PART II and III

ITEM 1. OFFERING CIRCULAR

Explanatory Note: This Post-Qualification Offering Circular amends the offering circular of NUGL, INC. qualified on September 27, 2021, in order to update the Financials, Business Section, and per share offering price in the Offering.

Form 1-A: Tier 1

Post-Qualification Amendment No. 2

NUGL, INC.,

an Oklahoma Corporation

13771 Roswell Ave Suite F

Chino, CA 91701

Best Efforts Offering of up to 60,000,000 Common Shares

Minimum Purchase: 200,000 Shares ($3,000)

This prospectus relates to the offering and sale of up to Sixty million (60,000,000) Common Shares of the Company for an aggregate, maximum gross dollar offering of Nine Hundred Thousand ($900,000) Dollars (the “Offering”). The Offering is being made pursuant to Tier 1 of Regulation A, promulgated under the Securities Act of 1933. Each Common Share will be offered at One Point Five cents ($0.015) per share. There is a minimum purchase amount of Two Hundred Thousand Common Shares, at $0.015 per share for an aggregate purchase price of Three Thousand Dollars.

Investing in this offering involves high degree of risk, and you should not invest unless you can afford to lose your entire investment. See “Risk Factors” beginning on page 4. This offering circular relates to the offer and sale or other disposition of up to Sixty million (60,000,000) Common Shares, at $0.015 per share. See “Securities Being Offered” beginning on page 25.

This is our offering, and our common stock currently trades under the symbol NUGL on OTCMarkets.com. The Offering price is arbitrary and bears to relationship to any criteria of value. Our common stock is listed for trading on a quotation system. The Company presently does intend to seek a listing for its common stock on a listed exchange in the future, but should it hereinafter elect to do so, there can be no assurances that such listing will ever materialize.

The proposed sale will begin as soon as practicable after this Offering Circular has been qualified by the Securities and Exchange Commission (the “SEC”) and the relevant state regulators, as necessary and will terminate on the sooner of the sale of the maximum number of shares being sold, twelve months from the effective date of this Offering Statement or the decision by Company management to deem the offering closed. The shares offered hereby are offered on a “best efforts” basis, and there is no minimum offering.

We have made no arrangements to place subscription proceeds or funds in an escrow, trust, or similar account, which means that the proceeds or funds from the sale of common stock will be immediately available to us for use in our operations and once received and accepted are irrevocable. See “Plan of Distribution” and “Securities Being Offered” for a description of our capital stock.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

THE COMMON SHARES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR APPLICABLE STATE SECURITIES LAWS, AND ARE BEING OFFERED AND SOLD IN RELIANCE ON EXEMPTIONS FROM THE REGISTRATION REQUIREMENTS OF THESE LAWS. THE COMMON SHARES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE REGULATORY AUTHORITY NOR HAS THE COMMISSION OR ANY STATE REGULATORY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THIS OFFERING CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

| | | Number of Shares | | | Price to Public (3) | | | Underwriting discount and commissions (1) | | | Proceeds to issuer (2) | | | Proceeds to other persons | |

| Per Share | | | 1 | | | $ | 0.015 | | | $ | 0.00 | | | $ | 0.015 | | | $ | 0.00 | |

| Total Minimum | | | 200,000 | | | $ | 3,000.00 | | | $ | 0.00 | | | $ | 3,000.00 | | | $ | 0.00 | |

| Total Maximum | | | 60,000,000 | | | $ | 900,000.00 | | | $ | 0.00 | | | $ | 900,000.00 | | | $ | 0.00 | |

| | (1) | We do not intend to use commissioned sales agents or underwriters. |

| (2) | The amounts shown are before deducting organization and offering costs to us, which include legal, accounting, printing, due diligence, marketing, consulting, finder’s fees, selling, and other costs incurred in the offering of the common stock. |

| | (3) | The Shares are offered at $0.015 per share, with a Minimum Purchase of 200,000 Shares or $3,000. |

We are following the “Offering Circular” format of disclosure under Regulation A.

The date of this Post-Qualification Offering Circularis September 6, 2022

TABLE OF CONTENTS

| | |

| Summary Information | 1 |

| | |

| COVID-19 Risks Related to the Company | 4 |

| | |

| Risk Factors | 4 |

| | |

| Dilution | 12 |

| | |

| Plan of Distribution | 13 |

| | |

| Use of Proceeds | 14 |

| | |

| Description of Business | 15 |

| | |

| Description of Property | 18 |

| | |

| Managements’ Discussion and Analysis | 19 |

| | |

| Directors, Executives, and Significant Employees | 21 |

| | |

| Executive Compensation | 23 |

| | |

| Securities Ownership of Management and Control Persons | 24 |

| | |

| Interest of Management and Others In Certain Transactions | 24 |

| | |

| Securities Being Offered | 25 |

| | |

| Financial Statements | F-1 |

| | |

| Exhibits | 26 |

| | |

| Signatures | 27 |

FORWARD LOOKING STATEMENTS

THIS OFFERING CIRCULAR MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS ESTIMATE, PROJECT, BELIEVE, ANTICIPATE, INTEND, EXPECT AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENTS CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE.

SUMMARY OF INFORMATION IN OFFERING CIRCULAR

As used in this prospectus, references to the “Company”, “we”, “our”, or “us” refer to NUGL, Inc., unless the context otherwise indicated.

You should carefully read all information in the prospectus, including the financial statements and their explanatory notes, under the Financial Statements prior to making an investment decision.

The Company

| Organization: | NUGL, Inc. (the Company”) was incorporated on November 5, 1998 in the State of Nevada as USA Telecom with the spelling later changed in that year to USA Telcom and subsequently changed its name at various times as follows: USA Telecom Internationale (April 2000), ZannWell Inc. (June 2004), Blackhawk Fund (January 2005), Vidable, Inc. (June 2011), VIBE I (June 2011), and Coresource Strategies, Inc. (June 2015). |

On May 24, 2017, the Company entered into a Definitive Merger Agreement (the “Nugl Merger”) with NUGL, Inc., a Nevada corporation (“NUGL”). On August 24, 2017, the Company underwent a Statutory A Reorganization (the “Nugl Reorganization”) pursuant to Section 1081(a) of the Oklahoma General Corporation Law, as a tax-free reorganization. Pursuant to the reorganization, on August 24, 2017, Coresource Strategies, Inc. caused NUGL to be incorporated in the State of Oklahoma, as a direct, wholly owned subsidiary. Concurrently, NUGL caused Coresource Operations, Inc., to be incorporated as a direct, wholly owned subsidiary. Under the terms of the reorganization, Coresource Strategies, Inc. was merged with and into Coresource Operations., Inc. pursuant to Section 1081(g) of the General Corporation Law of the State of Oklahoma. Upon consummation of the reorganization, each issued and outstanding equity of Coresource Strategies, Inc. was converted into and exchanged for an equivalent equity of NUGL (on a one for one basis) having the same designations, rights, powers and preferences, and qualifications, limitations and restrictions as the equities of Coresource Strategies, Inc. being converted. There was no spinoff and Coresource Strategies, Inc. corporate existence ceased. Under the Reorganization, Coresource Strategies, Inc. equity holders became equity holders of NUGL, in the same proportion.

In connection with the Nugl Merger and Nugl Reorganization, the Company completed a name change to NUGL, Inc. and symbol change to NUGL. This corporate action was declared effective on December 7, 2017 by the Financial Industry Regulatory Authority, Inc. (“FINRA”).

| Capitalization: | Our Articles of Incorporation, as amended provide for the issuance of up to (i) 1,000,000,000 shares of Common Stock, par value $0.0001 and (ii) 1,000,000 shares of Preferred Stock, par value $0.0001. As of the date of this Prospectus there are 840,747,280 shares consisting of 840,747,280 shares of Common Stock, and ZERO shares of Preferred Stock issued and outstanding. |

| Independence: | We are not a blank check company, as such term is defined by Rule 419 promulgated under the Securities Act of 1933, as amended, as we have a specific business plan, more than no or nominal operations and assets, and we presently have no binding plans or intentions to engage in a merger or acquisition with an unidentified company, companies, entity, or person. |

Our Business

| Description of Operations: | On April 03, 2022, the Company closed the acquisition of 100% of Kaya LLC in exchange for 797,310,985 shares of Company common stock. Following the merger, the Company became a multifaceted cannabis lifestyle company deriving globally diverse revenue streams from a portfolio of powerful brands, and operations delivering quality at scale. Kaya operates a store in Kingston, one in the historic town of Falmouth, and its flagship retail store and farm operations in the tourism Mecca that is Ocho Rios. Kaya plans to open its first Wellness Center at The Gap, located in the pristine hills of the Blue Mountains, in August 2022. Kaya Herb House Drax Hall was the first legal Medical Marijuana dispensary in Jamaica and offers tours of Kaya Farm, which has a variety of over 75 different genetics being cultivated and processed. Our retail complex includes Kaya Herb House with Dab Bar & Consumption Lounge on premise. Our famous Square Grouper Bar hosts an impressive lineup of reggae acts on a regular basis. |

NUGL features media assets such as NUGL Magazine and NUGL TV, which has in and out of network shows such as Lil Eazy-E TV Pod Cast hosted by LiL Eazy-E. NUGL App highlights profiles for businesses in all sectors of the cannabis industry, including retail stores, brands, services, events, & more. Our platform allows businesses to build and structure detailed items within our global menu, aiding connections between business and consumer communities through targeted networking and enabling a variety of advertising opportunities to expand reach. NUGL uses its own servers, software, and proprietary technology.

| Historical Operations: | Since inception, the Company has limited its operations to advertising and marketing services for the marijuana industry, the development of the NUGL brand through its media platforms including NUGL Magazine and NUGL TV, and the strategic acquisition of Kaya LLC. As of June 30, 2022, we have an accumulated deficit of $6,683,650. |

| Management: | Our Chief Executive Officer and Director is Balram Vaswani. Our Chief Operating Officer and Director is Curtis J. Melone. There are two other Directors of the Company as of the date of this filing. The CEO and COO spend approx. 40 hours per week dedicated to the affairs of the Company. This is expected to continue following qualification of this offering and as Company operations commence. |

The Offering

| Securities Offered: | 60,000,000 shares of Common Stock at $0.015 per share. |

| | |

| Common Stock Outstanding before the Offering: | 840,747,280 shares of Common Stock. |

| | |

Common Stock Outstanding after the Offering: | 900,747,280 shares of Common Stock. |

| | |

| Use of Proceeds: | The proceeds will be deployed for acquisitions and product development and related working capital expenses. |

| | |

| Termination of the Offering: | The offering will commence as soon as practicable after this Offering Circular has been qualified by the SEC and relevant state regulators, as necessary, and will terminate on the sooner of the sale of the maximum number of shares being sold, twelve months from the effective date of this Offering Statement, or the decision by Company management to extend or to deem the offering closed. |

| | |

| Offering Cost: | We estimate our total offering registration costs to be $60,000. |

| | |

| Market for the Shares: | The Shares being offered herein are not listed for trading on any exchange or automated quotation system. The Company does not intend to seek such a listing at any time hereinafter. |

| | |

| Market for our Common Stock: | Currently, our common stock is quoted on the OTC Pink Market Place under the trading symbol “NUGL”. |

| | |

| Common Stock Control: | Our Officers and Directors currently own approximately 26% if the issued and outstanding common stock of the company. None of the Preferred Shares has been issued. |

| | |

| Best Efforts Offering: | We are offering our common stock on a best-efforts basis through our Management, including our Chief Executive Officer and Chief Operating Officer, who will not receive any discounts or commissions for selling the shares. There is no minimum number of shares that must be sold in order to close this offering. |

| | |

ITEM 2. RISK FACTORS

Investing in our shares involves risk. In evaluating the Company and an investment in the shares, careful consideration should be given to the following risk factors, in addition to the other information included in this Offering circular. Each of these risk factors could materially adversely affect The Company’s business, operating results, or financial condition, as well as adversely affect the value of an investment in our shares. The following is a summary of the most significant factors that make this offering speculative or substantially risky. The Company is still subject to all the same risks that all companies in its industry, and all companies in the economy, are exposed to. These include risks relating to economic downturns, political and economic events, and technological developments (such as cyber-security). Additionally, early-stage companies are inherently more risky than more developed companies. You should consider general risks as well as specific risks when deciding whether to invest.

COVID-19 Risks Related to the Company

Risks Related to the Company

Our having generated reduced revenues in the past year, makes it difficult for us to evaluate our future business prospects and make decisions based on those estimates of our future performance.

We have historically generated limited revenues. Following the acquisition of Kaya LLC, we generated revenues of approximately $638.800 for three months ended June 30, 2022. Consequently, given limited history with Kaya, it is difficult, if not impossible, to forecast our future results based upon our historical data. Because of the related uncertainties, we may be hindered in our ability to anticipate and timely adapt to increases or decreases in revenues and expenses. If we make poor budgetary decisions as a result of unreliable data, we may never become profitable or incur losses, which may result in a decline in our stock price.

The company has realized significant operating losses to date and expects to incur losses in the future

The company has operated at a loss since inception, and these losses are likely to continue. Until the company achieves profitability, it will have to seek other sources of capital in order to continue operations.

The Company has limited capitalization and a lack of working capital and as a result is dependent on raising funds to grow and expand its business.

The Company lacks sufficient working capital in order to execute its business plan. The ability of the Company to move forward with its objective is therefore highly dependent upon the success of the offering described herein. Should we fail to obtain sufficient working capital through this offering we may be forced to abandon our business plan.

Because we have a limited history of operations, we may not be able to successfully implement our business plan.

Although we have been a public company for nearly 5 years, we began trading under the symbol NUGL as of December 11, 2017. As a result, we have limited operational history in our industry. Accordingly, our operations are subject to the risks inherent in the establishment of a new business enterprise, including access to capital, successful implementation of our business plan and limited revenue from operations. We cannot assure you that our intended activities or plan of operation will be successful or result in revenue or profit to us and any failure to implement our business plan may have a material adverse effect on the business of the Company.

We are a publicly traded corporation with over nearly years of operating history, however we may not be able to successfully operate our business or generate sufficient operating cash flows to make or sustain distributions to our stockholders.

We were incorporated on November 5, 1998, and we have a limited operating history. Our financial condition, results of operations and ability to make or sustain distributions to our stockholders will depend on many factors, including:

| · | our ability to identify and attract advertising clients and other opportunities that are consistent with our growth strategy; our ability to consummate financing on favorable terms; |

| · | fluctuation in advertising rates in our markets; |

| · | our ability to absorb costs that are beyond our control, such as advertising rates on well-known platforms, cost-per-impression rates (CPM), media costs and compliance costs as a public company; |

| · | our ability to respond to changes in trends, products, and price points and in our markets; and, |

| · | economic conditions in our markets, as well as the condition of the financial investment markets and the economy generally. |

We are dependent on the sale of our securities to fund our operations.

We are dependent on the sale of our securities to fund our operations and will remain so until we generate sufficient revenues to pay for our operating costs. Our Officers and Directors have not made any written commitments with respect to providing a source of liquidity in the form of cash advances, loans and/or financial guarantees. There can be no guarantee that we will be able to successfully sell our equity securities. Such liquidity and solvency problems may force the Company to cease operations if additional financing is not available. No known alternative resources of funds are available in the event we do not generate sufficient funds from operations.

The Company is dependent on key personnel and loss of the services of any of these individuals could adversely affect the conduct of the Company's business.

Our business plan is significantly dependent upon the ability to hire and retain qualified individuals and key personal, who may be appointed as officers and directors, and their continued participation in our Company. It may be difficult to replace any of them at an early stage of development of the Company. The loss by or unavailability to the Company of their services would have an adverse effect on our business, operations, and prospects, in that our inability to replace them could result in the loss of one’s investment. There can be no assurance that we would be able to locate or employ personnel to replace any of our officers, should their services be discontinued. In the event that we are unable to locate or employ personnel to replace our officers we would be required to cease pursuing our business opportunity, which would result in a loss of your investment.

Our Certificate of Incorporation and Bylaws limit the liability of, and provide indemnification for, our officers and directors.

Our Articles of Incorporation, including controlling state statute permits us to indemnify our officers and directors, to the fullest extent authorized or permitted by law in connection with any proceeding arising by reason of the fact any person is or was an officer or director of the Company. Furthermore, our Articles of Incorporation provides that no director of the Company shall be personally liable to it or its shareholders for monetary damages for any breach of fiduciary duty by such director acting as a director. Notwithstanding this indemnity, a director shall be liable to the extent provided by law for any breach of the director's duty of loyalty to the Company or its shareholders, for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of the law, pursuant to section 174 of the General Corporation Law of Oklahoma (unlawful payment of a stock dividend or unlawful redemption of stock), or for any transaction from which a director derived an improper personal benefit. Our Articles of Incorporation permits us to purchase and maintain insurance on behalf of directors, officers, employees, or agents of the Company or to create a trust fund, grant a security interest and/or use other means to provide indemnification.

Our Bylaws permit us to indemnify our officers and directors to the full extent authorized or permitted by law. We have been advised that in the opinion of the Securities and Exchange Commission indemnification for liabilities arising under the Securities Act is against public policy as expressed in the Securities Act, and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities is asserted by one of our directors, officers, or controlling persons in connection with the securities being registered, we will, unless in the opinion of our legal counsel the matter has been settled by controlling precedent, submit the question of whether such indemnification is against public policy to court of appropriate jurisdiction. We will then be governed by the court's decision.

The Company may not be able to attain profitability without additional funding, which may be unavailable.

The Company has limited capital resources. Unless the Company begins to generate sufficient revenues to finance operations as a going concern, the Company may experience liquidity and solvency problems. Such liquidity and solvency problems may force the Company to cease operations if additional financing is not available. No known alternative resources of funds are available in the event we do not generate sufficient funds from operations.

Risks Relating to Our Business

Risks Relating to the Marijuana Business in the United States

NUGL is in the Marijuana Business

We are in the Marijuana Business as a marketing and advertising company for various brands and dispensary locations. Some investors are not comfortable with the licensing of Marijuana products particularly in States where “recreational use” is permitted. This may inhibit us to attract investment and shareholders.

The Marijuana Business is regulated at the State level

The Marijuana Business is regulated at the State level, not at the Federal level, as in the majority of medical products. As a result, NUGL, and its advertisers, are constantly having to adapt to new and changing regulations. This can create uncertainty with investors, resulting in unstable commercial operations by our advertisers. This, in turn, can effect their ability to make consistent payments under their advertising and promotion agreements.

The profitability of attempted acquisitions and other business developments is uncertain.

We intend to acquire and develop new marketing technologies and companies selectively. The acquisition and development of these technologies entails risks that investments may fail to perform in accordance with expectations. In undertaking these projects, we will incur certain risks, including the expenditure of funds on, and the devotion of management's time to, transactions that may not come to fruition. Additional risks inherent in the projects include risks that the intended advertisers will not accept our new products and may not achieve additional anticipated sales using these new products. As a result, capital expenditure used to develop these new products, may be amortized over a much longer time than expected. Expenses may be greater than anticipated.

Marijuana investments are generally illiquid.

Because marijuana investments are relatively illiquid, our ability to vary our portfolio promptly in response to economic or other conditions will be limited. This is because there is still apprehension among investors in general, because of federal restrictions and significant differences at the state level. The foregoing and any other factor or event that would impede our ability to respond to adverse changes in the performance of our investments could have an adverse effect on our financial condition and results of operations.

If we purchase or develop assets at a time when the Marijuana market is experiencing substantial influxes of capital investment and competition for opportunities, the acquisitions we purchase or develop may not appreciate or may decrease in value.

The marijuana markets are currently experiencing a substantial influx of capital from investors worldwide, and a corresponding greater valuation than for other businesses with similar operations. This substantial flow of capital, combined with significant competition for acquisitions, may result in inflated purchase prices for such assets. To the extent we companies or brands in such an environment, we are subject to the risk that if the marijuana ceases to attract the same level of capital investment in the future as it is currently attracting, or if the number of companies seeking to acquire such assets decreases, our returns will be lower and the value of our assets may not appreciate or may decrease significantly below the amount we paid for or expended in the development of such assets.

The value of marijuana businesses may be adversely affected by national and regional economic conditions, changing state regulations and conditions such as an oversupply of opportunities or a reduction in demand for opportunities, availability of opportunities, competition from other similar companies to ours, our ability to provide adequate maintenance, insurance, and management services, increased operating costs, and the attractiveness and location of the asset. Our performance will be linked to economic conditions in the regions where our opportunities will be located and in the market for marijuana products generally. Therefore, to the extent that there are adverse economic conditions in those regions, and in these markets generally, that impact the applicable market prices, such conditions could result in a reduction of our income and cash available for distributions and thus affect the amount of distributions we can make to you.

We may not make a profit if we sell a marijuana company or brand

If and when we determine to sell a marijuana company or brand, will depend on many factors that are presently unknown, including the operating history, tax treatment of the investment, demographic trends in the area and available financing for the purchaser. There is a risk that we will not realize any significant appreciation on our investment. This may result in a loss of confidence in our share price and limit our ability to raise capital through the sale of shares. Accordingly, an investor’s ability to recover all or any portion of an investment under such circumstances will depend on the amount of funds so realized and claims to be satisfied therefrom.

Cannabis remains illegal under federal law, and any change in the enforcement priorities of the federal government could render our current and planned future operations unprofitable or even prohibit such operations.

The cultivation, manufacture, distribution, and possession of marijuana continues to be illegal under U.S. federal law. The Supremacy Clause of the United States Constitution establishes that the US Constitution and federal laws made pursuant to it are paramount and, in case of conflict between federal and state law, the federal law must be applied. Accordingly, federal law applies even in those states in which the use of marijuana has been legalized. Enforcement of federal law regarding marijuana would harm our business, prospects, results of operation, and financial condition.

The United States federal government regulates drugs through the Controlled Substances Act (the “CSA”), which places controlled substances, including cannabis, on one of five schedules. Cannabis is currently classified as a Schedule I controlled substance, which is viewed as having a high potential for abuse and having no currently accepted medical use in treatment in the United States. No prescriptions may be written for Schedule I substances, and such substances are subject to production quotas imposed by the United States Drug Enforcement Administration (the “DEA”). Because of this, doctors may not prescribe cannabis for medical use under federal law, although they can recommend its use under the First Amendment.

Currently, numerous U.S. states, the District of Columbia and U.S. territories have legalized cannabis for medical and/or recreational adult use. Such state and territorial laws conflict with the federal CSA, which makes cannabis use and possession illegal at the federal level. Because cannabis is a Schedule I controlled substance, however, the development of a legal cannabis industry under the laws of these states conflicts with the CSA, which makes cannabis use and possession illegal on a national level. The United States Supreme Court has confirmed that the federal government has the right to regulate and criminalize cannabis, including for medical purposes, and that federal law criminalizing the use of cannabis preempts state laws that legalize its use. We would likely be unable to execute our business plan if the federal government were to strictly enforce federal law regarding cannabis.

Considering such conflict between federal laws and state laws regarding cannabis, the administration under President Obama had effectively stated that it was not an efficient use of resources to direct law federal law enforcement agencies to prosecute those lawfully abiding by state-designated laws allowing the use and distribution of medical cannabis. For example, the DOJ Deputy Attorney General of the Obama administration, James M. Cole, issued a memorandum (the “Cole Memo”) to all United States Attorneys providing updated guidance to federal prosecutors concerning cannabis enforcement under the CSA (see “Business—Government and Industry Regulation—The Cole Memo”). In addition, the Financial Crimes Enforcement Network (“FinCEN”) provided guidelines on February 14, 2014, regarding how financial institutions can provide services to cannabis-related businesses consistent with their Bank Secrecy Act obligations.

Congress previously enacted an omnibus spending bill that included a provision (the “Rohrabacher-Blumenauer Amendment”) prohibiting the DOJ from using funds to prevent states with medical cannabis laws from implementing such laws. This provision is renewed annually by Congress and is current through March 11, 2022. In August 2016, a Ninth Circuit federal appeals court ruled in United States v. McIntosh that the Rohrabacher-Blumenauer Amendment bars the DOJ from spending funds on the prosecution of conduct that is allowed by state medical cannabis laws, provided that such conduct is in strict compliance with applicable state law. In March 2015, bipartisan legislation titled the Compassionate Access, Research Expansion, and Respect States Act (the “CARERS Act”) was introduced, proposing to allow states to regulate the medical use of cannabis by changing applicable federal law, including by reclassifying cannabis under the Controlled Substances Act to a Schedule II controlled substance and thereby changing the plant from a federally-criminalized substance to one that has recognized medical uses. More recently, the Respect State Marijuana Laws Act of 2017 has been introduced in the U.S. House of Representatives, which proposes to exclude persons who produce, possess, distribute, dispense, administer, or deliver marijuana in compliance with state laws from the regulatory controls and administrative, civil, and criminal penalties of the CSA.

Additionally, financial transactions involving proceeds generated by cannabis-related conduct can form the basis for prosecution under the federal money laundering statutes, unlicensed money transmitter statutes and the Bank Secrecy Act. Prior to the DOJ's rescission of the “Cole Memo”, supplemental guidance from the DOJ issued under the Obama administration directed federal prosecutors to consider the federal enforcement priorities enumerated in the “Cole Memo” when determining whether to charge institutions or individuals with any of the financial crimes described above based upon cannabis-related activity. It is unclear what impact the recent rescission of the “Cole Memo” will have, but federal prosecutors may increase enforcement activities against institutions or individuals that are conducting financial transactions related to cannabis activities.

Additionally, as we are always assessing potential strategic acquisitions of new businesses, we may in the future also pursue opportunities that include growing and/or distributing medical or recreational cannabis, should we determine that such activities are in the best interest of the Company and our stockholders. Any such pursuit would involve additional risks with respect to the regulation of cannabis, particularly if the federal government determines to strictly enforce all federal laws applicable to cannabis.

Federal prosecutors have significant discretion, and no assurance can be given that the federal prosecutor in each judicial district where we operate our business will not choose to strictly enforce the federal laws governing cannabis production or distribution. Any change in the federal government's enforcement posture with respect to state-licensed cultivation of medical-use cannabis, including the enforcement postures of individual federal prosecutors in judicial districts where we purchase properties, would result in our inability to execute our business plan, and we would likely suffer significant losses, which would adversely affect the trading price of our securities. Furthermore, following any such change in the federal government's enforcement position, we could be subject to criminal prosecution, which could lead to imprisonment and/or the imposition of penalties, fines, or forfeiture.

Risks Relating to the Marijuana Business in Jamaica

We face exposure to markets in jurisdictions outside of the United States which subjects us to risks normally associated with any conduct of business in foreign countries, including varying degrees of political, legal, and economic risk.

We face exposure to markets in jurisdictions outside of the United States, specifically we face market, governmental, regulatory, and natural risks related to our business conducted in Jamaica. This side of the business is subject to the risks normally associated with any conduct of business in foreign and/or emerging countries including political risks; civil disturbance risks; changes in laws or policies of particular countries, including those relating to royalties, duties, imports, exports and currency; the cancellation or renegotiation of contracts; the imposition of royalties, net profits payments, tax increases or other claims by government entities, including retroactive claims; a disregard for due process and the rule of law by local courts; the risk of expropriation and nationalization; delays in obtaining or the inability to obtain necessary governmental permits or the reimbursement of refundable tax from fiscal authorities.

Threats or instability in a country caused by political events including elections, change in government, changes in personnel or legislative bodies, foreign relations or military control present serious political and social risk and instability causing interruptions to the flow of business negotiations and influencing relationships with government officials. Changes in policy or law may have a material adverse effect on our business, financial condition, and results of operations. The risks include increased “unpaid” state participation, higher energy costs, higher taxation levels and potential expropriation.

Other risks include the potential for fraud and corruption by suppliers or personnel or government officials which may implicate us, compliance with applicable anti-corruption laws, including the Foreign Corrupt Practices Act (“FCPA”) and the by virtue of our operating in a jurisdiction that may be vulnerable to the possibility of bribery, collusion, kickbacks, theft, improper commissions, facilitation payments, conflicts of interest and related party transactions and our possible failure to identify, manage and mitigate instances of fraud, corruption or violations of our code of conduct and applicable regulatory requirements.

There is also the risk of increased disclosure requirements; currency fluctuations; restrictions on the ability of local operating companies to hold U.S. dollars or other foreign currencies in offshore bank accounts; import and export regulations; increased regulatory requirements and restrictions; limitations on the repatriation of earnings or on our ability to assist in minimizing our expatriate workforce’s exposure to double taxation in both the home and host jurisdictions; and increased financing costs.

These risks may limit or disrupt our business, restrict the movement of funds, cause us to have to expend more funds than previously expected or required or result in the deprivation of contract rights or the taking of property by nationalization or expropriation without fair compensation, and may materially adversely affect our financial position and/or results of operations. In addition, the enforcement by us of our legal rights in foreign countries, including rights to exploit our properties or utilize our permits and licenses and contractual rights may not be recognized by the court systems in such foreign countries or enforced in accordance with the rule of law.

It is difficult to predict the future political, social, and economic direction of Jamaica and the impact government decisions may have on our business. Any political or economic instability in the countries in which we operate could have a material and adverse effect on our business, financial condition, and results of operations.

Risks Relating to Our Business – General

Our opportunities may not be diversified.

Our potential profitability and our ability to diversify our investments may be limited, both geographically and by type of opportunities purchased. We will be able to purchase or develop additional opportunities only as additional funds are raised and only if owners of marijuana businesses accept our stock in exchange for an interest in the target property or title to the property. Our opportunities may not be well diversified, and their economic performance could be affected by changes in local economic conditions.

Our performance is therefore linked to economic and regulatory conditions in the regions in which we will acquire and develop opportunities and in the market for marijuana companies or brands generally. Therefore, to the extent that there are adverse economic conditions in the regions in which our opportunities are located and in the market for marijuana opportunities, such conditions could result in a reduction of our income and cash to return capital and thus affect the amount of distributions we can make to you.

Competition with third parties for opportunities and other investments may result in our paying higher prices for opportunities which could reduce our profitability and the return on your investment.

We compete with many other entities engaged in marijuana brand development and investment activities, including individuals, corporations, REITs, and limited partnerships, many of which have greater resources than we do. Some of these investors may enjoy significant competitive advantages that result from, among other things, a lower cost of capital and enhanced operating efficiencies. In addition, the number of entities and the amount of funds competing for suitable investments may increase. Any such increase would result in increased demand for these assets and increased prices. If competitive pressures cause us to pay higher prices for opportunities, our ultimate profitability may be reduced, and the value of our opportunities may not appreciate or may decrease significantly below the amount paid for such opportunities. At the time we elect to dispose of one or more of our opportunities, we will be in competition with sellers of similar opportunities to locate suitable purchasers, which may result in us receiving lower proceeds from the disposal or result in us not being able to dispose of the property due to the lack of an acceptable return. This may cause you to experience a lower return on your investment.

The Company may not be able to effectively control the timing and costs relating to the acquisition opportunities, which may adversely affect the Company’s operating results and its ability to make a return on its investment or disbursements of dividends or interest to our shareholders.

Nearly all the opportunities to be acquired by the Company will require some level of capital expenditure immediately upon their acquisition or in the near future. The Company may acquire opportunities that it plans to extensively develop and require significant capital infusion. The Company also may acquire opportunities that it expects to be in good standing and operations but has problems that require extensive capital expenditure to fix.

If the Company’s assumptions regarding the costs or timing of business improvements prove to be materially inaccurate, the Company’s operating results and ability to make distributions to our Shareholders may be adversely affected.

The Company has not yet identified any specific opportunities to acquire or improve with net proceeds of this offering, and you will be unable to evaluate the economic merits of the company's investments made with such net proceeds before making an investment decision to purchase the Company’s securities.

The Company will have broad authority to invest a portion of the net proceeds of this offering in any opportunities the Company may identify in the future, and the Company may use those proceeds to make investments and improvements with which you may not agree. You will be unable to evaluate the economic merits of the Company’s opportunities before the Company invests in them and the Company will be relying on its ability to select attractive investment opportunities. In addition, the Company’s investment policies may be amended from time to time at the discretion of the Company’s Management, without out notice to the Company’s Shareholders. These factors will increase the uncertainty and the risk of investing in the Company’s securities.

The Company’s failure to apply the proper portion of the net proceeds of this offering effectively or find suitable opportunities to acquire in a timely manner or on acceptable terms could result in losses or returns that are substantially below expectations.

The costs of defending against claims of environmental liability, of complying with environmental regulatory requirements, of remediating any contaminated property or of paying personal injury or other damage claims could reduce the amounts available for distribution to our shareholders.

Many marijuana products may contain or have been made with toxic substances as part of their processing and/or extraction processing. This may require specific zoning and environmental regulations at the State, local and Federal level. The Company may be held liable under these regulations when making acquisitions. These laws and liabilities may be extended to the Company’s employees.

Under various federal, state, and local environmental laws, ordinances, and regulations, a current or previous real property owner or operator may be liable for the cost of removing or remediating hazardous or toxic substances on, under or in such property. These costs could be substantial. Such laws often impose liability whether or not the owner or operator knew of, or was responsible for, the presence of such hazardous or toxic substances. Environmental laws also may impose liens on property or restrictions on the manner in which property may be used or businesses may be operated, and these restrictions may require substantial expenditures or prevent us from entering into leases with prospective tenants that may be impacted by such laws. Environmental laws provide for sanctions for noncompliance and may be enforced by governmental agencies or, in certain circumstances, by private parties. Certain environmental laws and common law principles could be used to impose liability for the release of and exposure to hazardous substances, including asbestos-containing materials and lead-based paint. Third parties may seek recovery from real property owners or operators for personal injury or property damage associated with exposure to released hazardous substances and governments may seek recovery for natural resource damage. The costs of defending against claims of environmental liability, of complying with environmental regulatory requirements, of remediating any contaminated property, or of paying personal injury, property damage or natural resource damage claims could reduce the amounts available for distribution to you.

Risks Related to Our Securities

There is a limited established trading market for our Common Stock and if a trading market does not develop, purchasers of our securities may have difficulty selling their securities.

NUGL is a non-reporting company as defined by the SEC. It does not presently, as of the date of this prospectus, file periodic reports with the SEC. It is quoted on the OTC Markets as a PINK sheet company. There is a limited established public trading market for our Common Stock and an active trading market in our securities may not develop or, if developed, may not be sustained. While we intend to seek a quotation on a major national exchange or automated quotation system in the future, there can be no assurance that any such trading market will develop, and purchasers of the common stock may have difficulty selling their common stock. No market makers have committed to becoming market makers for our common stock and none may do so.

The offering price of the Shares being offered herein has been arbitrarily determined by us and bears no relationship to any criteria of value; as such, investors should not consider the offering price or value to be an indication of the value of the shares being registered.

Currently, there is a limited public market for our Shares. The offering price for the Shares being registered in this offering has been arbitrarily determined by us and is not based on assets, operations, book, or other established criteria of value. Thus, investors should be aware that the offering price does not reflect the market price or value of our common shares.

We may, in the future, issue additional shares of Common Stock, which would reduce investors percent of ownership and may dilute our share value.

We may issue additional shares of Common Stock at a later date to employees or for services. The future issuance of common stock may result in substantial dilution in the percentage of our common stock held by our then existing shareholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors and might have an adverse effect on any trading market for our common stock.

We are publicly traded company, and we finance our business through debt.

As with every other public company, we will from time to time finance our business through the sale of stock or promissory notes collateralized by our common stock We may also acquire debt in the form of mezzanine or bridge financing. We may borrow such funds from a traditional bank, or non-bank third party. We hope to finance acquisitions mostly with the sale of our common stock in this offering. As a result, our balance sheet may be unduly leveraged and if we cannot sell or liquidate our opportunities, we will be burdened by debt service, including, but not limited to payment of principal and interest and other fees.

We are subject to compliance with securities law, which exposes us to potential liabilities, including potential rescission rights.

We may offer to sell our common stock to investors pursuant to certain exemptions from the registration requirements of the Securities Act of 1933, as well as those of various state securities laws. The basis for relying on such exemptions is factual; that is, the applicability of such exemptions depends upon our conduct and that of those persons contacting prospective investors and making the offering. We may not seek any legal opinion to the effect that any such offering would be exempt from registration under any federal or state law. Instead, we may elect to rely upon the operative facts as the basis for such exemption, including information provided by investor themselves.

If any such offering did not qualify for such exemption, an investor would have the right to rescind its purchase of the securities if it so desired. It is possible that if an investor should seek rescission, such investor would succeed. A similar situation prevails under state law in those states where the securities may be offered without registration in reliance on the partial preemption from the registration or qualification provisions of such state statutes under the National Securities Markets Improvement Act of 1996. If investors were successful in seeking rescission, we would face severe financial demands that could adversely affect our business and operations. Additionally, if we did not in fact qualify for the exemptions upon which it has relied, we may become subject to significant fines and penalties imposed by the SEC and state securities agencies.

ITEM 3. DILUTION

If you invest in our shares, your interest will be diluted to the extent of the difference between the offering price per share of our common stock in this offering and the as adjusted net tangible book value per share of our capital stock after this Offering. The following table demonstrates the dilution that new investors will experience relative to the Company's net tangible book value as of June 30, 2022. Net tangible book value is the aggregate amount of the Company's tangible assets, less its total liabilities. The table presents three scenarios: a $225,000 raise from this Offering, a $450,000 raise from this Offering and a fully subscribed $900,000 raise from this Offering.

| | | | | | | | | | |

| Proceeds from Sale | | $ | 225,000 | | | $ | 450,000 | | | $ | 900,000 | |

| Percentage of Shares Sold | | | 25% | | | | 50% | | | | 100% | |

| Price Per share | | $ | 0.015 | | | $ | 0.015 | | | $ | 0.015 | |

| Shares Issued | | | 15,000,000 | | | | 30,000,000 | | | | 60,000,000 | |

| Capital Raised | | $ | 225,000 | | | $ | 450,000 | | | $ | 900,000 | |

| Less Offering Costs | | $ | 60,000 | | | $ | 60,000 | | | $ | 60,000 | |

| Net Proceeds | | $ | 165,000 | | | $ | 390,000 | | | $ | 840,000 | |

| Net Tangible Value Pre-Financing | | $ | 1,707,240 | | | $ | 1,707,240 | | | $ | 1,707,240 | |

| Net Tangible Value Post-Financing | | $ | 1,872,240 | | | $ | 2,097,240 | | | $ | 2,547,240 | |

| Shares Issued and Outstanding - Pre-Financing | | | 851,631,990 | | | | 851,631,990 | | | | 851,631,990 | |

| Shares Issued and Outstanding - Post-Financing | | | 866,631,990 | | | | 881,631,990 | | | | 911,631,990 | |

| Net Tangible Value Per Share - Pre-Financing | | $ | 0.0020 | | | $ | 0.0020 | | | $ | 0.0020 | |

| Increase/Decrease per Share Attributable to New Investors | | $ | 0.0002 | | | $ | 0.0004 | | | $ | 0.0008 | |

| Net Tangible Value Per Share - Post-Financing | | $ | 0.0022 | | | $ | 0.0024 | | | $ | 0.0028 | |

| Dilution to New Investors | | $ | (0.0128 | ) | | $ | (0.0126 | ) | | $ | (0.0122 | ) |

Another important way of looking at dilution is the dilution that happens due to future actions by the company. The investor's stake in a company could be diluted due to the company issuing additional shares. In other words, when the company issues more shares, the percentage of the company that you own will go down, even though the value of the company may go up. You will own a smaller piece of a larger company. This increase in number of shares outstanding could result from a stock offering (such as an initial public offering, a venture capital round, angel investment), employees exercising stock options, or by conversion of certain instruments (e.g. convertible bonds, convertible notes, preferred shares or warrants) into stock. If the company decides to issue more shares, an investor could experience value dilution, with each share being worth less than before, and control dilution, with the total percentage an investor owns being less than before.

The Company has authorized and issued two classes of shares of stock, namely Common Stock and Preferred Stock. Therefore, all of the Company's current shareholders and the investors in this Offering will experience the same dilution if the company decides to issue more shares in the future.

NOTE: As of the date of this offering, none of the Preferred stock has been issued.

ITEM 4. PLAN OF DISTRIBUTION

We are offering a maximum of 60,000,000 Common Shares with no minimum, on a best-efforts basis. We will sell the shares ourselves and do not plan to use underwriters or pay any commissions. We will be selling our shares using our best efforts and no one has agreed to buy any of our shares. This prospectus permits our existing, and future, officers, and directors to sell the shares directly to the public, with no commission or other remuneration payable to them for any shares they may sell. There is currently no plan or arrangement to enter into any contracts or agreements to sell the shares with a broker or dealer. Our officers and directors will sell the shares and intend to offer them to friends, family members and business acquaintances. There is no minimum amount of shares we must sell; so no money raised from the sale of our shares will go into escrow, trust or another similar arrangement.

The shares are being offered by Company Management. Management will be relying on the safe harbor in Rule 3a4-1 of the Securities Exchange Act of 1934 to sell the shares. No sales commission will be paid for shares sold by Management and Management is not subject to a statutory disqualification and is not associated persons of a broker or dealer.

Additionally, Management primarily performs substantial duties on behalf of the registrant other than in connection with transactions in securities. No one in Management has been a broker or dealer or an associated person of a broker or dealer within the preceding 12 months and they have not participated in selling an offering of securities for any issuer more than once every 12 months other than in reliance on paragraph (a)4(i) or (a)4(iii) of Rule 3a4-1 of the Securities Exchange Act of 1934.

The Offering will terminate upon the earlier to occur of: (i) the sale of all 60,000,000 shares being offered, or (ii) 365 days after this Offering Circular is declared qualified by the Securities and Exchange Commission or (iii) or the decision by Company management to deem the offering closed.

No securities are being sold for the account of security holders; all net proceeds of this offering will go to the Company.

ITEM 5. USE OF PROCEEDS TO ISSUER

We estimate that, at a per share price of $0.015, the net proceeds from the sale of the 60,000,000 shares in this Offering will be approximately $900,000, after deducting the estimated offering expenses of approximately $60,000.

We will utilize the net proceeds from this offering to identify and acquire business opportunities and to develop our products. Some funds will be used for operating expenses and other expenses.

Accordingly, we expect to use the net proceeds, estimated as discussed above as follows, if we raise the maximum offering amount:

| Maximum Offering Amount | | | Percentage | | Property Acquisition |

| $ | 180,000 | | | | 20 | % | | Acquisition Costs (1) |

| $ | 171,000 | | | | 19 | % | | Development Costs |

| $ | 489,060 | | | | 54.34 | % | | Working Capital |

| $ | 60,000 | | | | 6.66 | % | | Offering Expenses (2) |

| (1) | “Acquisition Costs” are costs related to the selection and acquisition of opportunities, including financing, and closing costs. These expenses include but are not limited to travel and communications expenses, legal and accounting fees, and miscellaneous expenses. The presentation in the table is based on the assumption that we will always finance the acquisition of opportunities whenever posable. |

| (2) | Offering Expenses include projected costs for Legal and Accounting, Publishing/Edgar, and Transfer Agents Fees. |

The above figures represent only estimated costs. This expected use of net proceeds from this offering represents our intentions based upon our current plans and business conditions. The amounts and timing of our actual expenditures may vary significantly depending on numerous factors, including the status of and results from operations. As a result, our management will retain broad discretion over the allocation of the net proceeds from this offering. We may find it necessary or advisable to use the net proceeds from this offering for other purposes, and we will have broad discretion in the application of net proceeds from this offering. Furthermore, we anticipate that we will need to secure additional funding for the fully implement our business plan.

The Company reserves the right to change the above use of proceeds if management believes it is in the best interests of the Company.

ITEM 6. DESCRIPTION OF BUSINESS

Our Company

On April 03, 2022, the Company closed the acquisition of 100% of Kaya LLC in exchange for 797,310,985 shares of Company common stock. Following the merger, the Company became a multifaceted cannabis lifestyle company deriving globally diverse revenue streams from a portfolio of powerful brands, and operations delivering quality at scale. Kaya operates a store in Kingston, one in the historic town of Falmouth, and its flagship retail store and farm operations in the tourism Mecca that is Ocho Rios. Kaya plans to open its first Wellness Center at The Gap, located in the pristine hills of the Blue Mountains, in August 2022. Kaya Herb House Drax Hall was the first legal Medical Marijuana dispensary in Jamaica and offers tours of Kaya Farm, which has a variety of over 75 different genetics being cultivated and processed. Our retail complex includes Kaya Herb House with Dab Bar & Consumption Lounge on premise. Our famous Square Grouper Bar hosts an impressive lineup of reggae acts on a regular basis. NUGL features media assets such as NUGL Magazine and NUGL TV, which has in and out of network shows such as Lil Eazy-E TV Pod Cast hosted by LiL Eazy-E. NUGL App highlights profiles for businesses in all sectors of the cannabis industry, including retail stores, brands, services, events, & more. Our platform allows businesses to build and structure detailed items within our global menu, aiding connections between business and consumer communities through targeted networking and enabling a variety of advertising opportunities to expand reach. NUGL uses its own servers, software, and proprietary technology.

Acquisition of Kaya LLC

On April 3, 2022, the Company acquired 100% of Kaya LLC in exchange for 797,310,985 shares of company common stock. The Company has appointed Bali Vaswani, Chairman and CEO of Kaya, as its CEO. CJ Melone, CEO of NUGL Inc., was appointed Chief Operating Officer and interim Chief Financial Officer of the combined companies, with a responsibility to build out the Kaya brand through established partnerships in key markets.

Kaya was the first to open a medical cannabis location in Jamaica in March 2018 and has established itself as a leading supplier and supporter of medical cannabis throughout the Caribbean. Its diverse operations include a licensed cultivation facility, processing facility, 3 retail herb houses, and one ganja franchise in Punta Del Este, Uruguay. Cannabis analytics firm Headset projects legal U.S. cannabis sales to surpass $30 billion this year and reach $45.8 billion by 2025. In addition to the U. S. market, Jamaica and the other Caricom countries are considered to be one of the fastest growing cannabis markets. In April 2015, the Government of Jamaica amended the Dangerous Drugs Act (DDA) to decriminalize cannabis possession, legalize home cultivation for medicinal, spiritual and sacramental use, and create a new, licensed industry for medical cannabis and hemp. In addition to this landmark legislation, a number of Caricom (Caribbean Community) countries are exploring the use of cannabis in health and wellness

Principal Products or Services, and their Markets

4 Retail Locations

Kaya is currently offering three retail locations, one consumption lounge, one maintaining facility and product/brand launch in Southern California. The Kaya name has become global and a leader in the cannabis community. Each retail facility features food, drink, retail and venue capabilities creating a lifestyle atmosphere. Kaya is not only known for its stronghold in cannabis, also known throughout Jamacia for their pizza and a breadth of merchandise.

Kaya is a leading designation and brand in all of Jamaica. Kaya has successfully gained local market share and brand recognition, while tapping into over 5MM Jamaican travelers per year. Kaya has cross marketed the client base selling cannabis, cannabis related items, food, drink, and venue activities while growing the brand. Kaya has combined sales of over 2.2M a year with a breakdown of 75% of cannabis driver product, 10% of merchandise and good, 15% of food and drink. The cost of customer acquisition has been greatly reduced by creating a destination and venue for customers that enjoy all product types and services.

Kaya Herbhouse Draxhall

On March 10, 2018, Kaya Group opened its first retail facility store located at Volume 1128 Folio 151, Greenwich Park, St. Ann’s Bay, Jamaica and had its 1st first legal sale of cannabis and the opening of its café, pizzeria, and bar. Located in an area of mixed residential and commercial properties, the Herbhouse is easily accessible to the local public and passersby alike. It offers a tranquil environment that customers can feel relaxed while enjoying our medicinal, food and beverage offerings.

Kaya Herbhouse Falmouth

Kaya Group then opened its 2nd retail facility store located at Volume 128 Folio 57, 1 Trelawny Street, Falmouth, Jamaica, and commenced trading on February 20, 2019, with its first legal sale of cannabis and the opening of its café, pizzeria, and bar. The smallest of our 3 current locations, our Falmouth store is nestled within the confines of the historic town, close to the cruise shipping pier.

Kingston Herbhouse Kingston

The third retail facility store located at 82 Lady Musgrave Road, Kingston, Jamaica, commenced trading on December 19, 2019, with its first legal sale of cannabis and the opening of its café, pizzeria, and bar. This retail location has come to be known as a hotspot for the people of Kingston and its business district. The relaxing atmosphere combined with large open spaces allow for customers to really unwind. The location is also used to host events such as parties and live music shows.

Kaya Farms

Located at Paddock 5 Bottom Pear Tree Greenwich Park, Draxhall St. Ann. The company was incorporated on March 8, 2016, and began trading in 2018. In December 2017, the company was granted a retail cultivator’s license The company facilitated the 1st legal harvest in Jamaica on February 20, 2018, and commenced trading on the 26th of February in the same year, with its first legal sale from farm to retail herb house in Draxhall. The farm sits on an adjacent parcel of 481,140 sq. ft of land with only 46,200 sq being used and is close to our flagship retail store at Greenwich Park, St. Ann’s Bay, and can cultivate between 4,047 – 20, 235 square meters of land with ganja for medical, scientific and therapeutic purposes.

Extraction

Kaya Extracts is located at Volume 1128 Folio 151, Paddock Bottom Pear Tree, Greenwich Park, St. Ann’s Bay, and currently holds a Tier 1 Processor’s License and can process ganja for medical, scientific, and therapeutic purposes, including the manufacturing of ganja-based products, in a space of up to 200 square meters. Our extraction operations provide our customers with the very best products, using a combination of knowledge, skill, and the best raw materials. Satisfaction guaranteed!

Blue Maintain (under construction)

When opened, The Gap location will provide our customers with not only our quality products, but of pristine views and a serene environment, with wellness in mind. Located in the hills of the Blue Mountains, this store will not fail to remind everyone of the beauty of nature and our need to preserve it.

NUGL Magazine

NUGL Magazine was launched in 2019 as a digital and print publication about cannabis lifestyle and happenings. NUGL Magazine covers the cannabis industry’s biggest news and how it affects our community. Our global contributors share real-life stories about current cannabis issues and events. We share bios, news, and advice straight from those who are actively participating in and shifting the cannabis industry. Whether it’s original compelling content or fan submissions, we seek to offer you the hippest trends, latest legislation, newest products, and best of everything in the cannabis world! We also publish a print version

NUGL TV/LIVE

NUGL TV was launched in 2020 as an is an in-house video hosting and streaming platform featuring in-house and third-party content. The NUGL TV podcast & NUGL LIVE stream, hosted by Bigg A of Rich & Ruthless and Jessica Serrano, introduce cannabis business owners, brands, and influencers to our fans in an exciting new live streaming format. Make sure to check back for the newest episode of NUGL TV airing right here, sooner than you think! NUGL TV and all video content is now hosted on our own servers and distributed by our own technology. We developed our platform to protect our intellectual property and content without interference or influence. We believe in free speech and respect the opinions of everyone. NUGL.com and NUGL TV are committed to supporting the truth about cannabis. For the people, by the people.

NUGL Online Store

The NUGL online store launched in 2022. The store features merchandise collections of the latest cannabis and lifestyle brands. Our store links with each business profile offering companies to expound there product line and revenue streams.

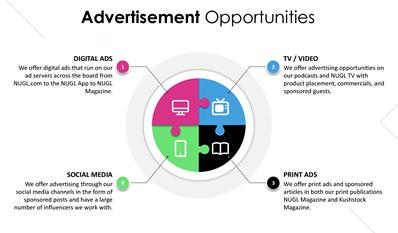

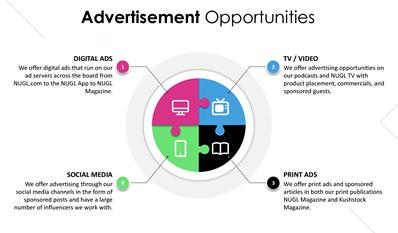

Advertisement Opportunities and Ad Server

NUGL offers print, digital and video advertisement opportunities. Our advertising platform is unbiased and uncensored for the cannabis community. Get your digital advertisements front and center across all NUGL platforms with the NUGL Ad Server. We’ll place your digital ads on NUGL.com, the NUGL App, NUGL Magazine, and NUGL TV. Your ads can link directly to your NUGL profile page or whichever external location you’d like. Unlike Google or Facebook we do not have biased censorship laws blocking your cannabis related ads from being displayed. With the NUGL Ad Server your ads will always be visible and never censored or removed.

Revenue Model

NUGL has created an in-house ad server that will allow us to run digital ads on all of our platforms as well as integrate it into any other 3rd party websites as well. NUGL will generate revenue on a monthly basis through the sale of provider listings and advertising revenue. We currently offer an array of packages ranging in price which can include, Homepage Takeover, geographic targeting, self-service sign up, and email support. We also offer digital Magazine Ads. Given high growth in the cannabis industry, new businesses are entering the market daily. We believe we can reach 100% of the addressable market with our platform, while charging 20% of the rates our competition is charging and while offering more features.

Tax Treatment of Registrant and its Security Holders.

We are a publicly traded company and investment typically takes the form of Common Stock as the final delivered asset. Therefore, we operate as a C corporation. As such, our profits are taxable at corporate level and dividends, if any, are taxable at individual level. These are typically taxed as a capital gain or dividend.

Competition

The marijuana market is highly competitive. We will compete in all of our markets with other owners and operators of single and multi-location operators. We will compete based on a number of factors that including experienced management and capital availability. As a public company, the Common Stock as a viable financial exit is attractive to small marijuana business owners.

We will compete with many third parties engaged in marijuana investment activities including REITs, specialty finance companies, hedge funds, investment banking firms, lenders, and other entities. There are also REITs with asset acquisition objectives similar to ours and others may be organized in the future. Some of these competitors have substantially greater marketing and financial resources than we will have and generally may be able to accept or manage more risk than we can prudently manage, including risks with respect to the businesses being acquired. In addition, these same entities may seek financing through the same channels that we do. Therefore, we will compete for investors and funding in a market where funds for marijuana businesses investment may decrease or grow less than the underlying demand.

Competition may limit the number of suitable investment opportunities offered to us and result in higher prices, making it more difficult for us to acquire new investments on attractive terms. In addition, competition for desirable investments could delay the investment of net proceeds from this offering in desirable assets, which may in turn reduce our cash flow from operations and negatively affect our ability to make or maintain distributions.

Government Regulation

Our business is subject to many laws and governmental regulations. Changes in these laws and regulations, or their interpretation by agencies and courts, occur frequently.

Investment Company Act of 1940

We intend to conduct our operations so that we are not required to register as an investment company under the Investment Company Act of 1940, as amended, or the 1940 Act.

Environmental Matters

Many marijuana products may contain or have been made with toxic substances as part of their processing and/or extraction processing. This may require specific zoning and environmental regulations at the State, local and Federal level. The Company may be held liable under these regulations when making acquisitions. These laws and liabilities may be extended to the Company’s employees.

Under various federal, state, and local laws, ordinances, and regulations, a current or previous owner or operator of real property may be held liable for the costs of removing or remediating hazardous or toxic substances. These laws often impose clean-up responsibility and liability without regard to whether the owner or operator was responsible for, or even knew of, the presence of the hazardous or toxic substances. The costs of investigating, removing, or remediating these substances may be substantial, and the presence of these substances may adversely affect our ability to rent or sell the property or to borrow using the property as collateral and may expose us to liability resulting from any release of or exposure to these substances. If we arrange for the disposal or treatment of hazardous or toxic substances at another location, we may be liable for the costs of removing or remediating these substances at the disposal or treatment facility, whether or not the facility is owned or operated by us. We may be subject to common law claims by third parties based on damages and costs resulting from environmental contamination emanating from a site that we own or operate. Certain environmental laws also impose liability in connection with the handling of or exposure to asbestos-containing materials, pursuant to which third parties may seek recovery from owners or operators of real opportunities for personal injury associated with asbestos-containing materials and other hazardous or toxic substances.

Other Regulations

The opportunities we acquire likely will be subject to various federal, state, and local regulatory requirements, such as zoning and state and local fire and life safety requirements. Failure to comply with these requirements could result in the imposition of fines by governmental authorities or awards of damages to private litigants. We generally will acquire opportunities that are in material compliance with all regulatory requirements. However, there can be no assurance that these requirements will not be changed or that new requirements will not be imposed which would require significant unanticipated expenditures by us and could have an adverse effect on our financial condition and results of operations.

Employees

Currently, the company has sixty four (64) full time employees. The company may hire a number of employees as needed after effectiveness of this offering primarily to support our acquisition and development efforts.

Legal Proceedings

We know of no existing or pending legal proceedings against us, nor are we involved as a plaintiff in any proceeding or pending litigation. There are no proceedings in which any of our directors, officers or any of their respective affiliates, or any beneficial stockholder, is an adverse party or has a material interest adverse to our interest.

ITEM 7. DESCRIPTION OF PROPERTY

Our principal offices are located at 13771 Roswell Ave Suite F, Chino, CA 91701 The office is leased at a cost of $2,200.00 per month. Our subsidiary has several leases in Jamaica as follows: Farm -USD$4000 monthly scheduled for increase in September 2022, Draxhall -GBP 425 monthly, Falmouth - USD$1,495 monthly, and Kingston- USD$9,200 monthly subject to increase. We do not currently lease or own any other real property.

ITEM 8. MANAGEMENTS DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion of our financial condition and results of operations should be read in conjunction with the financial statements and related notes to the financial statements included elsewhere in this Report. Some of the statements under “Management’s Discussion and Analysis,” “Description of Business” and elsewhere herein may include forward-looking statements which reflect our current views with respect to future events and financial performance. These statements include forward-looking statements both with respect to us specifically and our industry in general. Statements which include the words “expect,” “intend,” “plan,” “believe,” “project,” “anticipate,” “will,” and similar statements of a future or forward-looking nature identify forward-looking statements for purposes of the federal securities laws or otherwise. The safe harbor provisions of the federal securities laws do not apply to any forward-looking statements contained in this Report. All forward-looking statements address such matters that involve risks and uncertainties. Accordingly, there are or will be important factors that could cause our actual results to differ materially from those indicated in these statements. We undertake no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise. If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may vary materially from what we projected. Any forward-looking statements you read herein reflect our current views with respect to future events and are subject to these and other risks, uncertainties and assumptions relating to our written and oral forward-looking statements attributable to us or individuals acting on our behalf and such statements are expressly qualified in their entirety by this paragraph.

General