UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| x | | Soliciting Material under §240.14a-12 |

Intersil Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

Intersil and Renesas Better Together

Additional Information and Where to Find It This communication is being made in respect of the proposed transaction involving Intersil and Renesas. Intersil intends to file with the SEC a proxy statement in connection with the proposed transaction with Renesas as well as other documents regarding the proposed transaction. The definitive proxy statement will be sent or given to the stockholders of Intersil and will contain important information about the proposed transaction and related matters. INTERSIL’S SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT REGARDING THE PROPOSED TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. The proxy statement and other relevant materials (when they become available), and any other documents filed by Intersil with the SEC, may be obtained free of charge at the SEC’s website, at www.sec.gov. In addition, security holders of Intersil will be able to obtain free copies of the proxy statement through Intersil’s website, www.intersil.com, or by contacting Intersil by mail at Attn: Corporate Secretary, 1001 Murphy Ranch Road, Milpitas, California 95035. Participants in the Solicitation Intersil, Renesas, and their respective directors, executive officers and other members of management and certain of their respective employees may be deemed to be participants in the solicitation of proxies in connection with the proposed merger. Information about Intersil’s directors and executive officers is included in Intersil’s Annual Report on Form 10-K for the fiscal year ended January 1, 2016 filed with the SEC on February 12, 2016, and the proxy statement filed with the SEC on March 4, 2016 for Intersil’s annual meeting of stockholders held on April 21, 2016. Additional information regarding these persons and their interests in the merger will be included in the proxy statement relating to the proposed merger when it is filed with the SEC. These documents, when available, can be obtained free of charge from the sources indicated above. Safe Harbor for Forward-looking Statements Throughout this document pertaining to the merger transaction between Intersil and Renesas, Intersil makes forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995, within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended. You should not place undue reliance on these statements. These forward-looking statements include statements that reflect the current expectations, estimates, beliefs, assumptions, and projections of Intersil’s senior management about future events with respect to Intersil’s business and its industry in general. Statements that include words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “believes,” “seeks,” “estimates,” “may,” “will,” “should,” “would,” “potential,” “continue,” “goals,” “targets” and variations of these words (or negatives of these words) or similar expressions of a future or forward-looking nature identify forward-looking statements. In addition, any statements that refer to projections or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Although Intersil believes the expectations reflected in any forward-looking statements are reasonable, they involve known and unknown risks and uncertainties, are not guarantees of future performance, and actual results, performance or achievements may differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements and any or all of Intersil’s forward-looking statements may prove to be incorrect. Consequently, no forward-looking statements may be guaranteed and there can be no assurance that the actual results or developments anticipated by such forward looking statements will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, Intersil or its businesses or operations. Factors which could cause Intersil’s actual results to differ from those projected or contemplated in any such forward-looking statements include, but are not limited to, the following factors: the ability of the parties to consummate the merger transaction in a timely manner or at all; satisfaction of the conditions precedent to consummation of the merger transaction, including the ability to secure regulatory approvals in a timely manner or at all, and approval by Intersil’s stockholders; the possibility of litigation and other unknown liabilities; the parties’ ability to successfully integrate their operations, product lines, technology and employees and realize synergies and other benefits from the merger transaction; the potential impact of the announcement or consummation of the merger transaction on the parties’ relationships with customers, suppliers and other third parties; and other risks described in Intersil’s filings with the SEC. The foregoing review of important factors that could cause actual events to differ from expectations should not be construed as exhaustive and should be read in conjunction with statements that are included herein and elsewhere, including the risk factors included in Intersil’s most recent Annual Report on Form 10-K, and Intersil’s more recent Quarterly Report on Form 10-Q and Current Reports on Form 8-K filed with the SEC (which you may obtain for free at the SEC's website at http://www.sec.gov or on Intersil’s website at http://ir.intersil.com). Intersil can give no assurance that the conditions to the merger will be satisfied. Except as required by applicable law, Intersil cannot undertake any obligation to revise or update any forward-looking statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise. Intersil does not intend, and assumes no obligation, to update any forward-looking statements. Additional Information and Forward-looking Statements

Slowing industry growth and strong balance sheets make M&A attractive Companies can gain scale and increase market share, growing through consolidation Since 2013, more than a third of the companies in the S&P semi index have been acquired Best long-term outcomes are acquisitions with a strong strategic rationale Good product, technology and end market alignment driving the combination A Consolidating Industry

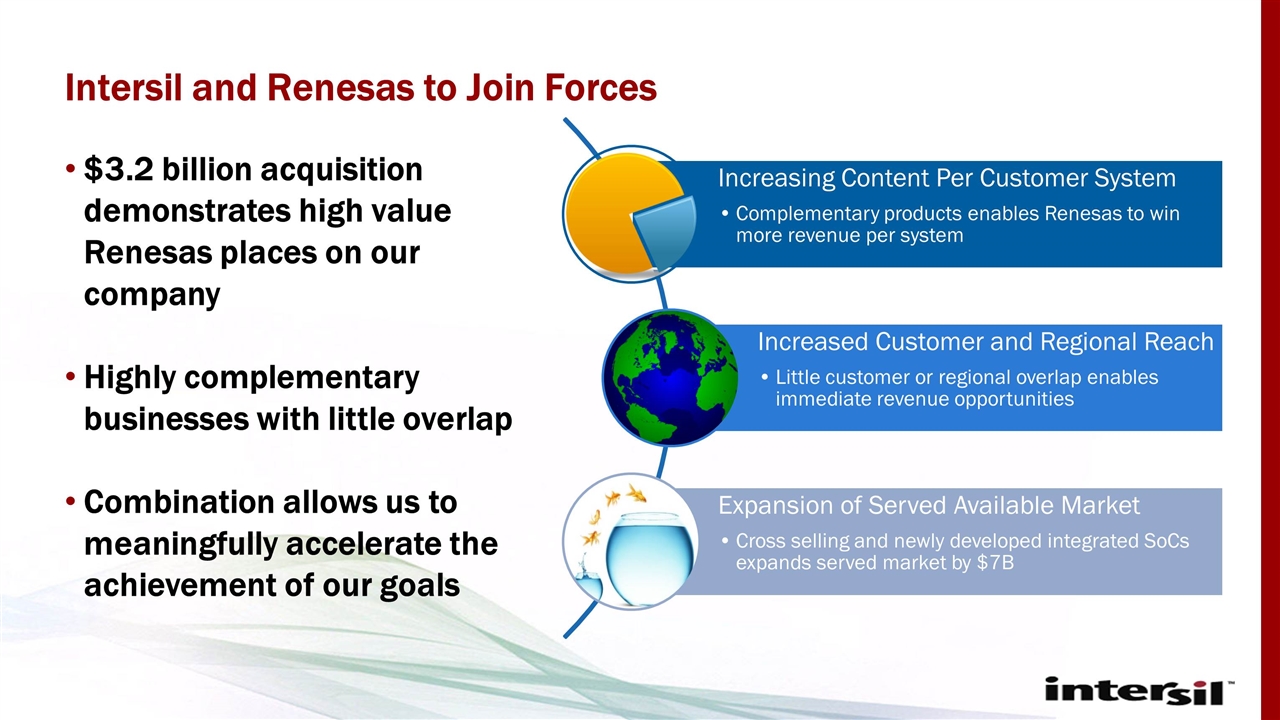

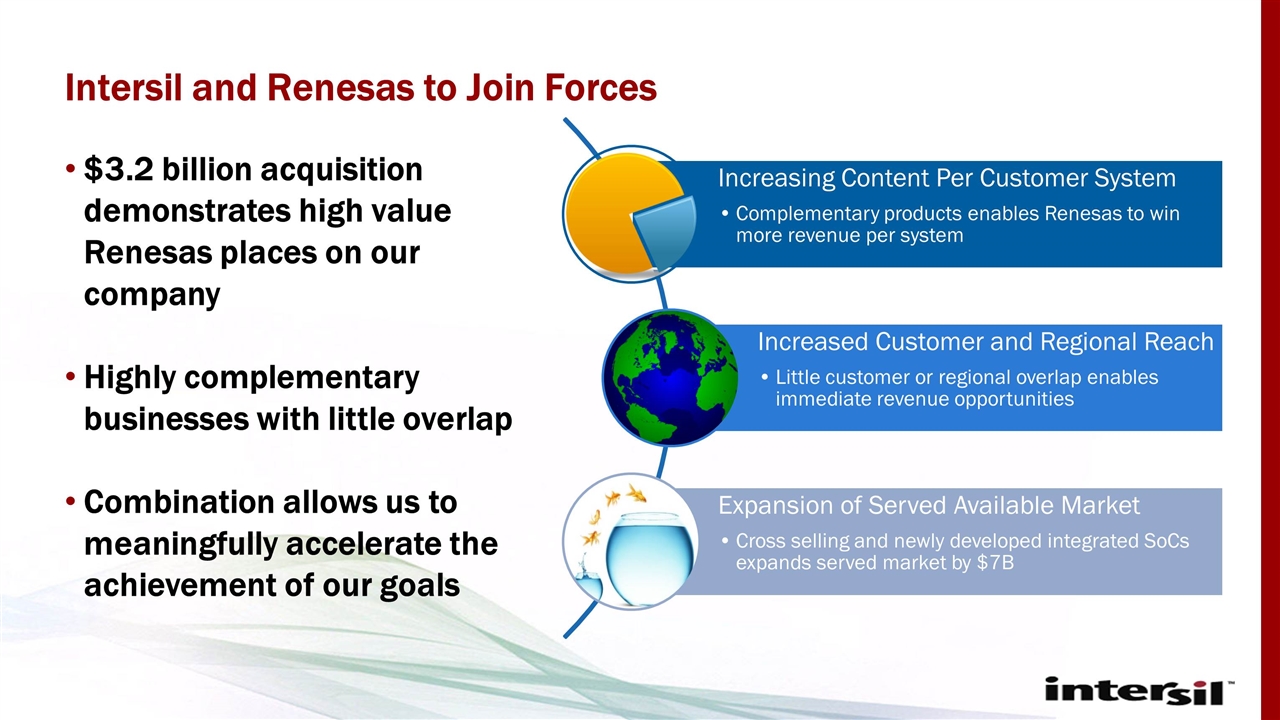

$3.2 billion acquisition demonstrates high value Renesas places on our company Highly complementary businesses with little overlap Combination allows us to meaningfully accelerate the achievement of our goals Intersil and Renesas to Join Forces Increasing Content Per Customer System Increased Customer and Regional Reach Cross selling and newly developed integrated SoCs expands served market by $7B Complementary products enables Renesas to win more revenue per system Little customer or regional overlap enables immediate revenue opportunities Expansion of Served Available Market

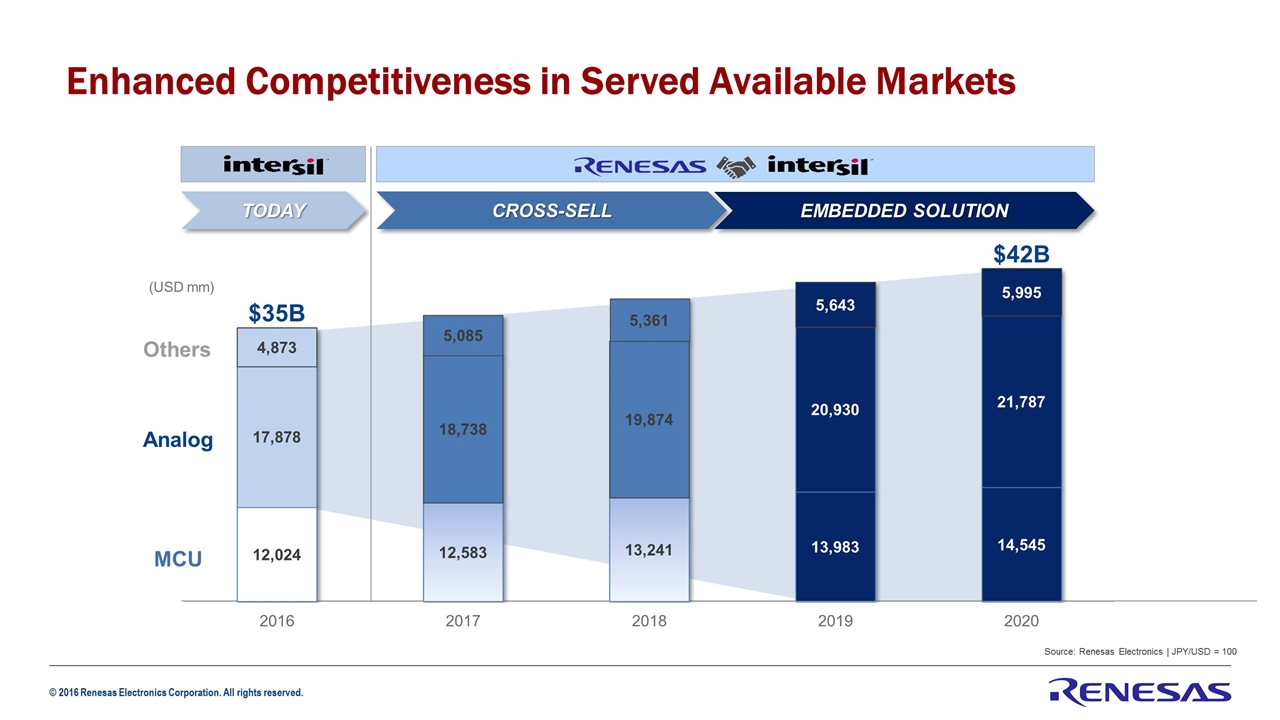

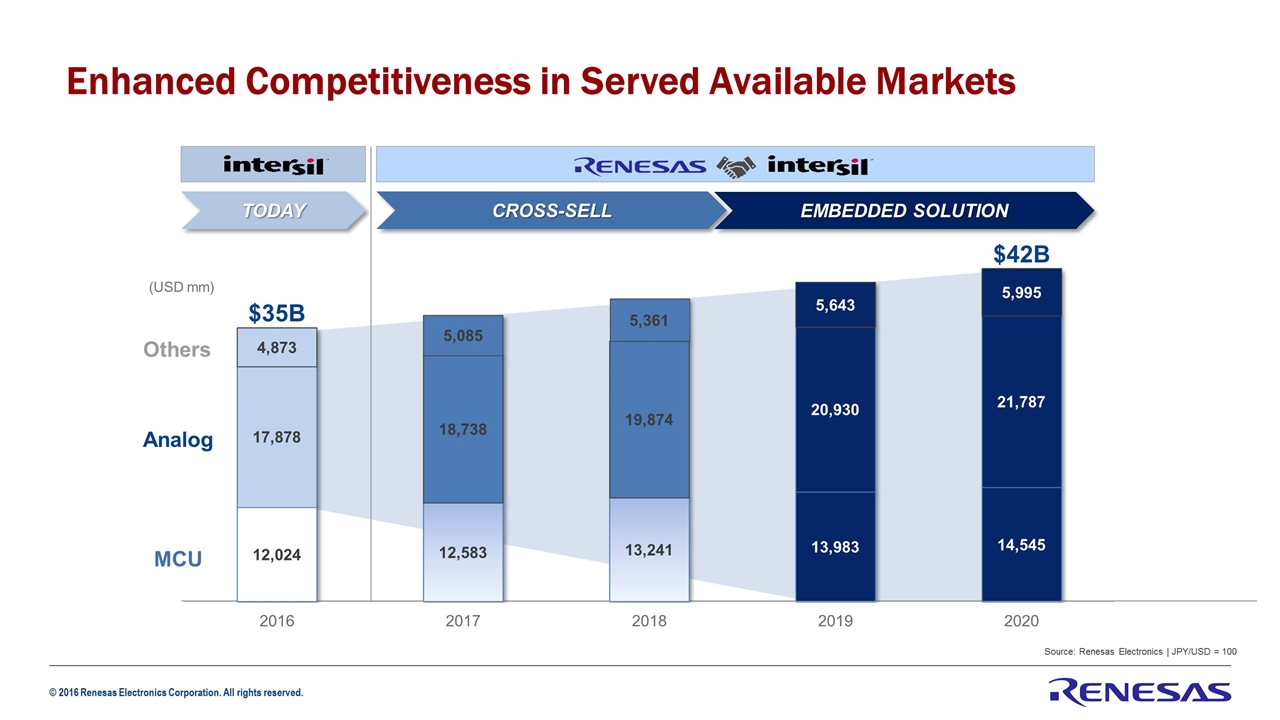

Source: Renesas Electronics | JPY/USD = 100 Enhanced Competitiveness in Served Available Markets (USD mm) Analog MCU Others $35B $42B CROSS-SELL EMBEDDED SOLUTION TODAY

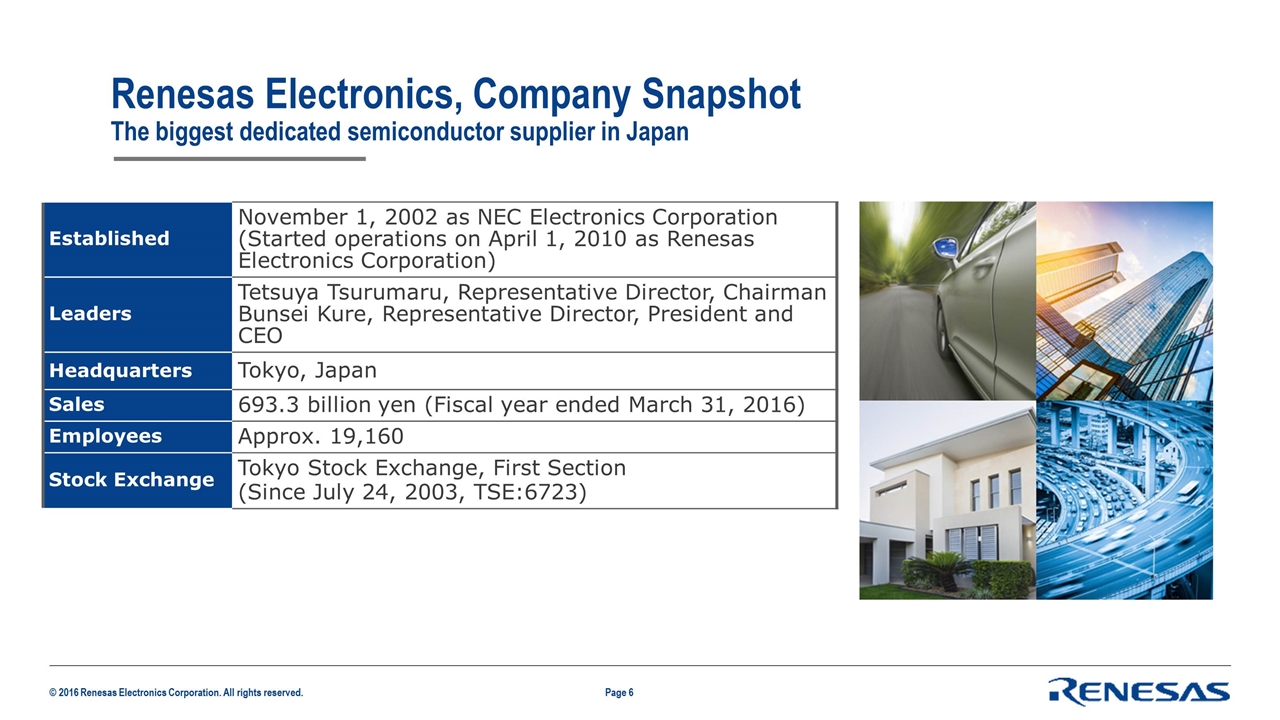

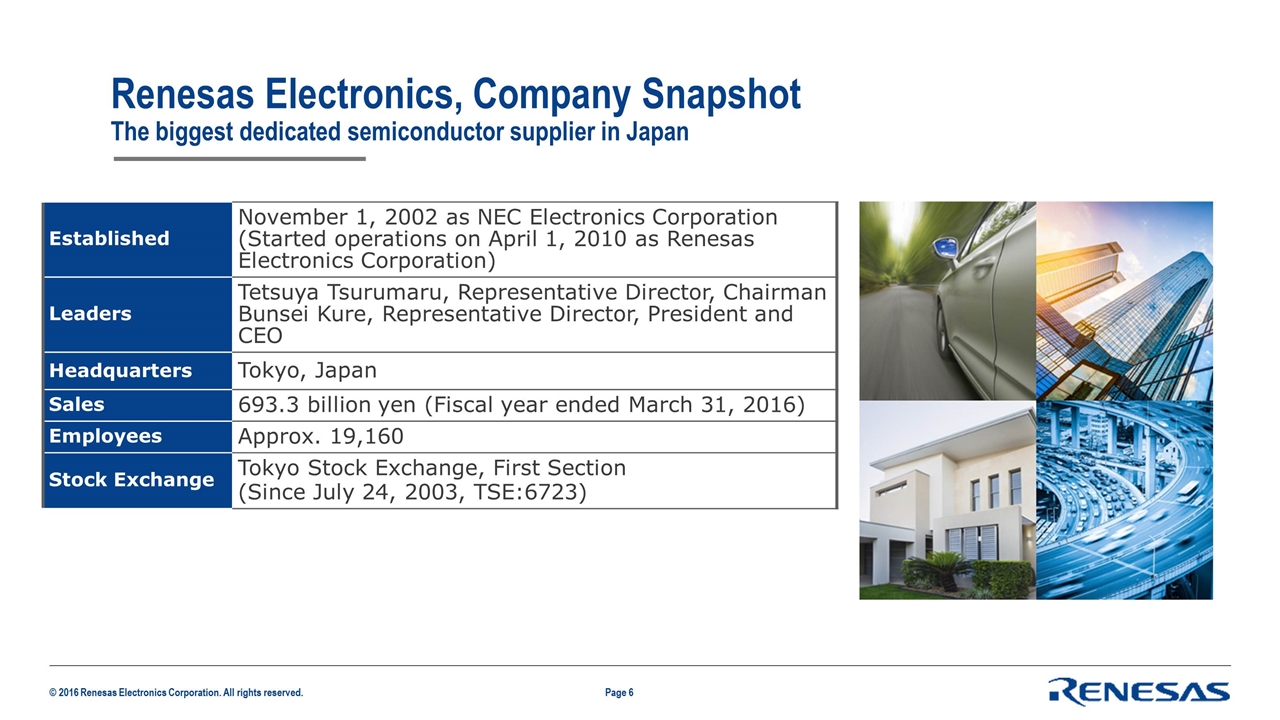

Page Renesas Electronics, Company Snapshot The biggest dedicated semiconductor supplier in Japan Established November 1, 2002 as NEC Electronics Corporation (Started operations on April 1, 2010 as Renesas Electronics Corporation) Leaders Tetsuya Tsurumaru, Representative Director, Chairman Bunsei Kure, Representative Director, President and CEO Headquarters Tokyo, Japan Sales 693.3 billion yen (Fiscal year ended March 31, 2016) Employees Approx. 19,160 Stock Exchange Tokyo Stock Exchange, First Section (Since July 24, 2003, TSE:6723)

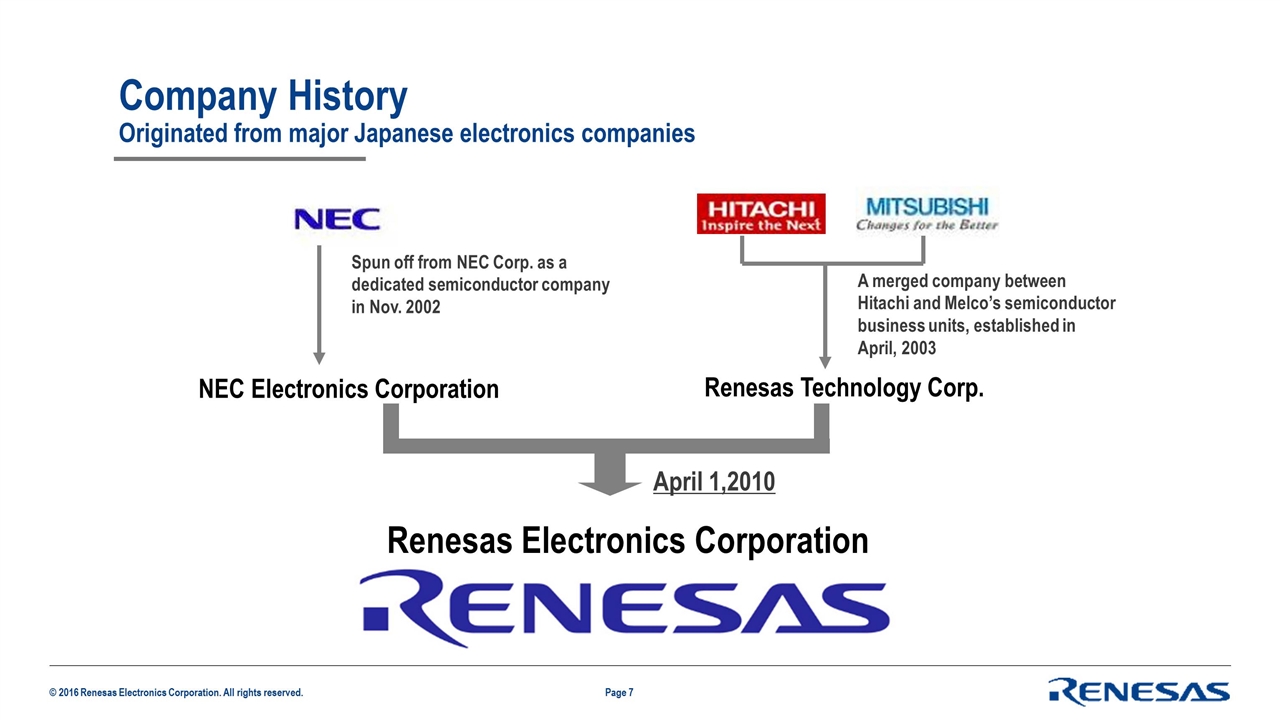

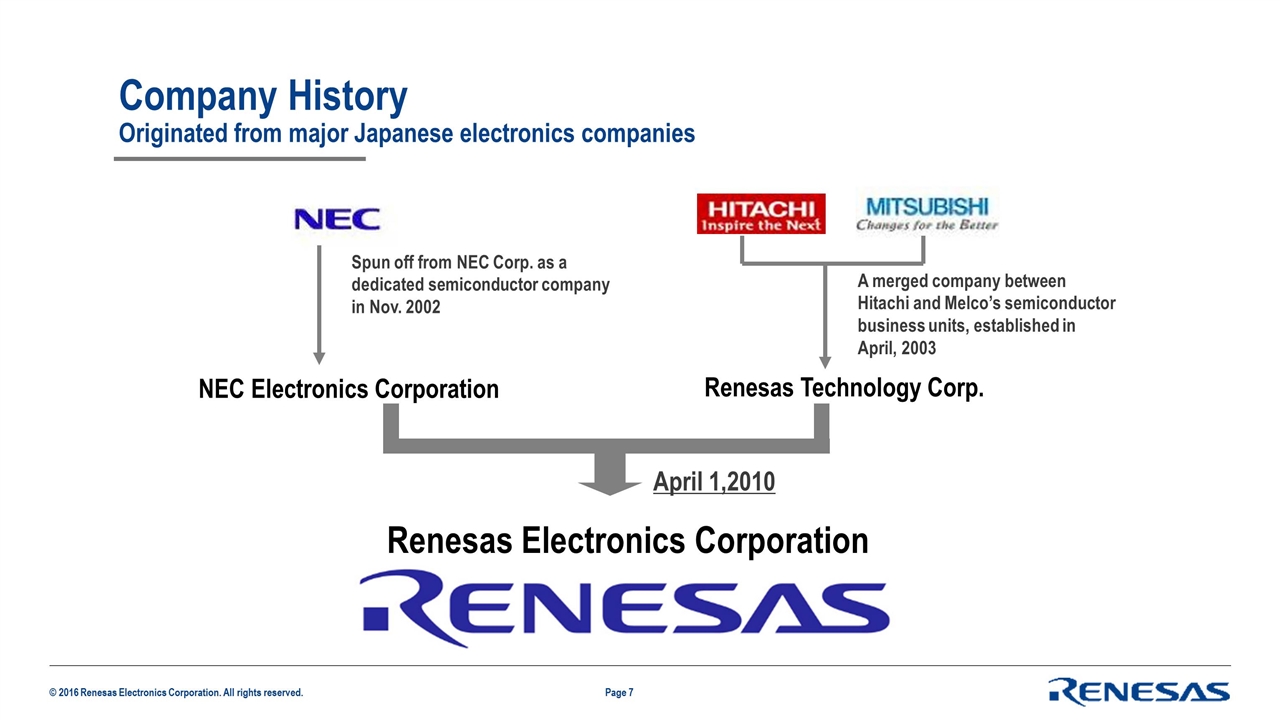

Company History Originated from major Japanese electronics companies Renesas Technology Corp. NEC Electronics Corporation Renesas Electronics Corporation April 1,2010 Spun off from NEC Corp. as a dedicated semiconductor company in Nov. 2002 A merged company between Hitachi and Melco’s semiconductor business units, established in April, 2003 Page

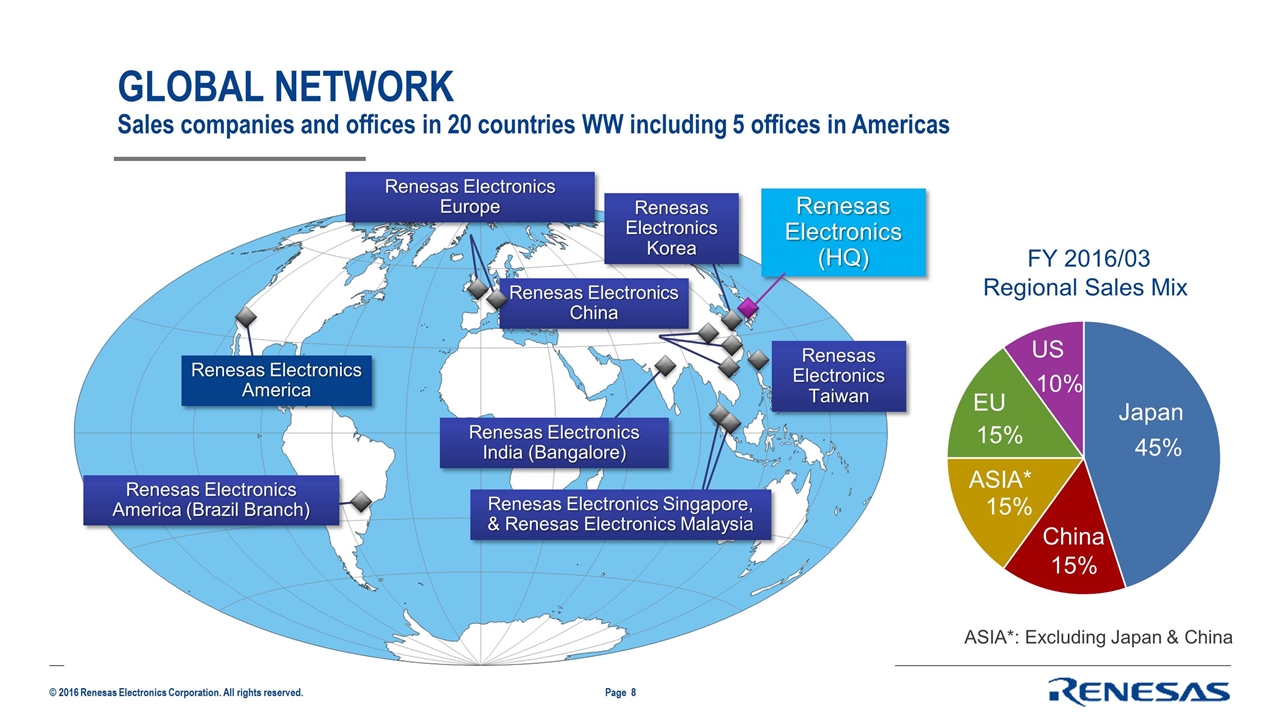

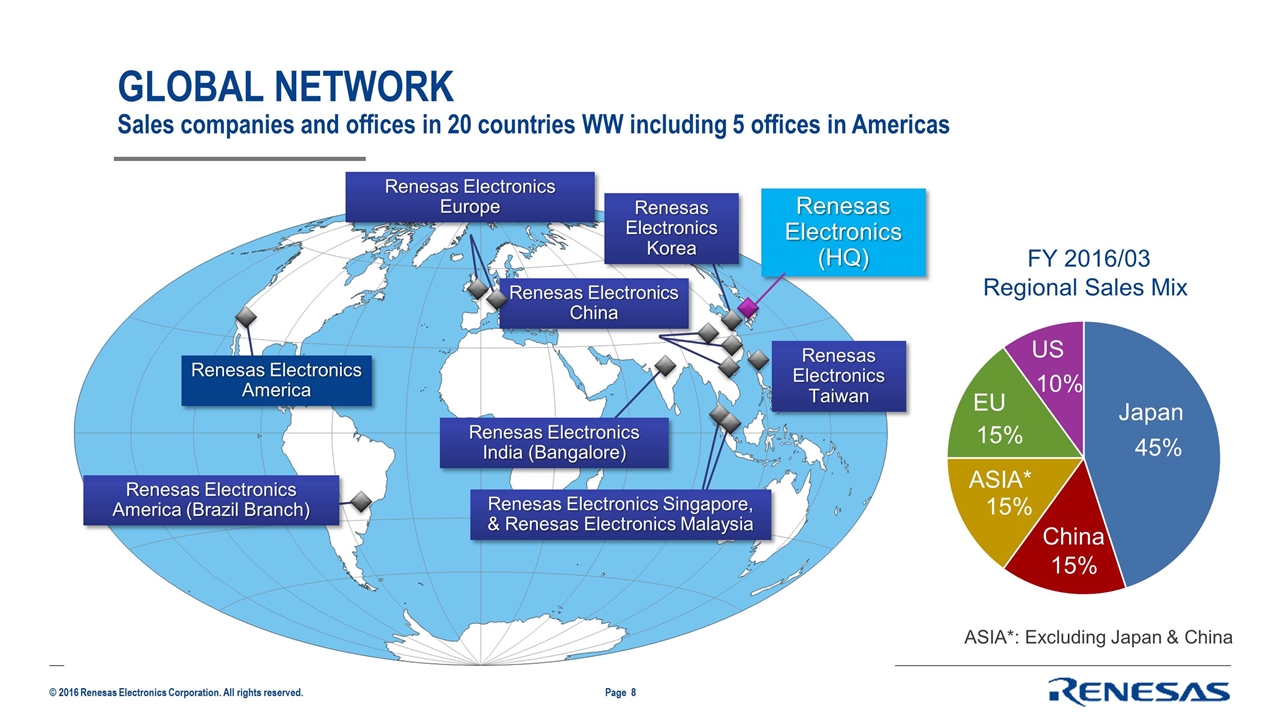

GLOBAL NETWORK Sales companies and offices in 20 countries WW including 5 offices in Americas Page Renesas Electronics (HQ) Renesas Electronics Taiwan Renesas Electronics Korea Renesas Electronics China Renesas Electronics Singapore, & Renesas Electronics Malaysia Renesas Electronics India (Bangalore) Renesas Electronics Europe Renesas Electronics America (Brazil Branch) Renesas Electronics America FY 2016/03 Regional Sales Mix Japan China ASIA* ASIA*: Excluding Japan & China EU US

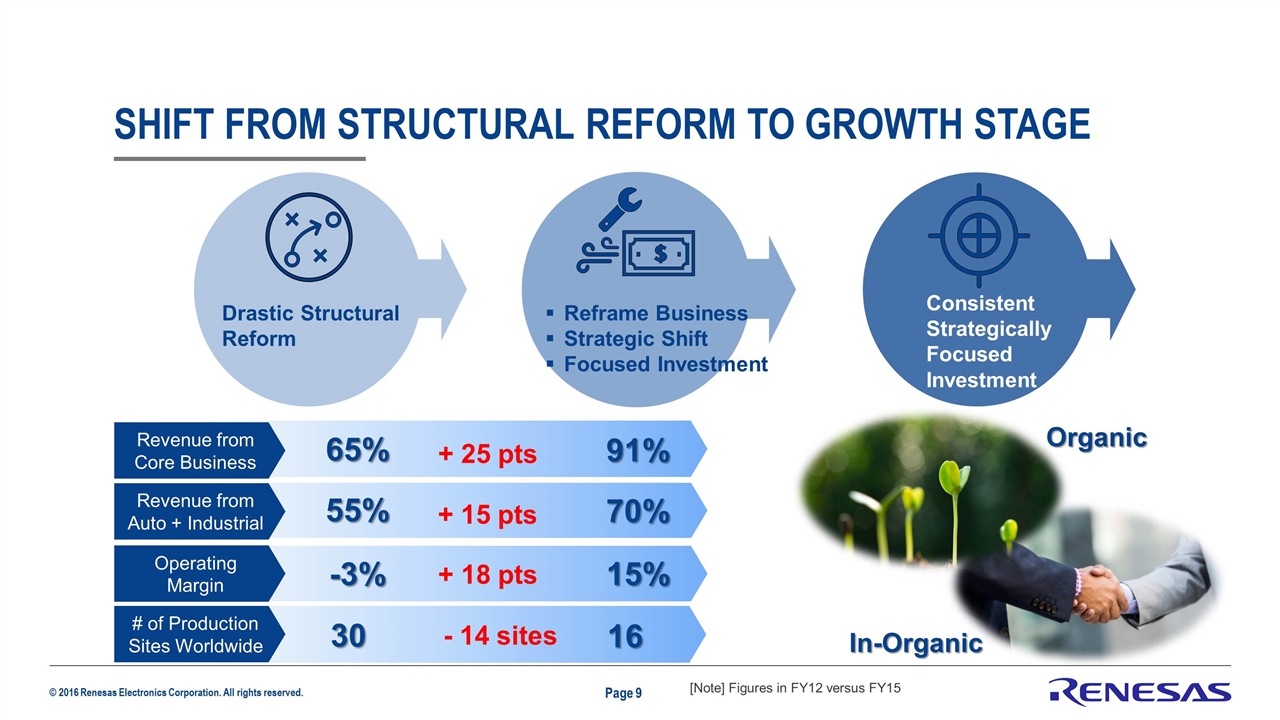

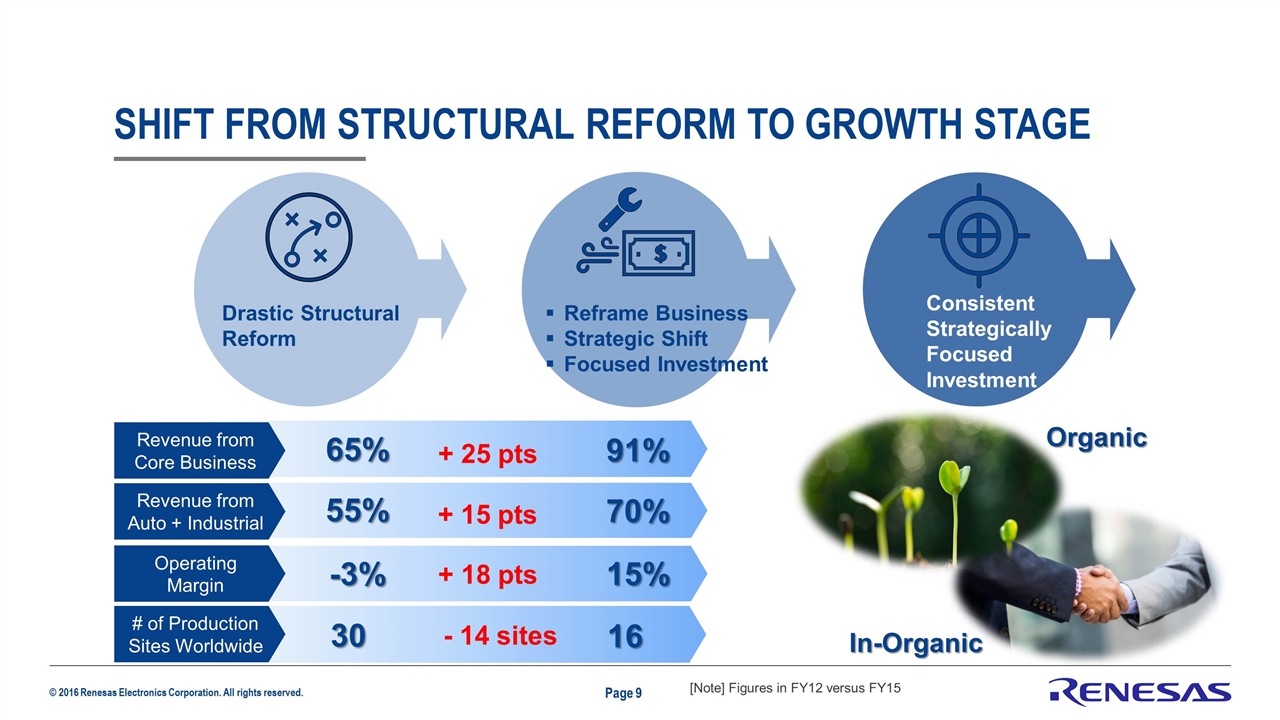

Page Shift from structural reform to growth stage Drastic Structural Reform Reframe Business Strategic Shift Focused Investment Consistent Strategically Focused Investment [Note] Figures in FY12 versus FY15 65% 91% + 25 pts Revenue from Core Business -3% 15% + 18 pts Operating Margin 30 16 - 14 sites # of Production Sites Worldwide 55% 70% + 15 pts Revenue from Auto + Industrial In-Organic Organic

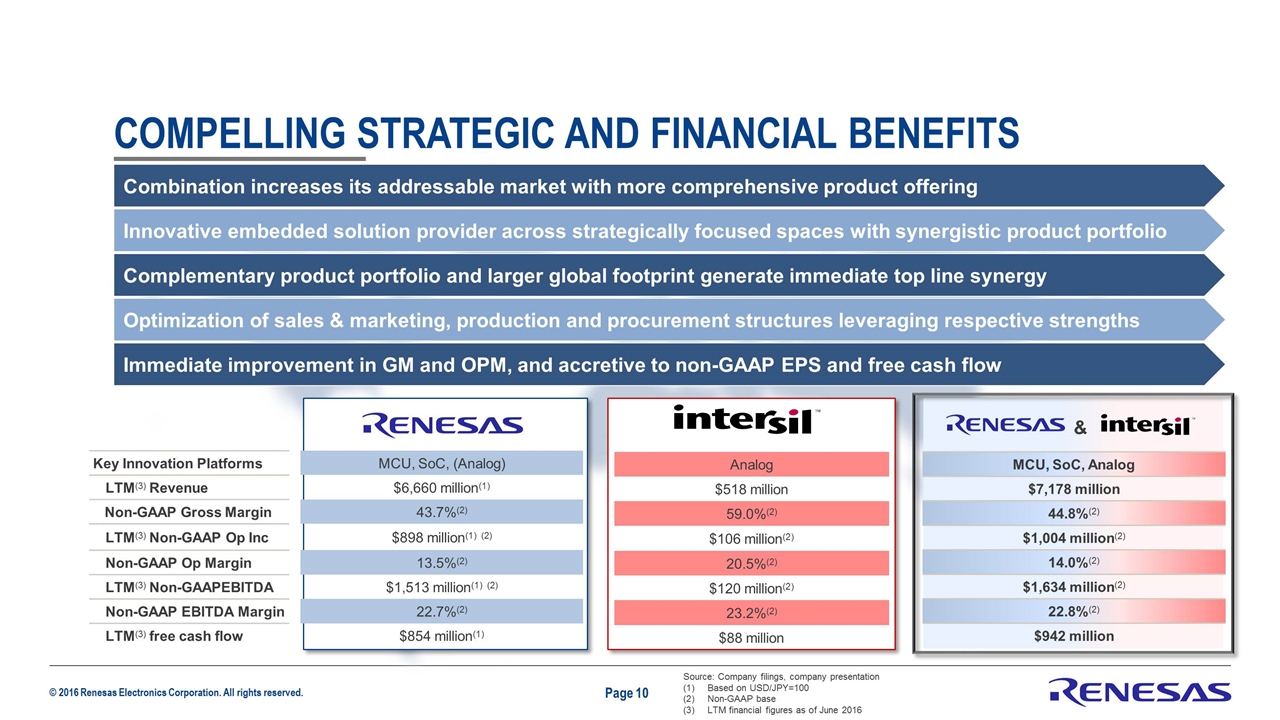

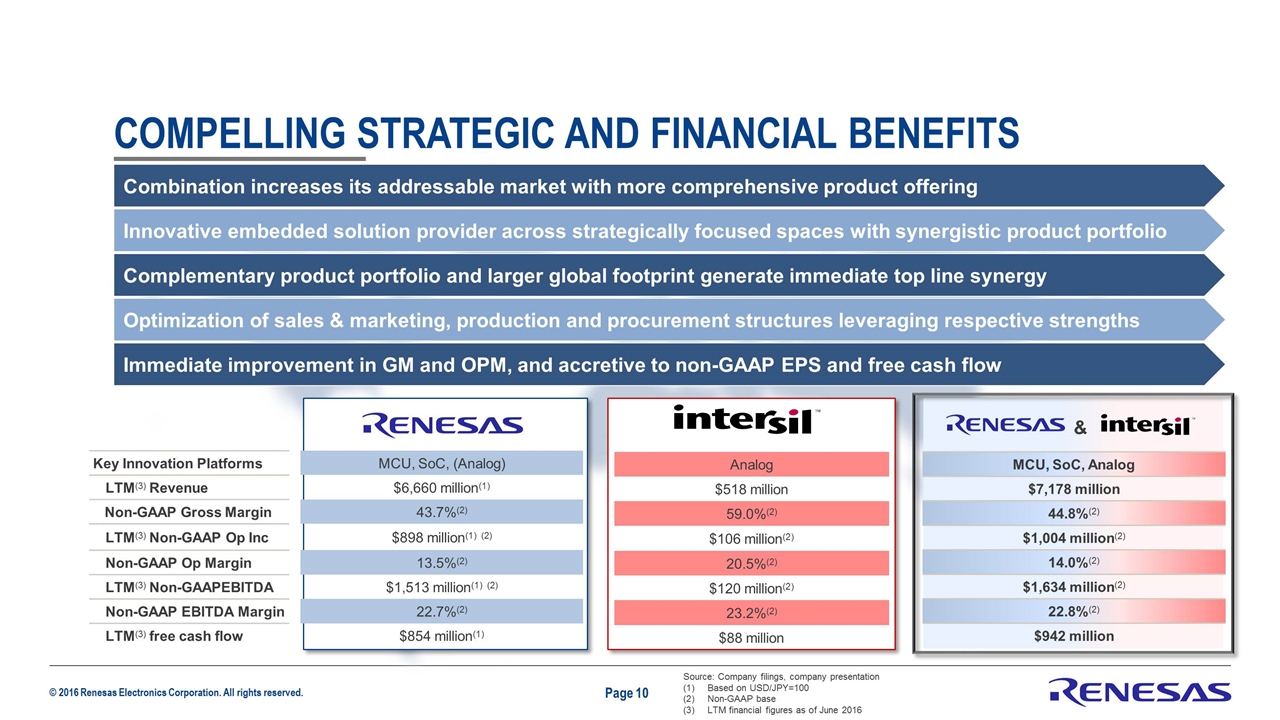

Page Compelling Strategic and Financial Benefits Source: Company filings, company presentation Based on USD/JPY=100 Non-GAAP base LTM financial figures as of June 2016 Key Innovation Platforms MCU, SoC, (Analog) LTM(3) Revenue $6,660 million(1) Non-GAAP Gross Margin 43.7%(2) LTM(3) Non-GAAP Op Inc $898 million(1) (2) Non-GAAP Op Margin 13.5%(2) LTM(3) Non-GAAPEBITDA $1,513 million(1) (2) Non-GAAP EBITDA Margin 22.7%(2) LTM(3) free cash flow $854 million(1) MCU, SoC, Analog $7,178 million 44.8%(2) $1,004 million(2) 14.0%(2) $1,634 million(2) 22.8%(2) $942 million & Analog $518 million 59.0%(2) $106 million(2) 20.5%(2) $120 million(2) 23.2%(2) $88 million Combination increases its addressable market with more comprehensive product offering Innovative embedded solution provider across strategically focused spaces with synergistic product portfolio Complementary product portfolio and larger global footprint generate immediate top line synergy Optimization of sales & marketing, production and procurement structures leveraging respective strengths Immediate improvement in GM and OPM, and accretive to non-GAAP EPS and free cash flow

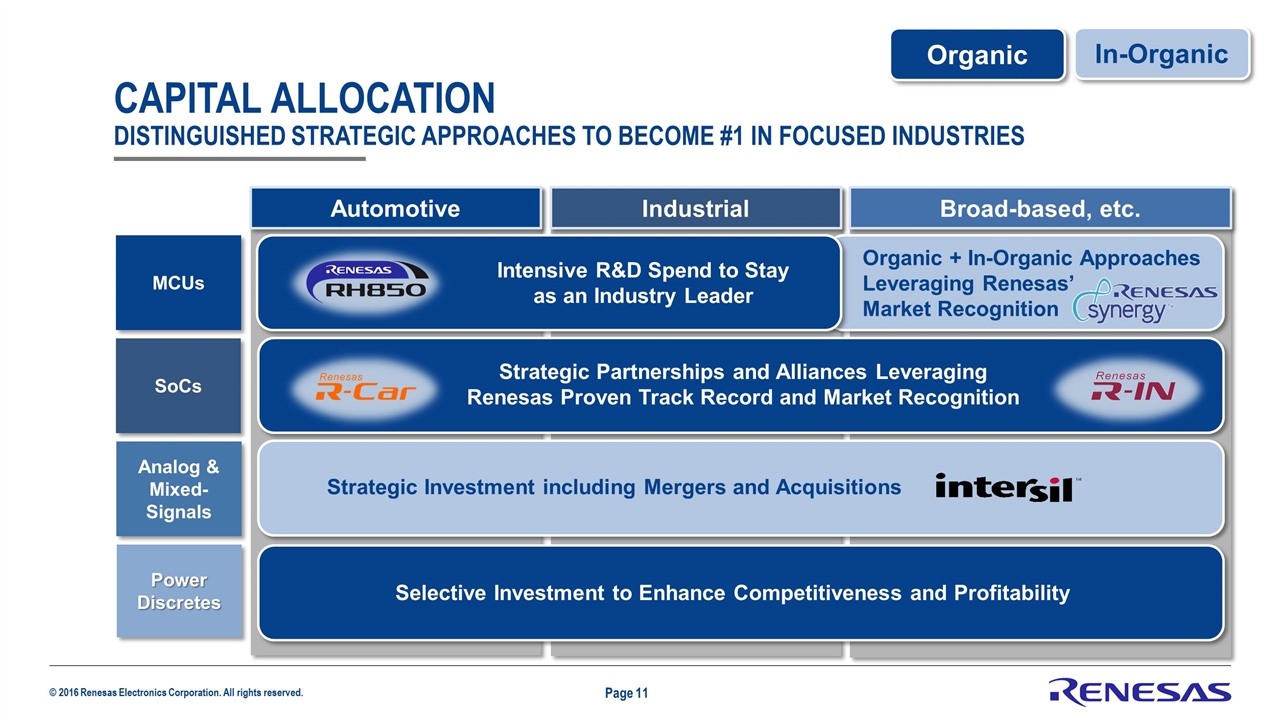

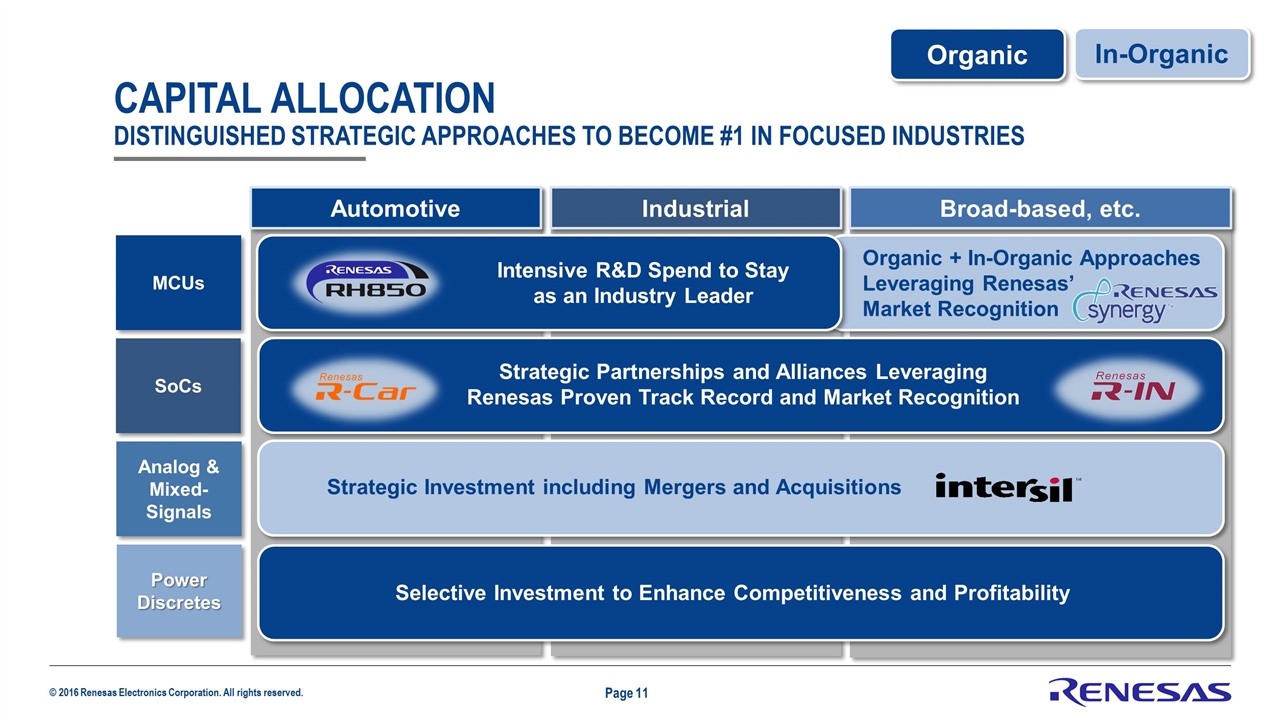

Page Capital allocation distinguished strategic approaches to become #1 in focused industries Organic In-Organic Automotive Industrial Broad-based, etc. SoCs MCUs Analog & Mixed-Signals Power Discretes Organic + In-Organic Approaches Leveraging Renesas’ Market Recognition Strategic Partnerships and Alliances Leveraging Renesas Proven Track Record and Market Recognition Intensive R&D Spend to Stay as an Industry Leader Strategic Investment including Mergers and Acquisitions Selective Investment to Enhance Competitiveness and Profitability

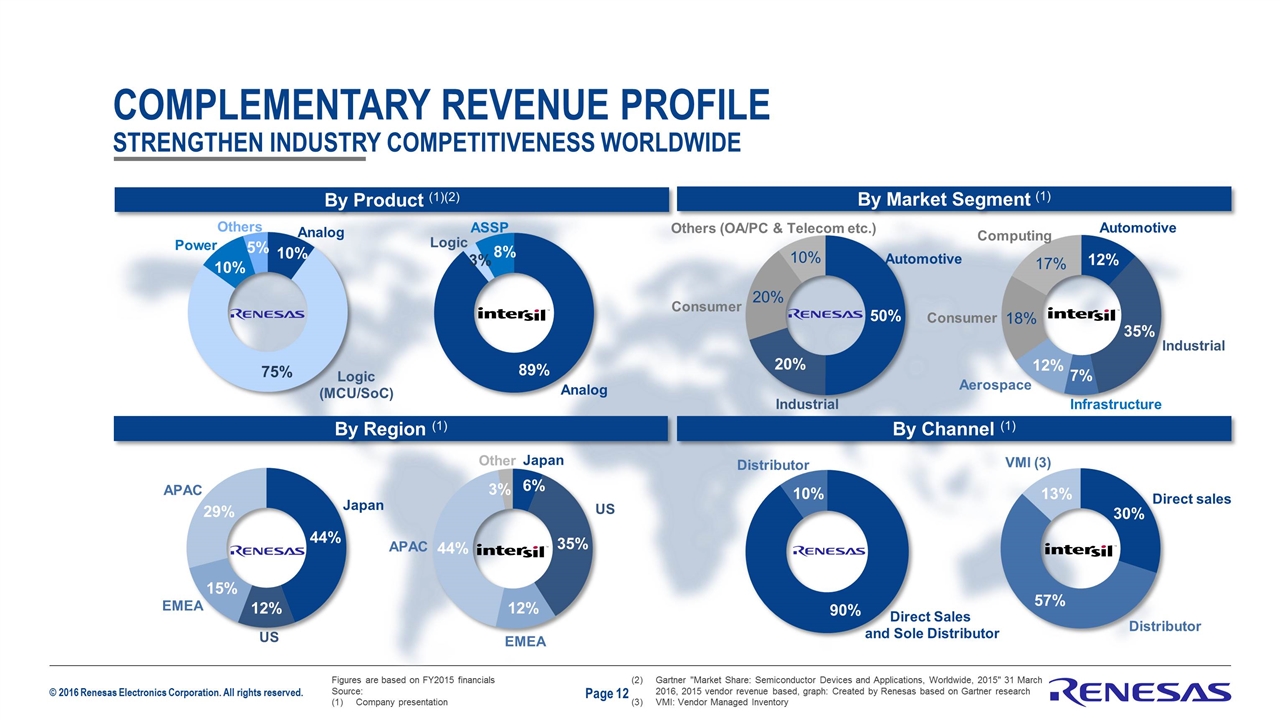

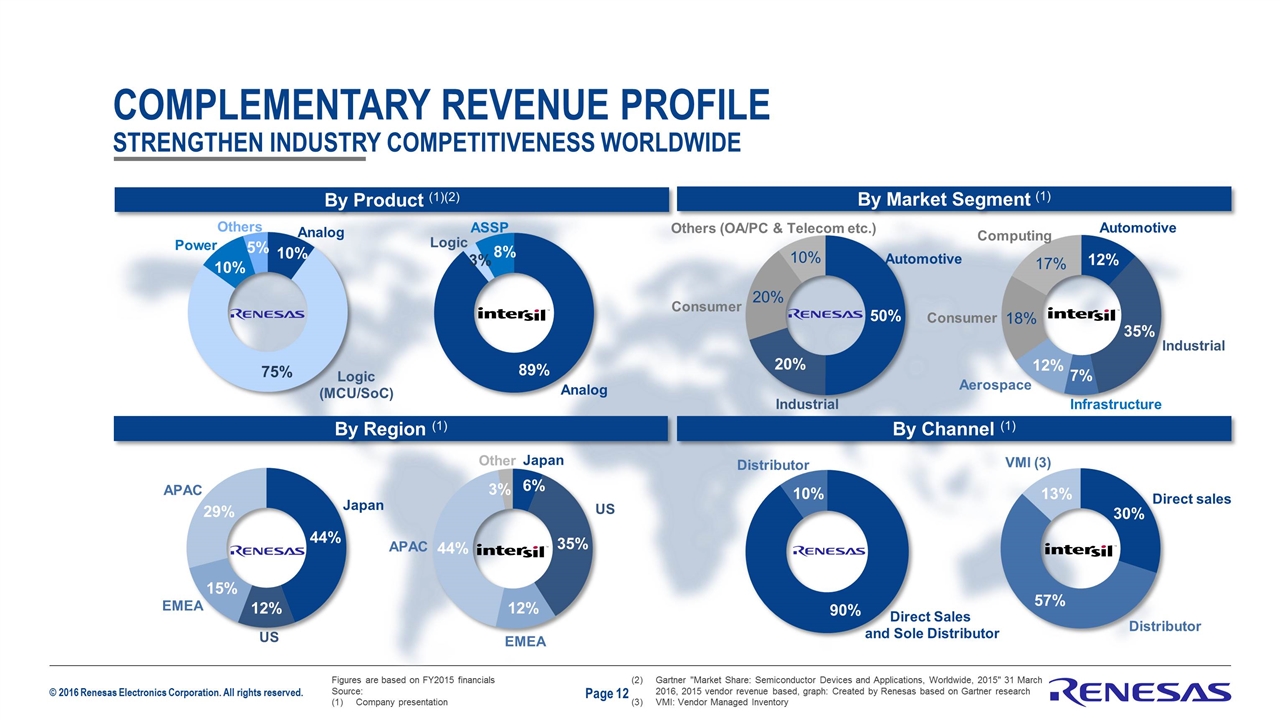

Complementary Revenue Profile strengthen industry competitiveness worldwide Page By Product (1)(2) By Market Segment (1) By Region (1) By Channel (1) Automotive Industrial Infrastructure Aerospace Computing US EMEA APAC Other Japan Consumer Analog Logic (MCU/SoC) Power Others Japan US EMEA APAC Direct Sales and Sole Distributor Distributor Direct sales Distributor VMI (3) Automotive Industrial Consumer Others (OA/PC & Telecom etc.) Analog Logic ASSP Figures are based on FY2015 financials Source: Company presentation Gartner "Market Share: Semiconductor Devices and Applications, Worldwide, 2015" 31 March 2016, 2015 vendor revenue based, graph: Created by Renesas based on Gartner research VMI: Vendor Managed Inventory

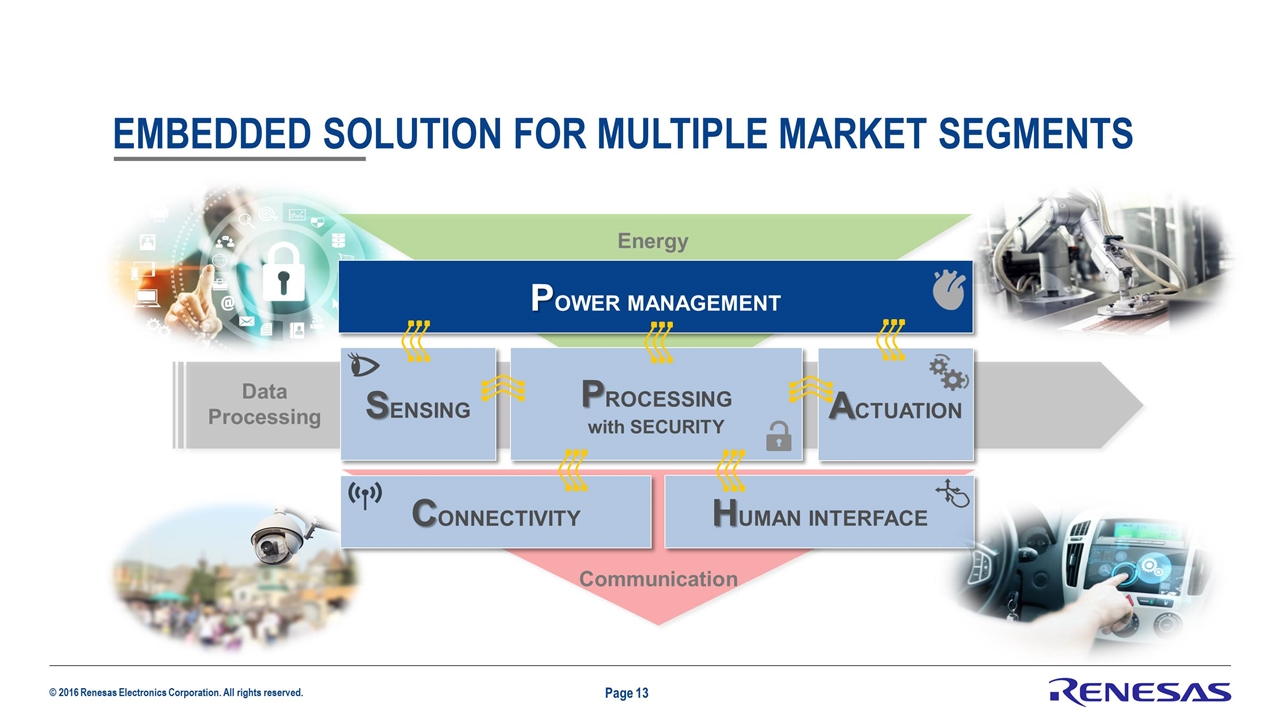

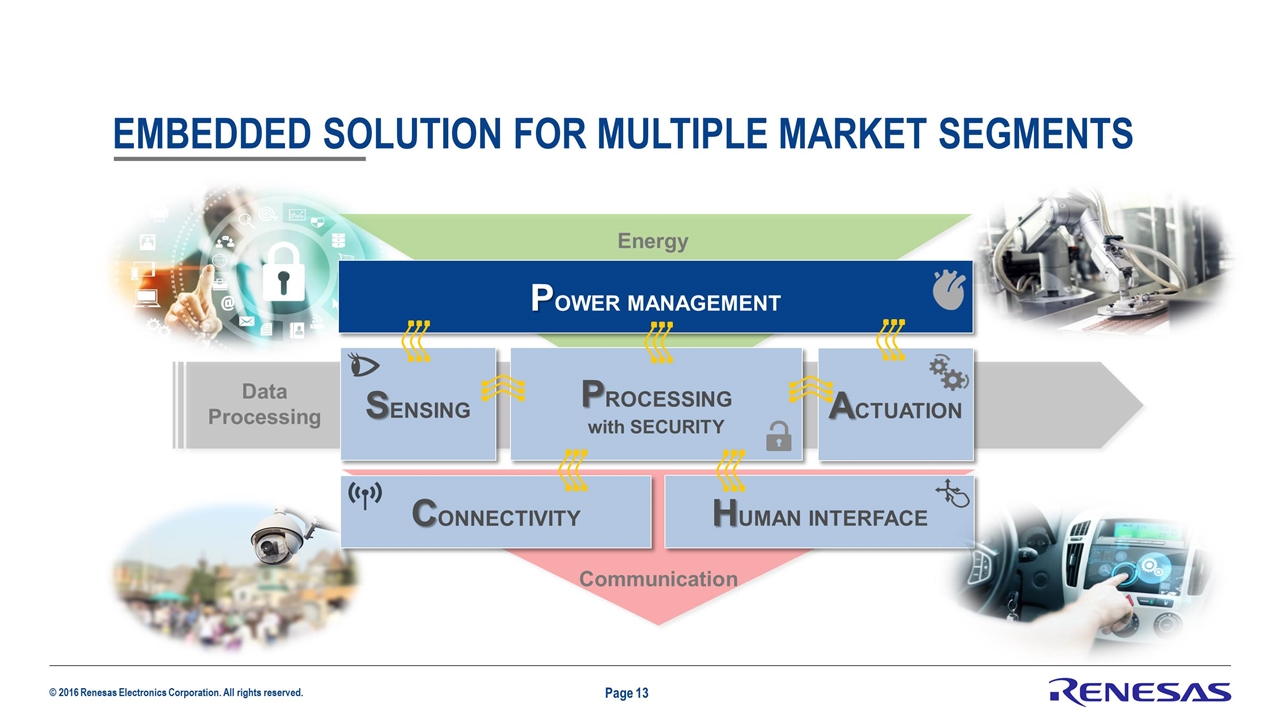

Page Embedded Solution for Multiple Market Segments POWER MANAGEMENT PROCESSING with SECURITY SENSING ACTUATION HUMAN INTERFACE CONNECTIVITY Data Processing Energy Communication

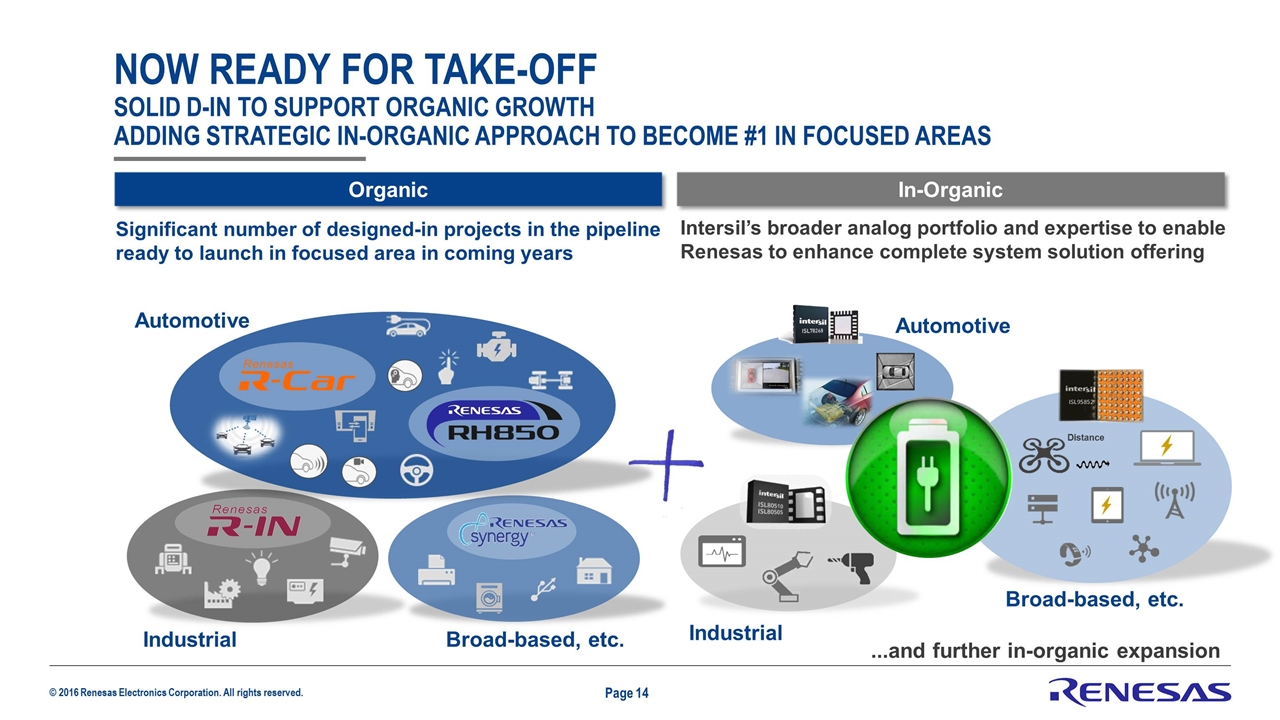

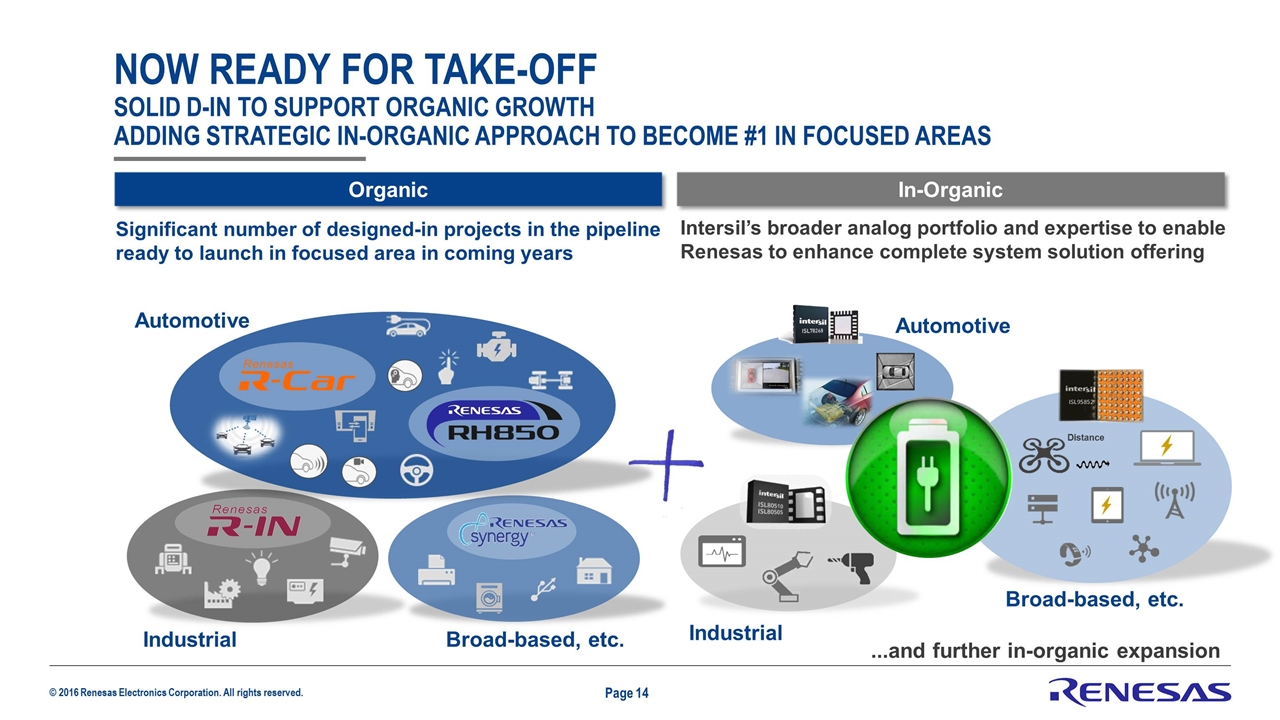

Distance Page Now Ready for Take-off solid d-in to support organic growth adding strategic in-organic approach to become #1 in focused areas Organic Significant number of designed-in projects in the pipeline ready to launch in focused area in coming years Industrial Broad-based, etc. Automotive Automotive Industrial Broad-based, etc. In-Organic Intersil’s broader analog portfolio and expertise to enable Renesas to enhance complete system solution offering ...and further in-organic expansion

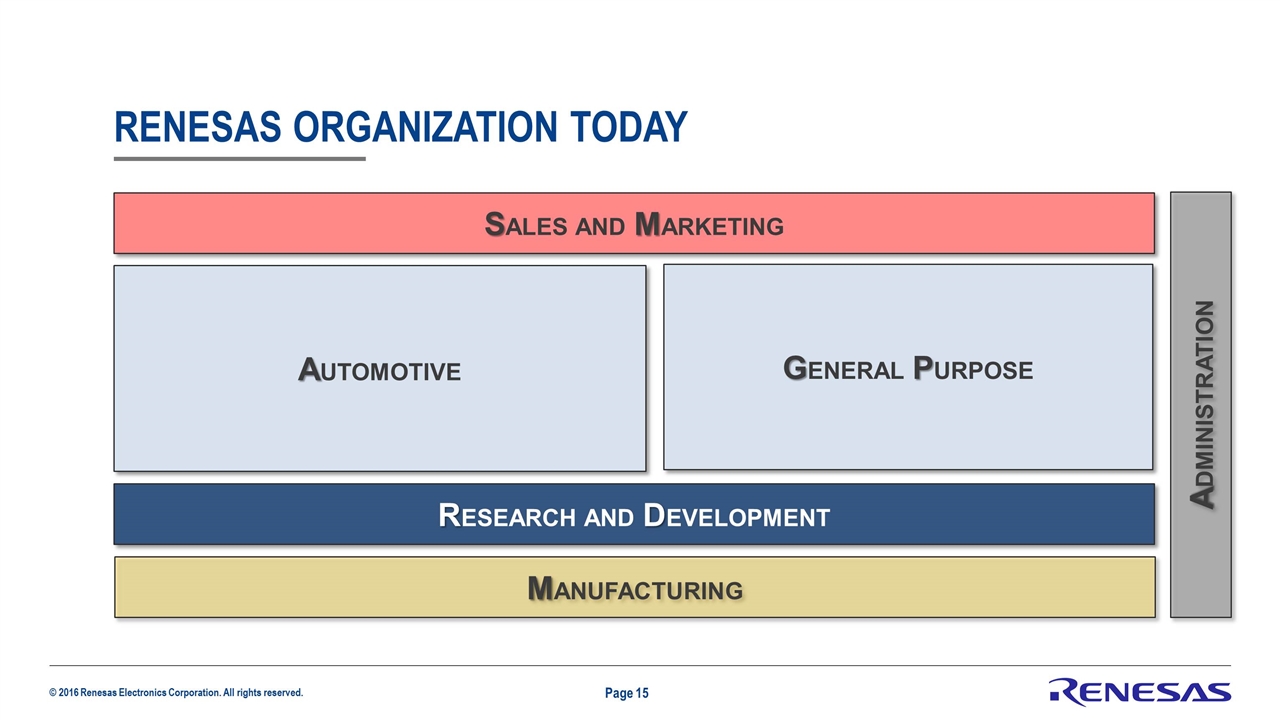

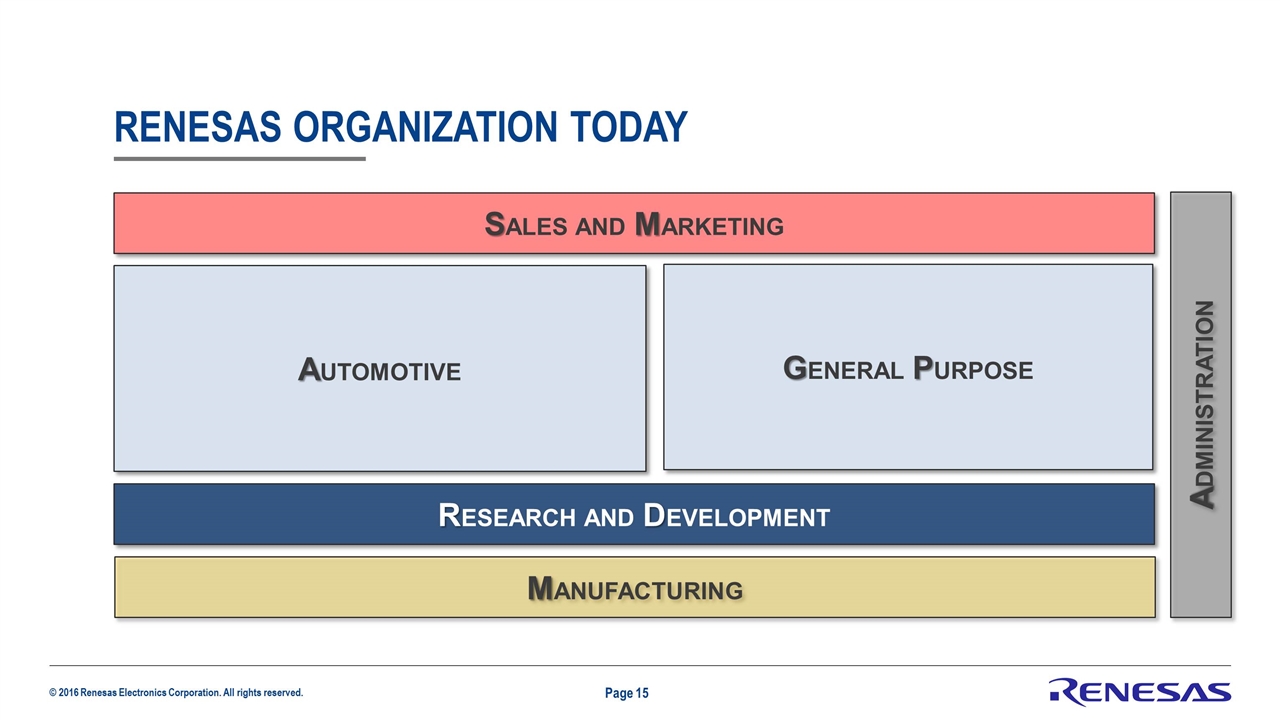

Page Renesas organization today Selective Investment to Enhance Competitiveness and Profitability SALES AND MARKETING MANUFACTURING ADMINISTRATION RESEARCH AND DEVELOPMENT AUTOMOTIVE GENERAL PURPOSE

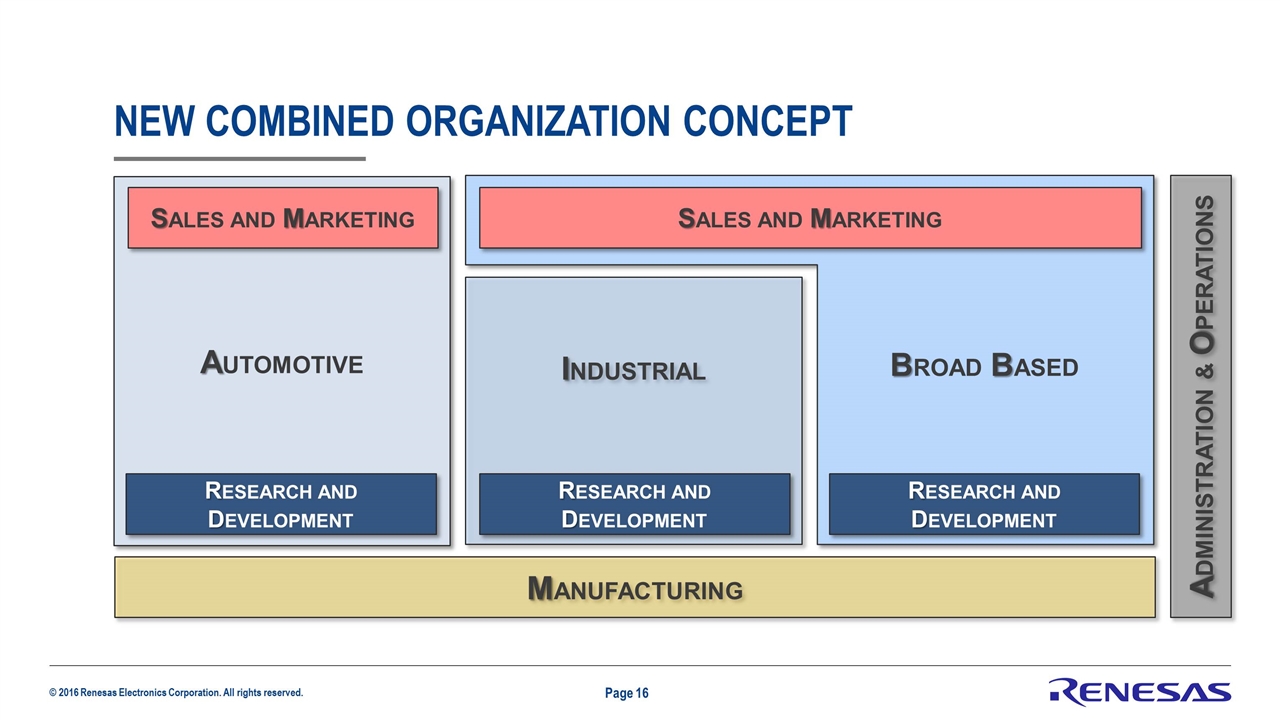

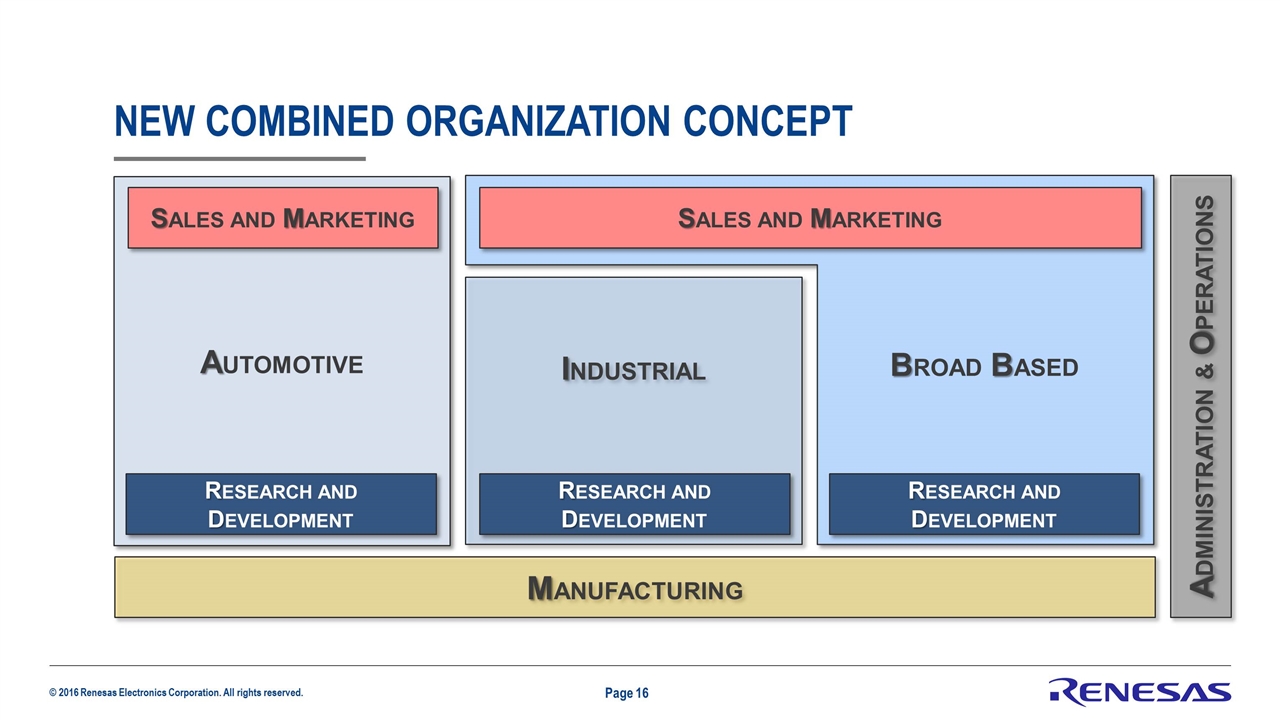

AUTOMOTIVE New combined organization concept Page MANUFACTURING ADMINISTRATION & OPERATIONS INDUSTRIAL SALES AND MARKETING SALES AND MARKETING RESEARCH AND DEVELOPMENT RESEARCH AND DEVELOPMENT RESEARCH AND DEVELOPMENT BROAD BASED

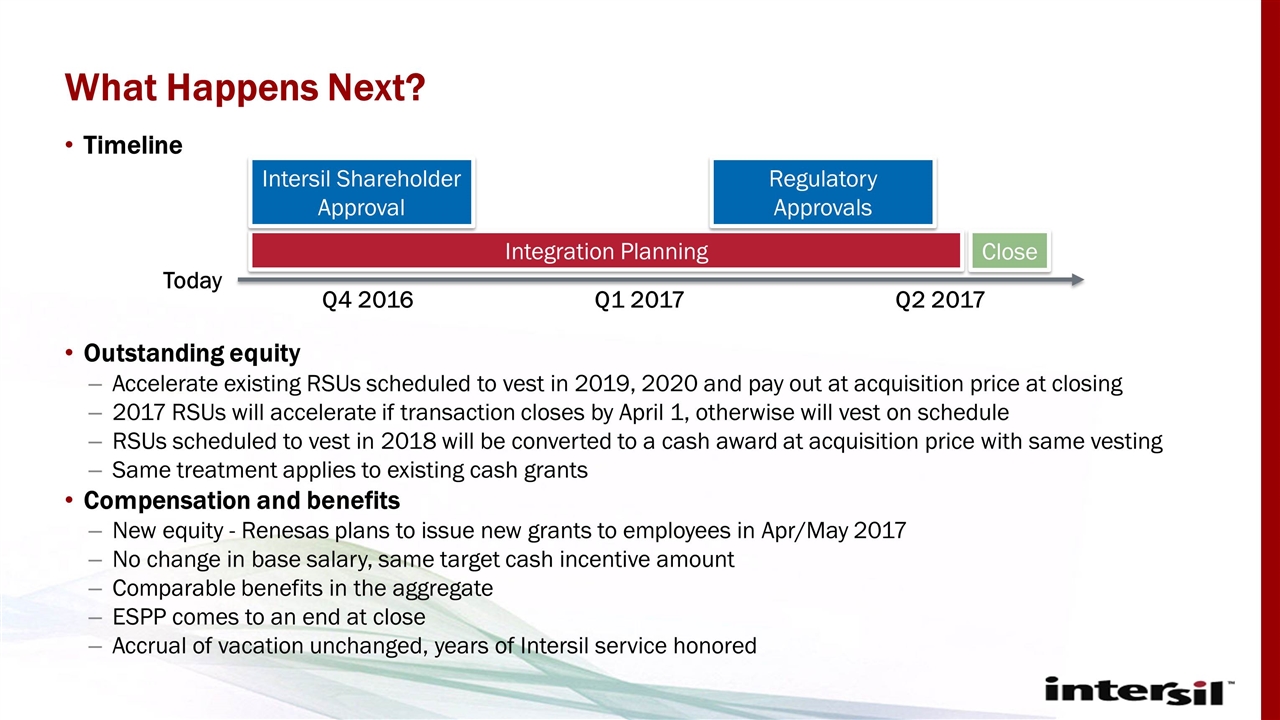

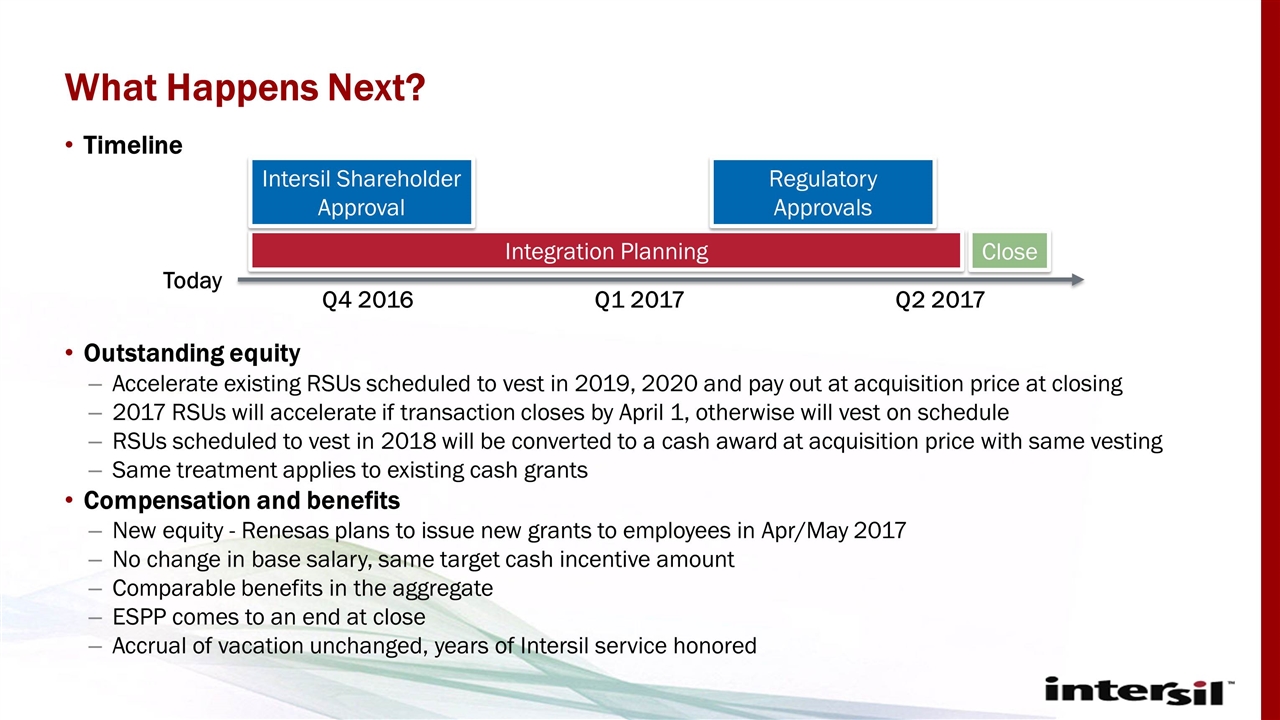

Timeline Outstanding equity Accelerate existing RSUs scheduled to vest in 2019, 2020 and pay out at acquisition price at closing 2017 RSUs will accelerate if transaction closes by April 1, otherwise will vest on schedule RSUs scheduled to vest in 2018 will be converted to a cash award at acquisition price with same vesting Same treatment applies to existing cash grants Compensation and benefits New equity - Renesas plans to issue new grants to employees in Apr/May 2017 No change in base salary, same target cash incentive amount Comparable benefits in the aggregate ESPP comes to an end at close Accrual of vacation unchanged, years of Intersil service honored What Happens Next? Today Q4 2016 Q1 2017 Q2 2017 Integration Planning Intersil Shareholder Approval Regulatory Approvals Close