United States

Securities and Exchange Commission

Washington, DC 20549

FORM 10/A

GENERAL FORM FOR REGISTRATION OF SECURITIES Pursuant to Section 12(b) or (g) of The Securities Exchange Act of 1934

NT Mining Corporation

(Exact name of Registrant as specified in its Charter)

| | |

| Nevada | 1040 | 94-3342064 |

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer Identification No.) |

| incorporation or organization) | Classification Code Number) | |

Suite 280 - 13071 Vanier Place, Richmond, British Columbia, V6J 2J1 CANADA

(Address of Principal Executive Offices) (Zip Code)

Telephone: 604-249-5001

(Registrant’s telephone number, including area code)

Copies to:

Christopher Dieterich

Dieterich & Mazarei, LP

11300 West Olympic Blvd., Suite 800

Los Angeles, California 90064

Securities to be registered pursuant to Section 12(b) of the Act:

| |

| Title of Each Class | Name of Each Exchange on Which |

| to be so Registered | Each Class is to be Registered |

| None | None |

Securities to be registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.001 (Title of Class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer __ Accelerated Filer __

Non-Accelerated Filer __ (Do not check if a smaller reporting company) Smaller reporting company X

1

TABLE OF CONTENTS

|

|

| Item 1. Description of Business |

| Item 1A. Risk Factors |

| Item 2. Financial Information |

| Item 3. Properties |

| Item 4. Security Ownership of Certain Beneficial Owners and Management |

| Item 5. Directors and Executive Officers |

| Item 6. Executive Compensation |

| Item 7. Certain Relationships and Related Transactions, and Director Independence |

| Item 8. Legal Proceedings |

| Item 9. Market Price of and Dividends on Registrant’s Common Equity and |

| Related Stockholder Matters |

| Item 10. Recent Sales of Unregistered Securities |

| Item 11. Description of Registrant’s Securities to be Registered |

| Item 12. Indemnification of Directors and Officers |

| Item 13. Financial Statements and Supplementary Data |

| Item 14. Changes in and Disagreements With Accountants |

| on Accounting and Financial Disclosure |

| Item 15. Financial Statements and Exhibits |

| List of Exhibits |

| SIGNATURES |

| Index to Financial Statements |

2

EXPLANATORY NOTE

NT Mining Corporation is filing this Registration Statement on Form 10 (“Registration Statement”) under the Securities Exchange Act of 1934, as amended (“Exchange Act”) on a voluntary basis to provide current public information to the investment community. In this Registration Statement, “the Company,” “we,” “us,” and “our” refer to NT Mining Corporation.

3

ITEM 1. DESCRIPTION OF BUSINESS

Our Company

Business Development

NT Mining Corporation, (the "Company") was incorporated in the State of Nevada, February 10, 1997, as Clear Water Mining, Inc. The Company completed a private placement offering pursuant to Regulation D, Rule 504 for 11,000,000 shares at $.01 per share for a total of $110,000.00 and also issued 1 million shares valued at $10,000 for services in November 1997. With the proceeds of the offering the company acquired a mineral property located in Mexico and commenced exploration activities. There were a total of 12,000,000 common shares outstanding as of December 31, 1998 and an authorized cap ital of 50,000,000 shares of $.001 par value, common shares.

On March 5, 1999 the shareholders ratified the acquisition of proprietary rights to software for an Internet gaming operation, a Costa Rican International license and the trade style of E-Casino Gaming Corporation, a Nevada corporation, in exchange for 2,000,000 shares of authorized but unissued common stock.

On March 9, 1999 an offering was completed selling 1,500,000 shares of stock for $150,000.00 pursuant to Regulation D, Rule 504.

On March 11, 1999 the Company's name was changed to E-Casino Gaming Corporation. At this time the companies’ activity was directed towards Casino gaming and telecommunications operations.

E-Casino Gaming Corporation.

On March 15, 1999, the Company sold its wholly owned subsidiary, True Vista Mining De Mexico, S.A. for $30,000.00 and a 10% stock interest to True Vista Mining, Inc., a Nevada corporation, thereby divesting its Mexican Mining interest.

March 29, 1999 an additional offering of 600,000 shares of common stock for $150,000.00 pursuant to Regulation D, Rule 504.

May 11, 1999 the Company issued 1,000,000 shares of common stock and 100 Class A Warrants, pursuant to an offering under Regulation D, Rule 504.

On May 15, 1999 the Company entered into a rescission agreement and assumed full control of Global E-Com, S.A. Costa Rican telecommunications Corporation.

At a shareholders meeting held June 1, 1999 the Company changed its name to E-Vegas.Com, Inc. the name change became effective on June 21, 1999

E-Vegas.Com, Inc.

In June the Company sold 1,000,000 shares and 680,000 shares for $250,000.00 and $170,000.00 respectively. Said shares were sold in Isolated transactions to two parties and were restricted shares by investment letters.

These funds were used to buy equipment, software and working capital. At this time the company had interests in three subsidiary corporations; (1) 21st Century Software Solutions, Inc., a Nevada corporation, a software company, (2) Siglo Veintiuno Soluccians Informaticas, S.A., a Costa Rican corporation, that operates the international gaming operation, (3) Global E-COM, S.A., a Costa Rican corporation, a telecommunications company. Global E-COMM, S.A. was established in Costa Rica and its operation office is located in San Jose, Costa Rica. The Company was formed as a subsidiary of 21st Century Software Solutions, Inc., which is a subsidiary of E-Vegas.COM, Inc., The Company is a service provider for all information technology.

During the last six months of 1999 the company raised $903,000 through the issue of 3,612,000 shares and also issued a total of 1,288,817 Shares for consulting services valued at $322,204.

December 31, 1999 the company had 23,680,817 common shares outstanding.

On March 31, 2000, the Company completed a private placement of 480,000 shares of common stock at $.25 per share for a total of $120,000. On May 16, 2000 the Company completed a private placement for 240,000 shares of common stock at $.25 per shares for a total of $60,000. On July 20, 2000 at the Annual Meeting of Shareholders the shareholders ratified by proxy vote to change the name of the Company to 1st GENX.COM, Inc.

1st GENX.COM, Inc.

On December 31, 2000 the Company completed a private placement of 210,000 shares of common stock at $.25 per share for a total of $52,500.

In addition during the year 2000 company issued 3,350,000 shares for consulting services valued at $837,500

December 31, 2000 the company had 27,960,817 common shares outstanding

During January 2001 the company issued 16,008,440 restricted shares in settlement of debt in the amount of $405,495.

January 31, 2001 the company issued 500,000 restricted shares for cash in the amount of $12,937. On the same date the company issued 3,500,000 restricted shares in settlement of debt in the amount of $90,563.

April 26, 2001 company issued 1 million restricted shares in settlement of consulting services valued at $25,875.

May 10, 2001 shareholders authorized a share consolidation of one new share for each four shares presently held, upon completion of the share consolidation including shares issued for rounding the company had 12,242,315 shares outstanding.

September 17, 2001 the company issued 12 million restricted shares for cash in the amount of $306,375. On the same date issued 1 million restricted shares for consulting services valued at $25,875. Plus 2 million restricted shares at $0.025 for cash and plus a subscription receivable of $15,000.

On October 16, 2001 at a special meeting of the shareholders held in Las Vegas, Nevada it was ratified by the shareholders to acquire 100% of the capital stock of Oasis Information Systems, Inc. in exchange for 20,000,000 shares of common stock and 3,000,000 shares of preferred stock. Based on the approval of the Plan of Reorganization the shareholders voted in favour of changing the corporate name to Oasis

Information Systems, Inc., this motion was also approved at the meeting. At this same meeting shareholders ratified a reverse split (consolidation) on the basis of one new share for each to shares currently held.

As part of the Plan of Reorganization and to comply with reporting standards Oasis Information Systems, Inc. was to provide audited financial statements in a timely manner. However, Oasis Information Systems, Inc. never complied with this item. Due to this non - performance the Plan of Reorganization was never consummated, however the Company retained the name Oasis Information Systems, Inc., during this period of time the company became somewhat dormant while searching for a new business activity.

Oasis Information Systems, Inc.

At December 31, 2001 the Company had 13,621,158 shares of common stock issued and outstanding.

On May 31, 2002 the company settled $267,242 in debt by the issue of 35,546,680 shares.

June 5, 2002 the company issued 4,250,000 shares at a price of $ 0.0075 per share for net proceeds of $318,750 to cover a lease obligation June 7, 2002 the company settled $347,625 in debt through the issue of 58,249,985 shares on 21 June 2002 the company consolidated its shares on the basis of one new share for each 10 shares held following the consolidation the company issued a further 2293 shares in order to round up shareholders. Upon completion of the consolidation the company had 11,269,094 shares outstanding.

26th of June 2002 1,940,000 shares were returned to treasury for cancellation.

18th of July 2002 the company issued for investment purposes 950,000 shares at a price of $0.0075 per share for net proceeds of $71,250 on the same date the company issued for consulting services 400,000 shares at a price of $0.0075 for net proceeds of $30,000.

9th September 2002 the company issued for investment purposes 200,000 shares at a price of $0.0075 for net proceeds of $15,000.

At December 31, 2002 the company had 10,879,094 common shares outstanding

17th of April 2003 the company settled $29,465 in debt by the issue of 5,893,000 shares.

At December 31, 2003 the company had 16,772,094 common shares outstanding.

During 2004 there were no transactions until 31st of December at which time the company was merged into Trans-pacific on a share per share basis and the name was changed to 777 Sports Entertainment, Inc., the intention at this time was to resume casino gaming operations through an online casino.

777 Sports Entertainment, Inc.

On February 2, 2005 the company reversed the transaction dated June 5, 2002 and 4,250,000 shares were returned to treasury, on the same date company issued for services 7.2 million shares to extinguish debt of $7200. Upon completion of the above the company shares were consolidated on the basis of one new share for each 300 existing shares.

On completion of the above and the issue of additional shares to round out shareholders with odd lots that were 149,495 shares issued.

On 22 March 2005 the company settled 30,000 in debt by the issue of 1.2 million shares additionally on the same date the company issued 10 million restricted shares for $10,000 in cash.

22nd of August 2005 the company issued 2 million shares to the original Trans-pacific shareholders as per the merger agreement.

September 20, 2005 the company issued 355,100 free trading shares in settlement of debt in the amount of $35,510 and an also issued 174,900 restricted shares in settlement of debt in the amount of $1749.

October 17, 2005 the company issued 300,000 restricted shares in settlement of consulting services valued at $300. November 23, 2005 the company issued 530,000 restricted shares in settlement of consulting services valued at $530.

December 31, 2005 the company had 14,709,495common shares outstanding

March 3, 2006 the company issued 370,000 restricted shares in settlement of debt in the amount of $18,500. May 8, 2006 the company issued 100,000 restricted shares for services valued at $1000.

May 24, 2006 the company issued 475,000 restricted shares for services valued at $500. July 13, 2006 the company issued 300,000 restricted shares for services valued at $7500.

December 31, 2006 the company had 15,954,495common shares outstanding.

January 9, 2007 the company issued 12,492,000 restricted shares for services valued at 12,492.

November 12, 2007 the company issued 17,500,000 restricted shares in settlement of debt in the amount of $131,250. November 14, 2007 the company issued 25 million restricted shares in settlement of debt in the amount of $187,500.

November 15, 2007 500,000 previously issued shares returned to the company for cancellation the services for which the shares had been issued were not provided and the shares were returned.

December 7, 2007 the company issued 3 million shares in settlement of debt in the amount of $3000. On December 13, 2007 the shares were returned to the company and cancelled.

13th of December 2007 the company issued 3 million shares in settlement of debt in the amount of $22,500..

December 15, 2007 the company's president and chief executive officer died and management of the company was transferred to the corporate secretary who had limited experience in casino gaming and elected to change the company's direction from casino gaming back to the mining exploration and development December 17, 2007 the company issued 17,675,200 shares in settlement of debt in the amount of $132,564.

December 31, 2007 the company had 91,121,695common shares outstanding.

February 1, 2008 the company issued 21,050,000 restricted shares in settlement debt valued at $157,875.

23rd of September 2008 the company issued 3 million restricted shares in settlement of debt in the amount of three thousand dollars. In September 2008 the shareholder approved a stock consolidation and a change of name to NT Mining Corporation.

October 14, 2008 the company entered into an agreement to purchase Bullmoose Mines Ltd., a privately held Canadian corporation that controlled the lease known as the Bullmoose mine property a former producing gold mine. It is the intention of the company to raise funds to do additional work on the property and if deemed feasible resume gold production.

November 4, 2008 the company shares were consolidated on the basis of one new share for each 2000 shares presently issued.

NT Mining Corporation.

19th of November 2008 the company has issued a further 239 shares to round out shares to existing shareholders. November 20, 2008 the company issued 3 million restricted shares in settlement of debt in the amount of $3000.

November 24, 2008 the company accepted for cancellation 1500 shares that had been returned to treasury and on the same date issued 3 million restricted shares for the Bullmoose property valued at $3000.

November 24, 2008 the company issued 17,200,000 restricted shares in settlement date valued at $172,000. November 26, 2008 the company issued 280,000 restricted shares for cash in the amount of $154,000.

December 31, 2008 the company had 23,536,407 common shares issued and outstanding.

We have no property other than ownership of a former producing Gold Mine located in the Northwest Territory in Canada, which property is held through our wholly owned Canadian subsidiary Bullmoose Mines Ltd. There is no assurance that a commercially viable mineral deposit exists on any the mineral claims which we have purchased. Extensive exploration will be required before a final evaluation as to the economic and legal feasibility of the claims is determined. Economic feasibility refers to a formal evaluation completed by an engineer or geologist, which confirms that the properties can be successfully operated as a mine. Legal feasibility refers to a formal survey of the claims boundaries to ensure that all discovered mineralization is contained within these boundaries.

We will be engaged in the acquisition and exploration of additional mineral properties with a view to exploit any mineral deposits we discover that demonstrate economic feasibility.

Our business office is located at Suite 280 - 13071 Vanier Place, Richmond, British Columbia, V6J 2J1 CANADA.

Our fiscal year end is December 31. As of December 31, 2008 we had raised $153,720 through the sale of common stock. As of December 31, 2008 There was $59,503 cash on hand in the corporate bank account. NT Mining Corporation currently has outstanding current liabilities of $239,645 including a payment on the debenture due October 14, 2009.. We also will have to expend work costs of aproximately $8,300 on the located mineral claims surrounding the Bullmoose Lease by July 15, 2009 and payable by July 15 each year in 2010 and 2011. As of the date of this Registration Statement, we have not yet generated or realized any revenues from our business operations. The financial information included herein summarizes the more complete historical financial information as indicated on the audited financial statements of NT Mining Corporation filed with this Registration Statement.

ITEM 1.

Business

The Company changed its business focus during 2007 and in 2008 has completed the changeover to mining exploration and development, which was the original intention when the Company was incorporated in 1997. In order to complete the transformation, the Company completed a reverse split (consolidation of its shares) in September 2008 and settled the majority of its liabilities through a share exchange for debt. The Company has acquired a former Gold producer plus some exploration properties in the Northwest Territory, Canada, through the acquisition of a Canadian Corporation "Bullmoose Mines Ltd".

GOLD

Our primary focus with respect to our mineral claims is the extraction of gold from previously mined ore and the further exploration and development of the Mineral Property.

5

Gold production

Jan 22nd 2009

From The Economist print edition

7

The output of the world’s gold mines fell by 4% last year, according to estimates in a new report from the GFMS, a consultancy. More than half the 88-tonne fall in production was accounted for by a slump in gold mining in Indonesia. Supply from South Africa, once the world’s largest producer, fell by 14%—the biggest drop since the Boer War. Last year’s fall was partly owing to new safety procedures, which helped reduce the industry’s fatality rate. Skills shortages and power cuts also affected operations. Australia’s output fell by 14%, too, amid reports that some fledgling mining firms faced closure because of scarce credit. Of the world’s six big producers, China, Russia and Peru all increased output last year.

ITEM 1A.

RISK FACTORS

Risks Related to Our Business

We were incorporated on February 10, 1997 and have a limited operating history. There is no basis upon which you can evaluate our proposed business and prospects and to date we have been involved primarily in organizational activities and obtaining our Purchase agreement on the Bullmoose Mine.

Management of the company has changed, the corporate move back into the exploration and development of minerals will take time to develop as, current management has limited technical knowledge of the mining industry in order overcome this problem management intends to hire competent engineers and consultants as needed.

Mining companies and their exploration and development programs consume large amounts of capital with limited success. When they are successful the returns justify the cost of exploration and development. The Bullmoose mine project has proven in the past but there is gold on the property and that it can be extracted profitably. The downside is that the location in the far north limits the time in which operations can be conducted cheaply. During the period 1984 through 1987 operations were conducted 24/7/365 with the winter operation costs about 40% higher.

- We have not begun the exploration of our Claims, and there is no way to evaluate the likelihood of whether we will be able to operate our proposed business successfully.

- If our business fails to develop in the manner we have anticipated, you will lose your investment in the shares.

- If our business develops management may be unable to effectively or efficiently operate our business in which event you will lose your investment in the shares.

Newly formed mineral exploration companies encounter extraordinary risks, and unforeseen problems

- Because we just recently commenced our business, our prospects for success must be considered in the light of the extraordinary risks, unforeseen expenses and problems that newly formed mineral exploration companies normally encounter.

8

• The creation, execution and maintenance of our plans for our business operation are based solely upon the opinion of our management and they may not have adequately anticipated unforeseen expenses and other problems that newly formed mineral exploration companies normally encounter. If we have failed to adequately address business commencement risks, our business will not develop or grow, and you will lose your investment in the shares.

- New mineral exploration companies are traditionally subject to high rates of failure.

- New mineral exploration companies can be expected to encounter unanticipated problems relating to exploration and additional costs and expenses that may exceed current estimates.

As a newly formed mineral exploration company, we will be required to implement our proposed business, and if we are unable to do so you will lose your investment in the shares .

- The likelihood of success must be considered in the light of problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake.

- We can provide no assurance to investors that we will generate any operating revenues or ever achieve profitable operations.

- If we are unsuccessful in implementing exploration plans or those plans prove unsuccessful our business will likely fail and you will lose your entire investment in the shares.

As a newly formed mineral exploration company, we will be required to anticipate and handle potential growth and we may not be able to do so in which event you will lose your investment in the shares.

- If our Claims prove successful, our potential for growth will place a significant strain on our technical, financial and managerial resources. We may have to implement new operational and financial systems and procedures, and controls to expand, train and manage employees and to coordinate our technical and accounting staffs, and if we fail to do so you will lose your investment in the shares.

Because of the limited capital available to us for the foreseeable future, we may not have sufficient capital to fully implement our business plan.

- We are obligated to pay our operating expenses as they arise, including required annual fees to the State of Nevada. We will also incur legal and accounting expenses to comply with our reporting obligations to the SEC. If we fail to pay any of the forgoing, we may be forced to cease our business operations unless terms are renegotiated.

If we need to raise additional funds, the funds may not be available when we need them. We may be required to provide rights senior to the rights of our shareholders in order to attract additional funds and if we use equity securities to raise additional funds dilution to our shareholders will occur .

- To the extent that we require additional funds, we cannot assure you that additional financing will be available when needed on favorable terms or at all, and if the funds are not available when we need them, we may be forced to terminate our business.

9

• If additional funds are raised through the issuance of equity securities, the percentage ownership of our existing stockholders will be reduced; and those equity securities issued to raise additional funds may have rights, preferences or privileges senior to those of the rights of the holders of our common stock.

If we fail to make required payments under the Purchase Agreement we will lose the right to the Mineral Lease and Claims.

- In order to maintain our rights under the Purchase Agreement we must timely make annual payments to the Claim Owner and if we fail to do so we will lose our claims as the Purchase Agreement will be terminated.

- If our Purchase Agreement is terminated we may be forced to cease our business operations in which event you will lose your investment in the shares.

If our exploration program provides results indicating a commercially viable mineral deposits exist within the Subject Claims we will be required to raise substantial additional capital or locate a joint venture partner in order to achieve production and generate revenue from such deposits.

- If the initial results of our exploration program are successful, we may try to enter a joint venture agreement with a partner for the further exploration and possible production from any mineral deposits within the Claims.

- If we enter into a joint venture agreement, we would likely be required to assign a percentage of our interest in the Claims to the joint venture partner.

- If we are unable to enter into a joint venture agreement with a partner, or if we are otherwise unable to raise substantial additional capital, our business may fail and you will lose your entire investment in the shares.

Most, if not all, of our competition will be from larger, more well established and better financed companies, and if we are unable to successfully compete with other companies our business will fail .

- If we are able to implement our business operations, substantially all of our competitors will have greater financial resources, technical expertise and managerial capabilities than we do.

- If we are unable to overcome such competitive disadvantages, we will be forced to cease our business operations.

We currently have no employees other than our Directors who serve on a part-time basis, we do not pay our officer any cash compensation, and if they were to leave our employ, our business could fail.

- Because our ability to engage in business is dependent upon, among other things, the personal efforts, abilities and business relationships of our Directors, if they were to terminate employment with us or become unable to provide such services before a qualified successor, if any, could be found, our business could fail.

- Our current Directors do not provide full time services to us, and we will not have full-time management until such time, if ever, as we engage employees on a full-time basis.

- We do not maintain "key person" insurance on our Directors, and if our Directors were to die or become disabled, we do not have any insurance benefits to defer the costs of

- seeking replacements.

10

We may be unable to attract or retain employees in which event our business could fail.

- Competition for personnel in the junior mineral exploration industry is intense. Because of our limited resources, we may not be able to compensate our employees at the same level as our competitors. If we are unable to attract, retain and motivate skilled employees, our business could fail.

- We cannot make any assurances that we will have the financial resources to hire full–time personnel when they are needed or that qualified personnel will then be available, and if we are unable to hire full– time personnel when they are needed, our business could fail.

As a result of the speculative nature of mineral property exploration, there is substantial risk that no commercially exploitable minerals will be found and our business will fail .

- Exploration for minerals is a speculative venture necessarily involving substantial risk. We can provide you with no assurance that our Subject Claims contain any commercially exploitable reserves.

- The exploration work that we intend to conduct on the Subject Claims may not result in the discovery of commercial quantities of gold.

- Problems, such as unusual and unexpected rock formations and other conditions, are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan and you would lose your entire investment in the shares.

There are inherent dangers involved in mineral exploration, and, as a result, there is a risk that we may incur liability or damages as we conduct our business .

- The search for valuable minerals involves numerous hazards and risks, such as cave-ins and pollution liability. Additional risks include, but are not limited to:

- unanticipated ground and water conditions and adverse claims to water rights;

- geological problems;

- metallurgical and other processing problems;

- the occurrence of unusual weather or operating conditions and other force majeure events;

- lower than expected ore grades;

- accidents;

- delays in the receipt of or failure to receive necessary government permits;

- delays in transportation;

- labor disputes;

- government permit restrictions and regulation restrictions;

- unavailability of materials and equipment;

11

- the failure of equipment or processes to operate in accordance with specifications or expectations.

- We may be unable or unwilling to obtain insurance against such hazards and risks. We currently have no insurance, and we not expect to obtain any such insurance in the foreseeable future.

- If we were to incur such hazards or risks, the costs of overcoming these hazards may exceed our ability to do so, in which event we could be required to liquidate all our assets and you will lose your entire investment in the shares.

- The risks associated with exploration and development and if applicable, mining as described above could cause personal injury or death, environmental damage, delays in mining, monetary losses and possible legal liability. We are not currently engaged in mining operations because we are in the exploration phase and have not yet any proved gold reserves. We do not presently carry property and liability insurance nor do we expect to get such insurance for the foreseeable future Cost effective insurance contains exclusions and limitations on coverage and may be unavailable in some circumstances.

If our exploration program is able to confirm commercial concentrations of Gold on our Claims, it is unlikely that we will be able to successfully place any of the Claims into commercial production .

- If our exploration programs are successful in confirming deposits of commercial tonnage and grade, we will require a joint venture partner or additional funds in order to place the Subject Claims into commercial production.

- In such an event, we may be unable to locate a joint venture partner or obtain any required funds, in which event you may lose your entire investment in the shares.

Because access to our Claims is can be restricted by inclement weather, we may be delayed in implementing or continuing with our exploration, as well as, with any future mining efforts .

- Access to the Subject claims may be hindered during the period between November and March of each year due to inclement weather conditions in the area. As a result, any attempts to visit, test, or explore the Claims are largely limited to a several months of the year when weather permits such activities.

- These limitations can result in significant delays in our exploration efforts, as well as, any mining and production in the event that commercial amounts of minerals are found. Such delays can result in our inability to meet our obligations under the Purchase Agreement. Such failures could cause our business to fail and you would lose the entire investment in the shares.

As we undertake exploration of our Claims, we will be subject to compliance of government regulation that may increase the anticipated time and cost of our exploration program .

- There is much governmental regulation that materially affects the exploration of minerals. We will be subject to the mining laws and regulations of the Northern Territories as well as the laws and regulations of Canada or other countries where we may choose to operate.

- We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with applicable law.

12

• Our planned exploration program budgets provide amounts for anticipated regulatory compliance, however, there is a risk that the amounts budgets may be inadequate due to errors, omissions or additional regulations, any one of which prevent us from carrying out our exploration program.

Market factors in the mining business are beyond our ability. As a result, we may not be able to market any minerals that may be found.

- The mining industry, in general, is intensively competitive, and we are unable to predict that a ready market will exist of the sale of gold or other minerals, even if we commercial quantities of are discovered within the Claims.

- Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection.

- The exact effect of these factors cannot be accurately predicted, but the impact or any one or a combination thereof may result in our inability to generate any revenue, in which event you will lose your entire investment in the shares.

If the Company is unable to generate or raise adequate funds for its operations, it may not be able to continue to meet it reporting requirements with the United States Securities and Exchange Commission.

In March of 2006, the Company, then in a different line of business, was unable to produce enough revenue to continue its operation and reporting requirements. At that time, the Company made the decision to file a withdrawal of its registration (Form 15) and became a non-reporting company. If the Company again fails to produce enough income to continue its operations, it may again be forced to withdraw its registration and become a non-reporting company.

Risks Related to Our Common Stock

We are not listed or quoted on any exchange and we may never obtain such a listing or quotation.

- There may never be a market for stock and stock held by our shareholders may have little or no value. There is presently no public market in our shares. We intend to contact an authorized OTC Bulletin Board market maker for sponsorship of our securities, we cannot guarantee that such sponsorship will be approved and our stock listed and quoted for sale. Even if our shares are quoted for sale, buyers may be insufficient in numbers to allow for a robust market, it may prove impossible to sell your shares.

- Even if we obtain a listing on an exchange and a market for our shares develops, sales of a substantial number of shares of our common stock into the public market by certain stockholders may result in significant downward pressure on the price of our common stock and could affect your ability to realize the current trading price of our common stock.

The trading price of our common stock on the may fluctuate significantly and stockholders may have difficulty reselling their shares.

- Additional issuances of equity securities may result in dilution to our existing stockholders. Our Articles of Incorporation authorize the issuance of 50,000,000 shares of common stock.

Our common stock is subject to the "penny stock" rules of the SEC.

- Our common stock is subject to the "penny stock" rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

- Because our stock is not traded on a stock exchange or on the NASDAQ National Market or the NASDAQ Small Cap Market and because the market price of the common stock is less than $5.00 per share, the common stock is classified as a "penny stock. The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a "penny stock," for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less

13

-600 than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

- That a broker or dealer approve a person's account for transactions in penny stocks; and

- The broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

- In order to approve a person's account for transactions in penny stocks, the broker or dealer must:

Obtain financial information and investment experience objectives of the person; and

Make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the Commission relating to the penny stock market, which:

Sets forth the basis on which the broker or dealer made the suitability determination; and;

That the broker or dealer received a signed, written agreement from the investor prior to the transaction.

- Generally, brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

- Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

A decline in the future price of our common stock could affect our ability to raise further working capital and adversely impact our operations.

- Our directors and officers reside outside the United States, with the result that it may be difficult for investors to enforce within the United States any judgments obtained against us or any of our directors or officers.

- Investing in our Common Stock will provide you with an equity ownership in a resource company. As one of our stockholders, you will be subject to risks inherent to our business. The trading price of your shares will be affected by the performance of our business relative to, among other things, competition, market conditions and general economic and industry conditions. The value of your investment may decrease, resulting in a loss. You should carefully consider the following factors as well as other information contained in this registration statement before deciding to invest in shares of our Common Stock.

- The factors identified below are important factors (but not necessarily all of the important factors) that could cause actual results to differ materially from those expressed in any forward-looking statement made by, or on behalf of, the Company. Where any such forward-looking statement includes a statement

14

of the assumptions or bases underlying such forward-looking statement, we caution that, we believe such assumptions or bases to be reasonable and make them in good faith, assumed facts or bases almost always vary from actual results, and the differences between assumed facts or bases and actual results can be material, depending upon the circumstances. Where, in any forward-looking statement, the Company, or its management, expresses an expectation or belief as to the future results, such expectation or belief is expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the statement of expectation or belief will result, or be achieved or accomplished. Taking into account the foregoing, the following are identified as important risk factors that could cause actual results to differ materially from those expressed in any forward-looking statement made by, or on behalf of, the Company.

40.79% of our shares of Common Stock are controlled by Principal Stockholders and Management.

40.79% of our Common Stock is controlled by five stockholders of record. This figure includes stock controlled by directors and officers who are the beneficial owners of about 12.74% of our Common Stock. Such ownership by the Company's principal shareholders, executive officers and directors may have the effect of delaying, deferring, preventing or facilitating a sale of the Company or a business combination with a third party.

Even taking into account the limitations of Rule 144, the future sales of restricted shares could have a depressive effect on the market price of the Company’s securities in any market, which may develop.

The 23,536,407 shares of Common Stock presently issued and outstanding, as of the date hereof, are “restricted securities” as that term is defined under the Securities Act of 1933, as amended, (the “Securities Act”) and in the future may be sold in compliance with Rule 144 of the Securities Act, or pursuant to a Registration Statement filed under the Securities Act. Rule 144 provides, in essence, that a person, who has not been an affiliate of the issuer for the past 90 days and has held restricted securities for six months of an issuer that has been reporting for a period of at least 90 days, may sell those securities so long as the Company is current in its reporting obligations. After one year, non-affiliates are permitted to sell their restricted securities freely without being subject to any other Rule 144 condition. Sales of restricted shares by our affiliates who have held the shares for s ix months are limited to an amount equal to one percent (1%) of the Company’s outstanding Common stock that may be sold in any three-month period. After the shares registered herein are freely traded, unregistered holders of the restricted shares may each sell approximately 235,364 shares during any ninety-day (90 day) period after the registration statement becomes effective. Additionally, Rule 144 requires that an issuer of securities make available adequate current public information with respect to the issuer. Such information is deemed available if the issuer satisfies the reporting requirements of sections 13 or 15(d) of the Securities and Exchange Act of 1934 (the “Securities Exchange Act”) or of Rule 15c2-11 thereunder. There is no limitation on such sales and there is no requirement regarding adequate current public information. Sales under Rule 144 or pursuant to a Registration Statement filed under the Act, may have a depressive effect on the market price of our securities in any ma rket, which may develop for such shares.

If shareholders sell a large number of shares all at once or in blocks, the value of our shares would most likely decline.

The Company has 23,536,407 shares of Common Stock outstanding as of December 31, 2008, of which 17,536.407 will eventually become freely tradable. The availability for sale of a large amount of shares may depress the market price for our Common Stock and impair our ability to raise additional capital through the public sale of Common Stock. The Company has no arrangement with any of the holders of our shares to address the possible effect on the price of the Company's Common Stock of the sale by them of their shares.

Our auditors have expressed substantial doubt about our ability to continue as a going concern .

15

The accompanying financial statements have been prepared assuming the we will continue as a going concern. As discussed in Note 1 to the financial statements, we were incorporated on February 10, 1997, and we do not have a history of earnings, and as a result, our auditors have expressed substantial doubt about our ability to continue as a going concern. Continued operations are dependent on our ability to complete equity or debt financings or generate profitable operations. Such financings may not be available or may not be available on reasonable terms. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty.

FORWARD-LOOKING STATEMENTS

Our actual results may differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us described in this Risk Factors section and elsewhere in this prospectus.

This registration statement contains forward-looking statements as that term is used in federal securities laws, about our financial condition, results of operations and business that involve risks and uncertainties. We use words such as anticipate, believe, plan, expect, future, intend and similar expressions to identify such forward-looking statements. These statements include, among others:

statements concerning the benefits that we expect will result from our business activities and certain transactions that we have completed, such as increased revenues, decreased expenses and avoided expenses and expenditures; and statements of our expectations, beliefs, future plans and strategies, anticipated developments and other matters that are not historical facts.

These statements may be made expressly in this document or with documents that we will file with the SEC. You can find many of these statements by looking for words such as "believes," "expects," "anticipates," "estimates" or similar expressions used in this prospectus. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled "Risk Factors" that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. We caution you not to put undue reliance on these statements, which speak only as of the date of this Prospectus. Further, the information contained in this registration statement is a statement of our present intention and is based on present facts and assumptions, and may change at any time and without notice, based on changes in such facts or assumptions.

These forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results. The safe harbor for forward-looking statements provided in the Private Securities Litigation Reform Act of 1995 does not apply to the offering made in this prospectus.

ITEM 3.

FINANCIAL INFORMATION

The data set forth in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” below should be read in conjunction with our financial statements and other financial information included elsewhere in this Registration Statement.

16

Management’s Discussion and Analysis of Financial Condition and Results of Operations

This discussion and analysis contains forward-looking statements relating to our future events or our future financial performance. These forward-looking statements involve certain risks, uncertainties and assumptions. In light of these risks and uncertainties, the forward-looking events discussed in this registration statement might not occur. Our actual financial results and performance may differ materially from those anticipated. Factors that may cause actual results or events to differ materially from those contemplated by the forward-looking statements include, among other things, the matters set forth in “Risk Factors,” “Business” and elsewhere in this Registration Statement. You are cautioned not to place undue reliance on forward-looking statements contained in the Registration Statement as they speak only as of the date of this Registration Statement. We do not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. See “Special Note Regarding Forward-Looking Statements.”

Overview

Our business activities to date have not provided any cash flow. During the next twelve months we anticipate incurring costs and expenses related to filing of Exchange Act reports, exploratory work on our claims and maintenance of our Purchase Agreement to those claims as well as costs related to the management of a public company if we are successful in bringing the Company to trade. Management will fund the costs and expenses to be incurred as a result of such activities through further investment in our Company through additional equity financing by private investors. Based on our history as a developmental stage company, it is difficult to predict our future results of operations. Our operations may never generate significant revenues or any revenues whatsoever, and we may never achieve profitable operations.

We incurred total operating expenses in the amount of $61,372 for the period from our inception on February 10, 1997 to December 31, 2008 Additionally, the Company wrote off $7,038,112 incurred by discontinued operations.

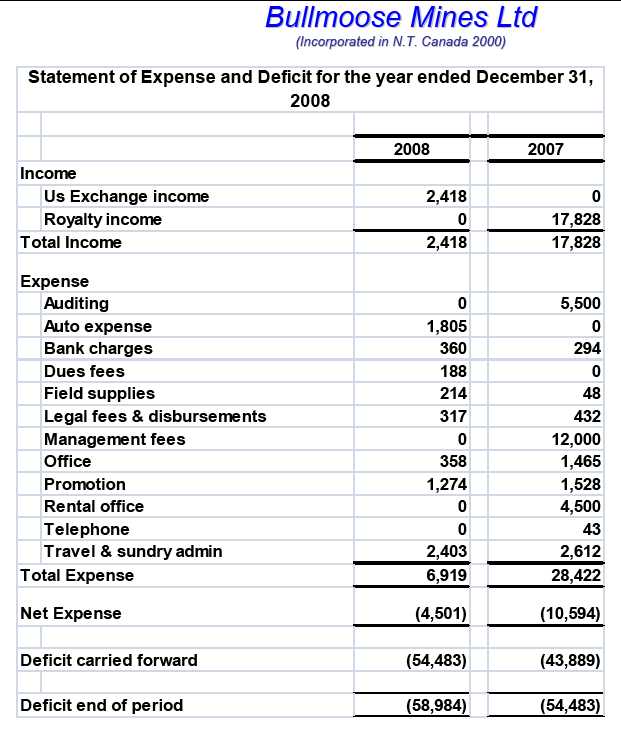

Year Ended December 31, 2008 Compared to the Year Ended December 31, 2007

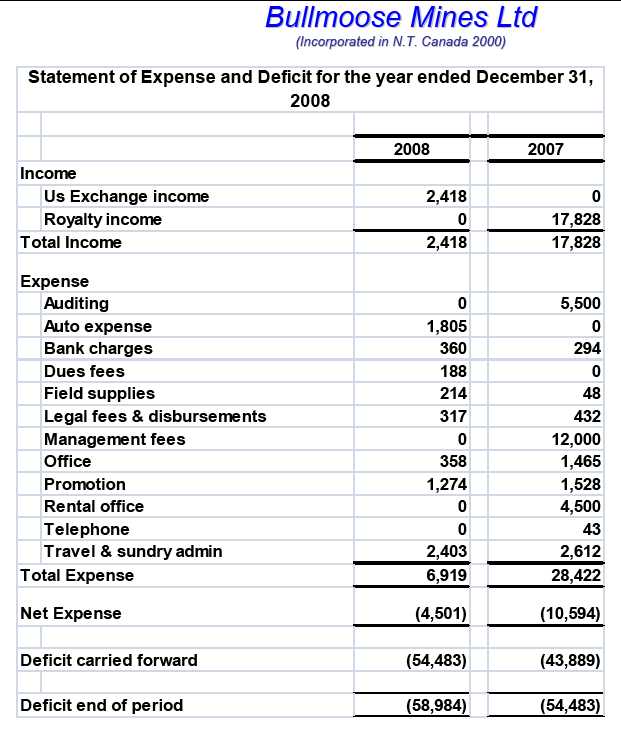

Total Operating Expenses were $48,496 for the year ended December 31, 2008, as compared to $16,508 for the year ended December 31, 2007, an increase of $31,988. The increase was attributable to an increase in Audit, accounting and legal fees during the 2008 fiscal year.

As a result of the increased expenses, we incurred a net loss of $48,496 for the year ended December 31, 2008 compared to a net loss of $16,508 for the year ended December 31, 2007.

Liquidity and Capital Resources

At December 31, 2008, our current assets total was $61,070. This included a cash balance of $59,503 and prepaid expenses of $1,567.

We expect to spend $1 million over the next 12 months. These funds will be utilized as follows: purchase of equipment $250,000; mining operations $350,000; overhead and travel $87,000. In addition to this, we have a debenture payment of $120,624 due on October 14, 2009 plus a contingency reserve of $192,376 for a total of $1 million.

The required funds will be raised by private placements and or loans as required..

To date, the Company’s operations have been funded by private placement (non-US persons) investors, under a private placement exemption available under regulation S.

Our independent auditors have issued a going concern paragraph in their opinion on the financial statements for the year ended December 31, 2008 that states there is substantial doubt about our ability to continue as a going concern. Specifically, our independent auditor has stated that the Company had a working capital deficit of $175,575 at December 31, 2008 and does not have sufficient working capital for the next twelve months. These factors create substantial doubt as to the ability of the Company to continue as a going concern. Realization values may be substantially different from the carrying values as shown in these financial statements should the Company be unable to continue as a going concern. Management is in the process of identifying sources for additional financing to fund the ongoing development of the Company’s business, In the current fiscal year management intends to commence activities at the Bullmoose property. These expenditures are expected to total approximately $ 250,000. To this must be added the debenture payment plus the operating costs for one year of an additional $ 250,000. In order to meet our cash requirements and to maintain regulatory reporting guidelines, management intends to raise $1 million.

Critical Accounting Policies

The Company's significant accounting policies are summarized as follows:

Use of Estimates

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the financial statements and the reported amounts of revenue and expenses during the reporting periods. Actual results could differ from these estimates.

Cash and cash equivalents

Cash and cash equivalents include cash on hand.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements, investments in special purpose entities or undisclosed borrowings or debt. Additionally, we are not a party to any derivative contracts or synthetic leases.

Q uantitative and Qualitative Disclosures About Market Risk

Not required by Regulation S-K for smaller reporting companies.

ITEM 3. PROPERTIES

Held in the name of our Canadian Subsidiary Bullmoose Mines Ltd

South Mackenzie Mining District in the Northwest Territory (NT) – Canada

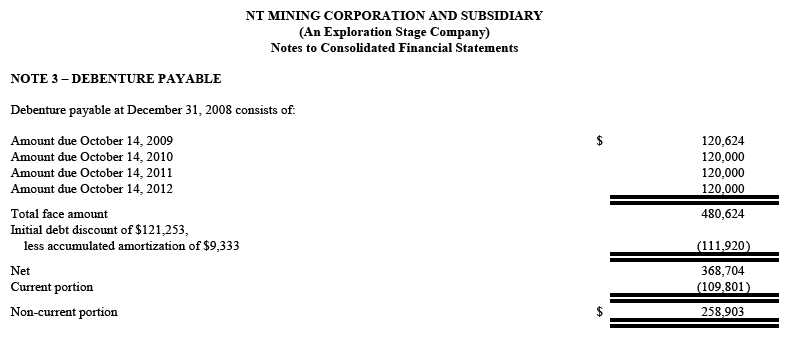

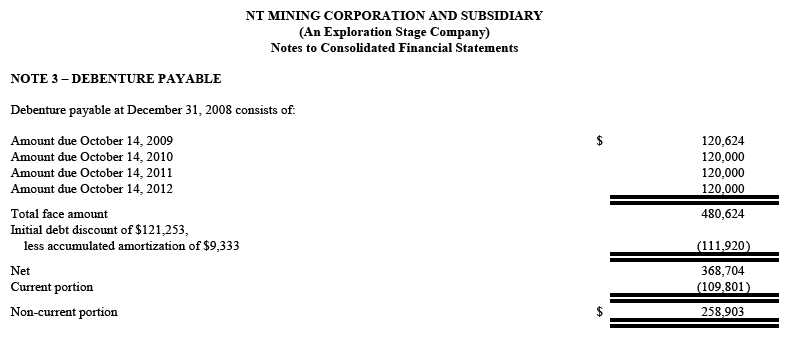

The Company entered into a purchase agreement dated October 14, 2008 to acquire the Corporation Bullmoose Mines Ltd from Hughes Maritime Corp, for cash, shares and a debenture with a face value of $480,624 plus a net smelter royalty of 6%.

Pursuant to the agreement, the Company paid $12,000 and issued 3,000,000 common shares at $0.001 per share to cover the first payment. The Debenture calls for annual payments as noted below:

The properties consist of Mineral Lease #2775 with the next lease payment due August 22, 2010 in the amount of $790.00 (Canadian) funds plus 4 located mineral claims the Big Boo 5, 6, 7 and 8. The title to all properties is held in the name of the company's wholly-owned subsidiary Bullmoose Mines Ltd. The lease requires annual payments in the amount of $790 Canadian, The located mineral claims require expenditures each year on the anniversary date of $200 per acre or in the case of our located mineral claims $9542 by October 18, 2009. This amount may be paid in cash or by expanding $9542 in unauthorized expenditures on the claims before the due date.

The royalty of 6% on the net smelter return is payable to Hughes Maritime Corp. In addition, The Canada Mining Regulations require each mine to pay an annual royalty to the Crown based upon the value of output of the mine. The value of output for this purpose is defined as the market value of the mine's production less allowable deductions for such items as:

- transportation, smelting and refining costs;

- mine and mill operating costs;

- exploration and development costs at the mine;

- depreciation of the buildings, plant, equipment and machinery used in production at the mine (an allowance of up to 15% of the cost of depreciable assets not to exceed 100% of the original cost of the assets);

- amortization of preproduction exploration and development costs (an allowance of up to 15% of such costs incurred prior to commercial production not to exceed 100% of these costs);

- exploration expenses incurred elsewhere in the N.W.T. up to 10% of market value of production; and

- if the production is further processed in the N.W.T., a processing allowance of 8% of the cost of processing assets to a maximum of 65% of the value of output.

Royalty is levied on this value of output on the following scale

$10,000 to $1 million: 3%

$1 million to $5 million: 5%

with the rate increasing 1% for each additional $5 million in value of output to a maximum of 12% at a value of output of $35 million and above.

No royalties are required to be paid for the first 3 years after the start of commercial production.

There are no other royalties or amounts due, other than debenture payments to Hughes Maritime Corp. in the amount of $480,624 which is payable over the next four years.

Mineral rights are acquired in the Northwest Territories by staking following which the acquirer has two years in which to solidify the claim. This maybe done by spending a minimum of $200 in work exploring the claims or the claim may be held for a further length of time by the payment of $200 per acre in cash to the territorial government. Within 10 years, a claim may be converted into a mineral lease with a 21 year life by establishing a mineral reserve and having the claims surveyed..

18

The four (4) unpatented claims were required under the Northwest Territories Mining division as lode mineral claims which are renewable annually. The mineral lease was issued by the Northwest Territories Mining division and covers a surveyed area of 395 acres.

Please refer to the Technical Report dated April 30, 2008 on our website www.ntminingcorporation.com named as follows:

TECHNICAL REPORT ON THE BULLMOOSE GOLD PROJECT

Bullmoose Lake, N.W.T. South Mackenzie Mining District 62º 17'N. Latitude, 112º 44' W. Longitude. NTS 85 1/7 prepared by

Marvin A. Mitchell, P. Eng.

Mitchell Geological Services Inc.

Suite 1028-470 Granville St.

Vancouver, B C. Canada. V6C1V5

e-mail marvingeol@hotmail.com

ITEM 4. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table summarizes certain information regarding the beneficial ownership (as such term is defined in Rule 13d-3 under the Securities Exchange Act of 1934 of the Company’s outstanding common stock as of December 31, 2008 by (i) each person known by the Company to be the beneficial owner of more than 5% of the Company’s outstanding common stock, (ii) each director of the Company, (iii) each person named in the Summary Compensation Table, and (iv) all current executive officers and directors as a group. Except as indicated in the footnotes below, the security and stockholders listed below possess sole voting and investment power with respect to their shares. The figures are based on a total of 23,536,413 issued common shares as of December 31, 2008.

Beneficial ownership means sole and shared voting power or investment power with respect to a security. In computing the number and percentage of shares beneficially owned by a person, shares of Common Stock subject to options and/or warrants currently exercisable, or exercisable at a later date, are counted as outstanding, but these shares are not counted as outstanding for computing the percentage ownership of any other person. At this time, however, there are no such options or warrants granted or outstanding.

19

Beneficial Ownership of Securities : Pursuant to Rule 13d-3 under the Securities Exchange Act of 1934, involving the determination of beneficial owners of securities, includes as beneficial owners of securities, any person who directly or indirectly, through any contract, arrangement, understanding, relationship or otherwise has, or shares, voting power and/or investment power with respect to the securities, and any person who has the right to acquire beneficial ownership of the security within sixty days through any means including the exercise of any option, warrant or conversion of a security.

(1) Atrypa Gold Corporation, is a company incorporated in British Columbia, Canada and is owned as to 97.3% by Richard Fesiuk, a director and officer of the Company.

(2) Capcora Investment Corp., is a company incorporated in British Columbia, Canada and is owned as to 100.0% by Jordan Wangh, a director and officer of the Company.

(3) Hughes Maritime Corp., is a company incorporated in British Columbia, Canada and is owned as to 100.0% by Heidrun S. Hughes, an affiliate of the Company by virtue of the fact that she is the beneficial owner of 12.75% of the issued shares of the Company.

(4) Karis Marine Inc., is a company incorporated in British Columbia, Canada and is owned as to 75.0% by Jurgen R. Hughes, an affiliate of the Company by virtue of the fact that he is the beneficial owner of 7.22% of the issued shares of the Company.

20

(5) Palo Verde Investment Corp., is a company incorporated in British Columbia, Canada and is owned as to 90.0% by Robert Hughes, an affiliate of the Company by virtue of the fact that he is the beneficial owner of 8.08% of the issued shares of the Company.

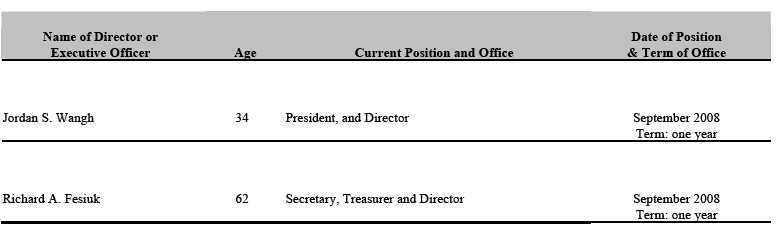

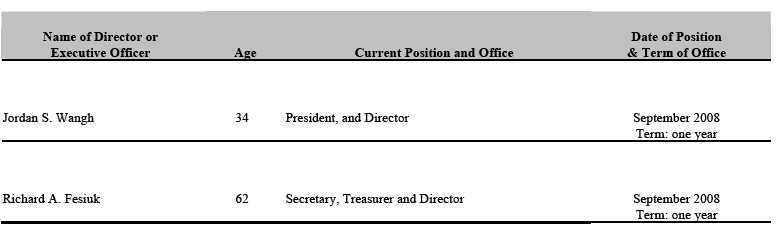

ITEM 5. DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth the names and ages of our current directors and executive officers, their principal offices and positions and the date each such person became a director or executive officer. The Board of Directors elects our executive officers annually. Our directors serve one-year terms or until their successors are elected and accept their positions. The executive officers serve terms of one year or until their death, resignation or removal by the Board of Directors. There are no family relationships or understandings between any of the directors and executive officers. In addition, there was no arrangement or understanding between any executive officer and any other person pursuant to which any person was selected as an executive officer.

Jordan S. Wangh, President and Director:

Mr. Wangh is president of Omnexis Consulting Corporation, a company he founded in 2005 to provide financial and public company consulting services, he is also the president and CEO of World Web Publishing.com Corp., which provides e-commerce solution and consulting. In the past five years, he has held a variety of positions in sales, (2003 through 2005 Automobile Internet Sales Manager) management (2005 to 2007 worked with 777 Sports Entertainment, Corp and managed the gaming software development program), software development and IT consulting. From 2000-2003, he designed, built and developed customized large scale IT systems based on client consultation and corporate needs. He was also the North America sales manager of Comony Enterprise, which is an International textile/garment company until 2005.

Mr. Wangh was educated in Taiwan Australia and the United States and received his B.S. degree in computer engineering from Santa Clara University. In California. He has spent proximately 35% of his days working on the affairs of the company during the past year. It is anticipated that this will increase as the project moves forward.

Richard A. Fesiuk, Secretary, Treasurer and Director:

Mr. Fesiuk is currently the president of Atrypa Gold Corp., a private management and research company that was formed over 20 years ago, and has previously served as a director or officer of several TSX Venture-listed companies, including General Energy Corp. and Avance International Inc. His experience in the mining industry is extensive, encompassing all phases of exploration, development and production throughout North, Central and South America. During the 1980’s he worked with General Energy Corp., on various gold and silver property developments. During the 1990s he worked with Avance Venture Corp., on a gold project in Costa Rica. He has conducted extensive research for innovative mineral extraction methods involving jigs of various types and has constructed and repaired mineral concentration equipment through his previous experience as a heavy duty mechanic.

Mr. Fesiuk was educated in Canada and during the past 12 months spent proximately 15% of his time working on the company's affairs at this time he is developing the program to commence operations in the Northwest Territories the summer. It is expected that time spent on company affairs will increase dramatically once mining operations commence.

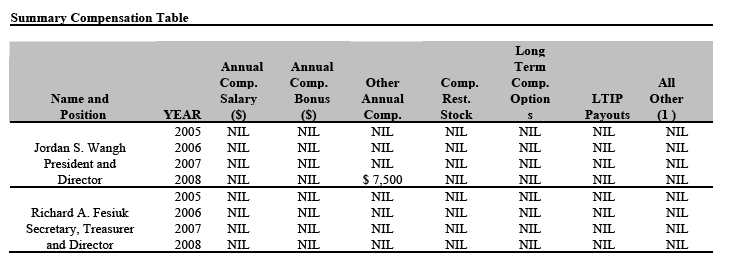

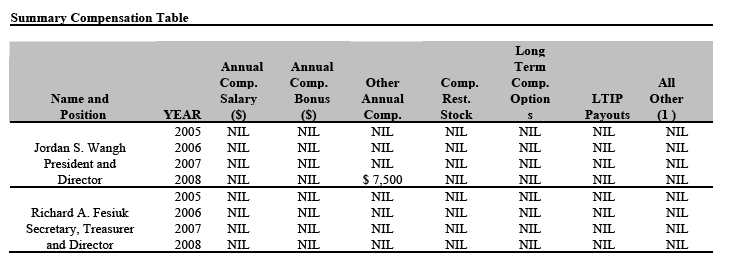

ITEM 6. EXECUTIVE COMPENSATION

The following table sets forth the total compensation paid to or accrued, during the fiscal years ended December 31, 2005 through December 31, 2008 to the Company’s highest paid executive officers. No salaries were paid prior to 2008. No restricted stock awards, long-term incentive plan payout or other types of compensation were paid to these executive officers during these fiscal years.

(1) If applicable, all other compensation includes health insurance and life insurance plans or benefits, car allowances, etc. The Company may omit information regarding group life, health, hospitalization, medical reimbursement or relocation plans that do not discriminate in scope, terms or operation, in favor of executive officers of directors of the registrant and that available generally to all salaried employees.

LTIP: "Long-Term Incentive Plan" means any plan providing compensation intended to serve as incentive for performance to occur over a period longer than one fiscal year, whether such performance is measured by reference to financial performance of the Company or an affiliate, the Company's stock price, or any other measure, but excluding restricted stock, stock option and Stock Appreciation Rights (SAR) plans

To date, no options to purchase shares of the Company’s common stock have been granted.

The financial statements indicate that in addition to the $7500 paid to the president amounts of $3036 were payable to Omnexis Consulting Corp. this amount was to reimburse Omnexis for payments made on the company's behalf.

The amounts due to Atrypa Gold Corp represents reimbursement for payments made on the company's behalf.

It is anticipated that the directors will be compensated in the future based on actual work performed.

Additional Compensation of Directors

We have no official plan or policy for compensating directors with stock options or stock awards. Other than pursuant to current salaries for their executive positions with the Company, if applicable. No other directors are currently compensated by the Company in consideration of their service as a director.

Narrative Disclosure to Summary Compensation Table

ITEM 7. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE .

None of the following parties has, since our date of incorporation, had any material interest, direct or indirect, in any transaction with the Company or in any presently proposed transaction that has or will materially affect us:

| * | Any of our directors or officers; |

| * | Any person proposed as a nominee for election as a director; |

| * | Our promoter(s) Mr. Wangh and Mr. Fesiuk; |

| * | Any member of the immediate family of any of the foregoing persons. |

By virtue of the Purchase Agreement to Acquire Bullmoose Mines Ltd. ("BML") between the Company and Hughes Maritime Corp. ("HMC") dated October 14, 2008, HMC will beneficially own 12.75% of the voting rights attached to our outstanding shares of common stock if the Agreement is fully consummated. As of the

date of the execution of the Agreement, HMC held no shares or any other interest in the Company and the Agreement to acquire BML was made at arms length.

Expenses and Meetings

All officers and directors will be reimbursed for any expenses incurred on our behalf, including travel, lodging and meals. They may also, at such time as we have sufficient revenues from operations of our business, receive a fee for Board meetings attended, including meetings of committees of our Board, however, no such fees have been paid as of the date of this filing.

ITEM 8. LEGAL PROCEEDINGS.

We are currently not a party to nor do we have any knowledge of any pending legal proceedings concerning our Company or its subsidiary Bullmoose Mines Ltd or any of its directors or officers.

ITEM 9. MARKET PRICE OF AND DIVIDENDS ON THE REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS.

The number of record holders of our Common Stock was 122 holders as of December 31, 2008.

Our Common Stock is not publicly traded or quoted on any stock exchange or other interdealer electronic trading facility. We have no present plans, proposals, arrangements or understandings with any person with regard to the development of a trading market in the Common Stock. We cannot make any assurances that a trading market for our Common Stock will ever develop. We have not registered the Common Stock for resale under the blue-sky laws of any state. The holders of shares of our Common Stock, and persons who may wish to purchase shares of our Common Stock in any trading market that might develop in the future, should be aware that significant state blue sky laws and regulations may exist which could limit the ability of our stockholders to sell their shares and limit potential purchasers from acquiring our Common Stock.

The shares were originally quoted for trading on the OTC bulletin board and when the company fell behind in filing’s with the SEC trading was migrated to the PinkSheets, the company intends to bring its filings up to date with the PinkSheets have to pay $3000 annual fee.

As of December 31, 2008, 13,934,913 shares of our Common Stock would be eligible for resale under Rule 144 of the Securities Act were a trading market in our Common Stock to develop, which calculation excludes shares of our Common Stock held by our executive officers and directors. In general, under certain provisions of Rule 144, a person may sell shares of Common Stock acquired from us immediately without regard to manner of sale, the availability of public information about us or volume limitations, if: the person is not our affiliate and has not been our affiliate at any time during the three months preceding the sale; and the person has beneficially owned the shares proposed to be sold for at least one year, including the holding period of any prior owner other than one of our affiliates. There is currently no trading market for the Common Stock.

Employee Compensation Plans

As of December 31, 2008, we do not have any equity compensation plans.

23

ITEM 10. RECENT SALE OF UNREGISTERED SECURITIES

On February 2, 2005, the Company effected a 1 for 300 reverse stock split. On September 1, 2008, the Company effected a 1 for 2000 reverse stock split. The financial statements have been retroactively adjusted to reflect these reverse stock splits.

In 2007, the Company issued a total of 37,584 shares of its common stock to settle debt totaling $485,805.

In 2008, the Company issued a total of 20,210,846 shares of its common stock (including 1,500,000 shares to Capcora Investment Corp., a corporation controlled by Jordan Wangh, the Company’s president and director, and 1,500,000 shares to Atrypa Gold Corporation, a corporation controlled by Richard Fesiuk, the Company’s secretary and director, to settle debt totaling $332,876. On November 26, 2008, the Company sold a total of 280,000 shares of its common stock to three investors at a price of $0.55 per share or $154,000 total.

All of the above shares were sold or issued under the auspices of Regulation “S” and or the private placement exemption as sales to non-US persons.

At December 31, 2008, the outstanding debenture is convertible into up to 961,248 shares of the Company’s common stock and 961,248 warrant to purchase up to 961,248 additional shares of the Company’s common stock at a price of $0.60 per share at any time from the exercise of the conversion option to two years thereafter.

ITEM 11. DESCRIPTION OF REGISTRANT’S SECURITIES TO BE REGISTERED .

We currently have authorized capital of 200,000,000 shares, all shares of which are designated as common stock with a par value of $0.001 per share. As of December 31, 2008, the Company has outstanding 23,536,413 shares of common stock. Our common stock is not listed for trading on any exchange. In the past the Company shares have traded on the bulletin board and subsequently transferred to the pink sheets, in 2008 following the 2000 for one stock consolidation the pink sheets ceased posting a bid and ask on the Company shares and listed the company has caveat emptor, as the company had not filed anything with the pink sheets or the SEC for several years.

The company intends to complete the filings necessary and to pay the $3000 fee to the pink sheets to reinstate the companies bid and ask on that system, upon satisfactory filing and refinancing of the company it is anticipated that the Company shares will be reinstated for trading on the bulletin board.

Common Stock

As of December 31, 2008, there were 23,536,413 shares of our common stock issued and outstanding that is held by 122 stockholders of record.

All shares of our common stock have equal voting rights and are entitled to one vote per share in all matters to be voted upon by our stockholders. The shares of common stock do not entitle their holders to any preemptive, subscription, conversion or redemption rights, and may be issued only as fully paid and non-assessable shares. Cumulative voting in the election of directors is not permitted, which means that the holders of a majority of the issued and outstanding shares of common stock represented at any meeting at which a quorum is present will be able to elect our entire board of directors if they so choose. In that event, the holders of the remaining shares of common stock will not be able to elect any directors. In the event of our liquidation, each stockholder is entitled to receive a proportionate share of the assets available for distribution to stockholders after the payment of liabilities and after dist ribution in full of preferential amounts, if any, to be distributed to holders of our preferred stock. Holders of shares of common stock are entitled to share pro rata in dividends and distributions with respect to the common stock when, as and if declared by our board of directors out of funds legally available for dividends. We have not paid any dividends on our common stock and intend to retain earnings, if any, to finance the development and expansion of our business. Future dividend policy is subject to the discretion of the board of directors. All issued and outstanding shares of our common stock are fully paid and non-assessable. The transfer agent and registrar for our common stock is as follows:

24

Interwest Transfer Company, Inc.

1981 Murray Holladay Rd., Suite 100

P.O. box 17136

Salt Lake City, UT 84117

Phone (801) 272-9294 Fax (801) 277-3147

Preferred Stock

The Company does not have an authorized class of preferred stock.

Dividend Policy

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future.

Share Purchase Warrants

We have not issued and do not have outstanding any warrants to purchase shares of our common stock.

Options

We have not issued and do not have outstanding any options to purchase shares of our common stock.

Convertible Securities

We have not issued and do not have outstanding any securities convertible into shares of our common stock or any rights convertible or exchangeable into shares of our common stock.

Transfer Agent

Interwest Transfer Company, Inc. 1981 Murray Holladay Rd., Suite 100 P.O. Box 17136 Salt Lake City, UT 84117 Phone (801) 272-9294 Fax (801) 277-3147

Registration Rights

None of our directors, officers or shareholders hold registration rights for our common stock.

ITEM 12. INDEMNIFICATION OF DIRECTORS AND OFFICERS

Section 78.751 of Nevada Revised Statutes provides, in effect, that any person made a party to any action by reason of the fact that he is or was a director, officer, employee or agent of the Company may and, in certain cases, must be indemnified by NT Mining Corporation against, in the case of a non-derivative action, judgments, fines, amounts paid in settlement and reasonable expenses (including attorneys’ fees) incurred by him as a result of such action, and in the case of a derivative action, against expenses (including attorneys’ fees), if in either type of action he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the Company and in any criminal proceeding in which such person had

25

reasonable cause to believe his conduct was lawful. This indemnification does not apply, in a derivative action, to matters as to which it is adjudged that the director, officer, employee or agent is liable to the Company, unless upon court order it is determined that, despite such adjudication of liability, but in view of all the circumstances of the case, he is fairly and reasonably entitled to indemnification for expenses.

As authorized by Section 78.037 of Nevada Revised Statutes, the Company’s Articles of Incorporation eliminate or limit the personal liability of a director to the Company or to any of its shareholders for monetary damage for a breach of fiduciary duty as a director, except for: