17

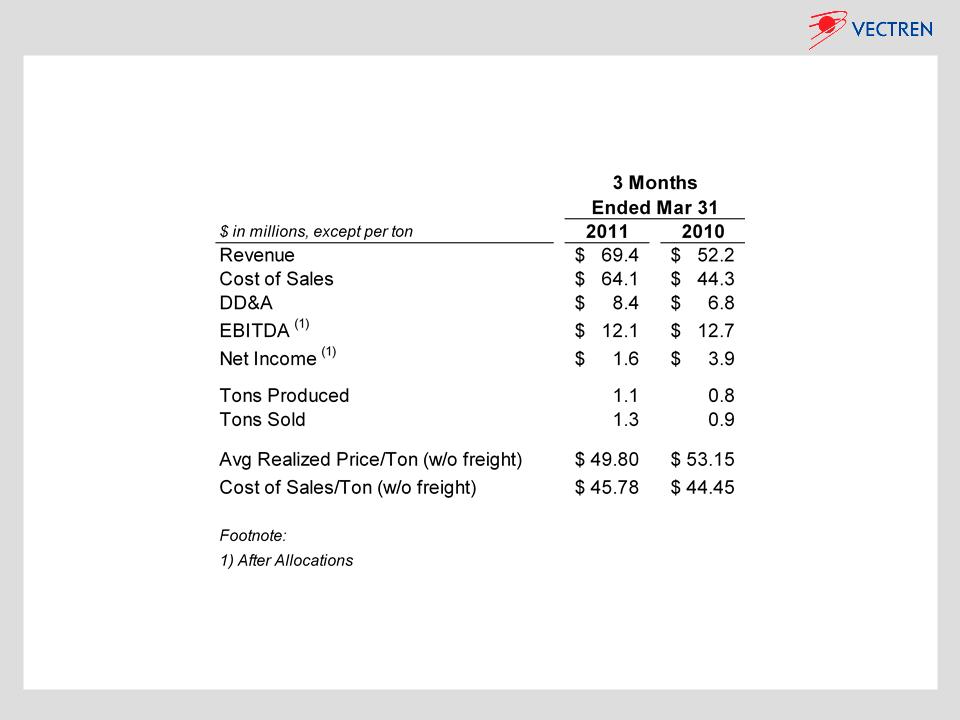

Coal Mining

Ø Mines and sells Indiana coal to Vectren’s utility

operations and other third parties

• 2010 revenues of $210 million

• 750 contract mining jobs with completion of Oaktown

mines

Ø Competitive location - 13 power plants within 50

mile radius of underground mines

Ø 2011 sales estimated at 5.1 million tons compared

to 3.7 million in 2010

• 90% contracted and priced

• Reduced costs at Oaktown 1 due to additional volumes

• ~1.9 million tons to Vectren, incl. 200k deferred

Ø Approximately 40% and 15%, respectively, of

2012 and 2013 expected production already

contracted and priced

Ø As 2nd Oaktown mine comes online in 2012,

production costs per ton expected to decline

• Will enable cost sharing of investments already

made in wash plant, rail spur, etc., plus other

operating efficiencies

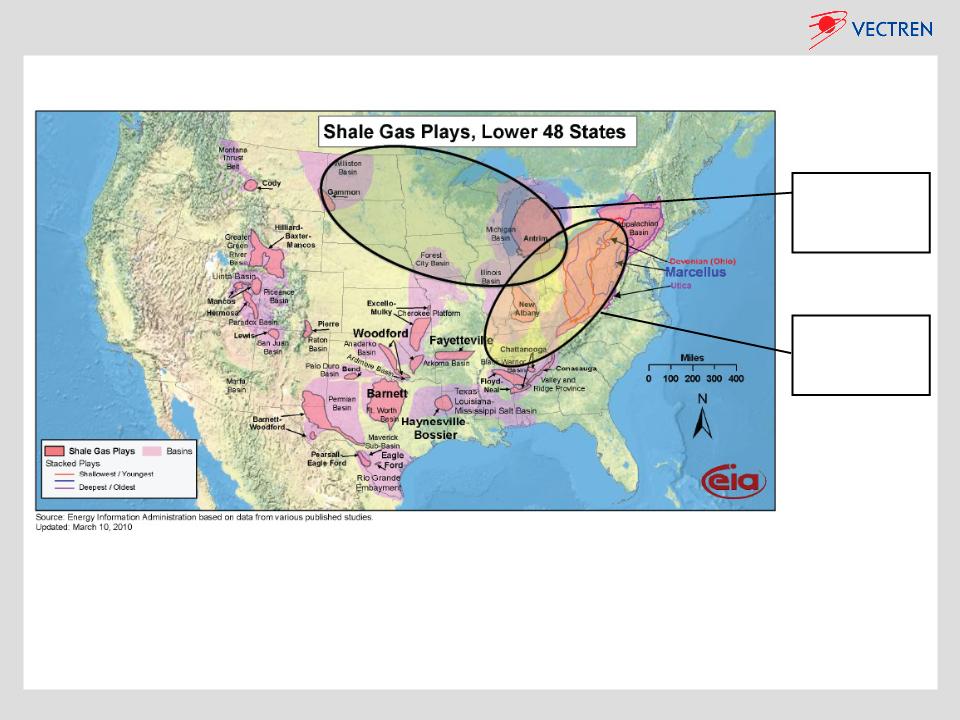

Ø Long-term Illinois Basin coal demand expected to

continue increasing as economy improves,

inventory levels reduced, scrubbers are installed,

and as Appalachian production declines

Ø Prosperity Mine

• 32 million tons of reserves

• 4.0 lbs SO2 - 11,300 BTU

• Est. max annual production up to 3 million

tons

• Mine reconfiguration was completed 1st

quarter 2011, driving cost reductions

Ø Oaktown Mines 1 & 2

• 104 million tons of reserves

• Less than 6.0 lbs SO2 - 11,200 BTU

• Est. max annual production

– Oaktown #1 up to 3 million tons

– Oaktown #2 up to 2 million tons

– Ramp up in production dependent on

contracts, negotiations continue

• Through December 2010, $185 million in

development costs already incurred of

expected $205 million total for both mines