UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Ohio Legacy Corp

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

OHIO LEGACY CORP

305 WEST LIBERTY STREET

WOOSTER, OHIO 44691

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To our Shareholders:

The 2005 Annual Meeting of Shareholders of Ohio Legacy Corp will be held at 10:00 a.m., on April 28, 2005, at the Holiday Inn of Belden Village, located at 4520 Everhard Road NW, North Canton, OH, 44718, for the following purposes:

| | 1. | To elect three (3) Class II directors to serve until the 2008 Annual Meeting and until their successors are elected and qualified. |

| | 2. | To act upon such other matters as may properly come before the Annual Meeting or any adjournments thereof. |

Shareholders of record as of close of business on March 1, 2005, are entitled to notice of and to vote at the Annual Meeting.

Whether you expect to attend the meeting or not, please mark, date, sign and return the enclosed proxy in the enclosed, self-addressed envelope as promptly as possible. You have the option to revoke your proxy at any time prior to the Annual Meeting regardless of your voting method, or to vote your shares personally on request if you attend the meeting.

|

By Order of the Board of Directors |

|

| |

Daniel H. Plumly Secretary and Chairman |

March 14, 2005

OHIO LEGACY CORP

305 WEST LIBERTY STREET

WOOSTER, OHIO 44691

PROXY STATEMENT

VOTING INFORMATION

The accompanying proxy is solicited by the Board of Directors of the Company and will be voted in accordance with the instructions given, unless revoked. If no direction is indicated, such shares will be voted in favor of all the proposals set forth in this Proxy Statement and in favor of the election to the Board of Directors of the nominees named in this Proxy Statement. A shareholder may revoke his or her proxy without affecting any vote previously taken by giving notice to the Secretary of the Company in writing or by voting in person at the Annual Meeting.

The record date for determination of shareholders entitled to vote at the Annual Meeting is March 1, 2005. On that date, the number of outstanding common shares of the Company was 2,121,320 without par value. Each shareholder will be entitled to one vote per share on all matters to be submitted at the Annual Meeting. Shareholders representing the majority of the then outstanding shares entitled to vote at the Annual Meeting shall constitute a quorum. An abstention will be considered present at the meeting for purposes of determining a quorum, but will not be counted as voting for or against the issue to which it relates.

The approximate date upon which this Proxy Statement and proxy will first be mailed to shareholders is March 14, 2005. All costs associated with the solicitation of proxies will be paid by the Company. Proxies will be solicited primarily by mail, but certain officers and employees of the Company, or its subsidiary, Ohio Legacy Bank, N.A., may solicit proxies, personally or by telephone, without additional compensation.

BOARD STRUCTURE

In the proxy statement for the 2004 Annual Meeting of Shareholders, the Company announced that the Board of Directors had initiated a sweeping corporate governance program. As part of that program, the Company’s board implemented a series of actions designed to ensure that the Company would continue to adhere to the highest standards for corporate governance. In 2005, the Board of Directors believes that additional actions should be taken to strengthen director independence and to enhance corporate flexibility.

In order to accomplish the goals of the Board of Directors, the Company and its subsidiary, Ohio Legacy Bank, N.A. (Bank), will no longer maintain identical Boards of Directors. While the Bank’s board will remain at its current size, the Company’s board will be reduced to nine members. The Company’s board will continue to consist of three classes, but the classes will be organized so that each consists of three directors. A smaller Company board consisting of a greater percentage of independent directors will continue to aid the Company’s compliance with the listing standards of the NASD and will allow flexibility to add future members to the Company’s board in the event of an acquisition or expansion into new geographic markets.

The Class I Directors, whose terms end after the annual meeting in 2006, will consist of Messrs. Diamond, Douce and Plumly. The Class III Directors, whose terms end after the 2007 annual meeting, will consist of Messrs. Allen, Fitzpatrick and Meenan. The Class II Directors, who are nominated for election this year, will consist of Messrs. Belden, Long and Yoder, with their terms ending in 2008. Biographies of the directors and nominees are provided below.

The directors not continuing service on the Company’s board are Mr. Thomas W. Schervish, who will not stand for reelection in 2005, and Messrs. William T. Baker, Randy G. Jones and Steven G. Pettit, who have indicated they will tender their resignations to the Company’s Board of Directors immediately following the 2005 Annual Meeting to complete the Board realignment. Each of these directors has indicated his support for the board restructuring. Messrs. Schervish, Baker, Jones and Pettit will continue their service on the Bank’s board. Mr. Benjamin J. Mast, currently a Class II director, has indicted his desire to retire from the Board of Directors of the

- 1 -

Company immediately following the 2005 Annual Meeting, which is the end of his term. The Company’s board, as part of the restructuring, will not fill the unexpired terms of the resigning directors.

As noted earlier, no changes are planned to the composition of the Bank’s board, except Mr. Yoder will replace Mr. Mast due to Mr. Mast’s retirement. No changes are planned in the number of anticipated meetings, the content or conduct of those meetings or the relationship between the individual members of the two boards.

PROPOSAL 1

ELECTION OF DIRECTORS

The terms of office of the current Class II directors of the Company will expire on the day of the 2005 Annual Meeting, upon the election of their successors. Messrs. Mast and Schervish, currently Class II directors, are not standing for reelection. Mr. Mast is retiring from the boards of the Company and the Bank. However, Mr. Schervish will continue as a director of the Bank. See “Board Structure” above for further information.

Proxies will be voted for the election of the following Class II directors to serve for three-year terms expiring in 2008 and until their successors are elected and qualified: Robert F. Belden, Gregory A. Long and Melvin J. Yoder. Messrs. Belden, Long and Yoder have been determined by the Board of Directors to be independent under the rules of the National Association of Securities Dealers (NASD). All nominees have consented to be named in this Proxy Statement and have agreed to serve if elected. If, prior to election, any nominee becomes unable or unwilling to serve, and the number of directors is not decreased accordingly, proxies will be voted for such other nominee as the Board of Directors may select. However, the Company has no reason to believe that any of the nominees will not be available. Biographical information is set forth below for each nominee for director and each director who will continue in office after the Annual Meeting.

The nominees who receive the greatest number of votes for the director positions to be filled will be elected to those positions.

The Board of Directors recommends that you voteFOR election of the Company’s nominees for director.

Nominees to the Board of Directors

Class II Directors - Term ending in 2008

ROBERT F. BELDEN (age 57)

Director since 1999, Independent

Since 1995, Mr. Belden has served as the President of the Belden Brick Company, a company based in Canton since 1885. From 1983 to 1995, Mr. Belden served as the Vice President of Marketing for Belden Brick. Mr. Belden served as a director of Signal Corporation and Signal Bank, N.A., from 1988 to 1999. He graduated from the University of Notre Dame in 1969 with a B.S. degree in Mathematics and then graduated from the University of Michigan Graduate School of Business in 1971. Mr. Belden has been very active in community affairs including the American Red Cross, Canton Regional Chamber of Commerce, Junior Achievement of Stark County, Stark County Foundation and other community groups.

GREGORY A. LONG (age 55)

Director since 1999, Independent, Audit Committee Financial Expert

Mr. Long is a licensed CPA with over 30 years experience as an accountant. He graduated from Kent State University in 1971. Mr. Long currently serves as the President of Long, Cook & Samsa, Inc., CPA’s of Wooster. Mr. Long is actively involved as a board member and Past-President of the Wayne County Historical Society and is the past President of Buckeye Council, Inc., and Boy Scouts of America. He is also a Treasurer of the Rotary Club and Chair-Elect of the Wooster Area Chamber of Commerce, a coach and board member of Wooster Youth Baseball, a member of board of trustees for Boys’ Village, Inc., and is Troop Committee Chairman of Boy Scout Troop 61 of Wooster. Mr. Long is retired from the Army Reserve as a Lieutenant Colonel.

- 2 -

MELVIN J. YODER (age 59)

New nominee recommended by non-employee directors, Independent

Mr. Yoder is Vice President and Corporate Operations Officer of Yoder Lumber Co., Inc., of Millersburg, Ohio. He is also part owner of Tri-County Lumber, LLC, and Buckhorn Woods, LLC, which are real estate holding companies, and Rolling Ridge Woods, LLC, a log and timber procurement company. Mr. Yoder currently serves on the board of Joel Pomerene Foundation and the East Holmes Council. He served as past President of the Ohio Forestry Association.

Class I Continuing Directors - Term ending in 2006

J. EDWARD DIAMOND (age 66)

Director since 1999, Independent

Mr. Diamond, a private investor since 1984 in the Canton area, is the retired Chairman of Glendale Oxygen Company, a Canton-based supplier of cryogenic gases and welding supplies. He has served on the boards of Arrowhead Country Club, The Canton Club, The Canton Ballet and The Canton Symphony Orchestra Association. He is a graduate of the University of Virginia and has been a lifelong Canton resident.

L. DWIGHT DOUCE (age 56)

Director since 1999, Employee Director

Mr. Douce is President and Chief Executive Officer of the Company and has more than 29 years of financial institution experience in a diverse number of positions, with 21 years of experience in the Wooster area. From October 1996 to February 1999, Mr. Douce served as President-Chief Operating Officer of Signal Bank, N.A. From 1983 to October 1996, Mr. Douce served as Executive Vice President and Chief Financial Officer of First Federal Savings and Loan Association (Signal Bank’s predecessor). During Mr. Douce’s tenure, Signal Bank grew in assets from a $200 million community bank to a $1.8 billion financial services institution. Mr. Douce graduated from Capital University with a B.S. in Business Administration. He has been a resident of the Wooster area for the last 21 years and has been very active in community organizations, including the American Red Cross, the Wooster Chamber of Commerce Board, Kiwanis International and the United Way.

DANIEL H. PLUMLY (age 51)

Director since 1999, Chairman and Secretary

Since 1981, Mr. Plumly has been a member of Critchfield, Critchfield & Johnston, Ltd., and currently serves as its Managing Member. The law firm has five offices located in central Ohio. Mr. Plumly served on the Board of Directors of Signal Corporation and Signal Bank, N.A., from 1986 to 1999. Mr. Plumly graduated from Muskingum College in 1975 with a B.A. in History and received his J.D. from Case Western Reserve University in 1978. Mr. Plumly is the Immediate Past President of Meals on Wheels of Stark and Wayne Counties and has been involved in coaching youth football, basketball and lacrosse. He also serves as a member of the Board of Trustees of the United Methodist Church, as a member of the Board of Directors of Main Street, Inc., and is a member of the Wayne County Children Services Advisory Board. Mr. Plumly previously served on the board of Goodwill Industries of Wayne County, Inc., as President and Trustee of the Wooster Lacrosse Club, as President of the Board of Trustees of Wooster Country Club and as Chairman of the Board of Governors of Wooster Country Club.

Class III Continuing Directors - Term ending in 2007

D. WILLIAM ALLEN (53)

Director since 1999, Independent

Mr. Allen is the Chief of Staff and Director of Budget for the City of Canton, Ohio. Mr. Allen also is President of SPC Realty Company, a real estate investment company. From 1994 to 1997, Mr. Allen served as the President, Chief Operating Officer and owner of Service Packaging Corporation. Mr. Allen is the immediate past President of Congress Lake Club and Secretary of the Board of Governors of Mercy Medical Hospital. Mr. Allen is also involved with the Pro Football Hall of Fame Festival, where his involvement spans 28 years, and served as its General Chairman in 1993. Mr. Allen served as Chairman of the Board of Trustees of the Greater Canton Chamber of Commerce in 2002 and is currently serving as its Treasurer. He also served as President of Meals on Wheels of Stark and Wayne Counties in 1999 and 2000.

- 3 -

SCOTT J. FITZPATRICK (52)

Director since 1999, Independent

Since 1973, Mr. Fitzpatrick has served as a partner in Fitzpatrick Enterprises in Canton, Ohio. Mr. Fitzpatrick is primarily involved in the development of commercial real estate for his own portfolio.

MICHAEL D. MEENAN (51)

Director since 1999, Independent

Since 1989, Mr. Meenan has served as the President and owner of Riverview Industrial Wood Products, Inc., which is based in Wooster. He graduated from Kent State University in 1976 with a Bachelor’s degree in Business Administration. Mr. Meenan is a member and past President of the Wooster All Sports Booster Club and has served on the Wooster City Charter Review Commission.

EXECUTIVE OFFICERS

Mr. Douce is the President and Chief Executive Officer of the Company. His biographical information appears above.

Eric S. Nadeau, CPA, age 34, is the Company’s Chief Financial Officer and Treasurer and Chief Financial Officer and Vice President of Ohio Legacy Bank, N.A. He was employed most recently by Horizon PCS, Inc., a wireless personal communications services carrier and PCS affiliate of Sprint Corp., as Director of Financial Reporting. Before that he worked for Crowe Chizek and Company LLC in Columbus, Ohio, providing audit, tax and profitability consulting services to regional and community banks and thrifts. Mr. Nadeau graduated from the Richard T. Farmer School of Business Administration at Miami University in Oxford, Ohio, with a B.S. in Business Administration, majoring in Accountancy. He is a member of Rotary International and serves as Treasurer of the Wayne County Humane Society, Inc. He is also a member of the Ohio Society of Certified Public Accountants, the American Institute of Certified Public Accountants, and the Institute of Management Accountants.

Steven G. Pettit, age 47, is Senior Loan Officer and President - Stark County Region, Ohio Legacy Bank, N.A. Mr. Pettit has 19 years of commercial banking experience in a diverse number of lending positions in both Stark and Wayne Counties. From February to September 1999, Mr. Pettit held the position of Senior Vice President, Senior Loan Officer for two regions of FirstMerit Bank, N.A. From March 1996 to February 1999, Mr. Pettit held the same position at Signal Bank, N.A. From January 1994 to March 1996, Mr. Pettit served as Manager of Commercial Lending for FirstMerit. Mr. Pettit graduated from the University of Tennessee with a B.S. degree in Business Administration and from Ashland University with an MBA in Executive Management. Mr. Pettit has been a resident of the Canton area his entire life and has been active in various social and civic activities, including Meals on Wheels of Stark and Wayne Counties, Mercy Medical Center, Boy Scouts of America and Plain Local Schools. Mr. Pettit has communicated his intent to resign as a director of the Company, effective immediately following the 2005 Annual Meeting, to facilitate the restructuring described above in “Board Structure.” However, he will continue to serve as a director of the Bank.

Robert E. Boss, age 48, is the Senior Vice President of Commercial Lending and the President - Holmes County Region of Ohio Legacy Bank, N.A. Mr. Boss has more than 22 years of financial institution experience in a variety of lending positions. From January 1990 to March 2000, Mr. Boss held several positions at the Commercial and Savings Bank of Millersburg, Ohio, the last of which was the position of Senior Vice President and Senior Lending Officer. Mr. Boss previously worked in various loan areas for Bank One of Wooster from 1987 to 1990. Mr. Boss is President of the board of the Holmes County Training Center, past President of the Holmes County Chamber of Commerce, Treasurer of the Holmes County Economic Development Council and a director of the Buckeye Council of the Boy Scouts of America. Mr. Boss is a graduate of Mount Union College with a B.A. in Accounting.

- 4 -

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

Director Compensation

Employee directors receive no compensation for their services as directors. The Chairman of the Board of Directors receives $1,000 per month as compensation for his services. Each non-employee director receives $100 per monthly board and committee meeting attended. Committee chairpersons receive $150 per meeting. In addition, subject to compliance with the restrictions and requirements of the FDIC stock benefit plan policy, each non-employee director will receive automatic awards of nonqualified stock options under the Company’s Omnibus Stock Option, Stock Ownership and Incentive Plan (Stock Ownership Plan) consisting of initial options to purchase 2,500 common shares of the Company awarded on the date of commencement of service as a non-employee director, and, thereafter, annual options to purchase 1,000 common shares of the Company. Initial options vest and become exercisable over a period of five years at the rate of 20% per year, while annual options vest and become exercisable upon their grant dates. For fiscal year 2004, the Company granted annual options to non-employee directors to purchase 11,000 common shares of the Company at an exercise price of $12.00 per share. During 2004, the board granted an additional award of options to purchase 10,000 common shares at an exercise price of $12.00 per share to the Chairman of the Board of Directors. For fiscal year 2005, the Company will grant annual options to non-employee directors to purchase 11,000 common shares of the Company at an exercise price equal to the closing price of the Company’s stock on the date of the annual meeting. Mr. Yoder will receive an additional grant of options to purchase 2,500 shares upon his initial election to the Board of Directors, commensurate with the terms of the Stock Ownership Plan.

Executive Compensation

Summary Compensation Table

The following table sets forth certain information concerning the annual and long-term compensation of the Chief Executive Officer (CEO) of the Company and other executive officers who received an annual salary or bonus during the last completed fiscal year that exceeded $100,000 (together, the Named Executives).

| | | | | | | | | | | | | |

| | | | | Annual Compensation

| | Stock Options

Granted

|

| | | Fiscal

Year

| | Salary

| | Bonus

| | Other Annual

Compensation(1)

| |

L. Dwight Douce President and Chief Executive Officer | | 2004

2003

2002 | | $

| 128,501

116,050

106,300 | | $

| 12,000

—

— | | $

| 2,329

3,172

— | | 5,000

5,000

10,000 |

| | | | | |

Steven G. Pettit Senior Loan Officer and President - Stark County Region | | 2004

2003

2002 | | $

| 128,501

116,050

106,300 | | $

| 17,000

4,000

— | | $

| 3,435

4,553

3,158 | | 4,000

5,000

10,000 |

| | | | | |

Robert E. Boss Senior Vice President of Commercial Lending and President - Holmes County Region | | 2004 | | $ | 104,600 | | $ | 12,000 | | $ | 1,905 | | 4,000 |

| | | | | |

Eric S. Nadeau Chief Financial Officer and Treasurer | | 2004 | | $ | 90,001 | | $ | 10,000 | | $ | — | | 4,000 |

| (1) | Other annual compensation includes dues for country club membership |

- 5 -

Option Grants In Last Fiscal Year

The following table sets forth information regarding stock option grants to the Named Executives during the 2004 fiscal year. All options were awarded at exercise prices that were equal to the market price of the Company’s common shares on the date of grant and vest on the third anniversary of the grant date. Any unexercised shares lapse on the earlier of 10 years from the grant date or 90 days after termination of employment with the Company.

| | | | | | | | | | |

Named Executive

| | Number of

Securities

Underlying

Options Granted

| | % of Total

Options Granted

To Employees in

Fiscal Year

| | | Exercise

Price

($/Share)

| | Expiration Date

|

L. Dwight Douce | | 5,000 | | 13.3 | % | | $ | 12.00 | | February 17, 2014 |

Steven G. Pettit | | 4,000 | | 10.7 | | | | 12.00 | | February 17, 2014 |

Robert E. Boss | | 4,000 | | 10.7 | | | | 12.00 | | February 17, 2014 |

Eric S. Nadeau | | 4,000 | | 10.7 | | | | 12.00 | | February 17, 2014 |

Aggregated Option Exercises and Fiscal Year-End Option Value Table

No stock options were exercised by the Named Executives during fiscal years 2004 or 2003. The following table sets forth certain information concerning the value of unexercised stock options granted under the Stock Ownership Plan and held as of December 31, 2004, by the Named Executives.

| | | | | | | | | | |

| | | Number of Securities

Underlying

Unexercised Options at

Fiscal Year End (#)

| | Value of Unexercised

In-the-Money Options at

Fiscal Year End ($)

|

Named Executive

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

L. Dwight Douce | | — | | 20,000 | | $ | — | | $ | 97,500 |

Steven G. Pettit | | — | | 19,000 | | | — | | | 94,500 |

Robert E. Boss | | — | | 18,000 | | | — | | | 88,000 |

Eric S. Nadeau | | — | | 9,000 | | | — | | | 44,500 |

Employment and Severance Agreements

The Company and Ohio Legacy Bank, N.A., have entered into employment agreements with Messrs. Douce, Pettit and Boss. Each employment agreement renews annually, automatically, for an additional year unless either party furnishes at least 60 days prior notice to the other of its intent to terminate the agreement. Upon a change in control of the Company or a diminution in the officer’s duties, each will have the right to terminate his employment and receive a severance payment equal to 2.99 times his current annual compensation. In addition, all stock options previously granted will vest in the event of a termination of employment upon a change in control or a diminution in the officer’s duties.

The Bank has entered into a change of control agreement with Mr. Nadeau. Upon a change in control of the Bank, Mr. Nadeau will have the right to terminate his employment and receive a severance payment equal to 2.99 times his current annual compensation. In addition, all stock options previously granted will vest.

- 6 -

Report of the Compensation Committee

The Compensation Committee of the Board of Directors is comprised of three directors, each of whom has been determined by the Board of Directors to be independent under NASD rules and satisfies the requirements of an outside director for purposes of Section 162(m) of the Internal Revenue Code. The members of the Committee may be removed, with or without cause, by a majority vote of the Board of Directors. Messrs. Belden, Meenan and Mast currently serve on the committee. Mr. Allen has been appointed to replace Mr. Mast upon his retirement from the Board. The committee met two times during 2004.

Under the committee’s charter, the committee’s primary duties include:

| | • | | approving corporate goals and objectives relevant to the compensation of the CEO and reviewing and approving the goals and objectives of executive officers as proposed by the CEO; |

| | • | | reviewing and evaluating the performance of the CEO, executive officers and key employees of the Company in light of the goals and objectives of the Company and approving their annual compensation packages, including base salaries and bonuses, stock options and other stock-based incentives, variable pay amounts and variable pay metrics, based on these evaluations; |

| | • | | reviewing and approving executive incentive compensation plans and equity-based plans in which executive officers and members of the Board of Directors are eligible to participate; and |

| | • | | supervising the administration of the Company’s incentive compensation and stock programs, and providing oversight with respect to the financial aspects of the Company’s benefit plans, including funding policies and investment performance. |

The general philosophy of the Compensation Committee is to provide executive compensation programs designed to enhance shareholder value, including annual compensation, which consists of salary and bonus awards, and long-term incentive compensation, consisting of stock options. The committee designs compensation and incentive plans to align the financial interests of the Company’s executive officers to the interests of its shareholders and to attract and retain talented leadership. In making decisions affecting executive compensation, the committee reviews the nature and scope of the executive officer’s responsibilities as well as his or her effectiveness in supporting the Company’s long-term goals. The committee also considers the compensation practices of other companies of similar size and complexity to determine an appropriate level of executive compensation.

On January 1, 2004, the committee implemented an Incentive Bonus Plan (Bonus Plan) for executive officers that develops an incentive bonus pool, as defined by the Bonus Plan, which may be allocated to each Bonus Plan participant based upon specific financial and personal performance goals. The Bonus Plan seeks to first challenge executive officers to exceed financial performance goals in order to develop the incentive bonus pool, from which bonuses may be paid. Allocations are then made to participants based on their ability to meet other specific criteria. Messrs. Douce, Pettit, Boss and Nadeau are eligible to earn incentive compensation equal to 50%, 40%, 30% and 25%, respectively, of their base salary. If the incentive bonus pool does not have enough funds to meet the sum of those bonuses, allocations are made on a pro rata share basis. If the incentive bonus pool exceeds the sum of the bonuses prescribed, the committee may, at its sole and complete discretion, further allocate the pool among participants in a manner of its own choosing, or it may withdraw those funds from the pool and not allocate it further.

The Compensation Committee grants options to purchase shares of the Company’s common shares to executive officers under the Stock Ownership Plan. During 2004, the committee granted options to the executives of the Company to purchase an aggregate of 17,000 shares of stock at an exercise price of $12.00 per share. These options were granted at an exercise price that was equal to the fair value of the Company’s shares on the date of grant. The options vest on the third anniversary of the date of grant and expire ten years from the date of grant.

- 7 -

The Company’s CEO received an annual base salary of $128,501 during 2004, which represents an increase of 10.7% over his base salary during 2003. This increase reflects the improved profitability and growth of the Company during 2004. The CEO is eligible to participate in the Company’s 401(k) Plan, Stock Ownership Plan and Bonus Plan. The Summary Compensation Table under Compensation of Directors and Executive Officers above details other information regarding compensation and benefits paid to the CEO.

The Compensation Committee also considers the potential impact of Section 162(m) of the Internal Revenue Code of 1986, as emended, which disallows a tax deduction for any publicly held corporation for individual compensation exceeding $1.0 million in any taxable year for the CEO and other executive officers, other than compensation that is performance-based under a plan that is approved by the shareholders of the corporation. Based on these requirements, the committee has determined that Section 162(m) will not prevent the Company from receiving a tax deduction for any of the compensation paid to executive officers during 2003.

Submitted by the Compensation Committee

Robert F. Belden, Chairperson

Benjamin M. Mast

Michael D. Meenan

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

AND RELATED STOCKHOLDER MATTERS

Security Ownership of Management and Directors

Information is set forth below regarding beneficial ownership of common shares of the Company by each current director and all directors and executive officers as a group. Except as otherwise noted, each person has sole voting and investment power as to his common shares. The information set forth below is as of March 1, 2005.

| | | | | | | | | |

Name

| | Common

Shares

Beneficially

Owned

| | Common Shares

Underlying

Warrants and

Options

Exercisable

Within 60 Days

| | Total

| | Percent

Of

Class

| |

D. William Allen | | 13,000 | | 16,200 | | 29,200 | | 1.4 | % |

William T. Baker | | 55,000 | | 13,700 | | 68,700 | | 3.2 | |

Robert F. Belden(1) | | 85,000 | | 34,200 | | 119,200 | | 5.5 | |

J. Edward Diamond | | 125,000 | | 35,200 | | 160,200 | | 7.4 | |

L. Dwight Douce | | 70,530 | | 39,700 | | 110,230 | | 5.1 | |

Scott J. Fitzpatrick | | 62,500 | | 32,700 | | 95,200 | | 4.4 | |

Randy G. Jones | | 22,000 | | 6,500 | | 28,500 | | 1.3 | |

Gregory A. Long | | 36,313 | | 27,200 | | 63,513 | | 3.0 | |

Benjamin M. Mast | | 23,000 | | 7,100 | | 30,100 | | 1.4 | |

Michael D. Meenan | | 21,750 | | 26,500 | | 48,250 | | 2.2 | |

Steven G. Pettit | | 18,300 | | 13,400 | | 31,700 | | 1.5 | |

Daniel H. Plumly | | 25,000 | | 36,600 | | 61,600 | | 2.9 | |

Thomas W. Schervish | | 43,504 | | 28,550 | | 72,054 | | 3.4 | |

All Directors and Executive Officers as a Group (15 persons) | | 621,597 | | 331,550 | | 953,147 | | 38.9 | % |

| (1) | Includes 60,000 common shares and warrants to acquire 12,000 common shares held by Belden Brick Company. Mr. Belden disclaims beneficial ownership of those shares and warrants. |

- 8 -

Security Ownership of Certain Beneficial Owners

Information is provided below about each person known by the Company to be the beneficial owner of more than 5% of its outstanding common shares at March 1, 2005.

| | | | | | | | | |

Name and Address of Beneficial Owner

| | Common

Shares

Beneficially

Owned

| | Common Shares

Underlying

Warrants and

Options

Exercisable

Within 60 Days

| | Total

| | Percent

of

Class

| |

Wellington Management Company, LLP 75 State Street Boston, Massachusetts 02109 | | 194,200 | | -0- | | 194,200 | | 9.2 | % |

| | | | |

Tontine Financial Partners, L.P. Tontine Management, L.L.C. Jeffrey L. Gendell 55 Railroad Avenue, 3rd Floor, Greenwich, Connecticut 06830 | | 159,100 | | -0- | | 159,100 | | 7.5 | |

| | | | |

J. Edward Diamond P.O. Box 9187 Canton, OH 44711 | | 125,000 | | 35,200 | | 160,200 | | 7.4 | |

| | | | |

Bay Pond Partners, L.P. 75 State Street Boston, Massachusetts 02109 | | 153,000 | | -0- | | 153,000 | | 7.2 | |

| | | | |

Millenco, L.P. Millennium Management, LLC Israel A. Englander 666 Fifth Avenue New York, New York 10103 | | 149,510 | | -0- | | 149,510 | | 7.0 | |

| | | | |

United Community Financial Corp. 275 Federal Plaza West Youngstown, Ohio 44503-1203 | | 136,000 | | -0- | | 136,000 | | 6.4 | |

| | | | |

Robert F. Belden(1) P.O. Box 20910 Canton, Ohio 44701 | | 85,000 | | 34,200 | | 119,200 | | 5.5 | |

| | | | |

L. Dwight Douce 305 W. Liberty Street Wooster, Ohio 44691 | | 70,530 | | 39,700 | | 110,230 | | 5.1 | |

| (1) | Includes 60,000 common shares and warrants to acquire 12,000 common shares held by Belden Brick Company. Mr. Belden disclaims beneficial ownership of those shares and warrants. |

- 9 -

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

During fiscal year 2004, certain directors and executive officers and their associates were customers of, or had transactions with the Company’s subsidiary, Ohio Legacy Bank, N.A. All outstanding loans that were part of such transactions were made in the ordinary course of business and on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with unrelated parties, and did not involve more than a normal risk of loss or present other unfavorable features. The Company expects that similar transactions will occur in the future.

Loans to individual directors and officers also must comply with Ohio Legacy Bank’s lending policies, regulatory restrictions and statutory lending limits, and directors with personal interest in any loan application are excluded from the consideration of that loan application. As of December 31, 2004, the aggregate balance of all such loans was approximately $3.0 million, or 2.3% of the total net loans then outstanding.

The Bank’s Holmes County banking center is leased from an entity that is owned by Messrs. Baker and Jones, who are each directors of the Company and the Bank. The term of the lease is fifteen years, which commenced upon occupancy of the property in March 2002. Rent is $87,000 annually for the first five years with increases to $96,000 for years six through ten and to $105,000 for years eleven through fifteen.

During fiscal year 2004, the law firm of Critchfield, Critchfield & Johnston, Ltd., and an affiliated company, Heartland Title Agency, provided legal and other services to the Company and the Bank. Mr. Plumly is the Chairman and Secretary of the boards of the Company and the Bank and also is the Managing Member of the law firm of Critchfield, Critchfield & Johnston, Ltd. During 2004, the Company and the Bank paid $83,536 to the law firm of Critchfield, Critchfield & Johnston, Ltd., and $2,800 to Heartland Title Agency. Management and the board believe the cost of services they provided is comparable to that available from a non-affiliated firm.

In early 2004, a limited liability partnership owned by Messrs. Pettit and Schervish purchased property in North Canton, Ohio. Subsequent to the purchase, the Bank agreed to acquire the property from the partnership owned by Messrs. Pettit and Schervish at that entity’s cost. The partnership and Messrs. Pettit and Schervish will not recognize a profit or gain on the sale of the property to the Bank, which will be the site of a branch office to be operated by the Bank. As a result of the acquisition, Mr. Schervish can not be considered as an independent director of the Company. Mr. Pettit, as an employee director, was not considered an independent director previously.

COMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE ACT

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s officers and directors, and persons who own more than ten percent of a registered class of the Company’s equity securities, to file reports of ownership and changes in ownership with the Securities and Exchange Commission (SEC). Officers, directors and greater than ten percent shareholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

Based solely upon a review of Forms 3 and 4 and amendments thereto furnished to the Company during 2004 and Forms 5 and amendments thereto furnished to the Company with respect to 2004, no director, officer or beneficial owner of more than ten percent of the Company’s outstanding common shares failed to file on a timely basis during 2004 any reports required by Section 16(a) of the Exchange Act.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

The Audit and Compliance Committee has the sole authority to select, compensate, oversee, evaluate and, where appropriate, replace the Company’s independent auditor. Additionally, the charter requires the Audit and Compliance Committee to review and approve in advance any audit and non-audit services to be provided by the Company’s independent auditor, other than “prohibited non-auditing services.” The Committee has the sole authority to make these approvals, although such approval has been delegated to the Chairman of the Audit and Compliance Committee. Any actions taken by the Chairman are subsequently presented to the Committee for ratification.

- 10 -

Crowe Chizek and Company LLC (Crowe Chizek) has acted as the principal independent accountant of the Company since October 2000. The Audit and Compliance Committee has appointed Crowe Chizek to continue as the Company’s independent external auditors for fiscal year 2005. Representatives of Crowe Chizek will be at the 2005 Annual Meeting of Shareholders. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions. During 2004 and 2003, the Company paid fees in the aggregate of $50,250 and $81,050, respectively, to Crowe Chizek for various accounting services. Those fees and services are detailed below.

Audit Fees

The following table summarizes the aggregate fees billed for each of the last two fiscal years for professional services rendered by Crowe Chizek for the audit of the Company’s annual financial statements and the review of financial statements included in the Company’s Form 10-QSB:

| | | | | | |

| | | 2004

| | 2003

|

Annual financial statement audit | | $ | 28,500 | | $ | 26,000 |

Quarterly reviews of Form 10-QSB | | | 12,450 | | | 12,000 |

Compliance review of Form 10-KSB | | | 4,650 | | | 4,500 |

| | |

|

| |

|

|

Total audit fees | | $ | 45,600 | | $ | 42,500 |

| | |

|

| |

|

|

Audit-Related Fees

The following table summarizes the aggregate fees billed by Crowe Chizek in each of the last two fiscal years for services that were reasonably related to the performance of the audit of the Company’s financial statements that are not reported in the table under “Audit Fees:”

| | | | | | |

| | | 2004

| | 2003

|

Audit of eligible collateral schedule | | $ | — | | $ | 1,000 |

Extended audit services | | | — | | | 25,000 |

| | |

|

| |

|

|

Total audit-related fees | | $ | — | | $ | 26,000 |

| | |

|

| |

|

|

There were no audit-related services provided by Crowe Chizek during 2004 that are not reported in the table under “Audit Fees” above.

“Audit of eligible collateral schedule” services are required by the Federal Home Loan Bank (FHLB) to determine the existence and compliance of financial assets pledged as collateral for the Bank’s borrowings from the FHLB.

Extended audit services included Crowe Chizek’s assistance in developing an annual risk-based internal audit plan for fiscal 2003. The plan was reviewed with management and approved by the Company’s Audit and Compliance Committee. Crowe Chizek directed, reviewed and supervised the performance of the internal audit plan, but did not perform management functions, make management decisions or give the appearance of acting in a capacity equivalent to a member of the Company’s management. Additionally, Crowe Chizek was not involved in any activities such as authorizing, executing or consummating transactions or otherwise exercising authority on behalf of the Company and Crowe Chizek did not perform ongoing monitoring or control activities, prepare source documents on transactions or have custody of the Company’s or the Bank’s assets.

- 11 -

The Company engaged Crowe Chizek to perform internal audit services during fiscal 2003 before the effective date of SEC rules that now prohibit a registrant’s external auditor from providing such services. Crowe Chizek completed their internal audit plan in December 2003. To comply with independence guidance, the Company’s Audit and Compliance Committee engaged another accounting firm in 2004 to perform internal audit services. Crowe Chizek will continue as the Company’s independent external auditor to audit the Company’s 2005 financial statements and to review the financial statements included in the Company’s 2005 Forms 10-QSB.

Tax Fees

The Company engaged Crowe Chizek to assist management with the preparation of the Company’s 2004 and 2003 federal income tax returns and the State of Ohio franchise tax returns. Fees related to these tax compliance services were $4,650 and $4,500 during fiscal years 2004 and 2003, respectively. Crowe Chizek did not perform tax planning services on a contingency fee basis.

All Other Fees

The following table summarizes the aggregate fees billed by Crowe Chizek in each of the last two fiscal years for other services that are not reported under the sections above:

| | | | | | |

| | | 2004

| | 2003

|

Equity offering services | | $ | — | | $ | 3,500 |

Compliance consulting report | | | — | | | 3,800 |

Other consultative services | | | — | | | 750 |

| | |

|

| |

|

|

Total of all other fees | | $ | — | | $ | 8,050 |

| | |

|

| |

|

|

There were no other services provided by Crowe Chizek during 2004 that are not reported in the sections above.

“Equity offering services” include compliance reviews of the Company’s registration statements and other filings with the SEC related to the Company’s over-allotment offering of 150,000 Common Shares, Without Par Value, in January 2003.

“Compliance consulting report” services relate to review procedures designed with the objective to evaluate the Bank’s compliance with certain operations regulations; specifically, the Bank Secrecy Act, Office of Foreign Assets Control and Automated Clearing House transactions. The services included the review of related policies and procedures and observation and inquiry of Bank personnel to determine compliance with such policies and procedures, and the testing of certain detail records.

“Other consultative services” during 2003 related to the review of the Company’s process for the identification and analysis of branch site acquisition and development. Crowe Chizek did not assist the Company with the identification of any specific sites the Company may have considered during 2003.

The Audit and Compliance Committee has considered whether the provision of these other services is compatible with maintaining Crowe Chizek’s independence and has concluded that Crowe Chizek’s independence was not impaired. The pre-approval requirement for audit-related, tax or other fees was not waived for any of those services during fiscal years 2004 or 2003. During fiscal years 2004 and 2003, no work related to the audit of the Company’s financial statements was performed by persons other than Crowe Chizek employees.

- 12 -

INFORMATION REGARDING BOARD MEETINGS AND

COMMITTEES OF THE BOARD OF DIRECTORS

During 2004, the Board of Directors of the Company met 13 times. Additionally, the independent directors of the Company met 12 times during 2004 without members of management and employee directors present. During 2004, each director attended at least 75% of the total number of meetings of the Board of Directors of the Company and the board committees on which he served except for Mr. Mast, who has elected to retire from the boards of the Company and the Bank upon the expiry of his term at the 2005 Annual Meeting.

Although the Company does not have a formal policy regarding attendance by members of the Board of Directors at the Company’s Annual Meeting of Shareholders, directors are encouraged to attend and historically have done so. At the 2004 and 2003 Annual Meetings, all of the Company’s directors were in attendance.

Corporate Governance Program

In order to place an enhanced focus on the processes utilized by the Company in the conduct of its business, the Company’s Board of Directors has implemented a corporate governance program. The highlights of the program are as follows:

| | • | | the positions of CEO and Chairman are held by different people. The separation of these offices provides focused leadership at the board level that is independent of management; |

| | • | | charters have been adopted for the Corporate Governance and Nominating Committee, the Audit and Compliance Committee, Compensation Committee and the Executive Committee; |

| | • | | the board has adopted and implemented a Code of Ethics for Senior Financial Officers, a Director Code of Conduct and a Code of Business Conduct and Ethics for all employees of the Company and its subsidiary; |

| | • | | the Board of Directors established a Corporate Governance and Nominating Committee that is responsible for implementing the corporate governance program and any additional requirements mandated by law or deemed necessary or appropriate by the Board of Directors; and |

| | • | | the Audit and Compliance Committee has developed a process for the receipt, retention and investigation of anonymous submissions by employees or external parties of concerns regarding questionable accounting or auditing matters. |

Charters for the Audit and Compliance Committee, the Nominating and Corporate Governance Committee, the Compensation Committee and the Executive Committee, as well as codes of conduct and ethics, are available, free of charge, on the Company’s website, http://www.ohiolegacycorp.com. The development and implementation of this corporate governance program is intended to be proactive in nature, comprehensive in scope and forceful in application. The goal of this program is to establish a governance process that fosters, promotes and mandates that appropriate actions are taken and appropriate behavior is maintained, at both the corporate and employee level, to ensure the ongoing success of the Company.

- 13 -

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee is comprised of three directors whom the board has determined are independent under rules of the NASD and the SEC. Messrs. Meenan, Belden and Diamond are members, with Mr. Meenan serving as the committee Chairperson. The members of this committee are appointed by the Board of Directors and each may be removed, with or without cause, by a majority vote of the Board of Directors. The Corporate Governance and Nominating Committee met four times during 2004.

A summary of the duties of the Corporate Governance and Nominating Committee are as follows:

| | • | | make recommendations regarding the size and composition of the board, determine the appropriate committee structure of the board and recommend board committee assignments and any changes to such assignments; |

| | • | | establish criteria for the selection of new directors to serve on the Board of Directors and identify individuals qualified to become board members; |

| | • | | make recommendations to the board regarding the director nominees for the next Annual Meeting of Shareholders or the filling of any vacancies on the board; |

| | • | | oversee the evaluation of the board and the board’s effectiveness in fulfilling its role, including a review and evaluation, at least annually, of the performance of the Nominating and Corporate Governance Committee, and make periodic recommendations for improving the board’s effectiveness, at least annually; |

| | • | | act as a forum to hear special concerns relating to substantive and material issues that might arise which require the attention of non-employee directors; and |

| | • | | develop and recommend to the board a set of corporate governance principles applicable to the Company. |

Director qualifications and nominations

The committee’s goal is to assemble a Board of Directors that brings to the Company a variety of perspectives and skills derived from high quality business and professional experience. Although the committee has not adopted specific minimum criteria for director nominees, the committee considers the following factors when evaluating nominees:

| | • | | the appropriate size of the Company’s Board of Directors; |

| | • | | specific needs of the Company with respect to the particular talents and experience of its directors; |

| | • | | the knowledge, skills and experience of nominees, including experience in business, finance, administration or public service, in light of prevailing business conditions and the knowledge, skills and experience already possessed by other members of the board; |

| | • | | experience with accounting rules and practices and the financial services industry; and |

| | • | | the desire to balance the benefit of continuity with the fresh perspective provided by new members. |

- 14 -

The committee identifies nominees by first evaluating the current members of the Board of Directors willing to continue in service. Current members of the board with skills and experience that are relevant to the Company’s business and who are willing to continue in service are considered for re-nomination. If any member of the board does not wish to continue in service, or if the committee decides not to nominate a member for re-election, the committee first considers the appropriateness of the size of the board. If the committee determines the board seat should remain and a vacancy exists, the committee identifies the desired skills and experience of a new nominee in light of the factors described above. The committee may poll existing board members for candidates or engage a third party to identify, evaluate or assist in the selection of a candidate to fill the vacancy for the unexpired term. To date, the committee has not utilized or paid a third party to assist in the process of identifying and evaluating candidates

Nominations of candidates for election as directors of the Company may be made at a meeting of shareholders by or at the direction of the directors, by any nominating committee or person appointed by the directors, or by any shareholder of the Company entitled to vote for the election of directors who complies with the notice procedures set forth in the Company’s Code of Regulations. Nominations by shareholders are to be made pursuant to timely notice in writing to the Secretary of the Company, as described more fully under “Shareholder Proposals for the 2006 Annual Meeting” below.

Such shareholder nominations must set forth:

| | (a) | as to each person who is not an incumbent director whom the shareholder proposes to nominate for election as a director: |

| | (i) | the name, age, business address and residence address of such person; |

| | (ii) | the principal occupation or employment of such person; |

| | (iii) | the class and number of shares of the Company which are beneficially owned by such person; and |

| | (iv) | any other information relating to such person that is required to be disclosed in solicitations for proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934 (or any comparable successor rule or regulation under such Act), |

and

| | (b) | as to the shareholder giving the notice: |

| | (i) | the name and record address of such shareholder; and |

| | (ii) | the class and number of shares of the Company that are beneficially owned by the shareholder. Such notice shall be accompanied by the written consent of each proposed nominee to serve as a director of the Company, if elected. |

To date, the Company has not received a shareholder nominee for director.

According to Section 10 of the Company’s Code of Regulations, except as otherwise provided by Ohio law, any director(s) may be removed from office, with or without assigning any cause, by the affirmative vote of at least eighty percent (80%) of the outstanding voting stock present in person or represented by proxy, entitled to vote in respect thereof, at an annual meeting or at any special meeting duly called.

- 15 -

Shareholder communications and proposals

The Company’s Code of Regulations provides guidance for shareholders as to the information required to be submitted to the Company and the manner of communications with the Board of Directors, as well as defining timely submissions by shareholders. The information required by the Code of Regulations related to shareholder nominees to the Board of Directors is provided above under “Director qualifications and nominations.” Timely submissions and the manner of their delivery are described under “Shareholder Proposals for the 2006 Annual Meeting” below.

Report of the Audit and Compliance Committee

The Company’s Board of Directors has created a separately-designated standing Audit and Compliance Committee comprised of four independent directors, as defined by Rule 10A-3 of the Exchange Act, Section 301(3)(B) of the Sarbanes Oxley Act of 2002, and applicable NASD rules. The Board of Directors has granted specific authority and responsibilities to the Audit and Compliance Committee through the Audit and Compliance Committee Charter. This charter was filed with the SEC and is available on the Company’s website. The Audit and Compliance Committee was formed with the purpose of, among other duties described in the charter, overseeing the Company’s accounting and financial reporting processes and audits of the Company’s financial statements. Messrs. Long, Fitzpatrick, Mast and Meenan are members of the Audit and Compliance Committee. The Audit and Compliance Committee met eight times during 2004.

The Audit and Compliance Committee has designated Mr. Long to serve as the committee’s chairperson and the Company’s Audit Committee Financial Expert. The committee determined Mr. Long has an understanding of generally accepted accounting principles and financial statements and the ability to assess the general application of those principles in connection with the accounting for estimates, accruals and reserves. Mr. Long has an understanding of internal control over financial reporting and the functions of an audit committee. He acquired these attributes through his education and experience in preparing, auditing and analyzing financial statements.

The Audit and Compliance Committee has developed procedures for the receipt, retention and treatment of complaints received by the Company from shareholders regarding accounting, internal accounting controls or auditing matters and a process for receiving and investigating confidential, anonymous submission by employees of the Company or its subsidiary of concerns regarding questionable accounting or auditing matters. Any such submissions may be made to the Chairperson of the Audit and Compliance Committee at the following address and phone number:

Mr. Gregory A. Long

Long, Cook & Samsa, Inc., CPAs

505 North Market Street

Wooster, Ohio 44691

330-262-7111

The Audit and Compliance Committee has reviewed and discussed with the Company’s management the audited financial statements of the Company for the fiscal year ended December 31, 2004. The committee has also discussed with Crowe Chizek all matters required by Statements on Auditing Standards No. 61,Communications with Audit Committees. The committee has also received the written disclosures and the letter from Crowe Chizek required by Independence Standards Board Standard No. 1, and has discussed with Crowe Chizek its independence.

- 16 -

Based on the review and discussions noted above, the Audit and Compliance Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-KSB for the fiscal year ended December 31, 2004, for filing with the SEC.

Submitted by the Audit and Compliance Committee

Gregory A. Long, Chairperson

Scott J. Fitzpatrick

Benjamin M. Mast

Michael D. Meenan

Other Committees of the Board of Directors

The Executive Committee is comprised of five directors. The directors currently serving on this committee include Messrs. Plumly, Diamond, Baker, Belden and Douce. The Executive Committee meets on an as needed basis, and its primary responsibility is to exercise the authority of the Board of Directors in between board meetings, to the extent permitted by law. During 2004, the Executive Committee met two times.

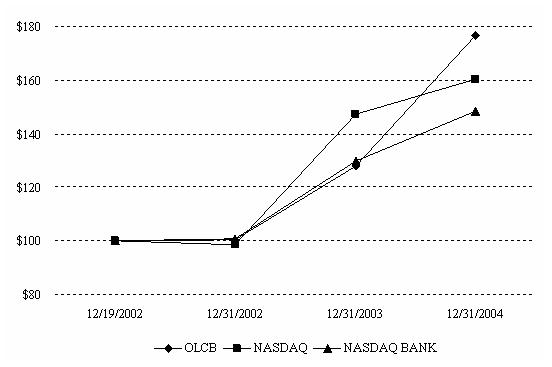

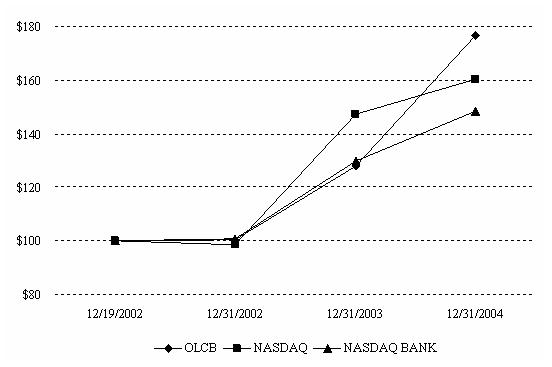

PERFORMANCE GRAPH

The following graph compares the cumulative total shareholder return on the Company’s common shares from December 19, 2002, until December 31, 2004, with the cumulative total return, including reinvestment of dividends, of the NASDAQ Composite Index and the NASDAQ Bank Index. The graph assumes the investment of $100 in the Company’s common shares, the NASDAQ Composite Index and the NASDAQ Bank Index.

| | | | | | | | |

| | | 12/19/2002

| | 12/31/2002

| | 12/31/2003

| | 12/31/2004

|

Ohio Legacy Corp (OLCB) | | 100 | | 101 | | 128 | | 177 |

NASDAQ Composite Index | | 100 | | 99 | | 147 | | 160 |

NASDAQ Bank Index | | 100 | | 101 | | 130 | | 148 |

- 17 -

SHAREHOLDER PROPOSALS FOR THE 2006 ANNUAL MEETING

To be considered timely, a shareholder’s notice shall be delivered to or mailed and received at the principal executive offices of the Company not less than 60 days nor more than 90 days prior to the meeting; provided, however, that in the event that less than 75 days’ notice or prior public disclosure of the date of the meeting is given or made to shareholders, notice by the shareholder to be timely must be so received not later than the close of business on the 15th day following the earlier of the day on which such notice of the date of the meeting was mailed or such public disclosure was made.

The 2006 Annual Meeting of Shareholders of Ohio Legacy Corp is scheduled to be held on April 27, 2006. Any shareholder who intends to present a proposal at that meeting, and who wishes to have the proposal included in the Company’s proxy statement and form of proxy for that meeting, must deliver the proposal to the Company not later than November 28, 2005, or 150 days prior to the date of the 2006 Annual Meeting. Any shareholder who intends to present a proposal at the 2006 Annual Meeting other than for inclusion in the Company’s proxy statement and form of proxy must deliver the proposal to the Company no later than February 26, 2006 (60 days prior to the meeting), and no earlier than January 27, 2006 (90 days prior to the meeting), to be considered a timely submission. The Company reserves the right to exercise discretionary voting authority with respect to any untimely shareholder proposals.

All written submissions of candidates for nomination to the Board of Directors of the Company and other proposals for inclusion in the proxy statement or annual meeting should be made to the Secretary of the Company as follows:

Mr. Daniel H. Plumly

Critchfield, Critchfield & Johnston, Ltd.

225 N. Market Street

Wooster, Ohio 44691

The Secretary shall document the receipt of the notice and forward the notice to the Chairperson of the Corporate Governance and Nominating Committee for review and consideration by the entire committee.

OTHER MATTERS

The Board of Directors is unaware of any matters other than those outlined in this Proxy Statement that may be presented at the Annual Meeting for action on the part of the shareholders. In case any other matters should properly come before the Annual Meeting, or any adjournment thereof, it is the intention of the person named in the enclosed proxy to vote in accordance with his best judgment.

|

| By Order of the Board of Directors |

|

| |

Daniel H. Plumly Secretary and Chairman |

March 14, 2005

- 18 -

THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS.

OHIO LEGACY CORP

THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS

DETACH PROXY CARD HERE

Please complete, date, sign and mail the

detached proxy card in the enclosed postage-prepaid envelope.

Print your name(s) here

Signature

Signature, if jointly held

Date , 2005

NOTE: The signature(s) on this Proxy should correspond with the name(s) in which your shares are registered. When shares are registered jointly in the names of two or more persons,all should sign. When signing as an attorney, executor, administrator, trustee or guardian, please give your full title as such. A proxy given by a corporation should be signed in thecorporate name by the Chairman of its Board of Directors, its President, Vice President, Secretary or Treasurer.

IMPORTANT

THE PROMPT RETURN OF PROXIESWILL SAVE THE COMPANY THE EXPENSE OF FURTHER REQUESTS FOR PROXIES TO ENSURE A QUORUM AT THE MEETING. A SELF-ADDRESSED, POSTAGE-PREPAID ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE.

OHIO LEGACY CORP

PROXY

ANNUAL MEETING OF SHAREHOLDERS

April 28, 2005

This proxy is solicited on behalf of the Board of Directors of Ohio Legacy Corp

The undersigned hereby appoints L. Dwight Douce, the proxy of the undersigned, with full power of substitution to vote all common shares of Ohio Legacy Corp, whichthe undersigned is entitled to vote at the Annual Meeting of shareholders of Ohio Legacy Corp, to be held April 28, 2005 as specified below:

1. Election of Directors:

Class II: 01 Robert F. Belden

02 Gregory A. Long

03 Melvin J. Yoder

FOR all Nominees WITHHOLD AUTHORITY to vote for all Nominees

(Instructions: If you wish to withhold authority to vote for any individual nominee, write that nominee’s name in the space below.)

2. In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting.

Important: Please sign and date this proxy on the reverse side.

IMPORTANT: THE PROMPT RETURN OF PROXIES WILL SAVE THE COMPANY THE EXPENSE OFFURTHER REQUESTS FOR PROXIES TO ENSURE A QUORUM AT THE MEETING. A SELF-ADDRESSED,POSTAGE-PREPAID ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE.