WASHINGTON, D.C. 20549

SulphCo, Inc.

850 Spice Islands Drive

Sparks, NV 89431

www.sulphco.com

NOTICE OF THE 2006 ANNUAL MEETING OF STOCKHOLDERS

To Be Held On June 19, 2006

Dear Stockholder:

You are cordially invited to attend the 2006 Annual Meeting of Stockholders of SulphCo, Inc., a Nevada corporation (the “Company”). The annual meeting will be held on Monday, June 19, 2006 at 10:00 a.m. local time at the Company’s offices at 850 Spice Islands Drive, Sparks, NV 89431 for the following purposes:

| | 1. | To elect six directors of the Company, to hold office until the 2007 Annual Meeting of Stockholders; |

| | 2. | To approve the adoption of the 2006 Stock Option Plan; and |

| | 3. | To conduct any other business properly brought before the annual meeting or any adjournment or postponement thereof. |

These items of business are more fully described in the Proxy Statement accompanying this Notice. The record date for the annual meeting is June 2, 2006. Only stockholders of record at the close of business on that date may vote at the annual meeting or any adjournment or postponement thereof. A list of the stockholders entitled to vote at the annual meeting will be available for examination by any stockholder for any purpose reasonably related to the annual meeting during ordinary business hours in the office of the Secretary of the Company during the ten days prior to the annual meeting.

You are cordially invited to attend the annual meeting in person. Whether or not you expect to attend the annual meeting, please complete, date, sign and return the enclosed proxy card as promptly as possible in order to ensure your representation at the annual meeting. A return envelope (which is postage prepaid if mailed in the United States) is enclosed for your convenience. Even if you have voted by proxy, you may still vote in person if you attend the annual meeting. Please note, however, that if your shares are held of record by a broker, bank, or other nominee and you wish to vote at the annual meeting, you must obtain a proxy issued in your name from that record holder.

By Order of the Board of Directors,

/s/ Rudolf W. Gunnerman

Rudolf W. Gunnerman

Chairman and CEO

Sparks, Nevada

June 2, 2006

SulphCo, Inc.

850 Spice Islands Drive

Sparks, NV 89431

www.sulphco.com

PROXY STATEMENT

FOR THE 2006 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 19, 2006

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why am I receiving these materials?

We sent you this proxy statement and the enclosed proxy card because the Board of Directors of SulphCo, Inc. (sometimes referred to as the “Company” or “SulphCo”) is soliciting your proxy to vote at the 2006 Annual Meeting of Stockholders. You are invited to attend the annual meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the annual meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card. The Company intends to mail this proxy statement and accompanying proxy card on or about June 5, 2006, to all stockholders of record entitled to vote at the annual meeting.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on June 2, 2006, will be entitled to vote at the annual meeting. On this record date, there were 72,403,410 shares of common stock outstanding and entitled to vote.

Stockholders of Record: Shares Registered in Your Name

If on June 2, 2006, your shares were registered directly in your name with our transfer agent, Integrity Stock Transfer, Inc., then you are a stockholder of record. As a stockholder of record, you may vote in person at the annual meeting or vote by proxy. Whether or not you plan to attend the annual meeting, we ask you to fill out and return the enclosed proxy card if you wish to have your vote recorded.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on June 2, 2006, your shares were held in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name’’ and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the annual meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are two matters scheduled for a vote:

| | 1. | Election of six directors of the Company, to hold office until the 2007 Annual Meeting of Stockholders; and |

| | 2. | Approval of the adoption of the 2006 Stock Option Plan. |

How do I vote?

You may either vote “For’’ all the nominees to the Board or you may withhold from voting for any nominee you specify. For each of the other matters to be voted on, you may vote “For” or “Against” or abstain from voting. The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the annual meeting, or vote by proxy using the enclosed proxy card. Whether or not you plan to attend the annual meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the annual meeting and vote in person if you have already voted by proxy.

| | 1. | To vote in person, come to the annual meeting and we will give you a ballot when you arrive. |

| | 2. | To vote using the enclosed proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from us. Simply complete and mail the proxy card or follow the instructions included with the proxy materials to vote by telephone or Internet to ensure that your vote is counted. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of June 2, 2006.

What if I return a proxy card but do not make specific choices?

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted “For” the election of all of the Company’s nominees for director and “For” the approval of the adoption of the 2006 Stock Option Plan. If any other matter is properly presented at the annual meeting, your proxy (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors and employees may also solicit proxies in person, by telephone or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the annual meeting. You may revoke your proxy in any one of three ways:

| | 1. | You may submit another properly completed proxy bearing a later date. |

| | 2. | You may send a written notice that you are revoking your proxy to SulphCo’s Secretary at 850 Spice Islands Drive, Sparks, NV 89431. |

| | 3. | You may attend the annual meeting and vote in person. Simply attending the annual meeting will not, by itself, revoke your proxy. |

When are stockholder proposals due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by February 1, 2007, to SulphCo’s Secretary at 850 Spice Islands Drive, Sparks, NV 89431. Stockholders wishing to submit proposals or director nominations that are not to be included in such proxy materials must do so between March 31, 2007 and April 30, 2007, provided that if the 2007 annual meeting is to be held before May 19, 2007, the proposal must be received by us either 90 days prior to the actual meeting date or 10 days after we first publicly announce the meeting date. Stockholders are also advised to review the Company’s Bylaws, which contain additional requirements with respect to advance notice of stockholder proposals and director nominations.

How are votes counted?

Votes will be counted by the inspector of election appointed for the annual meeting, who will separately count “For” and (with respect to proposals other than the election of directors) “Against” votes, abstentions and broker non-votes. Abstentions will be counted towards the vote total for each proposal and will have the same effect as “Against” votes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

If your shares are held by your broker as your nominee (that is, in “street name”), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. If the broker or nominee is not given specific instructions, shares held in the name of such broker or nominee may not be voted on those matters and will not be considered as present and entitled to vote with respect to those matters. Shares represented by such “broker non-votes” will, however, be counted in determining whether there is a quorum.

How many votes are needed to approve each proposal?

| | 1. | For the election of directors, the six nominees receiving the most “For” votes (among votes properly cast in person or by proxy) will be elected. Broker non-votes will have no effect. |

| | 2. | To be approved, Proposal No. 2 approving the adoption of the 2006 Stock Option Plan must receive “For” votes from the majority of shares present and entitled to vote either in person or by proxy. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares are represented by stockholders present at the meeting or by proxy. On the record date, there were 72,403,410 shares outstanding and entitled to vote. Thus 36,201,706 shares must be represented by stockholders present at the annual meeting or by proxy to have a quorum. Your shares will be counted towards the quorum only if you submit a valid proxy vote or vote at the annual meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, a majority of the votes present at the annual meeting may adjourn the annual meeting to another date.

How can I find out the results of the voting at the annual meeting?

Voting results will be published in the Company’s quarterly report on Form 10-Q for the quarter ending June 30, 2006.

PROPOSAL 1

ELECTION OF DIRECTORS

SulphCo’s Board is currently comprised of seven members, each serving a one year term. One of the current directors, Michael T. Heffner, has advised the Board of Directors that he prefers not to be re-nominated as a director when his term expires at the 2006 Annual Meeting. Accordingly, the number of directors has been reduced to six persons at this time. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy shall serve for the remainder of the term of that director and until the director’s successor is elected and qualified. This includes vacancies created by an increase in the number of directors.

The Board has recommended for election Dr. Rudolf W. Gunnerman, Dr. Hannes Farnleitner, Richard L. Masica, Robert Henri Charles van Maasdijk, Christoph Henkel, and Dr. Raad Alkadiri. If elected at the annual meeting, these directors would serve until the 2007 Annual Meeting and until their successors are elected and qualified, or until their earlier death, resignation or removal.

Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote at the annual meeting. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of Dr. Rudolf W. Gunnerman, Dr. Hannes Farnleitner, Richard L. Masica, Robert Henri Charles van Maasdijk, Christoph Henkel and Dr. Raad Alkadiri. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as the Board may propose. Each of Dr. Rudolf W. Gunnerman, Dr. Hannes Farnleitner, Richard L. Masica, Robert Henri Charles van Maasdijk, Christoph Henkel and Dr. Raad Alkadiri has agreed to serve if elected, and we have no reason to believe that they will be unable to serve.

Our directors and nominees, their ages, positions with SulphCo, the dates of their initial election or appointment as director are as follows:

Name | | Age | | Position With SulphCo | | Served From |

| | | | | | | |

| Rudolf W. Gunnerman | | 78 | | Chief Executive Officer, Chairman of the Board and Director | | December 2000 |

| Dr. Hannes Farnleitner | | 66 | | Director | | November 2005 |

| Richard L. Masica | | 69 | | Director | | November 2004 |

| Robert Henri Charles van Maasdijk | | 61 | | Director | | April 2005 |

| Dr. Raad Alkadiri | | 39 | | Director | | May 2005 |

| Christoph Henkel | | 48 | | Director | | December 2005 |

The following is a brief biography of each director nominee.

Dr. Rudolf W. Gunnerman, our Chief Executive Officer, Chairman of the Board and Director, is a 78 year old entrepreneur who studied mathematics and physics at the University of Munich, Germany before he immigrated to the United States. Dr. Gunnerman has invented a series of successful technologies, including fireproof building materials and wood pellets. Thereafter, in his quest to reduce Nitrous Oxide, a major source of ozone depletion, Dr. Gunnerman invented a new range of clean fuel products known as A-55 Clean Fuels. Dr. Gunnerman founded Clean Fuels Technology, Inc. in 1997 to develop and commercialize A-55 Clean Fuels, and served as its CEO from 1997 to 2000, and as its Chairman from 1997 to 2003. Dr. Gunnerman holds three honorary doctorate degrees. Dr. Gunnerman has served as a director and Chairman of the Board of SulphCo since December 2000 and has served as our CEO since July 2001.

Richard L. Masica, a Director since November 2004, served as the President of Texaco Chemical, Inc. from 1994 to 1997. During his 39-year career at Texaco (now ChevronTexaco Corporation), Mr. Masica also held other positions, including the position of Vice-President-Business Management of Texaco Chemical Company from 1992 to 1994, and Plant Manager of Texaco Refining & Marketing, Inc. from 1985 to 1992. During his tenure with Texaco, Mr. Masica participated in a leadership role in two major divestitures, as well as other domestic and foreign reorganizations, mergers and startups. Since retiring from Texaco in 1998, Mr. Masica founded and is the President of Peak One Consulting, Inc., a private management consulting firm.

Dr. Hannes Farnleitner, a Director since November 2005, is a former federal minister for economic affairs for the country of Austria. Dr. Farnleitner has served in policy-making roles in Austria involving economics and international trade for more than 40 years. Since 2002, he has served as a member of the Convent of the European Union and representative of the Federal Chancellor of Austria. He earned his Juris Doctor degree at the School of Law of the University of Vienna.

Robert Henri Charles van Maasdijk, a Director since April 2005, is the chairman and CEO of Attica Alternative Investment Fund, Ltd. (AAI), a private investment fund which he has headed since 1999. For the previous 16 years, he served as managing director and CEO of Lombard Odier Investment Portfolio Management Ltd., one of the oldest and largest private banks in Switzerland. Over his 35-year career, he has held executive, portfolio management and research positions with Ivory & Sims, Edinburgh; Banque Lambert, Brussels; Pierson Heldring Pierson, Amsterdam; and with Burham and Company, New York.

Dr. Raad Alkadiri, a Director since May 2005, has been with the international energy advisory firm PFC Energy, Inc. since 1998. Dr. Alkadiri is Director for Middle East and Africa in PFC’s Country Strategies Group and heads its Iraq advisory service. Dr. Alkadiri focuses on the political, economic and sectoral factors that influence oil and gas producing states, particularly those in the Middle East. Dr. Alkadiri served as policy advisor and assistant private secretary to the United Kingdom’s special representatives to Iraq from 2003 - 2004. In this role, he assisted in shaping UK policy toward Iraq during the occupation, as well as planning Iraq’s transition to sovereignty. He was invested as an Officer of the Order of the British Empire for his work in Baghdad. Prior to joining PFC Energy in 1998, Alkadiri was Middle East analyst at the UK-based consultancy Oxford Analytica, where he focused on political and economic developments in the northern Persian Gulf states. From 2000 to 2001, he was associate professor at the School of Advanced International Studies, Johns Hopkins University. He was a teaching fellow of politics at the University of St. Andrews from 1990 to 1991.

Christoph Henkel, a Director since December 2005, is vice chairman of the Shareholders Committee of Henkel KGaA, a $13 billion international consumer products company based in Dusseldorf, Germany. Prior to joining Henkel in 1989, Mr. Henkel held various management positions at Nestle and Henkel subsidiaries. He has served on the boards of Loctite Inc., the Clorox Company, as well as sporting goods company Head N.A. Mr. Henkel currently is principal and founding partner of Canyon Equity LLC, a private equity firm based in California.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE IN FAVOR OF EACH NAMED NOMINEE.

Information Regarding the Board of Directors

During the fiscal year ended December 31, 2005, the Board met nine times, and during the fiscal year each Board member attended at least 75% of the aggregate of Board of Director meetings and meetings of committees on which he served during his tenure as a director or committee member. The Board has determined that Dr. Hannes Farnleitner, Richard L. Masica, Robert Henri Charles van Maasdijk, Christoph Henkel and Dr. Raad Alkadiri are “independent” directors as defined in applicable SEC regulations, utilizing the independence standards adopted by The American Stock Exchange. The Board has determined that Dr. Rudolf W. Gunnerman is not an “independent” director as defined in applicable SEC regulations. The Board has established three committees, the Audit Committee, the Compensation Committee and the Option Committee.

The Board has not established a formal nominating committee. Therefore, decisions relating to the nomination of directors are addressed by the entire Board of Directors. As described above, a majority of the Board is “independent” as currently defined under SEC rules. The Board has not established any specific minimum qualifications that must be met for recommendation for a position on the Board. Instead, in considering candidates for director, the Board will generally consider all relevant factors, including among others the candidate’s applicable expertise and demonstrated excellence in his or her field, the usefulness of such expertise to the Company, the availability of the candidate to devote sufficient time and attention to the affairs of the Company, the candidate’s reputation for personal integrity and ethics and the candidate’s ability to exercise sound business judgment. Other relevant factors, including diversity, age and skills, will also be considered. Candidates for director are reviewed in the context of the existing membership of the Board (including the qualities and skills of the existing directors), the operating requirements of the Company and the long-term interests of its stockholders. The Board uses its network of contacts when compiling a list of potential director candidates and may also engage outside consultants (such as professional search firms). At this time, the Board does not consider director candidates recommended by stockholders. The Board believes that it is in the best position to identify, review, evaluate and select qualified candidates for Board membership.

Information Regarding the Audit Committee

The Audit Committee is currently comprised of Robert Henri Charles van Maasdijk, Dr. Hannes Farnleitner and Dr. Raad Alkadiri. Dr. Alkadiri was appointed to the Audit Committee in May 2006 when the Audit Committee was expanded to three persons. In 2005, the Audit Committee met five times. The Board has determined that Robert Henri Charles van Maasdijk, Dr. Hannes Farnleitner and Dr. Raad Alkadiri are independent (as independence is currently defined in applicable SEC and American Stock Exchange rules). The Board has determined that Robert Henri Charles van Maasdijk qualifies as an “audit committee financial expert,” as defined in applicable SEC rules. The Board made a qualitative assessment of Mr. van Maasdijk’s level of knowledge and experience based on a number of factors, including his formal education and experience.

The Audit Committee is responsible for overseeing the Company’s corporate accounting, financial reporting practices, audits of financial statements and the quality and integrity of the Company’s financial statements and reports. In addition, the Audit Committee oversees the qualifications, independence and performance of the Company’s independent auditors. In furtherance of these responsibilities, the Audit Committee’s duties include the following: evaluating the performance of and assessing the qualifications of the independent auditors; determining and approving the engagement of the independent auditors to perform audit, review and attest services and to perform any proposed permissible non-audit services; evaluating employment by the Company of individuals formerly employed by the independent auditors and engaged on the Company’s account and any conflicts or disagreements between the independent auditors and management regarding financial reporting, accounting practices or policies; discussing with management and the independent auditors the results of the annual audit; reviewing the financial statements proposed to be included in the Company’s annual report on Form 10-K; discussing with management and the independent auditors the results of the auditors’ review of the Company’s quarterly financial statements; conferring with management and the independent auditors regarding the scope, adequacy and effectiveness of internal auditing and financial reporting controls and procedures; and establishing procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting control and auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters.

Information Regarding the Compensation Committee

The Compensation Committee was formed in February 2006 and is currently comprised of Messrs. Masica and Henkel, each of whom is independent under applicable SEC and American Stock Exchange Rules. Prior to this time the entire Board of Directors acted as the Compensation Committee. The Compensation Committee reviews and, as it deems appropriate, recommends to the Board policies, practices and procedures relating to the compensation of the officers and other managerial employees and the establishment and administration of employee benefit plans. It advises and consults with the officers of the Company as may be requested regarding managerial personnel policies. The Compensation Committee also has such additional powers as may be conferred upon it from time to time by the Board. The Compensation Committee’s report is included elsewhere in this proxy statement.

Information Regarding the Option Committee

The Option Committee was formed in May 2006 to administer the 2006 Stock Option Plan and is currently comprised of Messrs. Masica, Henkel and Alkadiri, each of whom is independent under applicable SEC and American Stock Exchange Rules. The Option Committee exercises all authority under any employee stock option plans of the Company as the Committee therein specified, unless the Board resolution appoints any other committee to exercise such authority.

Compensation of Directors

We have not provided cash compensation to directors for their services as directors. The members of the Board are eligible for reimbursement for their expenses incurred in attending Board meetings in accordance with Company policy. Under our current policy, all directors receive 50,000 shares of our common stock upon joining the Board, other than Dr. Rudolf W. Gunnerman.

Policy Regarding Directors’ Attendance at Annual Meeting of Stockholders

The Board has not adopted a policy with respect to director attendance at annual meetings of stockholders. Directors are not compensated for attending an annual meeting of stockholders. However, directors are reimbursed for out-of-pocket expenses for attendance at an annual meeting of stockholders. The Board encourages each director to attend the annual meeting of stockholders, whether or not a Board meeting is scheduled for the same date of the annual meeting.

Stockholder Communications with the Board of Directors

A stockholder may contact one or more of the members of the Board of Directors in writing by sending such communication to the Secretary at the Company’s address. The Secretary will forward stockholder communications to the appropriate director or directors for review. Anyone who has a concern about the conduct of the Company or the Company’s accounting, internal accounting controls or auditing matters, may communicate that concern to the Secretary, the Chairman of the Board or any member of the Board of Directors at the Company’s address. The Company encourages individual directors to attend the annual meeting. We believe our responsiveness to stockholder communications to the Board has been adequate.

REPORT OF THE AUDIT COMMITTEE

The material in the Report of the Audit Committee is not “soliciting material,” is not deemed filed with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended (the “Exchange Act”), whether made before or after the date hereof and irrespective of any general incorporation language in such filing.

The Audit Committee of the Company for the fiscal year 2005 was composed of Loren J. Kalmen and Robert Henri Charles van Maasdijk. It is currently composed of three directors, Robert Henri Charles van Maasdijk, Dr. Hannes Farnleitner and Dr. Raad Alkadiri, and operates under the written Audit Committee charter adopted by the Board of Directors in 2004. The Audit Committee provides assistance and guidance to the Board in fulfilling its oversight responsibilities to the Company’s stockholders with respect to the Company’s corporate accounting and reporting practices as well as the quality and integrity of the Company’s financial statements and reports. The Company’s principal executive officer and principal financial officer have the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. The Company’s independent auditors are responsible for auditing the Company’s financial statements and expressing an opinion on the conformity of the audited financial statements with generally accepted accounting principles. The Audit Committee’s responsibility is to monitor and oversee these processes. To this end, the Audit Committee has reviewed and discussed the audited financial statements of the Company for the fiscal year ended December 31, 2005 with management and Marc Lumer & Company, the Company’s independent auditors. The Audit Committee has discussed with Marc Lumer & Company certain matters related to the conduct of the audit as required by Statement on Auditing Standards 61, as amended by Statement on Auditing Standards 90. In addition, the Audit Committee has received from Marc Lumer & Company the written disclosures and the letter regarding the auditor’s independence required by Independence Standards Board Standard No. 1 and has discussed with Marc Lumer & Company its independence. Based on the review and discussions described above, the Audit Committee recommended to the Board that the Company’s audited financial statements for the fiscal year ended December 31, 2005 be included in the Company’s Annual Report on Form 10-KSB/A for the year ended December 31, 2005. The Audit Committee has selected Marc Lumer & Company as the Company’s independent auditors for the fiscal year ending December 31, 2006. The selection of auditors is determined by the Audit Committee. This matter is not being submitted to the stockholders for approval as this is not required under applicable law.

AUDIT COMMITTEE

Robert Henri Charles van Maasdijk (Chair)

Dr. Hannes Farnleitner

Dr. Raad Alkadiri

Changes in Accountants

On July 18, 2005, Mark Bailey & Company, Ltd. resigned as the Company’s principal auditor, effective as of such date. On July 18, 2005, the Company appointed Marc Lumer & Company as its principal auditor, effective as of such date. The resignation of Mark Bailey & Company, Ltd. and the appointment of Marc Lumer & Company were approved by our audit committee and Board of Directors.

The report of Mark Bailey & Company, Ltd. on the Company’s financial statements for the 2003 and 2004 fiscals year did not contain an adverse opinion or a disclaimer of opinion and was not qualified or modified as to uncertainty, audit scope, or accounting principles. SulphCo authorized Mark Bailey & Company, Ltd. to respond fully to questions of its successor independent auditors.

There were no disagreements with Mark Bailey & Company, Ltd. for the 2003 or 2004 fiscal years and the subsequent interim periods through the date of resignation, on any matters of accounting principles or practices, financial statement disclosure, or auditing scope and procedures which if not resolved to the satisfaction of Mark Bailey & Company, Ltd., would have caused Mark Bailey & Company, Ltd. to make reference to the matter in their report.

We did not consult with Marc Lumer & Company prior to its engagement by the Company regarding the application of accounting principles to a specific completed or contemplated transaction or the type of audit opinion that might be rendered on our financial statements.

Independent Auditors' Fees

The following table represents aggregate fees billed for each of our fiscal years ended December 31, 2005, and December 31, 2004, by our independent auditors.

Independent Audit Firm | | Fiscal Year Ended |

| | | 2005 | 2004 |

| Marc Lumer & Company | | | |

| Audit Fees | | $105,282 | -0- |

| Audit-related Fees | | -0- | -0- |

| Tax Fees | | -0- | -0- |

| All Other Fees | | -0- | -0- |

| Total Fees | | $105,282 | -0- |

| | | | |

| Mark Bailey & Company, Ltd | | | |

| Audit Fees | | $ 50,975 | $60,000 |

| Audit-related Fees | | -0- | -0- |

| Tax Fees | | -0- | -0- |

| All Other Fees | | -0- | -0- |

| Total Fees | | $ 50,975 | $60,000 |

Fees for audit services included fees associated with the annual audit and reviews of our quarterly reports, as well as services performed in conjunction with our filings of Registration Statements on Form SB-2 and Form S-8. All fees described above were approved by the Audit Committee.

PROPOSAL 2

PROPOSED ADOPTION OF 2006 STOCK OPTION PLAN

Introduction

The Company's 2006 Stock Option Plan was adopted by the Board of Directors effective May 23, 2006, subject to shareholder approval (the "Plan"). The Plan allows the Company to grant options to purchase the Company's Common Stock to designated employees, executive officers, directors, consultants, advisors and other corporate and divisional officers of the Company and its subsidiaries ("Participants"). The Board adopted the Plan to provide employee and non-employee Participants with additional incentives to make significant and extraordinary contributions to the long-term performance and growth of the Company and to attract and retain employees, directors, consultants and advisors of exceptional ability.

The Board of Directors recommends that shareholders vote "FOR" the adoption of the Plan in order to assure that Company will have a vehicle for attracting and retaining employees, directors, consultants and advisors of exceptional ability.

The text of the Plan is set forth as Appendix "A" to this Proxy Statement. The following is a summary of the principal features of the Plan and does not purport to be complete. Shareholders are urged to read the Plan in its entirety. This summary is subject to and qualified in its entirety by reference to Appendix "A." Any capitalized terms which are used in this summary description but not defined here or elsewhere in this Proxy Statement have the meanings assigned to them in the Plan.

Principal Features of the Plan

The Plan authorizes the Committee to grant stock options exercisable for up to an aggregate of Two Million (2,000,000) shares of Common Stock. Stock options granted under the Plan will be “incentive stock options” within the meaning of Section 422 of the Internal Revenue Code of 1986 if so designated by the Committee on the date of grant. Stock Options which are not so designated on the date of grant will be non-statutory stock options and are not eligible for the tax benefits applicable to incentive stock options. No stock options may be granted under the Plan after May 2016. If a stock option expires, terminates or is cancelled for any reason without having been exercised in full, the shares of Common Stock not purchased thereunder are available for future grants.

The Plan is administered by the Committee of three or more persons established by the Board of Directors from time to time. The current Committee members are Messrs. Masica, Henkel and Alkadiri, each of whom is an independent director under applicable SEC and American Stock Exchange Rules. The Committee has complete authority, subject to the express provisions of the Plan, to approve the persons to be granted stock options, to determine the number of stock options to be granted to Participants, to set the terms and conditions of stock options, to remove or adjust any restrictions and conditions upon stock options and to adopt such rules and regulations, and to make all other determinations, deemed necessary or desirable for the administration of the Plan.

In selecting optionees, consideration is given to factors such as employment position, duties and responsibilities, ability, productivity, length of service, morale, interest in the Company and recommendations of supervisors. Awards may be granted to the same Participant on more than one occasion. Each stock option is evidenced by a written option agreement in a form approved by the Committee.

The purchase price (exercise price) of option shares must be at least equal to the fair market value of such shares on the date the stock option is granted. In the case of a grant of Option Shares by management made subject to Committee approval, for purposes of determining fair market value the Committee may use either (i) the date of Committee approval of the grant, or (ii) the date of grant by management if within thirty (30) days of the date of the Committee’s approval of such grant. Notwithstanding the foregoing, the Committee may grant an aggregate of not more than 2,000 shares under the Plan with an exercise price of $7.00 regardless of the fair market value of the shares on the date of grant.

The stock option term is for a period of ten years from the date of grant or such shorter period as is determined by the Committee. Each stock option may provide that it is exercisable in full or in cumulative or non-cumulative installments, and each stock option is exercisable from the date of grant or any later date specified therein, all as determined by the Committee. The Committee's authority to take certain actions under the Plan includes authority to accelerate vesting schedules and to otherwise waive or adjust restrictions applicable to the exercise of stock options.

Each stock option may be exercised in whole or in part (but not as to fractional shares) by delivering a notice of exercise to the Company together with payment of the exercise price. The exercise price may be paid in cash, by cashier's check or certified check.

Except as otherwise provided below or unless otherwise provided by the Committee, an optionee may not exercise a stock option unless from the date of grant to the date of exercise the optionee remains continuously in the employ of the Company. If the employment of the optionee terminates for any reason other than death, disability or retirement at or after the age of 65, the stock options then currently exercisable remain exercisable for a period of 90 days after such termination of employment (except that the 90 day period is extended to 12 months if the optionee dies during such 90 day period), subject to earlier expiration at the end of their fixed term. If the employment of the optionee terminates because of death, disability or retirement at or after the age of 65, the stock options then currently exercisable remain in full force and effect and may be exercised at any time during the option term pursuant to the provisions of the Plan; unless otherwise provided by the Committee, all stock options to the extent then not presently exercisable shall terminate as of the date of termination of employment.

Each stock option granted under the Plan is exercisable during an optionee's lifetime only by such optionee. Stock options are transferable only by will or the laws of intestate succession unless otherwise determined by the Committee.

The Board of Directors may at any time suspend, amend or terminate the Plan. Shareholder approval is required, however, to materially increase the benefits accruing to optionees, materially increase the number of securities which may be issued (except for adjustments under anti-dilution clauses) or materially modify the requirements as to eligibility for participation. The Plan authorizes the Committee to include in stock options provisions which permit the acceleration of vesting in the event of a change in control of the Company resulting from certain occurrences. The Company intends to maintain a current registration statement under the Securities Act of 1933 with respect to the shares of Common Stock issuable upon the exercise of stock options granted under the Plan.

Summary of Option Grants

There are currently 23 employees (including four executive officers) and six non-employee directors eligible to participate in the Plan. The Plan also allows grants of stock options to consultants and advisors. The Plan authorizes the Committee to grant stock options exercisable for up to an aggregate of Two Million (2,000,000) shares of Common Stock. From the inception of the Plan through June 1, 2006, stock options to purchase an aggregate of 1,127,000 option shares were granted under the Plan, subject to stockholder approval.

The following table sets forth certain information with respect to stock option grants made under the Plan to certain individuals and groups as of June 1, 2006. All of these grants were made subject to stockholder approval of the Plan at the 2006 Annual Meeting.

New Plan Benefits

2006 Stock Option Plan

Name | Number of Options Granted | Exercise Price |

| | | |

Rudolf W. Gunnerman (1) | 1,000,000 | $9.03 |

Peter W. Gunnerman | 0 | -- |

Executive Officer Group | 1,000,000 | $9.03 |

Non-Executive Officer Director Group (2) | 125,000 | $9.03 |

Non-Executive Officer Employee Group | 0 | -- |

| (1) | These options vest immediately and have a term of three years from the date of grant. However, they are not exercisable until the Company has reported cumulative revenues of not less than $50 million unless there is a change in control of the Company. |

| (2) | Represents options granted to Robert Van Maasdijk, a director and Chairman of the Audit Committee. These options vest immediately and have a term of three years. |

On June 1, 2006, the last sales price of the Common Stock, as reported on the American Stock Exchange, was $9.47 per share.

In addition to the options set forth in the foregoing table, as of June 1, 2006, the Company granted stock options under the Plan exercisable for 2,000 shares of Common Stock to a consultant, exercisable at $7.00 per share.

Future grants under the Plan will be made at the discretion of the Committee and are not yet determinable.

Certain Federal Income Tax Consequences

The following is a brief summary of the material federal income tax consequences of benefits under the plan under present law and regulations:

Incentive Stock Options. The grant of an incentive stock option will not result in any immediate tax consequences to us or the optionee. An optionee will not realize taxable income, and we will not be entitled to any deduction, upon the timely exercise of an incentive stock option, but the excess of the fair market value of the shares of our common stock acquired over the option exercise price will be includable in the optionee’s “alternative minimum taxable income” for purposes of the alternative minimum tax. If the optionee does not dispose of the shares of our common stock acquired within one year after their receipt, and within two years after the option was granted, gain or loss realized on the subsequent disposition of the shares of our common stock will be treated as long-term capital gain or loss. Capital losses of individuals are deductible only against capital gains and a limited amount of ordinary income. In the event of an earlier disposition, the optionee will realize ordinary income in an amount equal to the lesser of (i) the excess of the fair market value of the shares of our common stock on the date of exercise over the option exercise price or (ii) if the disposition is a taxable sale or exchange, the amount of any gain realized. Upon such a disqualifying disposition, we will be entitled to a deduction in the same amount as the optionee realizes such ordinary income.

Non-qualified Stock Options. In general, the grant of a non-qualified stock option will not result in any immediate tax consequences to us or the optionee. Upon the exercise of a non-qualified stock option, generally the optionee will realize ordinary income and we will be entitled to a deduction, in each case, in an amount equal to the excess of the fair market value of the shares of our common stock acquired at the time of exercise over the option exercise price.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE "FOR" THE PROPOSED ADOPTION OF THE 2006 STOCK OPTION PLAN.

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table presents certain information as of May 15, 2006, regarding the beneficial ownership of our common stock by (i) each of our directors and executive officers individually, (ii) all persons known by us to be beneficial owners of five percent or more of our common stock, and (iii) all of our directors and executive officers as a group. Unless otherwise noted, the persons listed below have sole voting and investment power and beneficial ownership with respect to such shares. The mailing address of the beneficial owners is 850 Spice Islands Drive, Sparks, NV 89431.

Name (1) | | Number of Shares Beneficially Owned (1) | | Percent Beneficially Owned(1) | |

| | | | | | |

Directors and Named Executive Officers: | | | | | |

| | | | | | |

| Dr. Rudolf W. Gunnerman | | | 27,799,913 | (2) | | 38.3 | % |

| Richard L. Masica | | | 50,000 | | | * | |

| Robert Henri Charles van Maasdijk | | | 50,000 | | | * | |

| Dr. Raad Alkadiri | | | 50,000 | | | * | |

| Dr. Hannes Farnleitner | | | 57,000 | | | * | |

| Christoph Henkel | | | 150,000 | | | * | |

| Michael T. Heffner | | | 120,000 | | | * | |

| Peter W. Gunnerman | | | 1,915,000 | | | 2.6 | % |

| Loren J. Kalmen (3) | | | 97,000 | | | * | |

| Michael Applegate | | | 70,000 | | | * | |

| All Executive Officers and Directors as a Group (10 persons) | | | 30,358,913 | | | 41.9 | % |

* | Denotes less than 1% |

(1) | Beneficial ownership is determined in accordance with rules of the SEC, and includes generally voting power and/or investment power with respect to securities. Shares of common stock which may be acquired by a beneficial owner upon exercise or conversion of warrants, options or rights which are currently exercisable or exercisable within 60 days of May 15, 2006, are included in the Table as shares beneficially owned and are deemed outstanding for purposes of computing the beneficial ownership percentage of the person holding such securities but are not deemed outstanding for computing the beneficial ownership percentage of any other person. Except as indicated by footnote, to our knowledge, the persons named in the table above have the sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them. |

(2) | Includes 27,797,913 shares owned by Dr. Gunnerman in joint tenancy with his wife, Doris Gunnerman, with whom he shares voting and investment power. |

| (3) | Includes 5,000 shares owned by Mr. Kalmen’s daughter, in which shares he disclaims beneficial ownership. |

Section 16(a) Beneficial Ownership Reporting Compliance

To our knowledge the officers, directors and beneficial owners of more than 10% of our common stock have filed their initial statements of ownership on Form 3 on a timely basis with respect to fiscal 2005, and the officers, directors and beneficial owners of more than 10% of our common stock have also filed the required Forms 4 or 5 on a timely basis with respect to fiscal 2005, except as follows:

| | Number of Late Reports | Number of Transactions Not Reported Timely |

| Alan Austin | 1 | 1 |

| Richard Masica | 1 | 1 |

| Robert van Maasdijk | 1 | 1 |

| Dr. Raad Alkadiri | 1 | 1 |

| Dr. Hannes Farnleitner | 1 | 1 |

| Christoph Henkel | 2 | 1 |

MANAGEMENT

Business Experience of Executive Officers Who Are Not Directors

The following is a brief biography of each our executive officers who are not directors or nominees.

Peter W. Gunnerman, age 40, has been our President since June 2005, and also served as Chief Operating Officer from June 2005 until January 2006. Prior to joining us he headed Global 6, LLC, a consulting company he founded in 2004 that assists national and international technology companies with a variety of business functions, including marketing and financial support. We were a client of Global 6, LLC from January 2005 through May 2005. Mr. Gunnerman spent the majority of his career with Clean Fuels Technology, Inc. (“CFT”), a privately held company which develops and markets emulsified fuels. Mr. Gunnerman co-founded CFT with his father, Dr. Rudolf W. Gunnerman, in 1992. From 2002 to 2004 Mr. Gunnerman served as President of CFT’s Residual Oil Division, where he was responsible for product development and product verification testing at domestic and foreign trial sites. Prior thereto he served as CFT’s President - Business Development from 2000 to 2002, Executive Vice President - Business Development from 1998 to 2000, and as Vice President - Operations from 1992 to 1998.

Loren J. Kalmen, age 53, was appointed as our Chief Financial Officer in November 2005, and served as a Director from June 2003 until his appointment as Chief Financial Officer in 2005. Mr. Kalmen received his bachelor’s degree in accounting from the University of Nevada, Reno, in 1974, and his license as a Certified Public Accountant in 1978. Mr. Kalmen has maintained his own public accounting practice in Reno, Nevada, since 1988.

Michael Applegate, age 53, was appointed as our Chief Operating Officer on January 9, 2006. Mr. Applegate has spent the majority of his career at Applegate Drayage Company, a tractor-trailer fleet operator in California, Nevada and Utah. The company employed more than 100 drivers, dock workers, mechanics and administrative staff. Applegate served as president, a position he held since 1988. Mr. Applegate has served as both president and chairman of the board of the California Trucking Association, the largest state trucking association in the United States. He also served on the board of the Nevada Motor Transportation Association.

Executive Compensation

The following table sets forth information about compensation paid or accrued by us during the years ended December 31, 2005, 2004 and 2003 to our chief executive officer and our other executive officers who served as executive officers in 2005 and who received at least $100,000 in annual compensation in 2005.

Summary Compensation Table

Fiscal Years 2005, 2004 and 2003

| | | | | Annual Compensation | | | | Long Term Compensation Awards |

| | | | | | | | | | | | | |

| Name and Principal Position | | Year | | Salary | | Bonus | | Other Annual Compensation | | Securities Underlying Options (#) | | All Other

Compensation |

| | | | | | | | | | | | | | | |

Rudolf W. Gunnerman Chairman and Chief Executive Officer | | 2005 2004 2003 | | $ $ $ | 360,000 370,000 300,000 | (1) (1) (1) | | 0 0 0 | | 0 0 0 | | 0 0 0 | | 0 0 0 |

Peter W. Gunnerman (2) President | | 2005 2004 2003 | | $ $ $ | 132,917 0 0 | | | 0 0 0 | | 0 0 0 | | 0 0 0 | | 0 0 0 |

Alan L. Austin, Jr. (3) Vice President of Finance and Chief Financial Officer | | 2005 2004 2003 | | $ $ $ | 188,000 0 0 | | | 0 0 0 | | $204,000 (4) 0 0 | | 0 0 0 | | 0 0 0 |

___________________

| (1) | These payments are consulting payments paid to RWG, Inc., a Nevada corporation, owned by Rudolf W. Gunnerman. |

| (2) | Peter Gunnerman was appointed President in June 2005. From January 2005 through May 2005 we maintained a monthly consulting arrangement with Global 6, LLC, a company owned by Peter Gunnerman, which provided for Global 6 to provide management consulting services to us on a month-to-month basis, for a monthly consulting fee of $10,000. Amounts in the above table do not include these consulting payments. |

| (3) | Mr. Austin resigned as Vice President of Finance and Chief Financial Officer on November 10, 2005. |

| (4) | Mr. Austin received 50,000 shares of SulphCo stock upon employment valued at $204,000. |

Employment and Consulting Contracts

We procure the full time services of our chairman of the board and chief executive officer, Dr. Rudolf W. Gunnerman, pursuant to a Consulting Agreement with RWG, Inc., a Nevada corporation owned by Dr. Gunnerman. As of July 1, 2004, we were obligated to pay a fee of $480,000 annually as a consulting payment through July 2006. Effective as of November 1, 2004, this amount was reduced by mutual agreement to $30,000 per month until we receive substantial additional funds. On May 8, 2006, the Company’s Board of Directors approved the reinstatement of Dr. Gunnerman’s consulting fees to $40,000 per month ($480,000 per annum), effective April 1, 2006, in view of the receipt of approximately $27 million of proceeds from a private placement completed on March 29, 2006.

Peter Gunnerman was appointed President and Chief Operating Officer on June 7, 2005. In connection with Mr. Gunnerman’s appointment we entered into a written Employment Agreement which provided for a base salary of $220,000 per annum, effective June 1, 2005. Mr. Gunnerman’s base salary was increased to $300,000 per annum in December 2005 and he received a performance bonus of $100,000 under this agreement in April 2006. The Employment Agreement is terminable by either party at any time. If Mr. Gunnerman’s employment is terminated by reason of his “disability,” or by us without “good cause” or by Mr. Gunnerman for “good reason,” Mr. Gunnerman is entitled to a severance payment equal to three months base salary plus medical and dental coverage for six months following the date of termination. Mr. Gunnerman received a performance bonus of $100,000 in April 2006. From January 2005 through May 2005 we maintained a monthly consulting arrangement with Global 6, LLC, a company owned by Peter Gunnerman, which provided for Global 6 to provide management consulting services to us on a month-to-month basis, for a monthly consulting fee of $10,000.

On November 14, 2005, we announced the appointment of Loren J. Kalmen as Chief Financial Officer of the Company, effective November 10, 2005. In connection with the appointment of Mr. Kalmen to the position of Chief Financial Officer, the Company and Mr. Kalmen executed an employment agreement dated November 10, 2005. According to the terms of the employment agreement, Mr. Kalmen’s employment with us commenced November 10, 2005 and Mr. Kalmen assumed the position of Vice President of Finance and Chief Financial Officer effective November 10, 2005. Under the terms of the employment agreement, Mr. Kalmen is entitled to receive a base salary of $25,000 per month (or $300,000 on an annualized basis). Mr. Kalmen is also entitled to receive additional bonuses as determined by our board of directors and customary equity compensation and benefits as other of our similarly situated senior executives.

Compensation Committee Report

The Compensation Committee was formed in February 2006 and is currently comprised of Messrs. Masica and Henkel, each of whom is independent under applicable SEC and American Stock Exchange Rules. Prior to this time the entire Board of Directors acted as the Compensation Committee. The Compensation Committee approves, or recommends to the independent directors for approval, salary practices and performance objectives for executive officers, including the Chief Executive Officer,

The Company’s policy in compensating executive officers is to establish methods and levels of compensation that will provide strong incentives to promote its growth and profitability and reward superior performance. Compensation of executive officers includes salary as well as stock-based compensation in the form of stock options and stock grants. During 2005, salary accounted for all of the executive officers' direct compensation other than a stock grant of 50,000 shares to the former Chief Financial Officer.

To date the Company has relied primarily upon equity financing as a source of working capital and has not yet generated any material revenues. As a result, the Company places special emphasis on equity-based compensation, in the form of options, to preserve its cash for operations. This approach also serves to match the interests of the Company’s executive officers with the interest of its shareholders. The Company seeks to reward achievement by its executive officers of long and short-term performance goals.

We procure the full time services of our chairman of the board and chief executive officer, Dr. Rudolf W. Gunnerman, pursuant to a Consulting Agreement with RWG, Inc., a Nevada corporation owned by Dr. Gunnerman. As of July 1, 2004, we were obligated to pay Dr. Gunnerman's fee of $480,000 annually as a consulting payment pursuant to a written consulting agreement. Effective as of November 1, 2004, this amount was reduced by mutual agreement to $30,000 per month until we received substantial additional funds. Effective April 1, 2006, Dr. Gunnerman’s was reinstated to $40,000 per month in view of the receipt of approximately $27 million of proceeds from a private placement completed on March 29, 2006.

Included in the factors considered in setting the compensation of the Company’s Chief Executive Officer during 2005 were the establishment of strategic business relationships and the progress made in the development of our technology and prototypes. During 2005, the Company made significant progress in connection with its efforts to complete development activities and establishing strategic business relationships. Although the Company made substantial progress in the growth in these areas, in order to maximize the Company’s use of working capital, during 2005 Dr. Gunnerman, voluntarily elected to forego any increase in his compensation during 2005 and to continue the reduction in his compensation.

COMPENSATION COMMITTEE

Richard L. Masica

Christoph Henkel

Compensation Committee Interlocks and Insider Participation

During the last fiscal year, none of the Company’s executive officers served on the board of directors or compensation committee of any other entity whose officers served either the Company’s Board of Directors or Compensation Committee.

Certain Transactions

Following is a description of transactions involving more than $60,000 since January 1, 2005, between us and our directors, nominees, executive officers, or members of their immediate family.

On July 1, 2004, and July 1, 2005, we entered into Engagement Agreements with RWG, Inc., an affiliate of Dr. Gunnerman, providing for Dr. Gunnerman to render services to us as chairman of the Board and as chief executive officer. Each Engagement Agreement was for a term of one year, and provided for an annual fee to be paid to RWG, Inc. of $480,000. Effective as of November 1, 2004, this amount has been reduced by mutual agreement to $30,000 per month until we receive substantial additional funds. On May 8, 2006, the Company’s Board of Directors approved the reinstatement of Dr. Gunnerman’s consulting fees to $40,000 per month ($480,000 per annum), effective April 1, 2006, in view of the receipt of approximately $27 million of proceeds from a private placement completed on March 29, 2006.

On December 30, 2003, we issued a $500,000 promissory note to Dr. Gunnerman, of which $250,000 was advanced by Dr. Gunnerman on December 30, 2003 and the remaining $250,000 was advanced on March 22, 2004. The note was due on December 30, 2004, and required the payment to Dr. Gunnerman, in lieu of interest, of 500,000 shares of our common stock. On January 5, 2004, we issued 500,000 shares to Dr. Gunnerman valued at $0.37 per share and discounted 20% because of their restricted status, or $148,000, as prepaid interest through December 30, 2004 in lieu of a cash interest payment for the loan of $500,000. In December 2004 Dr. Gunnerman agreed to extend the maturity of the note from December 30, 2004, to December 30, 2005 at an interest rate of 8% per annum. The extension agreement also provides for mandatory prepayments from revenues we receive from the sale of our products or the licensing of our technology or otherwise, and from the amount of unrestricted loan or equity financings we receive. In December 2005 Dr. Gunnerman again agreed to extend the maturity of the note from December 30, 2005, to December 30, 2006 at an interest rate of 8% per annum. The extension agreement also provides for payment on demand of Dr. Gunnerman prior to December 30, 2006. The loan was repaid in full in May 2006.

In April 2004 Dr. Gunnerman furnished a commitment to fund up to an additional $2,000,000 in loans to us, of which $200,000 was advanced to us as of May 2004. In June 2004 the commitment was superseded by the funding under the June 3, 2004 and June 15, 2004 private placements. Accordingly, the $200,000 advanced by Dr. Gunnerman was repaid by us in June 2004.

In December 2004 Dr. Gunnerman advanced $7 million to us as a loan. The loan is evidenced by a promissory note which bears interest at the rate of 0.5% above the “LIBOR” rate, payable annually, and the entire principal amount is due and payable in December 2007. In May 2006 the Company made a voluntary partial principal prepayment of $2 million, reducing the outstanding principal balance to $5 million.

On December 30, 2003, we issued a $500,000 promissory note to Erika Herrmann, the sister-in-law of Dr. Gunnerman, of which $250,000 was advanced by Ms. Herrmann on December 30, 2003, and the remaining $250,000 was advanced on April 28, 2004. The note was due on December 30, 2004, and required the payment to Ms. Herrmann, in lieu of interest, of 500,000 shares of our common stock. On January 5, 2004, we issued 500,000 shares to Ms. Herrmann valued at $0.37 per share and discounted 20% because of their restricted status, or $148,000, as prepaid interest through December 30, 2004, in lieu of a cash interest payment for the loan of $500,000. As of December 10, 2004, $500,000 remained outstanding under this note. In December 2004 Ms. Herrmann agreed to extend the maturity of the note from December 30, 2004, to December 30, 2005 at an interest rate of 8% per annum. The extension agreement also provides for mandatory prepayments from revenues we receive from the sale of our products or the licensing of our technology or otherwise, and from the amount of unrestricted loan or equity financings we receive. The note was paid off in December 2005.

Effective November 1, 2004, we entered into a consulting agreement with Peak One Consulting, Inc., a company owned by Richard L. Masica, a director, under which Peak One has agreed to provide management consulting services to SulphCo from time to time, as requested by SulphCo, until December 31, 2005, subject to earlier termination by either party. The consulting agreement provides for a consulting fee of $1,500 per day or $200 per hour, whichever is less.

In connection with Mr. Masica's appointment to the Board of Directors in November 2004, SulphCo agreed to grant Mr. Masica 25,000 shares of our common stock on January 1, 2005 for services as a director if he is then serving as a director. Mr. Masica was also granted an option on November 30, 2004, to acquire 25,000 shares of our common stock at an exercise price of $2.86 per share in consideration of services to be provided as a director, with the option expiring on November 30, 2007. These issuances of were based upon SulphCo’s determination of the value of the services rendered and to be rendered by Mr. Masica as a director. On December 27, 2004, our Board of Directors amended the terms of Mr. Masica’s compensation as a director to coincide with past compensation practices regarding outside directors and in view of Mr. Masica’s expected contributions to SulphCo. The amended terms provided for Mr. Masica to receive 50,000 shares of our common stock in lieu of the original proposal for 25,000 shares and 25,000 options, effective January 1, 2005. In January 2005 the 50,000 restricted shares of common stock were issued to him at $5.47 per share, for services valued at $273,500.

From January 2005 through May 2005 we maintained a monthly consulting arrangement with Global 6, LLC, a company owned by Peter Gunnerman, which provided for Global 6 to provide management consulting services to SulphCo on a month-to-month basis, for a monthly consulting fee of $10,000. Peter Gunnerman is the son of Rudolf Gunnerman, our Chairman and Chief Executive Officer. The consulting arrangement was terminated immediately prior to Mr. Gunnerman joining the Company as President in June 2005. For information regarding Mr. Gunnerman’s employment agreement entered into in June 2005 see “Employment and Consulting Contracts.”

Kristina Ligon, the daughter of Dr. Rudolf Gunnerman, has been employed by us as Dr. Gunnerman’s executive assistant. She received salaries of $162,500 in 2005 and $139,500 in 2004.

In April 2005, 50,000 restricted shares of common stock were issued to a Director, Robert Van Maasdijk, upon joining our Board of Directors.

In May 2005, 50,000 restricted shares of common stock were issued to a Director, Dr. Raad Alkadiri, upon joining our Board of Directors.

In November 2005, 50,000 restricted shares of common stock were issued to a Director, Dr. Hannes Farnleitner, upon joining the Board of Directors.

In December 2005, 50,000 restricted shares of common stock were issued to a Director, Christoph Henkel, upon joining the Board of Directors.

In January 2006, 50,000 restricted shares of common stock were issued to Michael Applegate upon joining SulphCo as Chief Operating Officer, subject to a vesting period of 90 days.

All share issuances and option exercise prices described in this section were equal to the fair market value of our common stock on the date the share or option issuances, as the case may be, and were approved by our board of directors, except as otherwise specifically noted. All of the transactions described in this section, although involving related parties, are believed to be on terms no more favorable than could have been obtained from an independent third party.

In May 2006 the Option Committee awarded options to Dr. Gunnerman and Mr. Van Maasdijk, subject to approval of the Plan at the 2006 Annual Meeting of Stockholders. For further information regarding these grants see “Summary of Option Grants” elsewhere in this Proxy Statement.

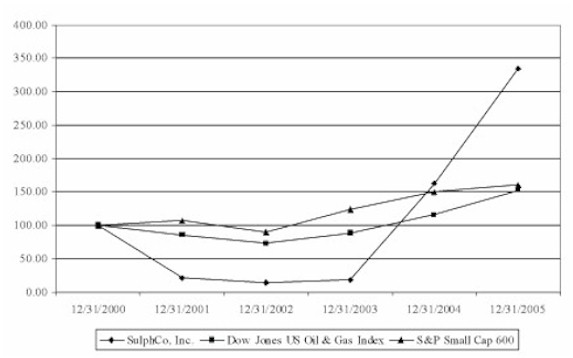

Performance Graph

The following graph compares on a cumulative basis the yearly percentage change, assuming dividend reinvestment, over the five fiscal years, of the total cumulative return of SulphCo common stock with (a) the total return on the Standard & Poors SmallCap 600 index, a broad equity market index, and (b) the total return on the Dow Jones US Oil & Gas Index, an industry group index. We included the Standard & Poor’s SmallCap 600 Index in our Performance Graph as a basis for comparison because this index includes companies that typically have a market capitalization between $300 million and $2 billion. The comparisons in the graph are required by the SEC and are not intended to forecast or be indicative of possible future performance of SulphCo, Inc. common stock.

COMPARISON OF CUMULATIVE TOTAL RETURN (*)

| | | |

| | | Period Ended |

| | | Dec. 31, | | | Dec. 31, | | | Dec. 31, | | | Dec. 31, | | | Dec. 31, | | | Dec. 31, |

Index | | 2000 | | | 2001 | | | 2002 | | | 2003 | | | 2004 | | | 2005 |

| |

| SulphCo, Inc. | | | 100.00 | | | | 21.07 | | | | 14.25 | | | | 18.40 | | | | 162.34 | | | | 335.37 |

| Dow Jones US Oil & Gas Index | | | 100.00 | | | | 86.24 | | | | 72.51 | | | | 89.09 | | | | 115.76 | | | | 152.81 |

| Standard & Poor’s SmallCap 600 | | | 100.00 | | | | 106.67 | | | | 89.54 | | | | 123.15 | | | | 149.73 | | | | 159.69 |

(*) $100 invested on December 31, 2000, in stock or index, including reinvestment of dividends. Fiscal year ending December 31.

Family Relationships

Dr. Rudolf W. Gunnerman, the Chief Executive Officer, is the father of Peter Gunnerman, the President. There are no other family relationships between the directors, executive officers or any other person who may be selected as a director or executive officer of SulphCo.

Code of Ethics

The Company has adopted the SulphCo Code of Ethics that applies to its principal executive officer and principal financial officer. The Code of Ethics was filed with the SEC on March 29, 2004 as Exhibit 14 to our Form 10-KSB. We intend to disclose on our website any substantive amendment to our code of ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, other executive officers and directors within five business days of such amendment. In addition, we intend to disclose the nature of any material waiver, including an implicit waiver, from a provision of our code of ethics that is granted to any executive officer or director, the name of such person who is granted the waiver and the date of the waiver as required by applicable laws, rules and regulations.

ANNUAL REPORT

A copy of the Company’s Annual Report on Form 10-KSB for the year ended December 31, 2005, which has been filed with the SEC pursuant to the 1934 Act, is being mailed to you along with this Proxy Statement. Additional copies of this Proxy Statement and/or the Annual Report, as well as copies of any Quarterly Report may be obtained without charge upon written request to the Secretary, SulphCo, Inc., 850 Spice Islands Drive, Sparks, NV 89431, or on the SEC’s internet website at www.sec.gov.

OTHER MATTERS

The Board knows of no other matters that will be presented for consideration at the annual meeting. If any other matters are properly brought before the annual meeting, it is the intention of the persons named in the accompanying proxy to vote on such matters in accordance with their best judgment.

By Order of the Board of Directors

/s/ Rudolf W. Gunnerman

Rudolf W. Gunnerman

Chairman and CEO

June 2, 2006

Appendix “A”

SulphCo, Inc. 2006 Stock Option Plan

1. Purpose.

This Stock Option Plan (the "Plan") is intended to allow designated employees, executive officers, directors, consultants, advisors and other corporate and divisional officers (all of whom are sometimes collectively referred to herein as "Employees") of SulphCo, Inc., a Nevada corporation ("SulphCo" or the “Company”), and its subsidiaries which it may have from time to time (SulphCo and such subsidiaries being together referred to herein as the "Company") to receive certain options ("Stock Options") to purchase SulphCo's common stock, $.001 par value ("Common Stock"), as herein provided. The purpose of the Plan is to provide Employees with additional incentives to make significant and extraordinary contributions to the long-term performance and growth of the Company and to attract and retain Employees of exceptional ability.

2. Administration.

(a) The Plan shall be administered by a Committee of three or more persons ("Committee") established by the Board of Directors of SulphCo (the "Board") from time to time, which may consist of the Compensation Committee, the full Board of Directors or such persons as the Board shall designate. A majority of its members shall constitute a quorum. The Committee shall be governed by the provisions of SulphCo's By-Laws and of Nevada law applicable to the Board, except as otherwise provided herein or determined by the Board.

(b) The Committee shall have full and complete authority, in its discretion, but subject to the express provisions of the Plan: to approve the Employees nominated by the management of the Company to be granted Stock Options; to determine the number of Stock Options to be granted to an Employee; to determine the time or times at which Stock Options shall be granted; to establish the terms and conditions upon which Stock Options may be exercised; to remove or adjust any restrictions and conditions upon Stock Options; to specify, at the time of grant, provisions relating to the exercisability of Stock Options and to accelerate or otherwise modify the exercisability of any Stock Options; and to adopt such rules and regulations and to make all other determinations deemed necessary or desirable for the administration of the Plan. All interpretations and constructions of the Plan by the Committee, and all of its actions hereunder, shall be binding and conclusive on all persons for all purposes.

(c) The Company hereby agrees to indemnify and hold harmless each Committee member and each employee of the Company, and the estate and heirs of such Committee member or employee, against all claims, liabilities, expenses, penalties, damages or other pecuniary losses, including legal fees, which such Committee member or employee or his or her estate or heirs may suffer as a result of his or her responsibilities, obligations or duties in connection with the Plan, to the extent that insurance, if any, does not cover the payment of such items.

3. Eligibility and Participation.

Employees eligible under the Plan shall be approved by the Committee from those Employees who, in the opinion of the management of the Company, are in positions which enable them to make significant and extraordinary contributions to the long-term performance and growth of the Company. In selecting Employees to whom Stock Options may be granted, consideration shall be given to factors such as employment position, duties and responsibilities, ability, productivity, length of service, morale, interest in the Company and recommendations of supervisors.

4. Grants.

The Committee may grant Stock Options in such amounts, at such times, and to such Employees nominated by the management of the Company as the Committee, in its discretion, may determine. Stock Options granted under the Plan shall constitute "incentive stock options" within the meaning of Section 422 of the Internal Revenue Code of 1986 (the “Code"), if so designated by the Committee on the date of grant. The Committee shall also have the discretion to grant Stock Options which do not constitute incentive stock options and any such Stock Options shall be designated non-statutory stock options by the Committee on the date of grant. The aggregate fair market value (determined as of the time an incentive stock option is granted) of the Common Stock with respect to which incentive stock options are exercisable for the first time by any Employee during any one calendar year (under all plans of the Company and any parent or subsidiary of the Company) may not exceed the maximum amount permitted under

Section 422 of the Code (currently $100,000.00). Non-statutory stock options shall not be subject to the limitations relating to incentive stock options contained in the preceding sentence. Subject to the provisions of paragraph 11 hereof, the number of shares of Common Stock issued and issuable pursuant to the exercise of Stock Options granted hereunder shall not exceed Two Million (2,000,000) shares of the Common Stock of SulphCo from time to time outstanding. Each Stock Option shall be evidenced by a written agreement (the "Option Agreement") in a form approved by the Committee, which shall be executed on behalf of the Company and by the Employee to whom the Stock Option is granted. If a Stock Option expires, terminates or is cancelled for any reason without having been exercised in full, the shares of Common Stock not purchased thereunder shall again be available for purposes of the Plan.

5. Purchase Price.

The purchase price (the "Exercise Price") of shares of Common Stock subject to each Stock Option ("Option Shares") shall equal the fair market value ("Fair Market Value") of such shares on the date of grant of such Stock Option. Notwithstanding the foregoing, the Exercise Price of Option Shares subject to an incentive stock option granted to an Employee who at the time of grant owns stock possessing more than 10% of the total combined voting power of all classes of stock of the Company or of any parent or Subsidiary shall be at least equal to 110% of the Fair Market Value of such shares on the date of grant of such Stock Option. The Fair Market Value of a share of Common Stock on any date shall be equal to the closing price of the Common Stock on the date of grant, and the method for determining the closing price shall be determined by the Committee. In the case of a grant of Option Shares by management made subject to subsequent Committee approval, for purposes of determining Fair Market Value the Committee may use either (i) the date of Committee approval of the grant, or (ii) the date of grant by management if within thirty (30) days of the date of the Committee’s approval of such grant. Notwithstanding the foregoing, the Committee may authorize a grant of not more than 2,000 shares under this Plan with an exercise price of $7.00 regardless of the fair market value of the shares on the date of grant.

6. Option Period.

The Stock Option period (the "Term") shall commence on the date of grant of the Stock Option and shall be ten (10) years or such shorter period as is determined by the Committee. Notwithstanding the foregoing, but subject to the provisions of paragraphs 2(b) and 11(c), Stock Options granted to Employees who are subject to the reporting requirements of Section 16(a) of the U.S. Securities Exchange Act of 1934 ("Section 16 Reporting Persons") shall not be exercisable until at least six months and one day from the date the Stock Option is granted, or, if later, from the date of stockholder approval of the Plan. If an Employee shall not in any period purchase all of the Option Shares which the Employee is entitled to purchase in such period, the Employee may purchase all or any part of such Option Shares at any time prior to the expiration of the Stock Option.

7. Exercise of Options.