Exhibit 99.7

RENESAS AND INTERSIL CLEAR PATH TO BECOME WORLD’S LEADING EMBEDDED SOLUTIONS PROVIDER September 13, 2016 © 2016 Renesas Electronics Corporation. All rights reserved.

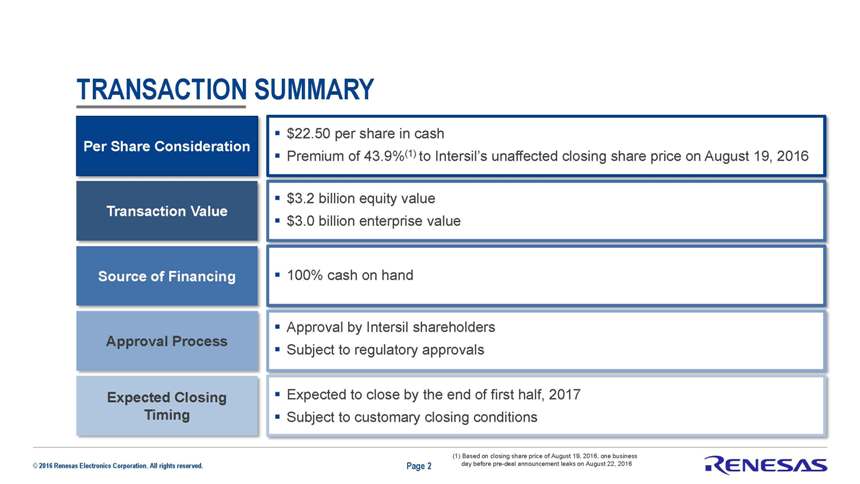

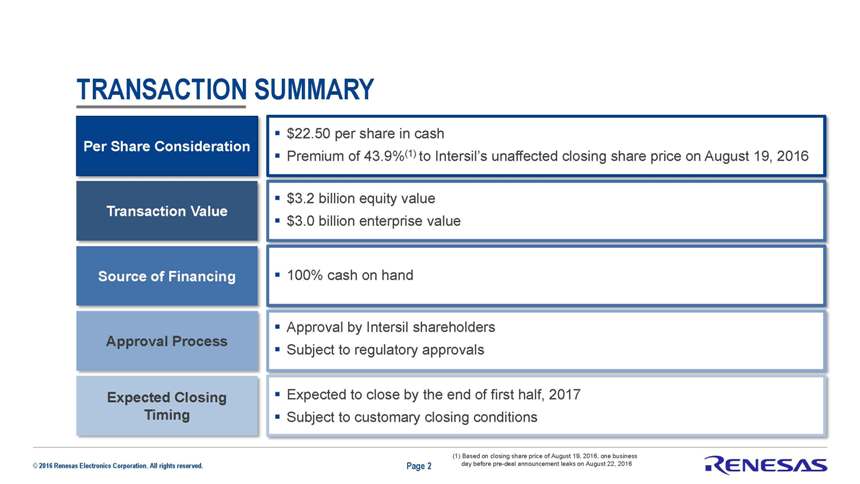

TRANSACTION SUMMARY Per Share Consideration§ $22.50 per share in cash § Premium of 43.9%(1) to Intersil’s unaffected closing share price on August 19, 2016 Transaction Value§ $3.2 billion equity value§ $3.0 billion enterprise value Source of Financing§ 100% cash on hand § Approval by Intersil shareholders Approval Process § Subject to regulatory approvals Expected Closing § Expected to close by the end of first half, 2017 Timing§ Subject to customary closing conditions (1) Based on closing share price of August 19, 2016, one business © 2016 Renesas Electronics Corporation. All rights reserved. Page 2 day before pre-deal announcement leaks on August 22, 2016

Organic In-Organic CAPITAL ALLOCATION DISTINGUISHED STRATEGIC APPROACHES TO BECOME #1 IN FOCUSED INDUSTRIES Automotive Industrial Broad-based, etc. Organic + In-Organic Approaches Intensive R&D Spend to Stay MCUs Leveraging Renesas as an Industry Leader Market Recognition Strategic Partnerships and Alliances Leveraging SoCs Renesas Proven Track Record and Market Recognition Analog & Mixed- Strategic Investment including Mergers and Acquisitions Signals Power Selective Investment to Enhance Competitiveness and Profitability Discretes © 2016 Renesas Electronics Corporation. All rights reserved. Page 3

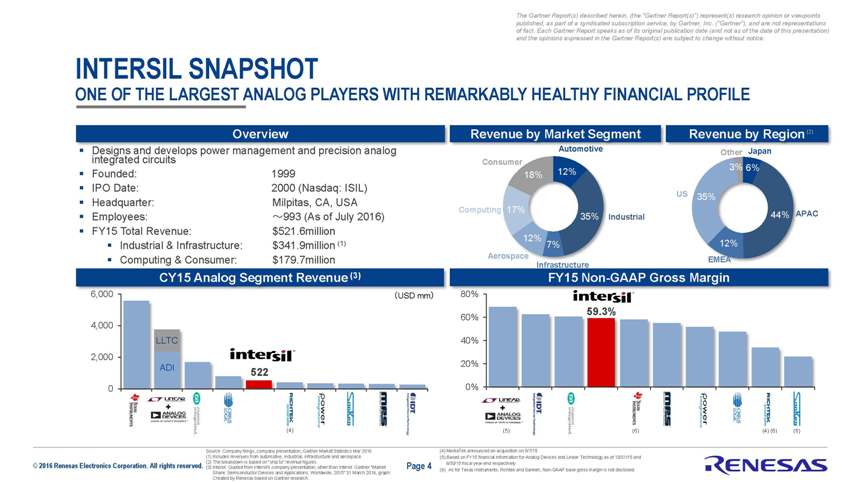

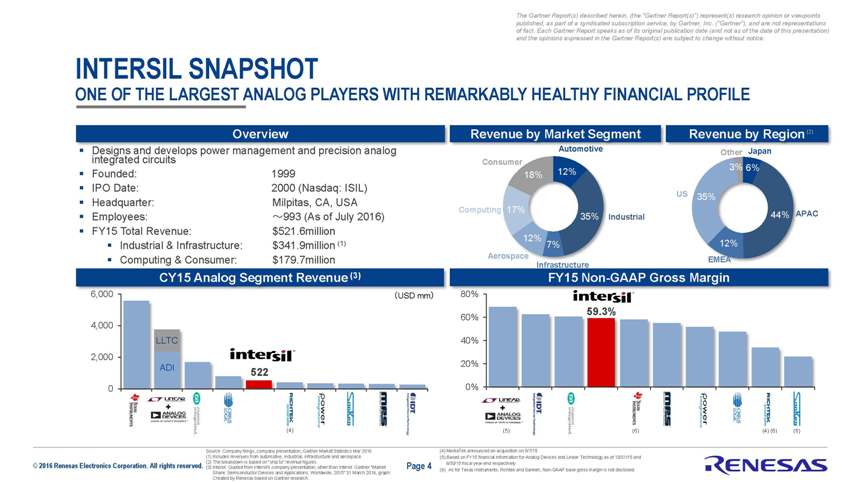

The Gartner Report(s) described herein, (the “Gartner Report(s)”) represent(s) research opinion or viewpoints published, as part of a syndicated subscription service, by Gartner, Inc. (“Gartner”), and are not representations of fact. Each Gartner Report speaks as of its original publication date (and not as of the date of this presentation) and the opinions expressed in the Gartner Report(s) are subject to change without notice. INTERSIL SNAPSHOT ONE OF THE LARGEST ANALOG PLAYERS WITH REMARKABLY HEALTHY FINANCIAL PROFILE Overview Revenue by Market Segment Revenue by Region(2) ? Designs integrated and circuits develops pow and precision analog Consumer 3% 6% ? Founded: 1999 18% 12%? IPO Date: 2000 (Nasdaq: ISIL) ? Headquarter: Milpitas, CA, USA US 35% Computing 17% ? Employees: ?993 (As of July 2016) 35% Industrial 44% APAC? FY15 Total Revenue: $521.6million 12% ? Industrial & Infrastructure: $341.9million (1) 7% 12% Aerospace ? Computing & Consumer: $179.7million EMEA In CY15 Analog Segment Revenue (3) FY15 Non-GAAP Gross Margin 6,000 -248”iUSD mm-247”j 80% 59.3% 60% 4,000 LLTC 40% 2,000 20% ADI 522 0 0% + + (4) (5) (6) (4) (6) (6) Source: Company filings, company presentation, Gartner Market Statistics Mar 2016 (4) MediaTek announced an acquisition on 9/7/15 (1) Includes revenues from automotive, industrial, infrastructure and aerospace. (5) Based on FY15 financial information for Analog Devices and Linear Technology as of 10/31/15 and “©2016 Renesas Electronics Corporation. All rights reserved. (2) The breakdown is based on ““hip to””revenue figures. 6/30/15 fiscal year-end respectively (3) Intersil: Quoted from Intersil's company presentation, other than Intersil: Gartner "Market Page 4 (6) As for Texas Instruments, Richtek and Sanken, Non-GAAP base gross margin is not disclosed Share: Semiconductor Devices and Applications, Worldwide, 2015" 31 March 2016, graph: Created by Renesas based on Gartner research

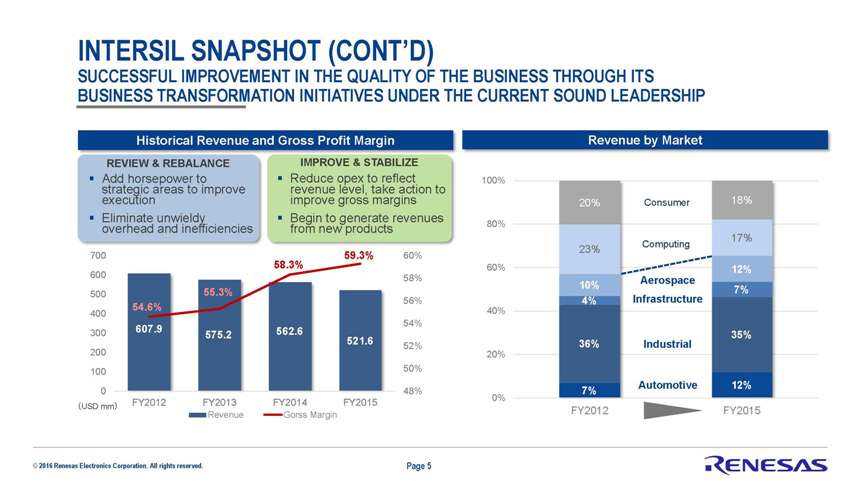

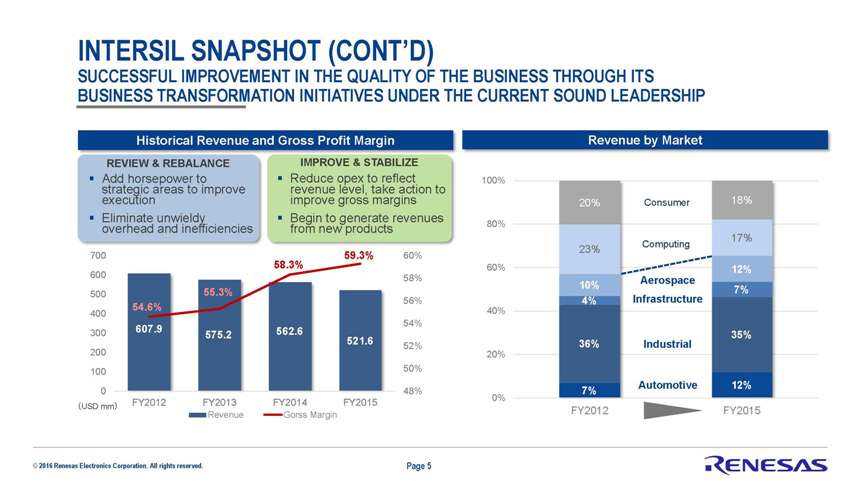

INTERSIL SNAPSHOT (CONT’D) SUCCESSFUL IMPROVEMENT IN THE QUALITY OF THE BUSINESS THROUGH ITS BUSINESS TRANSFORMATION INITIATIVES UNDER THE CURRENT SOUND LEADERSHIP Historical Revenue and Gross Profit Margin Revenue by Market REVIEW & REBALANCE IMPROVE & STABILIZE Add strategic horsepower areas to to improve revenue Reduce opex level,to take reflect action to 100% execution improve gross margins 20% Consumer 18% Eliminate unwieldy Begin to generate revenues overhead and inefficiencies from new products 80% 17% Computing 23% 700 58.3% 59.3% 60% 60% 12% 600 58% Aerospace 10% 7% 500 55.3% 56% 4% Infrastructure 54.6% 40% 400 54% 300 607.9 562.6 575.2 35% 521.6 36% Industrial 52% 200 20% 100 50% Automotive 12% 0 48% 7% 0% USD mm FY2012 FY2013 FY2014 FY2015 Revenue Gorss Margin FY2012 FY2015 © 2016 Renesas Electronics Corporation. All rights reserved. Page 5

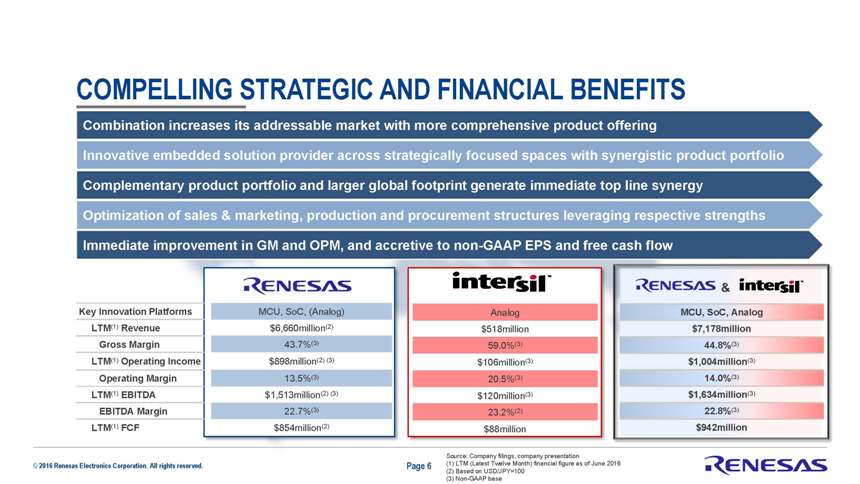

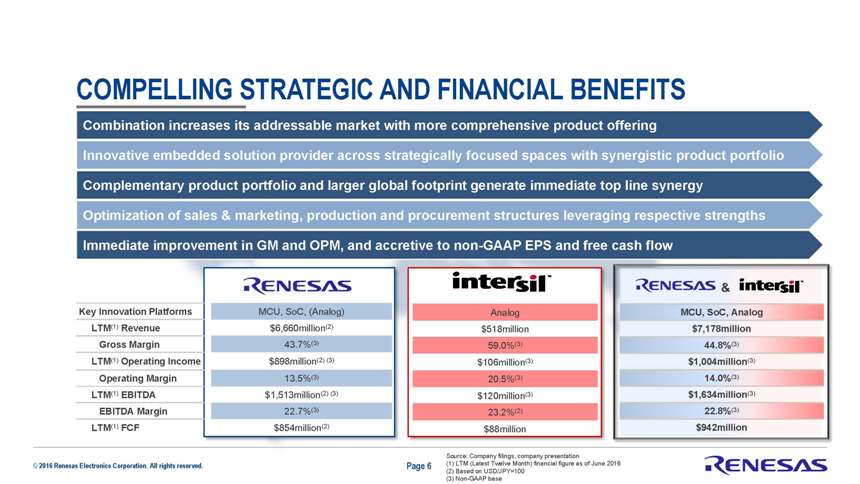

COMPELLING STRATEGIC AND FINANCIAL BENEFITS Combination increases its addressable market with more comprehensive product offering Innovative embedded solution provider across strategically focused spaces with synergistic product portfolio Complementary product portfolio and larger global footprint generate immediate top line synergy Optimization of sales & marketing, production and procurement structures leveraging respective strengths Immediate improvement in GM and OPM, and accretive to non-GAAP EPS and free cash flow Key Innovation Platforms MCU, SoC, (Analog) Analog LTM(1) Revenue $6,660million(2) $518million Gross Margin 43.7%(3) 59.0%(3) LTM(1) Operating Income $898million(2) (3) $106million(3) Operating Margin 13.5%(3) 20.5%(3) LTM(1) EBITDA $1,513million(2) (3) $120million(3) EBITDA Margin 22.7%(3) 23.2%(2) LTM(1) FCF $854million(2) $88million Source: Company filings, company presentation © Page 6 (1) LTM (Latest Twelve Month) financial figure as of June 2016 (2) Based on USD/JPY=100 (3) Non-GAAP base

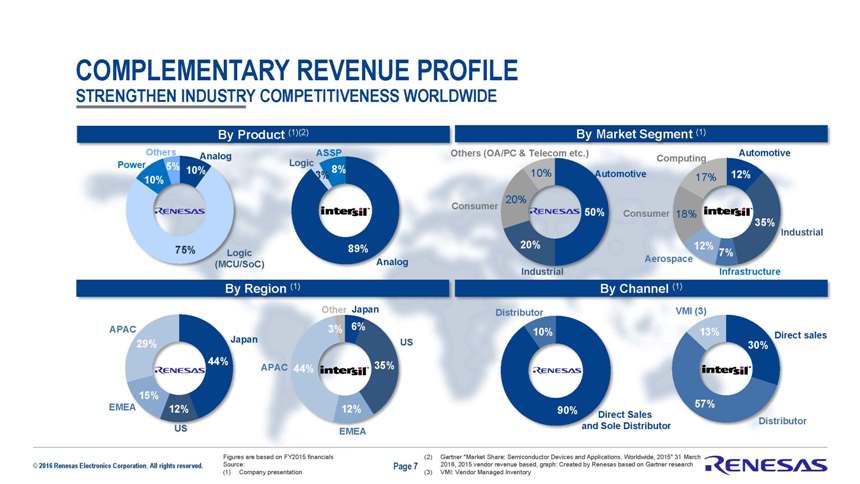

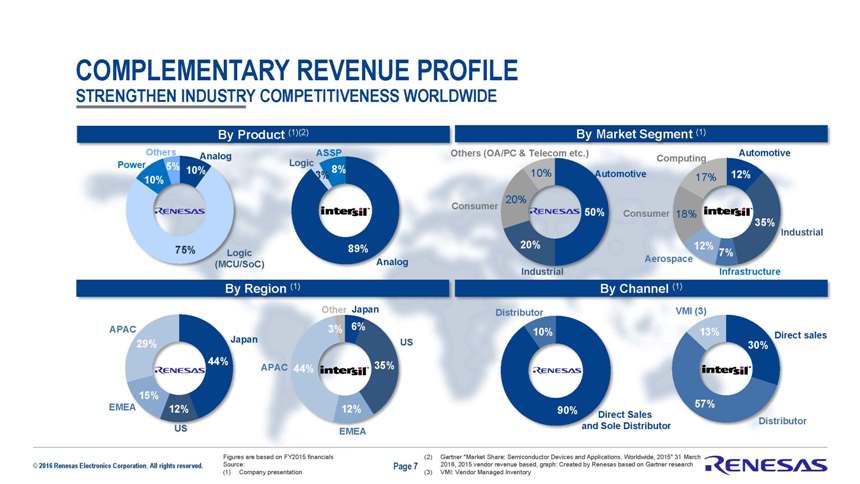

COMPLEMENTARY REVENUE PROFILE STRENGTHEN INDUSTRY COMPETITIVENESS WORLDWIDE By Product (1)(2) By Market Segment (1) Others Analog ASSP Others (OA/PC & Telecom etc.) Automotive Computing Power 5% Logic 10% 8% 10% 3% Automotive 17% 12% 10% 20% Consumer 50% Consumer 18% 35% Industrial 89% 20% 12% 75% Logic Aerospace 7% (MCU/SoC) Analog Industrial Infrastructure By Region (1) By Channel (1) Other Japan Distributor VMI (3) APAC 3% 6% 10% 13% Direct sales 29% Japan US 30% 44% 35% APAC 44% 15% EMEA 57% 12% 12% 90% Direct Sales Distributor US and Sole Distributor EMEA Figures are based on FY2015 financials (2) Gartner “Market Share: Semiconductor Devices and Applications, Worldwide, 2015” 31 March © Source: Page 7 2016, 2015 vendor revenue based, graph: Created by Renesas based on Gartner research (1) Company presentation (3) VMI: Vendor Managed Inventory

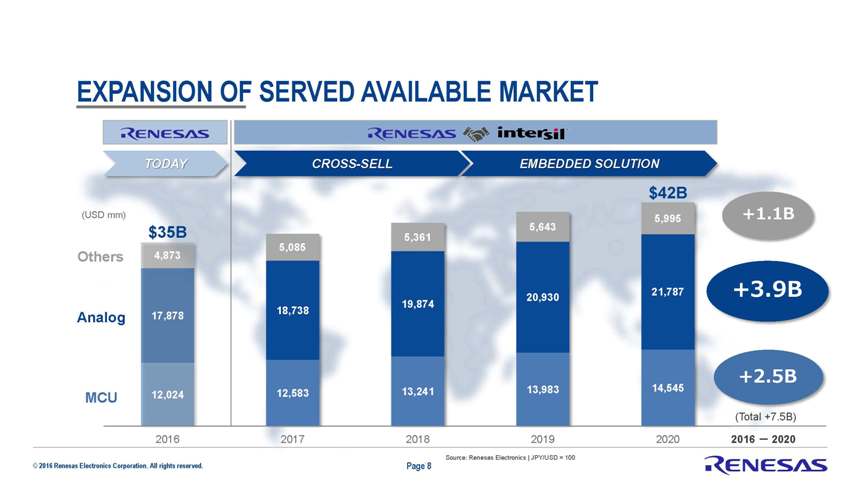

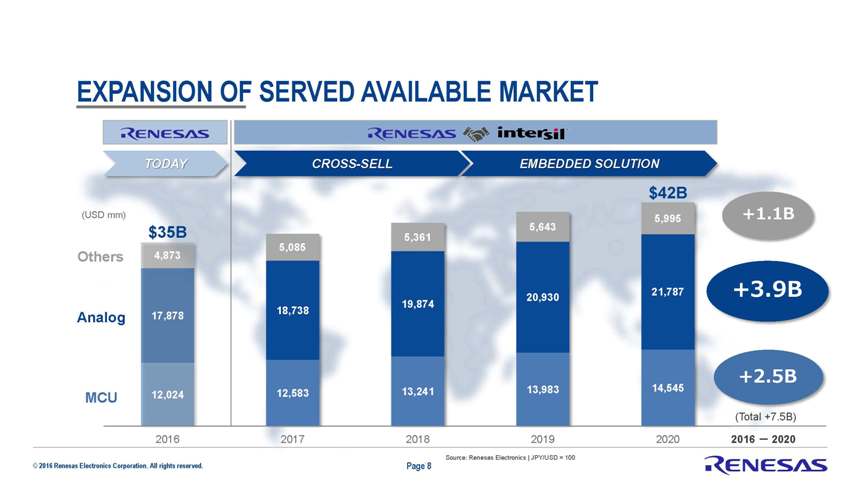

EXPANSION OF SERVED AVAILABLE MARKET TODAY CROSS SELL EMBEDDED SOLUTION $42B (USD mm) 5,995 +1.1B $35B 5,643 5,361 5,085 Others 4,873 21,787 +3.9B 20,930 19,874 18,738 Analog 17,878 14,545 +2.5B 12,583 13,241 13,983 MCU 12,024 (Total +7.5B) 2016 2017 2018 2019 2020 2016 – 2020 Source: Renesas Electronics | JPY/USD = 100 © Page 8

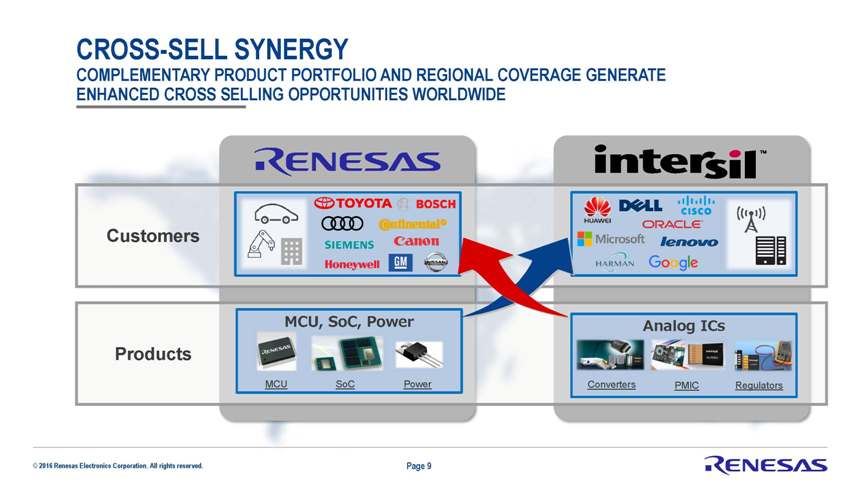

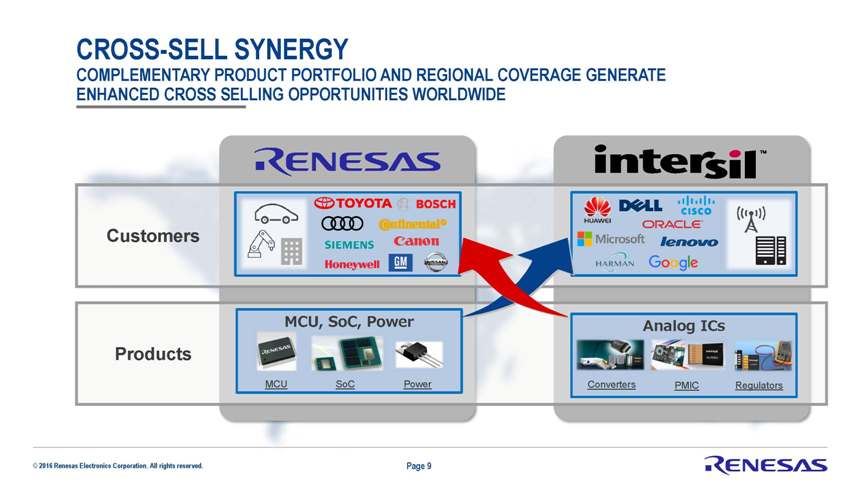

CROSS-SELL SYNERGY COMPLEMENTARY PRODUCT PORTFOLIO AND REGIONAL COVERAGE GENERATE ENHANCED CROSS SELLING OPPORTUNITIES WORLDWIDE Customers MCU, SoC, Power Analog ICs Products MCU SoC Power Converters PMIC Regulators Page 9

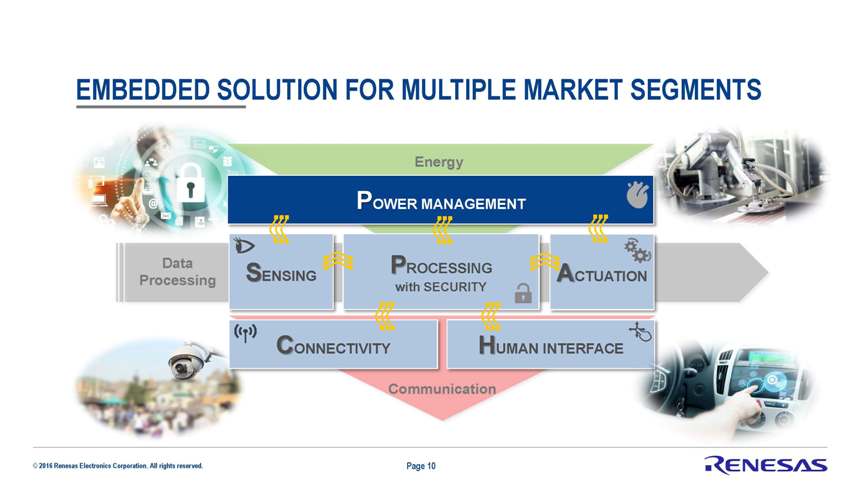

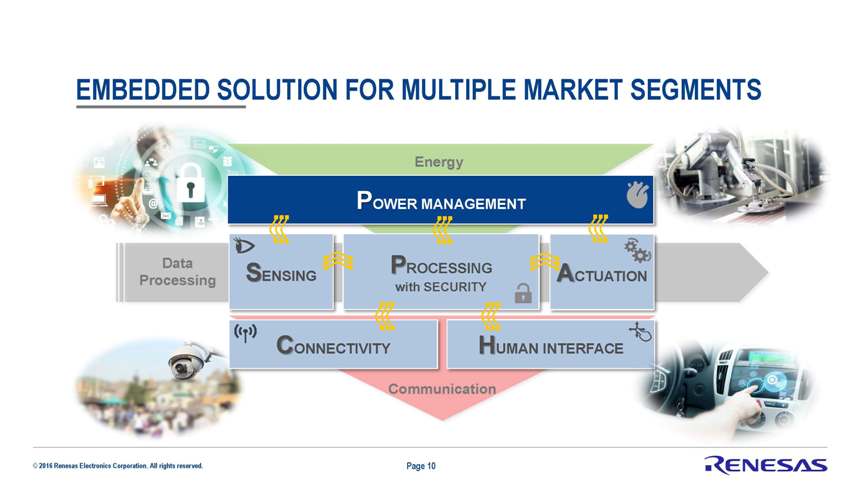

EMBEDDED SOLUTION FOR MULTIPLE MARKET SEGMENTS Energy POWER MANAGEMENT Data S PROCESSING Processing ENSING ACTUATION with SECURITY CONNECTIVITY HUMAN INTERFACE Communication © 2016 Renesas Electronics Corporation. All rights reserved. Page 10

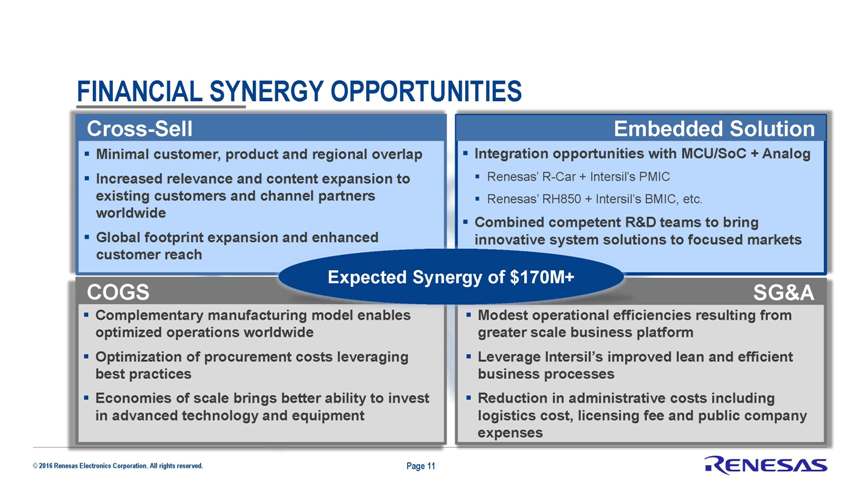

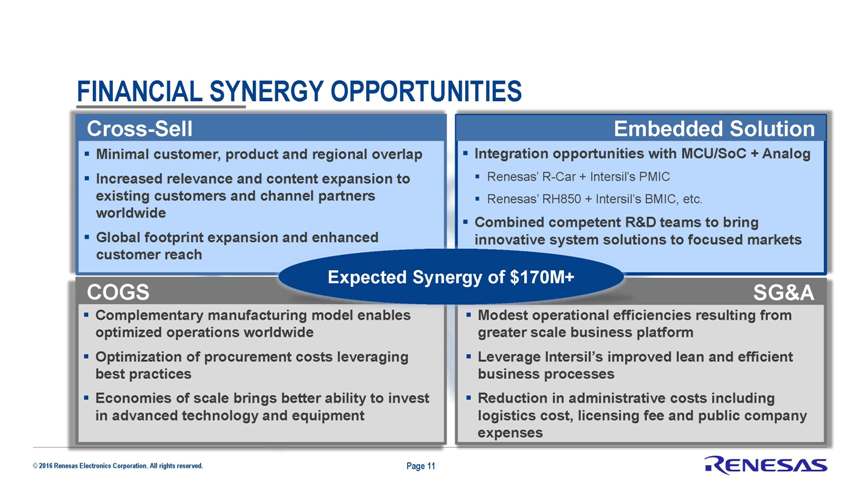

FINANCIAL SYNERGY OPPORTUNITIES Cross-Sell Embedded Solution Minimal customer, product and regional overlap Integration opportunities with MCU/SoC + Analog Increased relevance and content expansion to Renesas’ R-Car + Intersil’s PMIC existing customers and channel partners Renesas’ RH850 + Intersil’s BMIC, etc. worldwide Combined competent R&D teams to bring Global footprint expansion and enhanced innovative system solutions to focused markets customer reach Expected Synergy of $170M+ COGS SG&A Complementary manufacturing model enables Modest operational efficiencies resulting from optimized operations worldwide greater scale business platform Optimization of procurement costs leveraging Leverage Intersil’s improved lean and efficient best practices business processes Economies of scale brings better ability to invest Reduction in administrative costs including in advanced technology and equipment logistics cost, licensing fee and public company expenses © Page 11

VALUES TO OUR STAKEHOLDERS ??Highly complementary businesses accelerate product/technology development to address customers’ system requirements Customers ??Synergistic and broader range of product offerings enable “one-stop” system solution proposition??Accessibility to extensive offering of quality products; Strategic??Enables joint development partners to provide higher level of solution, service and support Business Partners??Brings new value-add business opportunities to strategic partners including R-IN / R-Car consortium partners ??Consistent R&D investment focused on strategic areas to further drive market-leading innovations Employees ??Expanded global business platforms and cross-cultural work environment provide greater opportunities for business and professional growth??Expected to be immediately accretive to key financial statistics such as Non-GAAP gross profit margin and free cash flow Shareholders ??Excellent business combination will drive significant topline and cost synergies in both short and mid-to-long term © Page 12

RENESAS intersilTM

FORWARD-LOOKING STATEMENTS This presentation contains certain statements that are “forward-looking statements” within the meaning of the securities laws. Renesas Electronics Group (hereinafter “Renesas”) and Intersil Corporation (hereinafter “Intersil”) have identified some of these forward-looking statements with words like “believe,” “may,” “could,” “would,” “might,” “possible,” “will,” “should,” “expect,” “intend,” “plan,””anticipate,” or “continue,” the negative of these words, other terms of similar meaning or the use of future dates. Forward-looking statements in this presentation include statements regarding the anticipated benefits of the transaction; statements regarding the expected timing of the completion of the transaction; and any statements of assumptions underlying any of the foregoing. We caution you in advance that actual results, earnings or performance could differ materially from such forward-looking statements due to several factors. The important factors that could cause actual results to differ materially from such statements include, but are not limited to: the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; Intersil’s shareholders failing to approve the merger; a competing proposal being made; and the possibility that various closing conditions for the transaction may not be satisfied or waived, including that required governmental approvals of the merger may not be obtained or may not be obtained on the terms expected or on the anticipated schedule, and adverse regulatory conditions may be imposed in connection with any such governmental approvals. Among other factors, general economic conditions in our markets, which are primarily Japan, North America, Asia and Europe; demand for, and competitive pricing pressure on, our products and services in the marketplace; our ability to continue to win acceptance of its products and services in these highly competitive markets; movements in currency exchange rates, particularly the rate between the yen and the U.S. dollar; a worsening of the world economy; a worsening of financial conditions in the world markets, and a deterioration in the domestic and overseas stock markets, could cause actual results to differ from the projected results forecast. These forward-looking statements are made only as of the date of this communication and Renesas undertakes no obligation to update or revise these forward-looking statements. Renesas does not adopt and is not responsible for any forward-looking statements and projections made by others in this presentation. Additional Information and Where to Find It This communication may be deemed to be solicitation material in respect of the proposed acquisition of Intersil by Renesas. In connection with the acquisition, Interesil intends to file relevant materials with the SEC, including a proxy statement on Schedule 14A. SECURITY HOLDERS OF INTERSIL ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING INTERSIL’S PROXY STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain the documents free of charge at the SEC’s web site, www.sec.gov, and may obtain documents filed by Intersil free of charge from Intersil’s website at http://www.intersil.com. In addition, the proxy statement and other documents filed by Intersil with the SEC (when available) may be obtained from Intersil free of charge by directing a request to Intersil Corporation, investor@intersil.com. Participants in the Solicitation Intersil and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Intersil investors and security holders in connection with the contemplated transactions. Information about Intersil’s directors and executive officers is set forth in its proxy statement for its 2016 Annual Meeting of Stockholders. The document may be obtained for free at the SEC’s website at www.sec.gov. Additional information regarding the interests of participants in the solicitation of proxies in connection with the contemplated transactions will be included in the proxy statement that Intersil intends to file with the SEC. © 2016 Renesas Electronics Corporation. All rights reserved.