UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F /A

Amendment No. 1

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or 12(g) OF THESECURITIES EXCHANGE ACT OF 1934

OR

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THESECURITIES EXCHANGE ACT OF 1934

For the fiscal year endedFebruary 28, 2009

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THESECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________to _______________

OR

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THESECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report _______________

Commission file number 000-30588

ROCKWELL DIAMONDS INC.

(Exact name of Registrant specified in its charter)

NOT APPLICABLE

(Translation of Registrant's name into English)

BRITISH COLUMBIA, CANADA

(Jurisdiction of incorporation or organization)

Level 1, Wilds View, Isle of Houghton,

Cnr. Carse O’Gowrie & Boundary Rd, Houghton Estate, Johannesburg 2198

P O Box 3011 Houghton, South Africa, 2041

(Address of principal executive offices)

COMMON SHARES WITHOUT PAR VALUE

(Title of Class)

- ii -

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of Each Class | Name of each exchange on which registered |

| None | Not applicable |

Securities registered or to be registered pursuant to Section 12(g) of the Act

Common Shares without Par Value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Number of outstanding shares of Rockwell's only class of capital stock as at February 28, 2009.

237,924,152 Common Shares without Par Value

Indicate by check mark if the Registrant is a well known seasoned issuer as defined in Rule 405 of theSecurities Act.

Yes [ ] No [X]

If this report is an annual or transition report, indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of theSecurities Exchange Act of 1934

Yes [ ] No [X]

Indicate by check mark whether Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of theSecurities Exchange Act of 1934during the preceding 12 months (or for such shorter period that Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant (1) has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405of this chapter) during the preceding 12 months (or for such period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer or non-accelerated filer. See definition of "accelerated filer" and "large accelerated filer" in Rule 12b 2 of the Exchange Act.

| [ ] Large Accelerated Filer | [ ] Accelerated Filer | [X] Non Accelerated Filer |

- ii -

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP [ ] | International Financial Reporting Standards as issued

by the International Accounting Standards Board [ ] | Other [X] |

If “"Other”" has been check in response to the previous question, by check mark which financial statement item Registrant has elected to follow:

Item 17 [X] Item 18 [ ]

If this is an annual report, indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b 2 of the Exchange Act):

Yes [ ] No [X]

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether Registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of theSecurities Exchange Act of 1934subsequent to the distribution of securities under a plan confirmed by a court.

NOT APPLICABLE

Currency and Exchange Rates

All monetary amounts contained in this Annual Report are, unless otherwise indicated, expressed in Canadian dollars. On February 27, 2009 the Bank of Canada noon rate for Canadian Dollars was US$1.00: Cdn$1.2707 (see Item 3A for further historical Exchange Rate Information).

NOTE REGARDING FORWARD LOOKING STATEMENTS

Except for statements of historical fact, certain information contained herein constitutes "forward-looking statements" including, without limitation, statements containing the words "believes," "anticipates," "intends," "expects" and words of similar import, as well as all projections of future results. Such forward-looking statements involved known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Rockwell to be materially different from any future results, performance or achievements of Rockwell expressed or implied by such forward-looking statements. Such risks are discussed in Item 3D "Risk Factors." The statements contained in Item 4B "Business Overview", Item 5 "Operating and Financial Review and Prospects" and Item 11 "Quantitative and Qualitative Disclosures About Market Risk" are inherently subject to a variety of risks and uncertainties that could cause actual results, performance or achievements to differ significantly.

- ii -

EXPLANATORY NOTE

This Annual Report on Form 20-F is being amended in response to a comment letter dated November 19, 2009 from the Securities and Exchange Commission in order to: (i) provide certain information that was inadvertently not included on the cover of the 20-F as originally filed, (ii) revise the Company’s disclosure regarding changes in internal control over financial reporting, (iii) revise the certifications included in Exhibit 12.1 and 12.2 to comply with Rule 13a-14(a), (iv) provide a revised auditor report together with the report from the Company’s predecessor auditor and (v) amend certain of the notes to the Company’s audited financial statements.

| T A B L E O F C O N T E N T S |

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected Financial Data

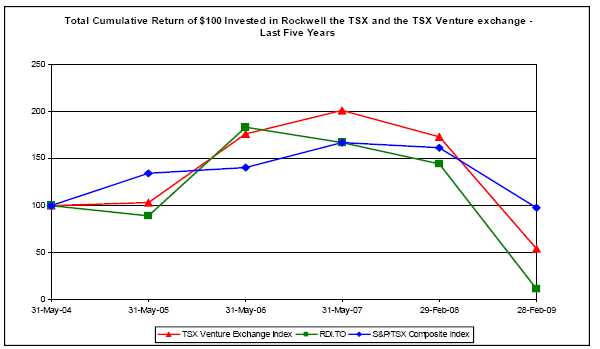

The following table summarizes selected consolidated financial data for Rockwell Diamonds Inc. (the "Company" or "Rockwell" or the "Registrant") for the year ended February 28, 2009, the nine months ended February 29, 2008 and the year ended May 31, 2007, 2006 and 2005. The financial statements have been prepared in accordance with Canadian generally accepted accounting principles ("Cdn GAAP"). Note 17 to the financial statements included herein provides descriptions of the material measurement differences between Cdn GAAP and United States generally accepted accounting principles ("US GAAP") as they relate to the Company and a reconciliation to US GAAP of the Company's financial statements.

The information in the table was extracted from the detailed consolidated financial statements and related notes included in this annual report, and should be read in conjunction with such financial statements included elsewhere in the document and with the information appearing under the heading, "Item 5. Operating and Financial Review and Prospects."

The selected financial data is presented in Canadian dollars and in accordance with Canadian GAAP and United States GAAP.

– Page 2 –

| (In Canadian Dollars) | | As at | | | As at | | | | | | | | | | |

| | | February 28 | | | February 29 | | | | | | As at May 31 | | | | |

| Balance Sheet Data | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| Total assets (Cdn GAAP) | $ | 106,362,416 | | $ | 133,693,124 | | $ | 129,606,38 | | $ | 288,647 | | $ | 659,577 | |

| Total assets (US GAAP) | | 106,362,416 | | | 133,693,124 | | | 130,135,690 | | | 288,646 | | | 612,720 | |

| Total liabilities (Cdn GAAP) | | 35,941,390 | | | 46,578,317 | | | 58,013,541 | | | 1,146,070 | | | 29,976 | |

| Total liabilities (US GAAP) | | 35,941,390 | | | 46,578,317 | | | 58,013,541 | | | 1,146,070 | | | 29,976 | |

| Share capital (Cdn GAAP) | | 119,952,532 | | | 112,095,390 | | | 88,903,530 | | | 11,857,649 | | | 11,815,792 | |

| Share capital (US GAAP) | | 119,952,532 | | | 112,095,390 | | | 88,903,530 | | | 11,857,649 | | | 11,815,792 | |

| (Deficit) (Cdn GAAP) | | (41,982,624 | ) | | (29,006,662 | ) | | (19,603,634 | ) | | (13,238,492 | ) | | (11,637,819 | ) |

| (Deficit) (US GAAP) | | (41,982,624 | ) | | (29,006,662 | ) | | (20,062,027 | ) | | (13,696,885 | ) | | (12,740,977 | ) |

| Shareholders’ equity (Cdn GAAP) | | 70,421,026 | | | 87,114,807 | | | 71,592,842 | | | 857,423 | | | 629,601 | |

| Shareholders’ equity (US GAAP) | | 70,421,026 | | | 87,114,807 | | | 71,592,841 | | | 857,424 | | | 582,744 | |

| Weighted Average No. Shares | | 237,924,152 | | | 196,428,551 | | | 55,418,242 | | | 23,640,123 | | | 23,776,122 | |

| | | | | | Nine months | | | | | | | | | | |

| | | Year ended | | | ended | | | | | | | | | | |

| | | February 28 | | | February 29 | | | Year ended May 31 | |

| | | | | | | | | | | | | | | | |

| Statement of Operations Data | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| Revenues (US and Cdn GAAP) | $ | 34,633,477 | | $ | 36,149,308 | | $ | 10,103,328 | | $ | Nil | | $ | Nil | |

| Loss for the year(1)(Cdn GAAP) | | 12,975,962 | | | 9,403,028 | | | 6,365,142 | | | 1,600,673 | | | 1,485,694 | |

| Loss for the year(1)(US GAAP) | | 12,975,962 | | | 9,403.028 | | | 6,365,142 | | | 1,553,817 | | | 1,485,694 | |

| Loss per share (Cdn GAAP) | $ | 0.05 | | $ | 0.05 | | $ | 0.11 | | $ | 0.07 | | $ | 0.06 | |

| Loss per share (US GAAP) | $ | 0.05 | | $ | 0.05 | | $ | 0.11 | | $ | 0.07 | | $ | 0.06 | |

Notes:

(1)Loss from continuing operations and loss for the year are the same for all periods presented.

No cash or other dividends have been declared.

Annual Exchange Rates

Except as otherwise indicated, all dollar amounts are stated in Canadian dollars, Rockwell's reporting currency. The following table sets out the exchange rates, based on the noon rates as reported by the Bank of Canada, for the conversion of United States dollars into one Canadian dollar in effect at the end of the specified periods, the average exchange rates during such periods (based on daily noon rates as reported by the Bank of Canada) and the range of high and low exchange rates for such periods:

– Page 3 –

Exchange Rates

| | | Year Ended | | | Nine Months | | | Years Ended May 31 | |

| | | February 28 | | | Ended | | | | | | | | | | |

| | | | | | February 29 | | | | | | | | | | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| End of Period | | 0.7870 | | | 1.0206 | | | 0.9347 | | | 0.9079 | | | 0.7994 | |

| Average for Period | | 0.9045 | | | 0.8831 | | | 0.8800 | | | 0.8521 | | | 0.7937 | |

| High for Period | | 1.0006 | | | 1.0339 | | | 0.9347 | | | 0.9099 | | | 0.8493 | |

| Low for Period | | 0.8031 | | | 0.9338 | | | 0.8437 | | | 0.7951 | | | 0.7261 | |

The following table sets out the high and low exchange rates, based on the noon rate as reported by the Bank of Canada, for the conversion of United States dollars into one Canadian dollar, for the following periods:

Exchange Rates

| | | High | | | Low | |

| March 2008 | | 1.0241 | | | 0.9713 | |

| April 2008 | | 1.0002 | | | 0.9682 | |

| May 2008 | | 1.0179 | | | 0.9761 | |

| June 2008 | | 1.0052 | | | 0.9690 | |

| July 2008 | | 1.0025 | | | 0.9733 | |

| August 2008 | | 0.9768 | | | 0.9332 | |

| September 2008 | | 0.9711 | | | 0.9241 | |

| October 2008 | | 0.9447 | | | 0.7695 | |

| November 2008 | | 0.8713 | | | 0.7721 | |

| December 2008 | | 0.8423 | | | 0.7688 | |

| January 2009 | | 0.8503 | | | 0.7834 | |

| February 2009 | | 0.8224 | | | 0.7855 | |

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

This annual report contains forward-looking statements which relate to future events or Rockwell's future performance, including its future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "expects", "plans", "anticipates", "believes", "estimates", "predicts", or "potential" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in enumerated in this section entitled "Risk Factors", that may cause Rockwell's or the mining industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

– Page 4 –

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect Rockwell's current judgment regarding the direction of its business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested in this annual report. Except as required by applicable law, including the securities laws of the United States, Rockwell does not intend to update any of the forward-looking statements to conform these statements to actual results.

An investment in Rockwell's common stock involves a number of very significant risks. The investor should carefully consider the following risks and uncertainties in addition to other information in this annual report in evaluating Rockwell and its business before purchasing shares of Rockwell's common stock. Rockwell's business, operating results and financial condition could be seriously harmed due to any of the following risks. The risks described below are not the only ones facing Rockwell. Additional risks not presently known to Rockwell may also impair its business operations. The investor could lose all or part of your investment due to any of these risks.

– Page 5 –

Risks Associated With Mining

There is no assurance that Rockwell can formally establish the existence of any mineral reserve on any of its properties. Until Rockwell is able to establish a mineral reserve, there can be no assurance that production from these properties will continue for any period of time and if production fails, Rockwell's business may ultimately fail.

Although Rockwell now owns and operates properties with a history of sporadic to regular diamond production, which have been subject to examination, testing and quantification through scientific exploration techniques, a reliable determination of grade is difficult in alluvial deposits. Accordingly, there is no assurance that Rockwell can formally establish the existence of any mineral reserve on any of its properties. A mineral reserve is defined by the Securities and Exchange Commission in its Industry Guide 7 (which can be viewed over the Internet athttp://www.sec.gov/divisions/corpfin/forms/industry.htm#secguide7) as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. The probability of an individual prospect ever having a "reserve" that meets the requirements of the Securities and Exchange Commission's Industry Guide 7 is remote. If none of our current or future mineral resource properties contains any "reserve," any funds that Rockwell spends on exploration will be lost.

Even if Rockwell discovers a mineral reserve, there can be no assurance that the related property will be developed.

Even if Rockwell eventually discovers a mineral reserve on one or more of its properties, there can be no assurance that it will be able to develop the properties into producing mines. Both mineral exploration and development involve a high degree of risk and few properties which are explored are ultimately developed into producing mines.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade and other attributes of the mineral deposit, the proximity of the resource to infrastructure such as a smelter, roads and a point for shipping, government regulation and market prices. Most of these factors will be beyond Rockwell's control, and any of them could increase costs and make extraction of any identified mineral resource unprofitable.

Mineral operations are subject to applicable law and government regulation. Even if Rockwell discovers a mineral resource in a commercially exploitable quantity, these laws and regulations could restrict or prohibit the exploitation of that mineral resource. If Rockwell cannot exploit any mineral resource that it might discover on our properties, its business may fail.

Both mineral exploration and extraction require permits from various foreign, federal, state, provincial and local governmental authorities and are governed by laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that Rockwell will be able to obtain or maintain any of the permits required for the continued exploration of its mineral properties or for the construction and operation of a mine on its properties at economically viable costs. If Rockwell cannot accomplish these objectives, our business could fail.

Rockwell believes that it is in compliance with all material laws and regulations that currently apply to its activities but there can be no assurance that it can continue to do so. Current laws and regulations could be amended and the Company might not be able to comply with them, as amended. Further, there can be no assurance that Rockwell will be able to obtain or maintain all permits necessary for our future operations, or that it will be able to obtain them on reasonable terms. To the extent such approvals are required and are not obtained, Rockwell may be delayed or prohibited from proceeding with planned exploration or development of its mineral properties.

– Page 6 –

In addition, environmental hazards unknown to Rockwell which have been caused by previous or existing owners or operators of the properties may exist on the properties in which Rockwell holds an interest. Even if Rockwell relinquishes its licenses, it will still remain responsible for any required reclamation and rehabilitation of the properties.

Mineral exploration and development are subject to particular operating risks. Rockwell does not currently insure against these risks. In the event of a cave-in or similar occurrence, Rockwell's liability may exceed its resources, which would have an adverse impact on Rockwell.

All Rockwell’s operations are shallow opencast which has an inherently lower risk than other deeper operations which are susceptible to cave-ins.

Mineral exploration, development and production involve many risks which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Hazards such as unusual or unexpected formations and other conditions are involved.

Rockwell's operations will be subject to all the hazards and risks inherent in the exploration, development and production of resources, including liability for pollution, cave-ins or similar hazards against which it cannot insure against or which it may elect not to insure. Any such event could result in work stoppages and damage to property, including damage to the environment. Rockwell applies international best practices principles in all areas of the operations and complies with all health, safety and mining legislation of the South African Republic. Rockwell does not currently maintain any insurance coverage against these operating hazards. The payment of any liabilities that arise from any such occurrence may have a material, adverse impact on Rockwell.

The prediction of grade can be more challenging for the type of deposit which the Company is exploiting.

In the case of alluvial diamond deposits, the prediction of grade can be challenging due to the inherent geological nature of such deposits. The alluvial diamonds are laid down by rivers flowing over uneven terrain and the diamonds vary in terms of size and quality. Individual diamonds are not evenly or uniformly distributed through out an alluvial deposit; neither are they randomly distributed. Rather, their distribution has been described as a random distribution of clusters of points. The clusters are both randomly distributed in space, and the point density of the cluster is also random. In order to determine grade under such circumstances it is necessary to process large volumes of material (bulk testing) in order to be sure that grade calculations are representative and accurate. Moreover, in the case of such deposits, drilling is only of use in the determination of gravel distribution and not diamond content, since the volume of material recovered is insufficiently representative of grade. Notwithstanding the above caution, bulk testing is a straightforward technique that is currently being applied across all of Rockwell's South African operations. Furthermore, size frequency distribution curves can be used to accurately predict the relative abundance of diamonds in terms of stone size, thus mitigating risk.

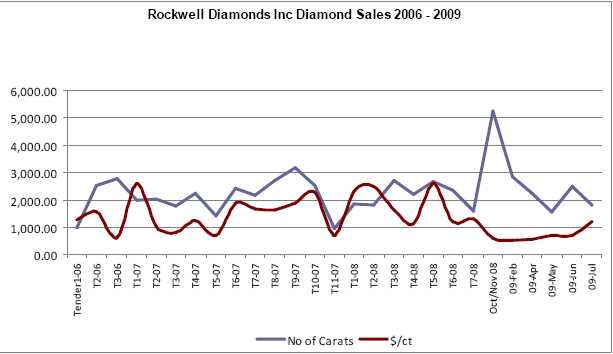

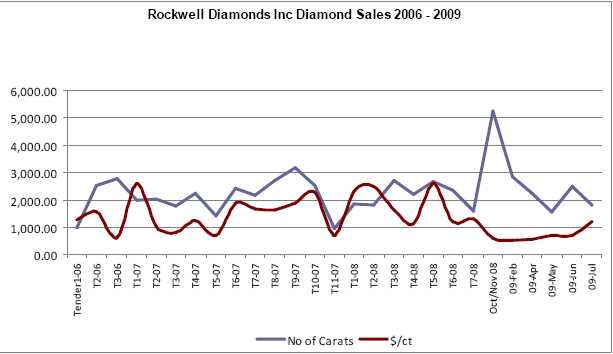

Mineral prices are subject to dramatic and unpredictable fluctuations.

Rockwell expects to derive revenues from the extraction and sale of diamonds. The prices of diamonds have fluctuated widely in recent years, and are affected by numerous factors beyond Rockwell's control including international, economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global or regional consumptive patterns, speculative activities and increased production due to new extraction developments and improved extraction and production methods. The effect of these factors on the price of diamonds and base metals, and, therefore, the economic viability of any of Rockwell's projects, cannot accurately be predicted.

– Page 7 –

The mining industry is highly competitive and there is no assurance that Rockwell will continue to be successful in acquiring mineral claims. If Rockwell cannot continue to acquire properties to explore for mineral resources, it may be required to reduce or cease operations.

The mineral exploration, development, and production industry is largely unintegrated. Rockwell competes with other exploration companies looking for mineral resource properties and the resources that can be produced from them. However, the mining business operates in a worldwide market, and prices for minerals are derived from relatively pure market forces. Accordingly, competition to sell any metals or concentrates produced should not be an issue if metals prices warrant production

Rockwell competes with many companies possessing greater financial resources and technical facilities. This competition could adversely affect Rockwell's ability to acquire suitable prospects for exploration in the future. Accordingly, there can be no assurance that Rockwell will acquire any interest in additional mineral resource properties that might yield reserves or result in commercial mining operations.

Risks Related to Rockwell

The recoverability of the amounts shown for the Company’s mineral property interests, property, plant and equipment and inventory is dependent upon the existence of economically recoverable mineral resources and future profitable production or proceeds from the disposition of the mine. The Company’s continuing operations are also dependent upon the discovery and existence of economically recoverable mineral reserves, the ability of the Company to obtain the necessary financing to complete the exploration and development of its mineral property interests, and upon future profitable production or proceeds from the disposition of its mineral property interests.

Rockwell requires additional financing in order to continue in business as a going concern, the availability of which is uncertain.

The Company and its subsidiaries incurred losses of $13 million during the year ended February 28, 2009 and continue to incur losses subsequent to year end. Costs have reduced substantially, however sales are irregular. The risk that the cash and near cash resources will not be sufficient to fund the continuing losses up to break-even indicates that a material uncertainty exists which may cast substantial doubt on the ability of the Company and its subsidiaries to continue as a going concern. Based on the following, the directors believe that the Company and its subsidiaries will continue as going concerns for the year ahead:

- At year end the Company’s current assets exceeded its current liabilities by $0.6 million and the Company’s total assets exceeded its total liabilities by $70.4 million.

- The cash flow forecasts for the year ahead indicate that additional funds of $4 million will be required to enable the Company and its subsidiaries to continue as a going concern. The additional funding was calculated on the assumption that volumes remain constant with current production, with the new plant still operating at below 50% capacity, prices remain at current depressed levels which are 55% below pre crisis levels and the South African Rand remains at current levels.

The directors have already commenced with plans to raise finance, and the following plans have been considered to raise these funds:

– Page 8 –

- Private placement.

- Prospectus

- Rights offering

The directors have started the process towards exercising either a rights offering or a private placement, and have identified and communicated with current investors and potential new investors to ensure that the desired investment is raised.

Despite the current economic challenges the directors believe that the Company will be successful in raising the additional funding as and when it will be required. The directors will be able to raise up to 25% of market capital before seeking shareholders approval, which will raise up to $4.1 million.

Some of Rockwell's directors and officers serve on the boards of other exploration companies, which could potentially give rise to conflicts of interest.

Some of Rockwell's directors and officers are engaged, and will continue to be engaged, in the search for additional business opportunities on their own behalf and on behalf of other companies. Situations may arise where these directors and officers will be in direct competition with Rockwell. Conflicts, if any, will be dealt with in accordance with the relevant provisions of theBusiness Corporations Act(British Columbia) and applicable law.

The loss of any of Rockwell's key management employees could have a material adverse effect on Rockwell's business.

The nature of Rockwell's business and Rockwell's ability to continue its exploration activities and to exploit any mineral reserves that it may find in the future depends, in large part, on Rockwell's ability to attract and maintain qualified key management personnel. Competition for such personnel is intense, and there can be no assurance that Rockwell will be able to attract and retain such personnel. Rockwell's development now and in the future will depend on the efforts of key management figures, such as John W. Bristow, Rockwell's Chief Executive Officer, and Desmond Morgan, Chief Financial Officer. The loss of any of these key people could have a material adverse effect on Rockwell's business. Rockwell does not currently maintain key-man life insurance on any of its key employees.

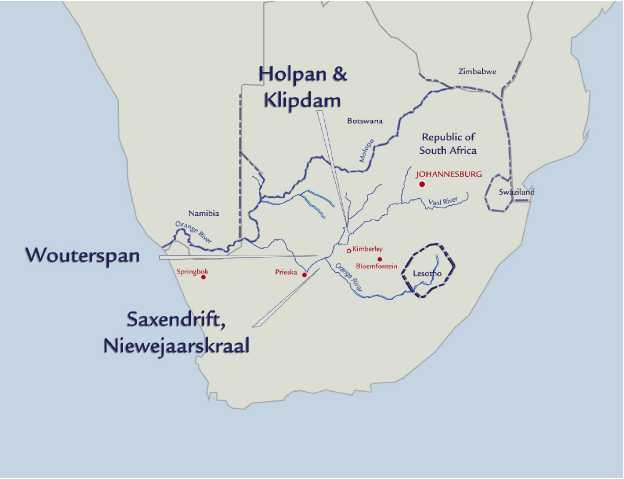

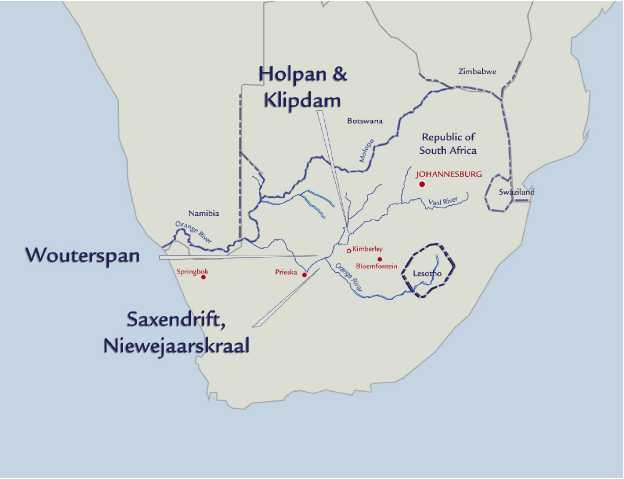

Rockwell's properties are located in the Republic of South Africa

All mineral properties are located in the Republic of South Africa. Exploration initiatives in the Democratic Republic of the Congo (the “DRC”) and Chile have been discontinued due to varying degrees by political instability and economic uncertainties.

Operations may be affected in varying degrees by government regulations with respect to restrictions on production, repatriation of profits, price controls, export controls, income taxes, expropriations or property, environmental legislation and mine safety.

South Africa has undergone major constitutional changes to effect majority rule, and also to effect mineral title. Accordingly, many laws may be considered relatively new, resulting in risks such as possible misinterpretation of new laws, modification of mining or exploration rights, operating restrictions, increased taxes, environmental regulation, mine safety and other risks arising out of a new sovereignty over mining, Rockwell's operations may also be affected in varying degrees by political and economic instability, terrorism, crime, extreme fluctuations in currency exchange rates and inflation.

– Page 9 –

South African government empowerment initiatives may adversely affect Rockwell's ability to obtain or maintain permits and licenses for mining rights in South Africa.

In order to address inequalities to Historically Disadvantaged Persons ("HDP") engendered by South Africa's former apartheid system, the South African Government has initiated certain government empowerment initiatives.

In October 2002, the South African government enacted the Mineral Development Act that deals with the state's policy towards the future of ownership of minerals rights and the procedures for conducting mining transactions in South Africa. The Mineral Development Act is a statute with wide-ranging objectives, including sustainable development and the promotion of equitable access to South Africa's mineral wealth by the inclusion of HDP into the industry. The Mineral Development Act came into effect in May 2004. The South African government has stated that, under the Mineral Development Act, it will be issuing permits and licenses for prospecting and mining rights to applicants using a "scorecard" approach. Applicants will need to demonstrate their eligibility for consideration based upon the number of credits accumulated in terms of quantifiable ownership transformation criteria, such as employment equity and human resource development.

Future amendments to, and interpretations of, the economic empowerment initiatives by the South African government and the South African courts could adversely affect the business of Rockwell and its results of operations and its financial condition.

Absence of dividends

Rockwell has paid no dividends on its shares since incorporation, and does not anticipate doing so in the foreseeable future.

Rockwell is subject to potentially volatile exchange rate fluctuations

Rockwell conducts operations in currencies other than Canadian dollars. Of particular significance is the fact that Rockwell’s operations in South Africa are almost entirely paid for in South African Rand, which has historically devalued against the United States dollar, but which recently has shown unexpected and substantial strength against most major world currencies, including the United States dollar. The strength in the South African Rand, if it continues, will negatively impact the potential profitability of Rockwell’s mining operations.

Rockwell expects to be a passive foreign investment company, which could have consequences for U.S. investors.

Potential investors who are U.S. taxpayers should be aware that Rockwell expects to be a passive foreign investment company ("PFIC") for the current fiscal year, that it may also have been a PFIC in prior years, and that it may also be a PFIC in subsequent years. If Rockwell is a PFIC for any year during a U.S. taxpayer's holding period, then such U.S. taxpayer generally will be required to treat any so-called "excess distribution" received on its common shares, or any gain realized upon a disposition of common shares, as ordinary income and to pay an interest charge on a portion of such distribution or gain, unless the taxpayer makes a qualified electing fund ("QEF") election or a mark-to-market election with respect to the shares of Rockwell. In certain circumstances, the sum of the tax and the interest charge may exceed the amount of the excess distribution received, or the amount of proceeds of disposition realized, by the taxpayer. A U.S. taxpayer who makes a QEF election generally must report on a current basis its share of Rockwell's net capital gain and ordinary earnings for any year in which Rockwell is a PFIC, whether or not Rockwell distributes any amounts to its shareholders.

– Page 10 –

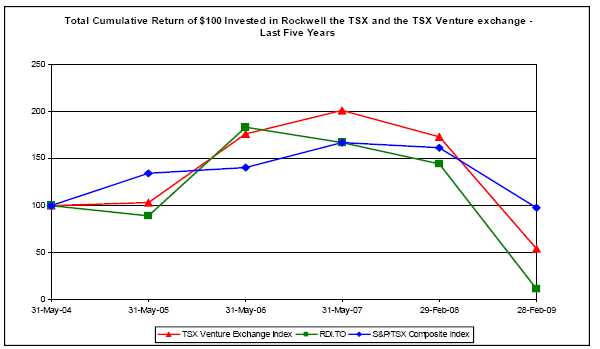

Rockwell's stock is a penny stock. Trading of Rockwell's stock may be restricted by the SEC's penny stock regulations which may limit a stockholder's ability to buy and sell Rockwell's stock.

Because the market price for Rockwell's shares is less than US$5.00, its securities are classified as "penny stock". For transactions involving a penny stock, brokers or dealers are required to approve a previous account for penny stock transactions, which involves obtaining financial information concerning the investor and satisfying themselves that the investor has sufficient knowledge and experience to evaluate the risks associated with penny stock. The broker or dealer must also deliver certain information to investors on penny stock, including disclosure concerning the risks associated with penny stock, and must receive a written agreement from investors prior to the transactions. As a result of the penny stock restrictions, brokers or potential investors may be reluctant to trade in Rockwell's securities, which may result in less liquidity for Rockwell's stock.

NASD sales practice requirements may limit a stockholder's ability to buy and sell Rockwell's stock.

In addition to the "penny stock" rules promulgated by the Securities and Exchange Commission (see above for discussions of penny stock rules), the National Association of Securities Dealers (“NASD”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, the NASD believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The NASD requirements make it more difficult for broker-dealers to recommend that their customers buy Rockwell common stock, which may limit the ability to buy and sell Rockwell stock and have an adverse effect on the market for Rockwell shares.

Rockwell has a number of outstanding share purchase options and warrants, the exercise of which could result in equity dilution.

At February 28, 2009, Rockwell had a significant number of share purchase options (7,956,168) and warrants (161,379,154). On May 9 2009, 121,779,154 share purchase warrants expired with the balance remaining on May 31 2009 being 39,600,000 exercisable at $1.00 per share expiring on November 28 2009. If exercised could likely act as an upside damper on the trading price range of Rockwell's shares. The underlying shares issuable upon exercise of these securities represent approximately 20% of Rockwell's currently issued shares.

– Page 11 –

ITEM 4. INFORMATION ON THE COMPANY

SUMMARY

| A. | History and Development of Rockwell |

| | |

| 1. | The legal name of the Registrant is "Rockwell Diamonds Inc." |

| | |

| 2. | Rockwell was incorporated under theCompany Act(British Columbia) (the predecessor legislation to theBusiness Corporations Act(British Columbia)) on November 10, 1988 under the name "Annabel Gold Mines Inc." |

| | |

| 3. | The Company changed its name to "Carissa Mining Corporation" on January 24, 1994. On October 26, 1995, the Company changed its name to "Rockwell Ventures Inc.", consolidated its share capital on the basis of five shares to one and subsequently increased its authorized share capital to 200,000,000 Common Shares without par value. |

| | |

| 4. | On December 29, 2004, Rockwell increased its authorized share capital to consist of an unlimited number of Common Shares without par value. |

| | |

| 5. | At the Company's Annual and Extraordinary General Meeting held on November 28, 2005, the Company's shareholders approved the creation of a class of preferred shares and the consolidation of the Company's Common Shares on a four old shares for one new basis. Regulatory approval of this capital reorganization was received on January 27, 2006. |

| | |

| 6. | The Company changed its name from "Rockwell Ventures Inc." on May 14, 2007 to "Rockwell Diamonds Inc." |

| | |

| 7. | The principal events in the development of Rockwell's business are: |

| | (i) | In June 2006, Rockwell entered into an agreement to acquire (the "Durnpike Acquisition") all of the shares and loans in Durnpike Investments (Pty) Limited ("Durnpike"), a private South African company, from eight arm's length individuals (the "Vendors"), for consideration payable in the common shares of Rockwell ("Common Shares") on specified dates described inItem B. Business Overview – Alluvial Diamond Propertiesbelow. Durnpike held an interest and/or rights in four alluvial diamond properties in South Africa and the Democratic Republic of the Congo. These were: |

| | | | |

| | | | Holpan/Klipdam Property in South Africa ("RSA or "South Africa") |

| | | | Wouterspan Property in South Africa |

| | | | Galputs Mineral Project in South Africa. |

| | | | Kwango River Project in the Democratic Republic of the Congo ("DRC") |

| | | | |

| | | On January 31, 2007, all the conditions precedent to implementation of the Durnpike Acquisition were fulfilled. The Company also received the necessary regulatory approvals in Canada and South Africa. |

| | | | |

| | (ii) | As a result of the acquisition of Durnpike, the Company assumed the option to purchase the Makoenskloof property. |

– Page 12 –

| | (iii) | On March 6, 2007, the Company and Trans Hex Group Limited (“Trans Hex”) entered into a conditional agreement whereby the Company’s wholly owned South African subsidiary, Rockwell Resources RSA (Pty) Ltd. (“Rockwell RSA”), would acquire through Trans Hex’s wholly-owned subsidiary, Trans Hex Operations (Pty) Ltd. (“THO”), two open pit alluvial diamond mines, namely Saxendrift and Niewejaarskraal, and three alluvial diamond exploration projects, namely Kwartelspan, Zwemkuil- Mooidraai and Remhoogte-Holsloot, which are located along the southern bank of the Middle Orange River in the Northern Cape Province of South Africa (“Northern Cape”) and which are collectively referred to as the Middle Orange River Operations and Projects (or “MORO”). The agreement included: |

| | | | |

| | | | the rights to prospect, explore and/or mine precious stones and/or other minerals and/or metals held directly or indirectly by THO in the Saxendrift area of the Northern Cape; |

| | | | |

| | | | a series of large remnant alluvial diamond terraces; |

| | | | |

| | | | the plant, machinery, equipment and other movable assets owned and/or used by THO; |

| | | | |

| | | | certain employees of THO; and |

| | | | |

| | | | a rehabilitation liability which will be taken over by the Company. |

In April 2008 the Company completed the MORO acquisition, including registration and transfer of Saxendrift Mine Pty (Ltd) and the Saxendrift mining right, as well as prospecting rights in respect of the Kwartelspan, Zwemkuil-Mooidraai and part of the Remhoogte-Holsloot projects.

As at February 28, 2009, the Company was committed to pay Trans Hex for the acquisition of the remaining Niewejaarskraal mining rights and thus complete the MORO acquisition. The Company had placed $2.7 million in trust toward application of the remaining payment, to be released to Trans Hex upon the anticipated grant of Ministerial Consent to the cession of each of the Outstanding Mining Rights to the Company and registration of cession of such rights in its name.

On April 11, 2009 all the conditions precedent were met and the Company paid ZAR 18.9 million ($2.6 million) in cash to Trans Hex for the remaining Niewejaarskraal mining rights of which ZAR 16.5 million ($2.0 million) was capitalized. This action completed the Saxendrift/Remhoogte-Holsloot transaction negotiated during April 2008. The Company has no further commitments in relation to more acquisitions.

The results of the Saxendrift operations have been included in the consolidated financial statements since the date of acquisition on April 11, 2008. The following table summarizes the total purchase consideration of the Saxendrift assets:

| | | | Amount | | | Amount | |

| | | | (ZAR) | | | ($) | |

| | Cash consideration | | 73,536,000 | | $ | 9,618,508 | |

| | Acquisition costs and other | | 4,912,895 | | | 642,607 | |

| | Other commitments | | 2,988,619 | | | 390,911 | |

| | Total purchase consideration | | 81,437,514 | | $ | 10,652,026 | |

– Page 13 –

The total acquisition price has been allocated to the net assets acquired and liabilities assumed of Saxendrift as follows:

| | | | Amount | | | Amount | |

| | | | (ZAR) | | | ($) | |

| | Inventory | | 1,000,000 | | $ | 130,800 | |

| | Plant and equipment | | 47,750,000 | | | 6,245,700 | |

| | Other assets | | 100 | | | 12 | |

| | Mineral property interests | | 40,487,414 | | | 5,295,754 | |

| | Reclamation obligation | | (7,800,000 | ) | | (1,020,240 | ) |

| | | | 81,437,514 | | $ | 10,652,026 | |

| The allocation of purchase price is based on management’s estimates of the fair value of the assets acquired and liabilities assumed at the date of acquisition, April 2008. |

| | |

| Effective July 1, 2008, a Black Economic Empowerment (“BEE”) company Liberty Lane Investments (Pty) Ltd, part of the African Vanguard group, acquired a shareholding of 26% by subscribing for shares in Saxendrift. The acquisition was financed by Rockwell Resources RSA (Pty) Ltd and will therefore only result in a reduction of shareholding to 74% once the loan is paid. The Company continues to maintain good standing with its BEE partner and is operating under the terms of its BEE agreement, including the appointment of a director to its Board. |

| | |

| 8. | Rockwell's principal capital expenditures and exploration expenditures in the fiscal years ended February 28, 2009, May 31, 2007, and nine months ended February 29, 2008 are as follows: |

| | | | | | | | | | | | | Exploration | | | | |

| | | | Exploration | | | Mineral | | | | | | Expenditures | | | | |

| | | | Expenditures | | | Property | | | | | | Expensed | | | Mineral | |

| | | | Deferred | | | Acquisition | | | Property, Plant | | | (excluding related | | | Property | |

| | | | (capitalized | | | Cost | | | and Equipment | | | stock-based | | | Acquisitions | |

| | Year | | or invested) | | | Capitalized | | | Acquired | | | compensation) | | | Expensed | |

| | 2009 | | nil | | $ | 5,351,500 | | $ | 18,937,995 | | $ | 498,739 | | | nil | |

| | 2008 | | nil | | $ | 1,822,138 | | $ | 26,751,592 | | $ | 604,169 | | | nil | |

| | 2007 | | nil | | $ | 18,696,487 | | $ | 46,340,914 | | $ | 1,371,351 | | | nil | |

The Company held a 100% interest in the Ricardo Property, a copper prospect located within the Calama Mining District, Chile that it acquired in 1998. Exploration was carried out by two companies who optioned the property in 2000 and 2004. Since that time, Rockwell has sought partners to continue exploration or to divest of the property. In July 2008, the Ricardo property was acquired by Hunter Dickinson Acquisitions Inc., a company with certain directors and officers in common with Rockwell. No significant divestitures have occurred in the years presented.

| 9. | No principal capital expenditures are currently anticipated for the ensuing year. |

– Page 14 –

| 10. | Pala Takeover bid - September 9, 2008 |

| | | |

| On September 9,2008, Pala Investment limited (“Pala”), a Swiss based investment fund with a significant shareholding holding (approximately 17%) in Rockwell through its indirect wholly- owned subsidiary 0833824 B.C. Ltd., made an unsolicited offer to purchase all of the outstanding common shares of Rockwell for $0.36 per share. |

| | | |

| In response to the offer, the Board of Directors established a special committee of its independent directors. The special committee, assisted by its independent financial and legal advisors, carefully reviewed and considered all aspects of Pala’s offer and, based on that review, unanimously recommended that Rockwell shareholders should reject the offer as it fell significantly short of providing fair value. |

| | | |

| The Board of Directors’ rejected the bid for following key reasons: |

| | | |

| | The offer significantly undervalued Rockwell’s asses and growth potential; |

| | The Special Committee’s independent financial advisor had determined that the consideration under the Offer was inadequate, from a financial point of view, to Shareholders; |

| | The Offer was highly conditional; and |

| | The timing of the offer was opportunistic |

| | | |

| Following concerted efforts by Pala to mobilize existing and new shareholders to accept its offer, Pala withdrew its hostile bid in November 3, 2008, thereby ending the hostile bid process that they had initiated on September 9, 2008. |

| | |

| This permitted Rockwell, and its Directors and Management to proceed with the normal business of the Company. |

| | | |

| Pala request for a special general meeting – April 29, 2009 |

| | | |

| In a further effort to take control of Rockwell following their previous hostile bid process for Rockwell, Pala announced on April 29, 2009 that it had called a Special General Meeting (the “meeting”) of the common shareholders of Rockwell to be held on June 17th, 2009, in Vancouver British Columbia, Canada. |

| | | |

| Pala proposed three resolutions to be passed by Shareholders at the meeting. The three Resolutions were as follows: |

| | 1. | To consider and, if deemed advisable, to pass a special resolution of the shareholders to remove all the directors of the Company, in particular David Copeland (chairman), Mark Bristow, and John Bristow |

| | | |

| | 2. | To elect new directors of the Company in place of the removed directors comprising: of Marthinus Von Wielligh, Phillip Reynolds, Sandile Zungu, Hennie van Wyk, William Fisher, Terrence Janes, and Greg Radke. |

| | | |

| | 3. | To amend and then terminate the Company’s Shareholder Rights Plan Agreement |

– Page 15 –

In response to the Pala call for the Meeting, The Executive Directors of Rockwell comprising David Copeland, John Bristow, and Mark Bristow issued a circular opposing the Pala Circular and presenting four Resolutions for the Meeting as follows:

| | 1. | That the shareholders (“they”) vote against Pala’s proposal to remove any or all of the current directors from office. |

| | | |

| | 2. | That the they vote against Pala’s proposal to amend and then terminate the |

| | | |

| | 3. | Shareholder Rights Plan. |

| | | |

| | 4. | That shareholders vote to support a fair rights offering. |

| | | |

| | 5. | That shareholders vote for the denying Pala its expenses for requisitioning, calling and holding the meeting. |

At the Special General Meeting held in Vancouver on June 17th, 2009, counsel advised that Resolution #3 be removed from the meeting and vote count, and following the collation of the results it emerged that all of the proposals put forward by Pala were rejected by shareholder vote. Approximately 74% of the Company’s issued and outstanding votes were voted by proxy at this meeting, and in summary 57.33% of these shareholders voted against the removal of one or more of the current Directors, 62.0% voted to continue the Shareholder Rights Plan, and 57.14% voted to direct Rockwell not to reimburse Pala costs associated with the Meeting.

Given the outcome of the votes cast by Shareholders at the Meeting Pala’s proposal to remove the incumbent Directors and Management of Rockwell was convincingly defeated and the Company and its Directors thus received a strong mandate to continue with the management of the Company’s business.

Subsequent to this meeting Terence Janes and Greg Radke, Pala’s representatives on the Rockwell board, resigned from the Board of Rockwell.

B. Business Overview

Durnpike Agreement

On June 30, 2006, the Company entered into an Agreement-in-Principle to acquire interests and/or rights in the Holpan/Klipdam Property in South Africa, Wouterspan Property in South Africa, Kwango River Project in the DRC and Galputs Minerale Project in South Africa. Pursuant to the terms of a comprehensive agreement, (“the Definitive Agreement”), the Company acquired all of the shares in and claims on shareholder’s loan account of Durnpike, a private South African company, from eight vendors (the “Vendors”). Some of the underlying rights were held by the H Van Wyk Diamonds (“HVWD”) and Van Wyk Trust, collectively the Van Wyk Diamond Group (“VWDG”). For further details on these see the Notes to the Financial Statements.

Pursuant to the Definitive Agreement:

- The Company acquired from the Vendors all of their shares in and claims on loan account against Durnpike for consideration of ZAR 39.8 million ($6.1 million), payable in common shares of the Company on the earlier of (i) the date of the JSE listing; and (ii) within approximately 12 months from signature of the Definitive Agreement. By virtue of such acquisition, the Company acquired Durnpike’s interests in the four alluvial diamond properties in South Africa. The ZAR consideration did not include payment in respect of the Kwango River Project, which payment stood to be made by the Company only when (and if) the feasibility study referred to below has been completed and approved by the board of directors of the Company.

On November 30, 2007, the Company began trading on the JSE and hence completed its JSE listing condition. Consequently, the Company issued 7,848,663 Common Shares as settlement of its commitment and also 1,676,529 Common Shares as finder fees relating to the Durnpike acquisition.

– Page 16 –

- Durnpike’s interest in the Kwango River Project was constituted by an agreement concluded in 2006 (“Midamines Agreement”) with Midamines SPRL (“Midamines”), the holder of the exploration permit on the Kwango River Project, to act as contractor on behalf of Midamines to manage and carry out exploration and mining. Durnpike was entitled to an 80% share of the net revenue from the sale of any diamonds produced from the contract area.

Under the Midamines Agreement, Durnpike agreed to certain minimum royalty payments being made to Midamines, and Midamines undertook several obligations in favour of Durnpike including that of procuring and facilitating Durnpike’s access to the Kwango River Project site. The royalties took the form of a series of recurring annual minimum royalty payments of US$1,200,000 per annum (commencing on December 31, 2007). During 2008, pursuant to an amending agreement to the Midamines Agreement, the Company paid consideration of $600,000 to Midamines in order to increase the size of the concession (Permit 331). As part of such amending agreement Midamines waived its right to payment of the abovementioned US$1,200,000 royalty payment on 31 December 2007. Subsequently, and pursuant to Midamines’ persistent breach of material provisions of the Midamines Agreement (coupled with its failure to remedy such instances of breach notwithstanding notice to do so), Durnpike cancelled the Midamines Agreement and claimed damages.

Midamines has subsequently disputed Durnpike’s entitlement to cancel the Midamines Agreement and has demanded payment of US$1.2 million as well as other amounts which have not yet been particularized. Midamines has threatened to refer the dispute to arbitration and to joint Rockwell as party thereto, but no formal referral to arbitration has as yet been forthcoming.

- As provided for in the Definitive Agreement, the Company executed an agreement in relation to the acquisition of control of the mineral rights relating to the Galputs Minerale Project. For the Galputs deal to be fulfilled the condition precedent was that the South African Department of Minerals and Energy had to give its written approval to transfer the shares from the vendor to the purchaser by no later than May 31, 2008. No written approval was obtained, so this acquisition was not completed.

Makoenskloof property acquisition

In conjunction with the acquisition of Durnpike, HCVW had an option agreement to acquire the Makoenskloof alluvial diamond project in South Africa. As a result of the acquisition of HCVW by Durnpike, and concurrent acquisition of Durnpike by Rockwell, the Company assumed the option to purchase the Makoenskloof property. In November 2006, HCVW exercised its option to purchase the property and the company that held the mineral rights of the Makoenskloof property. The Company paid a total consideration of ZAR 19 million ($2.7 million) for the property and associated equipment.

A bulk sampling program was carried out during fiscal 2008. The property has been on care and maintenance since that time.

– Page 17 –

Middle Orange River Operations (“MORO”) Agreement

In March 2007, Rockwell and Trans Hex and its subsidiary THO announced that the companies had entered into an agreement whereby Rockwell’s wholly owned South African subsidiary, Rockwell RSA, would acquire the MORO from Trans Hex (“the Transaction”). Pursuant to the terms of the Transaction, Trans Hex was to transfer all its relevant mineral rights and associated assets into a new special purpose vehicle Saxendrift Mine Pty (Ltd) which Rockwell acquired via Rockwell RSA.

The MORO include:

the rights to prospect and explore for and/or mine precious stones and/or other minerals and/or metals held directly or indirectly by THO in the Saxendrift area (described above);

substantial indicated and inferred mineral resources;

the material plant, machinery, equipment and other movable assets owned and/or used by THO - These operating assets were independently valued by Manhattan Mining Equipment (Pty) Limited in April 2005 at ZAR 53.3 million ($8.0 million);

the employees of THO in terms of Section 197 of South Africa’s Labour Relations Act of 1995; and

a rehabilitation liability which will be taken over by Rockwell on the basis that the tailings and other heaps of unprocessed diamond bearing middlings gravel and Rooikoppie gravels will be reprocessed by Rockwell to recover contained diamonds. The plan is to process the material and simultaneously rehabilitate these areas.

The Transaction was substantially completed in April 2008 when the Ministerial consent to transfer the Saxendrift mining right, as well as prospecting rights in respect of the Kwartelspan, Zwemkuil-Mooidraai and part of the Remhoogte-Holsloot projects, was obtained. Cession of the Niewejaarskraal mining right occurred on March 4, 2009, and a payment of ZAR 18,901,294 ($2.4 million) plus interest of ZAR 2,381,294 ($0.3 million). Rockwell chose not to exercise the option on the Remhoogte prospecting right due to current harsh financial constraints and depressed diamond prices. All the other rights have been ceded to Saxendrift Mine (Pty) Ltd and Rockwell Resources RSA has taken ownership of the company.

Farhom Property

On July 30, 2007, H.C. Van Wyk Diamonds acquired 100% of the shares and shareholder loans of Farhom Mining & Construction (Pty) Ltd for ZAR10 million ($1.5 million). This company holds the mineral rights over the Farhom farm which is part of the Wouterspan property. This transaction was concluded in terms of an option granted to HCVW on February 24, 2005 and later amended on July 10, 2007.

Black Economic Empowerment Holdings (“BEE”) in Holpan, Klipdam and Wouterspan Properties

During the year ended May 31, 2007, African Vanguard Resources (Proprietary) Limited (“AVR”), the holding company of Richtrau No 136 (Proprietary) Limited (“Richtrau”) purchased through Richtrau a 15% interest in the VWDG from the Van Wyk Trust for an amount of ZAR22.5 million ($3.4 million). During November 30, 2008 AVR indicated its commitment to increase its shareholding in the VWDG to 26% by subscribing for an additional 11% shares in each of the entities comprising the VWDG. The additional 11% stake was acquired by another subsidiary of AVR at a subscription price of ZAR 17.5 million.

– Page 18 –

The AVR group was also contractually committed to inject ZAR 10.5 million in working capital into the VWDG. Given the credit crunch, depressed economic conditions and fall in diamond prices the AVR group indicated to the Board of Directors of Rockwell RSA (the holding company of the entities in VWDG) during the fourth quarter that it was unable to make these payments and that it would pursue funding mechanisms to complete its obligations. Rockwell RSA has endeavoured to identify alternate sources of funding with a view to assist AVR to complete its investment but these attempts were, unsuccessful. Rockwell RSA has entered into discussions with AVR and the Department of Minerals and Energy with the assistance of its legal counsel to address completion of the BEE participation in the share capital of the entities comprising the VWDG.

Hunter Dickinson Services Inc.

Hunter Dickinson Services Inc. ("HDSI") provides management services to Rockwell, pursuant to a geological and administrative services agreement dated January 1, 2001. HDSI is one of the larger independent mining exploration groups in North America and employs or retains staff or service providers substantially on a full-time basis. These individuals include professional technical staff (which include accredited professional engineers and geoscientists), professionally accredited accountants and administrative, office and field support staff.

HDSI has supervised mineral exploration projects throughout Canada and internationally in Brazil, Chile, China, the United States (Nevada and Alaska), Mexico and South Africa. HDSI allocates the costs of staff input into projects based on time records of involved personnel. Costs of such personnel and third party contractors are billed to the participating public companies on a full cost recovery basis (inclusive of HDSI staff costs and overhead) for amounts that are considered by Rockwell's management to be competitive with arm's-length suppliers. The shares of HDSI are owned equally by each of the participating corporations (including Rockwell) as long as HDSI services are being provided. However, should the Company terminate the service agreement, the Company will be required to surrender its single share at the time of termination pursuant to the terms of the service agreement. HDSI is managed by certain directors of Rockwell and who are generally also directors of the other corporate participants in similar arrangements with HDSI.

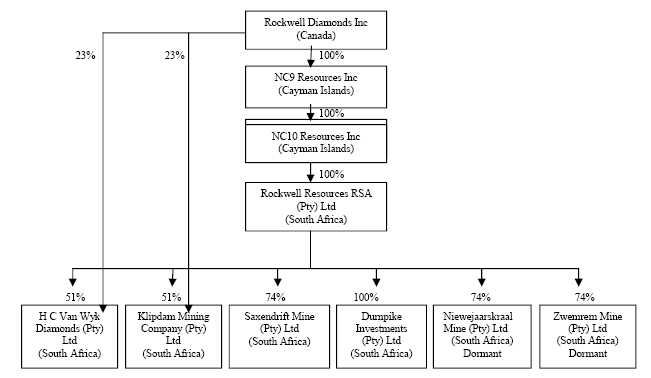

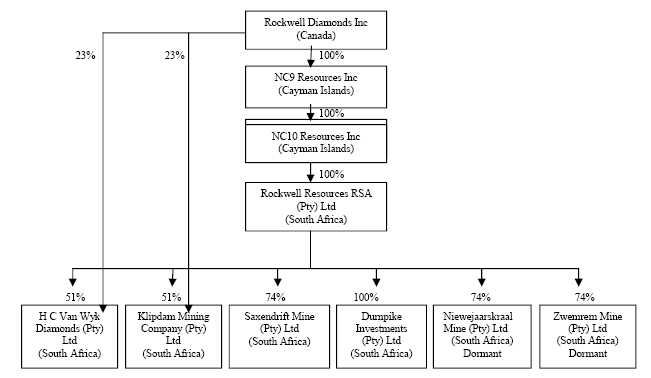

C. Organizational Structure

Rockwell Diamonds Inc is based in British Columbia, Canada. It also has corporate offices located in Johannesburg, South Africa. As at August 21, 2009, Rockwell had the following subsidiaries:

| | a) | N9C, a wholly owned subsidiary incorporated under the laws of the Cayman Islands of which Rockwell owns a direct 100% interest |

| | | |

| | b) | N10C, a wholly owned subsidiary incorporated under the laws of the Cayman Islands of which N9C owns a direct 100% interest |

| | | |

| | c) | Rockwell Resources RSA (Pty) Ltd. (“Rockwell RSA”), a wholly owned subsidiary incorporated under the laws of the South Africa of which N10C owns a direct 100% interest. Rockwell RSA holds a 51% interest and Rockwell Diamonds Inc holds 23% in both HC Van Wyk Diamonds Ltd and Klipdam Mining Company Ltd. |

– Page 19 –

| | d) | Durnpike Investments (Pty) Ltd (“Durnpike”) a wholly owned subsidiary incorporated under the laws of the South Africa of which Rockwell Resources RSA owns a direct 100% interest. |

| | | |

| | e) | HC Van Wyk Diamonds Ltd (“HCVW”) is a subsidiary incorporated under the laws of the South Africa of which Rockwell Resources RSA owns a direct 51% interest and of the Van Wyk Diamond Group (“VWDG”) assets. HC Van Wyk Diamonds Ltd is a diamond producer that conducts diamond exploration and mining on the Holpan/Klipdam properties, as well as mining on the Wouterspan and Makoenskloof properties. |

| | | |

| | f) | Klipdam Mining Company Ltd. (“Klipdam Mining”) is a subsidiary incorporated under the laws of the South Africa of which Rockwell Resources RSA owns a direct 51% interest. Of the VWDG assets. Klipdam Mining Company Ltd is a diamond producer that conducts diamond exploration and mining on the Klipdam property. |

| | | |

| | g) | Saxendrift Mine (Pty) Ltd a subsidiary incorporated under the laws of the Republic of South Africa of which Rockwell RSA, in April 2008, acquired a 74% interest. Saxendrift Mine (Pty) Ltd is a diamond producer that conducts diamond exploration and mining on the Saxendrift and Niewejaarskraal properties. |

| | | |

| | h) | The current organization structure of Rockwell is as follows: |

The Company’s legal registered office is in care of its Canadian attorneys Lang Michener LLP, Barristers & Solicitors, at Suite 1500, 1055 West Georgia Street, Vancouver, British Columbia, Canada V6E 4N7, telephone (604) 689-9111, facsimile (604) 685-7084. The South African head office of the Company is located at Level 1, Wilds View, Isle of Haughton, Cnr. Carse O’Gowrie and Boundary Road, Houghton Estate, Johannesburg 2198, telephone 27 (11) 481-7250, facsimile 27 (11) 481-7247. The Canadian head office of Rockwell is located at Suite 1020, 800 West Pender Street, Vancouver, British Columbia, Canada V6C 2V6, telephone (604) 684-6365, facsimile (604) 684-8092.

– Page 20 –

D. Property, Plant and Equipment

Rockwell has plant and equipment located on its Holpan, Klipdam, Wouterspan, Makoenskloof and Saxendrift properties as at February 28, 2009.

| | | As at February 28, 2009 | |

| | | Cost | | | Accumulated | | | Net book | |

| | | | | | Amortization | | | value | |

| | | | | | and | | | | |

| | | | | | Impairments | | | | |

| Land and Buildings | $ | 5,822,677 | | $ | 228,591 | | $ | 5,594,086 | |

| Processing plant and equipment | | 52,090,193 | | | 15,102,720 | | | 36,987,473 | |

| Processing plant and equipment under capital lease obligation | | 21,374,971 | | | 5,931,733 | | | 15,443,238 | |

| Office equipment | | 859,678 | | | 302,618 | | | 557,060 | |

| Vehicles and light equipment | | 1,579,592 | | | 592,263 | | | 987,329 | |

| Vehicles and light equipment under capital lease obligation | | – | | | – | | | – | |

| | $ | 81,727,111 | | $ | 22,157,925 | | $ | 59,569,186 | |

Glossaryof terms

Geological Terms

| NI 43-101 | National Instrument 43-101, the national securities law instrument in Canada respecting standards of disclosure for mineral projects. |

| Alluvial deposit | Accumulation of mineralization as a result of deposition in a river or stream. |

| Mineral Resource | A concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal, and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge.

The mineral deposit classifications in this annual report on Form 20F adheres to the resource/reserve definitions and classification criteria developed in 2005 by the Canadian Institute of Mining as required under NI 43-101. Estimated mineral resources fall into two broad categories dependent on whether the economic viability of them has been established and these are namely “resources” (economic viability not established) and ore “reserves” (viable economic production is feasible). Resources are sub-divided into categories depending on the confidence level of the estimate based on the level of detail of sampling and geological understanding of the deposit. The categories, from lowest confidence to highest confidence, are inferred resource, indicated resource and measured resource. Reserves are similarly sub-divided by order of confidence into probable (lowest) and proven (highest). |

– Page 21 –

| Inferred Mineral Resource | The part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. |

| Indicated Mineral Resource | The part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics, can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. |

| Measured Mineral Resource | The part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. |

| SAMREC | South African Mineral Resource Code |

Measurement

Conversion of metric units into imperial equivalents is as follows:

| Metric Units | Multiply by | Imperial Units |

| hectares | 2.471 | = acres |

| meters | 3.281 | = feet |

| kilometers | 0.621 | = miles (5,280 feet) |

| grams | 0.032 | = ounces (troy) |

| tonnes | 1.102 | = tons (short) (2,000 |

| grams/tonne | 0.029 | = ounces (troy)/ton |

Mining in the Republic of South Africa

South Africa has recently undergone major constitutional changes to effect majority rule, and also to effect mineral title. Accordingly, many laws may be considered relatively new, resulting in risks such as possible misinterpretation of new laws, modification of mining or exploration rights, operating restrictions, increased taxes, environmental regulation, mine safety and other risks arising out of a new sovereignty over mining, any or all of which could have an adverse impact upon Rockwell. Rockwell's operations may also be affected in varying degrees by political and economic instability, crime, fluctuations in currency exchange rates and inflation.

– Page 22 –

Changes, if any, in mining or investment policies or shifts in political attitude in South Africa may adversely affect Rockwell's operations or likelihood of future profitability. Operations may be affected in varying degrees by government regulations with respect to, but not limited to, restrictions on production, price controls, export controls, currency remittance, income taxes, expropriation of property, foreign investment, maintenance of claims, environmental legislation, land use, land claims of local people, water use and mine safety.

The political situation in South Africa introduces a certain degree of risk with respect to Rockwell's activities. The Government of South Africa exercises control over such matters as exploration and mining licensing, permitting, exporting and taxation, which may adversely impact on Rockwell's ability to carry out exploration, development and mining activities. Failure to comply strictly with applicable laws, regulations and local practices relating to mineral right applications and tenure could result in loss, reduction or expropriation of entitlements or in the imposition of additional local or foreign parties as joint venture partners with existing or other interests.

Government Regulation

The exploration and mining activities of Rockwell are subject to various South African national, provincial and local laws governing prospecting, development, production, taxes, labour standards and occupational health, mine safety, toxic substance and other matters. Exploration activities and mining are also subject to various national, provincial and local laws and regulations relating to the protection of the environment. These laws mandate, among other things, the maintenance of certain air and water quality standards, and land reclamation. These laws also set forth limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Although Rockwell's activities are currently carried out in accordance with all applicable rules and regulations, to the best of its knowledge and belief no assurance can be given that new rules and regulations will not be enacted or that existing rules and regulations will not be applied in a manner which could limit or curtail production or development. Amendments to current laws and regulations governing operations and activities of exploration, mining and milling or more stringent implementation thereof could have a material adverse effect on Rockwell's business, results of operation and financial condition.

The mining industry in South Africa, where the Company's projects are located, is subject to extensive regulation. The regulatory environment is developing, lacks clarity in a number of areas and is subject to interpretation, review and amendment as the mining industry is further developed and liberalized. In addition, the regulatory process entails a public comment process, which makes the outcome of legislation and regulatory controls uncertain and may cause delays in the regulatory process.

In October 2006, the Government of South Africa released theMineral and Petroleum Resources Royalty Bill 2006(the "Royalty Bill") and theDiamond Export Levy Bill 2006(the "Export Levy Bill"). The Royalty Bill requires that companies extracting diamonds pay a royalty of 5% from the sales of those metals, payable on gross revenue.

In order to address inequalities to Historically Disadvantaged Persons ("HDP") engendered by South Africa's former apartheid system, the South African government has initiated certain government empowerment initiatives (See discussion inRisk Factors).

– Page 23 –

Basis for Unit of Production and Depletion of Mineral Resources by Rockwell

No guidelines have been established for mineral reserves in alluvial diamond deposits because diamond distribution in the deposit is not uniformly distributed. In addition, the size and quality of the diamonds (and hence the value) may vary.

Diamond resources are established by drilling on a regular pattern across an area to assess the volume of gravel units and taking several bulk samples that are processed to assess the number of diamonds, ie estimate the grade over the volume of gravel drilled. Detailed assessments of the distribution of the size and quality of diamonds in the bulk samples are also done.

- Rockwell uses a 2mm size cut off to establish grade for resource estimates.

- Rockwell’s grades for resource estimates incorporate losses due to mining dilution and process efficiencies.

- Mineral resources are sate for 100% ownership. All mines are owned 74% by Rockwell as indicated in the Form 20-F on Page 19 Section B Business Overview.

- The achieved value of the diamonds sales from bulk sampling or mining is used to represent the average diamond value for the resource at the time of the estimate.

Trial mining (and processing) commonly occurs after drilling to increase the comfort that the gravel unit is adequately diamondiferous to support the cost of extraction and processing.

Once mining is underway, the information from processing each year is used to inform the resource estimate, and the grade (and value per carat received) is adjusted to reflect the actual results. Depletion of mineral resources is calculated using the carats produced as the numerator and estimated carat resource available as the denominator.

HCVW1 and Klipdam

Period

| Calculation

| Depletion

Percentage |

| February 1, 2007 to May 2007 | 7007 /387,921 | 1.80% |

| June 2007 to February 2008 | 17,746 /387,921 | 4.58% |

| March 2008 to Feruary 2009 | 15,066 /387,921 | 3.88% |

| Total | 39,820 /387,921 | 10.26% |

Saxendrift

Period

| Calculation

| Depletion

Percentage |

| February 1, 2007 to May 2007 | 0/103,155 | 0.00% |

| June 2007 to February 2008 | 0/103,155 | 0.00% |

| March 2008 to Feruary 2009 | 2,437 /103,155 | 2.36% |

| Total | 2,437 /103,155 | 2.36% |

– Page 24 –

Annual Production

| Productiion Periods (Carats) | HCVW1 & Klipdam | Saxendrift | Total Production |

| February 1, 2007 to May 2007 | 7,007 | | 7,007 |

| June 2007 to February 2008 | 17,746 | | 17,746 |

| March 2008 to Feruary 2009 | 15,066 | 2,437 | 17,503 |

| | 39,820 | 2,437 | 42,257 |

1HCVW are operations acquired from HC van Wyk, including Holpan and Wouterspan mines and Makoenskloof project.

Estimated resources available at Rockwell Mines as at February 28, 2009

| Holpan and Klipdam Mineral Resources | | | | | | | |

| | | | | | | Estimated Carats Available |

| Inferred Resources | Indicated Resources | | | | Inferred Resources | Indicated Resources | Total |

| Description of Gravel Resource | Volume | Volume | Grade | Value | | | | |

| (cubic meters) | (cubic meters) | (carats/100 cubic meters) | (US$/carat) | | | | |

| Holpan Fluvial- alluvial Gravel | 294,000 | | 0.74 | 2008 - 1,157 | | | | |

| | 2,176 | | 2,176 |

| Holpan Rooikoppie gravel | 5,643,000 | 1,137,273 |

| 2009# - 671 | | 41,758 | 8,416 | 50,174 |

| Klipdam Fluvial- alluvial Gravel | 1,504,163 | | 0.91 | 2008 - 3,892 | | | | - |

| | 13,688 | | 13,688 |

| Klipdam Rooikoppie gravel | 1,312,000 | 1,135,229 |

| 2009# - 915 | | 11,939 | 10,331 | 22,270 |

| TOTAL | 8,753,163 | 2,272,502 | 0.84 | | | 69,561 | 18,746 | 88,307 |

| | | | | | | | | |

– Page 25 –

| Wouterspan Mineral Resources | | | | | | | |

| | | | | | | Estimated Carats Available |

| Inferred Resources | Indicated Resources | | | | Inferred Resources | Indicated Resources | Total |

| Description of Gravel Resource | Volume | Volume | Grade2 | Value3 | | | | |

| (cubic meters) | (cubic meters) | (carats/100 cubic meters) | (US$/carat) | | | | |

| Rooikoppie | 5,911,000 | 716,769 | 0.7 | 1,511 | | 41,377 | 5,017 | 46,394 |

| Fluvial- alluvial | 31,863,000 | 4,311,167 | | 223,041 | 30,178 | 253,219 |

| TOTAL | 37,774,000 | 5,027,936 | 0.7 | 1,511 | | 264,418 | 35,196 | 299,614 |

| | | | | | | | | |

| | | | | | | 333,979 | 53,942 | 387,921 |

| Saxendrift Mineral Resources | | | | | | | | |

| | | | | | | Estimated Carats Available |

| MINING AREA | RESOURCE | Volume | Grade | Value | | | | |

| CLASSIFICATION | (cubic meters) | (carats/100 cubic meters) | (US$/carat) | | Inferred Resources | Indicated Resources | Total |

| Saxendrift Terrace A | Indicated 1 | 804,945 | 1.32 | 2,154 | | | 10,625 | 10,625 |

| Indicated 2 | 2,483,494 | 0.8 | | | 19,868 | 19,868 |

| Saxendrift Terrace B | Indicated | 1,774,660 | 1.15 | 1,540 | | | 20,409 | 20,409 |

| | | | | | | | | |

| TOTAL Indicated | 5,063,099 | 1.01 | | | | | - |

| Saxendrift Terrace A | Inferred | 3,629,127 | 0.8 | 1,540 | | 29,033 | | 29,033 |

| Saxendrift Terrace B | Inferred | 86,476 | 0.68 | 1,540 | | 588 | | 588 |

| Stockpiles | Inferred | 642,540 | 0.29 | 2,154 | | 1,863 | | 1,863 |

| TOTAL Inferred | 4,358,143 | 0.72 | | | 31,484 | 50,902 | 82,386 |

– Page 26 –

Kwartelspan Mineral

Resources |

|

|

|

|

|

|

|

| | | | | | Estimated Carats Available |

Resource classification | Volume | Grade | Value | | | | |

(cubic

meters) | (carats/100

cubic

meters) |

(US$/carat) |

| Inferred

Resource

$ | Indicated

Resources

| Total

|

| Inferred | 1,384,577 | 1.5 | 793 | | 20,768.66 | | 20,769 |

| | | | | | | | |

| | | | | | 52,253 | 50,902 | 103,155 |