As noted above, our E-commerce business is highly seasonal, reflecting the general pattern associated with the retail industry of peak sales and earnings during the holiday shopping season. We have also noticed lower traffic and reduced advertising spending on our Online Media web sites during the summer months.

We believe our success will depend in part on our continued ability to attract and retain highly-qualified personnel in a competitive market for experienced and talented software engineers and sales and marketing personnel. Our employees are not represented by any collective bargaining organization; we have never experienced a work stoppage; and we believe that our relations with our employees are good. As of July 31, 2007, our employee base totaled 101, including 33 in operations, 20 in sales and marketing, 28 in research and development and 20 in finance and administration.

CURRENT AND PROSPECTIVE INVESTORS IN SOURCEFORGE SECURITIES SHOULD CAREFULLY CONSIDER THE RISKS DESCRIBED BELOW BEFORE MAKING AN INVESTMENT DECISION. IN ADDITION, THESE RISKS ARE NOT THE ONLY ONES FACING OUR COMPANY. ADDITIONAL RISKS OF WHICH WE ARE NOT PRESENTLY AWARE OR THAT WE CURRENTLY BELIEVE ARE IMMATERIAL MAY ALSO IMPAIR OUR BUSINESS OPERATIONS. OUR BUSINESS COULD BE HARMED BY ANY OF THESE RISKS. THE TRADING PRICE OF OUR COMMON STOCK COULD DECLINE DUE TO ANY OF THESE RISKS, AND INVESTORS MAY LOSE ALL OR PART OF THEIR INVESTMENT.

Our reliance upon user-generated content requires that we develop and maintain tools and services designed to facilitate:

We cannot assure that any new tools or services that we offer to facilitate creation of user-generated content will be developed and/or improved in a timely or cost-effective manner. If we are unable to develop and/or improve tools and services facilitating creation of user-generated content, or if our infrastructure is not sufficiently robust to ensure that such tools and services are highly available, we will be unable to attract, retain and expand a loyal user base that is desirable to advertisers, resulting in an inability to generate sufficient revenue to grow our online business.

The successful development and production of marketing programs is subject to numerous uncertainties, including our ability to:

We cannot assure that our online marketing programs will enable us to attract and retain advertisers and generate revenue consistent with our estimates or sufficient to sustain operations. In addition, we cannot assure that any new marketing programs will be developed in a timely or cost-effective manner. If we are unable to deliver innovative marketing programs that allow us to expand our advertiser base, we will be unable to generate sufficient revenue to grow our online business.

Decreases or delays in advertising spending due to general economic conditions could harm our ability to generate advertising revenue, which would adversely affect our financial results.

Our advertiser’s spending patterns tend to be cyclical, reflecting both overall economic conditions and seasonality as well as their company-specific budgeting and buying patterns. Because we derive a large part of our Online Media revenue from these advertisers, decreases in or delays of advertising spending could reduce our revenue or negatively impact our ability to grow our revenue.

The market in which SourceForge.net participates is becoming more competitive, and if we do not compete effectively, our Online Media business could be harmed.

SouceForge.net hosts more than 158,000 open source software projects, and we derive revenue from SourceForge.net primarily through advertisements and sponsorship campaigns run on the site. Google, Inc. (“Google”) offers open source code hosting capabilities that may be viewed as competitive to SourceForge.net’s offering. Because Google enjoys substantial competitive advantages in the online space generally, including powerful brand identity, established marketing relationships, larger visitor base, and greater financial, technical, and other resources, we may be unable to compete effectively with Google’s offering. Further, other companies and organizations offer open source code hosting, open source code search, and open source software development-related services. Our competitors may be able to respond more quickly and effectively than we can to new or changing open source software opportunities, technologies, standards, or user requirements. Because of competitors’ advantages, even if our services are more effective than those of our competitors, users might accept the services of our competitors in lieu of ours. If we fail to compete effectively, our Online Media business could be negatively impacted.

We are devoting significant research and development resources and spending on development of the SourceForge.net Marketplace, so if it does not achieve market acceptance our business and operating results will be materially and adversely affected.

In fiscal year 2007, we spent $5.4 million on research and development within our Online Media business, including $1.8 million on internally developed software related to our SourceForge.net Marketplace offering. We expect to allocate a substantial portion of our research and development resources to the SourceForge.net Marketplace for the foreseeable future, a portion of which may be capitalized as internally developed software. There can be no assurance, however, that we will be sufficiently successful in marketing, upgrading and supporting the SourceForge.net Marketplace to offset our substantial research and development expenditures. On May 15, 2007, we began offering a beta version of the SourceForge.net Marketplace. Failure to grow revenue derived from the SourceForge.net Marketplace sufficiently to offset the significant research and development costs will materially and adversely affect our business and operating results.

Unplanned system interruptions and capacity constraints and failure to effect efficient transmission of user communications and data over the Internet could harm our business and reputation.

The success of our Online Media business largely depends on the efficient and uninterrupted operation of the computer and communications hardware and network systems that power our web sites. We do not currently have a formal disaster recovery plan and our computer and communications systems are located in a single data center in Santa Clara County, California. Although we intend to build a new data center during fiscal year 2008, given the current location of our single data center and our lack of a formal disaster recovery plan, our systems and operations remain vulnerable to damage or interruption from earthquake, fire, power loss, telecommunications failure and similar events.

During fiscal year 2007, we experienced service interruptions with our online sites, including service outages associated with our SourceForge.net and Slashdot.org sites. Service interruptions during fiscal year 2007 were caused by a variety of factors, including capacity constraints, single points of hardware failure, software design flaws and bugs, and third party denial of service attacks. Although we continue to work to improve the performance and uptime of our web sites, and have taken steps to mitigate these risks, we expect that service interruptions will continue to occur from time to time. If our web sites experience frequent or lengthy service interruptions, our business and reputation will be seriously harmed.

9

Risks Related to Our E-Commerce Business

We are exposed to significant inventory risks as a result of seasonality, new product launches, rapid changes in product cycles and changes in consumer tastes with respect to our products offered at our ThinkGeek E-commerce web site. Failure to properly assess our inventory needs will adversely affect our financial results.

In order to be successful, we must accurately predict our customers’ tastes and avoid over-stocking or under-stocking products. Demand for products can change significantly between the time inventory is ordered and the date of sale. In addition, when we begin selling a new product, it is particularly difficult to forecast product demand accurately. The acquisition of certain types of inventory, or inventory from certain sources, may require significant lead-time and prepayment, and such inventory may not be returnable. We carry a broad selection and significant inventory levels of certain products and we may be unable to sell products in sufficient quantities or during the relevant selling seasons.

We cannot predict our E-commerce customers’ preferences with certainty and such preferences may change rapidly. If we fail to accurately assess and predict our E-commerce customers’ preferences, it will adversely impact our financial results.

Our E-commerce offerings on our ThinkGeek.com web site are designed to appeal to IT professionals, software developers and others in technical fields. Misjudging either the market for our products or our customers’ purchasing habits will cause our sales to decline, our inventories to increase and/or require us to sell our products at lower prices, all of which would have a negative effect on our gross margins and our results of operations.

We are subject to risks as a result of our reliance on foreign sources of production for certain products.

In order to offer cost effective and innovative products, we are increasingly relying on manufacturers, located outside of the United States, most of which are located in Asia (primarily China), to supply us with these products in sufficient quantities to our forecasted customer demand and deliver these products in a timely manner.

Our arrangements with these manufacturers are usually not formalized and are generally limited to purchase orders tied to specific lots of goods. We are subject to the risks of relying on products manufactured outside the United States, including political unrest, trade restrictions, customs and tariffs, local business practice and political issues. Additionally, significant reliance on foreign sources of productions increases the risk of issues relating to compliance with domestic or international labor standards, compliance with domestic or international manufacturing and product safety standards, currency fluctuations, restrictions on the transfer of funds, work stoppages or slowdowns and other labor issues, economic uncertainties including inflation and government regulations, availability and costs of raw materials, potentially adverse tax consequences and other uncertainties. China, in particular, has in recent years experienced rapid social, political and economic change, and further changes may adversely affect our ability to procure our products from Chinese suppliers.

Our ability to obtain goods on a cost effective basis is also subject to our ability to maintain relationships with our suppliers, and our ability to negotiate and maintain supply arrangements on favorable terms. There is increasing political pressure on China to permit the exchange rate of its currency, the Chinese Yuan (“CNY”), to float against the U.S. Dollar (“USD”). Although substantially all of our purchase orders are denominated in USD, our suppliers could attempt to renegotiate these contracts and increase costs to us if the CNY/USD exchange rate were to change in a manner adverse to the USD. In addition, because our purchases are usually on a case by case basis, we are subject to the risk of unexpected changes in pricing or supply from these suppliers. We may also be unable to develop beneficial relationships with new vendors in the future.

We may be subject to product liability claims if people or property are harmed by the products we sell on our E-commerce web sites, which could be costly to defend and subject us to significant damage claims.

Some of the products we offer for sale on our E-commerce web sites, such as consumer electronics, toys, computers and peripherals, toiletries, beverages and clothing, may expose us to product liability claims relating to personal injury, death or property damage caused by such products, and may require us to take actions such as product recalls. Although we maintain liability insurance, we cannot be certain that our coverage will be adequate

10

for liabilities actually incurred or that insurance will continue to be available to us on economically reasonable terms, or at all. In addition, some of our vendor agreements with our suppliers do not indemnify us from product liability, and even if such agreement provides for indemnification, it may be prohibitively costly to avail ourselves of the benefits of the protection.

If we do not maintain sufficient E-commerce inventory levels, or if we are unable to deliver our E-commerce products to our customers in sufficient quantities, our E-commerce business operating results will be adversely affected.

We must be able to deliver our merchandise in sufficient quantities to meet the demands of our customers and deliver this merchandise to customers in a timely manner. We must be able to maintain sufficient inventory levels, particularly during the peak holiday selling seasons. If we fail to achieve these goals, we may be unable to meet customer demand, and our financial results will be adversely affected.

Our ThinkGeek E-commerce web site is dependent upon a single third party fulfillment and warehouse provider. The satisfaction of our E-commerce customers is highly dependent upon fulfillment of orders in a professional and timely manner, so any decrease in the quality of service offered by our fulfillment and warehouse provider will adversely affect our reputation and the growth of our E-commerce business.

Our ThinkGeek E-commerce web site’s ability to receive inbound inventory and ship completed orders efficiently to our customers is substantially dependent on a third-party contract fulfillment and warehouse provider. We currently utilize the services of Dotcom Distribution, Inc. (“Dotcom Distribution”), located in Edison, New Jersey. If Dotcom Distribution fails to meet our future distribution and fulfillment needs, our relationship with and reputation among our E-commerce customers will suffer and this will adversely affect our E-commerce growth. Additionally, if Dotcom Distribution cannot meet our distribution and fulfillment needs, particularly during the peak holiday selling seasons, or our contract with Dotcom Distribution terminates, we may fail to secure a suitable replacement or second-source distribution and fulfillment provider on comparable terms, which would adversely affect our E-commerce financial results.

Risks Related to Our Financial Results

Certain factors specific to our businesses over which we have limited or no control may nonetheless adversely impact our total revenue and financial results.

The primary factors over which we have limited or no control that may adversely impact our total revenue and financial results include the following:

- specific economic conditions relating to online advertising spending;

- the discretionary nature of our online media customers’ purchase and budget cycles;

- the size and timing of online media customer orders;

- long online media sales cycles;

- our ability to retain skilled engineering and sales personnel;

- economic conditions relating to online advertising and sponsorship, and E-commerce;

- our ability to demonstrate and maintain attractive online user demographics;

- the addition or loss of specific online advertisers or sponsors, and the size and timing of advertising or sponsorship purchases by individual customers; and

- our ability to keep our web sites operational at a reasonable cost.

If our revenue and operating results fall below our expectations, the expectations of securities analysts or the expectations of investors, the trading price of our common stock will likely be materially and adversely affected. You should not rely on the results of our business in any past periods as an indication of our future financial performance.

11

Disruptions and liquidity issues in the credit market may unfavorably impact our financial condition and results of operations

We invest excess funds in specific instruments and issuers approved for inclusion in our cash and short-term investments accounts pursuant to a written investment policy established by our Board of Directors and overseen by the Audit Committee of our Board of Directors. Our investment criteria are to invest only in top tier quality investments or federally sponsored investments. Top tier quality investments are determined by our investment advisors in conjunction with ratings of those investments provided by outside ratings agencies as well as our investment advisors’ internal credit specialists. Our cash consists of overnight instruments and instruments that will mature within ninety days after then end of our fiscal reporting period. Our investment portfolio consists of instruments that mature between ninety-one days and two years after the end of our fiscal reporting period.

Based up on recent events in the credit market, we may be impacted by the following risks:

- we may experience temporary or permanent declines in the value of certain instruments which would be reflected in our financial statements;

- we may experience rating agency downgrades of instruments we currently own which may degrade our portfolio quality and cause us to take impairment charges;

- we may not be able to reasonably value our investments if there is not a liquid resale market for those instruments.

Future changes in financial accounting standards, including pronouncements and interpretations of accounting pronouncements on revenue recognition, share-based payments, fair value measurements and financial instruments, may cause adverse unexpected revenue fluctuations and affect our reported results of operations.

From time to time, the American Institute of Certified Public Accountants (“AICPA”) and the SEC may issue accounting pronouncements, guidelines and interpretations regarding accounting pronouncements. A change in an accounting policy can have a significant effect on our reported results and may even affect our reporting of transactions completed before a change is announced. Accounting policies affecting our business, including rules relating to revenue recognition, share-based payments and financial instruments have recently been revised or are under review. In particular, new accounting pronouncements and varying interpretations of existing pronouncements on revenue recognition, share-based payments and financial instruments have occurred with frequency, may occur in the future and could impact our revenue and results of operations. There have also been recent accounting pronouncements on the reporting of changes in accounting policies and the consideration of the effects on prior year misstatements. Required changes in our application of accounting pronouncements could cause changes in our reported results of operations and our financial condition.

If we fail to adequately monitor and minimize our use of existing cash, we may need additional capital to fund continued operations beyond the next 12 months.

Although we generated cash from continuing operations during fiscal 2007 and fiscal 2006, which ended July 31, 2007 and July 31, 2006, respectively, we have historically experienced annual cash shortfalls. Unless we monitor and minimize the level of use of our existing cash, cash equivalents and marketable securities, we may require additional capital to fund continued operations beyond the next 12 months. While we believe we will not require additional capital to fund continued operations for the next 12 months, we may require additional funding within this time frame, and this additional funding, if needed, may not be available on terms acceptable to us, or at all. A slowdown in online advertising spending, as well as other factors that may arise, could affect our future capital requirements and the adequacy of our available funds. As a result, we may be required to raise additional funds through private or public financing facilities, strategic relationships or other arrangements. Any additional equity financing would likely be dilutive to our stockholders. Debt financing, if available, may involve restrictive covenants on our operations and financial condition. Our inability to raise capital when needed could seriously harm our business.

12

We have a history of losses and may incur net losses in the foreseeable future. Failure to remain profitable may materially and adversely affect the market price of our common stock and our ability to raise capital and continue operations.

Although we generated income from continuing operations during fiscal year 2007, which ended on July 31, 2007, and fiscal year 2006, which ended on July 31, 2006, we do not have a long history of profitability and have an accumulated deficit of $732.4 million as of July 31, 2007. We may incur net losses in the future. Failure to remain profitable may materially and adversely affect the market price of our common stock and our ability to raise capital and continue operations beyond the next 12 months.

Risks Related to Competition

Online competition is intense. Our failure to compete successfully could adversely affect our revenue and financial results.

The market for Internet content and services is intensely competitive and rapidly evolving. It is not difficult to enter this market and current and new competitors can launch new Internet sites at relatively low cost. We derive revenue from online advertising and sponsorships, for which we compete with various media including newspapers, radio, magazines and various Internet sites. We also derive revenue from E-commerce, for which we compete with other E-commerce companies as well as traditional, “brick and mortar” retailers. We may fail to compete successfully with current or future competitors. Moreover, increased competition could result in price reductions, reduced margins or loss of market share, any of which could have a material adverse effect on our future revenue and financial results. If we do not compete successfully for new users and advertisers, our financial results may be materially and adversely affected.

Risks Related to Intellectual Property

We are vulnerable to claims that our web sites infringe third-party intellectual property rights. Any resulting claims against us could be costly to defend or subject us to significant damages.

We expect that our web sites will increasingly be subject to infringement claims as the number of competitors in our industry segment grows and the functionality of web sites in different Internet industry segments overlaps. The scope of United States patent protection for software is not well defined and will evolve as the United States Patent and Trademark Office grants additional patents. Because patent applications in the United States are not publicly disclosed until the patent is issued, applications may have been filed that would relate to our products. In addition, we may receive patent infringement claims as companies increasingly seek to patent their software. Our developers may fail to perform patent searches and may therefore unwittingly infringe on third-party patent rights. We cannot prevent current or future patent holders or other owners of intellectual property from suing us and others seeking monetary damages or an injunction against our web site offerings. A patent holder may deny us a license or force us to pay royalties. In either event, our operating results could be seriously harmed. In addition, employees hired from competitors might utilize proprietary and trade secret information from their former employers without our knowledge, even though our employment agreements and policies clearly prohibit such practices.

Any litigation regarding our intellectual property, with or without merit, could be costly and time consuming to defend, divert the attention of our management and key personnel from our business operations and cause interruption in our web site offerings. Claims of intellectual property infringement may require us to enter into royalty and licensing agreements that may not be available on terms acceptable to us, or at all. In addition, parties making claims against us may be able to obtain injunctive or other equitable relief that could effectively block our ability to offer one or more of our web sites, or services thereon in the United States and abroad and could result in an award of substantial damages against us. Defense of any lawsuit or failure to obtain any required license could delay shipment of our products and increase our costs. If a successful claim is made against us and we fail to develop or license a substitute technology, our business, results of operations, financial condition or cash flows could be immediately and materially adversely affected.

13

If we fail to adequately protect our intellectual property rights, competitors may use our technology and trademarks, which could weaken our competitive position, reduce our revenue, and increase our costs.

We rely on a combination of copyright, trademark and trade-secret laws, employee and third-party nondisclosure agreements, and other arrangements to protect our proprietary rights. Despite these precautions, it may be possible for unauthorized third parties to copy our web sites, or services thereon or obtain and use information that we regard as proprietary to create sites that compete against ours. Some license provisions protecting against unauthorized use, copying, transfer, and disclosure of our licensed programs may be unenforceable under the laws of certain jurisdictions and foreign countries.

In addition, the laws of some countries do not protect proprietary rights to the same extent as do the laws of the United States. To the extent that we increase our international activities, our exposure to unauthorized copying and use of our web sites and proprietary information will increase.

Our collection of trademarks is important to our business. The protective steps we take or have taken may be inadequate to deter misappropriation of our trademark rights. We have filed applications for registration of and registered some of our trademarks in the United States and internationally. Effective trademark protection may not be available in every country in which we offer or intend to offer our products and services. Failure to protect our trademark rights adequately could damage our brand identity and impair our ability to compete effectively. Furthermore, defending or enforcing our trademark rights could result in the expenditure of significant financial and managerial resources.

Our success depends significantly upon our proprietary technology. Despite our efforts to protect our proprietary technology, it may be possible for unauthorized third parties to copy certain portions of our products or to reverse engineer or otherwise obtain and use our proprietary information. We do not have any software patents, and existing copyright laws afford only limited protection. In addition, we cannot be certain that others will not develop substantially equivalent or superseding proprietary technology, or that equivalent products will not be marketed in competition with our products, thereby substantially reducing the value of our proprietary rights. We cannot assure that we will develop proprietary offerings or technologies that are patentable, that any patent, if issued, would provide us with any competitive advantages or would not be challenged by third parties, or that the patents of others will not adversely affect our ability to do business. Litigation may be necessary to protect our proprietary technology. This litigation may be time-consuming and expensive.

Other Risks Related to Our Overall Business

We may be subject to claims as a result of information published on, posted on or accessible from our Internet sites, which could be costly to defend and subject us to significant damage claims.

We may be subject to claims of defamation, negligence, copyright or trademark infringement (including contributory infringement) or other claims relating to the information contained on our Internet sites, whether written by third parties or us.

Claims of defamation have been brought against online services in the past and can be costly to defend regardless of the merit of the lawsuit. Although federal legislation protects online services from some claims when third parties write the material, this protection is limited. Furthermore, the law in this area remains in flux and varies from state to state. We receive notification from time to time of potential claims, but have not been named as a party to litigation involving such claims. While no formal defamation complaints have been filed against us to date, our business could be seriously harmed if one were asserted.

Claims of infringement or other violations of intellectual property rights are common among Internet, media and technology companies because such companies often own large numbers of patents, copyrights, trademarks and trade secrets. Such claims often result in litigation, which is time consuming and can be costly to litigate, regardless of the merits of the claim or the eventual outcome of the claim. In addition, any time one of our online services links to or hosts material in which others allegedly own copyrights, we face the risk of being sued for copyright infringement or related claims. Because hosting of third party content comprises the majority of the online services that we offer, the risk of harm from such lawsuits could be substantial. Intellectual property claims are often time-consuming and may also be expensive to litigate or settle.

14

In addition to substantial defense costs, to the extent claims against us are successful, we may have to pay substantial monetary damages or discontinue one or more of our services or practices that are found to be in violation of another party’s rights. We may also acquire licenses or pay royalties in order to continue such practices, which may increase our operating expenses and have an adverse impact on our results of operations.

In September 2007, the Societe des Producteurs de Phonogrammes Francais filed copyright claims under French law against us alleging that the hosting on our SourceForge.net website of a certain third party open source software project, which may be used for so-called “peer-to-peer” file sharing, purportedly violates French law. An adverse result in this lawsuit may include an award of substantial monetary damages, costly royalty or licensing agreements or orders preventing us from offering downloads of certain third party open source software in France, which could result in a loss of revenue or an increase in operating expenses. In addition, this claim may require us to change in our business practices, which could result in a loss of revenue or otherwise harm to our business.

We make significant investments in our web sites and services offered thereon that may fail to become profitable endeavors.

We have made and will continue to make significant investments in research, development and marketing for our web sites and services offered thereon. For example, we are building a SourceForge.net Marketplace platform, including related support systems and infrastructure. Investments in new technology are inherently speculative.

Commercial success for web sites and services offered thereon depend on many factors including innovativeness, visitor support, and effective marketing. Significant revenue from our investments may not be achieved for a number of years, if at all. Moreover, our web sites and/or services offered thereon may not be profitable, and even if they are profitable, operating margins may not meet our internal expectations or the expectations of investors and securities analysts. If our web sites and/or services offered thereon fail to achieve financial results that meet public expectations, our business could be seriously harmed and our stock price will likely decline.

We may not detect weaknesses in our internal control over financial reporting in a timely manner, or at all.

Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 (“Section 404”), we are required to evaluate the effectiveness of our internal control over financial reporting as well as our disclosure controls and procedures each fiscal year. As of July 31, 2007 management has concluded that our internal control over financial reporting and our disclosure controls and procedures were effective. We will need to continue to evaluate, upgrade and enhance our internal controls. Because of inherent limitations, our internal control over financial reporting may not prevent or detect misstatements, errors or omissions, and any projections of any evaluation of effectiveness of internal controls to future periods are subject to the risk that the controls may become inadequate because of changes in conditions or that the degree of compliance with our policies or procedures may deteriorate. We cannot be certain in future periods that other control deficiencies that may constitute one or more “significant deficiencies” (as defined by the relevant auditing standards) or material weaknesses in our internal control over financial reporting will not be identified. If we fail to maintain the adequacy of our internal controls, including any failure to implement or difficulty in implementing required or new or improved controls, our business and results of operations could be harmed, the results of operations we report could be subject to adjustments, we could fail to be able to provide reasonable assurance as to our financial results or the effectiveness of our internal controls or meet our reporting obligations.

If we are unable to implement appropriate systems, procedures and controls, we may not be able to successfully offer our services and grow our business.

Our ability to successfully offer our services and grow our business requires an effective planning and management process. We updated our operations and financial systems, procedures and controls following our strategic decision to exit the hardware business, however, we still rely on manual processes and procedures that may not scale commensurately with growth. Our systems will continue to require automation, modifications and improvements to respond to current and future changes in our business. If we cannot grow our businesses, and manage that growth effectively, or if we fail to implement in a timely manner appropriate internal systems, procedures, controls and necessary automation and improvements to these systems, our businesses will suffer.

15

If we lose key personnel or fail to integrate replacement personnel successfully, our ability to manage our business could be impaired.

Our future success depends upon the continued service of our key management, technical, sales, and other critical personnel. Our officers and other key personnel are employees-at-will, and we cannot assure that we will be able to retain them. Key personnel have left our company in the past and there likely will be additional departures of key personnel from time to time in the future. The loss of any key employee could result in significant disruptions to our operations, including adversely affecting the timeliness of product releases, the successful implementation and completion of company initiatives, and the results of our operations. Competition for these individuals is intense, and we may not be able to attract, assimilate or retain highly qualified personnel. Competition for qualified personnel in our industry and the San Francisco Bay Area, as well as other geographic markets in which we recruit, is intense and characterized by increasing salaries, which may increase our operating expenses or hinder our ability to recruit qualified candidates. In addition, the integration of replacement personnel could be time consuming, may cause additional disruptions to our operations, and may be unsuccessful.

Our stock price has been volatile historically and may continue to be volatile.

The trading price of our common stock has been and may continue to be subject to wide fluctuations. During our fiscal year ended July 31, 2007, the closing sale prices of our common stock on the NASDAQ Global Market ranged from $3.32 to $5.44 per share and the closing sale price on July 31, 2007, the last trading day of our fiscal year 2007, was $3.71 per share. Our stock price may fluctuate in response to a number of events and factors, such as quarterly variations in operating results, announcements of technological innovations or new products and media properties by us or our competitors, changes in financial estimates and recommendations by securities analysts, the operating and stock price performance of other companies that investors may deem comparable to us, and news reports relating to trends in our markets or general economic conditions.

In addition, the stock market in general, and the market prices for Internet-related companies in particular, have experienced volatility that often has been unrelated to the operating performance of such companies. These broad market and industry fluctuations may adversely affect the price of our stock, regardless of our operating performance. Additionally, volatility or a lack of positive performance in our stock price may adversely affect our ability to retain key employees, all of whom have been granted stock options.

Sales of our common stock by significant stockholders may cause the price of our common stock to decrease.

Several of our stockholders own significant portions of our common stock. If these stockholders were to sell substantial amounts of their holdings of our common stock, then the market price of our common stock could be negatively impacted. The effect of such sales, or of significant portions of our stock being offered or made available for sale, could result in strong downward pressure on our stock price. Investors should be aware that they could experience significant short-term volatility in our stock if such stockholders decide to sell a substantial amount of their holdings of our common stock at once or within a short period of time.

Our networks may be vulnerable to unauthorized persons accessing our systems, which could disrupt our operations and result in the theft of our proprietary information.

A party who is able to circumvent our security measures could misappropriate proprietary information or cause interruptions or malfunctions in our Internet operations. We may be required to expend significant capital and resources to protect against the threat of security breaches or to alleviate problems caused by breaches in security.

Increasing regulation of the Internet or imposition of sales and other taxes on products or services sold or distributed over the Internet could harm our business.

The e-commerce market on the Internet is relatively new and rapidly evolving. While this is an evolving area of the law in the United States and overseas, currently there are relatively few laws or regulations that directly apply to commerce on the Internet. Changes in laws or regulations governing the Internet and e-commerce, including, without limitation, those governing an individual’s privacy rights, pricing, content, encryption, security, acceptable payment methods and quality of products or services could have a material adverse effect on our business, operating results and financial condition. Taxation of Internet commerce, or other charges imposed by government agencies or by private organizations, may also be imposed. Any of these regulations could have an adverse effect on our future sales and revenue growth.

16

Business disruptions could affect our future operating results.

Our operating results and financial condition could be materially and adversely affected in the event of a major earthquake, fire or other catastrophic event. Our corporate headquarters, the majority of our research and development activities, our third-party data center and certain other critical business operations are located in California, near major earthquake faults. A catastrophic event that results in the destruction of any of our critical business or information technology systems could severely affect our ability to conduct normal business operations and as a result our future operating results could be adversely affected.

System disruptions could adversely affect our future operating results.

Our ability to attract and maintain relationships with users, advertisers, merchants and strategic partners will depend on the satisfactory performance, reliability and availability of our Internet channels and network infrastructure. Our Internet advertising revenue relates directly to the number of advertisements delivered to our users. System interruptions or delays that result in the unavailability of Internet channels or slower response times for users would reduce the number of advertisements and sales leads delivered to such users and reduce the attractiveness of our Internet channels to users, strategic partners and advertisers or reduce the number of impressions delivered and thereby reduce revenue. In the past twelve months, some of our sites have experienced a small number of brief service interruptions. We will continue to suffer future interruptions from time to time whether due to capacity constraints, natural disasters, telecommunications failures, other system failures, rolling blackouts, viruses, hacking or other events. System interruptions or slower response times could have a material adverse effect on our revenue and financial condition.

ITEM 1B.Unresolved Staff Comments

None.

ITEM 2.Properties

Our principal locations are as follows:

| Location | | Purpose | | Approximate

Size

(in square feet) | | Expiration

of

Lease |

| United States of America | | | | | | |

| Fremont, California | | 100% sublet through lease expiration date | | 102,544 | | 2010 |

| Fremont, California | | Former corporate headquarters; Online-media sales and marketing, finance and administration, research and development | | 36,767 | | 2010 |

| Mountain View, California | | New Corporate headquarters (effective October 2007); Online-media sales and marketing, finance and administration, research and development | | 14,583 | | 2012 |

| Fairfax, Virginia | | ThinkGeek operations | | 5,139 | | 2009 |

ITEM 3.Legal Proceedings

Information with respect to this Item may be found in Note 5 of the Notes to Consolidated Financial Statements of this Annual Report on Form 10-K, which information is incorporated into this Item 3 by reference.

ITEM 4.Submission of Matters to a Vote of Security Holders

Not applicable.

17

PART II

| ITEM 5. | | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Our common stock is traded on the NASDAQ Global Market under the symbol LNUX. As of September 28, 2007, there were 754 holders of record of our common stock. We have not declared any cash dividends since our inception and do not expect to pay any dividends in the foreseeable future. The high and low closing sales prices, as reported by NASDAQ, of our common stock are as follows:

| | High | | Low |

| Fiscal Year Ended July 31, 2007: | | | |

| Fourth Quarter | $4.50 | | $3.48 |

| Third Quarter | $5.35 | | $3.63 |

| Second Quarter | $5.44 | | $4.01 |

| First Quarter | $4.64 | | $3.32 |

| Fiscal Year Ended July 31, 2006: | | | |

| Fourth Quarter | $5.55 | | $3.58 |

| Third Quarter | $5.83 | | $1.88 |

| Second Quarter | $1.89 | | $1.36 |

| First Quarter | $1.80 | | $1.32 |

The foregoing reflects interdealer prices without retail markup, markdown, or commissions and may not necessarily reflect actual transactions.

Stock Performance Graph

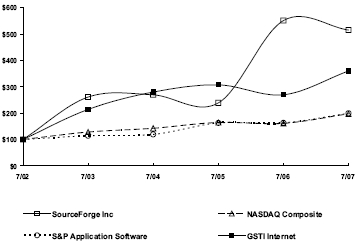

Set forth below is a line graph comparing the percentage change in the cumulative return to the stockholders of our Common Stock with the cumulative return of the NASDAQ Stock Market (U.S.) Index, the Goldman Sachs Technology Index (“GSTI”) Internet and the Standard & Poors (“S&P”) Application Software Index for the period commencing July 31, 2002 and ending on July 31, 2007. Returns for the indices are weighted based on market capitalization at the beginning of each measurement point.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among SourceForge Inc., The NASDAQ Composite Index,

The S&P Application Software Index And The GSTI Internet Index

| * | | The graph assumes that $100 was invested on July 31, 2002, in our Common Stock, at the closing price of $0.72 per share, and $100 was invested on July 31, 2002, in the NASDAQ Stock Market (U.S.) Index, the GSTI Internet index and the S&P Application Software Index, and that all dividends were reinvested. We have not declared or paid any dividends on our Common Stock. Stockholder returns over the indicated period should not be considered indicative of future stockholder returns. |

18

ITEM 6.Selected Consolidated Financial Data

You should read the selected consolidated financial data set forth below in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the related notes included elsewhere in this Form 10-K.

The statement of operations data for the fiscal years ended July 31, 2007, July 31, 2006 and July 31, 2005 and the balance sheet data as of July 31, 2007 and July 31, 2006 are derived from the audited financial statements and related notes appearing elsewhere in this Form 10-K. The statement of operations data for the fiscal years ended July 31, 2004 and July 31, 2003 and the balance sheet data as of July 31, 2005, July 31, 2004 and July 31, 2003 are derived from audited financial statements not appearing in this Form 10-K. The revenue, cost of revenue and operating expenses data excludes the results of our Software business, which was sold in April 2007 and our Online Images business, which was sold in December 2005. The historical results are not necessarily indicative of results that may be expected for any future period.

Summary Financial Information

(In thousands, except per share data)

| | For the years ended |

| July 31,

2007 | | July 31,

2006 | | July 31,

2005 | | July 31,

2004 | | July 31,

2003 |

| Selected Consolidated Statements of Operations Data: | | | | | | | | | | | | | | | | | |

| Net revenue from continuing operations | $ | 45,599 | | $ | 33,658 | | $ | 23,048 | | | $ | 22,344 | | | $ | 19,730 | |

| Cost of revenue from continuing operations | | 25,933 | | | 19,337 | | | 14,911 | | | | 13,182 | | | | 10,445 | |

| Gross margin from continuing operations | | 19,666 | | | 14,321 | | | 8,137 | | | | 9,162 | | | | 9,285 | |

| Income (loss) from continuing operations | | 5,955 | | | 3,923 | | | (257 | ) | | | 638 | | | | (1,660 | ) |

| Income (loss) from discontinued operations, netof income taxes | | 2,773 | | | 7,039 | | | (4,437 | ) | | | (8,278 | ) | | | (13,222 | ) |

| Net income (loss) | $ | 8,728 | | $ | 10,962 | | $ | (4,694 | ) | | $ | (7,640 | ) | | $ | (14,882 | ) |

| | | | | | | | | | | | | | | | | | |

| Income (loss) per share from continuing operations: | | | | | | | | | | | | | | | | | |

| Basic | $ | 0.09 | | $ | 0.06 | | $ | — | | | $ | 0.01 | | | $ | (0.03 | ) |

| Diluted | $ | 0.09 | | $ | 0.06 | | $ | — | | | $ | 0.01 | | | $ | (0.03 | ) |

| Income (loss) per share from discontinuedoperations: | | | | | | | | | | | | | | | | | |

| Basic | $ | 0.04 | | $ | 0.11 | | $ | (0.07 | ) | | $ | (0.14 | ) | | $ | (0.24 | ) |

| Diluted | $ | 0.04 | | $ | 0.11 | | $ | (0.07 | ) | | $ | (0.14 | ) | | $ | (0.24 | ) |

| Net income (loss) per share: | | | | | | | | | | | | | | | | | |

| Basic | $ | 0.13 | | $ | 0.18 | | $ | (0.08 | ) | | $ | (0.13 | ) | | $ | (0.28 | ) |

| Diluted | $ | 0.13 | | $ | 0.17 | | $ | (0.08 | ) | | $ | (0.13 | ) | | $ | (0.28 | ) |

| Shares used in per share calculation: | | | | | | | | | | | | | | | | | |

| Basic | | 66,254 | | | 62,328 | | | 61,454 | | | | 59,684 | | | | 54,110 | |

| Diluted | | 68,489 | | | 64,704 | | | 61,454 | | | | 59,684 | | | | 54,110 | |

| | | | | | | | | | | | | | | | | | |

| Selected Balance Sheet data at year-end: | | | | | | | | | | | | | | | | | |

| Cash, cash equivalents and investments | $ | 56,640 | | $ | 53,043 | | $ | 38,420 | | | $ | 44,042 | | | $ | 38,847 | |

| Working capital | $ | 44,103 | | $ | 51,265 | | $ | 34,369 | | | $ | 25,866 | | | $ | 28,825 | |

| Total assets | $ | 76,863 | | $ | 63,212 | | $ | 47,381 | | | $ | 53,679 | | | $ | 48,495 | |

| Liabilities, net of current portion | $ | 4,121 | | $ | 5,693 | | $ | 7,378 | | | $ | 9,192 | | | $ | 11,953 | |

| Total stockholders’ equity | $ | 65,094 | | $ | 49,378 | | $ | 31,665 | | | $ | 35,770 | | | $ | 27,202 | |

19

| ITEM 7. | | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion and analysis should be read in conjunction with “Selected Consolidated Financial Data” and our financial statements and the related notes included elsewhere in this Form 10-K. This discussion contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of certain factors including the risks discussed in “Item 1A. Risk Factors” and elsewhere in this Form 10-K. See Part I — Item 1 — “Special Note Regarding Forward-Looking Statements.”

Overview

We own and operate a network of media web sites, serving IT management and IT professional, software development and open source communities. Through our ThinkGeek, Inc. subsidiary, we also provide online sales of a variety of retail products of interest to these communities and other consumers. Our network of web sites include: SourceForge.net, Slashdot.org, ThinkGeek.com, Linux.com, freshmeat.net, ITManagersJournal.com and NewsForge.com. We provide a combination of user-developed content, online marketplaces and e-commerce, and intend to serve as the global technology community’s nexus for information exchange, open source software distribution and services and goods for geeks.

We were incorporated in California in January 1995 and reincorporated in Delaware in December 1999. From the date of our incorporation through October 2001, we sold Linux-based hardware systems and services under the name VA Linux Systems, Inc. On June 27, 2001, we announced our decision to exit our Linux-based hardware business. In December 2001, we changed our name to VA Software Corporation to reflect our decision to pursue our Software, Online Media, E-commerce, and Online Images businesses. In December 2005, we sold our Online Images business to Jupitermedia Corporation (“Jupitermedia”) and in April 2007, we sold our Software business to CollabNet, Inc. (“CollabNet”). On May 24, 2007, reflecting our strategic decision to focus on our network of media and e-commerce web sites, we changed our name to SourceForge, Inc. and merged with our wholly-owned subsidiary, OSTG, Inc.

As a result of the sale of our Software business to CollabNet and the sale of our Online Images business to Jupitermedia, we no longer have operations in these segments. In conjunction with the sale of our Software business, we restructured our facilities for the excess facility space formerly used by our Software business and also terminated the employment of those employees of our Software business not offered positions at CollabNet.

We currently view our business in two operating segments: Online Media and E-commerce. Our Online Media segment consists of a network of Internet web sites which connect millions of influential technology managers, professionals and enthusiasts. Our Online Media’s network of web sites include: SourceForge.net, Slashdot.org, Linux.com, freshmeat.net, ITManagersJournal.com and NewsForge.com. Our E-commerce segment sells online goods of interest to the software development and IT communities and other consumers, through our ThinkGeek.com web site.

Our network of web sites served an average of over 32 million unique visitors per month* over the past twelve months (*Source: Google Analytics and Omniture). During fiscal 2007 we served 779 million downloads from our SourceForge.net web site. Within the E-commerce segment, we continued to increase our customer base, increasing the number of orders shipped by 37% during fiscal 2007 as compared to fiscal 2006.

Our sales continue to be primarily attributable to customers located in the United States of America.

Net revenue from continuing operations increased 35% in fiscal 2007 as compared to fiscal 2006 due to revenue increases of 32% in our Online Media business and 38% in our E-commerce business. Within the Online Media segment, revenue increased due to our focus on developing innovative campaigns for targeted customers as well as increased revenue from greater levels of contextually-relevant advertising. E-commerce revenue increased due to a 37% increase in orders shipped to our customer base in this segment.

20

Net revenue from continuing operations increased 46% in fiscal 2006 as compared to fiscal 2005 due to increases of 63% in our Online Media business and 37% in our E-commerce business. Within the Online Media segment, revenue increased due to our focus on developing campaigns for targeted customers as well as increased revenue from greater levels of contextually-relevant advertising. E-commerce revenue increased due to an increase in orders from our customer base in this segment.

Our net income (loss) from continuing operations was $6.0 million, $3.9 million and ($0.3) million during fiscal years 2007, 2006 and 2005, respectively, or basic and diluted income per share of $0.09, $0.06 and $0.00, respectively.

Critical Accounting Policies

Accounting policies, methods and estimates are an integral part of the consolidated financial statements prepared by management and are based upon management’s current judgments. Those judgments are normally based on knowledge and experience with regard to past and current events and assumptions about future events. Certain accounting policies, methods and estimates are particularly sensitive because of their significance to the financial statements and because of the possibility that future events affecting them may differ markedly from management’s current judgments. While there are a number of accounting policies, methods and estimates affecting our financial statements, areas that are particularly significant include revenue recognition policies, the assessment of impairment of long-lived assets, restructuring reserves for excess facilities for non-cancelable leases, income taxes, and contingencies and litigation.

Revenue Recognition

Online Media Revenue

Online Media revenue is derived from the sale of advertising space on our various web sites. We recognize Online Media revenue in accordance with SEC Staff Accounting Bulletin (“SAB”) No. 104, “Revenue Recognition” over the period in which the advertisements are displayed, provided that persuasive evidence of an arrangement exists, no significant obligations remain, the fee is fixed or determinable, and collection of the receivable is reasonably assured. Our obligations typically include guarantees of a minimum number of “impressions” (times that an advertisement is viewed by users of our online services). To the extent that minimum guaranteed impressions are not met in the specified time frame, we do not recognize the corresponding revenue until the guaranteed impressions are achieved.

We measure revenue on barter transactions based on the recorded amount of the non-monetary asset relinquished. Our barter transactions generally consist of the exchange of advertising on our Online Media web sites in exchange for access and advertising at industry trade shows. Accordingly, we do not record any revenue as a result of these transactions.

E-commerce Revenue

E-commerce revenue is derived from the online sale of consumer goods. We recognize E-commerce revenue from the sale of consumer goods in accordance with SAB 104. Under SAB 104, product revenue is recognized when persuasive evidence of an arrangement exists, delivery has occurred, the sale price is fixed or determinable, and collectibility is reasonably assured. In general, we recognize E-commerce revenue upon the shipment of goods. We grant customers a right to return E-commerce products within 30 days of the shipment date. Such returns are recorded as incurred and have been immaterial for the periods presented.

Impairment of Long-Lived Assets

We continually evaluate whether events and circumstances have occurred that indicate the remaining estimated useful life of long-lived assets may warrant revision or that the remaining balance of long-lived assets may not be recoverable in accordance with Statement of Financial Accounting Standards “SFAS” No. 144, “Accounting for Impairment of Long-Lived Assets and for Long-Lived Assets to be Disposed of.” When factors indicate that long-lived assets should be evaluated for possible impairment, we use an estimate of the related undiscounted future cash flows over the remaining life of the long-lived assets in measuring whether they are recoverable. If the estimated

21

undiscounted future cash flows exceed the carrying value of the asset, a loss is recorded as the excess of the asset’s carrying value over fair value. Long-lived assets and certain identifiable intangible assets to be disposed of are reported at the lower of carrying amount or fair value less costs to sell.

Restructuring Costs and Other Special Charges

As discussed in Note 3 of the notes to the consolidated financial statements, we recorded significant restructuring charges in connection with exiting our hardware systems, managed services, and professional services and Linux software engineering services businesses during the fiscal years ended 2002 and 2001. A significant portion of these charges related to excess facilities, which were subject to non-cancelable leases or other costs relating to the abandonment or disposal of property and equipment. In fiscal 2005, we recorded a credit adjustment of $0.1 million to accurately reflect the current common area maintenance fees associated with the Fremont facilities. In conjunction with the sale of our Software business in fiscal 2007 we recorded an additional reserve of $0.6 million as discontinued operations expense due to the idle space resulting from this transaction. These accruals are subject to change should actual circumstances change. We will continue to evaluate and update, if applicable, these accruals quarterly.

�� Income Taxes

We estimate our income taxes in each of the jurisdictions in which we operate as part of the process for preparing our consolidated financial statements. This process involves estimating our actual current tax exposure together with assessing temporary differences resulting from differing treatment of items, such as deferred revenue, for tax and accounting purposes. These differences result in deferred tax assets or liabilities. We then assess the likelihood that our net deferred tax assets will be recovered from future taxable income and to the extent that we believe recovery is not likely, we establish a valuation allowance. In the event that we determine that realization of our deferred tax exceeds the recorded amount, we will adjust the deferred tax asset valuation allowance, which will increase income in the period in which such determination is made.

Contingencies and Litigation

We are subject to proceedings, lawsuits and other claims. We assess the likelihood of any adverse judgments or outcomes to these matters as well as ranges of probable losses. A determination of the amount of loss contingency required, if any, is assessed in accordance with SFAS No. 5, “Contingencies and Commitments” and recorded if probable after careful analysis of each individual matter. The required loss contingencies may change in the future as the facts and circumstances of each matter change.

Results of Operations

We believe that the application of accounting standards is central to a company’s reported financial position, results of operations and cash flows. We review our annual and quarterly results, along with key accounting policies, with our audit committee prior to the release of financial results. In addition, we have not entered into any significant transactions with related parties. We do not use off-balance-sheet arrangements with unconsolidated related parties, nor do we use other forms of off-balance-sheet arrangements such as research and development arrangements.

22

The following table sets forth our operating results for the periods indicated as a percentage of net revenue, represented by selected items from the consolidated statements of operations. This table should be read in conjunction with the consolidated financial statements and the accompanying notes included in this Form 10-K.

| | For the Year Ended July 31, |

| | 2007 | | 2006 | | 2005 |

| Consolidated Statements of Operations Data: | | | | | | | | |

| Online Media revenue | 38.4 | % | | 39.3 | % | | 35.3 | % |

| E-commerce revenue | 61.6 | | | 60.7 | | | 64.7 | |

| Net revenue | 100.0 | % | | 100.0 | % | | 100.0 | % |

| Online Media cost of revenue | 10.4 | | | 11.1 | | | 14.4 | |

| E-commerce cost of revenue | 46.5 | | | 46.4 | | | 50.3 | |

| Cost of revenue | 56.9 | | | 57.5 | | | 64.7 | |

| Gross margin | 43.1 | | | 42.5 | | | 35.3 | |

| Operating expenses: | | | | | | | | |

| Sales and marketing | 13.4 | | | 13.1 | | | 15.3 | |

| Research and development | 8.3 | | | 9.0 | | | 8.8 | |

| General and administrative | 14.1 | | | 13.4 | | | 16.5 | |

| Impairment of Long Lived Assets | — | | | — | | | 0.4 | |

| Restructuring costs and other special charges | — | | | — | | | (0.4 | ) |

| Total operating expenses | 35.8 | | | 35.5 | | | 40.6 | |

| Income (loss) from operations | 7.3 | | | 7.0 | | | (5.3 | ) |

| Interest and other income, net | 6.4 | | | 4.9 | | | 4.2 | |

| Income (loss) from continuing operations before income taxes | 13.7 | | | 11.9 | | | (1.1 | ) |

| Provision for income taxes | 0.6 | | | 0.3 | | | — | |

| Income (loss) from continuing operations | 13.1 | % | | 11.6 | % | | (1.1 | %) |

| Net Revenue | | | | | | | | | | | | | | | |

| | | | | | | | | | | | % Change

Fiscal 2007

to 2006 | | % Change

Fiscal 2006

to 2005 |

| | | Year Ended July 31, | | |

| ($ in thousands) | | 2007 | | 2006 | | 2005 | | |

| Online Media revenue | | | 17,496 | | | 13,242 | | | 8,130 | | 32 | % | | 63 | % |

| E-commerce revenue | | | 28,103 | | | 20,416 | | | 14,918 | | 38 | % | | 37 | % |

| Net revenue | | $ | 45,599 | | $ | 33,658 | | $ | 23,048 | | 35 | % | | 46 | % |

Sales for the fiscal years ended 2007, 2006, and 2005 were primarily to customers located in the United States of America.

For the fiscal years ended July 31, 2007, 2006, and 2005, respectively, no one customer represented 10% or greater of net revenue. Going forward, we do not anticipate that any one customer will represent more than 10% of net revenue.

| Online Media Revenue | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | % Change

Fiscal 2007

to 2006 | | % Change

Fiscal 2006

to 2005 |

| | | Year Ended July 31, | | |

| ($ in thousands) | | 2007 | | 2006 | | 2005 | | |

| Online Media revenue | | $ | 17,496 | | | $ | 13,242 | | | $ | 8,130 | | | 32 | % | | 63 | % |

| Percentage of total net revenue | | | 38 | % | | | 39 | % | | | 35 | % | | | | | | |

23

Online Media revenue was derived primarily from cash sales of advertising space on our various web sites as well as sponsorship-related arrangements and contextually-relevant advertising associated with advertising on these web sites.

| | | | | | | | | | | | % Change

Fiscal 2007

to 2006 | | % Change

Fiscal 2006

to 2005 |

| | | Year Ended July 31, | | |

| ($ in thousands) | | 2007 | | 2006 | | 2005 | | |

| Cash advertising | | $ | 11,091 | | $ | 9,193 | | $ | 5,805 | | 21 | % | | 58 | % |

| Sponsorships | | | 1,339 | | | 739 | | | 390 | | 81 | % | | 89 | % |

| Other revenue | | | 5,066 | | | 3,310 | | | 1,935 | | 53 | % | | 71 | % |

| Online Media revenue | | $ | 17,496 | | $ | 13,242 | | $ | 8,130 | | 32 | % | | 63 | % |

Cash advertising revenue is derived from advertisements or services delivered to advertisers. Such advertisements may be in the form of an advertising impression, a click, the display of a text link, the download of a file or the collection of some data, generally a lead.

The increase in cash advertising revenue during fiscal 2007 as compared to fiscal 2006 was due to the addition of new advertisers as well as additional spending by existing customers. The new customers were primarily due to the attractive demographics of the users of our web sites to these advertisers while the increased spending by existing customers was due to customers taking advantage of the programs we offer, such as our download program and custom landing page program.

The increase in cash advertising revenue during fiscal 2006 as compared to fiscal 2005 was due primarily to increased spending by existing customers and to a lesser extent the addition of new customers. The increase in spending by existing customers was due to our creating new programs, (e.g. the download and custom landing page program) for these customers.

Sponsorship revenue is derived from web marketing programs that are used to increase brand awareness. Revenue related to sponsorships is recognized ratably over the term of the marketing program or in conjunction with the delivery requirements set forth in the contract. The increase in sponsorship revenue in fiscal 2007 as compared to fiscal 2006 was primarily due to additional advertisers participating in our sponsorship programs as well as increased revenue from existing advertisers whose campaigns ran partially during fiscal 2006 and for a full year in fiscal 2007. The increase in sponsorship revenue in fiscal 2006 as compared to fiscal 2005 was due to new customers participating in our sponsorship and a fixed advertisement placement on certain of our web sites which links to a custom landing page, which is known as our powerbar, offerings.

Other revenue consists primarily of paid search, contextually-relevant advertising and referral fees. The increase in other revenue during fiscal 2007 as compared to fiscal 2006 was primarily due to an increase in revenue resulting from a higher allocation of unsold inventory to the providers of contextually-relevant advertising, including $0.7 million related to a new program with our largest partner. The increase in other revenue during fiscal 2006 as compared to fiscal 2005 was primarily due to an increase in revenue resulting from an increase in the allocation of unsold inventory and our selection of partners who are able to obtain improved yields on the inventory allocated to them.

We believe that our prominent position in serving the growing open source software, Linux markets and IT communities, along with our favorable online visitor demographics, makes us an attractive advertising vehicle for advertising customers. We expect our Online Media revenue to increase in the future as we continue to focus on increasing revenue from companies seeking to reach our web site visitors.

E-commerce Revenue

| | | | | | | | | | | | | | | % Change

Fiscal 2007

to 2006 | | % Change

Fiscal 2006

to 2005 |

| | | Year Ended July31, | | |

| | | 2007 | | 2006 | | 2005 | | |

| E-commerce revenue (in thousands) | | $ | 28,103 | | | $ | 20,416 | | | $ | 14,918 | | | 38 | % | | 37 | % |

| Percentage of total net revenue | | | 62 | % | | | 61 | % | | | 65 | % | | | | | | |

| Number of orders (per year) | | | 431,919 | | | | 316,060 | | | | 235,375 | | | 37 | % | | 34 | % |

| Average order size (in dollars) | | $ | 65.07 | | | $ | 64.60 | | | $ | 63.38 | | | 1 | % | | 2 | % |

24

E-commerce revenue is derived from the online sale of consumer goods, including shipping, net of any returns and allowances.

The growth in E-Commerce revenue in fiscal 2007 and 2006 as compared to the prior year was primarily due to increased consumer awareness of our web site as a result of broader product offerings, catalog marketing and media coverage of our web site which attracted a larger customer base, as well as web site enhancements, including improved search capability and customer communication features, that drove an increasing number of unique visitors to our web site. This increase in unique visitors resulted in a 37% and 34% increase in the number of orders shipped during fiscal 2007 and 2006, respectively. The average order size increased by 1% and 2% in fiscal 2007 and fiscal 2006, respectively, when compared to the prior fiscal year.

We expect E-commerce revenue to continue to grow as our E-commerce customer base grows.

Cost of Revenue/Gross Margin

| | | | | | | | | | | | | | | % Change

Fiscal 2007

to 2006 | | % Change

Fiscal 2006

to 2005 |

| | | Year Ended July 31, | | |

| ($ in thousands) | | 2007 | | 2006 | | 2005 | | |

| Cost of revenue | | $ | 25,933 | | | $ | 19,337 | | | $ | 14,911 | | | 34 | % | | 30 | % |

| Gross margin | | | 19,666 | | | | 14,321 | | | | 8,137 | | | 37 | % | | 76 | % |

| Gross margin % | | | 43 | % | | | 43 | % | | | 35 | % | | | | | | |

| Headcount | | | 33 | | | | 29 | | | | 24 | | | | | | | |

Gross margins increased in fiscal 2007 as compared to fiscal 2006 and increased fiscal 2006 as compared to fiscal 2005. The increase in gross margins in fiscal 2007 as compared to fiscal 2006 was primarily due to the 35% increase in net revenue, substantially offset by a 34% increase in cost of revenue. The increase in gross margins in fiscal 2006 as compared to fiscal 2005 was primarily due to increased gross margins in our Online Media business primarily due to the significant increase in revenue.

Cost of Revenue/Gross Margin by Segment

Online Media Cost of Revenue/Gross Margin

| | | | | | | | | | | | | | | % Change

Fiscal 2007

to 2006 | | % Change

Fiscal 2006

to 2005 |

| | | Year Ended July 31, | | |

| ($ in thousands) | | 2007 | | 2006 | | 2005 | | |

| Online Media cost of revenue | | $ | 4,733 | | | $ | 3,732 | | | $ | 3,320 | | | 27 | % | | 12 | % |

| Online Media gross margin | | | 12,763 | | | | 9,510 | | | | 4,810 | | | 34 | % | | 98 | % |

| Online Media gross margin % | | | 73 | % | | | 72 | % | | | 59 | % | | | | | | |

Online Media cost of revenue consists of personnel costs and related overhead associated with developing the editorial content of our sites and personnel and related overhead, equipment and bandwidth associated with delivering our media content. Online Media cost of revenue includes both costs which do not vary directly with revenue (fixed costs), such as equipment, personnel and editorial costs, as well as costs which are more directly affected by revenue (variable costs), such as bandwidth for delivering content and ad-serving costs. Our fixed costs will generally not vary directly with revenue; however, they will increase to the extent that we expand or upgrade the equipment necessary to operate our network or if we add additional sites to our network of web sites. Our variable costs generally vary based on the delivery of web pages or content. To the extent that we are able to increase our revenue without increasing our fixed costs, our gross margins will increase; however, to the extent that we expand our equipment in anticipation of increased activity, we may experience decreased gross margins. During fiscal 2007, we capitalized approximately $1.8 million of internally developed software costs related to our SourceForge.net Marketplace platform. We will begin amortization of these costs over the estimated useful life of the platform when the platform is ready for its intended use, which is expected to be in the first six months of our fiscal 2008.

25

The slight increase in Online Media gross margin percentage for fiscal 2007 as compared to fiscal 2006 was due to a 32% increase in revenue, partially offset by a $1.0 million, or 27%, increase in cost of revenue. The increase in cost of revenue was primarily due to an increase in personnel costs related to providing editorial content and additional maintenance of our web sites of $0.6 million, an increase in our co-location costs of $0.3 million, including bandwidth costs to deliver content to users, and an increase in ad-serving costs of $0.1 million due primarily to higher volumes of units served and to a lesser extent to the serving of rich media ads and Really Simple Syndication (“RSS”) feeds.

The increase in Online Media gross margin percentage for fiscal 2006 as compared to fiscal 2005 was primarily due to the 63% increase in Online Media revenue, partially offset by slightly higher cost of revenue of $0.4 million. The increase in cost of revenue was primarily due to an increase in the cost of our outsourcing our advertising serving system of $0.2 million and an increase in personnel overhead costs related to editorial content of $0.2 million.

We expect Online Media cost of revenue to increase in absolute dollars resulting from depreciation expense related to network equipment purchased for our new data center, as well as the associated ongoing operating costs, and amortization of software costs associated with the development of our SourceForge.net Marketplace platform. To the extent that Online Media revenue does not increase proportionately, our Online Media gross margins may decline.

E-commerce Cost of Revenue/Gross Margin

| | | | | | | | | | | | | | | % Change

Fiscal 2007

to 2006 | | % Change

Fiscal 2006

to 2005 |

| | | Year Ended July 31, | | |

| ($ in thousands) | | 2007 | | 2006 | | 2005 | | |

| E-commerce cost of revenue | | $ | 21,200 | | | $ | 15,605 | | | $ | 11,591 | | | 36 | % | | 35 | % |

| E-commerce gross margin | | | 6,903 | | | | 4,811 | | | | 3,327 | | | 43 | % | | 45 | % |

| E-commerce gross margin % | | | 25 | % | | | 24 | % | | | 22 | % | | | | | | |

E-commerce cost of revenue consists of product costs, shipping and fulfillment costs and personnel and related overhead associated with the operations and merchandising functions.

E-commerce gross margin percentage increased slightly in fiscal 2007 as compared to fiscal 2006 primarily as a result of lower affiliate commission, due to our replacing our largest affiliate with additional direct revenue, and to a lesser extent to lower operating expenses as a percent of revenue, offset slightly by lower product margins due to product mix. The increase in E-commerce cost of revenue in absolute dollars in fiscal 2007 as compared to fiscal 2006 was primarily due to increased product costs of $3.7 million, shipping costs of $1.2 million, and fulfillment costs of $0.6 million. Increases in product costs were the result of increased E-commerce revenue levels, shipping costs were directly related to the increased volume of orders shipped and fulfillment costs were directly related to increased revenue levels.

E-commerce gross margin percentage increased in fiscal 2006 as compared to fiscal 2005. E-commerce cost of revenue in fiscal 2006 increased as compared to fiscal 2005 consistent with increased E-commerce revenue levels; however, merchandising expenses increased at a lower rate than the increase in revenue, resulting in a slight improvement in gross margin percentage. The increase in E-commerce cost of revenue in absolute dollars in fiscal 2006 as compared to fiscal 2005 was primarily due to increased product costs of $2.5 million, fulfillment costs of $0.6 million, shipping costs of $0.5 million, affiliate commission of $0.2 million and merchandising costs of $0.2 million. The increase in product costs was the result of increased E-commerce revenue levels. The increase in fulfillment costs was due to increased third party fulfillment costs resulting from an increased number of orders, increased levels of inventory managed during fiscal 2006 and increased rates charged by the fulfillment house. The increase in shipping costs was partially related to increased revenue levels and fuel surcharges, partially offset by lower shipping rates. The increase in affiliate commission is due to increased revenue levels. The increase in merchandising costs was due to increased personnel and related overhead costs to increase the range of our product offering.

We expect E-commerce cost of revenue in absolute dollars to increase proportionately with E-commerce revenue. In addition, we expect E-commerce overall gross margins will remain relatively constant.

26

Operating Expenses

Sales and Marketing Expenses

Sales and marketing expenses consist primarily of personnel and related overhead expenses, including sales commission, for personnel engaged in sales, marketing and sales support functions, as well as costs associated with advertising and promotional activities.

| | | | | | | | | | | | | | | % Change

Fiscal 2007

to 2006 | | % Change

Fiscal 2006

to 2005 |

| | | Year Ended July 31, | | |

| ($ in thousands) | | 2007 | | 2006 | | 2005 | | |

| Sales and Marketing | | $ | 6,108 | | | $ | 4,426 | | | $ | 3,523 | | | 38 | % | | 26 | % |

| Percentage of total net revenue | | | 13 | % | | | 13 | % | | | 15 | % | | | | | | |

| Headcount | | | 20 | | | | 16 | | | | 14 | | | | | | | |