FORM 6K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of: February, 2005

Commission File Number: 0-30456

| CHARTWELL TECHNOLOGY INC. |

| (Translation of registrant’s name into English) |

Suite 400, 750 – 11th Street SW

Calgary, Alberta

Canada T2P 3N7 |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

| | Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders. |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

| | Note:Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR. |

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b) 82 —

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| March 30, 2005 | signed"Don Gleason"

Don Gleason, CFO |

EXHIBIT INDEX

| 1 | | Press Release dated February 23, 2005 |

| 2 | | Notice of Annual General Meeting of Shareholders dated February 15, 2005 |

| 3 | | Information Circular dated February 15, 2005 |

2

EXHIBIT 1

Chartwell Signs Sportingbet plc

| |

|---|

| Chartwell Technology Inc. | TSX:CWH |

Calgary, Canada, February 23, 2005, Chartwell Technology Inc. (TSX:CWH), a leading provider of gaming software systems to the online and remote gaming industry is very pleased to announce the addition of European based Sportingbet plc (AIM:SBT.L) to its growing list of clients.

Founded in 1998, Sportingbet is regarded byleading industry observereGamingReview as the largest online gaming company in the world. Sportingbet boasts betting turnover of over $2 Billion USD from a player base that exceeds 2.2 million customers in over 100 countries and currently averages over 13 bets per second. Sportingbet has grown through the development of its existing business and strategic acquisitions and provides access to the Sportingbet brand in 15 languages and 15 currencies.

While the growth of online gaming continues its meteoric expansion as a whole, various channels such as Soft Gaming and Bingo present exceptional opportunities for those wishing to cater to specific market segments. To capitalize on this opportunity, Sportingbet has licensed Chartwell’s suite of “Soft-games” and “Bingo games” on a fully integrated basis to pursue this new player demographic and enhance its product offering.

Lee Richardson, Chief Executive of Chartwell Games, said “This significant new signing further delivers on our commitment to developing our European client base; it also serves to reinforce that the Chartwell business model and products can add significant value to the most major of on-line gaming operators such as Sportingbet”.

About Sportingbet

Sportingbet plc (AIM:SPT.L) is a fully regulated, tax-free online sports betting and gaming company. Operating under fully regulated licenses in the UK, Australia, Antigua and Curacao, Sportingbet has over 2.2 million customers and trades in over 100 countries, 15 languages and 15 currencies. The Sportingbet mission is to be the leading operator of interactive gambling through the provision of secure, legal and ethical sports betting and gaming services through constant customer satisfaction and service that is convenient, innovative, safe and fair.

About Chartwell

Chartwell Technology Inc. specializes in the development of leading edge gaming applications and entertainment content for the Internet and wireless platforms and other remote access devices. Chartwell’s Java and Flash based software products and games are designed for deployment in gaming, entertainment, advertising and promotional applications. Chartwell does not participate in the online gaming business of its clients. Chartwell’s team of highly trained professionals is committed to delivering the highest quality software and maintaining its leading edge through continuous development and unparalleled customer support.

Chartwell invites you to preview and play our games at www.chartwelltechnology.com

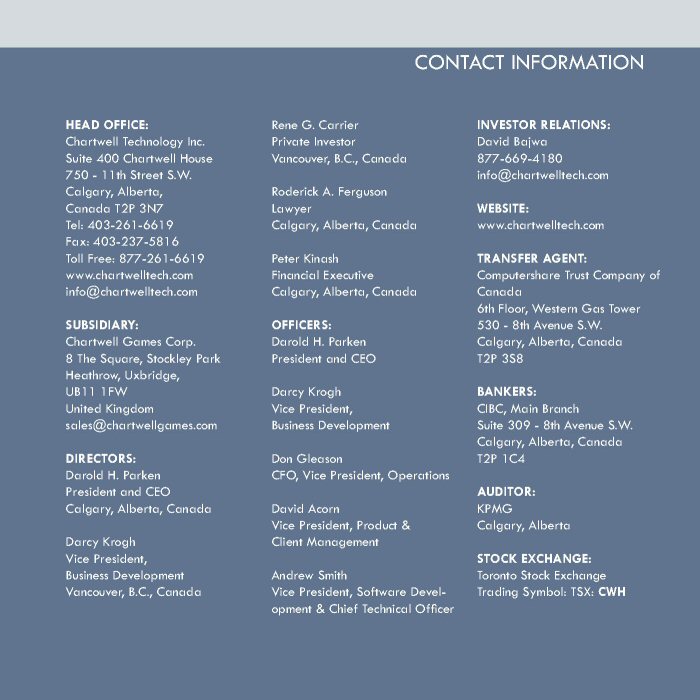

For further information, please contact:

| |

|---|

| Chartwell Games Corp. | Chartwell Technology Inc. |

| Lee Richardson, Chief Executive | David Bajwa, Investor Relations |

| +44 20 8610 6671 | (877) 669-4180 or (604) 669-4180 |

| lrichardson@chartwellgames.com | info@chartwelltechnology.com |

The Toronto Stock Exchange does not accept responsibility for the adequacy or accuracy of this press release.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: The statements contained herein which are not historical fact are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements, including, but not limited to, certain delays in testing and evaluation of products, regulation of the online gaming industry, and other risks detailed from time to time in Chartwell’s filings with the Securities & Exchange Commission. We assume no responsibility for the accuracy and completeness of these statements to actual results. This is not an offer to sell or a solicitation of an offer to purchase any securities.

EXHIBIT 2

CHARTWELL TECHNOLOGY INC.

NOTICE OF ANNUAL GENERAL MEETING

OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the Annual General Meeting of the Shareholders of Chartwell Technology Inc. (the “Corporation”) will be held at the Metropolitan Centre, Royal Room, 333 – 4th Avenue S.W., Calgary, Alberta, on Tuesday the 22ndday of March, 2005 at 3:00 p.m. (Calgary time) for the following purposes:

| 1. | To receive and consider the Financial Statements of the Corporation for the year ended October 31, 2004 and the Auditor’s Report thereon; |

| 3. | To appoint KPMG LLP, Chartered Accountants, as auditors of the Corporation, and to authorize the directors to fix their remuneration; and |

| 4. | To transact such other business as may be properly brought before the Meeting or any adjournment thereof. |

The specific details of all matters proposed to be put before the Meeting are set forth in the Circular accompanying this Notice.

SHAREHOLDERS OF THE CORPORATION WHO ARE UNABLE TO ATTEND THE MEETING IN PERSON ARE REQUESTED TO DATE AND SIGN THE ENCLOSED FORM OF PROXY AND TO MAIL IT TO OR DEPOSIT IT WITH COMPUTERSHARE TRUST COMPANY OF CANADA, 100 UNIVERSITY AVENUE, 9TH FLOOR, TORONTO, ONTARIO M5J 2Y1, ATTENTION: PROXY DEPARTMENT. PROXIES MAY ALSO BE DELIVERED BY FAX TO: (416) 263-9524 or 1-866-249-7775. IN ORDER TO BE VALID AND ACTED UPON AT THE MEETING, FORMS OF PROXY MUST BE RETURNED TO THE AFORESAID ADDRESS NOT LESS THAN 48 HOURS BEFORE THE TIME SET FOR THE HOLDING OF THE MEETING OR ANY ADJOURNMENT THEREOF.

SHAREHOLDERS ARE CAUTIONED THAT THE USE OF THE MAILS TO TRANSMIT PROXIES IS AT EACH SHAREHOLDERS’ RISK.

The Board of Directors of the Corporation has fixed the record date for the Meeting at the close of business on February 15, 2005 (the “Record Date”). Only shareholders of the Corporation of record as at that date are entitled to receive notice of the Meeting. Shareholders of record will be entitled to vote those shares included in the list of shareholders entitled to vote at the Meeting prepared as at the Record Date, unless any such shareholder transfers shares after the Record Date and the transferee establishes ownership of such shares and demands, not later than the close of business 10 days before the Meeting that the transferee’s name be included in the list of shareholders entitled to vote at the Meeting, in which case such transferee shall be entitled to vote such shares at the Meeting.

DATED at the City of Calgary, in the Province of Alberta, this 15th day of February, 2005

| |

|---|

| | By Order of the Board of Directors, |

| |

| | (signed) "Darold H. Parken" |

| | Darold H. Parken, President |

EXHIBIT 3

CHARTWELL TECHNOLOGY INC.

INFORMATION CIRCULAR — PROXY STATEMENT

For the Annual General Meeting

of Shareholders to be held on Tuesday, March 22, 2005

SOLICITATION OF PROXIES

This Information Circular — Proxy Statement is furnished in connection with the solicitation of proxies by the Management ofCHARTWELL TECHNOLOGY INC. (hereinafter referred to as the “Corporation” or “Chartwell”) for use at the Annual General Meeting of the Shareholders of the Corporation (the “Meeting”) to be held on the 22nd day of March, 2005, at 3:00 p.m. (Calgary time) at the Metropolitan Centre, Royal Room, 333 – 4th Avenue S.W., Calgary, Alberta, and at any adjournment thereof, for the purpose set forth in the Notice of Annual General Meeting.

Instruments of Proxy must be addressed to the Secretary of the Corporation and must reach Computershare Trust Company of Canada, Proxy Department, 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1, not less than 48 hours before the time for the holding of the Meeting or any adjournment thereof. Proxies may also be delivered by fax to: (416) 263-9524 or 1-866-249-7775. Pursuant to the Business Corporations Act (Alberta), the record date for the Meeting is the close of business on February 15, 2005. Only shareholders of the Corporation of record as at that date are entitled to receive notice of and to vote at the Meeting unless after that date a shareholder of record transfers his shares and the transferee, upon producing properly endorsed certificates evidencing such shares or otherwise establishing that he owns such shares, requests not later than ten (10) days prior to the Meeting that the transferee’s name be included in the list of shareholders entitled to vote, in which case, such transferee is entitled to vote such shares at the Meeting.

The instrument appointing a proxy shall be in writing and shall be executed by the shareholder or his attorney authorized in writing or, if the shareholder is a corporation, under its corporate seal or by an officer or attorney thereof duly authorized.

THE PERSONS NAMED IN THE ENCLOSED FORM OF PROXY ARE DIRECTORS AND/OR OFFICERS OF THE CORPORATION. A SHAREHOLDER SUBMITTING THE PROXY HAS THE RIGHT TO APPOINT A PERSON TO REPRESENT HIM AT THE MEETING (WHO NEED NOT BE A SHAREHOLDER OF THE CORPORATION) OTHER THAN THE PERSON OR PERSONS DESIGNATED IN THE FORM OF PROXY FURNISHED BY THE CORPORATION. TO EXERCISE SUCH RIGHT, THE NAMES OF THE PERSONS DESIGNATED BY MANAGEMENT SHOULD BE CROSSED OUT AND THE NAME OF THE SHAREHOLDER’S APPOINTEE SHOULD BE LEGIBLY PRINTED IN THE BLANK SPACE PROVIDED.

REVOCABILITY OF PROXY

A shareholder who has submitted a proxy may revoke it at any time prior to the exercise thereof. If a person who has given a proxy attends personally at the Meeting at which such proxy is to be voted, such person may revoke the proxy and vote in person. In addition to the revocation in any other manner permitted by law, a proxy may be revoked by instrument in writing executed by the shareholder or his attorney authorized in writing or, if the shareholder is a corporation, under its corporate seal or by an officer or attorney thereof duly authorized and deposited either at the registered office of the Corporation at any time up to and including the last business day preceding the day of the Meeting, or any adjournment thereof, at which the proxy is to be used, or with the Chairman of the Meeting on the day of the Meeting, or any adjournment thereof, and upon either of such deposits, the proxy is revoked.

1

BENEFICIAL HOLDERS OF SHARES

The information set forth in this section is of significant importance to beneficial holders of Common Shares of Corporation who do not hold their Common Shares in their own name (“Beneficial Shareholders”). Beneficial Shareholders should note that only proxies deposited by shareholders whose names appear on the records of the Corporation as the registered holders of shares can be recognized and acted upon at the Meeting. If shares are listed in an account statement provided to a Beneficial Shareholder by a broker, then in almost all cases those shares will not be registered in the Beneficial Shareholder’s name on the records of the Corporation. Such shares will more likely be registered under the name of the Beneficial Shareholder’s broker or an agent of that broker. In Canada, the vast majority of such shares are registered under the name of CDS & Co. (the registration name for The Canadian Depository for Securities Limited, which acts as nominees for many Canadian brokerage firms). Shares held by brokers or their nominees can only be voted (for or against resolutions) upon the instructions of the Beneficial Shareholder. Without specific instructions, the broker/nominees are generally prohibited from voting shares for their clients. The Corporation does not know for whose benefit the shares registered in the name of CDS & Co. are held.

Applicable regulatory policy requires intermediaries/brokers to seek voting instructions from Beneficial Shareholders in advance of shareholders’ meetings. Every intermediary/broker has its own mailing procedures and provides its own return instructions, which should be carefully followed by Beneficial Shareholders in order to ensure that their shares are voted at the Meeting. Often, the form of proxy supplied to a Beneficial Shareholder by its broker is a voting instruction form or a form which is identical to the form of proxy provided to registered shareholders. In either case, its purpose is limited to instructing the registered shareholder how to vote on behalf of the Beneficial Shareholder. The majority of brokers now delegate responsibility for obtaining instructions from clients to ADP Investor Communications (“ADP”). ADP typically mails the voting instruction forms or proxy forms to the Beneficial Shareholders and asks Beneficial Shareholders to return the forms to ADP. ADP then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of shares to be represented at the Meeting.A Beneficial Shareholder receiving a voting instruction request or a proxy form cannot use that voting instruction request or proxy form to vote Common Shares directly at the Meeting as the voting instruction request or proxy form must be returned as directed by ADP well in advance of the Meeting in order to have the shares voted. Accordingly, it is strongly suggested that Beneficial Shareholders return their completed instructions or proxies as directed by ADP well in advance of the Meeting.

PERSONS MAKING THE SOLICITATION

THIS SOLICITATION IS MADE ON BEHALF OF THE MANAGEMENT OF THE CORPORATION. The costs incurred in the preparation and mailing of the Form of Proxy, Notice of Annual General Meeting and this Information Circular — Proxy Statement will be borne by the Corporation. In addition to the use of mails, proxies may be solicited by personal interviews, telephone or fax by directors and officers of the Corporation, who will not be remunerated therefor.

EXERCISE OF DISCRETION BY PROXY

The shares represented by proxy in favour of management nominees shall be voted on any ballot at the Meeting and where the shareholder specifies a choice with respect to any matter to be acted upon, the shares shall be voted on any ballot in accordance with the specification so made.

2

IN THE ABSENCE OF SUCH SPECIFICATION, SHARES WILL BE VOTED IN FAVOUR OF ALL OF THE PROPOSED RESOLUTIONS. THE PERSONS APPOINTED UNDER THE FORM OF PROXY FURNISHED BY THE CORPORATION ARE CONFERRED WITH DISCRETIONARY AUTHORITY WITH RESPECT TO AMENDMENTS OR VARIATIONS OF THOSE MATTERS SPECIFIED IN THE PROXY AND NOTICE OF ANNUAL GENERAL MEETING. AT THE TIME OF MAILING OF THIS INFORMATION CIRCULAR — PROXY STATEMENT, MANAGEMENT OF THE CORPORATION KNOWS OF NO SUCH AMENDMENT, VARIATION, OR OTHER MATTER.

INFORMATION CONCERNING THE CORPORATION

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

As of the date hereof, 18,592,757 common shares (“Common Shares”) without nominal or par value of the Corporation are issued and outstanding, each such share carrying the right to one vote on any ballot at the Meeting.

As at the date hereof, to the knowledge of the directors and senior officers of the Corporation, no person or Corporation beneficially owns, directly or indirectly, or exercises control or direction over, voting shares carrying more than 10% of the voting rights attached to the common shares.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Except as described herein or in a previous Information Circular, there were no material interests, direct or indirect, of directors or senior officers of the Corporation, any shareholder who beneficially owns more than 10% of the common shares of the Corporation, or any known associate or affiliate of these persons in any transaction since the commencement of the Corporation’s last completed fiscal year or in any proposed transaction which has materially affected or would materially affect the Corporation.

STATEMENT OF EXECUTIVE COMPENSATION

The following sets forth the aggregate remuneration paid or payable by the Corporation in respect of the last completed fiscal year ended October 31, 2004 to the Directors of the Corporation in their capacity as Directors and to the Executive Officers of the Corporation in their capacity as Executive Officers or Employees of the Corporation.

Directors

Two independent Directors were paid $12,500 each and one Director was paid $9,500, all in cash compensation during the last completed fiscal year in their capacity as directors. Directors are reimbursed for out-of-pocket expenses incurred in carrying out their duties. During the last fiscal year ended October 31, 2004, 50,000 options were granted to a Director of the Corporation at an exercise price of $3.00 per share for a five-year term in accordance with the Corporation’s Stock Option Plan.

Executive Officers

The following table sets forth certain information regarding the compensation paid to Chartwell’s Chief Executive Officer and the other executive officers of Chartwell and its wholly owned subsidiary, Chartwell Games Corp., who had total annual salary and bonus exceeding $100,000 for the fiscal year ended October 31, 2004 (collectively, the “Named Executive Officers”).

3

Compensation Summary Table

| | | | | | | |

|---|

| | Annual | | Long-term |

Name and

Principal

Occupation | Year | Salary | Bonus | Other | | Stock

Options

Granted | All

Other |

Darold H. Parken(1)

President and Chief

Executive Officer | 2004

2003

2002 | $105,000

$105,000

$105,000 | $2,000

$2,000

$2,000 | nil

nil

nil | | nil

nil

nil | nil

nil

nil |

Darcy E. Krogh,

Vice President,

Business

Development | 2004

2003

2002 | $165,000

$165,000

$165,000 | $2,000

$2,000

$2,000 | nil

nil

nil | | nil

nil

nil | nil

nil

nil |

Donald Gleason,

Chief Financial

Officer and Vice

President,

Operations | 2004

2003

2002 | $122,000

$68,625

nil | $2,000

$2,000

nil | nil

nil

nil | | nil

100,000

nil | nil

nil

nil |

Andrew Smith,

Vice President,

Software

Development | 2004

2003

2002 | $150,000

$142,708

$125,000 | $2,000

$2,000

$2,000 | nil

nil

nil | | nil

nil

nil | nil

nil

nil |

4

| | | | | | | |

|---|

| | Annual | | Long-term |

Name and

Principal

Occupation | Year | Salary | Bonus | Other | | Stock

Options

Granted | All

Other |

Dave Acorn,

Vice President,

Product and Client

Management | 2004

2003

2002 | $125,000

$118,750

$100,000 | $2,000

$2,000

$2,000 | nil

nil

nil | | nil

50,000

nil | nil

nil

nil |

Lee Richardson,

Chief Executive,

Chartwell Games

Corp. | 2004

2003

2002 | $206,127

nil

nil | nil

nil

nil | nil

nil

nil | | 200,000

nil

nil | nil

nil

nil |

Notes:

| (1) | | A law firm in which Mr. Parken is principal received fees for legal services of $60,000 during the last completed fiscal year, $60,000 in fiscal 2003 and $60,000 in fiscal 2002. |

Options Exercised And Granted During the Fiscal Year Ended October 31, 2004

Stock Option Grants

During 2004, 200,000 options to purchase Common Shares were granted to a Named Executive Officer. The following table provides information concerning the options granted to this Named Executive Officer.

| | | | | |

|---|

Name | Securities Under

Options Granted

(#) | % of Total

Options

Granted to

Employees in

Fiscal 2004 | Exercise or

Base Price

($/Share) | Market Value of Common

Shares on the Day Prior to

the Date of Grant

($/Share) |

Expiration Date |

| Lee Richardson | 200,000 | 33.3% | $2.58 | $2.58 | Feb. 28, 2009 |

Stock Option Exercises and Year End Option Values

The following table sets forth all options exercised by Named Executive Officers during fiscal 2004 and the number of unexercised options and the value of in the money options at October 31, 2004.

5

| | | | |

|---|

Name | Securities

Acquired on

Exercise

(#) | Aggregate

Value

Realized(1)

($) | Unexercised Options at

October 31, 2004

Exercisable/Unexercisable

(#) | Value of Unexercised in-the-

Money Options at October 31,

2004(2)

Exercisable/Unexercisable($) |

Darold H.

Parken | nil | n/a | 625,000 | $2,000,000 |

| Darcy Krogh | 100,000 | $ 194,000 | 100,000 | $320,000 |

| Donald Gleason | nil | n/a | 100,000 | $321,000 |

| Dave Acorn | 9,400 | $29,046 | 90,600 | $290,420 |

| Andrew Smith | 5,000 | $12,700 | 145,000 | $417,000 |

| Lee Richardson | nil | n/a | 200,000 | $336,000 |

Notes:

| (1) | | Based on the difference between the closing price of the Common Shares on the Toronto Stock Exchange on the date the stock options were exercised and the exercise price of the stock options, multiplied by the number of Common Shares being acquired. |

| (2) | | Based on the difference between the closing price of $4.26 per Common Share on the Toronto Stock Exchange on October 29, 2004 and the exercise price of the stock options, multiplied by the number of Common Shares under option. |

Termination of Employment, Changes in Responsibility and Employment Contracts:

Chartwell has no compensatory plan or arrangement in respect of compensation received or that may be received by any Named Executive Officer in Chartwell’s most recently completed or current fiscal year to compensate such executive officer in the event of the termination of employment (resignation, retirement, change of control) or in the event of a change in responsibilities following a change in control.

STOCK OPTIONS

The Corporation has an approved stock option plan (the “Plan”) for directors, officers, employees and consultants of the Corporation and its subsidiaries. The Plan provides that the total number of Common Shares issuable shall not exceed 3,264,000 Common Shares and that the number of Common Shares reserved for issuance to any one optionee shall not exceed 5% of the number of outstanding Common Shares.

The exercise price of any option subject to the Plan shall not be less than the market price of the Common Shares, which shall mean the most recent closing price per share for Common Shares on the last trading day preceding the date of grant on which there was a closing price on the Toronto Stock Exchange.

The exercise period of options shall be a period of time fixed by the Board of Directors, not to exceed five (5) years. If a holder shall cease to be a director, officer, employee or consultant for any reason other than death, the options will expire if not exercised within a maximum of 45 days following such cessation. In the event of the death of a holder, the options are exercisable for a period of 12 months following the date of death by the person or persons to whom the holder’s rights under the options pass by will or by law.

6

Performance Graph

The following graph compares the total cumulative shareholder return since October 31, 1999 for $100 invested in common shares of the Corporation with the cumulative total return of the S&P/TSX Composite Index.

| | | | | | |

|---|

| | Oct. 31,

1999 |

2000 | 2001 | 2002 | 2003 | 2004 |

| Chartwell Year End Price | $100.00 | $48.75 | $46.25 | $25.00 | $42.50 | $106.50 |

| S&P/TSX Composite Index | $100.00 | $132.85 | $94.89 | $86.12 | $107.11 | $122.25 |

INDEBTEDNESS OF DIRECTORS AND SENIOR OFFICERS

The following table sets out the indebtedness of a director and senior officer of the Corporation during the last complete fiscal year. There are no other directors or senior officers indebted to the Corporation or any of its subsidiaries.

| | | | |

|---|

| Name | Largest Aggregate

Amount of

Indebtedness at

Any Time During

the Last Fiscal Year | Nature of

Indebtedness and

the Transaction in

Which it was

Incurred | Amount Presently

Outstanding | Rate of Interest

Paid or Charged |

| Darold H. Parken | $149,054 | Interest bearing

demand

promissory note

issued for

stock option

exercise | $149,054 | 6% per annum |

7

BUSINESS OF THE MEETING

Regular Business

At the Meeting, shareholders will consider the items of regular business as follows:

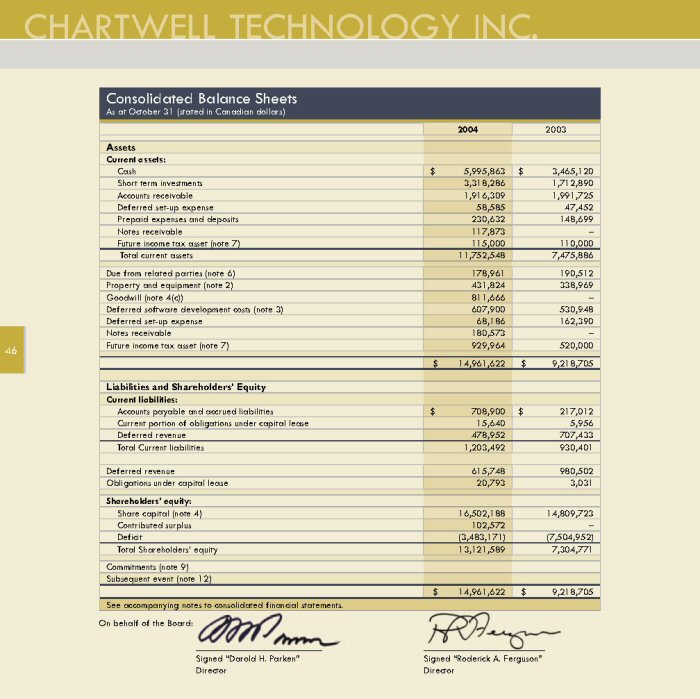

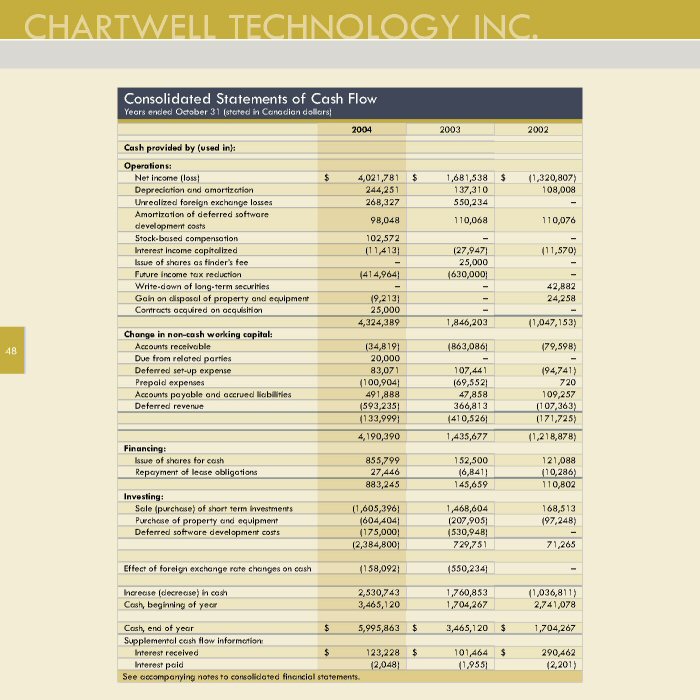

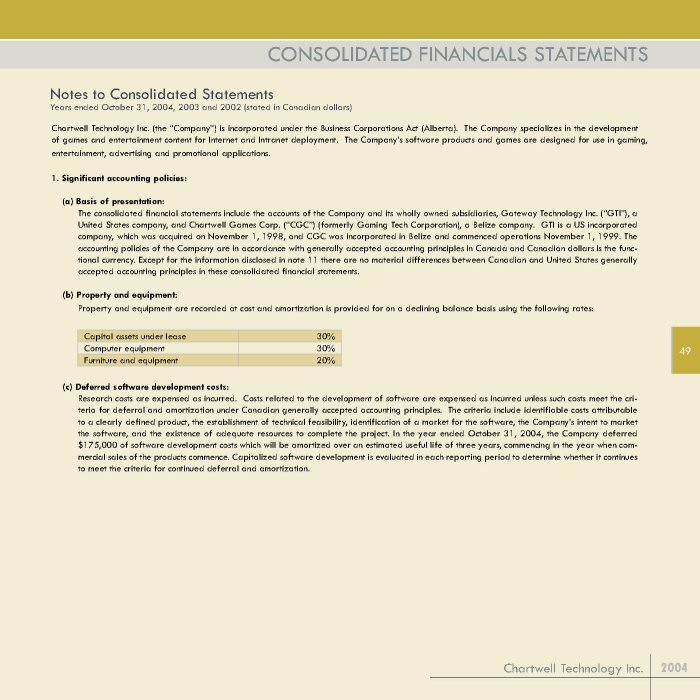

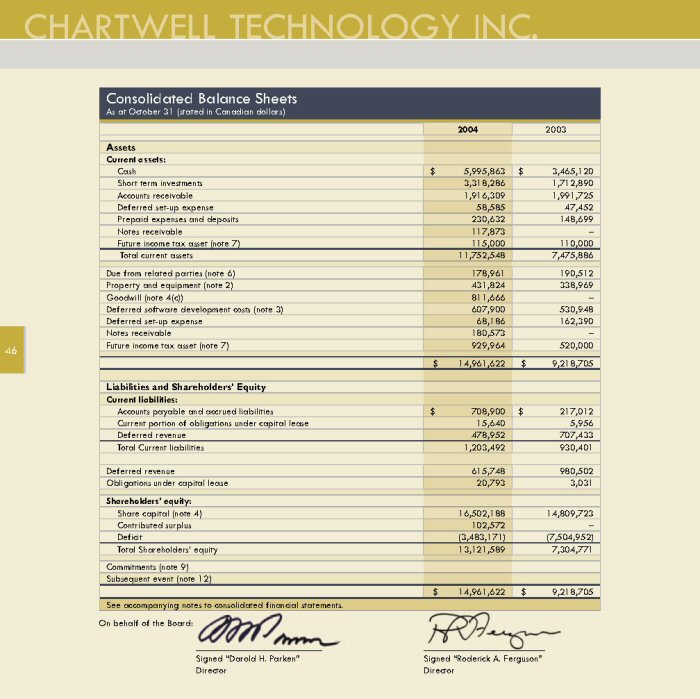

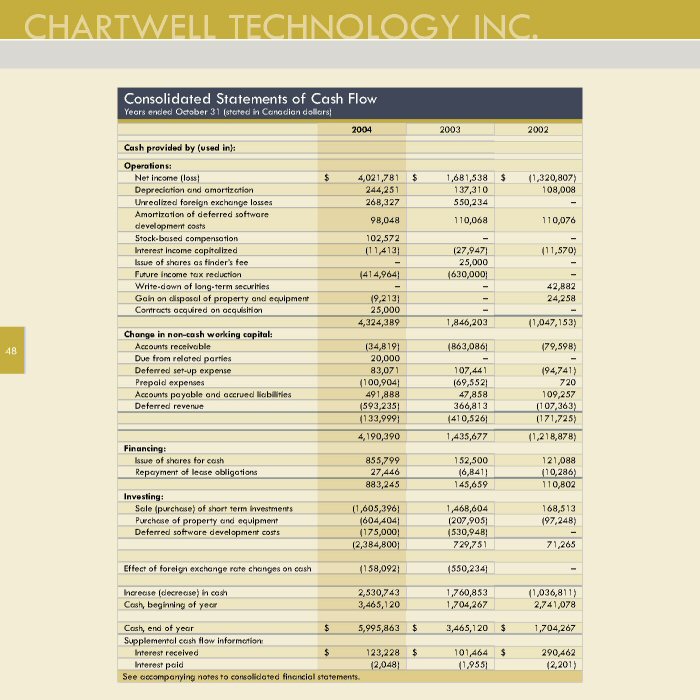

The shareholders will receive and consider the audited consolidated balance sheets of the Corporation as at October 31, 2004 and 2003 and the consolidated statement of operations and deficit and cash flows for each of the three years in the three-year period ended October 31, 2004 together with the auditor’s report.

At the Meeting, the shareholders will be asked to determine that the board of directors consist of six (6) directors and will be asked further to elect six (6) directors to succeed the present directors, whose terms of office expire on the day of the Meeting, to serve until the next annual general meeting, or until their respective successors have been elected or appointed. At the Meeting, shareholders may determine that a greater number of directors is desirable and, if so, additional nominations from shareholders will be considered for election.

Unless otherwise directed it is the intention of management to vote proxies in the accompanying form in favour of the election as directors of the six (6) nominees hereinafter set forth, provided that in the event a vacancy among such nominees occurs because of death or for any reason prior to the Meeting, the Proxy shall not be voted with respect to such vacancy:

Rene G. Carrier

Darold H. Parken

Darcy E. Krogh

Roderick A. Ferguson

Peter H. Kinash

Terence Shaunessy

The names of all the persons nominated for election as directors, all other positions and offices with the Corporation held by them, their principal occupations, dates on which they became directors of the Corporation and the number of common shares of the Corporation beneficially owned, directly or indirectly, or over which control or direction is exercised, by each of them as of February 15, 2005 are as follows:

| | | |

|---|

Name and

Position with

the Corporation | Principal Occupation During Past Five Years | Director Since | Common

Shares Held

as of

February 15,

2005(1) |

Rene G. Carrier(2)

Director

Vancouver, B.C., Canada | President, Euro-American Capital Corporation

(a private investment Corporation). Prior

thereto, Vice President of Pacific

International Securities Inc. (a brokerage

firm) from 1982 to 1991. | July 29/91 | 74,500 |

8

| | | |

|---|

Name and

Position with

the Corporation | Principal Occupation During Past Five

Years | Director Since | Common

Shares Held

as of

February 15,

2005(1) |

Darold H. Parken(3)

President, Chief

Executive Officer

and Director

Calgary, AB, Canada | President and Chief Executive Officer of

the Corporation. Prior thereto, Barrister &

Solicitor, Parken & Corporation since

February 1989. Prior thereto, partner with

Burnet, Duckworth & Palmer, Barristers &

Solicitors | Oct. 26/94 | 868,100 |

Darcy E. Krogh(3)

Vice President,

Business

Development and

Director

Vancouver, B.C., Canada | Vice President, Business Development of the

Corporation. Prior thereto, registered

representative with various Canadian

investment dealers for 18 years. | June 7/99 | 60,500 |

Roderick A. Ferguson(2)(4)

Director

Calgary, AB, Canada | Partner, Fasken Martineau DuMoulin LLP,

Barristers and Solicitors since 2004. Prior

thereto, Partner, Heenan Blaikie LLP,

Barristers and Solicitors since 2001 and

prior thereto Partner, Burnet Duckworth &

Palmer, Barristers and Solicitors. | July 10/01 | 15,000 |

Peter H. Kinash(2)(4)

Director

Calgary, AB, Canada | CFO of Guest-Tek Interactive

Entertainment Inc. from July 12, 2004 to

August 31, 2004. From September, 2001

to present, consultant and advisor on

financial matters to emerging and

established technology companies,

including serving as part-time CFO of

Replicon Inc. from November, 2002 to

present. Prior th3ereto CFO to Wi-LAN Inc.

from January, 2000 to August, 2001 and

Partner with KPMG LLP from September,

1990 to January, 2000. | March 23/04 | Nil |

Terence Shaunessy

Calgary, AB, Canada | President, Shaunessy & Co. Ltd.,

Investment Counsel and Portfolio

Management since 2001, prior thereto,

Vice President, Institutions, HSBC Asset

Management since 1999, prior thereto,

President and Managing Director, Gordon

Capital Corp. | Nominee | 5,000 |

Notes:

| (1) | | Messrs. Parken, Krogh, Ferguson and Kinash hold options to purchase 550,000, 100,000, 35,000 and 50,000 Common Shares respectively. |

| (2) | | Member of the Audit Committee. |

| (3) | | Member of the Compensation Committee |

| (4) | | Member of the Governance and Compliance Committee |

9

The information as to Common Shares beneficially owned, directly or indirectly, is based upon information furnished to the Corporation by the respective directors and nominees.

| 3. | | Appointment of Auditors |

Management of the Corporation proposes to nominate KPMG LLP, Chartered Accountants, as auditors of the Corporation to hold office until the next annual general meeting at a remuneration to be fixed by the Board of Directors. KPMG LLP were first appointed auditors of the Corporation on April 27, 2000.

COMMITTEES OF THE BOARD OF DIRECTORS

The board of directors has three committees: the Audit Committee, the Compensation Committee and the Governance and Compliance Committee. The terms of reference and mandate of each committee is outlined in the Corporate Governance Plan approved by the Board and is summarized below.

Audit Committee

The functions of the Audit Committee include the review and recommendation to the Board of the annual and interim financial statements and related management’s discussion and analysis of results. The Audit Committee has direct communication channels with internal personnel responsible for financial statement preparation and with the Corporation’s auditors. The Committee also meets with external auditors independent of Management. Additional responsibilities include monitoring the audit function, recommending the appoint of auditors, reviewing and approving all non-audit services provided by the auditors to the Corporation, reviewing any auditors’ reports to Management, and reviewing internal controls and procedures relating to financial reporting and compliance with material policies and laws. The current members of the Audit Committee are Messrs. Rene G. Carrier (Chairman), Roderick A. Ferguson and Peter H. Kinash.

Compensation Committee

The Compensation Committee is responsible for reviewing, on an annual basis, the Corporation’s executive compensation policies, practices and overall compensation philosophy, including the granting of stock options to employees and the adequacy and form of Directors’ compensation. The Committee also discusses personnel and human resources matters including recruitment and development and reviews and approves all salary increases, with the exception of increases for certain members of senior management. The current members of the Compensation Committee are Messrs. Darold H. Parken and Darcy E. Krogh.

Governance and Compliance Committee

The Corporation has recently established a Governance andCompliance Committee. The mandate of the Committee is to review the Corporation’s corporate governance practices and provide reports and recommendations to the Board, taking into account, among other things the Toronto Stock Exchange Guidelines. The current members of the Governance andCompliance Committee are Messrs. Roderick A. Ferguson and Peter H. Kinash.

INTEREST OF CERTAIN PERSONS AND COMPANIES IN MATERIAL TRANSACTIONS

Management of the Corporation is not aware of any material interests of any director or senior officer of the Corporation, any shareholder who beneficially owns more than 10% of the common shares of the Corporation, or any known associate or affiliate of those persons, in any material transaction or proposed material transaction since the beginning of the financial year ended October 31, 2004.

10

SECURITIES AUTHORIZED FOR ISSUANCE UNDER STOCK OPTION PLAN

The following table sets forth the number of Common Shares to be issued upon exercise of outstanding options issued pursuant to equity compensation plans, the weighted average exercise price of such outstanding options and the number of Common Shares remaining available for future issuance under equity compensation plans of the Corporation as at February 15, 2005.

| | | |

|---|

| Plan Category | (a) Number of

securities to be issued

upon exercise of

outstanding options,

warrants and rights | (b) Weighted-average

exercise price of

outstanding options,

warrants and rights | (c) Number of

securities remaining

available for future

issuance under equity

compensation plans

(excluding securities

reflected in column

(a)) |

Equity compensation

plans approved by

shareholders | 2,164,101 | $1.52 | 455,900 |

Equity compensation

plans not approved by

shareholders | nil | n/a | nil |

| Total | 2,164,101 | $1.52 | 455,900 |

STATEMENT OF CORPORATE GOVERNANCE PRACTICES

The Toronto Stock Exchange has set out a series of fourteen guidelines (the “TSX Guidelines”) for effective corporate governance. The TSX requires each listed company to disclose its alignment with the TSX Guidelines on an annual basis. The TSX Guidelines address matters such as the constitution and independence of corporate boards, the functions to be performed by the boards and their committees.

The Board of Directors (the “Board”) and management of the Corporation believe that maintaining best practices in corporate governance is important for the effective management of the Corporation and value creation for its shareholders. The Corporation has adopted governance standards and is continuing to review and assess its governance framework to reflect current best practices and evolving regulatory and legislative requirements. The following is a report on the Corporation’s corporate governance policies, board and committee mandates and terms of reference.

11

| 1. | | The Board of Directors should explicitly assume responsibility for stewardship of the Corporation. |

| | The Board has the responsibility for stewardship of the Corporation. In carrying out this mandate the Board meets regularly and a broad range of matters are discussed and reviewed. These matters include overall corporate plans and strategies, annual budgets, and interim and annual financial and operating results. The Board also has responsibility for the approval of all major transactions, including equity issuance, acquisitions and dispositions. The Board delegates to management the authority and responsibility for managing the everyday affairs of the Corporation. |

| | As part of the overall stewardship responsibility the Board should assume responsibility for the followingmatters: |

| | a) | | adoption of a strategic planning process; |

| | Corporation’s Alignment: Yes. |

| | Meetings of the Board focus, from time to time, on strategic planning matters and provide guidance to management on the development of corporate strategy. In addition, the Board requires management to prepare annual financial, operating and capital budgets for the Corporation and the Board reviews and approves those plans. Management also prepares quarterly financial forecasts and comparisons to plan which the Board utilizes to assess operating results and to evaluate whether the business is being properly managed. |

| | b) | | identification of the principal risk of the Corporation’s business and ensuring the implementation for appropriate systems to manage theses risks; |

| | Corporation’s Alignment: Yes |

| | The Board addresses issues relating to risks and delegates the responsibility for implementing risk management and mitigation programs to the Corporation’s management. |

| | c) | | succession planning, including appointing, training and monitoring senior management; |

| | Corporation’s Alignment: Yes |

| | The Board monitors the performance of senior management and, as appropriate, provides guidance with respect to recruiting and hiring senior management. |

| | d) | | a communication policy for the Corporation; |

| | Corporation ’s Alignment: Yes |

| | The Board has approved a disclosure policy for the Corporation covering the timely dissemination of all material information. The policy established consistent guidelines for determining what information is material, how it is to be disclosed and, to avoid selective disclosure, making all material disclosures on a widely disseminated basis. The Corporation communicates with its shareholders and other stakeholders through a variety of channels, including its annual report, quarterly reports and news releases. The Audit Committee reviews press releases dealing with financial matters and the Board reviews all material press releases and reviews and approves the annual information circular. |

| | e) | | integrity of the Corporation’s internal control and management information systems. |

| | Corporation’s Alignment: Yes |

12

| | The Board monitors these matters primarily through the Audit Committee. The Audit Committee is mandated to oversee the Corporation’s system of internal controls to ensure that the appropriate financial information is being provided and that management is discharging its responsibilities. |

| 2. | | The Board of Directors should be constituted with a majority of individuals who qualify as “unrelated”directors. |

| | Corporation’s Alignment: No. |

| | In summary, the Corporation will have six directors, four of whom are independent of management and three of whom are unrelated within the meaning of the TSX Guidelines. The TSX Guidelines define an “unrelated” director as a director who is independent of management and free from any business or other relationship that could, or could be reasonably perceived to, materially interfere with the director’s ability to act with a view to the best interest of the Corporation other than interests and relationships arising from shareholdings. The TSX Guidelines also focus on the importance of having an appropriate portion of members of the board who are independent of management. The Corporation is nominating for re-election five directors, three of whom are outside directors and two of whom are “unrelated” directors within the meaning of the TSX Guidelines. The Corporation is also nominating for election a sixth director who qualifies as an independent and unrelated director within the meaning of the TSX Guidelines. |

| 3. | | The Board of Directors should be responsible for applying the definition of “unrelated director” to the circumstances of each individual director and for disclosing annually whether the board has a majority of unrelated directors and an analysis of the application of the principles supporting this conclusion. |

| | Corporation’s Alignment: Yes. |

| | Darold H. Parken is an employee and officer of the Corporation and is therefore related. Darcy E. Krogh has a consulting agreement with the Corporation and is therefore related as a result of that agreement. Roderick A. Ferguson provides legal services to the Corporation as a partner in the legal firm of Fasken Martineau DuMoulin LLP and is therefore related as result of those services. Rene G. Carrier and Peter H. Kinash are considered unrelated directors in that none of them nor their associates (I) have material contracts with the Corporation, (ii) work for the Corporation or (iii) receive remuneration form the Corporation other than directors’ fees. Mr. Terence Shaunessy does not have any material business or other relationship with the Corporation, or members of the Corporation’s management, and if appointed to the Board of Directors following the Meeting, will therefore be considered to be an unrelated director. |

| 4. | | The Board of Directors should appoint a committee composed exclusively of outside directors, i.e non-management directors, a majority of whom are unrelated directors, with the responsibility for proposing new nominees to the board and for assessing directors on an ongoing basis. |

| | Corporation’s Alignment: No. |

| | The Board does not have a Nominating Committee at this time. The Board as a whole has assumed responsibility for this function and thoroughly reviews all of the relevant information pertaining to each nominee. |

| 5. | | The Board of Directors should implement a process for assessing the effectiveness of the Board as a whole, its committees and the contribution of individual directors. |

| | Corporation’s Alignment: No. |

| | The Board has no specific process in place at this time but will consider implementing an appropriate process in the near future. |

13

| 6. | | The Board of Directors should provide an orientation and education program for new directors. |

| | Corporation’s Alignment: Yes |

| | New directors to the Corporation are generally executives with extensive experience and directorship responsibilities on the boards of other public and private institutions. Orientation for these individuals is provided through meetings with the CEO, CFO and other senior management as appropriate as well as a review of other public and private documentation concerning the Corporation. |

| 7. | | The Board of Directors should examine its size in relation to effective decision-making and adjust its size where appropriate. |

| | Corporation’s Alignment: Yes |

| | The Board believes that given the nature and complexity of the Corporation’s business, a Board consisting of six directors is an appropriate size for the Corporation at this time. |

| 8. | | The Board of Directors should review the adequacy and form of director compensation and ensure the compensation adequately reflects the responsibilities and risks of being an effective director. |

| | Corporation’s Alignment: No |

| | The Board does not have a formal review process at this time but is considering the formation of an Executive Compensation Committee that will have the responsibility for reviewing and recommending to the Board the annual compensation for senior executives, officers and directors. Currently, outside directors of the Corporation receive fees in their capacities as directors described under “Compensation of Directors” and, in addition, all directors are eligible to participate in the Corporation’s stock option plan. |

| 9. | | Committees of the Board of Directors should generally be composed of non-management directors, a majority of whom are unrelated. |

| | Corporation’s Alignment: Yes |

| | The Audit Committee is composed entirely of non-management directors, the majority of whom are unrelated directors. The Corporate Governance and Compliance Committee is composed of two non-management directors, one of whom is an unrelated director. The Compensation Committee is composed of two directors, one of whom is an officer and employee of the Corporation and the other of whom is an officer and a consultant of the Corporation. |

| 10. | | The Board of Directors, or one of its committees, should expressly assume responsibility for developing the Corporation’s approach to governance issues, including its response to the TSX Guidelines. |

| | Corporation’s Alignment: Yes |

| | The Board has recently established a Corporate Governance and Compliance Committee, all of the members of which are non-management directors, that has the responsibility for reviewing the Corporation’s corporate governance policies and practices and assessing compliance with, among other things, the TSX Guidelines. |

| 11. | | The Board of Directors, together with the CEO, should develop position descriptions for the Board and for the CEO involving the definition of the limits to management’s responsibilities. In addition the Board should approve or develop corporate objectives that the CEO is responsible for meeting. |

| | Corporation’s Alignment: Yes. |

14

| | The terms of reference for the Board of Directors, the Chairman of the Board and the CEO are outlined as part of the Corporation’s Corporate Governance principles. The CEO is responsible for, among other things, meeting the Corporation’s annual performance targets which are approved by the Board as part of the Corporation’s annual strategic planning process. |

| 12. | | The Board of Directors should have appropriate structures and procedures to ensure that it can function independently of management. |

| | Corporation’s Alignment: Yes. |

| | The Board believes that it functions independent of management as a majority of the Board will be composed of non-management directors, three of whom will be unrelated. Only two of the directors are considered management. Mr. Darold H. Parken is both the CEO, President and Chairman of the Board of Directors and Mr. Darcy E. Krogh is Vice President of Business Development |

| 13. | | The Audit Committee of the Board of Directors should be comprised only of outside directors, with a specifically defined mandate, and have direct communication channels with the external auditors to discuss and review specific issues as appropriate. |

| | Corporation’s Alignment: Yes. |

| | The Audit Committee will be made up of three independent directors. Audit Committee members have a direct channel of communication to the independent auditors as appropriate and meet with the auditors without management being present. |

| | The Audit Committee is mandated to oversee the retention, independence, performance and compensation of the Corporation’s independent auditors and the establishment and oversight of the Corporation’s systems of internal accounting and auditing control. |

| | The Board believes that the three nominated directors who will comprise the Audit Committee are all financially literate and that Mr. Peter H. Kinash has the recommended accounting and financial expertise. |

| 14. | | The Board of directors should implement a system which enables individual directors to engage outside advisors at the Corporations expense, in appropriate circumstances. |

| | Corporation’s Alignment: No. |

| | There is no formal system in place, but the Board would consider any such request on its merits. |

REPORT ON EXECUTIVE COMPENSATION

Composition of the Compensation Committee

During the fiscal year ended October 31, 2004, the Compensation Committee of the Board of Directors of the Corporation was comprised of Darold H. Parken, an officer and employee of the Corporation and Darcy E. Krogh, an officer and consultant to the Corporation. The stated mandate of the Compensation Committee is to set and review the compensation of all officers (excluding the Named Executive Officers whose compensation is approved by the entire Board), employees and consultants of the Corporation including the determination as to bonuses and stock options to be granted from time to time as components of compensation.

Compensation Policy

For the fiscal year ended October 31, 2004, the primary emphasis of the Corporation was on fixed cash compensation for the executive officers of the Corporation in the form of an annual base salary an annual discretionary bonus. The base salary and discretionary bonus paid to the

15

executive officers was unchanged from the prior year. The Compensation Committee did approve a one-time grant of stock options for an individual as additional incentive to join the Corporation in a senior capacity. The Compensation Committee is of the view that the primary objective of the compensation plan for executive officers and employees should be to attract and retain qualified executive officers and employees and to also align the interests of such officers and employees with the interests of the shareholders of the Corporation through incentives based on corporate performance and increases in shareholder value through a mix of competitive salaries and cash bonuses.

OTHER MATTERS

Management knows of no amendment, variation or other matter to come before the Meeting other than those set forth in the Notice of Annual General Meeting. If any other matter properly comes before the Meeting, however, the accompanying proxy will be voted on such matter in accordance with the best judgement of the person or persons voting the proxy.

APPROVAL AND CERTIFICATION

The contents and sending of this Information Circular — Proxy Statement have been approved by the directors of the Corporation.

The foregoing contains no untrue statement of a material fact and does not omit to state a material fact that is required to be stated or that is necessary to make a statement not misleading in the light of the circumstances in which it was made.

DATED at Calgary, Alberta, this 15th day of February, 2005.

| |

|---|

| (signed) “Darold H. Parken” | (signed) “Donald Gleason” |

| Darold H. Parken | Donald Gleason |

| President and Chief Executive Officer | Secretary and Chief Financial Officer |

EXHIBIT 4

Required Elements for Proxy (Slate)

Please submit the following information for your initial form or Proxy. Insert your text in the box provided for each corresponding point.

| 1. | | Type of the Meeting: Annual Meeting, Special Meeting or Annual and Special Meeting. Please place an X in the box of your choice. |

Annual Meeting /X/ Special Meeting /__/ Annual and Special Meeting /__/

| |

|---|

2. Date of the Meeting

Enter here

March 22, 2005

Venue of Meeting

Enter here

Metropolitan Centre, Royal Room

Address of Meeting

Enter here

333 - 4th Avenue S.W., Calgary, Alberta | Time of Meeting

Enter here

3:00 PM (MST) |

| |

|---|

3. Slate Version - Election of Directors - Names of Directors

Enter here

Rene G. Carrier

Darcy E. Krogh

Darold H. Parken

Roderick A. Ferguson

Peter H. Kinash

Terence Shaunessy | |

| |

|---|

4. Appointment of Auditors Information

Enter here

KPMG LLP, Chartered Accountants | |

| |

|---|

5. Proxy Cut-Off

48 Hours/X/

Other (state time) | |

| |

|---|

6. Management Proxy Appointee(s): (list names)

Enter here | |

| | Darold H. Parken, President and CEO of the Corporation, of Calgary, Alberta, or, failing him, Darcy Krogh, Vice President, Business Development of the Corporation, of Vancouver, British Columbia |

| |

|---|

| 7. List of Additional Resolutions | |

| |

|---|

Resolution No. 1

At the discretion of the said Proxy, to vote upon any amendment or variation of the above matters or any other matter properly brought before the Meeting or any adjournment thereof in such manner as such Proxy in his sole judgment may determine. | Resolution No. 4

|

Resolution No. 2

| Resolution No. 5

|

Resolution No. 3

| Resolution No. 6

|

If you have any questions please contact your client services representative.

EXHIBIT 5