As filed with the Securities and Exchange Commission on March 20, 2013

Registration No. 333-183249

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

POST-EFFECTIVE AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

WILLIAM LYON HOMES

(Exact Name of Registrant as Specified in its Charter)

| | | | |

| Delaware | | 1531 | | 33-0864902 |

| (State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

4490 Von Karman Avenue

Newport Beach, California 92660

(949) 833-3600

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

William H. Lyon

Chief Executive Officer

William Lyon Homes

4490 Von Karman Avenue

Newport Beach, California 92660

(949) 833-3600

(Name, address, including zip code, and telephone number, including area code, of agent for service)

with copies to:

Cary K. Hyden, Esq.

Michael A. Treska, Esq.

Latham & Watkins LLP

650 Town Center Drive, 20th Floor

Costa Mesa, California 92626

(714) 540-1235

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | |

| Large accelerated filer ¨ | | | | Accelerated filer ¨ |

| Non-accelerated filer x | | (Do not check if a smaller reporting company) | | Smaller reporting company ¨ |

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

|

Title of Each Class of

Securities to be Registered | | Amount

to be Registered | | Proposed

Maximum Offering

Price

per Share | | Proposed

Maximum Aggregate

Offering Price | | Amount of

Registration Fee |

Class A Common Stock, par value $0.01 per share | | 178,952,742(1) | | $1.05(2) | | $90,222,993 | | $10,717 |

Class C Common Stock, par value $0.01 per share | | 93,026,082(3) | | $1.05(2) | | $16,821,355 | | $1,928 |

Convertible Preferred Stock, par value $0.01 per share | | 77,005,744(4) | | $1.15(2) | | $88,556,606 | | $12,080 |

Total | | | | | | | | $24,725(5) |

|

|

| (1) | Represents (a) 29,224,017 shares of Class A Common Stock issued in connection with the Prepackaged Joint Plan of Reorganization, or the Plan, of William Lyon Homes and certain of its subsidiaries, (b) the maximum number of shares of Class A Common Stock issuable upon conversion of the shares of Class B Common Stock issued in connection with the Plan at a conversion rate of one share of Class A Common Stock for each share of Class B Common Stock, or the Class B Conversion Rate, which is 31,464,548 shares of Class A Common Stock, (c) the maximum number of shares of Class A Common Stock issuable upon conversion of Class C Common Stock registered hereby at a conversion rate of one share of Class A Common Stock for each share of Class C Common Stock, which is 16,020,338 shares of Class A Common Stock, (d) the maximum number of shares of Class A Common Stock issuable upon conversion of the Convertible Preferred Stock registered hereby at a conversion rate of one share of Class A Common Stock for each share of Convertible Preferred Stock, which is 77,005,744 shares of Class A Common Stock, (e) 10,000,000 shares of Class A Common Stock issued in connection with a real estate purchase transaction that took place on June 28, 2012 and 15,238,095 shares of Class A Common Stock issued pursuant to a privately negotiated stock issuance to an affiliate of Paulson & Co. Inc., or the Paulson Transaction. Pursuant to Rule 416 under the Securities Act of 1933, as amended, or the Securities Act, the registrants are also registering such indeterminate number of shares of Class A Common Stock as may be issued from time to time as a result of the anti-dilution provisions applicable to stock splits, stock dividends and similar transactions. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(a) under the Securities Act. |

| (3) | Represents (a) 12,876,338 shares of Class C Common Stock issued in connection with the Plan, (b) the maximum number of shares of Class C Common Stock issuable upon conversion of Convertible Preferred Stock registered hereby at a conversion rate of one share of Class C Common Stock for each share of Convertible Preferred Stock, which is 77,005,744 shares of Class C Common Stock and (c) 3,144,000 shares of Class C Common Stock issued pursuant to an agreement with certain selling stockholders to backstop the offering of shares of Class C Common Stock and shares of Convertible Preferred Stock in connection with the Plan. |

| (4) | Represents 64,831,831 shares of Convertible Preferred Stock issued in connection with the Plan and 12,173,913 shares of Convertible Preferred Stock issued in connection with the Paulson Transaction. |

| (5) | A registration fee of $30,413 was previously paid based on an estimate of the proposed maximum aggregate offering price. |

The registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Post-Effective Amendment No. 1, or the Post-Effective Amendment No. 1, to the Registration Statement on Form S-1 (File No. 333-183249), as originally declared effective by the Securities and Exchange Commission, or the SEC, on February 13, 2013, is being filed to include information in the Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2012, which was filed with the SEC on March 18, 2013, and to update certain other information in the Registration Statement.

The information included in this filing amends the Registration Statement and the Prospectus contained therein. The Company is also registering additional securities under this Post-Effective Amendment No. 1 pursuant to certain registration rights granted to certain of our stockholders.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission relating to these securities is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated March 20, 2013

PROSPECTUS

William Lyon Homes

Shares of Class A Common Stock

Shares of Class C Common Stock

Convertible Preferred Stock

We are registering the following shares of Class A Common Stock, Class C Common Stock and Convertible Preferred Stock of William Lyon Homes, or the Company, to satisfy registration rights that we granted in connection with the Company’s Joint Plan of Reorganization on February 25, 2012 and certain recent corporate transactions, as more fully described elsewhere in the prospectus:

| | • | | 178,952,742 shares of the Company’s Class A Common Stock, $0.01 par value per share, or Class A Common Stock, which includes the shares of Class A Common Stock issuable upon conversion of the Company’s outstanding Class B Common Stock, $0.01 par value per share, or Class B Common Stock, upon conversion of the Company’s outstanding Class C Common Stock, $0.01 par value per share, or Class C Common Stock, and upon conversion of the Company’s Convertible Preferred Stock, $0.01 par value per share, or Convertible Preferred Stock; |

| | • | | 93,026,082 shares of Class C Common Stock, which includes the shares of Class C Common Stock issuable upon conversion of the outstanding Convertible Preferred Stock; and |

| | • | | 77,005,744 shares of Convertible Preferred Stock. |

We are not selling any securities under this prospectus and will not receive any proceeds from the sale of the securities by the selling stockholders. The securities to which this prospectus relates may be offered and sold from time to time directly by the selling stockholders or alternatively through underwriters, broker dealers or agents. The securities may be sold in one or more transactions, at the current fixed price per share of $1.05 for our Class A Common Stock and Class C Common Stock and $1.15 per share for our Convertible Preferred Stock until such shares are quoted on the OTC Bulletin Board or an exchange and thereafter at prevailing market prices at the time of sale or privately negotiated prices. Please read “Plan of Distribution.”

There is currently no public trading market for the capital stock of the Company and such capital stock is not presently traded on any market or securities exchange. We intend to have a registered broker-dealer apply to have the securities registered hereby quoted on the Over-the-Counter Bulletin Board.

You should read this prospectus carefully before you invest in our securities. You should read this prospectus together with additional information described under the headings “Where You Can Find More Information” before you make your investment decision.

Investing in our securities involves a high degree of risk. Before investing in any of our securities, you should read the discussion of material risks in the section entitled “Risk Factors” beginning on page 12 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2013.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus does not constitute an offer to sell, or a solicitation of an offer to purchase, the securities offered by this prospectus in any jurisdiction to or from any person to whom or from whom it is unlawful to make such offer or solicitation of an offer in such jurisdiction. The information contained in this prospectus is current only as of its date.

TABLE OF CONTENTS

PROSPECTUS SUMMARY

This summary highlights the information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. For a more complete understanding of this offering, we encourage you to carefully read this entire prospectus.

In this prospectus, unless otherwise stated or the context otherwise requires, the “Company,” “we,” “our,” and “us” refer to William Lyon Homes, a Delaware corporation, and its subsidiaries. In addition, unless otherwise stated or the context otherwise requires, “Parent” refers to William Lyon Homes, and “California Lyon” refers to William Lyon Homes, Inc., a California corporation and wholly-owned subsidiary of Parent.

Our Company

The Company is primarily engaged in the design, construction and sale of single family detached and attached homes in California, Arizona, Nevada and, as of December 2012, Colorado. Since the founding of the Company’s predecessor in 1956, the Company and its joint ventures have sold over 74,000 homes. The Company conducts its homebuilding operations through five reportable operating segments (Southern California, Northern California, Arizona, Nevada and, as of December 2012, Colorado). For the year ended December 31, 2012, 45% of home closings were derived from the Company’s California operations. In the 2012 period, on a consolidated basis, the Company had revenues from home sales of $261.3 million and delivered 950 homes. For the year ended December 31, 2011, approximately 59% of the home closings of the Company and its joint ventures were derived from its California operations. For the year ended December 31, 2011, on a consolidated basis, the Company had revenues from home sales of $207.1 million and delivered 614 homes.

The Company designs, constructs and sells a wide range of homes designed to meet the specific needs of each of its markets, although it primarily emphasizes sales to the entry-level and first time move-up home buyer markets. At December 31, 2012, the Company marketed its homes through 18 sales locations. In 2012, the average sales price for consolidated homes delivered by the Company was $275,100. Base sales prices for actively selling projects in 2012, including affordable projects, ranged from $88,000 to $690,000.

Bankruptcy Reorganization

On December 19, 2011, Parent and certain of its subsidiaries filed voluntary petitions, or the Chapter 11 Petitions, under Chapter 11 of Title 11 of the United States Code, as amended, or the Bankruptcy Code, in the U.S. Bankruptcy Court for the District of Delaware, or the Bankruptcy Court, to seek approval of the Prepackaged Joint Plan of Reorganization, or the Plan, of Parent and certain of its subsidiaries. The Chapter 11 Petitions are jointly administered under the captionIn re William Lyon Homes, et al., Case No. 11-14019, or the Chapter 11 Cases. The sole purpose of the Chapter 11 Cases was to restructure the debt obligations and strengthen the balance sheet of Parent and certain of its subsidiaries.

On February 10, 2012, the Bankruptcy Court confirmed the Plan. On February 25, 2012, Parent and certain of its subsidiaries consummated the principal transactions contemplated by the Plan, including:

| | • | | the issuance of 44,793,255 shares of Parent’s new Class A Common Stock, $0.01 par value per share, or Class A Common Stock, and $75 million aggregate principal amount of 12% Senior Subordinated Secured Notes due 2017, or the Notes, issued by California Lyon, in exchange for the claims held by the holders of the formerly outstanding notes of California Lyon; |

| | • | | the amendment of California Lyon’s loan agreement with ColFin WLH Funding, LLC and certain other lenders, or the Amended Term Loan Agreement, which resulted, among other things, in the increase in the principal amount outstanding under the prior loan agreement from $206 million to $235 million, the reduction in the interest rate payable under the prior loan agreement, and the elimination of any prepayment penalty under the prior loan agreement; |

1

| | • | | the issuance, in exchange for aggregate cash consideration of $25 million, of 31,464,548 shares of Parent’s new Class B Common Stock, $0.01 par value per share, or Class B Common Stock, and a warrant to purchase 15,737,294 shares of Class B Common Stock; |

| | • | | the issuance of 64,831,831 shares of Parent’s new Convertible Preferred Stock, $0.01 par value per share, or Convertible Preferred Stock, and 12,966,366 shares of Parent’s new Class C Common Stock, $0.01 par value per share, or Class C Common Stock, in exchange for aggregate cash consideration of $60 million; and |

| | • | | the issuance of an additional 3,144,000 shares of Class C Common Stock to Luxor Capital Group LP, or Luxor, as a transaction fee in consideration for providing the backstop commitment of the offering of shares of Class C Common Stock and shares of Convertible Preferred Stock in connection with the Plan. |

Principal Holders of Securities Issued in Connection with the Plan

Entities affiliated with Luxor acquired 21,427,135 shares of Class A Common Stock (29.7% of the Class A Common Stock outstanding as of March 11, 2013), 15,445,838 shares of Class C Common Stock (95.9% of the Class C Common Stock outstanding as of March 11, 2013) and 61,509,204 shares of Convertible Preferred Stock (79.9% of the Convertible Preferred Stock outstanding as of March 11, 2013) in connection with the Plan, which provides Luxor with 37.1% of the total voting power of the Company’s outstanding capital stock. Luxor received 3,144,000 of its 15,445,838 shares of Class C Common stock as a transaction fee in consideration for providing the backstop commitment described above. Luxor also received $35.9 million aggregate principal amount of the Notes issued in connection with the Plan.

General William Lyon and William H. Lyon, or the Lyons, acquired beneficial ownership of 31,464,548 of Class B Common Stock (100% of the current outstanding Class B Common Stock) and a warrant to purchase an additional 15,737,294 shares of Class B Common Stock, or the Class B Warrant. The 31,464,548 shares of Class B Common Stock and the Class B Warrant are owned by Lyon Shareholder 2012, LLC, or Lyon LLC. Lyon LLC is now managed by William H. Lyon and all interests in Lyon LLC are held for the benefit of William H. Lyon. The William Harwell Lyon Separate Property Trust separately acquired 24,199 shares of Parent’s Class A Common Stock (less than 1% of the then outstanding Class A Common Stock) and $40,000 in aggregate principal amount of the Notes issued in connection with the Plan in exchange for prepetition notes held by the William Harwell Lyon Separate Property Trust. William H. Lyon’s Class B Common Stock holdings and Class A Common Stock holdings provide William H. Lyon with 36.1% of the total voting power of the Company’s outstanding capital stock as of March 11, 2013.

Recent Events

Colony Transaction

On June 28, 2012, the Company consummated the purchase of certain real property (comprising of approximately 165 acres) in San Diego County, California, San Bernardino County, California, Maricopa County, Arizona and Clark County, Nevada, representing seven separate residential for sale developments, comprising over 1,000 lots. The aggregate purchase price of the property was $21,500,000. The Company paid $11,000,000 cash, and issued 10,000,000 shares of Class A Common Stock of Parent (18.3% of the then current outstanding Class A Common Stock), to investment vehicles managed by affiliates of Colony Capital, LLC as consideration for the property, which provides Colony with 3.8% of the total voting power of the Company’s outstanding capital stock.

2

Paulson Transaction

On October 12, 2012, the Company entered into a Subscription Agreement, or the Subscription Agreement, between the Company and WLH Recovery Acquisition LLC, a Delaware limited liability company and investment vehicle managed by affiliates of Paulson & Co. Inc., or Paulson, pursuant to which, the Company issued to Paulson (i) 15,238,095 shares of the Company’s Class A Common Stock, for $16,000,000 in cash, and (ii) 12,173,913 shares of the Company’s Convertible Preferred Stock, for $14,000,000 in cash, for an aggregate purchase price of $30,000,000, or the Paulson Transaction. Paulson currently holds 10.4% of the total voting power of the Company’s outstanding capital stock. In connection with the Paulson Transaction, the Company also amended (i) its Class A Common Stock Registration Rights Agreement and Convertible Preferred Stock and Class C Common Stock Registration Rights Agreement to include in such agreements the shares issued to Paulson so that Paulson may become a party to such agreements with equal rights, benefits and obligations as the other stockholders who are parties thereto, and (ii) its Amended and Restated Certificate of Incorporation, or the Charter, and Amended and Restated Bylaws to (a) increase the size of the Company’s board of directors, or the Board, from seven to eight members, up to and until the Conversion Date (as defined in “Description of Capital Stock”), (b) provide the holders of Class A Common Stock the right to elect the director to fill the newly created Board seat, (c) revise the definition of “Convertible Preferred Original Issue Price” to equal the price per share at which shares of Convertible Preferred Stock are issued and (d) incorporate various clarifying and conforming changes.

Equity Grants Under the Company’s 2012 Equity Incentive Plan

As previously disclosed in the Company’s Current Report on Form 8-K filed on October 16, 2012, the Company’s board of directors and stockholders approved the Company’s 2012 Equity Incentive Plan, or the 2012 Plan, in October 2012. The purpose of the 2012 Plan is to (1) provide an increased incentive for eligible employees, consultants and directors to assert their best efforts by conferring benefits based on the achievement of certain performance goals, (2) better align the interests of eligible participants with the interests of stockholders by providing an opportunity for increased stock ownership by such participants, and (3) encourage such participants to remain in the service of the Company. The Company approved its first grants under the 2012 Plan in October 2012 and has continued to make grants in accordance with the 2012 Plan under the administration of the Company’s Compensation Committee. See the section of this prospectus entitled “Executive Compensation” for additional information.

Senior Notes Offering and Debt Refinancing

On November 8, 2012, California Lyon completed its offering of 8.5% Senior Notes due 2020, or the New Notes, in an aggregate principal amount of $325 million. The New Notes were issued at 100% of their aggregate principal amount. The Company used the net proceeds from the sale of the New Notes, together with cash on hand, to refinance the Company’s (i) $235 million 10.25% Senior Secured Term Loan due 2015, (ii) approximately $76 million in aggregate principal amount of 12% Senior Subordinated Secured Notes due 2017, (iii) approximately $11 million in principal amount of project related debt, and (iv) to pay accrued and unpaid interest thereon.

Risks Affecting the Company

The Company’s business is subject to numerous risks, as more fully described in the section of this prospectus entitled “Risk Factors,” including the following:

| | • | | Adverse changes in general economic conditions could reduce the demand for homes and, as a result, could negatively impact the Company’s results of operations. |

3

| | • | | Increases in the Company’s cancellation rate could have a negative impact on the Company’s home sale revenue and home building margins. |

| | • | | Limitations on the availability of mortgage financing can adversely affect demand for housing. |

| | • | | The Company’s high level of indebtedness could adversely affect its financial condition and prevent it from fulfilling its obligations. At March 11, 2013, the total outstanding principal amount of our debt was $344.2 million. |

| | • | | The Company cannot be certain that the bankruptcy proceedings will not adversely affect the Company’s operations going forward. |

| | • | | Concentration of ownership of the voting power of the Company’s capital stock may prevent other stockholders from influencing corporate decisions and create perceived conflicts of interest. |

| | • | | There is currently no public trading market for the Company’s capital stock and a trading market may not develop, making it difficult for the Company’s stockholders to sell their capital stock. |

General Corporate Information

The Company’s principal executive offices are located at 4490 Von Karman Avenue, Newport Beach, California 92660 and its telephone number is (949) 833-3600. The Company plans to relocate its principle executive offices to 4695 MacArthur Court, 8th floor, Newport Beach, California, by the end of the second quarter of 2013. The Company’s website address is www.lyonhomes.com. Information contained on the Company’s website is not a part of this prospectus and the inclusion of the website address in this prospectus is an inactive textual reference only. Parent was incorporated in the State of Delaware on July 15, 1999.

The Offering

The following summary contains basic information about the capital stock registered hereby and is not intended to be complete. It does not contain all of the information that is important to you. For a more complete understanding of these securities, please refer to the section of this prospectus entitled “Description of Capital Stock”.

4

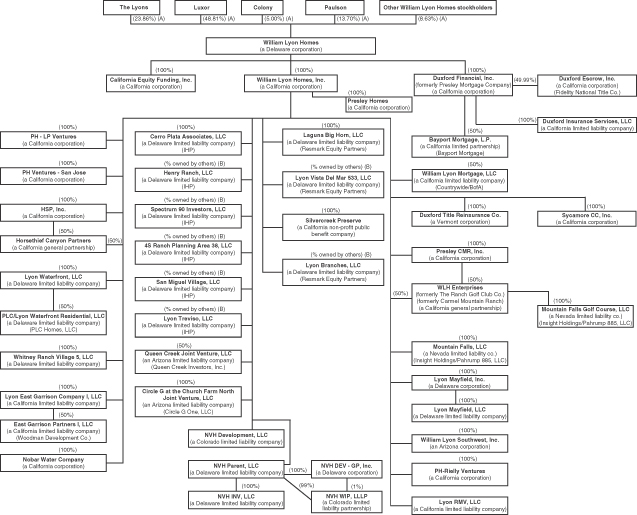

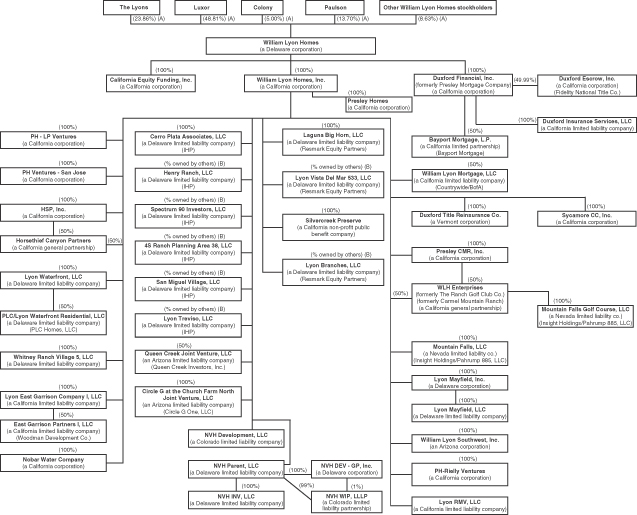

Diagram of the Company’s Corporate Structure

Footnotes:

| | (A) | Represents combined equity ownership of each holder as of March 11, 2013. See “Security Ownership of Certain Beneficial Owners and Management” for information regarding each holder’s percentage of total voting power. |

| | (B) | Due to waterfall provisions in each operating agreement, percentage ownership changes over time. |

5

Offering of Capital Stock

Summary Description of Capital Stock

Issuer of Capital Stock | William Lyon Homes, a Delaware corporation |

Capital Stock of William Lyon Homes Offered by the Selling Stockholders | Class A Common Stock, par value $0.01 per share, Class C Common Stock, par value $0.01 per share and Convertible Preferred Stock, par value $0.01 per share. |

Conversion Rights of the Holders of Class B Common Stock and Class C Common Stock | All shares of Class B Common Stock will be converted into an equal number of shares of Class A Common Stock on or after the Conversion Date if a majority of the holders of shares of Class B Common Stock vote in favor of such conversion. If, at any time (whether before, on or after the Conversion Date), any share of Class B Common Stock is not owned, beneficially or of record, by William Lyon and William H. Lyon, their sibling, spouses and lineal descendants, any entities wholly owned by one or more of the foregoing persons, or any trusts or other estate planning vehicles for the benefit of any of the foregoing, then such share of Class B Common Stock will automatically convert into one share of Class A Common Stock. |

| | All shares of Class C Common Stock will automatically convert into shares of Class A Common Stock at the rate of one share of Class A Common Stock for each share of Class C Common Stock at the Conversion Date, which occurs upon the earlier of: |

| | • | | the closing of a sale of at least $25,000,000 in shares of Class A Common Stock at a price that equals or exceeds 130% of the then-prevailing base price; |

| | • | | the date on which the majority of the holders of Class A Common Stock, voting together as a separate class, and the majority of the holders of Class C Common Stock and Convertible Preferred Stock, voting together as a separate class, vote in favor of the mandatory conversion of the shares of Class C Common Stock and the shares of Convertible Preferred Stock; or |

| | • | | the date on which the 30-day volume weighted average trading price on a national exchange equals or exceeds 130% of the then-prevailing base price and the aggregate dollar trading volume for such 30-day period is at least $4,000,000. |

| | Holders of Class B Common Stock and Class C Common Stock may at any time elect to convert any or all of their shares into Class A Common Stock at the rate of one share of Class A Common Stock for each share of Class B Common Stock or Class C Common Stock. |

| | The number of shares of Class A Common Stock issuable upon the conversion of shares of Class B Common Stock and Class C Common Stock is subject to customary adjustments for stock splits, stock dividends and transactions with similar effect. |

6

Conversion Rights of the Holders of Convertible Preferred Stock | Holders of our Convertible Preferred Stock may elect to convert any and all of their Convertible Preferred Stock into such number of fully paid and non-assessable shares of Class C Common Stock as determined by the then-prevailing conversion ratio. |

| | Upon the occurrence of the Conversion Date, each share of Convertible Preferred Stock will automatically convert into such number of fully paid and non-assessable shares of Class A Common Stock as is determined by the then applicable conversion ratio. See “Description of Capital Stock.” |

Redemption of Convertible Preferred Stock on Maturity Date | To the extent not previously converted to Class A Common Stock or Class C Common Stock, the Company is obligated to redeem all of the then outstanding shares of Convertible Preferred Stock on the fifteenth anniversary of the first issuance of Convertible Preferred Stock. See “Description of Capital Stock.” |

Voting Rights; Dividends | Each share of Class A Common Stock, Class B Common Stock and Class C Common Stock have identical powers, preferences, qualifications and limitations, except that so long as shares of Class B Common Stock remain outstanding, (i) each share of Class A Common Stock and Class C Common Stock are entitled to one vote per share and (ii) each share of Class B Common Stock is entitled to two votes per share. Following both the Conversion Date and the conversion of all Class B Common Stock, each share of Class A Common Stock is entitled to one vote per share. The voting, dividend and liquidation rights of the holders of the Company common stock are subject to and qualified by the rights, powers and preferences of the holders of the Company’s preferred stock. See “Management and Directors—Board of Directors” for a discussion of voting rights with respect to the election of directors. |

| | Each share of Convertible Preferred Stock has the right to one vote for each share of Class C Common Stock into which such share could be converted. |

| | We do not anticipate paying any cash dividends on our common stock following this offering. Any determination to pay dividends to holders of our common stock will be at the discretion of our board of directors. Except as described below, the payment of cash dividends is restricted under the terms of the indenture governing California Lyon’s 8.5% Senior Notes due 2020. |

| | Holders of our Convertible Preferred Stock are entitled to receive cumulative dividends at a rate of 6% per annum consisting of (i) cash dividends at the rate of 4% paid quarterly in arrears, and (ii) accreting dividends accruing at the rate of 2% per annum. |

National Securities Exchange; Initial Public Offering | On or prior to the third anniversary of the date of first issuance of our Class A Common Stock, we are required to use best efforts to cause |

7

| | our Class A Common Stock to become listed on a national securities exchange, and subject to certain exceptions, to complete a qualifying initial public offering. |

Use of Proceeds | We will not receive any of the proceeds from the sale by the selling stockholders of our capital stock. |

Material United States Federal Income Tax Considerations | For a discussion of United States federal income tax considerations for holders of the capital stock registered hereby, see “Material United States Federal Income Tax Considerations.” |

Absence of a Public Market for the Capital Stock | There is currently no established market for our capital stock. We intend to have a registered broker-dealer apply to have our capital stock registered hereby quoted on the Over-the-Counter Bulletin Board. However, we cannot assure you as to the development or liquidity of any market for our capital stock. |

8

PRO FORMA OPERATING STATEMENT

(in thousands except number of shares and per share amounts)

The following table sets forth our operating statement as of December 31, 2011, and our operating statement as of December 31, 2011 as adjusted for the plan of reorganization adjustments, giving effect to the adjustments as if the Company emerged from bankruptcy on January 1, 2011. The information in this table should be read in conjunction with the notes below.

| | | | | | | | | | | | |

| | | Year Ended

December 31,

2011 | | | Plan of

Reorganization

Adjustments | | | Pro forma

Year Ended

December 31,

2011 | |

Operating revenue | | | | | | | | | | | | |

Home sales | | $ | 207,055 | | | | — | | | $ | 207,055 | |

Lots, land and other sales | | | — | | | | — | | | | — | |

Construction services | | | 19,768 | | | | — | | | | 19,768 | |

| | | | | | | | | | | | |

| | | 226,823 | | | | — | | | | 226,823 | |

| | | | | | | | | | | | |

Operating costs | | | | | | | | | | | | |

Cost of sales — homes | | | (184,489 | ) | | | 982 | (a) | | | (183,507 | ) |

Cost of sales — lots, land and other | | | (4,234 | ) | | | — | | | | (4,234 | ) |

Impairment loss on real estate assets | | | (128,314 | ) | | | — | | | | (128,314 | ) |

Construction services | | | (18,164 | ) | | | — | | | | (18,164 | ) |

Sales and marketing | | | (16,848 | ) | | | — | | | | (16,848 | ) |

General and administrative | | | (22,411 | ) | | | — | | | | (22,411 | ) |

Amortization of intangible assets | | | — | | | | (3,151 | )(b) | | | (3,151 | ) |

Other | | | (3,983 | ) | | | — | | | | (3,983 | ) |

| | | | | | | | | | | | |

| | | (378,443 | ) | | | (2,169 | ) | | | (380,612 | ) |

| | | | | | | | | | | | |

Equity in income of unconsolidated joint ventures | | | 3,605 | | | | — | | | | 3,605 | |

| | | | | | | | | | | | |

Operating loss | | | (148,015 | ) | | | (2,169 | ) | | | (150,184 | ) |

Interest expense, net of amounts capitalized | | | (24,529 | ) | | | 9,778 | (c) | | | (14,751 | ) |

Other income, net | | | 838 | | | | — | | | | 838 | |

| | | | | | | | | | | | |

Loss before reorganization items and provision for income taxes | | | (171,706 | ) | | | 7,609 | | | | (164,097 | ) |

Reorganization items, net | | | (21,182 | ) | | | 21,182 | (d) | | | — | |

| | | | | | | | | | | | |

Loss before provision for income taxes | | | (192,888 | ) | | | 28,791 | | | | (164,097 | ) |

Provision for income taxes | | | (10 | ) | | | — | | | | (10 | ) |

| | | | | | | | | | | | |

Net loss | | | (192,898 | ) | | | 28,791 | | | | (164,107 | ) |

Less: Net income attributable to noncontrolling interest | | | (432 | ) | | | — | | | | (432 | ) |

| | | | | | | | | | | | |

Net loss attributable to William Lyon Homes | | | (193,330 | ) | | | 28,791 | | | | (164,539 | ) |

Preferred stock dividends | | | — | | | | (3,023 | )(e) | | | (3,023 | ) |

| | | | | | | | | | | | |

Net loss available to common stockholders | | $ | (193,330 | ) | | $ | 25,768 | | | $ | (167,562 | ) |

| | | | | | | | | | | | |

Loss per common share, basic and diluted | | $ | (193,330 | ) | | | | | | $ | (1.81 | ) |

Weighted average common shares outstanding, basic and diluted | | | 1,000 | | | | 92,368,169 | (f) | | | 92,368,169 | |

Weighted average additional common shares outstanding if preferred shares converted to common shares | | | — | | | | 64,831,831 | (f) | | | 64,831,831 | |

| (a) | Reflects adjustments made to cost of sales based on the fair value of inventory per the plan of reorganization. Adjustments were made to real estate inventories on a per project basis, were allocated pro rata to the number of homes in the project, and relieved to cost of sales based on the number of homes closed during the year. |

| (b) | Reflects the adjustment to amortization of intangible assets based on the Company emerging from Chapter 11 on January 1, 2011. The Company would have recorded intangible assets relating to homes in backlog with a fair value of $2.4 million, which would have been fully amortized during the 2011 period, as all the homes in backlog at January 1, 2011 closed during the 2011 period. Additionally, the Company would have recorded intangible assets relating to construction management contracts of $4.6 million and joint venture management contracts of $0.8 million and would have recorded amortization expense based on the number of homes closed of $0.6 million and $0.2 million respectively. |

| (c) | Reflects the adjustment to interest expense based on Term Loan of $206.0 million at 14% interest and Old Notes of $283.5 million at interest rates between 7.5% and 10.75% versus post-emergence Term Loan of $235.0 million at 10.25% interest, no outstanding balance on Old Notes and new Senior Note of $75.0 million at 12% interest for the 2011 period. |

9

| (d) | Reflects the reversal of reorganization items, which is comprised of legal and professional fees incurred in connection with the Chapter 11 cases. |

| (e) | Reflects the amount of preferred stock dividends that would have been accrued had the Company emerged from Chapter 11 on January 1, 2011. |

| (f) | Reflects the weighted average common shares outstanding in accordance with the plan of reorganization. |

The following table sets forth our operating statement for the year ended December 31, 2012, and our operating statement for the year ended December 31, 2012 as adjusted for the plan of reorganization adjustments, giving effect to the adjustments as if the Company emerged from bankruptcy on January 1, 2011. The information in this table should be read in conjunction with the notes below.

| | | | | | | | | | | | |

| | | Period Ended

December 31,

2012 | | | Plan of

Reorganization

Adjustments | | | Pro forma

December 31,

2012 | |

Operating revenue | | | | | | | | | | | | |

Home sales | | $ | 261,297 | | | $ | — | | | $ | 261,297 | |

Lots, land and other sales | | | 104,325 | | | | — | | | | 104,325 | |

Construction services | | | 32,708 | | | | — | | | | 32,708 | |

| | | | | | | | | | | | |

| | | 398,330 | | | | — | | | | 398,330 | |

| | | | | | | | | | | | |

Operating costs | | | | | | | | | | | | |

Cost of sales — homes | | | (217,801 | ) | | | 524 | (h) | | | (217,277 | ) |

Cost of sales — lots, land and other | | | (94,786 | ) | | | — | | | | (94,786 | ) |

Impairment loss on real estate assets | | | — | | | | — | | | | — | |

Construction services | | | (29,639 | ) | | | — | | | | (29,639 | ) |

Sales and marketing | | | (15,872 | ) | | | — | | | | (15,872 | ) |

General and administrative | | | (29,397 | ) | | | — | | | | (29,397 | ) |

Amortization of intangible assets | | | (5,757 | ) | | | 4,084 | (i) | | | (1,673 | ) |

Other | | | (3,096 | ) | | | — | | | | (3,096 | ) |

| | | | | | | | | | | | |

| | | (396,348 | ) | | | 4,608 | | | | (391,740 | ) |

| | | | | | | | | | | | |

Equity in income of unconsolidated joint ventures | | | — | | | | — | | | | — | |

| | | | | | | | | | | | |

Operating income | | | 1,982 | | | | 4,608 | | | | 6,590 | |

Loss on extinguishment of debt | | | (1,392 | ) | | | | | | | (1,392 | ) |

Interest expense, net of amounts capitalized — Note 1 | | | (11,634 | ) | | | 363 | (j) | | | (11,271 | ) |

Other income, net — Note 12 | | | 1,758 | | | | — | | | | 1,758 | |

| | | | | | | | | | | | |

Loss before reorganization items and provision for income taxes | | | (9,286 | ) | | | 4,971 | | | | (4,315 | ) |

Reorganization items, net — Note 4 | | | 230,933 | | | | (230,933 | )(k) | | | — | |

| | | | | | | | | | | | |

Income (loss) before provision from income taxes | | | 221,647 | | | | (225,962 | ) | | | (4,315 | ) |

Provision for income taxes — Note 13 | | | (11 | ) | | | — | | | | (11 | ) |

| | | | | | | | | | | | |

Net income (loss) | | | 221,636 | | | | (225,962 | ) | | | (4,326 | ) |

Less: Net income attributable to noncontrolling interest | | | (2,112 | ) | | | — | | | | (2,112 | ) |

| | | | | | | | | | | | |

Net income (loss) attributable to William Lyon Homes | | | 219,524 | | | | (225,962 | ) | | | (6,438 | ) |

| | | | | | | | | | | | |

Preferred stock dividends | | | (2,743 | ) | | | (459 | )(l) | | | (3,202 | ) |

| | | | | | | | | | | | |

Net income (loss) available to common stockholders | | $ | 216,781 | | | $ | (226,421 | ) | | $ | (9,640 | ) |

| | | | | | | | | | | | |

Income (loss) per common share, basic and diluted | | $ | 2.10 | | | | — | | | $ | (0.10 | ) |

Weighted average common shares outstanding, basic and diluted | | | 103,037,842 | | | | — | | | | 101,434,476 | |

Weighted average additional common shares outstanding if preferred shares converted to common shares | | | 68,002,529 | | | | — | | | | 67,526,058 | |

10

| (h) | Reflects adjustments made to cost of sales based on the fair value of inventory per the plan or reorganization. Adjustments were made to real estate inventories on a per project basis, were allocated pro rata to the number of homes in the project, and relieved to cost of sales based on the number of homes closed during the period. |

| (i) | Reflects the adjustment to amortization of intangible assets based on the Company emerging from Chapter 11 on January 1, 2011. The adjustment is comprised primarily of $4.0 million relating to amortization of homes in backlog that would have been fully amortized in the prior year, as well as adjustments to amortization of construction management contracts and joint venture management contracts for the period from January 1, 2012 through February 24, 2012. |

| (j) | Reflects the adjustment to interest expense based on Term Loan of $206.0 million at 14% interest and Old Notes of $283.5 million at interest rates between 7.5% and 10.75%, post emergence Term Loan of $235.0 million at 10.25% interest, zero Old Notes and new Senior Note of $75.0 million at 12% interest for the period from January 1, 2012 through February 24, 2012. |

| (k) | Reflects the reversal of reorganization items comprised of cancellation of debt of $298.9 million, plan implementation adjustments of $49.3 million, professional fees of $9.7 million and write-off of deferred loan costs of $8.3 million. |

| (l) | Reflects the amount of preferred stock dividends that would have been accrued for the period from January 1, 2012 through February 24, 2012. |

11

RISK FACTORS

An investment in the Company entails the following risks and uncertainties. These risk factors should be carefully considered when evaluating any investment in the Company. Any of these risks and uncertainties could cause the actual results to differ materially from the results contemplated by the forward-looking statements set forth herein, and could otherwise have a significant adverse impact on the Company’s business, prospects, financial condition or results of operations. In addition, please read “Cautionary Statement Concerning Forward-Looking Statements” in this prospectus, where we describe additional uncertainties associated with our business and the forward-looking statements included in this prospectus.

Market and Operational Risks

Increases in the Company’s cancellation rate could have a negative impact on the Company’s home sales revenue and home building gross margins.

During the years ended December 31, 2012, 2011 and 2010, the Company experienced cancellation rates of 14%, 18% and 19%, respectively. Cancellations negatively impact the number of closed homes, net new home orders, home sales revenue and the Company’s results of operations, as well as the number of homes in backlog. Home order cancellations can result from a number of factors, including declines or slow appreciation in the market value of homes, increases in the supply of homes available to be purchased, increased competition, higher mortgage interest rates, homebuyers’ inability to sell their existing homes, homebuyers’ inability to obtain suitable financing, including providing sufficient down payments, and adverse changes in economic conditions. Continued high levels of home order cancellations would have a negative impact on the Company’s home sales revenue and financial and operating results.

Limitations on the availability of mortgage financing can adversely affect demand for housing.

In general, housing demand is negatively impacted by the unavailability of mortgage financing as a result of declining customer credit quality, tightening of mortgage loan underwriting standards, or other factors. Most buyers finance their home purchases through third-party lenders providing mortgage financing. Over the last several years, many third-party lenders have significantly increased underwriting standards, and many subprime and other alternate mortgage products are no longer available in the marketplace in spite of a decrease in mortgage rates. If these trends continue and mortgage loans continue to be difficult to obtain, the ability and willingness of prospective buyers to finance home purchases or to sell their existing homes will be adversely affected, which will adversely affect the Company’s results of operations through reduced home sales revenue, gross margin and cash flow.

Changes in federal income tax laws may also affect demand for new homes. Various proposals have been publicly discussed to limit mortgage interest deductions and to limit the exclusion of gain from the sale of a principal residence. Enactment of such proposals may have an adverse effect on the homebuilding industry in general. No meaningful prediction can be made as to whether any such proposals will be enacted and, if enacted, the particular form such laws would take.

Difficulty in obtaining sufficient capital could result in increased costs and delays in completion of projects.

The homebuilding industry is capital-intensive and requires significant up-front expenditures to acquire land and begin development. Land acquisition, development and construction activities may be adversely affected by any shortage or increased cost of financing or the unwillingness of third parties to engage in joint ventures. The Company’s current financial position may make it more difficult for the Company to obtain capital for development projects. Any difficulty in obtaining sufficient capital for planned development expenditures could cause project delays and any such delay could result in cost increases and may adversely affect the Company’s sales and future results of operations and cash flows.

12

Financial condition and results of operations may be adversely affected by any decrease in the value of land inventory, as well as by the associated carrying costs.

The Company continuously acquires land for replacement and expansion of land inventory within the markets in which it builds. The risks inherent in purchasing and developing land increase as consumer demand for housing decreases, and thus, the Company may have bought and developed land on which homes cannot be profitably built and sold. The Company employs measures to manage inventory risks which may not be successful. In addition, inventory carrying costs can be significant and can result in losses in a poorly performing project or market, and the Company may have to sell homes at significantly lower margins or at a loss. Further, the Company may be required to write-down the book value of certain real estate assets in accordance with U.S. generally accepted accounting principles, or U.S. GAAP, and some of those write-downs could be material.

On February 24, 2012, the Company adopted fresh start accounting under ASC 852, Reorganizations, and recorded all real estate inventories at fair value. Subsequent to February 24, 2012 and throughout each quarter of 2012, there were no indicators of impairment, as sales prices and sales absorption rates have improved. For the 2012 period, there were no impairment charges recorded.

During 2011, the Company incurred non-cash impairment losses on real estate assets amounting to $128.3 million. As required by U.S. GAAP, in connection with our emergence from the Chapter 11 Cases, we adopted the fresh start accounting provisions of ASC 852,Reorganizations, effective February 24, 2012. See “Risks Related to Our Emergence from Chapter 11 Bankruptcy Proceedings” for further discussion. Under ASC 852, the reorganization value represents the fair value of the entity before considering liabilities and approximates the amount a willing buyer would pay for the assets of the Company immediately after restructuring. The reorganization value is allocated to the respective fair value of assets. The Company engaged a third-party valuation firm to assist with the analysis of the fair value of the entity, and respective assets and liabilities. In conjunction with the valuation of all of the assets of the Company, the Company re-set value on certain land holdings in the early stages of development, based on: (i) “as-is” development stages of the property instead of a discounted cash flow approach, (ii) relative comparables on similar stage properties that had recently sold, on a per acre basis, and (iii) location of the property, among other factors. As a result, the Company re-valued these particular assets as of February 24, 2012, and since the date of emergence from the Chapter 11 Cases is within six weeks of year end, management made the assumption that the values are approximately the same, and recorded the book value as fair value as of December 31, 2011. Therefore, the adjustment to fair value was made on December 31, 2011, with no subsequent adjustment necessary at February 24, 2012, on these particular assets. The difference between the new value applied to the property on December 31, 2011 and the carrying value as of December 31, 2011, was recorded as impairment loss on real estate assets.

In addition, the Company incurred non-cash impairment losses on real estate assets of $111.9 million for the year ended December 31, 2010. The Company assesses its projects on a quarterly basis, when indicators of impairment exist. Indicators of impairment include a decrease in demand for housing due to soft market conditions, competitive pricing pressures which reduce the average sales price of homes, which includes sales incentives for home buyers, sales absorption rates below management expectations, a decrease in the value of the underlying land and a decrease in projected cash flows for a particular project. The Company was required to write down the book value of its impaired real estate assets in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 360,Property, Plant and Equipment, or ASC 360.

If land is not available at reasonable prices, the Company’s home sales revenue and results of operations could be negatively impacted or the Company could be required to scale back the Company’s operations in a given market.

The Company’s operations depend on the Company’s ability to obtain land for the development of the Company’s residential communities at reasonable prices and with terms that meet the Company’s underwriting criteria. The Company’s ability to obtain land for new residential communities may be adversely affected by

13

changes in the general availability of land, the willingness of land sellers to sell land at reasonable prices given the deterioration in market conditions, competition for available land, availability of financing to acquire land, zoning, regulations that limit housing density, and other market conditions. If the supply of land appropriate for development of residential communities continues to be limited because of these factors, or for any other reason, the number of homes that the Company’s homebuilding subsidiaries build and sell may continue to decline. Additionally, the ability of the Company to open new projects could be impacted if the Company elects not to purchase lots under option contracts. To the extent that the Company is unable to purchase land timely or enter into new contracts for the purchase of land at reasonable prices, due to the lag time between the time the Company acquires land and the time the Company begins selling homes, the Company’s home sales revenue and results of operations could be negatively impacted and/or the Company could be required to scale back the Company’s operations in a given market.

Adverse changes in general economic conditions could reduce the demand for homes and, as a result, could negatively impact the Company’s results of operations.

The homebuilding industry is sensitive to changes in economic conditions such as the level of employment, consumer confidence, consumer income, availability of financing and interest rate levels. The national recession, credit market disruption, high unemployment levels, the absence of home price stability, and the decreased availability of mortgage financing have, among other factors, adversely impacted the homebuilding industry and our operations and financial condition over the last several years. Although the housing market appears to be recovering in most of the geographies in which we operate, we cannot predict the pace or scope of the recovery. If market conditions deteriorate or do not improve as anticipated, our results of operations and financial condition could be adversely impacted.

Adverse weather and geological conditions may increase costs, cause project delays and reduce consumer demand for housing, all of which would adversely affect the Company’s results of operations and prospects.

As a homebuilder, the Company is subject to numerous risks, many of which are beyond management’s control, such as droughts, floods, wildfires, landslides, soil subsidence, earthquakes and other weather-related and geologic events which could damage projects, cause delays in completion of projects, or reduce consumer demand for housing, and shortages in labor or materials, which could delay project completion and cause increases in the prices for labor or materials, thereby affecting the Company’s sales and profitability. Many of the Company’s projects are located in California, which has experienced significant earthquake activity and seasonal wildfires. In addition to directly damaging the Company’s projects, earthquakes or other geologic events could damage roads and highways providing access to those projects, thereby adversely affecting the Company’s ability to market homes in those areas and possibly increasing the costs of completion.

There are some risks of loss for which the Company may be unable to purchase insurance coverage. For example, losses associated with landslides, earthquakes and other geologic events may not be insurable and other losses, such as those arising from terrorism, may not be economically insurable. A sizeable uninsured loss could adversely affect the Company’s business, results of operations and financial condition.

The Company’s business is geographically concentrated, and therefore, the Company’s sales, results of operations, financial condition and business would be negatively impacted by a decline in regional economies.

The Company presently conducts all of its business in five geographic regions: Southern California, Northern California, Arizona, Nevada and, as of December 2012, Colorado. The economic downturn in these markets has caused housing prices and sales to decline, which has caused a material adverse effect on the Company’s business, results of operations and financial condition because the Company’s operations are concentrated in these geographic areas.

14

In particular, the Company generates a significant portion of its revenue and a significant amount of its profits from, and holds approximately one-half of the dollar value of its real estate inventory in, California. Over the last several years, land values, the demand for new homes and home prices have declined substantially in California, negatively impacting the Company’s profitability and financial position. In addition, the state of California is experiencing severe budget shortfalls and is considering raising taxes and increasing fees to offset the deficit. There can be no assurance that the profitability and financial position of the Company will not be further impacted if the challenging conditions in California continue or worsen.

The Company may not be able to compete effectively against competitors in the homebuilding industry.

The homebuilding industry is highly competitive. Homebuilders compete for, among other things, homebuying customers, desirable properties, financing, raw materials and skilled labor. The Company competes both with large homebuilding companies, some of which have greater financial, marketing and sales resources than the Company, and with smaller local builders. Our competitors may independently develop land and construct housing units that are substantially similar to our products. Many of these competitors also have longstanding relationships with subcontractors and suppliers in the markets in which we operate. We currently build in several of the top markets in the nation and, therefore, we expect to continue to face additional competition from new entrants into our markets. The Company also competes for sales with individual resales of existing homes and with available rental housing.

The Company’s success depends on key executive officers and personnel.

The Company’s success is dependent upon the efforts and abilities of its executive officers and other key employees, many of whom have significant experience in the homebuilding industry and in the Company’s divisional markets. In particular, the Company is dependent upon the services of General William Lyon, Chairman of the Board and Executive Chairman, William H. Lyon, Chief Executive Officer, and Matthew R. Zaist, President and Chief Operating Officer, as well as the services of the California region and other division presidents and division management teams and personnel in the corporate office. The loss of the services of any of these executives or key personnel, for any reason, could have a material adverse effect upon the Company’s business, operating results and financial condition.

Power shortages or price increases could have an adverse impact on operations.

In prior years, certain areas in Northern and Southern California have experienced power shortages, including mandatory periods without electrical power, as well as significant increases in utility costs. The Company may incur additional costs and may not be able to complete construction on a timely basis if such power shortages and utility rate increases continue. Furthermore, power shortages and rate increases may adversely affect the regional economies in which the Company operates, which may reduce demand for housing. The Company’s operations may be adversely impacted if further rate increases and/or power shortages occur.

The Company’s business and results of operations are dependent on the availability and skill of subcontractors.

Substantially all construction work is done by subcontractors with the Company acting as the general contractor. Accordingly, the timing and quality of construction depend on the availability and skill of the Company’s subcontractors. While the Company has been able to obtain sufficient materials and subcontractors during times of material shortages and believes that its relationships with suppliers and subcontractors are good, the Company does not have long-term contractual commitments with any subcontractors or suppliers. The inability to contract with skilled subcontractors at reasonable costs on a timely basis could have a material adverse effect on the Company’s business and results of operations.

15

Construction defect, soil subsidence and other building-related claims may be asserted against the Company, and the Company may be subject to liability for such claims.

As a homebuilder, we have been, and continue to be, subject to construction defect, product liability and home warranty claims, including moisture intrusion and related claims, arising in the ordinary course of business. These claims are common to the homebuilding industry and can be costly.

California law provides that consumers can seek redress for patent (i.e., observable) defects in new homes within three or four years (depending on the type of claim asserted) from when the defect is discovered or should have been discovered. If the defect is latent (i.e., non-observable), consumers must still seek redress within three or four years (depending on the type of claim asserted) from the date when the defect is discovered or should have been discovered, but in no event later than ten years after the date of substantial completion of the work on the construction. Consumers purchasing homes in Arizona, Nevada and Colorado may also be able to obtain redress under state laws for either patent or latent defects in their new homes.

With respect to certain general liability exposures, including construction defect claims, product liability claims and related claims, assessment of claims and the related liability and reserve estimation process is highly judgmental due to the complex nature of these exposures, with each exposure exhibiting unique circumstances. Furthermore, once claims are asserted for construction defects, it can be difficult to determine the extent to which the assertion of these claims will expand. Although we have obtained insurance for construction defect claims subject to applicable self-insurance retentions, such policies may not be available or adequate to cover liability for damages, the cost of repairs, and/or the expense of litigation surrounding current claims, and future claims may arise out of events or circumstances not covered by insurance and not subject to effective indemnification agreements with our subcontractors.

Material shortages could delay or increase the cost of home construction and reduce our sales and earnings.

The residential construction industry experiences serious material shortages from time to time, including shortages of insulation, drywall, cement, steel and lumber. These material shortages can be more severe during periods of strong demand for housing and during periods where the regions in which we operate experience natural disasters that have a significant impact on existing residential and commercial structures. From time to time, we have experienced volatile price swings in the cost of materials, including in particular, the cost of lumber, cement, steel and drywall. Shortages and price increases could cause delays in and increase our costs of home construction, which in turn could harm our operating results.

The Company’s limited geographic diversification could adversely affect the Company if the homebuilding industry in our markets declines.

The Company has homebuilding operations in California, Nevada, Arizona and, as of December 2012, Colorado. The Company’s limited geographic diversification could adversely impact the Company if the homebuilding business in its current markets should decline, since there may not be a balancing opportunity in a stronger market in other geographic regions.

Inflation could adversely affect the Company’s business, financial condition and results of operations, particularly in a period of oversupply of homes.

Inflation can adversely affect the Company by increasing costs of land, materials and labor. However, the Company may be unable to offset these increases with higher sales prices. In addition, inflation is often accompanied by higher interest rates, which have a negative impact on housing demand. In such an environment, the Company may be unable to raise home prices sufficiently to keep up with the rate of cost inflation, and, accordingly, its margins could decrease. Moreover, with inflation, the purchasing power of the Company’s cash resources can decline. Efforts by the government to stimulate the economy may not be successful, but have increased the risk of significant inflation and its resulting adverse effect on the Company’s business, financial condition and results of operations.

16

The Company’s business is seasonal in nature and quarterly operating results can fluctuate.

The Company’s quarterly operating results generally fluctuate by season. The Company typically achieves its highest new home sales orders in the spring and summer, although new homes sales order activity is also highly dependent on the number of active selling communities and the timing of new community openings. Because it typically takes the Company three to six months to construct a new home, the Company delivers a greater number of homes in the second half of the calendar year as sales orders convert to home deliveries. As a result, the Company’s revenues from homebuilding operations are higher in the second half of the year, particularly in the fourth quarter, and the Company generally experiences higher capital demands in the first half of the year when it incurs construction costs. If, due to construction delays or other causes, the Company cannot close its expected number of homes in the second half of the year, the Company’s financial condition and full year results of operations may be adversely affected.

The Company may be unable to obtain suitable bonding for the development of its communities.

The Company provides bonds to governmental authorities and others to ensure the completion of its projects. If the Company is unable to provide required surety bonds for its projects, the Company’s business operations and revenues could be adversely affected. As a result of the deterioration in market conditions, surety providers have become increasingly reluctant to issue new bonds and some providers are requesting credit enhancements in order to maintain existing bonds or to issue new bonds. If the Company is unable to obtain required bonds in the future, or is required to provide credit enhancements with respect to its current or future bonds, the Company’s liquidity could be negatively impacted.

Increased insurance costs and reduced insurance coverages may affect the Company’s results of operations and increase the potential exposure to liability.

Recently, lawsuits have been filed against builders asserting claims of personal injury and property damage caused by the presence of mold in residential dwellings. Some of these lawsuits have resulted in substantial monetary judgments or settlements against these builders. The Company’s insurance may not cover all of the potential claims, including personal injury claims, arising from the presence of mold or such coverage may become prohibitively expensive. If the Company is unable to obtain adequate insurance coverage, a material adverse effect on the Company’s business, financial condition and results of operations could result if the Company is exposed to claims arising from the presence of mold. At this time, the Company has not received any claims from homeowners arising from the presence of mold.

The cost of insurance for the Company’s operations has risen, deductibles and retentions have increased and the availability of insurance has diminished. Significant increases in the cost of insurance coverage or significant limitations on coverage could have a material adverse effect on the Company’s business, financial condition and results of operations from such increased costs or from liability for significant uninsurable or underinsured claims.

We periodically conduct certain of our operations through unconsolidated joint ventures with independent third parties in which we do not have a controlling interest and we can be adversely impacted by joint venture partners’ failure to fulfill their obligations.

We participate in land development joint ventures, or JVs, in which we have less than a controlling interest. We have entered into JVs in order to acquire attractive land positions, to manage our risk profile and to leverage our capital base. Our JVs are typically entered into with developers, other homebuilders and financial partners to develop finished lots for sale to the JV’s members and other third parties. However, our JV investments are generally very illiquid, due to a lack of a controlling interest in the JVs. In addition, our lack of a controlling interest results in the risk that the JV will take actions that we disagree with, or fail to take actions that we desire, including actions regarding the sale of the underlying property, which could have a negative impact on our operations.

17

The Company is the managing member in joint venture limited liability companies and may become a managing member or general partner in future joint ventures, and therefore may be liable for joint venture obligations.

Certain of the Company’s active JVs are organized as limited liability companies. The Company is the managing member in some of these and may serve as the managing member or general partner, in the case of a limited partnership JV, in future JVs. As a managing member or general partner, the Company may be liable for a JV’s liabilities and obligations should the JV fail or be unable to pay these liabilities or obligations.

We may incur additional healthcare costs arising from federal healthcare reform legislation.

In March 2010, the Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act of 2010, or the Healthcare Reform Legislation, was signed into law in the United States. The Healthcare Reform Legislation increases the level of regulatory complexity for companies that offer health and welfare benefits to their employees. Due to the breadth and complexity of the Healthcare Reform Legislation and the staggered implementation, the uncertain timing of the regulations and limited interpretive guidance, it is difficult to predict the overall impact of the healthcare reform legislation on our business over the coming years. Possible adverse effects include increased healthcare costs, which could adversely affect our business, financial condition and results of operations.

Risks Related to Our Indebtedness

The Company’s high level of indebtedness could adversely affect its financial condition and prevent it from fulfilling its obligations.

The Company is highly leveraged and, subject to certain restrictions, Parent, California Lyon and their subsidiaries may incur substantial additional indebtedness. At March 11, 2013, the total outstanding principal amount of our debt was $344.2 million. Based on the current outstanding principal amount of debt, the Company’s annual interest payments are $28.7 million. No principal payments are required for California Lyon’s outstanding 8.5% Senior Notes due 2020, or the New Notes, until 2020 and certain construction notes are due in 2015. The Company’s high level of indebtedness could have detrimental consequences, including the following:

| | • | | the ability to obtain additional financing as needed for working capital, land acquisition costs, building costs, other capital expenditures, or general corporate purposes, or to refinance existing indebtedness before its scheduled maturity, may be limited; |

| | • | | the Company will need to use a substantial portion of cash flow from operations to pay interest and principal on the New Notes and other indebtedness, which will reduce the funds available for other purposes; |

| | • | | if Parent or California Lyon is unable to comply with the terms of the agreements governing the indebtedness of the Company, the holders of that indebtedness could accelerate that indebtedness and exercise other rights and remedies against the Company; and |

| | • | | if the Company has a higher level of indebtedness than some of its competitors, it may put the Company at a competitive disadvantage and reduce the Company’s flexibility in planning for, or responding to, changing conditions in the industry, including increased competition. |

The Company cannot be certain that cash flow from operations will be sufficient to allow the Company to pay principal and interest on debt, support operations and meet other obligations. If the Company does not have the resources to meet these and other obligations, the Company may be required to refinance all or part of the existing debt, including the New Notes, sell assets or borrow more money. The Company may not be able to do so on acceptable terms, in a timely manner, or at all.

18

The indenture governing the New Notes imposes significant operating and financial restrictions, which may prevent Parent and its subsidiaries from capitalizing on business opportunities and taking some corporate actions.

The indenture governing the New Notes, or the Indenture, imposes significant operating and financial restrictions. These restrictions limit the ability of Parent, California Lyon and their subsidiaries, among other things, to:

| | • | | incur or guarantee additional indebtedness or issue certain equity interests; |

| | • | | pay dividends or distributions, repurchase equity or prepay subordinated debt; |

| | • | | make certain investments; |

| | • | | create certain restrictions on the ability of restricted subsidiaries to transfer assets; |

| | • | | enter into transactions with affiliates; |

| | • | | create unrestricted subsidiaries; and |

| | • | | consolidate, merge or sell all or substantially all of the Company’s assets. |

In addition, Parent or its subsidiaries may in the future enter into other agreements refinancing or otherwise governing indebtedness which impose yet additional restrictions. These restrictions may adversely affect Parent’s and its subsidiaries’ ability to finance future operations or capital needs or to pursue available business opportunities. A breach of any of these covenants could result in a default in respect of the related indebtedness. If a default occurs, the relevant lenders could elect to declare the indebtedness, together with accrued interest and other fees, to be immediately due and payable and proceed against any collateral securing that indebtedness.

Potential future downgrades of our credit ratings could adversely affect our access to capital and could otherwise have a material adverse effect on us.

Over the past few years, the rating agencies have downgraded the Company’s corporate credit rating due to the deterioration in our homebuilding operations, credit metrics, other earnings-based metrics, because the Company is highly leveraged and the significant decrease in our tangible net worth. These ratings and our current credit condition affect, among other things, our ability to access new capital, especially debt, and negative changes in these ratings may result in more stringent covenants and higher interest rates under the terms of any new debt. Our credit ratings could be further lowered or rating agencies could issue adverse commentaries in the future, which could have a material adverse effect on our business, results of operations, financial condition and liquidity. In particular, a weakening of our financial condition, including a significant increase in our leverage or decrease in our profitability or cash flows, could adversely affect our ability to obtain necessary funds, result in a credit rating downgrade or change in outlook, or otherwise increase our cost of borrowing. The current corporate credit rating from the ratings agencies Moody’s and Standard & Poor’s is ‘Caa2’ and ‘B-’, respectively.

Risks Related to Our Emergence from Chapter 11 Bankruptcy Proceedings

We cannot be certain that the bankruptcy proceedings will not adversely affect our operations going forward.

We emerged from bankruptcy on February 25, 2012. The full extent to which our bankruptcy will impact our business operations, reputation and relationships with our customers, employees, regulators and agents may not be known for some time, and there may be adverse ongoing effects associated with our voluntary petitions, or the Chapter 11 Petitions, under Chapter 11 of Title 11 of the United States Code, as amended, or the Bankruptcy Code.

19

Our actual financial results may vary significantly from the projections filed with the U.S. Bankruptcy Court, and investors should not rely on the projections.