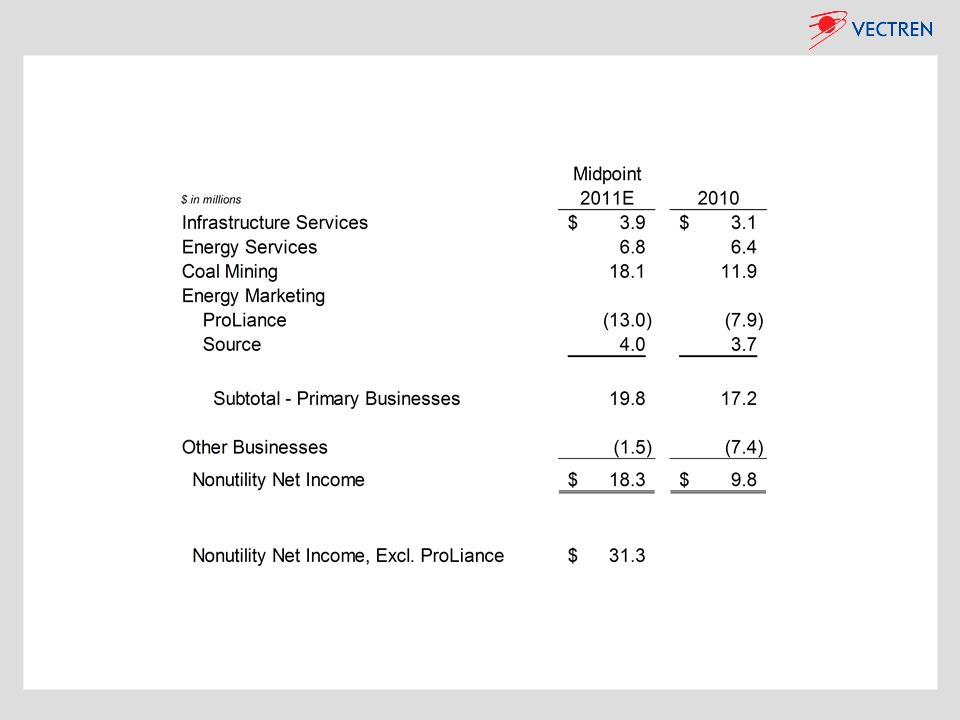

31

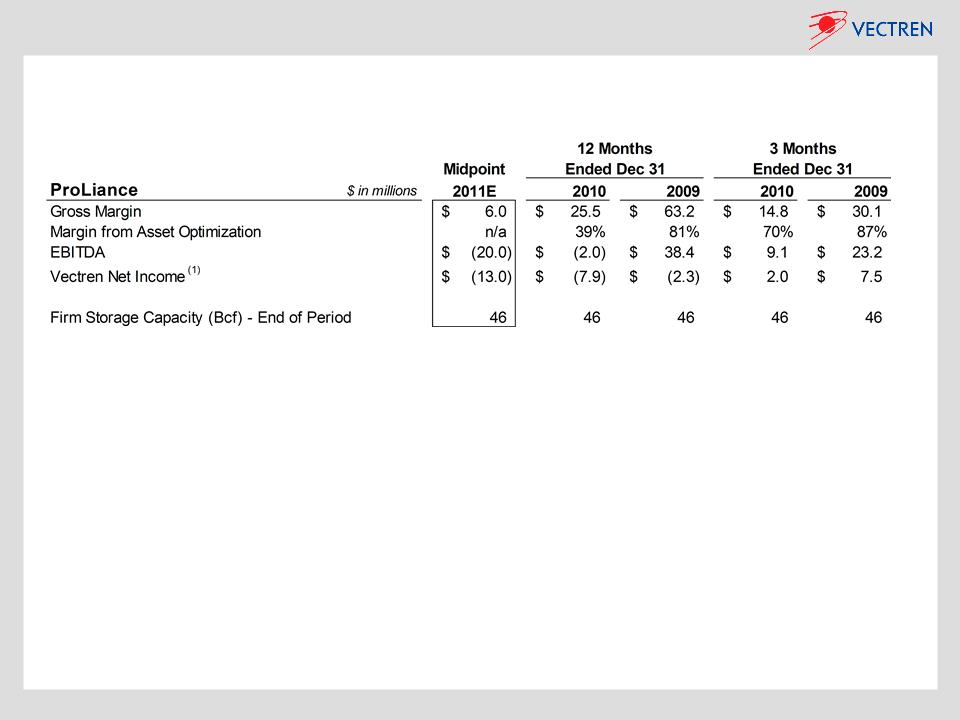

Energy Marketing - ProLiance Energy

Ø Energy marketing affiliate with Vectren

(61%) and Citizens Energy Group (39%) -

equity accounting

• 2010 revenues of $1.5 billion

• 100 employees

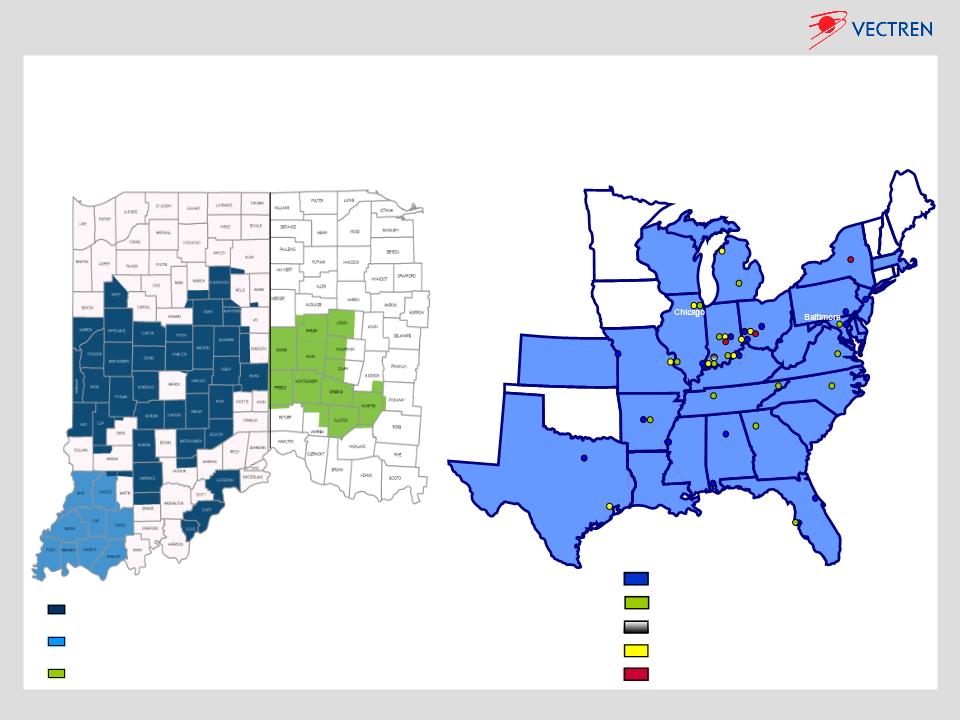

• Operates throughout the Midwest and

Southeast U.S

Ø Provides bundled gas services, including

base load, peaking sales, risk management,

and other ancillary services

• Retail services to over 1,750 Commercial and

industrial customers

• Wholesale services to utilities, municipals,

power generators

Ø Storage & Transportation optimization is

the primary earnings driver (includes

arbitrage opportunities for price differences

across time and location in physical and

financial markets)

• 46 Bcf of storage

• Balanced book approach - VaR capped at $2.5

million

Ø Margins associated with optimizing the

transportation and storage portfolio

reduced

• General compression of natural gas prices

and reduction of firm transportation spread

values between the production areas and the

Midwest market area due to:

– Lower industrial demand

– New shale gas supplies

– New pipeline infrastructure in service

– Lower relative gas prices

Ø Near-term focus to improve margin

opportunities

• Maintain flexibility to take advantage of price

volatility and widening seasonal spreads

• Focus on growing commercial and industrial

customer segment

• Cost reductions

• Looking for opportunities to renegotiate

transportation and storage contracts

– $25 million (one-third) of contracts expire

over next 3 years and $40 million (half)

over next 5 years

Appendix