Markel (MKL) 425Business combination disclosure

Filed: 19 Jul 10, 12:00am

Filed by Markel Corporation

Pursuant to Rule 425 under the Securities Act of 1933

Subject Company: Aspen Holdings, Inc.

Exchange Act File Number: 001-15811

The following slides were used by Markel Corporation in a presentation to employees of Aspen Holdings, Inc. on July 19, 2010.

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. To the extent that Markel determines that registration of the contingent value rights is necessary, Markel will file with the Securities and Exchange Commission (SEC) a registration statement on Form S-4 containing a preliminary proxy statement of Aspen that also constitutes a preliminary prospectus of Markel. A definitive proxy statement will be mailed to stockholders of Aspen, which will contain a prospectus of Markel if registration of the contingent value rights is necessary. Markel and Aspen may also file other documents with the SEC regarding the proposed transaction. INVESTORS AND SECURITY HOLDERS OF ASPEN ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT, AND PROSPECTUS, IF APPLICABLE, AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain any documents filed with the SEC (when available) free of charge at the SEC’s web site, www.sec.gov. Copies of any documents filed with the SEC by Markel will be available free of charge on Markel’s website at www.markelcorp.com under the tab “SEC Filings” on the “Investor Information” page or by contacting Markel’s Investor Relations Department at (800) 446-6671 (Toll Free). You may also read and copy any reports, statements and other information filed with the SEC at the SEC public reference room at 100 F Street N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at (800) 732-0330 or visit the SEC’s website for further information on its public reference room.

Confidential - Markel Welcome to Markel! |

Confidential - Markel The Markel Style Markel has a Commitment to Success. We believe in hard work and a zealous pursuit of excellence while keeping a sense of humor. Our creed is honesty and fairness in all our dealings. The Markel way is to seek to be a market leader in each of our pursuits. We seek to know our customers' needs and to provide our customers with quality products and service. Our pledge to our shareholders is that we will build the financial value of our Company. We respect our relationship with our suppliers and have a commitment to our communities. We are encouraged to look for a better way to do things...to challenge management. We have the ability to make decisions or alter a course quickly. |

Confidential - Markel The Markel Style (Cont’d.) The Markel approach is one of spontaneity and flexibility. This requires a respect for authority but a disdain of bureaucracy. At Markel we hold the individual's right to self-determination in the highest light, providing an atmosphere in which people can reach their personal potential. Being results oriented, we are willing to put aside individual concerns in the spirit of team work to achieve success. Above all, we enjoy what we are doing. There is excitement at Markel, one that comes from innovating, creating, striving for a better way, sharing success with others...winning. |

Confidential - Markel |

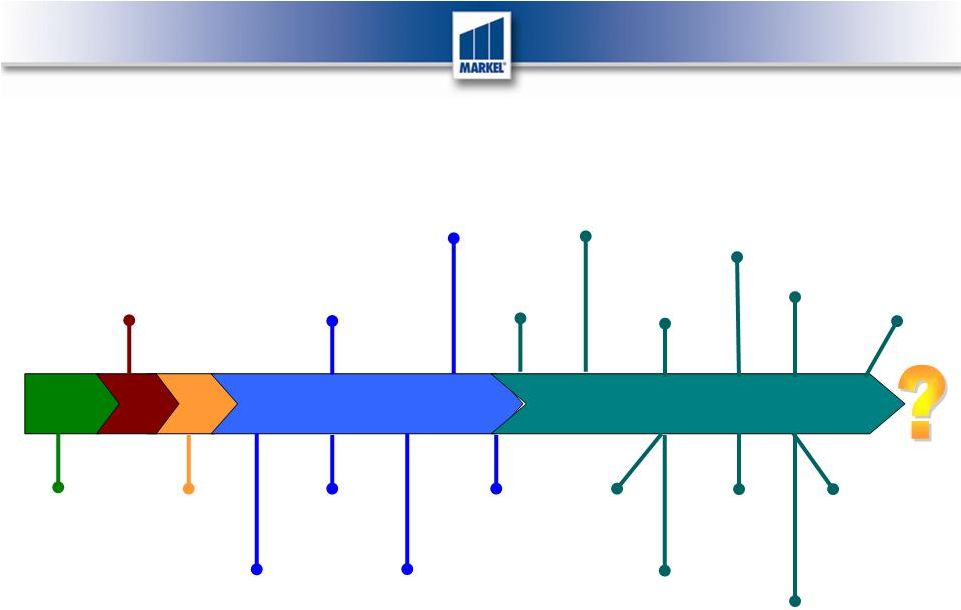

Markel – A History Still in the Making 1930 Markel Service Formed Essex Insurance Company 1980 Wall Street Shand Morahan & Co. Rhulen Agency Investors Underwriting Managers 1986 American Underwriting Managers Gryphon Terra Nova Acceptance West Brittany Black/White & Assoc. Prairie State Cambridge Specialized Ins., Inc. (Garage) 1987 1989 1996 1999 2000 2006 2007 2008 2009 Elliot Special Risk Agri-Risk Mint Equine Markel Ventures 2010 Aspen Confidential - Markel |

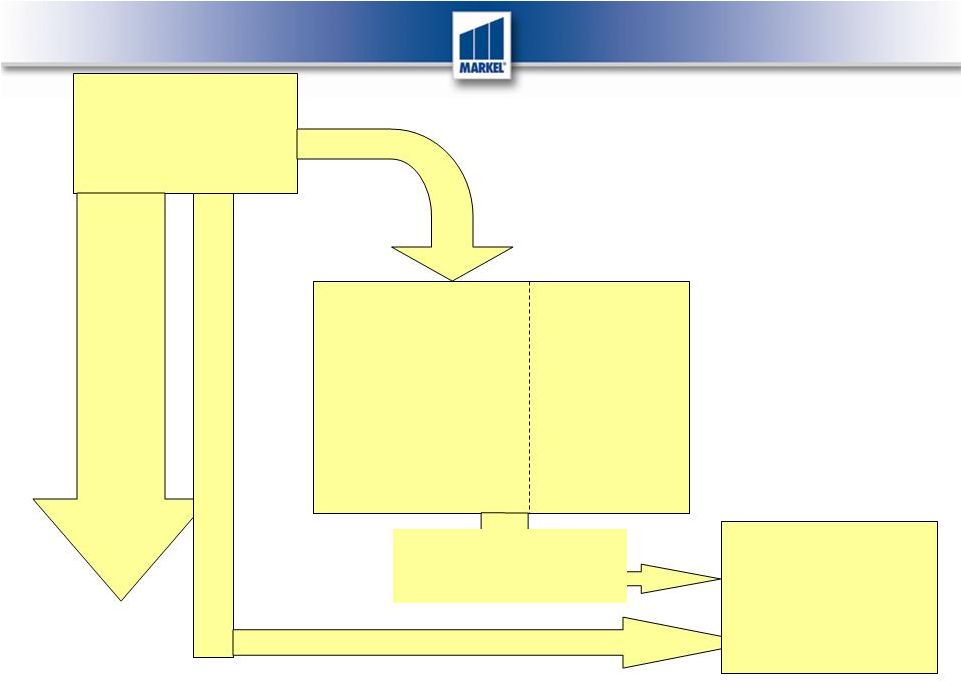

GROSS PREMIUMS REINSURER PREMIUMS TOTAL INVESTMENT PORTFOLIO Premium Cash Flow Shareholders’ Equity UNDERWRITING PROFITS NET PREMIUMS RETAINED SHAREHOLDERS INVESTMENT PROFITS MODEL FOR PROFIT Confidential - Markel |

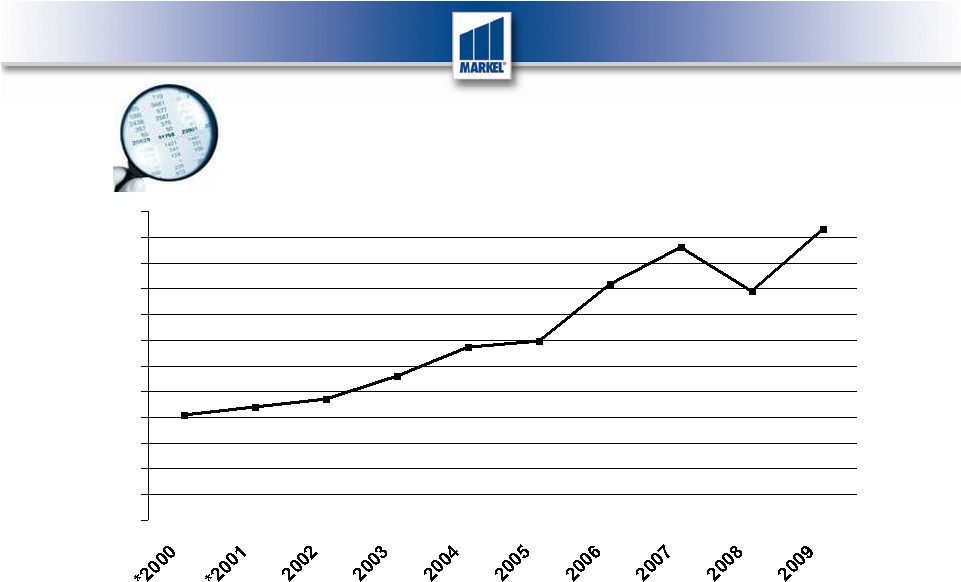

Confidential - Markel Book Value Growth $0 $25 $50 $75 $100 $125 $150 $175 $200 $225 $250 $275 $300 *Includes the effect of issuing stock in the Terra Nova transaction in 2000 and 2 Equity Offerings in 2001. |

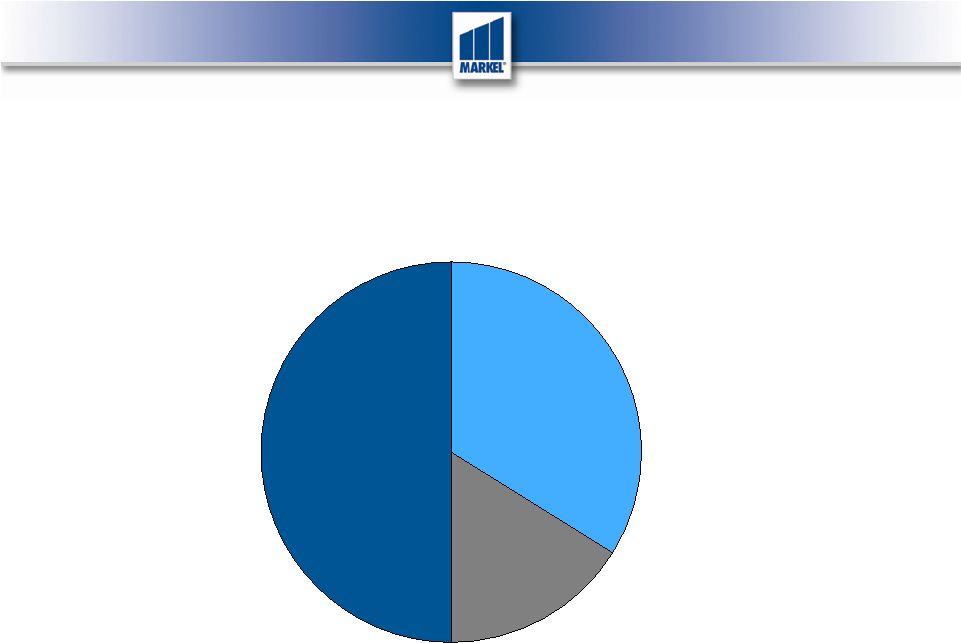

Confidential - Markel Markel Corporation 2009 Consolidated Gross Premium Volume ($1.9 billion) 34% 16% 50% Excess and Surplus Lines London Insurance Market Specialty Admitted |

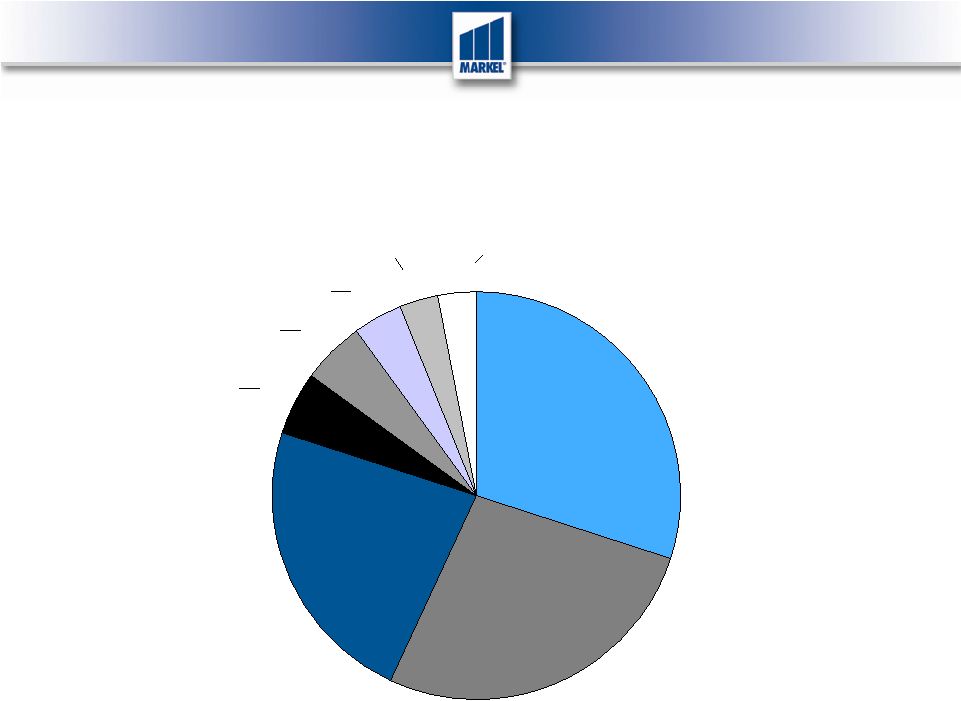

Confidential - Markel Excess and Surplus Lines Segments 2009 Gross Premium Volume ($1.0 Billion) 4% 3% 3% 30% 27% 23% 5% 5% Professional and Products Liability Property and Casualty Miscellaneous Coverages Environmental Excess and Umbrella Transportation Inland Marine Ocean Marine |

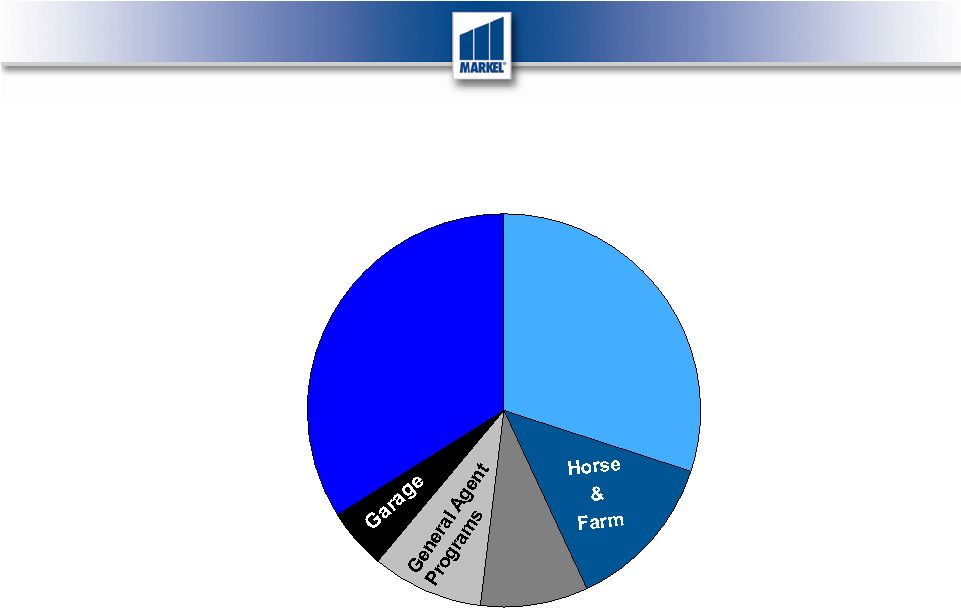

Confidential - Markel 30% 13% 9% 9% 5% 34% Property & Casualty Accident & Health Markel Risk Solutions Markel Specialty 2009 Gross Premium Volume ($210 Million) |

Confidential - Markel 25% 12% 5% 58% Marine Recreational Vehicle Property Markel American Specialty Personal & Commercial Lines 2009 Gross Premium Volume ($90 Million) |

Confidential - Markel 25% 16% 13% 9% 3% 34% Marine & Energy Professional & Financial Risks Specialty Non-Marine Property Retail London Insurance Market Segment 2009 Gross Premium Volume ($641 Million) |

Confidential - Markel MARKEL’S “5 IN 5” $5 Billion in Operating Revenue by 2014 • Keys: o Organic Growth o Acquisitions o International Expansion o New Products o Markel Ventures |