AGA Financial Forum Naples, FL May 5-7, 2013

2 Management Representatives Carl Chapman – Chairman, President and CEO Jerry Benkert – Executive VP and CFO Robert Goocher – Treasurer and VP - Investor Relations Susan Hardwick – VP, Controller and Assistant Treasurer Aaron Musgrave – Director, Investor Relations

3 Forward-Looking Statements All statements other than statements of historical fact are forward-looking statements made in good faith by the company and are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. Such statements are based on management’s beliefs, as well as assumptions made by and information currently available to management and include such words as “believe”, “anticipate”, ”endeavor”, “estimate”, “expect”, “objective”, “projection”, “forecast”, “goal”, “likely”, and similar expressions intended to identify forward-looking statements. Vectren cautions readers that the assumptions forming the basis for forward-looking statements include many factors that are beyond Vectren’s ability to control or estimate precisely and actual results could differ materially from those contained in this document. Forward-looking statements speak only as of the date on which our statement is made, and we assume no duty to update them. More detailed information about these factors is set forth in Vectren’s filings with the Securities and Exchange Commission, including Vectren’s 2012 annual report on Form 10-K filed on February 15, 2013. Robert L. Goocher, Treasurer and VP – Investor Relations rgoocher@vectren.com 812-491-4080

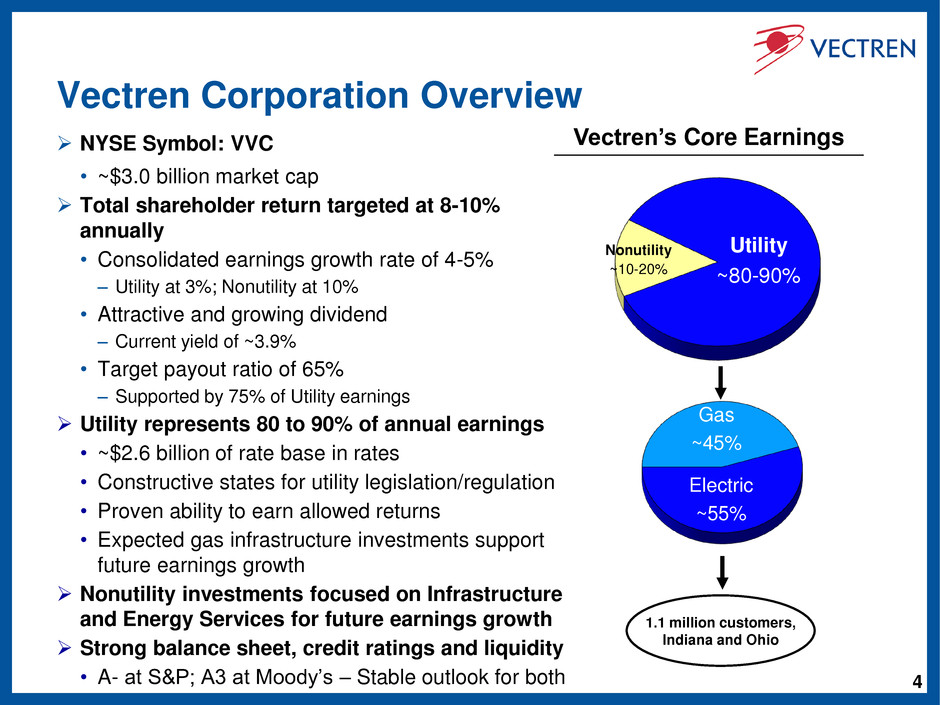

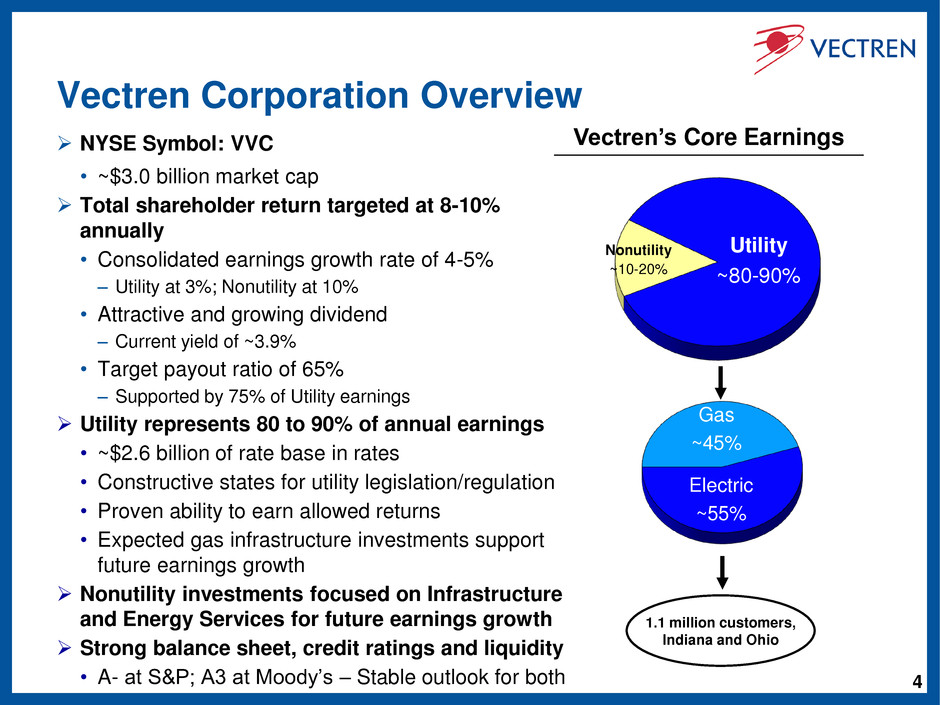

4 Vectren Corporation Overview NYSE Symbol: VVC • ~$3.0 billion market cap Total shareholder return targeted at 8-10% annually • Consolidated earnings growth rate of 4-5% – Utility at 3%; Nonutility at 10% • Attractive and growing dividend – Current yield of ~3.9% • Target payout ratio of 65% – Supported by 75% of Utility earnings Utility represents 80 to 90% of annual earnings • ~$2.6 billion of rate base in rates • Constructive states for utility legislation/regulation • Proven ability to earn allowed returns • Expected gas infrastructure investments support future earnings growth Nonutility investments focused on Infrastructure and Energy Services for future earnings growth Strong balance sheet, credit ratings and liquidity • A- at S&P; A3 at Moody’s – Stable outlook for both Vectren’s Core Earnings Utility ~80-90% Nonutility ~10-20% Electric ~55% Gas ~45% 1.1 million customers, Indiana and Ohio

5 Vectren Nonutility Infrastructure Services Energy Services Coal Mining Energy Marketing Distribution & Transmission Pipeline Construction Energy Saving Performance Contracting & Renewable Projects Mines and Sells Coal to Vectren and 3rd Parties Wholesale Gas Marketing Business Vectren Utility Vectren North Indiana Gas 575,000 Customers Vectren South SIGECO – Electric 142,000 Customers Vectren South SIGECO – Gas 111,000 Customers Vectren Ohio VEDO 314,000 Customers Vectren at a Glance

6 Operating Strategies to Achieve Financial Goals Utility Execute strategies to achieve annual earnings growth of 3% • Earn allowed returns in gas and electric utilities – Earn current returns on infrastructure investments as provided in IN & OH legislation/regulation – Aggressively manage costs through performance management & strategic sourcing – Gas and partial electric utility lost margin recovery mechanisms in place in all territories • Gas system infrastructure replacement to drive earnings growth, enhance reliability and public safety – Reinvest earnings to support growth – no planned equity offerings – Modest external debt financing requirements – internal cash flow generation remains high Nonutility Existing portfolio of businesses to target 10% annual earnings growth • Grow and enhance Vectren’s premier infrastructure services business by expanding footprint in the gas distribution, gas and oil transmission and wastewater markets • Grow Vectren’s successful energy services company by expanding the performance contracting geographic footprint, while growing the renewable energy business • As demand dictates, ramp up to near full production for all three mines (~7.5 million tons) • Continue the focus on improving ProLiance’s profitability prospects through further reductions in fixed cost structure and customer growth

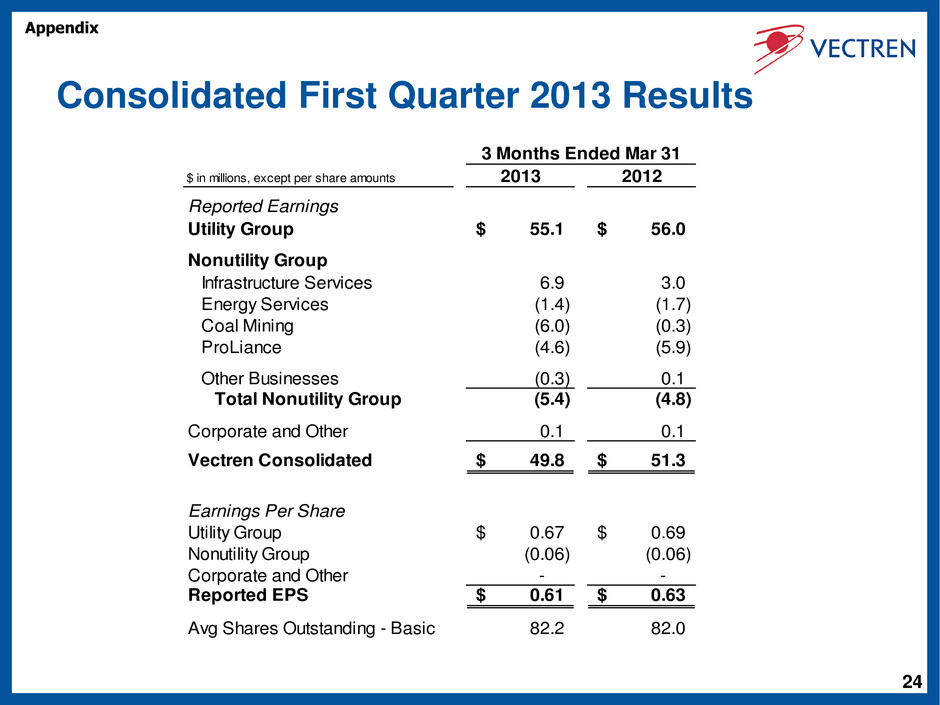

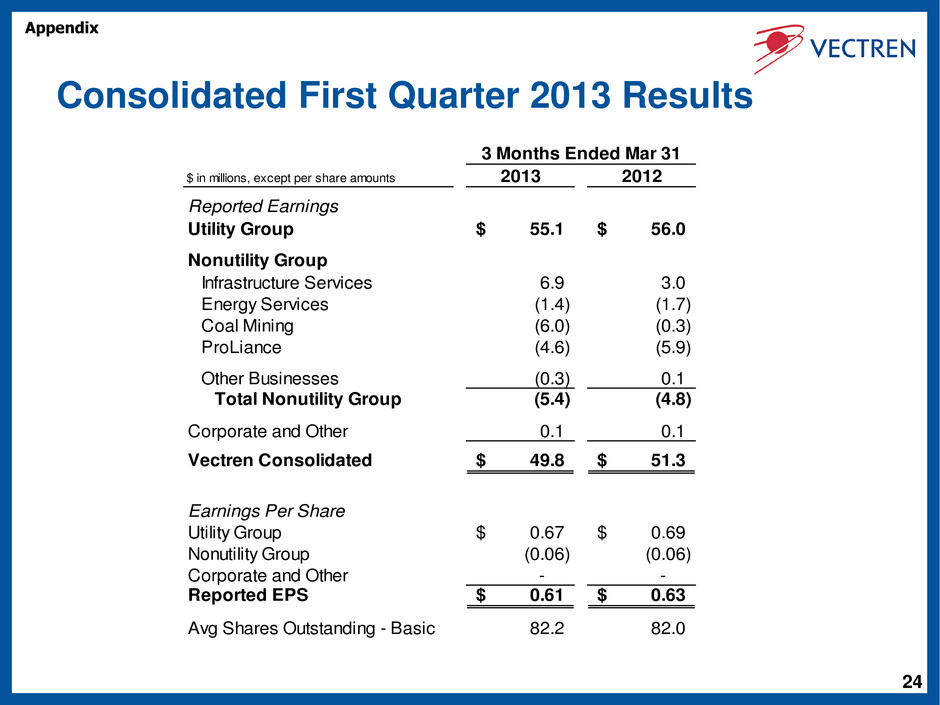

7 2013 YTD Review and Outlook Vectren consolidated 1st quarter 2013 earnings on plan • $49.8 million, or $0.61 per share, compared to $51.3 million, or $0.63 per share in 2012 • Utility earnings were down slightly vs. 2012, but were on plan for the quarter, keeping the utility businesses on track to earn at or near allowed returns for the year • Nonutility results overall were comparable to 2012 reflecting very strong results from Infrastructure Services and improved results from ProLiance, offset by lower contributions from Coal Mining – Related to ProLiance, seasonal and month-ahead spreads have contracted, limiting storage optimization opportunities – ProLiance continues to explore various strategies and alternatives to its historical business model – ProLiance’s 2013 results increasingly difficult to predict; excluding from 2013 earnings guidance Coal Mining Update • Oaktown 2 mine opened in April; three contracts now secured for Oaktown 2 for 2013 • Oaktown 1 continued to deliver competitive costs and perform well in the quarter, in line with expectations • Additional actions taken in April to address challenging conditions at Prosperity mine Energy Services Update • Though some successes in the quarter, customers still slow in committing to performance contracting projects − Awarded 2nd contract by U.S. Virgin Islands to complete energy efficiency retrofits at public schools

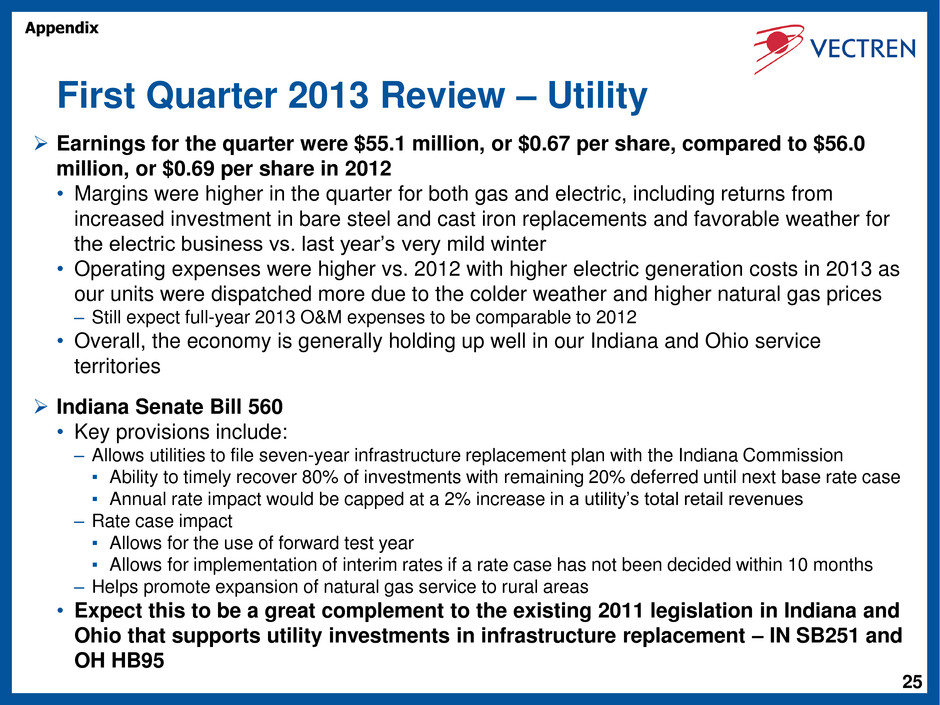

8 2013 YTD Review and Outlook, cont’d Infrastructure Services Update • Outstanding first quarter results driven by continued strong demand for transmission work • Wet and cold winter weather in distribution business territory led to typical slow first quarter • Estimated backlog of approx. $445 million as of 3/31/13, up $65 million from year-end Successfully refinanced $62 million of utility-related tax-exempt debt in April 2013 at weighted average interest rate of 4.03% (annualized interest savings of ~$800,000) • Including other recent refinancings, still on track to come in at or below $68 million of utility interest expense in 2013 vs. $80 million in 2011 Indiana Senate Bill 560 • Signed into law by Governor on April 30th; effective immediately • Further expands and enhances timely recovery of infrastructure investments, complementing legislation passed in 2011 (IN SB 251 and OH HB 95)

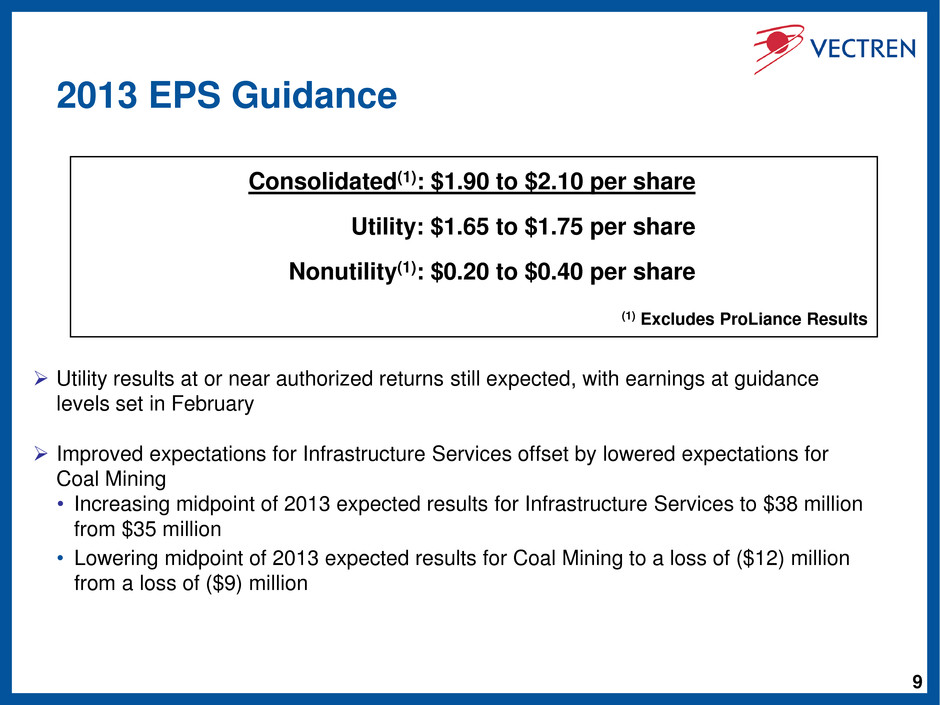

9 2013 EPS Guidance Consolidated(1): $1.90 to $2.10 per share Utility: $1.65 to $1.75 per share Nonutility(1): $0.20 to $0.40 per share Utility results at or near authorized returns still expected, with earnings at guidance levels set in February Improved expectations for Infrastructure Services offset by lowered expectations for Coal Mining • Increasing midpoint of 2013 expected results for Infrastructure Services to $38 million from $35 million • Lowering midpoint of 2013 expected results for Coal Mining to a loss of ($12) million from a loss of ($9) million (1) Excludes ProLiance Results

10 Vectren Energy Delivery of Indiana - North Vectren Energy Delivery of Indiana - South Vectren Energy Delivery of Ohio Utility – Service Territories & Rate Base Gas Utilities’ Rate Base: ~$1.2 billion* • ~$0.9 billion Indiana • ~$0.3 billion Ohio • ~10.2% Total Gas Allowed ROE Electric Utility Rate Base: ~$1.3 billion* • All Indiana; excludes FERC Transmission • 10.4% Allowed ROE FERC Electric Transmission Rate Base: ~$0.1 billion* • 12.38% Allowed ROE * From last rate cases, which total $2.6 billion; estimated at ~$2.8 billion today OH IN

11 Utility – Constructive Recovery Mechanisms Core Recovery Mechanisms Electric IN-South IN-North Ohio IN-South Recovery of Bare Steel/Cast Iron Replacement Costs Environmental CWIP Recovery Under SB 29 Recovery of MISO Transmission Investments Gas Cost and Fuel Cost Recovery Decoupling or Lost Margin Recovery Normal Temperature Adjustment Straight Fixed Variable Rate Design Bad Debt Expense - Tracked Bad Debt Related to Gas Costs - Tracked Unaccounted for Gas - Tracked Gas ent Infrastructur Inve tme t Recov ry Mechanisms Timely Legislation State Effective Recovery Deferred Notes S nate Bill 251 Indiana May 2011 80% 20% Federal Mandates Senate Bill 560 Indiana April 2013 80% 20% Infrastructure Replacement 7-Yr Plan House Bill 95 Ohio S pt. 2011 100% CapEx at Long-Term Debt Rate

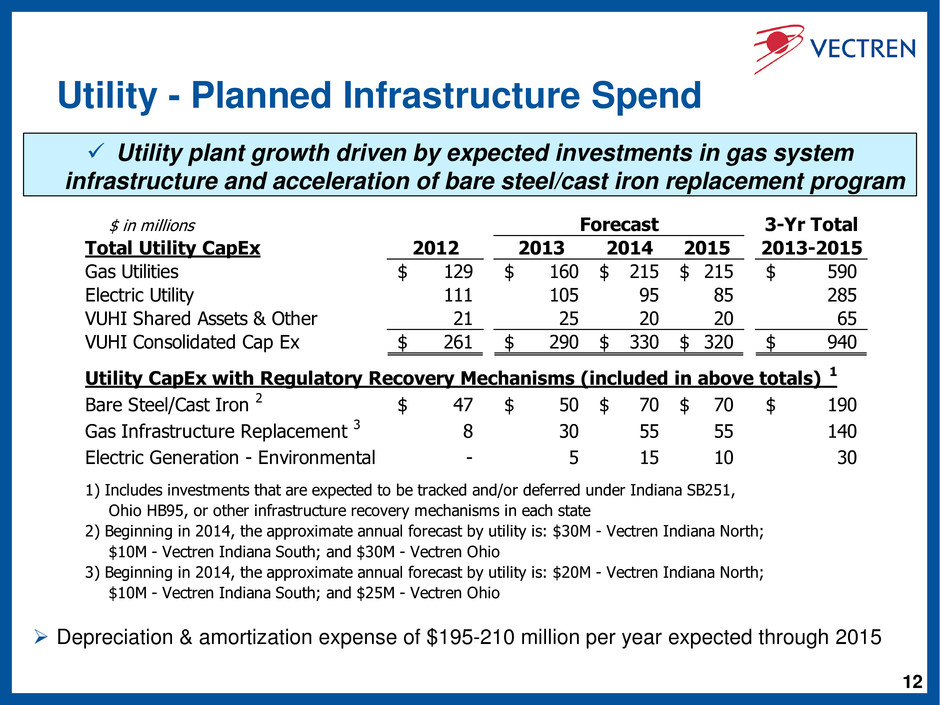

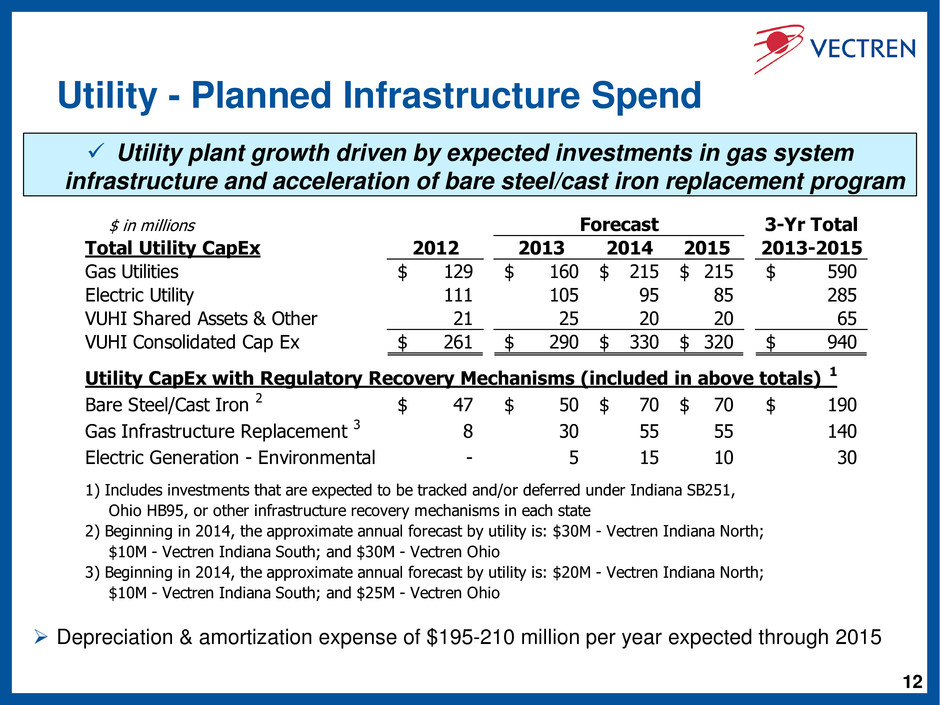

12 Utility - Planned Infrastructure Spend $ in millions 3-Yr Total Total Utility CapEx 2012 2013 2014 2015 2013-2015 Gas Utilities 129$ 160$ 215$ 215$ 590$ Electric Utility 111 105 95 85 285 VUHI Shared Assets & Other 21 25 20 20 65 VUHI Consolidated Cap Ex 261$ 290$ 330$ 320$ 940$ Utility CapEx with Regulatory Recovery Mechanisms (included in above totals) 1 Bare Steel/Cast Iron 2 47$ 50$ 70$ 70$ 190$ Gas Infrastructure Replacement 3 8 30 55 55 140 Electric Generation - Environmental - 5 15 10 30 1) Includes investments that are expected to be tracked and/or deferred under Indiana SB251, Ohio HB95, or other infrastructure recovery mechanisms in each state 2) Beginning in 2014, the approximate annual forecast by utility is: $30M - Vectren Indiana North; $10M - Vectren Indiana South; and $30M - Vectren Ohio 3) Beginning in 2014, the approximate annual forecast by utility is: $20M - Vectren Indiana North; $10M - Vectren Indiana South; and $25M - Vectren Ohio Forecast Depreciation & amortization expense of $195-210 million per year expected through 2015 Utility plant growth driven by expected investments in gas system infrastructure and acceleration of bare steel/cast iron replacement program

13 Utility – Elements of Consistent Earnings Growth Gas System Infrastructure Replacement & Bare Steel/Cast Iron Acceleration Background - Pipeline Safety, Regulatory Certainty and Job Creation act of 2011 requires PHMSA to implement new regulations for maximum allowable operating pressures, to expand integrity management (IM) regulations, and to study other items that could lead to changes in the replacement rates of cast iron pipe, for example Vectren’s Gas Infrastructure Replacement Plans • Transmission Pipeline Infrastructure Replacement - Investments to include hydrostatic testing, in-line inspection modifications (‘smart pigging’), installation of remotely-controlled valves, etc. • Distribution Pipeline Infrastructure Replacement - projects include inside meter move outs, obsolete equipment replacements, valve additions, vintage and odd pipe replacements, etc. Vectren’s Bare Steel/Cast Iron Acceleration Plans • Currently replacing ~50 miles annually; will propose to accelerate to ~95 miles annually Sustainable Cost Management and Process Improvement Initiatives Performance Management • Amended postretirement medical plans - improved access for retirees, lowered plan costs • Consolidated 29 operating centers to 13 based on efficiency gains & mobile technologies Strategic Sourcing • Modified fleet management strategy, saving $1.4 million annually

14 Infrastructure Services – Miller Pipeline & Minnesota Limited Distribution Business Provides underground pipeline construction and repair services for natural gas, water and wastewater companies Major customers are regional utilities, such as Vectren, NiSource, Duke, UGI, LG&E, Alagasco and Citizens Transmission Business Provides underground pipeline construction and repair services for natural gas and petroleum transmission companies Major customers include Alliance, Hess, Enbridge, CenterPoint and Minnesota Pipe Line Strategy: Drive business growth through sustainable, long-term customer relationships built upon high quality construction and customer service, and strategic acquisitions Station Fabrication and Pipeline Construction – Berthold, ND $236 $421 $664 $- $100 $200 $300 $400 $500 $600 $700 2010 2011* 2012 Infrastructure Services Gross Revenue In millions *Acquired Minnesota Limited on 3/31/11 Employees at Peak 1,600 2,600 3,300

15 Infrastructure Services – Miller Pipeline & Minnesota Limited Substantial earnings of $40.5 million in 2012 • Record 2012 earnings achieved due to execution amid strong demand and under very favorable weather conditions; significantly exceeds 2011 results of $14.9 million Key growth drivers: Able to take advantage of increased demand as a result of strong customer relationships & customer service; safe, high-quality construction work; and a proven ability to manage growth through attracting and retaining highly-skilled employees • Tenure of our management team, in the field and the office, is a key competitive advantage − Team understands controlled growth, both organic and through acquisitions – selectively adding the right people and treating them well in order to retain and expand skilled work force Strong demand expected to continue for many years for both transmission & distribution businesses • Repair & replacement due to aging natural gas and oil pipelines • New pipeline construction driven by the development of natural gas and oil found in shale formations Infrastructure Services & Energy Services – remain focus of future nonutility investments and earnings growth for Vectren

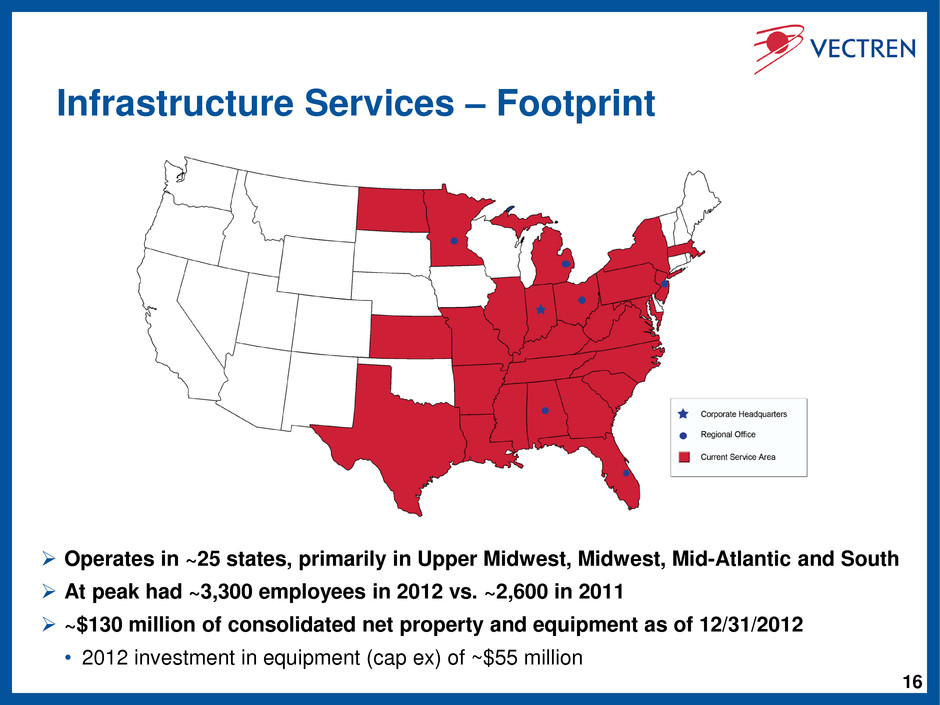

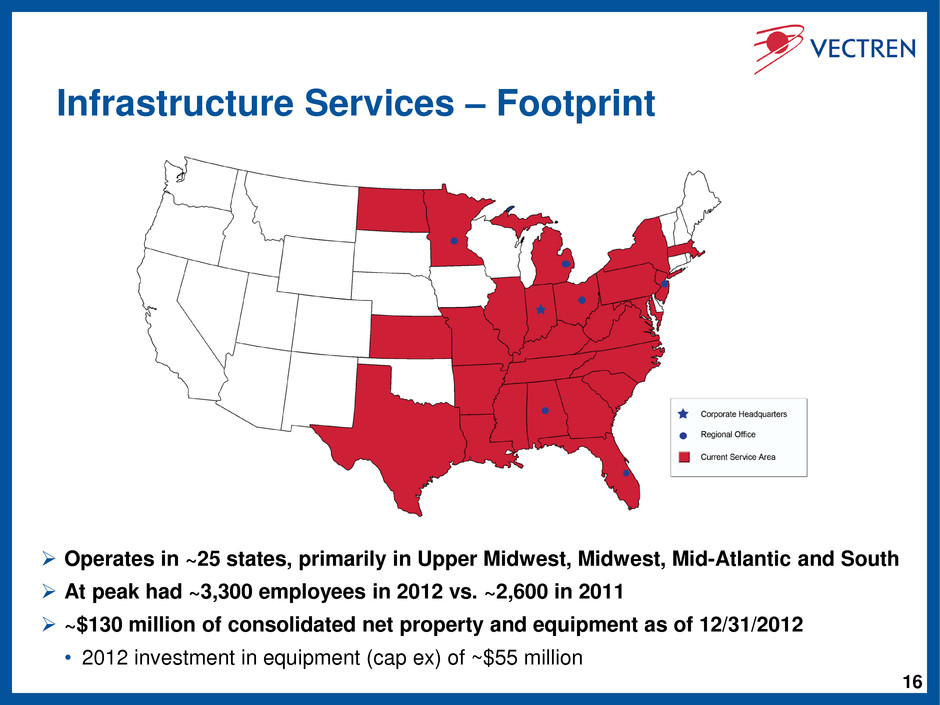

16 Infrastructure Services – Footprint Operates in ~25 states, primarily in Upper Midwest, Midwest, Mid-Atlantic and South At peak had ~3,300 employees in 2012 vs. ~2,600 in 2011 ~$130 million of consolidated net property and equipment as of 12/31/2012 • 2012 investment in equipment (cap ex) of ~$55 million

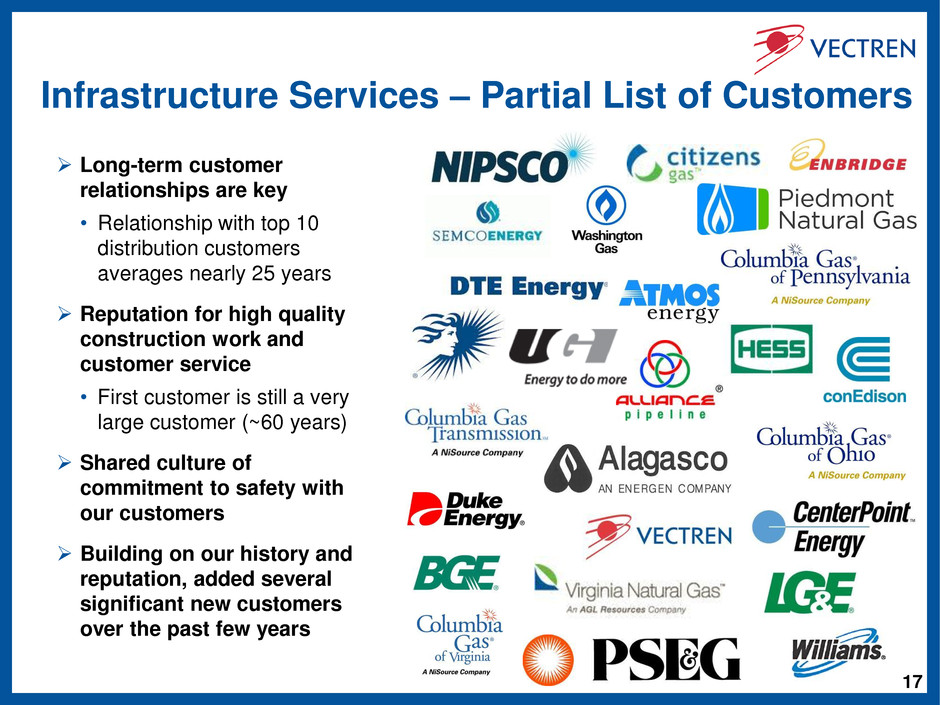

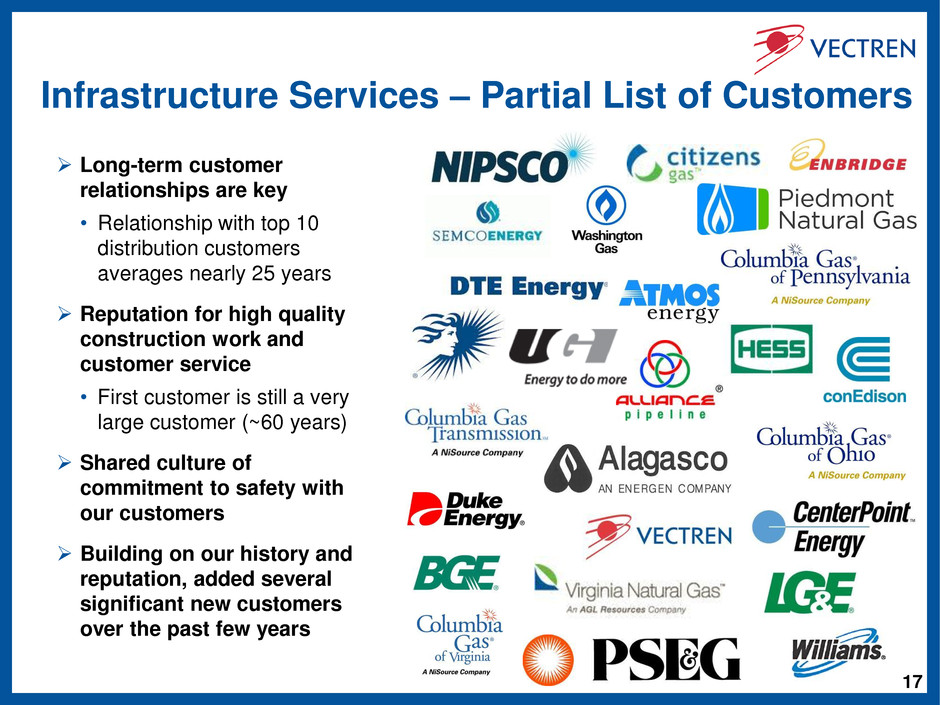

17 Infrastructure Services – Partial List of Customers Long-term customer relationships are key • Relationship with top 10 distribution customers averages nearly 25 years Reputation for high quality construction work and customer service • First customer is still a very large customer (~60 years) Shared culture of commitment to safety with our customers Building on our history and reputation, added several significant new customers over the past few years

18 Energy Services - Energy Systems Group (ESG) Performance Contracting Designs and constructs facility improvements that pay for themselves from energy savings and operational improvements • Assist customers with arranging financing (ESG does not provide financing) Major customers: municipals, universities, schools, and hospitals (MUSH market) and federal agencies Targeting projects that qualify for the Energy Efficient Commercial Building federal income tax deductions (Rev. Code 179D) - available thru 2013 Renewable Energy Services Designs, constructs, and often operates renewable energy projects • Recently completed projects include: – Landfill gas Two completed for customers in 2012 – Anaerobic digesters Three company-owned projects completed in 2012 • Tax credits available for certain renewable energy projects ~240 employees at 12/31/12 • ~45 sales professionals Licensed to do business in 40 states and in Puerto Rico and US Virgin Islands Strategy: Continue to grow performance contracting and renewable energy business segments through additional sales force and expanding geographic footprint Renewable Natural Gas Processing Facility at Seminole Rd. Landfill, DeKalb County, GA Installation of Chiller at Orlando (FL) Sanford International Airport

19 Energy Services – Energy Systems Group (ESG) Still committed to growing the business – both performance contracting & renewables • For example, recent announcement of a large landfill gas to power project • Will complete expansion of sales force in 2013 – already up 40% from 2010 to 2012 – Expected to grow to 50 by the end of 2013 vs. 33 at the end of 2010 • Industry efforts underway seeking to extend expiring Section 179D tax deductions • Federal government likely to rely on firms such as ESG to meet energy efficiency & renewable energy standards in its facilities - diminished governmental funds to achieve such goals • Customers’ HVAC, lighting, etc., replacement needs increase with passage of time • Projected increases in power prices expected to drive major energy efficiency projects Earnings for Energy Services will be limited through 2014 due to approx. 18-24 month lead time for new sales professionals to deliver bottom line impact (projects in construction) Infrastructure Services & Energy Services – remain focus of future nonutility investments and earnings growth for Vectren

20 Coal Mining – Vectren Fuels 2012 sales of 4.5 million tons 6.0 million and 5.5 million tons sold in 2013 and 2014, respectively • Includes 0.5 & 0.8 million tons in 2013 & 2014, respectively, in arbitration related to a price reopener Local sales opportunities – 13 power plants within 50 mile radius Additional sales made in Southeast and Northeast Easy access to CSX rail and barge for deliveries and trucking for local sales Strategy: Mine and sell Indiana (Illinois Basin) coal to Vectren’s electric utility and other third parties. Long-term demand expected to be strong as scrubbers are installed, Appalachian production declines, and natural gas prices remain above $3.00 Select Mine Data Oaktown 1 Oaktown 2 Prosperity Tons Mined (in millions) 2012 2.7 - 2.1 2011 2.7 - 2.5 2010 1.0 - 2.7 Maximum Annual Production (tons) ~3.0 million ~2.0 million ~2.5 million Coal Reserves (tons) ~60 million ~39 million ~28 million Average Heat Content (BTU/lb.) 11,100 11,300 11,300 Average Sulfur Content (lbs./ton) 5.6 4.8 4.0 Box Cuts at Oaktown Mines 1 & 2 Continuous Miner at Prosperity Mine

21 Coal Mining – Outlook for Illinois Basin (IB) Coal in 2014 and Beyond Drivers of Expected Improvements • Scrubbers are being installed increasing demand for IB coal compared to other coal basins • IB coal is displacing coal from other regions, particularly coal from Central Appalachia as production continues to decline in that basin • Prices expected to firm up and increase as supply and demand become more balanced – 2014 and 2015 NYMEX quotes for Central Appalachian coal prices reflect ~10% and ~20% increases over 2013 prices. Would reasonably expect IB coal to reflect price increases as well • Utility coal inventory levels expected to continue to decline in 2013 as utilities work down to desired levels, resulting in more coal purchases for 2014 and beyond • Natural gas prices forecasted to remain above $3 level reducing likelihood of coal to gas switching in Midwest Excerpts from 1-14-2013 U.S. Energy Information Administration Report • In 2012, U.S. coal production, down almost 7%, fell almost everywhere. By contrast, coal production volumes in the Illinois Basin rose above its five-year range, up 9% from 2011 • Scrubbers added to meet proposed EPA regulations limiting sulfur dioxide emissions underpinned much of the increasing demand for IB’s low-cost, but high-sulfur coal • Illinois Basin coal is more likely to be used in larger, more efficient plants with modern pollution control equipment, helping it compete against low natural gas prices

22 Vectren: Strength, Stability, Utility Stability Constructive regulatory environments Earnings stability driven by core utility operations Consistent earnings growth through disciplined investments and cost controls Growing dividends paid for 53 consecutive years Strength Anchored by solid utility franchises “A3/A-” rated by Moody’s & S&P Well respected utility & nonutility competencies in infrastructure development Utility ~80-90% Nonutility ~10-20% Utility: Vectren’s Core Earnings Electric ~55% Gas ~45% 1.1 million customers, Indiana and Ohio A management team that values the importance of financially strong, stable utility operations in delivering competitive shareholder returns

Appendix

24 Consolidated First Quarter 2013 Results $ in millions, except per share amounts 2013 2012 Reported Earnings Utility Group 55.1$ 56.0$ Nonutility Group Infrastructure Services 6.9 3.0 Energy Services (1.4) (1.7) Coal Mining (6.0) (0.3) ProLiance (4.6) (5.9) Other Businesses (0.3) 0.1 Total Nonutility Group (5.4) (4.8) Corporate and Other 0.1 0.1 Vectren Consolidated 49.8$ 51.3$ Earnings Per Share Utility Group 0.67$ 0.69$ Nonutility Group (0.06) (0.06) Corporate and Other - - Reported EPS 0.61$ 0.63$ Avg Shares Outstanding - Basic 82.2 82.0 3 Months Ended Mar 31 Appendix

25 First Quarter 2013 Review – Utility Earnings for the quarter were $55.1 million, or $0.67 per share, compared to $56.0 million, or $0.69 per share in 2012 • Margins were higher in the quarter for both gas and electric, including returns from increased investment in bare steel and cast iron replacements and favorable weather for the electric business vs. last year’s very mild winter • Operating expenses were higher vs. 2012 with higher electric generation costs in 2013 as our units were dispatched more due to the colder weather and higher natural gas prices – Still expect full-year 2013 O&M expenses to be comparable to 2012 • Overall, the economy is generally holding up well in our Indiana and Ohio service territories Indiana Senate Bill 560 • Key provisions include: – Allows utilities to file seven-year infrastructure replacement plan with the Indiana Commission ▪ Ability to timely recover 80% of investments with remaining 20% deferred until next base rate case ▪ Annual rate impact would be capped at a 2% increase in a utility’s total retail revenues – Rate case impact ▪ Allows for the use of forward test year ▪ Allows for implementation of interim rates if a rate case has not been decided within 10 months – Helps promote expansion of natural gas service to rural areas • Expect this to be a great complement to the existing 2011 legislation in Indiana and Ohio that supports utility investments in infrastructure replacement – IN SB251 and OH HB95 Appendix

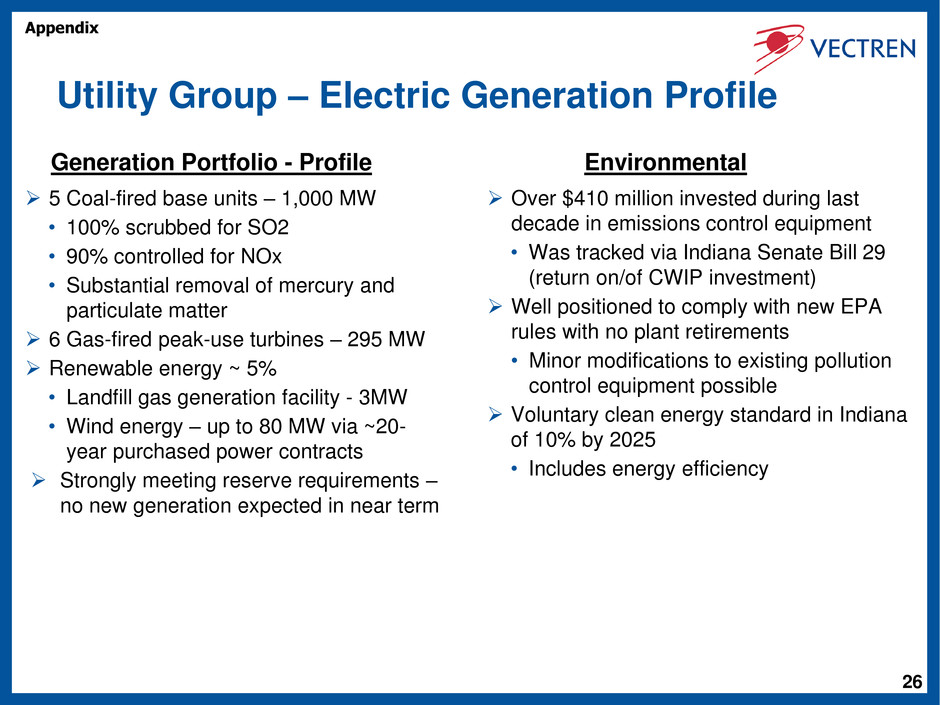

26 Environmental Generation Portfolio - Profile Utility Group – Electric Generation Profile Over $410 million invested during last decade in emissions control equipment • Was tracked via Indiana Senate Bill 29 (return on/of CWIP investment) Well positioned to comply with new EPA rules with no plant retirements • Minor modifications to existing pollution control equipment possible Voluntary clean energy standard in Indiana of 10% by 2025 • Includes energy efficiency 5 Coal-fired base units – 1,000 MW • 100% scrubbed for SO2 • 90% controlled for NOx • Substantial removal of mercury and particulate matter 6 Gas-fired peak-use turbines – 295 MW Renewable energy ~ 5% • Landfill gas generation facility - 3MW • Wind energy – up to 80 MW via ~20- year purchased power contracts Strongly meeting reserve requirements – no new generation expected in near term Appendix

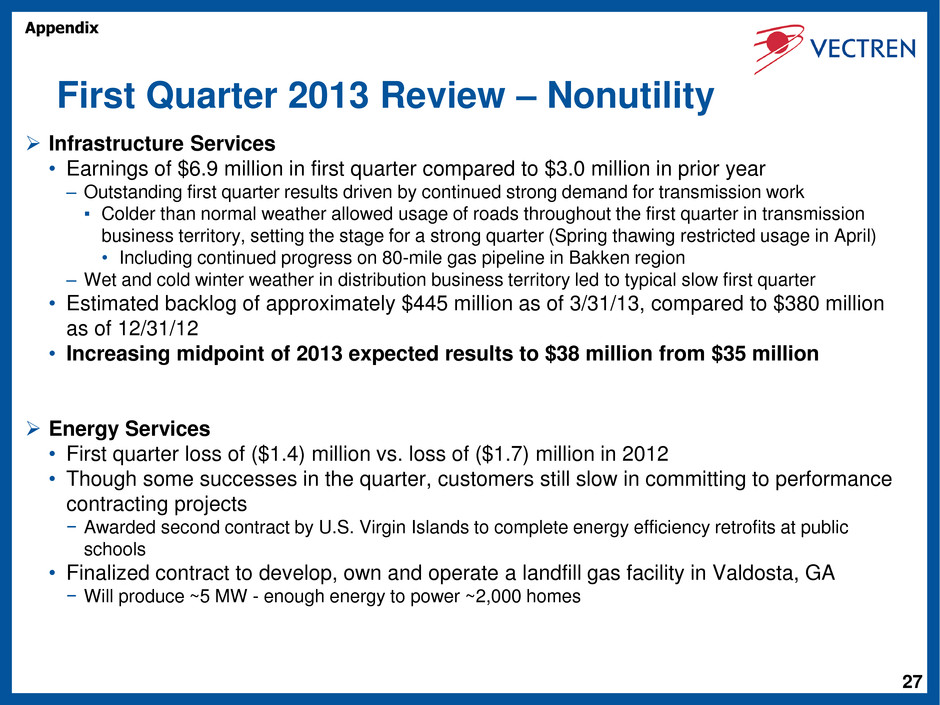

27 First Quarter 2013 Review – Nonutility Infrastructure Services • Earnings of $6.9 million in first quarter compared to $3.0 million in prior year – Outstanding first quarter results driven by continued strong demand for transmission work ▪ Colder than normal weather allowed usage of roads throughout the first quarter in transmission business territory, setting the stage for a strong quarter (Spring thawing restricted usage in April) • Including continued progress on 80-mile gas pipeline in Bakken region – Wet and cold winter weather in distribution business territory led to typical slow first quarter • Estimated backlog of approximately $445 million as of 3/31/13, compared to $380 million as of 12/31/12 • Increasing midpoint of 2013 expected results to $38 million from $35 million Energy Services • First quarter loss of ($1.4) million vs. loss of ($1.7) million in 2012 • Though some successes in the quarter, customers still slow in committing to performance contracting projects − Awarded second contract by U.S. Virgin Islands to complete energy efficiency retrofits at public schools • Finalized contract to develop, own and operate a landfill gas facility in Valdosta, GA − Will produce ~5 MW - enough energy to power ~2,000 homes Appendix

28 Infrastructure Services – Estimated Backlog General Description of Types of Customer Contracts for Infrastructure Services • Infrastructure Services operates primarily under two types of contracts – blanket contracts and fixed price contracts. Blanket contracts are ones which a customer is not contractually committed to specific volumes of services, but where we have been chosen to perform work needed by a customer in a given time frame (typically awarded on a yearly basis). Fixed price contracts are ones which a customer has contractually committed to a specific service to be performed for a specific price, whether in total for a project or on a per unit basis (e.g., per dig or per foot). General Description of Backlog for Infrastructure Services • Backlog represents an estimate of the amount of gross revenue that we expect to realize from work to be performed in the next 12 months on existing contracts or contracts we reasonably expect to be renewed or awarded based upon recent history or discussions with customers. While there is a reasonable basis to estimate backlog, there can be no assurance as to our customers’ eventual demand for our services each year or, therefore, the accuracy of our estimate of backlog. Backlog for Infrastructure Services estimated as follows: • For blanket contracts, estimated backlog as of 3/31/2013 is approx. $385 million. This estimate is based upon 80% of a rolling 12-month calculation of gross revenues. An 80% multiplier was used to factor in such unknowns as weather and potential budgetary restrictions of customers. • For fixed price contracts, backlog as of 3/31/2013 is approx. $60 million. This represents the value remaining on contracts awarded, but not yet completed as of 3/31/2013. • Total estimated backlog as of 3/31/2013: Approx. $445 million Appendix

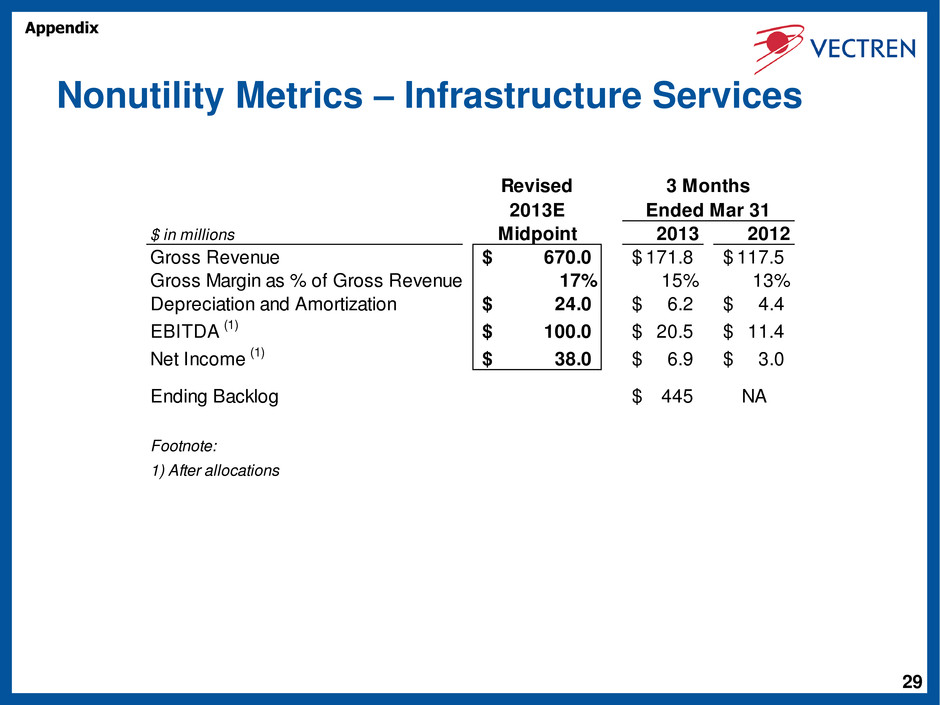

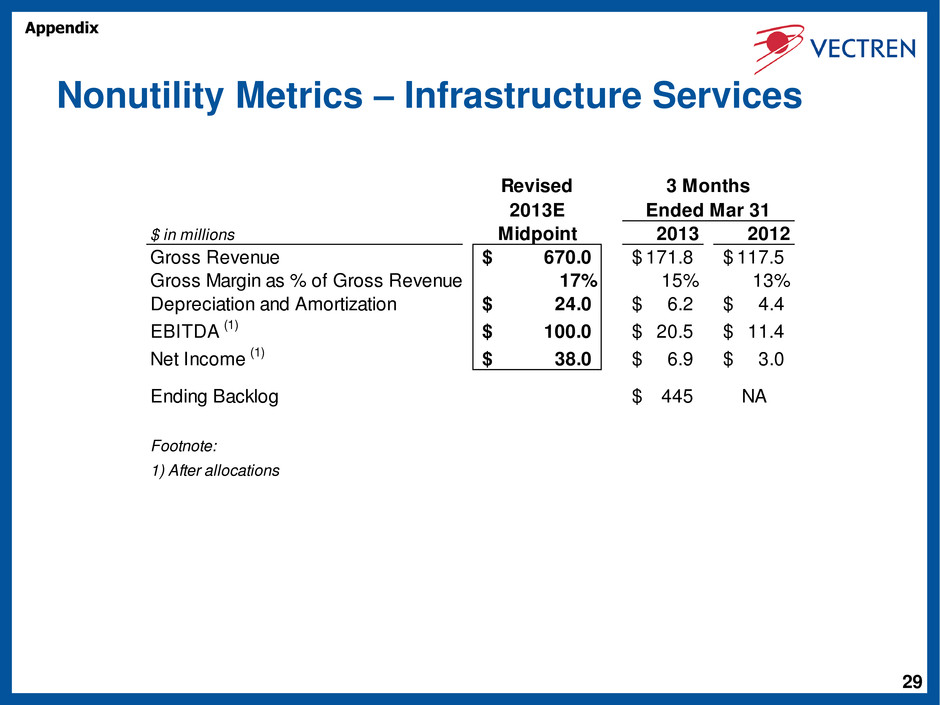

29 Nonutility Metrics – Infrastructure Services Revised 2013E $ in millions Midpoint 2013 2012 Gross Revenue 670.0$ 171.8$ 117.5$ Gross Margin as % of Gross Revenue 17% 15% 13% Depreciation and Amortization 24.0$ 6.2$ 4.4$ EBITDA (1) 100.0$ 20.5$ 11.4$ Net Income (1) 38.0$ 6.9$ 3.0$ Ending Backlog 445$ NA Footnote: 1) After allocations 3 Months Ended Mar 31 Appendix

30 Nonutility Metrics – Energy Services $ in millions 2013 2012 Revenue 20.5$ 22.2$ Gross Margin as % of Revenue 26% 26% EBITDA (1) (2.6)$ (2.6)$ Net Income (1) (1.4)$ (1.7)$ Endi g Backlog 71$ 73$ New Contracts 14$ 11$ Footnote: 1) After allocations Ended Mar 31 3 Months Appendix

31 First Quarter 2013 Review – Nonutility Coal Mining • First quarter loss of ($6.0) million compared to loss of ($0.3) million in 2012 – Driven by adverse mining conditions at Prosperity (thin coal seams; water behind mine seals) – Oaktown 1 continued to deliver competitive costs and perform well in the quarter, in line with expectations • Lowering midpoint of 2013 expected results to ($12) million from ($9) million – In April, mining equipment at Prosperity was moved to thicker coal seams and the first working section of lower profile mining equipment was placed into service – sets the stage for improved productivity for remainder of 2013 – With opening of Oaktown 2, expecting 2013 production of 6.2 million tons, sales of 6.3 million tons ▪ 6.0 million tons are sold - includes 0.5 million tons in arbitration related to a price reopener • Includes sales to utilities in Indiana, Southeast, and Northeast – Due to the expected higher costs of production during the Oaktown 2 start-up phase, the impact of these additional sales is not expected to materially impact Coal Mining’s earnings in 2013 – As 2013 progresses, Oaktown 2 cost/ton should continue to improve as startup phase is completed and production ramps up • 5.5 million tons sold for 2014 at ~$46 revenue/ton, including 0.8 million tons in arbitration – Represents a decrease of 0.3 million tons from prior projection, as some customers requested earlier delivery (in 2013) – Increased percentage of sales expected from the Oaktown mines in 2014 should improve total average cost per ton (assuming additional sales - demand dependent) Appendix

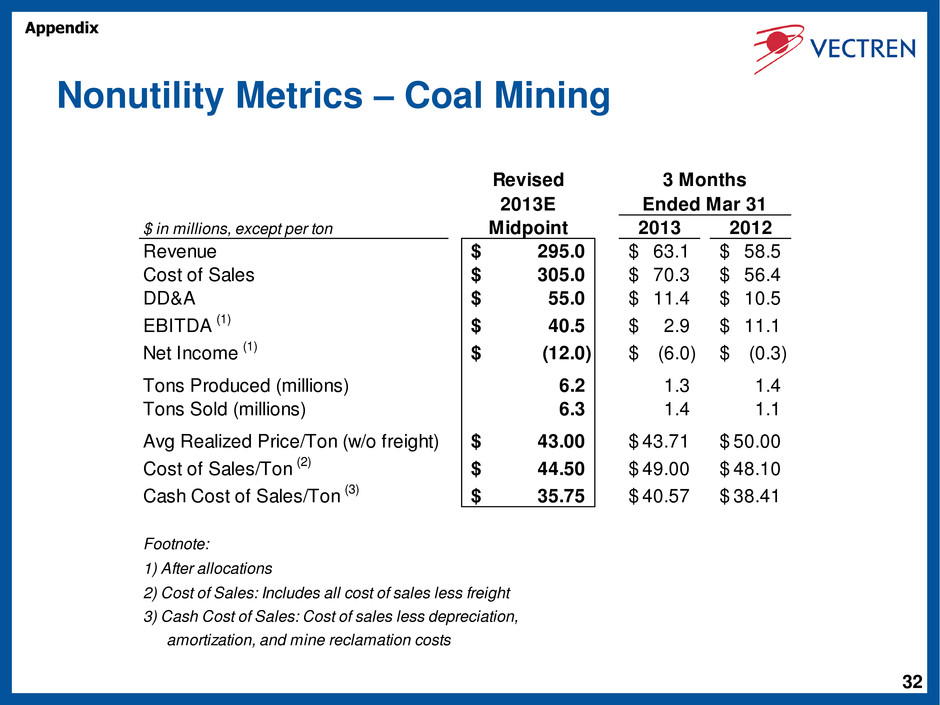

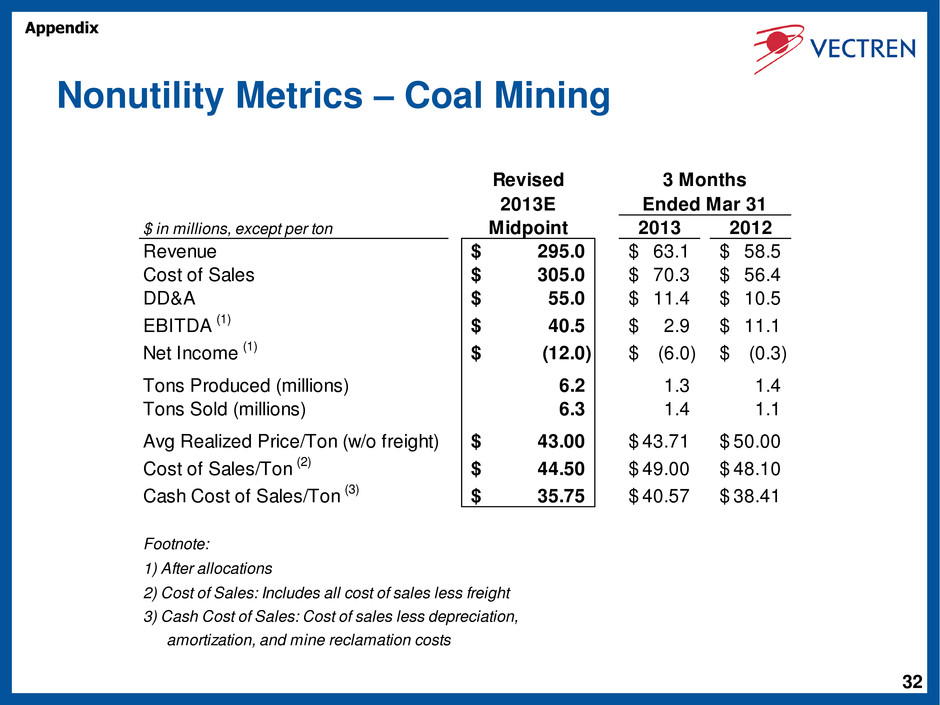

32 Nonutility Metrics – Coal Mining Revised 2013E $ in millions, except per ton Midpoint 2013 2012 Revenue 295.0$ 63.1$ 58.5$ Cost of Sales 305.0$ 70.3$ 56.4$ DD&A 55.0$ 11.4$ 10.5$ EBITDA (1) 40.5$ 2.9$ 11.1$ Net Income (1) (12.0)$ (6.0)$ (0.3)$ Tons Produced (millions) 6.2 1.3 1.4 Tons Sold (millions) 6.3 1.4 1.1 Avg Realized Price/Ton (w/o freight) 43.00$ 43.71$ 50.00$ Cost of Sales/Ton (2) 44.50$ 49.00$ 48.10$ Cash Cost of Sales/Ton (3) 35.75$ 40.57$ 38.41$ Footnote: 1) After allocations 2) Cost of Sales: Includes all cost of sales less freight 3) Cash Cost of Sales: Cost of sales less depreciation, amortization, and mine reclamation costs Ended Mar 31 3 Months Appendix

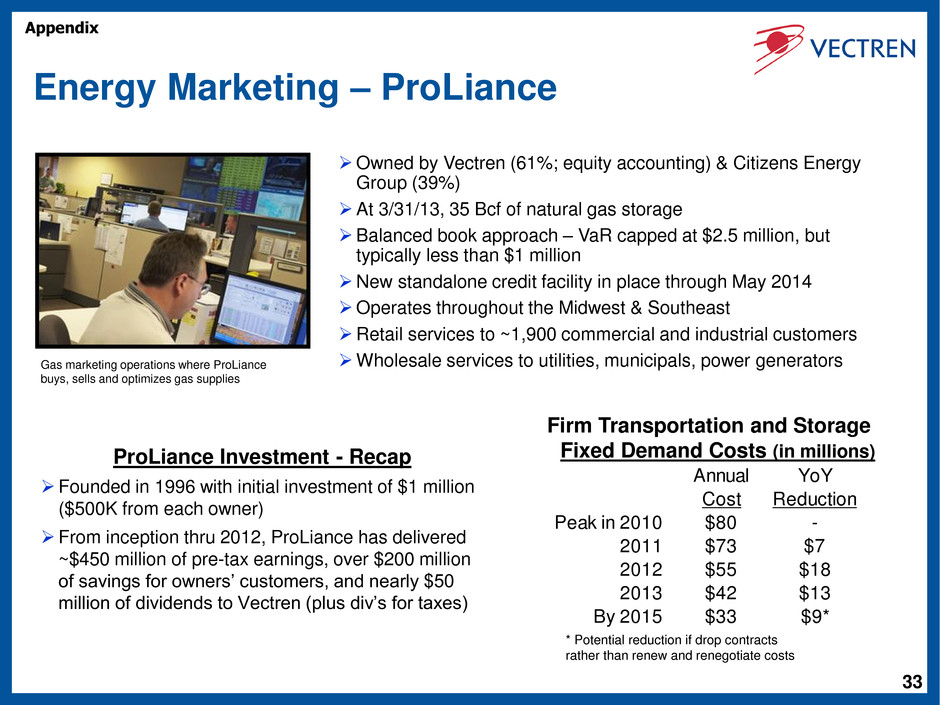

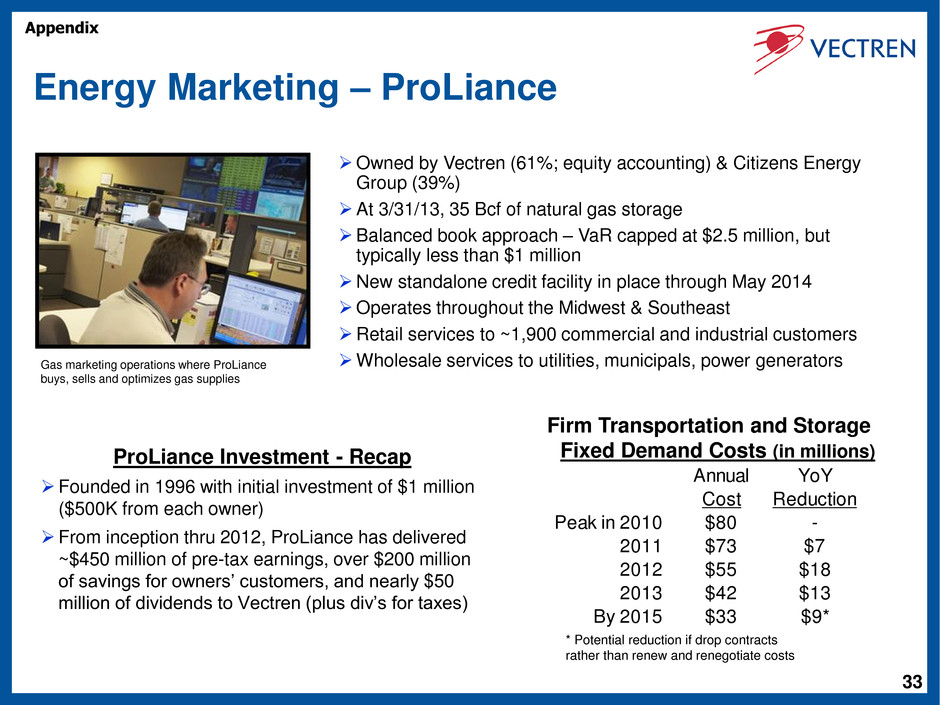

33 Energy Marketing – ProLiance ProLiance Investment - Recap Founded in 1996 with initial investment of $1 million ($500K from each owner) From inception thru 2012, ProLiance has delivered ~$450 million of pre-tax earnings, over $200 million of savings for owners’ customers, and nearly $50 million of dividends to Vectren (plus div’s for taxes) Owned by Vectren (61%; equity accounting) & Citizens Energy Group (39%) At 3/31/13, 35 Bcf of natural gas storage Balanced book approach – VaR capped at $2.5 million, but typically less than $1 million New standalone credit facility in place through May 2014 Operates throughout the Midwest & Southeast Retail services to ~1,900 commercial and industrial customers Wholesale services to utilities, municipals, power generators Gas marketing operations where ProLiance buys, sells and optimizes gas supplies Annual YoY Cost Reduction Peak in 2010 $80 - 2011 $73 $7 2012 $55 $18 2013 $42 $13 By 2015 $33 $9* Firm Transportation and Storage Fixed Demand Costs (in millions) * Potential reduction if drop contracts rather than renew and renegotiate costs Appendix

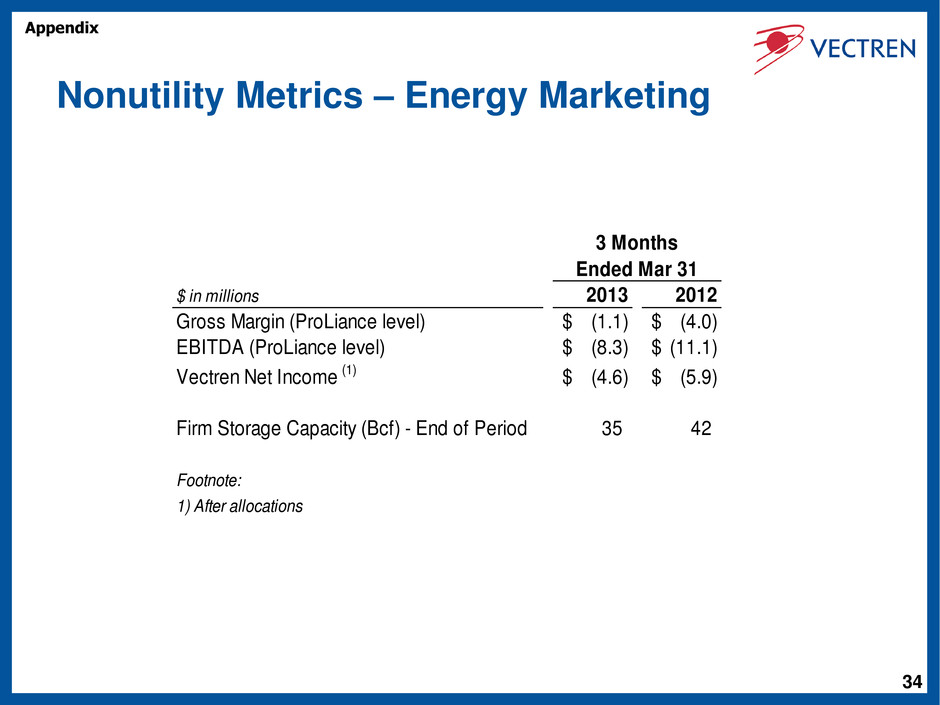

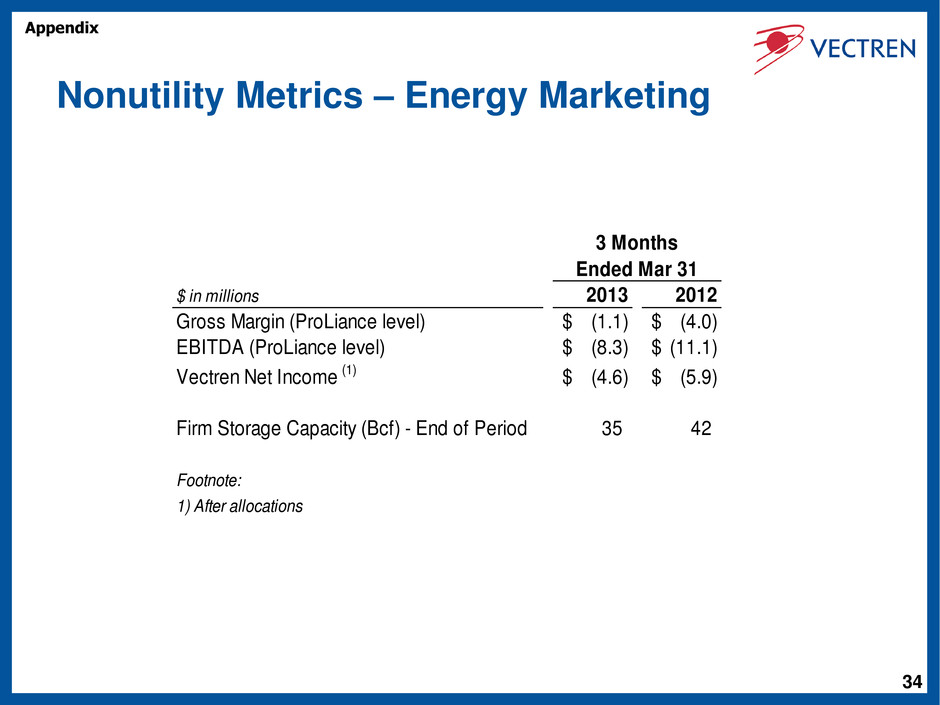

34 Nonutility Metrics – Energy Marketing $ in millions 2013 2012 Gross Margin (ProLiance level) (1.1)$ (4.0)$ EBITDA (ProLiance level) (8.3)$ (11.1)$ Vectren Net Income (1) (4.6)$ (5.9)$ Firm Storage Capacity (Bcf) - End of Period 35 42 Footnote: 1) After allocations 3 Months Ended Mar 31 Appendix

35 Use of Non-GAAP Performance Measures and Per Share Measures Per share earnings contributions of the Utility Group, Nonutility Group, and Corporate and Other are presented herein and are non-GAAP measures. Such per share amounts are based on the earnings contribution of each group included in Vectren’s consolidated results divided by Vectren’s basic average shares outstanding during the period. The earnings per share of the groups do not represent a direct legal interest in the assets and liabilities allocated to the groups, but rather represent a direct equity interest in Vectren Corporation's assets and liabilities as a whole. These non-GAAP measures are used by management to evaluate the performance of individual businesses. In addition, other items giving rise to period over period variances, such as weather, are presented on an after tax and per share basis. These amounts are calculated at a statutory tax rate divided by Vectren’s basic average shares outstanding during the period. Accordingly, management believes these measures are useful to investors in understanding each business’ contribution to consolidated earnings per share and in analyzing consolidated period to period changes and the potential for earnings per share contributions in future periods. Reconciliations of the non-GAAP measures to their most closely related GAAP measure of consolidated earnings per share are included throughout the presentation presented. The non-GAAP financial measures disclosed by the Company should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP. Appendix