UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 15, 2009

| | | | |

| Diamond Jo, LLC | | Peninsula Gaming, LLC | | Peninsula Gaming Corp. |

(Exact name of registrant as specified in its charter) | | (Exact name of registrant as specified in its charter) | | (Exact name of registrant as specified in its charter) |

| | |

| Delaware | | Delaware | | Delaware |

(State or other jurisdiction of incorporation or organization) | | (State or other jurisdiction of incorporation or organization) | | (State or other jurisdiction of incorporation or organization) |

| | |

| 42-1483875 | | 20-0800583 | | 25-1902805 |

| (I.R.S. Employer Identification No.) | | (I.R.S. Employer Identification No.) | | (I.R.S. Employer Identification No.) |

301 Bell Street

Dubuque, Iowa 52001

(Address of executive offices, including zip code)

(563) 690-4975

(Registrant’s telephone number, including area code)

Item 7.01. Regulation FD Disclosure.

On July 15, 2009, Peninsula Gaming LLC (the “Company”) announced a proposed offering of $530 million of senior notes consisting of $215 million of senior secured notes due 2015 (the “Secured Notes”) and $315 million of senior unsecured notes due 2017 (the “Unsecured Notes” and, together with the Secured Notes, the “Notes”). The Notes are being offered only to qualified institutional buyers under Rule 144A of the Securities Act of 1933, as amended (the “Securities Act”), to non-U.S. persons outside of the United States in compliance with Regulation S of the Securities Act and to a limited number of institutional accredited investors within the meaning of subparagraph (a)(1), (2), (3) or (7) of Rule 501 under the Securities Act. The Notes have not been registered under the Securities Act, any other federal securities laws or the securities laws of any state, and until so registered, the Notes may not be offered or sold in the United States except pursuant to an exemption from the registration requirements of the Securities Act and applicable state securities laws. This Current Report on Form 8-K shall not constitute an offer to sell or a solicitation of an offer to buy any securities.

In connection with the offering of the Notes, the Company disclosed certain information in an offering memorandum to prospective investors, including the information set forth below. Not all of the information contained in the offering memorandum appears below. Accordingly, certain sections referred to in cross references and certain definitions do not appear below.

Unless otherwise indicated, the terms the “Company,” “we,” “us” and “our” refer to Peninsula Gaming, LLC and its subsidiaries, as the context may require.

Overview

We are a casino entertainment company with gaming operations in local markets in Iowa and Louisiana. Founded in 1999, we seek to develop quality gaming operations in highly protected markets and currently own and operate three facilities we developed and built. We also have entered into an agreement to purchase a fourth facility, the Amelia Belle Casino, as described below.

The following summarizes certain features of our gaming properties as of July 10, 2009:

| | | | | | | | |

| | | | | Diamond Jo | | Evangeline Downs | | Diamond Jo Worth |

Opened | | | | December 2008 (replacing previous facility operating since 1994) | | December 2003 | | April 2006 (expansion completed in April 2007) |

| | | | |

Location | | | | Dubuque, Iowa | | Opelousas, Louisiana | | Northwood, Iowa |

| | | | |

Size | | | | 188,000 square feet (“sq. ft.”) | | 120,000 sq. ft. | | 107,213 sq. ft. |

| | | | |

Gaming | | | | • 987 slots • 18 table games | | • 1,425 slots • 980 horse capacity | | • 952 slots • 22 total table games |

| | | | |

Amenities | | | | • 800 person capacity entertainment venue • 30-lane bowling center • 5 table poker room • 120-seat steakhouse • 200-seat buffet • 50-seat deli/coffee shop | | • Seasonal thoroughbred and quarterhorse horses • Four off-track betting parlors • 90-seat steakhouse • 312-seat buffet • 90-seat cafe | | • 400-seat entertainment venue • 200-seat buffet • 114-seat steakhouse • 7 table poker room • 45-seat Burger King • Subway restaurant • Third-party 102-room hotel |

| | | | |

Parking | | | | 1,763 parking spaces | | 2,544 parking spaces | | 1,300 parking spaces |

On June 18, 2009, we agreed to acquire the Amelia Belle riverboat casino located in Amelia, Louisiana (the “Amelia Belle Casino”). The Amelia Belle Casino offers 823 slot machines, 25 table games and a full service buffet. It benefits from a strong local market and is strategically located in southern Louisiana, south of New Orleans and Baton Rouge. We believe the Amelia Belle Casino is an underdeveloped asset with significant potential for improvement and creates attractive synergies with our existing properties.

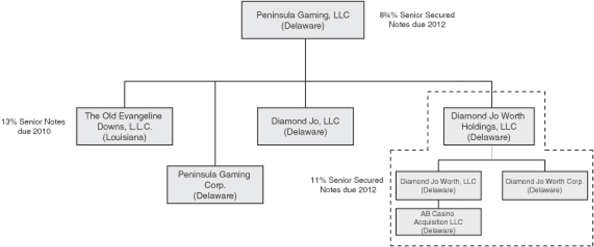

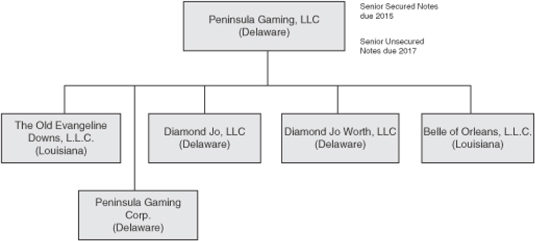

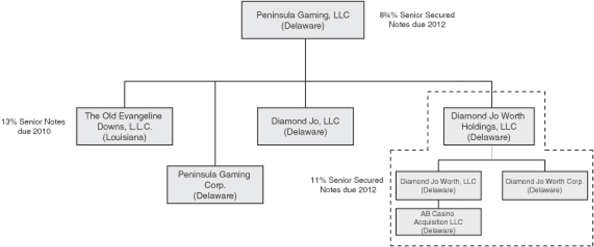

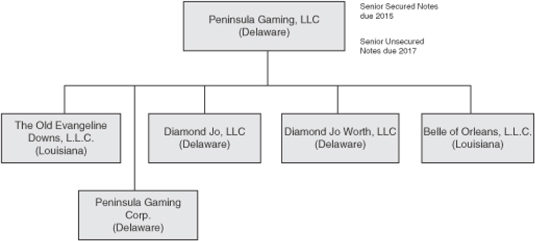

Business Structure

PGL is a holding company with no independent operations whose primary assets are its equity interests in the following wholly owned subsidiaries:

| | • | | Diamond Jo, LLC (“DJL”), which owns and operates the Diamond Jo casino in Dubuque, Iowa; |

| | • | | The Old Evangeline Downs, L.L.C. (“ EVD”), which owns and operates the Evangeline Downs Racetrack and Casino, or “racino,” in St. Landry Parish, Louisiana, and four off-track betting parlors (“OTB”) in Louisiana; and |

| | • | | Diamond Jo Worth, LLC (“DJW”), which owns and operates the Diamond Jo Worth casino in Worth County, Iowa. |

PGL is a wholly owned subsidiary of PGP. PGL’s other subsidiaries include PGC, which has no assets or operations but will serve as a co-issuer of the Notes, Diamond Jo Worth Holdings, LLC, a Delaware limited liability company (“DJWH”), which has no independent operations and whose sole assets are its equity interests in DJW, Diamond Jo Worth Corp., a Delaware corporation (“DJWC”), which has no assets or operations and AB Casino Acquisition LLC, a Delaware limited liability company (“AB Acquisition”), that was recently formed in order to effect the Proposed Amelia Belle Acquisition (as described below).

Related Transactions

On June 18, 2009, PGP and AB Acquisition entered into a definitive purchase agreement (the “Amelia Belle Purchase Agreement”) with Columbia Properties New Orleans, L.L.C. (“Columbia Properties”) to purchase 100% of the outstanding limited liability company interests of Belle of Orleans, L.L.C. (“Amelia Belle”) for $106.5 million, subject to certain adjustments (the “Proposed Amelia Belle Acquisition”). The Issuers are offering to issue the Notes in an aggregate principal amount of $530.0 million (the “Notes Issuance”), the net proceeds of which will be used, among other things, to fund the purchase price of Amelia Belle, to redeem all of PGL’s existing 8 3/4% senior secured notes due 2012 (the “PGL Notes”), to redeem all of DJW’s existing 11% senior secured notes due 2012 (the “DJW Notes”), to redeem all of EVD’s existing 13% senior notes due 2010 (the “EVD Notes”) and to reduce outstanding borrowings under the senior credit facility by and among DJL and EVD, as borrowers, PGL and PGC, as guarantors, the lenders party thereto and Wells Fargo Foothill, Inc., as arranger and agent (as amended, the “PGL Credit Facility”); provided, that if the Proposed Amelia Belle Acquisition is not consummated or the Amelia Belle Purchase Agreement is terminated, in either case, on or prior to December 31, 2009, a portion of the net proceeds of the Notes Issuance will be used to redeem $100 million in aggregate principal amount of outstanding Notes on a pro rata basis.

If the Proposed Amelia Belle Acquisition is consummated, (i) AB Acquisition will merge with and into PGL (with PGL surviving), and (ii) after giving effect to such merger, Amelia Belle will become a wholly-owned subsidiary of PGL and a guarantor of the Notes.

In connection with the transactions that the Company proposes to effect in connection with the Notes Issuance, as described under “Description of Related Transactions” (together with the Notes Issuance, the “Transactions”), (i) we will be seeking waivers and consents from the requisite lenders under the PGL Credit Facility in order to permit the Transactions, which include, among other things, the Notes Issuance and the addition of DJW and, if the Proposed Amelia Belle Acquisition is consummated, Amelia Belle, as guarantors of the Notes and borrowers under the PGL Credit Facility, and (ii) the 7.5% Urban Renewal Tax Increment Revenue Bonds, Taxable Series 2007 (the “City Bonds”) owned by DJW will be transferred to PGP and will no longer be an asset of the Issuers or their subsidiaries. The Notes Issuance is contingent upon the approval of such waivers and consents under the PGL Credit Facility, which will require, among other things, the execution of a new intercreditor agreement governing the priority of the liens securing the PGL Credit Facility and liens securing the Secured Notes.

Summary Historical and Pro Forma Financial Data

The following tables set forth certain summary historical and pro forma financial information for each of the years in the three-year period ended December 31, 2008, for the three months ended March 31, 2008 and as of and for the three months ended March 31, 2009. The summary historical and pro forma financial data set forth below should be read in conjunction with (i) the sections entitled “Use of Proceeds,” “Capitalization” and “Pro Forma Condensed Combined/Consolidated Financial Information” (ii) PGL’s consolidated financial statements and the notes thereto and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in PGL’s annual report on Form 10-K for the year ended December 31, 2008 and quarterly report on Form 10-Q for the quarterly period ended March 31, 2009, each of which is filed with the SEC and contained elsewhere in this offering memorandum and (iii) Amelia Belle’s annual financial statements and the notes thereto for the year end December 31, 2008 and interim financial statements and the notes thereto as of and for the three months ended March 31, 2009 and three months ended March 31, 2008 contained elsewhere in this offering memorandum.

The summary historical consolidated financial information for PGL for each of the years in the three-year period ended December 31, 2008 has been derived from PGL’s audited consolidated financial statements. The summary historical consolidated financial information for PGL for the three months ended March 31, 2008 and as of and for the three months ended March 31, 2009 has been derived from PGL’s condensed unaudited consolidated financial statements, and includes, in the opinion of management, all adjustments, consisting of normal, recurring adjustments, necessary for a fair presentation of such information. The financial data presented for the interim periods is not necessarily indicative of the results for the full year.

The summary historical financial information for Amelia Belle for the year ended December 31, 2008 has been derived from Amelia Belle’s audited financial statements. The summary historical financial information for Amelia Belle for the three months ended March 31, 2008 and as of and for the three months ended March 31, 2009 has been derived from Amelia Belle’s condensed unaudited financial statements, and includes, in the opinion of management, all adjustments, consisting of normal, recurring adjustments, necessary for a fair presentation of such information. The financial data presented for the interim periods is not necessarily indicative of the results for the full year.

The summary pro forma condensed combined financial information for the year ended December 31, 2008 and as of and for the three months ended March 31, 2009 has been prepared to give pro forma effect to (i) the Notes Issuance and the application of net proceeds therefrom to acquire Amelia Belle and repay indebtedness, as described in “Use of Proceeds,” (ii) the addition of Amelia Belle as a guarantor under the Indentures and (iii) the transfer of the City Bonds owned by DJW to PGP, in each case, as if such transaction had occurred on January 1, 2008, in the case of the statement of operations and other financial information for the year ended December 31, 2008 and the three months ended March 31, 2009 for PGL and the guarantors, and as of March 31, 2009, in the case of the balance sheet information for PGL and the guarantors.

The summary pro forma condensed consolidated financial information as of and for the three months ended March 31, 2009 has also been prepared to give pro forma effect to (i) the Notes Issuance and the application of net proceeds therefrom, assuming the Proposed Amelia Belle Acquisition is not consummated or the Amelia Belle Purchase Agreement is terminated, to redeem the Notes on a pro rata basis in an aggregate principal amount of $100 million at par and (ii) the transfer of the City Bonds owned by DJW to PGP, in each case, as if such transactions occurred on January 1, 2008 in the case of the statement of operations and other financial information for PGL and the guarantors and as of March 31, 2009 in the case of balance sheet and other financial information for PGL and the guarantors.

The summary pro forma condensed combined/consolidated financial information is derived from PGL’s and Amelia Belle’s audited financial statements for the year ended December 31, 2008 and condensed unaudited financial statements as of and for the three months ended March 31, 2009. Such data is based on assumptions of management and is presented for illustrative and informational purposes only and does not purport to represent what our actual financial position or results of operations would have been had the above transactions actually been completed on the date or for the periods indicated and is not necessarily indicative of our financial position or results of operations as of and for the specified dates or in the future.

| | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | | Three Months Ended

March 31, |

| | | 2006 | | 2007 | | | 2008 | | 2008 | | 2009 |

PGL Group Statement of Operations Data: (1) | | | | | | | | | | | | | | | | |

Net revenues | | $ | 234,417 | | $ | 253,193 | | | $ | 259,153 | | $ | 63,077 | | $ | 71,970 |

Expenses | | | 196,018 | | | 220,470 | | | | 199,228 | | | 50,999 | | | 57,429 |

Depreciation and amortization | | | 20,820 | | | 20,728 | | | | 20,134 | | | 4,863 | | | 6,065 |

Income from operations | | | 38,399 | | | 32,723 | | | | 59,925 | | | 12,078 | | | 14,541 |

Net income (loss) | | | 6,328 | | | (5,154 | ) | | | 22,756 | | | 2,558 | | | 3,799 |

| | | | | | | | | | | | | | | |

| | | Year Ended December 31, | | Three Months Ended

March 31, |

| | | 2006 | | 2007 | | 2008 | | 2008 | | 2009 |

Other Financial Data: | | | | | | | | | | | | | | | |

Adjusted EBITDA (2) | | $ | 69,938 | | $ | 75,253 | | $ | 74,623 | | $ | 19,214 | | $ | 21,285 |

Capital expenditures | | | 36,372 | | | 40,897 | | | 69,256 | | | 9,655 | | | 10,365 |

(Dollars in thousands)

| | | | | | | | | |

| | | Year Ended

December 31, | | Three Months Ended

March 31, |

| | | 2008 | | 2008 | | 2009 |

Amelia Belle Statement of Operations Data: | | | | | | | | | |

Net revenues | | $ | 54,060 | | $ | 13,332 | | $ | 14,598 |

Expenses | | | 37,200 | | | 11,982 | | | 10,452 |

Depreciation and amortization | | | 4,748 | | | 1,187 | | | 1,195 |

Income from operations | | | 16,860 | | | 1,350 | | | 4,146 |

Net income | | | 16,885 | | | 1,356 | | | 4,147 |

| | | |

Other Financial Data: | | | | | | | | | |

Adjusted EBITDA (2) | | $ | 18,607 | | $ | 5,266 | | $ | 5,341 |

Capital expenditures | | | 1,480 | | | 457 | | | 7 |

(Dollars in thousands)

| | | | | | |

| | | Year Ended

December 31, | | Three Months

Ended

March 31, |

| | | 2008 | | 2009 |

Pro Forma for Acquisition Combined Statement of Operations Data: (3) | | | | | | |

Net revenues | | $ | 313,213 | | $ | 86,568 |

Expenses | | | 234,195 | | | 67,319 |

Depreciation and amortization | | | 22,649 | | | 6,698 |

Income from operations | | | 79,018 | | | 19,249 |

Net income | | | 26,727 | | | 5,033 |

| | |

Other Financial Data: | | | | | | |

Adjusted EBITDA (2) | | $ | 93,230 | | $ | 26,626 |

Capital expenditures | | | 70,736 | | | 10,372 |

(Dollars in thousands)

| | | | | | |

| | | As of March 31, 2009 |

| | | Pro Forma for

Acquisition (3) | | As Adjusted for

Redemption (4) |

PGL Combined/Consolidated Balance Sheet Data: | | | | | | |

Total cash and cash equivalents | | $ | 26,999 | | $ | 31,734 |

Total assets | | | 530,105 | | | 425,063 |

Senior secured debt (5) | | | 227,556 | | | 186,990 |

Total debt | | | 542,556 | | | 442,556 |

Net debt (6) | | | 515,557 | | | 410,822 |

(Dollars in thousands)

| | | | | | |

| | | As of March 31, 2009 | |

| | | Pro Forma for

Acquisition (3) | | | As Adjusted for

Redemption (4) | |

PGL Combined/Consolidated Financial Ratios: (7) | | | | | | |

Senior secured debt/LQA Adjusted EBITDA | | 2.1 | x | | 2.2 | x |

Net debt/LQA Adjusted EBITDA | | 4.8 | x | | 4.8 | x |

| (1) | PGL Group is comprised of PGL, PGC, EVD, DJL and DJW. |

| (2) | EBITDA is defined as earnings before interest related to preferred members’ interest and net interest expense, depreciation and amortization and gain or loss on disposal of assets. Adjusted EBITDA is EBITDA adjusted for pre-opening expense, development expense or income, impairment on assets held for sale, non-cash equity based and other compensation, impairment related to terminated project costs, hurricane insurance net proceeds and impairment of related party receivables. EBITDA and Adjusted EBITDA are presented to enhance the understanding of our ability to service our debt. Although EBITDA and Adjusted EBITDA are not necessarily measures of our ability to fund our cash needs, we understand that EBITDA and Adjusted EBITDA are used by certain investors as measures of financial performance and to compare our performance with the performance of other companies that report EBITDA and Adjusted EBITDA. EBITDA and Adjusted EBITDA are not measurements determined in accordance with GAAP, are unaudited and should not be considered alternatives to, or more meaningful than, net income or income from operations, as indicators of our operating performance, or cash flows from operating activities, as measures of liquidity or any other measure determined in accordance with GAAP. EBITDA and Adjusted EBITDA may not be the same as that of similarly named measures used by other companies. The definition of EBITDA as used in this presentation is not the same as the definition of such term as used in the Indentures or any of our other debt agreements. |

The following tables set forth, for the periods indicated, a reconciliation of Adjusted EBITDA to net income (loss):

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | | | Three Months Ended

March 31, | |

| | | 2006 | | | 2007 | | | 2008 | | | 2008 | | | 2009 | |

PGL Group Adjusted EBITDA Reconciliation: | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | 6,328 | | | $ | (5,154 | ) | | $ | 22,756 | | | $ | 2,558 | | | $ | 3,799 | |

Interest expense related to preferred members’ interest, redeemable | | | 285 | | | | — | | | | — | | | | — | | | | — | |

Interest expense, net of amounts capitalized | | | 32,741 | | | | 40,505 | | | | 39,634 | | | | 10,264 | | | | 11,250 | |

Interest income | | | (955 | ) | | | (2,628 | ) | | | (2,465 | ) | | | (744 | ) | | | (508 | ) |

Depreciation and amortization | | | 20,820 | | | | 20,728 | | | | 20,134 | | | | 4,863 | | | | 6,065 | |

Loss on disposal of assets | | | 210 | | | | 2,731 | | | | 95 | | | | 103 | | | | 81 | |

| | | | | | | | | | | | | | | | | | | | |

EBITDA | | | 59,429 | | | | 56,182 | | | | 80,154 | | | | 17,044 | | | | 20,687 | |

| | | | | | | | | | | | | | | | | | | | |

Pre-opening expense | | | 966 | | | | 375 | | | | 785 | | | | 96 | | | | — | |

Development expense (income) | | | 777 | | | | 8,041 | | | | (922 | ) | | | 39 | | | | 82 | |

Impairment on assets held for sale | | | — | | | | — | | | | 831 | | | | — | | | | — | |

Non-cash equity based and other compensation | | | 8,766 | | | | 10,655 | | | | (6,225 | ) | | | 2,035 | | | | 516 | |

| | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA | | $ | 69,938 | | | $ | 75,253 | | | $ | 74,623 | | | $ | 19,214 | | | $ | 21,285 | |

| | | | | | | | | | | | | | | | | | | | |

(Dollars in thousands)

| | | | | | | | | | | | |

| | | Year Ended

December 31,

2008 | | | Three Months Ended

March 31, | |

| | | | 2008 | | | 2009 | |

Amelia Belle Adjusted EBITDA Reconciliation: | | | | | | | | | | | | |

Net income | | $ | 16,885 | | | $ | 1,356 | | | $ | 4,147 | |

Interest expense, net of amounts capitalized | | | — | | | | — | | | | — | |

Interest income | | | (25 | ) | | | (6 | ) | | | (1 | ) |

Depreciation and amortization | | | 4,748 | | | | 1,187 | | | | 1,195 | |

| | | | | | | | | | | | |

EBITDA | | | 21,608 | | | | 2,537 | | | | 5,341 | |

| | | | | | | | | | | | |

Impairment related to terminated project costs | | | 283 | | | | — | | | | — | |

Insurance proceeds, net (a) | | | (6,025 | ) | | | — | | | | — | |

Impairment of related party receivables (b) | | | 2,741 | | | | 2,729 | | | | — | |

| | | | | | | | | | | | |

Adjusted EBITDA | | $ | 18,607 | | | $ | 5,266 | | | $ | 5,341 | |

| | | | | | | | | | | | |

(Dollars in thousands)

| | | | | | | | |

| | | Year Ended

December 31,

2008 | | | Three Months

Ended

March 31,

2009 | |

Pro Forma for Acquisition Combined Adjusted EBITDA Reconciliation: | | | | | | | | |

Net income | | $ | 26,727 | | | $ | 5,033 | |

Interest expense | | | 52,902 | | | | 14,252 | |

Interest income | | | (611 | ) | | | (36 | ) |

Depreciation and amortization | | | 22,649 | | | | 6,698 | |

Loss on disposal of assets | | | 95 | | | | 81 | |

| | | | | | | | |

EBITDA | | | 101,762 | | | | 26,028 | |

| | | | | | | | |

Pre-opening expense | | | 785 | | | | — | |

Development expense (income) | | | (639 | ) | | | 82 | |

Impairment of assets held for sale | | | 831 | | | | — | |

Non-cash equity based and other compensation | | | (6,225 | ) | | | 516 | |

Insurance proceeds, net (a) | | | (6,025 | ) | | | — | |

Impairment of related party receivables (b) | | | 2,741 | | | | — | |

| | | | | | | | |

Adjusted EBITDA | | $ | 93,230 | | | $ | 26,626 | |

| | | | | | | | |

(Dollars in thousands)

| | (a) | In 2005, as a result of damages caused by Hurricane Katrina, Amelia Belle ceased its lease payments to the Orleans Levee District. Under a settlement agreement, Amelia Belle was to receive $6.7 million and $6.9 million to settle certain rent and property damages claims, respectively. All proceeds received in 2008 related to property damages and payment for rent / lease settlement. |

| | (b) | Related to slot machines and other gaming equipment transferred to Tropicana Entertainment, LLC and its subsidiaries, which filed for bankruptcy in 2008. |

| (3) | Pro Forma for Acquisition data gives pro forma effect to (i) the Notes Issuance and the application of net proceeds therefrom to acquire Amelia Belle and repay indebtedness, as described in “Use of Proceeds,” (ii) the consummation of the Proposed Amelia Belle Transaction and the addition of Amelia Belle as a guarantor under the Indentures and (iii) the transfer of the City Bonds owned by DJW to PGP, in each case, as if such transactions occurred on January 1, 2008 for the periods presented, in the case of statement of operations and other financial information for PGL and the guarantors, and as of March 31, 2009, in the case of the balance sheet information for PGL and the guarantors. |

| (4) | As Adjusted for Redemption data gives pro forma effect to (i) the Notes Issuance and the application of net proceeds therefrom, assuming the Proposed Amelia Belle Acquisition is not consummated, to redeem on a pro rata basis $100 million principal of the Notes at par and (ii) the transfer of the City Bonds owned by DJW to PGP, in each case, as if such transactions occurred as of March 31, 2009. |

| (5) | Senior secured debt is equal to total debt minus the aggregate principal amount of the Unsecured Notes proposed to be issued in this offering. |

| (6) | Net debt is equal to total debt minus total cash and cash equivalents. |

| (7) | Financial ratios are based on Adjusted EBITDA for the quarter ended March 31, 2009 annualized (“latest quarter annualized,” or “LQA”). In December 2008, we opened our new land-based casino entertainment facility in Dubuque, replacing our former riverboat facility. See footnote 2 above for the calculation of Adjusted EBITDA. Financial ratios based on LQA Adjusted EBITDA are presented for illustrative and informational purposes only and do not purport to represent what our actual financial position or results of operations would have been had the new land-based casino entertainment facility in Dubuque been in operation for a full fiscal year or otherwise and is not necessarily indicative of our financial position or results of operations as of or for the specified dates or in the future. |

Risk Factors

The risks described below are not the only risks we face. Additional risks and uncertainties not presently known to us, or that we currently deem immaterial, may also impair our business operations. We cannot assure you that any of the events discussed in the risk factors below will not occur. If they do, our business, financial condition and results of operations could be materially adversely affected. In such case, the trading price of our securities could decline, and you might lose all or part of your investment.

Risk Factors Relating to Our Business

Future Operating Performance – Our future operating performance could be adversely affected by disruptions in operations and reduced patronage of our properties as a result of poor economic conditions, severe weather and other factors.

Our future operating performance could be adversely affected by disruptions and reduced patronage of our properties as a result of poor economic conditions, severe weather and other factors. The impact of these factors will be more significant to us than it would be to a more diversified gaming company. Any or all of our properties could be completely or partially closed due to, among other things, severe weather, casualty, mechanical failure, including the failure of our slot machines, physical damage or extended or extraordinary maintenance or inspection. For example, hurricane Gustav forced the closure of Evangeline Downs for five days in 2008. Severe or inclement weather may also cause the closure of, or limit the travel on, highways which provide access to our properties and could reduce the number of people visiting these facilities. In addition, to maintain our gaming license for our racino, we must have a minimum of 80 live racing days in a consecutive 20-week period each year of live horse race meetings at the racetrack, and poor weather conditions may make it difficult for us to comply with this requirement. Although we maintain insurance policies, insurance proceeds may not adequately compensate us for all economic consequences of any such event.

We are also vulnerable to any adverse changes in general political, financial and economic conditions (including as a result of international conflict) and any negative economic, competitive, demographic or other conditions affecting the States of Iowa and Louisiana, the cities in which we operate and the surrounding areas from which we expect to attract patrons. If the economy of any of these areas suffers a downturn or if any of these areas’ larger employers lay off workers, we may be adversely affected by the decline in disposable income of affected consumers. In addition, the current recession or further downturn in the general economy, or in a region constituting a significant source of customers for our properties, could have a negative impact on our operations. Any of the foregoing factors could limit or result in a decrease in the number of patrons at any of our properties or a decrease in the amount that patrons are willing to wager.

History of Net Losses – We have had a net loss in recent years and may experience net losses in the future.

We had net losses in 2007 of $5.2 million, 2005 of $3.4 million and 2004 of $45.1 million (including $37.6 million related to a loss on early retirement of debt). As we continue to execute our business strategy, we may experience net losses in the future, which could have an adverse affect on our business, prospects, financial condition, results of operations and cash flows.

Licensing – If we fail to meet the minimum live racing day requirements, our gaming license with respect to the racino will be canceled and all slot machine gaming at the racino must cease.

Louisiana gaming regulations and our gaming license for the Evangeline Downs require that we, among other things, have a minimum of 80 live racing days in a consecutive 20-week period each year of live horse race meetings at the horse racetrack. Live racing days typically vary in number from year to year and are based on a number of factors, many of which are beyond our control, including the number of suitable race horses and the occurrence of severe weather. If we fail to have the minimum number of live racing days, our gaming license with respect to the racino may be canceled, and the casino will be required to cease operations. Any cessation of our operation would have a material adverse affect on our business, prospects, financial condition, results of operations and cash flows.

Reauthorization of Gaming in Iowa – The Dubuque County and Worth County electorate must vote in 2010 and every eight years thereafter whether to continue to allow gaming in Dubuque County and Worth County, Iowa. If gaming is discontinued, it is unlikely that DJL or DJW will be able to conduct its gaming operations.

Under Iowa law, a license to conduct gaming may be issued in a county only if the county electorate has approved the gaming, and a reauthorization referendum requiring majority approval must be held every eight years. On November 5, 2002, the electorate of Dubuque County, Iowa, which includes the City of Dubuque, approved gaming by approximately 79% of the votes cast. On June 24, 2003, Worth County, Iowa approved gaming in the county by approximately 75% of the votes cast. If any reauthorization referendum is defeated in either Dubuque or Worth County in 2010, it is unlikely that DJL or DJW, respectively, would be able to conduct gaming operations, and, in that case, we may not be able to continue to service our indebtedness, including the Notes.

Liquor Regulation – Revocation of any of our liquor licenses, which are subject to extensive regulation, could have a material adverse effect on our gaming operations.

The sale of alcoholic beverages at our properties is subject to licensing, control and regulation by state and local agencies in Iowa and Louisiana. Subject to limited exceptions, all persons who have a financial interest in DJL, EVD, PGL or DJW by ownership, loan or otherwise, must be disclosed in an application filed with, and are subject to investigation by, Iowa and Louisiana liquor agencies. All liquor licenses are subject to annual renewal, are revocable and are not transferable. The liquor agencies have broad powers to limit, condition, suspend or revoke any liquor license. Any disciplinary action with respect to any of our liquor licenses could, and any failure to renew or revocation of our liquor licenses would, have a material adverse effect on our business.

Competition – We face intense competition in our gaming markets and increased competition may have a material adverse effect on our business, financial condition and results of operations.

The gaming industry is intensely competitive. If our existing competitors expand and/or upgrade their facilities or operate more efficiently than we do, new gaming firms enter the markets in which we operate or our competitors offer amenities that our casinos do not have, we could lose market share or our gaming markets could become saturated and new opportunities for expanding our business could become limited. As a result, increased competition could have a material adverse effect on our business, financial condition, results of operations and cash flows.

In Dubuque, Iowa, we face competition primarily from the Mystique Casino (the “Mystique”), a pari-mutuel greyhound racing facility. Mystique’s facility includes 959 slot machines, 18 table games and 4 poker tables. Mystique has recently renovated its gaming facility. The renovation includes a new restaurant, entertainment facility and additional gaming space. In addition, a group of private investors opened a hotel adjacent to the Mystique in October 2005. The Mystique is owned and operated by the Dubuque Racing Association (the “DRA”). Besides the Mystique, we also currently face limited competition from other gaming facilities located approximately 60 to 120 miles from our operations. In May 2005, the Iowa Racing and Gaming Commission granted 4 new licenses (including ours in Worth County). The closest of these licensees to the Diamond Jo is one located in Waterloo, Iowa, approximately 85 miles to the west of Dubuque, which opened in June 2007.

Our primary competition at the Diamond Jo Worth casino is from the Native American gaming operations in Minnesota, the closest being approximately 110 miles from the Diamond Jo Worth casino. In addition, a new casino in Emmetsburg, Iowa, located approximately 90 miles from Diamond Jo Worth casino, commenced operations in June 2006. As noted above, a new casino located in Waterloo, Iowa opened in June 2007 and is located approximately 120 miles from our Diamond Jo Worth casino.

In Louisiana, the nearest competitor to Evangeline Downs is a Native American casino located approximately 50 miles to the south of Lafayette in Baldwin, Louisiana. We also face competition from several other casinos and pari-mutuel gaming facilities located 50 to 100 miles from our racino, including Native American casinos in Kinder and Marksville, Louisiana, and riverboat casinos in Baton Rouge and Lake Charles, Louisiana. The nearest horse racetrack to our racino that is allowed to have gaming operations is located in Vinton, Louisiana. We also face competition from truck stop video poker parlors and OTBs in the areas surrounding Lafayette and Opelousas, Louisiana.

We could also face additional competition if Louisiana or Iowa or any of the states bordering Iowa or Louisiana (i) adopts laws authorizing new or additional gaming or (ii) grants new licenses to licensees located in and around the markets in which we operate. There are applications for new gaming licenses currently pending in Iowa, including in Franklin county. Given the close proximity of Franklin county to our operations at Diamond Jo Worth, the grant of a new gaming license in Franklin county could have a material adverse effect on our business.

We also compete to some extent with other forms of gaming on both a local and national level, including state-sponsored lotteries, charitable gaming, on- and off-track wagering, internet gaming, and other forms of entertainment, including motion pictures, sporting events and other recreational activities. It is possible that these secondary competitors could reduce the number of visitors to our facilities or the amount they are willing to wager, which could have a material adverse effect on our ability to generate revenue or maintain our profitability and cash flows.

Increased competition may require us to make substantial capital expenditures to maintain and enhance the competitive positions of our properties, including updating slot machines to reflect changing technology, refurbishing rooms and public service areas periodically, replacing obsolete equipment on an ongoing basis and making other expenditures to increase the attractiveness and add to the appeal of our facilities. Because we are highly leveraged, after satisfying our obligations under our outstanding indebtedness, there can be no assurance that we will have sufficient funds to undertake these expenditures or that we will be able to obtain sufficient financing to fund such expenditures. If we are unable to make such expenditures, our competitive position could be materially adversely affected.

Governmental Regulation – Extensive gaming and racing-related regulation continuously impacts our operations and changes in such laws may have a material adverse effect on our operations by, among other things, prohibiting or limiting gaming in the jurisdictions in which we operate.

The ownership, management and operation of our gaming facilities are subject to extensive laws, regulations and ordinances which are administered by the Iowa Racing and Gaming Commission, the Louisiana State Gaming Control Board, the Louisiana State Racing Commission and various other federal, state and local government entities and agencies. We are subject to regulations that apply specifically to the gaming industry and horse racetracks and casinos, in addition to regulations applicable to businesses generally. If current laws, regulations or interpretations thereof are modified, or if additional laws or regulations are adopted, it could have a material adverse effect on our business.

Legislative or administrative changes in applicable legal requirements, including legislation to prohibit casino gaming, have been proposed in the past. For example, in 1996, the State of Louisiana adopted a statute in connection with which votes were held locally where gaming operations were conducted and which, had the continuation of gaming been rejected by the voters, might have resulted in the termination of operations at the end of their current license terms. During the 1996 local gaming referendums, Lafayette Parish voted to disallow gaming in the Parish, whereas St. Landry Parish, the site of our racino, voted in favor of gaming. All parishes where riverboat gaming operations are currently conducted voted to continue riverboat gaming, but there can be no guarantee that similar referenda might not produce unfavorable results in the future. Proposals to amend or supplement the Louisiana Riverboat Economic Development and Gaming Control Act and the Pari-Mutuel Act also are frequently introduced in the Louisiana State legislature. In the 2001 session, a representative from Orleans Parish introduced a proposal to repeal the authority of horse racetracks in Calcasieu Parish (the site of Delta Downs) and St. Landry Parish (the site of our racino) to conduct slot machine gaming at such horse racetracks and to repeal the special taxing districts created for such purposes. If adopted, this proposal would have effectively prohibited us from operating the casino portion of our racino. In addition, the Louisiana legislature, from time to time, considers proposals to repeal the Pari-Mutuel Act.

Similarly, in Iowa, the county electorate must reauthorize gaming in 2010 and every eight years thereafter. See “—Reauthorization of Gaming in Iowa.”

To date, we have obtained all governmental licenses, findings of suitability, registrations, permits and approvals necessary for the operation of our properties owned by DJL, EVD and DJW. However, we can give no assurance that any additional licenses, permits and approvals that may be required will be given or that existing ones will be renewed or will not be revoked. Renewal is subject to, among other things, continued satisfaction of suitability requirements. Any failure to renew or maintain our licenses or to receive new licenses when necessary would have a material adverse effect on us.

The legislation permitting gaming in Iowa authorizes the granting of licenses to “qualified sponsoring organizations.” Such “qualified sponsoring organizations” may operate the gambling structure itself, subject to satisfying necessary licensing requirements, or it may enter into an agreement with an operator to operate gambling on its behalf. An operator must be approved and licensed by the Iowa Racing and Gaming Commission. The DRA, a not-for-profit corporation organized for the purpose of operating a pari-mutuel greyhound racing facility in Dubuque, Iowa, first received a riverboat gaming license in 1990 and, pursuant to the Amended DRA Operating Agreement, has served as the “qualified sponsoring organization” of the Diamond Jo since March 18, 1993. The term of the Amended DRA Operating Agreement expires on December 31, 2018. The Worth County Development Authority (“WCDA”), pursuant to the WCDA Operating Agreement, serves as the “qualified sponsoring organization” of Diamond Jo Worth. The term of the WCDA Operating Agreement expires on March 31, 2015 and is subject to automatic three year renewal periods. If the Amended DRA Operating Agreement or WCDA Operating Agreement were to terminate, or if the DRA or WCDA were to otherwise discontinue acting as our “qualified sponsoring organization” with respect to our operation of the Diamond Jo or Diamond Jo Worth, respectively, and we were unable to obtain a license from the Iowa Racing and Gaming Commission for an alternative “qualified sponsoring organization” to act on our behalf, we would no longer be able to continue our Diamond Jo or Diamond Jo Worth operations, which would materially and adversely affect our business, results of operations and cash flows.

Legislative Changes – Changes in legislative rules and regulations may have a material adverse effect on our operations.

Changes in federal or state laws, rules and regulations, including tax laws, affecting the gaming industry, or in the administration of such laws, could have a material adverse affect on our business. Regulatory commissions and state legislatures from time to time consider limitations on the expansion of gaming in jurisdictions where we operate and other changes in gaming laws and regulations. Proposals at the national level have included a federal gaming tax and limitations on the federal income tax deductibility of the cost of furnishing complimentary promotional items to customers, as well as various measures which would require withholding on amounts won by customers or on negotiated discounts provided to customers on amounts owed to gaming companies. Proposals at the state level have also included changes in the gaming tax rate. It is not possible to determine with certainty the likelihood of possible changes in tax or other laws affecting the gaming industry or in the administration of such laws. The changes, if adopted, could have a material adverse effect on our business, results of operations and cash flows.

Legislation in various forms to ban indoor tobacco smoking has recently been enacted or introduced in many states and local jurisdictions, including the jurisdictions in which we operate. The current restrictions permit smoking on the casino gaming floor in the jurisdictions in which we operate. If additional restrictions on smoking are enacted in jurisdictions in which we operate, particularly if such restrictions ban tobacco smoking on the casino gaming floor, our business could be materially and adversely affected.

Environmental Matters – We are subject to environmental laws and potential exposure to environmental liabilities. This may affect our ability to develop, sell or rent our property or to borrow money where such property is required to be used as collateral.

We are subject to various federal, state and local environmental laws, ordinances and regulations, including those governing discharges to air and water, the generation, handling, management and disposal of petroleum products or hazardous substances or wastes, and the health and safety of our employees. Permits may be required for our operations and these permits are subject to renewal, modification and, in some cases, revocation. In addition, under environmental laws, ordinances or regulations, a current or previous owner or operator of property may be liable for the costs of removal or remediation of some kinds of hazardous substances or petroleum products on, under, or in its property, without regard to whether the owner or operator knew of, or caused, the presence of the contaminants, and regardless of whether the practices that resulted in the contamination were legal at the time they occurred. In addition, as part of our business in Worth County, Iowa, we operate a gas station, which includes a number of underground storage tanks containing petroleum products. The presence of, or failure to remediate properly, the substances may adversely affect the ability to sell or rent the property or to borrow funds using the property as collateral. Additionally, the owner of a site may be subject to claims by third parties based on damages and costs resulting from environmental contamination emanating from a site.

We have reviewed environmental assessments, in some cases including soil and groundwater testing, relating to our currently owned and leased properties in Dubuque, Iowa, and other properties we may lease from the City of Dubuque or other parties. As a result, we have become aware that there is contamination present on some of these properties apparently due to past industrial activities. With respect to parcels we currently own or lease, we believe, based on the types and amount of contamination identified, the anticipated uses of the properties and the potential that the contamination, in some cases, may have migrated onto our properties from nearby properties, that any cost to clean up these properties will not result in a material adverse effect on our earnings and cash flows. We have also reviewed environmental assessments and are not aware of any environmental liabilities related to our properties at EVD and DJW.

We do not anticipate any material adverse effect on our earnings, cash flows or competitive position relating to existing environmental matters, but it is possible that future developments could lead to material costs of environmental compliance for us and that these costs could have a material adverse effect on our business and financial condition, operating results and cash flows.

Taxation – An increase in the taxes and fees that we pay could have a material adverse effect on us, and might reduce the cash flow available to service our indebtedness.

We are subject to significant taxes and fees relating to our gaming operations, which are subject to increase at any time. Currently, in Iowa, we are taxed at an effective rate of approximately 21% of our adjusted gross receipts by the State of Iowa, we pay the city of Dubuque a fee equal to $0.50 per patron and we pay a fee equal to 4.5% and 5.76% of adjusted gross receipts to the DRA and WCDA, respectively. In addition, all Iowa riverboats share equally in costs of the Iowa Racing and Gaming Commission and related entities to administer gaming in Iowa, which is currently approximately $0.7 million per year per riverboat. Currently, in Louisiana, we are taxed at an effective rate of approximately 36.5% of our adjusted gross slot revenue and pay to the Louisiana State Racing Commission a fee of $0.25 for each patron who enters the racino on live race days from the hours of 6:00 pm to midnight, enters the racino during non-racing season from the hours of noon to midnight Thursday through Monday, or enters any one of our OTBs. In addition, there have been proposals in the past to tax all gaming establishments, including riverboat casinos, at the federal level. Any material increase in taxes or fees, or in costs of the Iowa Racing and Gaming Commission, the Louisiana State Racing Commission and related entities, would have a material adverse affect on our business.

Difficulty in Attracting and Retaining Qualified Employees – If we are unable to attract and retain a sufficient number of qualified employees or are required to substantially increase our labor costs, our business, results of operations, cash flows and financial condition will be materially adversely affected.

The operation of our business requires qualified executives, managers and skilled employees with gaming industry experience and qualifications to obtain the requisite licenses. We may have difficulty attracting and retaining a sufficient number of qualified employees and may be required to pay higher levels of compensation than we have estimated in order to do so. If we are unable to attract and retain a sufficient number of qualified employees for our current operations or are required to substantially increase our labor costs, we may not be able to operate our business in a cost effective manner or at all.

We are dependent upon the available labor pool of unskilled and semi-skilled employees. We are also subject to the Fair Labor Standards Act, which governs matters such as minimum wage, overtime and other working conditions. In February 2007, the State of Iowa passed a bill increasing the minimum wage for Iowa workers. Effective April 1, 2007, the minimum wage for the State of Iowa

increased from $5.15 per hour to $6.20 per hour and then to $7.25 effective January 1, 2008. Effective July 24, 2007 and July 24, 2008, the federal minimum wage increased to $5.85 and $6.55, respectively, and is scheduled to increase to $7.25 per hour effective July 24, 2009. Current Iowa law effectively requires that we pay Iowa employees 25% more than the federally mandated minimum wage rates. While DJL and DJW currently pay all of their employees more than the current minimum wage levels, these scheduled changes in minimum wage laws could increase our payroll costs in the future and have an adverse effect on our liquidity. Further changes in applicable state or federal laws and regulations, particularly those governing minimum wages, could increase labor costs, which could have a material adverse effect on the cash flow available to service our indebtedness.

Energy Costs – Our operations are affected by increases in energy costs.

We are a large consumer of electricity and other energy in connection with the operation of our gaming properties. Accordingly, increases in energy costs may have a negative impact on our operating results. Additionally, higher energy and gasoline prices, which affect our customers, may result in reduced visitation to our casinos and racino and a reduction in our revenues.

Interested Party Matters – All of the Company’s voting equity interests are indirectly beneficially owned in the aggregate by managers and executive officers of PGP, including affiliates of Jefferies & Company, Inc., an initial purchaser in this offering, and such ownership may give rise to conflicts of interest.

All of the Company’s voting equity interests are indirectly beneficially owned or controlled in the aggregate by M. Brent Stevens, Michael Luzich and Terrance W. Oliver. Specifically, Mr. Stevens, our Chief Executive Officer, is also the Chairman of the Board of Managers of PGP and the Chief Executive Officer of PGP, DJL, EVD, PGL and DJW. Mr. Stevens indirectly beneficially owns or controls (through his beneficial ownership or control of voting equity interests in PGP) approximately 66.2% of the Company’s voting equity interests. Mr. Luzich, our President and Secretary, is also a Manager of PGP and the President and Secretary of PGP, PGL, DJL, EVD and DJW. Mr. Luzich indirectly beneficially owns (through his ownership of voting equity interests in PGP) approximately 32.3% of the Company’s voting equity interests. Mr. Oliver, a Manager of PGP, indirectly beneficially owns (through his direct ownership of interests in The Oliver Family Trust) approximately 1.5% of the Company’s voting equity interests. Andrew Whittaker, a Manager of PGP, indirectly beneficially owns (through his indirect ownership of voting equity interests in PGP) approximately 4.2% (which is included in the calculation of the 66.2% owned or controlled by Mr. Stevens) of the Company’s voting equity interests. In addition, Mr. Stevens has the right to designate three of the five members of PGP’s board of managers, including one of the two independent managers, and Mr. Luzich has the right to designate two of the five members of PGP’s board of managers, including one of the two independent managers, for so long as Mr. Stevens and Mr. Luzich, respectively, beneficially hold at least 5% of the voting equity interests of PGP.

In addition, certain of our principal equity holders, managers and officers are also affiliates of Jefferies & Company, Inc., an initial purchaser in this offering. Mr. Stevens is also an Executive Vice President and the head of capital markets at Jefferies & Company, Inc. Mr. Whittaker is a Vice Chairman of Jefferies & Company, Inc. Also, other employees of Jefferies & Company, Inc. that are not managers or officers of PGP or the Company own indirect equity interests in PGP totaling approximately 9.2% of the equity interests in PGP.

Because of their controlling interests, these individuals have the power to elect a majority of our managers, appoint new management and approve any action requiring the approval of holders of our equity interests, including adopting amendments to our certificate of formation, approving mergers or sales of substantially all of our assets or changes to our capital structure. It is possible that the interests of these individuals, including those individuals affiliated with Jefferies & Company, Inc., an initial purchaser in this offering, may in some circumstances conflict with our interests and your interests as holders of Notes.

PGP is primarily responsible for managing DJL, EVD and DJW operations as well as supervising all development projects. Neither PGP nor any of its affiliates is restricted from managing other gaming operations, including new gaming ventures or facilities that may compete with ours, except that certain restrictions under the Amended DRA Operating Agreement will terminate if we or any of our affiliates operate another facility in Dubuque County or the adjoining counties of Illinois or Wisconsin. If PGP or any of its affiliates decides to manage other gaming operations, such activities could require a significant amount of attention from PGP’s officers and managers and require them to devote less time to managing our operations. While we believe that any new ventures will not detract from PGP’s ability to manage and operate our business, there can be no assurance that such ventures would not have a material adverse effect on us.

Acquisitions – The Company may not be able to successfully identify attractive acquisitions, successfully integrate acquired operations or realize the intended benefits of acquisitions.

The Company evaluates from time to time attractive acquisition opportunities involving casino and other gaming operations. This strategy is subject to numerous risks, including:

| | • | | an inability to obtain sufficient financing to complete its acquisitions; |

| | • | | an inability to negotiate definitive acquisition agreements on satisfactory terms; |

| | • | | difficulty in integrating the operations, systems and management of acquired assets and absorbing the increased demands on its administrative, operational and financial resources; |

| | • | | the diversion of its management’s attention from its other responsibilities; |

| | • | | the loss of key employees following completion of its acquisitions; |

| | • | | the failure to realize the intended benefits of and/or synergies created by its acquisitions; |

| | • | | its being subject to unknown liabilities; and |

| | • | | the need for a greater amount of capital, infrastructure or other spending than anticipated. |

The Company’s inability to effectively address these risks could force it to revise its business plan, incur unanticipated expenses or forego additional opportunities for expansion.

On June 18, 2009, the Company entered into the Amelia Belle Purchase Agreement to acquire the Amelia Belle Casino. See “Description of Related Transactions—Proposed Amelia Belle Acquisition.” There can be no assurance that the Company will be able to obtain any necessary regulatory consents and approvals.

Use of Proceeds

The following table sets forth the estimated sources and uses of funds in connection with the Transactions, as if the Transactions had closed on March 31, 2009:

| | | | | | | | |

Sources of Funds | | Uses of Funds |

| | | | | (Dollars in thousands) | | | |

New Senior Secured Notes | | $ | 215,000 | | Reduce outstanding borrowings under revolving credit facility | | $ | 22,000 |

New Senior Unsecured Notes | | | 315,000 | | Repay 8.75% senior secured notes | | | 255,000 |

Cash on hand | | | 15,988 | | Repay 11.00% senior secured notes (1) | | | 111,826 |

| | | | | Repay 13.00% senior notes | | | 6,910 |

| | | | | Purchase consideration for Amelia Belle (2) | | | 106,500 |

| | | | | Estimated working capital adjustment for Amelia Belle (2) | | | 2,000 |

| | | | | Pay redemption premium on notes (3) | | | 11,539 |

| | | | | Pay accrued interest on notes (4) | | | 15,963 |

| | | | | Fees and expenses (5) | | | 14,250 |

| | | | | | | | |

Total Sources of Funds | | $ | 545,988 | | Total Uses of Funds | | $ | 545,988 |

| | | | | | | | |

| (1) | We redeemed $1,797 in principal amount of DJW Notes in May 2009. |

| (2) | If the Proposed Amelia Belle Acquisition is not consummated or the Amelia Belle Purchase Agreement is terminated, in either case, prior to December 31, 2009, we will use the purchase consideration for the Proposed Amelia Belle Transaction to redeem the Secured Notes and Unsecured Notes on a pro rata basis in an aggregate principal amount of $100 million at par and increase cash on hand by $4.7 million, net of cash not acquired of $3.8 million. |

| (3) | Assumes (i) DJW Notes are redeemed at an optional redemption price equal to 103.667% and (ii) PGL Notes are redeemed at an optional redemption price equal to 102.917%. |

| (4) | Consists of interest of 8.75% on the PGL Notes, 11.00% on the DJW Notes and 13.00% on the EVD Notes from October 15, 2008 to March 31, 2009, October 15, 2008 to March 31, 2009 and March 1, 2009 to March 31, 2009, respectively, and does not include $2.8 million of interest for the 30 day period following the Notes Issuance in connection with the redemption of the PGL Notes, DJW Notes and EVD Notes. |

| (5) | Includes underwriter’s discount and fees and legal and other transaction costs and expenses related to the Notes Issuance. |

Capitalization

The following table sets forth cash and cash equivalents and capitalization for the Company as of March 31, 2009:

��

| | • | | (i) on a consolidated basis for PGL and each of its subsidiaries other than DJW and (ii) DJW; |

| | • | | on a Pro Forma for Acquisition basis, to give pro forma effect to (i) the Notes Issuance and the application of net proceeds therefrom to acquire Amelia Belle and repay indebtedness, as described in “Use of Proceeds,” and (ii) the transfer of the City Bonds owned by DJW to PGP, in each case, as if such transactions had occurred as of March 31, 2009; and |

| | • | | on an As Adjusted for Redemption basis, to give pro forma effect to (i) the Notes Issuance and the application of net proceeds therefrom, assuming the Proposed Amelia Belle Acquisition is not consummated, to redeem the Notes on a pro rata basis in an amount of $100 million at par and repay other indebtedness as described in “Use of Proceeds,” and (ii) the transfer of the City Bonds owned by DJW to PGP, in each case, as if such transactions had occurred as of March 31, 2009. |

This table should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the notes thereto contained in PGL’s annual report on Form 10-K for the year ended December 31, 2008 and its quarterly report on Form 10-Q for the three months ended March 31, 2009, and the “Pro Forma Condensed Combined/Consolidated Financial Information.”

| | | | | | | | | | | | |

| (Dollars in thousands) | | As of March 31, 2009 | |

| | | Actual | | | Pro Forma for

Acquisition (1) | | | As Adjusted for

Redemption (2) | |

PGL Consolidated (without DJW): | | | | | | | | | | | | |

Total cash and cash equivalents | | $ | 14,400 | | | $ | 26,999 | | | $ | 31,734 | |

| | | | | | | | | | | | |

Senior secured credit facility | | | 22,000 | | | | — | | | | — | |

FF&E term loan facility | | | 7,766 | | | | 7,766 | | | | 7,766 | |

Capital leases & notes payable (3) | | | 4,570 | | | | 4,790 | | | | 4,790 | |

8.75% senior secured notes (4) | | | 253,354 | | | | — | | | | — | |

New Senior Secured Notes | | | — | | | | 215,000 | | | | 174,434 | |

New Senior Unsecured Notes | | | — | | | | 315,000 | | | | 255,566 | |

13.00% senior notes (5) | | | 6,884 | | | | — | | | | — | |

| | | | | | | | | | | | |

Total PGL Consolidated (without DJW) debt | | $ | 294,574 | | | $ | 542,556 | | | $ | 442,556 | |

| | | | | | | | | | | | |

| | | |

Diamond Jo Worth (6) | | | | | | | | | | | | |

Total cash and cash equivalents | | $ | 24,822 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | |

Senior secured revolving credit facility | | | — | | | | — | | | | — | |

11.00% senior secured notes (7) | | | 111,294 | | | | — | | | | — | |

Capital leases & notes payable | | | 220 | | | | — | | | | — | |

| | | | | | | | | | | | |

Total Diamond Jo Worth debt | | $ | 111,514 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | |

| | | |

Combined/Consolidated | | | | | | | | | | | | |

Total debt | | $ | 406,088 | | | $ | 542,556 | | | $ | 442,556 | |

Total members’ deficit (8) | | | (44,282 | ) | | | (78,322 | ) | | | (81,011 | ) |

| | | | | | | | | | | | |

Total capitalization | | $ | 361,806 | | | $ | 464,234 | | | $ | 361,545 | |

| | | | | | | | | | | | |

| (1) | Pro Forma for Acquisition data gives pro forma effect to (i) the Notes Issuance and the application of net proceeds therefrom to acquire Amelia Belle and repay indebtedness, as described in “Use of Proceeds,” (ii) the addition of Amelia Belle as a guarantor under the indentures governing the Notes and (iii) the transfer of the City Bonds owned by DJW to PGP, in each case, as if such transactions occurred as of March 31, 2009. |

| (2) | As Adjusted for Redemption data gives pro forma effect to (i) the Notes Issuance and the application of net proceeds therefrom, assuming the Proposed Amelia Belle Acquisition is not consummated, to redeem the Notes on a pro rata basis in an amount of $100 million at par and repay other indebtedness, as described in “Use of Proceeds” and (ii) the transfer of the City Bonds owned by DJW to PGP, in each case, as if such transactions occurred as of March 31, 2009. As Adjusted for Redemption data assumes that upon the termination of the Amelia Belle Purchase Agreement, any deposit paid into escrow subsequent to March 31, 2009 is returned to the Company. |

| (3) | Net of discount of $103. |

| (4) | Net of discount of $1,646. |

| (5) | Net of discount of $26. |

| (6) | DJW is currently not a guarantor under the PGL Credit Facility or the outstanding PGL Notes. In connection with the Transactions, upon consummation of this offering, DJW will be a borrower under the PGL Credit Facility. |

| (7) | Net of discount of $532. We redeemed $1,797 of the outstanding balance during May 2009. |

| (8) | Adjusted for (i) net contribution of the City Bonds to PGP of $12.6 million, (ii) call premium related to the redemption of all of the outstanding PGL Notes and DJW Notes of $7.4 million and $4.1 million, respectively, assuming an optional redemption price on or after April 15, 2009 of 102.917% and 103.667%, respectively and (iii) write off of deferred financing, bond discount and derivative liability costs related to the redemption of the PGL Notes, DJW Notes and EVD Notes of $7.3 million, $2.5 million and $0.1 million, respectively. As Adjusted for Redemption data additionally gives effect to a $2.7 million write-off of deferred financing costs related to the redemption of $100 million principal amount of Notes. |

Pro Forma Condensed Combined/Consolidated Financial Information

The following pro forma condensed combined financial statements give effect to the Proposed Amelia Belle Acquisition as if it had been completed on January 1, 2008 for income statement purposes, and as if it had been completed on March 31, 2009 for balance sheet purposes, subject to the assumptions and adjustments as described in the accompanying notes. The pro forma condensed combined statement of income does not reflect the potential realization of cost savings or restructuring or other costs relating to the integration of the two companies nor does it include any other items not expected to have a continuing impact on the combined results of the companies.

The pro forma condensed combined financial information has been prepared using our significant accounting policies as disclosed in our financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2008. It is management’s opinion that the pro forma condensed combined financial information includes all adjustments necessary for the fair presentation of the transactions described below in accordance with generally accepted accounting principles in the United States. The pro forma condensed combined financial information should be read in conjunction with the historical financial statements and notes thereto of PGL and Amelia Belle.

The following pro forma condensed combined financial information sets forth our results of operations and financial position and the results of operations and financial position of Amelia Belle for the periods set forth below, on an actual basis and on a pro forma basis to give effect to the following transactions, in each case, as if such transactions occurred on January 1, 2008 for the periods presented, in the case of the income statement information, and as of March 31, 2009 in the case of the balance sheet information: (i) the offering of the Notes, (ii) the consummation of the Proposed Amelia Belle Acquisition, (iii) the redemption of all of the outstanding PGL Notes, (iv) the redemption of all of the outstanding DJW Notes, (v) the redemption of all of the outstanding EVD Notes, (vi) the reduction of outstanding borrowings under our revolving credit facility and (vii) the distribution of the City Bonds to PGP. Certain historical amounts for Amelia Belle have been reclassified to conform with our financial statement presentation. Pro forma adjustments related to the Proposed Amelia Belle Acquisition are based on management’s best estimates of the fair value of assets and liabilities to be acquired. We have not obtained any outside appraisals of the assets and liabilities to be acquired.

The proposed acquisition of Amelia Belle has been accounted for by applying the acquisition method in accordance with Statement of Financial Accounting Standards 141R, Business Combinations (“SFAS 141R”), with PGL as the acquirer of Amelia Belle. Transaction costs associated with the acquisition are expensed as incurred. The estimated purchase price consideration has been allocated on a preliminary basis to the assets acquired and liabilities assumed based on management’s best estimates. Management will continue to review information and intends to perform further analysis prior to finalizing the allocation of the purchase price. Therefore, it is likely that the recorded values of assets and liabilities acquired will vary from those shown below related to the proposed acquisition and the differences may be material.

For purposes of measuring the estimated fair value of the assets acquired and liabilities assumed as reflected in the pro forma condensed combined financial statements, we estimated fair values based on the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants (an exit price). Market participants are assumed to be buyers and sellers in the principal (most advantageous) market for the asset or liability. Additionally, fair value measurements for an asset assume the highest and best use of that asset by market participants. As a result, we may be required to value assets of Amelia Belle at fair value measurements that do not reflect our intended use of those assets. Use of different estimates and judgments could yield different results.

The pro forma condensed combined information is not intended to reflect our results of operations or the financial position that would have actually resulted had the transactions described above been effected on the dates indicated. Further, the pro forma condensed combined information is not necessarily indicative of the results of operations that may be obtained in the future.

Pro Forma Condensed Combined Income Statement for the Year Ended December 31, 2008

| | | | | | | | | | | | | | | | |

| (Dollars in thousands) | | Peninsula

Gaming, LLC | | | Amelia

Belle | | | Pro Forma

Adjustments | | | Pro Forma | |

REVENUES: | | | | | | | | | | | | | | | | |

Casino | | $ | 227,269 | | | $ | 55,622 | | | $ | — | | | $ | 282,891 | |

Racing | | | 17,986 | | | | — | | | | — | | | | 17,986 | |

Video poker | | | 5,901 | | | | — | | | | — | | | | 5,901 | |

Food and beverage | | | 16,767 | | | | 3,616 | | | | — | | | | 20,383 | |

Other | | | 11,809 | | | | 369 | | | | — | | | | 12,178 | |

Less: Promotional allowances | | | (20,579 | ) | | | (5,547 | ) | | | — | | | | (26,126 | ) |

| | | | | | | | | | | | | | | | |

Total net revenues | | | 259,153 | | | | 54,060 | | | | — | | | | 313,213 | |

| | | | | | | | | | | | | | | | |

EXPENSES: | | | | | | | | | | | | | | | | |

Casino | | | 97,421 | | | | 20,421 | | | | — | | | | 117,842 | |

Racing | | | 15,739 | | | | — | | | | — | | | | 15,739 | |

Video poker | | | 4,349 | | | | — | | | | — | | | | 4,349 | |

Food and beverage | | | 13,174 | | | | 3,040 | | | | — | | | | 16,214 | |

Other | | | 7,564 | | | | — | | | | — | | | | 7,564 | |

Selling, general and administrative | | | 34,657 | | | | 11,858 | | | | — | | | | 46,515 | |

Depreciation and amortization | | | 20,134 | | | | 4,748 | | | | (2,233 | )(1) | | | 22,649 | |

Pre-opening expense | | | 785 | | | | — | | | | — | | | | 785 | |

Development expense | | | (922 | ) | | | 283 | | | | — | | | | (639 | ) |

Affiliate management fees | | | 5,401 | | | | 134 | | | | — | | | | 5,535 | |

Impairment of assets held for sale | | | 831 | | | | — | | | | — | | | | 831 | |

Impairment of related party receivable | | | — | | | | 2,741 | | | | — | | | | 2,741 | |

Gain on insurance proceeds | | | — | | | | (6,025 | ) | | | — | | | | (6,025 | ) |

Loss on disposal of assets | | | 95 | | | | — | | | | — | | | | 95 | |

| | | | | | | | | | | | | | | | |

Total expenses | | | 199,228 | | | | 37,200 | | | | (2,233 | ) | | | 234,195 | |

| | | | | | | | | | | | | | | | |

INCOME FROM OPERATIONS | | | 59,925 | | | | 16,860 | | | | 2,233 | | | | 79,018 | |

| | | | | | | | | | | | | | | | |

OTHER INCOME (EXPENSE): | | | | | | | | | | | | | | | | |

Interest income | | | 2,465 | | | | 25 | | | | (1,879 | )(2) | | | 611 | |

Interest expense | | | (39,634 | ) | | | — | | | | (13,268 | )(3) | | | (52,902 | ) |

| | | | | | | | | | | | | | | | |

Total other expense | | | (37,169 | ) | | | 25 | | | | (15,147 | ) | | | (52,291 | ) |

| | | | | | | | | | | | | | | | |

NET INCOME | | $ | 22,756 | | | $ | 16,885 | | | $ | (12,914 | ) | | $ | 26,727 | |

| | | | | | | | | | | | | | | | |

| (1) | Represents adjustment to depreciation related to Property and Equipment based on estimated fair market value of the assets at the time of purchase. |

| (2) | Represents the elimination of interest income associated with the City Bonds. |

| (3) | Represents (i) interest on the Notes of $51.1 million and (ii) amortization of deferred financing costs related to the Notes of $2.0 million offset by (i) elimination of interest expense related to the redemption of all of the outstanding PGL Notes, DJW Notes and EVD Notes of $24.7 million, $13.9 million and $1.1 million, respectively and (ii) elimination of interest on the PGL Credit Facility of $0.1 million. For purposes of this presentation, it is assumed that Secured Notes in an aggregate principal amount of $215 million are issued in the offering bearing interest at an annual rate of 8 3/4% and Unsecured Notes in an aggregate principal amount of $315 million are issued in this offering bearing interest at an annual rate of 10 1/4%. The actual principal amount of Secured Notes or Unsecured Notes issued in the offering and the rate of interest applicable to such notes may be greater than or less than that assumed in this presentation. If the applicable interest rate on $215 million aggregate principal amount of Secured Notes were to increase or decrease by 0.25%, interest expense associated with such notes would change by $0.5 million. If the applicable interest rate on $315 million aggregate principal amount of Unsecured Notes were to increase or decrease by 0.25%, interest expense associated with such notes would change by $0.8 million. |

Pro Forma Condensed Combined Income Statement for the Three Months Ended March 31, 2009

| | | | | | | | | | | | | | | | |

| (Dollars in thousands) | | Peninsula

Gaming, LLC | | | Amelia

Belle | | | Pro Forma

Adjustments | | | Pro Forma | |

REVENUES: | | | | | | | | | | | | | | | | |

Casino | | $ | 65,757 | | | $ | 15,264 | | | $ | — | | | $ | 81,021 | |

Racing | | | 3,026 | | | | — | | | | — | | | | 3,026 | |

Video poker | | | 1,584 | | | | — | | | | — | | | | 1,584 | |

Food and beverage | | | 5,778 | | | | 1,059 | | | | — | | | | 6,837 | |

Other | | | 2,341 | | | | 83 | | | | — | | | | 2,424 | |

Less: Promotional allowances | | | (6,516 | ) | | | (1,808 | ) | | | — | | | | (8,324 | ) |

| | | | | | | | | | | | | | | | |

Total net revenues | | | 71,970 | | | | 14,598 | | | | — | | | | 86,568 | |

| | | | | | | | | | | | | | | | |

EXPENSES: | | | | | | | | | | | | | | | | |

Casino | | | 27,390 | | | | 5,531 | | | | — | | | | 32,921 | |

Racing | | | 2,884 | | | | — | | | | — | | | | 2,884 | |

Video poker | | | 1,062 | | | | — | | | | — | | | | 1,062 | |

Food and beverage | | | 4,301 | | | | 916 | | | | — | | | | 5,217 | |

Other | | | 1,484 | | | | — | | | | — | | | | 1,484 | |

Selling, general and administrative | | | 12,762 | | | | 2,778 | | | | — | | | | 15,540 | |

Depreciation and amortization | | | 6,065 | | | | 1,195 | | | | (562 | )(1) | | | 6,698 | |

Development expense | | | 82 | | | | — | | | | — | | | | 82 | |

Affiliate management fees | | | 1,318 | | | | 32 | | | | — | | | | 1,350 | |

Loss on disposal of assets | | | 81 | | | | — | | | | — | | | | 81 | |

| | | | | | | | | | | | | | | | |

Total expenses | | | 57,429 | | | | 10,452 | | | | (562 | ) | | | 67,319 | |

| | | | | | | | | | | | | | | | |

INCOME FROM OPERATIONS | | | 14,541 | | | | 4,146 | | | | 562 | | | | 19,249 | |

| | | | | | | | | | | | | | | | |

OTHER INCOME (EXPENSE): | | | | | | | | | | | | | | | | |

Interest income | | | 508 | | | | 1 | | | | (473 | )(2) | | | 36 | |

Interest expense | | | (11,250 | ) | | | — | | | | (3,002 | )(3) | | | (14,252 | ) |

| | | | | | | | | | | | | | | | |

Total other expense | | | (10,742 | ) | | | 1 | | | | (3,475 | ) | | | (14,216 | ) |

| | | | | | | | | | | | | | | | |

NET INCOME | | $ | 3,799 | | | $ | 4,147 | | | $ | (2,913 | ) | | $ | 5,033 | |

| | | | | | | | | | | | | | | | |

| (1) | Represents adjustment to depreciation related to Property and Equipment based on estimated fair market value of the assets at the time of purchase. |

| (2) | Represents the elimination of interest income associated with the City Bonds. |

| (3) | Represents (i) interest on the Notes of $12.8 million and (ii) amortization of deferred financing costs related to the Notes of $0.5 million offset by (i) the elimination of interest expense related to the redemption of all of the outstanding PGL Notes, DJW Notes and EVD Notes of $6.2 million, $3.5 million and $0.3 million, respectively and (ii) the elimination of interest on the PGL Credit Facility of $0.3 million. For purposes of this presentation, it is assumed that Secured Notes in an aggregate principal amount of $215 million are issued in the offering bearing interest at an annual rate of 8 3/4% and Unsecured Notes in an aggregate principal amount of $315 million are issued in the offering bearing interest at an annual rate of 10 1/4%. The actual principal amount of Secured Notes or Unsecured Notes issued in the offering and the rate of interest applicable to such notes may be greater than or less than that assumed in this presentation. If the applicable interest rate on $215 million aggregate principal amount of Secured Notes were to increase or decrease by 0.25%, interest expense associated with such notes would change by $0.1 million quarterly. If the applicable interest rate on $315 million aggregate principal amount of Unsecured Notes were to increase or decrease by 0.25%, interest expense associated with such notes would change by $0.2 million quarterly. |

Pro Forma Condensed Combined Balance Sheet as of March 31, 2009