SCHEDULE 14A INFORMATION

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

x Definitive Proxy Statement |

|

¨ Definitive Additional Materials |

|

¨ Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

WILLIAM LYON HOMES

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | ¨ | | Fee paid previously with preliminary materials. |

| | ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

April 15, 2003

Dear Stockholder:

This letter accompanies the Proxy Statement for our Annual Meeting of Holders of Common Stock to be held at 2:00 p.m. local time, on Thursday, May 8, 2003, at the Irvine Marriott Hotel, 18000 Von Karman Avenue, Irvine, California 92612. We hope that it will be possible for you to attend in person.

At the Annual Meeting, you will be asked to vote upon three matters:

| | • | | the election of nine directors to serve on our Board of Directors for the coming year (and until each director’s successor shall have been duly elected and qualified); |

| | • | | the ratification of the Board’s selection of Ernst & Young LLP as our independent auditors for the fiscal year ending December 31, 2003; and |

| | • | | the transaction of any other business that properly comes before the Annual Meeting or any adjournments or postponements thereof. |

In addition, we will present a report on our operations and activities for the past year. Following the meeting, management will be pleased to answer your questions about the Company.

The Notice of Annual Meeting and Proxy Statement accompanying this letter describe the matters upon which you will vote at the upcoming Annual Meeting and we urge you to read these materials, as well as the accompanying 2002 Annual Report, carefully. Your vote is very important, regardless of how many shares you own. We hope you can attend the Annual Meeting in person. However, whether or not you plan to attend the Annual Meeting,please complete, sign, date and return the Proxy Card in the enclosed envelope. If you attend the Annual Meeting, you may vote in person if you wish, even though you have previously returned your proxy.

Sincerely,

William Lyon

Chairman of the Board of Directors and

Chief Executive Officer

Wade H. Cable

President and

Chief Operating Officer

4490 Von Karman Avenue, Newport Beach, California 92660

NOTICE OF ANNUAL MEETING

OF HOLDERS OF COMMON STOCK

To Be Held Thursday, May 8, 2003

To the Holders of Common Stock of William Lyon Homes:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Holders of Common Stock of William Lyon Homes, a Delaware corporation, will be held at 2:00 p.m. local time, on Thursday, May 8, 2003, at the Irvine Marriott Hotel, 18000 Von Karman Avenue, Irvine, California 92612, for the following purposes:

| | • | | To elect nine directors to serve on our Board of Directors for the coming year (and until each director’s successor shall have been duly elected and qualified); |

| | • | | To consider and act upon a proposal to ratify the selection of Ernst & Young LLP as our independent auditors for the fiscal year ending December 31, 2003; and |

| | • | | To transact such other business that properly comes before the Annual Meeting or any adjournments or postponements thereof. |

Only stockholders of record of the Common Stock of William Lyon Homes at the close of business on Monday, March 17, 2003 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting or any adjournments or postponements thereof. A list of such stockholders entitled to vote will be available for inspection by any stockholder at the Annual Meeting or for 10 days prior to the Annual Meeting at our principal executive offices located at 4490 Von Karman Avenue, Newport Beach, California 92660.

By Order of the Board of Directors,

W. Douglass Harris

Vice President and Corporate Secretary

Newport Beach, California

April 15, 2003

To assure that your shares will be represented at the Annual Meeting, you are requested to complete, date and sign the attached proxy card and return it promptly in the postage paid, addressed envelope provided, whether or not you plan to attend the Annual Meeting in person. No additional postage is required if mailed in the United States. If you attend the meeting, you may vote in person even though you have sent in your proxy card. Your proxy can be withdrawn by you at any time before it is voted.

PROXY STATEMENT

SOLICITATION OF PROXIES

Meeting Date; Matters to be Voted Upon

This Proxy Statement is being furnished to the stockholders of William Lyon Homes, a Delaware corporation (“William Lyon Homes” or the “Company”), in connection with the solicitation of the accompanying proxy by the Board of Directors for use at the Annual Meeting of Holders of Common Stock to be held at 2:00 p.m. local time, on Thursday, May 8, 2003, at the Irvine Marriott Hotel, 18000 Von Karman Avenue, Irvine, California 92612, and at any adjournments or postponements thereof. At the Annual Meeting, Holders of William Lyon Homes common stock (“Common Stock”) will be asked to vote upon:

| | • | | the election of nine directors to serve on the Company’s Board of Directors for the coming year (and until each director’s successor shall have been duly elected and qualified); |

| | • | | the ratification of the Board’s selection of Ernst & Young LLP as the Company’s independent auditors for the fiscal year ending December 31, 2003; and |

| | • | | the transaction of any other business that properly comes before the Annual Meeting or any adjournments or postponements thereof. |

This Proxy Statement and the accompanying Proxy Card are first being mailed to the Company’s stockholders on or about April 15, 2003.

Solicitation of Proxies and Expenses

The cost of the solicitation of proxies will be paid by the Company. In addition to solicitation of proxies by use of the mails, directors, officers and employees may solicit proxies personally, or by other appropriate means. Following the original mailing of the proxies and other soliciting materials, the Company will request that brokers, custodians, nominees and other record holders forward copies of the proxy and other soliciting materials to persons for whom they hold shares of Common Stock and request authority for the exercise of proxies. In such cases, the Company will reimburse them for their reasonable expenses in doing so. The Company has retained the services of Proxy Express, Inc. to assist in the distribution and solicitation of proxies at an estimated cost of $550, plus certain out-of-pocket expenses.

VOTING

Record Date; Outstanding Shares; Quorum

Only holders of record of Common Stock at the close of business on Monday, March 17, 2003 (the “Record Date”) will be entitled to notice of and to vote at the Annual Meeting. As of the close of business on Monday, March 17, 2003, there were 9,758,681 shares of Common Stock outstanding and entitled to vote, held of record by approximately 1,576 stockholders. A majority of the shares issued and outstanding and entitled to vote, present in person or represented by proxy, will constitute a quorum for the transaction of business. Each holder of Common Stock is entitled to one vote for each share of Common Stock held as of the Record Date. A list of such stockholders entitled to vote will be available for inspection by any stockholder at the Annual Meeting, or for 10 days prior to the Annual Meeting, at the Company’s principal executive offices located at 4490 Von Karman Avenue, Newport Beach, California 92660.

Voting of Proxies; Revocation of Proxies

You are requested to complete, date, sign and return the accompanying Proxy Card in the enclosed envelope. All properly executed, returned and unrevoked proxies will be voted in accordance with the instructions indicated thereon.Executed but unmarked proxies will be voted for the election of each director nominee listed on the Proxy Card and for ratification of the Board’s selection of Ernst & Young LLP as the Company’s independent auditors for the fiscal year ending December 31, 2003. The William Lyon Homes Board of Directors does not presently intend to bring any business before the Annual Meeting other than that referred to in this Proxy Statement and specified in the Notice of the Annual Meeting. As to any business that may properly come before the Annual Meeting, including any motion made for adjournment or postponement of the Annual Meeting (including for purposes of soliciting additional votes for election of directors), the proxies will be voted at the Board’s discretion. Any William Lyon Homes stockholder who has given a proxy may revoke it at any time before it is exercised at the Annual Meeting by (i) filing a written revocation with, or delivering a duly executed proxy bearing a later date to, the Vice President and Corporate Secretary of William Lyon Homes, 4490 Von Karman Avenue, Newport Beach, California 92660, or (ii) attending the Annual Meeting and voting in person (although attendance at the Annual Meeting, by itself, will not revoke a proxy).

Votes Required

The affirmative vote of a plurality of the votes cast is required to elect any nominee for director. The ratification of the Board’s selection of auditors requires approval by a majority of the votes cast at the Annual Meeting.

Abstentions; Broker Non-Votes

If an executed proxy is returned and you have specifically abstained from voting on any matter, the shares represented by such proxy will be considered present at the Annual Meeting for purposes of determining a quorum and for purposes of calculating the vote, but will not be considered to have been cast with respect to such matter. Also, if an executed proxy is returned by a broker holding shares in street name that indicates that the broker does not have discretionary authority as to certain shares to vote on one or more matters, such shares will be considered present at the meeting for purposes of determining a quorum, but will not be considered to have been cast with respect to such matter. Thus, with respect to the election of directors and ratification of the Board’s selection of auditors, abstentions and broker non-votes will have no effect on the outcome of the vote. In addition, in the election of directors, a stockholder may withhold such stockholder’s vote. Withheld votes will be excluded from the vote and will have no effect on the outcome of such election.

2

PROPOSAL NO. 1

ELECTION OF DIRECTORS

At the Annual Meeting, you will be asked to vote on the election of nine directors who will constitute the Board of Directors of William Lyon Homes. The nine nominees receiving the highest number of votes from holders of shares of Common Stock represented and voting at the Annual Meeting will be elected to the Board of Directors. Each director so elected will hold office until the Company’s next Annual Meeting and until his successor is duly elected and qualified.

General

Each proxy received will be voted for the election of the persons named below, unless the stockholder signing such proxy withholds authority to vote for one or more of these nominees in the manner described on the proxy card. Although it is not contemplated that any nominee named below will decline or be unable to serve as a director, in the event any nominee declines or is unable to serve as a director, the proxies will be voted by the proxy holders as directed by the Board of Directors.

Except as described below, there are no family relationships between any director, nominee or executive officer and any other director, nominee or executive officer of William Lyon Homes. Except as described below, there are no arrangements or understandings between any director, nominee or executive officer and any other person pursuant to which he has been or will be selected as a director and/or executive officer of William Lyon Homes. See “Information Regarding the Directors of William Lyon Homes” on page 4. Except as may be described below, there are no material proceedings to which any of the following is a party adverse to the Company or any of its subsidiaries, or has a material interest adverse to the Company or any of its subsidiaries: any director, nominee, officer or affiliate of the Company, any owner of record or beneficially of more than five percent (5%) of the outstanding shares of Common Stock, or any associate of any such director, nominee, officer, affiliate of the Company, or security holder.

Name

| | Principal Occupation

| | Director Since (1)

|

General William Lyon | | Chairman of the Board of Directors and Chief Executive Officer of the Company | | 1987 |

|

Wade H. Cable | | President and Chief Operating Officer of the Company | | 1985 |

|

General James E. Dalton | | Independent defense industry consultant | | 1991 |

|

Richard E. Frankel | | Chairman of the Board and Chief Executive Officer of Duxford Financial, Inc. | | 2000 |

|

William H. Lyon | | Employee of the Company | | 2000 |

|

William H. McFarland | | Real estate developer | | 2000 |

|

Michael L. Meyer | | Chief Executive Officer of Michael L. Meyer Company | | 2000 |

|

Raymond A. Watt | | Real estate developer | | 1997 |

|

Randolph W. Westerfield | | Dean of the Marshall School of Business, University of Southern California | | 2000 |

| (1) | | Includes date of first service as a director for the former The Presley Companies or the Company, as applicable. On November 5, 1999, the former The Presley Companies acquired substantially all of the assets and assumed substantially all of the liabilities of the former William Lyon Homes, Inc., which subsequently changed its name to Corporate Enterprises, Inc. On November 11, 1999, The Presley Companies merged with and into the Company, which was a wholly-owned subsidiary of The Presley Companies. The Company was the surviving company in the merger. |

The Board of Directors recommends a vote “For” the election of all of the nominees listed above.

3

DIRECTORS AND COMMITTEES

Information Regarding the Directors of William Lyon Homes

The following table lists the persons nominated by the Board of Directors for election as directors of the Company and provides their respective ages and current positions with the Company as of March 31, 2003. Biographical information for each nominee is provided below.

Name

| | Age

| | Position

|

General William Lyon | | 80 | | Chairman of the Board of Directors and Chief Executive Officer |

Wade H. Cable | | 54 | | Director, President and Chief Operating Officer |

General James E. Dalton (a, b) | | 72 | | Director |

Richard E. Frankel | | 57 | | Director |

William H. Lyon | | 29 | | Director |

William H. McFarland (a, b) | | 63 | | Director |

Michael L. Meyer (a, b) | | 64 | | Director |

Raymond A. Watt (a, b) | | 84 | | Director |

Randolph W. Westerfield (a, b) | | 61 | | Director |

| (a) | | Member of the Audit Committee |

| (b) | | Member of the Compensation Committee |

GENERAL WILLIAM LYON was elected director and Chairman of the Board of the former The Presley Companies in 1987 and has served the Company in that capacity since November 1999. General Lyon is the Company’s Chief Executive Officer. General Lyon also serves as the Chairman of the Board, President and Chief Executive Officer of the former William Lyon Homes, which sold substantially all of its assets to the Company in 1999 and subsequently changed its name to Corporate Enterprises, Inc. In recognition of his distinguished career in real estate development, General Lyon was elected to the California Building Industry Foundation Hall of Fame in 1985. General Lyon is a retired USAF Major General and was Chief of the Air Force Reserve from 1975 to 1979. General Lyon is a director of Fidelity Financial Services, Inc.

WADE H. CABLE served from 1985 to 1999 as a director and President and Chief Executive Officer of the former The Presley Companies and has served as a director and President and Chief Operating Officer of the Company since November 1999. Prior to joining The Presley Companies, he worked for thirteen years with Pacific Enterprises as a senior executive in various of its real estate operations, including two years as an Executive Vice President of Pacific Lighting Real Estate Group and four years as the President of Fredricks Development Company, a residential developer and homebuilder.

GENERAL JAMES E. DALTON, USAF (Ret.), was elected in 1991 to the board of directors of the former The Presley Companies and has served the Company in that capacity since November 1999. He serves as Chairman of the audit committee. General Dalton was the President of Logicon R&D Associates, a subsidiary of Logicon Corporation (a defense contractor providing advanced technology systems and services), a position he held from 1985 until his retirement in December 1998. He also served as General Manager of Logicon’s Defense Technology Group from 1995 until his retirement in December 1998. General Dalton currently acts as an independent consultant to several companies in the defense industry and is a director of Defense Group, Inc. and Finance America, Inc.

RICHARD E. FRANKEL has been associated with homebuilding entities for over 25 years, and joined the board of directors on January 25, 2000. From 1993 to 1997, he held key positions including Chief Financial Officer, Investment Division Manager, Vice Chairman and President of the former William Lyon Homes. He currently serves as Chairman and Chief Executive Officer of Duxford Financial, Inc., a wholly-owned subsidiary of the Company.

4

WILLIAM H. LYON, son of Chairman William Lyon, worked full time with the former William Lyon Homes from November 1997 through November 1999 as an assistant project manager, has been employed by the Company since November 1999 and has been a member of the board of directors since January 25, 2000. Since joining the Company, Mr. Lyon has been employed as an assistant project manager and project manager and has participated in a training program designed to expose him to the many facets of real estate development. Currently he is the Company’s Director of Corporate Affairs. Mr. Lyon received a dual B.S. in Industrial Engineering and Product Design from Stanford University in 1997.

WILLIAM H. MCFARLAND was elected to the California Building Industry Foundation Hall of Fame, and has had a distinguished career in residential real estate and large-scale community development in California. He has been a member of the board of directors since January 25, 2000. Until July 1999, Mr. McFarland served in executive and director capacities of The Irvine Company, Irvine Community Development Company and Irvine Apartment Communities. Today, Mr. McFarland is a private developer and investor in real estate projects in California, and serves on the boards of Opus West Corporation, Cornerstone Ventures, Inc. and e-dn.com.

MICHAEL L. MEYER joined the board of directors on January 25, 2000, and currently is Chief Executive Officer of Michael L. Meyer Company, a principal and/or advisor to real estate entities, an officer of Advantage 4, LLC, a real estate telecommunications company, and a principal of TransPac Partners LLC and Pacific Capital Investors, which are both involved in real estate in Japan. In 1998, Mr. Meyer retired as Managing Partner of the E&Y Kenneth Leventhal Real Estate Group of Ernst & Young LLP Orange County, California office. Mr. Meyer was elected to the California Building Industry Foundation Hall of Fame and currently serves on the board of directors of City National Bank, City National Corporation and Cornerstone Ventures, Inc.

RAYMOND A. WATT was elected to the board of directors of the former The Presley Companies in 1997 and has served the Company in that capacity since November 1999. Mr. Watt serves as Chairman of the Company’s compensation committee. Mr. Watt is the founder and Chairman of the Board of Watt Group, Inc., a commercial and residential real estate development and building company, positions he has held since 1960. Mr. Watt has been honored with election to the California Building Industry Foundation Hall of Fame, serves as a director of Watt Communities, Inc. and Linserath, Inc., both real estate developers, and has served on the boards of several civic organizations.

DR. RANDOLPH W. WESTERFIELD is Dean of the Marshall School of Business, University of Southern California and has been a member of the board of directors since January 25, 2000. He has been a consultant to a number of large U.S. corporations. With expertise in the areas of corporate financial policy, investment management and analysis, mergers and acquisitions and stock market price behavior, Dr. Westerfield is co-author of three leading textbooks in corporate financial management. He currently serves on the board of directors of Health Management Associates.

Board Meetings, Board Committees and Director Compensation

The full Board of Directors of the Company had eight meetings in 2002. During 2002, each incumbent director of William Lyon Homes who is being nominated for re-election attended at least 75% of the aggregate of (i) the eight meetings of the Board of Directors, and (ii) the total number of meetings of the committees on which he served (during the periods that he served). The Board does not have an Executive Committee or a Nominating Committee. The full Board performs those functions itself.

Committees of the Board of Directors

Compensation Committee. The Company has a standing Compensation Committee, which is chaired by Mr. Watt and currently consists of Messrs. Watt, Dalton, McFarland, Meyer and Westerfield. The functions of the Compensation Committee are to: make recommendations to the Board of Directors regarding the hiring or termination of senior management, review and approve annual salaries and other compensation of the Company’s senior management, review and approve stock options and other grants pursuant to plans, review and administer

5

existing stock options and other plans and recommend changes to the Board of Directors, review and recommend to the Board of Directors compensation plans or management perquisites, review and recommend to the Board of Directors the type and amount of compensation for non-employee directors, and prepare and approve required reports. The Compensation Committee also administers the William Lyon Homes 2000 Stock Incentive Plan. The Compensation Committee had one formal meeting in 2002.

Audit Committee. The Company has a standing Audit Committee, which is chaired by General Dalton and currently consists of Messrs. Dalton, McFarland, Meyer, Watt and Westerfield. The Audit Committee must have at least three members, each of whom must meet certain criteria as set forth in the Audit Committee Charter adopted by the Board of Directors. All members of the Audit Committee are independent as defined in the listing standards of the New York Stock Exchange. Mr. Meyer was formerly a partner of Ernst & Young LLP, the Company’s auditors, and the Board has determined that in consideration of the circumstances, this relationship does not interfere with Mr. Meyer’s exercise of independent business judgment. Among other things, the functions of the Audit Committee are to:

| | • | | review and discuss with the Company’s management and independent auditors the Company’s audited financial statements, including the adequacy and effectiveness of the Company’s internal accounting and reporting controls; |

| | • | | recommend to the Board of Directors each year the appointment of the Company’s independent auditors; |

| | • | | review the independence and performance of the Company’s independent auditors; |

| | • | | review from time to time and make recommendations with respect to the Company’s policies relating to management conduct and oversee procedures and practices to ensure compliance with such policies; and |

| | • | | review and discuss legal and regulatory matters relating to the Company’s financial accounting and reporting with the Company’s legal counsel. |

The Board of Directors of the Company intends to amend the audit committee charter to comply with the requirements of the Sarbanes-Oxley Act of 2002, as well as the requirements of the Securities and Exchange Commission and the New York Stock Exchange, once such requirements are in final form. The Audit Committee had six formal meetings in 2002.

Director Term and Compensation

All directors hold office until the next Annual Meeting of Holders of Common Stock and until their successors are duly elected and qualified. In 2002, outside directors received an annual retainer of $30,000 per year plus $1,000 for each board of directors meeting attended and $1,000 per year per committee for service on committees of the board of directors, which are paid in cash. The Company adopted the William Lyon Homes Outside Directors Deferred Compensation Plan effective as of February 11, 2002, pursuant to which each outside director may elect to defer payment of a portion or all of his annual compensation until his retirement date or a fixed payment date in the future at which time he would receive all deferred amounts and accumulated earnings thereon, if any, in a lump sum. General Dalton is the only director who deferred all of his 2002 director compensation under the plan.

Under the Company’s Non-Qualified Retirement Plan for Outside Directors, each outside director is eligible to receive $2,000 per month beginning on the first day of the month following death, disability or retirement at age 72; or, in the case of an outside director who ceases participation in the plan prior to death, disability or retirement at age 72 but has completed at least ten years of service as a director, eligibility for benefit payments pursuant to the plan begins on the first day of the month following the latter of (a) the day on which such person attains the age of 65, or (b) the day on which such person’s service terminates after completing at least ten years

6

of service as a director. The monthly payments will continue for the number of months that equals the number of months the outside director served as a director and are payable to the director’s beneficiary in the event of the director’s death. If a retired outside director receiving payments under the plan resumes his status as a director or becomes an employee, the payments under the plan are suspended during the period of such service.

No options were granted during 2002 to any director. On May 9, 2000, Messrs. Dalton, Frankel, McFarland, Meyer, Watt and Westerfield were each granted options to purchase 10,000 shares of common stock at a price of $8.6875 per share. These options vested or will vest in the following installments: one-third on May 9, 2001, one-third on May 9, 2002 and one-third on May 9, 2003. All of the options expire if unexercised on May 9, 2010. Mr. Cable was granted options to purchase 50,000 shares of common stock. The option price, vesting schedule and expiration date of Mr. Cable’s options are the same as those granted to the other directors. The grant of options to Mr. Cable is also discussed in the section on “Executive Compensation”. No options were granted to General William Lyon or William H. Lyon.

Audit Committee Report

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process including the system of internal controls. The Committee has reviewed the audited financial statements of the Company and the notes thereto with management, including a discussion of the accounting principles, significant judgments and estimates, and the disclosures contained in the financial statements. Management has represented to the Committee that the financial statements were prepared in accordance with accounting principles generally accepted in the United States.

The Committee reviewed with the independent auditors, who are responsible for expressing an opinion of the conformity of those audited financial statements with generally accepted accounting principles, matters required to be discussed with the Committee under Statement of Auditing Standards No. 61, which establishes the requirements for communications with audit committees. In addition, the Committee has received and discussed with the independent auditors the written disclosures required by Independence Standards Board Standard No. 1 regarding the independence of the independent auditors.

The Committee discussed with the Company’s independent and internal auditors the overall scope and plans for their respective audits. The Committee meets with the independent and internal auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls, and the Company’s financial reporting.

Based on the reviews and discussions referred to above, the Committee recommended to the Board of Directors (and the Board of Directors has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2002 for filing with the Securities and Exchange Commission. The Committee and the Board of Directors have also recommended, subject to stockholder approval, the selection of Ernst & Young LLP as the Company’s independent auditors for 2003.

Submitted by the 2002 AUDIT COMMITTEE

James E. Dalton, Chairman

William H. McFarland

Michael L. Meyer

Raymond A. Watt

Randolph W. Westerfield

7

The Audit Committee Report, the disclosures concerning the independence of the members of the Audit Committee and the Audit Committee Charter shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates this information by reference.

Fees Billed by the Independent Auditors to the Company

Audit Fees: The aggregate fees billed to the Company by Ernst & Young LLP, the independent auditors for the Company, in connection with (i) the audit of the Company’s financial statements for the fiscal year ended December 31, 2002, and (ii) the review of the financial statements included in the Company’s Form 10-Q quarterly reports for the fiscal year ended December 31, 2002, were $261,500 and $56,500, respectively.

All Other Fees: The aggregate fees billed to the Company by Ernst & Young LLP for non-audit services were $231,497 during the fiscal year ended December 31, 2002. These fees were for tax services, registration statement services and other accounting consultation services provided by Ernst & Young LLP.

The Audit Committee considered the compatibility of the provision of other services by Ernst & Young LLP with the maintenance of Ernst & Young LLP’s independence.

8

SECURITY OWNERSHIP OF PRINCIPAL STOCKHOLDERS AND MANAGEMENT

The following table sets forth certain information as to the number of shares of Common Stock beneficially owned as of March 31, 2003. The following table includes information for (a) each person or group that is known to the Company to be the beneficial owner of more than 5% of the outstanding shares of Common Stock, (b) each of the directors of the Company, (c) each executive officer named in the Summary Compensation Table, and (d) all directors and executive officers of the Company as a group.

| | | As of March 31, 2003

| |

| | | Shares Beneficially Owned

| | | Shares Acquirable Within 60 Days(1)

| | | Percentage of All Common Stock(2)

| |

General William Lyon(3) | | 3,707,573 | (4) | | 50,000 | (5) | | 38.26 | % |

The William Harwell Lyon Trust(6) | | 1,749,259 | | | | | | 17.90 | % |

William H. Lyon(3) | | 0 | (7) | | | | | * | |

Wade H. Cable(3) | | 0 | | | 50,000 | | | * | |

Wade H. Cable & Susan M. Cable, Trustees

of the Cable Family Trust, Est. 7-11-88(3) | | 247,705 | (8) | | | | | 2.53 | % |

Richard E. Frankel(3) | | 0 | | | 3,333 | (9) | | * | |

General James E. Dalton(3) | | 0 | | | 10,000 | | | * | |

William H. McFarland(3) | | 0 | | | 6,666 | | | * | |

William H. & Rose-Marie McFarland, Trustees

(U/T/A dated February 13, 1998)(3) | | 3,334 | | | | | | | |

Michael L. Meyer(3) | | 0 | | | 10,000 | | | * | |

Michael L. Meyer, Trustee of the Michael L. Meyer

Living Trust, Est. July 4, 1989(3) | | 20,000 | | | | | | * | |

Raymond A. Watt(3) | | 0 | | | 3,333 | | | * | |

R.A. Watt 1994 Family Trust(3) | | 6,667 | | | | | | * | |

Randolph W. Westerfield(3) | | 3,333 | | | 3,333 | | | * | |

Thomas J. Mitchell(3) | | 0 | | | 8,333 | | | * | |

Douglas F. Bauer(3) | | 0 | | | 8,332 | | | * | |

Mary J. Connelly(3) | | 0 | | | 16,665 | | | * | |

Bricoleur Capital Management LLC(10) | | 1,733,940 | | | | | | 17.74 | % |

FMR Corp.(11) | | 672,000 | | | | | | 6.88 | % |

All directors and executive officers as a group (18 persons) | | 5,490,366 | (12) | | 198,492 | | | 57.06 | % |

| (1) | | Reflects the number of shares that could be purchased by exercise of options exercisable at March 31, 2003 or within 60 days thereafter under the William Lyon Homes 2000 Stock Incentive Plan. |

| (2) | | Shares of common stock subject to options that are currently exercisable or exercisable within 60 days of March 31, 2003 are deemed to be outstanding and beneficially owned by the person holding such options for the purpose of computing the percentage ownership of such person, but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person. |

| (3) | | Stockholder is at the following mailing address: c/o William Lyon Homes, 4490 Von Karman Avenue, Newport Beach, CA 92660 |

| (4) | | Includes 247,705 shares held by the Cable Family Trust. General William Lyon has the power to direct the vote of all of the shares beneficially owned by the Cable Family Trust pursuant to a voting agreement among William Lyon, Wade H. Cable and Susan M. Cable, Trustees of the Cable Family Trust and Wade H. Cable, individually, dated as of May 31, 2002 (the “Voting Agreement”). |

9

| (5) | | Includes 50,000 shares issuable upon exercise of outstanding options exercisable within sixty days of March 31, 2003 and deemed beneficially owned by Wade H. Cable. General William Lyon has the power to direct the vote of all of the shares beneficially owned by Wade H. Cable pursuant to the Voting Agreement. |

| (6) | | Stockholder is at the following mailing address: c/o Richard Sherman, Esq., Irell & Manella LLP, 840 Newport Center Drive, Suite 400, Newport Beach, CA 92660. |

| (7) | | Does not include 1,749,259 shares of common stock held in The William Harwell Lyon Trust, of which William H. Lyon is the sole beneficiary. William H. Lyon does not have or share, directly or indirectly, the power to vote or to direct the vote of these shares, and thus, William H. Lyon disclaims beneficial ownership of these shares. |

| (8) | | Does not include 1,203 shares directly owned by children of Mr. Cable, as to which shares Mr. Cable disclaims beneficial ownership. |

| (9) | | Includes 3,333 shares of common stock purchasable by Frankel Associates, L.P. upon the exercise of options exercisable at March 31, 2003 or within 60 days thereafter. Richard Frankel assigned the options the Company granted to him to Frankel Associates, L.P., a family limited partnership. Mr. Frankel is the President of the general partner of Frankel Associates, L.P. |

| (10) | | Stockholder is at the following mailing address: 12230 El Camino Real, Suite 100, San Diego, CA 92130. According to Item 6 of the Schedule 13G filed by stockholder for the year 2002 and dated February 13, 2003, as an investment adviser for certain accounts in which the reported shares are held, stockholder has been granted the authority to dispose of and vote those shares. Stockholder’s holdings are based upon the holdings disclosed in the Schedule 13G and any other information made available to the Company Stockholder has advised the Company that the shares are held in multiple funds and that no single fund is a beneficial owner of more than 5% of the Company’s common stock. |

| (11) | | Based solely on the Schedule 13G filed on February 13, 2002, stockholder is at the following mailing address: 82 Devonshire Street, Boston, MA 02109. According to Item 6 of such Schedule 13G, various persons have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of the Company’s shares. The interest of one fund, Fidelity Low Priced Stock Fund, amounted to 507,500 shares on December 31, 2002. |

| (12) | | Includes 1,749,259 shares held by The William Harwell Lyon Trust, of which William H. Lyon is the sole beneficiary. William H. Lyon does not have or share, directly or indirectly, the power to vote or direct the vote of these shares, and thus, William H. Lyon disclaims beneficial ownership of these shares. |

Except as otherwise indicated in the above notes, shares shown as beneficially owned are those as to which the named person possesses sole voting and investment power. However, under California law, personal property owned by a married person may be community property which either spouse may manage and control. The Company has no information as to whether any shares shown in this table are subject to California community property law.

10

WILLIAM LYON HOMES MANAGEMENT

Executive Officers

The executive officers of the Company are chosen annually by the Board of Directors and each holds office until his or her successor is chosen and qualified or until his or her death, resignation or removal. There are no family relationships between any director or executive officer and any other director or executive officer of the Company, except for William Lyon and William H. Lyon, who are father and son. The following table lists the Company’s executive officers and provides their respective ages as of March 31, 2003 and their current positions.

Name

| | Age

| | Position

|

General William Lyon | | 80 | | Chairman of the Board of Directors and Chief Executive Officer |

Wade H. Cable | | 54 | | President and Chief Operating Officer |

Douglas F. Bauer | | 41 | | Senior Vice President and Northern California Division President |

Mary J. Connelly | | 51 | | Senior Vice President and Nevada Division President |

W. Thomas Hickcox | | 50 | | Senior Vice President and Arizona Division President |

Thomas J. Mitchell | | 42 | | Senior Vice President and Southern California Division President |

Larry I. Smith | | 48 | | Senior Vice President and San Diego Division President |

Michael D. Grubbs | | 44 | | Senior Vice President and Chief Financial Officer |

Richard S. Robinson | | 56 | | Senior Vice President — Finance |

Cynthia E. Hardgrave | | 55 | | Vice President — Tax and Internal Audit |

W. Douglass Harris | | 60 | | Vice President, Corporate Controller and Corporate Secretary |

Officers serve at the discretion of the Board of Directors, subject to rights, if any, under contracts of employment. See “Employment Contracts” on page 15. Biographical information for General Lyon and Mr. Cable is provided above. See “Information Regarding the Directors of William Lyon Homes” on page 4.

DOUGLAS F. BAUER, Senior Vice President and Northern California Division President, joined the Company in 1999 when it acquired substantially all of the assets of the former William Lyon Homes, where Mr. Bauer had

served as Vice President — Finance and Chief Financial Officer and Northern California Division President since his hire in January 1989. Prior experience includes seven years at Security Pacific National Bank in Los Angeles, California in various financial positions. Mr. Bauer has more than 20 years experience in the real estate development and homebuilding industry.

MARY J. CONNELLY, Senior Vice President and Nevada Division President, joined The Presley Companies in May 1995, after eight years’ association with Gateway Development, six of which were served as Managing Partner in Nevada. Ms. Connelly was Vice President — Finance for the Company’s San Diego Division from 1985 to 1987, and she has more than 20 years experience in the real estate development and homebuilding industry.

W. THOMAS HICKCOX, Senior Vice President and Arizona Division President, joined the Company in May 2000. Mr. Hickcox was previously President of Continental Homes in Phoenix, Arizona, with 16 years of service at that company. Mr. Hickcox has more than 20 years experience in the real estate development and homebuilding industry.

THOMAS J. MITCHELL, Senior Vice President and Southern California Division President, joined the Company in 1999 when it acquired substantially all of the assets of the former William Lyon Homes, where Mr. Mitchell had served as a Project Manager, Vice President, and Division President since his hire in December 1988. Mr. Mitchell has more than 20 years experience in the real estate development and homebuilding industry.

LARRY I. SMITH, Senior Vice President and San Diego Division President, joined The Presley Companies in May 1995 and has served the Company in that capacity since November 1999, after six years as Vice President and Southern California Division Manager of Coleman Homes, Inc. Previous experience includes ten years in sales and marketing executive positions and consulting activities with southern California real estate firms. Mr. Smith has more than 20 years experience in the real estate development and homebuilding industry.

11

MICHAEL D. GRUBBS, Senior Vice President and Chief Financial Officer, joined the Company in 1999 when it acquired substantially all of the assets of the former William Lyon Homes, where Mr. Grubbs had served as Vice President and Corporate Controller after his hire in December 1992. Mr. Grubbs has more than 20 years experience in residential real estate and homebuilding finance.

RICHARD S. ROBINSON, Senior Vice President — Finance, joined the Company in 1999 when it acquired substantially all of the assets of the former William Lyon Homes, where Mr. Robinson had served since May 1997 as Senior Vice President, and as Vice President — Treasurer and other administrative positions at The William Lyon Company or one of its subsidiaries or affiliates since his hire in June 1979. His experience in residential real estate development and homebuilding finance totals more than 30 years.

CYNTHIA E. HARDGRAVE, Vice President — Tax and Internal Audit, joined the Company in 1999 when it acquired substantially all of the assets of the former William Lyon Homes, where Ms. Hardgrave had served in various tax management positions since her hire in July 1989. Ms. Hardgrave has more than 15 years experience in real estate tax and audit.

W. DOUGLASS HARRIS, Vice President and Corporate Controller joined The Presley Companies in June 1992 and has served the Company in that capacity since November 1999. Mr. Harris has served as the Corporate Secretary of the Company since October 2002. Previously, Mr. Harris spent seven years with Shapell Industries, Inc., another major California homebuilder, as its Vice President and Corporate Controller. Mr. Harris has been involved with the real estate development and homebuilding industry for more than 20 years.

Executive Compensation

Summary Compensation Table

The following table summarizes the annual and long-term compensation during 2002 of the Company’s Chief Executive Officer and the four additional most highly compensated executive officers whose annual salaries and bonuses exceeded $100,000 in total during the fiscal year ended December 31, 2002 (collectively, the “Named Officers”).

| | | | | Annual Compensation

| | Long-Term Compensation

| | |

| | | | | | Awards

| | |

Name and Principal Position

| | Year

| | Salary($)(1)

| | Bonus Paid in Specified Year But Earned in Earlier Years ($)(2),(3),(4),(5)

| | Bonus Earned During Specified Year But Payable in Future Years($)(3),(4),(5),(6)

| | Securities Underlying Options(#)

| | All Other Compensation ($)(7)

|

General William Lyon(8) Chairman of the Board and Chief Executive Officer | | 2002

2001

2000 | | $

| 495,000

495,000

495,000 | | $

| 1,985,408

1,440,023

0 | | $

| 2,488,838

2,007,200

1,920,030 | | 0

0

0 | | $ | 0

0

0 |

Wade H. Cable Director, President and Chief Operating Officer | | 2002

2001

2000 | |

| 424,330

424,330

424,330 | |

| 2,294,158

1,823,773

617,500 | |

| 2,488,838

2,007,200

1,920,030 | | 0 0 50,000 | | | 5,100

5,100

5,100 |

Thomas J. Mitchell(8) Senior Vice President and Southern California Division President | | 2002

2001

2000 | |

| 206,000

206,000

200,000 | |

| 647,259

385,875

0

| |

| 1,060,582

691,512

514,500

| | 0 0 25,000 | |

| 5,100

5,100

5,100 |

Douglas F. Bauer(8) Senior Vice President and Northern California Division President | | 2002

2001

2000 | |

| 206,000

206,000

200,000 | |

| 484,970

477,338

0

| |

| 500,000

434,476

636,450

| | 0 0 25,000 | |

| 5,100

5,100

5,100 |

Mary J. Connelly Senior Vice President and Nevada Division President | | 2002

2001

2000 | |

| 200,000

200,000

175,366 | |

| 461,627

321,014

172,131 | | | 500,000

429,332

288,510 | | 0 0 25,000 | |

| 5,100

5,100

5,100 |

12

| (1) | | Includes amounts which the executive would have been entitled to be paid, but which at the election of the executive were deferred by payment into the Company’s 401(k) plan and deferred compensation plan. Does not include perquisites and other personal benefits, securities or property received by the executive unless the aggregate amount of such compensation is greater than the lesser of $50,000 or 10 percent of the total annual salary and bonus reported for the executive. |

| (2) | | Represents amounts paid in 2002, 2001 or 2000, respectively, under the Company’s then existing executive bonus plan or employment agreement with the executive, but which were earned prior to the year of payment. |

| (3) | | The 2002 Cash Bonus Plan (the “2002 Plan”) provides that the Chief Executive Officer (“CEO”), the Chief Operating Officer (“COO”) and the Chief Financial Officer (“CFO”) are eligible to receive bonuses based upon specified percentages of pre-tax, pre-bonus income. Division presidents are eligible to receive bonuses based upon specified percentages of their respective division pre-tax, pre-bonus income. All other participants are eligible to receive bonuses based upon specified percentages of a bonus pool determined as a specified percentage of pre-tax, pre-bonus income. Awards are paid over two years, with 75% paid following the determination of bonus awards, and 25% paid one year later. The deferred amounts will be forfeited in the event of termination for any reason except retirement, death or disability. |

| (4) | | The 2001 Cash Bonus Plan (the “2001 Plan”) provides that the CEO, COO and CFO are eligible to receive bonuses based upon specified percentages of pre-tax, pre-bonus income. Bonus targets for division presidents are based upon division performance, as compared to the division’s 2001 Business Plan. For all other participants, the 2001 Plan stipulates annual setting of individual bonus targets, expressed as a percentage of each participant’s salary, with awards based on performance against goals pertaining to each participant’s operating area. All awards are prorated downward if the sum of all of the calculated awards exceeds 20% of the Company’s consolidated pre-tax income before bonuses. Awards are paid over two years, with 75% paid following the determination of bonus awards, and 25% paid one year later. The deferred amounts will be forfeited in the event of termination for any reason except retirement, death or disability. |

| (5) | | The 2000 Cash Bonus Plan (the “2000 Plan”) provides that the CEO and COO are eligible to receive bonuses based upon specified percentages of pre-tax, pre-bonus income. Bonus targets for division presidents are based upon division performance, as compared to the division’s 2000 Business Plan. For all other participants, the 2000 Plan stipulates annual setting of individual bonus targets, expressed as a percentage of each participant’s salary, with awards based on performance against goals pertaining to each participant’s operating area. All awards are prorated downward if the sum of all of the calculated awards exceeds 20% of the Company’s consolidated pre-tax income before bonuses. Awards are paid over two years, with 75% paid following the determination of bonus awards, and 25% paid one year later. The deferred amounts will be forfeited in the event of termination for any reason except retirement, death or disability. |

| (6) | | Includes amounts which the executive would have been entitled to be paid, but which at the election of the executive were deferred by payment into the Company’s executive deferred compensation plan. |

| (7) | | Represents matching contributions made by the Company into each executive’s 401(k) plan account in an amount equal to 3% of each executive’s eligible earnings. |

| (8) | | General William Lyon and Mssrs. Bauer and Mitchell served as executive officers from November 11, 1999 until the end of 1999, but did not earn salaries from the Company. They did earn salaries from the former William Lyon Homes. During 2000, General William Lyon and Mssrs. Bauer and Mitchell were paid bonuses of $530,956, $248,745 and $387,947, respectively, which were earned in prior years from the former William Lyon Homes. During 2001, General William Lyon and Mr. Mitchell were paid bonuses of $75,851 and $73,298, respectively, which were earned in prior years from the former William Lyon Homes. |

13

The Company’s board of directors approved a cash bonus plan applicable in 2002 for all of its full-time, salaried employees, including the CEO, COO, CFO, division presidents, executives, managers, field construction staff, and certain other employees. Under the terms of this plan, the CEO, COO and CFO are eligible to receive bonuses based upon specified percentages of the Company’s pretax, pre-bonus income. Division presidents are eligible to receive bonuses based upon specified percentages of their respective division pre-tax, pre-bonus income. All other participants are eligible to receive bonuses based upon specified percentages of a bonus pool determined as a specified percentage of pre-tax, pre-bonus income.

For the CEO, COO, CFO, division presidents, executives and managers, awards are paid over two years, with 75% paid following the determination of bonus awards, and 25% paid one year later. The deferred amounts will be forfeited in the event of termination for any reason except retirement, death or disability.

Effective on February 11, 2002, the Company implemented a deferred compensation plan that allows certain officers and employees to defer a portion of their total income (base salary and bonuses). The deferral amount can be up to 20% of total income with a minimum of $10,000 annually.

Options/SAR Grants in Fiscal Year Ended December 31, 2002

No options were granted during 2002 to any director or Named Officer.

On March 7, 2000, the compensation committee of the Company’s board of directors unanimously voted to recommend for approval to the board of directors a proposed compensation package which included the William Lyon Homes 2000 Stock Incentive Plan (the “Stock Incentive Plan”). Subject to adoption and approval of the Stock Incentive Plan by the Company’s stockholders, on April 6, 2000, acting by unanimous written consent, the board of directors approved and adopted the Stock Incentive Plan. At the Company’s 2000 Annual Meeting on May 9, 2000, the stockholders adopted and approved the Stock Incentive Plan. The Stock Incentive Plan is administered by the compensation committee, by a delegation of the board of directors.

The purpose of the Stock Incentive Plan is to attract and retain the best available personnel, to provide additional incentive to key employees, officers and directors, and to promote the success of the Company’s business. One million shares of common stock are reserved for issuance under the Stock Incentive Plan, subject to adjustments related to changes in capitalization.

Both options intended to qualify as incentive stock options and nonqualified options may be granted under the Stock Incentive Plan. Nonqualified stock options may be granted to employees, consultants and directors. Incentive stock options may be granted only to employees. Options may be coupled with a stock appreciation right. Grants or sales of common stock also may be made to employees, consultants or directors upon terms and conditions determined by the Stock Incentive Plan’s administrator.

The Stock Incentive Plan will continue in effect for a term of ten years, unless terminated earlier as provided for in the Stock Incentive Plan. The term of each option will be stated in the applicable option agreement, but in no event may the term be more than ten years from the date of grant.

Effective on May 9, 2000, the Company issued options under the Stock Incentive Plan to purchase a total of 627,500 shares of common stock at $8.6875 per share. During the year ended December 31, 2001, the Company issued additional options under the Stock Incentive Plan to purchase 32,500 shares of common stock at an average price of $11.50 per share. During the year ended December 31, 2002, options were exercised to purchase 102,504 shares and 3,334 shares of common stock at a price of $8.6875 and $13.00, respectively. During the year ended 2001, options were exercised to purchase 49,176 shares of common stock at a price of $8.6875 per share in accordance with the Stock Incentive Plan. As of December 31, 2002, 56,666 options have been forfeited and 448,320 options remain unexercised. The unexercised options are as follows: 419,154 options priced at $8.6875, 12,500 options priced at $9.10, and 16,666 options priced at $13.00. All unexercised options expire on the date that is ten years after the date of the grant of such option.

14

During the year ended December 31, 2002, options were exercised under the 1991 Stock Option Plan to purchase 13,912 shares and 7,998 shares of common stock at a price of $5.00 and $14.375, respectively. At December 31, 2002 there were no outstanding options to purchase common stock under the 1991 Stock Option Plan.

Aggregated Option Exercises and Fiscal Year-end Option Value Table

The following table sets forth the information noted for all exercises of stock options during the fiscal year ended December 31, 2002 by each of the Named Officers and the fiscal year end value of unexercised options.

| | | Shares Acquired On Exercise(#)(1)

| | Value Realized($)(2)

| | Number of Securities Underlying Unexercised Options/SARS At Fiscal Year-End(#)(1)

| | Value of Unexercised In-The-Money Options/SARS At Fiscal Year-End($)(1)

|

| | | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

General William Lyon | | — | | | — | | — | | — | | | — | | | — |

Wade H. Cable 1991 Plan 2000 Plan | | 13,912 — | | $ | 212,854 — | | 0 33,335 | | 0 16,665 | | $ | 0 438,105 | | $ | 0 219,020 |

Thomas J. Mitchell | | — | | | — | | 16,668 | | 8,332 | | $ | 219,059 | | $ | 109,503 |

Douglas F. Bauer | | 8,333 | | $ | 148,098 | | 0 | | 8,332 | | | 0 | | $ | 109,503 |

Mary J. Connelly | | — | | | — | | 8,333 | | 8,332 | | $ | 109,516 | | $ | 109,503 |

| (1) | | All exercised, exercisable and unexercisable options for each of the Named Officers were granted on May 9, 2000 under the Stock Incentive Plan, except for the 13,912 options exercised in 2002 by Mr. Wade Cable. The options granted under the Stock Incentive Plan vest one-third on May 9, 2001, one-third on May 9, 2002 and one-third on May 9, 2003. The exercise price of these options is $8.6875. The value of unexercised in-the-money options is calculated by determining the difference between the closing price of the Company’s common stock on the New York Stock Exchange ($21.83 per share) at December 31, 2002 and the exercise price of the options. |

| (2) | | The value realized is calculated by determining the difference between the closing price of the Company’s common stock on the New York Stock Exchange at exercise and the exercise price. |

Employment Contracts, Termination of Employment and Change-in-Control Arrangements

Employees, including executive officers, enter into annual employment agreements which provide that their employment is at-will. The employment agreements with each of General William Lyon, Wade Cable, Thomas Mitchell, Douglas Bauer and Mary Connelly provide for an annual salary effective January 1, 2003 of $600,000, $500,000, $225,000, $225,000 and $225,000 respectively. Each employment agreement also provides for a monthly automobile allowance of $400.

The Company has entered into indemnification agreements with all of its directors and the Named Officers, among others, to provide them with the maximum indemnification allowed under the Company’s certificate of incorporation and applicable law, including indemnification for all judgments and expenses incurred as the result of any lawsuit in which such person is named as a defendant by reason of being a director, officer or employee of the Company, to the maximum extent such indemnification is permitted by the laws of Delaware.

Compensation Committee Interlocks and Insider Participation

The members of the Company’s Compensation Committee are General James E. Dalton and Messrs. William H. McFarland, Michael L. Meyer, Raymond A. Watt and Randolph W. Westerfield. None of the members of the Compensation Committee has ever been an officer or employee of the Company or any of its subsidiaries. None of the Company’s executive officers has ever served as a director or member of the Compensation Committee (or other board committee performing equivalent functions) of another entity, one of whose executive officers served in either of those capacities for the Company. In April 2003, the Company will redeem the $1,000,000 in principal amount of 12 1/2% Senior Notes held by Mr. McFarland with the proceeds of a new issuance of 10 3/4% Senior Notes completed on March 17, 2003. See the section entitled “Certain Business Relationships and Related Transactions,” on page 17.

15

Compensation Committee Report on Executive Compensation

In order to attract and retain well-qualified executives, which the Compensation Committee believes is crucial to the Company’s success, the Compensation Committee’s general approach to compensating executives is to pay cash salaries which are commensurate with the executives’ experience and expertise and, where relevant, are competitive with the salaries paid to executives in the Company’s industry and primary geographic locations. In addition, to align executive compensation with the Company’s business strategies, values and management initiatives, both short and long term, the Compensation Committee may, with the Board’s approval, authorize the payment of discretionary bonuses based upon an assessment of each executive’s contributions to William Lyon Homes. In general, the Compensation Committee believes that these discretionary bonuses should be related to the Company’s and the executive’s performance.

Chief Executive Officer Compensation — The compensation program for the Chief Executive Officer (“CEO”) was comprised of two components, base salary and incentive compensation in the form of a bonus. The CEO’s base salary is established annually in light of the factors discussed above and job performance. The CEO participates in the 2002 Cash Bonus Plan as described below in which he is eligible to receive bonuses based upon specified percentages of the Company’s pre-tax, pre-bonus income. The CEO also receives an auto allowance, a policy that was instituted in 2000. No stock options were granted to the CEO during 2002.

Compensation With Respect to Other Executive Officers — The Company’s compensation for the other executive officers was comprised of a base salary and incentive compensation pursuant to the 2002 Cash Bonus Plan described below. Each of the Named Officers also receives an auto allowance, a policy that was instituted in 2000. The rate of compensation for each of the other executive officers has been in effect for varying periods, and is based in part upon the review of a survey of compensation paid by other homebuilders of similar size. No stock options were granted to the other executive officers during 2002.

2002 Cash Bonus Plan — The 2002 Cash Bonus Plan (the “2002 Plan”) provides that the CEO, the Chief Operating Officer (“COO”) and Chief Financial Officer (“CFO”) are eligible to receive bonuses based upon specified percentages of the Company’s pretax, pre-bonus income. Division presidents are eligible to receive bonuses based upon specified percentages of their respective division pre-tax, pre-bonus income. All other participants are eligible to receive bonuses based upon specified percentages of a bonus pool determined as a specified percentage of pre-tax, pre-bonus income. For the CEO, COO, CFO, division presidents, executives and managers, awards are paid over two years, with 75% paid following the determination of bonus awards, and 25% paid one year later. The deferred amounts will be forfeited in the event of termination for any reason except retirement, death or disability.

Section 162(m) — Section 162(m) of the Internal Revenue Code provides that any publicly-traded corporation will be denied a deduction for compensation paid to certain executive officers to the extent that the compensation exceeds $1,000,000 per officer per year. However, the deduction limit does not apply to “performance-based compensation,” as defined in Section 162(m). The 2002 Cash Bonus Plan is intended to provide bonuses that are considered “performance-based compensation” and therefore exempt from the deductibility limitations imposed under Section 162(m). Although the Company’s general approach is to establish compensation practices that are cost-efficient with respect to taxes, the Company reserves the authority to award compensation that is not deductible under Section 162(m) to the Company’s executive officers in the future to the extent consistent with other compensation objectives.

Submitted by the 2002 COMPENSATION COMMITTEE

Raymond A. Watt, Chairman

James E. Dalton

William H. McFarland

Michael L. Meyer

Randolph W. Westerfield

16

The Compensation Committee report shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates this information by reference.

Certain Business Relationships and Related Transactions

Redemption of 12½% Senior Notes Held by General William Lyon, a Trust of which William H. Lyon is the Sole Beneficiary, Wade H. Cable and William H. McFarland.

On March 17, 2003, the Company completed its public offering of a new issuance of 10¾% Senior Notes in the aggregate principal amount of $250,000,000. Concurrently with the completion of the offering, the Company issued a notice of redemption with respect to all of its existing 12½% Senior Notes and irrevocably deposited with the trustee under the indenture governing the 12½% Senior Notes funds in an amount sufficient to repay the $70,279,000 aggregate principal amount of 12½% Senior Notes outstanding, including $30,000,000 in principal amount held by General William Lyon and the trust for his son William H. Lyon, $2,323,000 in principal amount held by Wade H. Cable and the $1,000,000 in principal amount held by William H. McFarland. Under the notice of redemption, all of the 12½% Senior Notes will be redeemed by April 16, 2003 or on any earlier date that any holder of the 12½% Senior Notes accepts payment. As of March 31, 2003, all of the 12½% Senior Notes held by General William Lyon, the trust for William H. Lyon and Wade H. Cable were redeemed. The 12 1/2% Senior Notes held by William H. McFarland will be redeemed on or prior to April 16, 2003.

Acquisition of Real Estate Projects from Entities Controlled by General William Lyon and/or William H. Lyon.

The Company purchased real estate projects for a total purchase price of $8,468,000 during the year ended December 31, 2000, from entities controlled by General William Lyon and William H. Lyon. In addition, one-half of the net profits in excess of six to eight percent from the development of certain of the real estate projects are to be paid to the seller. During the year ended December 31, 2002, $1,770,000 was paid to the seller in accordance with this agreement.

On October 26, 2000, the Company’s board of directors (with General William Lyon and William H. Lyon abstaining) approved the purchase of 579 lots for a total purchase price of $12,581,000 from an entity controlled by General William Lyon and William H. Lyon. The terms of the purchase agreement provide for an initial option payment of $1,000,000 and a rolling option takedown of the lots. Phase takedowns of approximately 20 lots each are anticipated to occur at two to three month intervals for each of several product types through September 2004. In addition, one-half of the net profits in excess of six percent from the development are to be paid to the seller. During the years ended December 31, 2002 and 2001, the Company purchased 183 lots and 143 lots, respectively, under this agreement for a total purchase price of $4,150,000 and $2,777,000, respectively. In addition, during the year ended December 31, 2002, payments in the amount of $1,614,000 were made for one - half of the net profits in excess of six percent from the development. This land acquisition qualifies as an affiliate transaction under the Company’s 12½% Senior Notes due July 1, 2003 Indenture dated as of June 29, 1994 (“Indenture”). Pursuant to the terms of the Indenture, the Company has determined that the land acquisition is on terms that are no less favorable to the Company than those that would have been obtained in a comparable transaction by the Company with an unrelated person. The Company has delivered to the Trustee under the Indenture a resolution of the Company’s Board of Directors set forth in an Officers’ Certificate certifying that the land acquisition is on terms that are no less favorable to the Company than those that would have been obtained in a comparable transaction by the Company with an unrelated person and the land acquisition has been approved by a majority of the disinterested members of the Company’s Board of Directors of the Company. Further, the Company has delivered to the Trustee under the Indenture a determination of value by a real estate appraisal firm which is of regional standing in the region in which the subject property is located and is MAI certified.

On July 9, 2002, the Company’s Board of Directors (with General William Lyon and William H. Lyon abstaining) approved the purchase of 144 lots, through a land banking arrangement, for a total purchase price of $16,660,000 from an entity that purchased the lots from General William Lyon. The terms of the purchase agreement provide for an initial deposit of $3,300,000 (paid on July 23, 2002) and monthly option payments of

17

11.5% on the seller’s outstanding investment. Such option payments entitle the Company to phase takedowns of approximately 14 lots each, which are anticipated to occur at one to two month intervals through December 2003. As of December 31, 2002, 16 lots have been purchased under this agreement for a purchase price of $1,851,000. Had the Company purchased the property directly from General Lyon, the acquisition would qualify as an affiliate transaction under the Indenture. Even though the Company’s agreement is not with General William Lyon, the Company has chosen to treat it as an affiliate transaction. Pursuant to the terms of the Indenture, the Company has determined that the land acquisition is on terms that are no less favorable to the Company than those that would have been obtained in a comparable transaction by the Company with an unrelated person. The Company has delivered to the Trustee under the Indenture a resolution of the Board of Directors of the Company set forth in an Officers’ Certificate certifying that the land acquisition is on terms that are no less favorable to the Company than those that would have been obtained in a comparable transaction by the Company with an unrelated person and the land acquisition has been approved by a majority of the disinterested members of the Board of Directors of the Company. Further, the Company has delivered to the Trustee under the Indenture a determination of value by a real estate appraisal firm which is of regional standing in the region in which the subject property is located and is MAI certified.

Purchase of Land from Unconsolidated Joint Venture.

The Company purchased land for a total purchase price of $17,079,000, $5,371,000 and $7,128,000 during the years ended December 31, 2002, 2001 and 2000, respectively, from one of the Company’s unconsolidated joint ventures.

Agreements with Entities Controlled by William Lyon and William H. Lyon.

For the years ended December 31, 2002 and 2001, the Company incurred reimbursable on-site labor costs of $178,000 and $175,000, respectively, for providing customer service to real estate projects developed by entities controlled by General William Lyon and William H. Lyon, of which $72,000 was due to us at December 31, 2002. In addition, the Company earned fees of $99,000 and $108,000, respectively, for tax and accounting services performed for entities controlled by General William Lyon and William H. Lyon during the years ended December 31, 2002 and 2001.

For the year ended December 31, 2000, the Company earned management fees and were reimbursed for on-site labor costs of $330,000 and $593,000, respectively, for managing and selling real estate owned by entities controlled by General William Lyon and William H. Lyon.

Rent Paid to a Trust of which William H. Lyon is the Sole Beneficiary.

For the years ended December 31, 2002, 2001, and 2000, the Company incurred charges of $729,000, $729,000, and $717,000, respectively, related to rent on the Company’s corporate office, from a trust of which William H. Lyon is the sole beneficiary.

Charges Incurred Related to the Charter and Use of Aircraft Owned by an Affiliate of William Lyon.

During the years ended December 31, 2002 and 2001, the Company incurred charges of $177,000 and $201,000, respectively, related to the charter and use of aircraft owned by an affiliate of General William Lyon.

Mortgage Loans.

In 2002, the Company offered home mortgage loans to its employees and directors through its mortgage company subsidiary, Duxford Financial, Inc. These loans were made in the ordinary course of business and on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons. These loans did not involve more than the normal risk of collectability or present other unfavorable features and were sold to investors typically within 7 to 15 days.

18

Home Purchase.

The Company offers a 2% discount on new homes sold to its employees. In 2002, one of the Company’s executive officers, Larry Smith, and another employee purchased a new home from the Company for $327,048, and another executive officer, Mary J. Connelly, and her husband, also an employee of the Company, purchased a new home from the Company for $1,045,733.

Certain Family Relationships.

William H. Lyon, one of the Company’s directors and an employee, is the son of General William Lyon. General William Lyon is the Company’s Chairman of the Board of Directors and the Chief Executive Officer. In 2002, William H. Lyon received a base salary of $82,000 and a monthly car allowance of $400 from the Company, and earned a bonus of $121,588 under the terms of the Company’s 2002 Cash Bonus Plan. The bonus earned by William H. Lyon in 2002 is consistent with bonuses earned by other Company employees with similar responsibilities.

19

Common Stock Price Performance

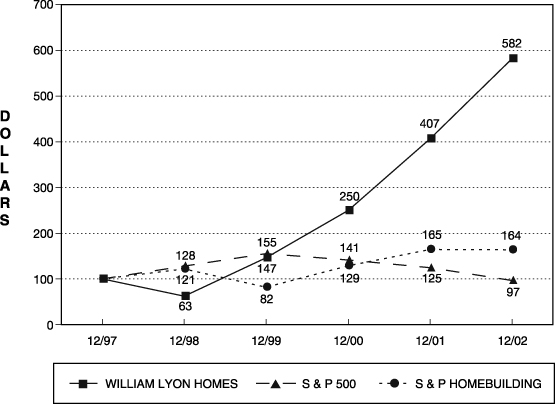

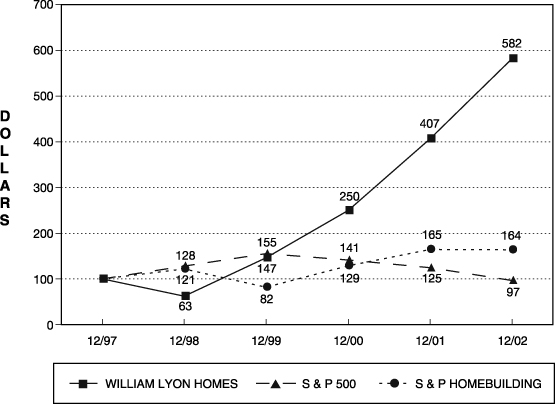

The graph below compares the cumulative total return of the Common Stock of the Company, the S & P 500 Index and the S & P Homebuilding Index:

The graph above is based upon common stock and index prices calculated as of December 31 for 1997, 1998, 1999, 2000, 2001 and 2002. The base period is December 31, 1997, on which date the closing price of the Common Stock of the former The Presley Companies was $3.75 per share, when adjusted for the Company’s one-for-five stock conversion pursuant to the merger of the former The Presley Companies with and into the Company. Total return assumes an investment of $100 at market close on December 31, 1997 in the Company, the S&P 500 Index and the S&P Homebuilding Index. On December 31, 2002, the Company’s Common Stock closed at $21.83 per share. The stock price performance of the Company’s Common Stock depicted in the graph above represents past performance only and is not necessarily indicative of future performance.

Section 16(a) Beneficial Ownership Reporting Compliance

Based solely upon a review of reports received by the Company during or with respect to the year ended December 31, 2002 pursuant to Rule 16a-3(e) of the Securities Exchange Act of 1934, all reports required during or with respect to the year ended December 31, 2002 on Form 3, Form 4 and Form 5 were timely filed by the Company’s directors, officers and 10% stockholders, except that an assignment of 10,000 stock options by Richard Frankel that occurred in 2001 was not timely reported on a Form 5, but such Form 5 was subsequently filed.

20

PROPOSAL NO. 2

RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The Board of Directors is seeking stockholder ratification of its selection of Ernst & Young LLP to serve as the Company’s independent auditors for the fiscal year ending December 31, 2003. Kenneth Leventhal & Company, which merged with Ernst & Young LLP in 1995, had served as the former The Presley Companies’ independent auditors since 1987 and the Company’s independent auditors since its formation. It is anticipated that representatives from Ernst & Young LLP will attend the Annual Meeting, will have the opportunity to make any statements they desire to make and will be available to respond to appropriate questions from stockholders.

The Board of Directors recommends a vote “For” the ratification of the

selection of Ernst & Young LLP as our independent auditors.

21

OTHER BUSINESS

We know of no other matters to be brought before the Annual Meeting. If other matters should come before the Annual Meeting, it is the intention of each person mentioned in the proxy to vote such proxy in accordance with his or her judgment on such matters. Discretionary authority with respect to such other matters is granted by the execution of the enclosed proxy materials.

STOCKHOLDER PROPOSALS FOR THE NEXT ANNUAL MEETING