UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant | x | |

| Filed by a party other than the Registrant | ¨ | |

Check the appropriate box:

| x | Preliminary proxy statement ] |

| ¨ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) ] |

| ¨ | Definitive proxy statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

| | VISTA INTERNATIONAL TECHNOLOGIES, INC. | |

| | (Name of Registrant as Specified in Its Charter) | |

| | | |

| | | |

| | (Name of person(s) filing proxy Statement, if other than the Registrant) | |

Payment of Filing Fee (Check the appropriate box):

| ¨ | No fee required. |

| x | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) |

| | | |

| | 1) | Title of each class of securities to which transaction applies: |

| | | |

| | | not applicable |

| | | |

| | 2) | Aggregate number of securities to which transaction applies: |

| | | |

| | | not applicable |

| | | |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | not applicable |

| | | |

| | 4) | Proposal maximum aggregate value of transaction: |

| | | $1,348,125 |

| | | |

| | 5) | Total fee paid: |

| | | |

| | | $269.63 |

| | | |

| ¨ | Fee paid previously with preliminary materials. |

| | $__________ |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offset fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | 1) | Amount previously paid: |

| | | |

| | | |

| | 2) | Form, Schedule or Registration Statement No.: |

| | | |

| | | |

| | 3) | Filing Party |

| | | |

| | | |

| | 4) | Date Filed |

| | | |

| | | |

| | | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

VISTA INTERNATIONAL TECHNOLOGIES, INC.

88 INVERNESS CIRCLE EAST, SUITE N-103

ENGLEWOOD, COLORADO 80112

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

July 29, 2011

The 2011 annual meeting of the stockholders of Vista International Technologies, Inc. (“Vista”) will be held on July 29, 2011 at 10:30 a.m., at our corporate office located at 88 Inverness Circle East, Suite N-103, Englewood, Colorado 80112 for the following purposes:

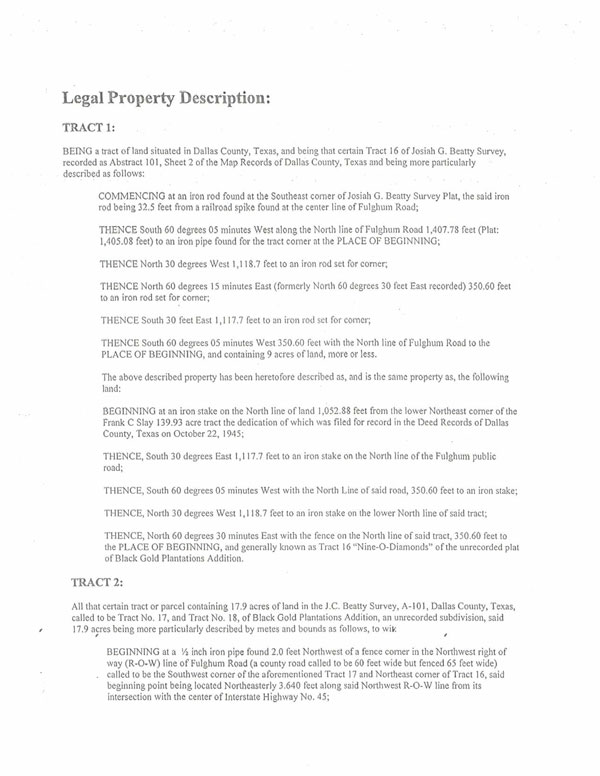

| | 1. | To consider and approve the sale of the real property underlying our tire processing and storage facility located at 1323 Fulghum Road, Hutchins, Texas 75141 (“Tire Facility”) to Brown-Lewisville Railroad Family First, L.P. (“Brown”) pursuant to a Real Estate Sales Contract (the “Sale Agreement”) dated as of February 14, 2011 between Vista and Brown; |

| | 2. | To elect a board of two directors; |

| | 3. | To ratify the appointment of GHP Horwath, P.C. as our independent registered public accounting firm for our fiscal year ending December 31, 2011; and |

| | 4. | To transact such other business as may properly come before the meeting or any adjournment or postponement of the meeting. |

The Annual Meeting may be adjourned from time to time without notice other than the announcement of the adjournment at the Annual Meeting or at any adjournment or adjournments of the Annual Meeting. Any business for which notice is given may be transacted at any adjourned Annual Meeting.

Descriptions of the foregoing matters are included in the accompanying Proxy Statement. A copy of the Sale Agreement is attached as an appendix to the Proxy Statement. The Board of Directors has unanimously approved the sale as being in the best interest of Vista and its stockholders. The Board recommends that you vote FOR the approval of these proposals.

Only stockholders of record at the close of business on June 6, 2011 will be entitled to notice of and to vote at the meeting and any adjournments or postponements of the meeting. As of June 6, 2011 there were 114,719,553 shares outstanding, each of which is entitled to one vote. We do not have cumulative voting.

IMPORTANT: WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED, REGARDLESS OF THE NUMBER OF SHARES YOU HOLD. ACCORDINGLY, YOU ARE ENCOURAGED TO VOTE BY FOLLOWING THE INSTRUCTIONS SET FORTH IN THE PROXY CARD THAT ACCOMPANIES THESE MATERIALS. THANK YOU FOR ACTING PROMPTLY.

Neither the Securities and Exchange Commission nor any state securities regulatory agency has approved or disapproved the sale, passed upon the merits or fairness of the sale or passed upon the adequacy or accuracy of the disclosure in this Proxy Statement. Any representation to the contrary is a criminal offense.

| | BY ORDER OF THE BOARD OF DIRECTORS, |

| | |

| | Bradley A. Ripps |

| | Interim Chief Executive Officer |

Englewood, Colorado

June 30, 2011.

PROXY STATEMENT

Annual Meeting of Stockholders

of

Vista International Technologies, Inc.

To Be Held On July 29, 2011

GENERAL INFORMATION

We are first making this Proxy Statement and accompanying proxy card on June 30, 2011. Our Board of Directors is soliciting your proxy to vote your shares of available common stock at the Annual Meeting of stockholders to be held on July 29, 2011, or at any adjournment or postponement of the Annual Meeting. The annual meeting will be held at our corporate offices located at 88 Inverness Circle East, Suite N-103, Englewood, CO 80112.

We will bear all expenses incurred in connection with this solicitation, which is expected to be primarily by mail. In addition to solicitation by mail, our directors, officers and regular employees may solicit your proxy by e-mail, telephone, by facsimile transmission or in person, for which they will not be compensated. If your shares of common stock are held through a broker, bank or other nominee (i.e., in “street name”), we have requested that they forward the proxy card to you and obtain your voting instructions, for which we will reimburse them for their reasonable out-of-pocket expenses.

If your shares of common stock were held in street name on the record date, the broker or other nominee that was the record holder of your shares of common stock may have the authority to vote them at the Annual Meeting on any matters requiring a stockholder vote that comes before the meeting, including matters other than those described in these proxy materials. If your shares of common stock are held in street name and you want to vote your shares of common stock in person at the Annual Meeting or change your vote, you must obtain a legal proxy from your broker or nominee.

You will receive more than one proxy card if your shares of common stock are held through more than one account (i.e., through different names or different brokers or nominees). Each proxy card only covers those shares of common stock held in the applicable account. If you hold shares of common stock in more than one account, you have to provide voting instructions as to all your accounts to vote all of your shares of common stock.

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements. This means that only one copy of our Proxy Statement may have been sent to multiple stockholders in your household. We will promptly deliver a copy of the Proxy Statement to you if you write or call us at the following address or phone number: Vista International

Technologies, Inc. 88 Inverness Circle East, Suite N-103, Englewood, Colorado 80112; Attention: Corporate Secretary, (303) 690-8300. If you would like to receive separate copies of annual reports or proxy statements in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker or other nominee holder, or you may contact us at the above address and phone number.

You may revoke your proxy at any time prior to its exercise by delivering a properly executed, later-dated proxy, by filing a written revocation of your proxy with our Corporate Secretary at our address set forth above or, if you are a stockholder of record (or hold a proxy from a stockholder of record), by voting in person at the Annual Meeting.

We may or may not hold an annual meeting of stockholders in 2012. If we do hold an annual meeting of stockholders in 2012 and if you want to submit a shareholder proposal to be included in the proxy materials distributed by us for such annual meeting you may do so by following the procedures described in Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). To be eligible for inclusion in our proxy materials these proposals must comply with our By-laws and Rule 14a-8 of the Exchange Act. Shareholder proposals proposed to be included in our proxy statement for our next annual meeting must be received by a reasonable time before we print and mail proxy materials for the 2012 meeting. A shareholder proposal submitted after the time described in Rule 14a-4(c)(1) of the Exchange Act will be considered untimely. Proposals should be sent to our Corporate Secretary at 88 Inverness Circle East, Suite N-103, Englewood, Colorado 80112.

The use of cell phones, PDA’s, pagers, recording and photographic equipment, camera phones and/or computers is not permitted in the meeting rooms at the Annual Meeting.

SUMMARY

This summary highlights selected information from this Proxy Statement and may not contain all of the information that is important to you. To understand the transactions to be acted upon at the annual meeting and for a more complete description of the legal terms of each transaction, you should read this entire document, including the information incorporated in this document by reference and the appendices to this Proxy Statement. In this Proxy Statement the words “we”, “us” and “our” refer to Vista. Unless otherwise defined in this Proxy Statement, capitalized terms used in this summary have the meanings assigned to them elsewhere in this Proxy Statement.

Purpose of the Annual Meeting

We are holding an Annual Meeting of stockholders at our principal executive offices located at 88 Inverness Circle East, Suite N-103, Englewood, Colorado 80112 at 10:30 a.m. MST time, on July 29, 2011. The phone number at our principal executive office is (303) 690-8300. At the Annual Meeting, you will be asked to vote to approve the following:

| | · | the sale of the real property upon which our tire processing and storage operations are conducted; |

| | · | the election of two directors; and |

| | · | ratification of the appointment of GHP Horwath, P.C. as our independent registered public accountant for our fiscal year ending December 31, 2011. |

Our Board of Directors recommends that you vote “FOR” each of the proposals at the Annual Meeting.

The Sale and Lease Back

We propose to sell the real property upon which our tire processing and storage facilities are located, including 27 acres of land and improvements, to the Brown-Lewisville Railroad Family First Limited Partnership (“Brown”). The basic terms of the transaction are as follows:

| | · | Purchase Price: $1,348,125, which is net of the first two years of lease payments of approximately $203,000 under the proposed lease. This amount is for land and land improvements with a net carrying amount on our financial statements of approximately $150,000 as of March 31, 2011; |

| | · | We will lease back 12.5 acres of the property at monthly rental rate of $675 per acre for the first two years of the lease (the “base period”); |

| | · | Rent payments totaling approximately $203,000 during the base period are waived by Brown; |

| | · | The lease has an initial term of 60 months (5 years); |

| | · | The monthly rent increases in each of the third, fourth, and fifth years based on the minimum rent for the immediately preceding year, plus the percentage increase in the Consumer Price Index for the immediately preceding year; |

| | · | The lease may be extended for one additional one year period and one additional three year period subject to certain terms and conditions; |

| | · | Under the terms of the lease, we are responsible for all executory and operating costs, including real property taxes, utilities, permits and all environmental remediation costs; |

| | · | We will retain title to the processing equipment, rolling stock and waste tire storage and processing permit; |

| | · | We will continue our tire processing operations on the 12.5 acres leased back from Brown; and |

| | · | Our Thermal Gasifier™ business segment is not included in the sale. |

The assets that comprise our tire processing and storage facilities are owned by us. For the three months ended March 31, 2011, our tire processing business generated all of our revenue, (approximately $102,000) which consisted solely of tipping fees (fees paid by persons to deposit waste tires at our facility). The Thermal Gasifier™ generated no revenue for the three months ended March 31, 2011. Because of the importance of the tire processing operation and the value of the underlying real estate to our business, we are required by Delaware law to submit the proposed sale to our stockholders for their approval. A description of the proposed sale and the leaseback and the continued operation of the tire processing business begins on page 29.

Our Board of Directors and management team have been reviewing the needs, prospects and long-term business goals for both the tire processing and Thermal Gasifier™ businesses for some time. The objective is to maximize the potential of both lines of business and therefore the value to our shareholders. We regularly have assessed trends and conditions impacting us and our industry, changes in the marketplace, applicable law and the competitive environment. One of the conclusions we reached as we reviewed the business plan for both the tire facility and the Thermal Gasifier™ was a need for additional capital to realize the potential benefits available from these two business units. The capital would be used to purchase additional equipment for the Texas tire facility for the production of TDF. This would provide a third revenue source for the tire facility. A portion of the

funds also will be used to pay down and/or satisfy in full outstanding indebtedness to our largest creditors and shareholders, Mr. Richard Strain, Mr. Timothy Ruddy, and certain persons associated with Mr. Ruddy, as well as tax liabilities to the Internal Revenue Service (the “IRS”) and certain other state and local taxing authorities.

We evaluated both debt and equity financing alternatives to raise capital to provide improvements to our tire fuel processing division and further the commercialization of our Thermal Gasifier™ technology, as well as to service our mounting debt. Potential lenders required collateral on our existing assets for moneys lent. Since the majority of our assets already serve as collateral for our indebtedness to Richard Strain, Tim Ruddy and certain persons associated with Mr. Ruddy, we could not negotiate debt financing with a third party lender which was both favorable to us and/or acceptable to any of these individuals. Due to the depressed value of our stock, the issuance of additional shares of common stock would not have provided the funding we required.

In April, 2010, our Board of Directors authorized us to explore and evaluate the estimated value of the real property underlying our tire processing facility. We also were requested to consider possible sale, joint venture or partnering arrangements.

In June, 2010 our Board of Directors determined the most complete and efficient way to find the best and highest value for the tire processing assets was to hire a broker. Several real estate and appraisal firms were contacted and considered. A final determination was made to secure a real estate broker versus an appraisal company. Finally, in July, 2010 the Board elected to engage Collier’s International, a world wide real estate company with expertise in marketing, leasing and property management.

Collier’s began assessing the market value of the tire processing assets. After several months of activity, Collier’s provided the Board with information concerning real estate industry trends, credit markets, strategic alternatives and other considerations affecting the sale of the real property underlying our tire processing facility. Additionally, they brought three different groups to us that expressed further interest in our tire processing assets. These companies included: Pallet Logistics of America, LLC (“PLA”), CleanTech Solutions Worldwide, LLC (“CTSW”) and Brown-Lewisville Railroad Family First Limited Partnership (“Brown”). The Company received different proposals from all three groups. PLA and CTSW proposed joint venture opportunities and Brown offered a sale/leaseback. The Board of Directors and management deliberated on the feedback from Collier’s regarding the market value of the assets along with the proposals from the three interested parties. Ultimately, the Board determined that the offer from Brown made the most sense for us.

In January of 2011, we began negotiations with Brown regarding the sale of the real estate underlying the tire shredding facility, along with a lease by Vista of 12.5 acres of that property. On February 14, 2011 we executed the Sale Agreement with Brown.

The Board considered Brown’s offer the highest and best use of our tire processing assets. Brown was deemed to be a viable purchaser due to the fact that a company owned by the Brown

principals has more than 15 years of experience in the recycled crushed concrete business and Brown was willing to pay cash for the real property.

The following risk factors are relevant to your decision whether or not to approve the sale and the Sale Agreement:

| | · | risks that the transactions contemplated by the Sale Agreement and the Lease will not close. |

| | · | risks that increases in rent over the term of the Lease will result in less funds available to us or will exceed the revenues generated by us as of the date the increase becomes effective. |

| | · | our ability to raise capital or obtain financing necessary to implement our business plan. |

| | · | our ability to improve the quantity and quality of the products produced by our tire processing facility and/or attract new customers. |

| | · | our ability to execute the other elements of our business plan including commercialization of our patented Thermal Gasifier™ technology, building Thermal Gasifiers™ that meet customers’ specifications and local regulatory, environmental and permit requirements. |

| | · | environmental risks associated with our tire processing operations. |

| | · | our ability to purchase sufficient equipment and maintain such equipment in good operation and repair so as to avoid a plant shut down. |

| | · | risks that other companies in the marketplace may have access to greater capital and therefore may be able to compete more effectively for business. |

| | · | risk that our tire processing permit may not be renewed or may be revised in a manner that is adverse to our continued operations. |

| | · | risks related to our ability to secure contracts for tire processing sales and Thermal Gasifier™ projects. |

| | · | our ability to satisfy our customers’ expectations. |

| | · | our ability to employ and retain qualified management and employees. |

| | · | changes in government regulations which are applicable to our business. |

| | · | the availability of a consistent, economically viable, and sustainable supply of waste tires to support the tire processing operations. |

| | · | the availability of a consistent, economically viable, and sustainable waste stream supply to fuel the Thermal Gasifier™ operations. |

| | · | changes in the demand for our products and services, including the impact from changes in governmental regulation and funding for alternative energy. |

| | · | the degree and nature of our competition, including the reliability and pricing of traditional energy sources. |

| | · | economic viability of other alternative energy sources such as wind and solar power. |

| | · | our ability to pay debt service on loans as they come due. |

| | · | our ability to generate sufficient cash to pay our creditors. |

| | · | disruption in economic and financial conditions primarily from the impact of terrorist attacks in the United States and overseas, threats of future attacks, police and military |

| | | activities, governmental unrest in certain parts of the world and other disruptive worldwide political events.y |

QUESTIONS AND ANSWERS ABOUT THE PROPOSALS

| Q: | Why did I receive a proxy card? |

| | |

| A: | We sent you a proxy card because our Board of Directors is soliciting your proxy to vote at our Annual Meeting. You do not need to attend the Annual Meeting to vote your shares of common stock. Instead, you may simply follow the instructions for voting on the proxy card. |

| | |

| Q: | What will I be voting on at the Annual Meeting? |

| | |

| A: | You will be asked to consider proposals to approve: |

| | | | |

| | | · | the Sale Agreement, under which we will sell the real estate underlying our tire processing facilities and operations; |

| | | | |

| | | · | the election of two directors; and |

| | | | |

| | | · | ratification of the appointment of GHP Horwarth, P.C. as our independent registered public accountant for our fiscal year ending December 31, 2011. |

| | |

| Q: | Will anything else be voted on at the Annual Meeting? |

| | |

| A: | We do not know of any other matters to be presented or acted upon at the meeting. If you vote as described in the proxy card without specifying your vote, your shares of common stock will be voted “FOR” the approval of the Sale Agreement indicated under Proposal 1 in this Proxy Statement, the election of the two directors indicated under Proposal 2 in this Proxy Statement and the ratification of our independent registered public accounting firm indicated under Proposal 3 in this Proxy Statement. |

| | |

| Q: | Who can vote? |

| | |

| A: | Stockholders of record of common stock at the close of business on June 6, 2011 (the “Record Date”) will be entitled to notice of and to vote at the Annual Meeting. On the Record Date, 114,719,553 shares of the common stock were outstanding. Each outstanding share of common stock entitles its holder to one vote on each matter that is considered at the meeting. We do not have cumulative voting. |

| | |

| Q: | What determines a quorum? |

| | |

| A: | The presence at the meeting, in person or by proxy, of holders of a majority of the outstanding common stock as of the Record Date will constitute a quorum. If you attend the meeting or vote |

| | your shares of common stock using the method described in the proxy card, your shares of common stock will be counted toward a quorum, even if you abstain from voting. Broker non-votes will not count for quorum purposes. |

| | |

| Q: | What happens if a quorum is not present? |

| | |

| A: | If a quorum is not present, the Annual Meeting may be adjourned from time to time until a quorum is present. |

| Q: | How do I vote? |

| | |

| A: | If you are a stockholder of record, you may vote using any of the following methods: |

| | | | |

| | | · | If you received a printed copy of the proxy materials, and reside in the United States or Canada, by dialing the following toll-free number: (866) 641-4276 and following the instructions for telephone voting on the proxy card that you received in the mail with your printed proxy materials. You will need the 12-digit control number printed on your proxy card; |

| | | | |

| | | · | If you received a printed copy of the proxy materials, by completing and mailing your proxy card; or |

| | | | |

| | | · | By casting your vote in person at the Annual Meeting. |

| | |

| | Telephone voting facilities for stockholders of record will close at 1:00 pm Central Daylight Time on July 28, 2011. If you return your signed proxy card or use telephone voting before the Annual Meeting, we will vote your shares as you direct. You have three choices on the sale and the sale agreement, each director nominee, the ratification of our independent registered public accountant and other matters to be voted upon. You may vote (abstain) by choosing FOR, AGAINST, or ABSTAIN. If you are a stockholder of record and do not specify on your returned proxy card or through telephone prompts how you want to vote your shares, we will vote them FOR approval of the Sale and Sale Agreement, FOR the election of the 2 director nominees and FOR the ratification of our independent registered public accountant set forth in this Proxy Statement. If your shares are held in a brokerage account in your broker’s name (“street name”), you should follow the voting directions provided by your broker or nominee. You may complete and mail a voting instruction card to your broker or nominee or, if your broker allows, submit voting instructions by telephone or the Internet. If you provide specific voting instructions by mail, telephone or the Internet, your broker or nominee will vote your shares as you have directed. Ballots will be passed out during the Annual Meeting to anyone who wants to vote in person at the |

| | Annual Meeting. If you hold your shares in street name, you must request a legal proxy from your broker or nominee to vote in person at the Annual Meeting. |

| | |

| Q: | What if I change my mind after I vote my shares? |

| A: | You can revoke your proxy at any time before it is voted at the Annual Meeting by: |

| | | | |

| | | · | Sending written notice of revocation to the Corporate Secretary, Vista International Technologies, Inc., 88 Inverness Circle East, Suite N-103, Englewood, CO 80112; |

| | | | |

| | | · | Submitting a properly signed proxy with a later date; |

| | | | |

| | | · | Voting by telephone at a time following your prior telephone vote; or |

| | | | |

| | | · | Voting in person at the Annual Meeting. |

| | |

| | You also may be represented by another person at the Annual Meeting by executing a proper proxy designating that person. |

| | |

| Q: | What does the Board of Directors recommend? |

| | |

| A: | The Board of Directors recommends that you vote “FOR” approval of the sale, and the Sale Agreement indicated under Proposal 1 in this Proxy Statement, the election of the two directors indicated under Proposal 2 in this Proxy Statement and the ratification of our independent registered public accountants indicated under Proposal 3 in this Proxy Statement. |

| | |

| Q: | Will I have dissenters’ rights? |

| | |

| A: | Under Delaware law, you do not have dissenters’ or appraisal rights in connection with the sale. |

| | |

| Q: | What will happen to Vista if the sale and the Sale Agreement are approved? |

| | |

| A: | As a result of the approval of the Sale Agreement, the real property underlying our tire processing facilities and operations will be sold to Brown-Lewisville Railroad Family First Limited Partnership. After the sale of the real property we intend to transfer the tire processing facility into a wholly-owned subsidiary of Vista for ease of administration, marketing and accounting. Our objectives after the closing will be focused on upgrading the tire processing facility, negotiating off-take contracts for the products produced by the tire processing facility and generating sufficient cash flow to continue commercialization of our patented Thermal Gasifier™ technology. This will include improving the quantity and quality of the products produced by our tire processing plant, upgrading our equipment at the tire facility, licensing of our patented Thermal Gasifier™ technology, creating energy infrastructures, and building, owning and operating small hydrocarbon-based waste-to-energy plants. We plan to utilize a portion of the proceeds, if any, which remain after the sale closes to fund these upgrades. If the proceeds are not sufficient, we |

| | may seek debt, equity or some combination of financing for these improvements. With respect to the Thermal Gasifier™ segment of our business, we plan to seek project financing for the Thermal Gasifier™ projects we may develop. We currently are exploring off-take contracts for our tire products with several third parties, but we have not reached any terms or agreements with any of these parties. For the three months ended March 31, 2011, the tire processing business generated gross revenue of approximately $102,000. For the same period, the Thermal Gasifier™ segment generated no revenue. We may cease to pursue any of these business objectives, and may consider other alternatives, at any time. Furthermore, if we sell the real property underlying our tire processing operations under the Sale Agreement, we will be able to pay a portion of our indebtedness to Richard Strain and Timothy Ruddy out of the proceeds from the sale. We also will be able to pay our outstanding obligations to certain other persons associated with Mr. Ruddy as well as the IRS and other state and local taxing authorities. This will reduce our indebtedness and accrued interest by approximately $596,000 as of the closing date. |

| | |

| Q. | What will happen to Vista if the sale and the Sale Agreement are not approved? |

| | |

| A. | If the sale and the Sale Agreement are not approved, we will retain ownership of the real property, and continue to operate the tire processing facility. In order to maintain those operations, and increase the quantity and quality of the products the facility produces, we will need to purchase more equipment and upgrade existing equipment. All of this will require additional capital. We also believe that if we are unable to sell the real property underlying our tire processing operations we will be unable to focus, or we will be delayed in focusing, on advancing our Thermal Gasifier™ business. This is because we then will be limited in our ability to obtain financing for Thermal Gasifier™ projects or otherwise fund this business. Additionally, in order for us to increase the quantity and quality of the products produced by the tire operations and thereby attract new customers, we will be required to improve our facilities and operations and acquire more equipment at a cost of approximately $550,000. We believe these improvements will allow us to maximize our revenues and improve our competitive position. We currently do not have funding for these projects, and do not expect to generate revenues or obtain debt or equity financing in the foreseeable future for this purpose. If the Sale Agreement is not approved, therefore, we probably would continue to seek alternative buyers or joint venture partners for the real property underlying the tire processing operations. As of March 31, 2011, notes payable - stockholder and notes payable – related parties were due immediately either by expiration of waivers or upon demand and were in default as follows: |

| | |

| | 9% promissory notes payable – Richard Strain – stockholder, due on demand, sesecured by a first priority security interest in our assets – default waived through August 31, 2011 | $ | 500,000 | |

| | | | | |

| | 9% line of credit - Richard Strain – stockholder, matured December 31, | | 92,752 | |

| | 2010, principal payments of $8,000 per month, secured by a first priority security interest in the our assets – default waived through August 31, 2011 | | | |

| | | Notes payable- stockholder | | 592,752 | |

| | | | | |

| | 8% promissory notes payable - Timothy Ruddy, due on demand, secured by all of our assets, security interest is subordinated to the loans extended by Mr. Strain | | 413,600 | |

| | | | | |

| | 12% promissory notes payable to Timothy Ruddy family members, cash interest of 10% and stock of Vista of 2%, secured by all of our assets, security interest is subordinated to the loans extended by Mr. Strain, interest due quarterly-default waived | | 45,000 | |

| | | Notes payable- stockholder | | 458,600 | |

| | | | | | |

| | Notes payable – stockholder The line of credit provides for certain equity redemption rights to Mr. Strain, on terms and conditions to be agreed upon. No equity redemption rights have been provided as of March 31, 2011. The maximum amount to be drawn under the line is $375,000. However, subsequent to initial draws of approximately $100,000 in 2009, Mr. Strain has declined to provide additional funding under the line. We received a waiver of default on the notes and line of credit on March 22, 2011, which specifies that non-payment defaults will be waived until the earlier of (a) the closing of the sale of our Texas industrial site or (b) August 31, 2011. As of March 31, 2011, accrued interest outstanding on these loans was approximately $51,400. Notes payable – related party We have a loan agreement with Mr. Timothy D. Ruddy, one of our directors, in which Mr. Ruddy has the option, at his discretion, to receive payment as follows: |

| | |

| |

| | | (a) | repayment of principal and interest; |

| | | | |

| | | (b) | conversion of outstanding amount without accrual of interest into our common stock based on the quoted market price of the stock at the dates loans were made; or |

| | | | |

| | | (c) | any combination of cash and stock as described in (a) and (b) |

| | | | |

| | As of March 31, 2011, accrued interest outstanding on these loans was approximately $43,500. Subsequent to March 31, 2011 and through June 1, 2011, Mr. Ruddy has loaned us an additional $60,000 under this agreement. |

| | Notes payable – related party family As of March 31, 2011, no interest payments have been made on these notes. In April 2011, all noteholders agreed to defer payment of interest due to the earlier of (a) the closing of the sale of our Texas industrial site or (b) December 31, 2011, in effect granting default waivers to us. As of March 31, 2011, accrued interest outstanding on these loans was approximately $4,900. We do not expect that we will have funds from operations or that we will be able to obtain debt or equity financing in order to make payments of the approximate $644,000 of indebtedness and accrued interest that is past due to Mr. Strain, to pay the approximately $507,000 owed to Mr. Ruddy or those persons associated with Mr. Ruddy or to pay the approximate $698,000 owed to the IRS and other state and local taxing authorities. Accordingly, we believe we have no viable alternative other than using the proceeds from the sale of the real property underlying our tire processing facility as detailed in the Sale Agreement to make full or partial payments on that indebtedness. Each of Mr. Strain, Mr. Ruddy and those persons associated with Mr. Ruddy has a security interest in all of our assets as collateral for our debt obligations owed to them. If we are unable to meet our payment obligations to any of these creditors when payment is due, they will have the right to declare a default and commence collection proceedings against us, including foreclosure proceedings against the real property underlying our tire processing facility. While there presently is no lien on the real property in favor of any taxing authority we have been informed by the taxing authorities they will lien and seize the property if payment in full is not made by August 31, 2011. |

| | |

| Q: | What is the purchase price to be received by Vista? |

| A: | The consideration to be received by Vista in the sale is approximately $1,348,000 in cash and the waiver of rental payments for the first twenty-four months of lease totaling approximately $203,000. |

| | |

| Q: | How was the purchase price determined? |

| A: | The amount of cash consideration was negotiated with Brown over a period of several weeks. |

| Q: | What funding is available to Vista until the sale is completed? |

| A: | Mr. Strain has deferred repayment of approximately $593,000 of indebtedness until the votes on the sale and the Sale Agreement have been counted. The IRS, state and local authorities, Mr. Ruddy and those persons associated with Mr. Ruddy also are waiting for the sale to close. Each of Mr. Strain and Mr. Ruddy are receiving a partial payment on his indebtedness. In addition Mr. Ruddy continues to fund our working capital needs. From March 31, 2011 through June 24, 2011 Mr. Ruddy has loaned us an additional $99,000. |

| Q: | What are the material terms of the Sale Agreement? |

| A: | In addition to the cash consideration we will receive at closing and the Lease, the Sale Agreement contains other important terms and provisions, including: |

| | | | |

| | | · | we will retain all liabilities not specifically assumed by Brown, including liabilities arising out of the operations of the tire facility; |

| | | | |

| | | · | we have agreed to indemnify Brown for any losses arising out of the breach by us of any of our representations, warranties or covenants set forth in the Sale Agreement, including our failure to pay the transaction expenses arising out of the sale; |

| | | | |

| | | · | we have agreed to conduct our business in the ordinary course and subject to certain other restrictions during the period prior to completion of the sale; |

| | | | |

| | | · | the obligations of Brown and Vista to close the sale are subject to several closing conditions, including the authorization of the sale by our stockholders and release of certain liens on the property; |

| | | | |

| | | · | the Sale Agreement may be terminated by us or Brown under a number of circumstances, in which case the sale will not be completed; and |

| | | | |

| | | · | if either party terminates the Sale Agreement, and if the termination by us is not due to a default by Brown, Brown will receive its earnest money back. |

| | | | |

| Q: | Are there any risks to the sale? |

A: | Yes. You should carefully read the section entitled “Risk Factors.” |

Q: | What are the tax consequences of the sale to U.S. stockholders? |

A: | The sale will not be taxable to our U.S. stockholders. See “Proposal No. 1: Sale ---Material U.S. Federal Income Tax Consequences of the Sale” on p. 36. |

| Q: | When is the closing expected to occur? |

A: | If the sale is authorized by our stockholders and all conditions to completing the sale are satisfied or waived, the sale is expected to occur shortly after the Annual Meeting. |

| | |

| Q: | What do I need to do now? |

| | |

| A: | After carefully reading and considering the information contained in this Proxy Statement, please cast your vote as soon as possible as directed by your proxy card, as applicable, so your shares of common stock may be represented at the Annual Meeting. In addition, you may attend and vote at |

| | the Annual Meeting in person, whether or not you have completed, signed and mailed your proxy card. |

| | |

| Q: | Whom should I call with questions? |

| | |

| A: | If you have any questions about the Sale Agreement or this Proxy Statement, please call Bradley Ripps, Interim Chief Executive Officer, at (303) 690-8300. |

| | |

| Q: | Where can I obtain a list of stockholders entitled to vote at the Annual Meeting? |

| | |

| A: | A list of stockholders entitled to vote at the Annual Meeting will be available at our principal executive offices located at 88 Inverness Circle East, Suite N-103, Englewood, Colorado 80112. |

TABLE OF CONTENTS

| | Page |

| | |

| SUMMARY | i |

| | |

| Purpose of the Annual Meeting | i |

| The Sale and Lease Back | i |

| | |

| QUESTIONS AND ANSWERS ABOUT THE PROPOSALS | v |

| | |

| Purpose of the Annual Meeting | 15 |

| Approval of the Sale | 18 |

| The Sale | 18 |

| Background | 25 |

| Purposes of the Sale | 29 |

| Sale Price | 32 |

| Our Planned Use of Proceeds | 33 |

| Conditions to Closing | 43 |

| Interest of Management in the Sale | 35 |

| Estimated Closing Date | 35 |

| Vote Required for Approval of the Sale | 35 |

| No Fairness Opinion | 35 |

| No Dissenters’ Rights | 36 |

| Material U.S. Federal Income Tax Consequences | 36 |

| Accounting Treatment | 36 |

| Recommendation of the Board of Directors | 53 |

| | |

| CAUTIONARY STATEMENT ABOUT FORWARD-LOOKING STATEMENTS | 17 |

| | |

| SALE RISK FACTORS | 18 |

| | |

| PROPOSAL 1: APPROVAL OF THE SALE | 18 |

| | |

| Background of Sale | 25 |

| Reasons for Sale; Recommendation of the Board of Directors | 29 |

| Accounting Treatment of the Sale | 36 |

| Material U.S. Federal Income Tax Consequences | 36 |

| Government and Regulatory Approvals | 32 |

| Arm’s Length Transaction | 32 |

| No Dissenters Rights | 36 |

| Required Vote | 35 |

| Interests of Certain Members of Management in the Transaction | 35 |

| Planned Use of Sale Proceeds | 33 |

| Our Business After the Sale | 36 |

| | |

| THE REAL ESTATE SALES CONTRACT | 38 |

| | |

| Property to be Sold | 40 |

| Liabilities Assumed | 40 |

| The Purchase Price | 40 |

| Representations and Warranties | 41 |

| Covenants | 42 |

| Conditions to Closing | 43 |

| Termination | 44 |

| Termination Fees; Expense Reimbursement | 44 |

| Indemnification | 45 |

| Survival of Representations and Warranties | 45 |

| Summary Compensation Table | 57 |

| Compensation of Directors | 57 |

| | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 58 |

| | |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 59 |

| | |

| PROPOSAL 2: ELECTION OF A BOARD OF TWO DIRECTORS | 53 |

| | |

| Nominees | 53 |

| Other Executive Officers | 54 |

| Family Relationships | 55 |

| Term of Office | 54 |

| Committees | 56 |

| Meetings | 53 |

| Compliance with Section 16(a) of the Exchange Act | 56 |

| | |

| PROPOSAL 3: RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS | 56 |

| | |

| INDEPENDENT PUBLIC ACCOUNTANTS | 60 |

| | |

| Principal Accountant Fees and Services | 60 |

| | |

| WHERE YOU CAN FIND MORE INFORMATION | 61 |

| | |

| INCORPORATION BY REFERENCE | 61 |

| | |

| OTHER BUSINESS | 62 |

| | |

| APPENDIX A | 63 |

| | |

| APPENDIX B | 93 |

INTRODUCTION

Purpose of the Annual Meeting

We are holding an annual meeting of stockholders at our principal executive offices located at 88 Inverness Circle East, Suite N-103, Englewood, Colorado 80112 at 10:30 a.m. MST time, on July 29, 2011. The phone number at our principal executive office is (303) 690-8300. At the Annual Meeting, you will be asked to vote to approve the following:

| | · | the sale of the real property upon which our tire processing and storage operations are conducted; |

| | · | the election of two directors; and |

| | · | ratification of the appointment of GHP Horwath, P.C. as our independent registered public accountants for our fiscal year ending December 31, 2011. |

Our Board of Directors recommends that you vote “FOR” each of the proposals at the Annual Meeting.

The Sale and Lease Back

We propose to sell the real property upon which our tire processing and storage facilities are located, including approximately 27 acres of land and improvements, to the Brown-Lewisville Railroad Family First Limited Partnership (“Brown”). The basic terms of the transaction are as follows:

| | · | Purchase Price: $1,348,125 for land and land improvements with a net carrying amount on our financial statements of approximately $150,000 as of March 31, 2011; |

| | · | We will lease back 12.5 acres of the property at a monthly rental rate of $675 per acre for the first two years of the lease (the “base period”); |

| | · | Rent payments totaling approximately $203,000 during the base period are waived by Brown; |

| | · | The lease has an initial term of 60 months (5 years); |

| | · | The lease may be extended for one additional one year period and one additional three year period subject to certain terms and conditions; |

| | · | The monthly rent increases in the third, fourth, and fifth years based on the rent for the immediately preceding year, plus the percentage increase in the Consumer Price Index for the immediately preceding year; |

| | · | Under the terms of the lease, we are responsible for all executory and operating costs, including real property taxes, utilities, permits and all environmental remediation costs; |

| | · | We will retain title to the processing equipment, rolling stock and waste tire storage and processing permit; |

| | · | We will continue our tire processing operations on the 12.5 acres leased back from Brown; and |

| | · | Our Thermal Gasifier™ business segment is not included in the sale. |

The assets that comprise our tire processing and storage facilities are owned by Vista. For the three months ended March 31, 2011, our tire processing business generated all of our revenues which consisted solely of tipping fees of approximately $102,000. Tipping fees are fees paid by persons to deposit waste tires at our facility. The Thermal Gasifier™ generated no revenue for the three months ended March 31, 2011. Because of the importance of the tire processing operations to our business, and the value of the underlying real estate, we are required by Delaware law to submit the proposed sale to our stockholders for their approval. A description of the proposed sale and the leaseback and the continued operation of the tire processing business begins on page 29.

CAUTIONARY STATEMENT ABOUT

FORWARD-LOOKING STATEMENTS

CERTAIN INFORMATION CONTAINED IN THIS PROXY STATEMENT MAY INCLUDE “FORWARD-LOOKING STATEMENTS” WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995, AND IS SUBJECT TO THE SAFE HARBOR CREATED BY THAT ACT. THE SAFE HARBOR CREATED BY THE SECURITIES LITIGATION REFORM ACT WILL NOT APPLY TO CERTAIN “FORWARD LOOKING STATEMENTS” RELATING TO OUR BUSINESS OR OPERATIONS BECAUSE WE ISSUED “PENNY STOCK” (AS DEFINED IN SECTION 3(A)(51) OF THE SECURITIES EXCHANGE ACT OF 1934 AND RULE 3A51-1 UNDER THE EXCHANGE ACT) DURING THE THREE YEAR PERIOD PRECEDING THE DATE(S) ON WHICH THOSE FORWARD LOOKING STATEMENTS WERE FIRST MADE. FORWARD LOOKING STATEMENTS REPRESENT OUR EXPECTATIONS OR BELIEFS CONCERNING FUTURE EVENTS, INCLUDING ANY STATEMENTS REGARDING THE RECEIPT AND USE OF THE CASH CONSIDERATION TO BE RECEIVED BY US UNDER THE SALE AGREEMENT, THE SUFFICIENCY OF OUR CASH BALANCES AND CASH USED IN OPERATIONS AND FINANCING AND/OR INVESTING ACTIVITIES FOR OUR FUTURE LIQUIDITY AND CAPITAL RESOURCE NEEDS. WE CAUTION READERS THAT CERTAIN IMPORTANT FACTORS MAY AFFECT OUR ACTUAL RESULTS AND COULD CAUSE SUCH RESULTS TO DIFFER MATERIALLY FROM ANY FORWARD-LOOKING STATEMENTS WHICH MAY BE DEEMED TO HAVE BEEN MADE IN THIS PROXY STATEMENT OR WHICH ARE OTHERWISE MADE BY OR ON BEHALF OF US. FOR THIS PURPOSE, ANY STATEMENTS CONTAINED IN THIS PROXY STATEMENT THAT ARE NOT STATEMENTS OF HISTORICAL FACT MAY BE DEEMED TO BE FORWARD-LOOKING STATEMENTS. WITHOUT LIMITING THE GENERALITY OF THE FOREGOING, WORDS SUCH AS “MAY”, “WILL”, “EXPECT”, “BELIEVE”, “EXPLORE”, “CONSIDER”, “ANTICIPATE”, “INTEND”, “COULD”, “ESTIMATE”, “PLAN”, “HOPE” OR “CONTINUE” OR THE NEGATIVE VARIATIONS OF THOSE WORDS OR COMPARABLE TERMINOLOGY ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS. INFORMATION REGARDING THE RISKS, UNCERTAINTIES AND OTHER FACTORS THAT COULD CAUSE ACTUAL RESULTS TO DIFFER FROM THE RESULTS IN THESE FORWARD-LOOKING STATEMENTS ARE DISCUSSED UNDER THE SECTION “RISK FACTORS” IN THIS PROXY STATEMENT. PLEASE CAREFULLY CONSIDER THESE FACTORS, AS WELL AS OTHER INFORMATION CONTAINED HEREIN AND IN OUR PERIODIC REPORTS AND DOCUMENTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. THE FORWARD-LOOKING STATEMENTS INCLUDED IN THIS PROXY STATEMENT ARE MADE ONLY AS OF THE DATE OF THIS PROXY STATEMENT. WE DO NOT UNDERTAKE ANY OBLIGATION TO UPDATE OR SUPPLEMENT ANY FORWARD-LOOKING STATEMENTS TO REFLECT SUBSEQUENT EVENTS OR CIRCUMSTANCES, EXCEPT AS REQUIRED BY LAW.

Proposal No. 1: The Sale

This discussion of the sale is qualified in its entirety by reference to the Sale Agreement which is attached to this Proxy Statement as Annex A. You should read the entire Sale Agreement, as well as the exhibits and schedules attached to the Sale Agreement, as it is the legal document that governs the sale.

There are a number of risk factors you should consider when deciding whether to vote to approve that proposals contained in this Proxy Statement. You also should consider the other information in the Proxy Statement and the additional information in our other reports on file with the Securities and Exchange Commission. For further discussion, you should read “Where You Can Find More Information” on page 38.

Sale Risk Factors

The risk factors may include, but are not limited to, the risks and uncertainties associated with:

| | · | risks that the transactions contemplated by the Sale Agreement and the lease will not close. |

| | · | risks that increases in rent over the term of the lease will result in less funds available to us or will exceed the revenues generated by us as of the date the increase becomes effective. |

| | · | our ability to raise capital or obtain financing necessary to implement our business plan. |

| | · | our ability to improve the quantity and quality of the products produced by our tire processing facility and/or attract new customers. |

| | · | our ability to execute the other elements of our business plan including commercialization of our patented Thermal Gasifier™ technology, building Thermal Gasifiers™ that meet customers’ specifications and local regulatory, environmental and permit requirements. |

| | · | environmental risks associated with our tire processing operations. |

| | · | our ability to purchase sufficient equipment and maintain such equipment in good operation and repair so as to avoid a plant shut down. |

| | · | risks that other companies in the marketplace may have access to greater capital and therefore may be able to compete more effectively for business. |

| | · | risk that our tire processing permit may not be renewed or may be revised in a manner that is adverse to our continued operations. |

| | · | risks related to our ability to secure contracts for tire processing sales and Thermal Gasifier™ projects. |

| | · | our ability to satisfy our customers’ expectations. |

| | · | our ability to employ and retain qualified management and employees. |

| | · | changes in government regulations which are applicable to our business. |

| | · | the availability of a consistent, economically viable, and sustainable supply of waste tires to support the tire processing operations. |

| | · | the availability of a consistent, economically viable, and sustainable waste stream supply to fuel the Thermal Gasifier™ operations. |

| | · | changes in the demand for our products and services, including the impact from changes in governmental regulation and funding for alternative energy. |

| | · | the degree and nature of our competition, including the reliability and pricing of traditional energy sources. |

| | · | economic viability of other alternative energy sources such as wind and solar power. |

| | · | our ability to pay debt service on loans as they come due. |

| | · | our ability to generate sufficient cash to pay our creditors. |

| | · | disruption in the economic and financial conditions primarily from the impact of terrorist attacks in the United States and overseas, threats of future attacks, police and military activities, governmental unrest in certain parts of the world and other disruptive worldwide political events. |

We Cannot Be Sure If Or When The Sale Will Be Completed

The consummation of the sale is subject to the satisfaction or waiver of various conditions, including the authorization of the sale by our stockholders and release of the following liens on the real property;

| | (a) | $800,000 Deed of Trust recorded April 2002 by Alternate Power, Inc. Management does not believe that the Deed of Trust secures any indebtedness or obligation to Alternate Power and is vigorously pursuing appropriate legal remedies to remove this deed of trust in order to complete the sale of the Texas facility; and |

| | (b) | Mechanic’s lien filed by a contractor for approximately $86,000 for services provided October, 2007 through April, 2008. This lien will be resolved at the completion of the property sale. The Company has recorded a liability in this amount in its March 31, 2011 financial statements. |

We cannot guarantee that we will be able to satisfy the closing conditions set forth in the Sale Agreement. If we are unable to satisfy the closing conditions, Brown will not be obligated to complete the sale.

If the sale is not completed, our Board of Directors, in discharging its fiduciary obligations to our stockholders, will evaluate other alternatives that may be less favorable to our stockholders than the sale, and we expect we will need to obtain financing or raise capital in order to continue as a going concern. We have been unsuccessful in our attempts to obtain long-term financing, and we cannot assure you that any financing or capital would be available to us on acceptable terms, if at all. A significant capital raise also could risk impairing the tax benefit attributed to our net operating losses.

By completing the proposed sale, we will be selling the real estate upon which substantially all of our operations occur.

Our tire fuel processing business comprises substantially all of our revenue producing operations. The real estate underlying this business is our most valuable asset. This segment of our business generated approximately $102,000 of gross revenue for the three months ended March 31, 2011. For the same period, the Thermal Gasifier™ business segment generated no revenue.

If we do not sell the real property underlying our tire processing operations, we probably will be unable to pay our indebtedness to Richard Strain and Timothy Ruddy as it comes due or satisfy our obligations to certain persons associated with Mr. Ruddy, the IRS or other state and local taxing authorities.

As of March 31, 2011, notes payable - stockholder and notes payable – related parties were due immediately either by expiration of waivers or upon demand and were in default as follows:

| 9% promissory notes payable – Richard Strain – stockholder, due on demand, secured by a first priority security interest in our assets – default waived through August 31, 2011 | | $ | 500,000 | |

| 9 9% line of credit - Richard Strain – stockholder, matured December 31, 2010, principal payments of $8,000 per month, secured by a first priority security interest in our assets – default waived through August 31, 2011 | | | 92,752 | |

| Notes payable- stockholder | | $ | 592,752 | |

| | | | | |

| 8 8% promissory notes payable - Timothy Ruddy, due on demand, secured by all of our assets, security interest is subordinated to the loans extended by Mr. Strain | | $ | 413,600 | |

| | | | | |

| 1 12% promissory notes payable to Timothy Ruddy family members, cash interest of 10% and stock of Vista of 2%, secured by all of our assets, security interest is subordinated to the loans extended by Mr. Strain, interest due quarterly-default waived | | | 45,000 | |

| Notes payable-related parties | | $ | 458,600 | |

Notes payable – stockholder

The line of credit provides for certain equity redemption rights to Mr. Strain, on terms and conditions to be agreed upon. No equity redemption rights have been provided as of March 31, 2011. The maximum amount to be drawn under the line is $375,000. However, subsequent to initial draws of approximately $100,000 in 2009, Mr. Strain has declined to provide additional funding under the line.

We received a waiver of default on the notes and line of credit on March 22, 2011, which specifies that non-payment defaults will be waived until the earlier of (a) the closing of the sale of our Texas industrial site or (b) August 31, 2011.

As of March 31, 2011, accrued interest outstanding on these loans was approximately $51,400.

Notes payable – related party

We have a loan agreement with Mr. Timothy D. Ruddy, one of our directors, in which Mr. Ruddy has the option, at his discretion, to receive payment as follows:

| | (a) | repayment of principal and interest; |

| | (b) | conversion of outstanding amount without accrual of interest into our common stock based on the quoted market price of the stock at the dates loans were made; or |

| | (c) | any combination of cash and stock as described in (a) and (b) |

As of March 31, 2011, accrued interest outstanding on these loans was approximately $43,500.

Subsequent to March 31, 2011 and through June 24, 2011, Mr. Ruddy has loaned us an additional $99,000 under this agreement.

Notes payable – related party family

As of March 31, 2011, no interest payments have been made on these notes. In April 2011, all noteholders agreed to defer payment of interest due to the earlier of (a) the closing of the sale of our Texas industrial site or (b) December 31, 2011, in effect granting default waivers to us.

As of March 31, 2011, accrued interest outstanding on these loans was approximately $4,900.

We do not expect we will have funds from operations or that we will be able to obtain debt or equity financing in order to make the payments to Mr. Strain or Mr. Ruddy or those persons associated with Mr. Ruddy on a timely basis. Accordingly, we believe we have no viable alternative other than using the proceeds from the sale under the Sale Agreement to pay down the indebtedness. Mr. Strain, Mr. Ruddy and those persons associated with Mr. Ruddy have a security interest in all of our assets as collateral for these obligations. If we are unable to meet our payment obligations to Mr. Strain, Mr. Ruddy and those persons associated with Mr. Ruddy when payment is due, they will have the right to declare their loans in default. They will be entitled to commence collection proceedings against us, including foreclosure proceedings against our assets. These assets include the assets and real property that comprise our tire processing facilities and operations.

As of March 31, 2011, we had a liability of approximately $578,000 for unpaid federal and state corporate income taxes, bulk sales taxes and property taxes.

As of March 31, 2011, we owed approximately $110,000 to the Internal Revenue Service for delinquent payroll taxes and penalties. Monthly payments of $5,000 have been made since December 28, 2010 and the final balloon payment is due August 31, 2011. In addition, we owe approximately $10,000 for delinquent state payroll taxes as of March 31, 2011.

While there currently is no lien on the real property in favor of any taxing authority, we have been advised by the taxing authorities they will lien and seize the property if payment in full is not made by August 31, 2011.

The Sale Agreement will expose us to contingent liabilities.

Under the Sale Agreement, we have agreed to indemnify Brown for a number of matters for a limited time including the breach of our representations, warranties, and covenants contained in the Sale Agreement. For further discussion, you should read “The Sale Agreement –Representations and Warranties, The Sale Agreement – Covenants, The Sale Agreement – Indemnification, and The Sale Agreement – Survival of Representations” beginning on page 38. For example, an indemnification claim by Brown might result if our representations made in the Sale Agreement are later proven to be incorrect.

The Sale Agreement precludes us from negotiating with any other person for the sale of our real property.

Under the terms of the Sale Agreement, we cannot negotiate with any third person for the sale of the real property which is covered by the Sale Agreement, unless and until the Sale Agreement terminates, in accordance with its terms, before closing. If a closing has not taken place by no later than 15 days after the end of the feasibility period because conditions to closing have not been met, either party may terminate the agreement.

Our estimate of the maximum amount available to repay or pay down our indebtedness, satisfy our obligations to the IRS and other state and local taxing authorities, upgrade our tire processing facility and further the commercialization of our patented Thermal Gasifier™ technology could be reduced if our expectations regarding our operating expenses are inaccurate.

Claims, liabilities and expenses from operations (such as operating costs, salaries, directors and officers’ insurance, federal and state income taxes, payroll and local taxes, legal and accounting fees and miscellaneous office expenses) will continue to be incurred as we seek to complete the sale. Our expectations regarding our expenses may be inaccurate. Any unexpected claims, liabilities or expenses, or any claims, liabilities or expenses that exceed our current estimates, could reduce the amount of cash available to repay or pay down our indebtedness, satisfy our obligations to the IRS and other state and local taxing authorities, upgrade our tire processing facility and further the commercialization of our patented Thermal Gasifier™ technology. If available cash and amounts received in the sale are not adequate to provide for our obligations, liabilities, expenses and claims, we may not be able to repay or pay down our indebtedness, satisfy our obligations to the IRS and

other state and local taxing authorities, upgrade our tire processing facility or further the commercialization of our patented Thermal Gasifier™ technology.

Our estimate of the maximum amount available to repay or pay down our indebtedness, satisfy our obligations to the IRS and other state and local taxing authorites, upgrade our tire processing facility and further the commercialization of our patented Thermal Gasifier™ technology does not include any estimates of, or reserves for, the settlement amounts, fines or penalties, if any, that we may incur with respect to our obligations to the IRS and other state and local taxing authorities as a result of the sale or the amount we may pay under the Sale Agreement to satisfy our indemnification obligations, if any, to Brown and its related parties.

The estimate of the maximum amount available to repay or pay down our indebtedness, satisfy our obligations to the IRS and other state and local taxing authorities, upgrade our tire processing facility and further the commercialization of our patented Thermal Gasifier™ technology does not include an estimate of additional penalties and interest that may be due on our obligation to the IRS and other state and local taxing authorities. The estimate also does not include an estimate of the amount we may pay under the Sale Agreement to satisfy our indemnification obligations, if any, to Brown and its related parties. Our cash outflows relating to our indemnification obligations under the Sale Agreement could be substantial. These amounts will reduce the assets available to repay or pay down our indebtedness, satisfy our obligations to the IRS and other state and local taxing authorities, upgrade our tire processing facility and further the commercialization of our patented Thermal Gasifier™ technology.

Our estimate of the maximum amount available to repay or pay down our indebtedness, satisfy our obligations to the IRS and other state and local taxing authorities, upgrade our tire processing facility and further the commercialization of our patented Thermal Gasifier™ technology is based on a number of assumptions, including with respect to our administrative and professional expenses incurred after the sale.

Our estimate of the maximum amount available to repay or pay down our indebtedness, satisfy our obligations to the IRS and other state and local taxing authorities, upgrade our tire processing facility and further the commercialization of our patented Thermal Gasifier™ technology also includes certain administrative and professional expenses we expect to incur for business operations after the sale. The amount of these expenses could be affected by negotiations to establish contractual arrangements as well as regulatory and legal requirements. The actual amounts expended for business operations after the sale could be significantly greater or less than the amounts estimated depending on the scope of such business operations after the sale.

Certain of our executive officers and directors and persons associated with them may have interests in the sale other than, or in addition to, the interests of our stockholders generally.

Members of our Board of Directors and our executive officers and persons associated with them may have interests in the sale that are different from, or are in addition to, the interests of our

stockholders generally. Our Board of Directors was aware of these interests and considered them, among other matters, in approving the Sale Agreement.

Mr. Bradley A. Ripps, our Interim Chief Executive Officer, will receive 50,000 shares of our common stock if the sale is consummated. In addition, Mr. Ruddy, one of our directors, will receive a payment of $50,000 on indebtedness owed to him by Vista at the closing of the sale. Certain other persons associated with Mr. Ruddy will receive a repayment of $45,000 of past due indebtedness owed to them at the closing of the sale.

For further information pertaining to interests of management, see the discussion under the caption “Proposal 1: Approval of the Sale – Interests of Certain Members of Management in the Transaction” beginning on page 18.

A delay in the closing of the sale will decrease the funds available to repay or pay down our indebtedness, satisfy our obligations to the IRS and other state and local taxing authorities, upgrade our tire processing facility and further the commercialization of our patented Thermal Gasifier™ technology.

Claims, liabilities and expenses from operations (including operating costs such as salaries, directors’ fees, directors and officers’ insurance, federal and state income taxes, payroll and local taxes, legal and accounting fees and miscellaneous office expenses) will continue to be incurred by us as we seek to close the sale. In the event the closing of the sale is delayed, we will incur additional claims, liabilities and expenses from operations that will reduce the net funds available to reapy or pay down our indebtedness, satisfy our obligations to the IRS and other state and local taxing authorities, upgrade our tire processing facility and further the commercialization of our patented Thermal Gasifier™ technology.

Our independent public accountant has raised doubts as to our ability to continue as a going concern.

As disclosed in our annual report on Form 10-K/A2 for the year ended December 31, 2010 and in our quarterly report on Form 10-Q/A for the three month period ended March 31, 2011, the continuing loss from operations and the lack of financing raise doubt about our ability to continue as a going concern. If the sale is not completed, we will need to consummate a substantial financing. Given the current credit markets, if available at all, this financing transaction would likely be an equity transaction that will result in significant dilution to the existing stockholders. There are no assurances that this financing will be available to us. If such financing is not available, we may need to cease operations.

We would confront urgent and significant liquidity challenges in the event the sale is not consummated.

During the last few years, we have faced liquidity challenges resulting mainly from the reduction of revenue and continuing significant operating losses. At present we are operating without the benefit of any line of credit. We have been operating under substantial cash restrictions. We have managed our operations with the assistance of shareholder loans, such as those from Mr. Strain, Mr. Ruddy and persons associated with Mr. Ruddy. We also have been stretching payments to vendors and suppliers.

At March 31, 2011, we had approximately $20,000 in cash on hand.

$592,752 of the indebtedness owed to Mr. Strain is due and payable immediately upon the termination of the Sale Agreement, and Brown has the right to terminate the Sale Agreement if our stockholders do not authorize the sale.

$592,752 of the indebtedness owed to Mr. Strain is due and payable if the Sale Agreement is terminated for any reason that does not involve a breach by Brown. Brown may terminate the Sale Agreement if, among other reasons, the stockholders do not authorize the sale or we are unable to procure the release of certain liens against the property.

We will continue to incur the expenses of complying with public company reporting requirements.

After the sale, we still will have an obligation to comply with the applicable reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), even though compliance with such reporting requirements is economically burdensome.

Background

We have been involved in the clean energy and waste to energy business since 1997. We had a helium and gas processing facility in Keyes, Oklahoma which we sold to Midstream Energy Services, LLC in 2005. Since that sale we have focused on our tire fuel processing operations, as well as our patented Thermal Gassifier™ technology.

The tire facility currently receives a disposal fee (“tipping fee”) for processing waste tires into partially shredded product. This material is then offered to end-users who pick the product up at our facility. Recently we have expanded into re-selling (“grading”) a portion of the qualified used tires to generate a new revenue stream. We are exploring additional revenue opportunities including the production of tire-derived-fuel (“TDF”). TDF is an alternative fuel to fossil fuels. The TDF can be purchased by third parties, thereby generating another revenue source. Alternatively, the TDF can be used as a fuel feedstock for our Thermal Gasifier™.

Our Board of Directors and management team have been reviewing the needs, prospects and long-term business goals for both the tire processing and Thermal Gasifier™ businesses for some time. The objective is to maximize the potential of both lines of business and therefore the value to our shareholders. We regularly have assessed trends and conditions impacting us and our industry, changes in the marketplace, applicable law and the competitive environment. One of the conclusions we reached as we reviewed the business plan for both the tire facility and the Thermal Gasifier™ was a need for additional capital to realize the potential benefits available from these two business units. The capital would be used to purchase additional equipment for the Texas tire facility for the production of TDF. This would provide a third revenue source for the tire facility. The capital also would be used to fund further development and research for the Thermal Gasifier™. A portion of the funds also will be used to repay or pay down outstanding indebtedness to our two largest creditors and shareholders, Mr. Richard Strain and Mr. Timothy Ruddy, together with certain other persons associated with Mr. Ruddy, as well as tax liabilities to the Internal Revenue Service (the “IRS”) and certain other state and local taxing authorities.

We evaluated both debt and equity financing alternatives to raise capital to provide improvements to our tire fuel processing division and further the commercialization of our Thermal Gasifier™ technology, as well as to service our mounting debt. Potential lenders required collateral on our existing assets for moneys lent. Since the majority of our assets already served as collateral for our indebtedness to Richard Strain and Tim Ruddy, together with certain other persons associated with Mr. Ruddy, we could not negotiate debt financing with a third party lender which was both favorable to us and/or acceptable to any of these individuals. Due to the depressed value of our stock, the issuance of additional shares of common stock would not have provided the funding we required.

In April, 2010, our Board of Directors authorized us to explore and evaluate the estimated value of the real property underlying our tire processing facility. We also were requested to consider possible sale, joint venture or partnering arrangements. In May and June 2010, we had interest from Liberty Tire Recycling, LLC, a local competitive tire processing company. Liberty expressed interest in a possible joint venture or the outright purchase of our tire processing business. Discussions with Liberty were terminated in July of 2010 when it became apparent that Liberty did not have the intention to conclude a reasonable transaction.

In June, 2010 our Board of Directors determined the most complete and efficient way to find the best and highest value for the tire processing assets was to hire a broker. Several real estate and appraisal firms were contacted and considered. A final determination was made to secure a real estate broker versus an appraisal company. Finally, in July, 2010 the Board elected to engage Collier’s International, a world wide real estate company with expertise in marketing, leasing and property management. The Board decided upon Collier’s due in part to their international connections and local familiarity with scrap processing clients. The Board felt the tire processing facility, with its access to a local intermodal, along with the products it produced, might appeal to an international purchaser seeking a foothold in the U.S. waste-to-energy market. Collier’s also has a strong presence in the Dallas marketplace, including direct experience with other scrap processors.

For the two years prior to the engagement of Collier’s by Vista, there was no relationship between Colliers and Vista or any of their officers, directors or affiliates. Collier’s will receive a commission of $35,222 upon the closing of the sale.

Collier’s began assessing the market value of the tire processing assets. They compared local properties and businesses of similar size and improvements. Additionally, they sent marketing data to all their national and international brokerage offices and contacted over 1,200 tenants, investors and owners. They also contacted all the scrap processing businesses in the Dallas/Ft. Worth area. After several months of activity, Collier’s provided the Board with information concerning real estate industry trends, credit markets, strategic alternatives and other considerations affecting the sale of the real property underlying our tire processing facility. Additionally, they brought three different groups to us that expressed further interest in our tire processing assets. These companies included: Pallet Logistics of America, LLC (“PLA”), CleanTech Solutions Worldwide, LLC (“CTSW”) and Brown-Lewisville Railroad Family First Limited Partnership (“Brown”). The Company received different proposals from all three groups. PLA and CTSW proposed joint venture opportunities and Brown offered a sale/leaseback. The Board of Directors and management deliberated on the feedback from Collier’s regarding the market value of the assets along with the proposals from the three interested parties. Ultimately, the Board determined that the offer from Brown made the most sense for us.

A copy of the report issued by Colliers to the Board is available for inspection or copying upon request presented to our Corporate Secretary, 88 Inverness Circle East, Suite N-103, Englewood, Colorado 80112. Copies shall be reviewed or requested during our regular business hours. A charge for copying and postage will be assessed for processing any such request.

In January of 2011, we began negotiations with Brown regarding the sale of the real estate underlying the tire shredding facility, along with a lease by Vista of 12.5 acres of that property. The lease between Vista and Brown is for the portion of the land where we conduct our tire processing operations. None of the equipment, structures or permit utilized in the tire processing operations are included in the sale.

The Board considered Brown’s offer the highest and best use of the tire processing assets. Brown was deemed to be a viable purchaser due to the fact that a company owned by the Brown principals has more than 15 years of experience in the recycled crushed concrete business and Brown was willing to pay cash for the real property.

On February 8, 2011, our Board of Directors approved the Letter of Intent with Brown-Lewisville Railroad Family First Limited Partnership (“Brown”), an affiliate of Mason Brown. The general partner of Brown is BLRR Management, LLC, whose members are Mason Brown, Barbara Brown (Mason Brown’s wife) and Michael A. Richard. The limited partners of Brown are Mason Brown and Barbara Brown.

The terms of the Letter of Intent were as follows: