SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to Section 240.14a-12 |

IVAX Diagnostics, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

IVAX Diagnostics, Inc.

2140 North Miami Avenue

Miami, Florida 33127

June 14, 2004

Dear Stockholder:

You are cordially invited to attend the 2004 Annual Meeting of Stockholders of IVAX Diagnostics, Inc., which will be held on July 14, 2004 at 10:00 a.m., local time, at the headquarters of IVAX Corporation at 4400 Biscayne Boulevard, Miami, Florida 33137.

At the Annual Meeting, holders of our Common Stock will: (1) elect three directors to our Board of Directors, and (2) consider any other business that may be properly brought before the Annual Meeting.

The Notice of Annual Meeting and Proxy Statement, which are contained in the following pages, more fully describe the actions to be considered by stockholders at the Annual Meeting.

Our Board of Directors recommends that you vote your shares “FOR” the election of each of the three nominees to the Board of Directors named in the following pages. IVAX Corporation holds approximately 72% of our issued and outstanding Common Stock and has advised us that it intends to vote all shares of Common Stock owned by it “FOR” the election of the three nominees to the Board of Directors named in this Proxy Statement. Accordingly, the election of each of the nominees nominated by the Board of Directors is assured.

Whether or not you plan to attend the Annual Meeting, and regardless of the size of your holdings, you are encouraged to promptly sign, date and mail the enclosed proxy in the pre-stamped envelope provided. Your participation is valued. The prompt return of your proxy will save additional solicitation expense and will not affect your right to vote in person in the event that you attend the Annual Meeting. Please vote today.

On behalf of our Board of Directors and our employees, I would like to express our appreciation for your continued support.

Sincerely,

Phillip Frost, M.D.,

Chairman of the Board of Directors

IVAX DIAGNOSTICS, INC.

2140 North Miami Avenue

Miami, Florida 33127

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on July 14, 2004

Notice is hereby given that the 2004 Annual Meeting of Stockholders of IVAX Diagnostics, Inc. (the “Company”) will be held at the headquarters of IVAX Corporation at 4400 Biscayne Boulevard, Miami, Florida 33137 on July 14, 2004 commencing at 10:00 a.m., local time, for the following purposes:

| | 1. | | To elect three directors to the Company’s Board of Directors, each of whom will serve for a three-year term; and |

| | 2. | | To consider such other business as may properly be brought before the Annual Meeting or any postponement or adjournment thereof. |

The foregoing matters are more fully described in the Proxy Statement which forms a part of this Notice.

Only stockholders of record at the close of business on June 10, 2004 are entitled to notice of and to vote at the Annual Meeting.

Sincerely yours,

Mark Deutsch,

Secretary

Miami, Florida

June 14, 2004

IMPORTANT: THE PROMPT RETURN OF PROXIES WILL SAVE THE COMPANY THE EXPENSE OF FURTHER REQUESTS FOR PROXIES; THEREFORE, EVEN IF YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE AND SIGN THE ENCLOSED PROXY AND RETURN IT IN THE ENVELOPE PROVIDED. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES.

IVAX DIAGNOSTICS, INC.

2140 North Miami Avenue

Miami, Florida 33127

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of IVAX Diagnostics, Inc. (the “Company”) of proxies for use at the 2004 Annual Meeting of Stockholders of the Company (the “Annual Meeting”) to be held at the headquarters of IVAX Corporation at 4400 Biscayne Boulevard, Miami, Florida 33137 on July 14, 2004 at 10:00 a.m., local time, and at any and all postponements or adjournments thereof, for the purposes set forth in the accompanying Notice of Meeting.

This Proxy Statement, Notice of Meeting and the accompanying proxy card are first being mailed to stockholders on or about June 17, 2004.

General Information

Each proxy solicited, if properly completed and received by the Company prior to the Annual Meeting and not revoked prior to its use, will be voted in accordance with the instructions contained therein. To vote by proxy, you must complete, sign and date the enclosed proxy card and return it in the prepaid envelope. Proxies received with no instructions will be voted “FOR” the election of each nominee to the Company’s Board of Directors. Although the Board of Directors is unaware of any other matter to be presented at the Annual Meeting upon which stockholders are entitled to vote, if any other matters are properly brought before the Annual Meeting, then the persons named in the proxy will vote as proxies in accordance with their own best judgment on those matters.

Any stockholder signing and returning a proxy on the enclosed form has the power to revoke it at any time before it is exercised by notifying the Secretary of the Company in writing at the address set forth above, or by submitting a proxy bearing a later date, or by attending the Annual Meeting and voting in person.

The Company will bear the expense of soliciting proxies and may reimburse brokers, banks and nominees for the out-of-pocket and clerical expenses of transmitting copies of the proxy materials to the beneficial owners of shares held of record by such brokers, banks and nominees. The Company does not intend to solicit proxies other than by use of the mail.

Record Date; Stockholders Entitled to Vote

Only holders of record of the Company’s Common Stock at the close of business on June 10, 2004 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting. If you hold your shares beneficially through a brokerage account or through a bank or other nominee, then you are considered the beneficial owner of the shares but not the record holder of the shares and your shares are held in “street name.” If you hold your shares in “street name,” then to vote your shares you must follow the voting instructions that you receive from your broker, bank or other nominee. If you hold your shares in “street name,” then you will not be entitled to vote in person at the Annual Meeting (although you will be permitted to attend), unless you have obtained a signed proxy from your broker, bank or other nominee giving you the right to vote the shares.

On the Record Date, there were 27,676,954 shares of Common Stock issued and outstanding. Holders of Common Stock are entitled to one vote per share on all matters to be considered at the Annual Meeting. IVAX Corporation, which holds approximately 72% of the issued and outstanding Common Stock, has advised the Company that it will vote all of its shares in favor of the election of each of the three nominees for director nominated by the Company’s Board of Directors. Accordingly, the election of each of these nominees is assured.

Quorum; Adjournment

The presence, in person or by proxy, of at least a majority of the issued and outstanding shares of Common Stock is necessary to transact business at the Annual Meeting. Both abstentions and “broker non-votes,” as described below, are counted as present for purposes of determining the presence of a quorum. In the event that there are not sufficient shares represented for a quorum, the Annual Meeting may be adjourned from time to time until a quorum is obtained.

Vote Required for Approval

To elect the three nominees to the Company’s Board of Directors, the affirmative vote of a plurality of the votes cast in person or by proxy at the Annual Meeting is required. There is no right to cumulative voting in the election of directors.

Voting of Proxies by Brokers

“Broker non-votes” occur when a broker, bank or other nominee who holds shares in “street name” for a beneficial owner does not have discretionary authority to vote on a matter and has not received instructions on how to vote from the beneficial owner of the shares. “Broker non-votes” and abstentions will have no effect on the election of directors.

Corporate Governance

Board of Directors. The Board of Directors met three times during the 2003 fiscal year. Each of the members of the Board of Directors attended at least 75% of the meetings of the Board of Directors and Committees on which he or she served, except Jane H. Hsiao, Ph.D., was unable to attend one of the meetings of the Board of Directors. All of the members of the Board of Directors attended the Company’s 2003 annual meeting of stockholders, although the Company has no formal policy requiring them to do so.

Under the applicable rules of the American Stock Exchange, the Company is considered a “controlled company” because IVAX Corporation owns approximately 72% of the issued and outstanding Common Stock. As a “controlled company,” the Company is not subject to certain corporate governance requirements of the American Stock Exchange, including the requirements to (i) maintain a majority of “independent” directors on the Board of Directors, (ii) have a nominating committee comprised solely of “independent” directors, or (iii) have a compensation committee comprised solely of “independent” directors. As described in more detail below, however, the Company has a compensation committee of the Board of Directors.

The Board of Directors has determined that four of the members of the Board of Directors—Jack R. Borsting, Ph.D., Glenn L. Halpryn, John B. Harley, M.D., and Jose Valdes-Fauli—are “independent” as such term is defined in the applicable rules of the American Stock Exchange relating to the independence of directors.

The Board of Directors has established an Audit Committee and a Compensation Committee.

Audit Committee. During fiscal year 2003, the Audit Committee consisted of Jose J. Valdes-Fauli, Chairman, Jack R. Borsting, Ph.D., and Glenn L. Halpryn. The Audit Committee met six times during the 2003 fiscal year. The primary responsibility of the Audit Committee is to oversee the Company’s financial reporting process on behalf of the Board of Directors and the stockholders and to report the results of its activities to the Board of Directors. The Audit Committee engages the independent auditors, approves all audit services and permitted non-audit services to be provided by the independent auditor, considers the fee arrangement and scope of the audit, reviews the financial statements and the independent auditors’ report, and reviews internal accounting procedures and controls with the Company’s financial and accounting staff. The Board of Directors has determined that all of the members of the Audit Committee are “independent” as such term is defined in the

2

applicable regulations of the Securities and Exchange Commission and rules of the American Stock Exchange relating to directors serving on audit committees. The Board of Directors determined that each of Dr. Borsting and Mr. Valdes-Fauli has the attributes, education and experience of an “audit committee financial expert,” as such term is defined in the applicable regulations of the Securities and Exchange Commission.

Compensation Committee. During fiscal year 2003, the Compensation Committee consisted of Neil Flanzraich, Chairman, Glenn L. Halpryn, and John B. Harley, M.D. The Compensation Committee met one time during the 2003 fiscal year. The Compensation Committee establishes and implements compensation policies and programs for executives of the Company, including the Chief Executive Officer, and recommends the compensation arrangements for executive management and directors. It also serves as the Stock Option Committee for the purpose of making grants of options under both of the Company’s stock option plans.

Director Nominations. As a “controlled company,” the Board of Directors is not required to, and does not, have a nominating committee. The Board of Directors believes that it is appropriate for the Company to not have a nominating committee because IVAX Corporation owns approximately 72% of the issued and outstanding Common Stock and is in a position to control the election of the Company’s directors. The Board of Directors of the Company, together with the executive management and board of directors of IVAX Corporation, performs the function of identifying and evaluating director nominees for the Company. The Board of Directors does not consider director nominees recommended by stockholders of the Company, other than those identified by IVAX Corporation. While the Board of Directors has not established specific, minimum qualifications, qualities or skills that a director nominee is required to have, the Board of Directors generally considers: (i) the size of the Board of Directors best suited to fulfill its responsibilities, (ii) the overall composition of the membership of the Board of Director to ensure that the Board of Directors has the requisite expertise and consists of persons with sufficiently diverse backgrounds, and (iii) the reputation, independence, integrity, education, and business, strategic and financial skills of director nominees. Each of the nominees for election as a director named in this Proxy Statement was unanimously recommended by the full Board of Directors for submission to the stockholders of the Company as the Board of Directors’ nominees.

Stockholder Communications with the Board of Directors. The Board of Directors has provided a process for stockholders of the Company to send communications to the Board of Directors or to a particular director. Any stockholder who wishes to communicate with the Board of Directors or any particular director may do so by sending all such communications in writing, via United States mail, postage prepaid, to: Secretary, IVAX Diagnostics, Inc., 2140 North Miami Avenue, Miami, Florida 33127. Each stockholder writing should include a statement indicating that the sender is a stockholder of the Company and should specify whether the communication is directed to the entire Board of Directors or to a particular director. Company personnel will review all properly sent stockholder communications and will forward the communication to the director or directors to whom it is intended, attempt to handle the inquiry directly if it relates to a routine or ministerial matter, or not forward the communication if it is primarily commercial in nature or if it is determined to relate to an improper or irrelevant topic.

Code of Ethics. The Board of Directors has adopted a Code of Conduct and Ethics, which applies to all of the Company’s directors, officers and employees, and a code of ethics, also known as a Senior Financial Officer Code of Ethics, which applies to the Company’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. The Code of Conduct and Ethics and the Senior Financial Officer Code of Ethics are posted in the “Investor Relations” section of the Company’s Internet web site at www.ivaxdiagnostics.com. If the Company makes an amendment to, or grants a waiver with respect to, any provision of the Senior Financial Officer Code of Ethics, then the Company intends to disclose the nature of such amendment or waiver by posting it in the “Investor Relations” section of the Company’s Internet web site at www.ivaxdiagnostics.com or by other appropriate means as required or permitted under the applicable regulations of the Securities and Exchange Commission and rules of the American Stock Exchange.

3

PROPOSAL FOR ELECTION OF DIRECTORS

Nominees for Election as Director

The Company’s Bylaws provide that the Board of Directors shall consist of no less than one director. The Company’s Board of Directors currently consists of eight directors divided into three classes, each of which has a three year term, which terms expire in annual succession. A total of three directors will be elected at the Annual Meeting, each of whom will be elected for a term expiring in 2007. IVAX Corporation has advised the Company that it will vote all shares of Common Stock owned by it in favor of all of the nominees. If any nominee is unable to serve, which the Board of Directors has no reason to expect, IVAX Corporation has advised the Company that it will vote all shares of Common Stock owned by it for the other named nominees and for the person, if any, who is designated by the Board of Directors to replace such nominee. Accordingly, election of the nominees nominated by the Board of Directors is assured.

The following table sets forth the names and ages of the director nominees and the year during which their terms of office will expire. Each director nominee is a current director of the Company who has been nominated for re-election at the Annual Meeting.

| | | | |

Name

| | Age

| | Term of Office

|

Jack R. Borsting, Ph.D. | | 75 | | 2007 |

| | |

Phillip Frost, M.D. | | 67 | | 2007 |

| | |

Glenn L. Halpryn | | 43 | | 2007 |

The following list contains certain information with respect to the director nominees, including the principal occupation or employment for at least the previous five years and his positions or offices at the Company or its subsidiaries—Delta Biologicals, S.r.l., Diamedix Corporation, and ImmunoVision, Inc.

Jack R. Borsting, Ph.D., age 75, has served as a director of the Company since the merger of the pre-merger IVAX Diagnostics, Inc. with b2bstores.com Inc. in 2001. Dr. Borsting is Dean Emeritus and a Professor at the Marshall School of Business at the University of Southern California. From 1995 to 2001, he served as the E. Morgan Stanley Professor of Business Administration and the Executive Director of the Center for Telecommunications Management at the University of Southern California. From 1988 to 1994, he was Dean and Professor of Business Administration at the University of Southern California, Los Angeles. From 1983 to 1988, he was Dean of the University of Miami School of Business Administration. Dr. Borsting is a member of the Army Science Board and a trustee of the Rose Hills Foundation, the Los Angeles Orthopedic Hospital Foundation and MetLife Investors.

Phillip Frost, M.D., age 67, has served as the Company’s Chairman of the Board of Directors since the merger of the pre-merger IVAX Diagnostics in 2001. He has served as the Chairman of the Board of Directors and Chief Executive Officer of IVAX Corporation since 1987. He served as President of IVAX Corporation from July 1991 until January 1995. He was the Chairman of the Department of Dermatology at Mt. Sinai Medical Center of Greater Miami, Miami Beach, Florida from 1972 to 1990. He is a director of Continucare Corporation (healthcare) and Northrop Grumman Corp. (aerospace). He is Chairman of the Board of Trustees of the University of Miami and a member of the Board of Governors of the American Stock Exchange.

Glenn L. Halpryn, age 43, has served as a director of the Company since December 2002. Mr. Halpryn has been Chairman of the Board of Directors and President of Orthodontix, Inc. since April 2001. Mr. Halpryn has also been Chief Executive Officer of Transworld Investment Corporation since June 2001. Since January 1987, Mr. Halpryn has been a portfolio manager of International Venture Capital, Ltd. From 1984 to June 2001, Mr. Halpryn served as Vice President of Transworld Investment Corporation. Since 1984, Mr. Halpryn has been engaged in real estate investment and development activities, including the management, finance and leasing of

4

commercial real estate. From April 1988 through June 1998, Mr. Halpryn was Vice Chairman of Central Bank, a Florida state-chartered bank. Since February 1987, Mr. Halpryn has been the President of United Security Corporation, a broker-dealer registered with the NASD. From June 1992 through May 1994, Mr. Halpryn served as the Vice President, Secretary and Treasurer and as a director of Frost Hanna Halpryn Capital Group, Inc., a “blank check” company whose business combination was effected in May 1994 with Sterling Healthcare Group, Inc.

THE BOARD OF DIRECTORS RECOMMENDS THAT

YOU VOTE “FOR” ALL OF THE NOMINEES FOR DIRECTOR

Directors Continuing in Office

The following list contains certain information with respect to the directors continuing in office, including the principal occupation or employment for at least the previous five years and his or her positions or offices at the Company or its subsidiaries.

Giorgio D’Urso, age 69, has served as the Company’s President and Chief Executive Officer and as a director since the merger of the pre-merger IVAX Diagnostics in 2001 and had served in the same capacities with the pre-merger IVAX Diagnostics since 1996 and his term of office as a director continues until the 2006 annual meeting. He has served as President and Chief Executive Officer of Diamedix since 1993, President of Delta since 1980, and President of ImmunoVision since 1995. He has over 35 years of diagnostics industry experience. Mr. D’Urso founded Delta, and was its Managing Director from 1980 to 1998. From 1976 to 1980, Mr. D’Urso founded and served as the General Manager of Menarini Diagnostici, Florence, Italy, a division of Menarini S.A.S. Mr. D’Urso also founded and supervised Menarini Diagnosticos S.A. in Spain. From 1974 to 1976, Mr. D’Urso served as the Marketing Manager of the diagnostic division of SmithKline & French S.P.A. in Milan, Italy. From 1969 to 1974, Mr. D’Urso served as the Marketing Manager of Laboratori Travenol S.P.A. in Rome, Italy.

Neil Flanzraich, age 60, has served as a director of the Company since the merger of the pre-merger IVAX Diagnostics in 2001 and had served as a director of the pre-merger IVAX Diagnostics since September 1998 and his term of office as a director continues until the 2005 annual meeting. He has served as Vice Chairman and President of IVAX Corporation since May 1998 and as a director of IVAX Corporation since 1997. He was a shareholder and served as Chairman of the Life Sciences Legal Practices Group of Heller Ehrman White & McAuliffe from 1995 to May 1998. From 1981 to 1994, he served in various capacities at Syntex Corporation (pharmaceuticals), most recently as its Senior Vice President, General Counsel and a member of the Corporate Executive Committee. From 1994 to 1995, after Syntex Corporation was acquired by Roche Holding Ltd., he served as Senior Vice President and General Counsel of Syntex (U.S.A.) Inc., a Roche subsidiary. He is a director of RAE Systems, Inc. (gas detection and security monitoring systems) and Continucare Corporation (healthcare).

John B. Harley, M.D., age 54, has served as a director of the Company since the merger of the pre-merger IVAX Diagnostics in 2001 and his term of office as a director continues until the 2005 annual meeting. He has held various positions at the University of Oklahoma Health Sciences Center since 1982. In the Department of Medicine, his positions include Chief of Rheumatology, Allergy and Immunology Section and Vice Chair for Research, George Lynn Cross Research Professor (1999 to present), James R. McEldowney Chair in Immunology and Professor of Medicine (1992 to present), Associate Professor (1986 to 1992), and Assistant Professor (1982 to 1986). Since 1996 Dr. Harley has been an Adjunct Professor in the Department of Pathology. In the Department of Microbiology, Dr. Harley has served as Adjunct Professor (1992 to present), Adjunct Associate Professor (1988 to 1992), and Adjunct Assistant Professor (1983 to 1988). Since 1982, Dr. Harley has also been associated with the Oklahoma Medical Research Foundation’s Arthritis and Immunology Program as Program Head (1999 to present), Member (1998 to present), Associate Member (1989 to present), Affiliated Associate Member (1986 to 1989), and Affiliated Assistant Member (1982 to 1986). Dr. Harley has also served

5

as a Staff Physician (1982, 1984 to 1987 and 1992 to present), and a Clinical Investigator (1987 to 1992), Immunology Section, Medical Service at the Veterans Affairs Medical Center, Oklahoma City, Oklahoma. In 1981 and 1982, Dr. Harley was a Postdoctoral Fellow in Rheumatology with the Arthritis Branch of the National Institute of Arthritis, Diabetes and Digestive and Kidney Diseases, National Institute of Health, Bethesda, Maryland. He was also a Clinical Associate at the Laboratory of Immunoregulation, National Institute of Allergy and Infectious Diseases, National Institutes of Health, Bethesda, Maryland from 1979 to 1982.

Jane H. Hsiao, Ph.D., age 57, has served as a director of the Company since the merger of the pre-merger IVAX Diagnostics in 2001 and her term of office as a director continues until the 2005 annual meeting. She has served as IVAX Corporation’s Vice Chairman-Technical Affairs and as a director of IVAX Corporation since February 1995, as IVAX Corporation’s Chief Technical Officer since July 1996, and as Chairman, Chief Executive Officer and President of DVM Pharmaceuticals, Inc., IVAX Corporation’s veterinary products subsidiary, since March 1998. From 1992 until February 1995, she served as IVAX Corporation’s Chief Regulatory Officer and Assistant to the Chairman, and as Vice President-Quality Assurance and Compliance of IVAX Research, Inc., IVAX Corporation’s principal proprietary pharmaceutical subsidiary. From 1987 to 1992, Dr. Hsiao was Vice President-Quality Assurance, Quality Control and Regulatory Affairs of IVAX Research, Inc.

Jose J. Valdes-Fauli, age 52, has served as a director of the Company since December 2002 and his term of office as a director continues until the 2006 annual meeting. Mr. Valdes-Fauli is a private investor. From January 1998 through October 2003, Mr. Valdes-Fauli was the President and Chief Executive Officer of Colonial Bank—South Florida Region, an affiliate of Colonial BancGroup. Mr. Valdes-Fauli has been involved in the banking industry for 27 years. He is a member of the Florida International University Foundation Board of Directors. He is also Director Emeritus of the Florida Grand Opera and a director of the Bass Museum of Art, the Concert Association of Florida and the Mercy Hospital Foundation. Mr. Valdes-Fauli is also a member of the Advisory Board of New Hope Charities, Inc. and a member of the Miami-Dade County Cultural Affairs Council.

Identification of Executive Officers

The following individuals are executive officers of the Company.

| | | | |

Name

| | Age

| | Position

|

Giorgio D’Urso | | 69 | | Chief Executive Officer, President and Director |

| | |

Duane M. Steele | | 53 | | Vice President—Business Development |

| | |

Mark S. Deutsch | | 41 | | Chief Financial Officer and Vice President—Finance |

| | |

Raul F. Alvarez | | 54 | | Vice President—International Marketing and Sales |

All officers serve until they resign or are replaced or removed at the pleasure of the Board of Directors.

The following additional information is provided for the executive officers shown above who are not directors of the Company or nominees for directors.

Duane M. Steele, age 53, has served as the Company’s Vice President—Business Development since the merger of the pre-merger IVAX Diagnostics in 2001 and had served in the same capacity with the pre-merger IVAX Diagnostics since 1996. He joined Diamedix in 1995 and has over 27 years of diagnostics industry experience. He has served as the Chief Operating Officer of Diamedix since 1997. From 1995 to 1997, he served as Vice President—Business Development of Diamedix. From 1990 to 1994, he served as President and Chief Executive Officer of LaserCharge, Inc. in Austin, Texas. From 1988 to 1989, Mr. Steele was the General Manger of Austin Biological Laboratories, Inc. From 1972 to 1987, Mr. Steele held a variety of positions with Kallestad Diagnostics, Inc., including Senior Vice President.

Mark S. Deutsch, age 41, has served as the Company’s Chief Financial Officer and Vice President—Finance since the merger of the pre-merger IVAX Diagnostics in 2001 and had served in the same capacities

6

with the pre-merger IVAX Diagnostics since 1996. He has served as the Vice President—Finance of Diamedix since 1993 and has 10 years of diagnostics industry experience. From 1988 to 1993, Mr. Deutsch held various positions including Accounting Manager of IVAX Corporation and Controller of certain subsidiaries of IVAX Corporation. From 1985 to 1988, Mr. Deutsch worked for Arthur Andersen & Co. as a Senior Accountant.

Raul F. Alvarez, age 54, has served as the Company’s Vice President—International Marketing and Sales since April 2001. Prior to joining the Company, Mr. Alvarez was Vice President—International Business of Immucor, Inc. from 1998 to 2001. From 1994 to 1998, he was Vice President—International Business of Gamma Biologicals, Inc. in Houston, Texas.

Directors’ Fees

Non-employee directors of the Company do not receive cash compensation for attendance at meetings of the Board of Directors or committee meetings. Directors who are also officers of the Company or its subsidiaries do not receive additional compensation for attendance at meetings of the Board of Directors or committee meetings. Non-employee directors have in the past received automatic grants of options to purchase shares of Common Stock. During the 2003 fiscal year, non-employee directors each received a grant of options to purchase 5,000 shares of the Company’s Common Stock under the Company’s 1999 Performance Equity Plan.

Employment Agreements

On October 1, 1998, the pre-merger IVAX Diagnostics entered into a five-year employment agreement with Giorgio D’Urso, President and Chief Executive Officer, at a base annual salary of $348,519, with discretionary annual adjustments. The Company assumed this employment agreement in the merger of the pre-merger IVAX Diagnostics. The Company has extended the term of Mr. D’Urso’s employment agreement until February 24, 2006. Mr. D’Urso’s employment may be terminated with or without cause at any time upon written notice. For a termination without cause, the Company must pay Mr. D’Urso his then current annual base salary in installments for the remainder of the employment term. While employed by the Company and for a two-year period thereafter, Mr. D’Urso cannot employ or contract with any current or former employees of the Company, except former employees who have not been employed by the Company for more than one year.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors, executive officers and 10% stockholders to file initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company with the Securities and Exchange Commission and the American Stock Exchange. Directors, executive officers and 10% stockholders are required to furnish the Company with copies of all Section 16(a) reports they file. Based on a review of the copies of such reports furnished to the Company and written representations from directors and executive officers of the Company that no other reports were required, the Company believes that its directors, executive officers and 10% stockholders complied with all Section 16(a) filing requirements applicable to them for the year ended December 31, 2003, except that Mr. D’Urso inadvertently failed to file one Form 4 within two business days after acquiring an indirect ownership of securities as a result of his marriage.

Certain Relationships and Related Transactions

Upon completion of the merger of the pre-merger IVAX Diagnostics, the Company entered into a registration rights agreement with IVAX Corporation that requires the Company to file a registration statement on Form S-3 (at any time after one year, and before the earlier of five years, following the completion of the merger or such time at which all the shares of the Company’s Common Stock owned by IVAX Corporation can be sold in any three-month period without registration) to register not less than $1.0 million of the Company’s Common Stock owned by IVAX Corporation. Additionally, IVAX Corporation may “piggyback” on registrations initiated by the Company or other holders exercising similar demand registration rights. The

7

Company may delay the filing of any registration statement for 120 days if the Company determines in good faith that to effect such registration statement would be detrimental to the Company or the Company’s stockholders. The Company has agreed to pay all fees and expenses in connection with such registrations, except for any underwriting discounts and commissions. If the Company files a registration statement in connection with an underwritten offering, IVAX Corporation has agreed to sign a customary underwriting agreement in connection with such registration and its rights to register shares is subject to a proration provision if the underwriters determine that the success of the offering will be jeopardized from too many shares being included in the offering. Shares to be sold by the Company on any registered offering will be included prior to the inclusion of any other shares of the Company’s Common Stock held by IVAX Corporation. The registration rights agreement also contains customary mutual indemnification and market stand-off provisions. IVAX Corporation can assign or transfer its rights under the registration rights agreement.

In connection with the merger of the pre-merger IVAX Diagnostics, the Company entered into a shared services agreement with IVAX Corporation pursuant to which IVAX Corporation would continue to provide administrative and management services previously provided by IVAX to the pre-merger IVAX Diagnostics prior to the merger at IVAX Corporation’s cost plus 15% for a period of three months. These services may include payroll, including printing paychecks and making associated tax filings; treasury, including cash management services such as disbursements, receipts, banking and investing; insurance, including procuring and administering policies; human resources, including administering employee benefits and plans; financial reporting, including public reports, income taxes; and information systems, including network and website hosting, phone and data systems, software licenses and information systems support.

In connection with the merger of the pre-merger IVAX Diagnostics, the Company entered into a use of name license with IVAX Corporation that grants the Company a non-exclusive, royalty free license to use the name “IVAX.” IVAX Corporation may terminate the license upon 90 days’ written notice. Upon termination of the agreement, the Company must take all steps reasonably necessary to change its name as soon as is practicable. If IVAX Corporation abandons its use of the name, IVAX Corporation must transfer all rights to the name to the Company. The termination of this agreement by IVAX Corporation could have a material adverse affect on the Company’s ability to market its products and on the Company.

As a subsidiary of IVAX Corporation, the Company’s director and officer insurance coverage falls within the scope of IVAX Corporation’s director and officer insurance policy. During 2003, the Company paid $604,000 to IVAX Corporation for premium payments for the Company’s director and officer insurance coverage.

Mary Celli D’Urso, the wife of the Company’s Chief Executive Officer and President, has been employed by the Company for annual compensation of $89,250.

Giulio D’Urso, the son of the Company’s Chief Executive Officer and President, has been engaged by the Company’s subsidiaries and the Company for annual compensation of $141,715. Due to currency exchange rate fluctuations, this amount of compensation may vary from year-to-year.

On November 5, 2002, pursuant to a Redemption Agreement, the Company repurchased an aggregate of 871,473 shares of the Company’s Common Stock from Randall K. Davis (who resigned from the Company’s Board of Directors on November 4, 2002) and Titanium Holdings Group, Inc. for an aggregate purchase price of approximately $1,437,900. The repurchased shares have been retired and have resumed the status of authorized and unissued shares. Pursuant to the Redemption Agreement, the Company also granted a general release to Titanium Holdings, Randall K. Davis, Steven Etra and Richard Kandel and paid them an aggregate of approximately $217,900 for the following:

| | • | | the Company was granted an option to acquire up to an additional 657,125 shares of the Company’s Common Stock from Titanium Holdings, Steven Etra and Richard Kandel at an exercise price of $4.00 per share at any time on or before May 5, 2004, which the Company exercised on April 29, 2004, as discussed below; |

8

| | • | | the optionees agreed that, until May 5, 2004, they would not transfer the shares of the Company’s Common Stock that are subject to the option to any person or entity other than to the Company or its affiliates; |

| | • | | Titanium Holdings and Steven Etra further agreed that, until May 5, 2004, they would not transfer an additional 307,125 and 150,000 shares of the Company’s Common Stock owned by them respectively to any person or entity other than to the Company; and |

| | • | | the Company and its affiliates received general releases from Titanium Holdings, Randall K. Davis, Steven Etra and Richard Kandel. |

On April 29, 2004, the Company announced that it had exercised its right to purchase and redeem a total of 657,125 shares of the Company’s Common Stock from the optionees at an exercise price of $4.00 per share in accordance with the terms of the Redemption Agreement and that it expects this purchase and redemption to close on June 25, 2004 and for the repurchased shares to be retired and resume the status of authorized and unissued shares.

Summary Compensation Table

The following table contains certain information regarding aggregate compensation paid or accrued by the Company during 2003, 2002 and 2001 to the Chief Executive Officer and to each of the Company’s other highest paid executive officers other than the Chief Executive Officer whose total annual salary and bonus exceed $100,000.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | |

| | | | | Annual Compensation

| | Long Term Compensation

|

Name and Principal Position

| | Year

| | Salary ($)

| | | Bonus ($)

| | Shares Underlying Stock Options (#)

|

Giorgio D’Urso Chief Executive Officer | | 2003

2002

2001 | | $

$

$ | 348,519

348,519

348,519 |

| |

$ | —

—

20,000 | | —

—

— |

| | | | |

Duane M. Steele Vice President— Business Development | | 2003

2002

2001 | | $

$

$ | 150,280

141,002

139,838 |

| | $

$ | 10,233

—

18,000 | | 10,233

—

50,000 |

| | | | |

Mark S. Deutsch Chief Financial Officer | | 2003

2002

2001 | | $

$

$ | 107,170

102,065

101,763 |

| | $

$ | 5,116

—

8,000 | | 5,116

—

30,000 |

| | | | |

Raul F. Alvarez Vice President— International Sales | | 2003

2002

2001(1) | | $

$

| 110,000

110,000

— | (2)

(2)

| |

| —

—

— | | —

—

— |

| (1) | | Mr. Alvarez became the Company’s Vice President—International Marketing and Sales in April 2001. He became an executive officer for purposes of Item 402(a)(3) of Regulation S-K on January 1, 2002. |

| (2) | | Includes a commission that the Company paid to Mr. Alvarez in the amount of $30,000. |

Stock Option Grants Table

The Company did not make any stock option grants during 2003 to the executive officers named in the “Summary Compensation Table.”

9

Stock Option Exercises and Year-End Option Value Table

The following table sets forth information concerning stock option exercises during 2003 by each of the executive officers named in the “Summary Compensation Table” and the year-end value of unexercised options held by such officers and does not include any stock option exercises for shares of IVAX Corporation under the IVAX Corporation 1997 Employee Stock Option Plan.

STOCK OPTION EXERCISES IN FISCAL YEAR 2003

AND FISCAL YEAR-END OPTION VALUES

| | | | | | | | | | | | | | |

| | | Shares Acquired on

Exercise (#)

| | | | Number of Shares

Underlying Unexercised

Stock Options at Fiscal

Year-End (#)

| | Value of Unexercised In-the-Money Stock Options at Fiscal Year-End ($)

|

Name

| | | Value Realized ($)

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Giorgio D’Urso | | — | | — | | 600,000 | | — | | $ | 2,460,000 | | | — |

| | | | | | |

Duane M. Steele | | — | | — | | 120,000 | | 50,000 | | $ | 492,000 | | $ | 91,500 |

| | | | | | |

Mark S. Deutsch | | — | | — | | 36,000 | | 30,000 | | $ | 147,600 | | $ | 54,900 |

| | | | | | |

Raul F. Alvarez | | — | | — | | 12,500 | | 12,500 | | $ | 22,875 | | $ | 22,875 |

10

COMPENSATION COMMITTEE REPORT ON

EXECUTIVE COMPENSATION

Executive Officer Compensation

The Company’s compensation program for executive officers consists of three key elements: a base salary, an incentive bonus and periodic grants of stock options. The Compensation Committee believes that this approach best serves the interests of stockholders by compensating the Company’s executive officers in a manner that advances both the short and long term interests of the Company and its stockholders. Thus, compensation for the Company’s executive officers involves a portion of pay that depends on incentive payments which are earned only if corporate goals are met or exceeded and stock options which directly relate a significant portion of an executive officer’s long term remuneration to stock price appreciation realized by the Company’s stockholders. The Company must compete for the services of its executives with numerous other companies, many of which have greater financial resources and more comprehensive benefit plans than the Company’s. The Compensation Committee believes that the Company’s compensation policies are appropriate.

Base Salary

The Company offers salaries it believes are competitive based on a review of market practices and the duties and responsibilities of each executive officer. In setting base compensation, the Compensation Committee periodically examines market compensation levels and trends observed in the labor market, primarily in the healthcare industry and primarily in the geographic areas in which the Company operates. Market information is used as an initial frame of reference for annual salary adjustments and starting salary offers. Salary decisions are determined based on an annual review by the Compensation Committee with input and recommendations from the Chief Executive Officer for executive officers other than the Chief Executive Officer. Salary determinations are made based on, among other things, the decision making responsibilities of each position, and the contribution, experience and work performance of each executive officer.

Annual Incentive Program

The Company’s management incentive program is designed to motivate executives by recognizing and rewarding performance. The annual incentive program is a discretionary bonus plan used to compensate executives based on the Company’s profitability and the achievement of individual performance goals with the greatest weight given to the Company’s profitability.

Each participant’s bonus is intended to take into account corporate and individual components, which are weighted according to the executive’s sphere of responsibility. The Company paid $15,349 in discretionary bonuses to the executive officers named in the “Summary Compensation Table” based upon their individual performances and the Company’s performance during 2003.

Stock Options

Stock options represent a significant portion of the total compensation for the Company’s executive officers. Stock options are generally awarded to executive officers at the time that they join the Company and periodically thereafter. Executive officers of the Company were granted stock options for the 2003 fiscal year. The granting of options is totally discretionary and options are awarded based on an assessment of an employee’s contribution to the success and growth of the Company. For executive officers other than the Chief Executive Officer, grants of stock options are generally based on the level of an executive’s position with the Company, an evaluation of the executive’s past and expected performance, the number of outstanding and previously granted options and discussions with the executive and, in addition, the Compensation Committee also considers the recommendations of the Chief Executive Officer. The Compensation Committee believes that providing executives with opportunities to acquire an interest in the future growth and prosperity of the Company through

11

the grant of stock options will assist the Company in attracting and retaining qualified and experienced executive officers and offer additional long term incentives. The Compensation Committee believes that utilization of stock options more closely aligns the executives’ interests with those of the Company’s stockholders because the ultimate value of such compensation is directly dependent on the stock price.

Compensation of the Chief Executive Officer

As previously indicated, the Compensation Committee believes that the Company’s total compensation program is appropriate based upon the Company’s business performance, market compensation levels, and personal performance of the Company’s executives. The Chief Executive Officer has previously entered into an employment agreement with the pre-merger IVAX Diagnostics, as described above. Under the terms of the employment agreement, the Compensation Committee reviews and fixes the base salary of the Chief Executive Officer based on those factors described above for other executive officers, as well as the Compensation Committee’s assessment of Mr. D’Urso’s past performance as Chief Executive Officer and its expectation as to his future contributions. In 2003, Mr. D’Urso did not receive a base salary increase, which was consistent with the underlying market conditions and was considered appropriate. Future salary increases and bonuses will continue to reflect the amounts paid to chief executive officers at other public companies, as well as the Company’s financial condition, operating results and attainment of strategic objectives.

The Company has noted Mr. D’Urso’s leadership during 2003, including his successful leadership in facilitating the Company’s new public structure and increasing the visibility of and interest in the Company. Accordingly, the Compensation Committee approved the extension of, and the Company has extended, the term of Mr. D’Urso’s employment agreement until February 24, 2006.

Submitted by the Members of the Compensation Committee:

Neil Flanzraich, Chairman

Glenn L. Halpryn

John B. Harley, M.D.

12

Compensation Committee Interlocks and Insider Participation

During fiscal year 2003, the Compensation Committee consisted of Neil Flanzraich, Chairman, Glenn L. Halpryn, and John B. Harley, M.D. Mr. Flanzraich is also a director and Vice Chairman and President of IVAX Corporation. IVAX Corporation owns approximately 72% of the Company’s issued and outstanding Common Stock. See “Certain Relationships and Related Transactions” above for a description of the transactions between IVAX Corporation and the Company.

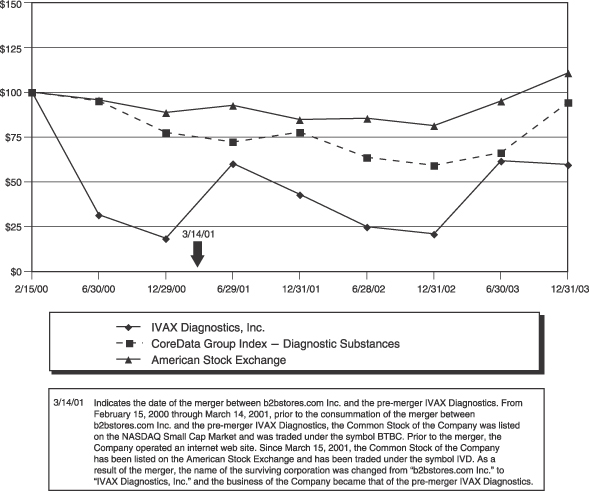

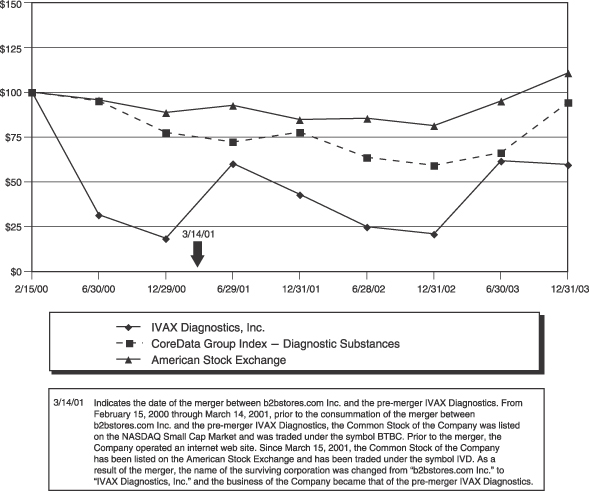

Stockholder Return Performance Graph

Set forth below are a graph and a table comparing the cumulative total returns (assuming reinvestment of dividends) for the Common Stock of the Company, the American Stock Exchange and the CoreData Industry Group Index—Diagnostic Substances. The graph and the table show semi-annual comparisons, assuming $100 was invested on February 15, 2000.

| | | | | | | | | | | | | | | | | | |

| | | 2/15/00 | | 6/30/00 | | 12/29/00 | | 6/29/01 | | 12/31/01 | | 6/28/02 | | 12/31/02 | | 6/30/03 | | 12/31/03 |

IVAX Diagnostics Inc. | | 100.00 | | 31.54 | | 18.46 | | 60.06 | | 42.83 | | 24.86 | | 20.92 | | 61.54 | | 59.45 |

CoreData Index—Diagnostic Substances | | 100.00 | | 94.81 | | 77.23 | | 71.96 | | 77.46 | | 63.42 | | 58.97 | | 66.06 | | 94.02 |

American Stock Exchange | | 100.00 | | 95.36 | | 88.40 | | 92.35 | | 84.44 | | 85.08 | | 81.07 | | 94.78 | | 110.35 |

13

AUDIT COMMITTEE REPORT

During fiscal year 2003, the Audit Committee consisted of Jose J. Valdes-Fauli, Chairman, Jack R. Borsting, Ph.D., and Glenn L. Halpryn. The Audit Committee operates under a written charter adopted and approved by the Board of Directors. The Audit Committee Charter was revised to reflect additional and enhanced practices adopted by the Audit Committee in light of the corporate governance reforms implemented under the Sarbanes-Oxley Act of 2002 by the Securities and Exchange Commission and the American Stock Exchange. A copy of the revised Audit Committee Charter is attached to this Proxy Statement as Appendix A.

The Audit Committee has reviewed and discussed the audited consolidated financial statements for the fiscal year ended December 31, 2003 with management and the Company’s independent auditors, Ernst & Young LLP (“Ernst & Young”).

The Audit Committee also discussed with the independent auditors matters required to be discussed with audit committees under generally accepted auditing standards, including, among other things, matters related to the conduct of the audit of the Company’s consolidated financial statements and the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

The Company’s independent auditors also provided to the Audit Committee the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee discussed with the independent auditors their independence from the Company. When considering Ernst & Young’s independence, the Audit Committee considered whether their provision of services to the Company was compatible with maintaining their independence. The Audit Committee also reviewed, among other things, the amount of fees paid to Ernst & Young for audit services and non-audit services.

The Audit Committee also met with the independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls and the overall quality of the Company’s financial reporting.

Based on the Audit Committee’s review and these meetings, discussions and reports, the Audit Committee recommended to the Board of Directors that the Company’s audited consolidated financial statements for the fiscal year ended December 31, 2003 be included in the Company’s Annual Report on Form 10-K.

Submitted by the Members of the Audit Committee:

Jose J. Valdes-Fauli, Chairman

Jack R. Borsting, Ph.D.

Glenn L. Halpryn

14

Principal Accountant Fees and Services

The following table sets forth the aggregate fees billed to the Company by Ernst & Young, the Company’s principal accountant, for the fiscal years ended December 31, 2003 and 2002.

| | | | | | |

| | | For the years ended

December 31,

|

| | | 2003

| | 2002

|

Audit Fees | | $ | 153,000 | | $ | 100,000 |

Audit-Related Fees | | | 12,549 | | | — |

Tax Fees | | | — | | | — |

All Other Fees | | | — | | | — |

| | |

|

| |

|

|

Total Fees | | $ | 165,549 | | $ | 100,000 |

| | |

|

| |

|

|

In the table above, pursuant to their definitions under the applicable regulations of the Securities and Exchange Commission, “audit fees” are fees for professional services rendered for the audit of the Company’s annual financial statements and review of the Company’s financial statements included in the Company’s quarterly reports on Form 10-Q and for services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements; “audit-related fees” are fees for assurance and related services that are reasonably related to the performance of the audit and review of the Company’s financial statements, and primarily include accounting consultations and audits in connection with acquisitions; “tax fees” are fees for tax compliance, tax advice and tax planning; and “all other fees” are fees for any services not included in the first three categories.

The Audit Committee of the Board of Directors is responsible for pre-approving all audit services and permitted non-audit services to be performed by the Company’s principal accountant, except in those instances which do not require such pre-approval pursuant to the applicable regulations of the Securities and Exchange Commission. The Audit Committee has established policies and procedures for its pre-approval of audit services and permitted non-audit services and, from time to time, the Audit Committee reviews and revises its policies and procedures for pre-approval.

15

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table indicates, as of May 17, 2004, information about the beneficial ownership of the Common Stock of the Company by (1) each director, (2) each executive officer named in the “Summary Compensation Table,” (3) all directors and executive officers as a group, and (4) each person who the Company knows beneficially owns more than 5% of the Common Stock of the Company. All such shares were owned directly with sole voting and investment power unless otherwise indicated. Unless otherwise indicated, the principal business address of each person listed below is 2140 North Miami Avenue, Miami, Florida 33127.

| | | | | | |

Name

| | Shares (#)(1)

| | | Percent of Class (%)

| |

IVAX Corporation 4400 Biscayne Boulevard Miami, Florida 33137 | | 20,000,000 | | | 72.3 | % |

Giorgio D’Urso | | 628,000 | (2) | | 2.3 | % |

Duane M. Steele | | 120,000 | (3) | | * | |

Mark S. Deutsch | | 36,000 | (4) | | * | |

Raul F. Alvarez | | 12,500 | (5) | | * | |

Phillip Frost, M.D. | | 52,354 | (6) | | * | |

Neil Flanzraich | | 20,000 | (7) | | * | |

Jane H. Hsiao, Ph.D. | | 15,000 | (8) | | * | |

Jack R. Borsting, Ph.D. | | 25,500 | (9) | | * | |

Glenn L. Halpryn | | 25,000 | (10) | | * | |

John B. Harley, M.D. | | 20,000 | (11) | | * | |

Jose J. Valdes-Fauli | | 20,000 | (12) | | * | |

All directors and executive officers as a group (11 persons) | | 974,354 | | | 3.5 | % |

| * | | Represents beneficial ownership of less than 1%. |

| (1) | | For purposes of this table, beneficial ownership is computed pursuant to Rule 13d-3 under the Securities Exchange Act of 1934. |

| (2) | | Includes options for 600,000 shares of common stock granted to Mr. D’Urso. Also includes options for 8,000 shares of common stock granted to Mr. D’Urso’s wife and 5,000 shares of common stock owned by Mr. D’Urso’s wife. Mr. D’Urso disclaims beneficial ownership of the stock options and shares of common stock owned by his wife. |

| (3) | | Includes options for 120,000 shares of common stock granted to Mr. Steele. |

| (4) | | Includes options for 36,000 shares of common stock granted to Mr. Deutsch. |

| (5) | | Includes options for 12,500 shares of common stock granted to Mr. Alvarez. |

| (6) | | Includes (a) options for 15,000 shares of common stock granted to Dr. Frost and (b) 37,354 shares of common stock owned by Frost Gamma Investments Trust, of which Dr. Frost is the trustee and Frost Gamma, L.P. is the sole and exclusive beneficiary. Dr. Frost is the sole limited partner of Frost Gamma, L.P. The general partner of Frost Gamma, L.P. is Frost Gamma, Inc., and the sole shareholder of Frost Gamma, Inc. is Frost-Nevada Corporation, and the sole shareholder of Frost-Nevada Corporation is Dr. Frost. Does not include any securities owned by IVAX, a corporation in which Dr. Frost is the Chairman of the Board of Directors and Chief Executive Officer and Dr. Frost disclaims beneficial ownership of securities held by IVAX. |

| (7) | | Includes options for 20,000 shares of common stock granted to Mr. Flanzraich. |

| (8) | | Includes options for 15,000 shares of common stock granted to Dr. Hsiao. |

| (9) | | Includes options for 25,000 shares of common stock granted to Dr. Borsting. |

| (10) | | Includes options for 25,000 shares of common stock granted to Mr. Halpryn. |

| (11) | | Includes options for 20,000 shares of common stock granted to Dr. Harley. |

| (12) | | Includes options for 20,000 shares of common stock granted to Mr. Valdes-Fauli. |

16

OTHER MATTERS

As of the date of this Proxy Statement, the Board of Directors is not aware of any matters, other than those referred to in the accompanying Notice of Meeting, to be brought before the Annual Meeting. However, if any other matters should properly come before the Annual Meeting, the persons named as proxy holders will have the discretion to vote any shares of Common Stock for which they hold proxies in accordance with their best judgment. If for any reason any of the nominees for election to the Board of Directors is not available as a candidate for director, the persons named proxy holders will vote any shares of Common Stock for which they hold proxies for such other candidate or candidates as may be nominated by the Board of Directors.

INDEPENDENT PUBLIC ACCOUNTANTS

Ernst & Young has been selected by the Company’s Audit Committee to serve as the Company’s independent certified public accountants for the fiscal year ending December 31, 2004. Arthur Andersen LLP (“Andersen”) acted as the Company’s independent public accountants for the fiscal year ended December 31, 2001 and for the quarter ended March 31, 2002. On June 21, 2002, upon the recommendation and approval of the Audit Committee, the Board of Directors dismissed Andersen and engaged the services of Ernst & Young as the Company’s new independent certified public accountants for the fiscal year ending December 31, 2002, effective immediately.

Andersen’s report on the Company’s consolidated financial statements as of and for the fiscal year ended December 31, 2001 did not contain an adverse opinion or a disclaimer of opinion nor was any such audit report qualified or modified as to uncertainty, audit scope or accounting principles.

During the fiscal year ended December 31, 2001 and the subsequent interim period through June 21, 2002, there were no disagreements between the Company and Andersen on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to Andersen’s satisfaction, would have caused Andersen to make reference to the subject matter of the disagreement in connection with its reports. None of the other reportable events described under Item 304(a)(1)(v) of Regulation S-K occurred within the fiscal year ended December 31, 2001 or the subsequent interim period through June 21, 2002. During the fiscal year ended December 31, 2001 and the subsequent interim period through June 21, 2002, the Company did not consult with Ernst & Young regarding any of the matters or events set forth in Item 304(a)(2)(i) and (ii) of Regulation S-K.

Representatives of Ernst & Young are expected to be present at the Annual Meeting, will have the opportunity to make a statement if they desire and will be available to respond to appropriate questions from stockholders.

17

STOCKHOLDER PROPOSALS

Proposals of stockholders intended to be presented at the next annual meeting of the Company, expected to be held in July 2005, and to be included in the Company’s proxy statement and form of proxy for that meeting must be in writing and in compliance with applicable rules and regulations and received by the Secretary of the Company at its main offices at 2140 North Miami Avenue, Miami, Florida 33127, no later than February 18, 2005. In addition to any other applicable requirements, for a stockholder to properly present any proposal at the next annual meeting of the Company, but not to be included in the Company’s proxy statement and form of proxy for that meeting, the proposal must be in writing and in compliance with the Company’s Bylaws and received by the Secretary of the Company at its main offices, as listed above, no earlier than February 18, 2005 and no later than April 16, 2005.

BY ORDER OF THE BOARD OF DIRECTORS

Mark Deutsch,

Secretary

June 14, 2004

18

Appendix A

IVAX DIAGNOSTICS, INC.

AUDIT COMMITTEE CHARTER

The primary function of the Audit Committee is to assist the Board of Directors in fulfilling its oversight responsibilities by reviewing the quality and integrity of the Corporation’s financial reports, the Corporation’s systems of internal controls regarding finance and accounting, and the Corporation’s auditing, accounting and financial reporting processes generally. The Audit Committee’s primary duties and responsibilities are to:

| | • | | Serve as an independent and objective party to monitor the Corporation’s financial reporting process and internal control system. |

| | • | | Review and appraise the audit efforts of the Corporation’s independent accountants and internal auditing function. |

| | • | | Provide an open avenue of communication among the independent accountants, financial and senior management, the internal auditing function, and the Board of Directors. |

The Audit Committee will primarily fulfill these responsibilities by carrying out the activities enumerated in Section III of this Charter.

The Audit Committee shall be composed of at least three directors, each of whom shall be “independent,” as defined by all applicable laws, rules and regulations. All members of the Audit Committee shall be “financially literate,” as this qualification is interpreted by the Board of Directors, at the time of their appointment. At least one member of the Audit Committee shall be “financially sophisticated” based on the criteria established by the American Stock Exchange. The Board of Directors shall determine whether at least one member of the Audit Committee qualifies as an “audit committee financial expert” in compliance with the criteria established by the Securities and Exchange Commission and other relevant regulations.

| III. | | Responsibilities and Duties |

The primary responsibility of the Audit Committee is to oversee the Corporation’s reporting processes on behalf of the Board of Directors and the stockholders and to report the results of its activities to the Board of Directors. While the Audit Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that the Corporation’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles. Management is responsible for the preparation, presentation, and integrity of the Corporation’s financial statements. The independent auditors are responsible for auditing the Corporation’s financial statements and for reviewing the Corporation’s unaudited interim financial statements. The Board of Directors recognizes that the Audit Committee’s functions are not intended to duplicate or certify the activities of management and the independent auditor, nor can the Audit Committee certify that the independent auditor is “independent” within the meaning of applicable rules and regulations.

In carrying out its responsibilities, the Audit Committee believes its policies and procedures should remain flexible to enable the Audit Committee to react to changing conditions and circumstances. The processes set forth below are intended to serve as a guide with the understanding that the Audit Committee may supplement or diverge from them as appropriate.

| A. | | Review Financial Reports |

1. Review the following with management and the independent accountants:

a) the Corporation’s annual financial statements, the accountants’ report thereon and related disclosures contained in the Form 10-K, including the Corporation’s disclosure under Management’s Discussion and Analysis of Financial Condition and Results of Operations (including the quality of financial reporting decisions and judgments);

b) the audit of the annual financial statements and the independent accountants’ report thereon;

c) any significant changes required in the independent accountants’ audit plan;

d) any significant difficulties or disputes encountered during the audit; and

e) disclosure of critical accounting policies for inclusion in the Form 10-K.

2. Recommend to the Board of Directors that the audited annual financial statements be included in the Corporation’s Form 10-K.

3. Review with management and the independent accountants the interim financial statements prior to filing the Corporation’s Form 10-Q and publicly releasing quarterly earnings.

| B. | | Independent Accountants |

1. Appoint the independent accountants to audit the financial statements of the Corporation and its divisions and subsidiaries. Supervise the work of the independent accountants and resolve any disagreements between management and the independent accountants. Meet with the independent accountants and financial management of the Corporation to review the scope of the proposed audit for the current year and the audit procedures to be utilized, and at the conclusion thereof review such audit, including any comments or recommendations of the independent accountants. The independent auditors shall be ultimately accountable to the Audit Committee.

2. Approve, in advance, all audit and permissible non-audit services to be provided by the independent accountants. Determine the amount of compensation to be paid to the independent accountants for such services. The Audit Committee may delegate pre-approval authority to a member of the Audit Committee. The decisions of any Audit Committee member to whom pre-approval authority is delegated must be presented to the full Audit Committee at its next scheduled meeting.

3. Evaluate the performance of the independent accountants and, where appropriate, terminate the independent accountants.

4. On an annual basis, obtain from the Corporation’s independent public accountants written disclosure delineating all relationships between such accountants and the Corporation and its affiliates, including the written disclosure and letter required by Independence Standards Board Standard No. 1.

5. Receive and review timely reports from the independent accountants regarding: (i) all critical accounting policies and practices to be used; (ii) all alternative accounting treatments of financial information within generally accepted accounting principles that have been discussed with management, including the ramifications of the use of such alternative disclosures and treatments, and the treatment preferred by the independent accountants; and (iii) other material written communications between the independent accountants and the management, such as any management letter or schedule of unadjusted differences.

6. Periodically discuss with the independent accountants out of the presence of management the Corporation’s internal controls, including their recommendations, if any, for improvements in the Corporation’s

A-2

internal controls and the implementation of such recommendations, the fullness and accuracy of the Corporation’s financial statements and certain other matters required to be discussed by Statement on Auditing Standards No. 61.

| C. | | Reviewing and Improving Process |

1. Hold regular meetings on at least a quarterly basis and as otherwise may be necessary, and hold special meetings as may be called by the Chairman of the Audit Committee or at the request of the independent accountants.

2. As part of its job to foster open communication, the Audit Committee should meet at least annually with management, the persons responsible for the Corporation’s internal audit function, and the independent accountants in separate executive sessions to discuss any matters that the Audit Committee or each of these groups believes should be discussed confidentially.

3. In consultation with the independent accountants and the internal auditors, review the integrity and quality of the organization’s financial reporting processes, both internal and external, and the independent accountant’s perception of the Corporation’s financial and accounting personnel.

4. On a quarterly basis, discuss the following with management and the independent accountants, if applicable:

a) all significant deficiencies in the design or operation of internal controls which could adversely affect the Corporation’s ability to record, process, summarize and report financial data and any material weaknesses in internal controls; and

b) any fraud, whether or not material, that involves management or other employees who have a significant role in the Corporation’s internal controls.

5. Consider the independent accountant’s judgments about the quality and appropriateness of the Corporation’s accounting principles as applied and significant judgments affecting its financial reporting.

6. Consider and recommend to the Board of Directors, if appropriate, major changes to the Corporation’s financial reporting, auditing and accounting principles and practices as suggested by the independent accountants, management, or the internal auditing function.

7. Establish procedures for: (i) the receipt, retention and treatment of complaints received by the Corporation regarding accounting, internal accounting controls or auditing matters; and (ii) the confidential, anonymous submission by employees of the Corporation of concerns regarding questionable accounting or auditing matters.

8. Hire independent advisors and counsel as the Audit Committee may, in its discretion, determine to be necessary to carry out its duties, and receive funding from the Corporation to do so.

| D. | | Ethical and Legal Compliance |

1. Review the adequacy and appropriateness of:

a) the Corporation’s Senior Financial Officer Code of Ethics;

b) the Corporation’s financial statements, reports and other financial information disseminated to the Securities and Exchange Commission and the public;

A-3

c) legal compliance matters, including the Corporation’s securities trading policies and any legal matter that could have a significant impact on the Corporation’s financial statements; and

d) policies with respect to risk assessment and risk management, including the Corporation’s major financial and accounting risk exposures and the steps management has undertaken to control them.

2. Prepare a report of the Audit Committee for inclusion in the Corporation’s annual proxy statement.

3. Review and reassess this Charter periodically, but at least annually, and recommend to the Board of Directors any amendments that the Audit Committee may deem necessary or advisable.

A-4

Appendix B

IVAX Diagnostics, Inc.

2140 North Miami Avenue

Miami, Florida 33127

PROXY

This Proxy is solicited on behalf of the Board of Directors of IVAX Diagnostics, Inc.

I (whether one or more of us) appoint Giorgio D’Urso and Duane Steele, and each of them separately, as my proxies, each with the power to appoint his substitute, and authorize each of them to vote as designated on the reverse side, all of my shares of Common Stock of IVAX Diagnostics, Inc. (the “Company”) held of record by me at the close of business on June 10, 2004, at the Annual Meeting of Stockholders to be held on July 14, 2004, and at any postponement or adjournment of the meeting.

When properly executed and returned, this Proxy will be voted in the manner directed by me. If no direction is indicated, this Proxy will be voted “FOR” the election of all director nominees and according to the discretion of the proxy holders on any other matters that may properly come before the Annual Meeting or any postponement or adjournment thereof.

Please complete, date and sign this Proxy on the reverse side, and mail it promptly in the enclosed envelope.

(continued and to be signed on other side)

(continued from other side)

The Board of Directors of IVAX Diagnostics, Inc. unanimously recommends a vote “FOR” all of the nominees for director:

| | | | | | |

FOR each nominee listed

(except as marked to the

contrary)

| | WITHHOLD AUTHORITY

to vote for all nominees listed

| | Name

| | Term of Office

|

| | | | | Jack R. Borsting, Ph.D. Phillip Frost, M.D. Glenn L. Halpryn | | 2007 2007 2007 |

| | |

¨ | | ¨ | | (INSTRUCTION: To withhold authority to vote for any individual nominee, draw a line through such nominee’s name.) |

| 2. | | In their discretion, the proxy holders are authorized to vote upon such other matters as may properly come before the meeting or any postponement or adjournment thereof. |

I acknowledge receipt of the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement for the July 14, 2004 meeting.

Dated: , 2004

|

|

|

Signature |

|

|

Signature if held jointly |

(Please date this Proxy and sign exactly as name or names appear on this Proxy. When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by president or other authorized officer. If a partnership, please sign in partnership name by authorized person.)

Please complete, date, sign and mail this Proxy promptly in the enclosed envelope. Postage is not necessary if mailed in the United States.

B-2