UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES |

EXCHANGE ACT OF 1934 for the fiscal year ended December 31, 2006

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

for the transition period from to

Commission File Number 0-28551

NutriSystem, Inc.

(Exact name of Registrant as specified in its charter)

| | |

| Delaware | | 23-3012204 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

300 Welsh Road, Building 1, Suite 100 Horsham, Pennsylvania | | 19044 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (215) 706-5300

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $.001 par value

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in the definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer (as defined in Exchange Act Rule 12b-2).

Large Accelerated Filer x Accelerated Filer ¨ Non-accelerated Filer ¨

Indicate by checkmark whether the registrant is a shell company (as defined by Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant as of June 30, 2006, was $2,044,570,247. Such aggregate market value was computed by reference to the closing price of the common stock as reported on the NASDAQ National Market on June 30, 2006 (the last business day of the Registrant’s most recently completed fiscal second quarter).

Number of shares outstanding of the Registrant’s Common Stock, $0.001 par value, as of February 20, 2007: 35,929,522 shares

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement to be filed with the Securities and Exchange Commission for NutriSystem, Inc.’s annual meeting of stockholders to be held on May 1, 2007, are incorporated by reference into Part III of this Form 10-K.

NutriSystem, Inc.

Table of Contents

2

Special Note Regarding Forward-Looking Statements

Except for the historical information contained herein, this Annual Report (“Report”) on Form 10-K contains certain forward-looking statements that involve substantial risks and uncertainties. Words such as “may,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “continue,” or similar words are intended to identify forward-looking statements, although not all forward-looking statements contain these words. Our actual results, performance or achievements could differ materially from the results expressed in, or implied by, these forward-looking statements. Factors that could cause or contribute to such differences include those set forth in “Risk Factors.” Accordingly, there is no assurance that the results in the forward-looking statements will be achieved.

PART I

Overview

We are a leading marketer and provider of a weight management system based on a portion-controlled, prepared meal program. Typically, our customers purchase monthly food packages containing a 28-day supply of breakfasts, lunches, dinners and desserts, which they supplement with fresh milk, fruit and vegetables. Most of our customers order on an auto-delivery basis, (“Auto-delivery”) in which we send a month’s food supply on an ongoing basis until notified by the customer to stop our shipments. Our Auto-delivery program is currently priced at $294 per shipment, or about $10 per day for a full day’s supply of three entree meals and one snack. Our food is shelf stable at room temperature and will last for up to two years, making it relatively inexpensive to ship and store.

Our program is based on the following five cornerstones that represent who we are to our customers:

Success. We believe our program enables our customers to lose weight successfully. Our NutriSystem Nourish program consists of over 130 portion-controlled food items that are designed to rank low on the Glycemic Index thereby providing dieters with a balanced intake of “good” carbohydrates, proteins and fats. The Glycemic Index is a measure of the quality of carbohydrates in foods. Foods on the lower end of the index are generally considered “good” carbohydrates.

Convenience. We sell our weight management programs primarily through a direct-to-consumer sales and distribution approach using the internet and telephone. Our customers can order 24 hours a day, seven days a week on our website, www.nutrisystem.com, and the food is shipped directly to the customer’s door.

Simplicity. We provide a comprehensive weight management program, consisting of a pre-packaged food program and counseling. Our customers can either choose one of our pre-set food packages or customize their monthly food orders for their specific tastes. There are no center visits, no measuring foods or counting calories.

Value. Our Auto-delivery program is currently priced at about $10 per day for a full day’s supply of three entree meals and one snack. We do not charge membership fees.

Privacy. The direct-to-consumer approach using the internet provides the privacy that our customers value. We provide online and telephone counseling and support to our customers using our trained diet counselors resulting in no need to travel for a face-to-face meeting.

3

Competitive Strengths

We believe that our system offers consumers a sensible approach to losing weight without the use of faddish, unhealthy or unrealistic weight loss methods. We intend to capitalize on the following competitive strengths to grow:

Product Efficacy. We believe our customers are very satisfied with our products and believe they have lost weight while using our program. A customer survey conducted by the National Business Research Institute in December 2005 found that clients lost an average of 19.4 pounds in just under 12 weeks on the NutriSystem weight loss program and 92% of those surveyed would refer our program to others.

Strong Brand Recognition. We believe that our brand is well recognized in the weight management industry. Our company and our predecessors have been in the weight management industry for more than 30 years, and we estimate that our company and our predecessors have spent hundreds of millions of dollars in advertising over that time period.

Low Cost, Highly Scalable Model. Unlike traditional commercial weight loss programs, which primarily sell through franchisee and company-owned centers, in our direct channel we generate revenue through the internet and telephone. Our method of distribution removes the fixed costs and capital investment associated with diet centers. We also minimize fixed costs and capital investments in food procurement and fulfillment: we outsource the production of our food products to a number of vendors and we outsource approximately 87% of our fulfillment operations to a third-party provider.

Superior Consumer Value Proposition. Our goal is to offer our customers a complete weight management program that is convenient, private and cost-effective. Our customers place their orders through the internet or over the phone and have their food delivered directly to their homes. This affords our customers the convenience and anonymity that other diets which rely on weight-loss centers cannot ensure. Additionally, we provide our customers with a month of food, including breakfast, lunch, dinner and desserts, which removes the confusion of reading nutrition labels, measuring portions or counting calories, carbohydrates or points. At a cost of about $10 a day for three meals and a snack, we believe our weight management program offers our customers significant value and is priced below those of our competitors. In addition, we do not charge a membership fee, whereas many of our competitors charge such a fee.

Our Industry

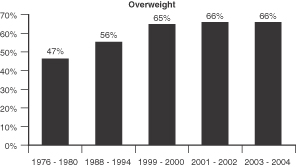

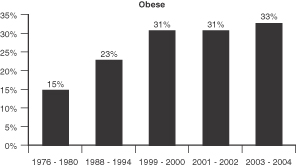

Weight management is a challenge for a significant portion of the U.S. population. The 2003-2004 National Health and Nutrition Examination Study estimated that 66% of the adult population is overweight and 33% is obese, an increase from 47% and 15%, respectively, in 1976:

According to the U.S. Department of Health and Human Services, overweight or obese individuals are increasingly at risk for diseases such as diabetes, heart disease, certain types of cancer, stroke, arthritis, breathing problems and depression. However, there is evidence that weight loss may reduce the risk of developing these diseases.

4

In addition to the health risks, there are also cultural implications for those who are overweight or obese. U.S. consumers are inundated with imagery in media, fashion, and entertainment that depicts the thin body as the ideal type.

Despite the high percentage of overweight or obese individuals in the U.S., the popularity of dieting would seem to indicate consumers’ desire to be thin. According to Gallup surveys, approximately 62 million people in the United States were on a diet during 2006. Approximately 6 million participated in commercial weight loss programs and 49 million conducted some form of self-directed diet. We believe the NutriSystem Nourish program is well positioned to attract both types of dieters.

Competition

The weight loss industry consists of pharmaceutical products and weight loss programs, as well as a wide variety of diet foods and meal replacement bars and shakes, appetite suppressants and nutritional supplements. The weight loss market is served by a diverse array of competitors. Potential customers seeking to manage their weight can turn to traditional center-based competitors such as Weight Watchers, Jenny Craig and LA Weight Loss, online diet-oriented sites such as eDiets.com and WeightWatchers.com, self-administered products and programs such as Atkins and the South Beach Diet and medically supervised programs.

We believe that the principal competitive factors in the weight loss market are:

| | • | | the availability, convenience and effectiveness of the weight reduction program; |

| | • | | brand recognition and trustworthiness; |

| | • | | the ability to attract and retain customers through promotion and personal referral. |

Based on these factors, we believe that we can compete effectively in the weight management industry. We, however, have no control over how successful competitors will be in addressing these factors. By providing a well-recognized food-based program using the direct channel, we believe that we have a competitive advantage in our market.

Our Products and Services

For 30 years, the NutriSystem name has been recognized as a leader in the weight loss industry. We provide a comprehensive weight management program, consisting primarily of a pre-packaged food program and counseling. Trained counselors are available an average of 17 hours per day, seven days per week to answer questions and make recommendations to help each customer achieve his or her weight loss goals. Customers support, encourage and share information with each other through hosted chat rooms and bulletin boards. These services are complemented with relevant information on diet, nutrition and exercise, which is provided on our website and emailed to our customers weekly.

In December 2003, we introduced NutriSystem Nourish, our current line of pre-packaged, portion-controlled foods sold under the NutriSystem brand. Our NutriSystem Nourish program consists of over 130 food items that are designed to rank low on the Glycemic Index, thereby providing dieters with a balanced intake of “good” carbohydrates, proteins and fats. NutriSystem Nourish also features new, easy-to-use exercise and behavior modification programs. Dieters also receive our checkbook-sized meal planner, dining out guide and food catalog.

Typically, our customers purchase monthly food packages containing 28 breakfasts, lunches, dinners and desserts, which they supplement with fresh milk, fruit and vegetables. Most customers order on an Auto-delivery basis in which we send food to the customers on a monthly basis until notified by the customer to cease shipments. With the Auto-delivery program, a full day’s supply of entrees and desserts currently is priced at about $10 a day. The food is shelf stable at room temperature, making it relatively inexpensive to ship and store. On our website, customers can order food 24 hours a day, seven days a week.

5

The features of our weight loss program address many of the most common limitations of traditional weight loss programs, including high initiation and recurring membership fees, the inconvenience of traveling to weight loss centers for scheduled appointments and lack of privacy. In addition, our prepared meals provide our customers with a structured program in which they do not have to weigh or measure foods or count calories, carbohydrates or points.

Marketing

Our primary marketing objective is to cost-effectively promote our established brand and to build sales of our weight management program through our direct channel. We use a combination of online and traditional offline advertising and promotional strategies to accomplish this objective.

Offline Advertising. Offline advertising is used to encourage qualified customers to call or visit our website and increase awareness of the program. We reach our target audiences primarily through a combination of television, print and direct mail advertising. We use unique toll-free numbers and URLs to individually track the response of our advertisements. On television and in print, direct response-focused advertisements capitalize on our brand name and focus on “before and after” comparisons and/or the program’s simplicity, convenience and “good” carbohydrate features. Direct mail and outbound telemarketing are companions to the media advertising and consist of mailings and calls to direct customers who have purchased or others who have signed up for access to our services.

Online Advertising. Our online advertising strategy includes the use of keyword search campaigns, affiliate programs, email newsletters and demographically segmented direct email campaigns. We place online banner advertising through a variety of web portals and ad networks with the goal of achieving the greatest reach at the most beneficial return on investment.

Public Relations. We have had success generating huge brand awareness for our program in various press, television and radio outlets. For example, our media relations success includes receiving favorable mentions in popular consumer publications such as People, Women’s World, Ladies Home Journal, First For Women and Forbes Magazine.

Moreover, we have promoted our brand and product through celebrity spokespersons who appear in our advertising, such as Dan Marino and Don Shula and third party endorsements that have appeared on television shows and in various reality television programs including “VH1-Celebrity Fit Club,” “The View,” “Entertainment Tonight,” “CBS Morning Show” and “NFL Today.”

Sales and Counseling

A majority of our direct business sales occur on our website. The remaining sales are by telephone, and our call center processes virtually all of them. A nominal percentage of overflow calls are handled by third party call centers during volume spikes and periods outside of normal operating hours, yet any sales through these calls are processed by our call center. Our weight loss program is also sold through QVC, a television home shopping network, which represented 5% of revenue in 2006.

As of December 31, 2006, we employed approximately 125 weight loss counselors and 250 sales agents. Staffing levels for counselors and sales agents are largely a function of the volume of revenue and orders, and staffing increased substantially in 2006 as revenue and orders increased. Sales agents are responsible for in-bound sales calls and will initiate out-bound sales calls to our leads and other targeted potential customers. Counselors handle some in-bound sales calls but primarily focus on in-bound counseling calls, email and voicemails. Counselors also handle online web conversations from new visitors and appointments with existing customers. Sales agents are available 24 hours per day, seven days a week and counselors typically operate from as early as 7 a.m. to 12 midnight, seven days per week. Sales agents are paid primarily on commission while counselors receive an hourly wage.

6

We seek to hire counselors with backgrounds in psychology, sociology, nutrition, dietetics or other health-related fields and suitable temperaments to talk with our customers. Our counselors are more experienced and have more training than our sales agents. Counselors are trained in our meal plan, our internet chat service, email, voicemail, motivational techniques and customer service problem solving.

Customer Service

As of December 31, 2006, we employed approximately 140 customer service representatives. Customer service representatives are trained to handle in-bound calls and email from customers who have questions or problems with an order after the sale transaction is completed. Typical customer inquiries relate to arrival date of their order shipment, report of missing or damaged items and credits and exchanges. For email inquiries, we have a software system that scans the customer’s email message for key words and automatically supplies the representative with a form response that is reviewed, edited and sent back to the customer. Customer service representatives are typically available from 8 a.m. to 12 midnight, Monday through Friday, and 8:30 a.m. to 5 p.m. on Saturday and Sunday. Customer service representatives are paid an hourly wage.

Fulfillment

We operate an integrated order receipt, billing, picking, shipping and delivery tracking system comprised of proprietary and third party components. This system integrates the front end, or website customer interface, with order processing and shipping, and allows internet customers to access shippers’ order tracking numbers online. Our computer-assisted picking system allows for virtually paperless order picking in all warehouse facilities. In 2006, we engaged in multiple projects designed to increase processing capabilities and provide greater operational flexibility and control within this integrated shipping system. Management believes these improvements provide reasonable assurance that our growth will continue to be supported.

We operate an integrated network of distribution facilities of which one is company-owned and five are outsourced. In December 2006, approximately 87% of our fulfillment was handled by our outsourced provider. In 2006, we completed an expansion and redesign of our warehouse network. These changes ensure higher volume capabilities while simultaneously reducing process/delivery times and outbound freight costs. Except for brief periods of peak demand in 2006, approximately 99% of all direct customer orders were shipped within two business days of the day received. In addition, we can ship to approximately 99% of the domestic population within four business days using standard ground transportation. Direct customers are not charged for their orders until the ordered product is shipped. We do not charge customers for shipping and handling on Auto-delivery food orders.

Product Development

All of our foods and supplements are currently outsourced from more than 30 manufacturers or vendors. Our product development department primarily creates ideas and concepts based on customer feedback, market trends, nutrition and food technology breakthrough and retail grocery trends. This starts at the laboratory level to determine if the product can meet our stringent demands (i.e. shelf stable, glycemic friendly etc.) and is then outsourced to our food manufacturers who further develop the new product based on our specifications. All new foods are created to enhance the variety of our current program, or to support the efforts of creating a new program. Also, new foods are presented to us by food manufacturers to see if they are compatible with our program. Most of our foods are created from market research and customer requests, as well as recommendations from our manufacturers. All of our new foods are evaluated for nutrition, compliance with our program, taste by using testing panels and cost considerations. The number of SKUs we introduce each year varies depending on whether we are introducing a new program like NutriSystem Nourish, where over 100 new items were created, or updating an existing program where approximately 20 new products are typically introduced. For 2007, in order to support a new marketing initiative, we have created, and in some cases recreated, over 70 items.

7

Our Customers

Based on our surveys and market research, our typical customer is female (over 76%), approximately 44 years of age and weighs 210 lbs. In January 2006 we initiated advertising programs directed toward men. As a result, men comprised approximately 24% of our new customers in 2006 compared to 13% in 2005. In early 2007 we also began to market to seniors in television advertising. We believe that, on average, our customers want to lose approximately 60 lbs. over a period of time. We believe our typical customers stay on our program for ten to eleven weeks (including the one free week most customers obtain with their initial order), lose 1.5 to 2.0 pounds per week and have tried other popular diet programs. Most of our customers say they would recommend the program to others and value the following NutriSystem program attributes:

| | • | | direct delivery to their door; |

| | • | | food can be easily prepared in minutes; |

| | • | | wide variety of food; and |

| | • | | they do not feel hungry while on the program. |

Information Systems

Our website, which is based on internally developed software and other third party software, is hosted in New York, New York at an AT&T co-location facility. This facility provides redundant network connections, an uninterruptible power supply, physical and fire security and diesel generated power back up for the equipment on which our website relies upon. Our servers and our network are monitored 24 hours a day, seven days a week.

We use a variety of security techniques to protect our confidential customer data. When our customers place an order or access their account information, we use a secure server (SSL) to transfer information. Our secure server software encrypts all information entered before it is sent to our server. All customer data is protected against unauthorized access. We use VeriSign and CyberSource software to secure our credit card transactions.

Slim and Tone Franchise Business

On December 2, 2004, we acquired Slim and Tone LLC, a franchisor of women’s express fitness centers. Slim and Tone franchisees provide women with an exercise facility that is safe, convenient, comfortable, supportive and one that meets their fitness needs. Members obtain a 30-minute workout using hydraulic resistance training equipment. Franchise operators now offer the NutriSystem Nourish program to their members, providing a comprehensive weight loss program that brings together diet and exercise. Revenue from our Slim and Tone operations represents less than 1% of 2006 revenue.

Intellectual Property

We own numerous trademarks domestically and internationally and other proprietary rights that are very important to our business. Depending upon the jurisdiction, trademarks are valid as long as they are used in the regular course of trade and/or their registrations are properly maintained.

Employees

As of December 31, 2006, we had approximately 595 administrative, sales, counseling and customer service personnel, 55 employees dedicated to fulfillment and 30 employees in marketing. None of our employees are represented by a labor union, and we consider relations with our employees to be good.

8

Seasonality

Typically in the weight loss industry, revenue is strongest in the first quarter and lowest in the fourth calendar quarter. We believe our business experiences seasonality, driven by the predisposition of dieters to initiate a diet and the placement of our advertising based on the price and availability of certain media. However, in 2005, our revenue increased sequentially every quarter due to our increased level of advertising spending and, in 2006, revenue in the third quarter was higher than revenue in the first quarter due in part to favorable conditions in the market for certain media. We believe the overall impact of seasonality on revenue is difficult to predict at this time.

Available Information

All periodic and current reports, registration statements, code of conduct, code of ethics and other material that the Company is required to file with the Securities and Exchange Commission (“SEC”), including the Company’s annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934 (the “1934 Act Reports”), are available free of charge through the Company’s investor relations page atwww.nutrisystem.com. Such documents are available as soon as reasonably practicable after electronic filing of the material with the SEC. The Company’s Internet web site and the information contained therein or connected thereto are not intended to be incorporated into this Annual Report on Form 10-K.

The public may also read and copy any materials filed by the Company with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site, www.sec.gov, which contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

Executive Officers of the Company

The Company’s executive officers and their respective ages and positions as of December 31, 2006 are as follows:

| | | | |

Name | | Age | | Position |

| | |

Michael J. Hagan | | 44 | | Chief Executive Officer, President and Chairman of the Board of Directors |

| | |

James D. Brown | | 48 | | Executive Vice President, Administration, Chief Financial Officer, Secretary & Treasurer |

| | |

Thomas F. Connerty | | 44 | | Executive Vice President, Program Development and Chief Marketing Officer |

| | |

Bruce Blair | | 50 | | Senior Vice President, Operations and Chief Information Officer |

Michael J. Hagan has served as the Chairman of our Board and as our Chief Executive Officer since December 2002 and as our president since July 2006. Prior to joining us, Mr. Hagan was the co-founder of Verticalnet, Inc., a business-to-business internet and software company, and held a number of executive positions at Verticalnet, Inc. since its founding in 1995, including Chairman of the Board from February 2002 to May 2005, President and Chief Executive Officer from January 2001 to February 2002, Executive Vice President and Chief Operating Officer from January 2000 to January 2001 and Senior Vice President prior to that time. Mr. Hagan is also a trustee of American Financial Realty Trust and a director of Verticalnet, Inc.

James D. Brown has served as our Chief Financial Officer since December 1999, our Treasurer since January 2000, our Secretary since January 2003 and our Executive Vice President, Administration since April 2005.

9

Thomas F. Connerty has served as our Chief Marketing Officer since November 2004 and our Executive Vice President, Program Development since July 2006. Prior to joining us, Mr. Connerty was the Vice President of Marketing at the Nautilus Group, a retailer of commercial and home use fitness equipment, including the Bowflex Home Gym, from 1999 to 2004.

Bruce Blair has served as our Senior Vice President, Operations and Chief Information Officer since April 2005. Prior to joining us, Mr. Blair was the Chief Information Officer and Executive Vice President of Creditek, a finance and accounting outsourcing firm from March 2003 to March 2005. Before Creditek, Mr. Blair was the President of GovXcel, a leading application provider of software used by municipalities to automate back office functions, from January 2001 to December 2001. He also served as Chief Information Officer and Senior Vice President of Operations at Verticalnet, Inc. from March 1999 to December 2000.

You should consider carefully the following risks and uncertainties when reading this Annual Report on Form 10-K. If any of the events described below actually occurs, the Company’s business, financial condition and operating results could be materially adversely affected.

Risks Related to Our Business

Our future growth and profitability will depend in large part upon the effectiveness and efficiency of our marketing expenditures and our ability to select the right markets and media in which to advertise.

Our marketing expenditures were $118.5 million, $47.8 million and $7.5 million in 2006, 2005 and 2004, respectively. Our future growth and profitability will depend in large part upon the effectiveness and efficiency of our marketing expenditures, including our ability to:

| | • | | create greater awareness of our brand and our program; |

| | • | | identify the most effective and efficient level of spending in each market, media and specific media vehicle; |

| | • | | determine the appropriate creative message and media mix for advertising, marketing and promotional expenditures; |

| | • | | effectively manage marketing costs (including creative and media) in order to maintain acceptable customer acquisition costs; |

| | • | | select the right market, media and specific media vehicle in which to advertise; and |

| | • | | convert consumer inquiries into actual orders. |

Our planned marketing expenditures may not result in increased revenue or generate sufficient levels of brand name and program awareness. We may not be able to manage our marketing expenditures on a cost-effective basis whereby our customer acquisition cost may exceed the contribution profit generated from each additional customer.

If we are able to grow our business, we may not be able to manage our growth successfully.

If we are able to increase our customer base and grow our business, we will face business risks commonly associated with rapidly growing companies, including the risk that existing management, information systems and financial controls may be inadequate to support our growth. We cannot predict whether we will be able to respond on a timely basis, or at all, to the changing demands that our growth may impose on our existing management and infrastructure. For example, increasing demands on our infrastructure could cause any of the following:

| | • | | delays in order intake time both on our website as well as through call centers; |

| | • | | delays in order processing, packaging and shipping; |

10

| | • | | failures to provide our customers with their specific food selections; |

| | • | | inadequate numbers of telephone counselors, customer service representatives and other personnel; and |

| | • | | an inability to route all calls during spikes to the appropriate personnel. |

If we fail to adapt our management, information systems and financial controls to our growth, or if we encounter other unexpected difficulties, our business, financial condition and operating results will suffer.

We rely on third parties to provide us with adequate food supply and certain fulfillment, internet, networking and call center services, the loss of any of which could cause our revenue, earnings or reputation to suffer.

Food Manufacturers. We rely solely on third-party manufacturers to supply all of the food and other products we sell, the top four of which supplied approximately 65% of our food in 2006. We currently have written contracts with only two of these manufacturers and therefore are not assured of an adequate supply or pricing on a long-term basis. If we are unable to obtain sufficient quantity, quality and variety of food and other products in a timely and low cost manner from our manufacturers, we will be unable to fulfill our customers’ orders in a timely manner, which may cause us to lose revenue and market share or incur higher costs, as well as damage the value of the NutriSystem brand.

Fulfillment. Approximately 87% of our order fulfillment is handled by a third party, Ozburn-Hessey Logistics, or OHL. Should OHL be unable to service our needs for even a short duration, our revenue and business could be harmed. Additionally, the cost and time associated with replacing OHL on short notice would add to our costs. Any replacement fulfillment provider would also require startup time, which could cause us to lose sales and market share.

Internet, Networking and Call Centers. Our business also depends on a number of third parties for internet access, networking and call center services, and we have limited control over these third parties. Should our network connections go down, our ability to fulfill orders would be delayed. Further, if our website or call centers become unavailable for a noticeable period of time due to internet or communication failures, our business could be adversely affected, including harm to our brand and loss of sales.

Therefore, we are dependent on maintaining good relationships with these third parties. The services we require from these parties may be disrupted by a number of factors associated with their businesses, including the following:

| | • | | financial condition of operations; |

| | • | | internal inefficiencies; |

| | • | | natural or man-made disasters; and |

| | • | | with respect to our food suppliers, shortages of ingredients or United States Department of Agriculture (“USDA”) and United States Food and Drug Administration (“FDA”) compliance issues. |

We are dependent on the QVC Shopping Network for a significant percentage of revenue.

In 2006, sales of our products through our relationship with the QVC Shopping Network accounted for 5% of our revenue. For 2007, we have a one year contractual agreement with QVC with an automatic extension

11

unless either party decides not to extend the agreement and a minimum level of sales has not been achieved for the year. Under the QVC agreement, QVC controls when and how often our products and services are offered on-air, and we are not guaranteed any minimum level of sales or transactions. QVC has the exclusive right to promote our products using home shopping television programs other than our own infomercials during the contract term and on a non-exclusive basis for two years thereafter. If QVC elects not to renew the agreement or reduces airtime for promoting our products, our operating profits will suffer and we will be prohibited from selling our products through competitors of QVC for six months after the termination of the agreement.

We may be subject to claims that our personnel are unqualified to provide proper weight loss advice.

Some of our counselors for our weight management program do not have extensive training or certification in nutrition, diet or health fields and have only undergone the training they receive from us. We may be subject to claims from our customers alleging that our personnel lack the qualifications necessary to provide proper advice regarding weight loss and related topics. We may also be subject to claims that our personnel have provided inappropriate advice or have inappropriately referred or failed to refer customers to health care providers for matters other than weight loss. Such claims could result in damage to our reputation and divert management’s attention from our business, which would adversely affect our business.

We may be subject to health-related claims from our customers.

Our weight loss program does not include medical treatment or medical advice, and we do not engage physicians or nurses to monitor the progress of our customers. Many people who are overweight suffer from other physical conditions, and our target consumers could be considered a high-risk population. A customer who experiences health problems could allege or bring a lawsuit against us on the basis that those problems were caused or worsened by participating in our weight management program. For example, our predecessor businesses suffered substantial losses due to health-related claims and related publicity. Currently, we are neither subject to any such allegations nor have we been named in any such litigation. However, if we were, we would defend ourselves against such claims. Defending ourselves against such claims, regardless of their merit and ultimate outcome, would likely be lengthy and costly, and adversely affect our results of operations. Further, our general liability insurance may not cover claims of these types.

The weight management industry is highly competitive. If any of our competitors or a new entrant into the market with significant resources pursues a weight management program similar to ours, our business could be significantly affected.

Competition is intense in the weight management industry and we must remain competitive in the areas of program efficacy, price, taste, customer service and brand recognition. Some of our competitors are significantly larger than us and have substantially greater resources. Our business could be adversely affected if someone with significant resources decided to imitate our weight management program. For example, if a major supplier of pre-packaged foods decided to enter this market and made a substantial investment of resources in advertising and training diet counselors, our business could be significantly affected. Any increased competition from new entrants into our industry or any increased success by existing competition could result in reductions in our sales or prices, or both, which could have an adverse effect on our business and results of operations.

New weight loss products or services may put us at a competitive disadvantage.

On an ongoing basis, many existing and potential providers of weight loss solutions, including many pharmaceutical firms with significantly greater financial and operating resources than us, are developing new products and services. The creation of a weight loss solution, such as a drug therapy, that is perceived to be safe, effective and “easier” than a portion-controlled meal plan would put us at a disadvantage in the marketplace and our results of operations could be negatively affected.

12

If we pursue competitive advertising, we may be subject to litigation from our competitors.

If we pursue competitive advertising, our competitors may pursue litigation regardless of its merit and chances of success. Defending such litigation may be lengthy and costly, strain our resources and divert management’s attention from their core responsibilities, which would have a negative impact on our business.

If consumers do not widely accept an online or telephonic source for weight management products and services, we will be unable to increase our customer base.

Our success depends on attracting and retaining a high volume of online and telephonic customers. Factors that could prevent or delay the widespread consumer acceptance of purchasing weight management products and services online or by telephone include problems with or customer concerns about:

| | • | | the security of online or telephonic transactions; |

| | • | | the loss of privacy with respect to personal weight and health information; |

| | • | | delays in responses to inquiries; |

| | • | | delivery time associated with online or telephone orders, compared to the immediate receipt of products at a store or weight loss center; |

| | • | | shipping charges, which do not apply to shopping at stores or traditional weight loss centers; |

| | • | | the ability to return or exchange orders; |

| | • | | the absence of face-to-face contact with counselors and other dieters; and |

| | • | | the loss of the discipline, accountability and support associated with group sessions. |

If these or other factors cause existing and potential customers not to accept our direct-to-consumer business strategy, we will not be able to maintain our growth and our operating results will suffer.

We may experience fluctuations in our operating results which may cause our stock price to be volatile.

In view of the rapidly evolving nature of our business and the seasonality inherent in the weight loss industry, our operating results may fluctuate significantly. The market price of our common stock is subject to fluctuations in response to our operating results, general trends in the weight loss industry, announcements by our competitors, our ability to meet or exceed securities analysts’ expectations, recommendations by securities analysts, the condition of the financial markets and other factors. These fluctuations, as well as general economic and market conditions, may adversely affect the market price of our common stock and cause it to fluctuate significantly.

Future acquisitions and the pursuit of new business opportunities present risks, and we may be unable to achieve the financial and strategic goals of any acquisition or new business.

A component of our growth strategy may be to acquire existing businesses or pursue other business opportunities in the market for weight management and fitness products and services. Even if we succeed in acquiring or building such businesses, we will face a number of risks and uncertainties, including:

| | • | | difficulties in integrating newly acquired or newly started businesses into existing operations, which may result in increasing operating costs that would adversely affect our operating income and earnings; |

| | • | | the risk that our current and planned facilities, information systems, personnel and controls will not be adequate to support our future operations; |

| | • | | diversion of management time and capital resources from our existing businesses, which could adversely affect their performance and our operating results; |

13

| | • | | dependence on key management personnel of acquired or newly started businesses and the risk that we will be unable to integrate or retain such personnel; |

| | • | | the risk that the new products or services we may introduce or begin offering, whether as a result of internal expansion or business acquisitions, will not gain acceptance among consumers and existing customers; |

| | • | | the risk that new efforts may have a detrimental effect on our brand; |

| | • | | the risk that we will face competition from established or larger competitors in the new markets we may enter, which could adversely affect the financial performance of any businesses we might acquire or start; and |

| | • | | the risk that the anticipated benefits of any acquisition or of the commencement of any new business may not be realized, in which event we will not be able to achieve any return on our investment in that new business. |

If we do not continue to receive referrals from existing customers, our customer acquisition cost may increase.

We rely on word of mouth advertising for a portion of our new customers. If our brand suffers or the number of customers acquired through referrals drops due to other circumstances, our costs associated with acquiring new customers and generating revenue will increase, which will, in turn, have an adverse affect on our profitability.

We use spokespersons to promote our products. If these spokespersons suffer adverse publicity, our revenue could be adversely affected.

Our marketing strategy depends in part on celebrity spokespersons, such as Dan Marino, Don Shula, Zora Andrich and Kat Carney, as well as customer spokespersons to promote our weight management program. Any of these spokespersons may become the subject of adverse news reports, negative publicity or otherwise be alienated from a segment of our customer base, whether weight loss related or not. If so, such events may reduce the effectiveness of his or her endorsement and, in turn, adversely affect our revenue and results of operations.

If we cannot protect and enforce our trademarks and other intellectual property rights, our brand and our business will suffer.

We believe that our trademarks and other proprietary rights are important to our success and competitive position. The actions we take to establish and protect our trademarks and other proprietary rights may prove to be inadequate to prevent imitation of our products or services or to prevent others from claiming violations of their trademarks and proprietary rights by us. In addition, others may develop similar trademarks or other intellectual property independently or assert rights in our trademarks and other proprietary rights. If so, third parties may seek to block or limit sales of our products and services based on allegations that use of some of our marks or other intellectual property constitutes a violation of their intellectual property rights. If we cannot protect our trademarks and other intellectual property rights, or if our trademarks or other intellectual property rights infringe the rights of third parties, the value of our brand may decline, which would adversely affect our results of operations.

We are dependent on our Chief Executive Officer and other key executive officers for future success.

Our future success depends to a significant degree on the skills, experience and efforts of Michael J. Hagan, our Chief Executive Officer, and other key executive officers. The loss of the services of any of these individuals could harm our business. Only one of our key executive officers, Thomas F. Connerty, has an employment agreement with us. In addition, we have not obtained life insurance on any key executive officers. If any key executive officers left us or were seriously injured and became unable to work, the business could be harmed.

14

Development of our Slim and Tone business may have a negative impact on our core business.

Development of our Slim and Tone business may require us to divert some of our capital resources and management’s time away from our weight management business. Since our Slim and Tone franchisees are independent third parties with their own financial objectives, actions taken by them, including breaches of their contractual obligations, may have negative impact on both our Slim and Tone and NutriSystem brands. Further, if we have to deal with disputes with our Slim and Tone franchisees regarding operations and other contractual issues, our management’s attention could be diverted which could have an adverse affect on our core business.

Our Slim and Tone subsidiary is subject to franchise law and regulations that govern its status as a franchisor and regulate aspects of its franchise relationships. Slim and Tone’s ability to develop facilities and to enforce contractual rights against its franchisees may be adversely affected by these laws and regulations, which could cause its franchise revenue to decline and adversely affect our growth strategy.

Slim and Tone is subject to federal and state laws and regulations, including the regulations of the Federal Trade Commission (the “FTC”), as well as similar authorities in individual states and other jurisdictions, in connection with the offer, sale and termination of Slim and Tone franchises and the regulation of the franchisor-franchisee relationship. Failure to comply with these laws could subject both Slim and Tone and us to liability to franchisees and to fines or other penalties imposed by governmental authorities. In addition, we may become subject to litigation with, or other claims filed with state or federal authorities by, Slim and Tone franchisees based on alleged unfair trade practices, implied covenants of good faith and fair dealing, payment of royalties, location of stores, advertising expenditures, franchise renewal criteria or express violations of franchise agreements. Our Slim and Tone business may encounter compliance problems from time to time and material disputes may arise with one or more Slim and Tone franchisees. Accordingly, Slim and Tone’s failure to comply with applicable franchise laws and regulations, or disputes with Slim and Tone franchisees, could have a material adverse effect on our results of operations, financial condition and growth strategy.

Provisions in our certificate of incorporation may deter or delay an acquisition of us or prevent a change in control, even if an acquisition or a change of control would be beneficial to our stockholders.

Provisions of our certificate of incorporation (as amended) may have the effect of deterring unsolicited takeovers or delaying or preventing a third party from acquiring control of us, even if our stockholders might otherwise receive a premium for their shares over then current market prices. In addition, these provisions may limit the ability of stockholders to approve transactions that they may deem to be in their best interests.

Our certificate of incorporation (as amended) permits our Board of Directors to issue preferred stock without stockholder approval upon such terms as the Board of Directors may determine. The rights of the holders of our common stock will be junior to, and may be adversely affected by, the rights of the holders of any preferred stock that may be issued in the future. The issuance of preferred stock could have the effect of making it more difficult for a third party to acquire, or of discouraging a third party from acquiring, a majority of our outstanding common stock. The issuance of a substantial number of preferred shares could adversely affect the price of our common stock.

Risks Related to Our Industry

The weight loss industry is subject to adverse publicity, which could harm our business.

The weight loss industry receives adverse publicity from time to time, and the occurrence of such publicity could harm us, even if the adverse publicity is not directly related to us. In the early 1990s, our predecessor businesses were subject to extremely damaging adverse publicity relating to a large number of lawsuits alleging that the NutriSystem weight loss program led to gall bladder disease. This publicity was a factor that contributed to the bankruptcy of our predecessor businesses in 1993. More recently, our predecessor businesses were severely impacted by significant litigation and damaging publicity related to their customers’ use of fen-phen as an appetite suppressant, which the FDA ordered withdrawn from the market in September 1997. The significant decline in business resulting from the fen-phen problems caused our predecessor businesses to close all of their company-owned weight loss centers.

15

Congressional hearings about practices in the weight loss industry have also resulted in adverse publicity and a consequent decline in the revenue of weight loss businesses. Future research reports or publicity that are perceived as unfavorable or that question certain weight loss programs, products or methods could result in a decline in our revenue. Because of our dependence on consumer perceptions, adverse publicity associated with illness or other undesirable effects resulting from the consumption of our products or similar products by competitors, whether or not accurate, could also damage customer confidence in our weight loss program and result in a decline in revenue. Adverse publicity could arise even if the unfavorable effects associated with weight loss products or services resulted from the user’s failure to use such products or services appropriately.

Our industry is subject to governmental regulation that could increase in severity and hurt results of operations.

Our industry is subject to federal, state and other governmental regulation. For example, some advertising practices in the weight loss industry have led to investigations from time to time by the FTC and other governmental agencies. Many companies in the weight loss industry, including our predecessor businesses, have entered into consent decrees with the FTC relating to weight loss claims and other advertising practices. We continue to be subject to these consent decrees, which restrict how we advertise the successes our customers have achieved in losing weight through the program and require us to include the phrase “results not typical” in advertisements. Regulation of advertising practices in the weight loss industry may increase in scope or severity in the future, which could have a material adverse impact on our business.

Other aspects of our industry are also subject to government regulation. For example, food manufacturers are subject to rigorous inspection and other requirements of the USDA and FDA, and companies operating in foreign markets must comply with those countries’ requirements for proper labeling, controls on hygiene, food preparation and other matters. If federal, state, local or foreign regulation of our industry increases for any reason, then we may be required to incur significant expenses, as well as modify our operations to comply with new regulatory requirements, which could harm our operating results. Additionally, remedies available in any potential administrative or regulatory actions may include requiring us to refund amounts paid by all affected customers or pay other damages, which could be substantial.

Changes in consumer preferences and discretionary spending could negatively impact our operating results.

Our program features pre-packaged food selections, which we believe offer convenience and value to our customers. Our continued success depends, to a large degree, upon the continued popularity of our program versus various other weight loss, weight management and fitness regimens, such as low carbohydrate diets, appetite suppressants and diets featured in the published media. Changes in consumer tastes and preferences away from our pre-packaged food and support and counseling services, and any failure to provide innovative responses to these changes, may have a materially adverse impact on our business, financial condition, operating results, cash flows and prospects.

Additionally, the success of our business and our operating results is dependent on discretionary spending by consumers. A decline in discretionary spending could adversely affect our business, financial condition, operating results and cash flows. Our business could also be adversely affected by general economic conditions, demographic trends, consumer confidence in the economy and changes in disposable consumer income.

The sale of ingested products involves product liability and other risks.

Like other distributors of products that are ingested, we face an inherent risk of exposure to product liability claims if the use of our products results in illness or injury. The foods that we resell are subject to laws and regulations, including those administered by the USDA and FDA that establish manufacturing practices and quality standards for food products. Product liability claims could have a material adverse effect on our business as we do not have contractual indemnification rights against our other suppliers, and our other remedies against

16

third parties and our existing insurance coverage may not be adequate. Distributors of weight loss food products, vitamins, nutritional supplements and minerals, including our predecessor businesses, have been named as defendants in product liability lawsuits from time to time. The successful assertion or settlement of an uninsured claim, a significant number of insured claims or a claim exceeding the limits of our insurance coverage would harm us by adding costs to the business and by diverting the attention of senior management from the operation of the business. We may also be subject to claims that our products contain contaminants, are improperly labeled, include inadequate instructions as to use or inadequate warnings covering interactions with other substances. Product liability litigation, even if not meritorious, is very expensive and could also entail adverse publicity for us and reduce our revenue.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

We currently lease two locations in Horsham, Pennsylvania and one location in Yardley, Pennsylvania. The two Horsham locations total approximately 125,300 square feet of office and warehouse space at a combined annual rent of $1,252,368. One lease in Horsham expires in 2009, while the other expires in 2010. In December 2006, we signed a third lease in Horsham, Pennsylvania with approximately 87,123 square feet of office space which we do not yet occupy. Rent payments will be approximately $856,710 in 2007. This lease expires in 2011. We also lease 950 square feet at an annual rent of $14,250 in Yardley, Pennsylvania. This lease expires in September 2007. We have additional fulfillment capacity in Chambersburg, Pennsylvania; Sparks, Nevada; Edwardsville, Kansas; McDonough, Georgia; Dallas, Texas; and Madison, Illinois through an outsourced provider. We also use an additional third party fulfillment provider in Warminster, Pennsylvania during periods of peak demand. We have no lease obligations to any of our outsourced fulfillment providers. Management believes the Horsham facilities, combined with the outsourced fulfillment capacity, are adequate to meet our needs for the foreseeable future.

None.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

None submitted.

17

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

The Company’s common stock traded on the American Stock Exchange from May 12, 2004 to June 22, 2005 and currently trades on the NASDAQ National Market. The Company’s common stock trades under the symbol “NTRI.” The following table sets forth, for the periods indicated, the high and low sale prices for the Company’s common stock as reported on the American Stock Exchange and NASDAQ National Market.

| | | | | | |

| | | High | | Low |

2006 First Quarter | | $ | 50.00 | | $ | 33.90 |

2006 Second Quarter | | | 76.33 | | | 44.14 |

2006 Third Quarter | | | 68.11 | | | 45.45 |

2006 Fourth Quarter | | | 76.20 | | | 58.45 |

| | |

2005 First Quarter | | $ | 6.71 | | $ | 2.81 |

2005 Second Quarter | | | 15.00 | | | 6.00 |

2005 Third Quarter | | | 25.25 | | | 14.52 |

2005 Fourth Quarter | | | 44.15 | | | 25.30 |

Holders

As of February 20, 2007, the Company had approximately 303 record holders of its common stock.

Dividends

The Company has not declared or paid any dividends since its inception. The Board of Directors has considered the declaration of a dividend and expects to give it further consideration in the future. The declaration and payment of dividends in the future will be determined by the Company’s Board of Directors in light of conditions then existing, including the Company’s earnings, financial condition, capital requirements and other factors. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources and other Financial Data.”

Securities Authorized for Issuance Under Equity Compensation Plans

The information under the heading “Equity Compensation Plan Information” in the Company’s definitive proxy statement for the 2007 annual meeting of stockholders is incorporated by reference.

Issuer Purchases of Equity Securities

We did not repurchase any of our equity securities during the quarter ended December 31, 2006.

18

STOCK PRICE PERFORMANCE GRAPH

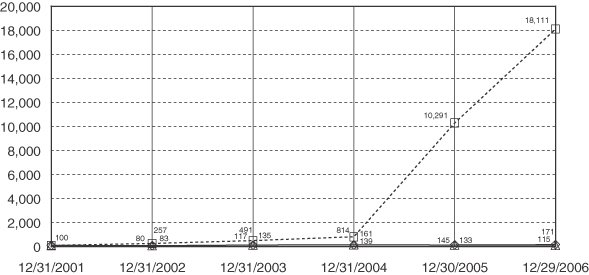

The following graph shows a comparison of cumulative total return since December 31, 2001 for our common stock, the Russell 2000 Index and the Dow Jones Consumer Services Index (a published industry index), each of which assumes an initial value of $100 and reinvestment of dividends. Our common stock traded on the NASDAQ National Market until May 24, 2001. It then traded on the OTC Bulletin Board under the ticker symbol THIN.OB., the American Stock Exchange under the ticker symbol NSI and now trades on the NASDAQ National Market under the ticker symbol NTRI.

Comparison of Cumulative Total Return Among NutriSystem, Inc.,

THE DOW JONES CONSUMER SERVICES INDEX AND THE RUSSELL 2000 INDEX

| | | | | | | | | | | | | | |

| | | | | 12/31/01 | | 12/31/02 | | 12/31/03 | | 12/31/04 | | 12/30/05 | | 12/29/06 |

¨ | | NutriSystem, Inc. | | 100 | | 257 | | 491 | | 814 | | 10,291 | | 18,111 |

| | | | | | | |

D | | Dow Jones Consumer Services Index | | 100 | | 83 | | 135 | | 161 | | 133 | | 115 |

| | | | | | | |

à | | Russell 2000 Index | | 100 | | 80 | | 117 | | 139 | | 145 | | 171 |

19

| ITEM 6. | SELECTED FINANCIAL DATA |

The selected consolidated financial data presented below has been derived from the Company’s Consolidated Financial Statements for each of the periods indicated. The data set forth below is qualified by reference to and should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Company’s Consolidated Financial Statements included as Items 7 and 8, respectively, in this Annual Report on Form 10-K.

Selected Consolidated Financial Data

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2006 | | 2005 | | 2004 | | 2003 | | | 2002 | |

Statement of Operations Data: | | | | | | | | | | | | | | | | | |

Revenue | | $ | 568,209 | | $ | 212,506 | | $ | 37,996 | | $ | 22,575 | | | $ | 27,569 | |

Costs and expenses: | | | | | | | | | | | | | | | | | |

Cost of revenue | | | 271,396 | | | 109,431 | | | 21,612 | | | 14,870 | | | | 17,655 | |

Marketing | | | 118,479 | | | 47,793 | | | 7,548 | | | 3,539 | | | | 1,263 | |

General and administrative | | | 43,169 | | | 21,009 | | | 7,039 | | | 5,829 | | | | 5,902 | |

New program development | | | — | | | — | | | — | | | 599 | | | | — | |

Depreciation and amortization | | | 3,047 | | | 983 | | | 268 | | | 223 | | | | 336 | |

| | | | | | | | | | | | | | | | | |

Operating income (loss) from continuing operations | | | 132,118 | | | 33,290 | | | 1,529 | | | (2,485 | ) | | | 2,413 | |

Interest income, net | | | 3,655 | | | 860 | | | 36 | | | 57 | | | | 41 | |

Other income (loss) | | | — | | | — | | | 134 | | | — | | | | (100 | ) |

Equity in losses of affiliate | | | — | | | — | | | — | | | (157 | ) | | | (143 | ) |

Income taxes (benefit) | | | 50,643 | | | 13,135 | | | 680 | | | (3,397 | )(a) | | | — | |

Discontinued operation | | | — | | | — | | | — | | | — | | | | 200 | (b) |

| | | | | | | | | | | | | | | | | |

Net income | | $ | 85,130 | | $ | 21,015 | | $ | 1,019 | | $ | 812 | | | $ | 2,411 | |

| | | | | | | | | | | | | | | | | |

Basic income per common share: | | | | | | | | | | | | | | | | | |

Continuing operations | | $ | 2.38 | | $ | 0.64 | | $ | 0.03 | | $ | 0.03 | | | $ | 0.08 | |

Disposal of discontinued operation | | | — | | | — | | | — | | | — | | | | 0.01 | |

| | | | | | | | | | | | | | | | | |

Basic | | $ | 2.38 | | $ | 0.64 | | $ | 0.03 | | $ | 0.03 | | | $ | 0.09 | |

| | | | | | | | | | | | | | | | | |

Diluted income per common share: | | | | | | | | | | | | | | | | | |

Continuing operations | | $ | 2.29 | | $ | 0.59 | | $ | 0.03 | | $ | 0.03 | | | $ | 0.08 | |

Disposal of discontinued operation | | | — | | | — | | | — | | | — | | | | 0.01 | |

| | | | | | | | | | | | | | | | | |

Diluted | | $ | 2.29 | | $ | 0.59 | | $ | 0.03 | | $ | 0.03 | | | $ | 0.09 | |

| | | | | | | | | | | | | | | | | |

Weighted average shares outstanding | | | | | | | | | | | | | | | | | |

Basic | | | 35,800 | | | 32,898 | | | 29,206 | | | 26,733 | | | | 26,475 | |

Diluted | | | 37,122 | | | 35,618 | | | 31,842 | | | 27,064 | | | | 26,917 | |

20

| | | | | | | | | | | | | | | |

| | | December 31, |

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 |

Balance Sheet Data: | | | | | | | | | | | | | | | |

Cash, cash equivalents and marketable securities | | $ | 82,254 | | $ | 45,968 | | $ | 4,201 | | $ | 2,684 | | $ | 3,005 |

Working capital | | | 134,049 | | | 65,470 | | | 5,100 | | | 5,664 | | | 4,445 |

Total assets | | | 197,867 | | | 107,246 | | | 17,825 | | | 13,688 | | | 8,277 |

Non-current liabilities | | | 831 | | | 254 | | | 272 | | | 2 | | | 255 |

Stockholders’ equity | | | 145,302 | | | 78,966 | | | 12,175 | | | 9,291 | | | 5,249 |

| (a) | In the second quarter of 2003, management determined that recognition of the benefits related to deferred tax assets was more likely than not based on an analysis of the cumulative level of pretax profits over the prior three years, projected levels of profits, schedule of reversal of temporary differences, and tax planning strategies. As a result, the valuation allowance was eliminated, a deferred tax asset and liability were recorded on the consolidated balance sheet and an income tax benefit was recorded in the statement of operations. |

| (b) | In 2002, the Company recorded a gain of $200 upon the sale of the intellectual property associated with an operation that was discontinued in 2001 (Sweet Success). |

The Company has not paid any dividends since its inception and currently has no plans to begin paying dividends.

21

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Except for the historical information contained herein, this Report on Form 10-K contains certain forward-looking statements that involve substantial risks and uncertainties. Words such as “may,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “continue,” or similar words are intended to identify forward-looking statements, although not all forward-looking statements contain these words. Our actual results, performance or achievements could differ materially from the results expressed in, or implied by, these forward-looking statements. Factors that could cause or contribute to such differences include those set forth in “Risk Factors.” Accordingly, there is no assurance that the results in the forward-looking statements will be achieved.

The following discussion should be read in conjunction with the financial information included elsewhere in this Annual Report on Form 10-K.

Background

We provide weight management and fitness products and services. Our pre-packaged foods are sold to weight loss program participants directly via the internet and telephone, referred to as the direct channel, and through independent commissioned representatives, the field sales channel, through independent center-based distributors, the case distributor channel, and through QVC, a television shopping network. We also own Slim and Tone LLC (“Slim and Tone”), a franchisor of women’s express fitness centers. Slim and Tone franchisees sell our diet program in their centers as commissioned representatives. Substantially all of our revenue is generated domestically.

Revenue consists primarily of food sales. For the year ended December 31, 2006, the direct channel accounted for 93% of total revenue compared to 5% for QVC and 2% for the other channels. We incur significant marketing expenditures to support our brand. We believe that our brand is continuing to gain awareness as we continue to increase our purchases of media in all media channels. New media channels are tested on a monthly basis and we consider our media mix to be highly diverse. We market our weight management system through television, print, direct mail, internet and public relations.

We review and analyze a number of key operating and financial metrics to manage our business, including the number of new customers, length of stay, total revenues, marketing per new customer, operating margins and reactivation revenue. In 2007, we will continue to focus on these metrics and expand our efforts with integrated database marketing, increased market segmentation with women, men and seniors and new and deeper marketing channel exploration. We will be focusing not only on the acquisition of customers but also the retention and reactivation of customers. We will look to improve the on-line experience with the member section of our website which should provide a more valuable, effective and interactive experience and increase the level of weight loss support that we offer with our program to our customers.

Critical Accounting Policies and Estimates

Our consolidated financial statements are prepared in accordance with U.S. generally accepted accounting principles. Our significant accounting policies are described in Note 2 of the consolidated financial statements included in Item 8.

The preparation of these financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the reporting period. Management develops, and changes periodically, these estimates and assumptions based on historical experience and on various other factors that are believed to be reasonable under the circumstances. Actual results may differ from these estimates under different assumptions or conditions. Management considers the following accounting

22

estimates to be the most critical in preparing our consolidated financial statements. These critical accounting estimates have been discussed with our audit committee.

Reserves for Returns. We review the reserves for customer returns at each reporting period and adjust them to reflect data available at that time. To estimate reserves for returns, we consider actual return rates in preceding periods and changes in product offerings or marketing methods that might impact returns going forward. To the extent the estimate of returns is inaccurate, we will adjust the reserve, which will impact the amount of product sales revenue recognized in the period of the adjustment. The provision for estimated returns for the years ended December 31, 2006, 2005 and 2004 were $39.6 million, $15.7 million and $2.2 million, respectively. The reserve for returns incurred but not received and processed was $2.6 million and $1.5 million at December 31, 2006 and 2005, respectively.

Impairment of Fixed Assets and Intangibles. We continually assess the impairment of long-lived assets whenever events or changes in circumstances indicate that the carrying value of the assets may not be recoverable. Judgments regarding the existence of impairment indicators are based on legal factors, market conditions and our operating performance. Future events could cause us to conclude that impairment indicators exist and the carrying values of fixed and intangible assets may be impaired. Any resulting impairment loss would be limited to the value of net fixed and intangible assets.

Income Taxes. Currently, we are recording income taxes at a rate equal to the combined federal and state statutory rates. For the year ended December 31, 2006, we recorded income tax expense of $50.6 million, which reflected an estimated annual effective tax rate of 37.3%. For the year ended December 31, 2005, we recorded $13.1 million of income taxes, which was recorded at an estimated annual effective tax rate of 38.5%. We estimate the annual effective tax rate at the beginning of each year and revise the estimate at each reporting period based on a number of factors including operating results, level of tax exempt interest income and sales by state, among other items.

Results of Operations

Revenue and expenses consist of the following components:

Revenue. Revenue consists primarily of food sales. Food sales include sales of food, supplements, shipping and handling charges billed to customers and sales credits and adjustments, including product returns. No revenue is recorded for food products provided at no charge as part of promotions. Revenue for Slim and Tone consists primarily of franchise fees and royalties. Revenue for franchise fees is recognized when a franchise center opens for business. Royalties are paid monthly and recognized in the month the royalty is earned.

Cost of Revenue. Cost of revenue consists primarily of the cost of the products sold, including compensation related to fulfillment, the costs of outside fulfillment, incoming and outgoing shipping costs, charge card fees, packing material and the write-off of obsolete packaging and product. Cost of products sold includes products provided at no charge as part of promotions and the non-food materials provided with customer orders. Cost of revenue also includes the fees paid to independent distributors and sales commissions. Cost of revenue for Slim and Tone consists of the costs incurred associated with the opening of a franchise center.

Marketing Expense. Marketing expense includes advertising, marketing and promotional expenses and payroll related expenses for personnel engaged in these activities. We follow the American Institute of Certified Public Accountants Statement of Position 93-7, “Reporting on Advertising Costs.” Internet advertising expense is recorded based on either the rate of delivery of a guaranteed number of impressions over the advertising contract term or on a cost per customer acquired, depending upon the terms. Direct-mail advertising costs are capitalized if the primary purpose was to elicit sales to customers who could be shown to have responded specifically to the advertising and results in probable future economic benefits. The capitalized costs are amortized to expense over the period during which the future benefits are expected to be received. All other advertising costs are charged to expense as incurred.

23

General and Administrative Expenses. General and administrative expenses consist of compensation for administrative, information technology, counselors (excluding commissions) and customer service personnel, share-based payment arrangements, facility expenses, website development costs, professional service fees and other general corporate expenses.

Interest Income, Net. Interest income, net consists of interest income earned on cash balances and marketable securities, net of interest expense.

Income Taxes. We are subject to corporate level income taxes and record a provision for income taxes based on an estimated effective tax rate for the year.

Overview of the Direct Channel

Our revenue and profitability have increased substantially from 2005 to 2006 driven primarily by profitable growth in the direct channel. In the years ended 2006, 2005 and 2004, the direct channel represented 93%, 89% and 81%, respectively, of our revenue. Revenue increases are primarily driven by new customer growth. Critical to acquiring new customers is our ability to increase our marketing spend while maintaining marketing effectiveness. The spending on advertising and marketing increased by $70.8 million to $118.1 million in 2006 from $47.3 million in 2005. Factors influencing our marketing effectiveness include the quality of the advertisements along with the availability of appropriate media. In addition to our marketing efforts, we also generate new customers through referrals and publicity, such as magazine articles and mentions on television. Former customers return to the program and, as the number of former customers grows, we generate an increasing amount of revenue from these returning customers. We refer to revenue derived from returning customers as reactivation revenue.

We measure growth in terms of total revenue, new customers and revenue per customer. A new customer is defined as a first time purchaser through the direct channel. We define a customer with an initial purchase of $100 or more to be a “program” new customer. These customers tend to stay on a weight loss program longer and spend substantially more than customers who make an initial purchase of less than $100. Program customers made up 99%, 97% and 93% of all new customers, with average acquisition costs of $147, $140 and $156, in 2006, 2005 and 2004, respectively. Profit margins are measured in terms of gross margin (revenue less cost of revenue) and total marketing expense as a percentage of revenue. We evaluate the cost effectiveness of our marketing programs based on the marketing cost per new customer, and new program customer, acquired. In 2006, $1.9 million of our total marketing spend was used to reach former customers. When calculating new customer acquisition cost we exclude this spend. Prior to 2006 this spend was immaterial.