QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrantý

|

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

CARBON ENERGY CORPORATION |

(Name of Registrant as Specified In Its Charter) |

|

(Name(s) of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

CARBON ENERGY CORPORATION

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

May 14, 2002

Dear Stockholder:

On behalf of the Board of Directors, it is my pleasure to invite you to attend our 2002 Annual Meeting of Stockholders. It will be held at 9:00 a.m. Mountain Daylight Time, on Thursday, June 13, 2002 in Denver, Colorado at our corporate office at 1700 Broadway, Suite 1150, Denver, Colorado 80290.

The meeting's purpose is to:

- 1.

- Elect six directors; and

- 2.

- Consider any other matters that are properly presented at the meeting.

The only voting class of security for Carbon Energy Corporation ("Carbon" or the "Company") is its common stock, no par value, each share of which entitles its holder to one vote. Only stockholders of record at the close of business on May 1, 2002 are entitled to receive notice of and to vote at the meeting. A list of stockholders entitled to vote will be available for examination at the meeting by any stockholder for any purpose relevant to the meeting. The list also will be available on the same basis for ten days prior to the meeting at our corporate office in Denver, Colorado.

If you wish to vote shares held in your name in person at the meeting, please bring to the meeting your proxy card, proof of identification and a letter or account statement showing that you are the beneficial owner on the record date. If you hold your shares in street name (that is, through a broker or other nominee), you must request a proxy from your broker in order to vote in person at the meeting. Corporations may attend and vote at the meeting by proxy or by a duly authorized representative.

If you plan to attend in person, please advise us by calling our Manager of Investor Relations at (303) 785-2631 by June 6, 2002, so we can assure that we will have sufficient space to accommodate all those wishing to attend.

We have enclosed the Company's 2001 annual report, including financial statements, and the proxy statement with this notice of annual meeting.

Please vote, sign and mail the enclosed proxy card as soon as possible to assure you are represented at the meeting. We have enclosed a return envelope, which requires no postage if mailed in the United States, for that purpose. The Board of Directors is soliciting your proxy.

| | | BY ORDER OF THE BOARD OF DIRECTORS |

|

|

Patrick R. McDonald

Secretary |

CARBON ENERGY CORPORATION

Annual Stockholders Meeting

Proxy Statement

| Annual Meeting Date | | June 13, 2002 9:00 a.m., MDT |

Location |

|

1700 Broadway, Suite 1150

Denver, Colorado 80290 |

Record Date |

|

5:00 p.m., EDT, May 1, 2002. If you were a stockholder at that time, you may vote at the meeting. Each share of common stock is entitled to one vote. You may not cumulate votes. On April 10, 2002, 6,128,258 shares of the Company's common stock were outstanding. |

Agenda |

|

1. Elect six directors; and |

|

|

2. Consider any other matters that are properly presented at the meeting. |

Proxies |

|

Unless you tell us differently on the proxy card, we will vote signed returned proxies "for" the Board's nominees for director. The Board or proxy holders will use their discretion on other matters. If a nominee cannot or will not serve as a director, the Board or proxy holders will vote for a person whom they believe will represent the best interests of the Company and its shareholders. |

Proxies Solicited By |

|

The Board of Directors of the Company. |

First Mailing Date |

|

We anticipate first mailing this proxy statement on or about May 14, 2002. |

Revoking Your Proxy |

|

You may revoke your proxy before it is voted at the meeting. To revoke your proxy, follow the procedures listed on page 16 under "Voting Procedures / Revoking Your Proxy." |

Solicitation Costs |

|

We will pay the costs of soliciting proxies from stockholders. |

|

|

A copy of Carbon's Report on Form 10-K for 2001 as filed with the Securities and Exchange Commission will be furnished without charge to shareholders. Such requests should be directed to: Carbon Energy Corporation, 1700 Broadway, Suite 1150, Denver, CO 80290, Attn: Investor Relations. |

PLEASE VOTE. YOUR VOTE IS IMPORTANT.

Prompt return of your proxy will help reduce the costs of re-solicitation.

Carbon Energy Corporation

2002 Proxy Statement

Table of Contents

BACKGROUND INFORMATION

On August 11, 1999, CEC Resources Ltd. (CEC) entered into a stock purchase agreement with Bonneville Pacific Corporation to acquire all outstanding shares of Bonneville Fuels Corporation (BFC). The rights and obligations of CEC under the stock purchase agreement were assigned in October, 1999 by CEC to Carbon Energy Corporation (Carbon). Yorktown Energy Partners III, L.P. (Yorktown) purchased in October 1999, 4,500,000 shares of Carbon pursuant to an Exchange and Financing Agreement (the Exchange Agreement). The funds from this purchase were used by Carbon to acquire on October 29, 1999, all outstanding BFC shares under the stock purchase agreement and pay expenses incurred in connection with the purchase and related transactions.

Carbon then made an exchange offer for CEC shares to combine BFC and CEC. In the exchange offer, Carbon offered to exchange one share of Carbon for each share of CEC. On February 17, 2000, Carbon completed the exchange offer and acquired 97% of the outstanding shares of common stock of CEC. On February 26, 2001, CEC completed an offer to purchase shares of CEC stock that were not owned by Carbon. After completion of the offer to purchase shares, Carbon owned 99.7% of CEC's outstanding shares. Carbon's business is comprised currently of the assets and properties of BFC through ownership of 100% of BFC's shares and CEC through ownership of 99.7% of CEC's outstanding shares.

PROPOSAL 1—ELECTION OF DIRECTORS

The Board currently has six members. Proxy holders will vote for the six nominees listed below. All nominees are currently members of the Board, and their terms will continue until the next Annual Meeting of Stockholders or until their successors are duly elected and qualified. Each of the nominees has consented to being named in the Proxy Statement and to serve if elected. If any nominee is unable to serve as a director, the current Board may designate a substitute nominee and the proxies will vote all valid proxy cards for the election of the substitute nominee.

Two of the nominees, Mr. Lawrence and Mr. Leidel, were persons selected as nominees by Yorktown in accordance with the Exchange Agreement. Mr. McDonald was selected as a nominee pursuant to requirements in the Exchange Agreement and his employment agreement. (Both agreements are described later in this Proxy Statement.) Pursuant to the Exchange Agreement, Yorktown has agreed to vote its shares of common stock in favor of these nominees. Because Yorktown owns approximately 73.4% of the outstanding common stock of the Company, its vote in favor of the nominees will be sufficient to elect these nominees regardless of the vote of the other shareholders.

The six nominees who receive the greatest number of votes cast for the election of directors by holders will become directors of the Company. Abstentions and broker non-votes will have no effect on the election of directors but will be counted for purposes of determining if a quorum is present. A broker non-vote occurs on a matter when a broker is not permitted to vote on that matter without instruction from the beneficial owner of the shares and no instruction is given.

Nominees for Election at Annual Meeting:

Name

| | Age

| | Principal Occupation and Biographical Information

|

|---|

| Patrick R. McDonald | | 45 | | Mr. McDonald became our President and Chief Executive Officer and a director in September 1999. He has been Chairman, President and Chief Executive Officer of CEC since July 1998. From 1987 until 1997, Mr. McDonald was Chairman and President of Interenergy Corporation, Denver, Colorado. Since January 1998, he has been the sole member of McDonald Energy, LLC. Mr. McDonald is a petroleum geologist. |

Cortlandt S. Dietler |

|

80 |

|

Mr. Dietler has served as a director of Carbon since December 1999. Mr. Dietler has been the Chairman of TransMontaigne Inc., which owns and operates terminals and pipelines for the transportation of oil, gas and other petroleum products, since April 1995. Mr. Dietler was Chief Executive Officer of TransMontaigne from April 1995 through September 1999. He was the founder, Chairman and Chief Executive Officer of Associated Natural Gas Corporation, a natural gas gathering, processing and marketing company, prior to its 1994 merger with PanEnergy Corporation, on whose Board he served as an Advisory Director, prior to its merger with Duke Energy Corporation. Mr. Dietler also serves as a director of Hallador Petroleum Company (OTC-HPCO.OB), Key Production Company, Inc. (NYSE-KP), and Forest Oil Corporation (NYSE-FST). |

David H. Kennedy |

|

52 |

|

Mr. Kennedy has served as a director of Carbon since September 1999. From March 1981 through December 1998, Mr. Kennedy was a managing director of First Reserve Corp. and was responsible for investing and monitoring part of its portfolio of energy investments. Since January 1999, Mr. Kennedy has acted as a consultant to and investor in the energy industry. He serves as a director of Maverick Tube Corporation (NYSE-MVK). |

Bryan H. Lawrence |

|

59 |

|

Mr. Lawrence has served as a director of Carbon since September 1999. Mr. Lawrence is a founder and member of Yorktown Partners LLC which was established in September 1997. Yorktown Partners LLC is the manager of private equity partnerships that invest in the energy industry. Mr. Lawrence had been employed at Dillon, Read & Co. Inc. since 1966, serving as a Managing Director until the merger of Dillon Read with SBC Warburg in September 1997. Mr. Lawrence also serves as a Director of D & K Healthcare Resources, Inc. (NASDAQ-DKWD), Hallador Petroleum Company (OTC-HPCO.OB), TransMontaigne Inc. (ASE-TMG), Vintage Petroleum, Inc. (NYSE-VPI) and certain non-public companies in the energy industry in which the Yorktown partnerships hold equity interests. |

|

|

|

|

|

Peter A. Leidel |

|

45 |

|

Mr. Leidel has served as a director of Carbon since September 1999. Mr. Leidel is a founder and member of Yorktown Partners LLC which was established in September 1997. Yorktown Partners LLC is the manager of private equity partnerships that invest in the energy industry. Previously, he was a partner of Dillon, Read & Co. Inc.'s venture capital fund and has invested in a variety of private companies with a particular focus on energy investments since 1983. He was previously employed in corporate treasury positions at Mobil Corporation and worked for KPMG Peat Marwick and the U.S. Patent and Trademark Office. Mr. Leidel is a director of Cornell Companies, Inc. (NYSE-CRN), Willbros Group, Inc. (NYSE-WG) and certain non-public companies in the energy industry in which the Yorktown partnerships hold equity interests. |

Harry A. Trueblood, Jr. |

|

76 |

|

Mr. Trueblood has served as a director of Carbon since February 2000. Mr. Trueblood is currently owner and managing member of HAT Resources, LLC. He was formerly President and Chief Executive Officer of CEC from 1972 until June 1998. Mr. Trueblood also was founder and served as Chairman, President and CEO of Columbus Energy Corp., the former parent of CEC, from 1982 through December 2000 and also was founder and served as President and CEO of Consolidated Oil & Gas, Inc., the former parent of both CEC and Columbus from 1958 to 1988. |

THE BOARD RECOMMENDS THAT YOU VOTE "FOR" THESE NOMINEES

BOARD INFORMATION

Meetings

The Board held four meetings in 2001, and also acted from time to time by unanimous written consent. All members attended all of the meetings of the Board of Directors and meetings of the Board Committees on which they served.

Committees

The Board has established three committees to assist in the discharge of its duties. These committees are the Compensation Committee, the Audit Committee and the Nominating Committee.

Members of the Compensation Committee are Messrs. Leidel (Chairman), Dietler and Kennedy. The Compensation Committee establishes and reviews the compensation policies of the Company and administers the Company's stock option and restricted stock plans. The Committee also establishes salary and bonus levels for officers. The Compensation Committee met once in 2001.

Members of the Audit Committee are Messrs. Kennedy (Chairman), Dietler, Leidel and Trueblood. Messrs. Dietler, Kennedy and Trueblood are independent directors as defined by rules of the American Stock Exchange. Mr. Leidel may not be viewed as independent under these rules because he is a member of Yorktown Partners LLC which may be considered an affiliate of the Company. The Board appointed Mr. Leidel to the Audit Committee because of his substantial experience in finance matters and because Mr. Leidel is not involved in the day-to-day operations of the Company or in the performance of any accounting functions of the Company. The primary functions of the Audit Committee are as follows:

- •

- Assist the Board in fulfilling its responsibilities to the shareholders, potential shareholders, and the investment community with regard to the integrity of the Company's financial reporting and adequacy of internal controls, policies and procedures.

- •

- Provide communication to the non-committee directors, management and the independent accountants with respect to accounting, financial reporting and compliance issues.

- •

- Function as a committee for the Board to report on the independence of the independent accountants and the adequacy of the Company's financial reporting.

- •

- Recommend the appointment of the independent accountants.

The Audit Committee met once during 2001.

Members of the Nominating Committee are Messrs. Lawrence (Chairman), Dietler, Kennedy and McDonald. The Nominating Committee is responsible for determining, on behalf of the Board of Directors of Carbon, nominees for the position of director of Carbon, or persons to be elected by the Board of Directors or shareholders to fill any vacancy in the Board of Directors of Carbon. The existence of the Nominating Committee is required by the Exchange Agreement. The Nominating Committee may consider nominees recommended by shareholders but has not adopted any procedures for shareholder recommendations. The Nominating Committee did not meet during 2001.

Director Compensation

Each of our directors who is neither an officer nor an employee will be paid a director's fee of $1,500 per quarter and $1,000 per committee meeting when the committee meeting is held separate from any regularly scheduled board meeting. Directors are also reimbursed for expenses incurred in attending Board of Directors and committee meetings, including expenses for travel, food and lodging.

Messrs. Dietler and Kennedy were each granted on October 14, 1999 and January 3, 2000, respectively, a non-qualified stock option to purchase 20,000 shares of Carbon common stock at $5.50 per share. Shares subject to these options vest one-half on the first anniversary and one-half on the second anniversary of the date of grant and have a ten year term. On September 6, 2001, Messrs. Dietler, Kennedy and Trueblood were each granted a non-qualified stock option to purchase 5,000 shares of Carbon common stock at $8.40 per share. Shares subject to these options vest one-third on the first, second and third anniversaries of the date of grant and have a ten year term.

Audit Committee Report

The Audit Committee is governed by a written charter which was adopted by the Board of Directors in June 2000. The Audit Committee assists the Board in oversight of the quality and integrity of the accounting, auditing and financial reporting practices of the Company.

The Audit Committee consists of three independent members of the Board of Directors and one member who may not be viewed as independent as defined by rules of the American Stock Exchange.

In performing its oversight function, the Audit Committee reviewed and discussed with management and the Company's independent auditors the audited consolidated financial statements of the Company as of and for the year ended December 31, 2001. The Audit Committee discussed with the independent auditors the matters required to be discussed by Statement of Auditing Standards No. 61, as amended, "Communication with Audit Committees."

The Audit Committee obtained from the independent auditors a formal written statement describing all relationships between the auditors and the Company that might bear on the auditors' independence consistent with Independence Standards Board Standard No. 1, "Independence Discussions with Audit Committees." The Audit Committee discussed with the auditors any relationships that may have an impact on their objectivity and independence and satisfied itself as to the auditors' independence. The Audit Committee also noted that the Company's independent auditors provided tax advisory services to the Company but were not providing any information technology services or other non-audit services to the Company which would be incompatible with their independence.

Based on this review and discussions with management and the independent auditors, the Audit Committee recommended to the Board that the Company's audited consolidated financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2001, for filing with the Securities and Exchange Commission.

| | | Audit Committee |

|

|

David H. Kennedy, Chairman

Cortlandt S. Dietler

Peter A. Leidel

Harry A. Trueblood, Jr. |

PRINCIPAL SHAREHOLDERS OF OUR COMPANY

The following table contains information regarding ownership of our common stock (the only class of stock outstanding) as of April 10, 2002 by each director, each executive officer named in the compensation table, all of our directors and executive officers as a group, and each shareholder who, to our knowledge, was the beneficial owner of five percent or more of the outstanding shares. All information is based on information provided by such persons to us. Unless otherwise indicated, their addresses are the same as Carbon's address and each person identified in the table holds sole voting and investment power with respect to the shares shown opposite such person's name. Footnotes supplement the information contained in the table.

Name and Address of Beneficial Owner

| | Amount and

Nature of

Beneficial

Ownership(a)

| | Percent

Outstanding

| |

|---|

| Patrick R. McDonald and McDonald Energy, LLC | | 381,766 | (b)(c) | 6.1 | % |

Kevin D. Struzeski |

|

53,332 |

(d) |

* |

|

Cortlandt S. Dietler

P.O. Box 5660

Denver, CO 80217 |

|

30,000 |

|

* |

|

David H. Kennedy

23 Lakeside Avenue

Darien, CT 06820 |

|

30,000 |

|

* |

|

Bryan H. Lawrence

410 Park Avenue, Suite 1900

New York, NY 10022 |

|

4,500,000 |

(e) |

73.4 |

% |

Peter A. Leidel

410 Park Avenue, Suite 1900

New York, NY 10022 |

|

4,500,000 |

(f) |

73.4 |

% |

Harry A. Trueblood, Jr.

1720 S. Bellaire Street

Suite 1005

Denver, CO 80222 |

|

268,396 |

(g) |

4.4 |

% |

All directors and executive officers as a group (7 persons including the above) |

|

5,263,494 |

|

82.8 |

% |

Yorktown Energy Partners III, L.P

410 Park Avenue, Suite 1900

New York, NY 10022 |

|

4,500,000 |

|

73.4 |

% |

- *

- Less than 1%

- (a)

- Includes the number of shares of common stock of the Company subject to stock options exercisable within 60 days after April 10, 2002, as follows: Mr. McDonald, 144,666 shares; Mr. Struzeski, 38,332 shares; Mr. Dietler, 20,000 shares; Mr. Kennedy, 20,000 shares and Mr. Trueblood, 5,000 shares; all directors and officers as a group, 227,998 shares.

- (b)

- Includes 50,000 shares of restricted stock granted pursuant to the Company's 1999 restricted stock plan, 23,333 of which have vested, 13,333 of which vest in 2002, 6,667 of which vest in 2003, 3,333 of which vest in 2004 and 3,334 of which vest in 2005.

- (c)

- Patrick R. McDonald is the sole member of McDonald Energy, LLC. The total includes 117,100 shares owned by CEC Resources Holdings, LLC of which McDonald Energy, LLC has a 58.3% interest.

- (d)

- Includes 15,000 shares of restricted stock, 7,499 of which have vested, 4,167 of which vest in 2002, 1,667 of which vest in 2003, 833 of which vest in 2004 and 834 which vest in 2005.

- (e)

- These shares are owned by Yorktown Energy Partners III, L.P. As a member of Yorktown Partners LLC, the manager of Yorktown Energy Partners III, L.P., Mr. Lawrence may be deemed to be a beneficial owner of these shares. Mr. Lawrence disclaims beneficial ownership of these shares.

- (f)

- These shares are owned by Yorktown Energy Partners III, L.P. As a member of Yorktown Partners LLC, the manager of Yorktown Energy Partners III, L.P., Mr. Leidel may be deemed to be a beneficial owner of these shares. Mr. Leidel disclaims beneficial ownership of these shares.

- (g)

- Does not include 35,711 shares which are owned by Lucile B. Trueblood, Mr. Trueblood's wife, which she acquired as her separate property and as to which Mr. Trueblood disclaims any beneficial ownership. Includes 12,000 shares owned by the Harry A. Trueblood, Jr. Charitable Remainder Unitrust dated June 1, 1998 as to which shares Mr. Trueblood disclaims ownership; however, as the only trustee, he does hold sole voting rights and dispositive powers with respect to such shares.

INFORMATION CONCERNING EXECUTIVE OFFICERS

Each of Carbon's two executive officers listed below serves at the pleasure of the Board and in accordance with their employment agreements.

Name

| | Age

| | Present Corporate Position and Business Experience

|

|---|

| Patrick R. McDonald | | 45 | | President and Chief Executive Officer. For information about Mr. McDonald, see "Proposal 1—Election of Directors." |

Kevin D. Struzeski |

|

43 |

|

Mr. Struzeski became our Treasurer and Chief Financial Officer on September 14, 1999. He has been Treasurer and Chief Financial Officer for CEC since November 1998. Mr. Struzeski was employed as Accounting Manager, MediaOne Group from 1997 to 1998 and prior to that he was employed as Controller, Interenergy Corporation from 1995 to 1997. |

EXECUTIVE COMPENSATION

The following table summarizes the compensation paid during the last three fiscal years by Carbon and CEC to each of the two executive officers of Carbon.

| |

| | Annual Compensation

| | Long Term Compensation

| |

| |

|---|

Name and Principal Position

| | Fiscal

Year

| | Salary

($)

| | Bonus(1)

($)

| | Restricted

Stock

Awards(2)

($)

| | Securites

Underlying

Options(3)

(#)

| | All Other

Compensation

($)

| |

|---|

Patrick R. McDonald

President and Chief Executive Officer | | 2001

2000

1999 | | 229,050

203,642

148,938 | | 138,000

102,733

132,798 | | —

58,625

165,000 | | —

—

90,000 | | 6,300

14,035

3,503 | (4)

|

Kevin D. Struzeski

Chief Financial Officer and Treasurer |

|

2001

2000

1999 |

|

110,000

100,321

91,787 |

|

25,000

30,000

20,000 |

|

—

14,656

55,000 |

|

—

5,000

25,000 |

|

5,250

9,774

1,815 |

(5)

|

- (1)

- Includes $90,000 and $25,000 paid in January 2002 to Mr. McDonald and Mr. Struzeski, respectively, for bonuses accrued in 2001.

- (2)

- Granted pursuant to the Company's 1999 restricted stock plan and valued at the fair market value of $5.865 and $5.50 per share on the date of grant for 2000 and 1999, respectively. No shares were granted under this plan during 2001. The restricted stock vests 33.33% each year over a three year period from the date of the grant. All restricted stock outstanding under this plan becomes fully vested upon a change of control as defined in the plan.

- (3)

- Granted pursuant to the Company's 1999 stock option plan.

- (4)

- Includes contributions of $5,250, $4,800 and $3,503 made by the Company in 2001, 2000 and 1999, respectively, to the Company's 401(k) plan on behalf of Mr. McDonald, $1,050 attributable to the Company's payment for a term life insurance policy on behalf of Mr. McDonald in 2001 and 2000 and $8,185 related to a cashout of sick leave due to a change in Company policy in 2000.

- (5)

- Includes contributions of $5,250, $5,250 and $1,815 made by the Company in 2001, 2000 and 1999, respectively, to the Company's 401(k) plan on behalf of Mr. Struzeski and $4,524 related to a cashout of sick leave due to a change in Company policy in 2000.

STOCK OPTION GRANTS AND EXERCISES

In 1999, Carbon adopted a stock option plan. All salaried employees of the Company and its subsidiaries are eligible to receive both incentive stock options and nonqualified stock options. Directors and consultants who are not employees of the Company or its subsidiaries are eligible to receive non-qualified stock options, but not incentive stock options under the plan. The option price for the incentive stock options granted under the plan are not to be less than 100% of the fair market value of the shares subject to the option. The option price for the nonqualified stock options granted under the plan are not to be less than 85% of the fair market value of the shares subject to the options. All outstanding options under the stock option plan become immediately exercisable in full, whether or not there are vesting requirements, upon the occurrence of a change in control as defined in the plan. The term of any stock option cannot exceed ten years. The aggregate number of shares of common stock which may be issued under options granted pursuant to the plan may not exceed 700,000 shares.

The specific terms of grant and exercise are determined by the Compensation Committee of the Board of Directors.

For the year ended December 31, 2001, the Compensation Committee did not grant any stock options to Carbon's executive officers.

YEAR-END OPTION VALUE TABLE

The following table summarizes information as of December 31, 2001 with respect to exercisable and non-exercisable options held by the Company's executive officers. The table also includes the value of "in-the-money" options, which represents the closing price of a share of common stock on December 31, 2001 of $8.69, less the exercise price, multiplied by the number of shares subject to the unexercised options.

2001 YEAR-END OPTION VALUES

| | Number of Securities

Underlying Unexercised

Options at Year-End

| | In-the-Money

Value of Unexercised

Options at Year End ($)

|

|---|

Name

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Patrick R. McDonald | | 144,666 | | 23,334 | | 486,484 | | 74,435 |

Kevin D. Struzeski |

|

38,332 |

|

11,668 |

|

139,175 |

|

36,011 |

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board of Directors is comprised of non-employee directors of the Company. The Committee establishes and reviews the compensation policies of the Company and administers the Company's stock option and restricted stock plans. The Committee also establishes salary and bonus levels for officers.

The Committee believes that it is in the best interest of the Company and its shareholders for the cash compensation of its executive officers to be competitive with the compensation of executives of oil and gas companies of comparable size and geographical location and complexity of operations.

Awards of stock options and restricted stock are intended to serve as long-term compensation designed to align the interests of Carbon's employees with the growth objectives of Carbon and its shareholders.

Stock options are granted only at the market price of the Company's stock and will have value only if the price of the Company's common stock increases. Options typically have a term of ten years and vest 33% each year for three years following the grant.

Restricted stock grants typically will vest 33% each year for three years following the grant.

The Committee considers various factors to determine the performance of the Company and its executives, including growth in natural gas and oil production, growth in net proved reserves of natural gas and oil, cash flow, earnings before interest, taxes and depreciation (EBITDA) and net income. The Committee has not established any particular formula nor identified any one particular factor as being more important than others in determining the performance of the Company and its executives.

For 2001, the Company reported record production volumes, increased net proved oil and natural gas reserves, and higher revenue, cash flow, EBITDA and net income. Production rose by 11% to an average of 16.6 MMcfe a day. Net proved reserves increased by 16% to 59.0 Bcfe, replacing over 232% of 2001 production. Total revenues for 2001 increased by 28% to $22.0 million. Cash flow before changes in working capital during 2001 was $8.5 million, an increase of 13% from cash flow before changes in working capital reported in 2000. EBITDA rose to $12.2 million, an increase of 40% from that reported for 2000. The Company reported $1.6 million in net income for the year, an increase of 8% from net income of $1.5 million reported in 2000. The common stock of Carbon Energy increased from $6.75 per share at December 31, 2000 to $8.69 per share at December 31, 2001, an increase of 29%.

The Committee reviewed the Company's operational and financial performance during 2001 to determine the level of compensation of its Chief Executive Officer, Patrick R. McDonald. Mr. McDonald has an employment agreement with the Company which provides for a base salary which is to be reviewed annually by the Compensation Committee of the Board of Directors or the Board of Directors. The Committee believes that the limitation on the deductibility of compensation for United States federal income tax purposes under Section 162(m) of the Internal Revenue Code does not apply to the 2001 compensation of the Company's executive officers. Mr. McDonald's base salary at January 1, 2001 was $225,000 and increased to $233,100, effective July 1, 2001. The Committee recommended an increase to Mr. McDonald's base salary to $240,000, effective January 1, 2002 and recommended that Mr. McDonald receive a performance bonus of $90,000 to be paid January 31, 2002.

| | | Compensation Committee |

|

|

Peter A. Leidel, Chairman

Cortlandt S. Dietler

David H. Kennedy |

EMPLOYMENT AGREEMENTS

In October, 1999, Patrick R. McDonald and Carbon entered into a three-year employment agreement, which provides for Mr. McDonald to be the President and Chief Executive Officer of Carbon at a base salary of not less than $200,000 per year, to be adjusted on each July 1 for cost of living increases in the U.S. consumer price index and to be reviewed annually by the Board of Directors or the Compensation Committee. Carbon is to provide Mr. McDonald benefits that he received as an executive of CEC, and is to maintain for his benefit a life insurance policy in the amount of $1 million and a disability insurance policy with terms mutually agreeable to Carbon and Mr. McDonald. If a payment to Mr. McDonald is subject to an excise tax under the Internal Revenue Code, Carbon will pay to Mr. McDonald an additional amount to cover the excise tax on an after-tax basis. According to the employment agreement, Carbon is also to nominate and endorse Mr. McDonald as a director on Carbon's Board of Directors so long as he is an officer of Carbon.

If Mr. McDonald's employment is terminated by Carbon for any reason other than "cause" (as defined in the agreement) or upon the death or disability of Mr. McDonald or if Mr. McDonald terminates his employment because of a material breach of the employment agreement by Carbon or because of a change in the position of Mr. McDonald with Carbon, then Mr. McDonald is to be paid a lump sum payment equal to 300% of his average annual compensation (which includes base salary and incentive compensation). Also, in that event, his options and restricted stock become 100% vested.

Either Carbon or Mr. McDonald may terminate the agreement if there is a change in control of Carbon as defined in the employment agreement. In the event of a change in control not supported by a majority of the Board of Directors, Mr. McDonald is to be paid 400% of his average annual compensation upon termination of the employment agreement. In the event of a change in control supported by the Board of Directors, Mr. McDonald is to be paid 300% of his average annual compensation upon termination of the employment agreement by Carbon or 200% of his compensation upon termination of his employment by him. In addition, upon a change in control, any outstanding stock options, stock appreciation rights and incentive awards (including restricted stock) granted to Mr. McDonald become 100% vested, without any restrictions.

In October, 1999, the Company entered into a two-year employment agreement with Mr. Struzeski, which provides for Mr. Struzeski to be the Chief Financial Officer of Carbon at a base salary of $100,000 per year to be reviewed annually by the Board of Directors or the Compensation Committee, together with all benefits offered by Carbon to Carbon's employees generally. If Mr. Struzeski's employment is terminated by Carbon for any reason other than "cause" or upon the death or disability of Mr. Struzeski or if Mr. Struzeski terminates his employment because of a change in the position of Mr. Struzeski with Carbon, Carbon is to pay Mr. Struzeski an amount equal to his compensation (pro rated on a monthly basis) multiplied by the remaining months of his employment agreement. Also, in that event, his options and restricted stock become 100% vested. The employment agreement with Mr. Struzeski provides that either Carbon or Mr. Struzeski may terminate the contract if there is a change in control of Carbon. In the event of a change in control not supported by a majority of the Board of Directors, Mr. Struzeski is to be paid 300% of his average annual compensation (which includes base salary and incentive compensation) upon termination of the employment agreement. In the event of a change in control supported by the Board of Directors, Mr. Struzeski is to be paid 200% of his compensation upon termination of his employment agreement by the Company or 100% of his compensation upon termination of his employment by him. In the event of a change in control, any outstanding stock options, stock appreciation rights and incentive awards (including restricted stock) granted to Mr. Struzeski will become 100% vested, without restrictions.

As required by the employment agreements, Carbon granted to Mr. McDonald and Mr. Struzeski in October 1999, options and restricted stock as shown in tables earlier in this Proxy Statement.

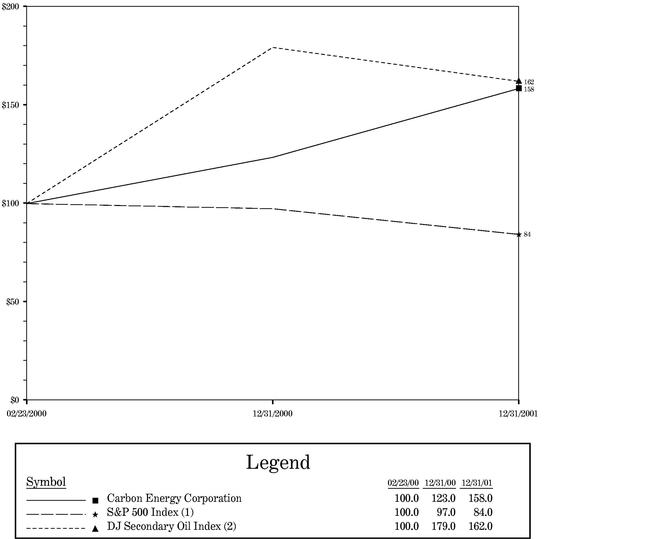

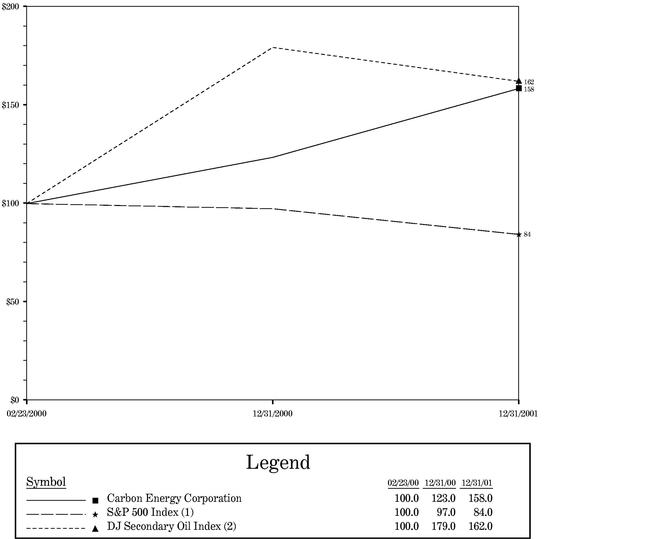

PERFORMANCE GRAPH

The following performance graph compares the cumulative total stockholders' return for Carbon's common stock with the cumulative total return for the S&P 500 Index and the Dow Jones Secondary Oil Index commencing February 23, 2000 (the initial trading date for Carbon shares) and ending December 31, 2001. The closing sales price of the Company's common stock on the last trading day of 2001 was $8.69.

The table assumes that the value of an investment in Carbon common stock and each index was $100 on February 23, 2000 and that all dividends were reinvested. The stock price performance shown on the graph is not necessarily indicative of future price performance.

- (1)

- Source: Fact Set Research Systems, Inc.

- (2)

- Source: Bloomberg

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In October 1999, Yorktown purchased an aggregate of 4,500,000 shares of our common stock for $24,750,000 in cash.

On October 14, 1999, Carbon, CEC and Yorktown signed the Exchange and Financing Agreement that provided for:

- •

- An assignment of the BFC stock purchase agreement to Carbon;

- •

- The purchase of common stock of Carbon by Yorktown as described above;

- •

- The exchange offer made for CEC shares;

- •

- Persons to be nominated as directors of the Company;

- •

- The adoption of the Company's 1999 stock option plan and the Company's 1999 restricted stock plan; and

- •

- The Company's entering into employment agreements with Mr. McDonald and Mr. Struzeski.

In the Exchange Agreement, Carbon, CEC and Yorktown agreed that the Board of Directors of Carbon will consist of five directors. Carbon, CEC and Yorktown agreed that the five directors initially would be David H. Kennedy, a person who passed away and was replaced by Cortlandt S. Dietler, Bryan H. Lawrence, Peter A. Leidel and Patrick R. McDonald. After completion of the exchange offer and Harry A. Trueblood, Jr.'s acceptance of the exchange offer for all CEC common stock beneficially owned by him, the number of Carbon directors was increased to six and Mr. Trueblood was elected as the sixth director. As long as Yorktown beneficially owns shares with 50% or more of the outstanding votes in the election of directors of Carbon, Yorktown has the right to designate for nomination two directors. If Yorktown beneficially owns shares with 25% or more but less than 50% of the outstanding votes in the election of directors of Carbon, then Yorktown has the right to designate for nomination one director. Yorktown has no right to designate directors for nomination under the Exchange Agreement if Yorktown beneficially owns shares with less than 25% of the outstanding votes in the election of directors of Carbon. So long as Mr. McDonald is an officer of Carbon, he is to be designated for nomination as a director of Carbon.

As provided by the Exchange Agreement, a Nominating Committee of Carbon's Board was established. The Nominating Committee consists of one Yorktown designated director, Mr. McDonald so long as he is a director of Carbon, and two independent directors. The Nominating Committee is responsible for determining nominees for the positions of directors of Carbon or persons to be elected by the Board of Directors or shareholders of Carbon to fill any vacancy in the Board of Directors. The Nominating Committee is required to nominate for director each Yorktown director which Yorktown has the right to designate and has designated. The Nominating Committee is required to nominate Mr. McDonald if he is entitled to be nominated. The Nominating Committee will then nominate the remaining directors; at least two of the persons nominated will be independent directors. If the size of the Board is changed and there are not sufficient positions for the election of two independent directors after taking into account the directors designated by Yorktown and Mr. McDonald, then the Nominating Committee is not required to nominate two independent directors. If there is a vacancy in the position relating to a Yorktown director, the remaining Yorktown director has the right to designate any replacement to fill the vacancy. The Nominating Committee has the right to designate any replacement to fill any other vacancy. The Exchange Agreement requires that any change in the size or composition of the Board of Directors or the Nominating Committee be approved by a supermajority vote of the Board consisting of a majority of the entire Board which includes a majority of all Yorktown directors and at least one independent director. The Exchange Agreement requires that Yorktown and Mr. McDonald take such actions as shareholders of Carbon as necessary to effectuate the election of directors nominated pursuant to the foregoing provisions. The provisions relating to election of directors cease to be effective on October 29, 2009 or, if earlier, when Yorktown beneficially owns shares with less than 25% of the outstanding votes in the election of directors and Mr. McDonald is no longer an officer of Carbon.

In the Exchange Agreement, the Company agreed to grant under its 1999 stock option plan substitute options for each option outstanding under the CEC stock option plan. Options granted by Carbon in substitution for options granted under the CEC stock option plan provide that they were granted in full satisfaction of, and in substitution for, any and all options for CEC stock previously granted under the CEC stock option plan. The material terms and conditions are the same as those relating to the specific options granted under the terms of the CEC stock option plan.

COMPLIANCE WITH SECTION 16(a) OF THE SECURITIES EXCHANGE ACT OF 1934

Section 16(a) of the Securities Exchange Act of 1934 requires executive officers, directors and persons who beneficially own more than ten percent of the Company's stock to file initial reports of ownership and reports of changes of ownership at specified times with the Securities and Exchange Commission and the American Stock Exchange. Copies of such reports are required to be furnished to the Company.

Based solely on a review of copies of such reports furnished to the Company, the Company believes that all Section 16(a) filing requirements of its directors, officers and beneficial owners of more than 10% of the outstanding shares of the Company for the year ending December 31, 2001 have been complied with in a timely manner.

INDEPENDENT ACCOUNTANTS

Arthur Andersen LLP has served as Carbon's independent accountants since the organization of Carbon. However, due to the widely reported recent developments concerning Arthur Andersen LLP, the Board of Directors has not yet selected the independent public accountants to audit the financial statements of Carbon for its 2002 fiscal year. As part of its process for selecting the independent public accountants for 2002, the Audit Committee and the Board of Directors will closely monitor the current developments concerning Arthur Andersen LLP.

To the knowledge of management, neither Arthur Andersen LLP nor any of its members has any direct or material indirect financial interest in Carbon nor any connection with Carbon in any capacity other than as independent public accountants. We expect a representative of Arthur Andersen LLP to attend the meeting, respond to appropriate questions and be given an opportunity to speak.

Disclosure of Auditor Fees:

Audit Fees: Fees paid or to be paid to Arthur Andersen LLP in connection with the audit of the Company's annual financial statements for the year ended December 31, 2001 and the review of the Company's interim financial statements included in the Company's Quarterly Reports on Form 10-Q during the year ended December 31, 2001, totaled approximately $76,250.

Financial Information Systems Design and Implementation Fees: The Company did not engage Arthur Andersen LLP to provide services to the Company regarding financial information systems design and implementation during the year ended December 31, 2001.

All Other Fees: Fees paid to Arthur Andersen LLP by the Company during the year ended December 31, 2001 for tax advisory services were approximately $43,300.

VOTING PROCEDURES / REVOKING YOUR PROXY

You can vote your shares by mail or in person at the meeting.

To vote by mail, complete and sign your proxy card—or your broker's voting instruction card if your shares are held by your broker—and return it in the enclosed business-reply envelope.

A quorum is present if at least a majority in total voting power of the Company's outstanding common stock as of the Record Date are present in person or by proxy. Those who fail to return a proxy or attend the meeting will not count towards determining any required majority or quorum. Abstentions and broker non-votes are counted for purposes of determining the presence or absence of a quorum for the transaction of business. The required votes for the election of directors are described in the sections dealing with this matter. With respect to any other matter which may properly come before the meeting, unless a greater number of votes is required by law, a matter is approved by the shareholders if the votes cast in favor of the matter exceeds the votes cast in opposition. Any shares not voted (whether by abstention, broker non-vote or otherwise) have no impact on the vote for these other matters, if any, so long as a quorum is present.

The enclosed proxies will be voted in accordance with the instructions you place on the proxy card. Unless otherwise stated, all shares represented by your returned, signed proxy will be voted as noted on the first page of this proxy statement.

Proxies may be revoked if you:

- •

- Deliver a signed, written revocation letter, dated later than the proxy, to Patrick R. McDonald, Secretary, at Carbon Energy Corporation, 1700 Broadway, Suite 1150, Denver, Colorado 80290, prior to the exercise of the proxy;

- •

- Execute a subsequent proxy; or

- •

- Attend the meeting and vote in person or by proxy. Attending the meeting alone will not revoke your proxy.

Proxy Solicitation:

We will reimburse banks, brokers, custodians, nominees and fiduciaries for reasonable expenses they incur in sending these proxy materials to you if you are a beneficial holder of our shares. Proxies may also be solicited by Company directors, officers and employees without additional compensation, personally or by telephone.

SUBMISSION OF SHAREHOLDER PROPOSALS

If you wish to present proposals for inclusion in the proxy statement and form of proxy for consideration at our next annual meeting, you must submit your proposals to our corporate secretary at our corporate office in Denver, Colorado. We must receive proposals for the 2003 annual meeting no later than January 14, 2003. Also, persons named in the proxy solicited by our Board of Directors for the 2003 Annual Meeting of Shareholders may exercise discretionary authority on any proposal presented by one of our shareholders at that meeting if we have not received notice of the proposal by March 30, 2003.

OTHER BUSINESS

The Board of Directors knows of no other matter to be presented for consideration at the annual meeting. If other business is properly presented, it is the intention of each person named in the proxy to vote signed, returned proxies in accordance with their best judgement on any such other matter.

Our Board of Directors urges you, even if you presently plan to attend the meeting in person, to execute the enclosed proxy and mail it as indicated immediately. You may revoke your proxy and vote in person if you attend the meeting.

| | | BY ORDER OF THE BOARD OF DIRECTORS |

|

|

Patrick R. McDonald

Secretary |

Common Stock Proxy

CARBON ENERGY CORPORATION

(a Colorado corporation)

THIS PROXY IS SOLICITED BY ITS BOARD OF DIRECTORS

The undersigned hereby appoints Patrick R. McDonald and Kevin D. Struzeski, and each of them, as proxies of the undersigned, with full power of substitution, to vote all shares of common stock of Carbon Energy Corporation which the undersigned is entitled to vote at the annual meeting of shareholders of Carbon Energy Corporation to be held on June 13, 2002 at 9:00 a.m. Mountain Daylight Time, and at any adjournment thereof.

Proposals:

| (1) | | Election of Directors for the nominees listed below (except as marked to the contrary below) / / | | Withhold authority to vote for all nominees listed below / / |

|

|

Cortlandt S. Dietler, David H. Kennedy, Bryan H. Lawrence, Peter A. Leidel, Patrick R. McDonald and Harry A. Trueblood, Jr. |

|

|

(Instruction: To withhold authority to vote for any individual nominee write that nominee's name on the space provided below. If authority is not withheld, it shall be deemed granted.) |

|

|

|

|

|

| (2) | | To consider any other matters that are properly presented at the meeting. |

Note: This proxy when properly executed, will be voted in the manner directed above. If no direction is made, this proxy will be voted for the election of directors and in the proxy holder's discretion on such other matters that are properly presented at the meeting, unless a contrary specification is made. The undersigned hereby revokes any proxies given prior to the date reflected below.

| | | PLEASE SIGN, DATE AND RETURN THIS PROXY CARD IMMEDIATELY. |

|

|

Date signed: |

|

|

| | | | |

|

|

|

Signature: |

|

|

|

|

X |

|

|

|

|

X |

|

|

|

|

Please sign exactly as your name appears on this proxy. If shares are held jointly, each holder should sign. When signing as attorney, executor, administrator, trustee, guardian or corporate official, please add your title. |

QuickLinks

Carbon Energy Corporation 2002 Proxy Statement Table of ContentsBACKGROUND INFORMATIONPROPOSAL 1—ELECTION OF DIRECTORSBOARD INFORMATIONPRINCIPAL SHAREHOLDERS OF OUR COMPANYINFORMATION CONCERNING EXECUTIVE OFFICERSEXECUTIVE COMPENSATIONSTOCK OPTION GRANTS AND EXERCISESYEAR-END OPTION VALUE TABLECOMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATIONEMPLOYMENT AGREEMENTSPERFORMANCE GRAPHCERTAIN RELATIONSHIPS AND RELATED TRANSACTIONSCOMPLIANCE WITH SECTION 16(a) OF THE SECURITIES EXCHANGE ACT OF 1934INDEPENDENT ACCOUNTANTSVOTING PROCEDURES / REVOKING YOUR PROXYSUBMISSION OF SHAREHOLDER PROPOSALSOTHER BUSINESSCARBON ENERGY CORPORATION (a Colorado corporation)