UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No.___)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

ENTERPRISE DIVERSIFIED, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | |

☒ | No fee required. |

| | |

☐ | Fee paid previously with preliminary materials |

| | |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

ENTERPRISE DIVERSIFIED, INC.

1806 Summit Avenue, Ste 300

Richmond, VA 23230

(434) 336-7737

Dear Stockholder:

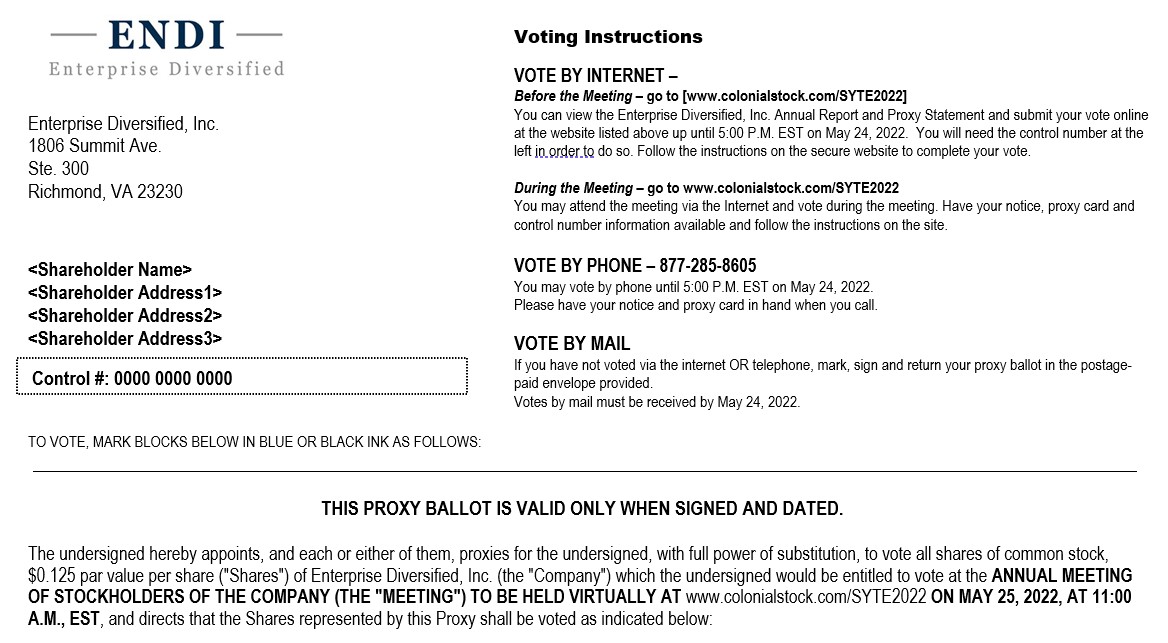

You are cordially invited to the Annual Meeting of Stockholders (the “Annual Meeting”) of Enterprise Diversified, Inc., a Nevada corporation (the “Company”), to be held virtually at 11:00 a.m. local time, on Wednesday, May 25, 2022. At the meeting, the stockholders will be asked to consider and act on the following items:

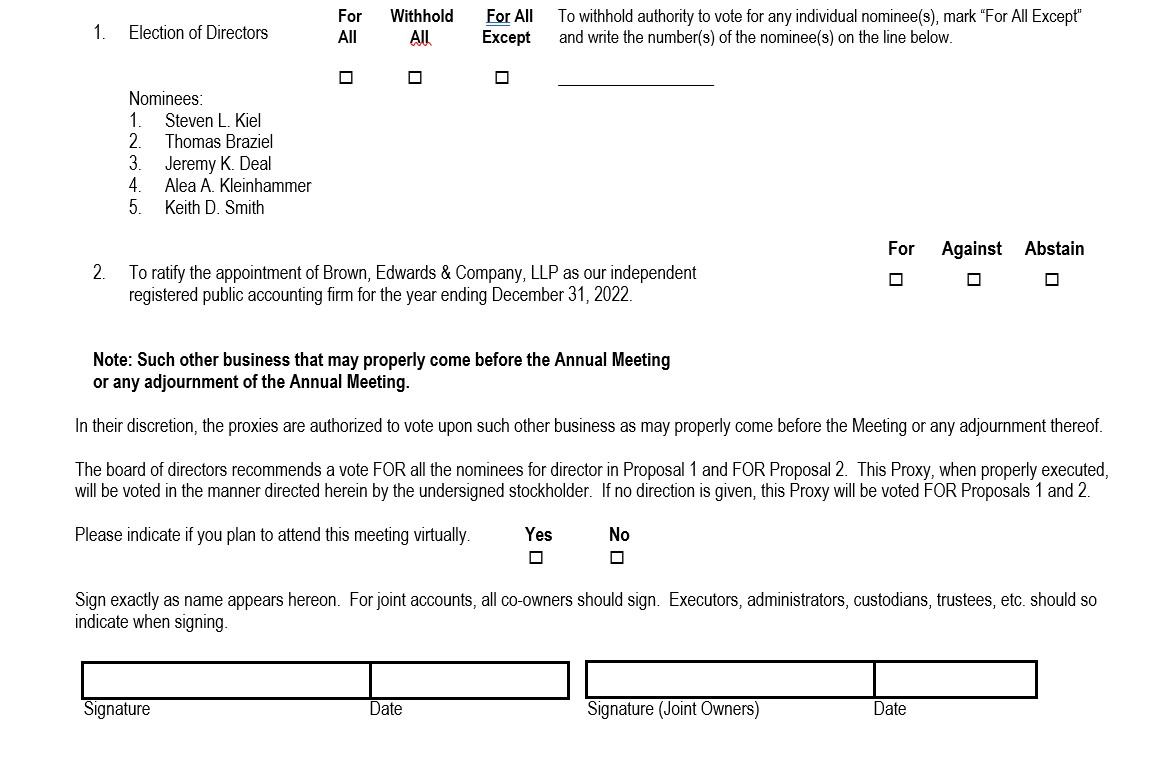

| | 1. | To re-elect five members of the board of directors of the Company, each to serve until our next Annual Meeting or until their respective successors are duly elected and qualified; |

| | 2. | To ratify the appointment of Brown, Edwards & Company, LLP as our independent registered public accounting firm for the year ending December 31, 2022; and |

| | 3. | To transact such other business that may properly come before the Annual Meeting or any adjournment of the Annual Meeting. |

You will also have the opportunity to ask questions and make comments at the meeting.

In accordance with the rules and regulations of the Securities and Exchange Commission, beginning on or about April 18, 2022, we are furnishing our Proxy Statement and Annual Report to stockholders and beneficial owners of record as of March 28, 2022, for the year ended December 31, 2021. The enclosed “Important Notice Regarding the Availability of Proxy Materials,” describes how you can access our proxy statement and annual report.

It is important that your stock be represented at the meeting regardless of the number of shares you hold. You are encouraged to specify your voting preferences by marking our proxy card and returning it as directed. The meeting can be accessed by visiting www.colonialstock.com/SYTE2022, where you will be able to listen to the meeting live, submit questions, and vote online. If you do attend the meeting virtually and wish to vote live during the meeting, you may revoke your proxy at the meeting. Whether or not you expect to attend the Annual Meeting, please vote as promptly as possible by following the instructions in the Notice of Internet Availability of Proxy Materials or the proxy card you receive in the mail.

If you have any questions about the Proxy Statement or the 2021 Annual Report, then please contact Alea Kleinhammer, our Chief Financial Officer, at (434) 336-7737.

| | Sincerely, |

| | |

| | /s/ Steven L. Kiel |

| | Steven L. Kiel |

| | Executive Chairman |

April 18, 2022

ENTERPRISE DIVERSIFIED, INC.

1806 Summit Avenue, Ste 300

Richmond, VA 23230

(434) 336-7737

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The Annual Meeting of Stockholders (the “Annual Meeting”) of Enterprise Diversified, Inc., a Nevada corporation (the “Company”) will be held virtually on Wednesday, May 25, 2022 at 11:00 a.m., Eastern Time. At the meeting, stockholders will consider and act on the following items:

| | 1. | To elect five members of the board of directors of the Company, each to serve until our next Annual Meeting or until their respective successors are duly elected and qualified; |

| | 2. | To ratify the appointment of Brown, Edwards & Company, LLP as our independent registered public accounting firm for the year ending December 31, 2022; and |

| | 3. | To transact such other business that may properly come before the Annual Meeting or any adjournment of the Annual Meeting. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only those stockholders of record as of the close of business on March 28, 2022, are entitled to vote at the Annual Meeting or any postponements or adjournments thereof.

On December 29, 2021, as previously announced by the Company, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) with CrossingBridge Advisors, LLC, a Delaware limited liability company (“CBA”) and Cohanzick Management, L.L.C., a Delaware limited liability company, among others. For more information regarding the Merger Agreement and related transactions contemplated thereby (the “Merger”), please read the Current Report on Form 8-K relating to the Merger filed with the U.S. Securities and Exchange Commission on December 29, 2021, including the complete text of the Merger Agreement provided as an exhibit thereto, and the proxy statement that the Company has filed in connection with the shareholder vote for the Merger when it becomes effective.

The Company and the other parties to the Merger Agreement are working towards satisfaction of the conditions precedent to the consummation of the Merger, including the submission of the Merger Agreement to the stockholders of the Company for approval. The Company does not expect that there will be sufficient time to complete the requirement to hold a special meeting of stockholder to approve the Merger Agreement before May 25, 2022. Instead, the special meeting of stockholder to approve the Merger Agreement and the consummation of the Merger are expected to take place as soon as practicable after May 25, 2022, however there is no assurance that the Company will be successful in completing such Merger prior to any specific date or at all. You are not being asked to vote on the Merger Agreement described above at this time. You will have the right to vote on the Merger Agreement if and when it is submitted to shareholders, which submission will be made pursuant to a separate proxy statement relating to the special meeting to approve the merger and the related matters

YOUR VOTE IS IMPORTANT!

Instructions on how to vote your shares are contained in the Proxy Statement and your proxy card. You may obtain, free of charge, a paper copy of our Annual Report on Form 10-K, including financial statements and exhibits, by writing to our Chief Financial Officer, Alea Kleinhammer, at 1806 Summit Avenue, Ste 300, Richmond, VA 23230, or by email at investorrelations@endi-inc.com. As of the date of the Notice of Annual Meeting of Stockholders and the Proxy Statement, such materials are also available online at www.enterprisediverisifed.com.

The meeting can be accessed by visiting www.colonialstock.com/SYTE2022, where you will be able to listen to the meeting live, submit questions, and vote online. Submitting your proxy does not affect your right to vote live at the Annual Meeting if you decide to virtually attend the Annual Meeting. You are urged to submit your proxy as soon as possible, regardless of whether or not you expect to attend the Annual Meeting. You may revoke your proxy at any time before it is exercised at the Annual Meeting by (i) delivering written notice to our Secretary, Jessica L. Greer, at the Company’s address above, (ii) submitting a later-dated proxy card, (iii) voting again via the Internet as described on your proxy card, or (iv) virtually attending the Annual Meeting and voting live. No revocation under (i) or (ii) will be effective unless written notice or the proxy card is received by our Secretary at or before the Annual Meeting.

When you submit your proxy, you authorize Jessica L. Greer or Alea Kleinhammer to vote your shares at the Annual Meeting and on any adjournments of the Annual Meeting in accordance with your instructions.

April 18, 2022 | By Order of the Board of Directors, /s/ Jessica L. Greer Jessica L. Greer Secretary |

ENTERPRISE DIVERSIFIED, INC.

1806 Summit Avenue, Ste 300

Richmond, VA 23230

(434) 382-7366

PROXY STATEMENT

This Proxy Statement and the accompanying proxy card are being made available via Internet access, beginning on or about April 18, 2022, to the owners of shares of common stock of Enterprise Diversified, Inc., a Nevada corporation (the “Company,” “our,” or “we”), as of March 28, 2022 in connection with the solicitation of proxies by our Board of Directors (“Board” or “Board of Directors”) for our 2022 Annual Meeting of Stockholders (the “Annual Meeting”).

The Annual Meeting will be held virtually, and can be accessed by visiting www.colonialstock.com/SYTE2022 on Wednesday, May 25, 2022, at 11:00 a.m., Eastern Daylight Time. Stockholders wishing to attend the Annual Meeting in person virtually are encouraged to login to the above internet address fifteen minutes prior to the commencement of the Annual Meeting. Our Board of Directors encourages you to read this document thoroughly and take this opportunity to vote, via proxy, on the matters to be decided at the Annual Meeting. As discussed below, you may revoke your proxy at any time before your shares are voted at the Annual Meeting.

Table of Contents

| | Pg No. |

Questions and Answers | |

Why did I receive an “Important Notice Regarding the Availability of Proxy Materials”? | 1 |

When and where will the Annual Meeting be held? | 1 |

How will proxy materials be delivered? | 1 |

What is the purpose of the Annual Meeting? | 1 |

Who is entitled to vote at our Annual Meeting? | 1 |

How do I vote my shares at the virtual Annual Meeting? | 1 |

How do I vote my shares without attending the Annual Meeting? | 2 |

What if I have technical difficulties or trouble accessing the virtual meeting? | 2 |

Why is the Annual Meeting a virtual, online meeting? | 2 |

What is a proxy? | 2 |

How will my shares be voted if I vote by proxy? | 2 |

How do I revoke my proxy? | 2 |

Is my vote confidential? | 3 |

How is voting conducted? | 3 |

What constitutes a quorum at the Annual Meeting? | 3 |

What vote is required to elect our directors for a one-year term? | 3 |

How will the outcome of the ratification of the appointment of Brown, Edwards & Company, LLP as our independent registered public accounting firm for the year ending December 31, 2021, be determined? | 3 |

What percentage of our outstanding stock do our directors and executive officers own? | 3 |

Who will bear the costs of this solicitation? | 3 |

How do I find out the voting results? | 3 |

How can I obtain a copy of our Annual Report on Form 10-K? | 3 |

Corporate Governance | |

Our Board of Directors | 4 |

Board Leadership Structure | 5 |

Communicating with the Board of Directors | 5 |

Risk Oversight | 5 |

Code of Ethics | 5 |

| Employee, Officer and Director Hedging | 5 |

Audit Committee | 6 |

Governance, Compensation, and Nominating Committee | 6 |

| Compensation Committee Interlocks and Insider Participation | 7 |

Nominating Process | 7 |

Independent Registered Public Accounting Firm Fees and Other Matters | |

Registered Public Accounting Firm Fees and Other Matters | 8 |

Preapproval of Services | 8 |

| Report of the Audit Committee | 9 |

Our Executive Officers | |

Executive Officers | 10 |

Executive Compensation | |

Compensation Philosophy and Objectives | 11 |

Summary Compensation Table | 11 |

Employment Agreements | 12 |

Director Compensation | |

Summary Director Compensation Table | 13 |

Equity Compensation Plan Information | 14 |

Related-Person Transactions | 15 |

Stock Ownership of Our Directors, Executive Officers, and 5% Beneficial Owners | 16 |

Proposal One: Election of Directors; Nominees | 17 |

Proposal Two: Ratify the Appointment of Brown, Edwards & Company, LLP as our Independent Registered Public Accounting Firm for the Year Ending December 31, 2022 | 18 |

Additional Information | |

Delivery of Documents to Security Holders Sharing an Address | 19 |

Stockholder Proposals for Our 2023 Annual Meeting | 19 |

Other Matters | 19 |

Attending the Annual Meeting | 20 |

Solicitation of Proxies | 20 |

Incorporation of Information by Reference | 20 |

QUESTIONS AND ANSWERS

Q. | Why did I receive an “Important Notice Regarding the Availability of Proxy Materials”? |

| | |

A. | In accordance with Securities and Exchange Commission (“SEC”) rules, instead of mailing a printed copy of our proxy materials, we may send an “Important Notice Regarding the Availability of Proxy Materials” to stockholders. All stockholders will have the ability to access the proxy materials on a website referred to in the notice or to request a printed set of these materials at no charge. You will not receive a printed copy of the proxy materials unless you specifically request one from us. Instead, the notice instructs you as to how you may access and review all of the important information contained in the proxy materials via the Internet and submit your vote via the Internet. |

Q. | When and where will the Annual Meeting be held? |

| | |

A. | The Annual Meeting will be held virtually on Wednesday, May 25, 2022, at 11:00 a.m., Eastern Daylight Time. The Annual Meeting will be conducted completely online via the Internet. Stockholders may attend and participate in the meeting by visiting www.colonialstock.com/SYTE2022. To access the Annual Meeting, you will need the 16-digit control number included on your Notice of Internet Availability of Proxy Materials on your proxy card or on your voting instruction form. We encourage you to access the meeting before the start time of 11:00 a.m., Eastern Daylight Time, on May 25, 2022. Please allow ample time for online check-in, which will begin at 10:45 a.m., Eastern Daylight Time, on May 25, 2022. |

Q. | How will proxy materials be delivered? |

A. | We have elected to provide all stockholders who hold shares of the Company’s common stock as of the Record Date (defined herein) and who are entitled to vote at the Annual Meeting access to our proxy materials electronically under the Securities and Exchange Commission’s “notice and access” rules. All stockholders will have the ability to access the proxy materials on a website referred to on the proxy card or to request a printed set of these materials at no charge. We are constantly focused on improving how people connect with information and believe that providing our proxy materials electronically increases the ability of our stockholders to connect with the information they need, while reducing the environmental impact of our Annual Meeting. If you want more information, then please see the Questions and Answers section of this proxy statement or visit the Annual Meeting section of our Investor Relations website (investorrelations@enterprisediversified.com). |

Q. | What is the purpose of the Annual Meeting? |

A. | During the Annual Meeting, our stockholders will act upon the matters outlined in the Notice of Annual Meeting of Stockholders accompanying this Proxy Statement, which are to (i) re-elect five members of the board of directors of the Company, each for a term of one year, (ii) ratify the appointment of Brown, Edwards & Company, LLP as our independent registered public accounting firm for the year ending December 31, 2022; and (iii) transact any other business that may properly come before the 2022 Annual Meeting or any adjournment thereof. You are not being asked to vote on the Merger Agreement described above at this time. You will have the right to vote on the Merger Agreement if and when it is submitted to shareholders, which submission will be made pursuant to a separate proxy statement relating to the special meeting to approve the merger and the related matters. |

Q. | Who is entitled to vote at our Annual Meeting? |

A. | The record holders of our common stock at the close of business on the record date of March 28, 2022, may vote at the Annual Meeting. Each share of Common Stock is entitled to one vote. There were 2,647,383 shares of common stock outstanding on the record date and entitled to vote at the Annual Meeting. |

Q. | How do I vote my shares at the virtual Annual Meeting? |

A. | You can vote virtually during the Annual Meeting by use of a proxy card if you receive a printed copy of our proxy materials, or via Internet or telephone as indicated on the proxy card. If you hold shares of our common stock as the stockholder of record, then you have the right to vote those shares at the Annual Meeting. If you are a beneficial owner and hold shares of our common stock in street name, then you can vote the shares you beneficially own through the online voting platform under a legal proxy from your bank, brokerage firm, or other nominee and are not required to take any additional action to obtain a legal proxy. Please follow the instructions at www.colonialstock.com/SYTE2022 in order to vote your shares during the Annual Meeting, whether you hold your shares of record or in street name. You will need the 16-digit control number provided on your proxy card, voting instruction form, or Notice of Internet Availability of Proxy Materials. Even if you plan to attend the virtual Annual Meeting, you should submit a proxy card or voting instruction form for your shares in advance, so that your vote will be counted if you later decide not to attend the virtual Annual Meeting. |

Q. A. | How do I vote my shares without attending the Annual Meeting? Whether you hold shares directly as the stockholder of record or indirectly as the beneficial owner of shares held for you by a broker or other nominee (i.e., in “street name”), you can direct your vote without attending the Annual Meeting. You may vote by granting a proxy or, for shares you hold in street name, by submitting voting instructions to your broker or nominee. In most instances, you will be able to do this by Internet, telephone, or by mail. Please refer to the summary instructions below and those included on your proxy card or, for shares you hold in street name, the voting instruction card provided by your broker or nominee. By Internet: If you have Internet access, then you can authorize your proxy from any location in the world as directed in our “Important Notice Regarding the Availability of Proxy Materials.” You can also access the proxy materials and voting instructions over the Internet via the web address provided on the “Important Notice Regarding the Availability of Proxy Materials.” To access the materials and to submit your proxy or voting instructions, you will need the 16-digit control number provided on the Notice you received in the mail. You can submit your proxy or voting instructions by following the instructions on the Notice or on the proxy voting website. By Telephone: If you are calling from the United States or Canada, then you may authorize your proxy by following the “By Telephone” instructions on the proxy card or, if applicable, the telephone voting instructions that may be described on the voting instruction card sent to you by your broker or nominee. By Mail: You may authorize your proxy by signing your proxy card and mailing it in the enclosed, postage-prepaid and addressed envelope. For shares you hold in street name, you may sign the voting instruction card included by your broker or nominee and mail it in the envelope provided. |

Q. | What if I have technical difficulties or trouble accessing the virtual meeting? |

A. | We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual Annual Meeting. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, then please call the technical support number that will be posted at www.colonialstock.com/SYTE2022 or at 877-285-8605. Technical support will be available starting at 10:00 a.m. Eastern Daylight Time on May 25, 2022. |

Q. | Why is the Annual Meeting a virtual, online meeting? |

A. | By conducting our Annual Meeting solely online via the Internet, we eliminate many of the costs associated with a physical meeting. In addition, we anticipate that a virtual meeting will provide greater accessibility for stockholders, encourage stockholder participation from around the world, and improve our ability to communicate more effectively with our stockholders during the meeting. |

| | A. | A proxy is a person or persons you appoint to vote your shares on your behalf. If you are unable to attend the Annual Meeting, then our Board of Directors seeks your appointment of a proxy so that your shares may be voted. If you vote by proxy, then you will be designating our Secretary, Jessica L. Greer or our Chief Financial Officer, Alea Kleinhammer, as your proxy. Such persons may act on your behalf and have the authority to appoint a substitute to act as your proxy. |

Q. | How will my shares be voted if I vote by proxy? |

A. | Your proxy will be voted according to the instructions you provide. If you complete and submit your proxy but do not otherwise provide instructions on how to vote your shares, then your shares will be voted (i) “FOR” the individuals nominated to serve as members of our Board of Directors, and (ii) “FOR” the ratification of the appointment of Brown, Edwards & Company, LLP as our independent registered public accounting firm for the year ending December 31, 2022. Presently, our Board does not know of any other matter that may come before the Annual Meeting. However, your proxies are authorized to vote on your behalf, using their discretion, on any other business that properly comes before the Annual Meeting. |

Q. | How do I revoke my proxy? |

A. | You may revoke your proxy at any time before your shares are voted at the Annual Meeting by: |

| | ● | delivering written notice to our Secretary, Jessica L. Greer, at our address above; |

| | ● | submitting a later-dated proxy card; |

| | ● | voting again via the Internet as described on the proxy card; or |

| | | |

| | ● | virtually attending the Annual Meeting and voting virtually in person. |

Q. | Is my vote confidential? |

| | A. | Yes. All votes remain confidential, unless you provide otherwise. |

Q. | How is voting conducted? |

| | A. | Before the Annual Meeting, our Board of Directors will appoint one or more inspectors of election for the meeting. The inspector(s) will determine the number of shares represented at the meeting, the existence of a quorum, and the validity and effect of proxies. The inspector(s) will also receive, count, and tabulate ballots and votes and determine the results of the voting on each matter that comes before the Annual Meeting. Abstentions and votes withheld, and shares represented by proxies reflecting abstentions or votes withheld, will be treated as present for purposes of determining the existence of a quorum at the Annual Meeting. They will not be considered as votes “for” or “against” any matter for which the stockholder has indicated their intention to abstain or withhold their vote. Broker or nominee non-votes, which occur when shares are held in “street name” by brokers or nominees who indicate that they do not have discretionary authority to vote on a particular matter, will not be considered as votes “for” or “against” that particular matter. Broker and nominee non-votes will be treated as present for purposes of determining the existence of a quorum and may be entitled to vote on certain matters at the Annual Meeting. |

Q. | What constitutes a quorum at the Annual Meeting? |

| | A. | In accordance with Nevada law (the law under which we are incorporated) and our bylaws, as amended and/or restated from time to time (“Bylaws”), the presence at the Annual Meeting, by proxy or by virtual attendance, of the holders of a majority of the outstanding shares of the capital stock entitled to vote at the Annual Meeting constitutes a quorum, thereby permitting the stockholders to conduct business at the Annual Meeting. Abstentions and votes withheld, and shares represented by proxies reflecting abstentions or votes withheld, will be treated as present for purposes of determining the existence of a quorum at the Annual Meeting. Broker or nominee non-votes, which occur when shares held in “street name” by brokers or nominees who indicate that they do not have discretionary authority to vote on a particular matter, will be treated as present for purposes of determining the existence of a quorum, and may be entitled to vote on certain matters at the Annual Meeting. If a quorum is not present at the Annual Meeting, then a majority of the stockholders virtually present and by proxy may adjourn the meeting to another date not more than 60 days from the record date of March 28, 2022. At any adjourned meeting at which a quorum is present, any business may be transacted that might have been transacted at the originally called meeting. |

Q. | What vote is required to elect the Company’s directors for a one-year term? |

| | A. | The affirmative vote of a plurality of the votes cast, by the holders of common stock virtually present or present by proxy, entitled to vote in the election. Abstentions, votes withheld, and broker or nominee non-votes will not affect the outcome of director elections. |

Q. | How will the outcome of the ratification of the appointment of Brown, Edwards & Company, LLP as our independent registered public accounting firm for the year ending December 31, 2022, be determined? |

A. | The affirmative vote of a majority of the votes cast, by the holders of common stock virtually present or present by proxy and entitled to vote at the Annual Meeting, is required to ratify the appointment of Brown, Edwards & Company, LLP as our independent registered public accounting firm for the year ending December 31, 2022. Abstentions and votes withheld will have the same effect as a negative vote. However, broker or nominee non-votes, and shares represented by proxies reflecting broker or nominee non-votes, will not have the effect of a vote “for” or “against” this proposal. |

Q. | What percentage of our outstanding common stock do our directors and executive officers own? |

| | |

| A. | As of March 31, 2022, our directors and executive officers owned, or have the right to acquire, approximately 34.1% of our outstanding common stock. See the discussion under the heading “Stock Ownership of Our Directors, Executive Officers, and 5% Beneficial Owners” on page 16 for more details. |

| | |

| Q. | Who will bear the costs of this solicitation? |

| | |

| A. | Our directors are making this solicitation on behalf of the Company, and the Company will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials. If you choose to access the proxy materials over the Internet; however, you are responsible for Internet access charges you may incur. The solicitation of proxies or votes may be made in person. We will also reimburse brokerage houses and other custodians, nominees, and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to shareholders. |

| | |

| Q. | How do I find out the voting results? |

| | |

| A. | Preliminary results are typically announced at the Annual Meeting. Final voting results will be reported on a Form 8-K filed with the SEC following the Annual Meeting. |

| | |

| Q. | How can I obtain a copy of the Company’s Annual Report on Form 10-K? |

| | |

| A. | We have filed our Annual Report on Form 10-K for the year ended December 31, 2021, with the Securities and Exchange Commission (“SEC”). The Annual Report on Form 10-K is also included in the 2021 Annual Report to Stockholders. You may obtain, free of charge, a paper copy of our Annual Report on Form 10-K, including financial statements and exhibits, by writing to our Chief Financial Officer, Alea Kleinhammer, or by emailing investorrelations@enterprisediversified.com. |

CORPORATE GOVERNANCE

Our Board of Directors

Our Bylaws provide that the business and affairs of the Company shall be managed, and all corporate powers shall be exercised, by or under the direction of the Board of Directors. Our Bylaws provide further that the Board of Directors shall consist of not less than one and not more than nine members unless changed by a duly adopted amendment to the articles of incorporation or by an amendment to the Bylaws adopted by the vote or written consent of holders of a majority of the outstanding shares entitled to vote.

The following individuals are being nominated for re-election to the Board (See “Election of Directors; Nominees”):

| | Age as of the Annual Meeting | Director Since | Audit Committee | Governance, Compensation, and Nominating Committee |

Steven L. Kiel Executive Chairman | 43 | 2015 | | |

Thomas Braziel | 37 | 2019 | ● | ● |

Jeremy K. Deal Vice-Chairman | 44 | 2018 | ☐ | ☐ |

Alea Kleinhammer Chief Financial Officer | 31 | 2019 | | |

Keith D. Smith | 58 | 2016 | | |

The following biographies set forth the names of our director nominees, their principal occupations, and employers for at least the past five years, any other directorships held by them during the past five years in companies that are subject to the reporting requirements of the Securities Exchange Act of 1934 (the “Exchange Act”), or any company registered as an investment company under the Investment Company Act of 1940, as well as additional information, all of which we believe sets forth each director nominee’s qualifications to serve on the Board. The age of our director nominees are set forth in the table above.

Steven L. Kiel has served as a director since 2015. Mr. Kiel is the President of Arquitos Capital Management, LLC and portfolio manager of Arquitos Capital Partners, LP and Arquitos Capital Offshore, Ltd. Mr. Kiel is a judge advocate in the Army Reserves, a veteran of Operation Iraqi Freedom, and currently holds the rank of Major. Previously, Mr. Kiel was an attorney in private practice. He is a graduate of George Mason School of Law and Illinois State University and is a member of the bar in Illinois (inactive) and Washington, DC. The Company believes that Mr. Kiel’s financial, leadership, and legal experiences qualify him to serve on the Board.

Thomas Braziel has served as a director of the Company since May 5, 2019. Mr. Braziel currently serves as the Co-Chief Executive Officer and Co-Chairman of the Board of Directors of Winland Holding. In 2018, Mr. Braziel cofounded 507 Capital LLC, an investment management firm specializing in distressed credit investments, where he currently serves as Managing Partner and CIO. Previously, Mr. Braziel cofounded and managed B.E. Capital Management, a U.S. domiciled hedge fund specializing in special situations and bankruptcy. Prior to cofounding B.E. Capital Management, Mr. Braziel founded Campden Grove Capital, an investment partnership taking advantage of small public company bankruptcies and other securities in bankruptcy. Mr. Braziel received his master’s in mathematics of finance in 2012 from Columbia University and graduated cum laude from New York University in 2007 with a B.A. in economics. The Company believes that Mr. Braziel’s experiences in the investment management industry and as a founder and bankruptcy and securities specialist qualify him to serve on the Board.

Jeremy K. Deal has been a director since he was appointed on March 29, 2018. Mr. Deal has served as the Chairman of the Company’s Governance, Compensation, and Nominating Committee since March 29, 2018, and as Chairman of the Company’s Audit Committee since November 8, 2018. He is the founder and portfolio manager of JDP Capital Management. Mr. Deal holds a Bachelor of Science in international business from Alliant International. The Company believes that Mr. Deal’s experience in evaluating investment decisions, as well as his familiarity with the Company’s holdings, qualify him to serve on the Board.

Alea A. Kleinhammer has served as a director of the Company since May 5, 2019. Ms. Kleinhammer currently serves as the Company’s Chief Financial Officer and has worked closely with all of the Company’s subsidiaries as part of the financial reporting process since 2016. Ms. Kleinhammer holds an active CPA license in the state of Virginia and has multiple years of experience working in the public accounting sector. Ms. Kleinhammer earned a Bachelor of Arts in accounting from the University of Maryland at College Park. The Company believes that Ms. Kleinhammer’s experience as an accountant and familiarity with the Company qualify her to serve on the Board.

Keith D. Smith has been a director since 2016. Since 2017, Mr. Smith has been the portfolio manager of Bonhoeffer Capital Management, which is affiliated with the Company’s asset management subsidiary, Willow Oak Asset Management, LLC. He was previously a valuation professional with more than 20 years of consulting, corporate finance, and “Big Four” accounting and auditing experience. Mr. Smith holds an MBA from University California, Los Angeles and a Bachelor of Science in electrical engineering from Union College. The Company believes that Mr. Smith’s experience in evaluating investment decisions qualifies him to serve on the Board.

There is no family relationship between or among any of our executive officers or directors.

There are no legal or regulatory proceedings involving any director, director nominee, or officer of the Company, except for the complaint filed by the Company on April 12, 2016, against its former President and Chief Executive Officer and current stockholder, Frank Erhartic, Jr., alleging monetary damages in excess of $350,000. This matter is currently pending with the Circuit Court for the City of Lynchburg.

During 2021, the Board held six meetings, our audit committee held four meetings, and our governance, compensation, and nominating committee held one meeting. During the period served, each Director attended 100% of the total number of meetings of the Board held during the year. Our directors are expected to attend each Annual Meeting of Stockholders, and it is our expectation that all director nominees will attend this year’s Annual Meeting. All directors attended the Annual Meeting of Shareholders in 2021, which was held virtually on May 27, 2021.

Board Leadership Structure

The Board does not have a formal policy regarding the separation of the roles of Principal Executive Officer and Executive Chairman, as the Board believes that it is in the best interests of the Company to make that determination based on the direction of the Company and the current membership of the Board. The Board has determined that having a director who is an executive officer serve as the Chairman is in the best interest of the Company’s stockholders at this time.

Communicating with the Board of Directors

Our Board has established a process by which stockholders can send communications to the Board. You may communicate with the Board as a group, or to specific directors, by writing to Jessica L. Greer, our Secretary, at our offices located at 1806 Summit Avenue, Ste 300, Richmond, VA 23230. Ms. Greer will review all such correspondence and regularly forward to the Board a summary of all correspondence and copies of all correspondence that deals with the functions of the Board or committees thereof or that otherwise requires their attention. Directors may at any time review a log of all correspondence we receive that is addressed to members of our Board and request copies of any such correspondence. Concerns relating to accounting, internal controls, or auditing matters may be communicated in this manner, or may be submitted on an anonymous basis via e-mail to investorrelations@endi-inc.com. These concerns will be immediately brought to the attention of our Audit Committee and resolved in accordance with procedures established by our Audit Committee.

Risk Oversight

The Company has a risk management program overseen by Jessica L. Greer, Corporate Secretary and Chief Compliance Officer. Ms. Greer, with the assistance of Alea Kleinhammer, Chief Financial Officer, and other members of management, identifies material risks and prioritizes them for our Board. Our Board regularly reviews information regarding our credit, liquidity, cybersecurity, operations, and regulatory compliance, as well as the risks associated with each.

Code of Ethics

The Company has adopted a code of ethics and it is available on the Company’s website www.enterprisediversified.com under Corporate Governance.

Employee, Officer and Director Hedging

The Company has not adopted policies applicable to employees, including officers, or directors, regarding the purchase of financial instruments or to otherwise engage in transactions that hedge or offset the market value of our securities.

Audit Committee

The Audit Committee currently consists of Jeremy K. Deal and Thomas Braziel. Our Board has determined each of Mr. Deal and Mr. Braziel to be independent. Mr. Deal chairs the Audit Committee.

The Audit Committee held four meetings and took no action(s) by unanimous written consent during the fiscal year ended December 31, 2021. The duties and responsibilities of the Audit Committee are set forth in the Audit Committee Charter, which is available on the Company’s website, located at www.enterprisediversified.com under the Information tab. Among other duties, the Audit Committee assists the Board of Directors in fulfilling its responsibility to the shareholders, potential shareholders, and investment community relating to corporate accounting, reporting practices of the Company, and the quality and integrity of the Company’s financial reporting. To fulfill its purposes, the Audit Committee’s duties include the following:

| | ● | to appoint, evaluate, compensate, oversee the work of, and, if appropriate, terminate, the independent auditor, who shall report directly to the Committee; |

| | ● | to approve in advance all audit engagement fees and terms of engagement, as well as all audit and non-audit services to be provided by the independent auditor; and |

| | ● | to engage independent counsel and other advisors, as it deems necessary, to carry out its duties. |

In performing these functions, the Audit Committee meets periodically with the independent auditors and management to review their work and confirm that they are properly discharging their respective responsibilities.

The report of the Audit Committee can be found on page 9 of this proxy statement.

Governance, Compensation, and Nominating Committee

The Governance, Compensation, and Nominating Committee currently consists of Jeremy K. Deal and Thomas Braziel. Our Board has determined each of Mr. Deal and Mr. Braziel to be independent. Mr. Deal chairs the Governance, Compensation, and Nominating Committee.

The Governance, Compensation, and Nominating Committee held one meeting and took no actions(s) by unanimous written consent during the fiscal year ended December 31, 2021. The duties and responsibilities of the Governance, Compensation, and Nomination Committee are set forth in the Governance, Compensation, and Nominating Committee Charter, which is available on the Company’s website, located at www.enterprisediversified.com under the Information tab. Among other duties, the Governance, Compensation, and Nominating Committee assists the Board of Directors in fulfilling its responsibility to the shareholders, potential shareholders, and investment community relating to corporate governance, compensation, and nomination oversight and director effectiveness and performance. To fulfill its purposes, the Governance, Compensation, and Nominating Committee’s duties include the following:

| | ● | recommending to the Board corporate governance guidelines applicable to the Company; |

| | ● | Monitoring the Company’s compliance with its Code of Ethics and all applicable laws and regulations; |

| | ● | identifying, reviewing, evaluating, and recommending individuals qualified to become members of the Board and its committees; |

| | ● | evaluating and recommending to the Board the compensation of the Board and its committees; |

| | ● | reviewing the effectiveness and performance of the Board and its members; |

| | ● | assessing and reviewing risks associated with the Company and, if necessary, recommending mitigation actions to the Board; and |

| | ● | setting the compensation of the Chief Executive Officer and performing other compensation and oversight. |

We believe that our Board of Directors as a whole should encompass a range of talent, skill, and expertise, enabling it to provide sound guidance with respect to our operations and interests. The committee evaluates all candidates for our Board of Directors by reviewing their biographical information and qualifications. If the independent directors determine that a candidate is qualified to serve on our Board of Directors, then such candidate is interviewed by at least one of the independent directors and our Principal Executive Officer. Other members of the Board of Directors also have an opportunity to interview qualified candidates. The independent directors then determine, based on the background information and the information obtained in the interviews, whether to recommend to the Board of Directors that the candidate be nominated for approval by the stockholders to fill a directorship. With respect to an incumbent director whom the independent directors are considering as a potential nominee for reelection, the independent directors review and consider the incumbent director’s service during his or her term, including the number of meetings attended, level of participation, and overall contribution to the Board of Directors. The manner in which the independent directors evaluate a potential nominee will not differ based on whether the candidate is recommended by our directors or stockholders.

Our Board of Directors has examined the composition of our Governance, Compensation, and Nominating Committee and the qualifications of the Committee members in light of the current rules and regulations governing nominating committees from certain stock exchanges. Based upon this examination, our Board of Directors has determined that each member of our Governance, Compensation, and Nominating Committee is independent and is otherwise qualified to be a member of our Governance, Compensation, and Nominating Committee in accordance with such rules.

The Governance, Compensation, and Nominating Committee Charter charges the Governance, Compensation, and Nominating Committee with reviewing and recommending corporate objectives relevant to the CEO’s compensation, as well as evaluating the CEO’s performance relative to those goals, and to make recommendations to the Board regarding the CEO’s compensation. The Governance, Compensation, and Nominating Committee also makes recommendations to the Board regarding all other executive compensation and non-management compensation. The Governance, Compensation, and Nominating Committee may, at its discretion, employ third-party advisors to assist in its performance of these functions.

We do not have a formal policy in place with regard to the consideration of diversity in considering candidates for our Board of Directors, but the Board of Directors strives to nominate candidates with a variety of complementary skills so that, as a group, the Board of Directors will possess the appropriate talent, skills, and expertise to oversee our business.

Compensation Committee Interlocks and Insider Participation

During the fiscal year ended December 31, 2021, no member of the Governance, Compensation, and Nominating Committee was an officer or employee of the Company or a former officer of the Company.

Nominating Process

With respect to an incumbent director whom the other directors are considering as a potential nominee for re-election, such directors review and consider the incumbent director’s service during his or her term, including the number of meetings attended, level of participation, and overall contribution to the Board.

Our Board will also consider candidates recommended by stockholders for nomination to our Board of Directors. A stockholder who wishes to recommend a candidate for nomination to our Board of Directors must submit such recommendation to our Corporate Secretary, Jessica L. Greer, at Enterprise Diversified, Inc., 1806 Summit Avenue, Ste 300, Richmond, VA 23230. Any recommendation must be received not less than 90 calendar days nor more than 120 calendar days before the anniversary date of the previous year’s annual meeting. All stockholder recommendations of candidates for nomination for election to our Board of Directors must be in writing and must set forth the following: (i) the candidate’s name, age, business address, and other contact information, (ii) the number of shares of the Company’s common stock beneficially owned by the candidate, (iii) a complete description of the candidate’s qualifications, experience, background, and affiliations, as would be required to be disclosed in the proxy statement pursuant to Schedule 14A under the Exchange Act, (iv) a sworn or certified statement by the candidate in which he or she consents to being named in the proxy statement as a nominee and to serve as director if elected, and (v) the name and address of the stockholder(s) of record making such a recommendation and the number of shares owned by the recommending stockholder(s).

Vacancies in the Board may be filled by a majority of the remaining directors, though less than a quorum, by (1) the unanimous written consent of the directors then in office, (2) the affirmative vote of a majority of the directors then in office at a meeting held pursuant to notice or waivers of notice complying with Nevada corporations law, or (3) a sole remaining director. Each director so elected shall hold office until the next annual meeting of the stockholders and until a successor has been elected and qualified, or until such director resigns or is removed from office. A vacancy in the Board of Directors created by the removal of a director may only be filled by the vote of a majority of the shares entitled to vote represented at a duly held meeting at which a quorum is present, or by the written consent of the holders of a majority of the outstanding shares.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FEES AND OTHER MATTERS

Brown, Edwards & Company, LLP has served as our independent registered public accounting firm since June 1, 2019 after it acquired Cherry Bekaert, LLP, our former accounting firm since 2016.

Our Board of Directors has asked the stockholders to ratify the selection of Brown, Edwards & Company, LLP as our independent registered public accounting firm. See Proposal Two: To ratify the appointment of Brown, Edwards & Company, LLP as our independent registered public accounting firm for the year ending December 31, 2022, on page 18 of this proxy statement. The Audit Committee has reviewed the fees described below and concluded that the payment of such fees is compatible with maintaining Brown, Edwards & Company, LLP’s independence. All proposed engagements of Brown, Edwards & Company, LLP, whether for audit services, audit-related services, tax services, or permissible non-audit services, were preapproved by our Audit Committee.

Registered Public Accounting Firm Fees and Other Matters

The following table summarizes the fees paid by the Company for audit, tax, and all other fees for 2021 and 2020:

| | | 2021 | | 2020 |

Audit fees (1) | | $ | 70,850 | | $ | 74,725 |

Audit-related fees (2) | | | 20,754 | | | — |

Tax fees (3) | | | 9,825 | | | 13,446 |

All Other Fees (4) | | | — | | | — |

Total | | $ | 101,429 | | $ | 88,171 |

(1) | Consists of fees for services provided in connection with the audit of the Company’s financial statements review of the Company’s quarterly financial statements, all paid to Brown, Edwards & Company, LLP, our current registered public accounting firm. |

(2) | Consists of fees for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s financial statements and other SEC filings and are not reported under “Audit fees,” all paid to Brown, Edwards & Company, LLP, our current registered public accounting firm. |

(3) | Consists of fees for preparation of Federal and state income tax returns, all paid to John Brogan, JD, CPA. |

(4) | Consists of fees billed for all products and services provided that are not included in (1), (2) and (3) above. No such fees were billed for any such services during the periods presented. |

Management notes that all audit fees paid during the years ended December 31, 2021, and December 31, 2020, respectively, were paid to Brown, Edwards & Company, LLP and were related to audit services for the years ended December 31, 2021, and December 31, 2020. All tax fees paid during the years ended December 31, 2021, and December 31, 2020, were paid to John Brogan, JD, CPA.

The engagement of Brown, Edwards & Company, LLP for the 2021 and 2020 fiscal years, and the scope of audit-related services, including the audits and reviews described above, were all preapproved by the Audit Committee.

The policy of the Audit Committee is to preapprove the engagement of the Company’s independent auditors and the furnishings of all audit and non-audit services.

Preapproval of Services

Our Audit Committee sets forth the procedures under which services provided by our independent registered public accounting firm will be preapproved by our Audit Committee. The potential services that might be provided by our independent registered public accounting firm fall into two categories:

| | ● | services that are permitted, including the audit of our annual financial statements, the review of our quarterly financial statements, related attestations, benefit plan audits and similar audit reports, financial and other due diligence on acquisitions, and federal, state, and non-US tax services; and |

| | ● | services that may be permitted, subject to individual, case-by-case preapproval, including compliance and internal control reviews, indirect tax services such as transfer pricing and customs and duties, and forensic auditing. |

Services that our independent registered public accounting firm may not legally provide include such services as bookkeeping, certain human resources services, internal audit outsourcing, and investment or investment banking advice.

All proposed engagements of our independent registered public accounting firm, whether for audit services or permissible non-audit services, are preapproved by the Audit Committee. We jointly prepare a schedule with our independent registered public accounting firm that outlines services that we reasonably expect we will need from our independent registered public accounting firm and categorize them according to the classifications described above. Each service identified is reviewed and approved or rejected by the Audit Committee.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee has reviewed and discussed the audited financial statements for the year ended December 31, 2021, with the Company’s management and the Company’s independent registered public accounting firm. The Audit Committee has also discussed with the Company’s independent registered public accounting firm the matters required to be discussed by the Statement on Auditing Standards No. 1301, Communications with Audit Committees, issued by the Public Company Accounting Oversight Board (United States).

The Audit Committee also has received and reviewed the written disclosures and the letter from the Company’s independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the Company’s independent registered public accounting firm’s communications with the Audit Committee concerning independence, and has discussed with the Company’s independent registered public accounting firm its independence from the Company.

Additionally, the SEC requires that at least one member of the Audit Committee have a “heightened level of financial and accounting sophistication.” Such person is known as the “audit committee financial expert” under relevant SEC rules. Our Board has determined that Mr. Braziel is an “audit committee financial expert” as the SEC defines that term. Please see Mr. Braziel’s biography on page 4 for a description of his relevant experience.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board that the financial statements referred to above be included in the Annual Report.

THE AUDIT COMMITTEE:

Jeremy K. Deal

Thomas Braziel

April 18, 2022

OUR EXECUTIVE OFFICERS

Executive Officers

Our current executive officers are:

Name | | Age | | Position |

Steven L. Kiel (1) | | 43 | | President, Principal Executive Officer and Executive Chairman |

Alea Kleinhammer (2) | | 31 | | Chief Financial Officer and Director |

(1) | On May 6, 2019, the Board elected Steven L. Kiel as Executive Chairman of the Company. Mr. Kiel had served as Chairman and Chief Executive Officer of the Company prior to this appointment from 2016-2018. |

Mr. Kiel is not related by blood, marriage, or adoption to any other director or executive officer. The biography of Mr. Kiel is presented in connection with “Corporate Governance” beginning on page 4 of this Proxy Statement.

(2) | On October 5, 2018, the Board elected Alea Kleinhammer as the Chief Financial Officer of the Company. Ms. Kleinhammer had served as Corporate Controller of the Company since September 2016. |

Ms. Kleinhammer is not related by blood, marriage, or adoption to any other director or executive officer. The biography of Ms. Kleinhammer is presented in connection with “Corporate Governance” beginning on page 4 of this Proxy Statement.

EXECUTIVE COMPENSATION

Compensation Philosophy and Objectives

Our compensation programs are designed to motivate our employees to work toward achievement of our corporate mission to create sustained stockholder value by generating attractive returns when measured over the long term. In order to achieve our key business and strategic goals, we must be able to attract, retain, and motivate quality employees in an exceptionally competitive environment. Our industries are highly regulated, scrutinized, and dynamic and, as a result, we require employees that are highly educated, dedicated, and experienced. The primary objectives of our executive compensation program are to:

| | ● | attract, retain, and motivate experienced and talented executives; |

| | ● | ensure executive compensation is aligned with our corporate strategies and business goals; |

| | ● | recognize the individual contributions of executives while fostering a shared commitment among executives; |

| | ● | promote the achievement of key strategic, development, and operational performance measures by linking compensation to the achievement of measurable corporate performance goals; and |

| | ● | align the interests of our executives with our stockholders by rewarding performance that leads to the creation of stockholder value. |

Summary Compensation Table

The following table sets forth the cash and other compensation that we paid to the named executive officers (“NEOs”) below or that was otherwise earned by such NEOs for their services in all capacities for the two fiscal years ended December 31, 2021 and 2020, respectively.

Name and Principal Position | Year | Salary ($) | Bonus ($) | Option Awards ($) | All Other Compensation ($) | Total ($) |

Steven L. Kiel, President, Principal Executive Officer, & Executive Chairman (1) | 2021 2020 | | | | 100,000 90,000 | 100,000 90,000 |

Alea A. Kleinhammer, Chief Financial Officer (2) | 2021 2020 | 126,000 120,000 | 25,000 | | 30,000 30,000 | 181,000 150,000 |

(1) | Appointed Chief Executive Officer on December 14, 2015, and Chief Financial Officer on March 3, 2016. As previously reported in our Current Report on Form 8-K filed with the SEC on October 9, 2018, on October 5, 2018, Mr. Kiel resigned as the Company’s Chief Executive Officer and Chief Financial Officer and was appointed as Chairman of the Board of Directors. As previously reported in our Current Report on Form 8-K filed with the SEC on May 6, 2019, on April 30, 2019, Mr. Kiel was appointed as the Company’s Principal Executive Officer and Executive Chairman. |

(2) | Appointed Chief Financial Officer on October 5, 2018. As previously reported in our Current Report on Form 8-K filed with the SEC on December 26, 2018, on December 21, 2018 the Company entered into an employment agreement with Alea Kleinhammer. Pursuant to the terms of the employment agreement, Ms. Kleinhammer will be entitled to receive a base salary at the annualized rate of $120,000 and will be eligible to receive an annual incentive bonus, in cash, upon meeting certain requirements and to participate in employee benefit plans as the Company may maintain from time to time. Ms. Kleinhammer will be eligible to receive an annual incentive bonus in an aggregate amount up to $30,000, as determined by the Board of Directors. Any such annual bonus will be comprised of three equal parts, based on and subject to, respectively, (1) Ms. Kleinhammer consistently demonstrating her development as a proactive executive of the Company and her implementation of appropriate and useful financial planning and analysis processes, tools, and reports, (2) the mitigation of financial risks concerning the Company’s Mt Melrose, LLC subsidiary, and (3) the Company achieving superior financial results as of year-end that outperform the Company’s annual budget. |

Employment Agreements

As described above, there is currently only one employment agreement in place. We entered into an employment agreement with Alea Kleinhammer, our Chief Financial Officer, on December 2, 2018, effective as of October 5, 2018 (the “Employment Agreement”). Capitalized terms used below but not otherwise defined have the meanings given to such terms in the Employment Agreement.

Compensation. Pursuant to the Employment Agreement, Ms. Kleinhammer receives an initial annualized salary of $126,000. The Employment Agreement further provides for an incentive bonus of up to $30,000 annually upon the achievement of certain goals outlined in the Employment Agreement.

Term. The Employment Agreement’s initial term ended on December 31, 2019 (the “Initial Termination Date”). The Employment Agreement automatically renews for one-year terms beginning on the anniversary of the Initial Termination Date, terminable upon a minimum of thirty days’ prior written notice to Ms. Kleinhammer of our intent not to renew.

Payments as a Result of Termination. If we terminate Ms. Kleinhammer’s employment without Cause, she would receive: (i) continuation of her then-current base salary for 12 months, payable in accordance with our normal payroll practices; (ii) any earned but unpaid Incentive Bonus amount for the immediately preceding calendar year; (iii) any amounts accrued and payable under any benefit plans; and (iv) any amounts payable for unreimbursed business expenses incurred prior to the termination date. If we terminate Ms. Kleinhammer’s employment with Cause or Ms. Kleinhammer resigns, she would be entitled only to payment of her then-current salary through the termination date, payable in accordance with our regular payroll practices, and the amounts of any unreimbursed business expenses incurred prior to the termination date. If Ms. Kleinhammer’s employment is terminated due to her death or disability, she or her estate, as applicable, would be entitled only to (i) payment of her then-current salary for three months, payable in accordance with our regular payroll practices, (ii) any earned but unpaid Incentive Bonus (as such term is defined in the Employment Agreement) amount for the immediately preceding calendar year; iii) any amounts accrued and payable under any benefit plans; and (iv) any amounts payable for unreimbursed business expenses incurred prior to the termination date.

DIRECTOR COMPENSATION

The following table sets forth the cash and other compensation paid by the Company to the non-employee members of the Board for all services in all capacities during 2021.

Summary Director Compensation Table

The Board of Directors is compensated through annual Company stock awards issued in accordance with the approved Equity Compensation Plan. Under the Equity Compensation Plan, the Company reserves the right to issue cash awards in lieu of stock awards if it is determined to be in the best interest of the Company.

Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) (1) | Option Awards ($) | Non-equity Incentive Plan Compensation ($) | Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) |

Steven L. Kiel | | 100,000 | | | | | 100,000 |

Jeremy K. Deal | | 30,000 | | | | | 30,000 |

Thomas Braziel | | 130,000 | | | | | 130,000 |

Alea A. Kleinhammer | | 30,000 | | | | | 30,000 |

Keith D. Smith | | 30,000 | | | | | 30,000 |

(1) | Cash awards were approved and expenses were incurred as of the year ended December 31, 2021. Awards were issued during January 2022. |

EQUITY COMPENSATION PLAN INFORMATION

Our equity compensation plans currently consist solely of the Enterprise Diversified, Inc. 2020 Equity Incentive Plan (the “Plan”), which was not approved by our stockholders. The Plan was adopted by the Company’s Board and made effective on January 31, 2020, with the stated intent of promoting the long-term financial success of the Company by providing a means to retain, reward, attract, incentivize, and further align the interests of current and potential Company employees, executives, and directors with those of the Company’s other shareholders through the ownership of additional common stock of the Company. Awards that may be granted under the Plan include: (i) Common Stock, (ii) Restricted Stock, and (iii) Restricted Stock Units.

The Plan is intended to be administered by the Company’s Governance, Compensation, and Nominating Committee of the Board (the “Committee”), or in the Board’s discretion, by the Board as a whole. The total share reserve under the Plan may not exceed 135,000 shares of Common Stock. Subject to the Committee’s discretion, all present and future management-level employees, officers, and directors of the Company or any Affiliate (whether currently existing or later created or acquired) shall be eligible to receive awards under the Plan. Awards made under the Plan may be of restricted or unrestricted Common Stock, subject to the restrictions placed by the Federal Securities Laws. Any restrictions on any awards made under the Plan shall automatically expire immediately upon a change in control (as defined below and under the Plan).

Administration of the Plan includes the discretion to, among other powers: (a) determine the number of shares of Common Stock, if any, to be made subject to each award made under the Plan; (b) prescribe the terms and conditions of each award made under the Plan; (c) amend any outstanding awards made under the Plan, including for the purpose of modifying the time or manner of vesting, or the term of any outstanding awards made under the Plan; (d) make decisions with respect to outstanding awards made under the Plan that may become necessary upon a change in corporate control or an event that triggers anti-dilution adjustments; and (e) exercise discretion to make any and all other determinations necessary or advisable for the administration of the Plan.

A “Change in Control” under the Plan means, unless otherwise determined by the Committee in an applicable agreement: (i) any one person, or more than one person acting as a group other than the Company, or any employee benefit plan sponsored by the Company, acquires ownership of stock of the Company that, together with stock held by such person or group, constitutes more than 70% of the total fair market value or total Voting Power of the stock of the Company; or (ii) any one person, or more than one person acting as a group other than the Company, or any employee benefit plan sponsored by the Company, acquires (or has acquired during the twelve-month period ending on the date of the most recent acquisition by such person or persons) ownership of stock of the Company possessing 70% or more of the total Voting Power of the stock of the Company; or (iii) a majority of members of the Board of Directors is replaced during any twelve-month period by directors whose appointment or election is not endorsed by a majority of the members of the Board of Directors before the date of each appointment or election; or (iv) any one person, or more than one person acting as a group, acquires (or has acquired during the twelve-month period ending on the date of the most recent acquisition by such person or persons) assets from the Company that have a total gross fair market value equal to or more than 70% of the total gross fair market value of all of the assets of the Company immediately before such acquisition or acquisitions. For purposes of subsection (iv), gross fair market value means the value of the assets of the Company, or the value of the assets being disposed of, determined without regard to any liabilities associated with such assets. The foregoing subsections (i) through (iv) shall be interpreted in a manner that is consistent with the Treasury Regulations promulgated pursuant to section 409A of the Code so that all, and only, such transactions or events that could qualify as a “change-in-control event” within the meaning of Treasury Regulation §1.409A-3(i)(5)(i) will be deemed to be a Change in Control for purposes of the Plan.

The Board may amend the Plan at any time and at its discretion. The Company may cancel any award made under the Plan, require reimbursement of any award by a Plan participant, and effect any other right of recoupment of equity or other compensation provided under the Plan in accordance with any Company policies that may be adopted and/or modified from time to time. Unless earlier terminated by the Board, the Plan shall terminate automatically on the date that the Company has issued shares of Common Stock under the Plan equal in number to the total share reserve of 135,000 shares of Common Stock. The Plan is governed by the laws of the State of Nevada.

RELATED-PERSON TRANSACTIONS

The written charter of the Audit Committee authorizes the Audit Committee to review and approve all related-party transactions to which the Company may be a party prior to their implementation to assess whether such transactions meet applicable legal requirements. In reviewing related-party transactions, the Audit Committee reviews the benefits of the transactions, terms of the transactions, and the terms available from unrelated third parties, as applicable. The Audit Committee reviews, at least on an annual basis, the expense reimbursements of officers and directors.

Bonhoeffer Fund, LP

The Company’s subsidiary, Willow Oak Asset Management, LLC, signed a fee share agreement on June 13, 2017, with Coolidge Capital Management, LLC (“Coolidge”), whose sole member is Keith D. Smith, also an ENDI director. Willow Oak is the sole member of Bonhoeffer Capital Management LLC, the general partner to Bonhoeffer Fund, LP, a private investment partnership. Under their agreement, Willow Oak pays all start-up and operating expenses that are not partnership expenses under the limited partnership agreement. Willow Oak receives 50% of all performance and management fees earned by the general partner. During the years ended December 31, 2021 and 2020, the Company earned $94,428 and $36,217, respectively, of revenue through this Bonhoeffer Fund arrangement.

Willow Oak Asset Management, LLC

On October 1, 2017, Willow Oak Asset Management, LLC entered into sub-lease agreements with Arquitos Capital Management, LLC, which is managed by our director and principal executive officer, Steven L. Kiel, JDP Capital Management, LLC, which is managed by our director and vice-chairman, Jeremy K. Deal, and B.E. Capital Management, LLC, which is managed by our director, Thomas Braziel. At the commencement of the sub-lease arrangement, neither Jeremy K. Deal nor Tomas Braziel met the criteria for a related party. Upon Jeremy K. Deal’s board appointment on April 3, 2018 and Thomas Braziel’s appointment on May 5, 2019, the sub-lease arrangements qualify as related party transactions. During the years ended December 31, 2021 and 2020, the Company earned $0 and $2,283, respectively, of sub-lease revenue through these arrangements. Willow Oak’s sub-lease agreement with Arquitos Capital Management, LLC expired on October 31, 2018, and as of December 31, 2019, the remaining two sub-lease arrangements have also expired. The revenue earned for the year ended December 31, 2020, related to the recognition of certain deferred amounts.

On November 1, 2018, Willow Oak Asset Management, LLC entered into a fund management services agreement with Arquitos Investment Manager, LP, Arquitos Capital Management, LLC, and Arquitos Capital Offshore Master, Ltd. (collectively “Arquitos”), which are managed by our director and principal executive officer, Steven L. Kiel, to provide Arquitos with Willow Oak Fund Management Services (“FMS”) consisting of the following services: investor relations, marketing, administration, legal, accounting and bookkeeping, annual audit coordination, and liaison to third-party service providers. Willow Oak earned monthly and annual fees as consideration for these services. On November 1, 2020, this arrangement was renewed with revised terms that include an exchange of services between Willow Oak and Arquitos. Steven Kiel, through Arquitos, has been contracted to perform ongoing consulting services for the benefit of Willow Oak in the following areas: strategic development, marketing, networking and fundraising. In exchange, Willow Oak continues to provide ongoing FMS services. Willow Oak continues to earn monthly and annual fees as consideration for these services. These terms are in effect until October 31, 2022. During the years ended December 31, 2021 and 2020, the Company earned $59,318 and $89,930, respectively, of revenue through this fund management services arrangement.

Financing Arrangement Regarding Triad Guaranty, Inc.

On December 27, 2021, the Company completed the purchase of an investment consisting of a $155,000 promissory note issued by Triad Guaranty, Inc., along with 393,750 common shares of Triad Guaranty, Inc., for $25,000 from B.E. Capital Management, LLC, which is managed by our director, Thomas Braziel. The discounted value of this purchase is reflective of the implied collectability of the promissory note and the relative illiquidity of Triad Guaranty, Inc. stock. Management believes that this addition to the Company’s existing note and related investment in Triad Guaranty, Inc. will be beneficial by strengthening the Company’s position as a creditor, which will ultimately result in a higher probability of collection when the note matures.

Voting and Support Agreement

As has been previously reported, on December 29, 2021, the Company, along with Arquitos Capitol Offshore Master, Ltd., Steven Kiel, Thomas Braziel, Jeremy Deal, Alea Kleinhammer, and Keith Smith (collectively the “Shareholders’), entered into a certain Voting and Support Agreement, in connection with the Company’s Business Combination previously discussed (see Note 11). Each of the Shareholders (other than Arquitos Capitol Offshore Master, Ltd. ) may be deemed to be an affiliate of the Company. Pursuant to the terms of the Voting and Support Agreement, the Shareholders have agreed with the Company to vote their shares of capital stock of the Company in favor of the Merger Agreement and transactions contemplated therein, including the Business Combination, and against any action, agreement, transaction or proposal that would result in a breach of any covenant or other provision of the Merger Agreement or that would reasonably be expected to result in the transactions contemplated by the Merger Agreement from not being completed. The Shareholders have also agreed to waive their dissenters rights under Nevada law with respect to the Business Combination, not to solicit or support any corporate transaction that constitutes or could reasonably be expected to constitute, an alternative to the Business Combination, and not to sell, transfer, assign or otherwise take any action that would have the effect of preventing or disabling the Shareholders from voting their shares of the Company in accordance with its obligations under the Voting Support Agreement. The Voting Support Agreement automatically terminates upon the termination of the Merger Agreement or upon the mutual agreement of the parties to the Voting Support Agreement. The Shareholders are not receiving any compensation or other renumeration in exchange for their entering into the Voting and Support Agreement.

STOCK OWNERSHIP OF OUR DIRECTORS, EXECUTIVE OFFICERS,

AND 5% BENEFICIAL OWNERS

The following table sets forth as of March 31, 2022, information regarding the beneficial ownership of the Company’s voting securities (i) by each person or group known by the Company to be the owner of record or beneficially of more than 5% of the Company’s voting securities; (ii) by each of the Company’s Directors and executive officers; and (iii) by all Directors and executive officers of the Company as a group. Except as indicated in the following notes, the owners have sole voting and investment power with respect to the shares. Unless otherwise noted, each owner’s mailing address is c/o Enterprise Diversified, Inc., 1806 Summit Avenue, Ste 300, Richmond, VA 23230.

Name of Beneficial Owner | Number of Shares Beneficially Owned | Percent of Class (1) ** |

Steven L. Kiel (2) | 754,015 | 28.5% |

Keith D. Smith | 81,879 | 3.1% |

Jeremy K. Deal | 49,979 | 1.9% |

Alea Kleinhammer | 8,529 | ** |

Thomas Braziel | 8,379 | ** |

Lawrence Goldstein (3) | 263,224 | 9.9% |

Richard H Witmer Jr. | 220,128 | 8.3% |

Frank R. Erhartic, Jr. | 199,073 | 7.5% |

Ricardo Polo Hottenrott (4) | 132,454 | 5.0% |

All Directors and Officers As a Group (five persons) | 902,781 | 34.1% |

**Less than 1%

(1) | Percent of class is based on 2,647,383 shares of Common Stock outstanding as of March 31, 2022. |

(2) | Includes 683,309 shares owned by Arquitos Capital Partners, LP. Arquitos Capital Management, LLC acts as the General Partner to Arquitos Capital Partners, LP. Steven L. Kiel is the Managing Member of Arquitos Capital Management, LLC and is deemed to have beneficial ownership over the Common Stock owned. |

(3) | Includes 263,224 shares owned by Santa Monica Partners, LP. Lawrence Goldstein is the Managing Member of Santa Monica Partners, LP and is deemed to have beneficial ownership over the Common Stock owned. |

(4) | Includes 132,454 shares owned by Inmuebles Polo SL. Ricardo Polo Hottenrott is the Managing Member of Inmuebles Polo SL and is deemed to have beneficial ownership over the Common Stock owned. |

PROPOSAL ONE

ELECTION OF DIRECTORS; NOMINEES

Our Bylaws provide that the Board of Directors shall consist of not less than one and not more than nine members unless changed by a duly adopted amendment to the articles of incorporation or by an amendment to the Bylaws adopted by the vote or written consent of holders of a majority of the outstanding shares entitled to vote. Our Board of Directors has passed a resolution setting the number of members at five, which is the current number of members. Five directors have been nominated for re-election at the Annual Meeting. Those individuals are Thomas Braziel (independent), Jeremy K. Deal (independent), Steven L. Kiel, Alea A. Kleinhammer, and Keith D. Smith. For information about each of the nominees and our Board generally, please see “Corporate Governance: Our Board of Directors” beginning on page 4. If re-elected, the nominees will hold office until the next annual meeting and until a respective successor is elected and has been qualified, or until such director resigns or is removed from office. Management expects that each of the nominees will be available for re-election, but if any of them is unable to serve at the time the election occurs, your proxy will be voted for the election of another nominee to be designated by the available members of our Board.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RE-ELECTION OF ALL OF THE NOMINEES FOR DIRECTOR. IF A CHOICE IS SPECIFIED ON THE PROXY BY THE STOCKHOLDER, THE SHARES WILL BE VOTED AS SPECIFIED. IF NO SPECIFICATION IS MADE, THE SHARES WILL BE VOTED “FOR” ALL OF THE NOMINEES. THE AFFIRMATIVE VOTE OF A PLURALITY OF THE VOTES CAST, BY THE HOLDERS OF COMMON STOCK VIRTUALLY PRESENT OR PRESENT BY PROXY, ENTITLED TO VOTE AT THE ANNUAL MEETING IS REQUIRED FOR THE ELECTION OF THE NOMINEES.

PROPOSAL TWO

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

The Board of Directors (and the Audit Committee of the Board of Directors for fiscal years 2017 and beyond) annually considers and selects our independent registered public accountants. The Board has selected Brown, Edwards & Company, LLP to act as our independent registered public accountants for fiscal 2022.