Presentation to the Rating Agencies February 2018 2018 Zelman Housing Summit September 27-28, 2018 Exhibit 99.1

Forward Looking Statements and Non-GAAP Information Certain statements contained in this presentation that are not historical information may constitute “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995, including, but not limited to, forward-looking statements related to: anticipated future communities; sales price ranges; business strategies; and anticipated operational and financial results. The forward-looking statements involve risks and uncertainties and actual results may differ materially from those projected or implied. William Lyon Homes (the “Company”) makes no commitment, and disclaims any duty, to update or revise any forward-looking statements to reflect future events or changes in these expectations. Further, certain forward-looking statements are based on assumptions of future events which may not prove to be accurate. Factors that may impact such forward-looking statements include, among others: the Company’s ability to successfully integrate RSI Communities’ homebuilding operations with its existing operations; any adverse effect on the Company’s business operations before or after the completion of the proposed acquisition; the availability of labor and homebuilding materials and increased construction cycle times; the availability and timing of mortgage financing; adverse weather conditions; our financial leverage and level of indebtedness and any inability to comply with financial and other covenants under our debt instruments; continued volatility and worsening in general economic or geopolitical conditions as well as restrictive policies such as tariffs or capital restrictions; increased outside broker costs; changes in governmental laws and regulations; potential changes to the tax code; worsening in markets for residential housing; the impact of construction defect, product liability and home warranty claims, including the applicability and sufficiency of our insurance coverage; decline in real estate values resulting in impairment of our real estate assets; volatility in the banking industry, credit and capital markets; building moratorium or "slow-growth" or "no-growth" initiatives that could be implemented in states in which we operate; changes in mortgage and other interest rates; conditions in the capital, credit and financial markets, including mortgage lending standards and the availability of mortgage financing; changes in generally accepted accounting principles or interpretations of those principles; and additional factors discussed under the sections captioned "Risk Factors" included in our annual and quarterly reports filed with the Securities and Exchange Commission. The foregoing list is not exhaustive. New risk factors may emerge from time to time and it is not possible for management to predict all such risk factors or to assess the impact of such risk factors on our business. This presentation contains certain supplemental financial measures that are not calculated pursuant to U.S. GAAP. These non-GAAP measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. A reconciliation of non-GAAP measures to GAAP measures is contained in the Appendix to this presentation. A copy of the press release reporting the Company’s financial results for the three and six months ended June 30, 2018 is available on the Company's website at www.lyonhomes.com.

Management Presenters Matthew R. Zaist President and Chief Executive Officer Colin T. Severn Senior Vice President and Chief Financial Officer

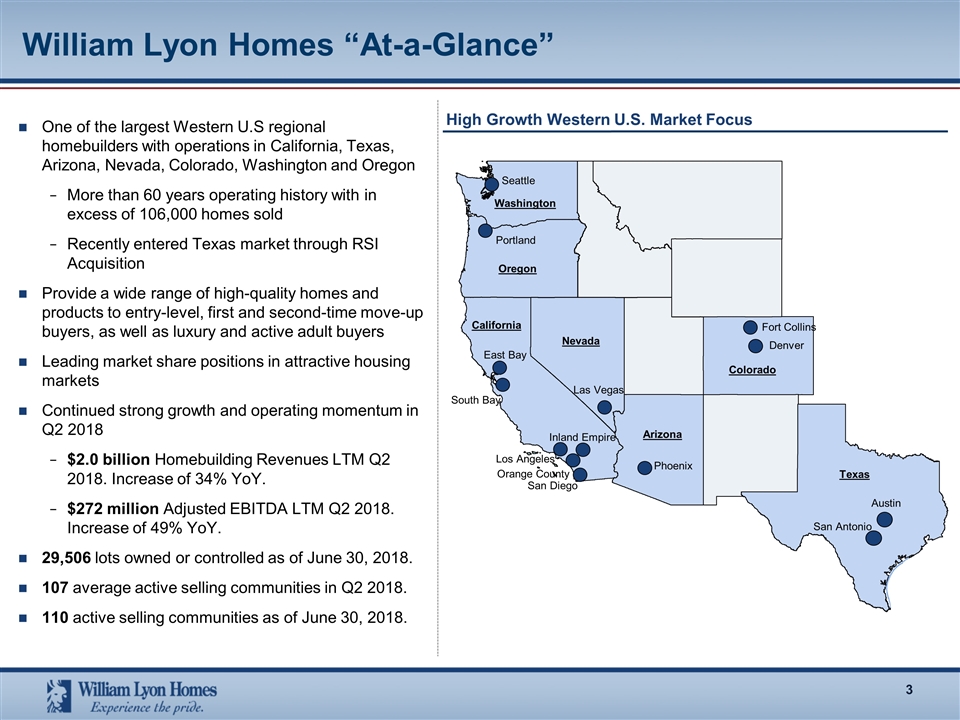

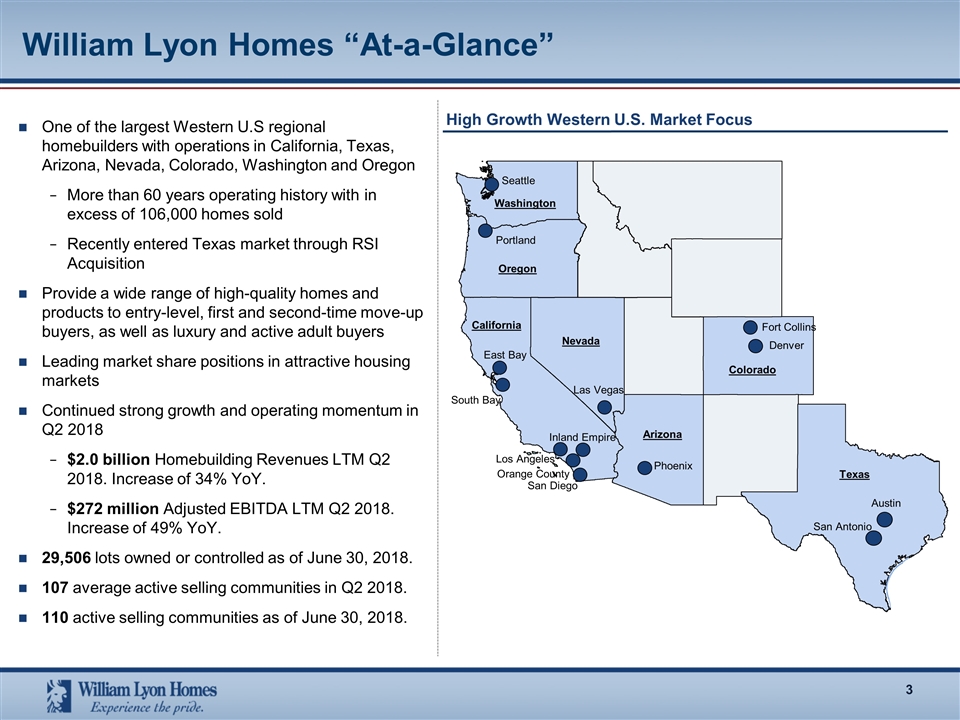

William Lyon Homes “At-a-Glance” One of the largest Western U.S regional homebuilders with operations in California, Texas, Arizona, Nevada, Colorado, Washington and Oregon More than 60 years operating history with in excess of 106,000 homes sold Recently entered Texas market through RSI Acquisition Provide a wide range of high-quality homes and products to entry-level, first and second-time move-up buyers, as well as luxury and active adult buyers Leading market share positions in attractive housing markets Continued strong growth and operating momentum in Q2 2018 $2.0 billion Homebuilding Revenues LTM Q2 2018. Increase of 34% YoY. $272 million Adjusted EBITDA LTM Q2 2018. Increase of 49% YoY. 29,506 lots owned or controlled as of June 30, 2018. 107 average active selling communities in Q2 2018. 110 active selling communities as of June 30, 2018. Seattle Portland East Bay South Bay Inland Empire Los Angeles Orange County San Diego Washington Oregon California Arizona Texas Colorado Fort Collins Denver Las Vegas Phoenix Austin San Antonio Nevada High Growth Western U.S. Market Focus

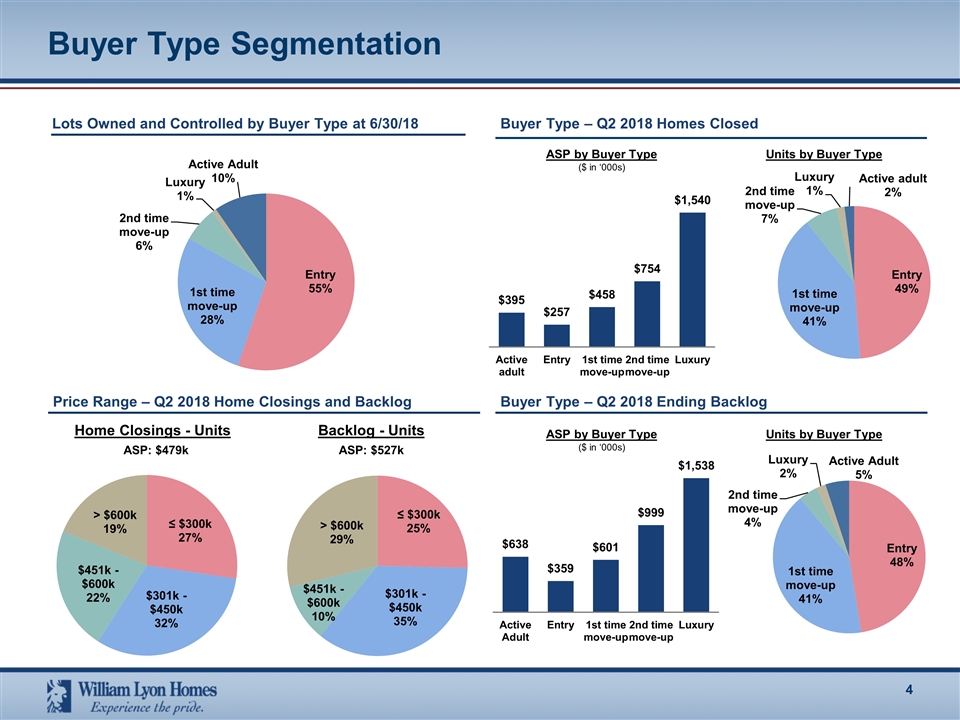

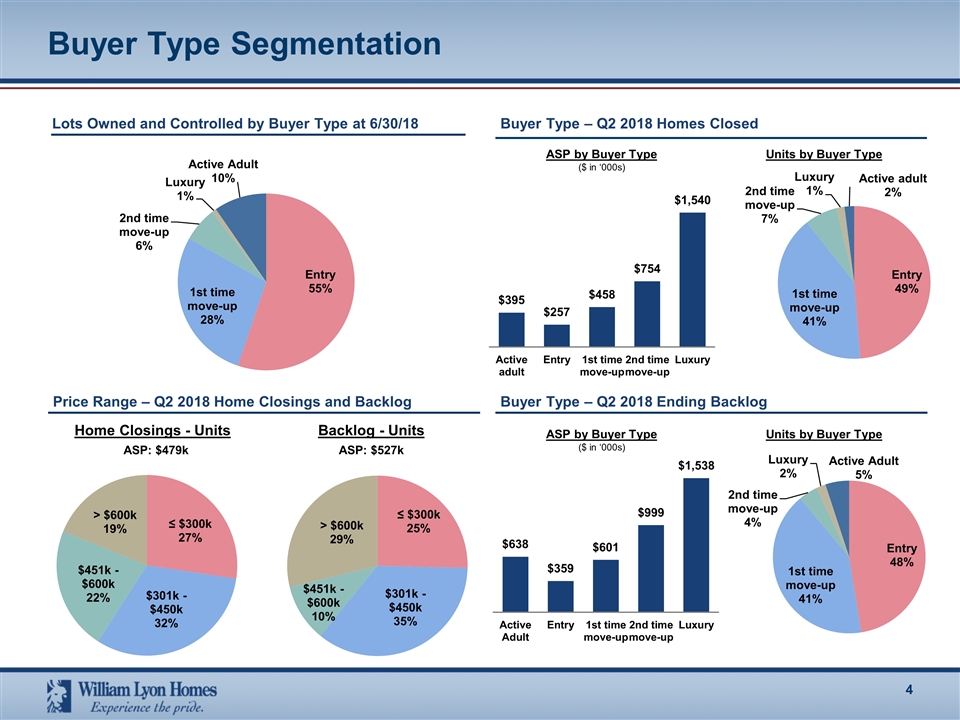

ASP by Buyer Type ($ in ‘000s) Units by Buyer Type Buyer Type Segmentation Buyer Type – Q2 2018 Homes Closed Price Range – Q2 2018 Home Closings and Backlog Home Closings - Units Backlog - Units ASP: $479k ASP: $527k Buyer Type – Q2 2018 Ending Backlog ASP by Buyer Type ($ in ‘000s) Units by Buyer Type Lots Owned and Controlled by Buyer Type at 6/30/18

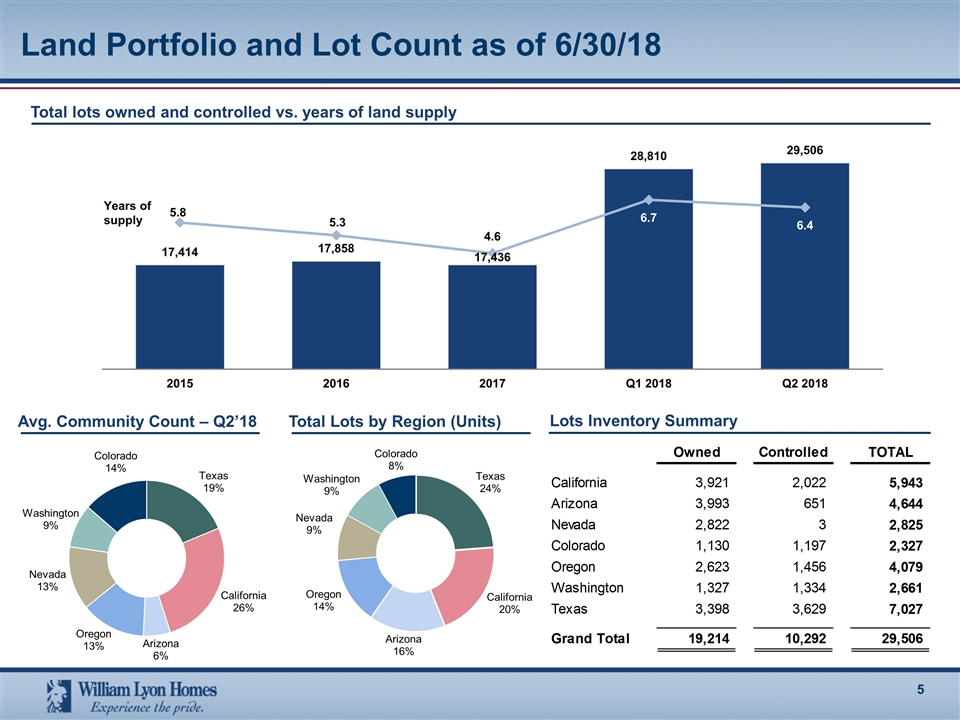

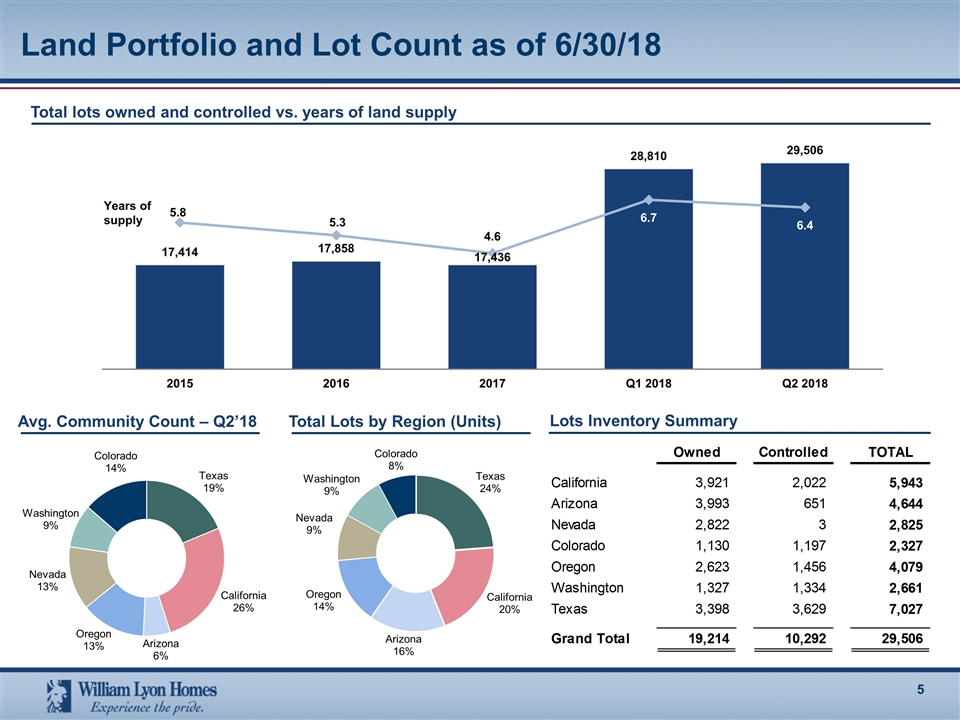

Land Portfolio and Lot Count as of 6/30/18 Total Lots by Region (Units) Lots Inventory Summary Total lots owned and controlled vs. years of land supply Avg. Community Count – Q2’18

Historical Financial Performance

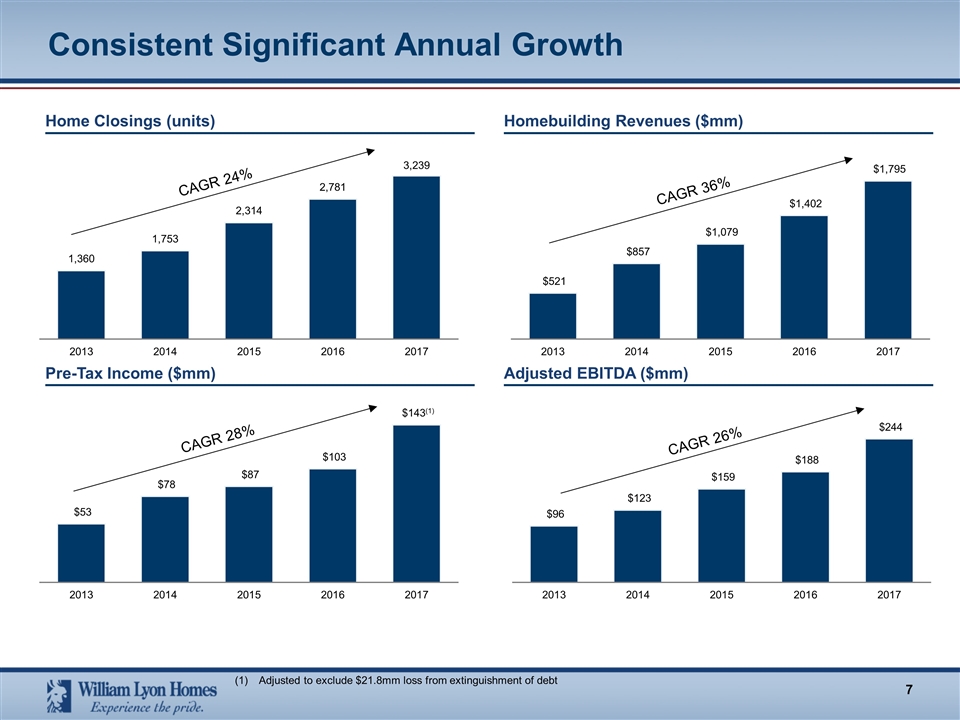

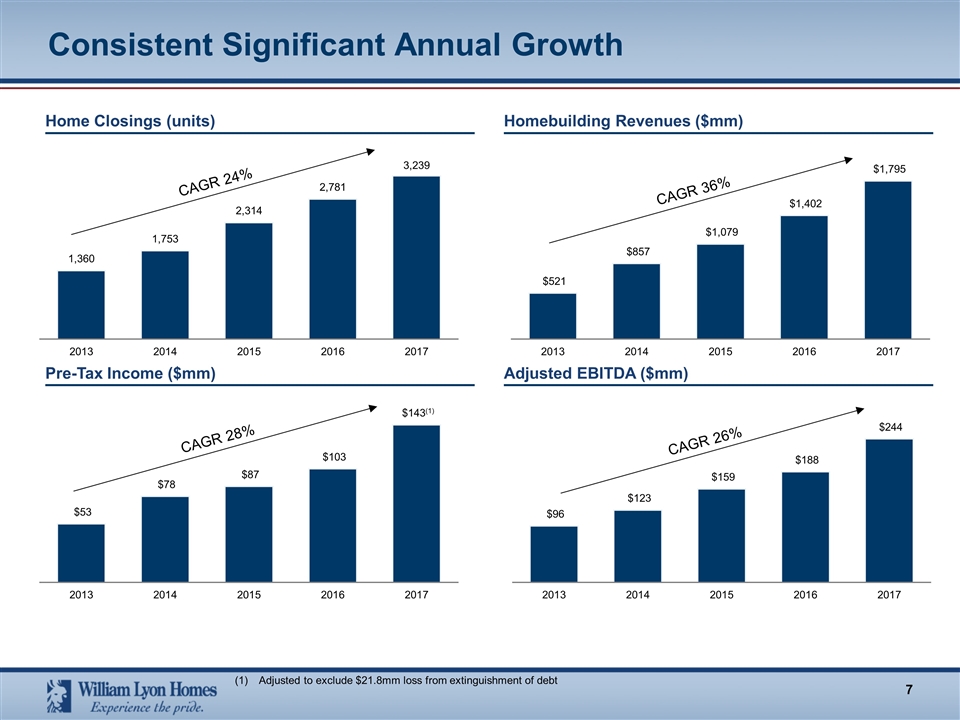

Consistent Significant Annual Growth Home Closings (units) Homebuilding Revenues ($mm) Pre-Tax Income ($mm) Adjusted EBITDA ($mm) Adjusted to exclude $21.8mm loss from extinguishment of debt CAGR 24% CAGR 36% CAGR 28% CAGR 26%

Q2 2018 Results

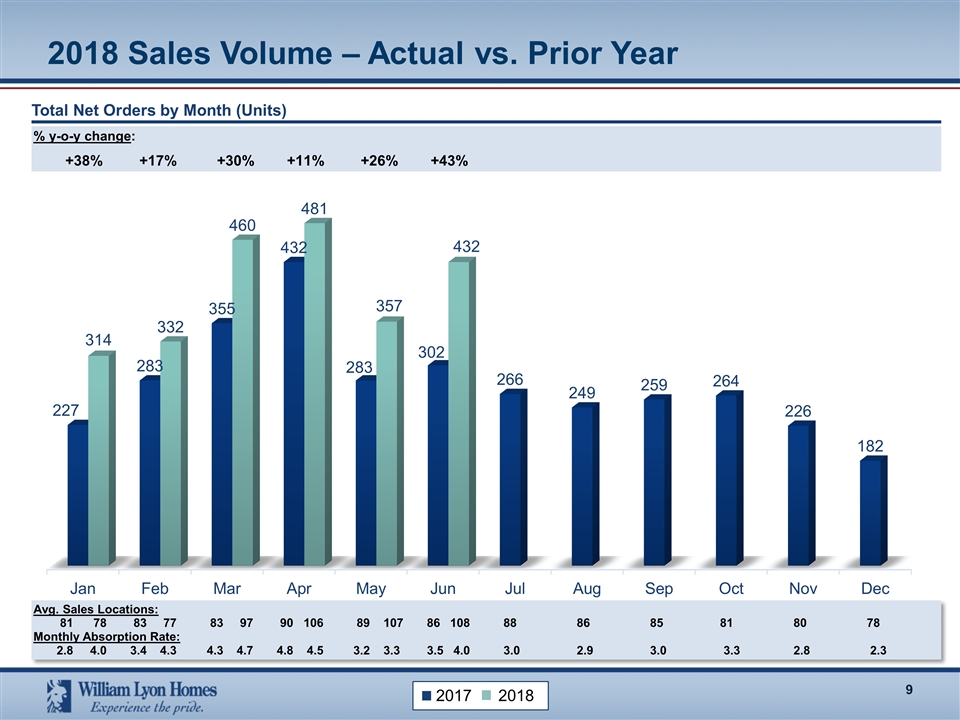

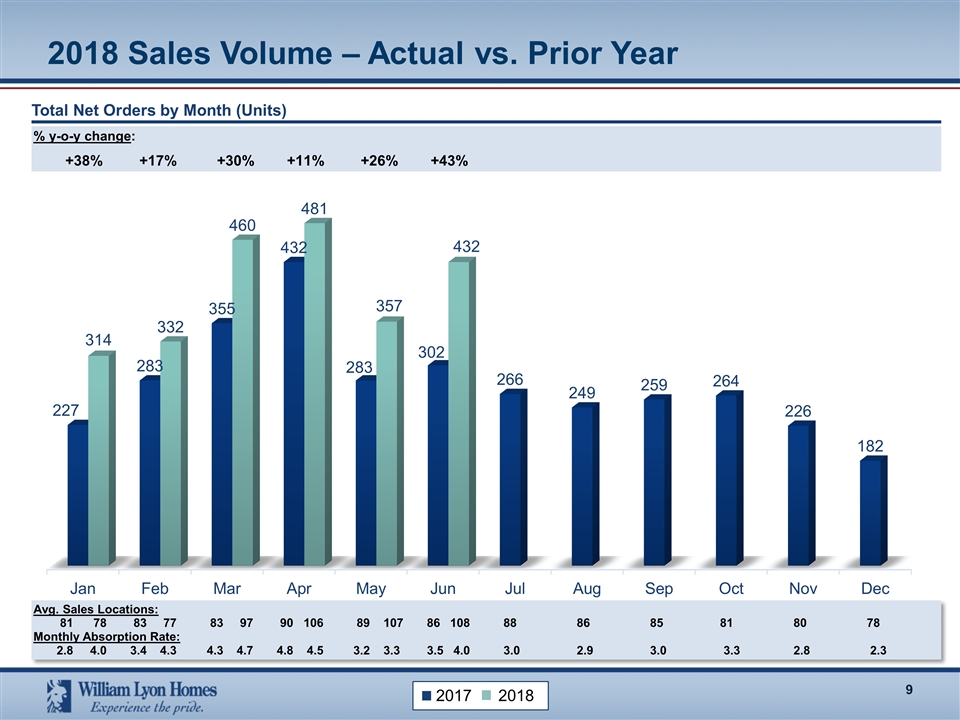

2018 Sales Volume – Actual vs. Prior Year Total Net Orders by Month (Units) % y-o-y change: +38% +17% +30% +11% +26% +43% Avg. Sales Locations: 81 78 83 77 83 97 90 106 89 107 86 108 88 86 85 81 80 78 Monthly Absorption Rate: 2.8 4.0 3.4 4.3 4.3 4.7 4.8 4.5 3.2 3.3 3.5 4.0 3.0 2.9 3.0 3.3 2.8 2.3 2017 2018

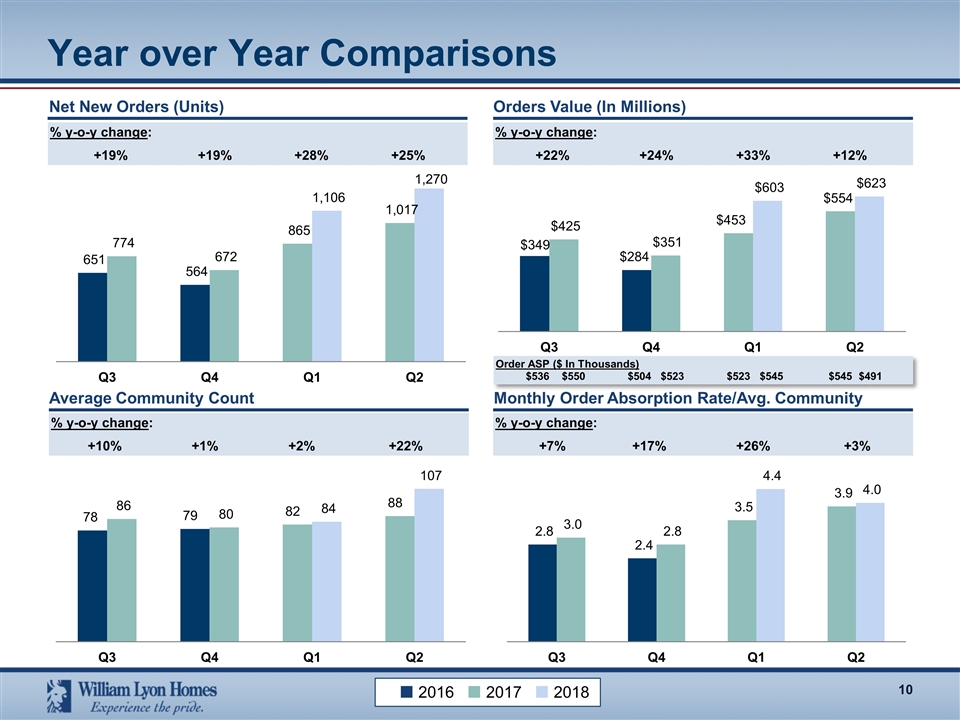

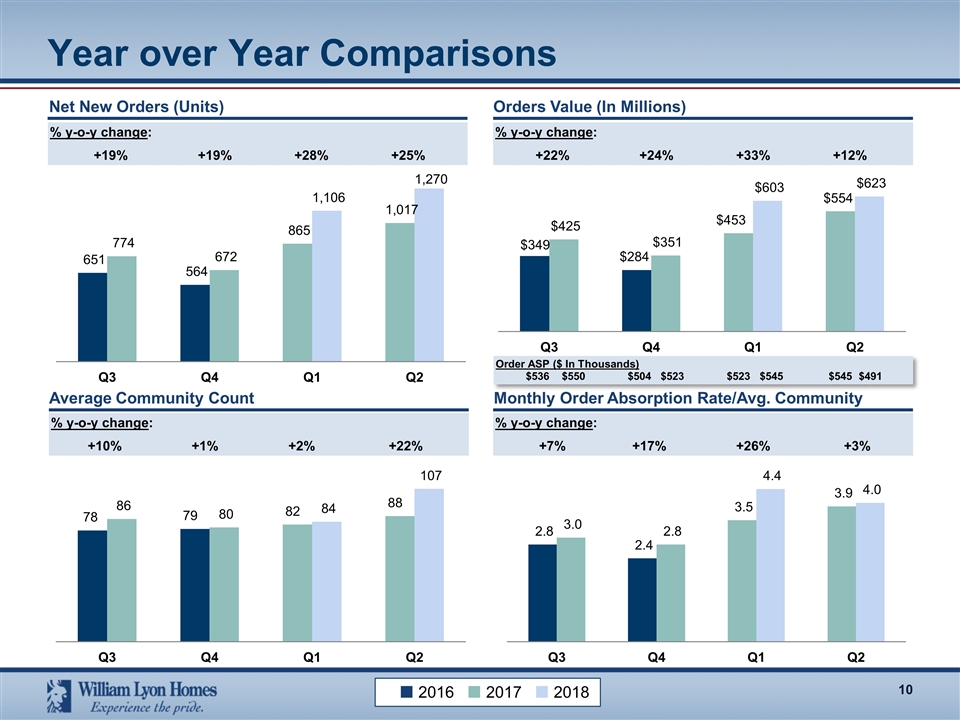

Year over Year Comparisons % y-o-y change: +19% +19% +28% +25% % y-o-y change: +10% +1% +2% +22% % y-o-y change: +7% +17% +26% +3% Net New Orders (Units) Orders Value (In Millions) Average Community Count Monthly Order Absorption Rate/Avg. Community % y-o-y change: +22% +24% +33% +12% Order ASP ($ In Thousands) $536 $550 $504 $523 $523 $545 $545 $491 ¢ 2016 ¢ 2017 ¢ 2018

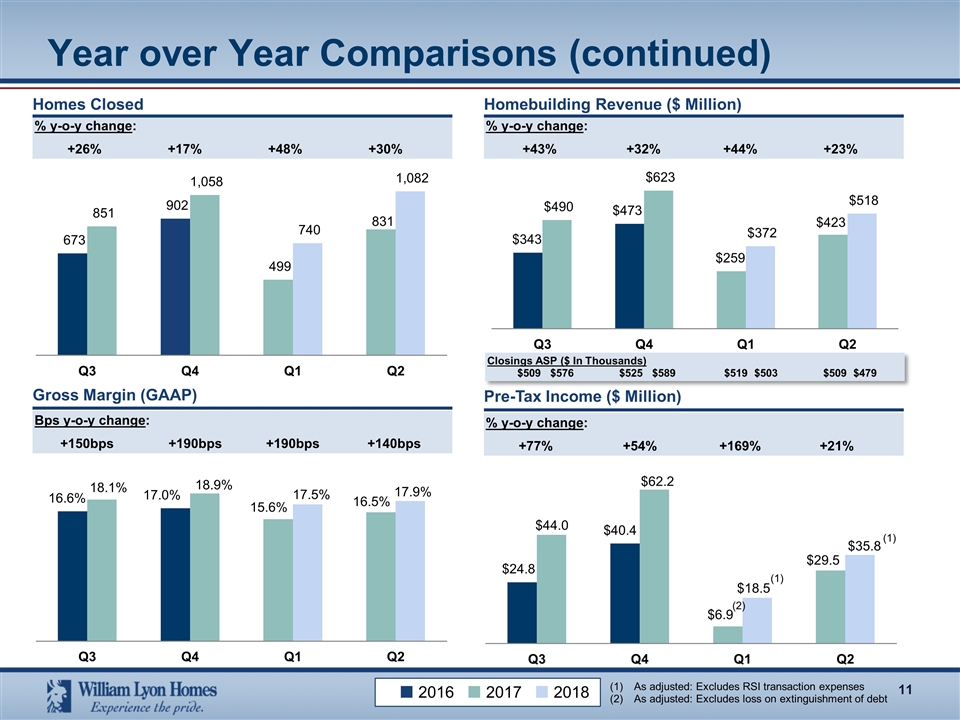

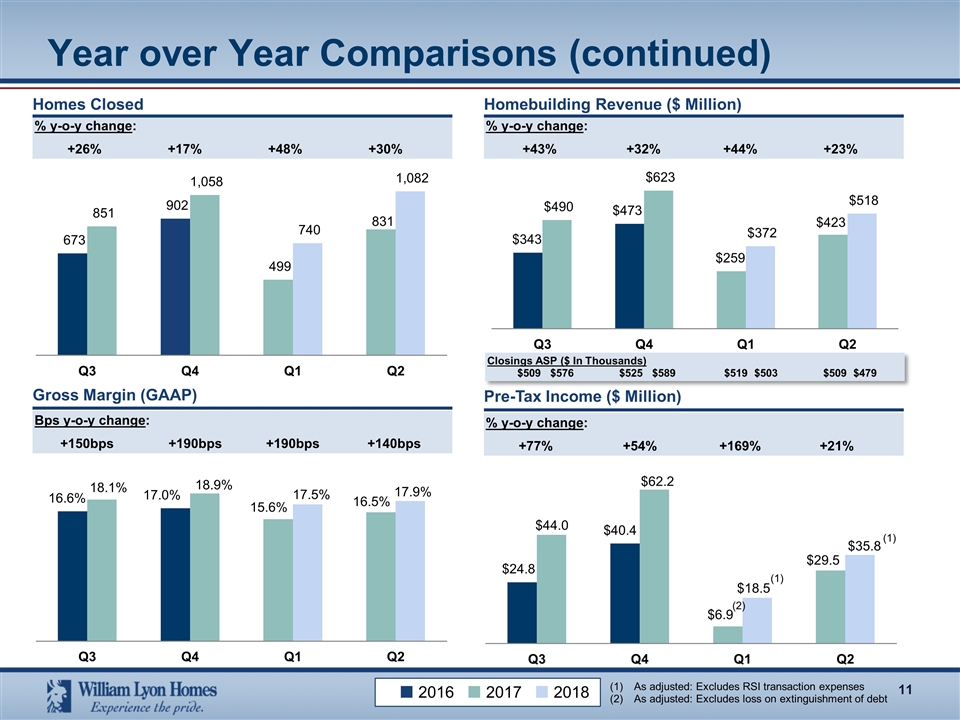

% y-o-y change: +43% +32% +44% +23% Year over Year Comparisons (continued) % y-o-y change: +26% +17% +48% +30% Homes Closed Homebuilding Revenue ($ Million) Bps y-o-y change: +150bps +190bps +190bps +140bps Gross Margin (GAAP) Closings ASP ($ In Thousands) $509 $576 $525 $589 $519 $503 $509 $479 ¢ 2016 ¢ 2017 ¢ 2018 % y-o-y change: +77% +54% +169% +21% Pre-Tax Income ($ Million) As adjusted: Excludes RSI transaction expenses As adjusted: Excludes loss on extinguishment of debt (1) (2) (1)

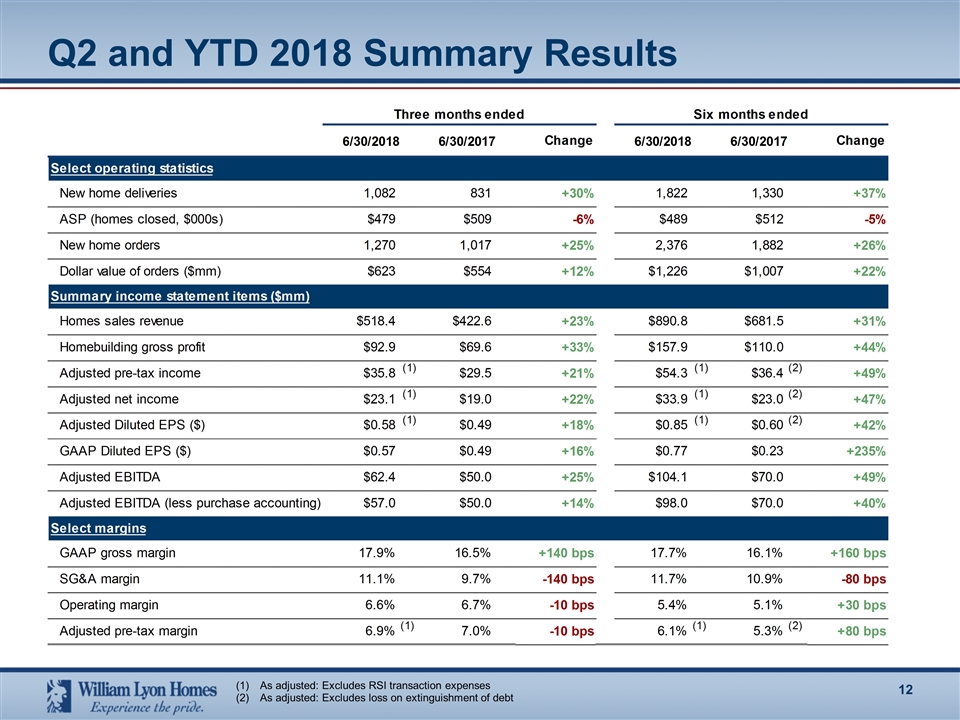

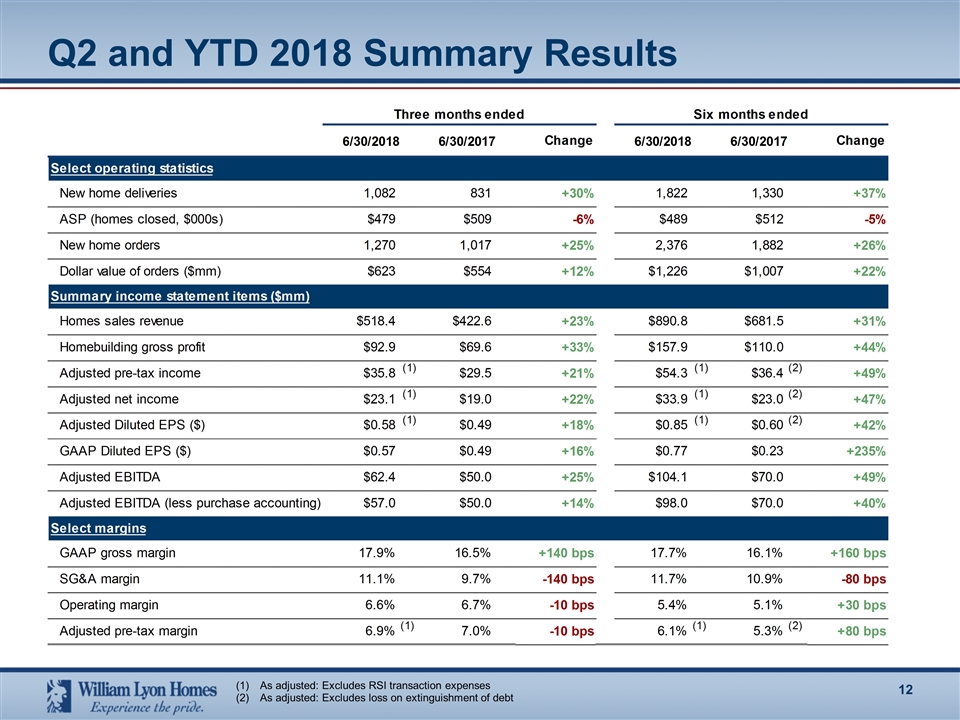

Q2 and YTD 2018 Summary Results As adjusted: Excludes RSI transaction expenses As adjusted: Excludes loss on extinguishment of debt

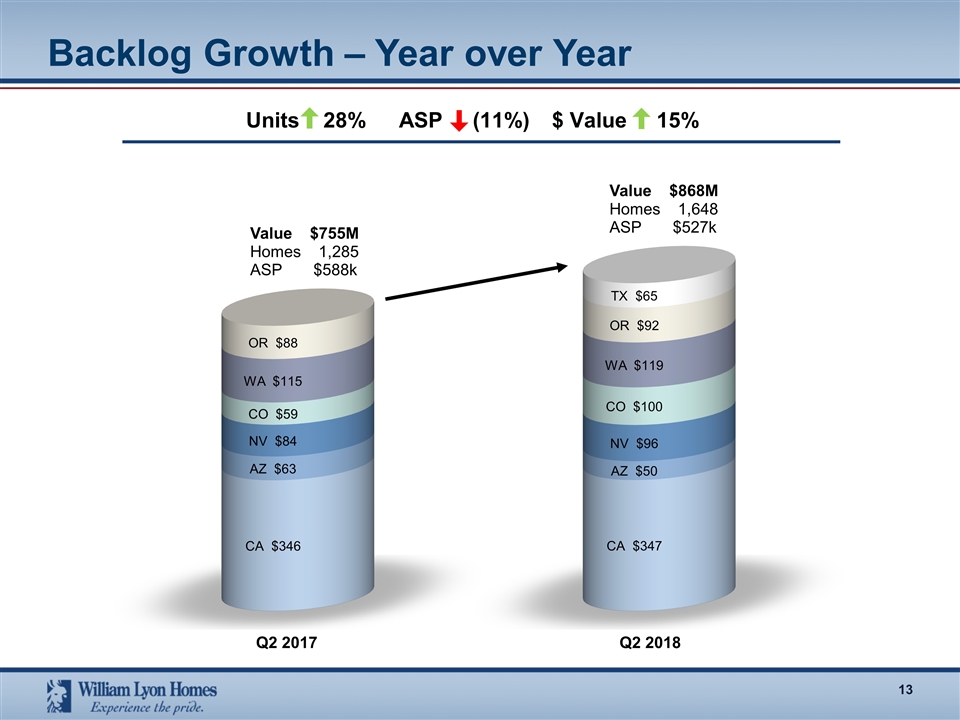

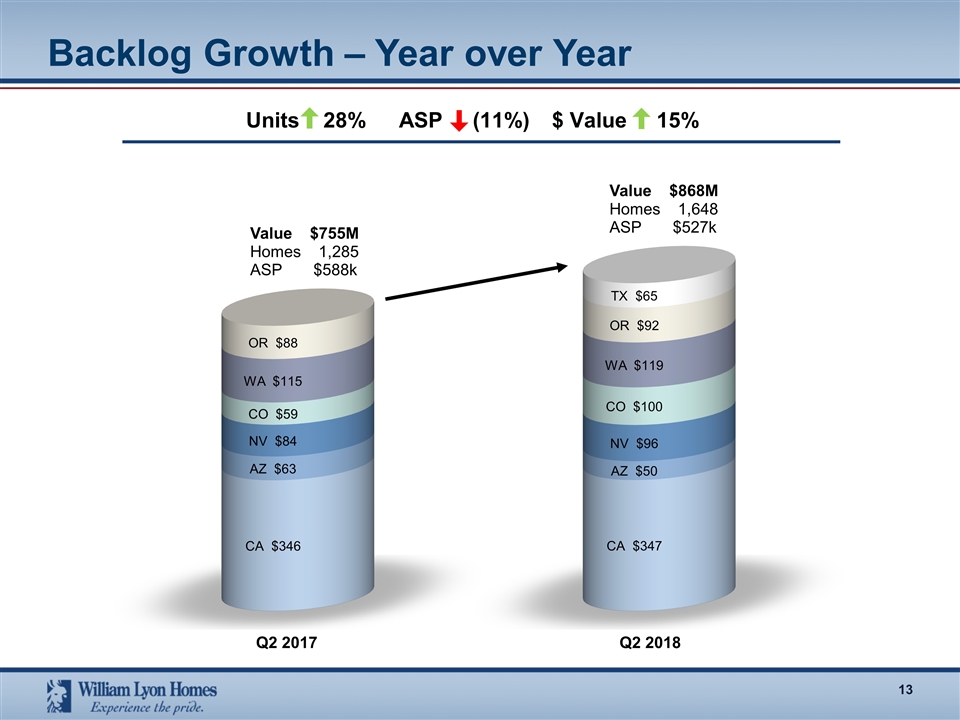

Backlog Growth – Year over Year Q2 2017 Value $868M Homes 1,648 ASP $527k Units 28% ASP (11%) $ Value 15% Q2 2018 Value $755M Homes 1,285 ASP $588k

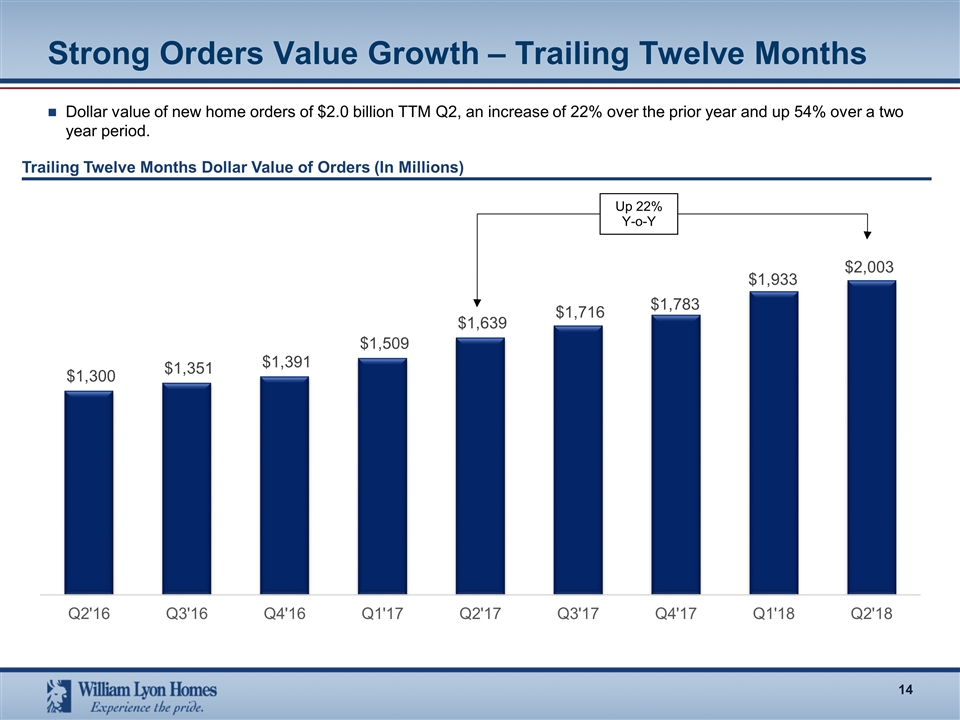

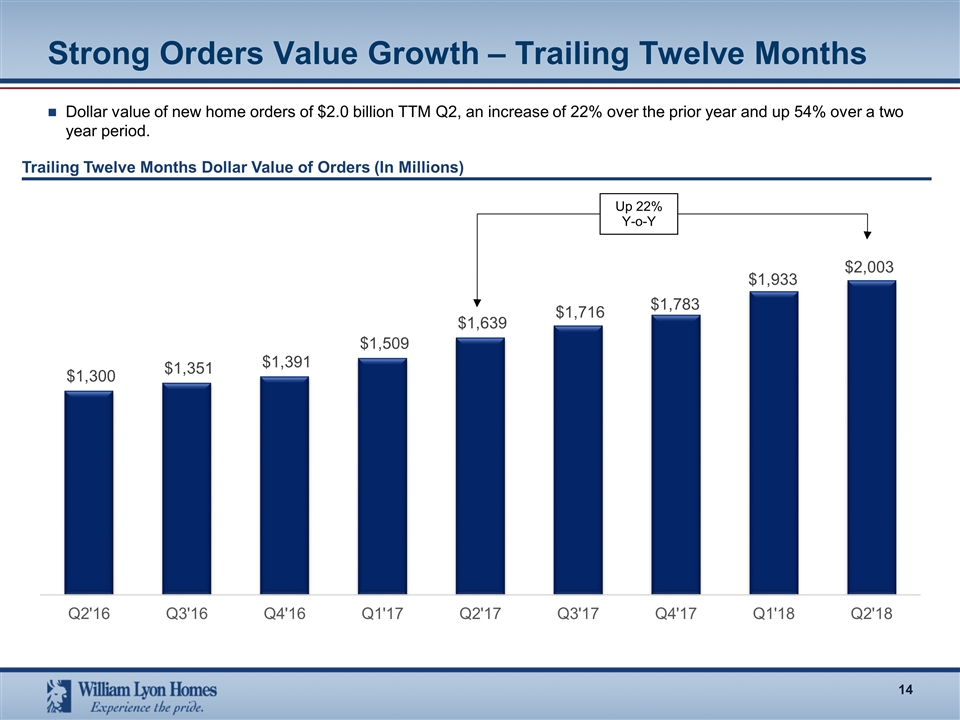

Strong Orders Value Growth – Trailing Twelve Months Dollar value of new home orders of $2.0 billion TTM Q2, an increase of 22% over the prior year and up 54% over a two year period. Up 22% Y-o-Y Trailing Twelve Months Dollar Value of Orders (In Millions)

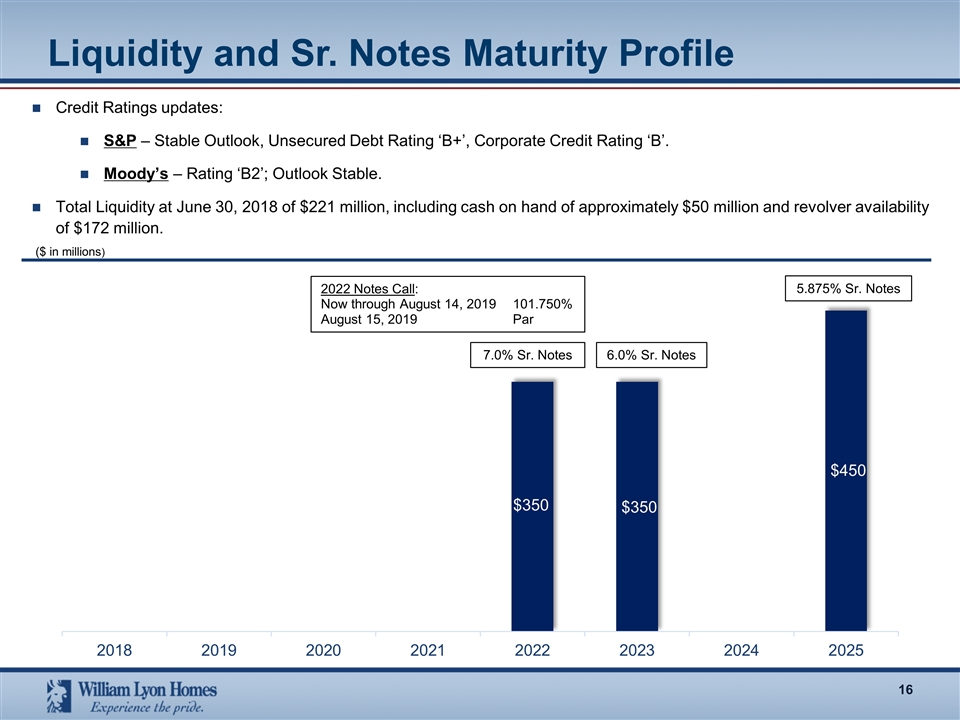

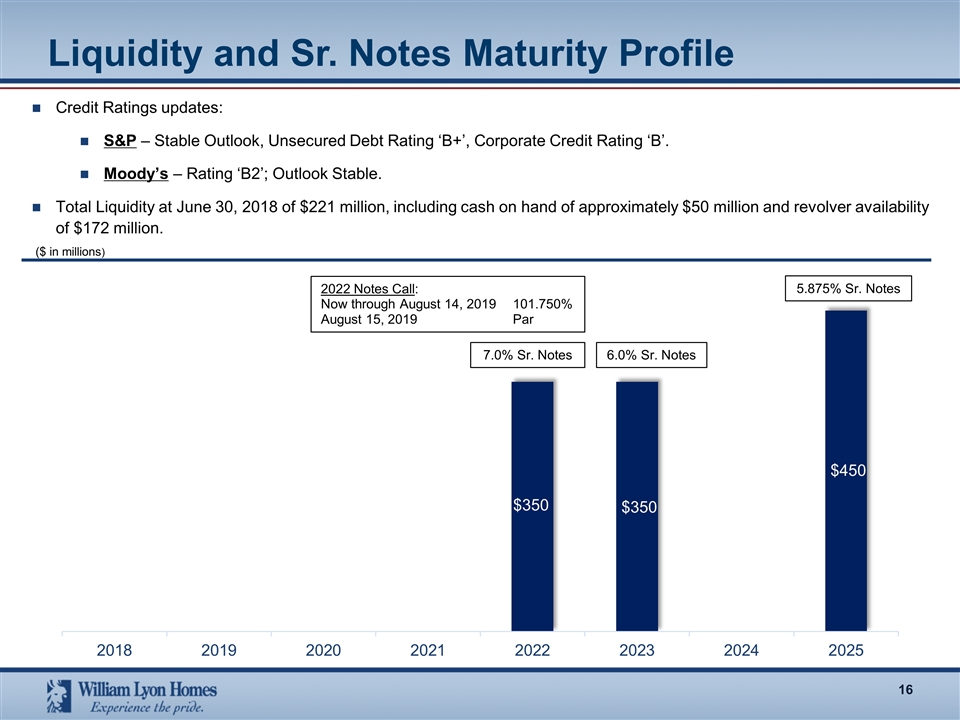

Debt Maturity

Credit Ratings updates: S&P – Stable Outlook, Unsecured Debt Rating ‘B+’, Corporate Credit Rating ‘B’. Moody’s – Rating ‘B2’; Outlook Stable. Total Liquidity at June 30, 2018 of $221 million, including cash on hand of approximately $50 million and revolver availability of $172 million. Liquidity and Sr. Notes Maturity Profile 5.875% Sr. Notes 7.0% Sr. Notes ($ in millions) 2022 Notes Call: Now through August 14, 2019101.750% August 15, 2019Par 6.0% Sr. Notes

Divisional Markets

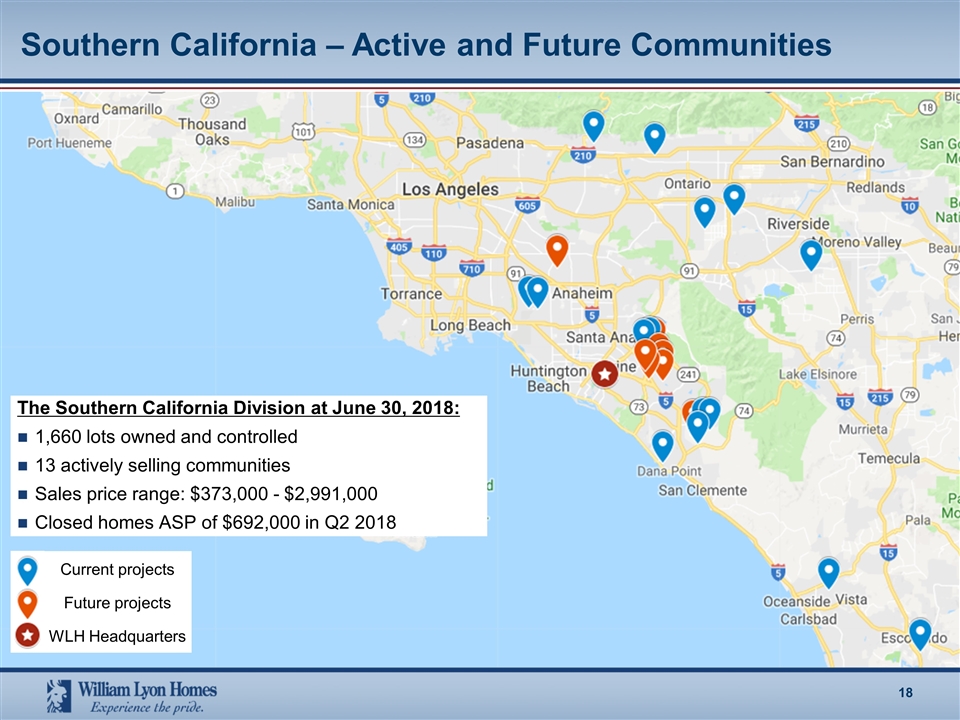

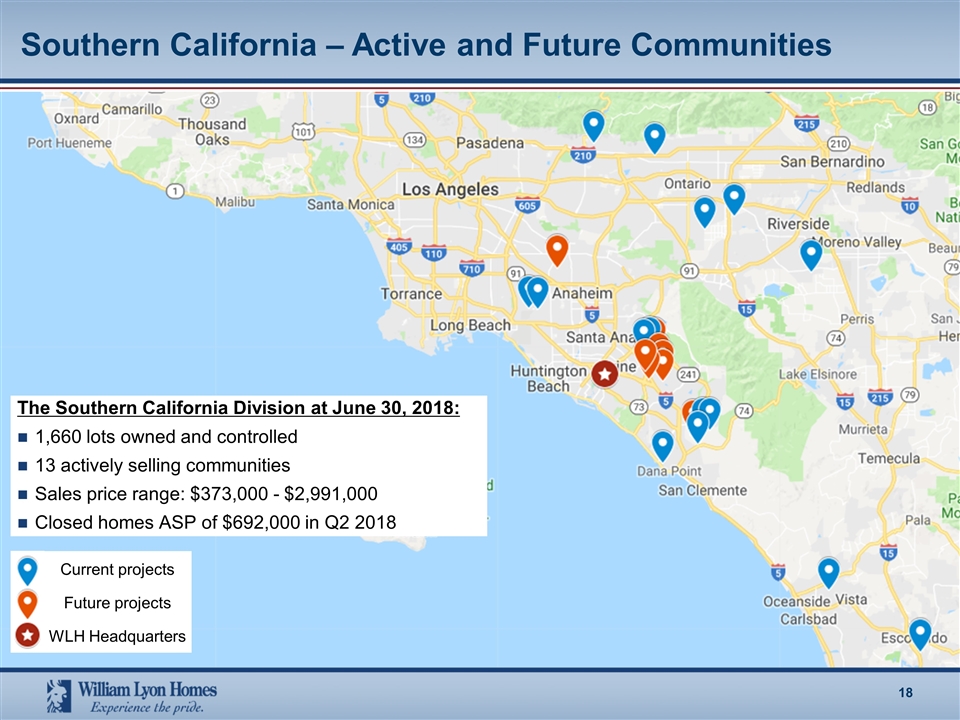

Southern California – Active and Future Communities The Southern California Division at June 30, 2018: 1,660 lots owned and controlled 13 actively selling communities Sales price range: $373,000 - $2,991,000 Closed homes ASP of $692,000 in Q2 2018 Current projects Future projects WLH Headquarters

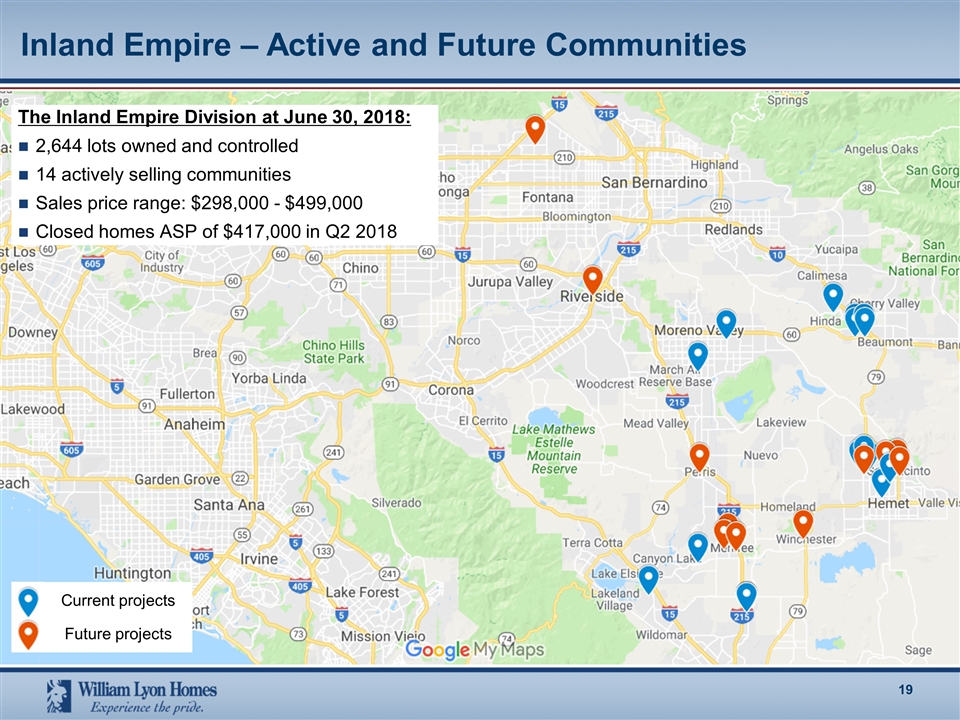

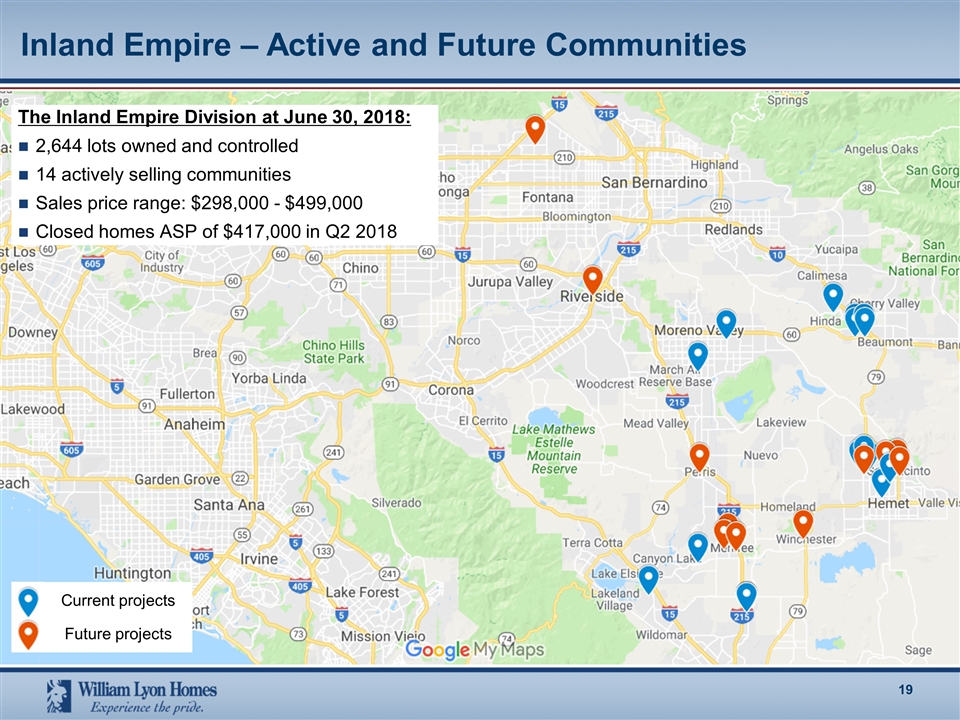

Inland Empire – Active and Future Communities The Inland Empire Division at June 30, 2018: 2,644 lots owned and controlled 14 actively selling communities Sales price range: $298,000 - $499,000 Closed homes ASP of $417,000 in Q2 2018 Current projects Future projects

Northern California – Active and Future Communities The Northern California Division at June 30, 2018: 1,639 lots owned and controlled 5 actively selling communities Sales price range: $957,000 - $1,508,000 Closed homes ASP of $962,000 in Q2 2018 Current projects Future projects

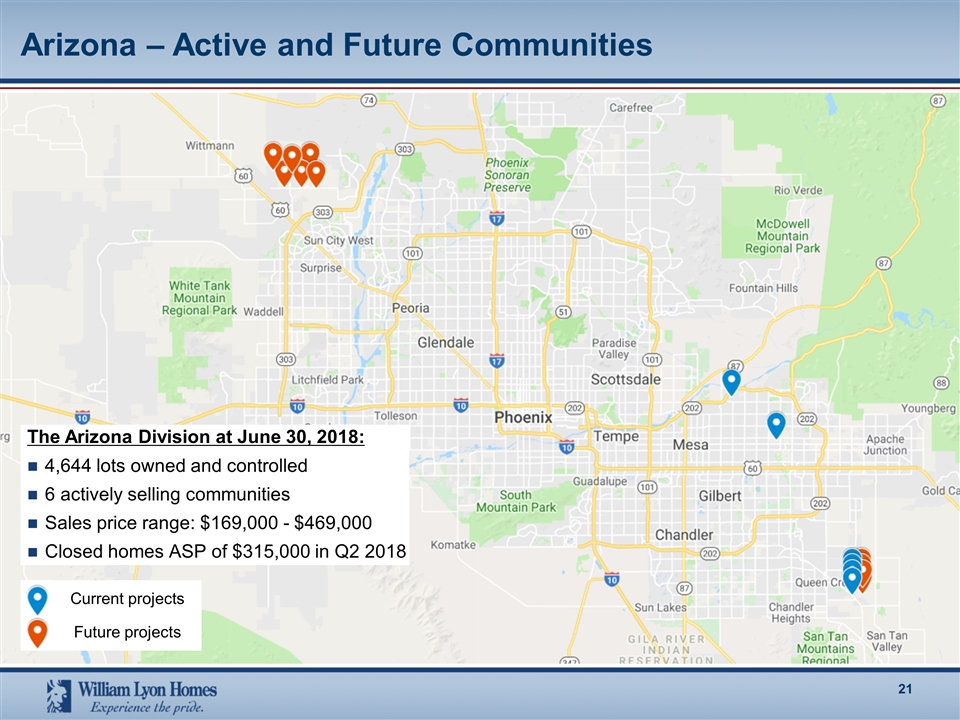

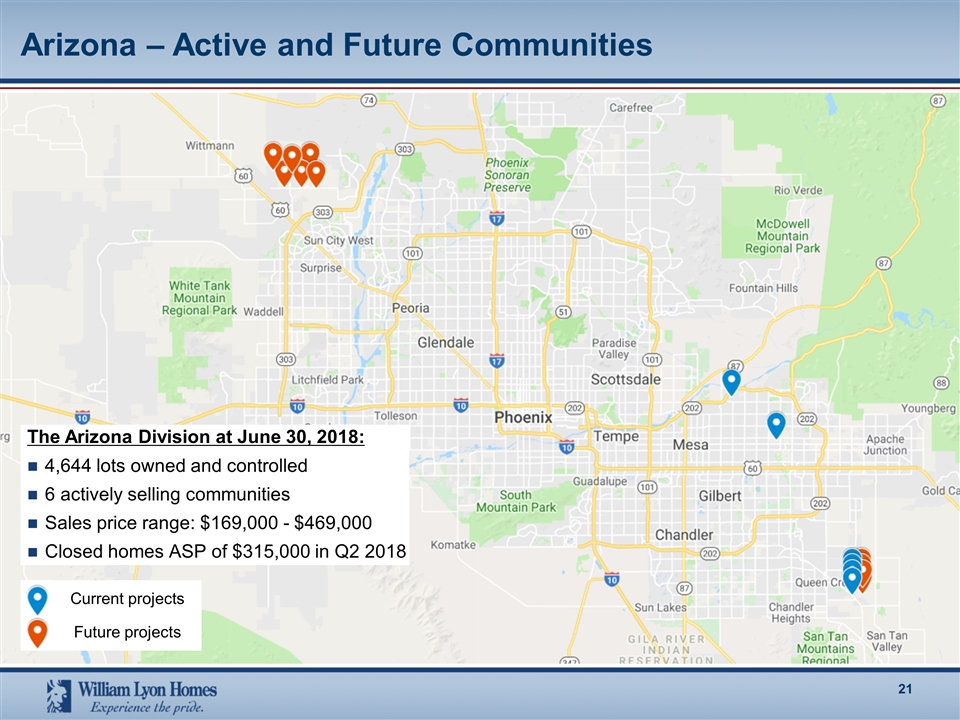

Arizona – Active and Future Communities The Arizona Division at June 30, 2018: 4,644 lots owned and controlled 6 actively selling communities Sales price range: $169,000 - $469,000 Closed homes ASP of $315,000 in Q2 2018 Current projects Future projects

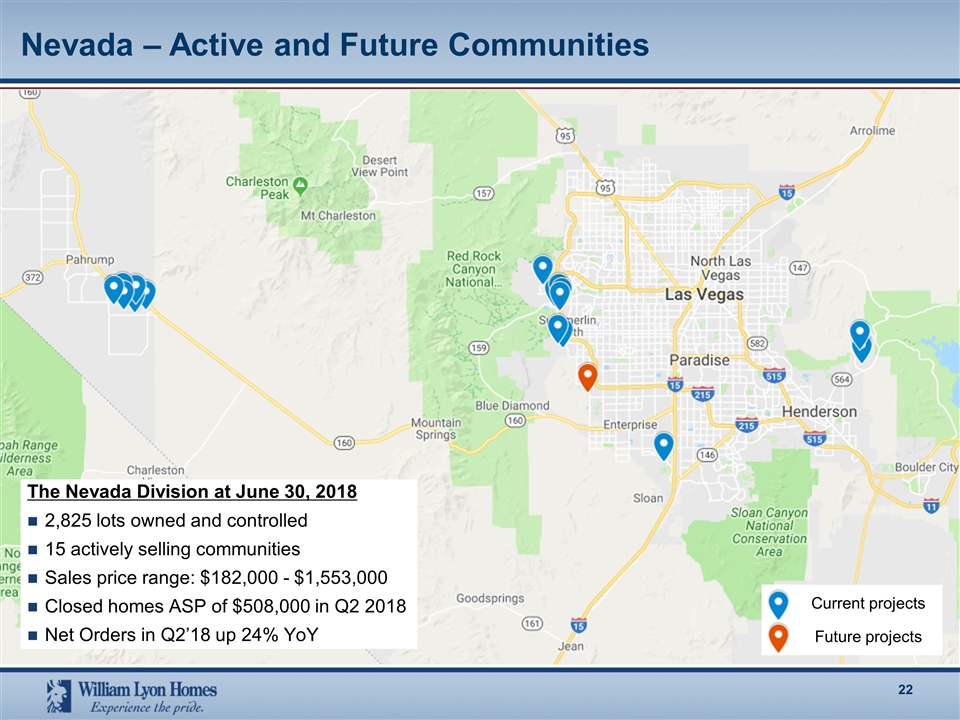

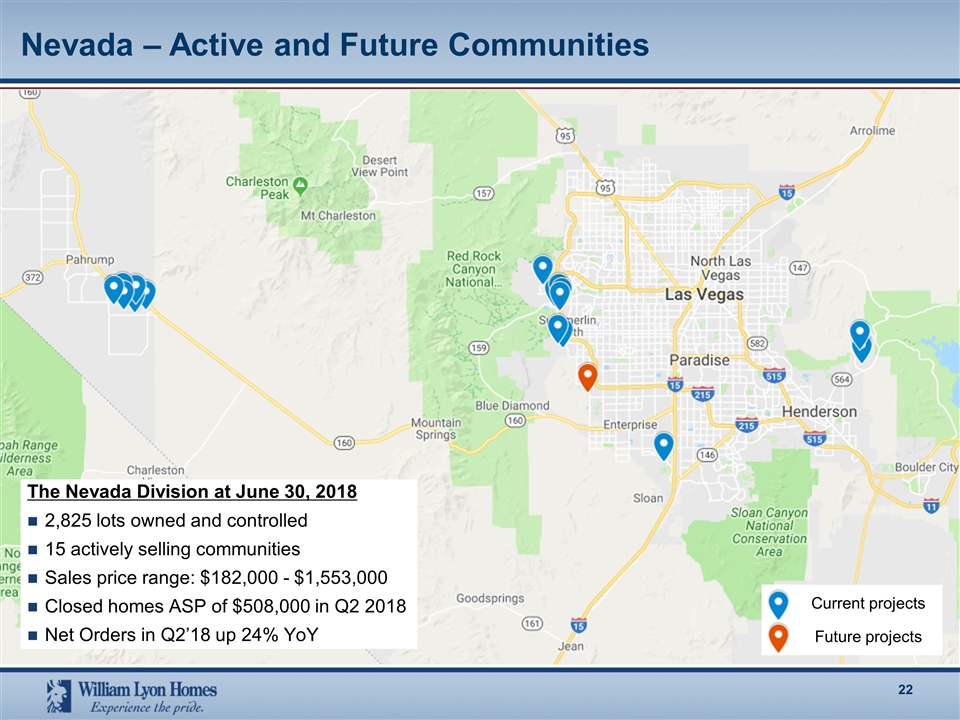

Nevada – Active and Future Communities The Nevada Division at June 30, 2018 2,825 lots owned and controlled 15 actively selling communities Sales price range: $182,000 - $1,553,000 Closed homes ASP of $508,000 in Q2 2018 Net Orders in Q2’18 up 24% YoY Current projects Future projects

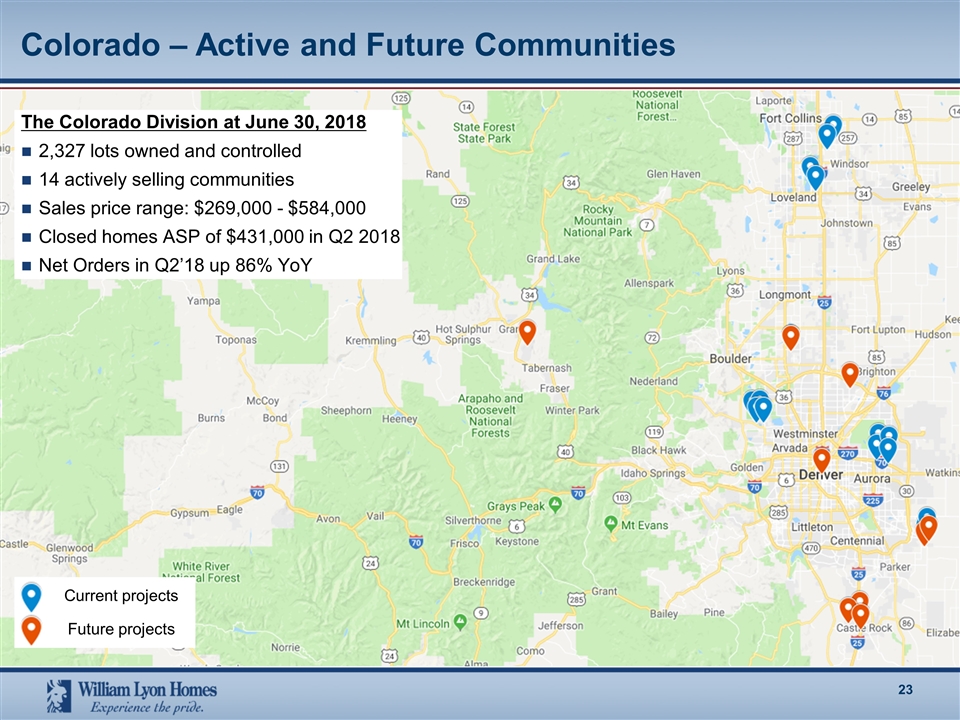

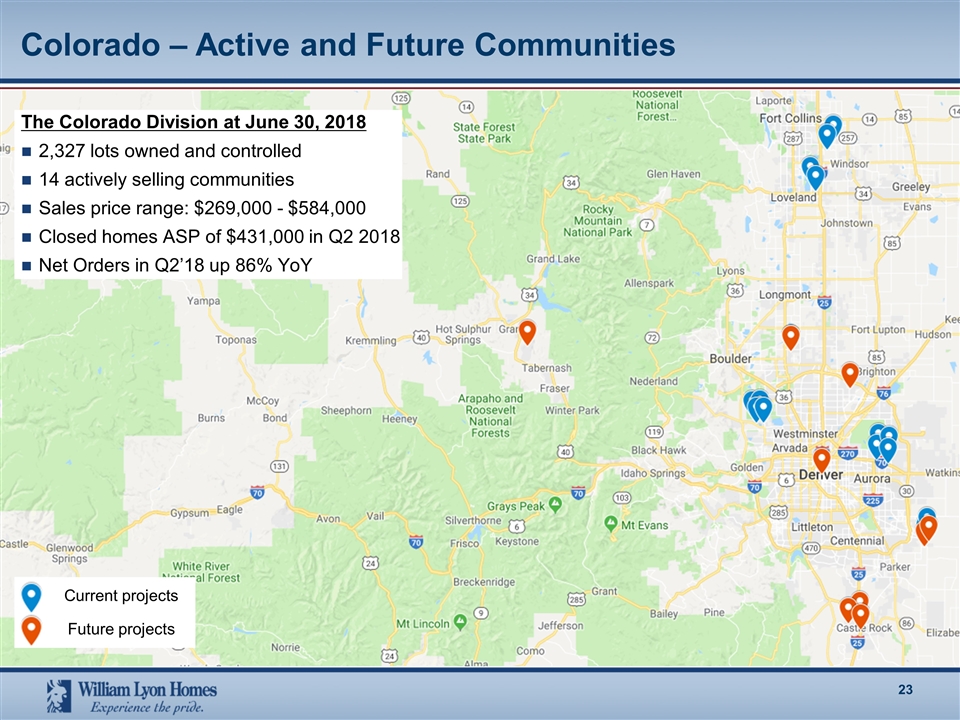

Colorado – Active and Future Communities The Colorado Division at June 30, 2018 2,327 lots owned and controlled 14 actively selling communities Sales price range: $269,000 - $584,000 Closed homes ASP of $431,000 in Q2 2018 Net Orders in Q2’18 up 86% YoY Current projects Future projects

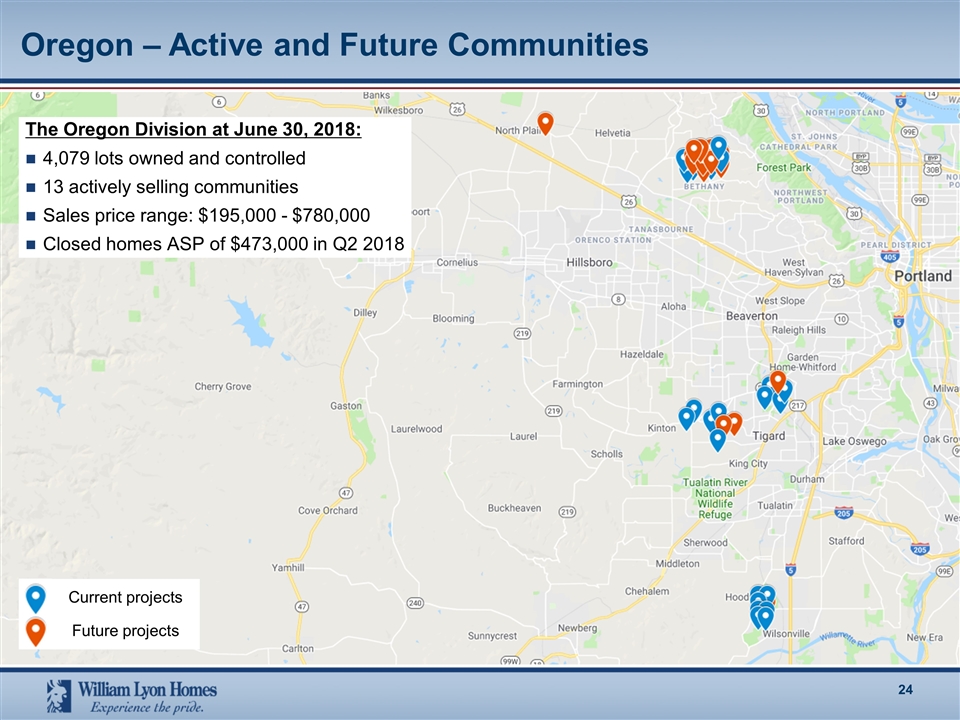

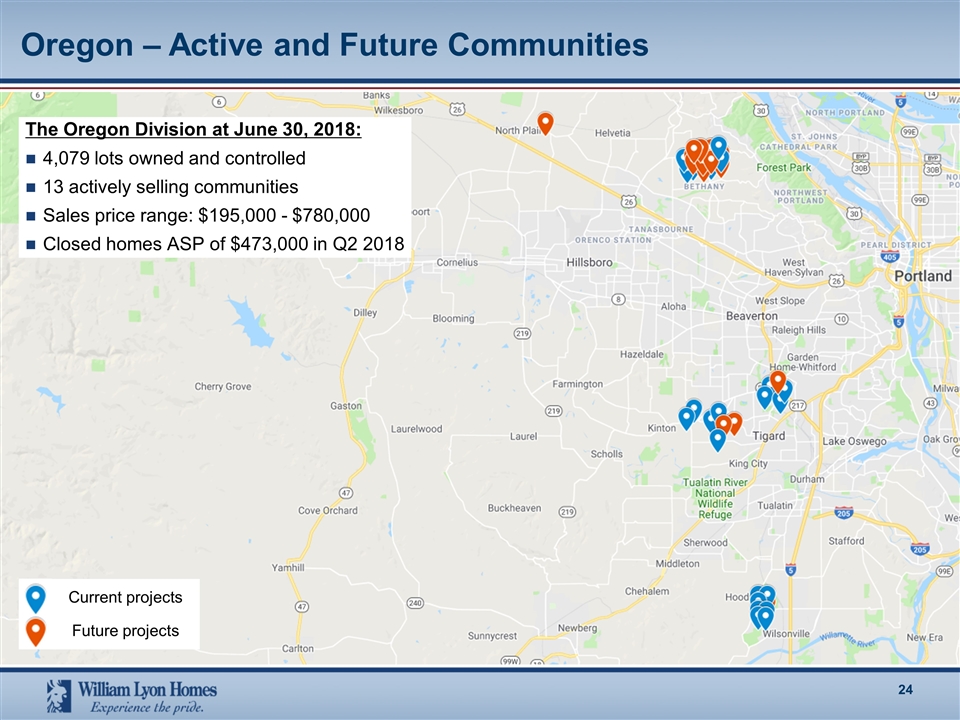

Oregon – Active and Future Communities The Oregon Division at June 30, 2018: 4,079 lots owned and controlled 13 actively selling communities Sales price range: $195,000 - $780,000 Closed homes ASP of $473,000 in Q2 2018 Current projects Future projects

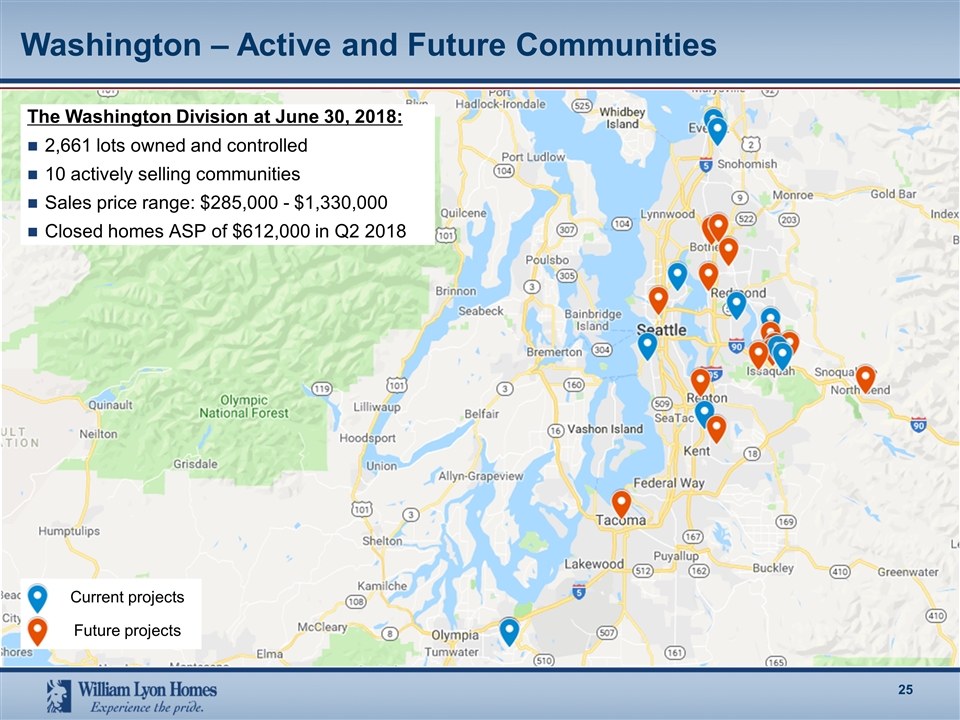

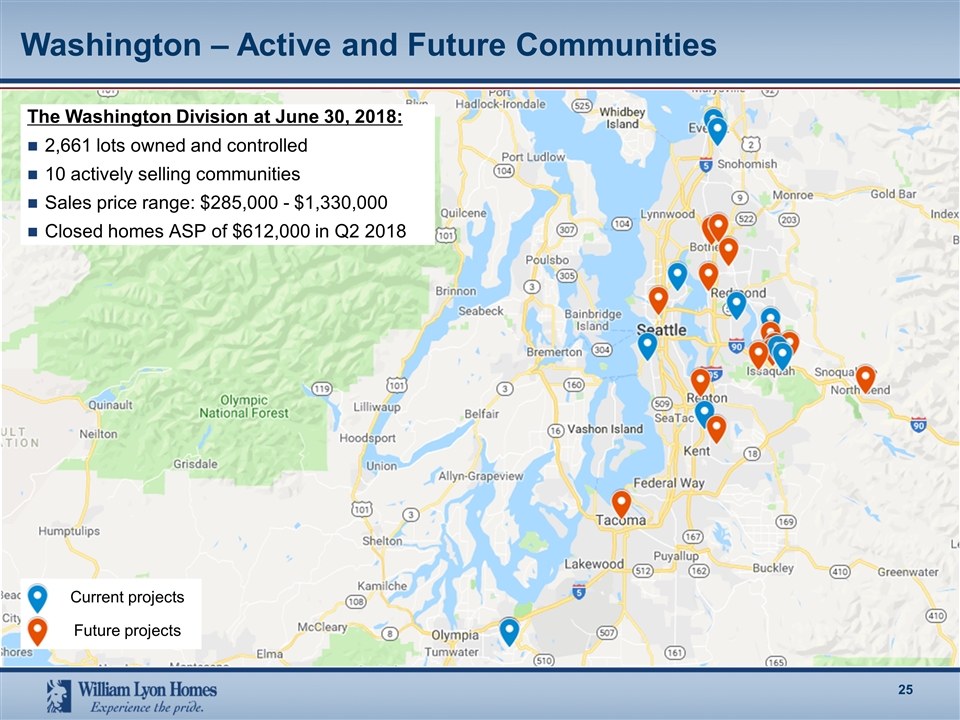

Washington – Active and Future Communities The Washington Division at June 30, 2018: 2,661 lots owned and controlled 10 actively selling communities Sales price range: $285,000 - $1,330,000 Closed homes ASP of $612,000 in Q2 2018 Current projects Future projects

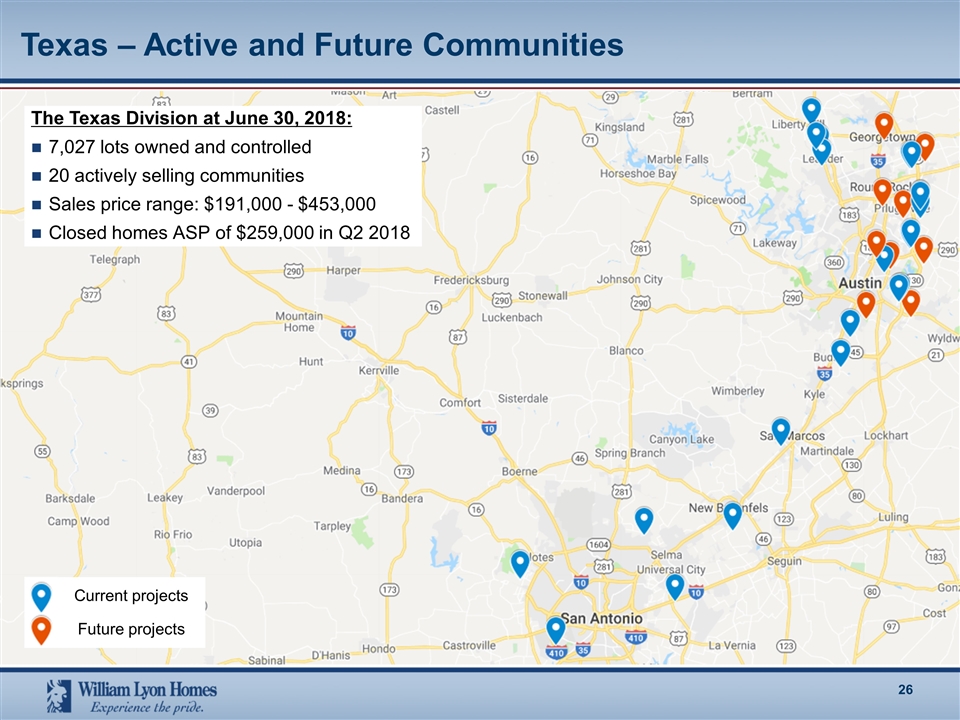

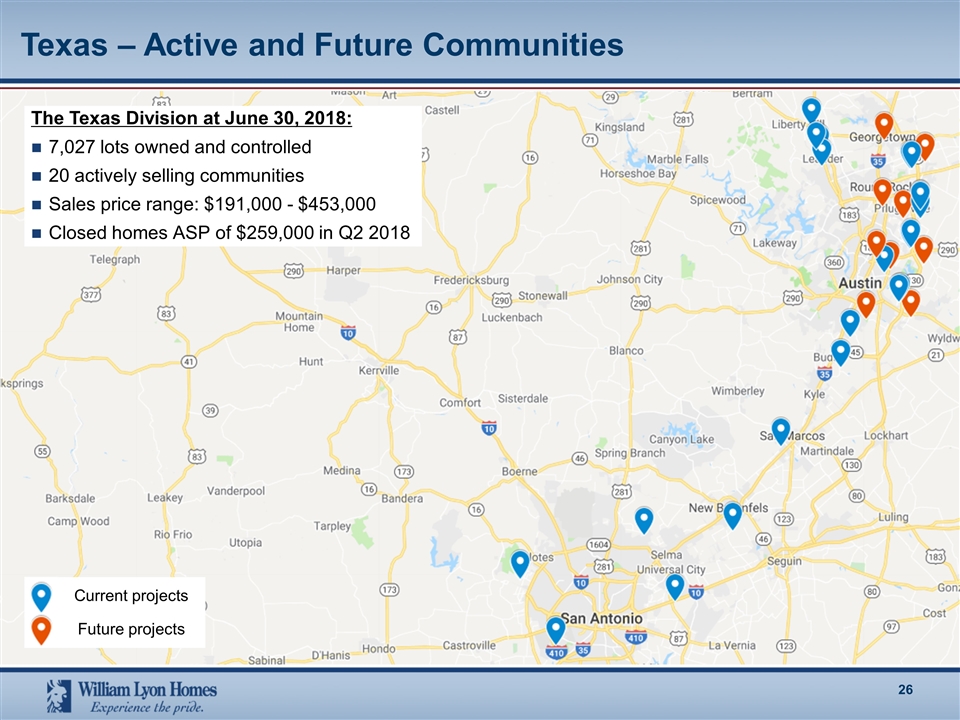

Texas – Active and Future Communities The Texas Division at June 30, 2018: 7,027 lots owned and controlled 20 actively selling communities Sales price range: $191,000 - $453,000 Closed homes ASP of $259,000 in Q2 2018 Current projects Future projects

Appendix

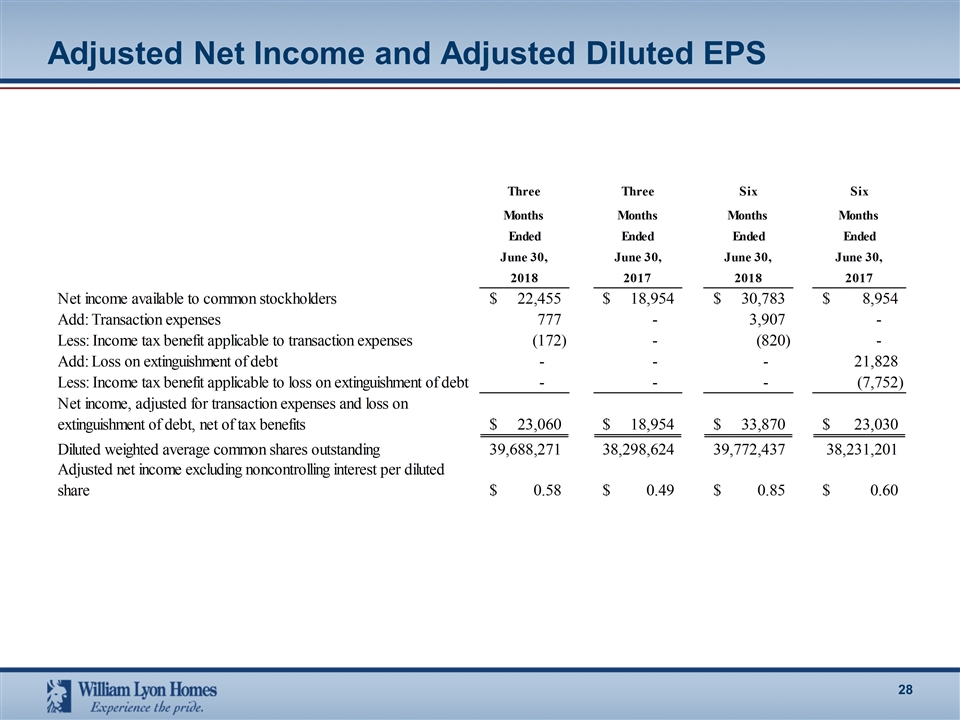

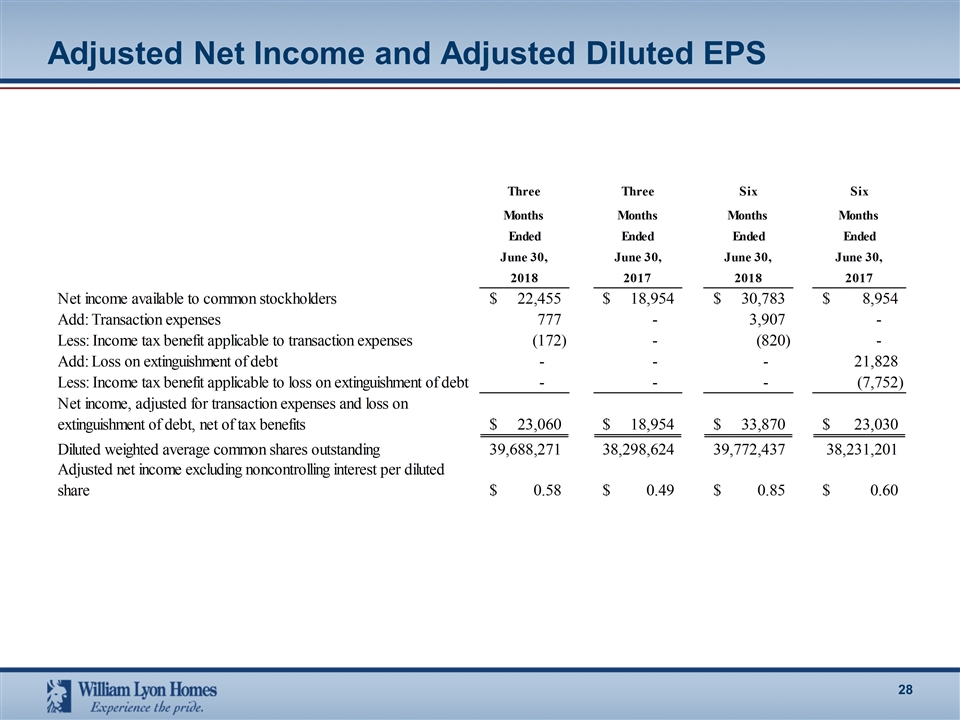

Adjusted Net Income and Adjusted Diluted EPS

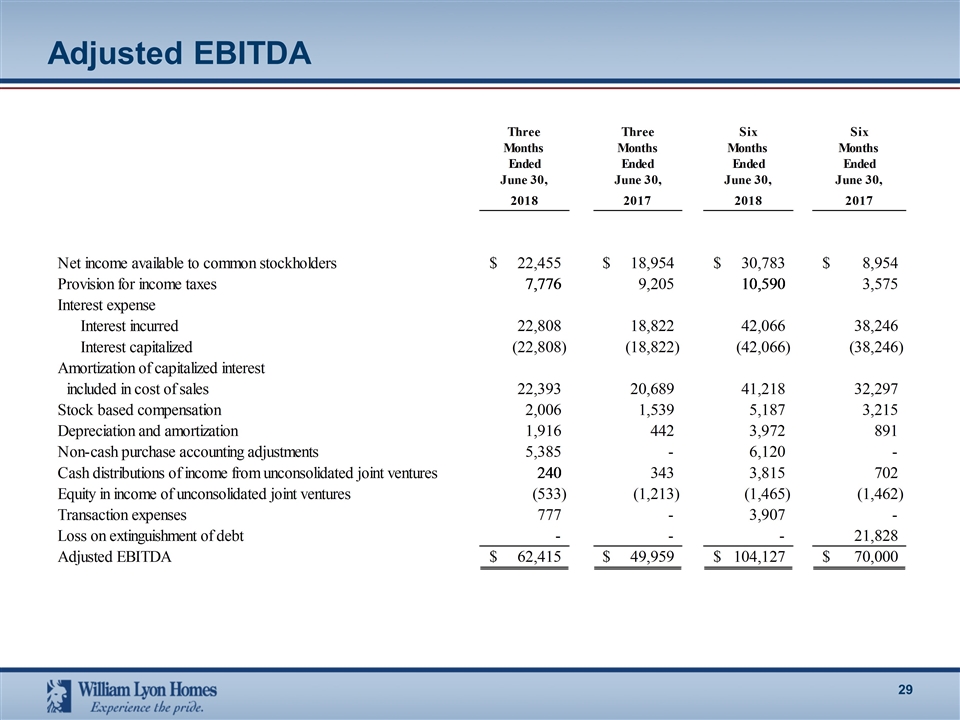

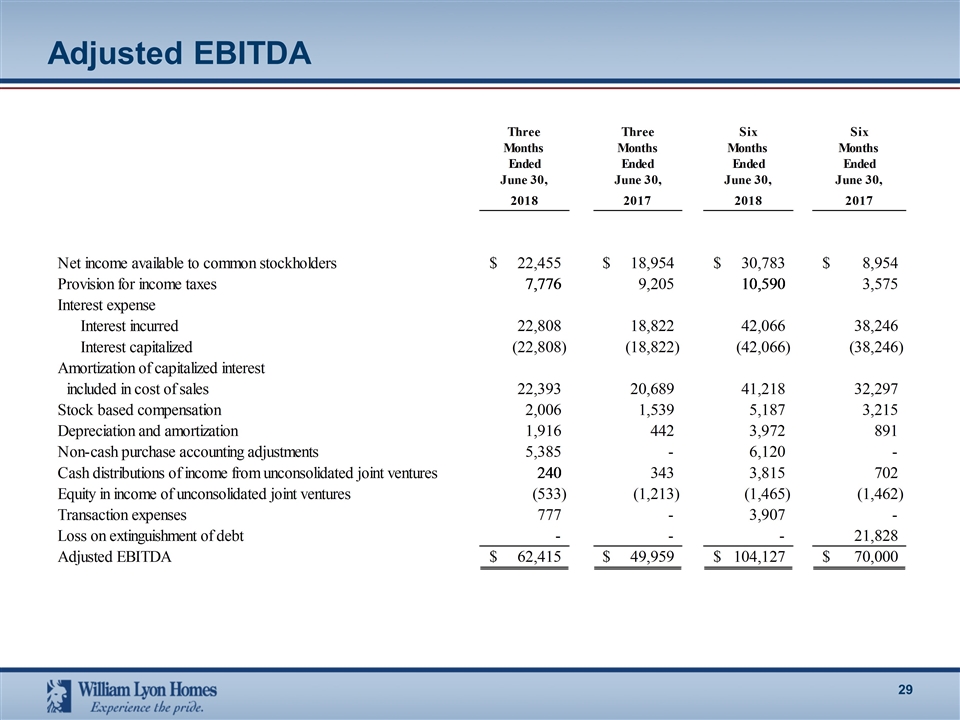

Adjusted EBITDA

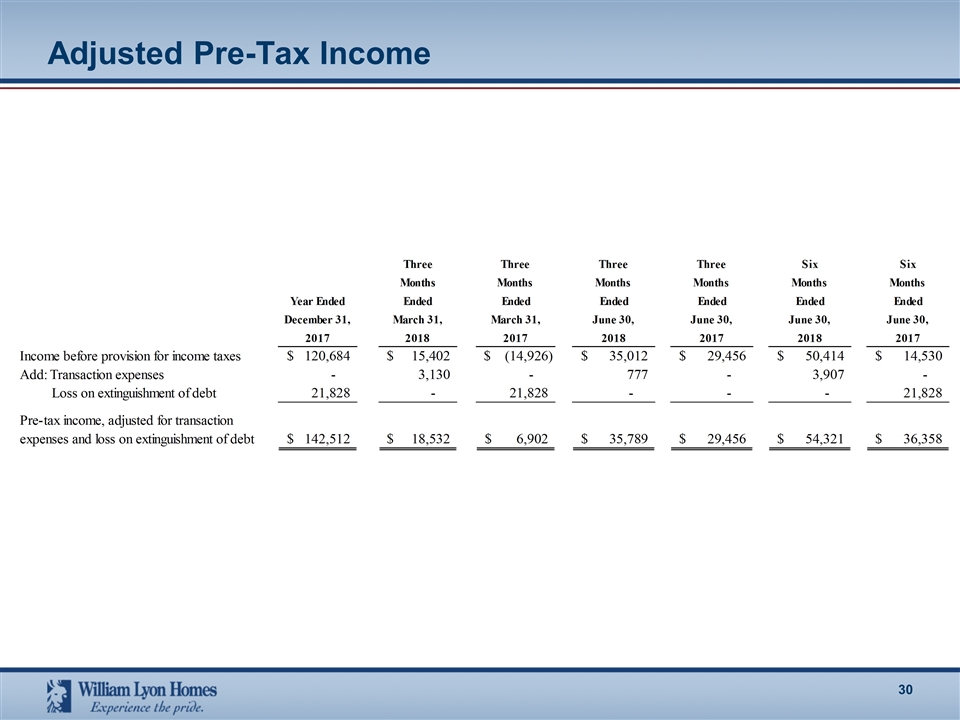

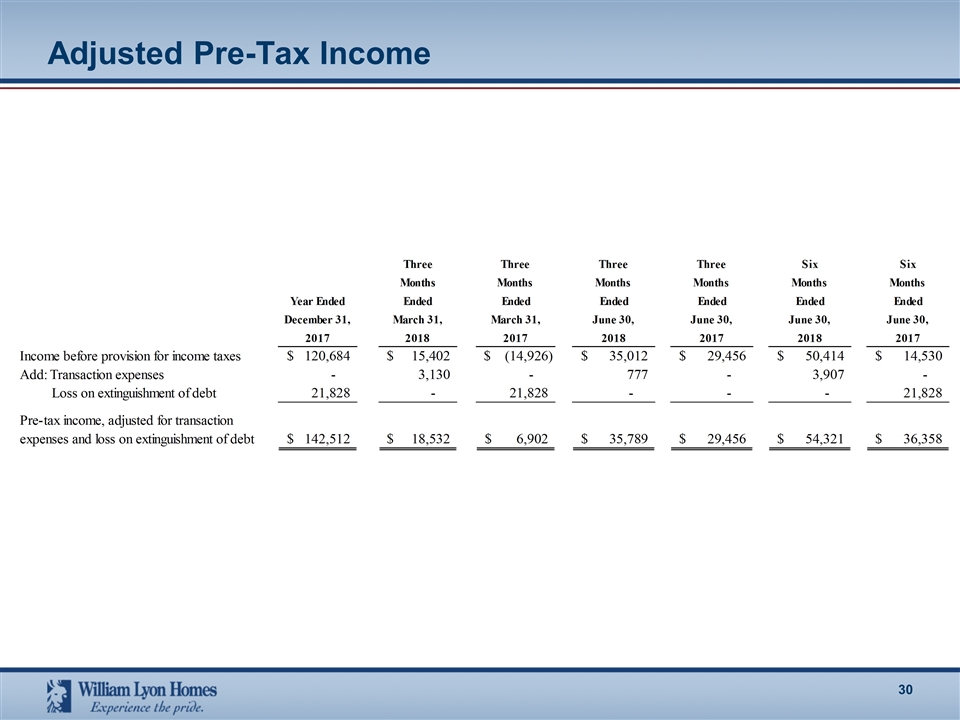

Adjusted Pre-Tax Income