We believe that the attractive fundamentals in our markets, our leading market share positions, our long-standing relationships with land developers, our significant land supply and our focus on providing the best possible customer experience position us to capitalize on meaningful growth as the U.S. housing market continues to improve.

Recent Developments

Preliminary Results for William Lyon Homes for the Quarter Ended June 30, 2014

Our financial statements as of and for the quarter ended June 30, 2014 are not yet available, and our independent registered public accounting firm has not completed its review of our results for the second quarter. Set forth below are certain preliminary estimates of the results of operations that we expect to report for our second quarter. Our actual results may differ materially from these estimates due to the completion of our financial closing procedures, final adjustments and other developments that may arise between now and the time the financial results for our second quarter are finalized.

The following are preliminary estimates for our quarter ended June 30, 2014:

During the three months ended June 30, 2014, we had 336 new home deliveries and an average sales price of homes delivered of $501,000, as compared to 345 new home deliveries and an average sales price of homes delivered of $350,000 during the three months ended June 30, 2013. Home sales revenue and total revenue increased 39% and 37%, respectively, to $168.2 million and $179.8 million for the three months ended June 30, 2014, from $120.6 million and $131.4 million for the three months ended June 30, 2013.

During the three months ended June 30, 2014, we had 388 net new home orders with an associated value of $195.5 million, as compared to 360 net new home orders with an associated value of $154.2 million during the three months ended June 30, 2013, representing an 8% increase in units and a 27% increase in value. We had 38 average selling communities during the three months ended June 30, 2014 and 24 average selling communities during the three months ended June 30, 2013. As of June 30, 2014, we were selling homes in 41 communities and had a consolidated backlog of 544 sold but unclosed homes, with an associated sales value of $303.3 million, representing a 6% increase in units and a 47% increase in value as compared to our backlog of 511 units with an associated sales value of $206.8 million as of June 30, 2013.

Acquisition of Polygon Northwest Homes

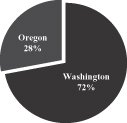

On June 22, 2014, California Lyon entered into a definitive purchase and sale agreement (the “Acquisition Agreement”) with PNW Home Builders, L.L.C. (“PNW Parent”), PNW Home Builders North, L.L.C., PNW Home Builders South, L.L.C. and Crescent Ventures, L.L.C. (collectively, the “Sellers”), to acquire the residential homebuilding business of PNW Parent. The residential homebuilding operations of PNW Parent and its affiliates are not conducted through a stand-alone legal entity, but rather are a combination of the residential homebuilding operations owned by Sellers through their direct and indirect ownership of certain limited liability companies that own real property (such operations being referred to herein as “Polygon Northwest Homes”) and conduct business as Polygon Northwest Company (“Polygon”). Pursuant to the Acquisition Agreement, California Lyon has agreed to purchase Polygon Northwest Homes through its acquisition of the membership interests of the underlying limited liability companies and certain service companies and other assets, for an aggregate cash purchase price of $520.0 million (the “Polygon Acquisition”). Separately, PNW Parent is also engaged in commercial building activities and rental operations, which are excluded from the Polygon Acquisition and are not being acquired by us.

The Polygon Acquisition will take place on a “zero cash, zero debt” basis, such that we will not be acquiring any cash on the balance sheet of Polygon Northwest Homes at closing and will not be assuming any of Polygon Northwest Homes’ existing debt, which will get paid off in connection with closing of the Polygon Acquisition. Sellers will retain all pre-closing liabilities pursuant to the terms of the Acquisition Agreement,