Filed pursuant to Rule 424(b)(3)

Registration No. 333-163675

PROSPECTUS

IVANY MINING, INC.

10,990,400

SHARES OF COMMON STOCK

PUBLIC OFFERING

___________________

The selling shareholders named in this prospectus are offering up all the shares of common stock being registered by this prospectus. The selling shareholders are registering in this prospectus 5,495,200 shares of common stock issued to them in private placements, as well as 5,495,200 shares of common stock underlying the warrants also issued to the selling shareholders in those private placements. We will not receive any proceeds from the sale of shares in this offering. We have not made any arrangements for the sale of these securities.

Our common stock is currently quoted on the OTC Bulletin Board (“OTCBB”), which is sponsored by the NASD, under the symbol “IVNM”. The OTCBB is a network of security dealers who buy and sell stock. The dealers are connected by a computer network that provides information on current "bids" and "asks", as well as volume information. As a result, the actual price of the stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling shareholders. The offering price will thus be determined by market factors and the independent decisions of the selling shareholders. On December 9, 2009, the last sale price of our common stock as reported by the OTCBB was $0.20per share.

The purchase of the securities offered through this prospectus involves a high degree of risk. See section entitled "Risk Factors" on pages 8-15.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The Date of This Prospectus Is: December 30, 2009

| | Page |

| 6 |

| 7 |

| 7 |

| If we do not obtain additional financing, our business plan will be delayed and our business will not survive. | 7 |

| Because we have our planned exploration activities have not been completed, we face a high risk of business failure. | 8 |

| If we are unable to generate significant revenues from our operations, the business will fail. | 8 |

| If we are unable to hire and retain key personnel, we may not be able to implement our business plan. | 8 |

| Because we are an exploration stage company, there is no assurance that commercially exploitable reserves of minerals exist on any property interests that we own or may acquire or that we will be able to profitably recover any reserves which do exist. | 8 |

| 9 |

| 9 |

| Our due diligence activities with respect to current and future property interests cannot assure that these properties will ultimately prove to be commercially viable. | 9 |

| In the event that we are unable to successfully compete within the mineral exploration business, we may not be able to achieve profitable operations. | 10 |

| 10 |

| 10 |

| Because certain stockholders in management control or have the ability to exert significant influence over the voting power of our capital stock, the ability of stockholders to exert influence over our policies and management may be limited. | 10 |

| Because executive management is free to devote time to other ventures, shareholders may not agree with their allocation of time. | 11 |

| Because our auditor has raised substantial doubt about our ability to continue as a going concern, our business has a high risk of failure. | 11 |

| Because executive management is free to devote time to other ventures, shareholders may not agree with their allocation of time. | 11 |

| 11 |

| If we do discover commercially exploitable reserves of minerals on our mineral claims and/or on any additional property interests that we may acquire, property disputes may prevent us from recovering those reserves in a timely and profitable manner, or at all. | 11 |

| Because we do not plan to secure any title insurance in the future, we are vulnerable to loss of title. | 12 |

| 12 |

| 13 |

| Because this registration statement does not render professional advice, investors should retain their own advisors regarding certain federal income tax and other considerations regarding this report. | 13 |

| Because of new legislation, including the Sarbanes-Oxley Act of 2002, we may be unable to retain or attract officers and directors. | 13 |

| Because the market may respond to our business operations and that of our competitors, our stock price will likely be volatile. | 13 |

| Because we do not expect to pay dividends for the foreseeable future, investors seeking cash dividends should not purchase our common stock. | 14 |

| Because our common stock is quoted on the over-the-counter bulletin board administered by the NASD and is subject to the “Penny Stock” rules, the level of trading activity in our stock may be reduced. | 14 |

| 14 |

| 14 |

| 15 |

| 15 |

| 15 |

| 15 |

| 17 |

| 18 |

| 20 |

| 30 |

| 34 |

| 34 |

| 36 |

| 37 |

| 41 |

| 42 |

| 42 |

| 44 |

| 45 |

| 45 |

| 46 |

| 46 |

| 47 |

| 47 |

| 48 |

| 50 |

| 50 |

| 51 |

Ivany Mining, Inc.

Our predecessor entity was originally incorporated as a Nevada corporation on April 23, 1990. By way of merger, we became an entity incorporated under the laws of the State of Delaware on July 13, 1999. On July 18, 2007, we changed our name to Ivany Mining, Inc. and commenced out current business operations in the field of mineral exploration and development.

We are a Canadian-based exploration stage company engaged in the exploration and planning the development of mineral properties in Canada and around the world. We are focused on the strategic acquisition and development of uranium, diamond, base metals, and precious metal properties on a worldwide basis. Our long-term objective is to become a sustainable mid-tier base & precious metal producer in Canada & Cambodia, to the benefit of all stakeholders, in a socially and environmentally responsible manner. Our overall strategy is to rapidly advance our recently acquired/optioned base & precious metal exploration properties.

Additional exploration of our mineral claims is required before a final determination as to their viability can be made. The existence of commercially exploitable mineral deposits in our mineral claims is not fully known at the present time and we will not be able to ascertain such information until we receive and evaluate the results of our ongoing exploration programs.

Our principal office is located at 8720-A Rue Du Frost, St. Leonard, Quebec, Canada, H1P 2Z5.

Our fiscal year end is June 30.

The Offering

Securities Being Offered | Up to 10,990,400 shares of our common stock, including 5,495,200 shares of common stock issued to the selling shareholders in private placements, as well as 5,495,200 shares of common stock underlying the warrants also issued to the selling shareholders in private placements |

| Offering Price and Alternative Plan of Distribution | All shares being offered are being sold by existing shareholders without our involvement, so the actual price of the stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling shareholders. The offering price will thus be determined by market factors and the independent decisions of the selling shareholders. |

| Minimum Number of Shares To Be Sold in This Offering | None |

| Securities Issued and to be Issued | 37,031,877 shares of our common stock are issued and outstanding as of December 10, 2009. All of the common stock to be sold under this prospectus will be sold by existing shareholders. There will be no increase in our issued and outstanding shares as a result of this offering. |

| Use of Proceeds | We will not receive any proceeds from the sale of the common stock by the selling shareholders. |

Summary Financial Information

Balance Sheet Data | Fiscal Year Ended June 30, 2009 (audited) | | Fiscal Year Ended June 30, 2008 (audited) |

Cash Total Assets Liabilities Total Stockholder’s Equity | $ | 455,250 458,549 106,636 357,913 | | $ | 102,983 108,289 17,686 90,603 |

Statement of Operations |

Revenue Net Loss for Reporting Period | $ $ | 0 520,690 | | $ $ | 0 2,631,422 |

You should consider each of the following risk factors and any other information set forth herein and in our reports filed with the SEC, including our financial statements and related notes, in evaluating our business and prospects. The risks and uncertainties described below are not the only ones that impact on our operations and business. Additional risks and uncertainties not presently known to us, or that we currently consider immaterial, may also impair our business or operations. If any of the following risks actually occur, our business and financial results or prospects could be harmed. In that case, the value of the Common Stock could decline.

Risks Related To Our Financial Condition and Business Model

If we do not obtain additional financing, our business plan will be delayed and our business not survive.

As of the date of this Offering Memorandum, we have had limited working capital and will require significant additional cash to complete the development of our business plan. Our business plan calls for ongoing expenses in connection with seeking and developing mineral exploration opportunities. Management believes that the company’s cash on hand and other existing financial resource, may not be sufficient to fund capital and operating requirements through such time as we are able to complete our business plan. Accordingly, we may desire to seek additional financing to fund our operations in the future. Such additional funds may be raised through the issuance of equity, debt, convertible debt or similar securities that may have rights or preferences senior to those of the shares. Moreover, if adequate funds are not available to satisfy our short-term or long-term capital requirements, we would be required to limit our operations. We currently have no immediate means for obtaining additional financing. There can be no assurance that such additional financing, when and if necessary, will be available to it on acceptable terms, or at all.

Because we have our planned exploration activities have not been completed, we face a high risk of business failure.

We have acquired our mineral claims in Canada relatively recently. Exploration of some of these claims is incomplete and remains in progress. In addition, we have not begun the exploration or development process on some of our claims. As a result, we have no way to reliably evaluate the likelihood that we will be able to operate the business successfully. We have not earned any revenues as of the date of this prospectus, and thus face a high risk of business failure.

If we are unable to generate significant revenues from our operations, the business will fail.

If we are unable to generate significant revenues from the development of our current mineral properties or any future mineral properties we may acquire, we will not be able to achieve profitability or continue operations.

If we are unable to hire and retain key personnel, we may not be able to implement our business plan.

Due to the unique nature of our business, having certain key personnel is essential to the exploration and development of our mineral claims and thus to the entire business itself. Consequently, the loss of any of those individuals may have a substantial effect on our future success or failure. We may have to recruit qualified personnel with competitive compensation packages, equity participation, and other benefits that may affect the working capital available for our operations. Management does not have any formal training in the mineral exploration and development field and may have to seek to obtain outside independent professionals to assist them in assessing the merits and risks of any exploration programs as well as assisting in the development of mineral claims. No assurance can be given that we will be able to obtain such needed assistance on terms acceptable to us. Our failure to attract additional qualified employees or to retain the services of key personnel could have a material adverse effect on our operating results and financial condition.

Because we are an exploration stage company, there is no assurance that commercially exploitable reserves of minerals exist on any property interests that we own or may acquire or that we will be able to profitably recover any reserves which do exist.

We are an exploration stage company and there is no assurance that commercially exploitable reserves of minerals exist on our mineral claims or on any additional property interests that we may acquire. In the event that commercially exploitable reserves of minerals exist on any property interests that we own or may acquire, we cannot guarantee that we will make a profit. If we cannot acquire or locate mineral deposits, or if it is not economical to recover such deposits, our business and operations will be materially and adversely affected

Because future exploration activities are subject to political, economic and other uncertainties, situations may arise that could have a significantly adverse material impact on us.

Our future property interests and proposed exploration activities are subject to political, economic and other uncertainties, including the risk of renegotiation or nullification of existing contracts, mining licenses and permits or other agreements, and changes in laws or taxation policies. Future government actions concerning the economy, taxation, or the operation and regulation of nationally important facilities such as mines could have a significant effect on us. No assurances can be given that our plans and operations will not be adversely affected by future developments.

Because of the unique difficulties and uncertainties inherent in mineral exploration business, we face a high risk of business failure.

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. Weather conditions can increase delays resulting in additional costs and expenses. The search for valuable minerals also involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards for which we cannot insure or for which we may elect not to insure. At the present time, we have no coverage to insure against these hazards. The payment of such liabilities may have a material adverse effect on our financial position. In addition, there is no assurance that the expenditures to be made by us in the exploration of the mineral claims will result in the discovery of commercially exploitable mineral deposits. We may be forced to revise our exploration program at an increased cost if we encounter unusual or unexpected formations. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts.

Our due diligence activities have been and will be limited, and to a great extent, we will rely upon information provided to us by third parties. Accordingly, no assurances can be given that the properties or mining rights we have acquired or may acquire in the future will contain adequate amounts of minerals for commercialization. Further, even if we recover minerals from such mining properties, we cannot guarantee that we will make a profit. If we cannot acquire or locate commercially exploitable mineral deposits, or if it is not economical to recover such deposits, our business and operations will be materially adversely affected.

In the event that we are unable to successfully compete within the mineral exploration business, we may not be able to achieve profitable operations.

The mineral exploration business is highly competitive. This industry has a multitude of competitors and many competitors dominate this industry. Many of our future competitors have greater financial resources than us. As a result, we may experience difficulty competing with other businesses when conducting mineral exploration activities or in the retention of qualified personnel. No assurances can be given that we will be able to compete effectively.

Due to numerous factors beyond our control which could affect the marketability of minerals including the market price for such minerals, we may have difficulty selling any minerals if commercially viable deposits are found to exist.

The availability of markets and the volatility of market prices are beyond our control and represent a significant risk. Even if commercially viable deposits of minerals are found to exist on our current or future property interests, a ready market may not exist for the sale of the reserves. Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. These factors could inhibit our ability to sell recovered minerals in the event that commercial viable deposits are found to exist.

Because of the speculative nature of exploration for minerals, there is substantial risk that our business will fail.

The search for minerals as a business is extremely risky. We cannot provide any assurances that the mining interests that we own or may acquire will contain commercially exploitable reserves of minerals. Exploration for minerals is a speculative venture necessarily involving substantial risk. The expenditures made and to be made by us in connection with exploration of future properties, will be substantial and may not result in the discovery of commercially exploitable reserves of minerals.

Because certain stockholders in management control or have the ability to exert significant influence over the voting power of our capital stock, the ability of stockholders to exert influence over our policies and management may be limited.

The table below indicates the number of shares and the respective percentage of 37,031,877 shares issued and outstanding as of December 4, 2009:

| Derek Ivany | 10,166,000 Shares | 27.45% |

| Victor Cantore | 7,104,001 Shares | 19.18% |

Because the above shareholders individually and collectively hold a significant portion of our common stock, they have the ability to exert significant influence over our policies and management. The interests of these stockholders may differ from the interests of our other stockholders.

Our executive officers and directors will devote only that portion of their time, which, in their judgment and experience, is reasonably required for the management and operation of our business. Executive management may have conflicts of interest in allocating management time, services and functions among us and any present and future ventures which are or may be organized by our officers or directors and/or their affiliates.

Because our auditor has raised substantial doubt about our ability to continue as a going concern, our business has a high risk of failure.

The audit report of Maddox Ungar Silberstein, PLLC, issued a going concern opinion and raised substantial doubt as to our continuance as a going concern. When an auditor issues a going concern opinion, the auditor has substantial doubt that the company will continue to operate indefinitely and not go out of business and liquidate its assets. This is a significant risk to investors who purchase shares of our common stock because there is an increased risk that we may not be able to generate and/or raise enough resources to remain operational for an indefinite period of time.

The success of our business operations depends upon our ability to achieve profitable operations from the commercial exploitation of interests in mineral claims. We plan to seek additional financing through debt and/or equity financing arrangements to secure funding for our operations. There can be no assurance that such additional financing will be available to us on acceptable terms or at all. It is not possible at this time for us to predict with assurance the outcome of these matters. If we are not able to successfully complete the development of our business plan and attain sustainable profitable operations, then our business will fail.

Risks Related To Legal Uncertainty

If we do discover commercially exploitable reserves of minerals on our mineral claims and/or on any additional property interests that we may acquire, property disputes may prevent us from recovering those reserves in a timely and profitable manner, or at all.

Disputes over land ownership are common, especially in the context of resource developments. Identifying all the affected landowners or related stakeholders, and structuring compensation arrangements that are both fair and acceptable to all of them, is often extremely difficult. We believe that the satisfactory resolution of any local landowner or related stakeholder concerns is essential to the eventual development and operation of modern mines. The failure to adequately address any such landowner or related stakeholder issues will disrupt our plans. Although we anticipate that we will spend considerable time, effort and expense in an attempt to resolve any landowner or related stakeholder issues associated with our planned operations, no assurance can be given that disruptions arising out of landowner or related stakeholder dissatisfaction will not occur. In addition, we cannot give any assurance that title to any of our property interests will not be challenged or impugned and cannot be certain that we will have or acquire valid title to these mining properties.

Because we do not plan to secure any title insurance in the future, we are vulnerable to loss of title.

We do not intend to secure any insurance against title. Title on mineral properties and mining rights involves certain inherent risks due to the difficulties of determining the validity of certain claims as well as the potential for problems arising from the frequently ambiguous conveyance history characteristic of many mining properties. We cannot give any assurance that title to our current or future properties will not be challenged or impugned and cannot be certain that we will acquire valid title to any mining properties. The possibility also exists that title to our current or future prospective properties may be lost due to an omission in the claim of title. As a result, any claims against us may result in liabilities we will not be able to afford resulting in the failure of our business.

Because our operations will be subject to various governmental regulations and environmental risks, we may incur substantial costs to remain in compliance.

Our operations will be subject to national, state, and local laws and regulations regarding environmental matters, the abstraction of water, and the discharge of mining wastes and materials. Any changes in these laws could affect our operations and economics. Environmental laws and regulations change frequently, and the implementation of new, or the modification of existing, laws or regulations could harm us. We cannot predict how national, state, or local agencies or courts will interpret existing laws and regulations or the effect of these adoptions and interpretations may have on our business or financial condition. We may be required to make significant expenditures to comply with governmental laws and regulations.

Any significant mining operations will have some environmental impact, including land and habitat impact, arising from the use of land for mining and related activities, and certain impact on water resources near the project sites, resulting from water use, rock disposal and drainage run-off. No assurances can be given that such environmental issues will not have a material adverse effect on our operations in the future. Exploration activities may give rise to significant liabilities on our part to the government and third parties and may require us to incur substantial costs of remediation.

Additionally, we do not intend to secure insurance against environmental risks. As a result, any claims against us may result in liabilities we will not be able to afford, resulting in the failure of our business.

Risks Related To This Offering

Because this registration statement does not render professional advice, investors should retain their own advisors regarding certain federal income tax and other considerations regarding this report.

The registration statement does not render professional advice. In particular, prospective investors should not construe the contents of this report as investment, legal or tax advice. Each prospective investor in our common stock should consult his own bankers, counsel, accountants and other advisors regarding the legal, tax, business, financial and other related aspects of a purchase of our common stock. No representation or warranty is made as to whether, or the extent to which, an investment in our common stock constitutes a legal investment for investors whose investment authority is subject to legal restrictions. These investors should consult their own legal advisors regarding such matters.

The Sarbanes-Oxley Act of 2002 was enacted in response to public concerns regarding corporate accountability in connection with recent accounting scandals. The stated goals of the Sarbanes-Oxley Act are to increase corporate responsibility, to provide for enhanced penalties for accounting and auditing improprieties at publicly traded companies, and to protect investors by improving the accuracy and reliability of corporate disclosures pursuant to the securities laws. The Sarbanes-Oxley Act generally applies to all companies that file or are required to file periodic reports with the SEC, under the Securities Exchange Act of 1934. As a public company, we are required to comply with the Sarbanes-Oxley Act. The enactment of the Sarbanes-Oxley Act of 2002 has resulted in a series of rules and regulations by the SEC that increase responsibilities and liabilities of directors and executive officers. The perceived increased personal risk associated with these recent changes may deter qualified individuals from accepting these roles. As a result, it may be more difficult for us to attract and retain qualified persons to serve on our board of directors or as executive officers. We continue to evaluate and monitor developments with respect to these rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

Because the market may respond to our business operations and that of our competitors, our stock price will likely be volatile.

Our common stock is currently quoted on the OTC Bulletin Board (“OTCBB”), which is sponsored by the NASD. The OTCBB is a network of security dealers who buy and sell stock. The dealers are connected by a computer network that provides information on current "bids" and "asks", as well as volume information. Our shares are quoted on the OTCBB under the symbol “IVNM.” We anticipate that the market price of our Common Stock will be subject to wide fluctuations in response to several factors, including: our ability to develop projects successfully; increased competition from competitors; and our financial condition and results of our operations.

Because we do not expect to pay dividends for the foreseeable future, investors seeking cash dividends should not purchase our common stock.

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future. Our payment of any future dividends will be at the discretion of our board of directors after taking into account various factors, including but not limited to our financial condition, operating results, cash needs, growth plans and the terms of any credit agreements that we may be a party to at the time. Accordingly, investors must rely on sales of their own common stock after price appreciation, which may never occur, as the only way to realize their investment. Investors seeking cash dividends should not purchase our common stock.

Because our common stock is quoted on the over-the-counter bulletin board administered by the NASD and is subject to the “Penny Stock” rules, the level of trading activity in our stock may be reduced.

Broker-dealer practices in connection with transactions in "penny stocks" are regulated by penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on some national securities exchanges or quoted on the over-the-counter bulletin board administered by the NASD). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer's presumed control over the market, and monthly account statements showing the market value of each penny stock held in the customer's account. In addition, broker-dealers who sell these securities to persons other than established customers and "accredited investors" must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. Consequently, these requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security subject to the penny stock rules, and investors in our common stock may find it difficult to sell their shares.

Forward-Looking Statements

This prospectus contains forward-looking statements that involve risks and uncertainties. We use words such as anticipate, believe, plan, expect, future, intend and similar expressions to identify such forward-looking statements. The actual results could differ materially from our forward-looking statements. Our actual results are most likely to differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us described in this Risk Factors section and elsewhere in this prospectus.

We will not receive any proceeds from the sale of the common stock offered through this prospectus by the selling shareholders.

Determination of Offering Price

All shares being offered will be sold by existing shareholders without our involvement, consequently the actual price of the stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling shareholders. The offering price will thus be determined by market factors and the independent decisions of the selling shareholders.

Dilution

The common stock to be sold by the selling shareholders is common stock that is currently issued and outstanding. Accordingly, there will be no dilution to our existing shareholders.

Selling Shareholders

The selling shareholders named in this prospectus are offering all of the 10,990,400 shares of common stock offered through this prospectus. At the time of the purchase, the selling shareholders had no agreements or understandings to distribute the securities. The shares include the following:

| · | 5,495,200 shares of our common stock which were sold to a total of ten (10) investors as part of a Private Placement which we completed on July 10, 2009. The issuance and sale of said securities was made in reliance upon exemptions from registration pursuant to Rule 506 of Regulation D under the Securities Act of 1933, as amended. |

| · | 5,495,200 shares of common stock underlying warrants to purchase common stock at an exercise price of $0.10 per share which were also issued to the ten (10) investors as part of the Private Placement which we completed on July 10, 2008. |

The following table provides information regarding the beneficial ownership of our common stock held by each of the ten (10) selling shareholders as of December 4, 2009, including:

1. the number of shares owned by each prior to this offering;

2. the total number of shares that are to be offered by each;

3. the total number of shares that will be owned by each upon completion of the offering;

4. the percentage owned by each upon completion of the offering; and

5. the identity of the beneficial holder of any entity that owns the shares.

The named party beneficially owns and has sole voting and investment power over all shares or rights to the shares, unless otherwise shown in the table. The numbers in this table assume that none of the selling shareholders sells shares of common stock not being offered in this prospectus or purchases additional shares of common stock, and assumes that all shares offered are sold. The percentages are based on 37,031,877 shares of common stock outstanding on December 4, 2009.

Name and Address of Selling Shareholder | Shares Owned Prior to This Offering | Shares To Be Received Upon The Exercise of Warrants | Total Number Of Shares To Be Offered For Selling Shareholder Account | Total Shares To Be Owned Upon Completion of This Offering(2) | Percent Owned Upon Completion Of This Offering(3) |

Firebird Global Master Fund, Ltd. c/o Trident Trust Company (Cayman) Limited 1 Capital Place, P.O. Box 847 Grand Cayman Cayman Islands(1) | 10,000,000 | 10,000,000 | 10,000,000 | 10,000,000 | 13.5% |

Tho Phuoc Nguyen 31 Exeter St. Toronto, Ontario M6N 1G3 Canada | 60,000 | 60,000 | 50,400 | 69,600 | 0.09% |

Thanh Tran Huynh 429 Dufferin St. Toronto, Ontario M6K 2A2 Canada | 60,000 | 60,000 | 50,400 | 69,600 | 0.09% |

Sam Nguyen 50 Noble St. Markham, Ontario L3R 8G1 Canada | 20,000 | 20,000 | 16,000 | 24,000 | 0.03% |

Phil Dang 40 Derrydown Rd. Toronto, Ontario M3J 1R3 Canada | 60,000 | 60,000 | 50,400 | 69,600 | 0.09% |

Nick Ciampittiello 7939 Provencher Montreal, Quebec H1R 2Y5 Canada | 200,000 | 200,000 | 168,000 | 232,000 | 0.31% |

Christian Radu 4165 Boulevard Gouin Est Montreal-Nord, Quebec H1H 5L9 Canada | 200,000 | 200,000 | 168,000 | 232,000 | 0.31% |

David Parry 1271 West 22nd St. North Vancouver, British Columbia Canada | 120,000 | 120,000 | 100,800 | 139,200 | 0.19% |

Greg Karamanian 24790 1024 Ave. Maple Ridge, British Columbia V2W 0A1 Canada | 80,000 | 80,000 | 67,200 | 92,800 | 0.13% |

Afonso Tarenta 5 Saint Marks Rd. Toronto, Ontario M6S 2H5 Canada | 380,000 | 380,000 | 319,200 | 440,800 | 0.60% |

(1) FGS Advisors, LLC (“FGS”) serves and the Investment Manager of Firebird Global Master Fund, Ltd. (“Firebird”) and controls the investment and trading activities of Firebird. James Passin and Harvery Sawikin are managers and controlling principals of FGS. In their respective capacities, FGS, Mr. Passin, and Mr. Sawikin exercise voting and investment power with respect to the securities offered for resale by Firebird.

(2) Includes the named shareholder’s shares of common stock plus an equal number of additional shares to be received by the shareholder upon exercise of warrants.

(3)Percentage ownership based on the number of shares of common stock actually issued and outstanding in the name of shareholder following the completion of the offering, without inclusion of additional shares issuable upon exercise of warrant.

Except as set forth below, none of the selling shareholders;

| (1) | has had a material relationship with us other than as a shareholder at any time within the past three years; |

| (2) | has been one of our officers or directors; or |

| (3) | are broker-dealers or affiliates of broker-dealers. |

Sam Nguyen is our Vice President and a member of our board of directors.

The selling stockholders may, from time to time, sell any or all of their shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These sales may be at fixed or negotiated prices. The selling stockholders may use any one or more of the following methods when selling shares:

| · | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| · | block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| · | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| · | an exchange distribution in accordance with the rules of the applicable exchange; |

| · | privately negotiated transactions; |

| · | broker-dealers may agree with the selling stockholders to sell a specified number of such shares at a stipulated price per share; |

| · | a combination of any such methods of sale; and |

| · | any other method permitted pursuant to applicable law. |

The selling stockholders may also sell shares under Rule 144 or Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), if available, rather than under this prospectus.

Broker-dealersengaged by the selling stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling stockholders (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated. The selling stockholders do not expect these commissions and discounts to exceed what is customary in the types of transactions involved. Any profits on the resale of shares of common stock by a broker-dealer acting as principal might be deemed to be underwriting discounts or commissions under the Securities Act. Discounts, concessions, commissions and similar selling expenses, if any, attributable to the sale of shares will be borne by a selling stockholder. The selling stockholders may agree to indemnify any agent, dealer or broker-dealer that participates in transactions involving sales of the shares if liabilities are imposed on that person under the Securities Act.

The selling stockholders may from time to time pledge or grant a security interest in some or all of the shares of common stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of common stock from time to time under this prospectus after we have filed a supplement to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act, supplementing or amending the list of selling stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this prospectus.

The selling stockholders also may transfer the shares of common stock in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus and may sell the shares of common stock from time to time under this prospectus after we have filed a supplement to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act supplementing or amending the list of selling stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this prospectus.

The selling stockholders and any broker-dealers or agents that are involved in selling the shares of common stock may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares of common stock purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

We are required to pay all fees and expenses incident to the registration of the shares of common stock. We have agreed to indemnify the selling stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

The selling stockholders have advised us that they have not entered into any agreements, understandings or arrangements with any underwriters or broker-dealers regarding the sale of their shares of common stock, nor is there an underwriter or coordinating broker acting in connection with a proposed sale of shares of common stock by any selling stockholder. If we are notified by any selling stockholder that any material arrangement has been entered into with a broker-dealer for the sale of shares of common stock, if required, we will file a supplement to this prospectus. If the selling stockholders use this prospectus for any sale of the shares of common stock, they will be subject to the prospectus delivery requirements of the Securities Act.

The anti-manipulation rules of Regulation M under the Securities Exchange Act of 1934 may apply to sales of our common stock and activities of the selling stockholders.

Common Stock

We have 200,000,000 common shares with a par value of $0.001 per share of common stock authorized, of which 37,031,877 shares were outstanding as of December 10, 2009.

Voting Rights

Holders of common stock have the right to cast one vote for each share of stock in his or her own name on the books of the corporation, whether represented in person or by proxy, on all matters submitted to a vote of holders of common stock, including the election of directors. There is no right to cumulative voting in the election of directors. Except where a greater requirement is provided by statute or by the Articles of Incorporation, or by the Bylaws, the presence, in person or by proxy duly authorized, of the holder or holders of a majority of the outstanding shares of the our common voting stock shall constitute a quorum for the transaction of business. The vote by the holders of a majority of such outstanding shares is also required to effect certain fundamental corporate changes such as liquidation, merger or amendment of the Company's Articles of Incorporation.

Dividends

There are no restrictions in our articles of incorporation or bylaws that restrict us from declaring dividends. The Delaware General Corporation Law (the “DGCL”) provides that a corporation may pay dividends out of surplus, out the corporation's net profits for the preceding fiscal year, or both provided that there remains in the stated capital account an amount equal to the par value represented by all shares of the corporation's stock raving a distribution preference.

We have not declared any dividends, and we do not plan to declare any dividends in the foreseeable future.

Pre-emptive Rights

Holders of common stock are not entitled to pre-emptive or subscription or conversion rights, and there are no redemption or sinking fund provisions applicable to the Common Stock. All outstanding shares of common stock are, and the shares of common stock offered hereby will be when issued, fully paid and non-assessable.

Share Purchase Warrants

As of December 10, 2009, share purchase warrants outstanding for the purchase of common shares as follows:

| | WARRANTS OUTSTANDING |

| WARRANT TYPE | EXERCISE PRICE | NUMBER OF SHARES | EXPIRY DATE |

Warrants Issued 7/10/09 Warrants Issued 1/31/08 Employee Stock Options Other options Other options | $0.10 $0.10 $0.10 $90.00 $1,000 | 11,180,000 12,639,613 2,400,000 1,000 250 | July 10, 2012 July 10, 2012 June 26, 2010 February 28, 2011 February 28, 2010 |

Convertible Securities

With the exception of the Warrants and Options discussed above, we do not have outstanding any securities convertible into shares of our common stock or any rights convertible or exchangeable into shares of our common stock.

Transfer Agent

Our transfer agent is Nevada Agency and Trust Company, located at 50 West Liberty Street, Suite 880

Reno, Nevada 8950. Phone: (775) 322-0626.

Delaware Anti-Takeover Laws

We are subject to the provisions of Section 203 of the DGCL, which applies to "business combinations" such as a merger, asset or stock sale or other transaction that result in financial benefit to an "interested stockholder". An "interested stockholder" is a person who, together with affiliates and associates, owns, or within three years prior, did own, 15% or more of a corporation's outstanding voting stock. Section 203 generally prohibits a publicly held Delaware corporation from engaging in a "business combination" with an "interested stockholder" for a period of three years following the time that the stockholder became an interested stockholder, unless:

| · | prior to entering into the business combination,, the board of directors of the corporation approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder; |

| · | upon consummation of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for purposes of determining the number of shares outstanding, those shares owned by persons who are directors and also officers, and employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or |

| · | on or subsequent to that time, the business combination is approved by the board of directors and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least two-thirds of the outstanding voting stock that is not owned by the interested stockholder. |

This provision may have the effect of delaying, deterring or preventing a change in control over us without further actions by our stockholders.

Interests of Named Experts and Counsel

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

Cane Clark LLP, our independent legal counsel, has provided an opinion on the validity of our common stock.

Maddox Ungar Silberstein, PLLC, Certified Public Accountants, has audited our financial statements included in this prospectus and registration statement to the extent and for the periods set forth in their audit report. Maddox Ungar Silberstein, PLLC, has presented their report with respect to our audited financial statements. The report of Maddox Ungar Silberstein, PLLC is included in reliance upon their authority as experts in accounting and auditing.

Principal Place of Business

Our principal offices are located at 8720-A Rue Du Frost, St. Leonard, Quebec, Canada, H1P 2Z5.

Overview

Ivany Mining Inc. was formed as a Delaware corporation on July 13, 1999. Our principal executive offices are located at 8720-A Rue Du Frost, St. Leonard, Quebec, Canada H1P 2Z5. Our telephone number is 514-325-4567.

We are in the business of mineral exploration and development. We have acquired or entered into agreements to acquire several mineral claims in the provinces and Quebec and Alberta, Canada. Our plan is to attempt to identify and pursue opportunities for the acquisition and development of mining properties in Canada and around the world.

We are focused on the strategic acquisition and development of uranium, diamond, base metals, and precious metal properties on a worldwide basis. Our long-term objective is to become a sustainable mid-tier base & precious metal producer in Canada & Cambodia, to the benefit of all stakeholders, in a socially and environmentally responsible manner. Our overall strategy is to rapidly advance our recently acquired/optioned base & precious metal exploration properties.

Exploration of our mineral claims is required before a final determination as to their viability can be made. The existence of commercially exploitable mineral deposits in our mineral claims is unknown at the present time and we will not be able to ascertain such information until we receive and evaluate the results of our exploration programs.

Zama Lake Pb-Zn Property

Acquisition of Property

On September 11, 2007, we entered into a Letter of Intent Purchase Agreement (the “Purchase Agreement”) with Star Uranium Corp. (“Star Uranium”). Under the terms of the Purchase Agreement, Star Uranium has agreed to transfer to us ten mining claims located in the Zama Lake area of northern Alberta, Canada. Under the Purchase Agreement, we paid Star Uranium a cash purchase price of $100,000CDN. Also, we issued Star Uranium 150,000 shares of our common stock as additional consideration for the purchased mining claims. The mining claims transferred under the Purchase Agreement cover a total of approximately 92,160 hectares.

Under the Purchase Agreement, we have also agreed to invest certain minimum amounts in the development of the mineral properties. Subject to any negotiated adjustments which may be made by the parties based on future geological evaluation, we were required to spend a minimum of $400,000CDN toward exploration of the properties before May 16, 2008. We are required to spend an additional $1,000,000CDN toward exploration and development before May 16, 2010.

Star Uranium has retained a 2% smelter royalty on the properties and has retained all diamond rights. We have the option to buy-down the retained net smelter royalty to 1% by making an additional payment of $1,000,000CDN to Star Uranium at any time. The Purchase Agreement, which is in the form of a short Letter of Intent, may be replaced by a more formal agreement if deemed necessary by the parties.

On September 12, 2007, we acquired additional claims in Alberta under an Alberta Mining Claims Purchase Agreement (the “Purchase Agreement”) with Derek Ivany and Royal Atlantis Group, Inc. (“Royal Atlantis”). Under the terms of the Purchase Agreement, Mr. Ivany and Royal Atlantis have transferred to us a total of six mining claims located in the province of Alberta, Canada.

In exchange for the mining claims transferred to us under the Purchase Agreement, we paid a total of $20,000 ($10,000 each) to Mr. Ivany and Royal Atlantis.

In 2007, Ivany Mining Inc. hired Paul A. Hawkins & Associates Ltd. an independent geological services firm to further analyze and complete a National Instrument 43-101 compliance form on the property. The report covers the property optioned from Star Uranium and outlines a detailed exploration program.

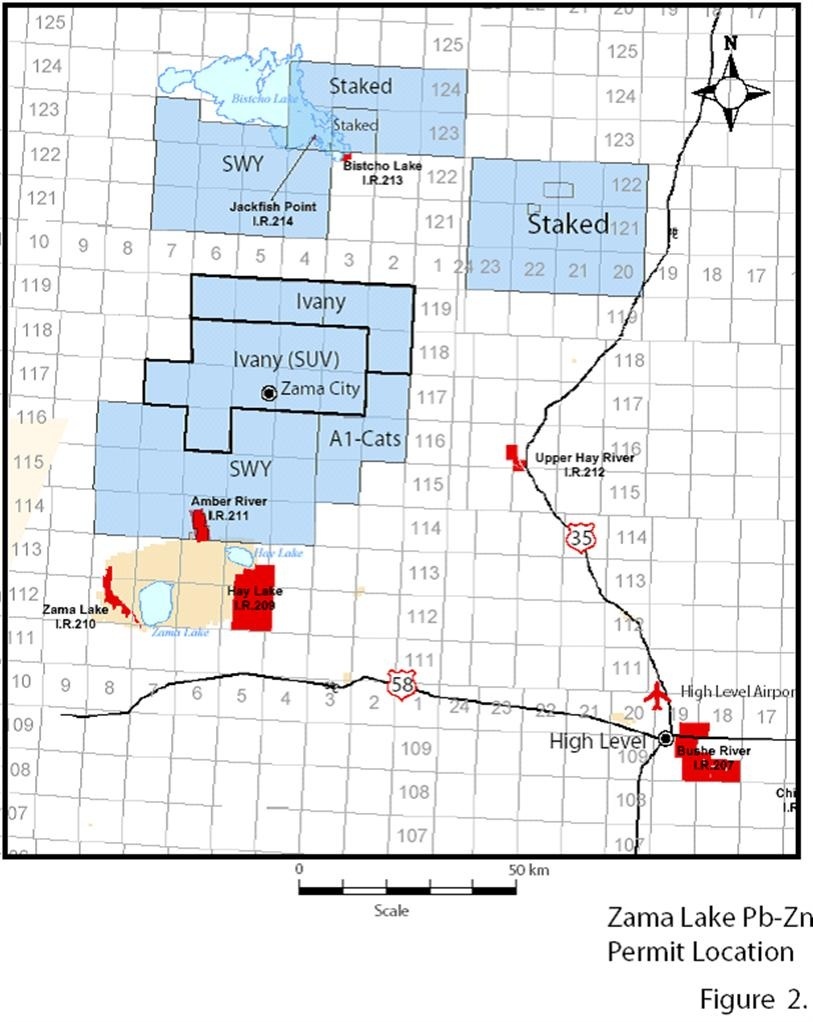

Description and Location of the Zama Lake Property

The Zama Lake Pb-Zn property consists of ten metallic mineral permits covering 92,160 hectares (227,732.3 acres) located 700 km north northwest of Edmonton Alberta. The property is a grass roots Pb-Zn Play staked as the result of the discovery of anomalous sphalerite and galena grains found in till samples collected during diamond exploration. The property area is forested and hosts parts of the Zama Lake Oil and Gas field. Zama Lake and Zama City are oil industry support bases and are located within the property.

The Zama Lake Pb-Zn consists of ten metallic mineral permits covering 92,160 hectares (227,732.3 acres) located 700 km north northwest of Edmonton Alberta. The property is a grass roots Pb-Zn Play staked as the result of the discovery of anomalous sphalerite and galena grains found in till samples collected during diamond exploration. The property area is forested and hosts parts of the Zama Lake Oil and Gas field. Zama Lake and Zama City are oil industry support bases and are located within the property. The First Nation Dene Tha’ (Assumption-Habay-Chateh) settlement exists to the south of the property.

Exploration Potential

The presence of anomalous concentrations of sphalerite and galena in the coarse sand fraction of till from the Zama Lake area suggests the possible presence of proximal Pb-Zn mineralization. Given the area geology, this mineralization may be either Sedex mineralization in the underlying shale or MVT mineralization in the deeper carbonates.

Northern Alberta hosts a thick sequence of shale, which is cut by the Great Slave Shear Zone which extends southwest from the Pine Point area into the Zama Lake / Rainbow Lake area. Core studies of Keg River carbonate in the area show dolomitization, brecciation, and the presence of cements containing fluorite, chalcopyrite, sphalerite, and / or galena, which are indicative of hydrothermal activity in the immediate region. This hydrothermal activity is likely present because the association of higher temperature saddle dolomite with epigenetic lead and zinc mineralization, hydrocarbons, and sulfate-rich carbonate proximal to major basement faults. The discovery of significant concentrations of Zn and Pb in modern saline formation waters emanating from Middle Devonian Keg River Formation in northern Alberta suggests a possible ore-source in the area that has not yet been discovered (Hitchon, 1993).

Throughout northern Alberta and southern Northwest Territories, numerous and extensive thick carbonate successions occur in the cratonic platform wedge of strata within the Western Canadian Sedimentary Basin. These same rocks host the Pine Point MVT mineralization. No Sedex deposits have been found in Cenozoic or Mesozoic age rocks but there is a clear association and close genetic link between deposit types. Potential exists for both types of deposit in the Zama Lake area.

The exploration potential of the Zama Lake Pb-Zn property lies in the recognition that the discovery of sphalerite, galena, barite grains in heavy mineral concentrates are being indicative of the metal bearing hydrothermal fluids ascending through a sedimentary package which hosts carbonates and shale where they could have deposited economic Pb-Zn deposits. Previous to this, sphalerite and galena occurrences were known in the Devonian carbonate rocks in oil wells in northern Alberta. High levels of metals were also found in saline formation waters in Devonian Keg River Formation. Both the federal (GSC) and provincial (AGS) geological surveys have been promoting the Pb-Zn conceptual potential of the Western Canadian Sedimentary Basin for several years (Rice, 2001; Hannigan, 2002; Hannigan et al., 2003). Previous analyses of Devonian formation waters in Northern Alberta show these waters to be Pb-rich and are thus not related to Pine Point because the deposit is Zn-rich. Recent analysis shows that Zn values are in an order of magnitude greater than Pb (Hannigan et al., 2003). Lead isotope dating of the Pine Point deposits is 290 Ma (290 million years ago or Late Pennsylvanian age). The metal-bearing fluids responsible for Pine Point are much older and likely different than modern formation waters. Modern formation waters are likely driven by a Laramide deformation event within the Cretaceous. This would make the whole sedimentary package prospective for Pb-Zn deposition.

The presence of the classical Pb - Zn - Mo anomalous geochemistry on a regional basis in the surficial environment in the clay silt fraction of till within the Zama Lake area indicates proximal source and not a far traveled transported anomaly. This potential has only recently been recognized. The structural setting of the Zama Lake Area along parallel structures to the MacDonald - Great Slave Fault northeast-southwest system and cross cutting northwest-southwest structures is similar in setting to the Pine Point Area. Most of these structures are basement features, which have been reactivated over time and penetrate nearly the full sedimentary package. These structures are likely one of the major controls localizing mineralization.

Exploration on the Zama Lake property consisting of till sampling, examination of indicator mineral concentrates and silt geochemistry indicates the likely proximal presence of Pb-Zn mineralization near surface. The best potential likely exists along structural breaks (faults), collapse structures, porous zones (tuffs), and proximal or up dip of petroleum zones. This potential likely exists beyond the carbonates at depth and into the shale. Further work is required to evaluate this grass-roots Pb-Zn property of merit.

Geological Exploration Program in General and Recommendations From Our Consulting Geologist

We have obtained an independent Technical Report on the Zama Lake property from Paul A. Hawkins, P.Eng. Mr. Hawkins prepared the Technical Report and reviewed all available exploration data completed on these mineral claims.

The property that is the subject of the Zama Lake property is undeveloped and does not contain any open-pit or underground mines which can be rehabilitated. There is no commercial production plant or equipment located on the property that is the subject of the mineral claim. Our exploration program is exploratory in nature and there is no assurance that mineral reserves will be found. In order to further evaluate the potential of the Zama Lake property, our consulting geologist has recommended a two-phase exploration program.

Phase I

Sub-surface data should be compiled from select wells on the property to compile the shallow stratigraphy from well logs. Any structural information from the logs would also be valuable. Bedrock topography would also be important to avoid areas of deep overburden. This information can likely be acquired at a minimum cost.

Further, more extensive bulk till and silt geochemical sampling should be untaken at a higher density using ATV for better access into more remote and wetter areas where summer access does not exist. Coverage of silt geochemistry sampling should be expanded beyond that of addition bulk till sampling. Orientation studies should also be undertaken to define variation with depth and lateral variation within burrow pits near current anomalous areas. Increasing bulk till sample size should also be evaluated. Data from GSC / AGS multi-element sampling should be fully integrated into a single database.

Isotopic age dating of the sulfide indicator minerals recovered is warranted to date the age of the mineralization. The age date for mineralization at Pine Point is 290 million years ago. The age date for mineral at Zama Lake in the subsurface within Devonian carbonates is of a similar age. Mineralization near surface may relate to the Laramide Orogeny 47 ±10 Ma (million years ago). This Laramide Orogeny likely deforms rocks up and including Cretaceous age rock. If the age dates are much younger than the old lead dates for Pine Point, the potential for the play increases significantly. Several of the grains should have their isotopic composition determined.

Processing of aeromagnetic data should be completed and targets selected for ground follow-up. Follow-up ground geophysics should likely initially consist of ground magnetometer, VLF-EM, HLEM and selected induced polarization (IP) surveys. The best suite of surveys should be determined given the local ground conditions and overburden thickness. It will likely be possible in some cases to use pre-existing grid lines from seismic surveys. Total cost for the Phase I program is estimated at $400,000.

Phase II

The recommended Phase II program is largely a winter drilling program because of access issues. A suite of ground geophysics would delineate drill targets. Drilling would then be conducted on defined targets within 152.4 m (500 ft) of surface. Where possible, surface access would be gained by using pre-existing winter roads. Operations would likely be based out of one of Zama City’s open camps. Special care would be required in areas of shallow natural gas. The special care procedures would not be cost prohibitive but include extra training of crews, spark arrestor on diesel engines and gas deflector on casings. The drilling component of the Phase II program budget is contingent on the delineation of suitable drill targets. A phase II budget of $1,000,000 is recommended.

Exploration Budget

| Phase I | | | |

| | | | |

| Well Log Data Compilation | $ | 25,000 | | |

| Heavy Mineral Sampling | $ | 25,000 | | |

| Laboratory & Isotopic Analysis | $ | 35,000 | | |

| Ground Geophysics (IP, EM and Mag) | $ | 265,000 | | |

| Project Management and Reporting | $ | 50,000 | | |

| Phase I Total | $ | 400,000 | | $ | 400,000 |

| | | | | | |

| Phase II | | | | | |

| | | | | | |

| Ground Geophysics (IP, EM and Mag) | $ | 200,000 | | | |

| Diamond Drilling (3000 m.) | $ | 750,000 | | | |

| Project Management and Reporting | $ | 50,000 | | | |

| Sub-total= | $ | 1,000,000 | | $ | 1,000,000 |

| | | | | | |

| Project Total= | $ | 1,400,000 | | | |

Quebec Properties

We have also acquired a 100% interest in two large sets of mineral claims in the province of Quebec, Canada. We have not yet commissioned geological or technical reports on these properties and can give no data or other assurances regarding their value or exploration potential at this time. We plan to obtain independent reports regarding these properties in the near future. The following is a brief description of the Quebec properties our plans for conducting initial surveying and sampling on these claims:

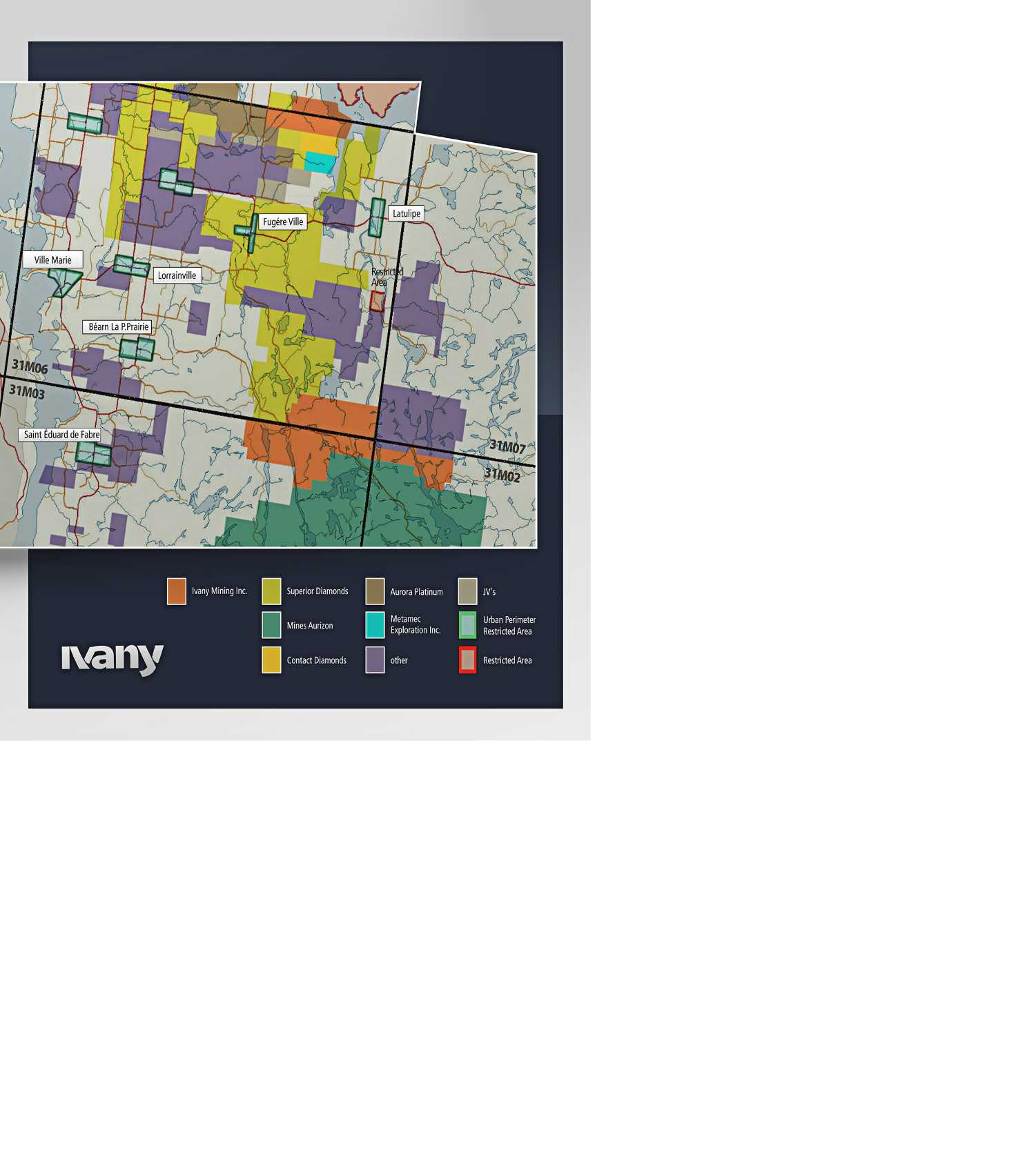

Temiscamingue property

The Temiscamingue property is located approximately 40 kilometers east of the town of Ville Marie and 100 kilometers south of Rouyn Noranda, halfway between the Elliott Lake Uranium camp in Ontario and the Abitibi Gold Belt, within the Grenville Province Front. The project is accessible via logging roads. Government regional stream sediment survey have identified many anomalies in the area. Property is strategically located between the claims of Superior Diamonds (adjacent to the north) where new kimberlites have recently been discovered and the property of Aurizon Mines (adjacent to the south) which has reported as much as 100 grams of gold per ton during till sampling with the objective of identifying the gold dispersion trains previously outlined. Ivany Mining has acquired a 100% undivided interest of 24928.68 acres in this mineral rich Temiscamingue region.

Regional Geology

The Superior Province is the largest Archean craton in the world, half of which is located in Québec. This craton is a highly prospective region for kimberlite exploration, meeting all four criteria for hosting economic grades of diamond-bearing kimberlite: 1) the presence of an Archean craton; 2) the refractive, relatively cool and low-density peridotitic root of the craton has been insulated against reheating and excessive tectonic reworking; 3) the presence of major tectonic structures; and 4) association of diamonds with other intrusive rocks. Four kimberlite fields have been identified in Québec, the Temiscamingue Field being one of these.

Local Geology

The Property over thrusts 2 geological structural provinces, intruded by granite-granodiorite-mafic and ultramafic rocks all faulted and sheared. Fault sets and lineaments intersect the Structural Thrust Front. It is on the Central-median ridge of the “Temiscamingue Lake Rift” and on the strike of many Diamond Kimberlite occurrences.

Stream sediment geochemistry points to strong anomalies for Nickel, Uranium, and Rare Earths Elements along with good gold potential and many circular shape magnetic anomalies to be tested for their Kimberlitic potential.

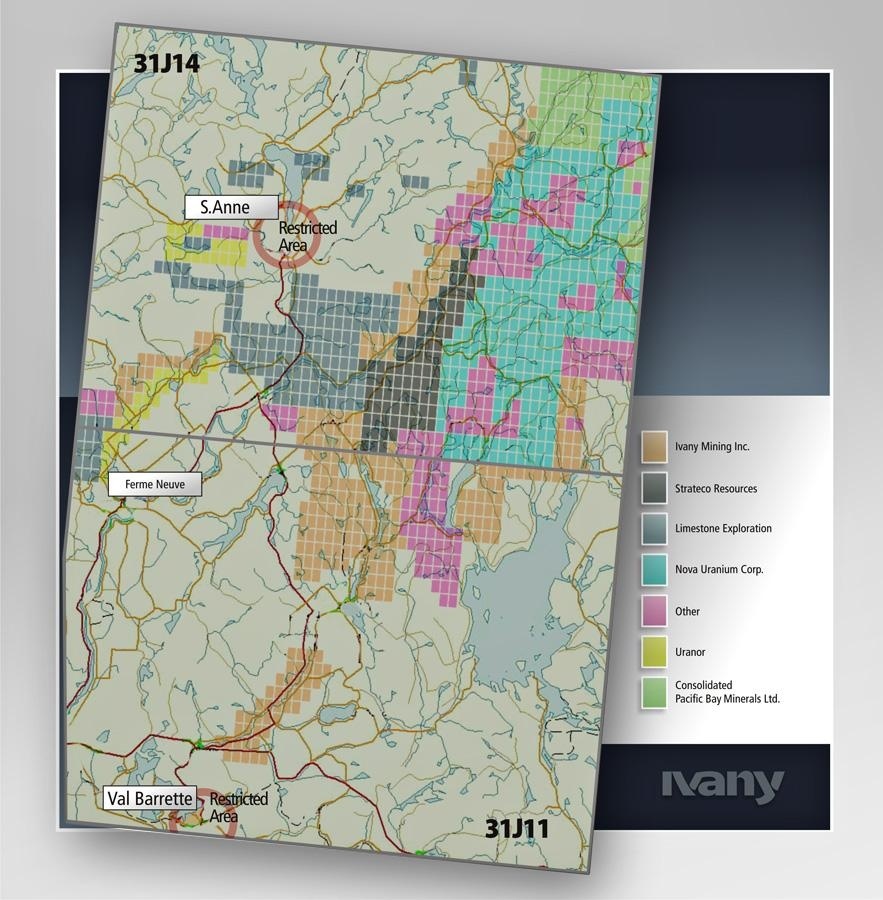

Mont Laurier properties

Ivany Mining owns a 100% interest in a large group of claims situated in the area of Mont Laurier, Quebec, the property is located less than 200 kilometers northwest of Montreal and is easily accessible by both paved and gravel roads. The Mont Laurier properties were acquired after Nova Uranium and Strateco Resources made several discoveries in the area. Ivany Mining has claims adjacent to Strateco and Nova uranium in a North/South trend. Previous exploration in the area has resulted in many uranium showings including a grab sample showing a result of over 70lbs/ton of U308. Also, there are estimations of sizeable U308 reserves in the area, but theses reserves are pre NI-43 101 therefore not compliant. With the price of U308 recently climbing to $136 per pound, there has been renewed interesting the area. The close proximity to a major metropolitan city makes this project very attractive as exploration and mining costs are sharply reduced as compared to projects in remote areas.

Regional Mineralization

The Mont Laurier Uranium Exploration Camp area is one of many radioactive districts scattered throughout the Grenville Structure Province. Many of the Grenville radioactive occurrences (chiefly related to intrusives of granitic composition) are found in the southwestern extent of the structural province, extending from southwest Quebec into eastern Ontario.

Local Mineralization

The Property hosts at least 21 historical uranium showings, where syngenetic uranium mineralization is found in metamorphic pegmatites and granites. Some of these major mineral showings are comprised of a collection of smaller individual uranium occurrences.

As a general rule, syngenetic uranium deposits form as the result of high temperature igneous and/or metamorphic differentiation caused by the exclusion of uranium (and other radioactive elements) from the crystal structure of most rock-forming minerals. This type of uranium deposit is confined to high-grade metamorphic terrains, typically occurring within Achaean to early Proterozoic aged basement granite gneiss complexes. Deposits are normally associated with major regional scale structural faults and/or structures related to the emplacement of deep-seated alkaline intrusive bodies. Host rock lithologies are generally granitic in composition, occurring as intricate dyke-sill complexes, varying in texture from aplitic to pegmatitic. Ore minerals typically include finely disseminated crystals of uraninite, uranothorite and allanite, with less common secondary minerals like, uranophane or pitchblende.

Competition

The mineral exploration industry, in general, is intensely competitive and even if commercial quantities of reserves are discovered, a ready market may not exist for the sale of the reserves.

Most companies operating in this industry are more established and have greater resources to engage in the production of mineral claims. We have only recently acquired or entered into agreements to acquire our mineral claims and our operations are not well-established. Our resources at the present time are limited. We may exhaust all of our resources and be unable to complete full exploration of the Zama Lake mineral claims or our other properties. There is also significant competition to retain qualified personnel to assist in conducting mineral exploration activities. If a commercially viable deposit is found to exist and we are unable to retain additional qualified personnel, we may be unable to enter into production and achieve profitable operations. These factors set forth above could inhibit our ability to compete with other companies in the industry and entered into production of the mineral claim if a commercial viable deposit is found to exist.

Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result our not receiving an adequate return on invested capital.

Compliance with Government Regulation

The Metallic Minerals and Industrial Minerals Permits (“Permits”) which comprise the Zama Lake Property were staked under the terms of the Mines and Minerals Act – Metallic and Industrial Minerals Tenure Regulation (AR 145/2005). The permits grants the holder:

(a) the non-exclusive right to explore for metallic and industrial minerals on the surface of the location,

(b) the exclusive right to explore for metallic and industrial minerals in the subsurface strata within and under the location, and

(c) the right to remove samples of metallic and industrial minerals from the location for the purposes of assaying and testing and of metallurgical, mineralogical and other scientific studies. (AR 145/2005)

The regulations require that the recorded holder of permits shall perform, or have performed, exploration and development work (assessment work) on the permits to a per hectare value of $5 in the first assessment period. A permit assessment period is two years. In the second and third assessment periods this increases to $10 per hectare. In the fourth to seventh assessment period this increases to $15 per hectare. No filing fees are associated with filing assessment work. These assessment work requirements are calculated from the date of issue of the current permit.

A permit may be held for fourteen years and can vary in size from a minimum of 16 hectares to a maximum of 9,216 hectares. Permit boundaries are defined by the Alberta Township Survey system. Permit locations are therefore defined by a township, range, section, and legal subdivision. A township is 9,216 hectares in size while a section is 256 hectares. A legal survey division (“LSD”) is 16 hectares in size. Permits may be grouped for application of assessment work provided they are contiguous.

The holder of a permit may after two years apply for a lease provided the first year’s rent for the lease is paid in advance and the Minister of Energy has been provided evidence that a deposit exists on the location applied for. The lease has a term of fifteen years and may be extended a further fifteen years upon approval of the Minister of Energy. The lease permits the holder to hold the ground fee simple without further assessment work requirements.

Prospecting for Crown minerals using hand tools is permitted throughout Alberta without a license, permit, or regulatory approval, as long as there is no surface disturbance (AR 213, 1998). Prospecting on privately owned land or land under lease is permitted without any departmental approval, however, the prospector must obtain consent from the landowner or leaseholder before starting to prospect. Unoccupied public lands may be explored without restriction, but as a safety precaution prospectors working in remote areas should inform the local Sustainable Resource Development (forestry) office of their location.

When prospecting, the prospector can use a vehicle on existing roads, trails and cut line. If the work is on public land, the prospector can live on the land in a tent, trailer, or other shelter for up to fourteen days. For periods longer than fourteen days, approval should be obtained from the Land Administration Division. If the land is privately owned or under lease, the prospector must make arrangements with the landowner or leaseholder. Exploration approval is not needed for aerial surveys or ground geophysical and geochemical surveys, providing they do not disturb the land or vegetation cover.

If mechanized exploration equipment is to be used and/or the land surface disturbed, the prospector or company must obtain the appropriate approvals and permits, as required under the Metallic and Industrial Minerals Exploration Regulation. Most projects require an Exploration License, Exploration Permit and Exploration Approval. The following sections describe the criteria and procedures for each of these.

An Exploration License must be obtained before a person or company can apply for, or carry out an exploration program. The license holder is then accountable for all work done under this exploration program. However, the licensee cannot carry out any actual exploration activity until the Department of Environmental Protection issues an Exploration Approval for each program submitted under that license. A fee of $50 must accompany the license application. The license is valid throughout Alberta and remains in effect as long as the company is operating in the province. If a license holder wants to use exploration equipment, such as a drilling rig, an Exploration Permit must be obtained. A fee of $50 must accompany the license application. The permit is valid throughout Alberta and remains in effect as long as the company is operating in the province.

Approval must be obtained if an exploration project involves environmental disturbance such as drilling, trenching, bulk sampling or the cutting of grids that involves more than limbing trees and removing underbrush. Samples up to 20 kg in size may be taken for assay and testing purposes, but larger samples must be authorized by the Department of Energy. The licensee does not need to hold the mineral rights for an area to apply for an Exploration Approval.

Project approval is through the Land and Forest Service of Alberta Environmental Protection. If an application has been completed and the appropriate field staff has copies of the program, approval can usually be obtained in about ten working days. Each application for exploration approval must be accompanied by a fee of $100. After receiving exploration approval, the prospector or exploration company may conduct the approved activity. However, if they modify their program, the designated field officer must be contacted to review and approve the changes. A final report must be submitted to Land and Forest Service of Alberta Environmental Protection within sixty days following completion of the exploration program. The report must show the actual fieldwork, and include a map showing the location of drilling, test pits, excavations, constructed roads, existing trails utilized and all other land disturbances.

Competition and Market for Our Products and Services

The mineral exploration industry, in general, is intensely competitive and even if commercial quantities of reserves are discovered, a ready market may not exist for the sale of the reserves.

Most companies operating in this industry are more established and have greater resources to engage in the production of mineral claims. We have only recently acquired or entered into agreements to acquire our mineral claims and our operations are not well-established. Our resources at the present time are limited. We may exhaust all of our resources and be unable to complete full exploration of the Zama Lake mineral claims or our other properties. There is also significant competition to retain qualified personnel to assist in conducting mineral exploration activities. If a commercially viable deposit is found to exist and we are unable to retain additional qualified personnel, we may be unable to enter into production and achieve profitable operations. These factors set forth above could inhibit our ability to compete with other companies in the industry and entered into production of the mineral claim if a commercial viable deposit is found to exist.

Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result our not receiving an adequate return on invested capital.

Employees

We have no employees as of the date of this prospectus. We conduct our business largely through agreements with consultants and other independent third party vendors.

Research and Development Expenditures

We have not incurred any research or development expenditures since our incorporation.

Subsidiaries

We have neither formed, nor purchased any subsidiaries since our incorporation.

Patents and Trademarks

We do not own, either legally or beneficially, any patent or trademark.

Zama Lake Property