Exhibit 99.1

INVESTOR PRESENTATION August 16, 2019

DISCLAIMER This presentation may contain forward-looking statements intended to qualify for the safe harbor contained in Section 27A of theSecurities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements often include words such as may, will, should, anticipate, estimate, expect, project, intend, plan, believe, seek, would, could, and similar words or expressions and are made in connection with discussions of future operating or financial performance. Forward-looking statements reflect management’s expectations at the date of this presentation regarding future conditions, events, or results. They are not guarantees of future performance. By their nature, forward-looking statements are subject to risks and uncertainties. Our actual results and financial condition may differ materially from what is anticipated by the forward-looking statements. There are many factors that could cause actual conditions, events, or results to differ from those anticipated by the forward-looking statements contained in this presentation.Readers are cautioned not to place undue reliance on forward-looking statements in this presentation. We do not undertake to update any forward-looking statements included in this presentation. The statements in thispresentation are for the convenience of our shareholders, capital partners, and other stakeholders and are qualified in theirentirety by reports that we file with the SEC.

OVERVIEW Enterprise Diversified is an alternative asset manager with a focus on emerging managers. The company also has interests in several historical, non-core lines of business including an internet service provider, a royalty stream on a previously owned home services business, real estate, and other opportunistic investments.

Q2 NOTABLES In the second quarter of 2019, Enterprise Diversified refocused the company on the asset management business where we have maximum optionality and long-term upside potential. Sold the home services and Mt Melrose subsidiaries, significantly reducing overall debt and risk to the company Decreased future cash debt payments and eliminated ongoing financial obligations Simplified asset-heavy operations and public reporting requirements Generated one-time write-downs that have the potential to be offset in subsequent quarters Significantly lowered ongoing overhead and SG&A expenses Eliminated costly distractions in order to allow the company to focus squarely on Willow Oak Asset Management

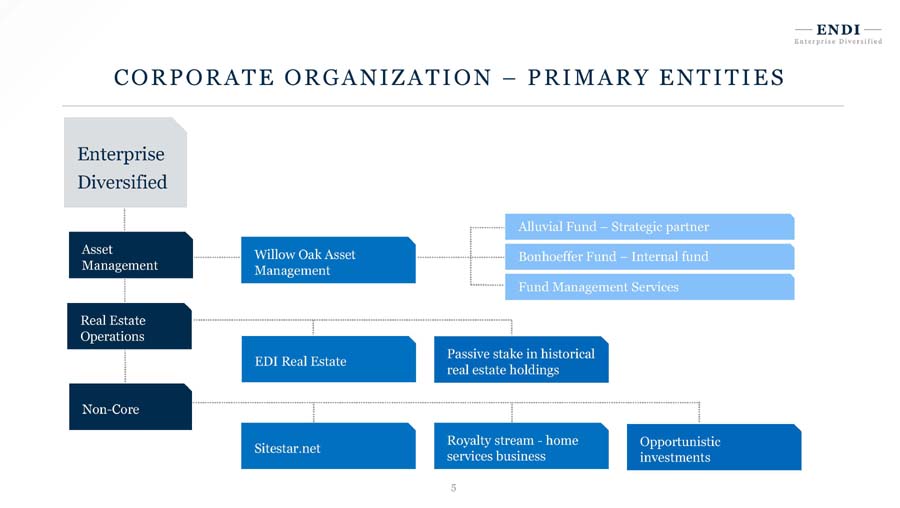

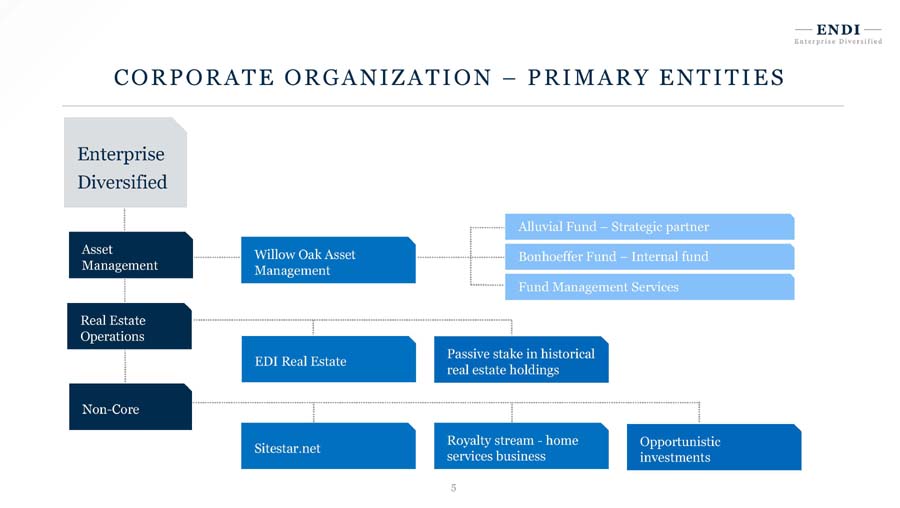

CORPORATE ORGANIZATION –PRIMARY ENTITIES Enterprise Diversified Asset Management Real Estate Operations Non-Core Willow Oak Asset Management EDI Real Estate Sitestar.net Passive stake in historical real estate holdings Royalty stream -home services business Opportunistic investments Alluvial Fund –Strategic partner Bonhoeffer Fund –Internal fund Fund Management Services

LEADERSHIP TEAM Steven Kiel Executive chairman Oversees the execution of the strategic vision for Enterprise Diversified and its subsidiaries Strategically drives the growth of Willow Oak Asset Management Jessica GreerVice President & Chief of Staff Monitors and manages the operational strength of Enterprise Diversified and its subsidiaries Manages the daily activities of the asset management division including investor relations and Fund Management Services Enterprise DiversifiedBoard of Directors Defines and approves the strategic vision of Enterprise Diversified Advises and supports network growth of Willow Oak Asset Management AleaKleinhammerVice President & Chief Financial Officer Monitors and reports on the financial strength of Enterprise Diversified and its subsidiaries Oversees the activities and drives the strategic direction of each subsidiary

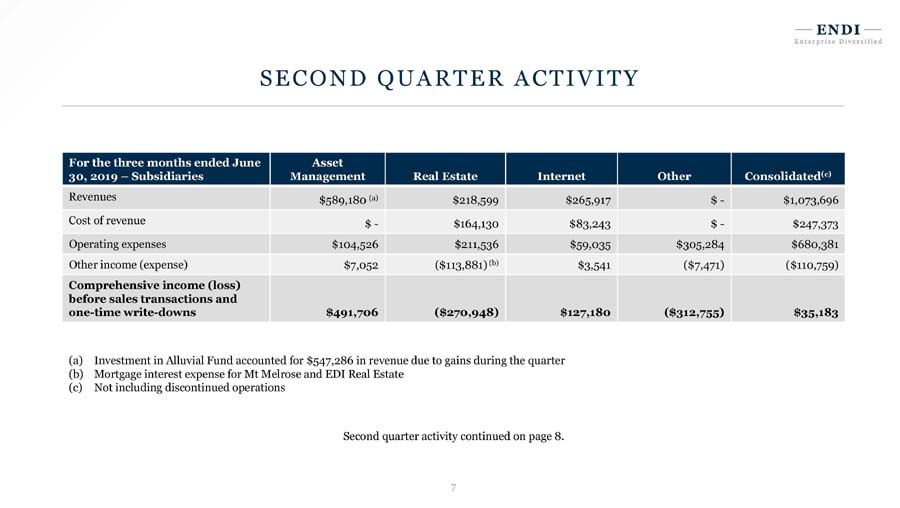

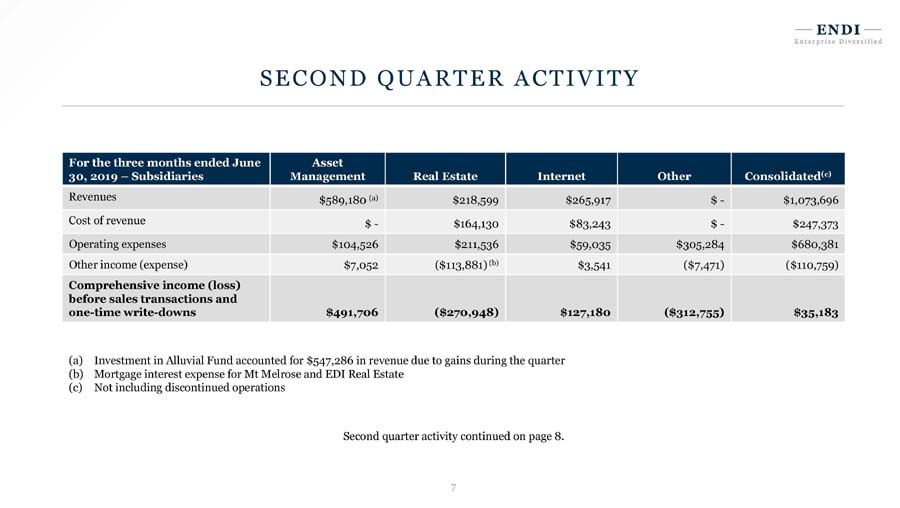

SECOND QUARTER ACTIVITY For the three months ended June 30, 2019 –Subsidiaries Asset Management Real Estate Internet Other Consolidated(c) Revenues $589,180 (a) $218,599 $265,917 $ - $1,073,696 Cost of revenue $ - $164,130 $83,243 $ - $247,373 Operating expenses $104,526 $211,536 $59,035 $305,284 $680,381 Other income (expense) $7,052 ($113,881)(b) $3,541 ($7,471) ($110,759) Comprehensive income (loss) before sales transactions and one-time write-downs $491,706 ($270,948) $127,180 ($312,755) $35,183 (a) Investment in Alluvial Fund accounted for $547,286 in revenue due to gains during the quarter (b) Mortgage interest expense for Mt Melrose and EDI Real Estate (c) Not including discontinued operations Second quarter activity continued on page 8.

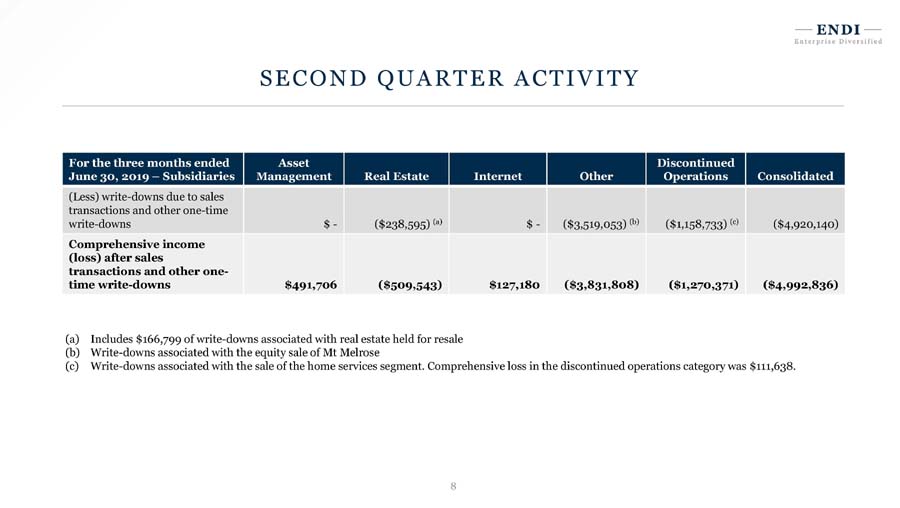

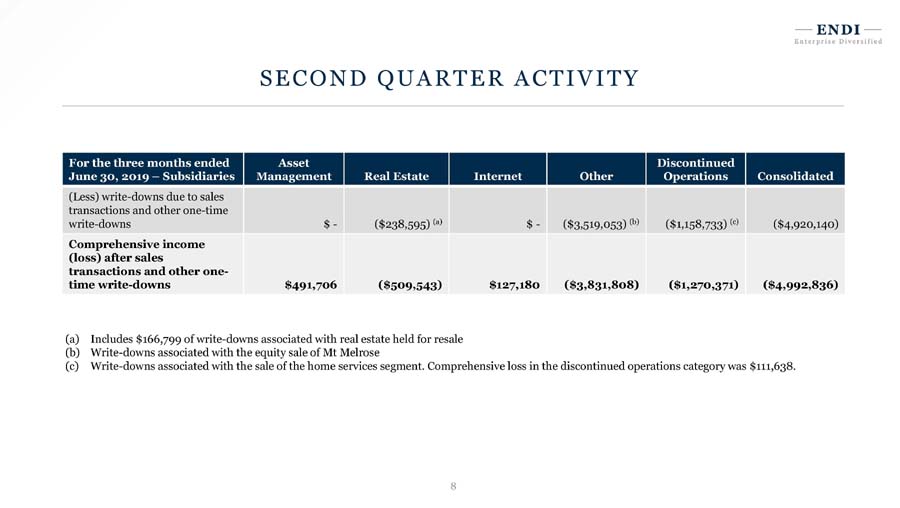

SECOND QUARTER ACTIVITY For the three months ended June 30, 2019 –Subsidiaries Asset Management Real Estate Internet Other Discontinued Operations Consolidated (Less) write-downs due to sales transactions and other one-time write-downs $ - ($238,595) (a) $ - ($3,519,053) (b) ($1,158,733) (c) ($4,920,140) Comprehensive income (loss) after sales transactions and other one-time write-downs $491,706 ($509,543) $127,180 ($3,831,808) ($1,270,371) ($4,992,836) (a) Includes $166,799 of write-downs associated with real estate held for resale (b) Write-downs associated with the equity sale of Mt Melrose (c) Write-downs associated with the sale of the home services segment. Comprehensive loss in the discontinued operations category was $111,638.

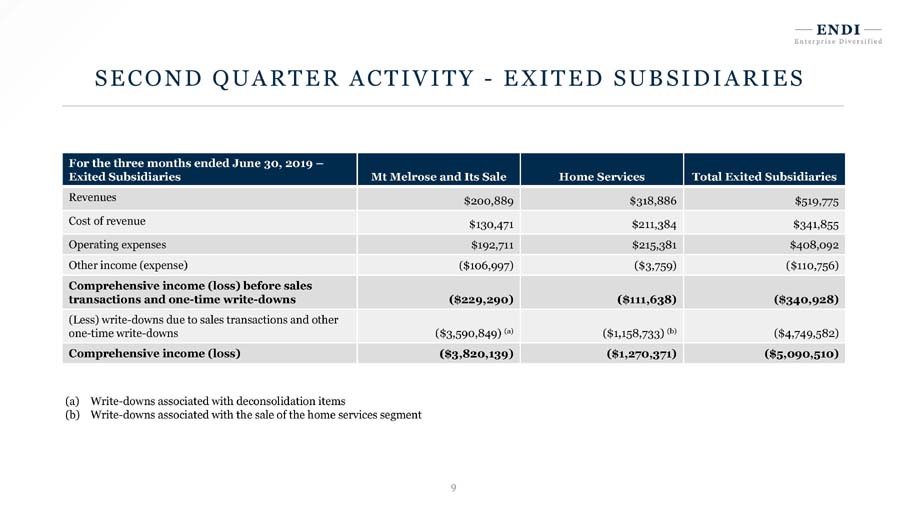

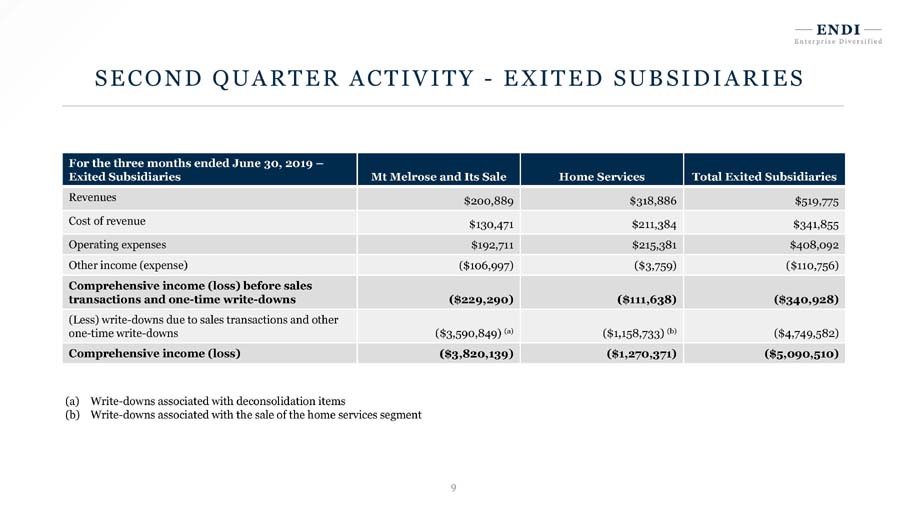

SECOND QUARTER ACTIVITY -EXITED SUBSIDIARIES For the three months ended June 30, 2019 –Exited Subsidiaries Mt Melrose and Its Sale Home Services Total Exited Subsidiaries Revenues $200,889 $318,886 $519,775 Cost of revenue $130,471 $211,384 $341,855 Operating expenses $192,711 $215,381 $408,092 Other income (expense) ($106,997) ($3,759) ($110,756) Comprehensive income (loss) before sales transactions and one-time write-downs ($229,290) ($111,638) ($340,928) (Less) write-downs due to sales transactions and other one-time write-downs ($3,590,849) (a) ($1,158,733) (b) ($4,749,582) Comprehensive income (loss) ($3,820,139) ($1,270,371) ($5,090,510) (a) Write-downs associated with deconsolidation items (b) Write-downs associated with the sale of the home services segment

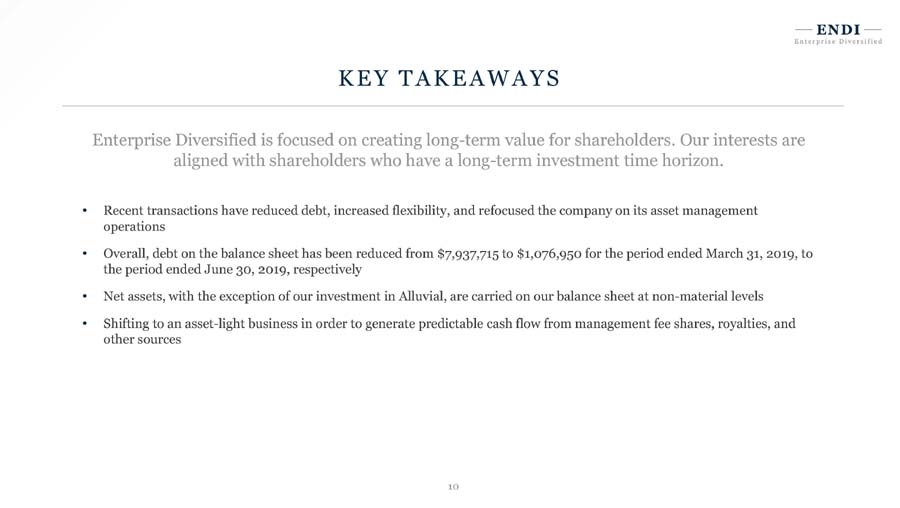

KEY TAKEAWAYS Enterprise Diversified is focused on creating long-term value for shareholders. Our interests are aligned with shareholders who have a long-term investment time horizon. Recent transactions have reduced debt, increased flexibility, and refocused the company on its asset management operations Overall, debt on the balance sheet has been reduced from $7,937,715 to $1,076,950 for the period ended March 31, 2019, to the period ended June 30, 2019, respectively Net assets, with the exception of our investment in Alluvial, are carried on our balance sheet at non-material levels Shifting to an asset-light business in order to generate predictable cash flow from management fee shares, royalties, and other sources

ASSET MANAGEMENT Willow Oak Asset Management partners with unique emerging investment managers.

AFFILIATED FUNDS Alluvial Fund Identifies and profits from deeply mispriced securities spanning industries and borders Invests in market segments where mispricingsare most likely to occur Focus: small firms, thinly traded issues, undiscovered value Bonhoeffer Fund Identifies and invests in undervalued securities that are either undiscovered or misunderstood Invests in overlooked companies in international and emerging markets Focus: compound mispricings, miscategorized firms, and corporate actions Fund Management Services Manages administration and compliance, investor relations and marketing, and infrastructure and support to internal and external funds Focused on providing support from the portfolio manager’s perspective Through direct ownership, seed investments, fee share agreements, and outsourced services relationships, Willow Oak seeks to grow a network of emerging managers.

FOCUSED ON GROWTH Increasing assets under management Adding funds to the Willow Oak platform Increasing visibility ofWillow Oak and associated funds Growing the Willow Oak network of emerging manager partners, investors, and Fund Management Services clients

WILLOW OAK BY THE NUMBERS Q2 2019 ASSETS UNDER MANAGEMENT $53 Mil MANAGEMENT/FMS FEES $41,101 INVESTORS 144 ALLUVIAL FUND $9.7 Mil Direct investment as of June 30, 2019 Willow Oak is also entitled to a fee share from the performance fees earned by each affiliated fund. Performance fees will be reported upon crystallization. Network Growth In the second quarter of 2019, Willow Oak Asset Management hosted a panel discussion, Value Investing in a Volatile Environment, in Omaha, Nebraska, in conjunction with the Berkshire Hathaway annual shareholder meeting. The event featured eight emerging managers, drew a crowd of more than 250 value investors,and has since drawn more than 3,000 views online. In addition to launching a greater social media presence on Twitter and YouTube, Willow Oak launched our new website at willowoakfunds.com and welcomed a third Advisory Council Member.

REAL ESTATE Enterprise Diversified holds a 35% stake in Mt Melrose and operates a historical property portfolio located in Roanoke, Virginia.

REAL ESTATE EDI Real Estate, LLC (EDI) Consists of a portfolio of 12 properties located in Roanoke, Virginia. These properties are legacy properties that were purchased by previous management prior to 2016 as part of a reinvestment strategy for the internet segment’s excess cash flows. Mt Melrose, LLC (MM) Enterprise Diversified holds a 35% ownership stake in Mt Melrose and is in partnership with a third-party operator. Financial results for Mt Melrose have been deconsolidated as of June 30, 2019.

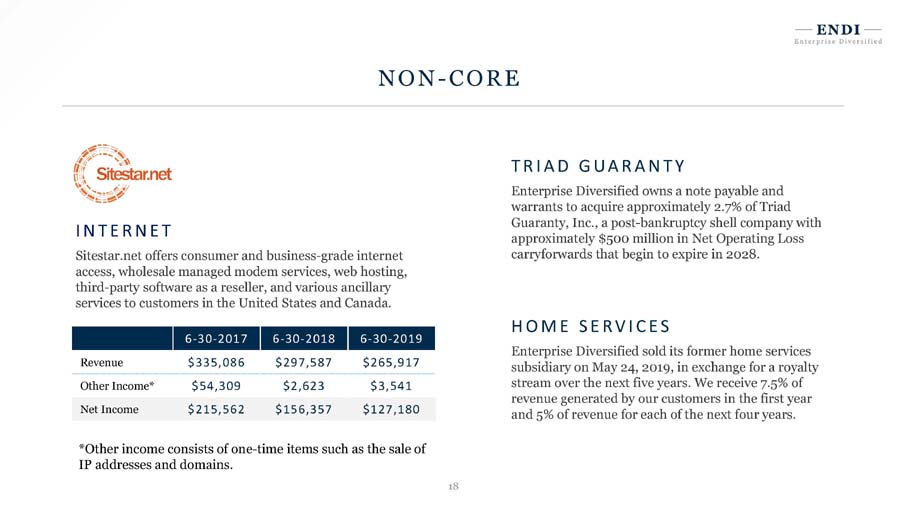

NON-CORE Enterprise Diversified carries out several non-core activities consisting of legacy businesses and opportunistic investments.

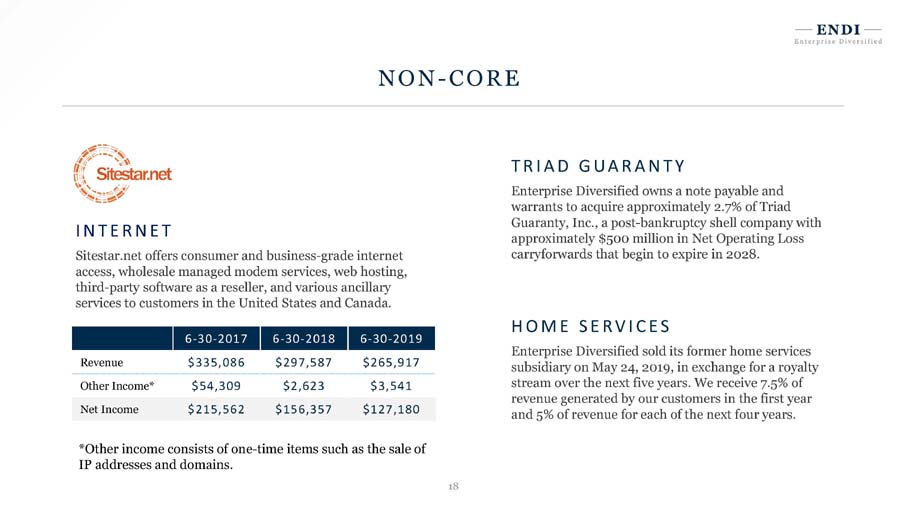

NON-CORE INTERNET Sitestar.net offers consumer and business-grade internet access, wholesale managed modem services, web hosting, third-party software as a reseller, and various ancillary services to customers in the United States and Canada. TRIAD GUARANTY Enterprise Diversified owns a note payable and warrants to acquire approximately 2.7% of Triad Guaranty, Inc., a post-bankruptcy shell company with approximately $500 million in Net Operating Loss carryforwards that begin to expire in 2028. 6-30-2017 6-30-2018 6-30-2019 Revenue $335,086 $297,587 $265,917 Other Income* $54,309 $2,623 $3,541 Net Income $215,562 $156,357 $127,180 *Other income consists of one-time items such as the sale of IP addresses and domains. HOME SERVICES Enterprise Diversified sold its former home services subsidiary on May 24, 2019, in exchange for a royalty stream over the next five years. We receive 7.5% of revenue generated by our customers in the first year and 5% of revenue for each of the next four years.

www.enterprisediversified.com