| ||||||||

SECURITIES AND EXCHANGE COMMISSION | ||||||||

FORM 10-K/A | ||||||||

(Mark One) | ||||||||

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||

| FOR THE FISCAL YEAR ENDED APRIL 30, 2008 | |||||||

OR | ||||||||

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||

| FOR THE TRANSITION PERIOD OF __________________ TO________________ | |||||||

| ||||||||

| ||||||||

OILSANDS QUEST INC. | ||||||||

(Exact name of Registrant as specified in its charter) | ||||||||

| ||||||||

Colorado |

| 98-0461154 | ||||||

State or other jurisdiction of incorporation or organization |

| (I.R.S. Employer Identification No.) | ||||||

| ||||||||

205, 707-7th AVENUE SW, CALGARY, ALBERTA, CANADA T2P 3H6 | ||||||||

(Address of principal executive offices) | ||||||||

| ||||||||

Issuer’s telephone number, including area code: (403) 263-1623 | ||||||||

| ||||||||

Securities registered or to be registered pursuant to Section 12(b) of the Act: | ||||||||

| ||||||||

Title of Each Class |

| Name of Each Exchange on Which Registered | ||||||

Common Stock, $.001 Par Value |

| The American Stock Exchange | ||||||

Two Year Warrants Issued 2007 |

| The American Stock Exchange | ||||||

| ||||||||

Securities registered or to be registered pursuant to Section 12(g) of the Act: None | ||||||||

| ||||||||

Indicate by check mark if the registrant is a well known, seasoned issuer, as defined in Rule 405 of the Securities Act: | ||||||||

Yes x | No o |

| ||||||

| ||||||||

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act: | ||||||||

Yes o | No x |

| ||||||

| ||||||||

Check whether the Issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | ||||||||

Yes x | No o |

| ||||||

| ||||||||

Check here if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-K contained in this form, and no disclosure will be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. | ||||||||

Yes o | No x |

| ||||||

| ||||||||

Large Accelerated Filer: x | Accelerated filer: o | Non-accelerated filer: o | Smaller reporting company: o | |||||

| (Do not check if a smaller reporting company) |

| ||||||

| ||||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES o NO x | ||||||||

| ||||||||

The aggregate market value of the common stock held by non-affiliates of the Registrant as of October 31, 2007 was approximately $1,026,140,269 based upon the closing sale price of the Registrant’s Common Stock on such date. As of June 16, 2008 there were 226,848,719 shares of common stock issued and outstanding. | ||||||||

This Amendment No. 1 on Form 10-K/A (this “Amendment”) amends the Annual Report on Form 10-K for the year ended April 30, 2008, filed on June 27, 2008 (the “Original Filing”). Oilsands Quest Inc. (the “Company”) has filed this Amendment to remove all information relating to our bitumen resources, to include selected quarterly financial data required to be disclosed under Item 302 of Regulation of S-K which was inadvertently omitted from the Original Filing and to remove, pursuant to Rule 3-20 of Regulation S-X, the Canadian dollar disclosures that were previously included in our Note 4-Property and Equipment to the Financial Statements.

Other information contained herein has not been updated. Therefore, this Amendment should be read together with other documents that the Company has filed with the Securities and Exchange Commission subsequent to the filing of the Original Filing. Information in such reports and documents updates and supersedes certain information contained in this Amendment. The filing of this Amendment shall not be deemed an admission that the Original Filing, when made, included any known, untrue statement of material fact or knowingly omitted to state a material fact necessary to make a statement not misleading.

2

Page | |||

2 | |||

4 | |||

5 | |||

|

| ||

PART I | 5 | ||

| 5 | ||

| 20 | ||

| 28 | ||

| 32 | ||

| 32 | ||

|

|

| |

PART II |

| 32 | |

| 32 | ||

| 37 | ||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 38 | |

| 47 | ||

| 47 | ||

| CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 47 | |

| 47 | ||

| 48 | ||

|

|

| |

PART III |

| 49 | |

| 49 | ||

| 53 | ||

| 63 | ||

| 66 | ||

|

|

|

|

PART IV |

| 67 | |

| 67 | ||

| 68 | ||

3

This Annual Report on Form 10-K includes certain statements that may be deemed to be “forward-looking statements.” All statements, other than statements of historical facts, included in this Form 10-K that address activities, events or developments that our management expects, believes or anticipates will or may occur in the future are forward-looking statements. Such forward-looking statements include discussion of such matters as:

| • | the amount and nature of future capital, development and exploration expenditures; |

| • | the timing of exploration activities; |

| • | business strategies and development of our business plan and drilling programs; |

| • | potential estimates as to the volume and nature of petroleum deposits that are expected to be found present when lands are developed in a project; and |

| • | potential reservoir recovery optimization processes. |

Forward-looking statements are statements other than relating to historical fact and are frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “potential”, “prospective” and other similar words or statements that certain events or conditions “may” “will” or “could” occur. Forward-looking statements such as references to Oilsands Quest’s drilling program, geophysical programs, reservoir field testing and analysis program, preliminary engineering and economic assessment program for a first commercial project, and the timing of such programs are based on the opinions and estimates of management and the company’s independent evaluators at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements, which include but are not limited to risks inherent in the oil sands industry, regulatory and economic risks, lack of infrastructure in the region in which the company’s resources are located and risks associated with the company’s ability to implement its business plan. Oilsands Quest undertakes no obligation to update forward-looking information if circumstances or management’s estimates or opinions should change, except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements.

4

Unless otherwise specified, all dollar amounts are expressed in United States dollars. All future payments in Canadian dollars have been converted to United States dollars using an exchange rate of $1.00 U.S. = $1.0095 CDN, which was the April 30, 2008 exchange rate.

PART I

When we use the terms “Oilsands Quest Inc.”, the “Company,” “we,” “us,” “our,” or “OQI,” we are referring to Oilsands Quest Inc. and its subsidiaries, unless the context otherwise requires. We have included technical terms important to an understanding of our business under “Glossary of Common Terms” at the end of “Item 1. Description of Business”. Throughout this document we make statements that are classified as “forward-looking.” Please refer to the “Cautionary Statement about Forward-Looking Statements” section at the front of this document for an explanation of these types of assertions.

Background and Corporate Structure

We are a Colorado corporation formed on April 3, 1998 as Uranium Power Corporation. On November 2, 2004 we changed our name to CanWest Petroleum Corporation. On October 31, 2006 we changed our name to Oilsands Quest Inc. Our principal executive office is located at 205, 707 – 7th Avenue S.W., Calgary, Alberta, Canada T2P 3H6. Our website is www.oilsandsquest.com.

The Company operates through its subsidiary corporations and conducts limited joint venture activities directly. Our primary operating subsidiary is Oilsands Quest Sask Inc. (“OQI Sask”), an Alberta corporation. OQI Sask was established as an operating subsidiary of the Company primarily to explore for and develop oil sands deposits in the provinces of Saskatchewan and Alberta. We currently own 100% of the issued and outstanding voting common shares of OQI Sask following the acquisition of the non-controlling (minority) interest of OQI Sask on August 14, 2006. Following this acquisition, our Board of Directors was reorganized and the executive team of OQI Sask was appointed as the Company’s executive team.

In addition to OQI Sask, we also have the following subsidiaries:

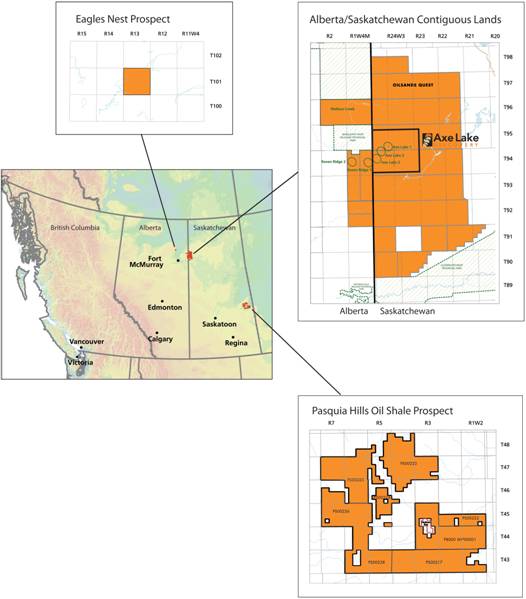

| • | We own 100% of Township Petroleum Corporation (“Township”), an Alberta corporation. Township owns an oil sands lease in the Province of Alberta acquired in 2005, (referred to as the Eagles Nest Prospect), and is currently developing plans for exploring the oil sands potential on the lease. |

| • | We own 100% of Western Petrochemicals Corp. (“WPC”), an Alberta corporation. WPC formerly owned certain rights relating to exploration for oil shale, referred to as the Pasquia Hills Oil Shale Prospect, and is currently inactive. |

| • | We own 100% of Stripper Energy Services Inc. (“Stripper”), acquired in 2007 and currently a wholly- owned subsidiary of OQI Sask. |

| • | We own 100% of 1291329 Alberta Ltd., incorporated in 2007 to own assets related to camp facilities and equipment. |

| • | We own 100% of Oilsands Quest Technology Inc., incorporated in 2007 to assess technologies related to bitumen and shale oil extraction and to ensure any proprietary information created from the development of our prospects can be commercially exploited. Since incorporation, this subsidiary has been focused on assessing technologies related to the extraction of bitumen and planning research for the development technologies applicable for the extraction of resources from its lands. |

| • | We owned 100% of Anhydride Petroleum (USA) Inc. (“Anhydride USA”) and Anhydride USA’s wholly owned subsidiary, Anhydride Petroleum (Canada) Inc. (“Anhydride Canada”), both acquired April 30, 2002. On October 31, 2005 Anhydride Canada was sold to a third party for nominal cash proceeds, and on October 12, 2007 Anhydride Petroleum (USA) Inc. was dissolved. |

Strategy

Our strategy is to focus on business opportunities in the oil and gas sector and in particular the oil sands and oil shale sectors in Western Canada with the objective of maximizing value on a per share basis. We will execute our strategy by:

| • | Selectively identifying and acquiring key targets in the oil sands and oil shale sectors. We have amassed one of the largest contiguous land positions in the oil sands industry in Canada along with a significant oil shale land position in Saskatchewan. We have an undivided, 100% interest in each of the permits, licenses and leases held. |

| • | Exploring and delineating resources on our lands. Our operating teams have conducted extensive exploration programs, consisting of drilling 349 exploration and delineation wells, conducting 1,847 kilometres of 2-D and 3-D seismic surveys, and other exploration activities resulting in the Axe Lake and Raven Ridge Discoveries and the identification of multiple other oil sands prospects. We manage and operate all of our activities. |

| • | Exploiting the oil sands resources identified. We are focused on the development of the Axe Lake Discovery and are in the process of conducting a comprehensive reservoir test program to select the optimal recovery processes that will be utilized to produce bitumen from the Axe Lake Discovery. Our development strategy includes considering partners on a joint venture basis on specific projects to accelerate the development of such projects in a timely and responsible manner. |

Our business plan is to focus on the exploration, delineation and exploitation of bitumen resources on our oil sands exploration permits, licenses and lease located in the provinces of Saskatchewan and Alberta. In the present market we also view our oil shale prospects as having significant long-term potential value.

General Development of the Business

Initially our primary business activity was the exploration for uranium and petroleum in Canada. However, during the year ended April 30, 2003 we wrote off our investments in the uranium resource properties as we had no further plans to develop them. We then began to actively seek new business opportunities in the oil and gas sector.

Over the past five years, the Company has focused primarily on business opportunities in the oil and gas sector and in particular the oil sands and oil shale sectors in Western Canada. The Company has grown its asset base by acquiring exploration rights for oil sands and, to a lesser extent, oil shale in the provinces of Saskatchewan and Alberta.

Acquisition of Oil Sands Exploration Rights

Oil sands permits and licenses in Saskatchewan

On September 24, 2004 we acquired all of the issued and outstanding shares of 808099 Alberta Ltd., which was previously inactive, and on November 3, 2004 this company changed its name to Oilsands Quest Inc. On November 1, 2006, this entity changed its name to Oilsands Quest Sask Inc. Following external issuances of equity by OQI Sask, at July 31, 2006 we owned 64.08% of the shares of common stock of OQI Sask. On August 14, 2006, we closed a reorganization agreement with OQI Sask, which was executed on June 9, 2006, whereby we acquired the non-controlling (minority) interest in OQI Sask, increasing from a 64.08% ownership interest to a 100% voting interest (the “Reorganization Agreement” or the “Reorganization”). In connection with the Reorganization Agreement, we also entered into a Voting and Exchange Trust Agreement with OQI Sask and Computershare Trust Company of Canada (“CTC”), and a Support Agreement with OQI Sask. Collectively, these agreements are referred to as the “Acquisition Agreements”.

In accordance with the Acquisition Agreements, all OQI Sask common shares other than those held by us were exchanged for a new class of OQI Sask shares called Exchangeable Shares pursuant to a ratio of one OQI Sask common share to 8.23 Exchangeable Shares. The Exchangeable Shares are exchangeable at any time on a one-for-one basis, at the option of the holder, for shares of our common stock. An Exchangeable Share provides a holder with economic terms and voting rights which are, as nearly as practicable, equivalent to those of a share of our common stock. Holders of Exchangeable Shares have registration rights with respect to the resale of our common stock to be received upon exchanging the Exchangeable Shares into our shares. The holders of the Exchangeable Shares will receive up to an aggregate of 76,504,304 shares of our common stock at each holder’s election. The Exchangeable Shares are represented for voting purposes in the aggregate by one share of our Series B Preferred Stock (the “Preferred Share”), which Preferred Share is held by CTC. CTC will in turn vote the one Preferred Share as indicated by the individual holders of Exchangeable Shares. The one Preferred Share represents a number of votes equal to the total outstanding Exchangeable Shares on the applicable record date for the vote submitted to our shareholders. At April 30, 2008 35,054,264 shares of common stock had been issued on exchange of Exchangeable Shares and 41,450,040 shares of common stock remain to be issued on future exchanges of Exchangeable Shares.

On September 29, 2004 OQI Sask acquired a 49% interest in certain oil shale exploration permits that covered approximately 2,000 square miles (1,400,000 acres) in northwestern Saskatchewan along the Alberta border. The 49% interest in the permits was acquired for $769,125, plus 50,000 shares of our common stock and a 2.5% gross overriding royalty (the “2.5% GORR”). In order to finance the purchase of the 49% interest, OQI Sask borrowed funds from the Company in the form of a convertible debenture. On November 18, 2005, the principal and accrued interest on the debenture was converted into 788,769 shares of common stock of OQI Sask.

We entered into an agreement dated November 8, 2004, as amended (the “WCM Agreement”), to acquire all of the shares of Western Canadian Mint Inc. (“WCM”), a company that owned all of the shares of American Oilsands Company Inc., which owned the remaining 51% working interest in the permits, subject to a $0.07 per barrel royalty which could be bought at any time by paying $7,000,000 and a $0.04 per barrel royalty held by various arm’s-length parties. Prior to completing this acquisition, we assigned all of our rights and obligations to OQI Sask pursuant to a letter agreement dated November 12, 2004 and an assignment dated April 27, 2005. As a result, on May 3, 2005, pursuant to the terms of the WCM Agreement, OQI Sask acquired all of the outstanding shares of WCM. The combined consideration paid by us and OQI Sask was $1,202,131, 2,000,000 shares of our common stock and the assumption of the $0.07 per barrel royalty which could be bought at any time by paying $7,000,000 and a $0.04 per barrel royalty held by various arm’s-length parties. WCM was then merged with OQI Sask.

As a result of these transactions, OQI Sask held an undivided 100% interest, subject to the above noted royalties, in Saskatchewan Oil Shale Exploration Permit Nos. PS00205, PS00206, PS00207, PS00208, PS00209, PS00210, PS00211, PS00212, PS00213, PS00214, PS00215, PS00216 and PS00217, granted originally on June 1, 2004. The permits were granted by the Province of Saskatchewan in 2004 under the Oil Shale Regulations, 1964 as amended, revised or substituted from time to time, for a term of five years. The permits provide for the right to explore and work the permit lands but not to remove, produce or recover, except for test purposes, oil products until a lease pursuant to these regulations has been granted. The term of the permits may be extended for up to three, one-year extensions subject to regulatory approvals, as required.

By agreement with the Saskatchewan government, we were required to relinquish at least 40% of the total acreage covered by the permits by the first anniversary date of the permits (May 31, 2005) and to relinquish a further 40% of the remaining acreage by the second anniversary date (May 31, 2006). OQI Sask relinquished 40% of the total acreage covered by the permits on May 31, 2005, and under an extension of the 2006 relinquishment completed the second relinquishment on July 9, 2007. As at April 30, 2007, the Saskatchewan permits comprised an area totaling 846,680 acres and following all relinquishments the Saskatchewan permits on July 9, 2007 comprised an area totaling 508,080 acres consisting of Saskatchewan Oil Shale Exploration Permit Nos. PS00205, PS00206, PS00208, PS00210, PS00212, PS00213 and PS00215.

The permits, when granted, were subject to annual rental payments and commitments to certain levels of expenditures annually pursuant to the terms of the permits and government regulations. The annual rentals were payable in advance as to $0.02 ($0.02 CDN) per acre for the first year and escalating to $0.10 ($0.10 CDN) per acre in the fifth year. On May 7, 2007, the Saskatchewan government updated the Oil Shale Regulations, 1964 requiring an increase to annual rentals of $0.10 ($0.10 CDN) per acre for the remaining term of the permits. The required exploration expenditures to hold the permits were also increased to $0.80 ($0.81 CDN) per acre for each of the remaining years of the permits and $1.20 ($1.21 CDN) per acre for each year that the permits are extended. The Company has paid all required annual rentals and complied with the annual exploration expenditure requirements.

On August 13, 2007 the Company acquired five oil sands licenses totaling 109,920 acres granted under the Petroleum and Natural Gas Regulations, 1969 (Saskatchewan), as amended, revised or substituted from time to time, for a term of five years for an aggregate cost of $2,140,233 ($2,249,089 CDN). The licenses provide for the exclusive right to search for oil sands on the lands granted and to win, recover, extract, carry off, dispose of and sell the oils sands products found on the license lands. The oil sands licenses provide the opportunity to convert up to 100% of the licenses to a production lease on the basis of one section of land for every well that intersects an oil sands zone. Licenses require annual rental payments of $0.70 ($0.71 CDN) per acre. The Company has paid all required annual rental payments for the licenses granted.

Gross Overriding Royalties on original Saskatchewan oil sands permit lands

As noted above, as part of the acquisition of the Saskatchewan permits, OQI Sask assumed the 2.5% GORR and a $0.04 per barrel royalty held by various arm’s-length parties.

On August 15, 2006 the Company closed a transaction with the shareholders of Stripper Energy Services Inc. (“Stripper”), a non-related inactive entity. The Company purchased all of the issued and outstanding shares of Stripper’s common stock for a total purchase price of $17,948,722 ($20,000,000 CDN), including the original option payment of $1,250,000 CDN. Stripper’s sole asset is the 2.5% GORR royalty on the permits. As a result of the transaction, the 2.5% GORR is now held by Stripper, a wholly-owned subsidiary of OQI Sask.

On September 21, 2007, in conjunction with the acquisition of the interests of an external joint venture partner to the Triple 7 Joint Venture described below, the Company acquired the $0.07 per barrel royalty obligation for consideration of $99,980 ($100,000 CDN) cash plus the issuance of 500,000 shares of its common stock valued at $2,195,000 based on the September 20, 2007 closing market price of the shares.

The Saskatchewan permits are now only subject to $0.04 per barrel royalty.

Oil sands permits and lease in Alberta

- Raven Ridge Prospect and Raven Ridge Discovery

During the year ended April 30, 2007, the Company acquired four oil sands permits totaling 67,053 acres (“Raven Ridge Prospect”) in a public offering of Crown Oil Sands Rights for an aggregate cost of $22,221,968 ($25,651,985 CDN). The permits were granted by the Province of Alberta under the terms of the Mines and Minerals Act, Alberta. The permits provide the opportunity to convert up to 100% of the permits to a production lease following the completion of specified work requirements. Permits are granted for a five-year primary term and require annual rental payments of $1.41 ($1.42 CDN) per acre. We funded the acquisition of some of the permits with a secured line of credit from a major Canadian bank pursuant to a Credit Agreement dated March 19, 2007. The line of credit was repaid on May 4, 2007 and all security was released.

The Raven Ridge Prospect is located in Alberta directly west of and contiguous to our Axe Lake Discovery lands on our oil sands permits in Saskatchewan. Following the evaluation of the 2007/2008 exploration program, we announced a discovery on the Raven Ridge Prospect.

- Wallace Creek Prospect

On January 23, 2008 the Company acquired two oil sands permits totaling 45,546 acres (“Wallace Creek Prospect”) in a public offering of Crown Oil Sands Rights (permits were officially granted on January 24, 2008). The total consideration paid for these permits was $9,732,500 ($10,010,880 CDN). The permits were granted by the Province of Alberta under the terms of the Mines and Minerals Act, Alberta. The permits provide the opportunity to convert up to 100% of the permits to a production lease following the completion of specified work requirements. Permits are granted for a five-year primary term and require annual rental payments of $1.41 ($1.42 CDN) per acre.

The Wallace Creek Prospect is located in Alberta directly west of and contiguous to our Axe Lake Discovery lands on our oil sands permits in Saskatchewan.

- Eagles Nest Prospect

On August 25, 2005 Township acquired Oil Sands Lease No. 7405080355 located in northern Alberta for $727,187 at an Alberta Crown land sale (“Eagles Nest Prospect”). This lease comprises an area of approximately 22,773 acres and is located in the Athabasca oil sands region in Alberta in Township 101, Range 13 West of the fourth Meridian. The lease provides for the right to drill for, win, work and recover and the right to remove bitumen resources from the lease for a term of 15 years, subject to the Mines and Minerals Act, Alberta.

Prior to bidding on the Eagles Nest Prospect, on June 1, 2005, Township entered into an agreement with three third parties (collectively the “Triple 7 Joint Venture”) to post, acquire, develop and produce oil sands deposits located in the Athabasca Region of Alberta, Canada (the “Triple 7 Joint Venture Agreement”). As a result of this agreement, Township acquired one lease consisting of approximately 22,800 acres (the “Eagles Nest Oil Sands Lease”) at a cost of $727,187. Pursuant to the terms of this agreement we issued the Triple 7 Joint Venture 114,015 of our shares of common stock with a fair value of $127,432. Township has also agreed to pay the Triple 7 Joint Venture partners, as ongoing fees, $148,588 ($150,000 CDN) in cash or in shares of our common stock (at the

discretion of the Company) on the first and second anniversary dates of the agreement. On the third anniversary date and each subsequent anniversary date of the agreement Township shall pay to the Triple 7 Joint Venture $445,765 ($450,000 CDN) until such time as the lease is surrendered or a commercial project has been identified. In the event that Township receives a feasibility study, conducted by an independent third party, which indicates that a commercial project is economic and wishes to construct a commercial project, Township is required to notify the Triple 7 Joint Venture. Upon commencement of construction of such a commercial project, Township shall pay to the Triple 7 Joint Venture the sum of $5,943,536 ($6,000,000 CDN). In addition to such payments Township has granted each of the three Triple 7 Joint Venture partners a royalty in the acquired leases of $0.03 ($0.03 CDN) on each barrel of crude bitumen produced, saved and sold or $148,588 ($150,000 CDN) per joint venture partner per year, whichever is greater. Such royalty is governed by the royalty procedure which stipulates, among other things, that the royalty will be secured by a lien, first charge or security interest on the royalty lands, and that the royalty is assignable or transferable subject to a right of first offer to Township. On September 21, 2007, in conjunction with the acquisition of the royalty described above, the Company acquired all of the rights of one of the three external joint venture partners for consideration of $49,939 ($50,000 CDN) plus the issuance of 250,000 shares of the Company’s common stock valued at $1,097,500 based on the September 20, 2007 closing market price of the shares. On June 17, 2008, we acquired the rights of the remaining external joint venture partners for aggregate consideration of $1,632,000 CDN and 640,000 shares of the Company’s common stock valued at $2,860,800 based on the May 29, 2008 closing market price of the shares. The Company’s obligations under the Triple 7 Joint Venture Agreement have therefore been eliminated.

To finance the acquisition of the Eagles Nest Prospect area in 2005 the Company issued convertible debentures pursuant to which Township also granted royalties of $0.0057 ($0.0058 CDN), net after a buy back, on each barrel of crude bitumen produced, saved and sold from the project. The convertible debentures have all been converted to common stock.

Pursuant to the terms of the lease Township’s annual lease rentals are $31,952 ($32,256 CDN). OQI Sask has paid all required annual rentals and the lease is in good standing.

Acquisition of Oil Shale Rights in Saskatchewan

- Pasquia Hills Oil Shale Prospect

On April 21, 2005 we acquired a 97.53% interest in Western Petrochemicals Corporation (“WPC”) through the issuance of 10,728,124 shares of our common stock and then in April 2006 increased our ownership to 100% by issuing 271,865 shares of our common stock to the remaining WPC shareholders. WPC held a 100% interest in exploration permits covering an area of approximately 337,775 acres granted under the provisions of the Oil Shale Regulations, 1964, as amended from time to time by the Province of Saskatchewan. The exploration permits were scheduled to expire in 2006, and during the year ended April 30, 2007, all of the original Pasquia Hills exploration permits held by WPC expired and were returned to the Saskatchewan government.

We reacquired nine exploration permits on the original Pasquia Hills oil shale prospect area from the Province of Saskatchewan in September and October 2006. In accordance with the terms of the new permits and following an initial assessment, we relinquished 30% of the total acreage of the granted permits within 90 days of the grant. We currently hold Oil Shale Permit Nos. PS00222, PS00223, PS00224, PS00225, PS00226, PS00237 and PS00238 granted under the Oil Shale Regulations, 1964, as amended or revised or substituted from time to time for five-year terms from the date of grants. The term of the permits may be extended for up to three one-year extensions subject to regulatory approvals, as required. The permits total 405,961 acres and are located near Hudson Bay, Saskatchewan. The permits provide for the right to explore, mine, quarry and work the permit lands, but not to produce or recover oil shale except for test purposes until a lease has been granted.

The annual rental payable in advance was $0.05 ($0.05 CDN) per acre for the first year and on May 7, 2007, the Saskatchewan government updated the regulations requiring annual rentals of $0.10 ($0.10 CDN) per acre for the remaining term of the permit. The required exploration expenditures to hold the permits were also increased to $0.40 ($0.40 CDN) per acre for the second year of the permits, $0.80 ($0.81 CDN) per acre for the last three years of the permits and $1.20 ($1.21 CDN) per acre for each year that the permit is extended, as required.

On August 13, 2007, we acquired one additional oil shale exploration permit granted under the Petroleum and Natural Gas Regulations, 1969 (Saskatchewan) as amended, revised or substituted from time to time for a term of five years totaling 83,769 acres in the same area near Hudson Bay, Saskatchewan. This permit, together with the nine exploration permits acquired in September and October 2006 as described above, are collectively referred to as the “Pasquia Hills Oil Shale Prospect”. The permit provides for the right, license, privilege and authority to explore for oil shale within the permit lands. The term of the permit may be extended for up to three one-year extensions subject to regulatory approvals, if required. This oil shale permit was acquired under a land sale work

commitment bid for the first two years of the permit. The Company bid a total work commitment of $298,730 ($301,568 CDN) to be incurred during the first two years of the permit and the permit requires a further work commitment of $0.80 ($0.81 CDN) per acre for the last three years and $1.20 ($1.21 CDN) for each extension year plus annual rental payments of $0.10 ($0.10 CDN) per acre. We have paid the required annual rental payments to maintain this permit in good standing and our planned exploration program in 2008 will comply with our expenditure requirements.

The key challenge to producing kerogen (shale oil) on a commercial basis lies in finding an economic process. No field operations were carried out on the Pasquia Hills oil shale prospect during the year as we concentrated our efforts on internally evaluating the oil shale potential of our permit lands.

Activities to Date

Oil sands permits and licenses

Exploration of our Saskatchewan oil sands permits commenced in the winter of 2005/2006. An exploration drilling program consisting of 24 resource delineation wells was completed by April 2006. In August 2006 the Company received the independent geological consultants’ assessment of in-place volumes of bitumen in the area covered by the winter 2005/2006 exploration program. The assessment, prepared by Norwest Corporation of Calgary, was made in accordance with the Canadian Oil and Gas Evaluation Handbook (“COGEH”), which is a primary reference for reporting resources under Canadian Securities Administrators National Instrument 51-101 Standards of Disclosure for Oil and Gas Activities (“NI 51-101”). The area covered in the assessment represented approximately 1.4 percent of the Saskatchewan oil sands permits of approximately 508,000 acres. The End of Season Report for the winter 2005/2006 exploration drilling program documenting conformance with the original plans and summarizing the environmental effects of the program, impacts, socio-economic benefits, reclamation and mitigative actions was prepared and submitted to the adjacent communities, aboriginal groups and Canadian federal and provincial governments.

Beginning in July 2006 site infrastructure development activities, including road construction, drill pad preparation and camp construction, were undertaken, and the application for the winter 2006/2007 exploration program, including the installation of an airstrip, was submitted.

In October 2006, an approximately 5-kilometre (3-mile), 2-D geophysical program was successfully completed, demonstrating that seismic techniques could contribute to the planned exploration program. In November 2006 exploration drilling began with one drilling rig and by the end of the month three drilling rigs were working on the site. These three rigs drilled continuously until the scheduled Christmas break on December 21, 2006. Drilling recommenced in early January 2007 with four rigs and by the end of February 2007, a total of eight rigs were in place and drilling. Three residential camps with a total camp capacity of over 200 persons supported the needs of the 2006/2007 exploration program. Approval for the airstrip was received in late February 2007 and construction began in early March 2007. The winter 2006/2007 drilling season ended on March 30, 2007.

In January 2007, due to the extent of land covered by our drilling, we designated the discovery area, plus certain additional prospective lands associated with it, as the Axe Lake Discovery. The designated Axe Lake Discovery area is a notional area identified by us as being located in an area of approximately 72 sections (72 square miles) located in Townships 94 and 95, Ranges 24 and 25 West of the 3rd Meridian. As a result of the winter 2007/2008 program the Axe Lake Discovery drilled area now covers approximately 65 sections (65 square miles) of Permits PS00208 and PS00210 (100% Oilsands Quest) located in the north half of Township 94 and the south half of Township 95, Ranges 24 and 25 West of the 3rd Meridian.

In February 2007 an 850-kilometre (528-mile) helicopter-borne, combined electromagnetic and magnetic survey was undertaken and a 166-kilometre (103-mile) 2-D seismic program was completed. This included 64 kilometres (40 miles) of surveys in Alberta.

In May 2007, permits were granted by the Province of Saskatchewan for the continuation and expansion of 2-D seismic surveys.

In May and June 2007 two fixed-wing aircraft completed a high-resolution, intensive 21,000-kilometre (13,000-mile) airborne magnetic survey program within the Company’s Saskatchewan permit lands building further on the airborne surveys made during the 2006/2007 winter program.

In August 2007 we received approvals from the Province of Saskatchewan for the following: testing of Electrical Resistance Tomography; exploration drilling of up to 97 holes under non-frozen ground conditions; miscellaneous use general construction (including road and airstrip construction) permits on the Saskatchewan permit lands; and an extensive 2-D and 3-D seismic program

10

on the Saskatchewan permit lands under non-frozen ground conditions. Approval from the Province of Alberta for a major 2-D and 3-D seismic program on the Raven Ridge Prospect was also received in August 2007. Field work under these approved work programs began immediately with drilling in Saskatchewan commencing on September 14, 2007. In October 2007 we received approvals for drilling up to 122 holes on the Alberta permit lands.

In November 2007 we announced the results of the independent review and evaluation of the Axe Lake Discovery by McDaniel & Associates Consultants Ltd. (“McDaniel”) based on data obtained from the results of drilling up to March 31, 2007 and other sources, including the physical examination of cores and geophysical logs. The independent review and evaluation was prepared and presented in accordance with the Canadian standards set out in the COGEH and NI 51-101.

In December 2007 a comprehensive exploration program application, consisting of drilling up to 316 core test wells, 2-D seismic surveys and 3-D seismic surveys to be conducted under frozen ground conditions, was submitted to the Federal and Saskatchewan governments for approval. The application also included requests for approvals for conducting reservoir tests, which included the installation and operation of steam generation facilities, thermally completed vertical reservoir test wells and related observation wells including fluid storage facilities at three potential test sites at the Axe Lake Discovery area.

In January 2008 we received regulatory approval for our applications and we announced a program of reservoir testing at up to three sites within the Axe Lake Discovery. This reservoir test program was designed on the basis of extensive, ongoing laboratory testing and reservoir simulation studies conducted since June 2007 by our independent consultants and on the studies undertaken by our in-house reservoir engineering group. For a complete description of the nature and activities of the test program, see Part 1, Item 1, “Description of Business — Activities to Date” and “Axe Lake Discovery – Reservoir Development Activities”.

On March 26, 2008, our winter 2007/2008 exploration program ended. The program demonstrated continued success on the Company’s contiguous oil sands exploration lands in Saskatchewan and Alberta. Overall, a total of 175 test wells were drilled with 150 in Saskatchewan and 25 in the Company’s first exploration program conducted on its adjacent land holdings in Alberta. Evaluation of core and other data from these test wells is being conducted. As anticipated, the drilling results continue to show continuity of bitumen resources over a large area. The exploration drilling in Alberta was completed in 12 sections (12 square miles). Of the 175 test wells drilled in the winter 2007/2008 exploration program, 155 were exploration and delineation test wells in Saskatchewan and Alberta of which 103 encountered meaningful intercepts of bitumen-bearing McMurray formation (67 percent). The 175 test wells represent a total of 35,000 metres (114,850 feet). The 349 test wells drilled to date represent 66,871 metres (219,388 feet). The following table summarizes the drilling program accomplishments to date.

Table1: Results of drilling programs

| Winter 2007 / 2008 |

| ||

|

|

|

| Wells |

Axe Lake Discovery | 125 | 264 | 65 | 4.06 |

Saskatchewan Exploration (outside Axe Lake) | 5 | 40 | 30 | 1.33 |

Reservoir Test (Axe Lake) | 4 | 4 | n/a | n/a |

Environmental Monitoring (Axe Lake) | 16 | 16 | n/a | n/a |

Raven Ridge Discovery | 25 | 25 | 12 | 1.04 |

Total | 175 | 349 | 107 | 2.93 |

We also completed a comprehensive 2-D and 3-D seismic program which utilized CGG Veritas’ highest-quality three-component 3-D technology. The table below summarizes Oilsands Quest’s completed seismic programs.

Table 2: Seismic Surveys

| Saskatchewan | Alberta | ||

| Km | Miles | Km | Miles |

2-D | 48 | 30 | 106 | 66 |

3-D | 1,192 | 741 | 501 | 312 |

Total | 1,240 | 771 | 607 | 378 |

The 3-D program covered over 24 square kilometres (15 square miles) in Saskatchewan and 10 square kilometres (6 square miles) in Alberta. A 40-metre (124-foot) by 40 metre grid density was used. The data from this program has been processed and interpretation of the data is underway. A detailed summary of the activities by prospect area is noted below.

During the winter 2007/2008 exploration program, we continued conducting environmental monitoring and baseline assessment activities related to a comprehensive $4 million CDN program of environmental studies on our Saskatchewan and Alberta permits. The program addresses a wide range of factors important for defining baseline conditions, including ambient air quality, water, soils, vegetation and wildlife. The work formed the basis of an Environmental Protection Plan submitted to and approved by the Federal and Saskatchewan Provincial governments. This program, which is integral to the timeline for potential project development at the Axe Lake Discovery, began in early April 2007 and will continue through 2008/2009.

A total of nine drilling rigs were utilized, and two camp facilities in Saskatchewan housing in excess of 400 personnel at peak levels were operated by the Company during the winter 2007/2008 drilling season.

In May 2008, in order to communicate more clearly about our operations and activities in the future, we named areas of interest in addition to the Axe Lake Discovery area resulting from our winter operations. In the Axe Lake Discovery area, three distinct areas of interest were named Axe Lake 1, 2 and 3 to correspond to the three proposed development sites. Our Alberta oil sands permits that are located immediately west of the Axe Lake Discovery area and directly east of the Encana Borealis project area (Township 94 Range 1 west of the 4th Meridian) were named the Raven Ridge Prospect. Here, our drilling has identified two areas of interest: Raven Ridge 1 and Raven Ridge 2.

On June 26, 2008, immediately preceding filing of this Form 10-K, we announced the results of the independent review and evaluation of the Axe Lake Discovery and of the Raven Ridge Discovery by McDaniel based on data obtained from the results of drilling up to March 26, 2008 and other sources, including physical examination of cores and geophysical logs. The independent review and evaluation was prepared and presented in accordance with the Canadian standards set out in the COGEH and NI 51-101.

Further north, on our Alberta permits in Township 96 Range 1 and Range 2 West of the 4th Meridian, a new area of interest, defined through seismic survey, was named the Wallace Creek Prospect.

A summary of the activities in each area is outlined below.

Axe Lake Discovery

In January 2007 following our initial drilling season, we designated the discovery area, plus certain additional prospective lands associated with it, as the Axe Lake Discovery. The Axe Lake Discovery is a notional area identified by us and located in an area of approximately 72 sections (72 square miles) located in Townships 94 and 95, Ranges 24 and 25 West of the 3rd Meridian. As a result of the winter 2007/2008 program the drilled portion of the Axe Lake Discovery now covers approximately 65 sections (65 square miles) of permits PS00208 and PS00210 (100% Oilsands Quest) located in the north half of Township 94 and the south half of Township 95, Ranges 24 and 25 West of the 3rd Meridian.

The 3-D seismic survey program in Saskatchewan was concentrated in the Axe Lake Discovery area and covered over 24 square kilometres (15 square miles). We are using seismic survey data as one of the key tools to further define geological structure and reservoir characteristics within the Axe Lake Discovery to assist in the ongoing reservoir studies and technical planning related to the development of this resource. For a description of the seismic program on the Axe Lake Discovery, see tables in Part 1, Item 1, “Description of Business — Activities to Date”.

Axe Lake Discovery — Reservoir Development Activities

In January 2008, following extensive, ongoing laboratory testing, reservoir simulation studies and the determination of the initial definition of a reservoir field test program to evaluate reservoir response to varying temperatures and pressures of steam and steam with solvents, we announced a program of reservoir testing at up to three sites within the Axe Lake Discovery for 2008.

Site preparation and construction of facilities for Oilsands Quest’s reservoir test program at Axe Lake commenced in January 2008 and were halted through April and May for spring break-up. Activity recommenced in June 2008 and is ongoing at present. The large steam generator Final Acceptance Test was successfully concluded and the steam generator is being transported to site. Other major equipment will also arrive on site during facilities installation which commences first week of July. Steam and hot water injection into the reservoir on Test Site 1 is planned for late summer 2008.

Phase One of the Axe Lake Discovery reservoir test program will consider up to three test sites (with varying overburden and pay thicknesses) with one vertical injection well and five vertical observation wells per test site. The purpose of Phase One of the Axe Lake test program is to measure resource specific heat and fluid movement under specific operating conditions on a field scale to complement our ongoing simulation and laboratory analysis studies. Phase One has received regulatory approval. Current plans call for placement of horizontal wells in late summer 2008, with injection to begin following initial results from the Phase One program at Test Site 1 subject to the requisite approvals.

Phase Two of the test program will consider expanding the three test sites with horizontal wells and/or injecting mobilization agents other than steam. The purpose of Phase Two is to evaluate and analyze information gathered from Phase One regarding mobilization with steam and/or hot water and to measure field-scale response using horizontal wells. Phase Three of the Axe Lake Discovery test program is currently in the scoping phase; options being considered range from a continued reservoir test program to a technology feasibility pilot to a full commercial demonstration project.

By June 2008 six 1,000-barrel heated liquid storage tanks were received at Test Site 1, and two 1,000-barrel heated liquid storage tanks were delivered to both Test Sites 2 and 3. The preliminary engineering contracts for the surface facilities for Test Site 2 were awarded and design work has commenced. The large steam generator Final Acceptance Test was successfully concluded and the steam generator is being transported to site. Other major equipment will also arrive on site during facilities installation which commences first week of July and most of this equipment will be installed in all-season building structures. Construction of these facilities is expected to be completed approximately eight weeks after the arrival of the major equipment.

By the end of July 2008, we expect to resume drilling of the wells required for injection and monitoring at the three reservoir test sites, including the remaining two of the six wells at Test Site 1 and wells at Test Site 2 and 3 as appropriate.

Raven Ridge Discovery Activities

In March 2007, prior to acquiring the key permits comprising the Raven Ridge Discovery, we completed 64 kilometres of 2-D seismic survey to assess the potential of the permit land and identify potential drilling targets. As a result of this survey we expected that the Axe Lake Discovery reservoir would extend into Alberta and that numerous attractive exploration drilling targets would be identified. Approval for exploration drilling in Alberta was received in December 2007 and 25 exploration holes were drilled in 12 sections (12 square miles) during the 2007/2008 program. Of the 25 holes, 18 encountered meaningful intercepts of McMurray formation (72 percent) at depths of 113 metres (371 feet) to 227 metres (745 feet). The thickness of the bitumen-bearing zone within the McMurray formation was observed to be between 7 metres (23 feet) and 34 metres (112 feet) (net pay) with an average of 15.5 metres (51 feet).

The Raven Ridge Discovery drilling program has demonstrated continuity of bitumen characteristics extending from our Axe Lake Discovery in Saskatchewan westward into Alberta and we have identified, through drilling, two areas of specific interest for potential development: Raven Ridge 1 and Raven Ridge 2. Notably, a key success of the program was achieved by the correlation observed between the drilling results and the estimates made based on the Company’s 2007 2-D seismic program.

Reservoir Recovery Optimization for Axe Lake and Raven Ridge Discoveries

Similar to other bitumen accumulations within the eastern portion of Alberta, the Axe Lake and Raven Ridge Discovery areas lack a distinct overlying shale zone. McDaniel is of the opinion that the absence of a distinct overlying shale zone may preclude the use of certain high-pressure in-situ recovery methods, but that the quality of the reservoirs and high bitumen saturations present at the Axe

Lake and Raven Ridge areas provide the potential for extraction using a number of existing technologies as well as other low pressure in-situ extraction methods currently in pilot testing within other areas of the Athabasca Oil Sands region. At this time, Oilsands Quest is actively engaged in executing its reservoir test program and related laboratory simulation studies that will support the technical review and analysis of the suitability of each of these methods for extraction operations at Axe Lake and Raven Ridge. Potential extraction methods that may be applicable to Axe Lake and Raven Ridge include low-pressure SAGD operations, enhanced SAGD, SAGD combined with methane injection to manage steam-chamber growth, and electro-thermal heating. Oilsands Quest has received interim results from laboratory simulation and computer simulation studies that indicate there is good potential for bitumen recovery using hot water and/or steam and steam/solvents. Further, these studies indicate that it is reasonable to expect that steam pressures can be managed and controlled to ensure that penetration above the McMurray bitumen-containing formation is limited and that heat losses to the overburden would be minimal. These simulation studies are being conducted to assist in the specification of pressure and temperature conditions that will form part of the on-site reservoir test program later this year.

Wallace Creek Prospect Activities

In January 2008, prior to acquiring the Wallace Creek permits, we completed 53 kilometres of 2-D seismic survey to assess the potential of the permit lands and identify potential exploration targets. To date, we have reviewed and interpreted the results of the data from the seismic surveys. As a result, we have identified a number of exploration targets for drilling. Further, there are five legacy test wells drilled on the property. We have reviewed the results of this old drilling and are completing our assessment of the geological potential for the area and are in the process of completing plans for the exploration program in 2008/2009.

Eagles Nest Prospect Activities

Over the winter of 2005/2006 we undertook a detailed assessment of the historical data available on the Eagles Nest Prospect. During 2007/2008 we concentrated our efforts in acquiring the interests of the Triple 7 Joint Venture partners. On September 21, 2007, we acquired all of the rights of one of the three external joint venture partners to the Triple 7 Joint Venture Agreement and, on June 17, 2008, we acquired the rights of the remaining two external joint venture partners. For a description of these transactions, see Part 1, Item 1, “Description of Business — General Development of Business — Acquisition of Oil Sands Exploration Rights”. The Company’s obligations under the Triple 7 Joint Venture Agreement have therefore been eliminated.

With the achievement of unencumbered ownership and control of the Eagles Nest Prospect, an independent assessment has been commissioned to evaluate the resource potential of the lands and we are initiating an exploration strategy for the 2008/2009 drilling season.

Other

Apex Joint Ventures

During the years ended April 30, 2005 and 2006, we entered into four joint venture agreements to fund research and development relating to the improvement of bitumen recovery. On February 28, 2007 we sold our interests in these joint ventures to one of the remaining partners for consideration of $419,384 which was credited to exploration costs. Our rights and obligations under the agreements were assigned to and assumed by the purchasing partner, and we were released from any further obligations and liabilities under the agreements.

Pearl Exploration and Production Ltd. (formerly known as Watch Resources Ltd. and Energy 51 Inc.)

On April 7, 2004 we entered into an equity participation and farm-out agreement with Energy 51 Inc., a private oil and gas company. Pursuant to the equity participation agreement we purchased 1,500,000 common shares of Energy 51 for $310,291.

We participated with Energy 51 in the Sylvan Lake and Barrhead oil and gas prospects and incurred $5,325 (2007 – $64,105) in exploration costs in 2008. The 2008 costs relate to the abandonment of the prospects. We no longer maintain a right to participate in future Energy 51 farm-out prospects.

On January 2, 2007 Energy 51 Inc. was amalgamated with Watch Resources Ltd. (“Watch”), a public company. On amalgamation the 1,500,000 shares in Energy 51 Inc. held by OQI were replaced by 300,000 common shares in Watch. On August 2, 2007 Watch was acquired by Pearl Exploration and Production Ltd. (“Pearl”), a public company. On the acquisition the 300,000 common shares of Watch held by us were replaced by 69,000 common shares of Pearl.

We account for our interest in Pearl as securities available for sale and will carry the investment on our balance sheet as a current asset valued at the trading value of the securities on the balance sheet date.

Forum Uranium Corp.

During the year ended April 30, 2008 we received 600,072 common shares of Forum Uranium Corp. (“Forum”) in exchange for our interest in a uranium prospect written off in 2003. As costs associated with the property had previously been written off the value of the shares received has been credited to exploration costs.

We account for our interest in Forum as securities available for sale and will carry the investment on our balance sheet as a current asset valued at the trading value of the securities on the balance sheet date.

Outlook

Over the next twelve months we will initiate the activities necessary to establish a commercial development plan for the Axe Lake Discovery, including aggressively progressing the reservoir test programs in order to evaluate an optimum in-situ oil sands recovery process. We expect to select one or more recovery technology options, conduct one or more technology feasibility tests and commence development of a commercial project. The following is an overview of key activities continuing and planned in the next twelve months:

| • | continue exploration and delineation activities to further define the location, extent and quality of the resources at Axe Lake and Raven Ridge (for a complete description of our independent resource estimates, see Part 1, Item 2, “Properties and Statement of Oil and Gas Information”); |

|

|

|

| • | continue to undertake computer reservoir modeling and simulation studies to aid in the selection of the optimal recovery technologies at Axe Lake and Raven Ridge; |

| • | continue to engineer and procure surface and down-hole equipment for reservoir field tests; |

| • | conduct injection tests with steam and other mobilization agents in vertical and horizontal wells to confirm laboratory and simulation studies; |

| • | continue to conduct environmental programs to establish base-line data and facilitate regulatory approvals; |

| • | continue to conduct advanced economic feasibility and risk assessment studies for full commercial project development; |

| • | continue to accelerate scoping and engineering designs for our initial commercial development at the Axe Lake Discovery, including initiating engineering plans for the first 30,000 barrels per day commercial project at the Axe Lake Discovery; |

| • | initiate joint venture partnership and capital market negotiations for the development of the Axe Lake Discovery; and |

| • | evaluate market alternatives for bitumen sales from one or more commercial projects at Axe Lake. |

Oilsands Quest and its engineering consultants have embarked upon preliminary engineering of an initial 30,000 barrels per day commercial project planned for the development of a portion of Axe Lake in the specific area where the first series of reservoir tests are being conducted. Management also continues to conduct advanced economic feasibility and risk assessment studies for full commercial project development, including assessment of an aggressive approach to a first prospective project, which could result in completion during 2012 or 2013. Oilsands Quest has also commissioned a study of infrastructure and markets by Purvin & Gertz Inc. to assist in its planning process. Development of a commercial project remains subject to regulatory and other contingencies such as successful reservoir tests, board sanctioning and financing.

Table of Contents

In addition, we will continue to conduct an extensive exploration program activity to further define the location, extent and quality of the potential oil sands resource at the Wallace Creek and Eagles Nest Prospects. We also intend to conduct an exploratory drilling program on the Pasquia Hills Oil Shale Prospect in 2008/2009 and research potential methods for kerogen recovery from oil shales.

Our planned activities over the next twelve months as outlined above will require expenditures of approximately $200 — $250 million. If we accelerate commercial development at Axe Lake or any of our other prospects, our cash requirements over the next two years will increase significantly from the amount noted above. Additional funding may also be required if our current planned activities are changed in scope or if actual costs differ from estimates of current plans. We believe the Company will have access to sufficient funding and sources of capital for its planned activities to April 30, 2009. Because we constantly and actively monitor our expenditure budgets, if sufficient funding is not available we can adjust our expenditure plans based on available cash. We plan to fund future operations by way of financing, including a public offering or private placement of equity or debt securities. Our development strategy also includes considering partners on a joint venture basis on our specific projects to fund the development of such projects in a timely and responsible manner. However, there is no assurance that debt or equity financing or joint venture partner arrangements will be available to us on acceptable terms, if at all, to meet these requirements. The Company has no revenues, and its operating results, profitability and the future rate of growth depend solely on management’s ability to successfully implement the business plans and on the ability to raise further funding.

Employees

As at June 16, 2008 the Company had 51 employees, including 15 seasonal field employees of OQI Sask. Additional employees will be added as activity levels dictate and field exploration activities increase.

Available Information

We maintain an internet website at www.oilsandsquest.com. The information on our website is not incorporated by reference in this annual report on Form 10-K.

We make available on or through our website certain reports and amendments to those reports that we file with or furnish to the Securities and Exchange Commission (the “SEC”) in accordance with the Securities Exchange Act of 1934, as amended. Alternatively, you may read and copy any information we file with the SEC at its public reference room at 100 “F” Street NE, Washington, D.C. 20549. You may obtain information about the operation of the public reference room by calling 1-800-SEC-0330.

You may also obtain this information from the SEC’s website, http://www.sec.gov. We also file this information with Canadian securities regulators and it is available at www.sedar.com.

The Oil Sands Industry in Canada

The following information quotes liberally from the Canadian Association of Petroleum Producers, the Energy Resources Conservation Board of Alberta, the National Energy Board of Canada and a variety of technical reports and publications.

Canada is the world’s fifth largest producer of energy. It is the world’s third largest natural gas producer and its seventh largest crude oil producer. Between 1980 and 2007, energy production in Canada almost doubled, with oil and gas accounting for 90 percent of the increase.

In terms of global energy sources, Canada’s oil reserves are second only to those of Saudi Arabia, which has an estimated 264 billion barrels of oil reserves. Canada’s oil reserves are estimated to be 179 billion barrels, of which 173 billion barrels are oil sands reserves considered economically recoverable with today’s technology.

Canada’s oil sands deposits contain a vast quantity of crude bitumen: an initial volume-in-place of 1.7 trillion barrels which includes an ultimate potential of 315 billion barrels recoverable. The Canadian Association of Petroleum Producers (“CAPP”) estimates that, at current production levels, oil sands reserves could sustain production of 3.0 million barrels/day for more than 150 years.

Production from the oil sands continues to replace diminishing reserves of conventional crude oil in Western Canada. According to CAPP, oil sands production has grown four-fold since 1990 and, in 2007, exceeded 1.2 million barrels per day. Today, oil sands production accounts for one out of every two barrels of production in Western Canada. By 2015, oil sands’ share of production will rise to three out of every four barrels. By 2015, CAPP estimates oil sands production will be 2.8 million barrels per day and, by 2020, 3.5 million barrels per day.

CAPP reports that, from 1997 to 2006, a total of $59 billion CDN was invested in the oil sands and further predicts that, between 2007 and 2010, another $80 billion will be invested in the industry which has become increasingly vital to meeting the energy needs of both Canada and the United States. Canada is the largest supplier of energy to the U.S. and, in 2007, exported over 1.8 million barrels of crude oil per day to the U.S., almost 19 percent of total U.S. demand. About 1.6 million barrels per day come from Western Canada.

Oil sands deposits are composed primarily of sand, silt and clay, water and bitumen, along with minor amounts of other minerals. Typical composition might be 75 to 80 percent inorganic material (mostly quartz sands), 3 to 7 percent water, and 10 to 12 percent by weight bitumen, with bitumen saturation varying between zero and 18 percent by weight.

Oil from the oil sands is often called “crude bitumen” to distinguish it from conventional crude oil. Bitumen is a thick, black, tar-like substance that pours extremely slowly. Compared to typical crude oils, which contain approximately 14 percent hydrogen, bitumen is deficient in hydrogen. In order to make crude bitumen an acceptable feedstock for conventional refineries, it must be upgraded through the addition of hydrogen or the rejection of carbon. In order to transport crude bitumen to refineries, it must be blended with a diluent, usually condensate, to meet pipeline specifications for density and viscosity.

Oil sands deposits are located at a variety of depths. Economically recoverable oil sands that are located less than 200 feet deep can be recovered by open pit mining methods; those located deeper than 200 feet can be produced using in-situ (or “in place”) methods of bitumen recovery.

Alberta has three major oil sands areas, each with a number of bitumen-bearing deposits: Athabasca, Cold Lake and Peace River. According to the Energy Resources Conservation Board (“ERCB”) of Alberta, an estimated 20 percent of the Province’s initial established reserves are mineable; the remainder are suitable only for in-situ recovery methods. The Athabasca oil sands cover the largest area; this is also where the province’s mineable deposits are located. The ERCB also estimates that, in Alberta, the vast majority of lands thought to contain bitumen that could be recovered by either method are currently already leased.

In 2007 Alberta produced 243 million barrels of oil from the mineable oil sands and 196 million barrels from the in-situ area; this is equivalent to 1.2 million barrels per day. In open pit mining operations, overburden is removed, oil sands ore is mined and bitumen is extracted from the mined material essentially using hot water processes. With in-situ recovery, generally steam, water or other solvents are injected into the reservoir to reduce the viscosity of the bitumen, which allows it to flow to a vertical or horizontal well bore.

Commercial production from the Alberta oil sands began in the 1960s. The first two integrated mining projects were Great Canadian Oil Sands (now Suncor), which began operations in 1967, and Syncrude, which came onstream in 1978. The ERCB estimates that, at the end of 2007, almost two-thirds of the initial established reserves in the surface-mineable area were under active development. There are now three mining projects, another two mine projects are under construction and seven are in various stages of project development.

Aside from primary production (including water injection), which has limited use in Cold Lake and Peace River areas, two main in-situ methods are being used to commercially produce bitumen: cyclic steam stimulation (CSS) and steam-assisted gravity drainage (SAGD). In the Athabasca oil sands area, there are nine operating in-situ projects and another 20 in various stages of development. In the Cold Lake area, three in-situ projects are operating and two more are in development. The Peace River area has one operating in-situ project and another one in the development stage.

The term upgrading is given to a process that converts bitumen and heavy crude oil into synthetic crude oil. Alberta’s first crude bitumen upgrader is located in Edmonton; two more are operating in the Athabasca region. Three upgraders are currently under construction in the Athabasca region and another ten are in various stages of development.

Oil sands projects are capital intensive, mainly driven by global steel prices and construction costs. CAPP estimates that an integrated, 100,000 barrel/day oil sands project which cost $3.3 billion to construct in 2001 would now cost approximately $10 to $11 billion CDN.

In addition to capital costs, the challenges Canada’s oil sands industry faces include labour shortages and environmental issues. However, according to the National Energy Board: “The challenges faced by the oil sands industry are counter-balanced by the opportunities. At a time of increasing resource nationalism around the world, Canada’s huge oil sands reserves, set in a climate of relatively stable political and economic policy, represent an attractive target for investment. The potential for technological innovation to reduce the costs of bitumen extraction and upgrading is an additional attraction. Given the outlook for continued higher oil prices, return on investment should be sufficient to drive oil sands expansion.”

Government Regulation

Our business is subject to various federal, provincial and local laws and governmental regulations that may be changed from time to time in response to economic, technical or political conditions. In Saskatchewan, the legislated mandate for the responsible development of the Province’s oil and gas resources is set out in the Energy and Mines Act that provides the Minister with the responsibility for the exploration, development, management and conservation of non-renewable resources. The Oil and Gas Conservation Act allows the orderly exploration for, and development of, oil and gas in the Province and optimizes recovery of these resources. For permits granted prior to May 7, 2007, the exploration of oil shales, which includes oil sands, is regulated under the Oil Shale Regulations, 1964, as amended from time to time, under the Crown Minerals Act. These regulations apply to oil shale rights that are the property of the Province and establish the terms under which exploration permits and leases are granted. Since 2005, the Province of Saskatchewan undertook a consultation review process with all stakeholders in an effort to update the oil sands and oil shale regulations to align regulations better with other regimes in the country and to encourage exploration and development activity in the Province. On May 7, 2007 the Province of Saskatchewan issued new regulations for oil sands and oil shales under the Petroleum and Natural Gas Amendment Regulations 2007 whereby oil sands and oil shale mineral rights will be available under the competitive bid and work commitment bid processes, respectively. Previously issued oil sands and oil shale dispositions will continue to be administered under amended provisions to the Oil Shale Regulations, 1964 which were also updated for today’s economic and technical considerations. OQI’s current Saskatchewan oil sand and oil shale permits will continue to be administered under the Oil Shale Regulations, 1964, as amended.

In Alberta, oil sands activities are legislated under the Mines and Minerals Act which governs the management and disposition of rights in Crown owned mines and minerals, including the levying and collecting of bonuses, rents and royalties. The Oil Sands Conservation Act establishes a regulatory regime and scheme of approvals administered by the Energy Resources Conservation Board (formerly the Alberta Energy and Utilities Board) for the development of oil sands resources and related facilities in Alberta. The Acts are supported by the following regulations: Oil Sands Tenure Regulation, Oil Sands Royalty Regulation 1984, Oil Sands Royalty Regulation, 1997, Experimental Oil Sands Royalty Regulation, Oil Sands Conservation Regulation, and Mines and Minerals Administration Regulation.

We are required to comply with the environmental guidelines and regulations established at the federal, provincial and local levels for our field activities and access requirements on our permit lands, license lands and leases. Any development activities, when determined, are expected to require detailed and comprehensive environmental impact assessments studies and approvals of federal, provincial and local regulators. Each provincial jurisdiction also maintains specific royalty regimes that will be applied to all oil sands and oil shale development projects consistent with other resource developments.

Glossary of Common Terms

The terms defined in this section are used throughout this Form 10-K.

Bbl | Barrel |

|

|

Bitumen or crude bitumen | A highly viscous oil which is too thick to flow in its native state, and which cannot be produced without altering its viscosity; a naturally occurring mixture, mainly consisting of viscous hydrocarbons heavier than pentane, that may contain sulphur compounds and that in its naturally occurring viscous state does not usually flow to a well. The density of bitumen is generally less than 10 degrees API (as that term is defined by the American Petroleum Institute). |

|

|

Core | Cylindrical sample of rock taken from a formation for the purpose of examination and analysis. |

|

|

Core hole, Stratigraphic test well, or Exploration Stratigraphic test well | A drilling effort, geologically directed, to obtain information pertaining to a specific geologic condition. Ordinarily, such wells are drilled without the intention of being completed for hydrocarbon production. They include wells for the purpose of core tests and all types of expendable holes related to hydrocarbon exploration. |

| Stratigraphic test wells are classified as |

|

|

| (a) “exploratory type” if not drilled into a proved property; or |

|

|

| (b) “development type”, if drilled into a proved property. |

|

|

| Development type stratigraphic wells are also referred to as “evaluation wells”. |

| |

Crude oil (conventional) | A mixture that consists mainly of pentanes and heavier hydrocarbons, which may contain sulphur and other non-hydrocarbon compounds, that is recoverable at a well from an underground reservoir and that is liquid at the conditions under which its volume is measured or estimated. It does not include solution gas or natural gas liquids. |

|

|

Degrees API | A measure of hydrocarbon density; the lower the number, the higher the viscosity (see “viscosity”). |

|

|

Exploration costs | Costs incurred in identifying areas that may warrant examination and in examining specific areas that are considered to have prospects that may contain oil and gas reserves, including costs of drilling exploratory wells and exploratory type stratigraphic test wells. |

|

|

Formation | A bed or deposit composed throughout of substantially the same kind of rock. Each different formation is given a name, often as a result of the study of the formation outcrop at the surface and sometimes based on fossils found in the formation. |

|

|

In-situ | In its original place; in position. When referring to oil sands, in-situ recovery refers to various methods used to recover deeply buried bitumen deposits, including steam injection, solvent injection and firefloods. |

| Steam assisted gravity drainage (SAGD) is an example of an in-situ process used to recover bitumen from oil sand located too deep to be profitably mined. |

|

|

Kerogen | The hydrocarbon content of oil shale. Kerogen is also known as shale oil. |

|

|

Lease | An agreement granting to the lessee rights to explore, develop and exploit a property. |

|

|

Oil sands | Sand and other rock materials containing bitumen; the crude bitumen contained in those sands and other rock materials. Each particle of sand is coated with a layer of water and a thin film of bitumen. |

|

|

Oil sands deposit | A natural reservoir containing or appearing to contain an accumulation of oil sands separated or appearing to be separated from any other accumulation. |

|

|

Oil shale | A geologic formation consisting of shale which contains hydrocarbons. |

|

|

Overburden | Thickness of material above an occurrence of bitumen. The thickness of the overburden determines the method of bitumen recovery (mining or in-situ techniques). Overburden could consist of layers of sand, gravel and shale; in many places overburden underlies muskeg which is a water-soaked layer of decaying plant material one to three metres (three to ten feet) thick. Muskeg supports the growth of shallow-root trees. |

|

|

Permeability | Ability of a porous rock to transmit fluid through its pore spaces. A rock may be highly porous and yet impermeable if it has no interconnecting pore network (communication). |

|

|

Porosity | Volume of a rock available to contain fluids. Volume of pore spaces between mineral grains expressed as a percentage of the total rock volume. |

| |

Reservoir | Porous, permeable sedimentary rock structure or trap containing oil and/or gas. A reservoir can contain more than one pool (accumulation of oil or gas). |

Unproved property | A property or part of a property to which no reserves have been specifically attributed. |

|

|

Viscosity | A measure of the resistance of a liquid to flow. The viscosity of petroleum products is commonly expressed in terms of the time required for a specific volume of the liquid to flow through an orifice of a specific size. |

|

|

Working interest | The operating interest that gives the owner the right to drill, produce and conduct operating activities on the property and to share in the production. |

Our business activities, and the oil and gas industry in general, are subject to a variety of risks. If any of the following risk factors should occur, our profitability, financial condition or liquidity could be materially impacted. As a result, holders of our securities could lose part or all their investment in Oilsands Quest Inc.

RISKS RELATED TO OUR BUSINESS:

Due to Our History of Operating Losses, We are Uncertain That We Will Be Able to Maintain Sufficient Cash to Accomplish Our Business Objectives