Vectren Corporation AGA Financial Forum May 14-17, 2016

Carl Chapman Chairman, President and CEO Management Representatives Susan Hardwick Senior Vice President and CFO Naveed Mughal Treasurer and Vice President, Investor Relations 2 Aaron Musgrave Manager, Investor Relations

All statements other than statements of historical fact are forward-looking statements made in good faith by the company and are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. Such statements are based on management’s beliefs, as well as assumptions made by and information currently available to management and include such words as “believe”, “anticipate”, ”endeavor”, “estimate”, “expect”, “objective”, “projection”, “forecast”, “goal”, “likely”, and similar expressions intended to identify forward-looking statements. Vectren cautions readers that the assumptions forming the basis for forward-looking statements include many factors that are beyond Vectren’s ability to control or estimate precisely and actual results could differ materially from those contained in this document. Forward-looking statements speak only as of the date on which our statement is made, and we assume no duty to update them. More detailed information about these factors is set forth in Vectren’s filings with the Securities and Exchange Commission, including Vectren’s 2015 annual report on Form 10-K filed on February 23, 2016. Vectren also uses non-GAAP measures to describe its financial results. More information can be found in the Appendix related to the use of such measures. Naveed Mughal, Treasurer and VP, Investor Relations nmughal@vectren.com 812-491-4916 Forward-Looking Statements and Non-GAAP Measures 3

4 Vectren Overview Including Q1 2016 Results and 2016 Earnings Guidance

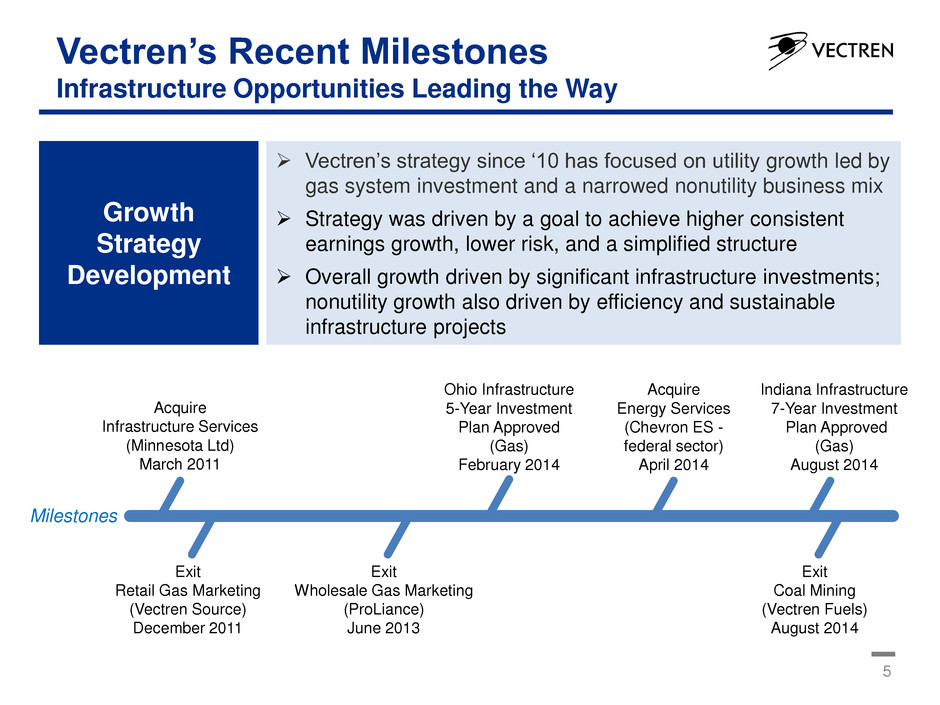

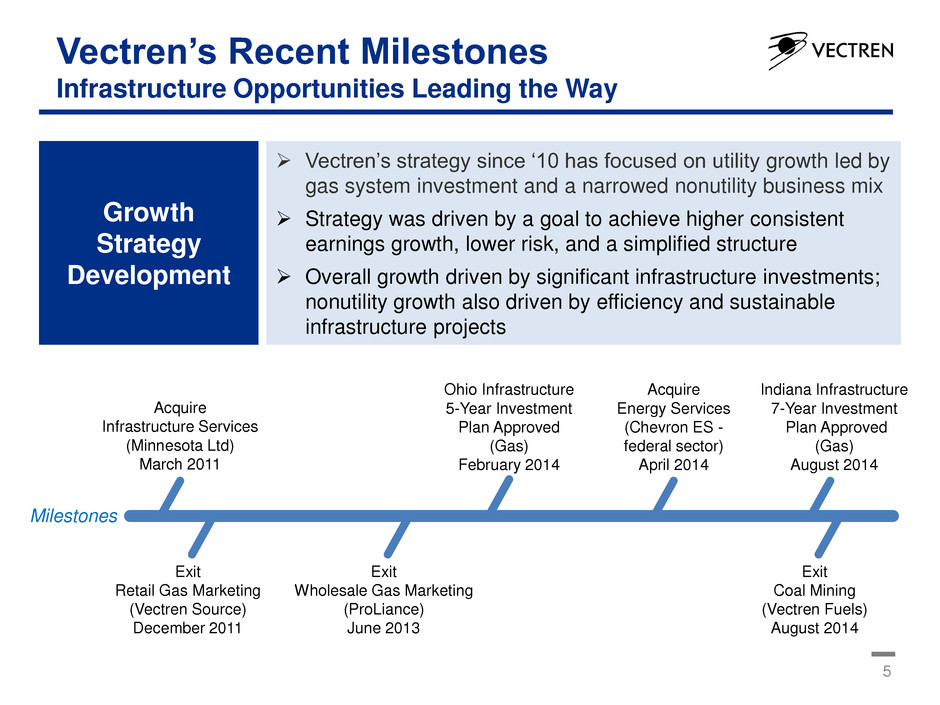

Vectren’s Recent Milestones Infrastructure Opportunities Leading the Way 5 Acquire Infrastructure Services (Minnesota Ltd) March 2011 Milestones Acquire Energy Services (Chevron ES - federal sector) April 2014 Exit Retail Gas Marketing (Vectren Source) December 2011 Exit Wholesale Gas Marketing (ProLiance) June 2013 Exit Coal Mining (Vectren Fuels) August 2014 Indiana Infrastructure 7-Year Investment Plan Approved (Gas) August 2014 Ohio Infrastructure 5-Year Investment Plan Approved (Gas) February 2014 Growth Strategy Development Vectren’s strategy since ‘10 has focused on utility growth led by gas system investment and a narrowed nonutility business mix Strategy was driven by a goal to achieve higher consistent earnings growth, lower risk, and a simplified structure Overall growth driven by significant infrastructure investments; nonutility growth also driven by efficiency and sustainable infrastructure projects

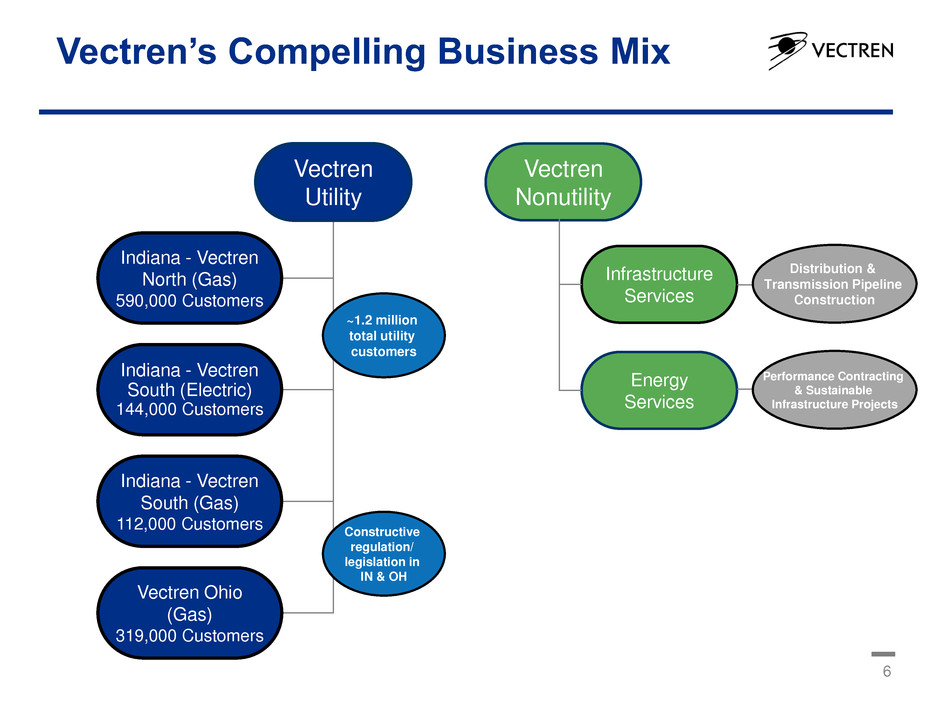

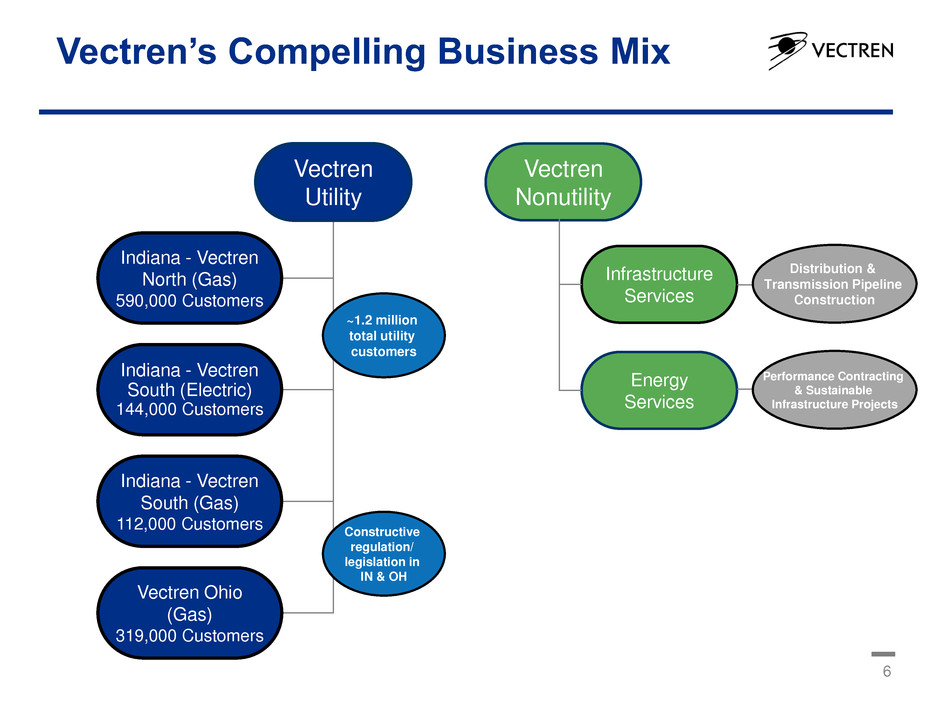

Vectren’s Compelling Business Mix 6 Vectren Nonutility Infrastructure Services Energy Services Vectren Utility Indiana - Vectren North (Gas) 590,000 Customers Indiana - Vectren South (Electric) 144,000 Customers Indiana - Vectren South (Gas) 112,000 Customers Vectren Ohio (Gas) 319,000 Customers ~1.2 million total utility customers Constructive regulation/ legislation in IN & OH Distribution & Transmission Pipeline Construction Performance Contracting & Sustainable Infrastructure Projects

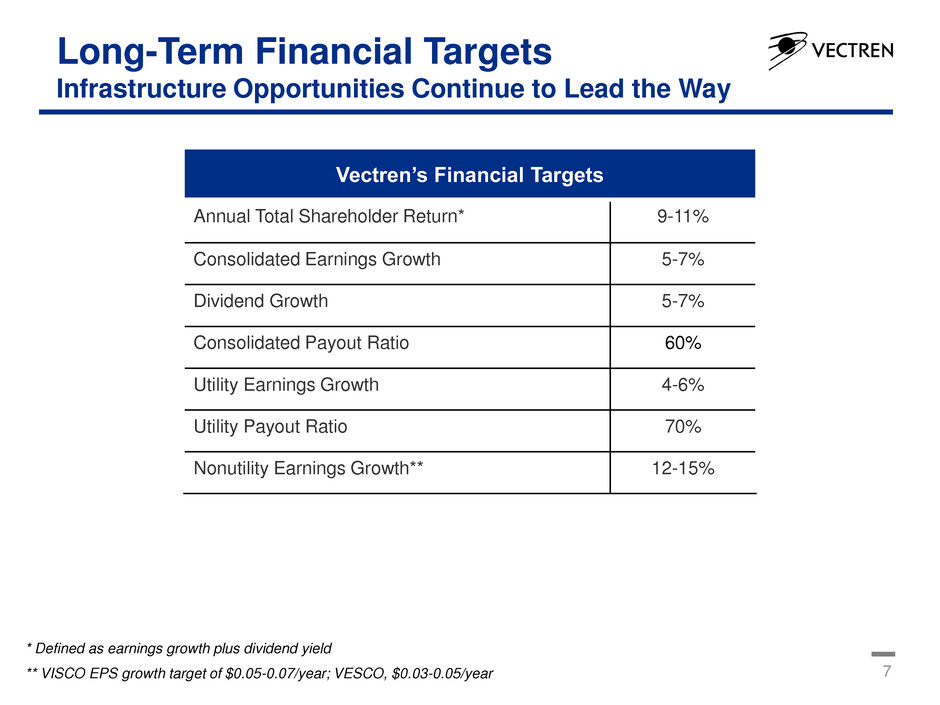

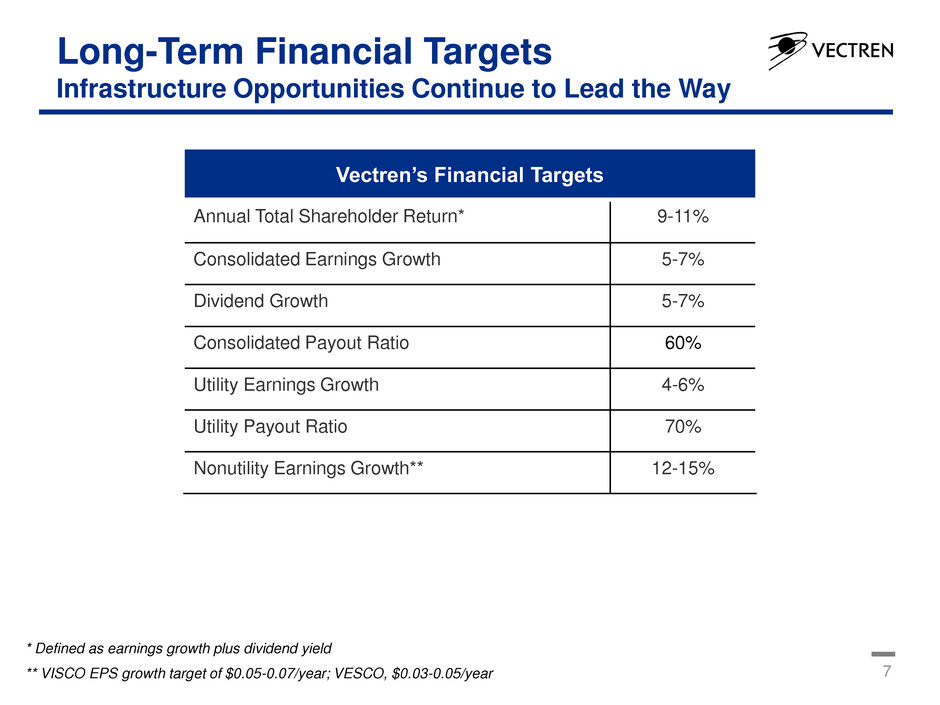

Vectren’s Financial Targets Annual Total Shareholder Return* 9-11% Consolidated Earnings Growth 5-7% Dividend Growth 5-7% Consolidated Payout Ratio 60% Utility Earnings Growth 4-6% Utility Payout Ratio 70% Nonutility Earnings Growth** 12-15% 7 Long-Term Financial Targets Infrastructure Opportunities Continue to Lead the Way * Defined as earnings growth plus dividend yield ** VISCO EPS growth target of $0.05-0.07/year; VESCO, $0.03-0.05/year

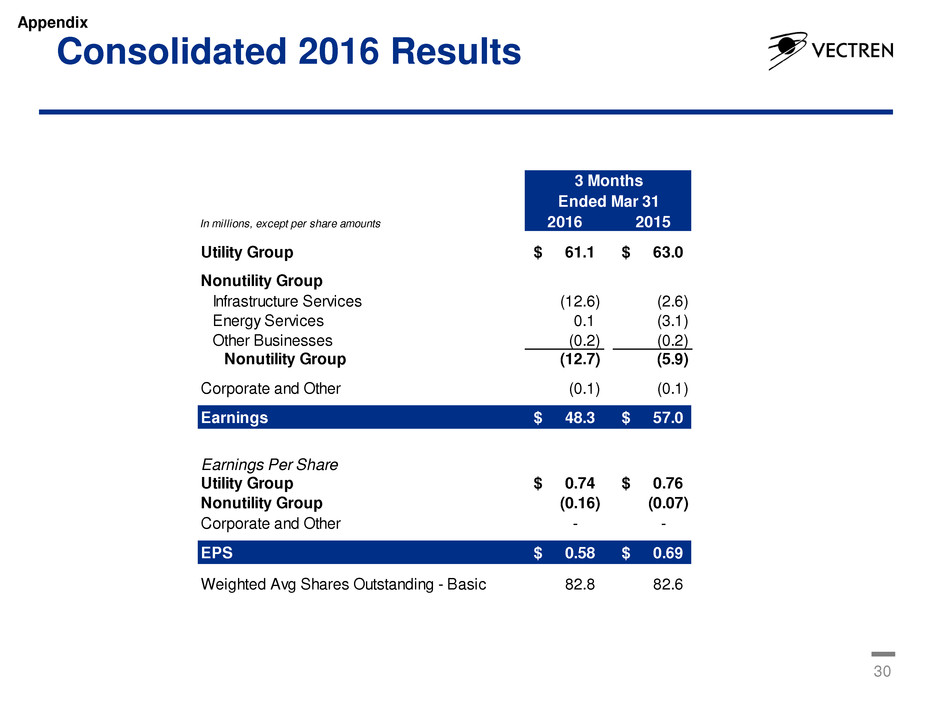

8 2016 Q1 Results and Highlights Utility Results on Track Despite Warm Winter Weather Utility Q1 ‘16 results slightly higher than Q1 ’15, excl. unfavorable weather variance of (~$0.03-$0.04)/sh. Growing returns on gas infrastructure programs On track to earn overall allowed return again in 2016 Nonutility Strong / early customer demand for VISCO Distribution work As expected, VISCO Transmission results remained pressured under tough market conditions Record Q1 VESCO revenue along with higher margins Consolidated Q1 ‘16 EPS of $0.58 vs Q1 ‘15 EPS of $0.69 Solid Utility results led by gas infrastructure investments Improved VISCO Distribution & VESCO results vs. Q1 ‘15

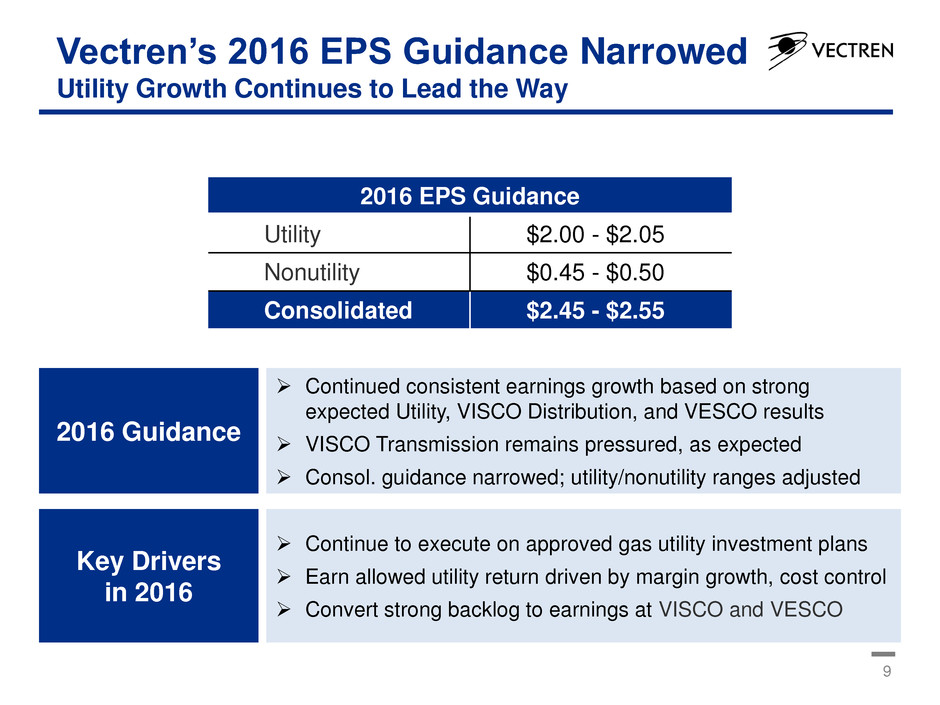

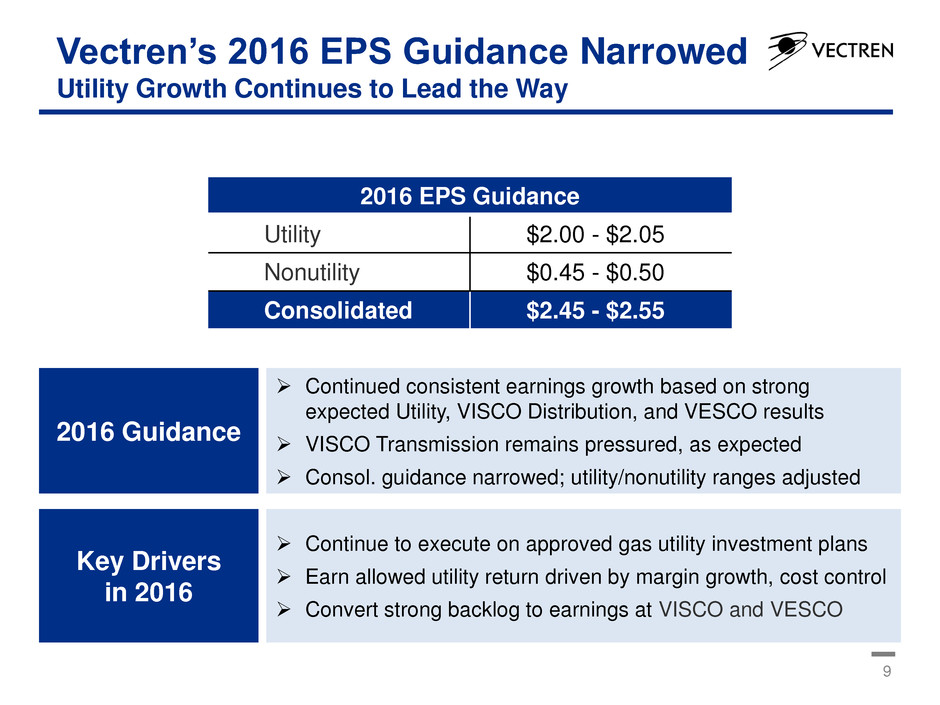

Vectren’s 2016 EPS Guidance Narrowed Utility Growth Continues to Lead the Way 9 2016 EPS Guidance Utility $2.00 - $2.05 Nonutility $0.45 - $0.50 Consolidated $2.45 - $2.55 Key Drivers in 2016 Continue to execute on approved gas utility investment plans Earn allowed utility return driven by margin growth, cost control Convert strong backlog to earnings at VISCO and VESCO 2016 Guidance Continued consistent earnings growth based on strong expected Utility, VISCO Distribution, and VESCO results VISCO Transmission remains pressured, as expected Consol. guidance narrowed; utility/nonutility ranges adjusted

10 Consistent Earnings Growth Continues As Does Higher Dividend Growth * Excluding ProLiance in 2013 - year of disposition ** Excluding Coal Mining in 2014 - year of disposition *** 2016E dividend represents annualized Dec. 1, 2015 dividend $1.65 $1.73 $1.94 $2.12 $2.28 $2.39 $2.45-$2.55 $1.37 $1.39 $1.41 $1.43 $1.46 $1.54 $1.60 83% 80% 72% 67% 64% 64% 63-65% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% $1.00 $1.25 $1.50 $1.75 $2.00 $2.25 $2.50 $2.75 $3.00 $3.25 $3.50 2010 2011 2012 2013 * 2014 ** 2015 2016E *** P a y ou t Rati o P e r S ha re EPS Dividend Payout Five Years of Consistent Earnings Growth; Expected to Continue

11 Utility Outlook Significant gas infrastructure investments to drive growth

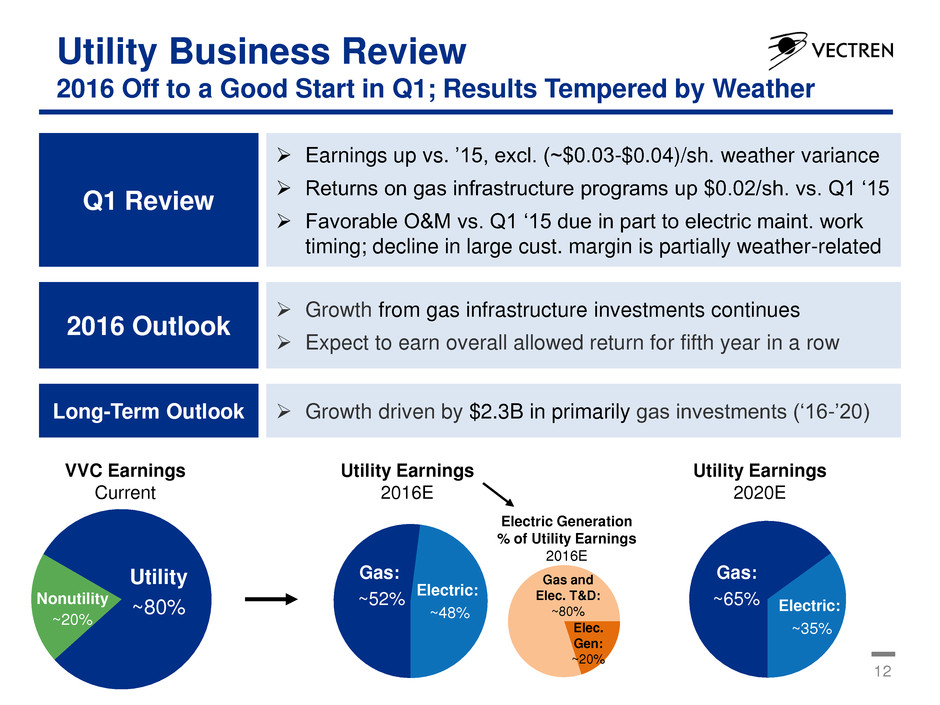

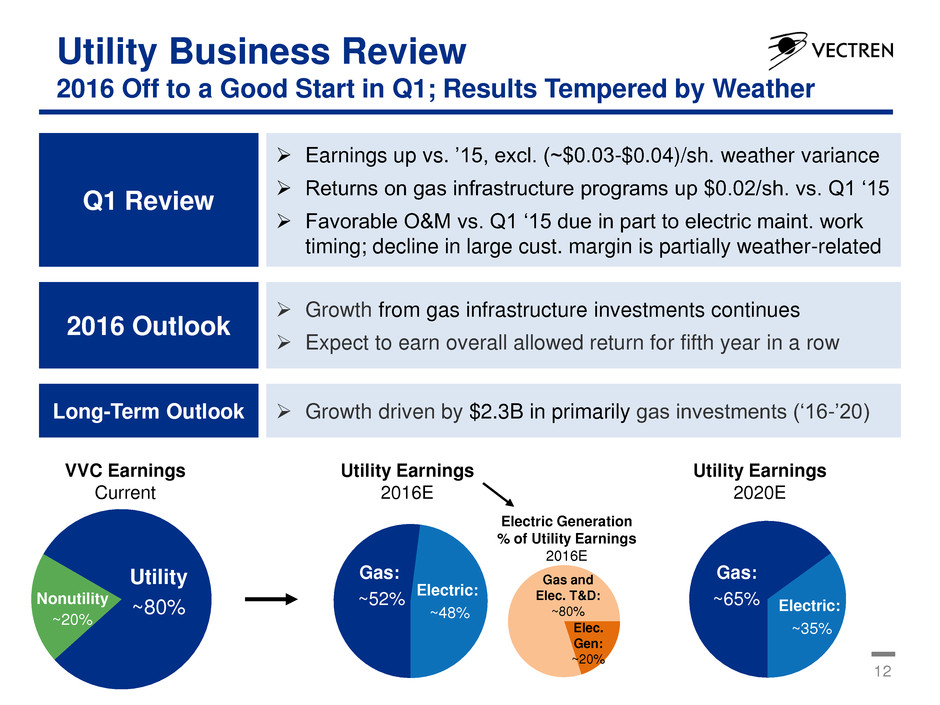

Utility Business Review 2016 Off to a Good Start in Q1; Results Tempered by Weather Q1 Review 2016 Outlook Growth from gas infrastructure investments continues Expect to earn overall allowed return for fifth year in a row Earnings up vs. ’15, excl. (~$0.03-$0.04)/sh. weather variance Returns on gas infrastructure programs up $0.02/sh. vs. Q1 ‘15 Favorable O&M vs. Q1 ‘15 due in part to electric maint. work timing; decline in large cust. margin is partially weather-related Long-Term Outlook Growth driven by $2.3B in primarily gas investments (‘16-’20) Utility ~80% Nonutility ~20% Electric: ~48% Gas: ~52% VVC Earnings Current Utility Earnings 2016E Electric: ~35% Gas: ~65% Utility Earnings 2020E 12 Elec. Gen: ~20% Gas and Elec. T&D: ~80% Electric Generation % of Utility Earnings 2016E

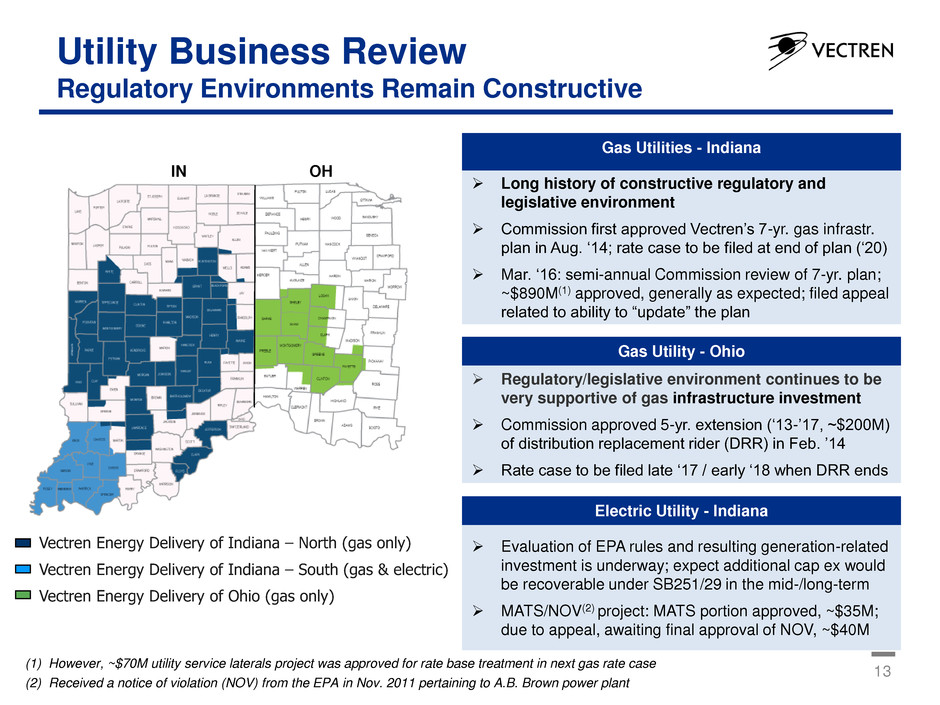

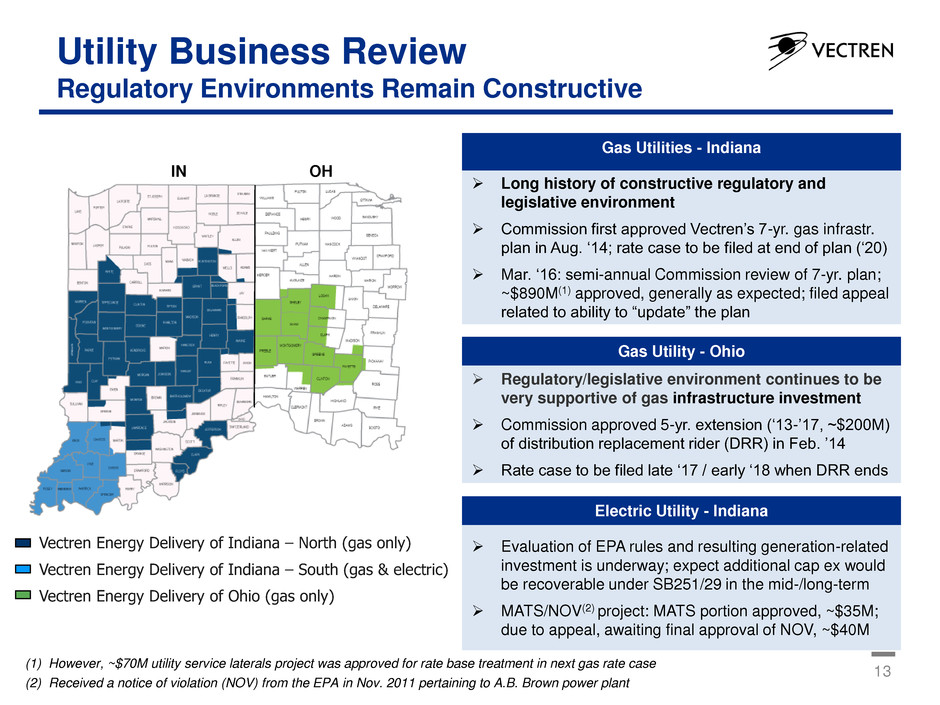

13 Utility Business Review Regulatory Environments Remain Constructive Long history of constructive regulatory and legislative environment Commission first approved Vectren’s 7-yr. gas infrastr. plan in Aug. ‘14; rate case to be filed at end of plan (‘20) Mar. ‘16: semi-annual Commission review of 7-yr. plan; ~$890M(1) approved, generally as expected; filed appeal related to ability to “update” the plan Gas Utilities - Indiana Evaluation of EPA rules and resulting generation-related investment is underway; expect additional cap ex would be recoverable under SB251/29 in the mid-/long-term MATS/NOV(2) project: MATS portion approved, ~$35M; due to appeal, awaiting final approval of NOV, ~$40M Electric Utility - Indiana Regulatory/legislative environment continues to be very supportive of gas infrastructure investment Commission approved 5-yr. extension (‘13-’17, ~$200M) of distribution replacement rider (DRR) in Feb. ’14 Rate case to be filed late ‘17 / early ‘18 when DRR ends Gas Utility - Ohio Vectren Energy Delivery of Indiana – North (gas only) Vectren Energy Delivery of Indiana – South (gas & electric) Vectren Energy Delivery of Ohio (gas only) OH IN (1) However, ~$70M utility service laterals project was approved for rate base treatment in next gas rate case (2) Received a notice of violation (NOV) from the EPA in Nov. 2011 pertaining to A.B. Brown power plant

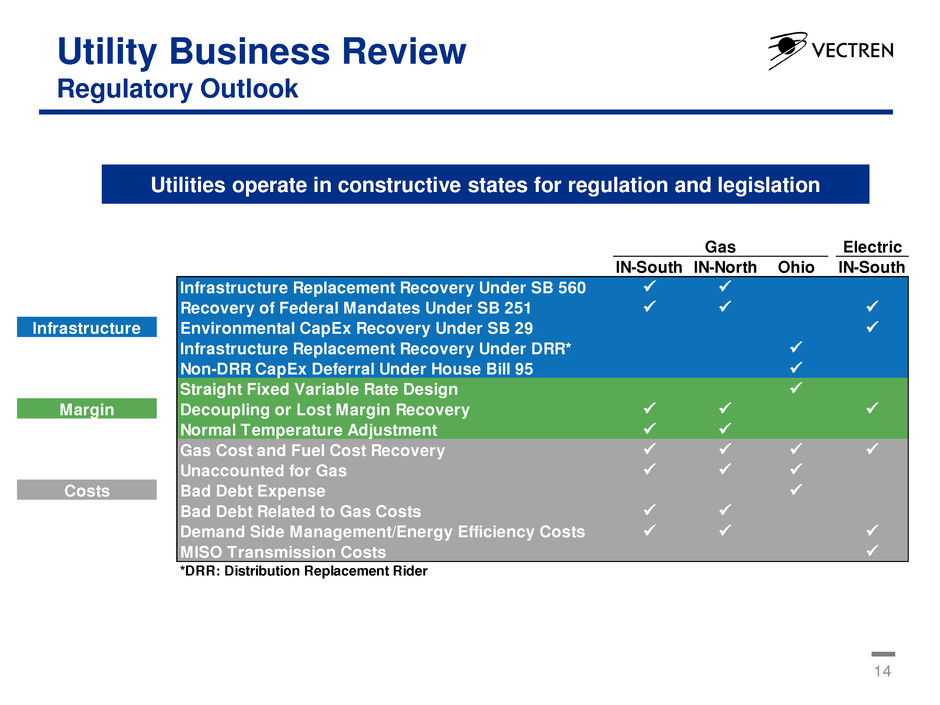

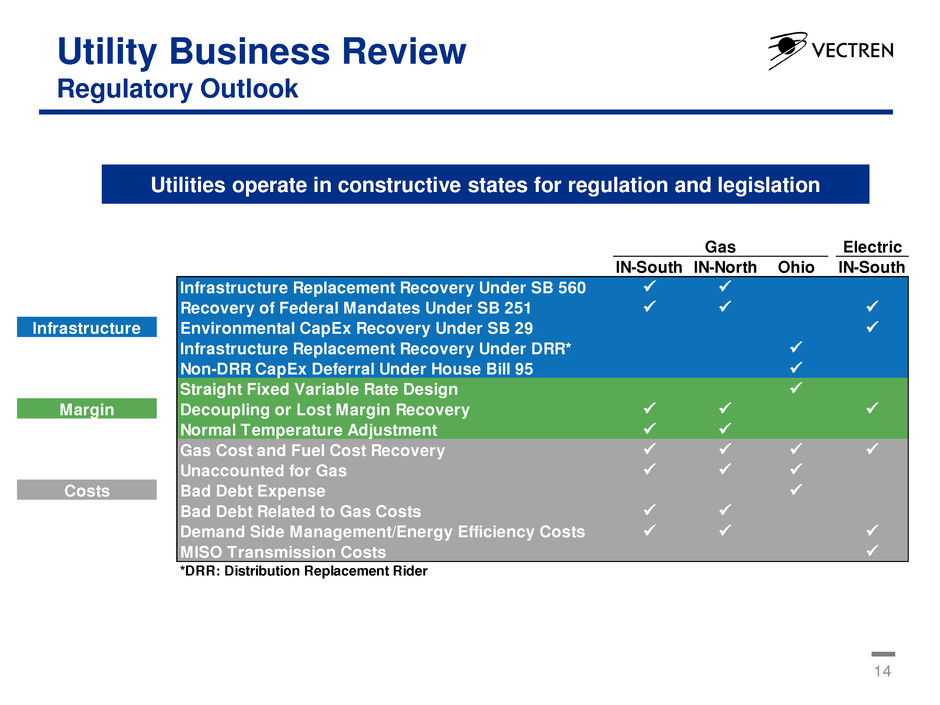

14 Utility Business Review Regulatory Outlook Utilities operate in constructive states for regulation and legislation Electric IN-South IN-North Ohio IN-South Infrastructure Replacement Recovery Under SB 560 Recovery of Federal Mandates Under SB 251 Infrastructure Environmental CapEx Recovery Under SB 29 Infrastructure Replacement Recovery Under DRR* Non-DRR CapEx Deferral Under House Bill 95 Straight Fixed Variable Rate Design Margin Decoupling or Lost Margin Recovery Normal Temperature Adjustment Gas Cost and Fuel Cost Recovery Unaccounted for Gas Costs Bad Debt Expense Bad Debt Related to Gas Costs Demand Side Management/Energy Efficiency Costs MISO Transmission Costs *DRR: Distribution Replacement Rider Gas

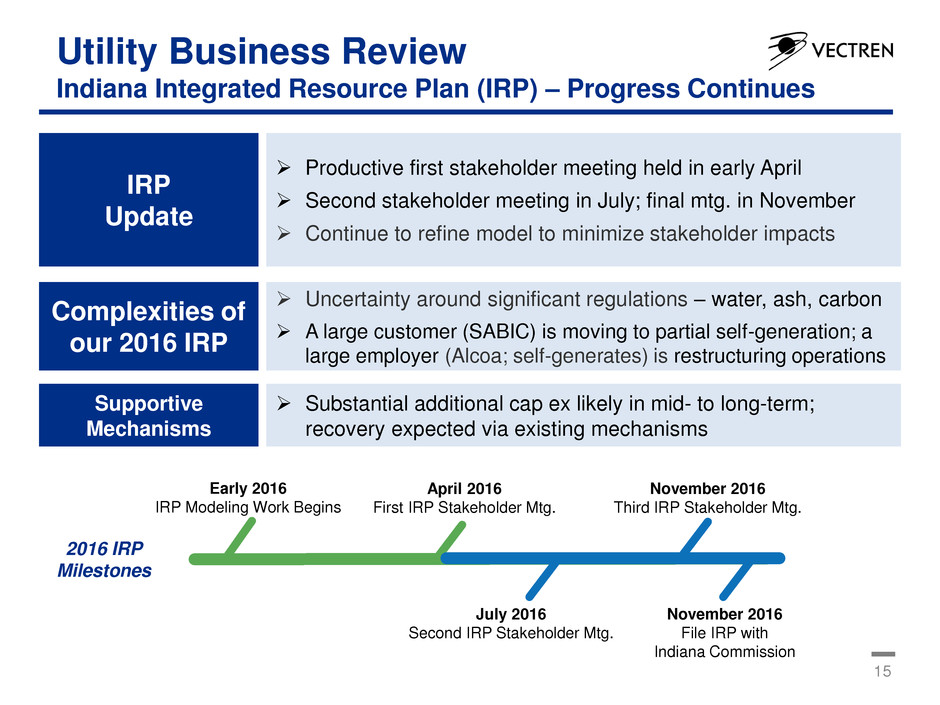

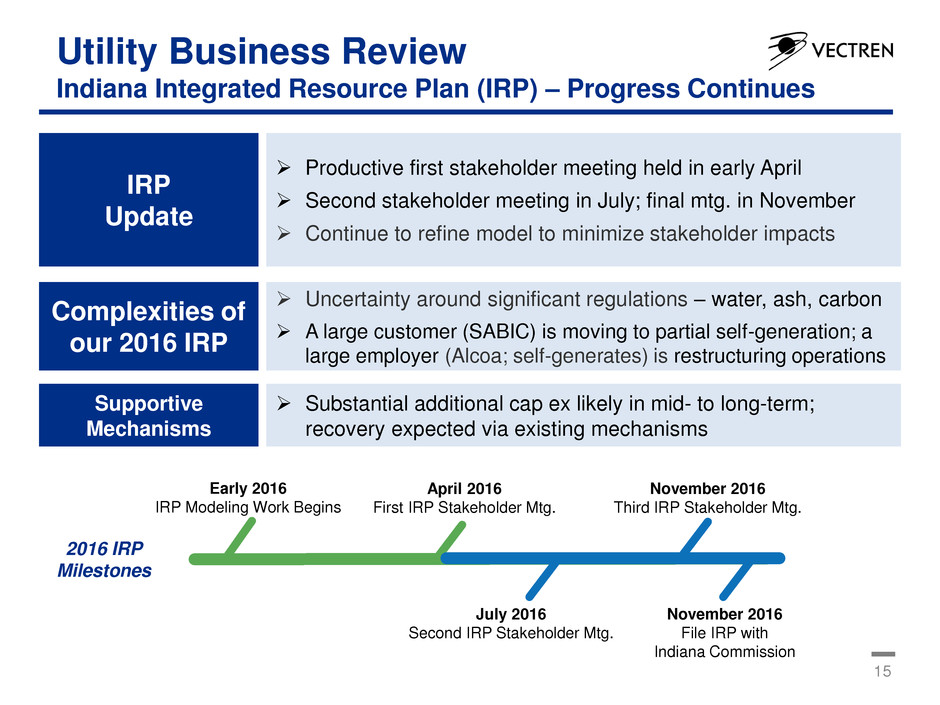

15 Utility Business Review Indiana Integrated Resource Plan (IRP) – Progress Continues 2016 IRP Milestones April 2016 First IRP Stakeholder Mtg. July 2016 Second IRP Stakeholder Mtg. November 2016 File IRP with Indiana Commission November 2016 Third IRP Stakeholder Mtg. Early 2016 IRP Modeling Work Begins IRP Update Productive first stakeholder meeting held in early April Second stakeholder meeting in July; final mtg. in November Continue to refine model to minimize stakeholder impacts Complexities of our 2016 IRP Uncertainty around significant regulations – water, ash, carbon A large customer (SABIC) is moving to partial self-generation; a large employer (Alcoa; self-generates) is restructuring operations Supportive Mechanisms Substantial additional cap ex likely in mid- to long-term; recovery expected via existing mechanisms

16 Utility Business Review Current Thoughts on Bonus Depreciation Extension Dec. 2015: bonus depreciation extended for 5 years (’15-’19) Bonus depreciation rule is 50% for property placed in service in 2015-2017, 40% in 2018, and 30% in 2019 Background Ongoing analysis includes: impact on customer rates; accelerated or incremental investment opportunities; balance sheet strength We currently expect to use incremental cash (~$225M thru ‘19) from accelerated deduction to delay planned financing associated with current cap ex plans and to invest in capital needs in Ohio ($30M in both ‘16 and ‘17); modestly EPS positive impact Current Viewpoint Continue to analyze potential impact, including cap ex needs related to our significant gas infrastructure investments and potential increased electric cap ex driven by regulations Higher gas and/or electric cap ex could drive reconsideration of use of cash available from bonus depreciation election Next Steps

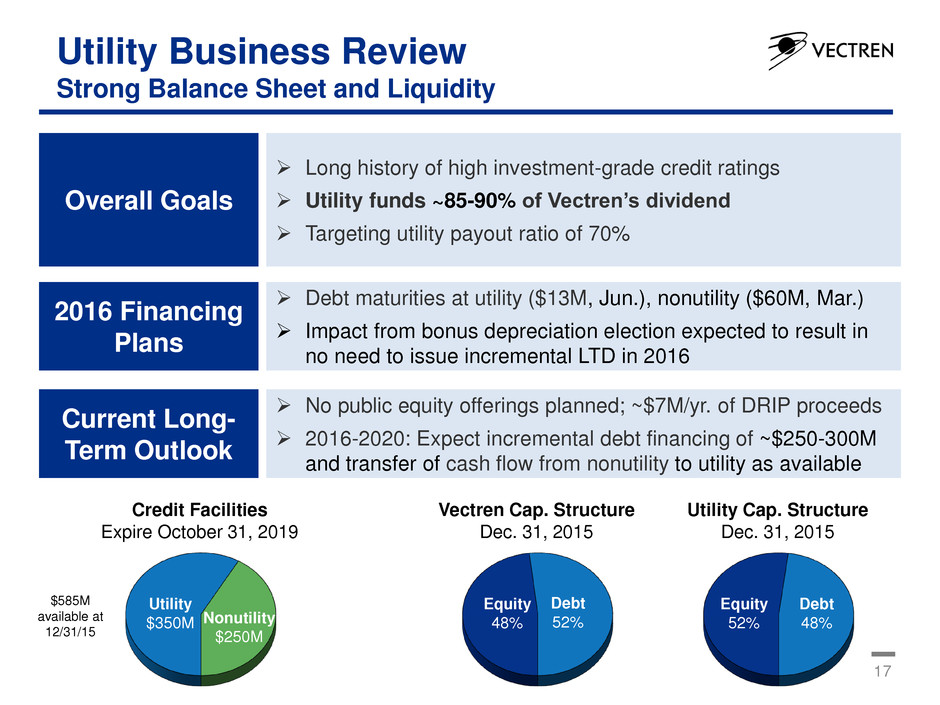

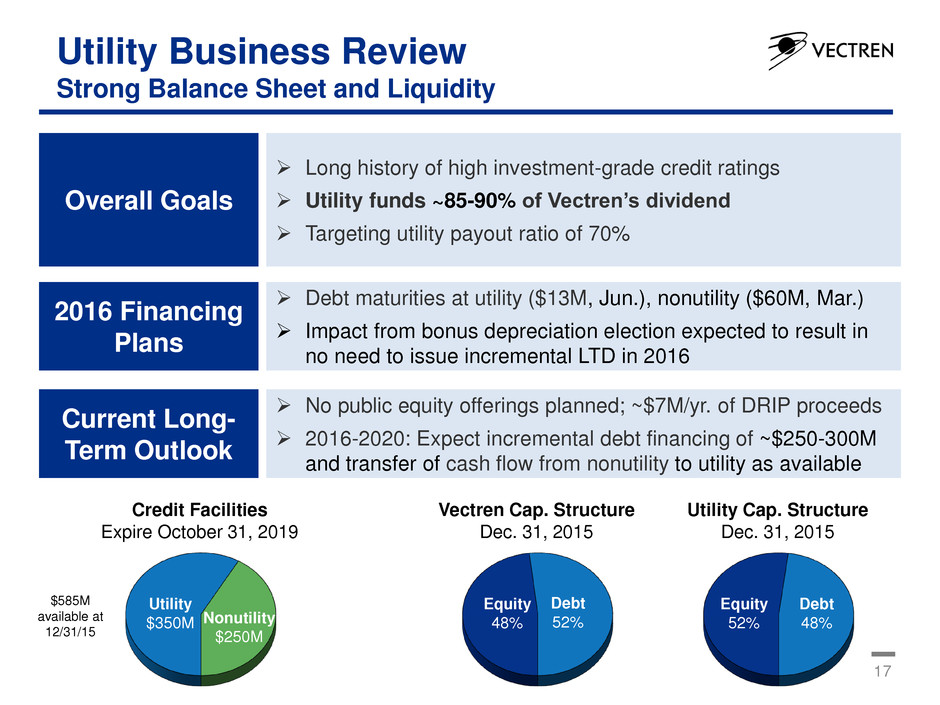

17 Utility Business Review Strong Balance Sheet and Liquidity Overall Goals Long history of high investment-grade credit ratings Utility funds ~85-90% of Vectren’s dividend Targeting utility payout ratio of 70% 2016 Financing Plans Debt maturities at utility ($13M, Jun.), nonutility ($60M, Mar.) Impact from bonus depreciation election expected to result in no need to issue incremental LTD in 2016 Current Long- Term Outlook No public equity offerings planned; ~$7M/yr. of DRIP proceeds 2016-2020: Expect incremental debt financing of ~$250-300M and transfer of cash flow from nonutility to utility as available Vectren Cap. Structure Dec. 31, 2015 Equity 48% Debt 52% Utility Cap. Structure Dec. 31, 2015 Equity 52% Debt 48% Credit Facilities Expire October 31, 2019 Utility $350M Nonutility $250M $585M available at 12/31/15

18 Utility Business Review Cap Ex Utility growth driven by expected investments in gas system infrastructure $ in millions 5-Yr Total Utility Cap Ex 2015A 2016E 2017E 2018E 2019E 2020E 2016E-2020E Indiana 194$ 255$ 225$ 170$ 165$ 170$ 985$ Ohio 106 120 140 105 110 105 580 Gas Utilities 300$ 375$ 365$ 275$ 275$ 275$ 1,565$ Electric Utility 86 95 95 115 100 90 495 Utility Shared Assets & Other 25 40 30 40 70 50 230 Utility Consolidated 411$ 510$ 490$ 430$ 445$ 415$ 2,290$ Ga Utility Cap Ex with Recovery/Deferral Mechanisms (included in table above) Indiana, Gas Utilities - SB251 85$ 90$ 80$ 80$ 80$ 415$ Indiana, Gas Utilities - SB560 80 35 35 35 30 215 Ohio - Distribution Replacement Rider (DRR) 55 50 60 60 55 280 Ohio - HB95 65 90 45 50 50 300 Subtotal - Gas 285$ 265$ 220$ 225$ 215$ 1,210$ Forecast Rate base growth thru 2020 primarily due to approved/recoverable gas investments • Five-year total for gas cap ex is up to ~$1.6 billion from ~$1.5 billion • Tables above include updates related to Mar. ‘16 approval of 7-yr. gas infrastructure investment plan in IN and ~$60M of gas investments needed in OH that will be funded by bonus depreciation cash ($30M each in ‘16 and ‘17) • Five-year electric utility cap ex includes some infrastructure improvement projects for which we are evaluating appropriate recovery options; further analysis and consideration is ongoing • Five-year shared assets cap ex reflects evaluation of needs for upgraded information systems to support operations Depreciation & amortization expense of ~$215-265 million per year expected through 2020 • Gas utilities: ~$105-140 million/yr.; Electric: ~$85-95 million/yr.; Utility shared: ~$25-30 million/yr.

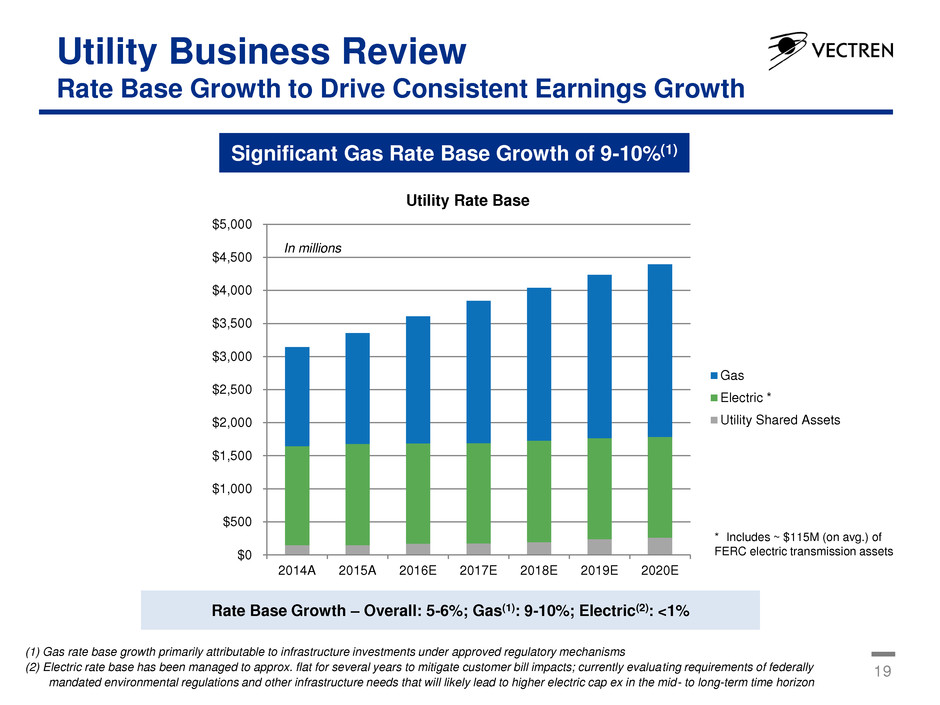

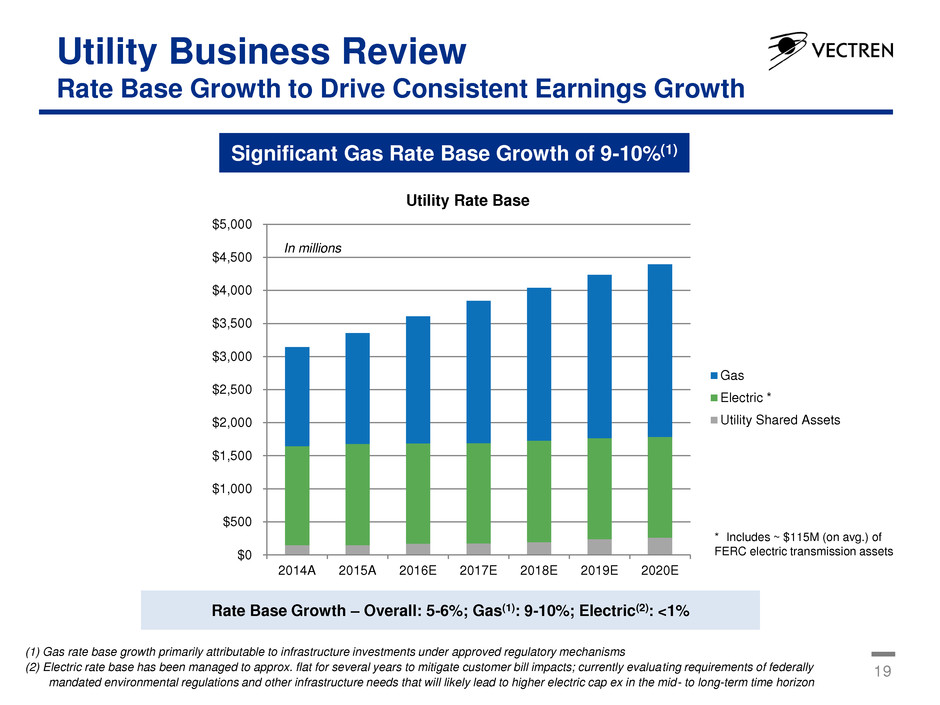

19 Utility Business Review Rate Base Growth to Drive Consistent Earnings Growth Significant Gas Rate Base Growth of 9-10%(1) (1) Gas rate base growth primarily attributable to infrastructure investments under approved regulatory mechanisms (2) Electric rate base has been managed to approx. flat for several years to mitigate customer bill impacts; currently evaluating requirements of federally mandated environmental regulations and other infrastructure needs that will likely lead to higher electric cap ex in the mid- to long-term time horizon $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 $5,000 2014A 2015A 2016E 2017E 2018E 2019E 2020E Utility Rate Base Gas Electric * Utility Shared Assets In millions * Includes ~ $115M (on avg.) of FERC electric transmission assets Rate Base Growth – Overall: 5-6%; Gas(1): 9-10%; Electric(2): <1%

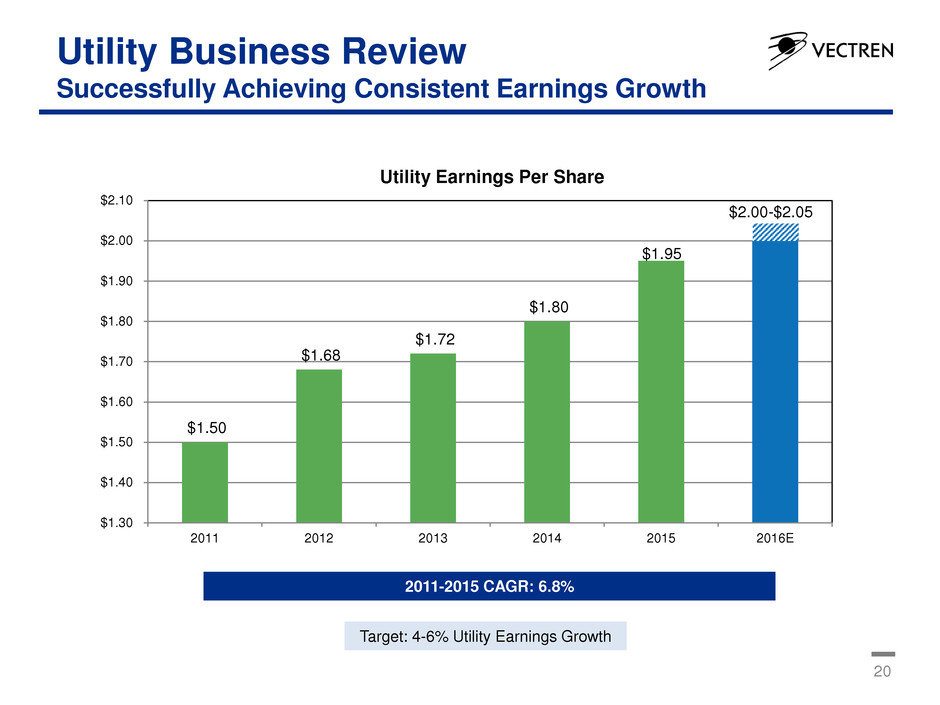

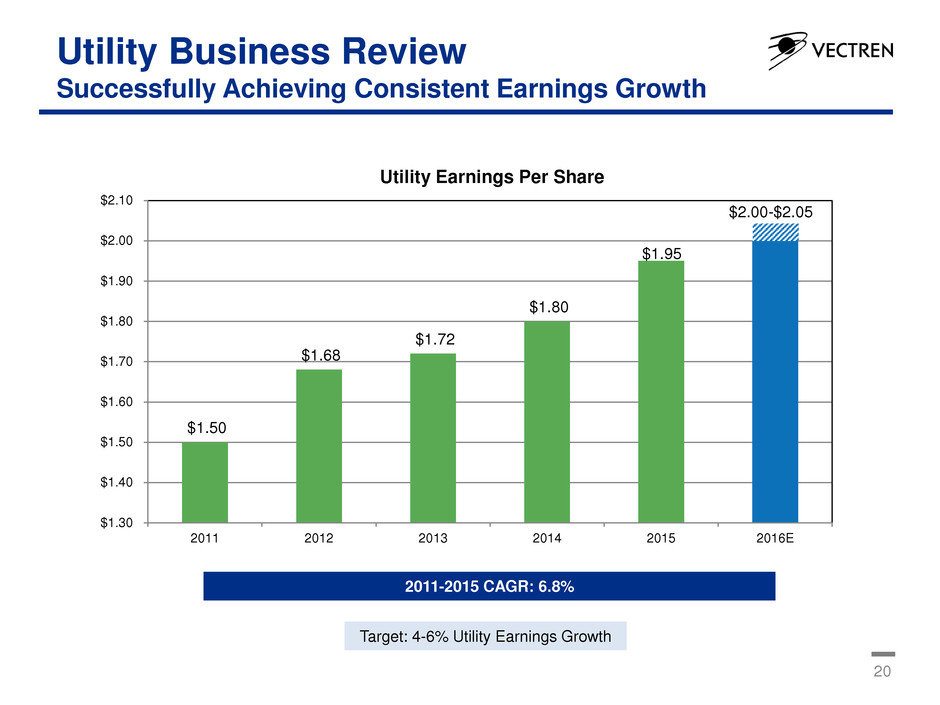

20 Utility Business Review Successfully Achieving Consistent Earnings Growth $1.50 $1.68 $1.72 $1.80 $1.95 $2.00-$2.05 $1.30 $1.40 $1.50 $1.60 $1.70 $1.80 $1.90 $2.00 $2.10 2011 2012 2013 2014 2015 2016E Utility Earnings Per Share 2011-2015 CAGR: 6.8% Target: 4-6% Utility Earnings Growth

21 Nonutility Outlook U.S. gas utilities’ investments drive VISCO’s long-term growth VESCO continues to build on the return to profitability in 2015

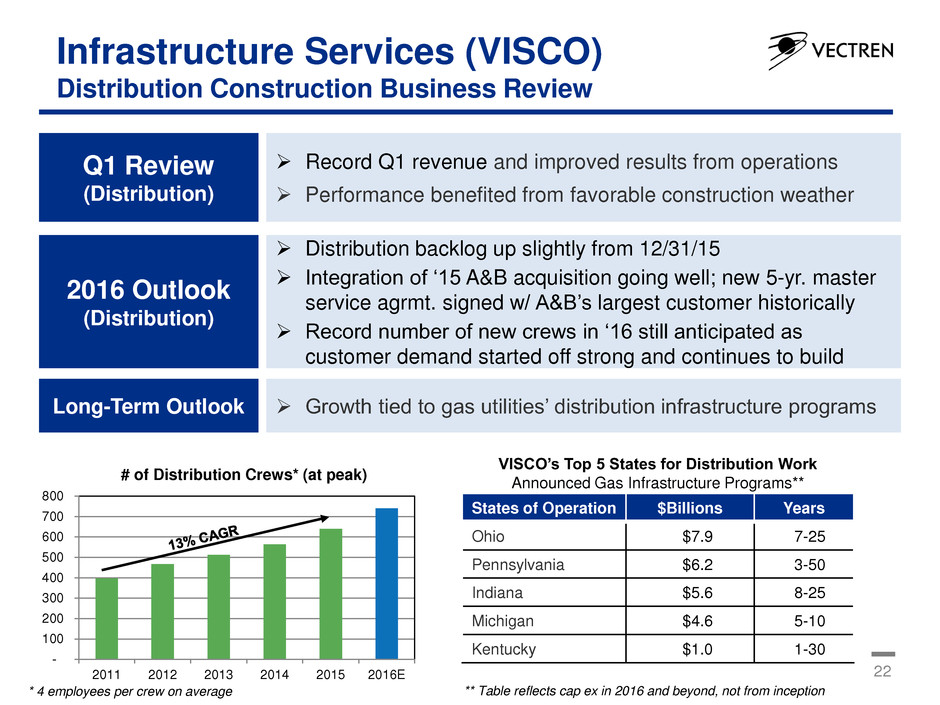

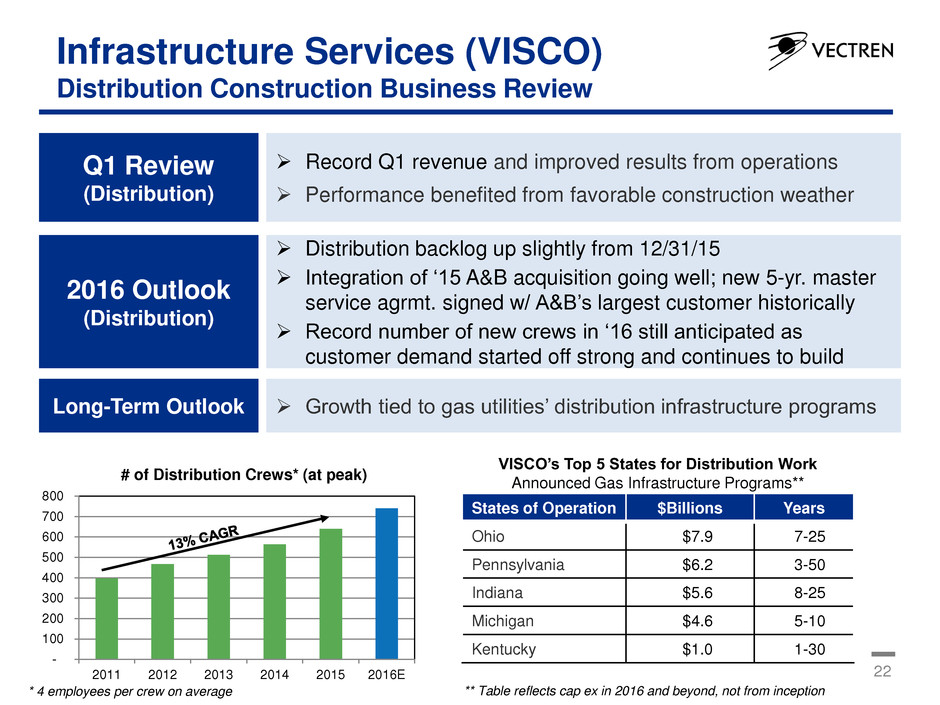

- 100 200 300 400 500 600 700 800 2011 2012 2013 2014 2015 2016E # of Distribution Crews* (at peak) 22 Infrastructure Services (VISCO) Distribution Construction Business Review Q1 Review (Distribution) 2016 Outlook (Distribution) Distribution backlog up slightly from 12/31/15 Integration of ‘15 A&B acquisition going well; new 5-yr. master service agrmt. signed w/ A&B’s largest customer historically Record number of new crews in ‘16 still anticipated as customer demand started off strong and continues to build Record Q1 revenue and improved results from operations Performance benefited from favorable construction weather Long-Term Outlook Growth tied to gas utilities’ distribution infrastructure programs * 4 employees per crew on average States of Operation $Billions Years Ohio $7.9 7-25 Pennsylvania $6.2 3-50 Indiana $5.6 8-25 Michigan $4.6 5-10 Kentucky $1.0 1-30 VISCO’s Top 5 States for Distribution Work Announced Gas Infrastructure Programs** ** Table reflects cap ex in 2016 and beyond, not from inception

23 Infrastructure Services (VISCO) Transmission Construction Business Review Q1 Review (Transmission) 2016 Outlook (Transmission) Backlog remains high, though down modestly vs. 12/31/15 Significant pipeline project delays, more environmental scrutiny Bidding activity remains strong as new pipeline projects are still scheduled to get underway in late 2016 and beyond As expected, Q1 ‘16 loss much higher than prior year due to tough market conditions and significant station work in Q1 ‘15 Efforts continue to add projects for 2H ’16 and throughout ’17 Long-Term Outlook Growth tied to PHMSA-driven maintenance/integrity work Integrity dig project Station fabrication and pipeline construction

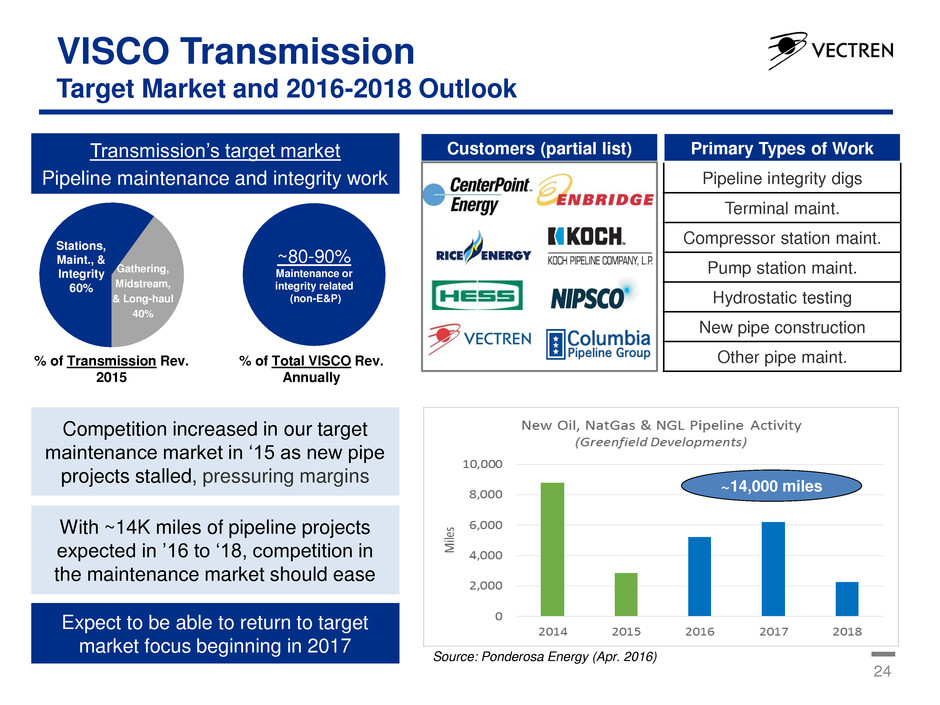

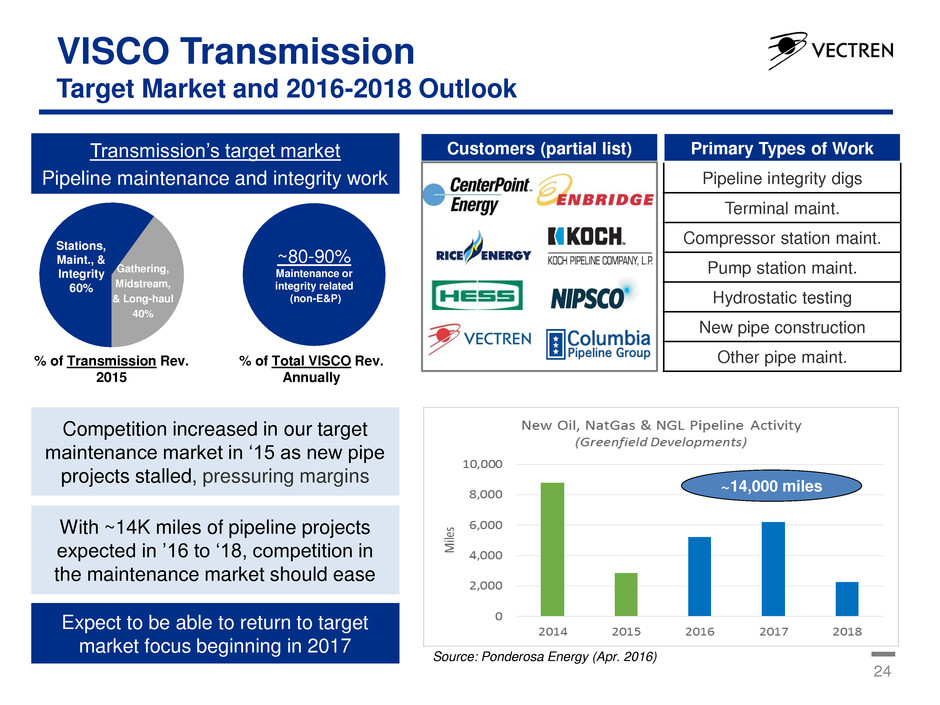

24 VISCO Transmission Target Market and 2016-2018 Outlook Source: Ponderosa Energy (Apr. 2016) Primary Types of Work Pipeline integrity digs Terminal maint. Compressor station maint. Pump station maint. Hydrostatic testing New pipe construction Other pipe maint. Transmission’s target market Pipeline maintenance and integrity work Competition increased in our target maintenance market in ‘15 as new pipe projects stalled, pressuring margins With ~14K miles of pipeline projects expected in ’16 to ‘18, competition in the maintenance market should ease Customers (partial list) % of Transmission Rev. 2015 Expect to be able to return to target market focus beginning in 2017 Stations, Maint., & Integrity 60% Gathering, Midstream, & Long-haul 40% % of Total VISCO Rev. Annually ~80-90% Maintenance or integrity related (non-E&P) ~14,000 miles

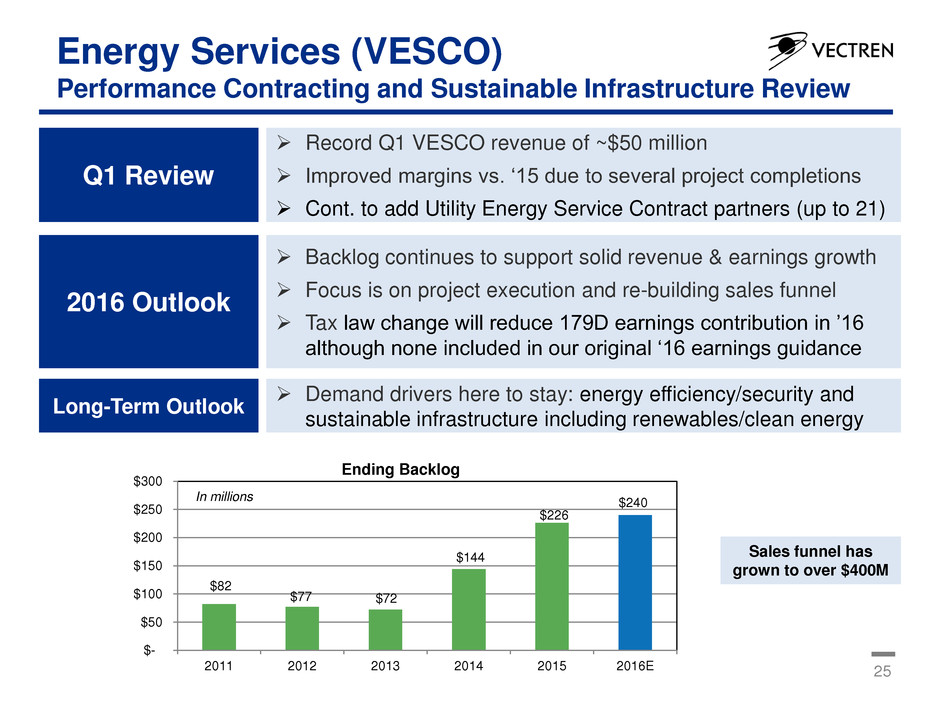

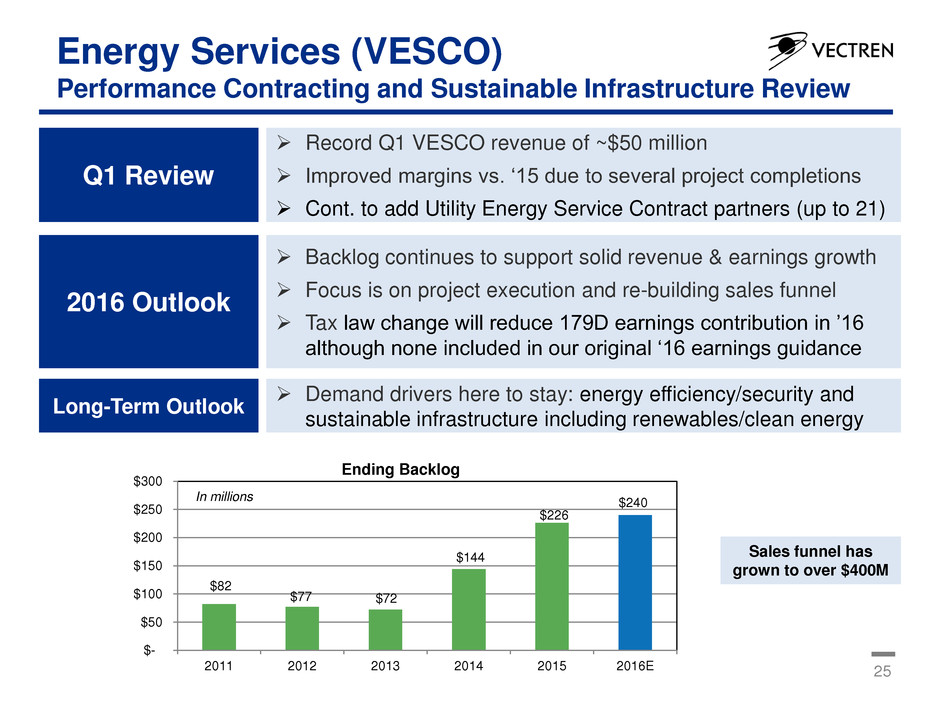

$82 $77 $72 $144 $226 $240 $- $50 $100 $150 $200 $250 $300 2011 2012 2013 2014 2015 2016E Ending Backlog In millions 25 Energy Services (VESCO) Performance Contracting and Sustainable Infrastructure Review Q1 Review 2016 Outlook Backlog continues to support solid revenue & earnings growth Focus is on project execution and re-building sales funnel Tax law change will reduce 179D earnings contribution in ’16 although none included in our original ‘16 earnings guidance Record Q1 VESCO revenue of ~$50 million Improved margins vs. ‘15 due to several project completions Cont. to add Utility Energy Service Contract partners (up to 21) Long-Term Outlook Demand drivers here to stay: energy efficiency/security and sustainable infrastructure including renewables/clean energy Sales funnel has grown to over $400M

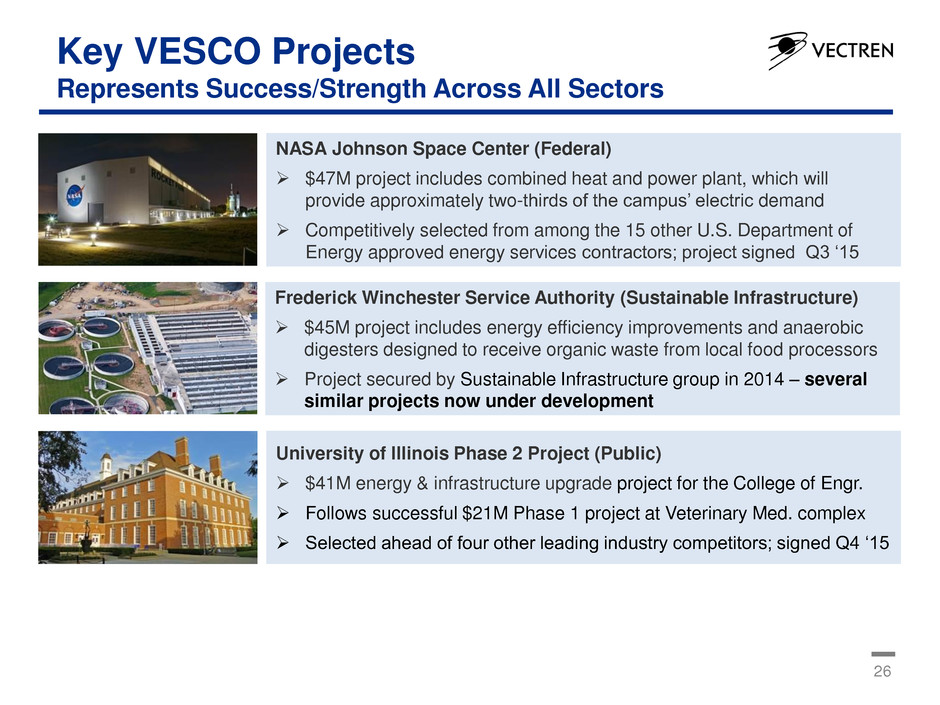

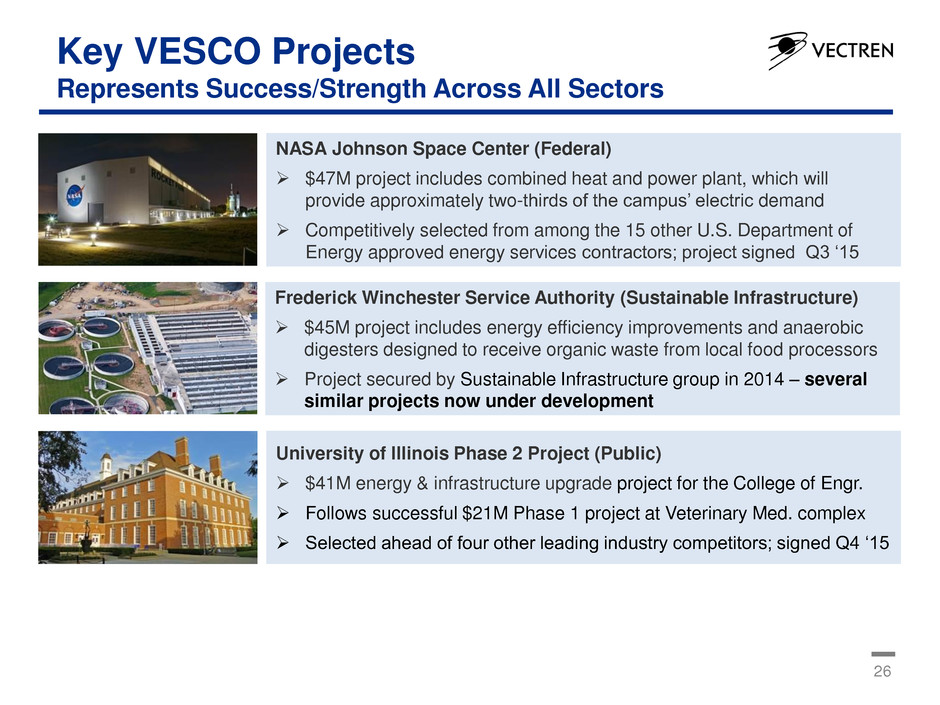

26 Key VESCO Projects Represents Success/Strength Across All Sectors NASA Johnson Space Center (Federal) $47M project includes combined heat and power plant, which will provide approximately two-thirds of the campus’ electric demand Competitively selected from among the 15 other U.S. Department of Energy approved energy services contractors; project signed Q3 ‘15 Frederick Winchester Service Authority (Sustainable Infrastructure) $45M project includes energy efficiency improvements and anaerobic digesters designed to receive organic waste from local food processors Project secured by Sustainable Infrastructure group in 2014 – several similar projects now under development University of Illinois Phase 2 Project (Public) $41M energy & infrastructure upgrade project for the College of Engr. Follows successful $21M Phase 1 project at Veterinary Med. complex Selected ahead of four other leading industry competitors; signed Q4 ‘15

Closing Remarks 27

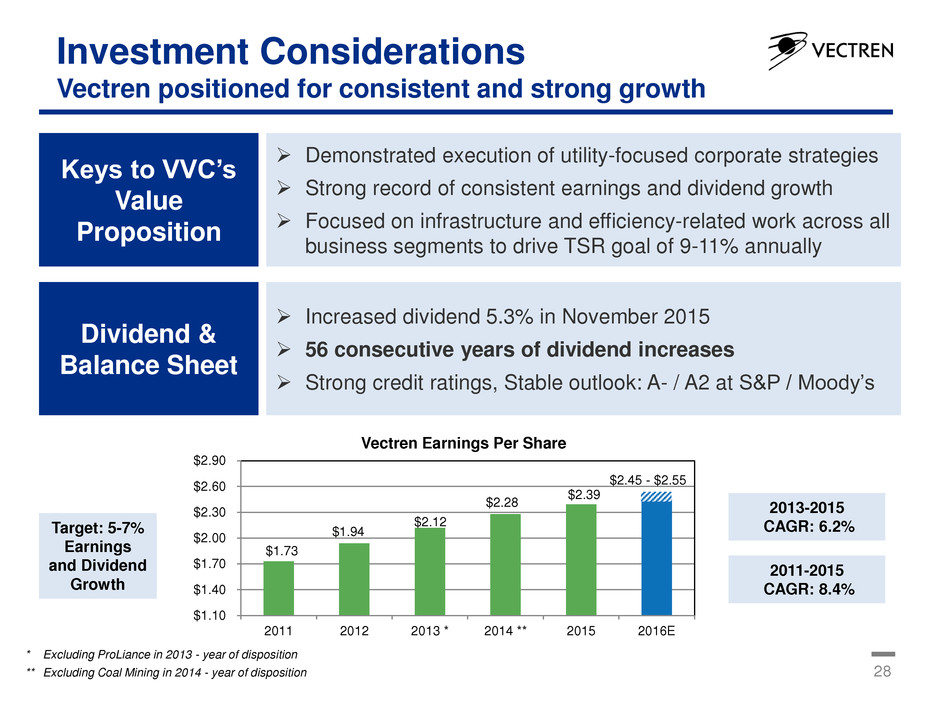

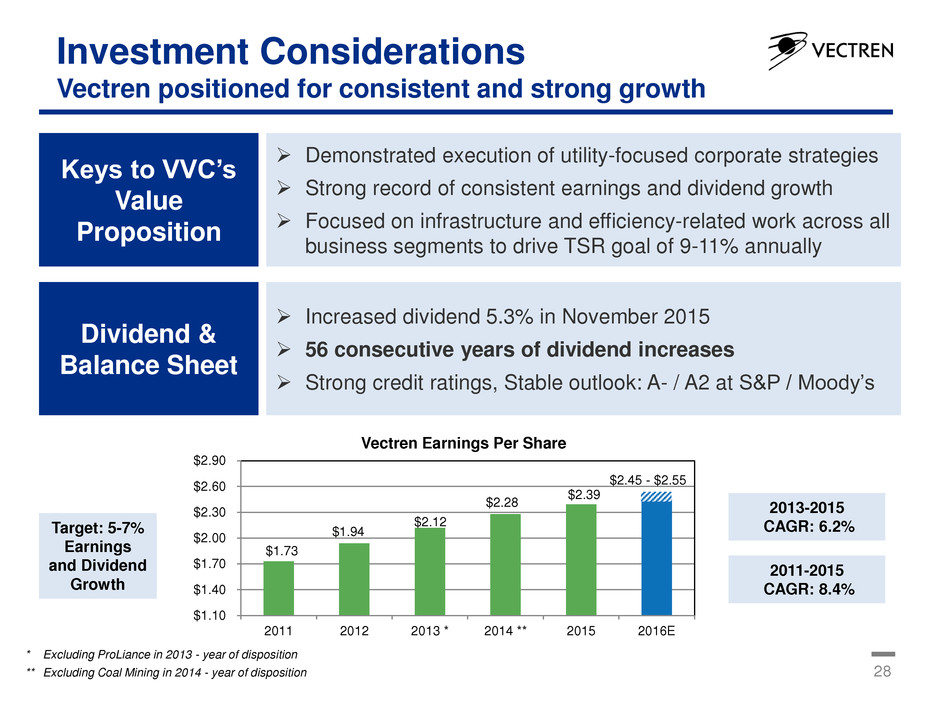

28 Investment Considerations Vectren positioned for consistent and strong growth $1.73 $1.94 $2.12 $2.28 $2.39 $2.45 - $2.55 $1.10 $1.40 $1.70 $2.00 $2.30 $2.60 $2.90 2011 2012 2013 * 2014 ** 2015 2016E Vectren Earnings Per Share * Excluding ProLiance in 2013 - year of disposition ** Excluding Coal Mining in 2014 - year of disposition Target: 5-7% Earnings and Dividend Growth 2011-2015 CAGR: 8.4% Keys to VVC’s Value Proposition Demonstrated execution of utility-focused corporate strategies Strong record of consistent earnings and dividend growth Focused on infrastructure and efficiency-related work across all business segments to drive TSR goal of 9-11% annually 2013-2015 CAGR: 6.2% Dividend & Balance Sheet Increased dividend 5.3% in November 2015 56 consecutive years of dividend increases Strong credit ratings, Stable outlook: A- / A2 at S&P / Moody’s

Appendix

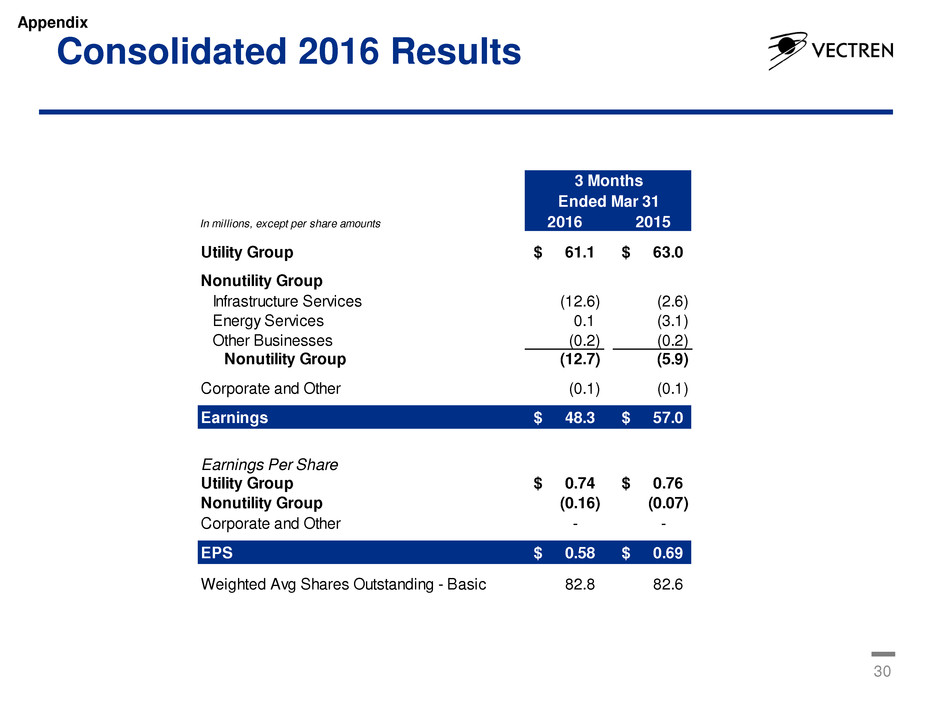

Consolidated 2016 Results In millions, except per share amounts 2016 2015 Utility Group 61.1$ 63.0$ Nonutility Group Infrastructure Services (12.6) (2.6) Energy Services 0.1 (3.1) Other Businesses (0.2) (0.2) Nonutility Group (12.7) (5.9) Corporate and Other (0.1) (0.1) Earnings 48.3$ 57.0$ Earnings Per Share Utility Group 0.74$ 0.76$ Nonutility Group (0.16) (0.07) Corporate and Other - - EPS 0.58$ 0.69$ Weighted Avg Shares Outstanding - Basic 82.8 82.6 Ended Mar 31 3 Months 30 Appendix

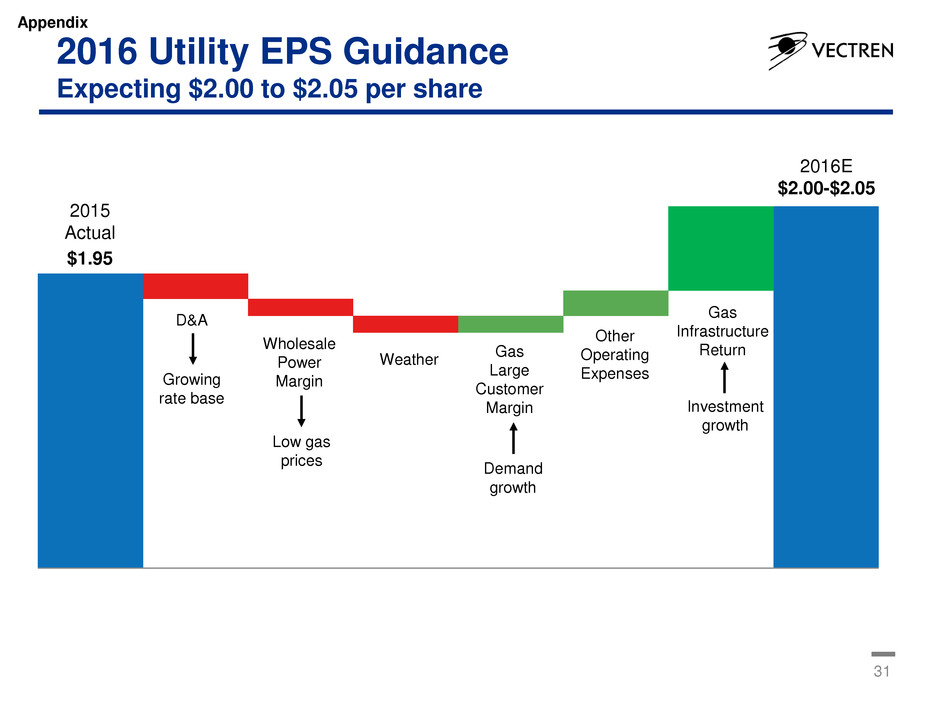

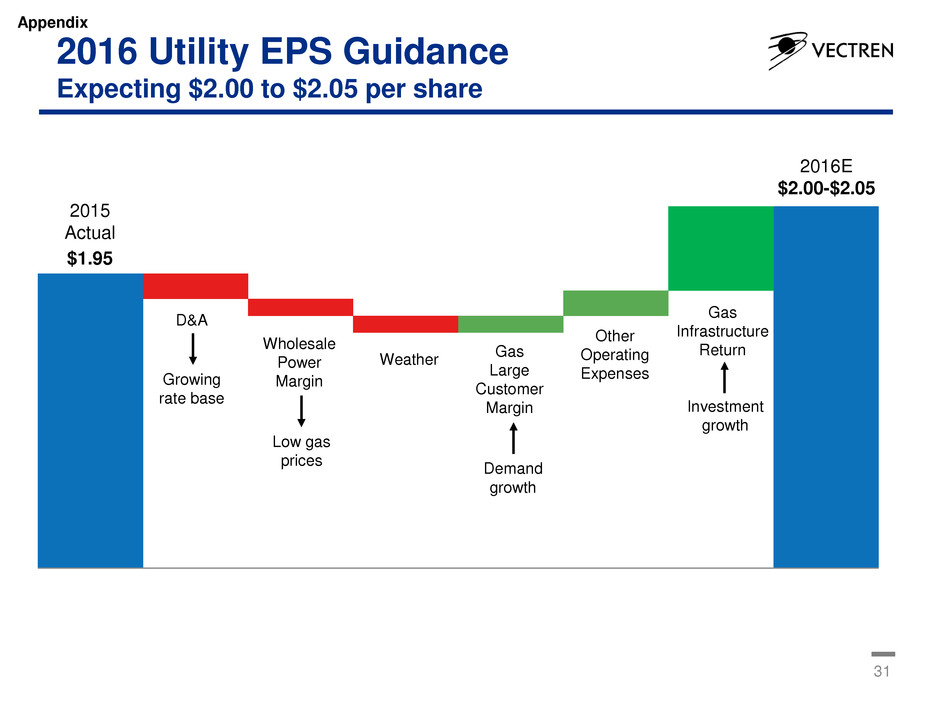

2016 Utility EPS Guidance Expecting $2.00 to $2.05 per share Appendix 31 D&A Growing rate base Wholesale Power Margin Low gas prices Gas Large Customer Margin Demand growth Gas Infrastructure Return Investment growth 2015 Actual $1.95 2016E $2.00-$2.05 Other Operating Expenses Weather

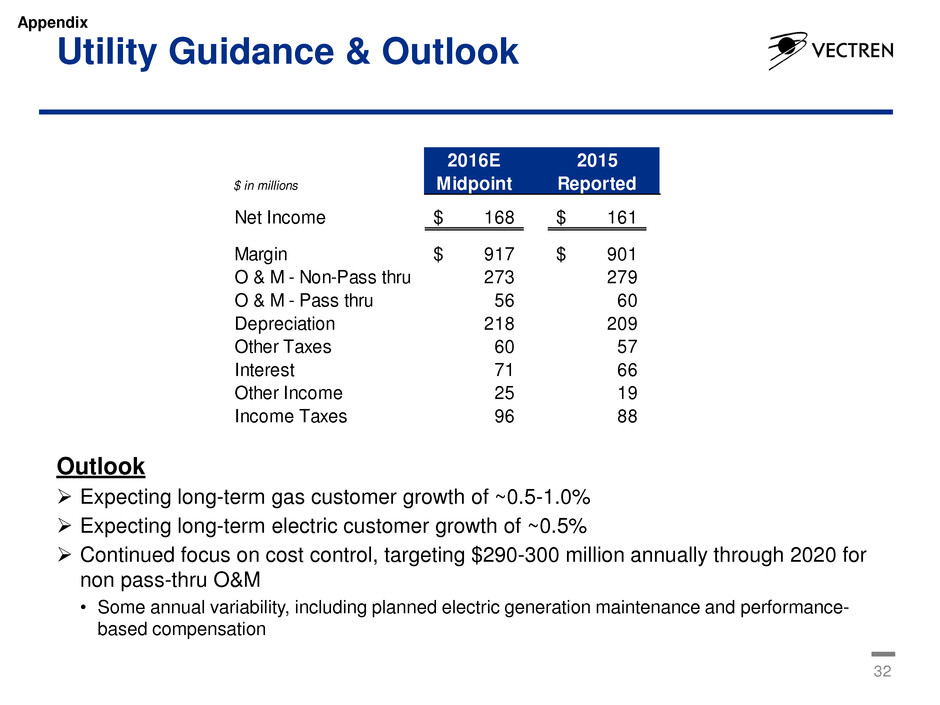

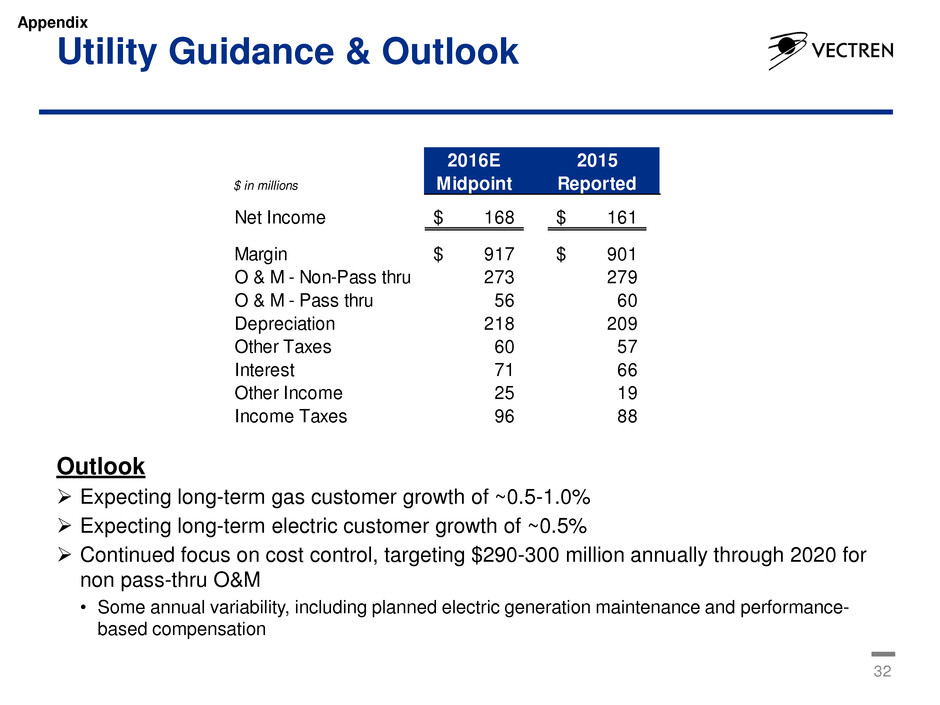

Outlook Expecting long-term gas customer growth of ~0.5-1.0% Expecting long-term electric customer growth of ~0.5% Continued focus on cost control, targeting $290-300 million annually through 2020 for non pass-thru O&M • Some annual variability, including planned electric generation maintenance and performance- based compensation Utility Guidance & Outlook 2016E 2015 $ in millions Midpoint Reported Net Income 168$ 161$ Margin 917$ 901$ O & M - Non-Pass thru 273 279 O & M - Pass thru 56 60 Depreciation 218 209 Other Taxes 60 57 Interest 71 66 Other Income 25 19 Income Taxes 96 88 Appendix 32

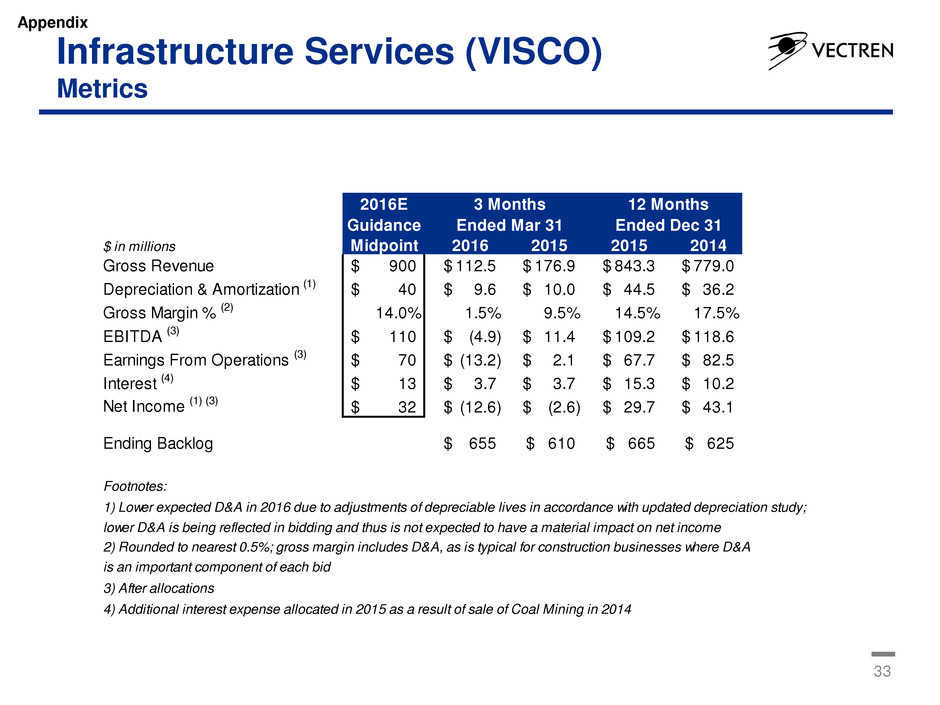

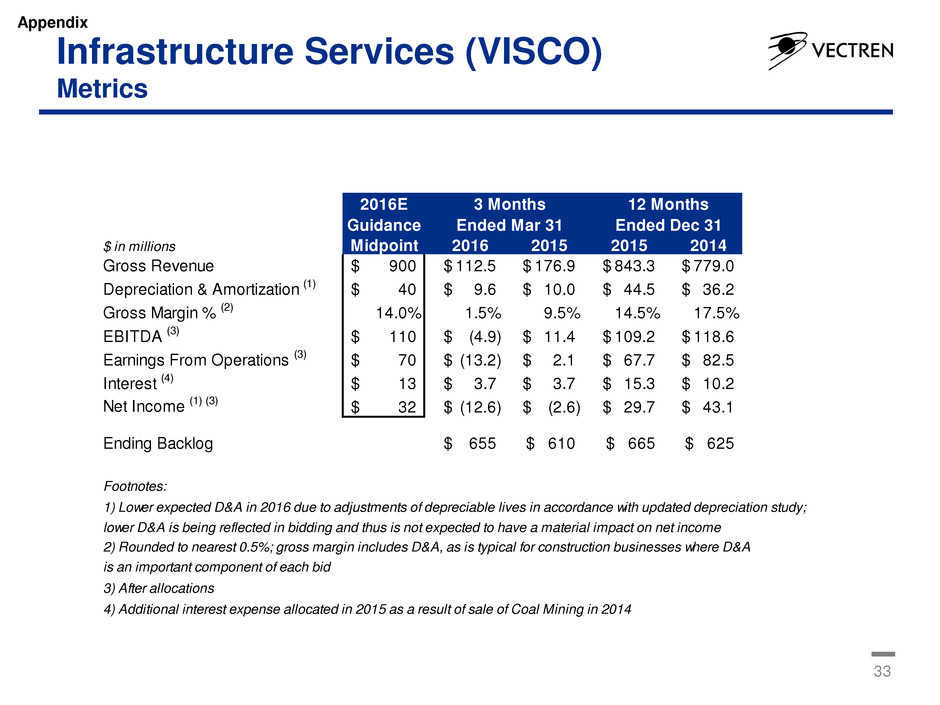

33 2016E Guidance $ in millions Midpoint 2016 2015 2015 2014 Gross Revenue 900$ 112.5$ 176.9$ 843.3$ 779.0$ Depreciation & Amortization (1) 40$ 9.6$ 10.0$ 44.5$ 36.2$ Gross Margin % (2) 14.0% 1.5% 9.5% 14.5% 17.5% EBITDA (3) 110$ (4.9)$ 11.4$ 109.2$ 118.6$ Earnings From Operations (3) 70$ (13.2)$ 2.1$ 67.7$ 82.5$ Interest (4) 13$ 3.7$ 3.7$ 15.3$ 10.2$ Net Income (1) (3) 32$ (12.6)$ (2.6)$ 29.7$ 43.1$ Ending Backlog 655$ 610$ 665$ 625$ Footnotes: 1) Lower expected D&A in 2016 due to adjustments of depreciable lives in accordance with updated depreciation study; lower D&A is being reflected in bidding and thus is not expected to have a material impact on net income 2) Rounded to nearest 0.5%; gross margin includes D&A, as is typical for construction businesses where D&A is an important component of each bid 3) After allocations 4) Additional interest expense allocated in 2015 as a result of sale of Coal Mining in 2014 12 Months Ended Dec 31 3 Months Ended Mar 31 Infrastructure Services (VISCO) Metrics Appendix

General Description of Types of Customer Contracts for Infrastructure Services • Infrastructure Services operates primarily under two types of contracts – blanket contracts and bid contracts. Blanket contracts are ones which a customer is not committed to specific volumes of services, but where we have been or expect to be chosen to perform work needed by a customer in a given time frame (typically awarded on a yearly basis). Bid contracts are ones which a customer will commit to a specific service to be performed for a specific price, whether in total for a project or on a per unit basis (e.g., per dig or per foot). General Description of Backlog for Infrastructure Services • For blanket work, backlog represents an estimate of the amount of gross revenue that we expect to realize from work to be performed in the next 12 months on existing contracts or contracts we reasonably expect to be renewed or awarded based upon recent history or discussions with customers. • For bid work, backlog represents the value remaining on contracts awarded or that we reasonably expect to be awarded, but are not yet completed. • While there is a reasonable basis to estimate backlog, there can be no assurance as to our customers’ eventual demand for our services each year or, therefore, the accuracy of our estimate of backlog. Backlog for Infrastructure Services estimated as follows: • For blanket work, estimated backlog as of 3/31/16 is $440 million. The estimate of the amount of gross revenue that we expect to realize from work to be performed in the next 12 months is multiplied by 80% to factor in such unknowns as weather and potential budgetary restrictions of customers. • For bid work, estimated backlog as of 3/31/16 is $215 million. • Total estimated backlog as of 3/31/16: $655 million compared to $665 million at 12/31/15 34 Infrastructure Services (VISCO) Estimated Backlog Appendix

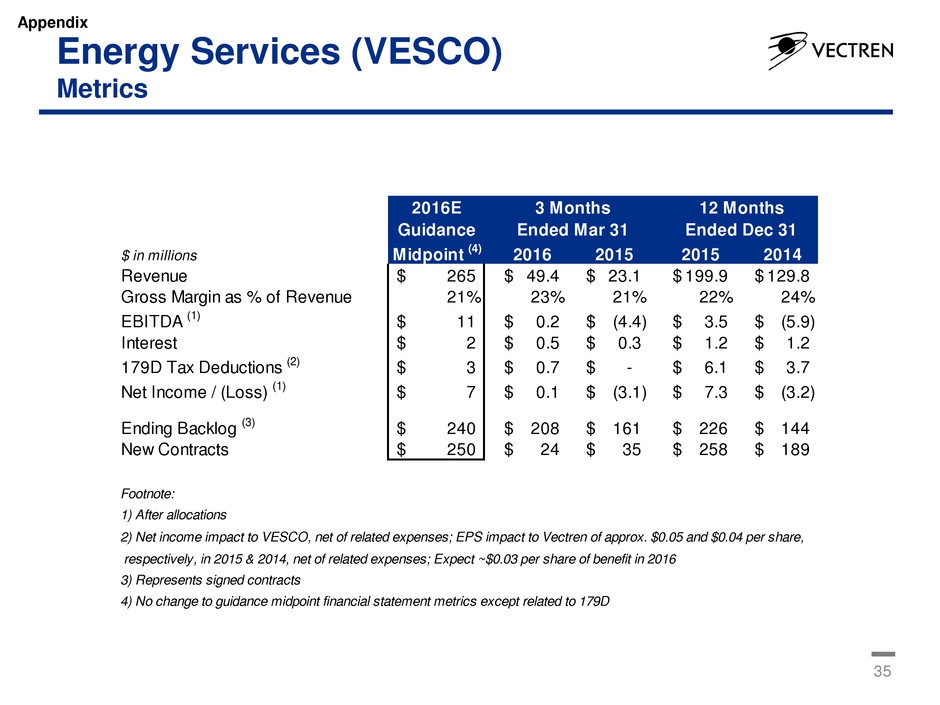

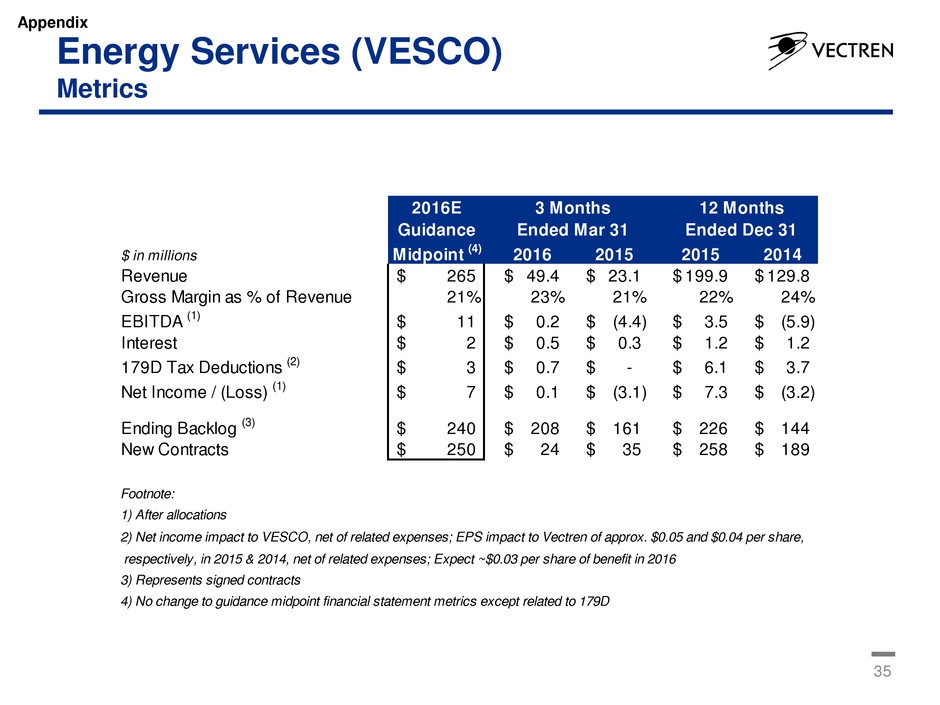

35 2016E Guidance $ in millions Midpoint (4) 2016 2015 2015 2014 Revenue 265$ 49.4$ 23.1$ 199.9$ 129.8$ Gross Margin as % of Revenue 21% 23% 21% 22% 24% EBITDA (1) 11$ 0.2$ (4.4)$ 3.5$ (5.9)$ Interest 2$ 0.5$ 0.3$ 1.2$ 1.2$ 179D Tax Deductions (2) 3$ 0.7$ -$ 6.1$ 3.7$ Net Income / (Loss) (1) 7$ 0.1$ (3.1)$ 7.3$ (3.2)$ Ending Backlog (3) 240$ 208$ 161$ 226$ 144$ New Contracts 250$ 24$ 35$ 258$ 189$ Footnote: 1) After allocations 2) Net income impact to VESCO, net of related expenses; EPS impact to Vectren of approx. $0.05 and $0.04 per share, respectively, in 2015 & 2014, net of related expenses; Expect ~$0.03 per share of benefit in 2016 3) Represents signed contracts 4) No change to guidance midpoint financial statement metrics except related to 179D 3 Months Ended Mar 31 12 Months Ended Dec 31 Energy Services (VESCO) Metrics Appendix

36 Contribution to Vectren's Basic EPS Per share earnings contributions of the Utility Group, Nonutility Group, and Corporate and Other are presented and are non- GAAP measures. Such per share amounts are based on the earnings contribution of each group included in the Company's consolidated results divided by the Company's basic average shares outstanding during the period. The earnings per share of the groups do not represent a direct legal interest in the assets and liabilities allocated to the groups, but rather represent a direct equity interest in Vectren Corporation's assets and liabilities as a whole. These non-GAAP measures are used by management to evaluate the performance of individual businesses. In addition, other items giving rise to period over period variances, such as weather, may be presented on an after tax and per share basis. These amounts are calculated at a statutory tax rate divided by the Company's basic average shares outstanding during the period. Accordingly, management believes these measures are useful to investors in understanding each business' contribution to consolidated earnings per share and in analyzing consolidated period to period changes and the potential for earnings per share contributions in future periods. Per share amounts of the Utility Group and the Nonutility Group are reconciled to the GAAP financial measure of basic EPS by adding the two together. If there is a difference, that difference results from corporate and other operations. The non-GAAP financial measures disclosed by the Company should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP. Use of Non-GAAP Performance Measures and Per Share Measures Appendix

37 Additional Nonutility Information Appendix

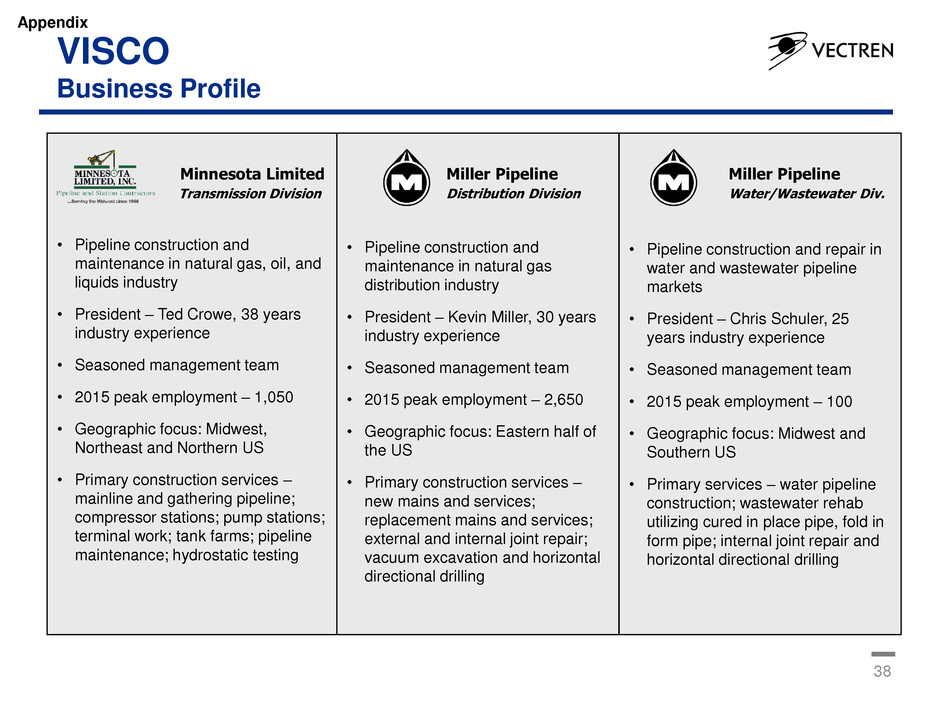

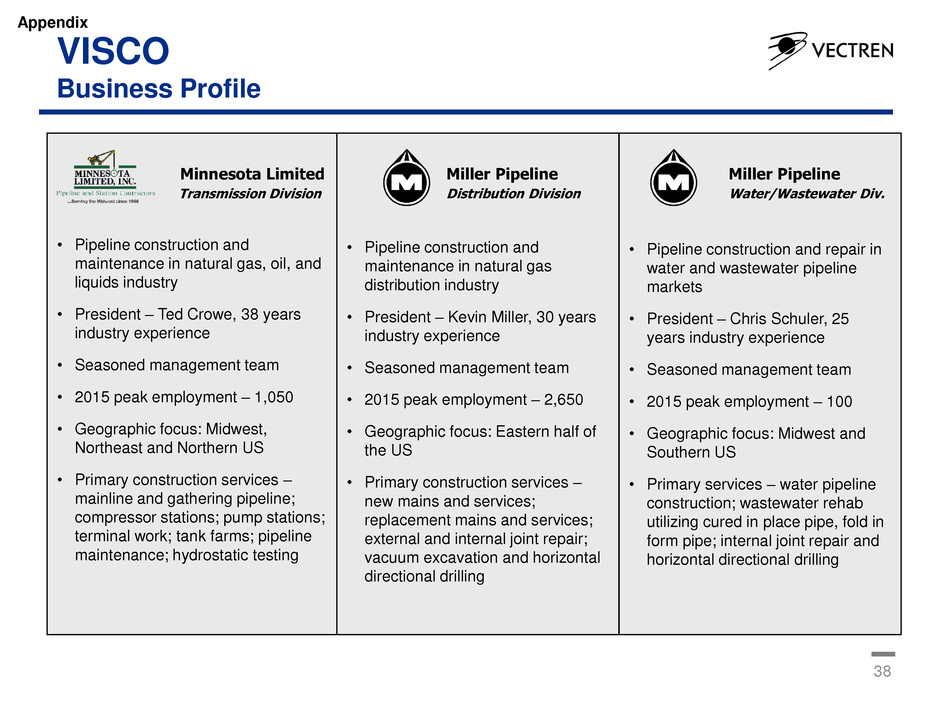

VISCO Business Profile 38 Appendix Minnesota Limited Transmission Division • Pipeline construction and maintenance in natural gas, oil, and liquids industry • President – Ted Crowe, 38 years industry experience • Seasoned management team • 2015 peak employment – 1,050 • Geographic focus: Midwest, Northeast and Northern US • Primary construction services – mainline and gathering pipeline; compressor stations; pump stations; terminal work; tank farms; pipeline maintenance; hydrostatic testing Miller Pipeline Distribution Division • Pipeline construction and maintenance in natural gas distribution industry • President – Kevin Miller, 30 years industry experience • Seasoned management team • 2015 peak employment – 2,650 • Geographic focus: Eastern half of the US • Primary construction services – new mains and services; replacement mains and services; external and internal joint repair; vacuum excavation and horizontal directional drilling Miller Pipeline Water/Wastewater Div. • Pipeline construction and repair in water and wastewater pipeline markets • President – Chris Schuler, 25 years industry experience • Seasoned management team • 2015 peak employment – 100 • Geographic focus: Midwest and Southern US • Primary services – water pipeline construction; wastewater rehab utilizing cured in place pipe, fold in form pipe; internal joint repair and horizontal directional drilling

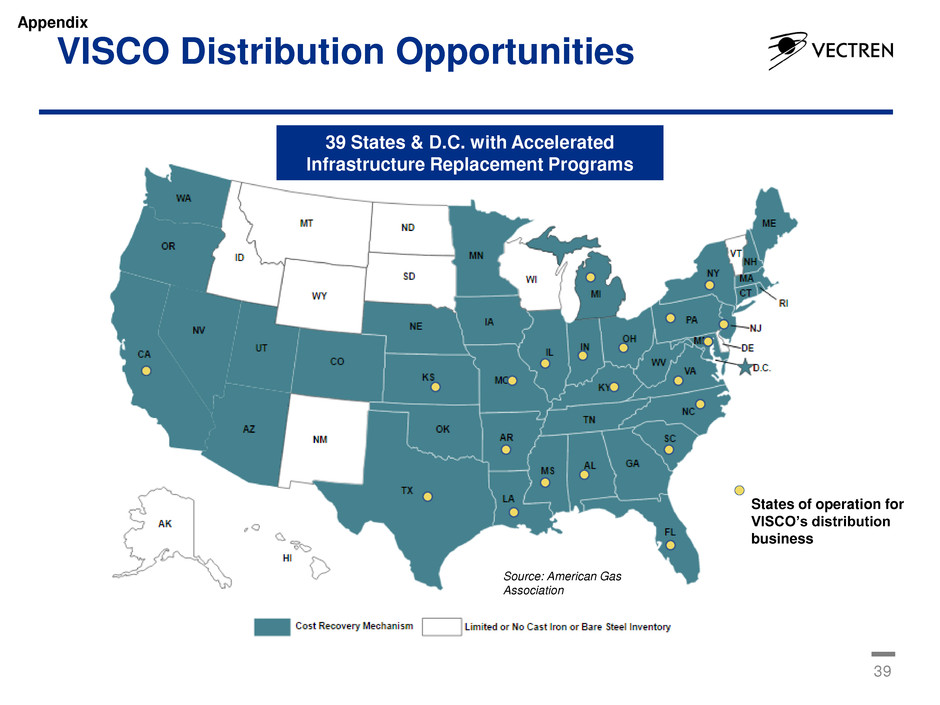

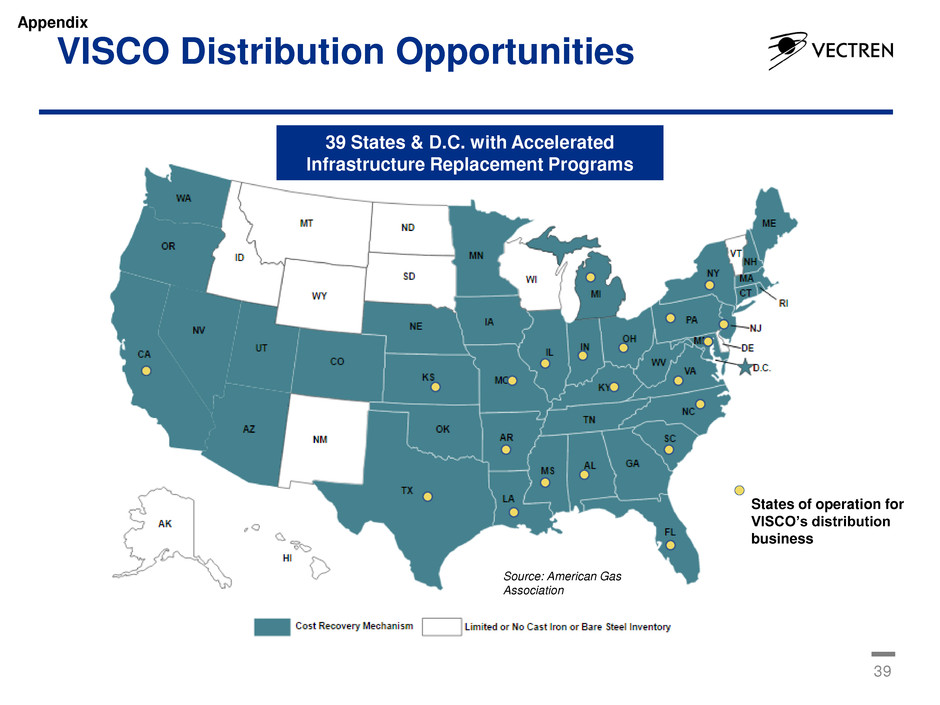

39 VISCO Distribution Opportunities States of operation for VISCO’s distribution business Source: American Gas Association 39 States & D.C. with Accelerated Infrastructure Replacement Programs Appendix

VISCO Long-Term Customer Relationships 40 Appendix Long-Term Customers Long-term customer relationships are key • Relationship with top 10 distribution customers averages ~25 years Reputation for high quality construction work and customer service Shared culture of commitment to safety with our customers Building on our history and reputation, added several significant new customers over the past few years

VISCO Competitive Landscape 41 Appendix Overview of the Competitive Landscape Consolidation continues in our industry • Fragmented market – many small family-owned contractors still servicing geographic territories •Market has a preference for larger contractors • VISCO has strong brand recognition in the industry VISCO’s seasoned management team has the ability to adapt to market changes • Extensive acquisition experience over many years • 8 acquisitions (1 large – Minnesota Ltd - and 7 small) Note: Two competitors – Sheehan and Midwest Underground - recently filed bankruptcy and have placed equipment for sale

VESCO Business Profile 42 Appendix Performance Contracting • Public & Federal Sectors •Design and construction of efficiency projects where savings are used to finance the improvements • Excess savings often used to fund deferred maintenance projects • Solid reputation among customers for innovative solutions and quality work •Key Drivers • Aging infrastructure • Need to reduce operating costs • Lack of capital budgets • Escalating electricity prices • Sustainability initiatives • Strong public policy support • Efficiency is the cheapest resource Sustainable Infrastructure • Public, Private and Federal Sectors •Design and construction of larger scale capital projects •Combined heat and power (CHP) •Anaerobic digesters, landfill gas and other renewable energy projects •Compressed natural gas (CNG) transportation fuel infrastructure •Key Drivers • Prospect of increasing electric rates and stable natural gas prices • Desire for control of energy prices • Electric grid reliability concerns • Increasing environmental regulations (air, water, organic waste) • Advances in technology (microgrids, renewables, and storage) • Corporate and institutional sustainability initiatives Operations & Maintenance •Focus on plants and projects built by VESCO – currently nine locations •Steam, electricity, chilled water and power conditioning •Accounts for approximately 25% of VESCO’s work force •Contributes $20M - $25M of revenue annually, but some recent large projects will add to this total in coming years •Key Drivers • Customer convenience and risk reduction (focus on core business) • VESCO reduces risks associated with any savings or operations guarantees • Attractive recurring revenue stream • Fed projects often require long-term operations & maintenance agreements

VESCO At a Glance 43 Appendix Primary subsidiary, Energy Systems Group, founded in 1994 Accredited by the National Association of Energy Service Companies (NAESCO) Licensed to do business in 46 states, the U.S. Virgin Islands, and Puerto Rico ~315 Employees - 165 Sales/Engr./Proj. Mgt. - 75 O&M Staff Developed $2+ billion in projects for 340+ customers Facilitated in excess of $1 billion of project financing $450+ million in multiple phase (repeat customer) projects Equipment Independent / Vendor Neutral

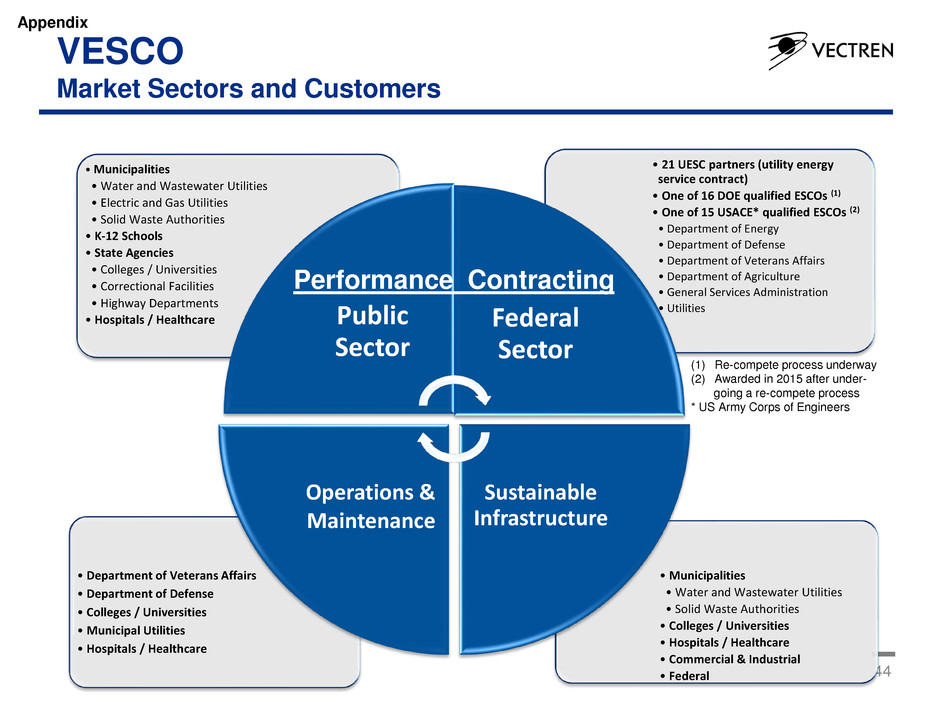

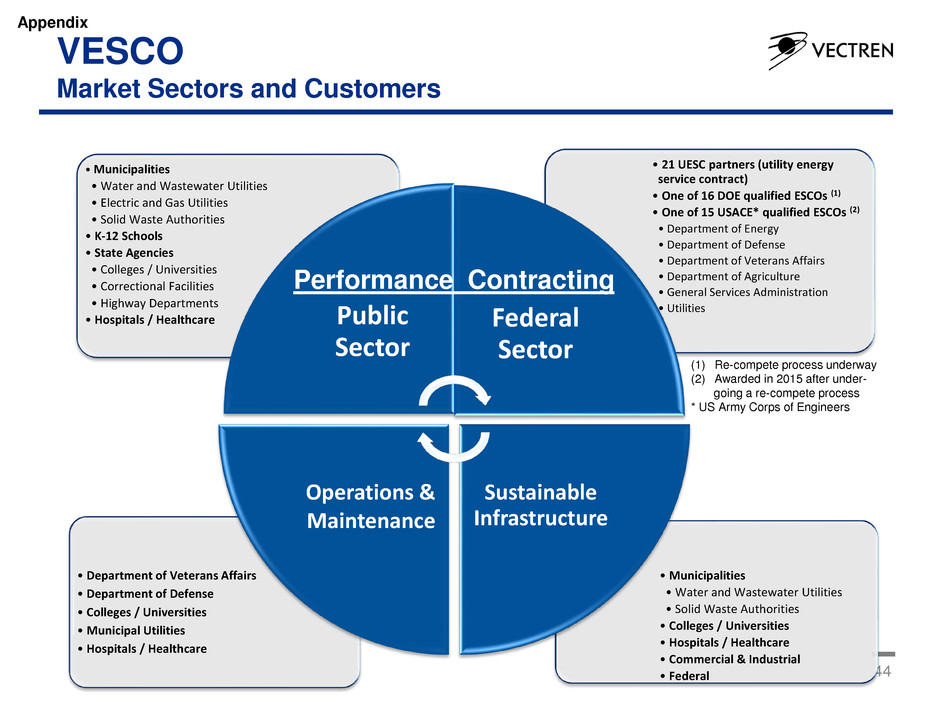

VESCO Market Sectors and Customers 44 Appendix (1) Re-compete process underway (2) Awarded in 2015 after under- going a re-compete process * US Army Corps of Engineers • Municipalities • Water and Wastewater Utilities • Solid Waste Authorities • Colleges / Universities • Hospitals / Healthcare • Commercial & Industrial • Federal • Department of Veterans Affairs • Department of Defense • Colleges / Universities • Municipal Utilities • Hospitals / Healthcare • 21 UESC partners (utility energy service contract) • One of 16 DOE qualified ESCOs (1) • One of 15 USACE* qualified ESCOs (2) • Department of Energy • Department of Defense • Department of Veterans Affairs • Department of Agriculture • General Services Administration • Utilities • Municipalities • Water and Wastewater Utilities • Electric and Gas Utilities • Solid Waste Authorities • K-12 Schools • State Agencies • Colleges / Universities • Correctional Facilities • Highway Departments • Hospitals / Healthcare Public Sector Federal Sector Sustainable Infrastructure Operations & Maintenance Performance Contracting

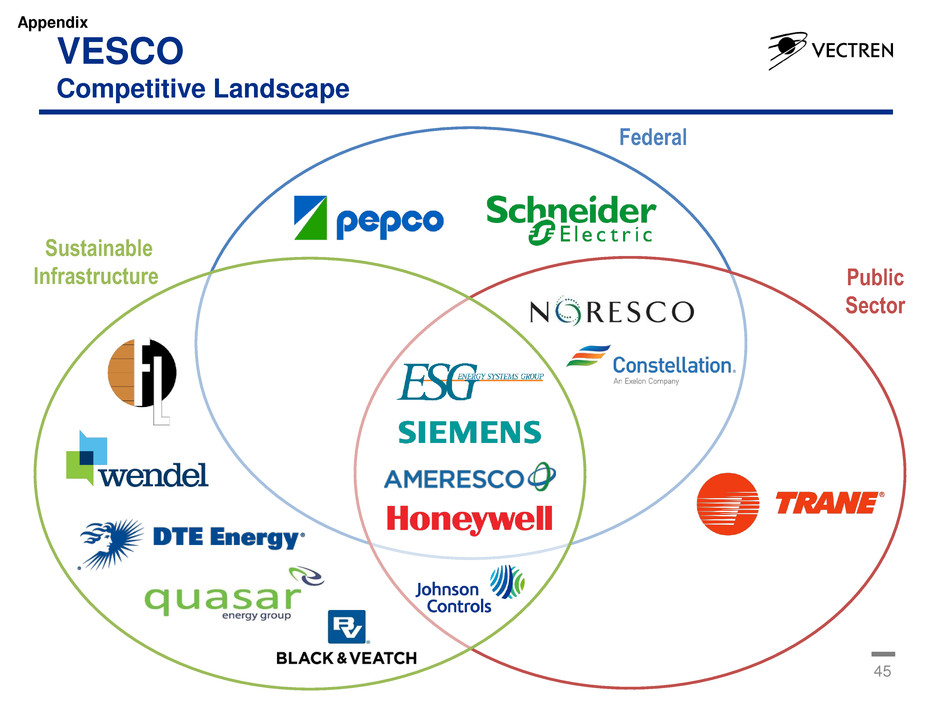

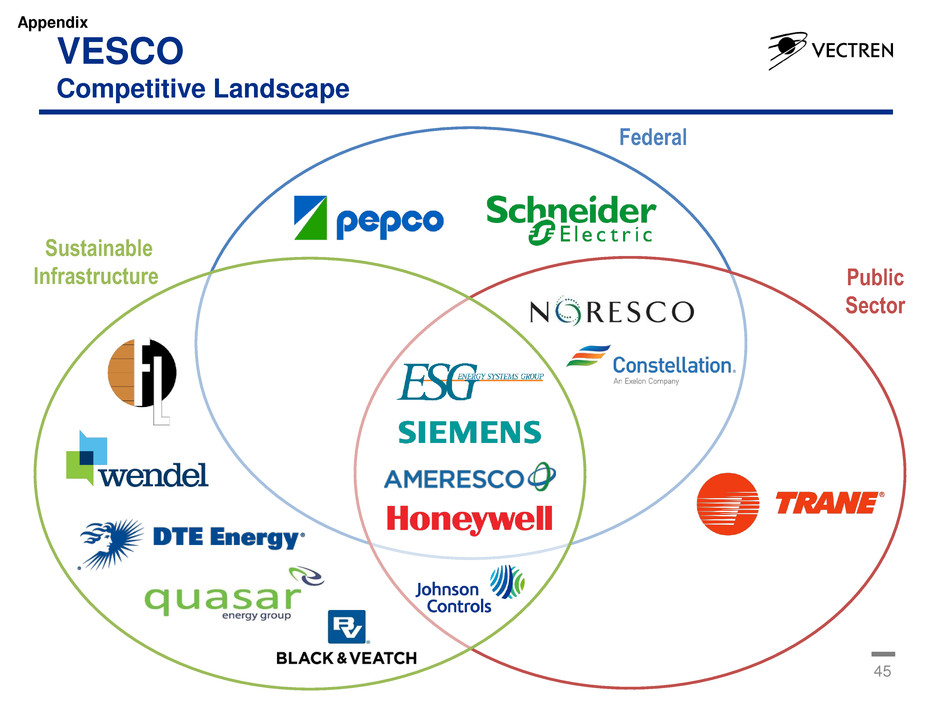

VESCO Competitive Landscape 45 Appendix Sustainable Infrastructure Federal Public Sector