received from a settlement of litigation, which had no impact on the Fund’s total return. |

| (e) | Includes the Fund’s share of the Master Portfolios’ allocated expenses and/or net investment income. |

| (f) | Excludes expenses incurred indirectly as a result of investments in underlying funds as follows: |

| | | | | | | | | | | | | | | | | | | | |

| | |

| | | Year Ended September 30, | |

| | | | | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| | | | | |

Investments in underlying funds | | | 0.03 | % | | | 0.02 | % | | | 0.01 | % | | | 0.01 | % | | | — | % |

| | | | | | | | | | | | | | | | | | | | |

| (g) | Includes the Fund’s share of the Master Portfolios’ allocated fees waived of 0.01%. |

| (h) | Excludes transactions in the Master Portfolios. |

| (i) | Includes MDRs. Additional information regarding portfolio turnover rate is as follows: |

| | | | | | | | | | | | | | | | | | | | |

| | |

| | | Year Ended September 30, | |

| | | | | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| | | | | |

Portfolio turnover rate (excluding MDRs) | | | 274 | % | | | 241 | % | | | 350 | % | | | 540 | % | | | 598 | % |

| | | | | | | | | | | | | | | | | | | | |

See notes to financial statements.

| | |

F I N A N C I A L H I G H L I G H T S | | 17 |

Financial Highlights (continued)

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | |

| | | BlackRock Balanced Capital Fund, Inc. (continued) | |

| |

| | | Class K | |

| | | Year Ended September 30, | | | | Period from 01/25/18 to 09/30/18 | (a) |

| | | 2020 | | | 2019 | | | | |

| | | | | |

Net asset value, beginning of period | | $ | 23.32 | | | $ | 23.95 | | | | | | | $ | 23.61 | |

| | | | | | | | | | | | | | | | |

| | | | |

Net investment income(b) | | | 0.34 | | | | 0.49 | | | | | | | | 0.33 | |

Net realized and unrealized gain | | | 2.47 | | | | 0.52 | | | | | | | | 0.25 | |

| | | | | | | | | | | | | | | | |

| | | | |

Net increase from investment operations | | | 2.81 | | | | 1.01 | | | | | | | | 0.58 | |

| | | | | | | | | | | | | | | | |

| | | | |

Distributions(c) | | | | | | | | | | | | | | | | |

From net investment income | | | (0.38 | ) | | | (0.42 | ) | | | | | | | (0.24 | ) |

From net realized gain | | | (0.86 | ) | | | (1.22 | ) | | | | | | | — | |

| | | | | | | | | | | | | | | | |

| | | | |

Total distributions | | | (1.24 | ) | | | (1.64 | ) | | | | | | | (0.24 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

Net asset value, end of period | | $ | 24.89 | | | $ | 23.32 | | | | | | | $ | 23.95 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Return(d) | | | | | | | | | | | | | | | | |

Based on net asset value | | | 12.42 | % | | | 5.23 | % | | | | | | | 2.46 | %(e) |

| | | | | | | | | | | | | | | | |

| | | | |

Ratios to Average Net Assets(f) | | | | | | | | | | | | | | | | |

Total expenses(g) | | | 0.72 | %(h) | | | 0.73 | % | | | | | | | 0.81 | %(i) |

| | | | | | | | | | | | | | | | |

| | | | |

Total expenses after fees waived and/or reimbursed(g) | | | 0.46 | %(h) | | | 0.46 | % | | | | | | | 0.51 | %(i) |

| | | | | | | | | | | | | | | | |

| | | | |

Net investment income(g) | | | 1.47 | %(h) | | | 2.15 | % | | | | | | | 2.07 | %(i) |

| | | | | | | | | | | | | | | | |

| | | | |

Supplemental Data | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 36,970 | | | $ | 21,901 | | | | | | | $ | 8,283 | |

| | | | | | | | | | | | | | | | |

| | | | |

Portfolio turnover rate of the Fund(j) | | | — | % | | | 4 | % | | | | | | | 140 | %(k) |

| | | | | | | | | | | | | | | | |

| | | | |

Portfolio turnover rate of the Master Total Return Portfolio(l) | | | 556 | % | | | 574 | % | | | | | | | 734 | %(k) |

| | | | | | | | | | | | | | | | |

| | | | |

Portfolio turnover rate of the Master Advantage Large Cap Core Portfolio | | | 99 | % | | | 151 | % | | | | | | | 148 | %(k) |

| | | | | | | | | | | | | | | | |

| (a) | Commencement of operations. |

| (b) | Based on average shares outstanding. |

| (c) | Distributions for annual periods determined in accordance with U.S. federal income tax regulations. |

| (d) | Where applicable, assumes the reinvestment of distributions. |

| (e) | Aggregate total return. |

| (f) | Includes the Fund’s share of the Master Portfolios’ allocated expenses and/or net investment income. |

| (g) | Excludes expenses incurred indirectly as a result of investments in underlying funds as follows: |

| | | | | | | | | | | | | | | | |

| | | | Year Ended September 30, | | | | | | |

| Period from

01/25/18 to 09/30/18 |

(a) |

| | | 2020 | | | 2019 | | | | |

| | | | | |

Investments in underlying funds | | | 0.03 | % | | | 0.02 | % | | | | | | | 0.01 | % |

| | | | | | | | | | | | | | | | |

| (h) | Includes the Fund’s share of the Master Portfolios’ allocated fees waived of 0.01%. |

| (j) | Excludes transactions in the Master Portfolios. |

| (k) | Portfolio turnover is representative of the Fund for the entire year. |

| (l) | Includes MDRs. Additional information regarding portfolio turnover rate is as follows: |

| | | | | | | | | | | | | | | | |

| | | | Year Ended September 30, | | |

| Period from

01/25/18 to 09/30/18 |

(a) |

| | | 2020 | | | 2019 | | | | |

| | | | | |

Portfolio turnover rate (excluding mortgage dollar roll transactions) | | | 274 | % | | | 241 | % | | | | | | | 350 | % |

| | | | | | | | | | | | | | | | |

See notes to financial statements.

| | |

| 18 | | 2 0 2 0 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Financial Highlights (continued)

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | BlackRock Balanced Capital Fund, Inc. (continued) | |

| |

| | | Class R | |

| |

| | | Year Ended September 30, | |

| | | | | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| | | | | |

Net asset value, beginning of year | | $ | 21.27 | | | $ | 22.00 | | | $ | 24.30 | | | $ | 22.31 | | | $ | 21.70 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income(a) | | | 0.17 | | | | 0.31 | | | | 0.29 | | | | 0.24 | | | | 0.22 | |

Net realized and unrealized gain | | | 2.24 | | | | 0.46 | | | | 1.77 | | | | 2.81 | | | | 1.52 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net increase from investment operations | | | 2.41 | | | | 0.77 | | | | 2.06 | | | | 3.05 | | | | 1.74 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Distributions(b) | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (0.23 | ) | | | (0.28 | ) | | | (0.33 | ) | | | (0.27 | ) | | | (0.29 | ) |

From net realized gain | | | (0.86 | ) | | | (1.22 | ) | | | (4.03 | ) | | | (0.79 | ) | | | (0.84 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total distributions | | | (1.09 | ) | | | (1.50 | ) | | | (4.36 | ) | | | (1.06 | ) | | | (1.13 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, end of year | | $ | 22.59 | | | $ | 21.27 | | | $ | 22.00 | | | $ | 24.30 | | | $ | 22.31 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Return(c) | | | | | | | | | | | | | | | | | | | | |

Based on net asset value | | | 11.67 | % | | | 4.47 | % | | | 9.51 | % | | | 14.11 | %(d) | | | 8.15 | %(d) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Ratios to Average Net Assets | | | | | | | | | | | | | | | | | | | | |

Total expenses(e) | | | 1.40 | %(f) | | | 1.41 | %(f) | | | 1.55 | %(g) | | | 1.56 | %(g) | | | 1.58 | %(g) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total expenses after fees waived and/or reimbursed(e) | | | 1.15 | %(f) | | | 1.14 | %(f) | | | 1.26 | %(g) | | | 1.25 | %(g) | | | 1.27 | %(g) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income(e) | | | 0.82 | %(f) | | | 1.50 | %(f) | | | 1.33 | %(g) | | | 1.04 | %(g) | | | 0.99 | %(g) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 11,840 | | | $ | 11,833 | | | $ | 14,363 | | | $ | 16,257 | | | $ | 12,731 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Portfolio turnover rate of the Fund(h) | | | — | % | | | 4 | % | | | 140 | % | | | 109 | % | | | — | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Portfolio turnover rate of the Master Total Return Portfolio(i) | | | 556 | % | | | 574 | % | | | 734 | % | | | 806 | % | | | 841 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Portfolio turnover rate of the Master Advantage Large Cap Core Portfolio | | | 99 | % | | | 151 | % | | | 148 | % | | | 130 | % | | | 39 | % |

| | | | | | | | | | | | | | | | | | | | |

| (a) | Based on average shares outstanding. |

| (b) | Distributions for annual periods determined in accordance with U.S. federal income tax regulations. |

| (c) | Where applicable, assumes the reinvestment of distributions. |

| (d) | Includes proceeds received from a settlement of litigation, which had no impact on the Fund’s total return. |

| (e) | Excludes expenses incurred indirectly as a result of investments in underlying funds as follows: |

| | | | | | | | | | | | | | | | | | | | |

| | |

| | | Year Ended September 30, | |

| | | | | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| | | | | |

Investments in underlying funds | | | 0.03 | % | | | 0.02 | % | | | 0.01 | % | | | 0.01 | % | | | — | % |

| | | | | | | | | | | | | | | | | | | | |

| (f) | Includes the Fund’s share of the Master Portfolios’ allocated fees waived of 0.01%. |

| (g) | Includes the Fund’s share of the Master Portfolios’ allocated fees waived of less than 0.01%. |

| (h) | Excludes transactions in the Master Portfolios. |

| (i) | Includes MDRs. Additional information regarding portfolio turnover rate is as follows: |

| | | | | | | | | | | | | | | | | | | | |

| | |

| | | Year Ended September 30, | |

| | | | | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| | | | | |

Portfolio turnover rate (excluding MDRs) | | | 274 | % | | | 241 | % | | | 350 | % | | | 540 | % | | | 598 | % |

| | | | | | | | | | | | | | | | | | | | |

See notes to financial statements.

| | |

F I N A N C I A L H I G H L I G H T S | | 19 |

Notes to Financial Statements

BlackRock Balanced Capital Fund, Inc. (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Fund is organized as a Maryland corporation. The Fund is classified as diversified. The Fund seeks to achieve its investment objective by investing directly in equity and fixed-income securities, indirectly through one or more funds that invest in such securities, or in a combination of securities and funds. The Fund intends to invest a significant portion of its fixed-income assets in Master Total Return Portfolio (the “Master Total Return Portfolio”) of Master Bond LLC, a mutual fund that has an investment objective and strategy consistent with that of the fixed-income portion of the Fund. The Fund intends to invest a significant portion of its equity assets in Master Advantage Large Cap Core Portfolio (the “Master Advantage Large Cap Core Portfolio”) of Master Large Cap Series LLC, a mutual fund that has an investment objective and strategy consistent with that of the equity portion of the Fund. Master Total Return Portfolio and Master Advantage Large Cap Core Portfolio, both affiliates of the Fund, are collectively referred to as the “Master Portfolios.” The value of the Fund’s investment in the Master Portfolios reflects the Fund’s proportionate interest in the net assets of the Master Portfolios. The performance of the Fund is directly affected by the performance of the Master Portfolios as well as the Fund’s direct investments. At September 30, 2020, the percentages of Master Advantage Large Cap Core Portfolio and Master Total Return Portfolio owned by the Fund were 20.5% and 2.1%, respectively. The financial statements of the Master Portfolios, including the Schedules of Investments, are included elsewhere in this report and should be read in conjunction with the Fund’s financial statements.

The Fund offers multiple classes of shares. All classes of shares have identical voting, dividend, liquidation and other rights and are subject to the same terms and conditions, except that certain classes bear expenses related to the shareholder servicing and distribution of such shares. Institutional and Class K Shares are sold only to certain eligible investors. Investor A, Investor C and Class R Shares bear certain expenses related to shareholder servicing of such shares, and Investor C and Class R Shares also bear certain expenses related to the distribution of such shares. Investor A and Investor C Shares are generally available through financial intermediaries. Class R Shares are sold only to certain employer-sponsored retirement plans. Each class has exclusive voting rights with respect to matters relating to its shareholder servicing and distribution expenditures (except that Investor C shareholders may vote on material changes to the Investor A Shares distribution and service plan).

The Board of Directors of the Fund and Boards of Directors of the Master Portfolios are referred to throughout this report as the “Board” and the members are referred to as “Directors.”

| | | | | | | | |

| | | | |

| Share Class | | Initial Sales Charge | | CDSC | | | Conversion Privilege |

| | | |

Institutional, Class K and Class R Shares | | No | | | No | | | None |

Investor A Shares | | Yes | | | No | (a) | | None |

Investor C Shares | | No | | | Yes | (b) | | To Investor A Shares after approximately 10 years(c) |

| | (a) | Investor A Shares may be subject to a contingent deferred sales charge (“CDSC”) for certain redemptions where no initial sales charge was paid at the time of purchase. | |

| | (b) | A CDSC of 1.00% is assessed on certain redemptions of Investor C Shares made within one year after purchase. | |

| | (c) | Effective November 23, 2020, the automatic conversion feature will be modified to reduce the conversion period from ten years to eight years. | |

The Fund, together with certain other registered investment companies advised by BlackRock Advisors, LLC (the “Manager”) or its affiliates, is included in a complex of equity, multi-asset, index and money market funds referred to as the BlackRock Multi-Asset Complex.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |