UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-09607

Fairholme Funds, Inc.

(Exact name of registrant as specified in charter)

5966 South Dixie Highway, Suite 300

South Miami, FL 33143

(Address of principal executive offices) (Zip code)

Bruce R. Berkowitz

5966 South Dixie Highway, Suite 300

South Miami, FL 33143

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-866-202-2263

Date of fiscal year end: November 30

Date of reporting period: November 30, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| | (a) | The Reports to Shareholders of each Fund are attached herewith. |

Annual Shareholder Report: November 30, 2024

This annual shareholder report contains important information about The Fairholme Fund (the "Fund") for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at www.fairholmefunds.com/prospectus. You can also request this information by contacting us at (866) 202-2263.

What were the Fund's costs for the last year?

(based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as percentage of a $10,000 investment |

|---|

| The Fairholme Fund | $82 | 0.80% |

|---|

How did the Fund perform during the last year?

For the year ended November 30, 2024, the Fund returned 4.17% compared to 33.89% for the S&P 500. The Fund invests in a limited number of securities. Lackluster performance for the past fiscal year was largely driven by a long-held investment in The St. Joe Co. (“Joe”), potentially due to perceived weakness in Joe’s residential real estate segment. Yet, Florida continues to be one of the fastest-growing states in the United States, and Joe’s targeted Bay and Walton County populations are growing at a faster rate than most counties in Florida. Population growth tends to drive real estate sales over time. Of additional note, Enterprise Products Partners increased already substantial cash distributions. Lastly, U.S. Treasury Bills added to performance by providing competitive interest income with minimum risk.

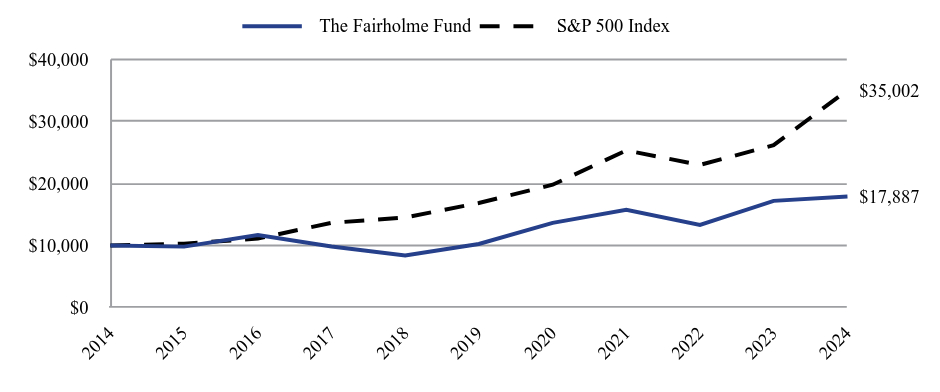

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

The graph shows the performance of a hypothetical $10,000 investment over the 10-year period ended November 30, 2024.

The Fund's past performance is not a good predictor of the Fund's future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| The Fairholme Fund | S&P 500 Index |

|---|

| 2014 | $10,000 | $10,000 |

|---|

| 2015 | $9,805 | $10,275 |

|---|

| 2016 | $11,661 | $11,103 |

|---|

| 2017 | $9,837 | $13,642 |

|---|

| 2018 | $8,376 | $14,498 |

|---|

| 2019 | $10,236 | $16,834 |

|---|

| 2020 | $13,632 | $19,773 |

|---|

| 2021 | $15,751 | $25,294 |

|---|

| 2022 | $13,310 | $22,964 |

|---|

| 2023 | $17,171 | $26,142 |

|---|

| 2024 | $17,887 | $35,002 |

|---|

Average Annual Total Returns (as of November 30, 2024)

| 1 Year | 5 years | 10 years |

|---|

| The Fairholme Fund | 4.17% | 11.81% | 5.99% |

|---|

| S&P 500 Index | 33.89% | 15.77% | 13.35% |

|---|

| Net Assets | $1,202,463,255 |

|---|

| # of Portfolio Holdings | 13 |

|---|

| Portfolio Turnover Rate | 2.97% |

|---|

| Advisory Fees Paid | $10,519,492 |

|---|

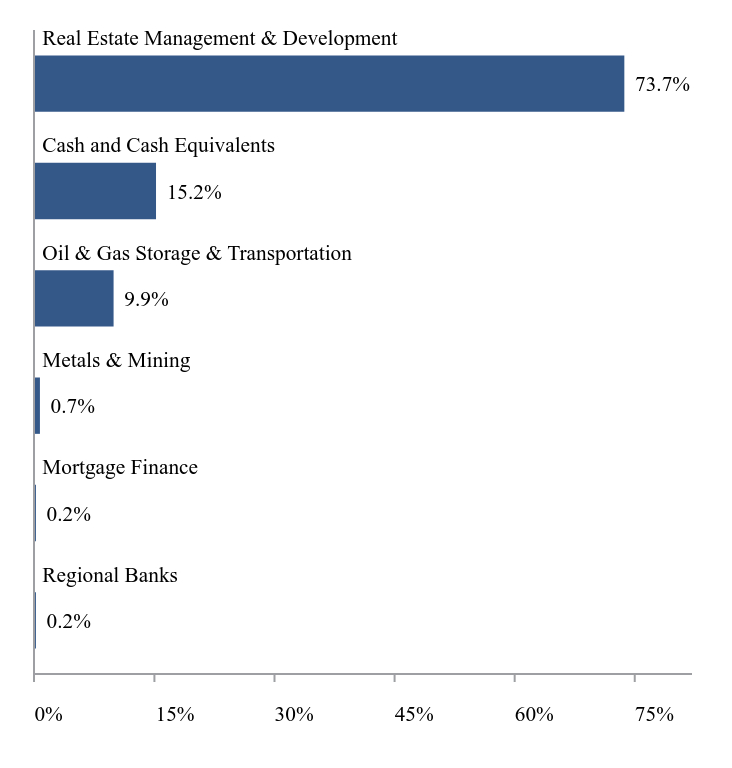

What are the Fund's Holdings?

The following table and graphs show the Fund's holdings as of November 30, 2024. Figures are expressed as percentages of the Fund's net assets.

| The St. Joe Co. | 73.7% |

| Enterprise Products Partners LP | 8.5% |

| Energy Transfer LP | 1.4% |

| Imperial Metals Corp. | 0.7% |

| Federal National Mortgage Association | 0.2% |

| Bank OZK | 0.2% |

| Value | Value |

|---|

| Regional Banks | 0.2% |

| Mortgage Finance | 0.2% |

| Metals & Mining | 0.7% |

| Oil & Gas Storage & Transportation | 9.9% |

| Cash and Cash Equivalents | 15.2% |

| Real Estate Management & Development | 73.7% |

| Value | Value |

|---|

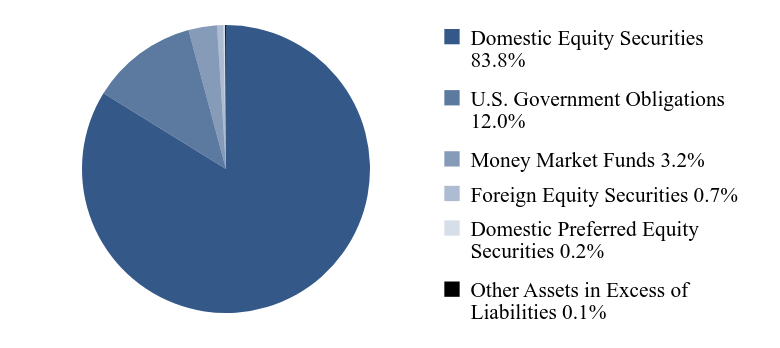

| Domestic Equity Securities | 83.8% |

| U.S. Government Obligations | 12.0% |

| Money Market Funds | 3.2% |

| Foreign Equity Securities | 0.7% |

| Domestic Preferred Equity Securities | 0.2% |

| Other Assets in Excess of Liabilities | 0.1% |

Where can I find additional information about the Fund?

Scan the QR code below or visit www.fairholmefunds.com/prospectus for additional information about the Fund, including the Fund's prospectus, financial information, portfolio holdings and proxy voting information.

Fairholme Funds, Inc.

P.O. Box 534443

Pittsburgh, PA 15253-4443

(866) 202-2263

Annual Shareholder Report: November 30, 2024

Annual Shareholder Report: November 30, 2024

The Fairholme Focused Income Fund

This annual shareholder report contains important information about The Fairholme Focused Income Fund (the "Fund") for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at www.fairholmefunds.com/prospectus. You can also request this information by contacting us at (866) 202-2263.

What were the Fund's costs for the last year?

(based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as percentage of a $10,000 investment |

|---|

| The Fairholme Focused Income Fund | $88 | 0.80% |

|---|

How did the Fund perform during the last year?

For the year ended November 30, 2024, the Fund returned 20.94% compared to 6.88% for the Bloomberg U.S. Aggregate Bond Index. The Fund invests in a limited number of securities. Positive performance for the past fiscal year was due in large part to equity ownership of Enterprise Products Partners, which continues to profitably grow domestic hydrocarbon transportation, processing, and storage assets while generating substantial cash distributions. More recent equity investments in Bank OZK and W.R Berkley also added to performance. Both companies are excellent underwriters of risk and efficient operators in their respective areas of banking and insurance. U.S. Treasury Bills provided competitive interest income yields for the Fund with the least possible risk.

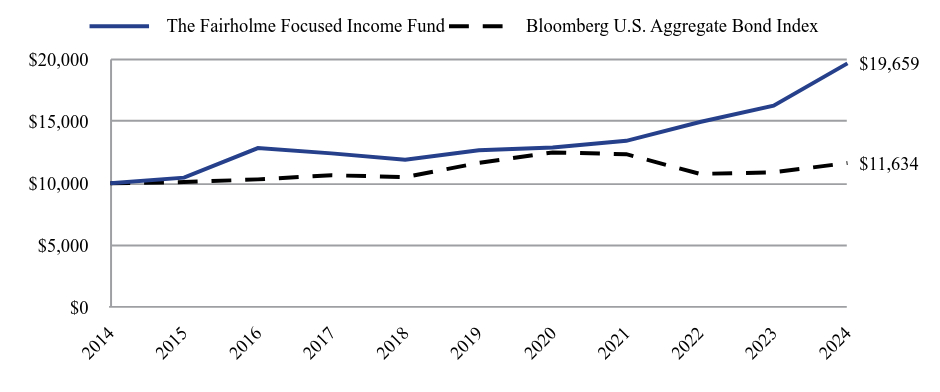

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

The graph shows the performance of a hypothetical $10,000 investment over the 10-year period ended November 30, 2024.

The Fund's past performance is not a good predictor of the Fund's future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| The Fairholme Focused Income Fund | Bloomberg U.S. Aggregate Bond Index |

|---|

| 2014 | $10,000 | $10,000 |

|---|

| 2015 | $10,460 | $10,098 |

|---|

| 2016 | $12,841 | $10,317 |

|---|

| 2017 | $12,411 | $10,649 |

|---|

| 2018 | $11,892 | $10,506 |

|---|

| 2019 | $12,663 | $11,640 |

|---|

| 2020 | $12,888 | $12,488 |

|---|

| 2021 | $13,424 | $12,344 |

|---|

| 2022 | $14,941 | $10,759 |

|---|

| 2023 | $16,255 | $10,886 |

|---|

| 2024 | $19,659 | $11,634 |

|---|

Average Annual Total Returns (as of November 30, 2024)

| 1 Year | 5 years | 10 years |

|---|

| The Fairholme Focused Income Fund | 20.94% | 9.20% | 6.99% |

|---|

| Bloomberg U.S. Aggregate Bond Index | 6.88% | -0.01% | 1.53% |

|---|

| Net Assets | $218,894,731 |

|---|

| # of Portfolio Holdings | 17 |

|---|

| Portfolio Turnover Rate | 47.45% |

|---|

| Advisory Fees Paid | $1,658,006 |

|---|

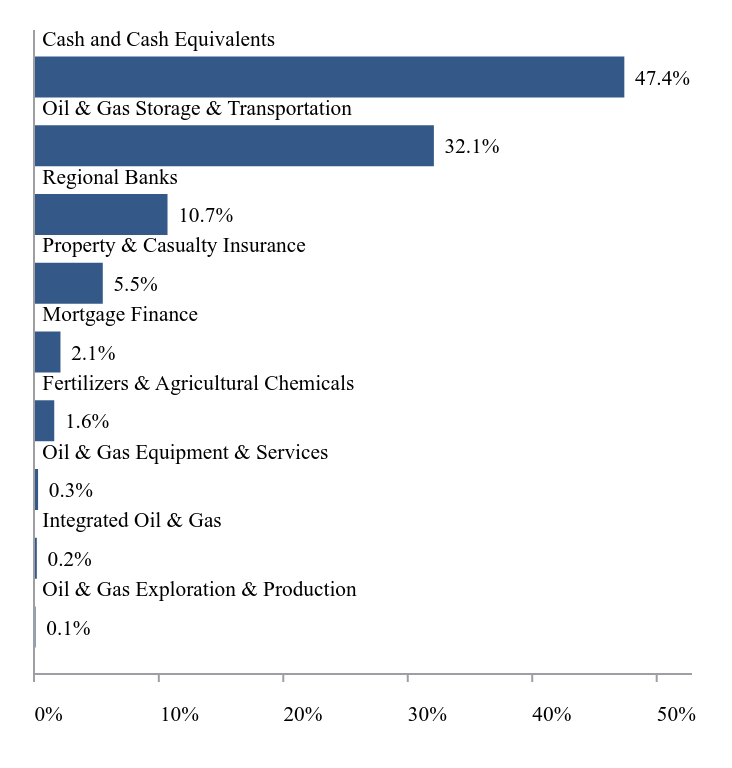

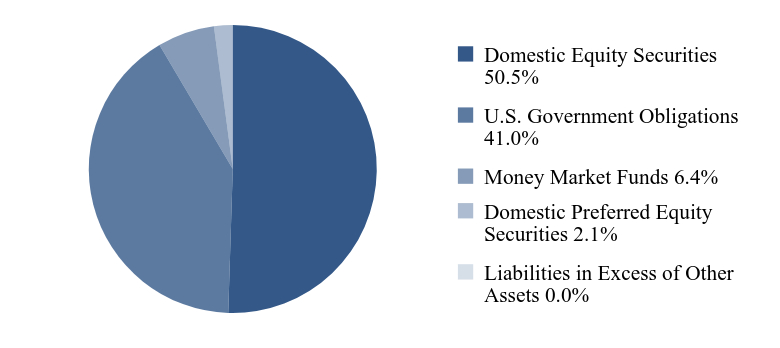

What are the Fund's Holdings?

The following table and graphs show the Fund's holdings as of November 30, 2024. Figures are expressed as percentages of the Fund's net assets.

| Enterprise Products Partners LP | 32.1% |

| Bank OZK | 10.7% |

| W. R. Berkley Corp. | 5.5% |

| Federal Home Loan Mortgage Corp. | 2.1% |

| CF Industries Holdings, Inc. | 1.6% |

| Liberty Energy, Inc. | 0.3% |

| Diamondback Energy, Inc. | 0.1% |

| Chevron Corp. | 0.1% |

| Occidental Petroleum Corp. | 0.1% |

| EOG Resources, Inc. | 0.0% |

| Value | Value |

|---|

| Oil & Gas Exploration & Production | 0.1% |

| Integrated Oil & Gas | 0.2% |

| Oil & Gas Equipment & Services | 0.3% |

| Fertilizers & Agricultural Chemicals | 1.6% |

| Mortgage Finance | 2.1% |

| Property & Casualty Insurance | 5.5% |

| Regional Banks | 10.7% |

| Oil & Gas Storage & Transportation | 32.1% |

| Cash and Cash Equivalents | 47.4% |

| Value | Value |

|---|

| Domestic Equity Securities | 50.5% |

| U.S. Government Obligations | 41.0% |

| Money Market Funds | 6.4% |

| Domestic Preferred Equity Securities | 2.1% |

| Liabilities in Excess of Other Assets | 0.0% |

Where can I find additional information about the Fund?

Scan the QR code below or visit www.fairholmefunds.com/prospectus for additional information about the Fund, including the Fund's prospectus, financial information, portfolio holdings and proxy voting information.

Fairholme Funds, Inc.

P.O. Box 534443

Pittsburgh, PA 15253-4443

(866) 202-2263

Annual Shareholder Report: November 30, 2024

The Fairholme Focused Income Fund

Item 2. Code of Ethics.

| | (a) | The registrant, as of the end of the period covered by this report, has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions (the “Code of Ethics”). |

| | (c) | During the period covered by this report, there were no substantive amendments to the provisions of the Code of Ethics. |

| | (d) | The registrant did not grant any waivers, including implicit waivers, from any provisions of the Code of Ethics during the period covered by this report. |

| | (f) | A copy of the Code of Ethics is filed as an Exhibit to this report. |

Item 3. Audit Committee Financial Expert.

3(a)(1) The registrant’s board of directors has determined that the registrant has at least one audit committee financial expert serving on its audit committee.

3(a)(2) Steven J. Gilbert is the “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3(a)(2) of Form N-CSR.

3(a)(3) Not applicable.

Item 4. Principal Accountant Fees and Services.

Audit Fees

| | (a) | The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audits of the annual financial statements of each series of the registrant or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years were $117,150 in 2023 and $123,755 in 2024. |

Audit-Related Fees

| | (b) | The aggregate fees billed in each of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the financial statements of each series of the registrant and are not reported under paragraph (a) of this Item were $0 in 2023 and $0 in 2024. |

Tax Fees

| | (c) | The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning were $45,285 in 2023 and $32,655 in 2024. These fees relate to the preparation and review of the various tax forms of each series of the registrant and also for the review of the dividend and distributions of each series of the registrant. |

All Other Fees

| | (d) | The aggregate fees billed in each of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item were $0 in 2023 and $0 in 2024. |

| | (e)(1) | Disclose the audit committee’s pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X. |

The audit committee has adopted policies and procedures that require the pre-approval by the audit committee of all audit and non-audit services to the registrant by the registrant’s principal accountant, including services provided to any entity affiliated with the registrant to the extent that such services are directly related to the operations or financial reporting of the registrant.

| | (e)(2) | The percentage of services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X are as follows: |

(b) 100%

(c) 100%

(d) Not Applicable

| | (g) | The aggregate non-audit fees billed by the registrant’s accountant for services rendered to the registrant, and rendered to the registrant’s investment adviser, and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant for each of the last two fiscal years of the registrant were $0 in 2023 and $0 in 2024. |

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

| (a) | Schedule of investments in securities of unaffiliated issuers as of the close of the reporting period is included as part of the report to shareholders filed under Item 1(a) of this Form or is included in the financial statements filed under Item 7 of this Form. |

| Item 7. | Financial Statements and Financial Highlights for Open-End Management Investment Companies. |

| (a) | An open-end management investment company registered on Form N-1A [17 CFR 239.15A and 17 CFR 274.11A] must file its most recent annual or semi-annual financial statements required, and for the periods specified, by Regulation S-X. |

| (b) | An open-end management investment company registered on Form N-1A [17 CFR 239.15A and 17 CFR 274.11A] must file the information required by Item 13 of Form N-1A. |

THE FAIRHOLME FUND

SCHEDULE OF INVESTMENTS

November 30, 2024

| | | | | | | | |

Shares | | | | | Value | |

| | |

| | | | DOMESTIC EQUITY SECURITIES — 83.8% | | | | |

| | |

| | | | OIL & GAS STORAGE & TRANSPORTATION —9.9% | | | | |

| | 852,900 | | | Energy Transfer LP | | $ | 16,938,594 | |

| | 2,953,100 | | | Enterprise Products Partners LP | | | 101,675,233 | |

| | | | | | | | |

| | | | | | | 118,613,827 | |

| | | | | | | | |

| | |

| | | | REAL ESTATE MANAGEMENT & DEVELOPMENT — 73.7% | | | | |

| | 17,351,224 | | | The St. Joe Co.(a) | | | 886,300,522 | |

| | | | | | | | |

| | |

| | | | REGIONAL BANKS — 0.2% | | | | |

| | 43,000 | | | Bank OZK | | | 2,148,710 | |

| | | | | | | | |

| |

| TOTAL DOMESTIC EQUITY SECURITIES

(COST $499,504,645) | | | 1,007,063,059 | |

| | | | | | | | |

| | |

| | | | FOREIGN EQUITY SECURITIES — 0.7% | | | | |

| | |

| | | | CANADA — 0.7% | | | | |

| | |

| | | | METALS & MINING — 0.7% | | | | |

| | 5,616,313 | | | Imperial Metals Corp.(b) | | | 8,584,629 | |

| | | | | | | | |

| |

| TOTAL FOREIGN EQUITY SECURITIES

(COST $42,429,357) | | | 8,584,629 | |

| | | | | | | | |

| | | | | | | | |

Shares | | | | | Value | |

| |

| | | | DOMESTIC PREFERRED

EQUITY SECURITIES —0.2% | |

| |

| | | | MORTGAGE FINANCE — 0.2% | |

| | 170,000 | | | Federal National Mortgage Association 5.100%, Series E(b) | | $ | 2,388,500 | |

| | | | | | | | |

| |

| TOTAL DOMESTIC PREFERRED EQUITY

SECURITIES (COST $639,200) | | | 2,388,500 | |

| | | | | | | | |

| | |

Principal | | | | | | |

| | |

| | | | U.S. GOVERNMENT OBLIGATIONS — 12.0% | | | | |

| | |

| | | | U.S. Treasury Bills | | | | |

| | $ 20,000,000 | | | 4.521%, 12/05/2024(c) | | | 19,992,591 | |

| | 25,000,000 | | | 4.518%, 12/10/2024(c) | | | 24,974,861 | |

| | 25,000,000 | | | 4.486%, 12/12/2024(c) | | | 24,968,458 | |

| | 25,000,000 | | | 4.483%, 12/19/2024(c) | | | 24,946,273 | |

| | 25,000,000 | | | 4.531%, 12/31/2024(c) | | | 24,908,469 | |

| | 25,000,000 | | | 4.530%, 01/02/2025(c) | | | 24,903,233 | |

| | | | | | | | |

| |

| TOTAL U.S. GOVERNMENT OBLIGATIONS

(COST $144,677,635) | | | 144,693,885 | |

| | | | | | | | |

| | |

Shares | | | | | | |

| |

| | | | MONEY MARKET FUNDS — 3.2% | |

| | |

| | 38,414,468 | | | Fidelity Investments Money Market Treasury Portfolio - Class I, 4.51%(d) | | | 38,414,468 | |

| | | | | | | | |

| |

| TOTAL MONEY MARKET FUNDS

(COST $38,414,468) | | | 38,414,468 | |

| | | | | | | | |

| |

| TOTAL INVESTMENTS — 99.9%

(COST $725,665,305) | | | 1,201,144,541 | |

| | | | OTHER ASSETS IN EXCESS OF LIABILITIES — 0.1% | | | 1,318,714 | |

| | | | | | | | |

| |

| | NET ASSETS — 100.0% | | $ | 1,202,463,255 | |

| | | | | | | | |

| (a) | Affiliated Company. See Note 8. |

| (b) | Non-income producing security. |

| (c) | Rates shown are the effective yields based on the purchase price. The calculation assumes the security is held to maturity. |

| (d) | Annualized based on the 1-day yield as of November 30, 2024. |

The accompanying notes are an integral part of the financial statements.

1

THE FAIRHOLME FUND

STATEMENT OF ASSETS & LIABILITIES

November 30, 2024

| | | | |

| |

Assets | | | | |

| |

Investments, at Fair Value: | | | | |

| |

Unaffiliated Issuers (Cost – $297,780,357) | | $ | 314,844,019 | |

| |

Affiliated Issuers (Cost – $427,884,948) | | | 886,300,522 | |

| |

Dividends and Interest Receivable | | | 2,583,012 | |

| |

Receivable for Capital Shares Sold | | | 27,261 | |

| | | | |

| |

Total Assets | | | 1,203,754,814 | |

| | | | |

| |

Liabilities | | | | |

| |

Accrued Management Fees | | | 782,907 | |

| |

Payable for Capital Shares Redeemed | | | 508,652 | |

| | | | |

| |

Total Liabilities | | | 1,291,559 | |

| | | | |

| |

NET ASSETS | | $ | 1,202,463,255 | |

| | | | |

| |

Net Assets consist of: | | | | |

| |

Paid-In Capital | | $ | 1,485,381,506 | |

| |

Total Accumulated Losses | | | (282,918,251 | ) |

| | | | |

| |

NET ASSETS | | $ | 1,202,463,255 | |

| | | | |

| |

Shares of Common Stock Outstanding* ($0.0001 par value) | | | 36,308,355 | |

| | | | |

| |

Net Asset Value, Offering and Redemption Price Per Share

($1,202,463,255 / 36,308,355 shares) | | $ | 33.12 | |

| | | | |

* 700,000,000 shares authorized in total.

The accompanying notes are an integral part of the financial statements.

2

THE FAIRHOLME FUND

STATEMENT OF OPERATIONS

| | | | | | | | |

| | | For the

Fiscal Year Ended

November 30, 2024 | |

Investment Income | | | | | | | | |

| | |

Interest — Unaffiliated Issuers | | | | | | $ | 8,500,189 | |

| | |

Dividends — Unaffiliated Issuers | | | | | | | 29,734 | |

| | |

Dividends — Affiliated Issuers | | | | | | | 9,533,300 | |

| | | | | | | | |

| | |

Total Investment Income | | | | | | | 18,063,223 | |

| | | | | | | | |

| | |

Expenses | | | | | | | | |

| | |

Management Fees | | | | | | | 13,149,365 | |

| | | | | | | | |

| | |

Total Expenses | | | | | | | 13,149,365 | |

| | | | | | | | |

| | |

Less: Voluntary Reduction of Management Fees | | | | | | | (2,629,873 | ) |

| | | | | | | | |

| | |

Net Expenses | | | | | | | 10,519,492 | |

| | | | | | | | |

| | |

Net Investment Income | | | | | | | 7,543,731 | |

| | | | | | | | |

| | |

Realized and Unrealized Gain (Loss) on Investments and Foreign Currency Related Transactions | | | | | | | | |

| | |

Net Realized Gain (Loss) on: | | | | | | | | |

| | |

Investments - Unaffiliated Issuers* | | | | | | | (9,979,199 | ) |

| | |

Investments - Affiliated Issuers | | | | | | | 48,796,703 | |

| | |

Foreign Currency Related Transactions | | | | | | | (25 | ) |

| | |

Net Change in Unrealized Appreciation (Depreciation) on Investments and Foreign Currency Related Translations: | | | | | | | | |

| | |

Unaffiliated Investments | | | | | | | 53,826,357 | |

| | |

Affiliated Investments | | | | | | | (42,880,437 | ) |

| | | | | | | | |

Net Realized and Unrealized Gain (Loss) on Investments and Foreign Currency Related Transactions | | | | | | | 49,763,399 | |

| | | | | | | | |

| | |

NET INCREASE IN NET ASSETS FROM OPERATIONS | | | | | | $ | 57,307,130 | |

| | | | | | | | |

| * | Realized gain includes $1,607,596.51 related to amounts received from a class action settlement for a security previously held by the Fund. |

The accompanying notes are an integral part of the financial statements.

3

THE FAIRHOLME FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | | | | | | | | | | | | | |

| | | For the Fiscal Year

Ended

November 30, 2024 | | | | | For the Fiscal Year

Ended

November 30, 2023 | |

CHANGES IN NET ASSETS | | | | | | | | | | | | | | | | | | | | |

From Operations | | | | | | | | | | | | | | | | | | | | |

Net Investment Income | | | | | | $ | 7,543,731 | | | | | | | | | | | $ | 5,590,513 | |

Net Realized Gain on Investments and Foreign Currency Related Transactions | | | | | | | 38,817,479 | | | | | | | | | | | | 29,306,559 | |

Net Change in Unrealized Appreciation (Depreciation) on Investments and Foreign Currency Related Translations | | | | | | | 10,945,920 | | | | | | | | | | | | 262,128,442 | |

| | | | | | | | | | | | | | | | | | | | |

Net Increase in Net Assets from Operations | | | | | | | 57,307,130 | | | | | | | | | | | | 297,025,514 | |

| | | | | | | | | | | | | | | | | | | | |

From Dividends and Distributions to Shareholders | | | | | | | | | | | | | | | | | | | | |

Net Decrease in Net Assets from Dividends and Distributions | | | | | | | (5,746,264 | ) | | | | | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

From Capital Share Transactions | | | | | | | | | | | | | | | | | | | | |

Proceeds from Sale of Shares | | | | | | | 9,234,433 | | | | | | | | | | | | 15,958,758 | |

Shares Issued in Reinvestment of Dividends and Distributions | | | | | | | 3,488,667 | | | | | | | | | | | | — | |

Cost of Shares Redeemed | | | | | | | (113,240,079 | ) | | | | | | | | | | | (119,212,979 | ) |

Redemption Fees | | | | | | | 33,271 | | | | | | | | | | | | 50,800 | |

| | | | | | | | | | | | | | | | | | | | |

Net Decrease in Net Assets from Shareholder Activity | | | | | | | (100,483,708 | ) | | | | | | | | | | | (103,203,421 | ) |

| | | | | | | | | | | | | | | | | | | | |

NET ASSETS | | | | | | | | | | | | | | | | | | | | |

Net Increase (Decrease) in Net Assets | | | | | | | (48,922,842 | ) | | | | | | | | | | | 193,822,093 | |

Net Assets at Beginning of Year | | | | | | | 1,251,386,097 | | | | | | | | | | | | 1,057,564,004 | |

| | | | | | | | | | | | | | | | | | | | |

Net Assets at End of Year | | | | | | $ | 1,202,463,255 | | | | | | | | | | | $ | 1,251,386,097 | |

| | | | | | | | | | | | | | | | | | | | |

SHARES TRANSACTIONS | | | | | | | | | | | | | | | | | | | | |

Issued | | | | | | | 268,132 | | | | | | | | | | | | 522,979 | |

Reinvested | | | | | | | 101,121 | | | | | | | | | | | | — | |

Redeemed | | | | | | | (3,248,407 | ) | | | | | | | | | | | (4,057,644 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net Decrease in Shares | | | | | | | (2,879,154 | ) | | | | | | | | | | | (3,534,665 | ) |

Shares Outstanding at Beginning of Year | | | | | | | 39,187,509 | | | | | | | | | | | | 42,722,174 | |

| | | | | | | | | | | | | | | | | | | | |

Shares Outstanding at End of Year | | | | | | | 36,308,355 | | | | | | | | | | | | 39,187,509 | |

| | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

4

THE FAIRHOLME FUND

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| | | For the Fiscal Year Ended November 30, | |

| | | | | |

| | | 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | |

PER SHARE OPERATING PERFORMANCE | | | | | | | | | | | | | | | | | | | | |

NET ASSET VALUE, BEGINNING OF YEAR | | | $31.93 | | | | $24.75 | | | | $29.29 | | | | $25.35 | | | | $19.19 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Investment Operations | | | | | | | | | | | | | | | | | | | | |

Net Investment Income (Loss)(1) | | | 0.20 | | | | 0.14 | | | | 0.02 | | | | (0.07 | ) | | | (0.08 | ) |

Net Realized and Unrealized Gain (Loss) on Investments | | | 1.14 | | | | 7.04 | | | | (4.56 | ) | | | 4.01 | | | | 6.41 | |

| | | | | | | | | | | | | | | | | | | | |

Total from Investment Operations | | | 1.34 | | | | 7.18 | | | | (4.54 | ) | | | 3.94 | | | | 6.33 | |

| | | | | | | | | | | | | | | | | | | | |

Dividends and Distributions | | | | | | | | | | | | | | | | | | | | |

From Net Investment Income | | | (0.15 | ) | | | — | | | | — | | | | — | | | | (0.17 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total Dividends and Distributions | | | (0.15 | ) | | | — | | | | — | | | | — | | | | (0.17 | ) |

| | | | | | | | | | | | | | | | | | | | |

Redemption Fees(1) | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) |

| | | | | | | | | | | | | | | | | | | | |

NET ASSET VALUE, END OF YEAR | | | $33.12 | | | | $31.93 | | | | $24.75 | | | | $29.29 | | | | $25.35 | |

| | | | | | | | | | | | | | | | | | | | |

TOTAL RETURN | | | 4.17 | % | | | 29.01 | % | | | (15.50 | )% | | | 15.54 | % | | | 33.19 | % |

Ratio/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net Assets, End of Year (in 000’s) | | | $1,202,463 | | | | $1,251,386 | | | | $1,057,564 | | | | $1,348,318 | | | | $1,269,211 | |

Ratio of Gross Expenses to Average Net Assets | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.01 | %(3) |

Ratio of Net Expenses to Average Net Assets | | | 0.80 | %(4) | | | 0.80 | %(4) | | | 0.80 | %(4) | | | 0.80 | %(4) | | | 0.81 | %(3)(4) |

Ratio of Net Investment Income (Loss) to Average Net Assets | | | 0.57 | % | | | 0.47 | % | | | 0.06 | % | | | (0.25 | )% | | | (0.41 | )% |

Portfolio Turnover Rate | | | 2.97 | % | | | 2.72 | % | | | 2.54 | % | | | 8.84 | % | | | 8.18 | % |

| (1) | Based on average shares outstanding. |

| (2) | Redemption fees represent less than $0.01. |

| (3) | 0.01% is attributable to legal expenses incurred outside of the 1.00% management fee. |

| (4) | Effective January 1, 2018, the Manager has agreed to waive, on a voluntary basis, a portion of the management fee of the Fund to the extent necessary to limit the management fee paid to the Manager by the Fund to an annual rate of 0.80% of the Fund’s daily average net asset value. |

The accompanying notes are an integral part of the financial statements.

5

THE FAIRHOLME FUND

NOTES TO FINANCIAL STATEMENTS

November 30, 2024

Note 1. Organization

Fairholme Funds, Inc. (the “Company”), a Maryland corporation, is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Company’s Articles of Incorporation permit the Board of Directors of the Company (the “Board” or the “Directors”) to issue 1,100,000,000 shares of common stock at $.0001 par value. 700,000,000 shares have been allocated to The Fairholme Fund (the “Fund”). The Fund is a non-diversified fund. The Fund may have a greater percentage of its assets invested in particular securities than a diversified fund, exposing the Fund to the risk of unanticipated industry conditions as well as risks specific to a single company or the securities of a single company. The Fund has different objectives, capitalizations, and considerations that may or may not lead to differing compositions of issuers, securities within an issuer, and cash levels within the Fund. The Board has the power to designate one or more separate and distinct series and/or classes of shares of common stock and to classify or reclassify any unissued shares with respect to such series.

The Fund’s investment objective is to provide long-term growth of capital. Under normal circumstances, the Fund seeks to achieve its investment objective by investing in a focused portfolio of equity and fixed-income securities. The proportion of the Fund’s assets invested in each type of asset class will vary from time to time based upon Fairholme Capital Management, L.L.C.’s (the “Manager”) assessment of general market and economic conditions and other factors. The Fund may invest in, and may shift frequently among, the asset classes and market sectors. The equity securities in which the Fund may invest include common and preferred stock (including convertible preferred stock), interests in publicly traded partnerships, business trust shares, interests in real estate investment trusts, rights and warrants to subscribe for the purchase of equity securities, and depository receipts. The Fund may invest in equity securities without regard to the jurisdictions in which the issuers of the securities are organized or situated and without regard to the market capitalizations or sectors of such issuers. The fixed-income securities in which the Fund may invest include U.S. corporate debt securities, non-U.S. corporate debt securities, bank debt (including bank loans and participations), U.S. government and agency debt securities (including U.S. Treasury bills), short-term debt obligations of foreign governments, and foreign money market instruments. Except for its investments in short-term debt obligations of foreign governments, the Fund may invest in fixed-income securities regardless of maturity or the rating of the issuer of the security. The Fund may also invest in “special situations” to achieve its objective. “Special situation” investments may include equity securities or fixed-income securities, such as corporate debt, which may be in a distressed position as a result of economic or company specific developments. Although the Fund normally holds a focused portfolio of equity and fixed-income securities, the Fund is not required to be fully invested in such securities and may maintain a significant portion of its total assets in cash and securities generally considered to be cash equivalents. The Manager serves as investment adviser to the Fund.

There is no guarantee that the Fund will meet its objective.

Note 2. Significant Accounting Policies

As an investment company, the Fund follows the investment company accounting and reporting guidance, which is part of U.S. generally accepted accounting principles (“U.S. GAAP”). The Fund’s investments are reported at fair value as defined by U.S. GAAP. The Fund calculates its net asset value as soon as practicable following the close of regular trading on the New York Stock Exchange (currently 4:00 p.m. Eastern Time) on each day the New York Stock Exchange is open.

A description of the valuation techniques applied to the Fund’s securities follows:

Security Valuation:

Securities for which market quotations are readily available are valued at market value, and other securities are valued at “fair value” as determined in accordance with policies and procedures approved by the Board. Pursuant to Rule 2a-5 under the 1940 Act, the Board has designated the Manager as valuation designee to perform fair value determinations relating to the Fund’s portfolio investments, subject to the Board’s oversight.

The Manager may determine the fair valuation of a security when market quotations are not readily available, when securities are determined to be illiquid or restricted, or when in the judgment of the Manager the prices or values available do not represent the fair value of the investment. Factors which may cause the Manager to make such a judgment include the following: (a)

6

THE FAIRHOLME FUND

NOTES TO FINANCIAL STATEMENTS (continued)

November 30, 2024

only a bid price or an asked price is available; (b) the spread between bid and ask prices is substantial; (c) the liquidity of the securities; (d) the frequency of sales; (e) the thinness of the market; (f) the size of reported trades; (g) actions of the investment’s markets, such as the suspension or limitation of trading; and (h) local market closures. The circumstances of fair valued securities are frequently monitored to determine if fair valuation measures continue to apply.

Equity securities (common and preferred stocks): Securities traded on a national securities exchange or reported on the NASDAQ national market are generally valued at the official closing price, or at the last reported sale price on the exchange or market on which the securities are traded, as of the close of business on the day the securities are being valued or, lacking any sales, at the last available bid price.

Fixed-income securities (U.S. government obligations, corporate bonds, convertible bonds, and asset backed securities): Fixed-income securities are valued at prices supplied by an independent pricing source or by pricing service providers based on broker or dealer supplied valuations or matrix pricing.

Open-end mutual fund: Investments in open-end mutual funds, including money market funds, are valued at their closing net asset value each business day.

Short-term securities: Investments in securities with remaining maturities of less than sixty days are valued at prices supplied by an independent pricing source or by one of the Fund’s pricing agents based on broker or dealer supplied valuations or matrix pricing.

The Fund uses third-party pricing services, which are approved by the Manager, to provide prices for some of the Fund’s securities. The Fund also uses other independent market trade data sources, as well as broker quotes provided by market makers.

U.S. GAAP defines fair value as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. U.S. GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value:

| • Level 1 — | quoted prices in active markets for identical securities; |

| • Level 2 — | other significant observable inputs (including quoted prices for similar securities, quoted prices in inactive markets for identical securities, interest rates, prepayment speeds, credit risk, etc.); and |

| • Level 3 — | significant unobservable inputs (including the Manager’s assumptions in determining the fair value of investments). |

7

THE FAIRHOLME FUND

NOTES TO FINANCIAL STATEMENTS (continued)

November 30, 2024

The inputs or methodology used for valuing investments are not necessarily an indication of the level of risk associated with investing in those investments. The summary of the Fund’s investments by inputs used to value the Fund’s investments as of November 30, 2024, is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Valuation Inputs | | | | |

| | | Level 1 -

Quoted Prices | | | | | | Level 2 - Other

Significant

Observable

Inputs | | | | | | Level 3 -

Significant

Unobservable

Inputs | | | | | | Total

Fair Value

at 11/30/24 | |

ASSETS: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

INVESTMENTS (Fair Value): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Domestic Equity Securities* | | $ | 1,007,063,059 | | | | | | | $ | — | | | | | | | $ | — | | | | | | | $ | 1,007,063,059 | |

Foreign Equity Securities* | | | 8,584,629 | | | | | | | | — | | | | | | | | — | | | | | | | | 8,584,629 | |

Domestic Preferred Equity Securities* | | | 2,388,500 | | | | | | | | — | | | | | | | | — | | | | | | | | 2,388,500 | |

U.S. Government Obligations | | | — | | | | | | | | 144,693,885 | | | | | | | | — | | | | | | | | 144,693,885 | |

Money Market Funds | | | 38,414,468 | | | | | | | | — | | | | | | | | — | | | | | | | | 38,414,468 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

TOTAL INVESTMENTS | | $ | 1,056,450,656 | | | | | | | $ | 144,693,885 | | | | | | | $ | — | | | | | | | $ | 1,201,144,541 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | Industry classification for these categories are detailed in the Schedule of Investments. |

There were no Level 3 investments at November 30, 2024 or November 30, 2023.

Dividends and Distributions: The Fund records dividends and distributions to its shareholders on the ex-dividend date. The Fund intends to distribute substantially all of its net investment income (if any) as dividends to its shareholders on an annual basis in December. The Fund intends to distribute any net long-term capital gains and any net short-term capital gains at least once a year. If the total dividends and distributions made in any tax year exceed net investment income and accumulated realized capital gains, a portion of the total distribution may be treated as a tax return of capital.

Foreign Currency Translation: The books and records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars on the following basis: (i) fair value of investment securities, assets, and liabilities at the current rate of exchange; and (ii) purchases and sales of investment securities, income, and expenses at the relevant rates of exchange prevailing on the respective dates of such transactions. The Fund does not isolate that portion of gains and losses on investment securities which is due to changes in the foreign exchange rates from that which is due to changes in the market prices of such securities.

Estimates: The preparation of financial statements in conformity with U.S. GAAP requires the Fund to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reported period. Actual results could differ from those estimates.

Redemption Fee: The Fund assesses a 2% fee on the proceeds of the Fund shares that are redeemed or exchanged within 60 days of their purchase. The redemption fee is paid to the Fund as applicable, for the benefit of remaining shareholders and is recorded as paid-in capital. The redemption fees retained by the Fund during the fiscal years ended November 30, 2024 and November 30, 2023, amounted to $33,271 and $50,800, respectively.

Other: The Fund accounts for security transactions on the trade date for financial statement purposes. The specific identification method is used for determining realized gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date net of foreign taxes withheld where recovery is uncertain and interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are amortized over the life of the respective securities using the effective yield method. Securities denominated in currencies other than U.S. dollars are subject to changes in value due to fluctuation in exchange rates. The Fund may invest in countries that require governmental approval for the repatriation of investment income, capital, or the proceeds of sales of securities by foreign investors. In addition, if there is deterioration in a

8

THE FAIRHOLME FUND

NOTES TO FINANCIAL STATEMENTS (continued)

November 30, 2024

country’s balance of payments or for other reasons, a country may impose temporary restrictions on foreign capital remittances abroad.

The Fund paid commissions and other brokerage fees during the period.

Note 3. Related Party Transactions

The Manager is a Delaware limited liability company and is registered with the SEC as an investment adviser. The Manager’s principal business is to provide investment management and advisory services to individuals, corporations, and other institutions throughout the world. Pursuant to an Investment Management Agreement, the Fund pays a management fee to the Manager for its provision of investment advisory and operating services to the Fund. Subject to applicable waivers or limitations, the management fee is paid at an annual rate equal to 1.00% of the daily average net assets of the Fund. Effective January 1, 2018, the Manager has agreed to waive, on a voluntary basis, a portion of the management fees of the Fund to the extent necessary to limit the management fee of the Fund to the annual rate of 0.80% of the Fund’s daily average net asset value (“Undertaking”). This Undertaking may be terminated by the Manager upon 60 days’ written notice to the Fund. The Manager is responsible pursuant to the Investment Management Agreement for paying the Fund’s expenses for the following services: transfer agency, fund accounting, fund administration, custody, legal, audit, compliance, directors’ fees, call center, fulfillment, travel, insurance, rent, printing, postage and other office supplies. The Manager is not responsible for paying for the following costs and expenses of the Fund: commissions, brokerage fees, issue and transfer taxes, and other costs chargeable to the Fund in connection with securities transactions or in connection with securities owned by the Fund, taxes, interest, acquired fund fees and related expenses, expenses in connection with litigation by or against the Fund, and any other extraordinary expenses.

The Manager earned, after the voluntary reduction of the management fees, $10,519,492 from the Fund for its services during the fiscal year ended November 30, 2024.

Bruce Berkowitz is the Chief Investment Officer of the Manager and Chairman of the Fund’s Board. As of November 30, 2024, Mr. Berkowitz and his affiliates owned an aggregate 13,309,401 shares of the Fund.

A Director and Officers of the Fund are also Officers of the Manager or its affiliates.

Note 4. Investments

For the fiscal year ended November 30, 2024, aggregated purchases and sales of investment securities other than short-term investments and U.S. government obligations were as follows:

| | | | | | | | | | |

| Purchases | | | | | | Sales | |

| $ | 34,032,560 | | | | | | | $ | 161,489,747 | |

Note 5. Tax Matters

Federal Income Taxes: The Fund intends to qualify each year as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended. By so qualifying, the Fund will not be subject to federal income taxes to the extent that it distributes all of its net investment income and any realized capital gains.

For U.S. federal income tax purposes, the cost of securities owned, gross unrealized appreciation, gross unrealized depreciation, and net unrealized appreciation/(depreciation) of investments at November 30, 2024, were as follows:

| | | | | | |

| | | Gross | | Gross | | Net Unrealized |

| | | Unrealized | | Unrealized | | Appreciation/ |

| Cost | | Appreciation | | Depreciation | | (Depreciation) |

| | | |

| $727,055,721 | | $509,341,393 | | $(35,252,573) | | $474,088,820 |

9

THE FAIRHOLME FUND

NOTES TO FINANCIAL STATEMENTS (continued)

November 30, 2024

The difference between book basis and tax basis net unrealized appreciation is attributable to the tax deferral of losses on wash sales, capitalized cost and basis adjustments on investments in partnerships.

The Fund’s tax basis capital gains are determined only at the end of each fiscal year. As of November 30, 2024, the components of distributable earnings on a tax basis were as follows:

| | | | |

Undistributed Ordinary Income | | | $7,543,658 | |

Capital Loss carryforwards | | | (764,550,729) | |

Net Unrealized Appreciation/(Depreciation) on Investments and Foreign Currency Related Transactions | | | 474,088,820 | |

| | | | |

Total | | | $(282,918,251) | |

| | | | |

The Fund is permitted to carry forward for an unlimited period capital losses incurred to reduce future required distributions of net capital gains to shareholders. Capital losses that are carried forward will retain their character as either short-term or long-term capital losses. As of November 30, 2024, net short-term and long-term capital loss carryforwards were as follows:

| | | | |

Long-term capital loss carryforward | | | $764,550,729 | |

| | | | |

Total | | | $764,550,729 | |

| | | | |

During the fiscal year ended November 30, 2024, the Fund utilized $38,816,333 of the capital loss carryforwards.

The Manager has analyzed the Fund’s tax positions taken on tax returns for all open tax years (current and prior three tax years) and has concluded that there are no uncertain tax positions that require recognition of a tax liability. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired (the current year and prior three years) are subject to examination by the Internal Revenue Service and state departments of revenue. Additionally, the Fund is not aware of any tax position for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

Note 6. Dividends and Distributions to Shareholders

Ordinary income and capital gain distributions are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP.

The tax character of dividends and distributions paid by the Fund were as follows:

| | | | | | | | |

| | | For the | | | For the | |

| | | Fiscal Year | | | Fiscal Year | |

| | | Ended | | | Ended | |

| | | November 30, | | | November 30, | |

| | | 2024 | | | 2023 | |

Dividends and Distributions paid from: | | | | | | | | |

Ordinary Income | | $ | 5,746,264 | | | $ | — | |

| | | | | | | | |

The Fund declared and made payable the following distributions on December 13, 2024:

Dividends and Distributions paid from:

| | |

Ordinary Income | | $7,543,988 |

Note 7. Reclassification in the Capital Accounts

In accordance with U.S. GAAP, the Fund has recorded reclassifications in its capital account. These reclassifications have no impact on the net asset value of the Fund and are designed generally to present undistributed income and realized gains on a tax basis which is considered to be more informative to the shareholder. Permanent differences were primarily due to the

10

THE FAIRHOLME FUND

NOTES TO FINANCIAL STATEMENTS (continued)

November 30, 2024

disallowance of certain non-tax deductible expenses from investments in partnerships for the Fund. As of November 30, 2024, the Fund recorded the following reclassifications to increase (decrease) the accounts listed below:

| | | | |

Total accumulated losses | | | $11,843 | |

Paid-in-Capital | | | (11,843 | ) |

Note 8. Transactions in Shares of Affiliates

Portfolio companies in which the Fund owns 5% or more of the outstanding voting securities of the issuer are considered affiliates of the Fund. The aggregate fair value of all securities of affiliates held by the Fund as of November 30, 2024 amounted to $886,300,522, representing approximately 73.71% of the Fund’s net assets.

Transactions in the Fund during the fiscal year ended November 30, 2024, in which the issuer of the security was an affiliate are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | November 30,

2023 | | | Gross Additions | | | Gross Deductions | | | November 30, 2024 | | | | | | | | | | |

| | | Shares/

Par Value | | | Shares/

Par Value | | | Shares/

Par Value | | | Shares/

Par Value | | | Fair Value | | | Realized

Gain

(Loss) | | | Investment

Income | | | Change in

Unrealized

Appreciation/

Depreciation | |

The St. Joe Co. | | | 19,394,724 | | | | — | | | | 2,043,500 | | | | 17,351,224 | | | $ | 886,300,522 | | | $ | 48,796,703 | | | $ | 9,533,300 | | | $ | (42,880,437 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | | | | | | | | | | | | | | | $ | 886,300,522 | | | $ | 48,796,703 | | | $ | 9,533,300 | | | $ | (42,880,437 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Note 9. Indemnifications

Under the Company’s organizational documents, its Officers and Directors are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In the normal course of business the Company or the Fund enters into contracts that contain a variety of representations and customary indemnifications. the Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on its experience to date, the Fund expects the risk of loss to be remote.

Note 10. Subsequent Events

Management has evaluated the impact on the Fund of all subsequent events occurring through the date the financial statements were issued and has determined that there were no subsequent events requiring recognition or disclosure in the financial statements.

11

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the shareholders of The Fairholme Fund and the Board of Directors of Fairholme Funds, Inc.:

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of The Fairholme Fund (the “Fund”), one of the funds constituting Fairholme Funds, Inc., as of November 30, 2024, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of November 30, 2024, and the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. Our procedures included confirmation of securities owned as of November 30, 2024, by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

/s/ DELOITTE & TOUCHE LLP

Boston, Massachusetts

January 27, 2025

We have served as the auditor of one or more Fairholme Funds, Inc. investment companies since 2004.

12

THE FAIRHOLME FUND

ADDITIONAL INFORMATION

November 30, 2024

Shareholder Tax Information (unaudited)

The Fund reported $5,746,264 of total distributions paid during the fiscal year ended November 30, 2024.

The information below is reported for the Fund’s fiscal year and not calendar year. Therefore, shareholders should refer to their Form 1099-DIV or other tax information which will be mailed in 2025 to determine the calendar year amounts to be included on their 2024 tax returns. Shareholders should consult their own tax advisors.

Please note that, for the fiscal year ended November 30, 2024, the percentages of ordinary income distributions paid by the Fund were reported as follows:

| | | | |

Qualified Dividend Income for Individuals | | | 100.00% | |

| |

Dividends Qualifying for the Dividends Received Deduction for Corporations | | | 100.00% | |

| |

Qualifying Interest Income | | | 40.06% | |

| |

U.S. Treasury Securities | | | 31.04% | |

* The law varies in each state as to whether and what percentage of dividend income attributable to U.S. Treasury securities is exempt from state and local income tax. It is recommended that you consult your tax advisor to determine if any portion of the dividends you received is exempt from income taxes.

All information reported is based on financial information available as of the date of this annual report and, accordingly, is subject to change. For each item, it is the intention of the Fund to report the maximum amount permitted under the Internal Revenue Code and the regulations thereunder.

13

THE FAIRHOLME FOCUSED INCOME FUND

SCHEDULE OF INVESTMENTS

November 30, 2024

| | | | | | | | |

Shares | | | | | Value | |

| | |

| | | | DOMESTIC EQUITY

SECURITIES — 50.5% | | | | |

| | |

| | | | FERTILIZERS & AGRICULTURAL

CHEMICALS — 1.6% | | | | |

| | 38,600 | | | CF Industries Holdings, Inc. | | $ | 3,460,876 | |

| | | | | | | | |

| |

| | | | INTEGRATED OIL & GAS — 0.2% | |

| | 1,000 | | | Chevron Corp. | | | 161,930 | |

| | 1,000 | | | Exxon Mobil Corp. | | | 117,960 | |

| | 3,000 | | | Occidental Petroleum Corp. | | | 151,740 | |

| | | | | | | | |

| | | | | | | 431,630 | |

| | | | | | | | |

| | |

| | | | OIL & GAS EQUIPMENT & SERVICES — 0.3% | | | | |

| | 30,000 | | | Liberty Energy, Inc. | | | 552,000 | |

| | | | | | | | |

| | |

| | | | OIL & GAS EXPLORATION & PRODUCTION — 0.1% | | | | |

| | 1,000 | | | Diamondback Energy, Inc. | | | 177,590 | |

| | 1,000 | | | EOG Resources, Inc. | | | 133,260 | |

| | | | | | | | |

| | | | | | | 310,850 | |

| | | | | | | | |

| | |

| | | | OIL & GAS STORAGE & TRANSPORTATION —32.1% | | | | |

| | 2,038,000 | | | Enterprise Products Partners LP | | | 70,168,340 | |

| | | | | | | | |

| | |

| | | | PROPERTY & CASUALTY INSURANCE — 5.5% | | | | |

| | 187,650 | | | W. R. Berkley Corp. | | | 12,112,807 | |

| | | | | | | | |

| | |

| | | | REGIONAL BANKS — 10.7% | | | | |

| | 469,300 | | | Bank OZK | | | 23,450,921 | |

| | | | | | | | |

| |

| TOTAL DOMESTIC EQUITY

SECURITIES (COST $70,981,998) | | | 110,487,424 | |

| | | | | | | | |

| | |

| | | | DOMESTIC PREFERRED EQUITY SECURITIES — 2.1% | | | | |

| | |

| | | | MORTGAGE FINANCE — 2.1% | | | | |

| | 298,800 | | | Federal Home Loan Mortgage Corp.

5.100%, Series H(a) | | | 4,482,000 | |

| | | | | | | | |

| |

| TOTAL DOMESTIC PREFERRED

EQUITY SECURITIES

(COST $2,016,900) | | | 4,482,000 | |

| | | | | | | | |

| | | | | | | | |

| Principal | | | | | Value | |

| | |

| | | | U.S. GOVERNMENT OBLIGATIONS — 41.0% | | | | |

| | | | U.S. Treasury Bills | | | | |

| | $ 20,000,000 | | | 4.521%, 12/05/2024(b) | | $ | 19,992,592 | |

| | 20,000,000 | | | 4.486%, 12/12/2024(b) | | | 19,974,767 | |

| | 20,000,000 | | | 4.483%, 12/19/2024(b) | | | 19,957,018 | |

| | 15,000,000 | | | 4.531%, 12/31/2024(b) | | | 14,945,081 | |

| | 15,000,000 | | | 4.530%, 01/02/2025(b) | | | 14,941,940 | |

| | | | | | | | |

| |

| TOTAL U.S. GOVERNMENT OBLIGATIONS

(COST $89,801,463) | | | 89,811,398 | |

| | | | | | | | |

| | |

| Shares | | | | | | |

| | |

| | | | MONEY MARKET FUNDS — 6.4% | | | | |

| | |

| | 14,109,878 | | | Fidelity Investments Money Market Treasury Portfolio - Class I, 4.51%(c) | | | 14,109,878 | |

| | | | | | | | |

| TOTAL MONEY MARKET FUNDS

(COST $14,109,878) | | | 14,109,878 | |

| | | | | | | | |

| TOTAL INVESTMENTS — 100.0%

(COST $176,910,239) | | | 218,890,700 | |

| | | | OTHER ASSETS IN EXCESS OF LIABILITIES — 0.0% | | | 4,031 | |

| | | | | | | | |

| | NET ASSETS — 100.0% | | $ | 218,894,731 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

1

THE FAIRHOLME FOCUSED INCOME FUND

SCHEDULE OF INVESTMENTS (continued)

November 30, 2024

| (a) | Non-income producing security. |

| (b) | Rates shown are the effective yields based on the purchase price. The calculation assumes the security is held to maturity. |

| (c) | Annualized based on the 1-day yield as of November 30, 2024. |

The accompanying notes are an integral part of the financial statements.

2

THE FAIRHOLME FOCUSED INCOME FUND

STATEMENT OF ASSETS & LIABILITIES

November 30, 2024

| | | | |

| |

Assets | | | | |

| |

Investments, at Fair Value (Cost — $176,910,239) | | $ | 218,890,700 | |

| |

Dividends and Interest Receivable | | | 58,963 | |

| |

Receivable for Capital Shares Sold | | | 223,394 | |

| | | | |

| |

Total Assets | | | 219,173,057 | |

| | | | |

| |

Liabilities | | | | |

| |

Accrued Management Fees | | | 136,989 | |

| |

Payable for Capital Shares Redeemed | | | 8,000 | |

| |

Payable for Securities Purchased | | | 133,337 | |

| | | | |

| |

Total Liabilities | | | 278,326 | |

| | | | |

| |

NET ASSETS | | $ | 218,894,731 | |

| | | | |

| |

Net Assets consist of: | | | | |

| |

Paid-In Capital | | $ | 186,757,631 | |

| |

Total Accumulated Gains | | | 32,137,100 | |

| | | | |

| |

NET ASSETS | | $ | 218,894,731 | |

| | | | |

| |

Shares of Common Stock Outstanding* ($0.0001 par value) | | | 15,157,037 | |

| | | | |

| |

Net Asset Value, Offering and Redemption Price Per Share

($218,894,731 / 15,157,037 shares) | | $ | 14.44 | |

| | | | |

* 200,000,000 shares authorized in total.

The accompanying notes are an integral part of the financial statements.

3

THE FAIRHOLME FOCUSED INCOME FUND

STATEMENT OF OPERATIONS

| | | | | | | | |

| | | For the

Fiscal Year Ended

November 30, 2024 |

Investment Income | | | | | | | | |

| | |

Interest | | | | | | $ | 6,285,520 | |

| | |

Dividends | | | | | | | 702,870 | |

| | | | | | | | |

| | |

Total Investment Income | | | | | | | 6,988,390 | |

| | | | | | | | |

| | |

Expenses | | | | | | | | |

| | |

Management Fees | | | | | | | 2,072,507 | |

| | | | | | | | |

| | |

Total Expenses | | | | | | | 2,072,507 | |

| | | | | | | | |

| | |

Less: Voluntary Reduction of Management Fees | | | | | | | (414,501 | ) |

| | | | | | | | |

| | |

Net Expenses | | | | | | | 1,658,006 | |

| | | | | | | | |

| | |

Net Investment Income | | | | | | | 5,330,384 | |

| | | | | | | | |

| | |

Realized and Unrealized Gain (Loss) on Investments and Foreign Currency Related Transactions | | | | | | | | |

| | |

Net Realized Gain on: | | | | | | | | |

| | |

Investments | | | | | | | 5,021,946 | |

| | |

Foreign Currency Related Transactions | | | | | | | 231 | |

| | |

Net Change in Unrealized Appreciation (Depreciation) on: | | | | | | | | |

| | |

Investments | | | | | | | 29,220,840 | |

| | |

Foreign Currency Related Transactions | | | | | | | (2 | ) |

| | | | | | | | |

| | |

Net Realized and Unrealized Gain (Loss) on Investments and Foreign Currency Related Transactions | | | | | | | 34,243,015 | |

| | | | | | | | |

| | |

NET INCREASE IN NET ASSETS FROM OPERATIONS | | | | | | $ | 39,573,399 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

4

THE FAIRHOLME FOCUSED INCOME FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | | | | | | | | | | | | | |

| | | For the Fiscal Year

Ended

November 30, 2024 | | | | | For the Fiscal Year

Ended

November 30, 2023 | |

CHANGES IN NET ASSETS | | | | | | | | | | | | | | | | | | | | |

From Operations | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net Investment Income | | | | | | $ | 5,330,384 | | | | | | | | | | | $ | 4,052,960 | |

Net Realized Gain on Investments and Foreign Currency Related Transactions | | | | | | | 5,022,177 | | | | | | | | | | | | 8,756,008 | |

Net Change in Unrealized Appreciation (Depreciation) on Investments and Foreign Currency Related Translations | | | | | | | 29,220,838 | | | | | | | | | | | | 2,860,991 | |

| | | | | | | | | | | | | | | | | | | | |

Net Increase in Net Assets from Operations | | | | | | | 39,573,399 | | | | | | | | | | | | 15,669,959 | |

| | | | | | | | | | | | | | | | | | | | |

From Dividends and Distributions to Shareholders | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net Decrease in Net Assets from Dividends and Distributions | | | | | | | (6,600,066 | ) | | | | | | | | | | | (4,539,140 | ) |

| | | | | | | | | | | | | | | | | | | | |

From Capital Share Transactions | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Proceeds from Sale of Shares | | | | | | | 17,686,311 | | | | | | | | | | | | 53,766,263 | |

| | | | | |

Shares Issued in Reinvestment of Dividends and Distributions | | | | | | | 3,062,487 | | | | | | | | | | | | 2,007,900 | |

| | | | | |

Cost of Shares Redeemed | | | | | | | (43,561,492 | ) | | | | | | | | | | | (28,717,725 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net Increase (Decrease) in Net Assets from Shareholder Activity | | | | | | | (22,812,694 | ) | | | | | | | | | | | 27,056,438 | |

| | | | | | | | | | | | | | | | | | | | |

NET ASSETS | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net Increase in Net Assets | | | | | | | 10,160,639 | | | | | | | | | | | | 38,187,257 | |

| | | | | |

Net Assets at Beginning of Year | | | | | | | 208,734,092 | | | | | | | | | | | | 170,546,835 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net Assets at End of Year | | | | | | $ | 218,894,731 | | | | | | | | | | | $ | 208,734,092 | |

| | | | | | | | | | | | | | | | | | | | |

SHARES TRANSACTIONS | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Issued | | | | | | | 1,361,512 | | | | | | | | | | | | 4,523,429 | |

| | | | | |

Reinvested | | | | | | | 240,570 | | | | | | | | | | | | 170,946 | |

| | | | | |

Redeemed | | | | | | | (3,372,084 | ) | | | | | | | | | | | (2,449,069 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net Increase (Decrease) in Shares | | | | | | | (1,770,002 | ) | | | | | | | | | | | 2,245,306 | |

| | | | | |

Shares Outstanding at Beginning of Year | | | | | | | 16,927,039 | | | | | | | | | | | | 14,681,733 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Shares Outstanding at End of Year | | | | | | | 15,157,037 | | | | | | | | | | | | 16,927,039 | |

| | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

5

THE FAIRHOLME FOCUSED INCOME FUND

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| | | For the Fiscal Year Ended November 30, | |

| | | 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | |

PER SHARE OPERATING PERFORMANCE | | | | | | | | | | | | | | | | | | | | |

NET ASSET VALUE, BEGINNING OF YEAR | | | $12.33 | | | | $11.62 | | | | $10.62 | | | | $10.31 | | | | $10.23 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Investment Operations | | | | | | | | | | | | | | | | | | | | |

Net Investment Income(1) | | | 0.33 | | | | 0.26 | | | | 0.10 | | | | 0.13 | | | | 0.07 | |

Net Realized and Unrealized Gain on Investments | | | 2.19 | | | | 0.74 | | | | 1.08 | | | | 0.30 | | | | 0.11 | (2) |

| | | | | | | | | | | | | | | | | | | | |

Total from Investment Operations | | | 2.52 | | | | 1.00 | | | | 1.18 | | | | 0.43 | | | | 0.18 | |

| | | | | | | | | | | | | | | | | | | | |

Dividends and Distributions | | | | | | | | | | | | | | | | | | | | |

From Net Investment Income | | | (0.41 | ) | | | (0.29 | ) | | | (0.18 | ) | | | (0.12 | ) | | | (0.10 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total Dividends and Distributions | | | (0.41 | ) | | | (0.29 | ) | | | (0.18 | ) | | | (0.12 | ) | | | (0.10 | ) |

| | | | | | | | | | | | | | | | | | | | |

NET ASSET VALUE, END OF YEAR | | | $14.44 | | | | $12.33 | | | | $11.62 | | | | $10.62 | | | | $10.31 | |

| | | | | | | | | | | | | | | | | | | | |

TOTAL RETURN | | | 20.94 | % | | | 8.80 | % | | | 11.30 | % | | | 4.16 | % | | | 1.78 | % |

Ratio/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net Assets, End of Year (in 000’s) | | | $218,895 | | | | $208,734 | | | | $170,547 | | | | $118,887 | | | | $107,109 | |

Ratio of Gross Expenses to Average Net Assets | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.02 | %(3) |

Ratio of Net Expenses to Average Net Assets | | | 0.80 | %(4) | | | 0.80 | %(4) | | | 0.80 | %(4) | | | 0.80 | %(4) | | | 0.82 | %(3)(4) |

Ratio of Net Investment Income to Average Net Assets | | | 2.57 | % | | | 2.20 | % | | | 0.89 | % | | | 1.20 | % | | | 0.74 | % |

Portfolio Turnover Rate | | | 47.45 | % | | | 53.48 | % | | | 46.25 | % | | | 118.05 | % | | | 100.67 | % |

| (1) | Based on average shares outstanding. |

| (2) | The amount shown for a share outstanding does not correspond with the aggregate net gain (loss) on investments for the period due to the timing of sales and redemptions of shares in relation to fluctuating market values of the investments of the Fund. |

| (3) | 0.02% is attributable to legal expenses incurred outside the management fee. |

| (4) | Effective January 1, 2018, the Manager has agreed to waive, on a voluntary basis, a portion of the management fee of the Fund to the extent necessary to limit the management fee paid to the Manager by the Fund to an annual rate of 0.80% of the Fund’s daily average net asset value. |

The accompanying notes are an integral part of the financial statements.

6

THE FAIRHOLME FOCUSED INCOME FUND

NOTES TO FINANCIAL STATEMENTS

November 30, 2024

Note 1. Organization

Fairholme Funds, Inc. (the “Company”), a Maryland corporation, is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Company’s Articles of Incorporation permit the Board of Directors of the Company (the “Board” or the “Directors”) to issue 1,100,000,000 shares of common stock at $.0001 par value. 200,000,000 shares have been allocated to The Fairholme Focused Income Fund (the “Fund”). The Fund is a non-diversified fund. The Fund may have a greater percentage of its assets invested in particular securities than a diversified fund, exposing the Fund to the risk of unanticipated industry conditions as well as risks specific to a single company or the securities of a single company. The Fund has different objectives, capitalizations, and considerations that may or may not lead to differing compositions of issuers, securities within an issuer, and cash levels within the Fund. The Board has the power to designate one or more separate and distinct series and/or classes of shares of common stock and to classify or reclassify any unissued shares with respect to such series.

The Fund’s investment objective is to seek current income. Under normal circumstances, the Fund seeks to achieve its investment objective by investing in a focused portfolio of cash distributing securities. To maintain maximum flexibility, the securities in which the Fund may invest include corporate bonds and other corporate debt securities of issuers in the U.S. and foreign countries, bank debt (including bank loans and loan participations), government and agency debt securities of the U.S. and foreign countries (including U.S. Treasury bills), convertible bonds and other convertible securities, and equity securities, including preferred and common stock of issuers in the U.S. and foreign countries, interests in publicly traded partnerships, and interests in real estate investment trusts. Although the Fund normally holds a focused portfolio of securities, the Fund is not required to be fully invested in such securities and may maintain a significant portion of its total assets in cash and securities generally considered to be cash equivalents. Fairholme Capital Management, L.L.C. (the “Manager”) serves as investment adviser to the Fund.

There is no guarantee that the Fund will meet its objective.

Note 2. Significant Accounting Policies

As an investment company, the Fund follows the investment company accounting and reporting guidance, which is part of U.S. generally accepted accounting principles (“U.S. GAAP”). The Fund’s investments are reported at fair value as defined by U.S. GAAP. The Fund calculates its net asset value as soon as practicable following the close of regular trading on the New York Stock Exchange (currently 4:00 p.m. Eastern Time) on each day the New York Stock Exchange is open.

A description of the valuation techniques applied to the Fund’s securities follows:

Security Valuation:

Securities for which market quotations are readily available are valued at market value, and other securities are valued at “fair value” as determined in accordance with policies and procedures approved by the Board. Pursuant to Rule 2a-5 under the 1940 Act, the Board has designated the Manager as valuation designee to perform fair value determinations relating to the Fund’s portfolio investments, subject to the Board’s oversight.

The Manager may determine the fair valuation of a security when market quotations are not readily available, when securities are determined to be illiquid or restricted, or when in the judgment of the Manager the prices or values available do not represent the fair value of the investment. Factors which may cause the Manager to make such a judgment include the following: (a) only a bid price or an asked price is available; (b) the spread between bid and ask prices is substantial; (c) the liquidity of the securities; (d) the frequency of sales; (e) the thinness of the market; (f) the size of reported trades; (g) actions of the investment’s markets, such as the suspension or limitation of trading; and (h) local market closures. The circumstances of fair valued securities are frequently monitored to determine if fair valuation measures continue to apply.

Equity securities (common and preferred stocks): Securities traded on a national securities exchange or reported on the NASDAQ national market are generally valued at the official closing price, or at the last reported sale price on the exchange or market on which the securities are traded, as of the close of business on the day the securities are being valued or, lacking any sales, at the last available bid price.

7

THE FAIRHOLME FOCUSED INCOME FUND

NOTES TO FINANCIAL STATEMENTS (continued)

November 30, 2024

Fixed-income securities (U.S. government obligations, corporate bonds, convertible bonds, and asset backed securities): Fixed-income securities are valued at prices supplied by an independent pricing source or by pricing service providers based on broker or dealer supplied valuations or matrix pricing.

Open-end mutual fund: Investments in open-end mutual funds, including money market funds, are valued at their closing net asset value each business day.

Short-term securities: Investments in securities with remaining maturities of less than sixty days are valued at prices supplied by an independent pricing source or by one of the Fund’s pricing agents based on broker or dealer supplied valuations or matrix pricing.

The Fund uses third-party pricing services, which are approved by the Manager, to provide prices for some of the Fund’s securities. The Fund also uses other independent market trade data sources, as well as broker quotes provided by market makers.

U.S. GAAP defines fair value as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. U.S. GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value:

| • Level 1 — | quoted prices in active markets for identical securities; |

| • Level 2 — | other significant observable inputs (including quoted prices for similar securities, quoted prices in inactive markets for identical securities, interest rates, prepayment speeds, credit risk, etc.); and |

| • Level 3 — | significant unobservable inputs (including the Manager’s assumptions in determining the fair value of investments). |

The inputs or methodology used for valuing investments are not necessarily an indication of the level of risk associated with investing in those investments. The summary of the Fund’s investments by inputs used to value the Fund’s investments as of November 30, 2024, is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Valuation Inputs | | | | |

| | | Level 1 -

Quoted Prices | | | | | | Level 2 - Other

Significant

Observable

Inputs | | | | | | Level 3 -

Significant

Unobservable

Inputs | | | | | | Total

Fair Value

at 11/30/24 | |

ASSETS: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

INVESTMENTS (Fair Value): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |