UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

|

| | |

| | Filed by a Party other than the Registrant | |

Check the appropriate box:

|

| | |

| | x | Preliminary Proxy Statement |

|

| | |

| | | Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

|

| | |

| | | Definitive Proxy Statement |

|

| | |

| | | Definitive Additional Materials |

|

| | |

| | | Soliciting Material Pursuant to §240.14a-12 |

GEEKNET, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | |

| | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

| | |

| | (1) | Title of each class of securities to which transaction applies: |

|

| | |

| | (2) | Aggregate number of securities to which transaction applies: |

|

| | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

| | |

| | (4) | Proposed maximum aggregate value of transaction: |

|

| | |

| | | Fee paid previously with preliminary materials. |

|

| | |

| | | Check box if any part of the fee is offset as provided by Exchange Act Rule 240.0-11and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

|

| | |

| | (1) | Amount Previously Paid: |

|

| | |

| | (2) | Form, Schedule or Registration Statement No.: |

Preliminary Proxy Statement – Subject to Completion

____________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 10, 2012

____________________

To the Stockholders:

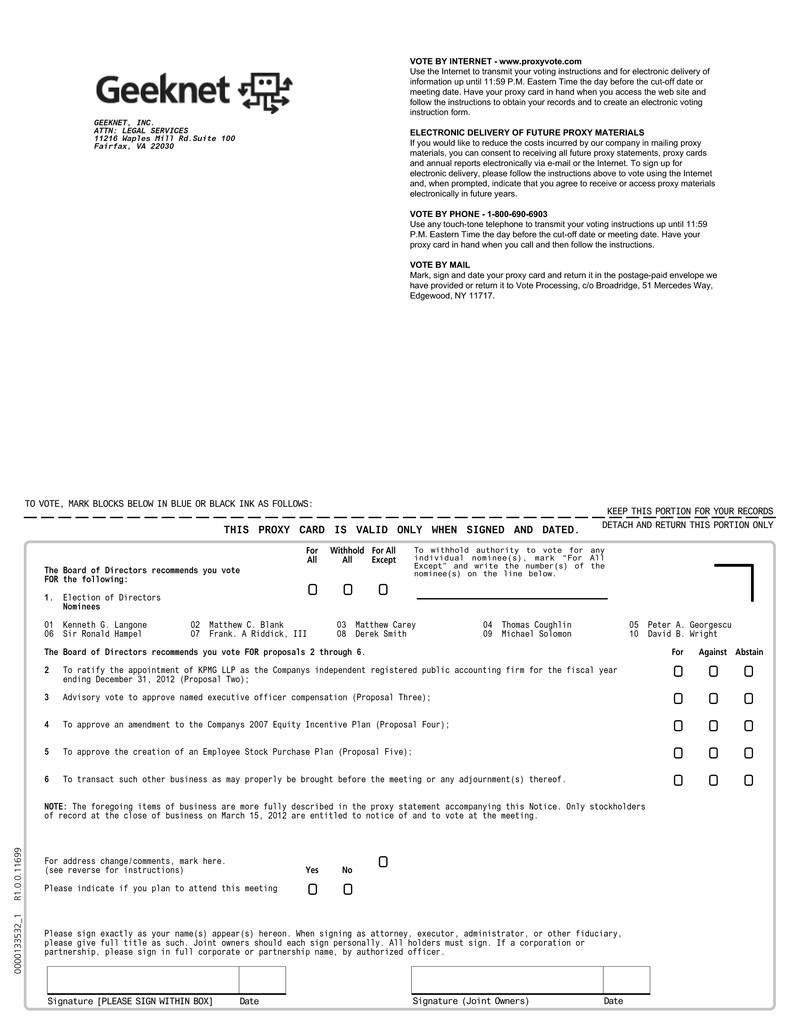

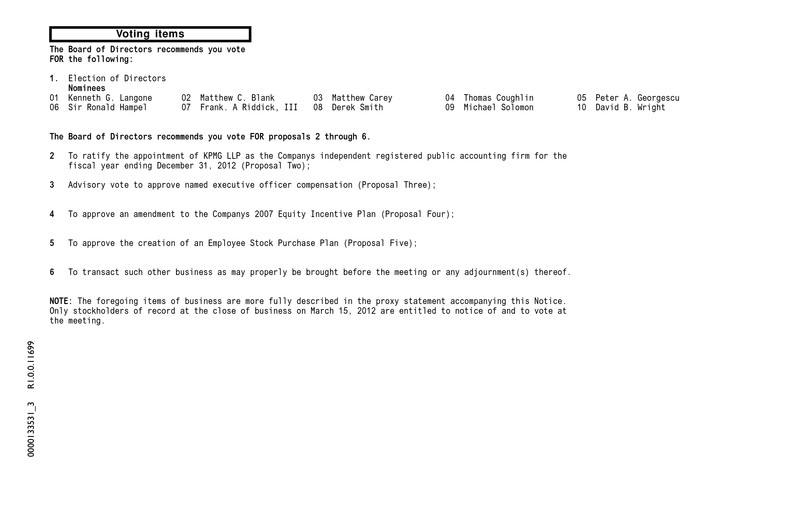

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Geeknet, Inc. (the “Company”), a Delaware corporation, will be held on Thursday, May 10, 2012 at 8 a.m., Eastern Daylight Time, at 125 East 50 Street, New York, NY 10022 for the following purposes:

|

| | |

| | (1) | To elect the ten (10) directors nominated by our Board of Directors and named in the proxy statement (Proposal One); |

|

| | |

| | (2) | To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2012 (Proposal Two); |

|

| | |

| | (3) | Advisory vote to approve named executive officer compensation (Proposal Three); |

|

| | |

| | (4) | To approve an amendment to the Company’s 2007 Equity Incentive Plan (Proposal Four); |

|

| | |

| | (5) | To approve the creation of an Employee Stock Purchase Plan (Proposal Five); |

|

| | |

| | (6) | To transact such other business as may properly be brought before the meeting or any adjournment(s) thereof. |

The foregoing items of business are more fully described in the proxy statement accompanying this Notice. Only stockholders of record at the close of business on March 15, 2012 are entitled to notice of and to vote at the meeting.

|

| | |

| | | |

| | | By Order of the Board of Directors, |

| | |

|

| | | Carol DiBattiste

Secretary |

Fairfax, VA

March [__], 2012

YOUR VOTE IS IMPORTANT

This proxy statement is furnished in connection with our solicitation of proxies, on behalf of the Board of Directors, for the 2012 Annual Meeting of Stockholders. The proxy statement and the related proxy form are being distributed on or about March 26, 2012. For specific instructions on how to vote your shares, please refer to the instructions on your enclosed proxy card. You can vote your shares using one of the following methods:

|

| | |

| | • | Vote through the Internet or by telephone by following the instructions shown on the proxy card; |

|

| | |

| | • | Vote by mail by completing and returning a written proxy card; or |

|

| | |

| | • | Attend our 2012 Annual Meeting of Stockholders and vote in person. |

Votes submitted through the Internet or by telephone must be received by 11:59 p.m., Eastern Daylight Time, on May 9, 2012. Internet and telephone voting are available 24 hours per day; if you vote via the Internet or telephone, you do not need to return a proxy card. Proxy cards submitted by mail must be received by the commencement of the Annual Meeting in order for your shares to be voted.

All stockholders are cordially invited to attend the meeting; however, to ensure your representation at the Annual Meeting, you are urged to vote via the Internet or telephone, or mark, sign, date and return the enclosed proxy card as promptly as possible in the pre-addressed envelope enclosed for that purpose. Any stockholder attending the Annual Meeting may vote in person even if he or she has voted via the Internet or telephone, or returned a proxy card.

GEEKNET, INC.

11216 Waples Mill Rd., Suite 100

Fairfax, VA 22030

____________________

PROXY STATEMENT

____________________

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The matters to be acted upon at the Annual Meeting of Stockholders (the “Meeting”) are described in the Notice of Annual Meeting of Stockholders and this proxy statement. Your Proxy is solicited on behalf of the Board of Directors of Geeknet, Inc. (the “Company”) for use at our Meeting to be held at 125 East 50 Street New York, NY 10022 on May 10, 2012, at 8 a.m. Eastern Daylight Time, and at any adjournment(s) thereof, for the purposes set forth herein. Our telephone number is (877) 433-5638.

The Notice, including the proxy statement, the Proxy and our Securities and Exchange Commission (“SEC”) Annual Report on Form 10-K, containing financial statements for the fiscal year ended December 31, 2011 (“Fiscal Year 2011”), was mailed or made available on the Internet, as applicable, on March 16, 2012 to all stockholders entitled to vote at the Meeting.

STOCKHOLDERS MAY RECEIVE A COPY OF THE COMPANY’S 2011 ANNUAL REPORT ON FORM 10-K, NOT INCLUDING EXHIBITS, AT NO CHARGE. IF A STOCKHOLDER PREFERS A COPY OF THE 2011 ANNUAL REPORT ON FORM 10-K INCLUDING EXHIBITS, THE STOCKHOLDER WILL BE CHARGED A REASONABLE FEE (WHICH SHALL BE LIMITED TO OUR REASONABLE EXPENSES IN FURNISHING SUCH EXHIBITS). REQUESTS FOR COPIES MUST BE MADE BY SENDING A WRITTEN REQUEST TO GEEKNET, INC., 11216 WAPLES MILL RD., SUITE 100, FAIRFAX, VA 22030, ATTN: INVESTOR RELATIONS.

Record Date and Share Ownership

Stockholders of record at the close of business on March 15, 2012 (which we will refer to as the “Record Date” throughout this proxy statement) are entitled to notice of and to vote at the Meeting and at any adjournment(s) thereof. We have one class of stock issued and outstanding, designated as Common Stock, $0.001 par value per share, and one class of undesignated Preferred Stock, $0.001 par value per share. As of the Record Date, 25,000,000 shares of our Common Stock were authorized and 6,393,452 shares of the Company’s Common Stock were outstanding. As of the Record Date, 1,000,000 shares of our Preferred Stock were authorized and no shares of our Preferred Stock were outstanding.

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it as follows:

|

| | | | |

| | (1) | Delivering to us at our principal offices (Attention: Investor Relations) a written notice of revocation before such proxy is used; or |

| | (2) | Delivering subsequent proxy instructions as follows: |

| | — | By Phone : Use the toll free telephone number provided on the proxy card to vote again prior to 11:59 p.m. Eastern Daylight Time (“EDT”) on May 9, 2012 (specific instructions for using the telephone voting system are provided on the proxy card and in the Notice); |

| | — | By Internet : Use the Internet voting site listed on the proxy card to vote again prior to 11:59 p.m. EDT on May 9, 2012 (specific instructions for using the Internet voting system are provided on the proxy card and in the Notice); |

| | — | By Mail : Sign, date and mail another proxy card bearing a later date and deliver such proxy card to our principal offices (Attention: Investor Relations) prior to the use of the original proxy; or |

| | — | In Person : Attend the Meeting and vote your shares in person. |

Voting

On all matters, each stockholder shall be entitled to one vote for each share of the Company’s Common Stock held by such stockholder.

With respect to the election of directors pursuant to “Proposal One — to elect the ten (10) directors nominated by our Board of Directors and named in the proxy statement,” Each director nominees receiving the affirmative vote of a plurality of the shares of our Common Stock present or represented by proxy and voting at the annual meeting shall be elected as directors for a one year term. Abstentions and broker non-votes will have no effect on the election of directors.

With respect to the ratification of KPMG, LLP as the Company’s Independent Registered Public Accountants for the fiscal year ending December 31, 2012 pursuant to “Proposal Two — To ratify the appointment of KPMG, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2012,” if a quorum is present and voting, the affirmative vote of the holders of a majority of the shares of Common Stock present in person or represented by proxy and entitled to vote is needed to ratify the appointment of KPMG, LLP as the Company’s independent registered public accounting firm, to audit the consolidated financial statements of the Company for our fiscal year ending December 31, 2012 (“Fiscal Year 2012”). Abstentions will have the effect of a vote “against” the ratification of KPMG LLP as our independent registered public accounting firm. Broker non-votes will have no effect on the outcome of the vote.

With respect to “Proposal Three — hold a non-binding vote on executive compensation,” if a quorum is present and voting the affirmative vote of the holders of a majority of the shares of Common Stock present in person or represented by proxy and entitled to vote at the annual meeting is required for approval of this proposal. Abstentions are treated as shares represented in person or by proxy and entitled to vote at the Annual Meeting and, therefore, will have the same effect as a vote “Against” the proposal. Broker non-votes will have no effect on the outcome of the vote.

With respect to the change in Section 3(b) in the Company’s 2007 Equity Incentive Plan regarding the calculation of restricted stock units and awards, pursuant to “Proposal Four — approve an amendment to the Company’s 2007 Equity Incentive Plan,” the affirmative vote of a majority of the votes cast (i.e., the number of shares voted “for” the proposal must exceed the number of shares voted “against” the proposal) is necessary to approve the amendment to the Company’s 2007 Equity Incentive Plan. Abstentions and broker non-votes will have no effect on the outcome of the vote.

With respect to “Proposal Five — to approve the creation of an Employee Stock Purchase Plan,” the affirmative vote of a majority of the votes cast (i.e., the number of shares voted “for” the proposal must exceed the number of shares voted “against” the proposal) is necessary to approve the amendment to the Company’s 2007 Equity Incentive Plan. Abstentions and broker non-votes will have no effect on the outcome of the vote.

Solicitation of Proxies

We will bear the cost of soliciting proxies. We may, upon request, reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding proxy solicitation materials to such beneficial owners. In addition, proxies may also be solicited by certain of our Directors, Officers and regular employees, without additional compensation, personally or by telephone or facsimile.

Quorum; Abstentions; Broker Non-Votes

Votes cast by proxy or in person at the Meeting (“Votes Cast”) will be tabulated by the inspector of elections (the “Inspector”) who will be one of our employees. The Inspector will also determine whether a quorum is present. Except in certain specific circumstances, the affirmative vote of a majority of shares present in person or represented by proxy at a duly held meeting at which a quorum is present is required under Delaware law for approval of proposals presented to stockholders. In general, Delaware law provides that a quorum consists of a majority of shares entitled to vote and present or represented by proxy at the Meeting.

The Inspector will treat shares that are voted WITHHELD or ABSTAIN as being present and entitled to vote for purposes of determining the presence of a quorum but will not treat such shares as votes in favor of approving any matter submitted to the stockholders for a vote. “Broker non-votes” will be counted as present but not entitled to vote and thus will not be counted for purposes of determining the number of Votes Cast with respect to a particular proposal; thus broker non-votes will not affect the outcome of any matter being voted on at the meeting. Abstentions will not affect the outcome of any matter being voted on at the meeting except the proposal regarding ratification of the independent accountants and the vote on executive compensation, in which case, abstentions will have the same effect as an “AGAINST” vote.

When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, the shares will be voted for (i) for the election of the ten nominees for directors set forth herein, (ii) for the ratification KPMG LLC as our independent registered public accounting firm for Fiscal Year 2012, (iii) for the advisory vote on the compensation of our executive officers, (iv) for amendment to the Company’s 2007 Equity Incentive Plan and (v) for the creation of an employee stock purchase plan. With respect to such other business as may properly come before the Meeting or any adjournment thereof, the shares will be voted in the discretion of the proxy holder.

Deadline for Receipt of Stockholder Proposals

Proposals of stockholders that are intended for inclusion in our proxy statement relating to our 2013 Annual Meeting of Stockholders must be received by us at our principal offices at 11216 Waples Mill Rd., Suite 100, Fairfax, VA 22030, Attention: Secretary (Carol DiBattiste), not later than November 1, 2012 and must satisfy the conditions established by the SEC and our bylaws for stockholder proposals in order to be included in our proxy statement for that meeting.

Stockholder proposals that are not intended to be included in our proxy materials for such meeting but that are intended to be presented by the stockholder are subject to the advance notice procedures described below.

Stockholders may present proposals for action at a future meeting only if they comply with the requirements of the proxy rules established by the SEC and our bylaws. In order for a matter to be deemed properly presented by a stockholder for consideration at our 2013 Annual Meeting of Stockholders under our bylaws, it must be received by our Secretary not before January 10, 2013 and not later than February 9. 2013. If our 2013 Annual Meeting of Stockholders is not within thirty days before or sixty days after May 10, 2013, the anniversary date of this year’s Annual Meeting, notice must be delivered no earlier than the one hundred and twentieth day prior to such annual meeting and not later than the close of business on the later of the ninetieth day prior to such meeting or ten days following any notice or publication of the meeting. The stockholder’s notice must comply with the requirements of our bylaws, which generally require that the notice set forth certain information that must be included concerning the stockholder’s proposal and ownership of our securities. The chairman of the meeting may refuse to acknowledge any matter not made in compliance with the advance notice procedures set forth in our bylaws. A copy of our bylaws may be obtained from the Secretary at our address set forth above.

Stockholder Information

If you share an address with another stockholder, you may receive only one set of proxy materials (including our Annual Report on Form 10-K and proxy materials) unless you have previously provided contrary instructions. If you wish to receive a separate set of proxy materials, please request additional copies by contacting us at GEEKNET, INC., 11216 WAPLES MILL RD., SUITE 100, FAIRFAX, VA 22030, ATTN: INVESTOR RELATIONS, or call (877) 825-4689.

Similarly, if you share an address with another stockholder and have received multiple copies of our proxy materials, you may contact us at the address above to request that only a single copy be delivered in the future.

Transaction of Other Business

As of the date of this proxy statement, the only business that the Board of Directors intends to present or knows that others will present at the Meeting is as set forth in this proxy statement. If any other matter(s) are properly brought before the Meeting, it is the intention of the persons named in the accompanying form of proxy to vote the proxy on such matters in accordance with their discretion. By signing the proxy card, you are granting the persons named in the proxy a proxy entitling them to vote your shares with such discretion.

PROPOSAL ONE

TO ELECT TEN (10) DIRECTORS

General

Our Board of Directors has ten authorized directors and currently consists of ten members.

Our stockholders are being asked to consider ten nominees for election to our Board of Directors to serve for a one year term until the 2013 annual meeting of stockholders.

Information Regarding the Nominees

On February 7, 2012, the Nominating and Governance Committee, which is comprised of Messrs. Smith, Hampel and Blank, recommended, and the Board of Directors, on February 8, 2012, determined, that it is in the best interests of the Company to nominate the following ten (10) directors for election to the Board of Directors. The nominees include:

|

| |

| — | Kenneth G. Langone |

| — | Matthew C. Blank |

| — | Matthew Carey |

| — | Thomas Coughlin |

| — | Peter A. Georgescu |

| — | Sir Ronald Hampel |

| — | Frank. A Riddick, III |

| — | Derek Smith |

| — | Michael Solomon |

| — | David B. Wright |

All of the nominees for directors are current Geeknet Directors.

We are not aware of any reason that any nominee will be unable or will decline to serve as a Director. The term of office of each person elected as a director at the 2012 Annual Meeting will continue until our annual meeting of stockholders held in 2013 and until a successor has been elected and qualified or the earlier of their death, resignation or removal. There are no arrangements or understandings between any of our Directors or Executive Officers and any other person pursuant to which he or she is or was to be selected as one of our Directors or Officers. There are no family relationships among Directors or Executive Officers of the Company.

Unless otherwise instructed, the proxy holders will vote the proxies received by them for the ten (10) nominees named above, all of whom are currently one of our Ddirectors. Each nominee has consented to be named as a nominee in this proxy statement and to continue to serve as a Director if elected. If any nominee becomes unable or declines to serve as a Director or if additional persons are nominated at the 2012 Annual Meeting, the proxy holders intend to vote all proxies received by them in such a manner as will assure the election of as many of the nominees listed above as possible (or, if new nominees have been designated by the Board of Directors, in such a manner as to elect such nominees), and the specific nominees to be voted for will be determined by the proxy holders.

Vote Required; Recommendation of the Board of Directors

If a quorum is present and voting, the ten nominees for Director will be elected by a plurality of the votes cast. Votes withheld from a nominee and broker non-votes will be counted for purposes of determining the presence or absence of a quorum but will have no legal effect on the election of Directors once a quorum is present. See “Information Concerning Solicitation And Voting — Quorum; Abstentions; Broker Non-Votes.”

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

VOTING “FOR” THE NOMINEES TO SERVE AS DIRECTORS.

Information Regarding the Nominees of the Board of Directors

The following table sets forth for each of our current Directors, their ages and present positions with the Company as of the Record Date.

|

| | | | |

| Name | | Age | | Position |

| Kenneth G. Langone | | 76 | | Director, Executive Chairman and Chief Executive Officer |

Matthew C. Blank (1) (2) | | 62 | | Director |

Matthew Carey (3) (4) | | 47 | | Director |

Thomas Coughlin (4) | | 62 | | Director |

Peter A. Georgescu (2) (4) | | 73 | | Director |

Frank A. Riddick III (2) (3) | | 55 | | Director |

Derek Smith (1) (4) | | 57 | | Director |

| Michael Solomon | | 64 | | Director |

David B. Wright (2) (4) | | 62 | | Director |

Sir Ronald Hampel (1) (3) | | 80 | | Director |

|

| | |

| | (1) | Member of the Nominating and Governance Committee. |

|

| | |

| | (2) | Member of the Compensation Committee. |

|

| | |

| | (3) | Member of the Audit Committee. |

|

| | |

| | (4) | Member of the Technology Committee. |

Kenneth G. Langone has served on our Board of Directors since July 2010 and since August 2010, Mr. Langone has served as Chief Executive Officer of the Company. Mr. Langone is the founder and, since 1974, has been Chairman of the Board, Chief Executive Officer and President of Invemed Associates, LLC, a New York Stock Exchange firm engaged in investment banking and brokerage. He is a co-founder of The Home Depot, Inc. and was a Director and member of the Executive Committee of its Board for 30 years. He also serves on the boards of YUM Brands and Unifi, Inc.

Mr. Langone brings operating and management experience, including as Chief Executive Officer of a financial services business, expertise in finance, strategic planning and business development and public company directorship and committee experience to the Company as a result of his professional experiences. These experiences provide the Board of Directors with, among other things, financial and strategic planning expertise important to the oversight of the Company’s financial reporting and business strategy implementation.

Matthew C. Blank has served on our Board of Directors since January 2010. Mr. Blank is the Chairman and Chief Executive Officer at Showtime Networks, having started that role in 1995. Prior to joining Showtime Networks in 1998 as Executive Vice President, Marketing, Mr. Blank worked for Home Box Office Inc. for 12 years from 1976 to 1988 departing as Senior Vice President of Consumer Marketing.

Mr. Blank is independent and brings to the Board of Directors decades of service in the entertainment industry, with special knowledge and understanding of the media business.

Mathew Carey has served on our Board of Directors since August 2010. Mr. Carey is Executive Vice President and Chief Information Officer for The Home Depot. Before joining The Home Depot in 2008, Matt served as Senior Vice President and Chief Technology Officer at eBay. Prior to joining eBay in 2006, Matt spent more than 20 years with Wal-Mart, where he was Senior Vice President and Chief Technology Officer.

Mr. Carey is independent and brings to the Board of Directors decades of service with various global technology companies. His extensive service as an executive officer with technology companies provides him with the knowledge and leadership experience necessary to serve as Chairman of our Technology Committee.

Thomas Coughlin has served on our Board of Directors since August 2011 and served as a consultant to the Company for one year prior to his being appointed to our Board of Directors. Mr. Coughlin spent a majority of his career with Wal-Mart, starting in 1979 in Wal-Mart’s security division, rising to Executive Vice President and Vice Chairman as a member of the company’s Board

of Directors, stepping down in 2005. During his tenure at Wal-Mart, he held positions in loss prevention, human resources, and operations and is widely recognized as a pioneer in leading the adoption of advanced information technologies, including RFID, to transform business processes and operational efficiency in retail. See “Involvement in Certain Legal Proceedings” below for information about legal proceedings to which Mr. Coughlin has been a party.

Mr. Coughlin brings to the Board of Directors his years of expertise in the retail operations and management, which is of particular value to our e-Commerce business.

Peter A. Georgescu has served on our Board of Directors since August 2010. Mr. Georgescu is Chairman Emeritus of Young & Rubicam Inc., and served as that company’s Chairman and Chief Executive Officer from 1994 until his retirement in January 2000. Until May 2011, Mr. Georgescu served as a Director of International Flavors & Fragrances. He has served on the Board of Directors of seven public companies, most recently Toys “R” Us, Inc., EMI Group PLC and Levi Strauss & Co., and chaired committees in each critical area: audit, nominating and governance and compensation. Mr. Georgescu’s experience has led him to be a major contributor in the Company’s boardroom. Mr. Georgescu is independent and brings to the Board of Directors decades of service in the media industry.

Sir. Ronald Hampel has served on our Board of Directors since May 2011. Sir Hampel has been Chairman of ISG (International Stadia Group), which provides forecasting and other consulting services to stadia and arenas, since January 2010. He previously spent 44 years with Imperial Chemical Industries PLC, a British chemical company, where he joined the Board in 1985, became Chief Operating Officer in 1991, Chief Executive Officer in 1993 and was Chairman from 1995-1999. He was knighted in the 1995 New Year’s Honours. He was a Non-Executive Director of Powell Duffryn PLC from 1983-1988, of Commercial Union Plc from 1987-1995, of BAE SYSTEMS plc from 1989-2002, of Alcoa Inc from 1995-2005, of TI Automotive from 2007-2009, an Advisory Director of Teijin (Japan) from 2000-2005, Chairman of United Business Media from 1999-2002, and Chairman of Templeton Emerging Markets Investment Trust from 2003-2007.

Mr. Hampel is independent and brings to the Board of Directors decades of service in various industries, including sales, marketing and business forecasting, and corporate governance, which are of particular value to the Company. Sir Ronald chaired the UK Committee on Corporate Governance formed in 1995 at the request of the then Government, the Bank of England, the London Stock Exchange and the CBI (Confederation of British Industry). The Hampel Committee established certain principles of governance which are now attached to the listing rules of the London Stock Exchange. The principles emphasize the need for full accountability of boards and for full disclosure of governance issues; they confirm the role of outside directors and members of boards both in developing prosperous growth and in ensuring good governance.

Frank A. Riddick, III has served on our Board of Directors since August 2010. Since March 2010, Mr. Riddick has been the Chief Executive Officer of JMC Steel Group, a manufacturer of steel tubular, where he had been Chief Operating Officer since August 2009. Prior to that, he was a consultant for TowerBrook Capital Partners LP, a New York and London based private equity firm from May 2008 to August 2009. Mr. Riddick was President and Chief Executive Officer of Formica Corporation, a manufacturer of surfacing materials, from January 2002 to April 2008. He also served as President and Chief Operating officer of Armstrong World Industries, Inc. from February 2000 to November 2001 where he also was Chief Executive Officer of Triangle Pacific Corp., a wholly owned subsidiary of Armstrong. From March 1995 to February 2000, he was Chief Financial Officer of Armstrong. Mr. Riddick has previously served as controller of Chicago-based FMC Corporation. Mr. Riddick also serves on the Board of Directors of World Wrestling Entertainment, Inc. and is a former Director of GrafTech International Ltd, a manufacturer of graphite and carbon products, as well as related technical services.

Mr. Riddick is independent and brings to the Board of Directors decades of service with various companies. His extensive service as an executive financial officer with various companies provides him with the knowledge and leadership experience necessary to serve as Chairman of our Audit Committee.

Derek Smith has served on our Board of Directors since August 2010. Mr. Smith has been Chairman and Chief Executive Officer of the Institute of Global Prescience, an interdisciplinary non-profit research, education and service organization, from 2008 Prior to that, Mr. Smith was the Chairman and Chief Executive Officer of ChoicePoint Inc., a data services provider and aggregation company, from 1997 until 2008. Mr. Smith serves on the Board of Directors for the Georgia Aquarium. He also is a minority owner of the Atlanta Falcons.

Mr. Smith is independent and brings to the Board of Directors decades of service with various companies, particularly in the areas of technology and information processing, analysis, data protection all of which are important to our businesses. He has been involved with the creation of technology driven businesses including identity theft, and data management and protection.

Michael Solomon has served on our Board of Directors since July 2010. Mr. Solomon serves as Managing Principal of Gladwyne Partners, LLC, an investment management firm. Prior to founding Gladwyne Partners in July 1998, Mr. Solomon was a partner of

Lazard Frères & Co. LLC, a global investment bank, from 1983 to 1998. Mr. Solomon has previously served on a number of other public and private company boards.

Mr. Solomon brings to the Board of Directors decades of service as an investor in, and financial and strategic advisor, to numerous companies.

David B. Wright has served on our Board of Directors since December 2001. Since February 2010, Mr. Wright has served as President and Chief Executive Officer of GridIron Systems, a privately-held company that deploys appliance software technology to maximize application performance for enterprise customers. From June 2006 until December 2009, Mr. Wright has served as Chairman and Chief Executive Officer for Verari Systems, Inc., a developer of platform-independent blade servers and storage systems. From August 2004 through May 2006, Mr. Wright served as Executive Vice President, Office of the Chief Executive Officer, strategic alliances and global accounts, for EMC Corporation (“EMC”), a provider of products, services, and solutions for information storage and management. From October 2003 until August 2004, Mr. Wright served as an EMC Executive Vice President and President of EMC’s Legato Systems division, which develops, markets and supports enterprise class storage software products and services. From October 2000 until its acquisition by EMC in October 2003, Mr. Wright served as President and Chief Executive Officer of Legato Systems, Inc. Mr. Wright serves on the Board of Directors of Verisk Analytics, Inc.

Mr. Wright is independent and brings to the Board of Directors decades of service with various global technology companies. His extensive service as an executive officer with technology companies and service on the Boards of Directors of public companies as lead independent director, compensation committee chairman and an audit committee member provide him with the knowledge and leadership experience necessary to serve as Chairman of our Compensation Committee. Mr. Wright also provides critical insights with respect to acquisition transactions, having been involved in over twenty such transactions. His international experience also provides Mr. Wright with a valuable understanding of the challenges facing a global company.

No Director has any family relationship with any Director, Executive Officer or person nominated or chosen by the Company to become a Director or Executive Officer.

See “Corporate Governance” and “Executive Compensation — Compensation of Directors” below for additional information regarding the Board of Directors.

Involvement in Certain Legal Proceedings

In January 2006, Mr. Coughlin pleaded guilty to charges of wire fraud and filing a false federal tax return in connection with the submission of false expense reimbursements and improper ordering of Wal-Mart company gift cards during his prior service as an officer of Wal-Mart Stores, Inc. (where he also served as a Director). The independent members of our Board of Directors were aware of the foregoing facts and unanimously determined that Mr. Coughlin’s continued service on our Board of Directors is in the best interests of the Company and its stockholders.

PROPOSAL TWO

TO RATIFY THE APPOINTMENT OF KPMG, LLP

AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

FOR THE FISCAL YEAR ENDING DECEMBER 31, 2012

Our Audit Committee has selected KPMG, LLP (“KPMG”), an independent registered public accounting firm, to audit our financial statements for Fiscal Year 2012, and based on this selection, our Board of Directors has unanimously recommended that stockholders vote for ratification of such appointment. Although action by stockholders is not required by law, the Board of Directors has determined that it is desirable to request approval of this selection by our stockholders. In September 2010, the Company changed its independent registered public accounting firm from Stonefield Josephson to KMPG, LLP to audit our financial statements for Fiscal Year 2010. The decision not to retain Stonefield Josephson was made and approved by the Audit Committee of the Company’s Board of Directors. Notwithstanding the selection or a ratification, the Audit Committee, in its discretion, may direct the appointment of new independent registered public accountants, at any time during the fiscal year, if the Audit Committee determines that such a change would be in the Company’s best interests and the interests of its stockholders. In the event of a negative vote or ratification, the Audit Committee may reconsider its selection.

There was no adverse opinion, disclaimer of opinion, nor qualification or modification as to any uncertainty by KPMG, LLP.

The reports of Stonefield Josephson on the Company’s financial statements for the years ended December 31, 2008 and 2009 contained no adverse opinion or disclaimer of opinion, and such reports were not qualified or modified as to uncertainty, audit scope or accounting principles.

During the years ended December 31, 2008 and 2009 and through September 14, 2010, there were no disagreements with Stonefield Josephson on any matter of accounting principles or practices, financial statement disclosure or auditing scope of procedure, which disagreements, if not resolved to the satisfaction of Stonefield Josephson would have caused Stonefield Josephson to make reference thereto in connection with its reports on Geeknet’s financial statements for such years.

During the years ended December 31, 2008 and 2009 and through September 14, 2010, there were no reportable events as described in Item 304(a)(1)(v) of Regulation S-K.

The Company has provided Stonefield Josephson with a copy of the foregoing disclosures. The Company requested that Stonefield Josephson furnish it with a letter addressed to the Securities and Exchange Commission stating whether or not it agrees with the above statements. A copy of Stonefield Josephson’s letter, dated September 15, 2010, stating its agreement with the above statements, is filed as Exhibit 16.1 to the Company’s Current Report on Form 8-K filed on September 16, 2010.

Attendance at the Annual Meeting

The Board of Directors expects that representatives of KPMG, LLP will be available in person and/or telephonically at the Meeting, afforded the opportunity to make a statement if they desire to do so, and be available to respond to appropriate questions from stockholders.

Accounting Fees

The following table shows the fees paid or accrued by the Company for the audit and other services provided by Stonefield Josephson and KPMG, LLP for the Company’s fiscal year ended December 31, 2011, and the fiscal year ended December 31, 2010 (“Fiscal Year 2010”) (in thousands):

|

| | | | | | |

| | Year Ended December 31 | Year Ended December 31 |

| Stonefield Josephson Fees | 2011 | 2010 |

Audit Fees (1) | $ | 23 |

| $ | 290 |

|

Audit Related Fees (2) | $ | — |

| $ | 4 |

|

| Tax Fees | $ | — |

| $ | — |

|

| All Other Fees | $ | — |

| $ | — |

|

| Total Stonefield Josephson Fees | $ | 23 |

| $ | 294 |

|

|

| | | | | | |

| | Year Ended December 31 | Year Ended December 31 |

| KPMG LLP Fees | 2011 | 2010 |

Audit Fees (1) | $ | 417 |

|

| $ 350 |

|

Audit Related Fees (2) | $ | — |

| $ | — |

|

| Tax Fees | $ | — |

| $ | — |

|

| All Other Fees | $ | — |

| $ | — |

|

| Total KPMG LLP Fees | $ | — |

|

| $ 350 |

|

|

| | |

| | (1) | “Audit fees” includes fees for professional services principally related to the integrated audits of the Company’s annual and quarterly financial statements and internal control over financial reporting, consultation on matters that arise during a review or audit, reviews of SEC filings and statutory audit fees. |

|

| | |

| | (2) | “Audit Related fees” includes fees which are for assurance and related services other than those included in Audit fees.

|

Pre-approval Policies and Procedures

The Audit Committee has adopted a policy regarding non-audit services provided by KPMG, LLP, our independent registered public accounting firm. First, the policy ensures the independence of our auditors by expressly naming all services that the auditors may not perform and reinforcing the principle of independence regardless of the type of service. Second, certain non-audit services such as tax-related services are permitted but limited in proportion to the audit fees paid. Third, the Chairman of the Audit Committee pre-approves, with subsequent ratification by the Audit Committee, non-audit services not specifically permitted under this policy and the full Audit Committee reviews the annual plan and any subsequent engagements. Thus, all of the services described above under audit-related fees, were approved by the Audit Committee pursuant to its pre-approval policies and procedures.

Independence Assessment by Audit Committee

The Company’s Audit Committee considered the provision of the services provided by KPMG, LLP as set forth herein, and determined that such services are compatible with maintaining KPMG, LLP’s independence.

Vote Required; Recommendation of the Board of Directors

If a quorum is present and voting, the affirmative vote of holders of a majority of the shares of Common Stock present in person or represented by proxy and entitled to vote is needed to ratify the appointment of KPMG, LLP as the Company’s independent registered public accounting firm, to audit the consolidated financial statements of the Company for Fiscal Year 2012. Abstentions will have the effect of a vote “AGAINST” the ratification of KPMG as our independent registered public accounting firm. Broker non-votes will have no effect on the outcome of the vote.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS VOTING “FOR” THE RATIFICATION OF THE APPOINTMENT OF KPMG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM, TO AUDIT THE CONSOLIDATED FINANCIAL STATEMENTS OF THE COMPANY FOR FISCAL YEAR 2012.

PROPOSAL THREE

ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, or the Dodd-Frank Act, enables our stockholders to vote to approve, on an advisory or non-binding basis, the compensation of our Named Executive Officers as disclosed in accordance with the SEC’s rules in the “Executive Compensation” section of this proxy statement beginning on page 25 below. This proposal, commonly known as a “say-on-pay” proposal, gives our stockholders the opportunity to express their views on our Named Executive Officers’ compensation as a whole. This vote is not intended to address any specific item of compensation or any specific Named Executive Officer, but rather the overall compensation of all of our Named Executive Officers and the philosophy, policies and practices described in this proxy statement.

The say-on-pay vote is advisory, and therefore not binding on the Company, the Compensation Committee or our Board of Directors. The say-on-pay vote will, however, provide information to us regarding investor sentiment about our executive compensation philosophy, policies and practices, which the Compensation Committee will be able to consider when determining executive compensation for the remainder of the current fiscal year and beyond. Our Board of Directors and our Compensation Committee value the opinions of our stockholders and to the extent there is any significant vote against the named executive officer compensation as disclosed in this proxy statement, we will consider our stockholders’ concerns and the Compensation Committee will evaluate whether any actions are necessary to address those concerns.

We believe that the information we’ve provided above and within the Executive Compensation Section of this proxy statement demonstrates that our executive compensation program was designed and administered appropriately and is working to ensure management’s interests are aligned with our stockholders’ interests to support long-term economic as well as shareholder value creation.

Accordingly, we ask our stockholders to vote “FOR” the following resolution at the Annual Meeting:

“RESOLVED, that the Company’s stockholders approve, on an advisory basis, the compensation of the Named Executive Officers, as disclosed in the Company’s Proxy Statement for the Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the Summary Compensation Table and the other related tables and disclosure.”

Vote Required; Recommendation of the Board of Directors

If a quorum is present and voting, the affirmative vote of the holders of a majority of the shares of Common Stock present in person or represented by proxy and entitled to vote is required for advisory approval of this proposal. Abstentions are treated as shares represented in person or by proxy and entitled to vote at the Annual Meeting and, therefore, will have the same effect as a vote “Against” the proposal. Broker non-votes will have no effect on the outcome of the vote.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ADVISORY (NON-BINDING) VOTE APPROVING EXECUTIVE COMPENSATION. THE AFFIRMATIVE VOTE OF THE HOLDERS OF A MAJORITY OF THE SHARES PRESENT AND ENTITLED TO VOTE IS NECESSARY FOR APPROVAL.

PROPOSAL FOUR

AMENDMENT TO THE COMPANY’S 2007 EQUITY INCENTIVE PLAN

We are asking stockholders to approve an amendment to our 2007 Equity Incentive Plan (the “Plan”) to amend the language in Section 3(b) in the Plan regarding the calculation of restricted stock units and (“RSUs”) so that we can continue to use the Plan to achieve the Company’s performance, recruiting, retention and incentive goals. On November 10, 2011, the Company’s Board of Directors (the “Board”) approved a change in Section 3(b) of the Plan, subject to stockholder approval at the Annual Meeting.

Since 2007, the Plan has not been modified other than to reflect an adjustment to the shares reserved and outstanding award under the Plan due to our one-for-ten reverse stock split, which occurred in November, 2010.

The Company currently grants stock options and restricted stock unit awards to the Company’s personnel as an incentive to increase long-term stockholder value. The Plan includes a variety of forms of equity-related awards, including stock options, stock appreciation rights, restricted stock, restricted stock units, performance units, and performance shares to allow the Company to adapt its equity compensation program to meet the needs of the Company in the changing business environment in which the Company operates.

The Board and management believe that equity awards motivate high levels of performance, align the interests of personnel and stockholders by giving service providers the perspective of an owner with an equity stake in the Company, and provide an effective means of recognizing employee contributions to the success of the Company. The Board and management believe that equity awards are a competitive necessity, and are essential to recruiting and retaining the highly qualified technical and other key personnel who help the Company meet its goals, as well as rewarding and encouraging current service providers. The Board and management believe that the ability to grant equity awards will be important to the future success of the Company. The Board believes this program is an appropriate long-term incentive.

Approval of the Plan requires the affirmative vote of a majority of the Votes Cast. If the stockholders approve the Plan, it will replace the version of the Plan that was approved by stockholders at the 2011 Annual Meeting. If stockholders do not approve the Plan, the Plan will not change and the version of the Plan approved in 2011 will remain in effect. Abstentions and broker non-votes will have no effect on the outcome of the vote.

Summary of the Plan

The following paragraphs provide a summary of the principal features of the Plan and its operation. The Plan is set forth in its entirety as Appendix A to this proxy statement. The following summary is qualified in its entirety by reference to the Plan.

Background and Purpose of the Plan. The Plan permits the grant of the following types of incentive awards: (1) stock options, (2) stock appreciation rights, (3) restricted stock, (4) restricted stock units; (5) performance units, and (6) performance shares (individually, an “Award”). The Plan is intended to attract, motivate, and retain (1) employees of the Company and its subsidiaries (approximately 140 individuals), (2) consultants who provide significant services to the Company and its subsidiaries (approximately 5 individuals), and (3) Directors of the Company who are employees of neither the Company nor any subsidiary (10 individuals).

Administration of the Plan. The Plan provides that it shall be administered by the Board or a committee of Directors appointed by the Board (referred to herein as the “Administrator”). To make grants to certain of the Company’s officers and key employees, the members of any such committee must qualify as “non-employee directors” under Rule 16b-3 of the Securities Exchange Act of 1934 (the “Exchange Act”), and as “outside directors” under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”) (so that the Company can receive a federal tax deduction for certain compensation paid under the Plan).

Subject to the terms of the Plan, the Administrator has the sole discretion to select the employees, consultants, and directors who will receive Awards, determine the terms and conditions of Awards (for example, the exercise price and vesting schedule), and construe and interpret the terms of the Plan and Awards granted pursuant to the Plan. The Administrator may, upon first receiving stockholder approval, implement an exchange program under which (i) outstanding Awards may be surrendered or cancelled in exchange for Awards of the same type, awards of a different type, or cash, (ii) participants would have the opportunity to transfer any outstanding Awards to a financial institution or other person or entity selected by the Administrator, and/or (iii) the exercise price of an outstanding Award could be reduced. The Administrator may not, however, reprice awards or exchange awards for other awards, cash or a combination thereof, without the approval of the stockholders.

Number of Shares of Common Stock Available Under the Plan. The number of Shares initially reserved for issuance under the Plan equaled (1) 525,000 Shares (taking into account the one-for-ten reverse stock split which occurred in November 2010), plus (2) up to those shares that may become available for issuance due to the expiration, cancellation or forfeiture of Awards granted under the Company’s 1998 Directors Plan (the “1998 Plan”) and the 1999 Stock Option Plan (the “1999 Plan”). As of December 31, 2011, a total of 800,044 Shares were subject to outstanding Awards out of all of the Company Plans, including 3,500 restricted stock awards, 388,318 restricted stock units and 411,726 shares subject to option grants and, prior to giving effect to the increase for which we are seeking approval, 270,479 Shares remain available for issuance out of the 2007 Plan. As of December 31, 2011, the weighted average exercise price of all outstanding options was $20.47 and weighted average remaining term of all outstanding options was 7.88 years.

Shares subject to Awards granted with an exercise price less than the fair market value on the date of grant count against the share reserve as two shares for every one share subject to such an Award. To the extent that a share that was subject to an Award that counted as two shares against the Plan share reserve pursuant to the preceding sentence is returned to the Plan, the Plan reserve will be credited with two shares that will thereafter be available for issuance under the Plan.

If an Award expires or becomes unexercisable without having been exercised in full, or, with respect to restricted stock, restricted stock units, performance shares or performance units, is forfeited to or repurchased by the Company, the unpurchased shares (or for Awards other than options and stock appreciation rights, the forfeited or repurchased shares) which were subject thereto will become available for future grant or sale under the Plan. Upon exercise of stock appreciation rights settled in shares, the gross number of shares covered by the exercised portion of the stock appreciation rights will cease to be available under the Plan. Shares that have actually been issued under the Plan under any Award will not be returned to the Plan and will not become available for future distribution under the Plan; provided, however, that if shares of restricted stock, restricted stock units, performance shares or performance units are repurchased by the Company or are forfeited to the Company, such shares will become available for future grant under the Plan as described above. Shares used to pay the exercise price of an Award or used to satisfy tax withholding obligations will not become available for future grant or sale under the Plan. To the extent an Award is paid out in cash rather than stock, such cash payment will not reduce the number of shares available for issuance under the Plan.

If the Company declares a stock dividend or engages in a reorganization or other change in its capital structure, including a merger, the Administrator will adjust the (i) number and class of shares available for issuance under the Plan, (ii) number, class and price of shares subject to outstanding Awards, and (iii) specified per-person limits on Awards to reflect the change.

Options. The Administrator is able to grant nonstatutory stock options and incentive stock options under the Plan. The Administrator determines the number of shares subject to each option, although the Plan provides that a participant may not receive options for more than 200,000 shares in any fiscal year, except in connection with his or her initial employment with the Company, in which case he or she may be granted an option to purchase up to an additional one million shares.

The Administrator determines the exercise price of options granted under the Plan, provided the exercise price must be at least equal to the fair market value of the Company’s Common Stock on the date of grant. In addition, the exercise price of an incentive stock option granted to any participant who owns more than 10% of the total voting power of all classes of the Company’s outstanding stock must be at least 110% of the fair market value of the Common Stock on the grant date.

The term of each option will be stated in the Award agreement. The term of an option may not exceed ten years, except that, with respect to any participant who owns 10% of the voting power of all classes of the Company’s outstanding capital stock, the term of an incentive stock option may not exceed five years.

After a termination of service with the Company, a participant will be able to exercise the vested portion of his or her option for the period of time stated in the Award agreement. If no such period of time is stated in the participant’s Award agreement, the participant will generally be able to exercise his or her option for (i) three months following his or her termination for reasons other than death or disability, and (ii) twelve months following his or her termination due to death or disability. The participant’s Award agreement may also provide that if the exercise of an option following the termination of the participant’s status as a service provider (other than as a result of the participant’s death or disability) would result in liability under Section 16(b) of the Exchange Act, then the option will terminate on the earlier of (i) the expiration of the term of the option, or (ii) the 10th day after the last date on which such exercise would result in such liability under Section 16(b). The participant’s Award agreement may also provide that if the exercise of an option following the termination of the participant’s status as a service provider (other than as a result of the participant’s death or disability) would be prohibited because the issuance of shares would violate securities laws, then the option will terminate on the earlier of (i) the expiration of the term of the option, or (ii) the expiration of a period of three months after the termination of the participant during which the exercise of the option would not violate securities laws.

Restricted Stock. Awards of restricted stock are rights to acquire or purchase shares of Company Common Stock, which vest in accordance with the terms and conditions established by the Administrator in its sole discretion. For example, the Administrator may set restrictions based on the achievement of specific performance goals. The Administrator, in its discretion, may accelerate the time at which any restrictions will lapse or be removed, except that with respect to restricted stock granted to employees, and except as otherwise provided in the Plan, shares of restricted stock will not vest more rapidly than one-third of the total number of shares subject to the Award each year from the date of grant, unless the Administrator determines that the

Award is to vest upon the achievement of performance criteria and the period for measuring such performance will cover at least twelve months. The Administrator may provide at the time of or following the date of grant for accelerated vesting for an Award of restricted stock (except that the number of shares of restricted stock eligible for such accelerated vesting will not exceed 5% of the total number of shares reserved for issuance under the Plan) or for accelerated vesting upon or in connection with a change in control or upon or in connection with a participant’s termination of service due to death, disability or retirement. The Award agreement generally will grant the Company a right to repurchase or reacquire the shares upon the termination of the participant’s service with the Company for any reason (including death or disability). The Administrator will determine the number of shares granted pursuant to an Award of restricted stock, but for shares of restricted stock intended to qualify as “performance-based compensation” within the meaning of Section 162(m) of the Code, no participant will be granted a right to purchase or acquire more than 60,000 shares of restricted stock during any fiscal year, except that a participant may be granted up to an additional 30,000 shares of restricted stock in connection with his or her initial employment with the Company.

Restricted Stock Units. Awards of restricted stock units result in a payment to a participant only if the vesting criteria the Administrator establishes is satisfied. For example, the Administrator may set vesting criteria based on the achievement of specific performance goals. The restricted stock units will vest at a rate determined by the Administrator; except that with respect to restricted stock units granted to employees, and except as otherwise provided in the Plan, restricted stock units will not vest more rapidly than one-third of the total number of shares subject to the Award each year from the date of grant, unless the Administrator determines that the Award is to vest upon the achievement of performance criteria and the period for measuring such performance will cover at least twelve months. The Administrator may provide at the time of or following the date of grant for accelerated vesting for Awards of restricted stock units (except that the number of restricted stock units eligible for such accelerated vesting will not exceed 5% of the total number of shares reserved for issuance under the Plan) or for accelerated vesting upon or in connection with a change in control or upon or in connection with a participant’s termination of service due to death, disability or retirement. Upon satisfying the applicable vesting criteria, the participant will be entitled to the payout specified in the Award agreement. The Administrator, in its sole discretion, may pay earned restricted stock units in cash, shares, or a combination thereof. Restricted stock units that are fully paid in cash will not reduce the number of shares available for grant under the Plan. On the date set forth in the Award agreement, all unearned restricted stock units will be forfeited to the Company. The Administrator determines the number of restricted stock units granted to any participant, but for restricted stock units intended to qualify as “performance-based compensation” within the meaning of Section 162(m) of the Code, during any fiscal year of the Company, no participant may be granted more than 60,000 restricted stock units during any fiscal year, except that the participant may be granted up to an additional 30,000 restricted stock units in connection with his or her initial employment to the Company.

Stock Appreciation Rights. The Administrator will be able to grant stock appreciation rights, which are the rights to receive the appreciation in fair market value of Common Stock between the exercise date and the date of grant. The Company can pay the appreciation in either cash, shares of Common Stock, or a combination thereof. Stock appreciation rights will become exercisable at the times and on the terms established by the Administrator, subject to the terms of the Plan. The Administrator, subject to the terms of the Plan, will have complete discretion to determine the terms and conditions of stock appreciation rights granted under the Plan, provided, however, that the exercise price may not be less than 100% of the fair market value of a share on the date of grant and the term of a stock appreciation right may not exceed ten years. No participant will be granted stock appreciation rights covering more than 200,000 shares during any fiscal year, except that a participant may be granted stock appreciation rights covering up to an additional 100,000 in connection with his or her initial employment with the Company.

After termination of service with the Company, a participant will be able to exercise the vested portion of his or her stock appreciation right for the period of time stated in the Award agreement. If no such period of time is stated in a participant’s Award agreement, a participant will generally be able to exercise his or her vested stock appreciation rights for (i) three months following his or her termination for reasons other than cause, death, or disability, and (ii) twelve months following his or her termination due to death or disability. The participant’s Award agreement may also provide that if the exercise of a stock appreciation right following the termination of the participant’s status as a service provider (other than as a result of the participant’s death or disability) would result in liability under Section 16(b) of the Exchange Act, then the stock appreciation right will terminate on the earlier of (i) the expiration of the term of the option, or (ii) the 10th day after the last date on which such exercise would result in such liability under Section 16(b). The participant’s Award agreement may also provide that if the exercise of a stock appreciation right following the termination of the participant’s status as a service provider (other than as a result of the participant’s death or disability) would be prohibited because the issuance of shares would violate securities laws, then the stock appreciation right will terminate on the earlier of (i) the expiration of the term of the stock appreciation right, or (ii) the expiration of a period of three months after the termination of the participant during which the exercise of the option would not violate securities laws. In no event will a stock appreciation right be exercised later than the expiration of its term.

Performance Units and Performance Shares. The Administrator will be able to grant performance units and performance shares, which are Awards that will result in a payment to a participant only if the performance goals or other vesting criteria the Administrator may establish are achieved or the Awards otherwise vest. Earned performance units and performance shares will be paid, in the sole discretion of the Administrator, in the form of cash, shares, or in a combination thereof. The Administrator will establish performance or other vesting criteria in its discretion, which, depending on the extent to which they are met, will determine the number and/or the value of performance units and performance shares to be paid out to participants. The performance units and performance shares will vest at a rate determined by the Administrator, except that with respect to performance units or performance shares granted to employees, and except as otherwise provided in the Plan, performance units/shares will not vest more rapidly than one-third of the total number of performance units/shares subject to the Award each year from the date of grant, unless the Administrator determines that the Award is to vest upon the achievement of performance

criteria and the period for measuring such performance will cover at least twelve months. The Administrator, in its discretion, may provide at the time of or following the date of grant for accelerated vesting for an Award of performance units/shares (except that the number of performance units/shares eligible for such accelerated vesting will not exceed 5% of the total number of shares reserved for issuance under the Plan) or for accelerated vesting upon or in connection with a change in control or upon or in connection with a participant’s termination of service due to death, disability or retirement. During any fiscal year, for performance units or performance shares intended to qualify as “performance-based compensation” within the meaning of Section 162(m) of the Code, no participant will receive more than 60,000 performance shares and no participant will receive performance units having an initial value greater than 100,000 dollars, except that a participant may be granted performance shares covering up to an additional 30,000 shares in connection with his or her initial employment with the Company. Performance units will have an initial value established by the Administrator on or before the date of grant. Performance shares will have an initial value equal to the fair market value of a share of the Company’s Common Stock on the grant date.

Performance Goals. Awards of restricted stock, restricted stock units, performance shares, performance units and other incentives under the Plan may be made subject to the attainment of performance goals relating to one or more business criteria within the meaning of Section 162(m) of the Code and may provide for a targeted level or levels of achievement including: assets; bond rating; cash flow; cash position; earnings before interest and taxes; earnings before interest, taxes, depreciation and amortization; earnings per share; economic profit; economic value added; equity or stockholder’s equity; market share; net income; net profit; net sales; operating cash flow; operating earnings; operating income; profit before tax; ratio of debt to debt plus equity; ratio of operating earnings to capital spending; return on equity; return on net assets; return on sales; revenue; sales growth; or total return to stockholders. The performance goals may differ from participant to participant and from Award to Award and may be used to measure the performance of the Company as a whole or a business unit of the Company and may be measured relative to a peer group or index.

Transferability of Awards. Awards granted under the Plan are generally not transferable, and all rights with respect to an Award granted to a participant generally will be available during a participant’s lifetime only to the participant.

Change in Control. In the event of a change in control of the Company, each outstanding Award will be treated as the Administrator determines, including, without limitation, that each Award will be assumed or an equivalent option or right substituted by the successor corporation or the parent or subsidiary of the successor corporation. The Administrator will not be required to treat all Awards similarly in the transaction. In the event that the successor corporation, or the parent or subsidiary of the successor corporation, refuses to assume or substitute for the Award, the participant will fully vest in and have the right to exercise all of his or her outstanding options or stock appreciation rights, including shares as to which such Awards would not otherwise be vested or exercisable, all restrictions on restricted stock will lapse, and, with respect to restricted stock units, performance shares and performance units, all performance goals or other vesting criteria will be deemed achieved at target levels and all other terms and conditions met. In addition, if an option or stock appreciation right becomes fully vested and exercisable in lieu of assumption or substitution in the event of a change in control, the Administrator will notify the participant in writing or electronically that the option or stock appreciation right will be fully vested and exercisable for a period of time determined by the Administrator in its sole discretion, and the option or stock appreciation right will terminate upon the expiration of such period.

Amendment and Termination of the Plan. The Administrator will have the authority to amend, alter, suspend or terminate the Plan, except that stockholder approval will be required for any amendment to the Plan to the extent required by any applicable laws. No amendment, alteration, suspension or termination of the Plan will impair the rights of any participant, unless mutually agreed otherwise between the participant and the Administrator and which agreement must be in writing and signed by the participant and the Company. The Plan will terminate in December 2017 unless the Board terminates it earlier.

Plan Benefits Table

The number of Awards that an employee, Director or consultant may receive under the Plan is in the discretion of the Administrator and therefore cannot be determined in advance. The following table sets forth (a) the aggregate number of shares of Common Stock subject to options granted under the Plan during the last fiscal year, (b) the average per share exercise price of such options, (c) the aggregate number of shares issued pursuant to awards of restricted stock units under the Plan during the last fiscal year, and (d) the dollar value of such shares based on $17.05 per share, the closing price per share of our Common Stock on the NASDAQ Global Market as of December 31, 2011.

|

| | | | |

| Name and Position | Number of Options Granted | Average Per Share Exercise Price | Shares of Restricted Stock Units Awarded | Dollar Value of Restricted Stock Units Awarded |

Kenneth G. Langone (1) Chief Executive Officer, President and Chairman of the Board of Directors | - | - | 2,229 | $38,004 |

Kathryn McCarthy Chief Financial Officer and Executive Vice President

| - | - | 78,125 | $1,332,031 |

Carol DiBattiste General Counsel, Chief Administrative Officer, and Executive Vice President

| - | - | 78,125 | $1,332,031 |

Jeff Drobick President and Chief Executive Officer, Geeknet, Media | - | - | 78,125 | $1,332,031 |

Colon Washburn President and Chief Executive Officer, ThinkGeek, Inc. | - | - | 78,125 | $1,332,031 |

| All executive officers, as a group | - | - | 314,729 | $5,366,128 |

| All directors who are not executive officers, as a group | - | - | 20,374 | $347,377 |

| All employees who are not executive officers, as a group | 174,017 | $24.34 | 80,288 | $1,368,910 |

| | | | | |

| (1) Mr. Langone received the award pursuant to his role as a Director of the Company |

In addition to the information set forth in the table above, our Board of Directors approved in November 2011, subject to the approval of the individual grants by the Compensation Committee, the granting of 20,000 restricted stock units, in the aggregate, to our Named Executive Officers. These restricted stock units have not yet been granted and it is not known how many will be granted to each of our Named Executive Officers.

Federal Tax Aspects

The following paragraphs are a summary of the general federal income tax consequences to U.S. taxpayers and the Company of Awards granted under the Plan. Tax consequences for any particular individual may be different.

Nonstatutory Stock Options. No taxable income is reportable when a nonstatutory stock option with an exercise price equal to the fair market value of the underlying stock on the date of grant is granted to a participant. Upon exercise, the participant will recognize ordinary income in an amount equal to the excess of the fair market value (on the exercise date) of the shares purchased over the exercise price of the option. Any taxable income recognized in connection with an option exercise by an employee of the Company is subject to tax withholding by the Company. Any additional gain or loss recognized upon any later disposition of the shares would be capital gain or loss.

As a result of Section 409A of the Code and the Treasury regulations promulgated thereunder (“Section 409A”), however, nonstatutory stock options and stock appreciation rights granted with an exercise price below the fair market value of the underlying stock or with a deferral feature may be taxable to the recipient in the year of vesting in an amount equal to the difference between the then fair market value of the underlying stock and the exercise price of such awards and may be subject to an additional 20% tax plus penalties and interest. In addition, certain states, such as California, have adopted similar tax provisions. We strongly encourage recipients of such Awards to consult their tax, financial, or other advisor regarding the tax treatment of such Awards.

Incentive Stock Options. No taxable income is reportable when an incentive stock option is granted or exercised (except for purposes of the alternative minimum tax (“AMT”)), in which case taxation is the same as for nonstatutory stock options). If the participant exercises the option and then later sells or otherwise disposes of the shares more than two years after the grant date and more than one year after the exercise date, the difference between the sale price and the exercise price will be taxed as capital gain or loss. If the participant exercises the option and then later sells or otherwise disposes of the shares before the end of the two- or one-year holding periods described above, he or she generally will have ordinary income at the time of the sale equal to the fair market value of the shares on the exercise date (or the sale price, if less) minus the exercise price of the option.

The difference between the exercise price and fair market value of the incentive stock option shares on the date of exercise is an adjustment to income for purposes of the AMT. Alternative minimum taxable income is determined by adjusting regular taxable income for certain items, increasing that income by certain tax preference items and reducing this amount by the applicable exemption amount. If a disqualifying disposition of the incentive stock option shares occurs in the same calendar year as exercise of the incentive stock option, there is no AMT adjustment with respect to those incentive stock option shares. Also, upon a sale of incentive stock option shares that is not a disqualifying disposition, alternative minimum taxable income is reduced in the year of sale by the excess of the fair market value of the incentive stock option shares at exercise over the amount paid for the incentive stock option shares.

Stock Appreciation Rights. No taxable income is reportable when a stock appreciation right with an exercise price equal to

the fair market value of the underlying stock on the date of grant is granted to a participant. Upon exercise, the participant will recognize ordinary income in an amount equal to the amount of cash received and the fair market value of any shares received. Any additional gain or loss recognized upon any later disposition of the shares would be capital gain or loss.

Restricted Stock, Restricted Stock Units, Performance Units and Performance Shares. A participant generally will not have taxable income at the time an Award of restricted stock, restricted stock units, performance shares or performance units are granted. Instead, he or she will recognize ordinary income in the first taxable year in which his or her interest in the shares underlying the Award becomes either (i) freely transferable, or (ii) no longer subject to substantial risk of forfeiture. However, the recipient of a restricted stock Award may elect to recognize income at the time he or she receives the Award in an amount equal to the fair market value of the shares underlying the Award (less any cash paid for the shares) on the date the Award is granted.

Tax Effect for the Company. The Company generally will be entitled to a tax deduction in connection with an Award under the Plan in an amount equal to the ordinary income realized by a participant and at the time the participant recognizes such income (for example, the exercise of a nonstatutory stock option). Special rules limit the deductibility of compensation paid to the Company’s Chief Executive Officer and to each of its four most highly compensated executive officers. Under Section 162(m) of the Code, the annual compensation paid to any of these specified executives will be deductible only to the extent that it does not exceed $1,000,000. However, the Company can preserve the deductibility of certain compensation in excess of $1,000,000 if the conditions of Section 162(m) are met. These conditions include stockholder approval of the Plan, setting limits on the number of Awards that any individual may receive and for Awards other than certain stock options, establishing performance criteria that must be met before the Award actually will vest or be paid. The Plan has been designed to permit the Administrator to grant Awards that qualify as performance-based for purposes of satisfying the conditions of Section 162(m), thereby permitting the Company to continue to receive a federal income tax deduction in connection.

THE FOREGOING IS ONLY A SUMMARY OF THE EFFECT OF FEDERAL INCOME TAXATION UPON PARTICIPANTS AND THE COMPANY WITH RESPECT TO THE GRANT AND EXERCISE OF AWARDS UNDER THE PLAN. IT DOES NOT PURPORT TO BE COMPLETE, AND DOES NOT DISCUSS THE TAX CONSEQUENCES OF A PARTICIPANT’S DEATH OR THE PROVISIONS OF THE INCOME TAX LAWS OF ANY MUNICIPALITY, STATE OR FOREIGN COUNTRY IN WHICH THE PARTICIPANT MAY RESIDE.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE PROPOSAL TO APPROVE THIS PROPOSAL NUMBER FOUR AND CHANGE SECTION 3(B) IN THE PLAN

PROPOSAL FIVE

CREATION OF AN EMPLOYEE STOCK PURCHASE PLAN

Subject to the approval of the shareholders at the Annual Meeting, the Board, on the recommendation of the Compensation Committee, has unanimously adopted the Geeknet, Inc. 2012 Employee Stock Purchase Plan (the "2012 ESPP'').

Summary of the Geeknet, Inc. 2012 Employee Stock Purchase Plan