May 9‐11, 2017

Management Representatives Dave Parker Director, Investor Relations Carl Chapman Chairman, President & CEO Susan Hardwick Exec. Vice President & CFO Vectren | NY/Boston Investor Meetings | May 20172

Forward‐Looking Statements All statements other than statements of historical fact are forward‐looking statements made in good faith by the company and are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. Such statements are based on management’s beliefs, as well as assumptions made by and information currently available to management and include such words as “believe”, “anticipate”, ”endeavor”, “estimate”, “expect”, “objective”, “projection”, “forecast”, “goal”, “likely”, and similar expressions intended to identify forward‐looking statements. Vectren cautions readers that the assumptions forming the basis for forward‐looking statements include many factors that are beyond Vectren’s ability to control or estimate precisely and actual results could differ materially from those contained in this document. Forward‐looking statements speak only as of the date on which our statement is made, and we assume no duty to update them. More detailed information about these factors is set forth in Vectren’s filings with the Securities and Exchange Commission, including Vectren’s 2016 annual report on Form 10‐K filed on February 23, 2017. Vectren also uses non‐GAAP measures to describe its financial results. More information can be found in the Appendix related to the use of such measures. Dave Parker – Director, Investor Relations d.parker@vectren.com 812‐491‐4135 Vectren | NY/Boston Investor Meetings | May 20173

Consolidated Q1 2017 Results Consistent Earnings Growth Continues In millions, except per share amounts 2017 2016 Utility Group 65.9$ 61.1$ Nonutility Group Infrastructure Services (VISCO) (9.3) (12.6) Energy Services (VESCO) (1.2) 0.1 Other Businesses ‐ (0.2) Nonutility Group (10.5) (12.7) Corporate and Other ‐ (0.1) Earnings 55.4$ 48.3$ Utility Group 0.80$ 0.74$ Nonutility Group (0.13) (0.16) Corporate and Other ‐ ‐ EPS 0.67$ 0.58$ Weighted Avg Shares Outstanding ‐ Basic 82.9 82.8 Ended Mar 31 3 Months Vectren | NY/Boston Investor Meetings | May 20174

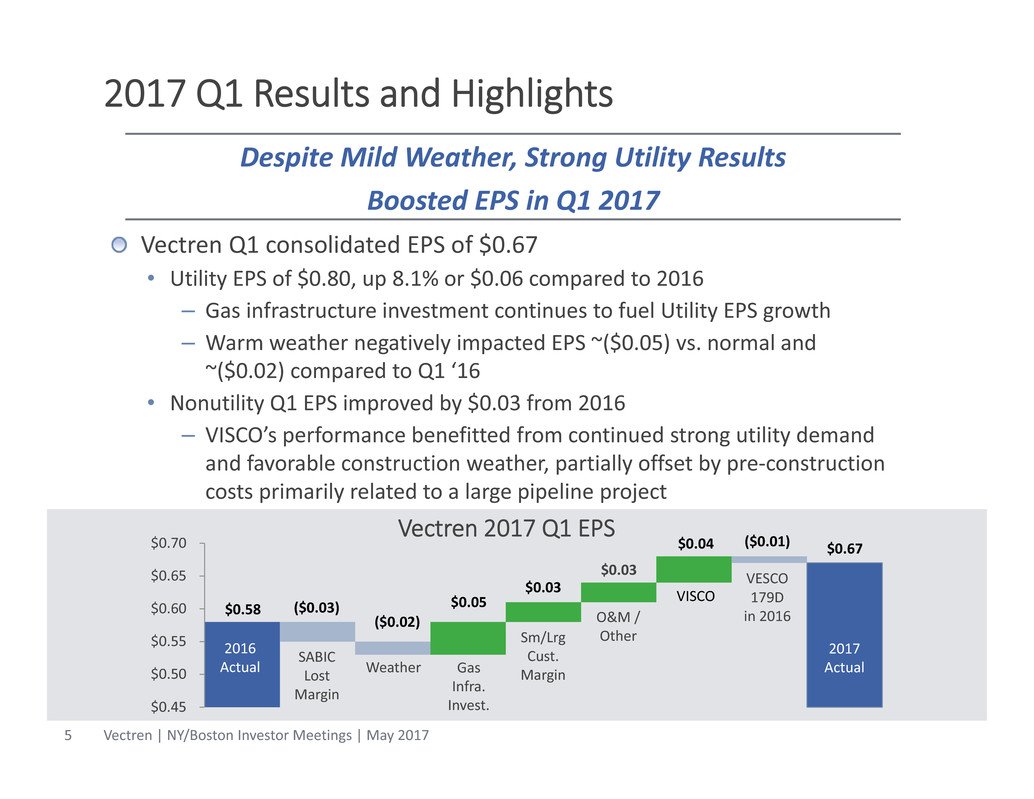

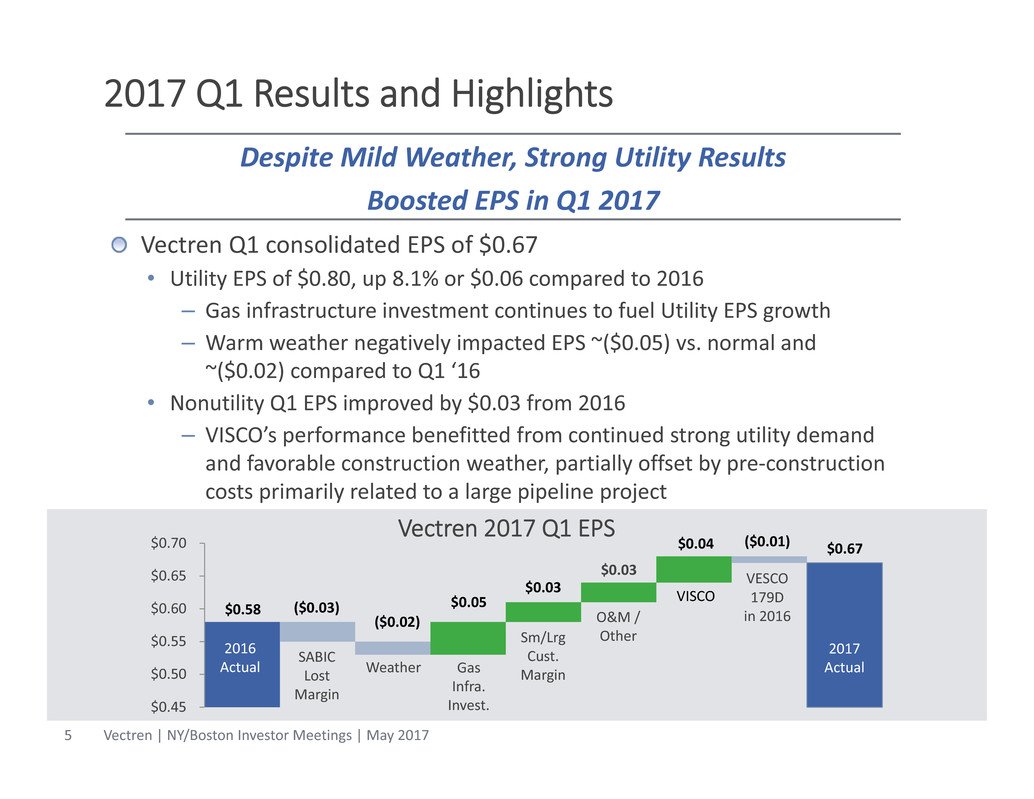

2017 Q1 Results and Highlights Vectren Q1 consolidated EPS of $0.67 • Utility EPS of $0.80, up 8.1% or $0.06 compared to 2016 – Gas infrastructure investment continues to fuel Utility EPS growth – Warm weather negatively impacted EPS ~($0.05) vs. normal and ~($0.02) compared to Q1 ‘16 • Nonutility Q1 EPS improved by $0.03 from 2016 – VISCO’s performance benefitted from continued strong utility demand and favorable construction weather, partially offset by pre‐construction costs primarily related to a large pipeline project Despite Mild Weather, Strong Utility Results Boosted EPS in Q1 2017 $0.45 $0.50 $0.55 $0.60 $0.65 $0.70 Weather Vectren 2017 Q1 EPS $0.58 $0.67 ($0.03) $0.04 $0.05 $0.03 $0.03 ($0.02) 2016 Actual VESCO 179D in 2016 Gas Infra. Invest. SABIC Lost Margin Sm/Lrg Cust. Margin O&M / Other 2017 Actual VISCO ($0.01) Vectren | NY/Boston Investor Meetings | May 20175

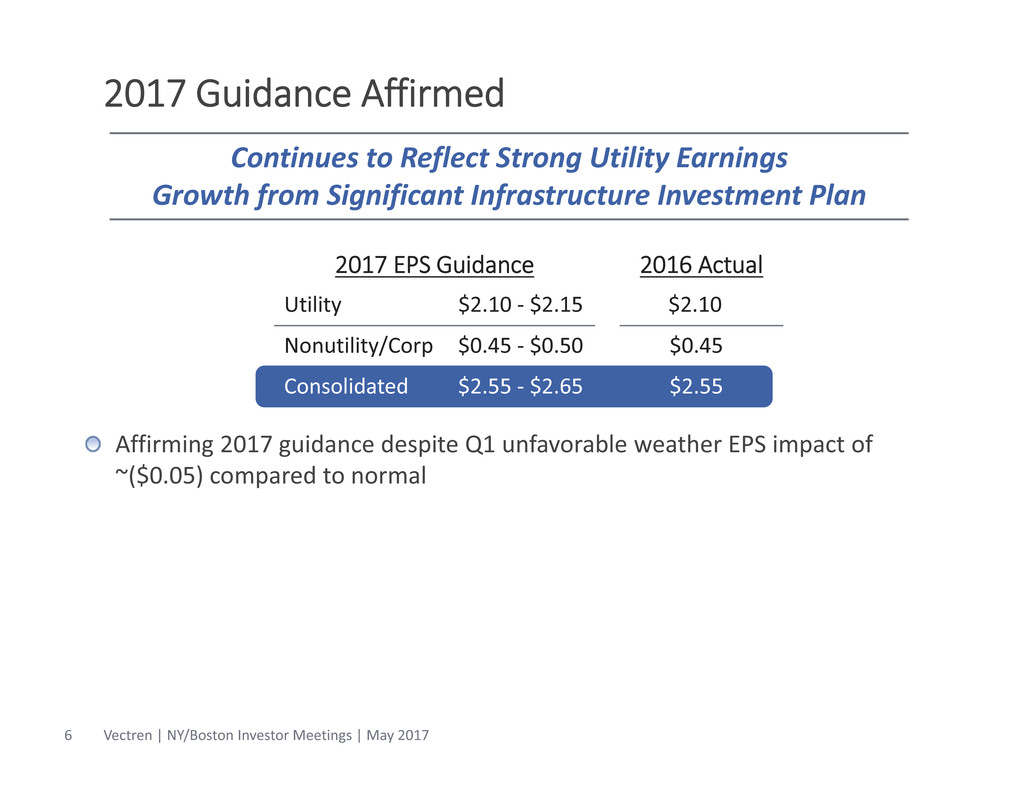

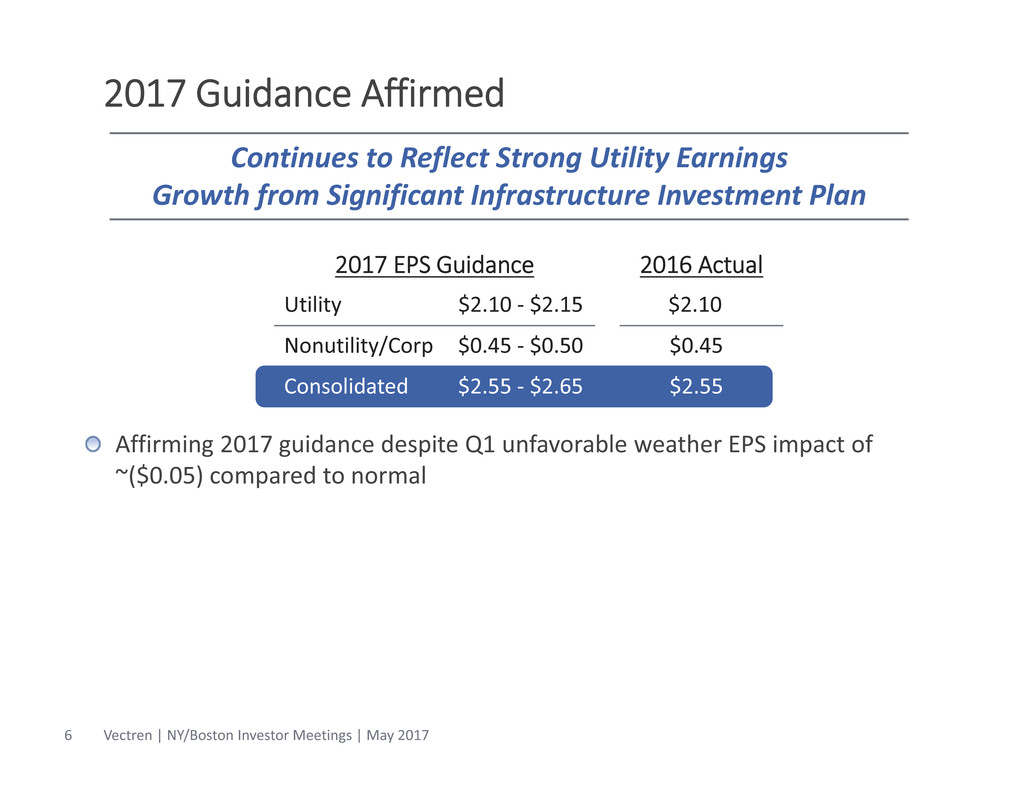

2017 Guidance Affirmed Continues to Reflect Strong Utility Earnings Growth from Significant Infrastructure Investment Plan 2017 EPS Guidance 2016 Actual Utility $2.10 ‐ $2.15 $2.10 Nonutility/Corp $0.45 ‐ $0.50 $0.45 Consolidated $2.55 ‐ $2.65 $2.55 Affirming 2017 guidance despite Q1 unfavorable weather EPS impact of ~($0.05) compared to normal Vectren | NY/Boston Investor Meetings | May 20176

Vectren Long‐Term Outlook 1.2M Utility Customers Vectren Energy Delivery of Indiana– North (Gas) Vectren Energy Delivery of Indiana– South (Gas & Electric) Vectren Energy Delivery of Ohio (Gas)

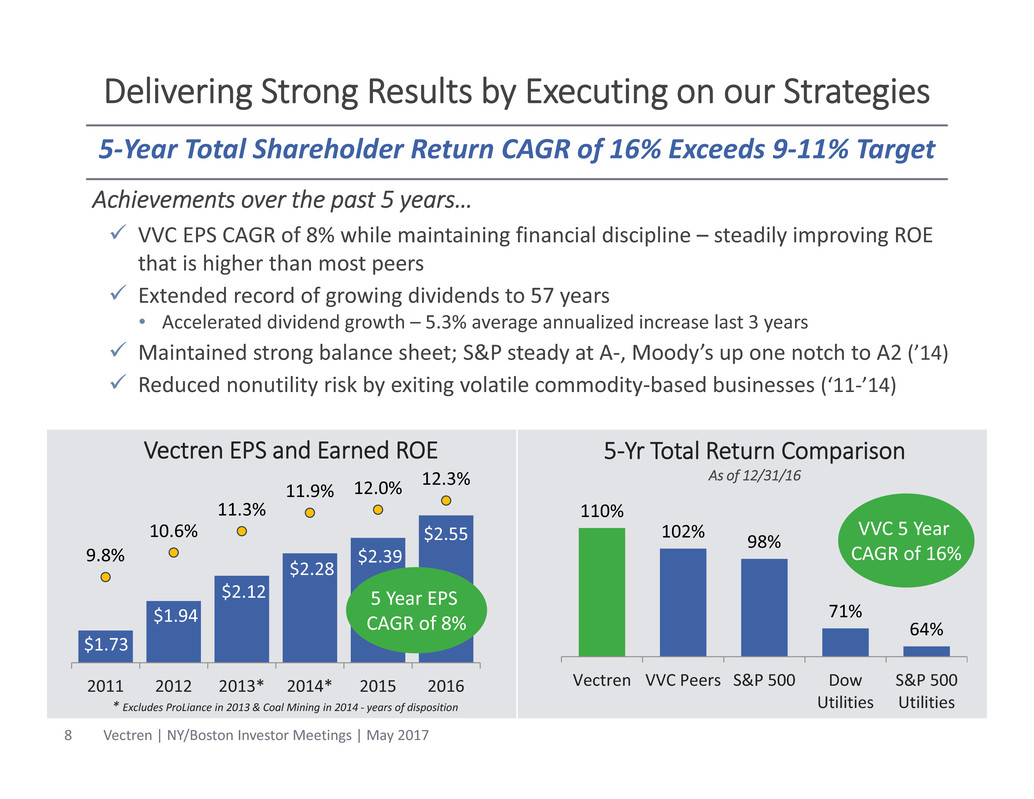

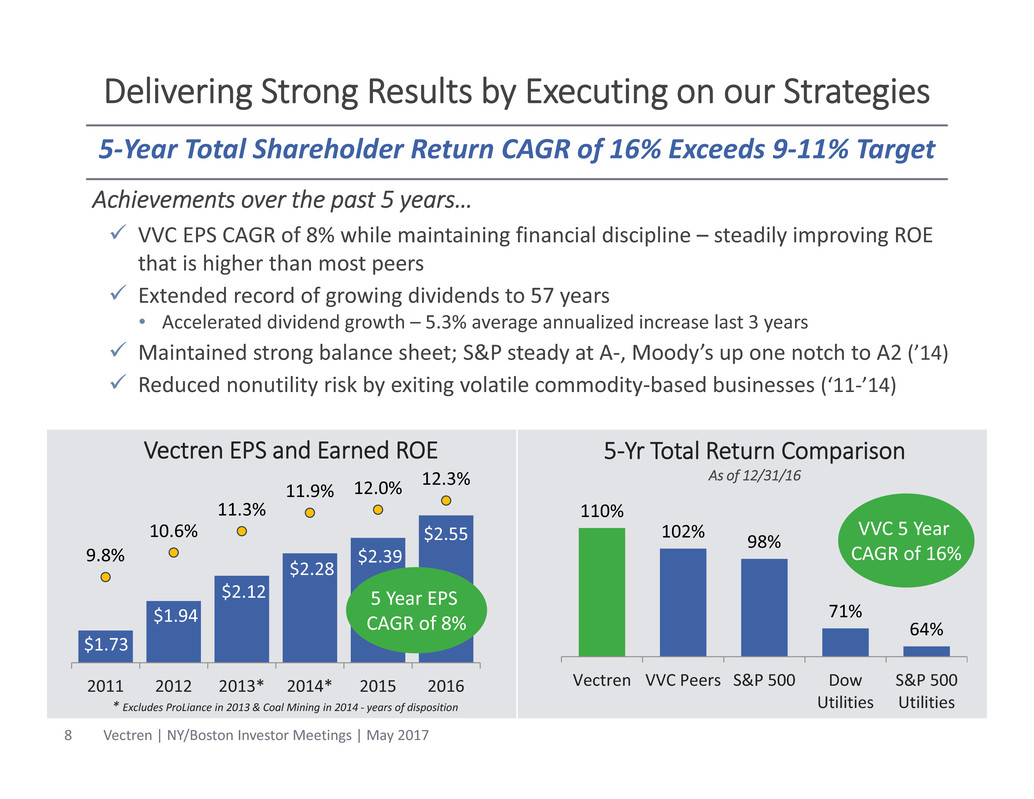

Delivering Strong Results by Executing on our Strategies Achievements over the past 5 years… VVC EPS CAGR of 8% while maintaining financial discipline – steadily improving ROE that is higher than most peers Extended record of growing dividends to 57 years • Accelerated dividend growth – 5.3% average annualized increase last 3 years Maintained strong balance sheet; S&P steady at A‐, Moody’s up one notch to A2 (’14) Reduced nonutility risk by exiting volatile commodity‐based businesses (‘11‐’14) $1.73 $1.94 $2.12 $2.28 $2.39 $2.55 9.8% 10.6% 11.3% 11.9% 12.0% 12.3% 2011 2012 2013* 2014* 2015 2016 * Excludes ProLiance in 2013 & Coal Mining in 2014 ‐ years of disposition Vectren EPS and Earned ROE 5 Year EPS CAGR of 8% 110% 102% 98% 71% 64% Vectren VVC Peers S&P 500 Dow Utilities S&P 500 Utilities 5‐Yr Total Return Comparison As of 12/31/16 5‐Year Total Shareholder Return CAGR of 16% Exceeds 9‐11% Target VVC 5 Year CAGR of 16% Vectren | NY/Boston Investor Meetings | May 20178

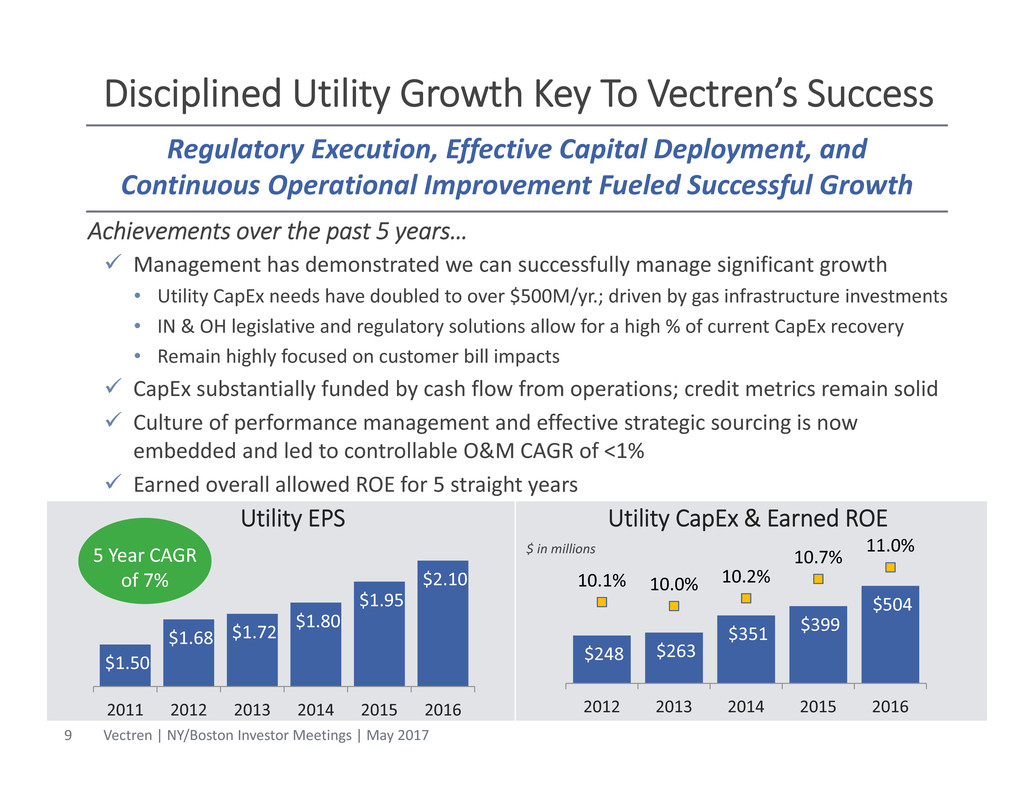

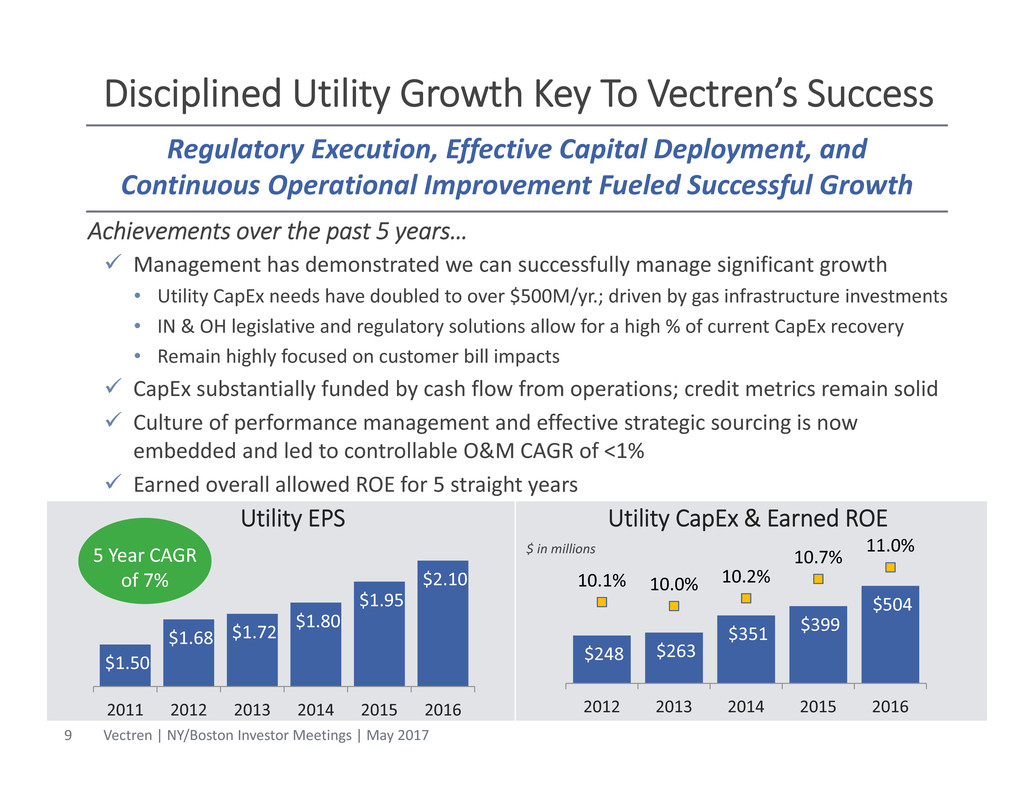

Disciplined Utility Growth Key To Vectren’s Success Management has demonstrated we can successfully manage significant growth • Utility CapEx needs have doubled to over $500M/yr.; driven by gas infrastructure investments • IN & OH legislative and regulatory solutions allow for a high % of current CapEx recovery • Remain highly focused on customer bill impacts CapEx substantially funded by cash flow from operations; credit metrics remain solid Culture of performance management and effective strategic sourcing is now embedded and led to controllable O&M CAGR of <1% Earned overall allowed ROE for 5 straight years $248 $263 $351 $399 $504 10.1% 10.0% 10.2% 10.7% 11.0% 2012 2013 2014 2015 2016 Utility CapEx & Earned ROE Regulatory Execution, Effective Capital Deployment, and Continuous Operational Improvement Fueled Successful Growth Achievements over the past 5 years… $1.50 $1.68 $1.72 $1.80 $1.95 $2.10 2011 2012 2013 2014 2015 2016 Utility EPS 5 Year CAGR of 7% $ in millions Vectren | NY/Boston Investor Meetings | May 20179

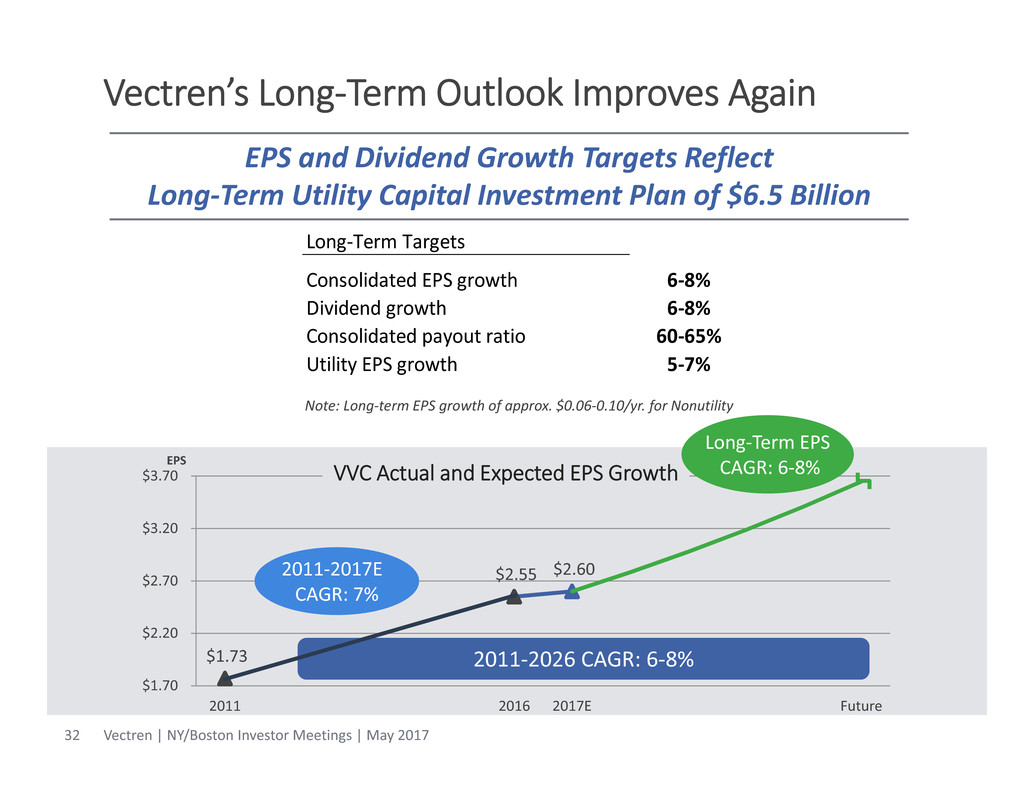

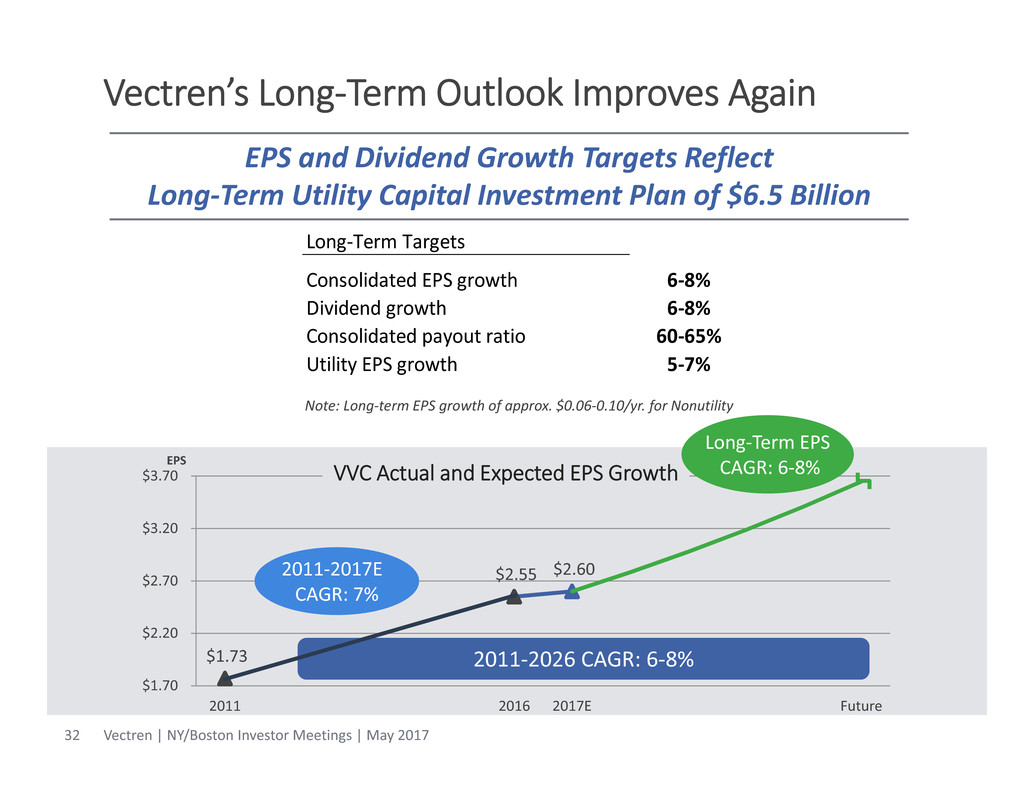

Long‐Term Targets Consolidated EPS growth 6‐8% Dividend growth 6‐8% Consolidated payout ratio 60‐65% Utility EPS growth 5‐7% Vectren’s Long‐Term Outlook Improves Note: Long‐term EPS growth of approx. $0.06‐0.10/yr. for Nonutility • $0.02‐$0.03 EPS growth/yr. for VESCO • $0.04‐$0.07 EPS growth/yr. for VISCO EPS and Dividend Growth Targets Reflect Long‐Term Utility Capital Investment Plan of $6.5 Billion Vectren | NY/Boston Investor Meetings | May 201710

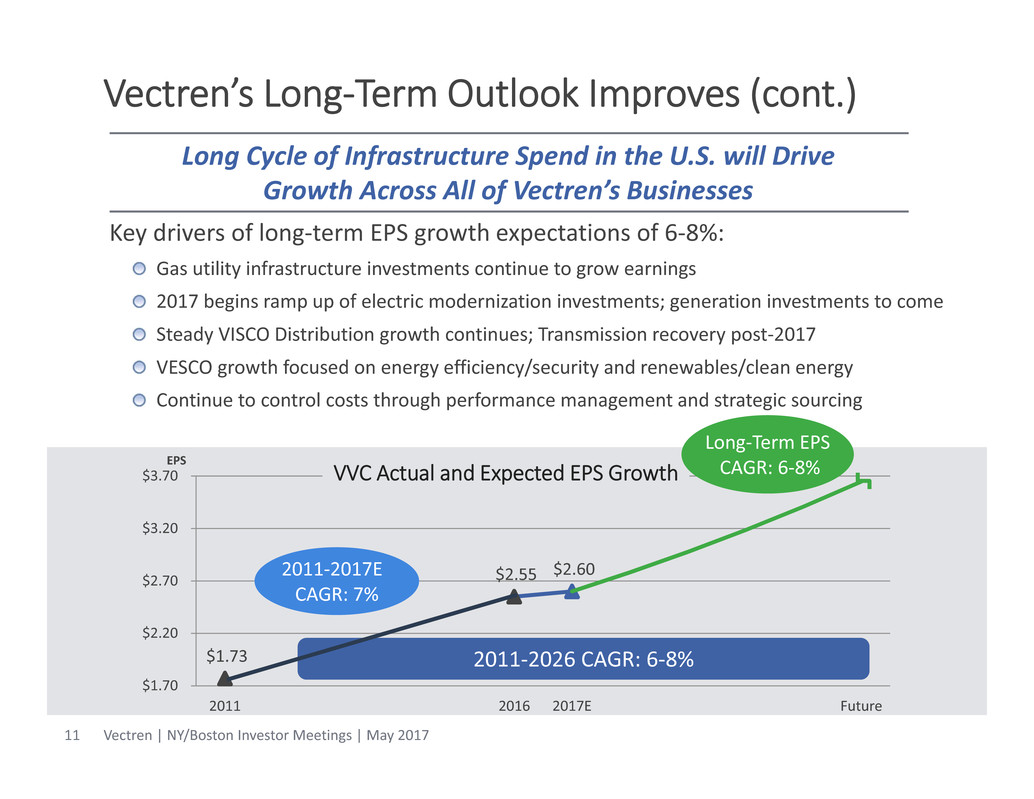

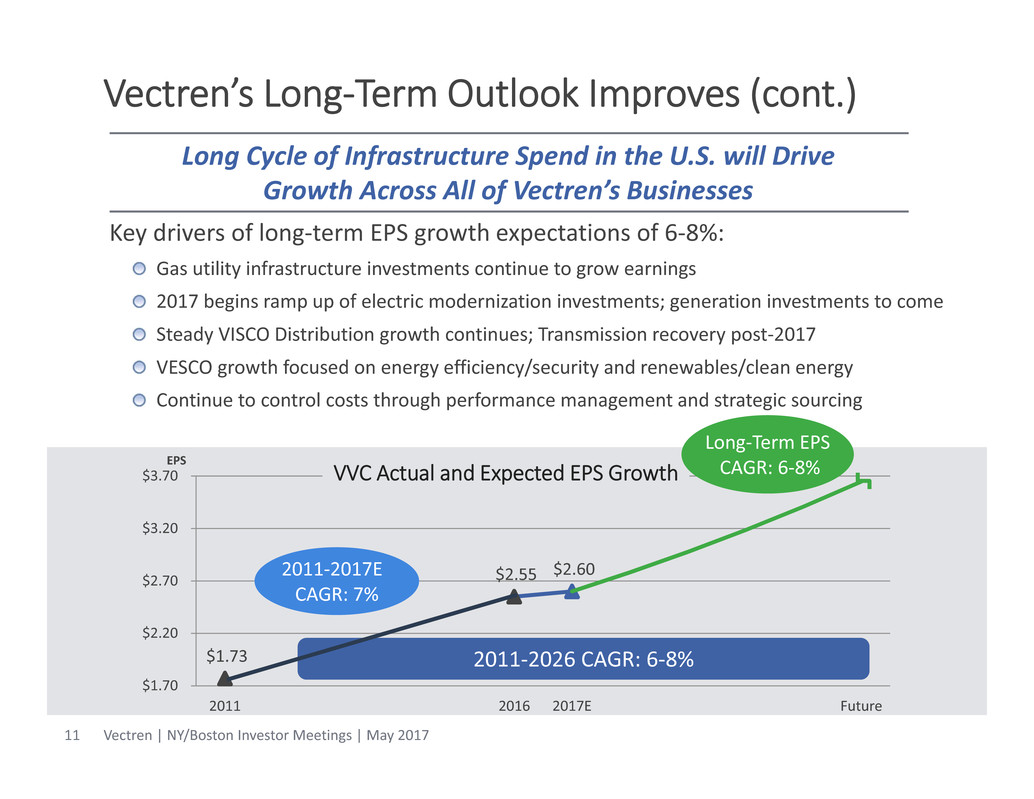

$1.73 $2.55 $2.60 $1.70 $2.20 $2.70 $3.20 $3.70 2011 2016 2017E Future EPS Key drivers of long‐term EPS growth expectations of 6‐8%: Gas utility infrastructure investments continue to grow earnings 2017 begins ramp up of electric modernization investments; generation investments to come Steady VISCO Distribution growth continues; Transmission recovery post‐2017 VESCO growth focused on energy efficiency/security and renewables/clean energy Continue to control costs through performance management and strategic sourcing Vectren’s Long‐Term Outlook Improves (cont.) Long Cycle of Infrastructure Spend in the U.S. will Drive Growth Across All of Vectren’s Businesses VVC Actual and Expected EPS Growth Long‐Term EPS CAGR: 6‐8% 2011‐2026 CAGR: 6‐8% 2011‐2017E CAGR: 7% Vectren | NY/Boston Investor Meetings | May 201711

Increased Utility CapEx Drives Earnings Accelerated Rate Base Growth Enhances Long‐ and Short‐Term EPS Performance $0 $2,000 $4,000 $6,000 $8,000 2011 2016 2021E 2026E Utility Shared Electric Gas 2021‐’26 CAGR: ~7.5% (Gas & Electric) $ in millions 2016‐’21 CAGR: ~6.5% (Mostly Gas)2011‐’16 CAGR: ~5% (Mostly Gas) Overall 10‐Yr CAGR: ~7% Gas: ~8% Electric: ~5.5% Growth targets supporting Vectren’s 6‐8% EPS CAGR: Robust utility growth of 5‐7% including equity issuances to help finance planned capital investment • Forecasting a rate base CAGR of ~7% the next 10 years EPS growth expectation of $0.06‐0.10/yr. for Nonutility • $0.04‐0.07/yr. for VISCO and $0.02‐0.03/yr. for VESCO Rate Base Growth Accelerates* * Reflects electric infrastructure plan filed in Feb. 2017 and IRP filed in Dec. 2016 Vectren | NY/Boston Investor Meetings | May 201712

Utility Outlook

Transforming Our Utility… Diversify generation portfolio (IRP‐driven) Improve system optionality/efficiencies Reduce carbon emissions by almost 60% by 2024 (base year 2005) Generation Diversification Further improve safety & reliability Reduce frequency & duration of outages Enhance customer experience including AMI Grid Modernization Continue to execute gas infrastructure upgrade and replacement plans Further improve safety & reliability Gas Infrastructure …for a Smart Energy Future Vectren | NY/Boston Investor Meetings | May 201714

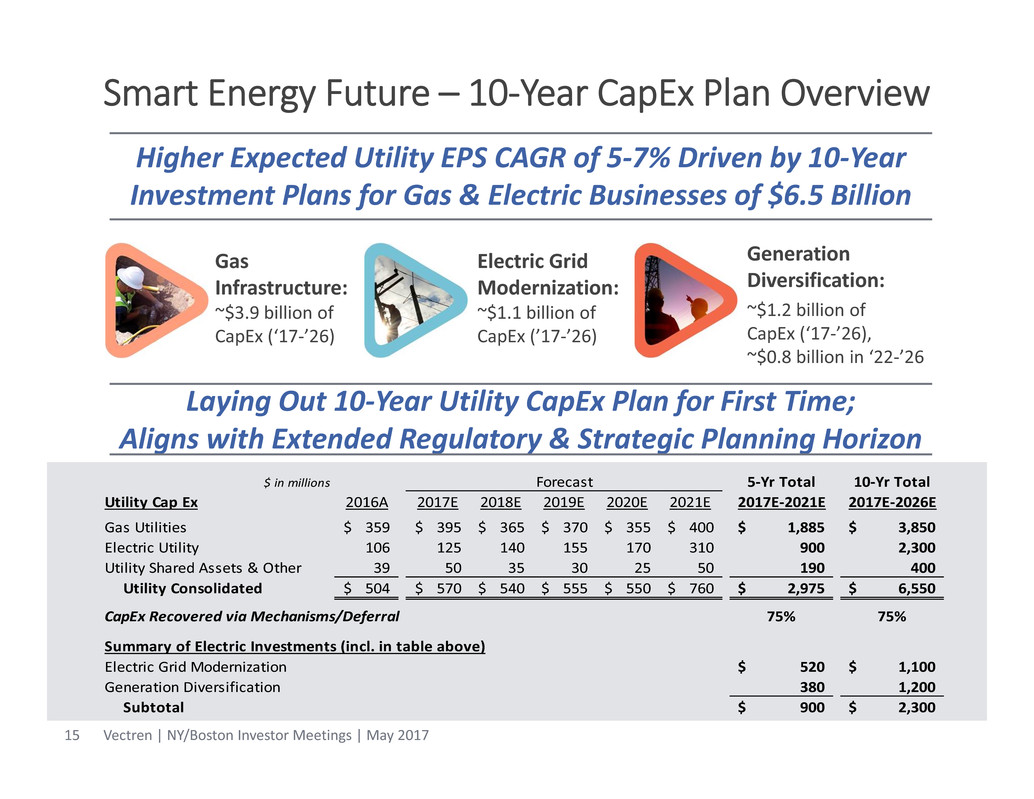

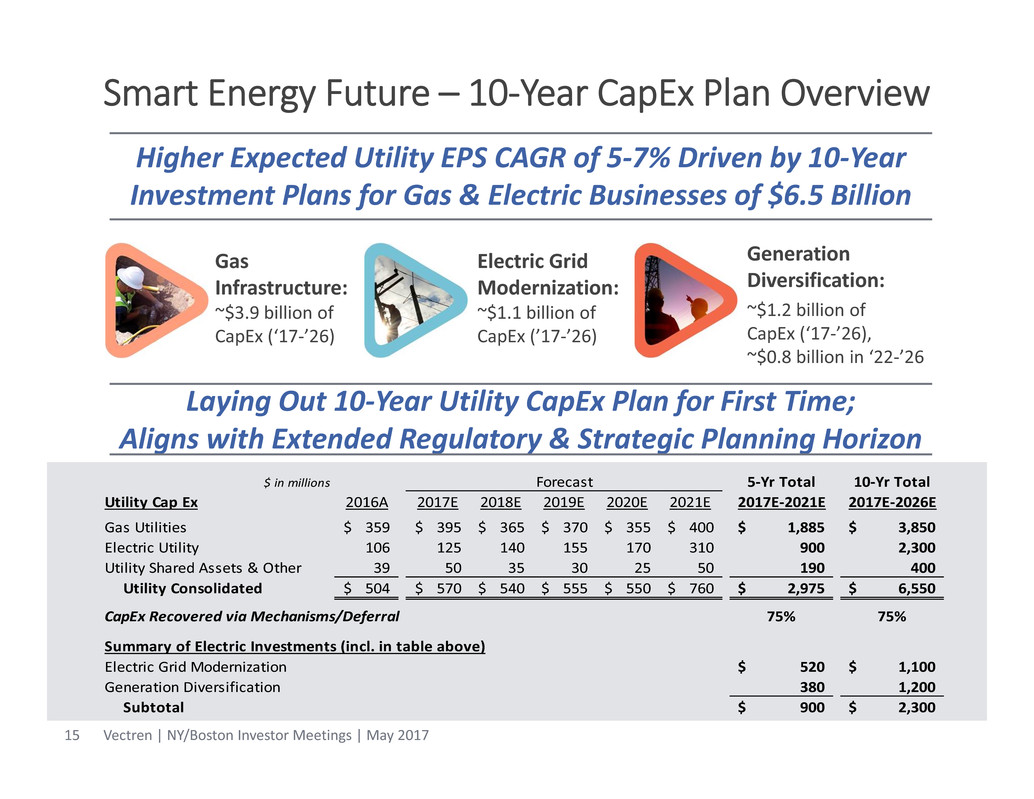

Higher Expected Utility EPS CAGR of 5‐7% Driven by 10‐Year Investment Plans for Gas & Electric Businesses of $6.5 Billion Generation Diversification: ~$1.2 billion of CapEx (‘17‐’26), ~$0.8 billion in ‘22‐’26 Gas Infrastructure: ~$3.9 billion of CapEx (‘17‐’26) Electric Grid Modernization: ~$1.1 billion of CapEx (’17‐’26) Smart Energy Future – 10‐Year CapEx Plan Overview $ in millions 5‐Yr Total 10‐Yr Total Utility Cap Ex 2016A 2017E 2018E 2019E 2020E 2021E 2017E‐2021E 2017E‐2026E Gas Utilities 359$ 395$ 365$ 370$ 355$ 400$ 1,885$ 3,850$ Electric Utility 106 125 140 155 170 310 900 2,300 Utility Shared Assets & Other 39 50 35 30 25 50 190 400 Utility Consolidated 504$ 570$ 540$ 555$ 550$ 760$ 2,975$ 6,550$ CapEx Recovered via Mechanisms/Deferral 75% 75% Summary of Electric Investments (incl. in table above) Electric Grid Modernization 520$ 1,100$ Generation Diversification 380 1,200 Subtotal 900$ 2,300$ Forecast Laying Out 10‐Year Utility CapEx Plan for First Time; Aligns with Extended Regulatory & Strategic Planning Horizon Vectren | NY/Boston Investor Meetings | May 201715

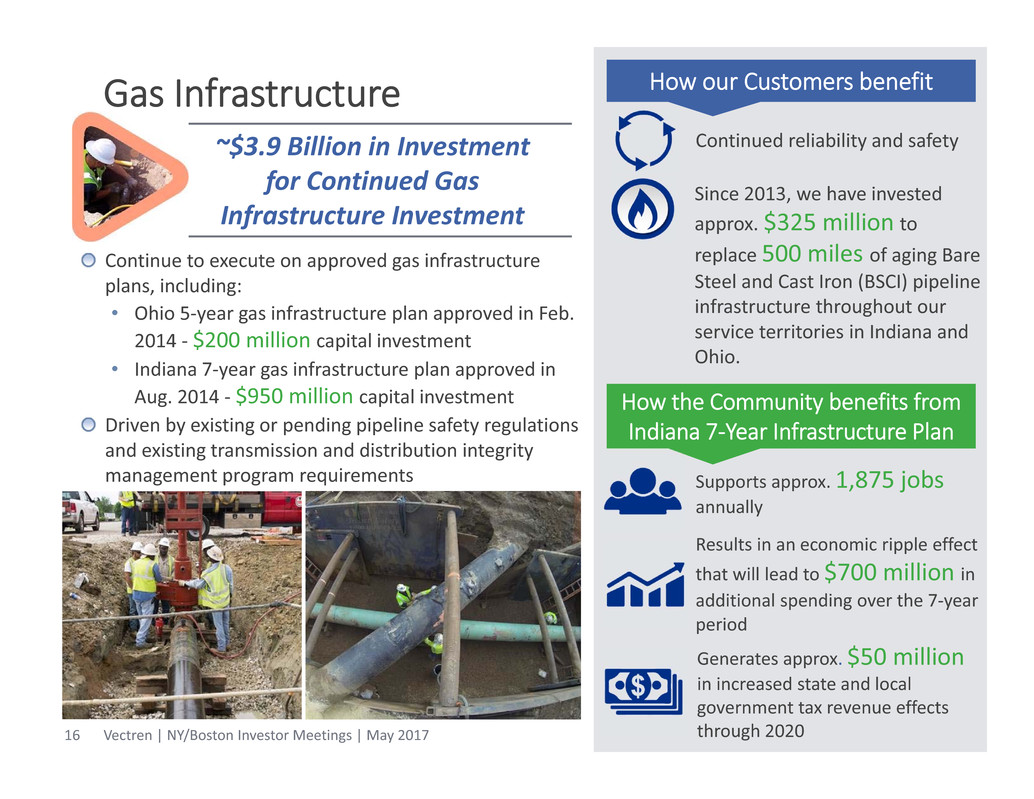

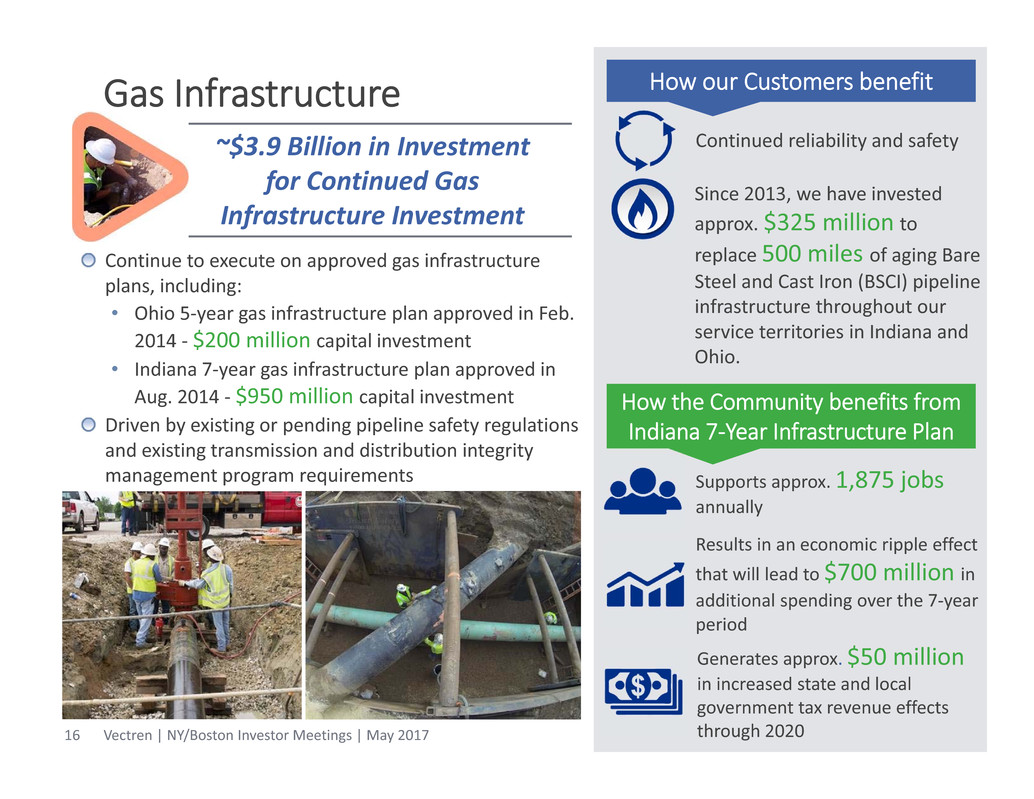

Gas Infrastructure Continue to execute on approved gas infrastructure plans, including: • Ohio 5‐year gas infrastructure plan approved in Feb. 2014 ‐ $200 million capital investment • Indiana 7‐year gas infrastructure plan approved in Aug. 2014 ‐ $950 million capital investment Driven by existing or pending pipeline safety regulations and existing transmission and distribution integrity management program requirements ~$3.9 Billion in Investment for Continued Gas Infrastructure Investment Generates approx. $50 million in increased state and local government tax revenue effects through 2020 Results in an economic ripple effect that will lead to $700 million in additional spending over the 7‐year period Supports approx. 1,875 jobs annually How the Community benefits from Indiana 7‐Year Infrastructure Plan How our Customers benefit Continued reliability and safety Since 2013, we have invested approx. $325 million to replace 500 miles of aging Bare Steel and Cast Iron (BSCI) pipeline infrastructure throughout our service territories in Indiana and Ohio. Vectren | NY/Boston Investor Meetings | May 201716

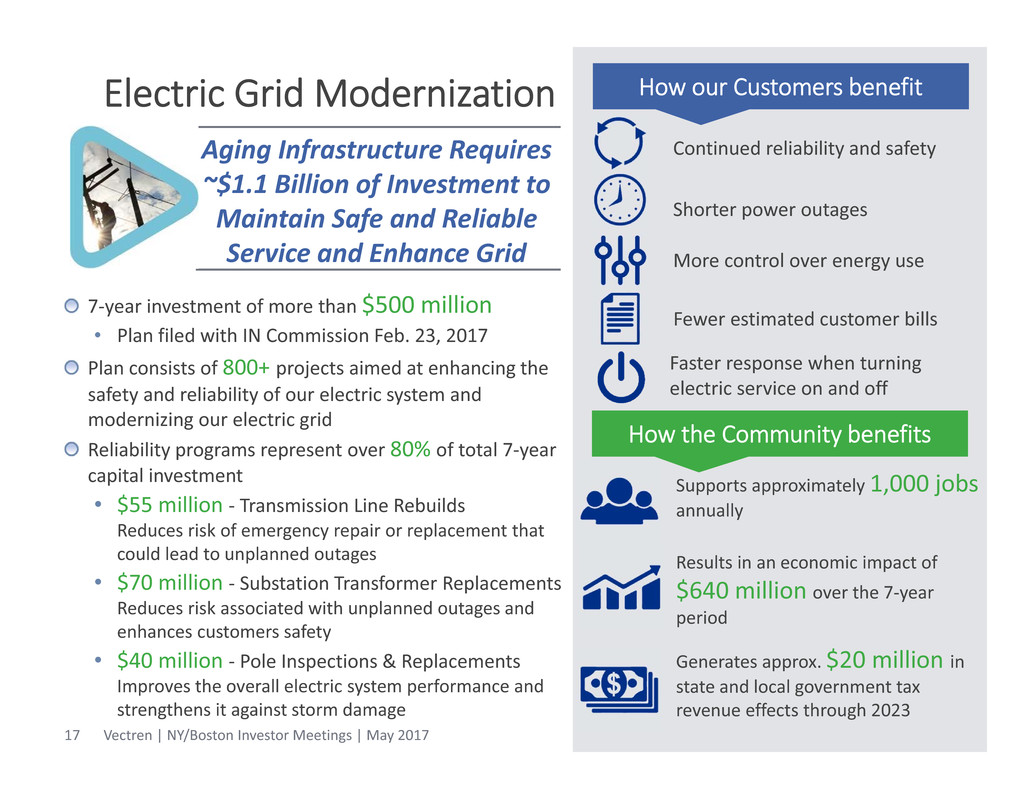

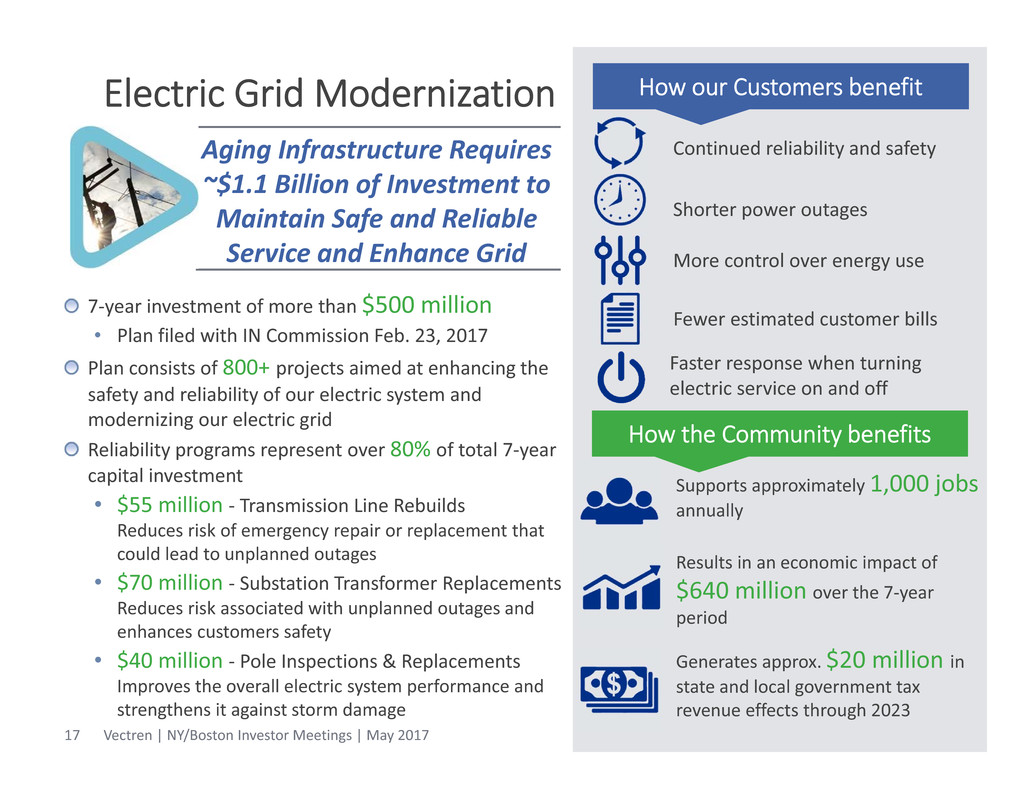

Electric Grid Modernization 7‐year investment of more than $500 million • Plan filed with IN Commission Feb. 23, 2017 Plan consists of 800+ projects aimed at enhancing the safety and reliability of our electric system and modernizing our electric grid Reliability programs represent over 80% of total 7‐year capital investment • $55 million ‐ Transmission Line Rebuilds Reduces risk of emergency repair or replacement that could lead to unplanned outages • $70 million ‐ Substation Transformer Replacements Reduces risk associated with unplanned outages and enhances customers safety • $40 million ‐ Pole Inspections & Replacements Improves the overall electric system performance and strengthens it against storm damage Aging Infrastructure Requires ~$1.1 Billion of Investment to Maintain Safe and Reliable Service and Enhance Grid How our Customers benefit Continued reliability and safety Shorter power outages Fewer estimated customer bills More control over energy use Supports approximately 1,000 jobs annually How the Community benefits Generates approx. $20 million in state and local government tax revenue effects through 2023 Results in an economic impact of $640 million over the 7‐year period Faster response when turning electric service on and off Vectren | NY/Boston Investor Meetings | May 201717

2015 Generation Mix (MWhs) Energy Efficiency, Renewables, Other 10% Coal Base Load 90% 50% reduction in carbon emissions by 2024 from 2012 levels and 60% reduction in carbon emissions from 2005 Renewables and ongoing Energy Efficiency account for approximately ~15% of total energy by 2026 Diversification provides flexibility to adapt to changes in customer needs and technology IRP Preferred Plan was filed with the IN Commission in Dec. 2016 Generation Diversification Integrated Resource Plan Benefits All Stakeholders How our Customers benefit Add 54MW of solar generation by 2019 Add ~900MW combined cycle gas plant to portfolio by 2024 Continue energy efficiency / demand response initiatives 2026 Generation Mix (MWhs) Energy Efficiency, Renewables, Other 15% Coal Base Load 30% Natural Gas 55% Vectren | NY/Boston Investor Meetings | May 201718

Financing Utility Investment Long history of high investment‐grade credit ratings will continue • Current S&P rating of A‐ (VVC), Moody’s rating of A2 (VUHI); Both stable Utility funds ~85‐90% of Vectren’s dividend; Continue to target utility payout of 70% Appropriate mix of long‐term debt and equity as needed • Significant cash flow from operations and enhanced by use of timely recovery through regulatory mechanisms • Nonutility cash flow also to be utilized as available to fund CapEx plan at utility • Appropriate mix of financing to be employed to maintain adequate regulatory capital structure and maintain solid credit metrics • Expectations for the next 5 years: o Cash from operations of $2.0‐2.5B o Incremental utility long‐term debt of ~$800M o Transfer of available cash flow from nonutility of $100‐200M o 6‐8% EPS growth target fully considers likely equity needs as generation investment begins to accelerate Evaluation of timing and possible use of equity forwards for any needed equity financing is ongoing • Tax reform could impact timing and size of financing needs Financing Goals Remain Unchanged: Strong Balance Sheet & Cap Structures, No Incremental Utility Parent Leverage Vectren | NY/Boston Investor Meetings | May 201719

Corporate Tax Reform Assuming loss of interest deductibility, full expensing of CapEx, and a 20% corporate tax rate: Expect that utility rates will be reset to reflect any reduction in tax expense • Any favorable nonutility impact likely reflected in competitive bidding activity going forward Revaluation of existing deferred taxes would occur at effective date of new tax rate • Utility impacts reflected as amounts due to customer • Nonutility impacts would be favorable at implementation Very little parent co. debt limits recurring exposure to loss of interest deductibility Loss of AMT credit carryforward would be expected at effective date of the new tax rate, partially offset by revaluation of existing nonutility deferred taxes Cash flow benefits from full CapEx expensing when investment ramps up later in the 10‐yr forecast period No impact to long‐term growth targets expected Proposed Tax Reform Not Expected to Materially Impact Long‐Term Outlook Vectren | NY/Boston Investor Meetings | May 201720

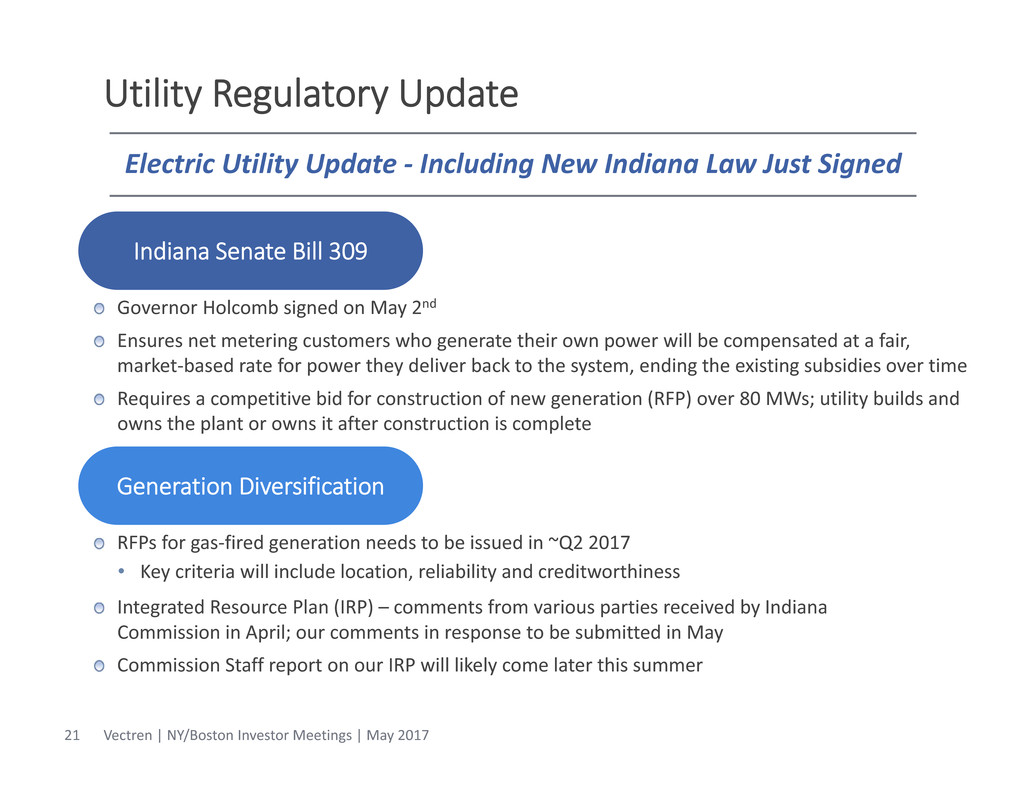

Utility Regulatory Update 21 RFPs for gas‐fired generation needs to be issued in ~Q2 2017 • Key criteria will include location, reliability and creditworthiness Integrated Resource Plan (IRP) – comments from various parties received by Indiana Commission in April; our comments in response to be submitted in May Commission Staff report on our IRP will likely come later this summer Governor Holcomb signed on May 2nd Ensures net metering customers who generate their own power will be compensated at a fair, market‐based rate for power they deliver back to the system, ending the existing subsidies over time Requires a competitive bid for construction of new generation (RFP) over 80 MWs; utility builds and owns the plant or owns it after construction is complete Indiana Senate Bill 309 Generation Diversification Electric Utility Update ‐ Including New Indiana Law Just Signed Vectren | NY/Boston Investor Meetings | May 2017

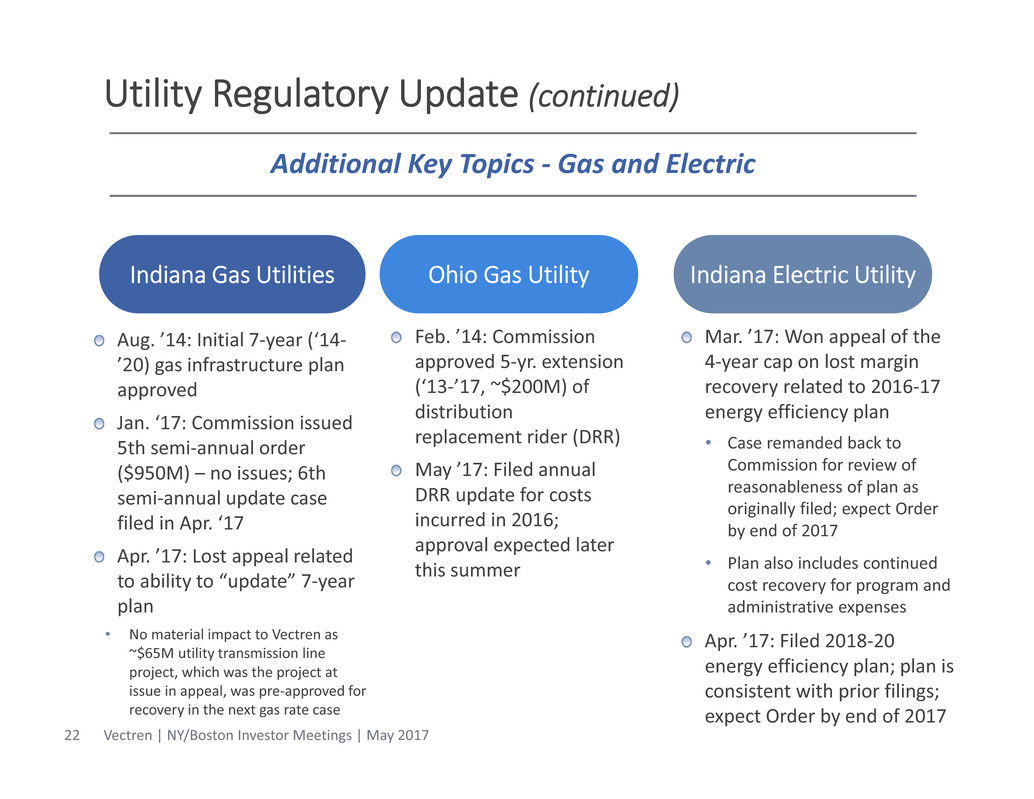

Utility Regulatory Update (continued) 22 Feb. ’14: Commission approved 5‐yr. extension (‘13‐’17, ~$200M) of distribution replacement rider (DRR) May ’17: Filed annual DRR update for costs incurred in 2016; approval expected later this summer Aug. ’14: Initial 7‐year (‘14‐ ’20) gas infrastructure plan approved Jan. ‘17: Commission issued 5th semi‐annual order ($950M) – no issues; 6th semi‐annual update case filed in Apr. ‘17 Apr. ’17: Lost appeal related to ability to “update” 7‐year plan • No material impact to Vectren as ~$65M utility transmission line project, which was the project at issue in appeal, was pre‐approved for recovery in the next gas rate case Indiana Gas Utilities Ohio Gas Utility Indiana Electric Utility Mar. ’17: Won appeal of the 4‐year cap on lost margin recovery related to 2016‐17 energy efficiency plan • Case remanded back to Commission for review of reasonableness of plan as originally filed; expect Order by end of 2017 • Plan also includes continued cost recovery for program and administrative expenses Apr. ’17: Filed 2018‐20 energy efficiency plan; plan is consistent with prior filings; expect Order by end of 2017 Additional Key Topics ‐ Gas and Electric Vectren | NY/Boston Investor Meetings | May 2017

Anticipated Timeline for Near‐Term Regulatory Activity 23 Limited Base Rate Activity Expected for Next Several Years 7-Year (’17-’23) Electric Grid Modernization Plan Filed w/ IN Commission February 2017 Key Activities IN Commission Approved 5th Semi-Annual Gas Infrastructure Filing January 2017 File Ohio Base Rate Case Q1 2018; Order likely in early 2019 IRP Filed w/ IN Commission December 2016 IN Commission Staff Comments on IRP Due ~Summer 2017 Issue RFPs for Electric Supply Needs ~Q2 2017 Cert. of Public Need for Electric Supply Needs Filed w/ IN Commission ~Q4 2017; Order likely in early 2019 Key Observations: Recovery mechanisms allow for timely recovery of investments and costs requiring fewer base rate cases Rate cases to be filed as required by mechanisms/legislation and unlikely before • OH Gas base rate case to be filed in 2018 • IN Gas base rate case to be filed in 2020 • IN Electric base rate case to be filed in 2023 4MW Universal Solar Plan Filed w/ IN Commission February 2017 IN Commission Order on 7-Year (’17-’23) Electric Grid Modernization Plan Due ~September 2017 Vectren | NY/Boston Investor Meetings | May 2017

Favorable Utility Environments Constructive Regulatory and Legislative Environments in Indiana & Ohio Support Required Capital Investment Electric IN-South IN-North Ohio IN-South Infrastructure Investment Recovery (1) Infrastructure Recovery of Federal Mandates Under SB 251 Environmental CapEx Recovery Under SB 29 Non-DRR CapEx Deferral Under House Bill 95 Decoupling or Lost Margin Recovery Margin Straight Fixed Variable Rate Design Normal Temperature Adjustment Gas Cost and Fuel Cost Recovery Unaccounted for Gas Costs Bad Debt Expense DSM/Energy Efficiency/MISO Transmission Costs DRR: Distribution Replacement Rider DSM: Demand Side Management (1) Under SB 560 in Indiana; Under DRR in Ohio Gas Vectren | NY/Boston Investor Meetings | May 201724

Nonutility Infrastructure Services (VISCO) Performance Contracting Sustainable Infrastructure Projects Energy Services (VESCO) Distribution Pipeline Construction Transmission Pipeline Construction Nonutility Outlook

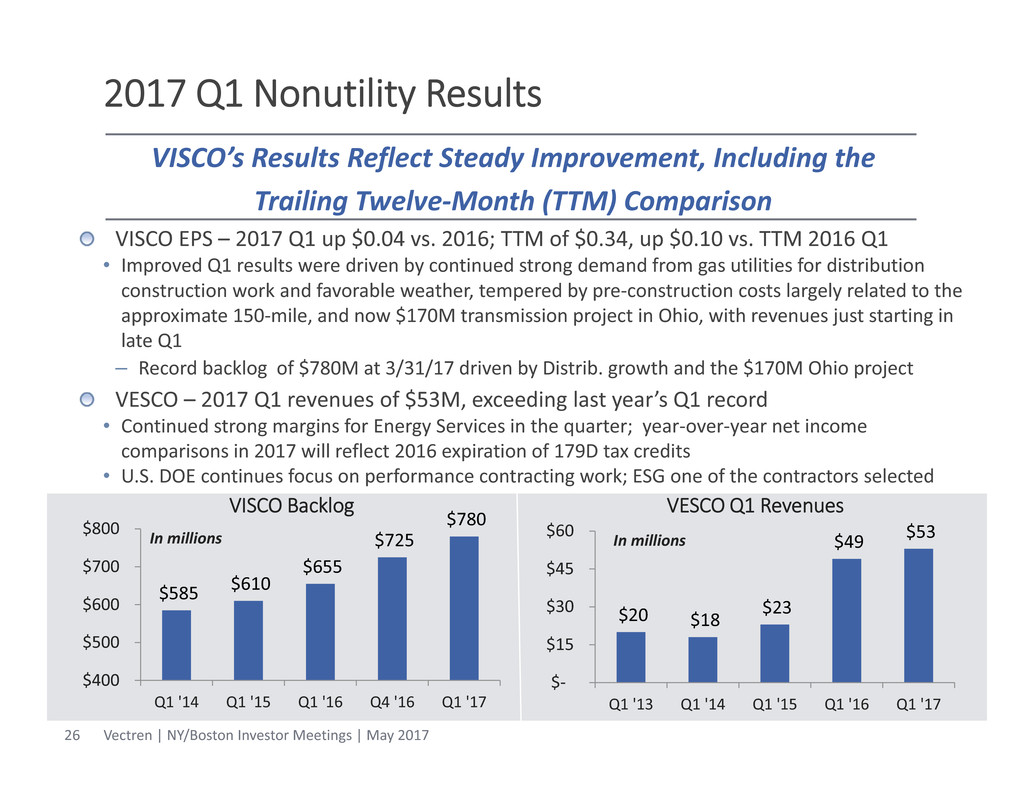

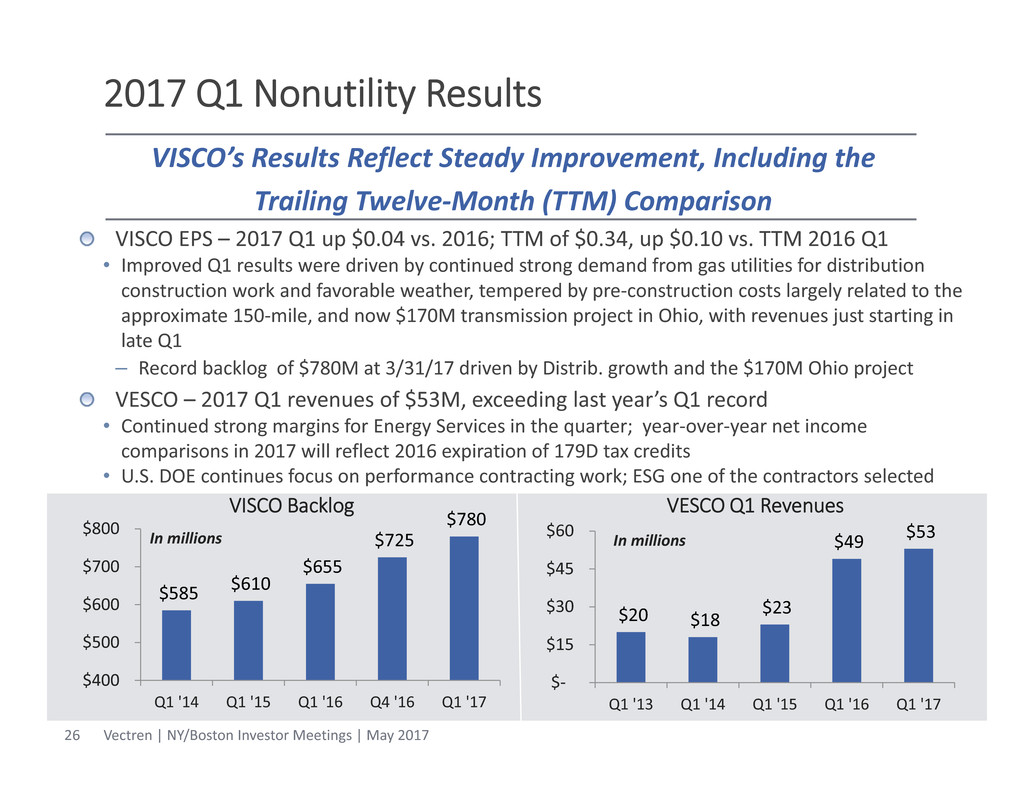

$20 $18 $23 $49 $53 $‐ $15 $30 $45 $60 Q1 '13 Q1 '14 Q1 '15 Q1 '16 Q1 '17 In millions 2017 Q1 Nonutility Results VISCO EPS – 2017 Q1 up $0.04 vs. 2016; TTM of $0.34, up $0.10 vs. TTM 2016 Q1 • Improved Q1 results were driven by continued strong demand from gas utilities for distribution construction work and favorable weather, tempered by pre‐construction costs largely related to the approximate 150‐mile, and now $170M transmission project in Ohio, with revenues just starting in late Q1 – Record backlog of $780M at 3/31/17 driven by Distrib. growth and the $170M Ohio project VESCO – 2017 Q1 revenues of $53M, exceeding last year’s Q1 record • Continued strong margins for Energy Services in the quarter; year‐over‐year net income comparisons in 2017 will reflect 2016 expiration of 179D tax credits • U.S. DOE continues focus on performance contracting work; ESG one of the contractors selected $585 $610 $655 $725 $780 $400 $500 $600 $700 $800 Q1 '14 Q1 '15 Q1 '16 Q4 '16 Q1 '17 In millions VISCO Backlog 26 VESCO Q1 Revenues VISCO’s Results Reflect Steady Improvement, Including the Trailing Twelve‐Month (TTM) Comparison Vectren | NY/Boston Investor Meetings | May 2017

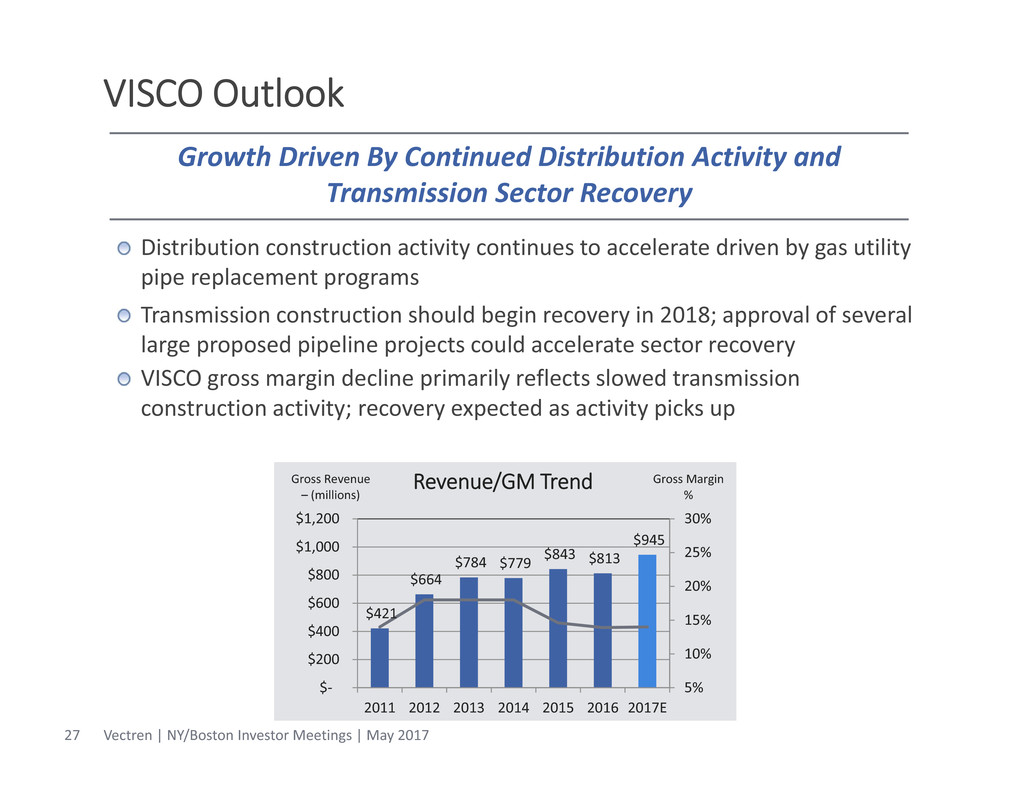

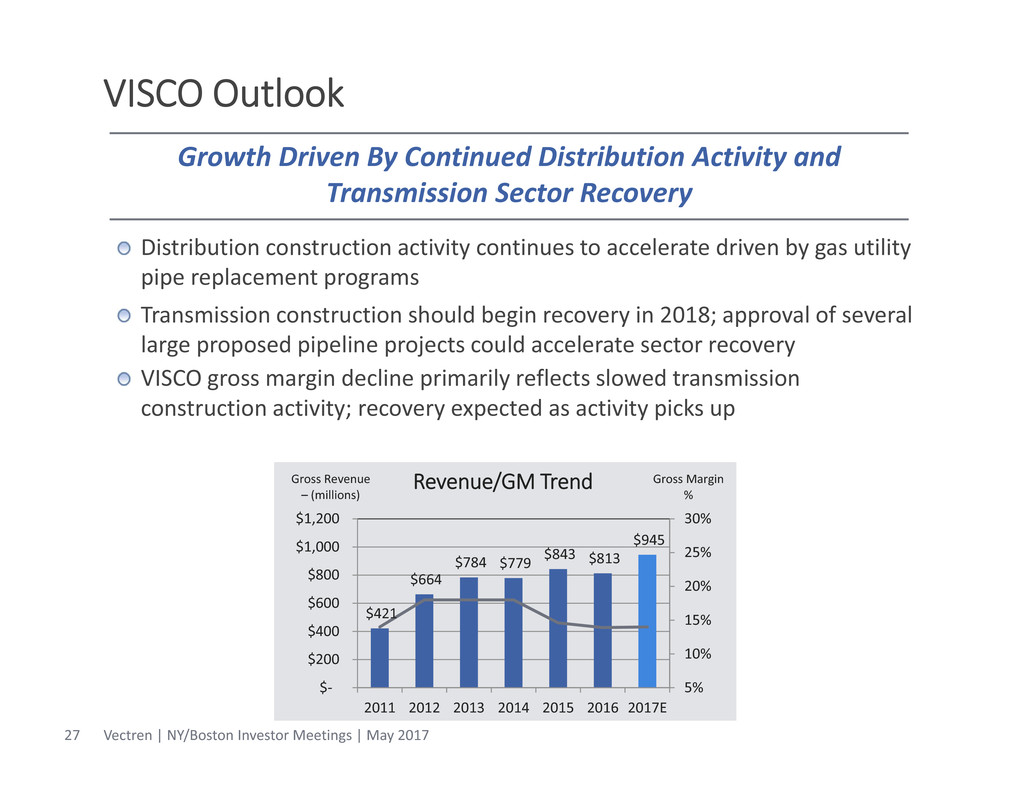

VISCO Outlook Distribution construction activity continues to accelerate driven by gas utility pipe replacement programs Transmission construction should begin recovery in 2018; approval of several large proposed pipeline projects could accelerate sector recovery VISCO gross margin decline primarily reflects slowed transmission construction activity; recovery expected as activity picks up Growth Driven By Continued Distribution Activity and Transmission Sector Recovery $421 $664 $784 $779 $843 $813 $945 5% 10% 15% 20% 25% 30% $‐ $200 $400 $600 $800 $1,000 $1,200 2011 2012 2013 2014 2015 2016 2017E Gross Margin % Gross Revenue – (millions) Revenue/GM Trend Vectren | NY/Boston Investor Meetings | May 201727

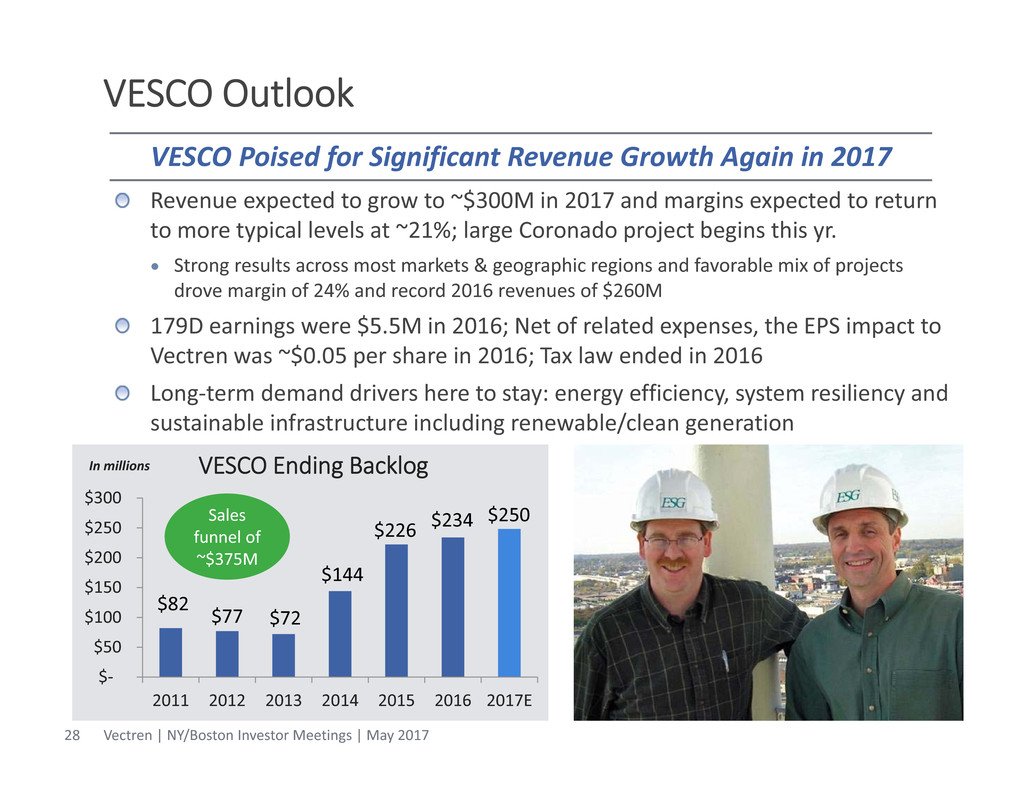

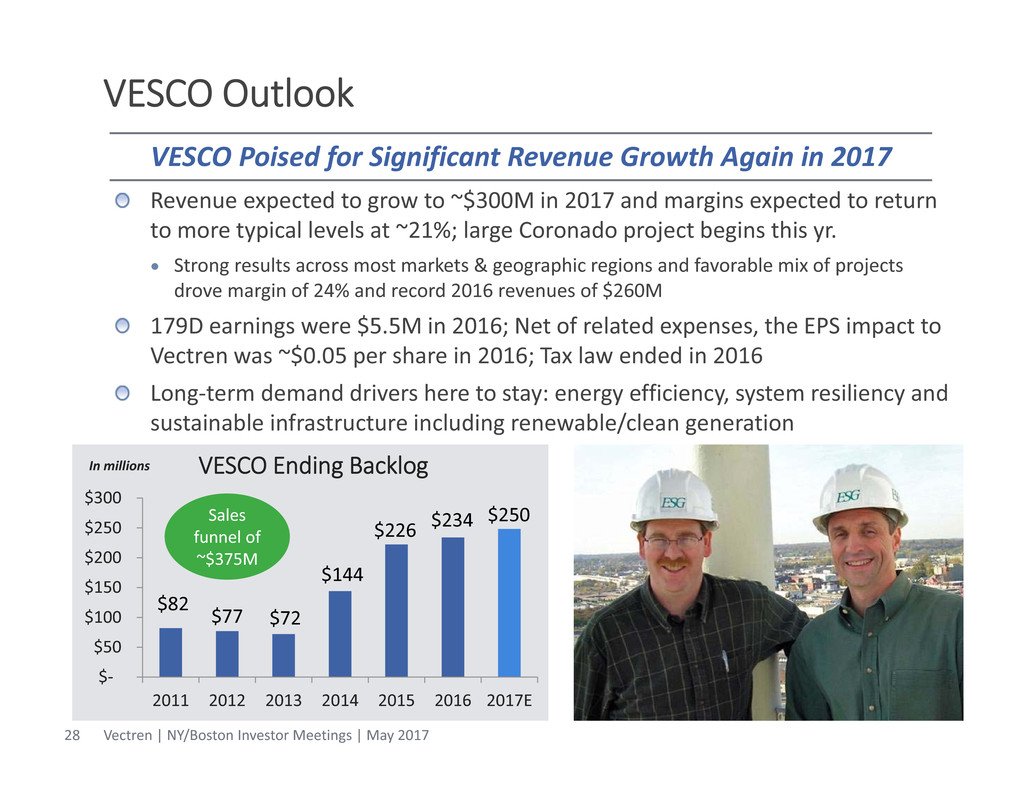

VESCO Outlook Revenue expected to grow to ~$300M in 2017 and margins expected to return to more typical levels at ~21%; large Coronado project begins this yr. Strong results across most markets & geographic regions and favorable mix of projects drove margin of 24% and record 2016 revenues of $260M 179D earnings were $5.5M in 2016; Net of related expenses, the EPS impact to Vectren was ~$0.05 per share in 2016; Tax law ended in 2016 Long‐term demand drivers here to stay: energy efficiency, system resiliency and sustainable infrastructure including renewable/clean generation $82 $77 $72 $144 $226 $234 $250 $‐ $50 $100 $150 $200 $250 $300 2011 2012 2013 2014 2015 2016 2017E In millions VESCO Ending Backlog VESCO Poised for Significant Revenue Growth Again in 2017 Sales funnel of ~$375M Vectren | NY/Boston Investor Meetings | May 201728

Closing Remarks

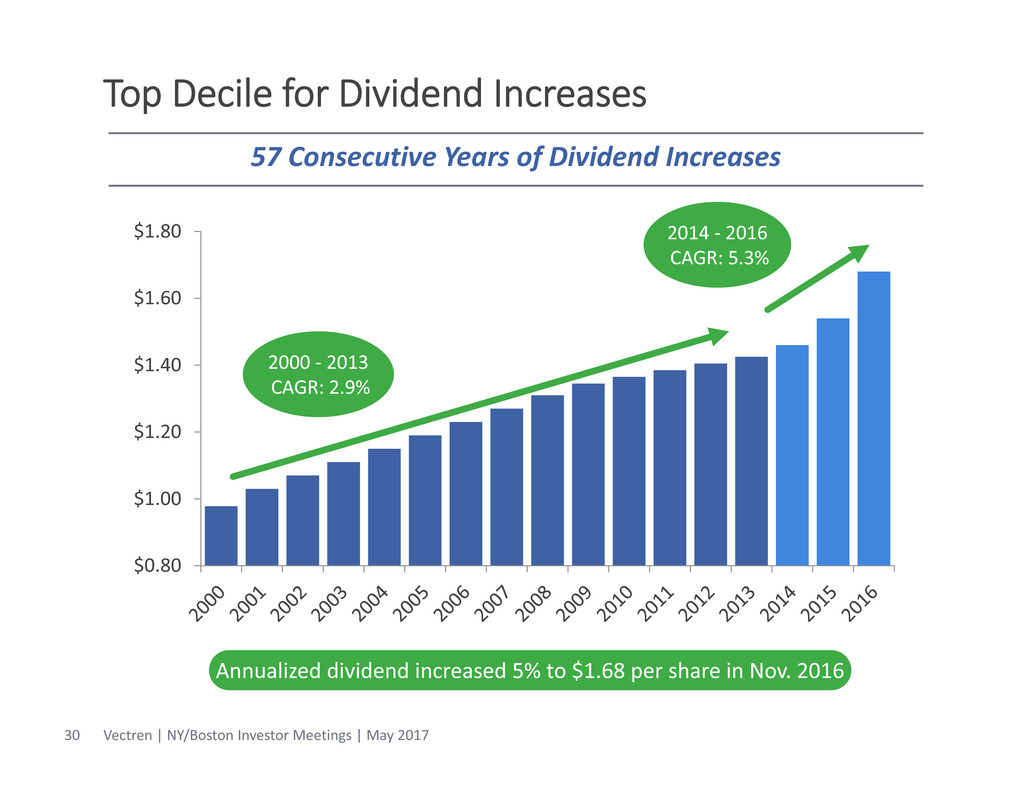

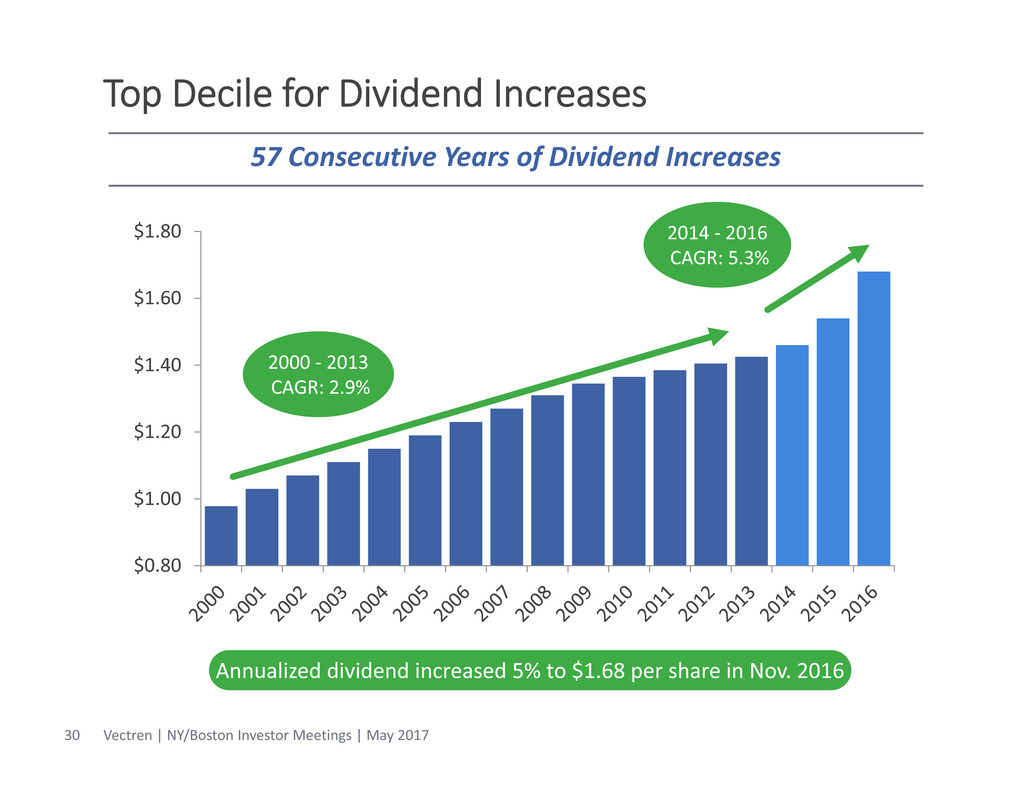

Top Decile for Dividend Increases $0.80 $1.00 $1.20 $1.40 $1.60 $1.80 2014 ‐ 2016 CAGR: 5.3% 2000 ‐ 2013 CAGR: 2.9% Annualized dividend increased 5% to $1.68 per share in Nov. 2016 57 Consecutive Years of Dividend Increases Vectren | NY/Boston Investor Meetings | May 201730

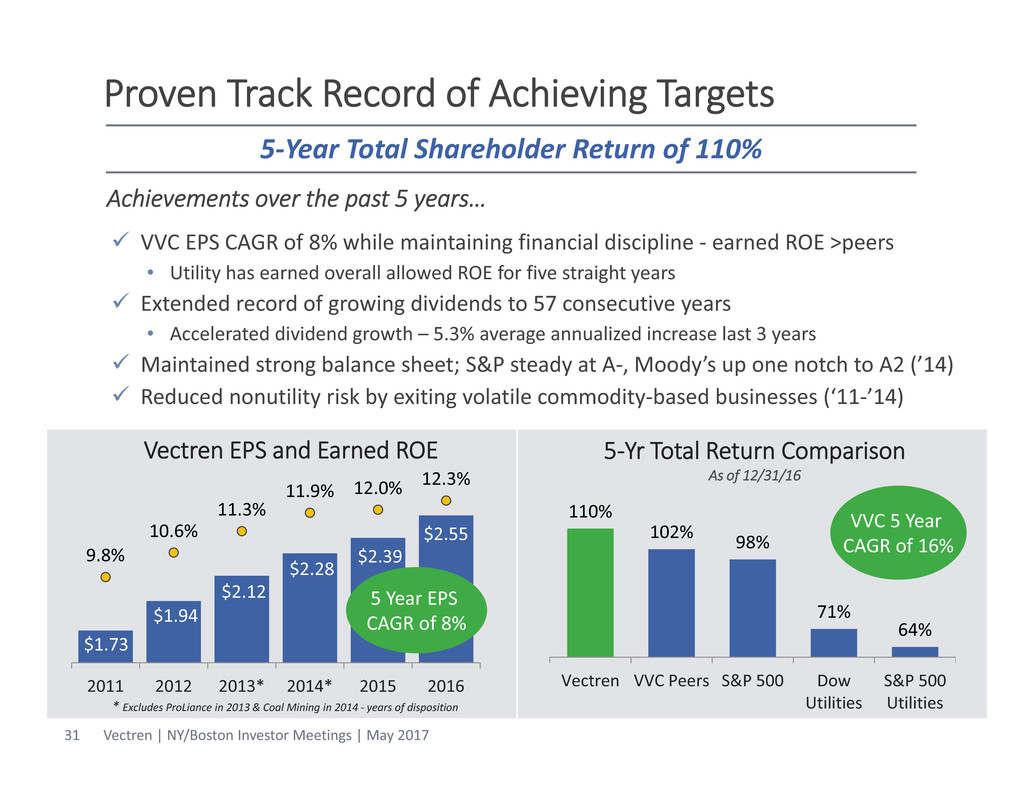

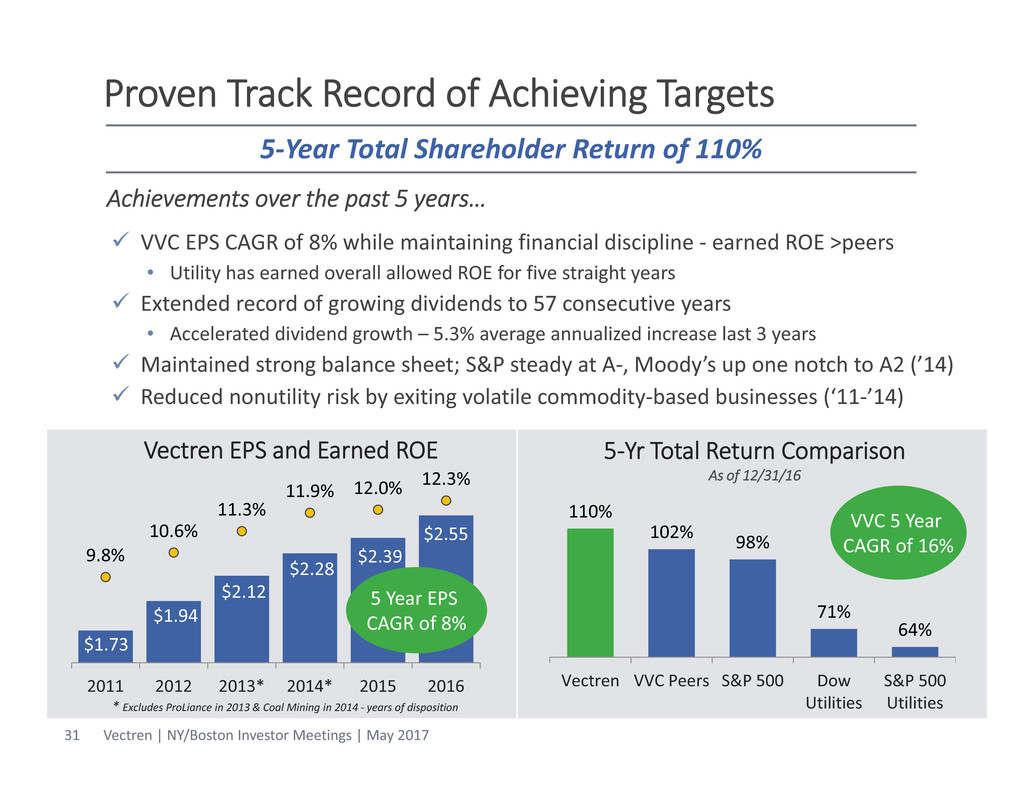

Proven Track Record of Achieving Targets Achievements over the past 5 years… VVC EPS CAGR of 8% while maintaining financial discipline ‐ earned ROE >peers • Utility has earned overall allowed ROE for five straight years Extended record of growing dividends to 57 consecutive years • Accelerated dividend growth – 5.3% average annualized increase last 3 years Maintained strong balance sheet; S&P steady at A‐, Moody’s up one notch to A2 (’14) Reduced nonutility risk by exiting volatile commodity‐based businesses (‘11‐’14) $1.73 $1.94 $2.12 $2.28 $2.39 $2.55 9.8% 10.6% 11.3% 11.9% 12.0% 12.3% 2011 2012 2013* 2014* 2015 2016 * Excludes ProLiance in 2013 & Coal Mining in 2014 ‐ years of disposition Vectren EPS and Earned ROE 5 Year EPS CAGR of 8% 5‐Yr Total Return Comparison As of 12/31/16 5‐Year Total Shareholder Return of 110% VVC 5 Year CAGR of 16% 110% 102% 98% 71% 64% Vectren VVC Peers S&P 500 Dow Utilities S&P 500 Utilities Vectren | NY/Boston Investor Meetings | May 201731

Vectren’s Long‐Term Outlook Improves Again Long‐Term Targets Consolidated EPS growth 6‐8% Dividend growth 6‐8% Consolidated payout ratio 60‐65% Utility EPS growth 5‐7% Note: Long‐term EPS growth of approx. $0.06‐0.10/yr. for Nonutility $1.73 $2.55 $2.60 $1.70 $2.20 $2.70 $3.20 $3.70 2011 2016 2017E Future EPS VVC Actual and Expected EPS Growth Long‐Term EPS CAGR: 6‐8% 2011‐2026 CAGR: 6‐8% 2011‐2017E CAGR: 7% EPS and Dividend Growth Targets Reflect Long‐Term Utility Capital Investment Plan of $6.5 Billion Vectren | NY/Boston Investor Meetings | May 201732

Appendix

2016 Highlights Vectren consolidated 2016 EPS of $2.55 • Utility EPS of $2.10, up 7.7% compared to 2015 • Favorable weather impacted EPS $0.02 vs. normal Strong utility earnings growth driven by gas infrastructure investment programs and margin growth from large customers Utility earned overall allowed ROE for the 5th year in a row Filed Integrated Resource Plan (IRP) in December 2016 Record year of earnings for VESCO and VISCO Distribution Dividend increased 5% in Nov. 2016 to $1.68/sh., annualized • 57 consecutive years of dividend increases $2.39 $0.15 Flat $0.01 $2.55 2015 Actual Utility Corp & Other Nonutility 2016 Actual Vectren Consolidated EPS Vectren Utility EPS Another Year of Consistent Earnings Growth; 2016 EPS Up 6.7% $1.95 $2.10$0.13 $0.02 Weather 2015 Actual 2016 Actual Infrastr. Investment Appendix Vectren | NY/Boston Investor Meetings | May 201734

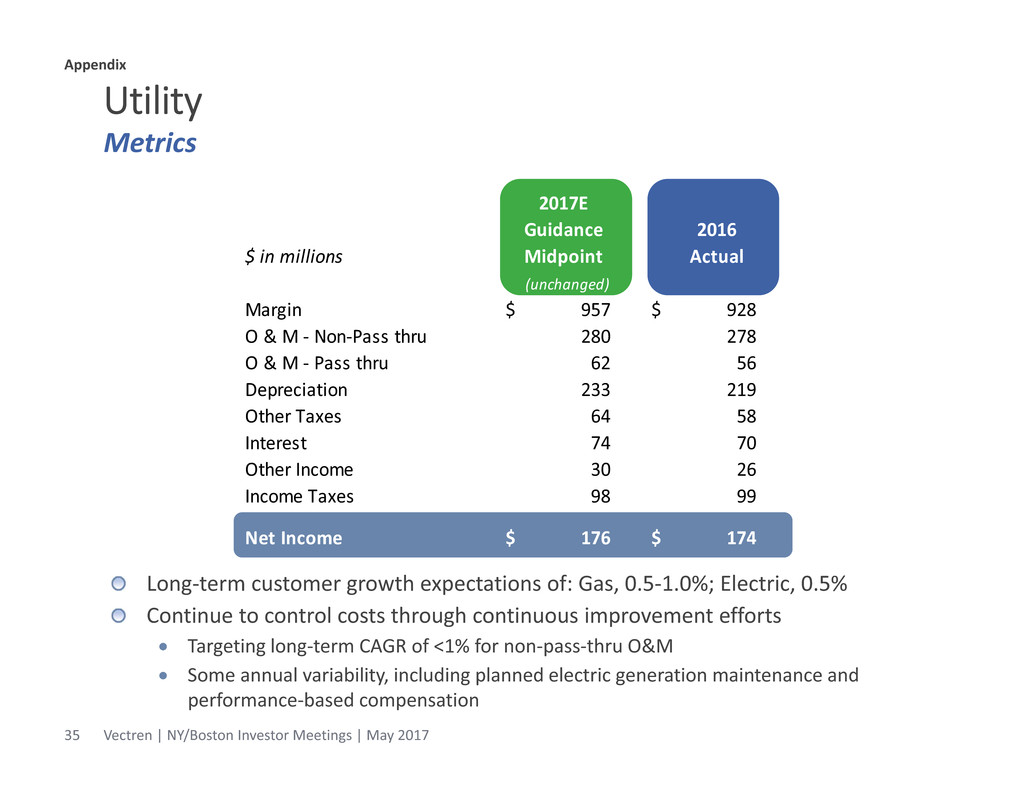

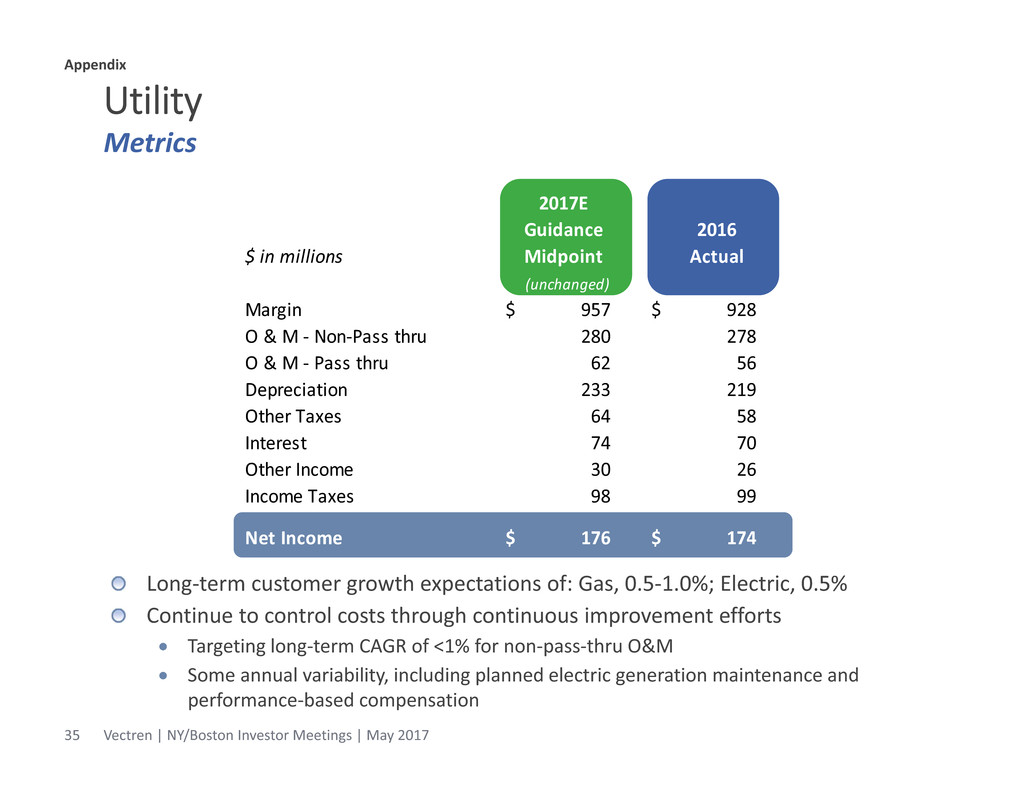

2017E Guidance 2016 $ in millions Midpoint Actual (unchanged) Margin 957$ 928$ O & M ‐ Non‐Pass thru 280 278 O & M ‐ Pass thru 62 56 Depreciation 233 219 Other Taxes 64 58 Interest 74 70 Other Income 30 26 Income Taxes 98 99 Net Income 176$ 174$ Utility Long‐term customer growth expectations of: Gas, 0.5‐1.0%; Electric, 0.5% Continue to control costs through continuous improvement efforts Targeting long‐term CAGR of <1% for non‐pass‐thru O&M Some annual variability, including planned electric generation maintenance and performance‐based compensation Metrics Appendix Vectren | NY/Boston Investor Meetings | May 201735

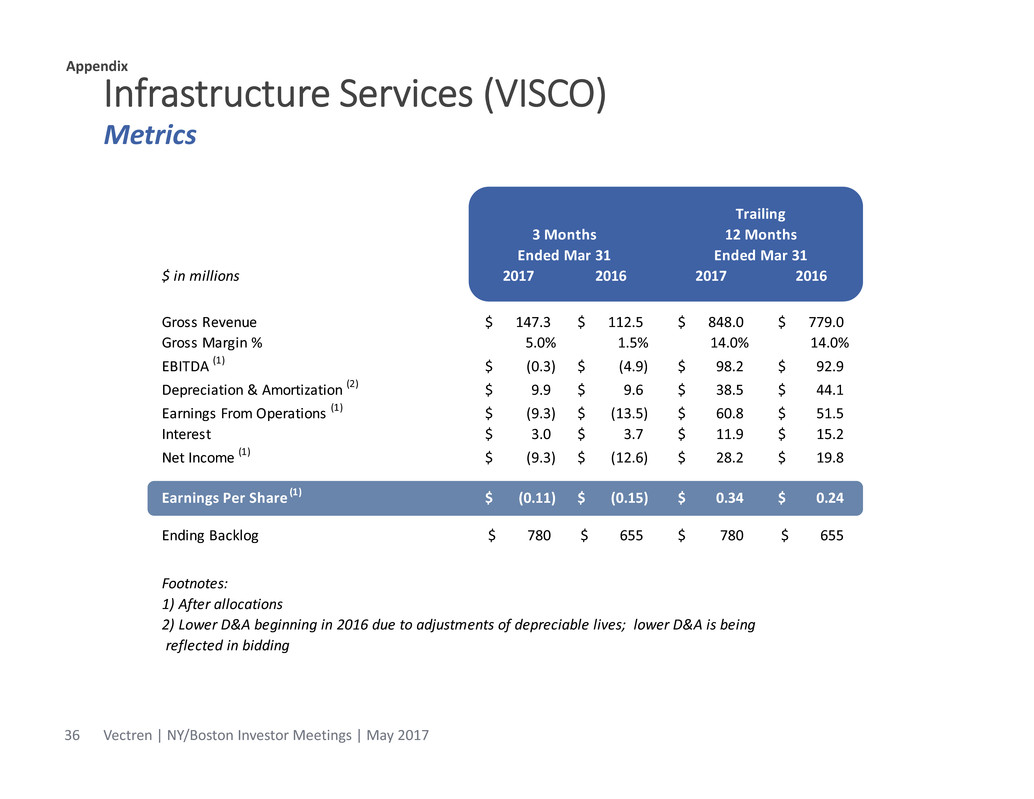

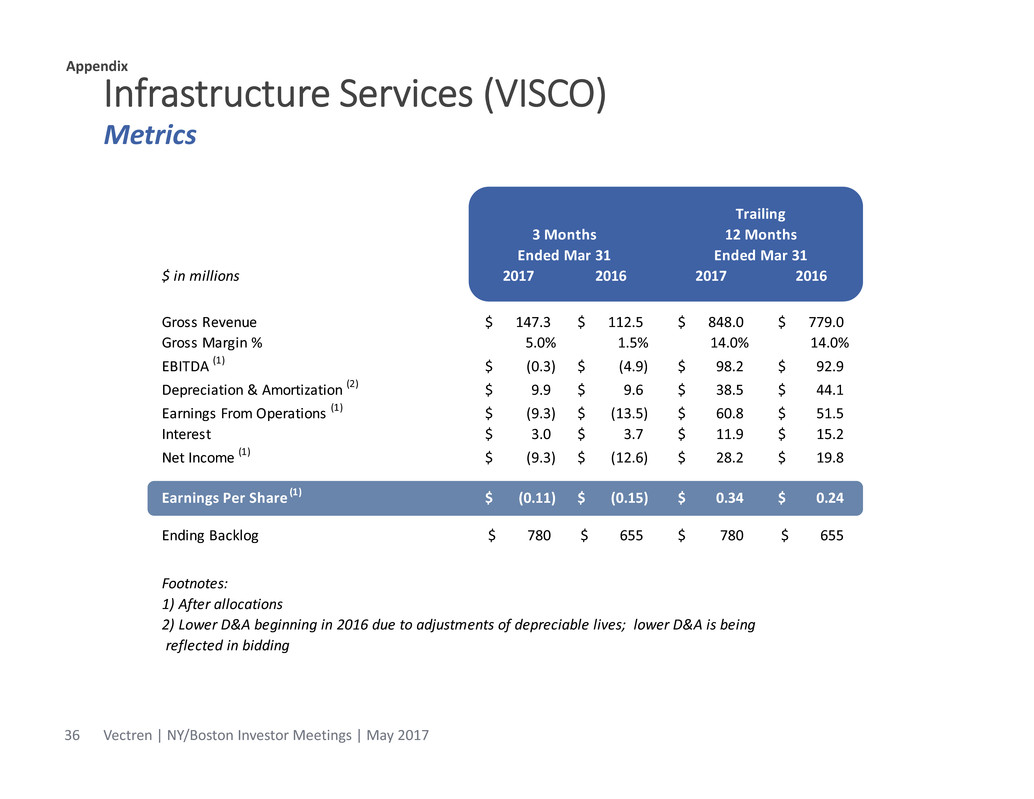

Infrastructure Services (VISCO) Metrics Appendix $ in millions 2017 2016 2017 2016 Gross Revenue 147.3$ 112.5$ 848.0$ 779.0$ Gross Margin % 5.0% 1.5% 14.0% 14.0% EBITDA (1) (0.3)$ (4.9)$ 98.2$ 92.9$ Depreciation & Amortization (2) 9.9$ 9.6$ 38.5$ 44.1$ Earnings From Operations (1) (9.3)$ (13.5)$ 60.8$ 51.5$ Interest 3.0$ 3.7$ 11.9$ 15.2$ Net Income (1) (9.3)$ (12.6)$ 28.2$ 19.8$ Earnings Per Share (1) (0.11)$ (0.15)$ 0.34$ 0.24$ Ending Backlog 780$ 655$ 780$ 655$ Footnotes: Trailing reflected in bidding Ended Mar 31 3 Months 12 Months Ended Mar 31 1) After allocations 2) Lower D&A beginning in 2016 due to adjustments of depreciable lives; lower D&A is being Vectren | NY/Boston Investor Meetings | May 201736

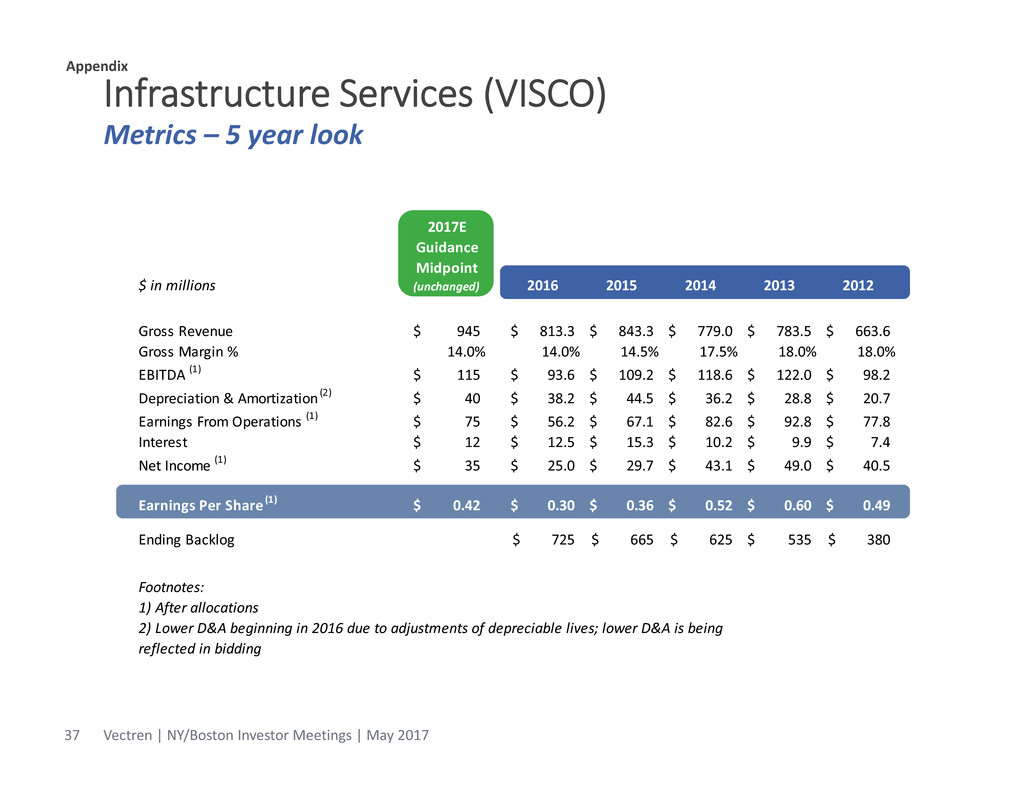

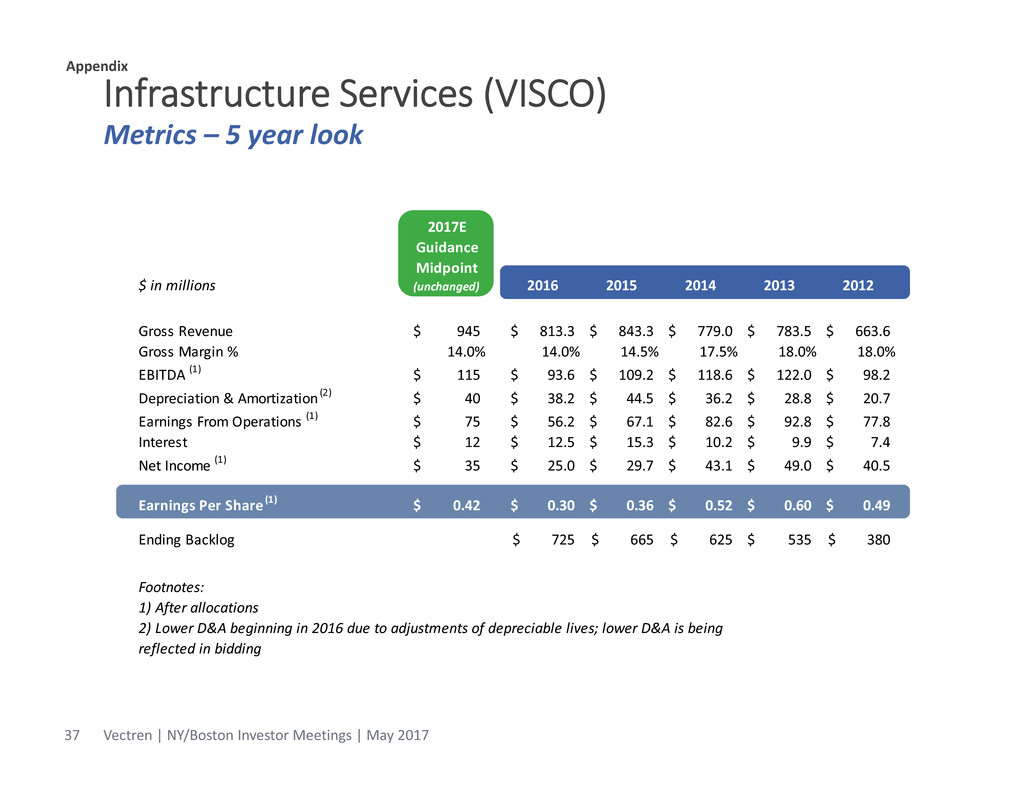

Infrastructure Services (VISCO) Metrics – 5 year look Appendix 2017E Guidance Midpoint $ in millions (unchanged) 2016 2015 2014 2013 2012 Gross Revenue 945$ 813.3$ 843.3$ 779.0$ 783.5$ 663.6$ Gross Margin % 14.0% 14.0% 14.5% 17.5% 18.0% 18.0% EBITDA (1) 115$ 93.6$ 109.2$ 118.6$ 122.0$ 98.2$ Depreciation & Amortization (2) 40$ 38.2$ 44.5$ 36.2$ 28.8$ 20.7$ Earnings From Operations (1) 75$ 56.2$ 67.1$ 82.6$ 92.8$ 77.8$ Interest 12$ 12.5$ 15.3$ 10.2$ 9.9$ 7.4$ Net Income (1) 35$ 25.0$ 29.7$ 43.1$ 49.0$ 40.5$ Earnings Per Share (1) 0.42$ 0.30$ 0.36$ 0.52$ 0.60$ 0.49$ Ending Backlog 725$ 665$ 625$ 535$ 380$ Footnotes: 2) Lower D&A beginning in 2016 due to adjustments of depreciable lives; lower D&A is being reflected in bidding 1) After allocations Vectren | NY/Boston Investor Meetings | May 201737

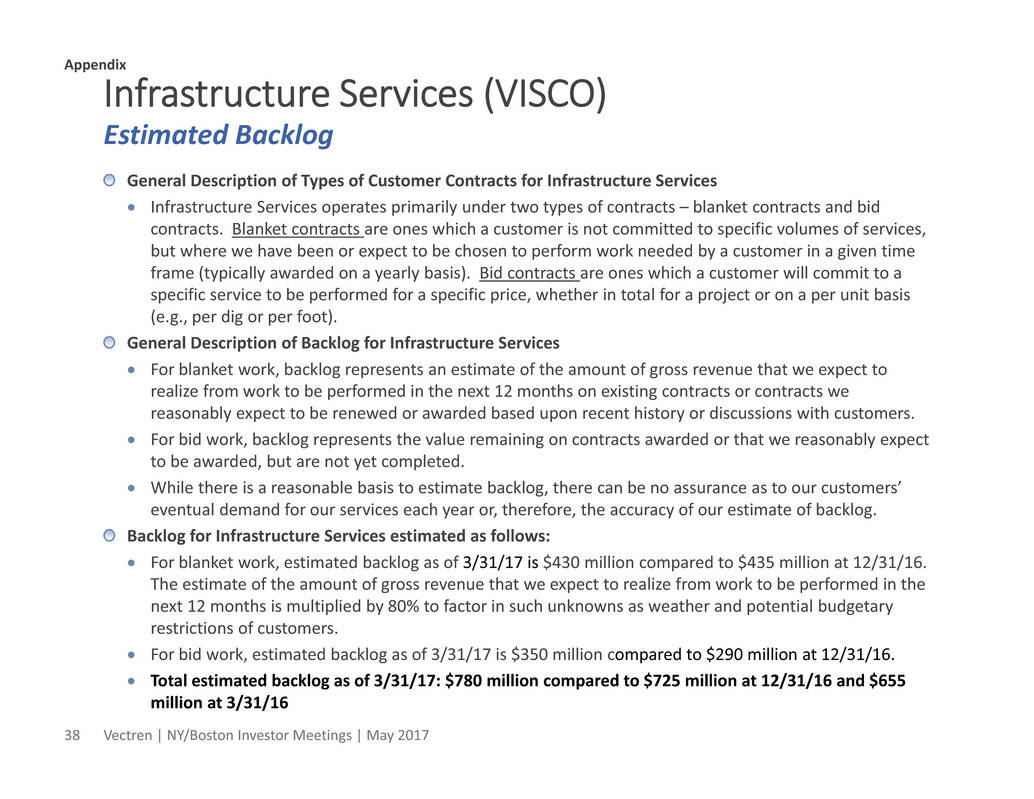

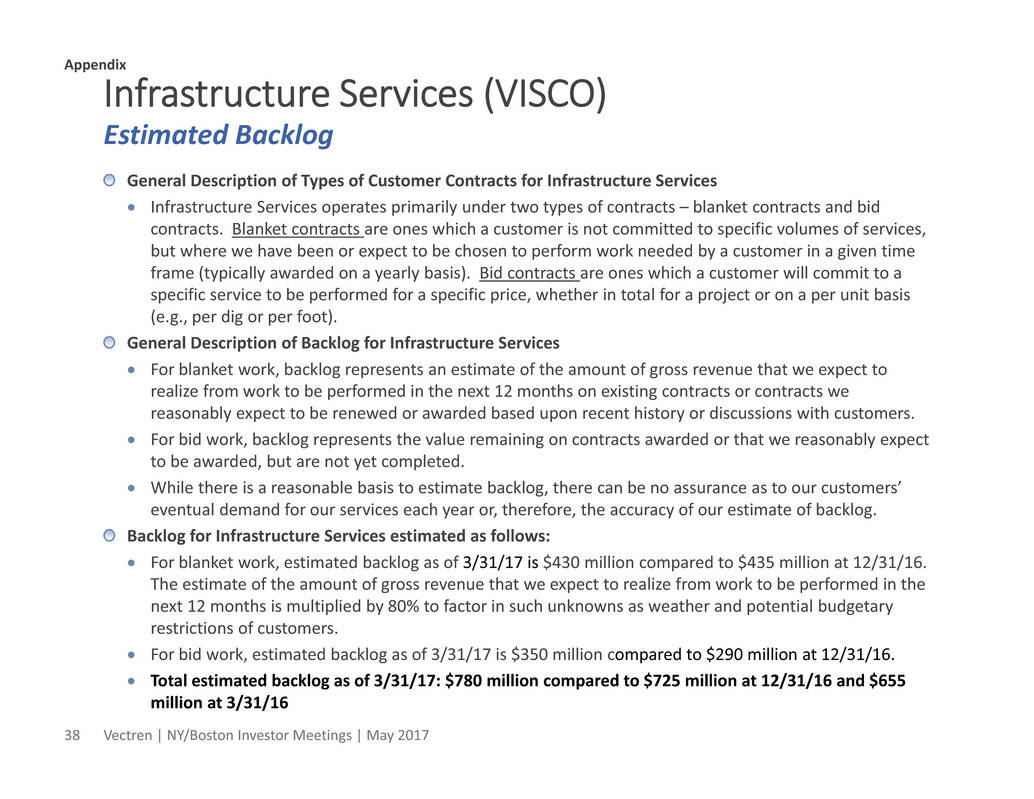

Infrastructure Services (VISCO) General Description of Types of Customer Contracts for Infrastructure Services Infrastructure Services operates primarily under two types of contracts – blanket contracts and bid contracts. Blanket contracts are ones which a customer is not committed to specific volumes of services, but where we have been or expect to be chosen to perform work needed by a customer in a given time frame (typically awarded on a yearly basis). Bid contracts are ones which a customer will commit to a specific service to be performed for a specific price, whether in total for a project or on a per unit basis (e.g., per dig or per foot). General Description of Backlog for Infrastructure Services For blanket work, backlog represents an estimate of the amount of gross revenue that we expect to realize from work to be performed in the next 12 months on existing contracts or contracts we reasonably expect to be renewed or awarded based upon recent history or discussions with customers. For bid work, backlog represents the value remaining on contracts awarded or that we reasonably expect to be awarded, but are not yet completed. While there is a reasonable basis to estimate backlog, there can be no assurance as to our customers’ eventual demand for our services each year or, therefore, the accuracy of our estimate of backlog. Backlog for Infrastructure Services estimated as follows: For blanket work, estimated backlog as of 3/31/17 is $430 million compared to $435 million at 12/31/16. The estimate of the amount of gross revenue that we expect to realize from work to be performed in the next 12 months is multiplied by 80% to factor in such unknowns as weather and potential budgetary restrictions of customers. For bid work, estimated backlog as of 3/31/17 is $350 million compared to $290 million at 12/31/16. Total estimated backlog as of 3/31/17: $780 million compared to $725 million at 12/31/16 and $655 million at 3/31/16 Estimated Backlog Appendix Vectren | NY/Boston Investor Meetings | May 201738

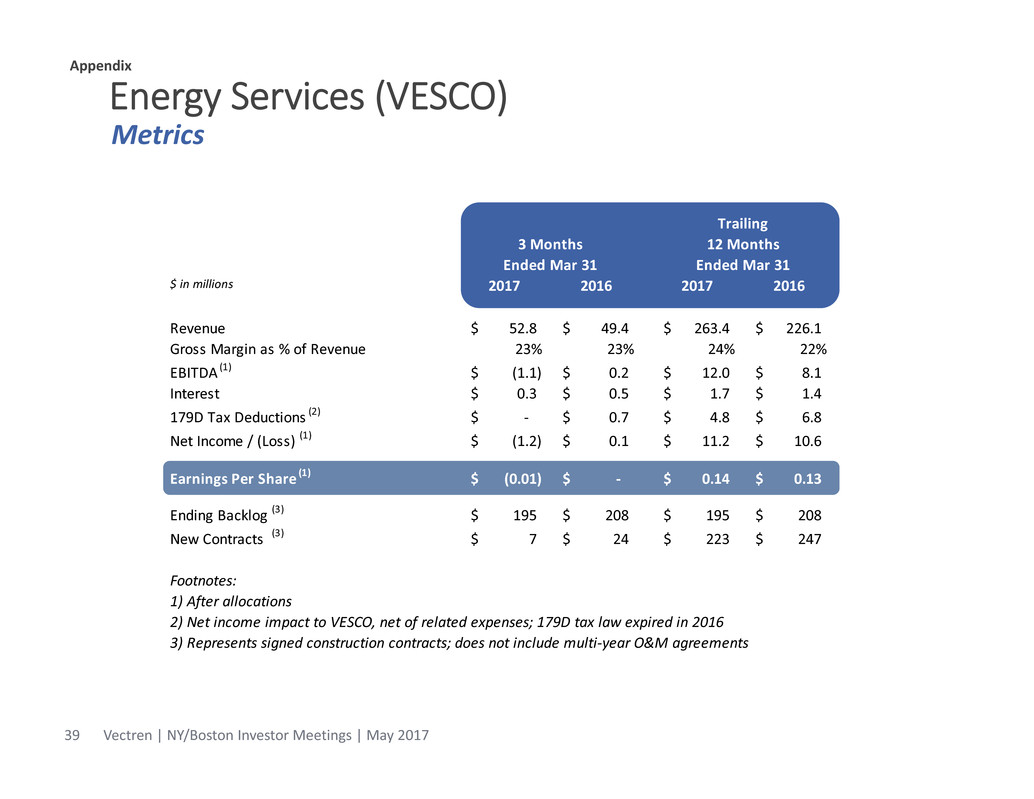

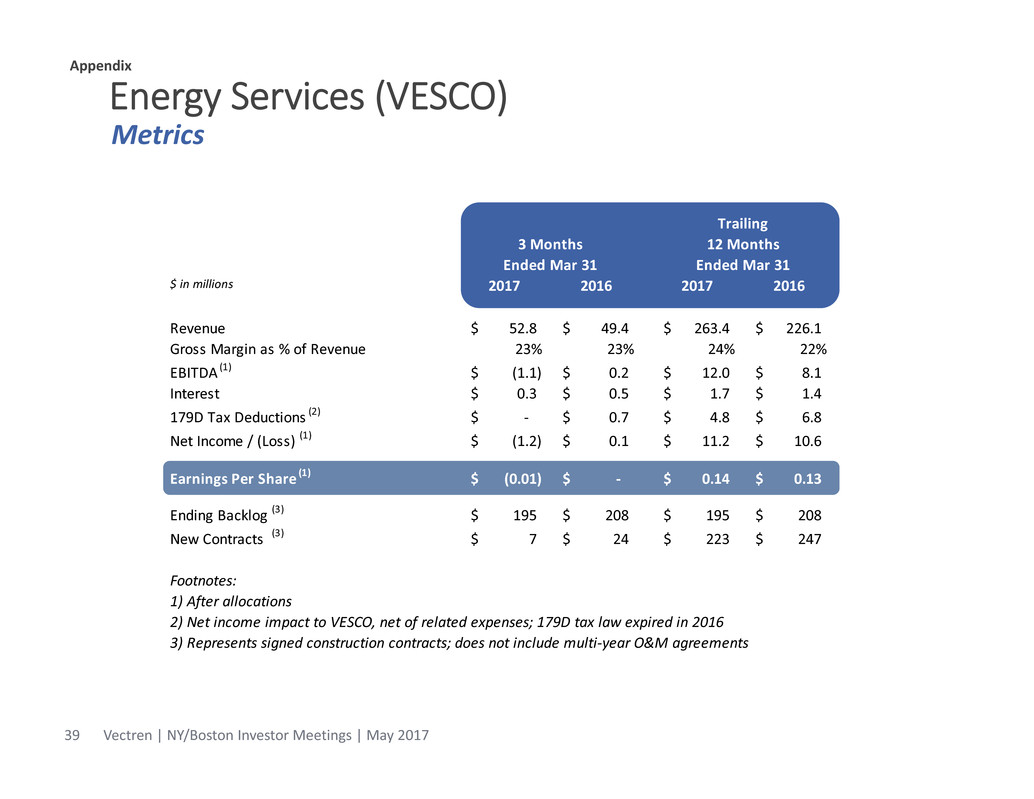

Energy Services (VESCO) Metrics Appendix $ in millions 2017 2016 2017 2016 Revenue 52.8$ 49.4$ 263.4$ 226.1$ Gross Margin as % of Revenue 23% 23% 24% 22% EBITDA (1) (1.1)$ 0.2$ 12.0$ 8.1$ Interest 0.3$ 0.5$ 1.7$ 1.4$ 179D Tax Deductions (2) ‐$ 0.7$ 4.8$ 6.8$ Net Income / (Loss) (1) (1.2)$ 0.1$ 11.2$ 10.6$ Earnings Per Share (1) (0.01)$ ‐$ 0.14$ 0.13$ Ending Backlog (3) 195$ 208$ 195$ 208$ New Contracts (3) 7$ 24$ 223$ 247$ Footnotes: 3) Represents signed construction contracts; does not include multi‐year O&M agreements Trailing 1) After allocations 2) Net income impact to VESCO, net of related expenses; 179D tax law expired in 2016 12 Months Ended Mar 31 3 Months Ended Mar 31 Vectren | NY/Boston Investor Meetings | May 201739

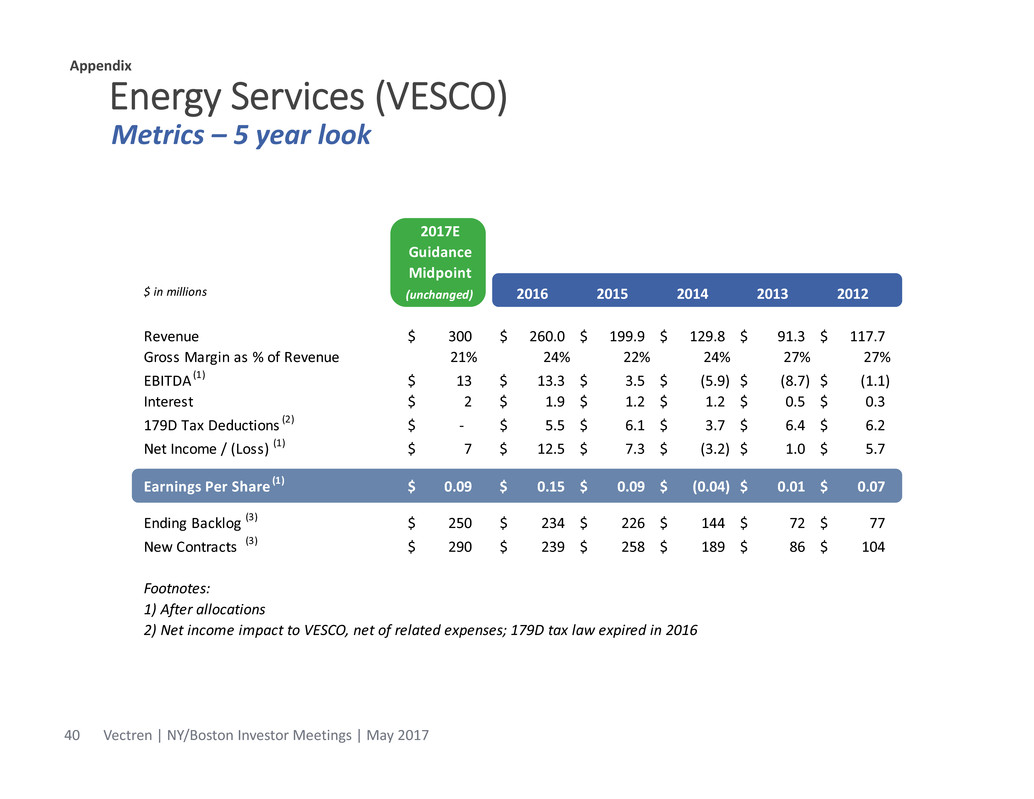

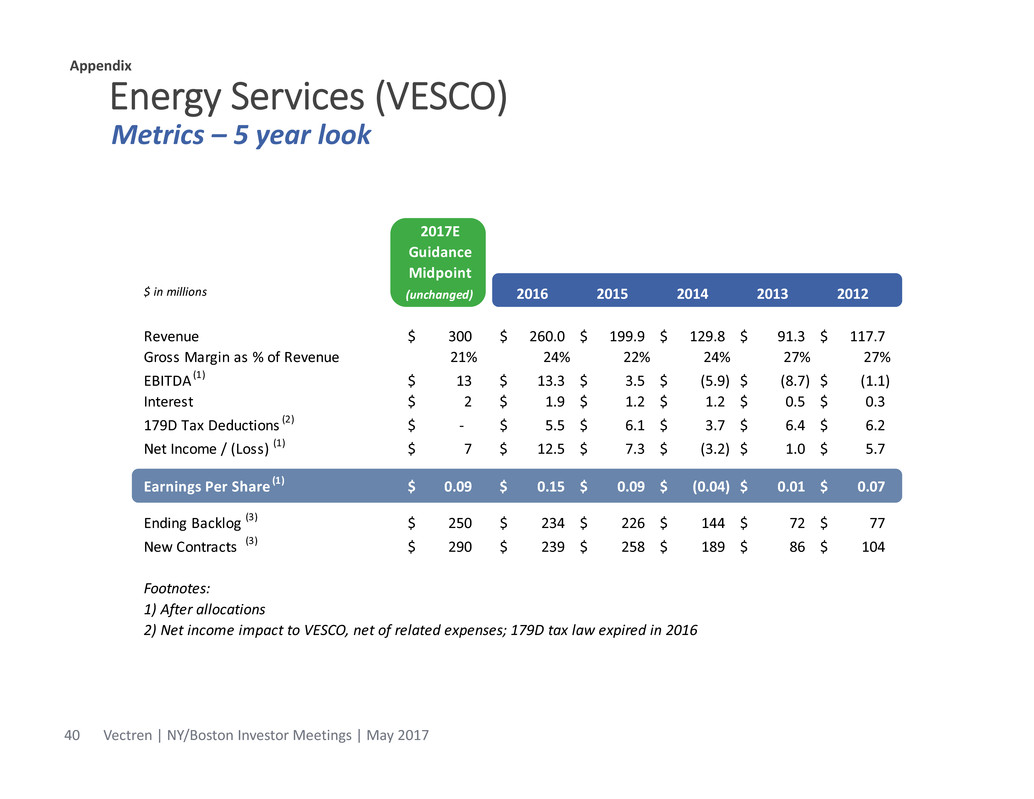

Energy Services (VESCO) Metrics – 5 year look Appendix 2017E Guidance Midpoint $ in millions (unchanged) 2016 2015 2014 2013 2012 Revenue 300$ 260.0$ 199.9$ 129.8$ 91.3$ 117.7$ Gross Margin as % of Revenue 21% 24% 22% 24% 27% 27% EBITDA (1) 13$ 13.3$ 3.5$ (5.9)$ (8.7)$ (1.1)$ Interest 2$ 1.9$ 1.2$ 1.2$ 0.5$ 0.3$ 179D Tax Deductions (2) ‐$ 5.5$ 6.1$ 3.7$ 6.4$ 6.2$ Net Income / (Loss) (1) 7$ 12.5$ 7.3$ (3.2)$ 1.0$ 5.7$ Earnings Per Share (1) 0.09$ 0.15$ 0.09$ (0.04)$ 0.01$ 0.07$ Ending Backlog (3) 250$ 234$ 226$ 144$ 72$ 77$ New Contracts (3) 290$ 239$ 258$ 189$ 86$ 104$ Footnotes: 1) After allocations 2) Net income impact to VESCO, net of related expenses; 179D tax law expired in 2016 Vectren | NY/Boston Investor Meetings | May 201740

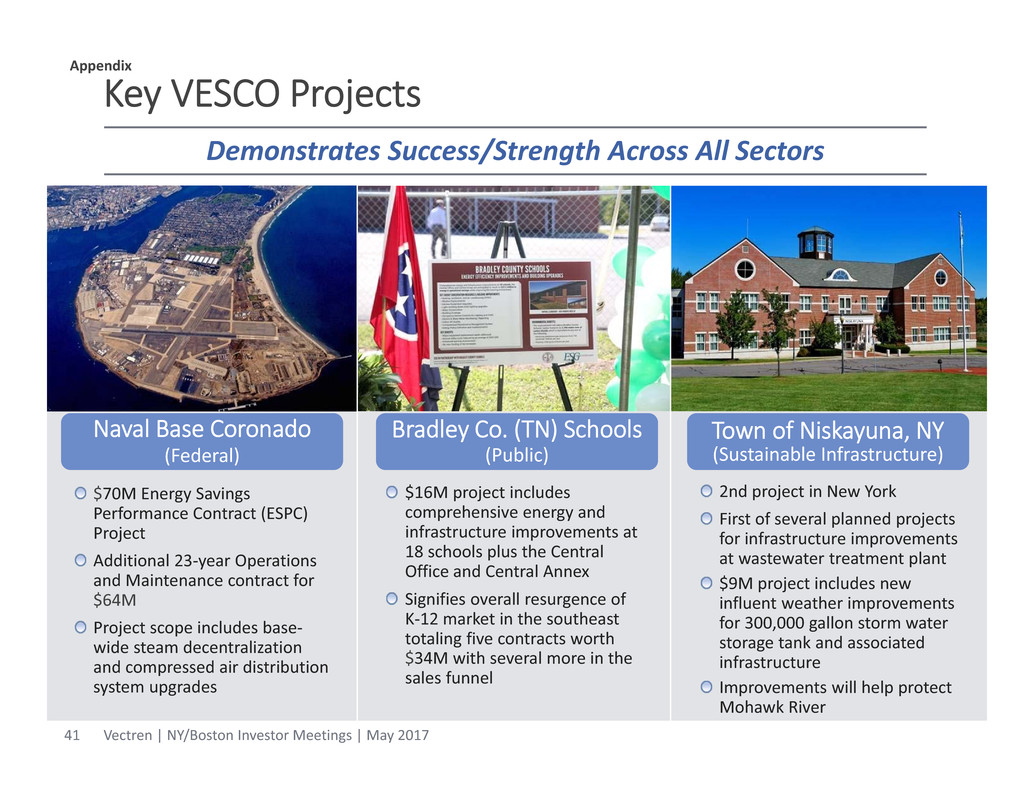

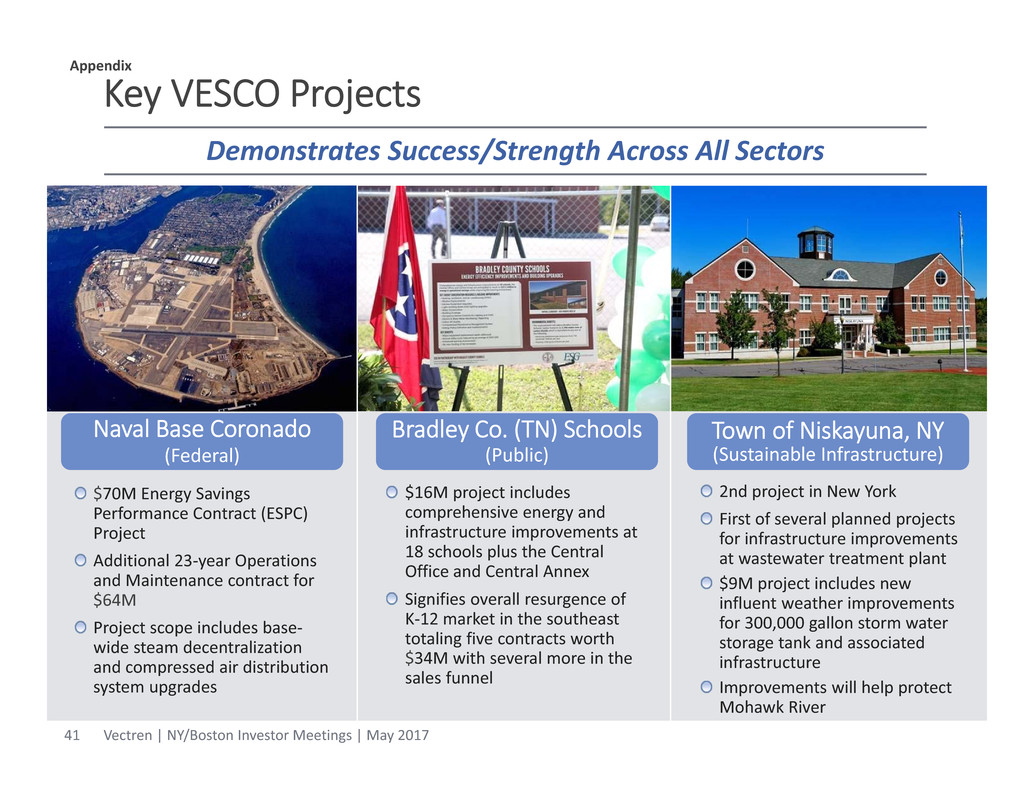

Key VESCO Projects $16M project includes comprehensive energy and infrastructure improvements at 18 schools plus the Central Office and Central Annex Signifies overall resurgence of K‐12 market in the southeast totaling five contracts worth $34M with several more in the sales funnel $70M Energy Savings Performance Contract (ESPC) Project Additional 23‐year Operations and Maintenance contract for $64M Project scope includes base‐ wide steam decentralization and compressed air distribution system upgrades 2nd project in New York First of several planned projects for infrastructure improvements at wastewater treatment plant $9M project includes new influent weather improvements for 300,000 gallon storm water storage tank and associated infrastructure Improvements will help protect Mohawk River Demonstrates Success/Strength Across All Sectors Naval Base Coronado (Federal) Bradley Co. (TN) Schools (Public) Town of Niskayuna, NY (Sustainable Infrastructure) Appendix Vectren | NY/Boston Investor Meetings | May 201741

A.B. Brown 1 A.B. Brown 2 F.B. Culley 2 F.B. Culley 3 Warrick 4* Year of Installation 1979 1986 1966 1973 1970 MW 245 245 90 270 150 10‐Yr Net Capacity Factor 60.7% 62.6% 38.4% 66.1% 69.2% 2015 Avg. Heat Rate (BTU/kWh) 11,174 10,881 15,582 10,592 10,918 Pollution Controls SO2 Flue gas desulphurization Flue gas desulphurization Flue gas desulphurization Flue gas desulphurization Flue gas desulphurization NOx Selective catalytic reduction Selective catalytic reduction Low NOx Burner Selective catalytic reduction Selective catalytic reduction Particulate Matter Fabric Filter Electrostatic precipitator Electrostatic precipitator Fabric Filter Electrostatic precipitator MATS Injection Injection Injection Injection Injection SO3 Injection Injection N/A Injection Injection Coal‐Fired Generation Appendix * 50% ownership of 300 MW with Alcoa Current Portfolio Vectren | NY/Boston Investor Meetings | May 201742

Integrated Resource Plan (IRP)* Preferred Portfolio Overview * Preferred Plan has been filed with the IN Commission; also, dialogue is ongoing with Alcoa relative to plans for the Warrick 4 unit Appendix 2015 Portfolio Resource Mix (MWhs) Energy Efficiency, Renewables, Other 10% Coal Base Load 90% 2026 Portfolio Resource Mix (MWhs) Energy Efficiency, Renewables, Other 15% Coal Base Load 30% Natural Gas 55% Vectren | NY/Boston Investor Meetings | May 201743

Use of Non‐GAAP Performance Measures and Per Share Measures Appendix Contribution to Vectren's Basic EPS Per share earnings contributions of the Utility Group, Nonutility Group, and Corporate and Other are presented and are non‐GAAP measures. Such per share amounts are based on the earnings contribution of each group included in the Company’s consolidated results divided by the Company’s basic average shares outstanding during the period. The earnings per share of the groups do not represent a direct legal interest in the assets and liabilities allocated to the groups; instead they represent a direct equity interest in the Company's assets and liabilities as a whole. These non‐GAAP measures are used by management to evaluate the performance of individual businesses. In addition, other items giving rise to period over period variances, such as weather, may be presented on an after tax and per share basis. These amounts are calculated at a statutory tax rate divided by the Company’s basic average shares outstanding during the period. Accordingly, management believes these measures are useful to investors in understanding each business’ contribution to consolidated earnings per share and in analyzing consolidated period to period changes and the potential for earnings per share contributions in future periods. Per share amounts of the Utility Group and the Nonutility Group are reconciled to the GAAP financial measure of basic EPS by combining the two. Any resulting differences are attributable to results from Corporate and Other operations. The non‐GAAP financial measures disclosed by the Company should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP. Vectren | NY/Boston Investor Meetings | May 201744