SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For April 23, 2008

Commission File Number: 333-11014

i-CABLE Communications Limited

(Exact name of Registrant as specified in its charter)

Cable TV Tower

9 Hoi Shing Road

Tsuen Wan, N.T.

Hong Kong

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F X Form 40-F

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes No X

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| i-CABLE Communications Limited | ||

| By: | /s/ William Kwan | |

| Name: | William Kwan | |

| Title: | Chief Financial Officer | |

Dated: April 23, 2008

- 2 -

i-CABLE

Stock code: 1097

Beijing 2008

CABLE TV

2008

Official New Media Broadcaster of the Beijing 2008

Olympic Games

2007

ANNUAL REPORT

i-CABLE COMMUNICATIONS LIMITED ANNUAL REPORT 2007

i-CABLE communications Limited is Hong Kong´s leading integrated communications company.

It is one of the largest producers of video, film and multimedia content based in Hong Kong, for distribution around the world over conventional and new media, with particular focus on news, information, sports and entertainment.

It owns and operates one of two near universal broadband telecommunications networks in Hong Kong, over which it provides Pay TV, Broadband and Voice services to well over one million subscribing households and businesses.

Content

02 MILESTONES

06 RESULTS HIGHLIGHTS

07 CORPORATE INFORMATION

08 CHAIRMAN’S STATEMENT

12 BUSINESS REVIEW

- OPERATING ENVIRONMENT AND COMPETITION

- internet And multimedia

- Hong Kong CABLE enterprises

- content production, distribution And

Programming

I-CABLE entertainment

I-CABLE sports

I-CABLE news

Sundream music

Sundream motion pictures

I-CABLE distribution

22 corporate And community affairs

23 outlook

Cable Boy

i-CABLE Sports’ mascot

Speed

Timely and speedy response to fast-changing

market realities has been instrumental to maintaining

the Group’s profitability and growth.

3 4 5 6

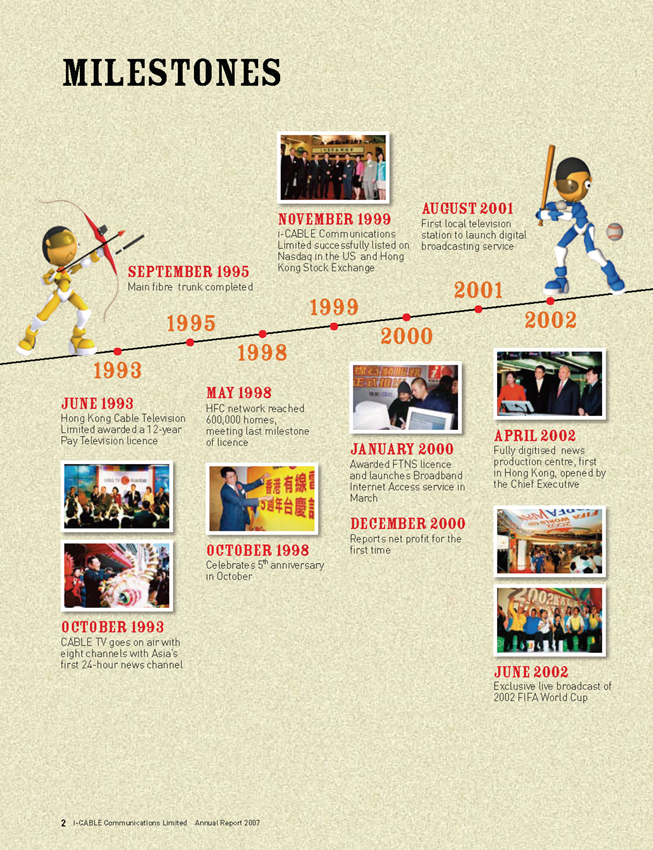

MILESTONES

SEPTEMBER 1995

Main fibre trunk completed

NOVEMBER 1999

i-CABLE Communications Limited successfully listed on Nasdaq in the US and Hong Kong Stock Exchange

AUGUST 2001

First local television station to launch digital broadcasting service

1995 1999 2001 1993 1998 2000 2002

JUNE 1993

Hong Kong Cable Television Limited awarded a 12-year Pay Television licence

MAY 1998

HFC network reached 600,000 homes, meeting last milestone of licence

JANUARY 2000

Awarded FTNS licence and launches Broadband Internet Access service in

March

APRIL 2002

Fully digitised news production centre, first in Hong Kong, opened by the Chief Executive

OCTOBER 1993

CABLE TV goes on air with eight channels with Asia’s first 24-hour news channel

OCTOBER 1998

Celebrates 5th anniversary in October

DECEMBER 2000

Reports net profit for the first time

JUNE 2002

Exclusive live broadcast of 2002 FIFA World Cup

2 i-CABLE Communications Limited Annual Report 2007

SEPTEMBER 2004

Completes universal coverage with launch of 20-channel satellite service

FEBRUARY 2006

Sundream’s first movie “49 Days” premiered

JUNE 2006

CABLE TV holds World Cup Carnival as official broadcaster for the second time

2003 2004 2005 2006 2007

APRIL 2003

TV service expanded beyond Hong Kong with launch of Horizon Channel

MARCH 2005

Kicks off film venture with launch of Sundream Motion Pictures Limited

JUNE 2007

Launch of Cable No 1 Channel, covering news, movies, sports, financial news updates,

documentaries and prime time dramas

AUGUST 2007

Announces clean sweep of major international sports events up to 2012, including the Olympics,

FIFA World Cup and UEFA Champions League

JULY 2003

Launch of world’s first round-the-clock Chinese entertainment news channel

APRIL 2005

Cable News celebrates 100,000 hours of non-stop broadcast

JUNE 2005

Television licence renewed for 12 years

AUGUST 2007

Integrated call centre in Guangzhou opened to further enhance customer services

OCTOBER 2007

i-CABLE opens prime retail stores

OCTOBER 2003

Celebrates 10th anniversary

JULY 2005

Hong Kong Cable News Express Limited and MTR (formerly KCRC) launch innovative news and advertising medium on trains

i-CABLE Communications Limited Annual Report 2007 3

Stamina

A sustainable and balanced development strategy steers us to enduring success in treacherous operating waters.

RESULTS

HIGHLIGHTS

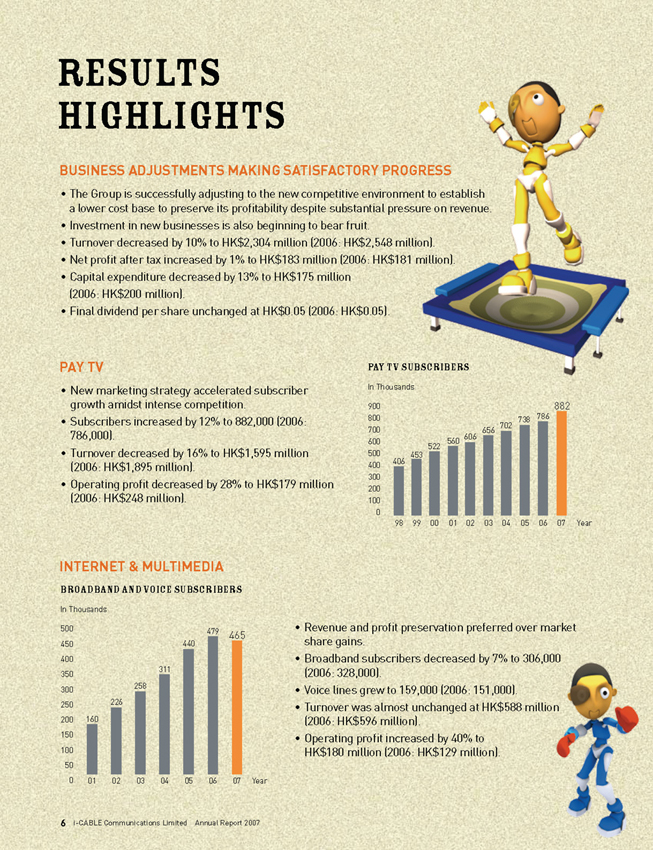

BUSINESS ADJUSTMENTS MAKING SATISFACTORY PROGRESS

• The Group is successfully adjusting to the new competitive environment to establish a lower cost base to preserve its profitability despite substantial pressure on revenue.

• Investment in new businesses is also beginning to bear fruit.

• Turnover decreased by 10% to HK$2,304 million (2006: HK$2,548 million).

Net profit after tax increased by 1% to HK$183 million (2006: HK$181 million). Capital expenditure decreased by 13% to HK$175 million (2006: HK$200 million).

Final dividend per share unchanged at HK$0.05 (2006: HK$0.05).

PAY TV

New marketing strategy accelerated subscriber growth amidst intense competition.

• Subscribers increased by 12% to 882,000 (2006: 786,000).

• Turnover decreased by 16% to HK$1,595 million (2006: HK$1,895 million).

• Operating profit decreased by 28% to HK$179 million (2006: HK$248 million).

PAY TV SUBSCRIBERS

98 99 00 01 02 03 04 05 06 07

900

800

700

600

500

400

300

200

100

0

In Thousands

Year

406 453 522 560 606 656 702 738 786 882

INTERNET & MULTIMEDIA

BROADBAND AND VOICE SUBSCRIBERS

In Thousands

500

450

400

350

300

250

200

150

100

50

0

In Thousands

01 02 03 04 05 06 07 Year

160 226 258 311 440 479 465

Revenue and profit preservation preferred over market share gains.

Broadband subscribers decreased by 7% to 306,000 (2006: 328,000).

• Voice lines grew to 159,000 (2006: 151,000).

Turnover was almost unchanged at HK$588 million 2006: HK$596 million).

• Operating profit increased by 40% to K$180 million (2006: HK$129 million).

6 CABLE Communications Limited Annual Report 2007

CORPORATE INFORMATION

BOARD OF DIRECTORS

Mr. Stephen t. H. Ng (Chairman & Chief Executive Oficer)

Mr. William j. H. Kwan (Chief Financial Officer)

Mr. Peter s. O. Mak

Dr. Dennis T. L. Sun, BBS, JP

Sir Gordon Y. S. Wu, GBS, KCMG, FICE

Mr. Patrick y. W. Wu

Mr. Anthony K. K. Yeung, JP

GROUP EXECUTIVES

Mr. Stephen t. H. Ng (Chairman & Chief Executive Officer)

Mr. William j. H. Kwan (Chief Financial Officer)

Mr. Ronald y. C. Chiu (Executive Director, i-CABLE

News Limited and i-CABLE

Sports Limited)

Mr. Vincent T. Y. Lam (Executive Director, i-CABLE

Network Limited)

Mr. Benjamin W. S. Tong (Executive Director,

Hong Kong Cable

Television Limited)

Mr. Siuming y. M. Tsui (Executive Director,

i-CABLE Entertainment

Limited; Chief Operating

Officer, i-CABLE Satellite

Television Limited;

President, Sundream

Motion Pictures Limited)

Mr. Samuel C. C. Tsang (General Manager,

Hong Kong Cable Enterprises

Limited)

Mr. Simon K. K. Yu (Vice President, i-CABLE

Network Operations Limited)

Mr. Garmen K. Y. Chan (Vice President, External

Affairs)

Mr. David C. T. Wong (Vice President, i-CABLE

Enterprises Limited)

Mr. Felix W. K. Yip (Vice President, Human

Resources & Administration)

COMPANY SECRETARY

Mr. Wilson W. S. Chan, FCIS

AUDITORS

KPMG

PRINCIPAL BANKERS

The Hongkong and Shanghai Banking Corporation

Limited

REGISTRARS

Tricor Tengis Ltd

26th Floor, Tesbury Centre, 28 Queen’s Road East,

Wanchai, Hong Kong

ADR DEPOSITARY

The Bank of New York Mellon

One Wall Street, New York, New York 10286, USA

REGISTERED OFFICE

16th Floor, Ocean Centre, Harbour City, Canton Road,

Kowloon, Hong Kong

Telephone: (852) 2118 8118 Fax: (852) 2118 8018

PRINCIPAL BUSINESS ADDRESS

CABLE TV Tower, 9 Hoi Shing Road, Tsuen Wan,

Hong Kong

LISTING

The Company’s shares are listed under the Code “1097” on

The Stock Exchange of Hong Kong Limited and its American

depositary shares, each representing 20 ordinary shares, traded in the over-the-counter markets in the United States under the symbol “ICABY”.

CORPORATE WEBSITE

www.i-cablecomm.com

INQUIRIES

info@i-cablecomm.com

i-CABLE Communications Limited Annual Report 2007 7

CHAIRMAN’S STATEMENT

Excellence

A commitment to the pursuit of excellence has empowered the Group to scale new heights year after year.

DEAR SHAREHOLDERS,

As Hong Kong Cable Television prepares to celebrate its 15th anniversary of service launch in October of this year, I am pleased to report that the Group is well placed for further development.

During 2007, the Group successfully adjusted to the new competitive environment to establish a lower cost base to preserve its profitability despite substantial pressure on revenue. Investment in new businesses also began to bear fruit.

Consolidated net profit after tax was steady at HK$183 million (2006: HK$181 million) in spite of a decline in turnover to HK$2,304 million (2006: HK$2,548 million). Prudent fiscal management contributed to the continuing healthy financial position of the Group, with net cash balance increasing to HK$642 million (2006: HK$586 million). The Board has recommended a final dividend of 5.0 cents per share to bring full year dividends per share to 8.5 cents (2006: 8.5 cents).

Anchoring on the Group’s content strength, as well as its adjusted marketing strategy, the Pay TV subscriber base grew by 12% to 882,000 (2006: 786,000). In Broadband, with preference given to revenue and profit preservation over market share gains, the subscriber base decreased by 7% to 306,000 (2006: 328,000) but a record operating profit was reported.

Over the past decade and a half, I am most grateful for the staunch support which shareholders, partners and customers have accorded to the Group. I am particularly thankful to our many colleagues for their dedication and commitment. They have been critical to the Group’s development and performance.

The continuous development and profitability of the Group proves the efficacy of its sustainable strategies, which are founded on balanced and unique local programming and production, optimisation of operating synergy, deliberate business diversification, as well as timely and strategic measures to try to stay ahead of shifting market realities.

I am confident that the dynamic and far-sighted approach in the running of our various businesses will continue to steer the Group through treacherous market waters to bring us growth and profitability amidst adversity.

Stephen T.H.Ng

Chairman and Chief Executive Officer

i-CABLE Communications Limited

Hong Kong, March 10, 2008

i-CABLE Communications Limited Annual Report 2007 9

Versatility

The versatility of the i-CABLE team is fully reflected in the success in all aspects of our diverse range of pursuits – Pay TV, Broadband, film, music and home line, as well as across all flagship content platforms – news, sports and entertainment.

i-CABLE Communications Limited Annual Report 2007 11

BUSINESS

REVIEW

OPERATING ENVIRONMENT AND COMPETITION

During the year, the Group successfully adjusted to the new competitive environment to establish a lower cost base to preserve its profitability despite substantial pressure on revenue. At the same time, it held steadfastly to its development strategy, emphasising sustainable long-term overall growth, as the main competitor continued with its attempts to shake the Pay TV market by aggressive marketing and content acquisition tactics.

Our comprehensive and balanced development approach to all major content platforms contrasted with that of our competitors.

During the year under review, we further strengthened the fundamentals of our popular news and entertainment platforms, and acquired a range of premier international sports events, which will maintain the strength and lead of our programming over the immediate and medium terms.

Complemented by an expanded range of subscription plans and marketing initiatives that are designed to tap all market strata in the shifting operating topography, growth in our subscriber base accelerated, against market speculation at the beginning of the year about massive customer drain.

The much-hyped Digital Terrestrial Television service of the two free-to-air broadcasters was officially launched at the end of 2007. The jury is however still out on whether the full potential of expanded channel capacity and improved picture quality of digital and High-Definition services would have much impact on the Pay TV market in the foreseeable future.

On the Broadband front, our subscriber base and turnover consolidated as we preferred revenue and profit preservation over market share gains. Profitability for this sector took a handsome leap, attributable to service and operational enhancements as well as cost management.

Hong Kong Cable TV Executive Director Benjamin Tong celebrates opening of first retail shop with i-CABLE Entertainment’s Zoie Tam (left) and Janis Chan (right).

12 i-CABLE Communications Limited Annual Report 2007

pay tV

The Group’s Pay TV business remained competitive in a challenging operating terrain. Pay TV subscribers grew 12% year-on-year to 882,000 with enhanced programming and more aggressive marketing strategies.

However, both subscription and advertising revenue weakened and combined to squeeze total turnover for this sector to HK$1,595 million (2006: HK$1,895 million). Operating profit was HK$179 million (2006: HK$248 million).

To expand our sales coverage, the Group is opening a number of retail stores in prime commercial districts. Five stores were opened in 2007 and five more will be opened in 2008. Response on new order acquisition and product sales from these shops has been encouraging.

Building for future growth, the Group continued to acquire new channels to meet the diverse viewing tastes of subscribers. Among the new channels introduced during the year included PGA Tour, NEO Sports, Nat Geo Wild and Aljazeera. The Group has also acquired exclusive broadcasting rights with a sweep of all of the world’s top international sporting events up to 2012.

On services to customers, the commissioning of the Group’s integrated customer service centre in Guangzhou in August has greatly enhanced our capability to handle customer enquiries and complaints.

These new initiatives are important bricks that the Group needs to lay to enable the Pay TV business to stay competitive in a competitive environment.

i-CABLE Chairman Stephen Ng unveils Cable No. 1 Channel with i-CABLE Entertainment Executive Director Siuming Tsui.

BUSINESS REVIEW

INTERNET AND MULTIMEDIA

Turnover in the Broadband sector slipped marginally to HK$588 million (2006: 596 million), as the subscriber base dipped to 306,000 (2006: 328,000). However, operating profit increased by 40% to set a record with HK$180 million (2006: HK$129 million).

Bundling subscription with Pay TV and residential voice services continued to be the main customer retention and acquisition tool.

At the same time, new content was introduced to the multimedia platform to enhance valueadded service of our product. A new online service “i-CABLE IPTV” with four free channels was launched to widen the video attraction of our portal. An education portal “eLeader” catering for children was introduced to enhance the appeal of our service.

The Group broke new ground when it was appointed official “New Media Broadcaster” of the 2008 Beijing Olympics for Hong Kong. It was the first time such rights have ever been granted for the world’s most prestigious sporting event. It would be an opportunity to showcase our production and online delivery capability in bringing to sports fans

Sundream Music’s Zoie Tam (left) and Ray Chung (right) set to create a new wave in the Hong Kong music scene.

unprecedented live coverage of Olympic events with interactive and archiving experience. Coupled with the mobile delivery rights which are also in the Group’s bag, the “anytime, anywhere” Olympic coverage will give a brand new experience to Hong Kong sports fans.

HONG KONG CABLE ENTERPRISES LIMITED (HKCE)

HKCE returned mixed results during the year. While the Pay TV commercial airtime sales business was lackluster in the absence of mega sports events, the Newsline Express service on MTR’s commuter trains reported outstanding growth.

HKCE’s joint venture in the Mainland, Ad On Media Limited (AOM), reported healthy growth in advertising revenue and profitability. On top of being the exclusive advertising agent for Sanlian Life Week magazine, AOM will be exploring other advertising sales opportunities in the Mainland.

CONTENT PRODUCTION, DISTRIBUTION AND PROGRAMMING

The Group continued to build on its concrete foundation as one of the biggest producers and distributors of quality content in Hong Kong.

Apart from forming the programming backbone for our Pay TV service, the full value of our content production strength is also exploited via our multi-platform distribution network, spanning television, online, satellite channels, cinemas, mobile media, as well as outdoors and audio-visual platforms on public transport locally and around the world.

While our productions continued to focus on entertainment, sports and news flagship programming, our relatively young movie-making arm, which has been in operation for just over two years, has already built a reputation as an award-winning producer that has injected much life into the sagging local movie industry.

During the year, the Group expanded the scope of its creative businesses by venturing into the music industry. Development of this sector will leverage on our production expertise, multiple media platforms and our ability to tap into the vast potential of the Greater China markets.

Investment, meanwhile, continued in premium content acquisition to maintain the attractiveness of Pay TV programming under a balanced and sustainable development strategy.

i-CABLE Communications Limited Annual Report 2007 15

BUSINESS REVIEW

I-CABLE ENTERTAINMENT

With expansion of our entertainment platform and the Entertainment News Channel, we have built up a strong bond with local and overseas artistes in the movie and music world. The channel has become an important launching pad for many top rate local, regional, and Hollywood movies and music projects.

CABLE No. 1 Channel was introduced to the market in 2007 as a channel of mass appeal. Showcasing premier CABLE TV programmes, it has proven to be successful and has built up impressive distribution and viewership within months of introduction.

Our self-produced programmes have reached new heights, both in viewership and sponsorship. Our cookery and astrology programmes constantly topped the most watched list. Efforts to enhance local production have served to widen the appeal of our entertainment platform, not only returning stable and rising viewership, but have also enhanced the popularity of our programme hosts, who have become household names. The DVD of our popular Fung Shui Lectures of Master So show became the best seller of its genre in the local market.

On the movie front, round-the-clock offering of Hollywood blockbusters was doubled in 2007 by the launch of a second HMC channel to create HMC 1 and HMC 2. That complemented the local blockbusters on Movie 1 and the international selections on Movie 2.

I-CABLE SPORTS

The year saw the sweep by i-CABLE Sports of the world’s biggest sports events up to 2012. Among these are the UEFA Champions League and UEFA Cup soccer tournaments from the 2009 soccer season onwards, 2010 FIFA World Cup in South Africa, the 2010 Winter Olympics in Vancouver and the 2012 Olympics in London.

In addition, the new exclusive Internet and mobile platform exhibition broadcast rights in Hong Kong for the Beijing 2008 Olympic Games awarded to the Group, meanwhile, will enable us to break terrestrial television’s hitherto dominance over Olympics broadcasting.

Our all-rounded sports platform excelled through the year. Highlights included the debut in January of PGA Tour to showcase the most competitive tour for professional golf in the world, the French Open in May wooed tennis enthusiasts, while soccer lovers were treated to top soccer actions from around the world.

16 i-CABLE Communications Limited Annual Report 2007

CABLE TV was also active in the local sports scene. As the official broadcaster of the Euro Asia Snooker Master Challenge 2007, a world-class event celebrating the 10th anniversary of the establishment of the HKSAR, we thrilled local fans of the sport with our live coverage from the venue at the Queen Elizabeth Stadium over four days.

Developments in 2007 have reaffirmed the leadership of our sports platform and its long-term commitment towards maintaining top-rated sports programme offerings to serve the wide spectrum of viewer interests.

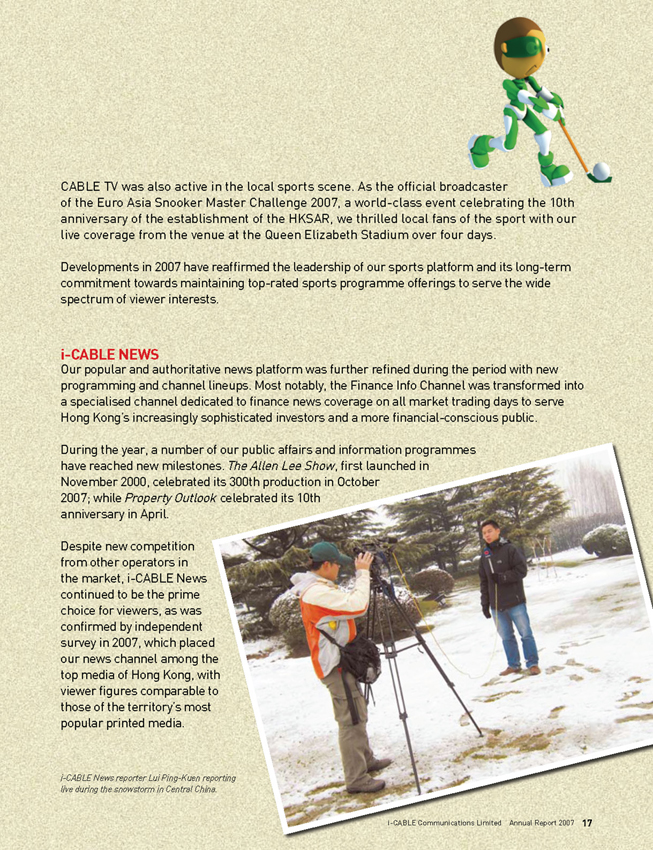

I-CABLE NEWS

Our popular and authoritative news platform was further refined during the period with new programming and channel lineups. Most notably, the Finance Info Channel was transformed into a specialised channel dedicated to finance news coverage on all market trading days to serve Hong Kong’s increasingly sophisticated investors and a more financial-conscious public.

During the year, a number of our public affairs and information programmes have reached new milestones. The Allen Lee Show, first launched in November 2000, celebrated its 300th production in October 2007; while Property Outlook celebrated its 10th anniversary in April.

Despite new competition from other operators in the market, i-CABLE News continued to be the prime choice for viewers, as was confirmed by independent survey in 2007, which placed our news channel among the top media of Hong Kong, with viewer figures comparable to those of the territory’s most popular printed media.

i-CABLE News reporter Lui Ping-Kuen reporting live during the snowstorm in Central China.

i-CABLE Communications Limited Annual Report 2007 17

BUSINESS REVIEW

The achievement of our news team was further affirmed by the prestigious awards they received from different organisations during the year, recognising the efforts of the team members, and the quality of their coverage and production in a wide range of subjects.

SUNDREAM MUSIC

Taking advantage of our production and artiste training expertise, multiple media platforms and the vast Greater China market potential, the Group added a music arm to its business during the year.

The new Sundream Music not only develops new talent for the music industry, it also supports the programming on CABLE TV and caters to the needs of the Group’s movie business as well.

To this end, a talent quest organised by Sundream Music drew over 1,000 high quality aspirants. The final was well attended by top-notched musicians as guest performers and judges. The success of this debut event helped to establish the Group’s presence in the local music scene.

The company also invests in and produces concerts, both in Hong Kong and in the Mainland, with at least two major concerts lined up in early 2008.

SUNDREAM MOTION PICTURES

Sundream’s production projects are well on track and have injected much-needed life to the local film industry.

Five of the movies released by Sundream to-date have, among them, won a total of 35 nominations to the 26th Hong Kong Film Awards, the 12th Golden Bauhinia

Sundream’s award-winning film “Eye in the Sky”

18 i-CABLE Communications Limited Annual Report 2007

Awards, the 16th Rooster Awards and the 44th Golden Horse Awards. They also won various awards, including the Most Recommended Film of the Year and Best Film, respectively for Eye in the Sky and A Battle of Wits.

Sundream has lined up 15 movies for release in 2008. Half of those are made for Sundream and include five projects which are already in post-production. Imported Hollywood and Korean movies round up the distribution list. A mega movie, Three Kingdoms: The Resurrection of the Dragon, will be released in Hong Kong in early April.

I-CABLE DISTRIBUTION

In the period, the Group continued to make aggressive expansion in its international distribution network, with new programme licensing arrangements and channel landings made in markets around the world, including the Mainland, New Zealand, Malaysia, Singapore, Vietnam, Thailand, Taiwan, Japan, the United States and Canada.

i-CABLE’s Chinese entertainment news made its entrance to the Mainland market in 2007, and is now available to audience through major broadcasters in Fujian, Guangzhou, Shanghai, Guizhou, Jiangsu and Beijing.

Our distribution is also being expanded to new media platforms such as mobile services and the Internet, with new distribution agreements with partners from Japan, Taiwan and the Mainland.

Channel distribution also did well. The i-CABLE News Channel and the i-CABLE Chinese Entertainment News Channel were launched in the United States in September through an IPTV platform. The Horizon Channel has further established its recognition and influence in both the Mainland and overseas markets in 2007.

Hong Kong evergreen singer Jacky Cheung (right) chats to i-CABLE Entertainment’s Luk Ho Ming in a Cable Entertainment News Channel programme.

Strength

The Group’s strength in production, programming, operation and marketing, firmly established over the past 15 years, has become the foundation of our leadership position.

CORPORATE AND COMMUNITY AFFAIRS

i-CABLE’s highly-motivated staff delivered another year of impressive performance in a challenging operating environment under our pay-for-performance culture in which we nurture a team of professionals and inspired talents to work together to drive business growth and development.

The Group had a total of 2,907 employees at the end of 2007 (2006: 3,016). Total gross amount of salaries and related costs incurred in the corresponding period amounted to HK$736 million (2006: HK$828 million) in a streamlined establishment for optimal efficiency.

The Group has always strived to contribute to the community. As one of Hong Kong’s 160 Caring Companies, we were awarded the “5 Consecutive Years Logo Award” by the Hong Kong Council of Social Service in 2007 in recognition of our continuous commitment in corporate social responsibility.

The Group’s volunteer team kept up their enthusiasm throughout the year, organising various outreaching activities to help the underprivileged. Meanwhile, the Group turned out in force to take part in territory-wide charitable events such as the Walk for Millions.

As one of the most influential media in the territory, the Group is committed to using this unique strength to bring about positive change to society. For example, we have leveraged on the popularity of our movie platform to mobilise movie lovers through 2007 to make charitable donations in a campaign entitled Vista of Joy.

We will continue to look for opportunities to discharge the responsibilities of a good corporate citizen and will continue to support as well as encourage employees to participate in social welfare activities, both in their individual capacity as well as a representative of the Group.

i-CABLE executives and artistes turn out in force to support Community Chest’s Walk for Millions.

OUTLOOK

The Group will celebrate the 15th anniversary of service commencement in October 2008.

Our production and programming prowess, as well as operational and marketing expertise, firmly established over the past decade and a half, are hard to emulate. Their roles as the cornerstone of our subscriber loyalty are more clearly demonstrated as competition further heats up in the market.

We are committed to building for the future. On top of scaling up our local television and movie production, we have bagged the most prized sports events in the world: the UEFA Champions League and UEFA Cup tournaments, the FIFA World Cup and the Vancouver Winter Olympic Games in 2010 and the London Olympic Games in 2012.

These investments demonstrate our confidence in the Group’s continued business development and our revitalised products and services will put us in good stead to reach more new milestones as we celebrate our 15th anniversary.

Financial Review

25

FINANCIAL REVIEW

- REVIEW OF 2007 RESULTS

- SEGMENTAL INFORMATION

- LIQUIDITY AND FINANCIAL RESOURCES

- CONTINGENT LIABILITIES

- HUMAN RESOURCES

27 CORPORATE GOVERNANCE REPORT

32 REPORT OF THE DIRECTORS

44 INDEPENDENT AUDITOR’S REPORT

45 CONSOLIDATED PROFIT AND LOSS ACCOUNT

46 CONSOLIDATED BALANCE SHEET

47 COMPANY BALANCE SHEET

48 CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

50 STATEMENT OF CHANGES IN EQUITY

51 CONSOLIDATED CASH FLOW STATEMENT

52 NOTES TO THE FINANCIAL STATEMENTS

93 FIVE-YEAR FINANCIAL SUMMARY

Financial Review

| (A) | Review of 2007 Results |

The Group accelerated the growth of its Pay TV subscriber base with enhanced programming and marketing strategies but preferred revenue and profitability preservation over market share for its Internet & Multimedia business.

Consolidated turnover decreased by HK$244 million or 10% to HK$2,304 million.

Successfully establishing a lower cost base to adjust to the new competitive environment, operating costs before depreciation decreased by 8% to HK$1,759 million. Programming costs decreased by 5% to HK$950 million, network and other operating costs decreased by 7% to HK$419 million, while selling, general and administrative expenses decreased by 16% to HK$390 million.

Earnings before interest, tax, depreciation and amortisation or EBITDA decreased by 13% to HK$545 million.

Depreciation decreased by 14% to HK$367 million due to lower depreciation charges on network assets and customer premises equipment following the expiry of their depreciation cycle.

Profit from operations decreased by HK$20 million or 10% to HK$178 million.

Net profit after HK$17 million of income tax expenses for the year increased by 1% to HK$183 million.

Basic and diluted earnings per share were 9.0 cents as compared to 9.0 cents in 2006.

| (B) | Segmental Information |

Pay Television

Subscribers increased by 96,000 or 12% year-on-year to 882,000. Turnover decreased by HK$300 million to HK$1,595 million. Operating costs after depreciation decreased by 14% to HK$1,417 million primarily due to the aforementioned decrease in programming, network operating and selling costs. Operating profit decreased by 28% to HK$179 million.

Internet & Multimedia

Broadband subscribers decreased by 22,000 or 7% year-on-year to 306,000. Turnover was little changed at HK$588 million. Operating costs after depreciation decreased by 13% to HK$407 million. Operating profit reported a record high HK$180 million as compared to HK$129 million a year ago.

| (C) | Liquidity and Financial Resources |

Net cash inflow reached HK$56 million after financial investments. After dividend payment of HK$172 million, net cash balance increased to HK$642 million at December 31, 2007, as compared to HK$586 million a year ago.

The consolidated net assets value of the Group as at December 31, 2007 was HK$2,271 million or HK$1.1 per share. At December 31, 2007, the Group had property, plant and equipment of net book value of approximately HK$594,000 (December 31, 2006: HK$848,000) held under finance lease contract.

The Group’s assets, liabilities, revenues and expenses were mainly denominated in Hong Kong dollars or U.S. dollars and the exchange rate between these two currencies has remained pegged.

Capital expenditure during the period amounted to HK$175 million as compared to HK$200 million last year. Major items included further network upgrade and expansion, investment in information systems, television production facilities and leasehold buildings.

The Group is comfortable with its present financial and liquidity position. Further capital expenditure and new business development will be funded by cash to be generated from operations and, if needed, bank borrowings or other external sources of funds. The Group also had total short-term bank credit facilities of approximately HK$32 million which remained unutilised as of December 31, 2007.

| i-CABLE Communications Limited Annual Report 2007 25 |

Financial Review(continued)

| (D) | Contingent Liabilities |

At December 31, 2007, there were contingent liabilities in respect of guarantees, indemnities and letters of awareness given by the Company on behalf of subsidiaries relating to overdraft and guarantee facilities provided by banks up to HK$199 million, of which HK$167 million had been utilised by the subsidiaries.

| (E) | Human Resources |

The Group had a total of 2,907 employees at the end of 2007 (2006: 3,016). Total gross amount of salaries and related costs incurred in the corresponding period amounted to HK$736 million (2006: HK$828 million).

With pay for performance culture linking remuneration and reward to Group performance, we nurture a team of professionals and inspired talents to work together and support our growth and development.

The Group has always strived to contribute to the local communities. Being one of the Caring Companies, we were awarded the

“5 Consecutive Years Logo Award” by the Hong Kong Council of Social Service in recognition of our continuous commitment in corporate social responsibility. The Group will continue to support and encourage employees to participate in social welfare activities.

| 26 | i-CABLE Communications Limited Annual Report 2007 |

Corporate Governance Report

| (A) | CORPORATE GOVERNANCE PRACTICES |

During the financial year ended December 31, 2007, all the code provisions set out in the Code on Corporate Governance Practices in Appendix 14 (the “Code”) of the Rules Governing the Listing of Securities (the “Listing Rules”) on The Stock Exchange of Hong Kong Limited were met by the Company, with the exception of one deviation as set out under section (D) below. The application of the relevant principles, and the reasons for the abovementioned deviation from a Code provision, are stated in the following sections.

| (B) | DIRECTORS’ SECURITIES TRANSACTIONS |

The Company has adopted the Model Code set out in Appendix 10 of the Listing Rules. Having made specific enquiry of all Directors of the Company who were in office during the financial year ended December 31, 2007, they have confirmed that they have complied with the Model Code during the financial year.

| (C) | BOARD OF DIRECTORS |

| (i) | Composition of the Board, number of Board meetings and Directors’ attendance |

The Company’s Board has a balance of skills and experience and a balanced composition of experience and executive and non-executive directors. Five Board meetings were held during the financial year ended December 31, 2007. The composition of the Board and attendance of the Directors are set out below:

Directors | Attendance at Meetings | |

| Chairman and Chief Executive Officer | ||

Mr. Stephen T. H. Ng | 5 | |

| Chief Financial Officer | ||

Mr. William J. H. Kwan(appointed on February 1, 2007) | 4 | |

| Non-executive Director | ||

Mr. Peter S. O. Mak | 5 | |

Independent Non-executive Directors | ||

Mr. Fa Kuang Hu, GBS, CBE, JP(retired on May 17, 2007) | 2 | |

Dr. Dennis T. L. Sun, BBS, JP | 5 | |

Sir Gordon Y. S. Wu, GBS, KCMG, FICE | 1 | |

Mr. Patrick Y. W. Wu(appointed on May 17, 2007) | 2 | |

Mr. Anthony K. K. Yeung, JP | 3 | |

Each Director of the Company has been appointed on the strength of his calibre, experience and stature, and his potential to contribute to the proper guidance of the Group and its businesses. Apart from formal meetings, matters requiring board approval were arranged by means of circulation of written resolutions.

| (ii) | Operation of the Board |

The Company is headed by an effective Board which takes decisions objectively in the interests of the Company. The Company’s management has closely monitored changes to regulations that affect its corporate affairs and businesses, and changes to accounting standards, and adopted appropriate reporting format in its interim report, annual report and other related documents to present a balanced, clear and comprehensible assessment of the Group’s performance, position and prospects. Where these changes are pertinent to the Company or Directors’ disclosure obligations, the Directors are either briefed during Board meetings or issued with regular updates and materials to keep them abreast of their responsibilities and of the conduct, business activities and development of the Group. Newly appointed Directors receive briefings and orientation on their legal and other responsibilities as a Director and the role of the Board. The Company has also provided appropriate information in a timely manner to the Directors to enable them to make an informed decision and to discharge their duties and responsibilities as Directors of the Company.

There is a clear division of responsibilities between the Board and the management. Decisions on important matters are specifically reserved to the Board while decisions on the Group’s general operations are delegated to the management. Important matters include those affecting the Group’s strategic policies, major investment and funding decisions and major commitments relating to the Group’s operations.

| i-CABLE Communications Limited Annual Report 2007 27 |

Corporate Governance Report(continued)

| (D) | CHAIRMAN AND CHIEF EXECUTIVE OFFICER |

Mr. Stephen T. H. Ng serves as the Chairman and Chief Executive Officer of the Company. This is a deviation from the Code provision with respect to the roles of Chairman and Chief Executive Officer to be performed by different individuals. The deviation is deemed necessary as, given the nature and size of the Company’s business, it is at this stage considered to be more efficient to have one single person to hold both positions. The Board of Directors believes that the balance of power and authority is adequately ensured by the operations of the Board which comprises experienced and high calibre individuals with a substantial number thereof being independent Non-executive Directors.

| (E) | NON-EXECUTIVE DIRECTORS |

All those existing Directors of the Company who do not hold any executive office of the Company have their respective terms of appointment coming to an end normally three years after their appointment to the Board or (in the case of Directors who were reelected to the Board at previous Annual General Meetings) their last re-election as Directors.

| (F) | REMUNERATION OF DIRECTORS |

The Company has set up a Compensation Committee consisting of two independent Non-executive Directors.

One Compensation Committee meeting was held during the financial year ended December 31, 2007. Attendance of the Members is set out below:

Members | Attendance at Meeting | |

Mr. Anthony K. K. Yeung, JP,Chairman (elected Chairman on May 17, 2007) | 1 | |

Mr. Fa Kuang Hu, GBS, CBE, JP(retired on May 17, 2007) | 0 | |

Dr. Dennis T. L. Sun, BBS, JP | 1 |

The terms of reference of the Compensation Committee are aligned with the provisions set out in the Code. Given below are the main duties of the Compensation Committee:

| (a) | to consider the Company’s policy and structure for all remuneration of Directors and senior management; |

| (b) | to determine the specific remuneration packages of all executive Directors and senior management; |

| (c) | to review performance-based remuneration by reference to corporate goals and objectives resolved by the Board from time to time; |

| (d) | to review the compensation payable to executive Directors and senior management in connection with any loss or termination of their office or appointment; and |

| (e) | to review compensation arrangements relating to dismissal or removal of Directors for misconduct. |

The work performed by the Compensation Committee for the financial year ended December 31, 2007 is summarised below:

| (a) | review of the Company’s policy and structure for all remuneration of Directors and senior management; |

| (b) | consideration of the emoluments for all Directors and senior management; and |

| (c) | review of the level of fees for Directors and Audit Committee Members. |

The basis of determining the emoluments payable to its Directors and senior management by the Company is by reference to the level of emoluments normally paid by a listed company in Hong Kong to directors and senior executives of comparable calibre and job responsibilities so as to ensure a fair and competitive remuneration package as is fit and appropriate. The basis of determining the Directors’ fees and the Audit Committee Members’ fees, currently at the rate of HK$60,000 per annum per Director, payable to Directors of the Company, and the Audit Committee Members’ fees, currently at the rate of HK$20,000 per annum per Member, payable to those Directors of the Company who are also Members of the Audit Committee of the Company is by reference to the level of fees of similar nature normally paid by a listed company in Hong Kong to its directors.

| 28 | i-CABLE Communications Limited Annual Report 2007 |

| (G) | NOMINATION OF DIRECTORS |

The Company does not have a nomination committee as the role and function of such committee are performed by the Board.

The Board is responsible for the formulation of nomination policies, making recommendations to Shareholders on Directors standing for re-election, providing sufficient biographical details of Directors to enable Shareholders to make an informed decision on the re-election, and where necessary, nominating Directors to fill casual vacancies. The Chairman from time to time reviews the composition of the Board with particular regard to ensuring that there is an appropriate number of Directors on the Board independent of management. He also identifies and nominates qualified individuals for appointment as new Directors of the Company. New Directors of the Company will be appointed by the Board. Any and all new Directors are subject to retirement from the Board at the Annual General Meeting of the Company immediately following his or her appointment and may stand for re-election at the Annual General Meeting.

| (H) | AUDITORS’ REMUNERATION |

The fees in relation to the audit and other services for the year 2007 provided by KPMG, the external auditors of the Company, amounted to HK$5,054,000 and HK$350,000 respectively.

| (I) | AUDIT COMMITTEE |

All the Members of the Audit Committee of the Company are appointed from the independent Non-executive Directors.

All Members have sufficient experience in reviewing audited financial statements as aided by the auditors of the Group whenever required.

Two Audit Committee meetings were held during the financial year ended December 31, 2007. Attendance of the Members is set out below:

Members | Attendance at Meetings | |

Mr. Anthony K. K. Yeung, JP,Chairman (elected Chairman on May 17, 2007) | 2 | |

Mr. Fa Kuang Hu, GBS, CBE, JP(retired on May 17, 2007) | 1 | |

Dr. Dennis T. L. Sun, BBS, JP | 1 | |

Mr. Patrick Y. W. Wu(appointed on May 17, 2007) | 1 |

| (i) | The terms of reference of the Audit Committee are aligned with the recommendations set out in “A Guide for Effective Audit Committees” issued by the Hong Kong Institute of Certified Public Accountants. Given below are the main duties of the Audit Committee: |

| (a) | to consider the appointment of the external auditors and any questions of resignation or dismissal; |

| (b) | to discuss with the external auditors before the audit commences, the nature and scope of the audit; |

| (c) | to review the half-year and annual financial statements before submission to the Board, focusing particularly on: |

| (1) | any changes in accounting policies and practices; |

| (2) | major judgmental areas; |

| (3) | significant adjustments resulting from the audit; |

| (4) | the going concern assumption; |

| (5) | compliance with accounting standards; and |

| (6) | compliance with stock exchange listing rules and legal requirements in relation to financial reporting; |

| i-CABLE Communications Limited Annual Report 2007 29 |

Corporate Governance Report(continued)

| (I) | AUDIT COMMITTEE(continued) |

| (d) | to discuss findings and reservations (if any) arising from the audits, and any matters the external auditors may wish to discuss (in the absence of management where necessary); and |

| (e) | to review the audit programme of the internal audit function. |

| (ii) | The work performed by the Audit Committee for the financial year ended December 31, 2007 is summarised below: |

| (a) | approval of the remuneration and terms of engagement of the external auditors; |

| (b) | review of the external auditors’ independence and objectivity and the effectiveness of audit process in accordance with applicable standards; |

| (c) | review of the half-year and annual financial statements before submission to the Board, with particular consideration of the points mentioned in paragraph (i)(c) above regarding the duties of the Audit Committee; |

| (d) | discussion with the external auditors before the audit commences, the nature and scope of the audit; |

| (e) | review of the audit programme of the internal audit function; |

| (f) | review of the Group’s financial controls, internal control and risk management systems; and |

| (g) | meeting with the external auditors without executive Board members present. |

| (J) | INTERNAL CONTROL |

The Directors are ultimately responsible for the internal control system of the Group and, through the Audit Committee, have reviewed the effectiveness of the system. The internal control system comprises a well-defined organisational structure with specified limits of authority in place. Areas of responsibility of each business and operational units are also clearly defined to ensure effective checks and balances.

Procedures have been designed for safeguarding assets against unauthorised use or disposition, maintenance of proper accounting records, assurance of the reliability of financial information for internal use or publication and compliance with relevant legislation and regulations. Such procedures are designed to manage risks of failure in operational systems and can provide reasonable assurance against material errors, losses or fraud.

The internal audit function monitors compliance with policies and standards and the effectiveness of internal control structures across the whole Group. The head of Internal Audit Department reports to the Audit Committee. A full set of internal audit reports will also be provided to the external auditors.

A review of the effectiveness of the Group’s internal control system and procedures covering all controls, including financial, operational and compliance and risk management, was conducted by the Audit Committee and subsequently reported to the Board during the financial year ended December 31, 2007. Based on the result of the review, in respect of the financial year ended December 31, 2007, the Directors considered that the internal control system and procedures of the Group were effective and adequate.

| 30 | i-CABLE Communications Limited Annual Report 2007 |

| (K) | DIRECTORS’ RESPONSIBILITIES FOR THE FINANCIAL STATEMENTS |

The Directors are responsible for overseeing the preparation of financial statements for the financial year ended December 31, 2007, which give a true and fair view of the affairs of the Company and of the Group and of the Group’s results and cash flow for the year then ended and in compliance with the requirements of the Hong Kong Companies Ordinance and the applicable disclosure provisions of the Listing Rules.

In preparing the financial statements for the financial year ended December 31, 2007:

| (i) | appropriate accounting policies are selected, applied consistently and in accordance with the Hong Kong Financial Reporting Standards; |

| (ii) | prudent and reasonable judgements and estimates are made; and |

| (iii) | the reasons for any significant departure from applicable accounting standards are stated, if applicable. |

| (L) | COMMUNICATION WITH SHAREHOLDERS |

The Group uses several formal channels to ensure fair disclosure and comprehensive and transparent reporting of its performances and activities. Annual and interim reports are printed and sent to all Shareholders. Press releases are posted on the Company’s corporate website www.i-cablecomm.com. The Company’s website provides email address, postal address, fax number and telephone number by which enquiries may be put to the Company’s Board. Constantly being updated in a timely manner, the website also contains a wide range of additional information on the Group’s business activities. As a standard part of the investor relations programme to maintain a constant dialogue on the Group’s performance and objectives, senior executives hold regular briefings and attend conferences with institutional investors and financial analysts.

The Company encourages its shareholders to attend Annual General Meetings to ensure a high level of accountability and to stay informed of the Group’s strategy and goals.

The Company keeps Shareholders informed of the procedure for voting by poll in all circulars to Shareholders which are from time to time despatched to Shareholders together with notices of general meetings of the Company.

| (M) | SHAREHOLDERS’ RIGHTS TO CONVENE AN EXTRAORDINARY GENERAL MEETING |

Pursuant to the Hong Kong Companies Ordinance, on requisition by one or more Shareholders in aggregate holding not less than 5% of the paid-up capital of the Company carrying the right to vote at general meetings, the Directors of the Company must convene an extraordinary general meeting.

| i-CABLE Communications Limited Annual Report 2007 31 |

Report of the Directors

The Directors have pleasure in submitting their Report and the Audited Financial Statements for the financial year ended December 31, 2007.

PRINCIPAL ACTIVITIES AND TRADING OPERATIONS

The principal activity of the Company is investment holding and those of its subsidiaries which principally affected the results, assets or liabilities of the Group are set out in Note 18 to the Financial Statements on pages 75 and 76.

During the financial year, more than 90% of the trading operations of the Company and its subsidiaries in terms of both turnover and operating profit (before borrowing costs) were carried on in Hong Kong. An analysis of the principal activities of the trading operations of the Company and its subsidiaries during the financial year is set out in Note 4 to the Financial Statements on pages 65 and 66.

RESULTS, APPROPRIATIONS AND RESERVES

The results of the Group for the financial year ended December 31, 2007 are set out in the Consolidated Profit and Loss Account on page 45.

Appropriations of profits and movements in reserves during the financial year are set out in the Consolidated Statements of Changes in Equity on pages 48 and 49.

DIVIDENDS

An interim dividend of 3.5 cents per share was paid on October 9, 2007. The Directors now recommend the payment on May 30, 2008 of a final dividend of 5.0 cents per share in respect of the financial year ended December 31, 2007, payable to Shareholders on record as at May 23, 2008. This recommendation has been disclosed in the Financial Statements.

PROPERTY, PLANT AND EQUIPMENT

Movements in property, plant and equipment during the financial year are set out in Note 13 to the Financial Statements on pages 72 and 73.

DONATIONS

The Group made donations during the financial year totalling HK$32,000.

DIRECTORS

The Directors of the Company during the financial year were Mr. Stephen T. H. Ng, Mr. William J. H. Kwan (appointed on February 1, 2007), Mr. Peter S. O. Mak, Mr. F. K. Hu (retired on May 17, 2007), Dr. Dennis T. L. Sun, Sir Gordon Y. S. Wu, Mr. Patrick Y. W. Wu (appointed on May 17, 2007) and Mr. Anthony K. K. Yeung.

Mr. Patrick Y. W. Wu, being appointed as Director of the Company after the last Annual General Meeting, is due to retire from the Board in accordance with Article 78 of the Company’s Article of Association, and Sir Gordon Y. S. Wu and Mr. Anthony K. K. Yeung will also retire from the Board, at the forthcoming Annual General Meeting. Sir Gordon Y. S. Wu has decided not to stand for re-election. The other Directors, being eligible, offer themselves for re-election. None of the retiring Directors proposed for re-election at the forthcoming Annual General Meeting has a service contract with the Company which is not determinable by the employer within one year without payment of compensation (other than statutory compensation).

INTERESTS IN CONTRACTS

No contract of significance in relation to the Company’s business to which the Company, its subsidiaries or its ultimate holding company or any subsidiary of that ultimate holding company was a party and in which a Director of the Company had a material interest, whether directly or indirectly, subsisted at the end of the financial year or at any time during the financial year.

| 32 | i-CABLE Communications Limited Annual Report 2007 |

MANAGEMENT CONTRACTS

There was in existence during the year ended December 31, 2007 a management services agreement dated November 1, 1999 with Wharf Limited (a wholly-owned subsidiary of The Wharf (Holdings) Limited (“Wharf”)), as revised by two supplemental agreements, whereby Wharf Limited agreed to continue to provide or procure the provision of services including corporate secretarial services, treasury services, provision of management personnel and other general corporate services to the Group for a term expiring on December 31, 2009. Mr. Stephen T. H. Ng and Mr. Peter S. O. Mak were directors of Wharf and/or its wholly-owned subsidiaries and are accordingly regarded as interested in the said agreement.

ARRANGEMENTS TO PURCHASE SHARES OR DEBENTURES

At no time during the financial year was the Company, its subsidiaries or its ultimate holding company or any subsidiary of that ultimate holding company a party to any arrangement to enable the Directors of the Company to acquire benefits by means of acquisition of shares in or debentures of the Company or any other body corporate, with the exception that there existed certain outstanding options to subscribe for ordinary shares of the Company granted under the Company’s Share Option Scheme (the “Share Scheme”) to certain executives/employees of companies respectively in the Group, one or more of whom was/were Director(s) of the Company during the financial year.

Under the rules of the Share Scheme (subject to any such restrictions or alterations as may be prescribed or provided under the Listing Rules from time to time in force), shares of the Company would be issued at such prices, not being less than 80% of the Company’s average closing price on the Hong Kong Stock Exchange for the five trading days immediately preceding the date of offer of the options, and the relevant options would be exercisable during such periods, not being beyond the expiration of 10 years from the date of grant, as determined by the board of directors of the Company. During the financial year, no share of the Company was issued to any Director of the Company under the Share Scheme.

PURCHASE, SALE OR REDEMPTION OF SHARES

Set out below are particulars of repurchases by the Company of its own ordinary shares made on The Stock Exchange of Hong Kong Limited (the “Stock Exchange”) during the financial year:

Month of repurchase | Total number of shares repurchased | Highest price paid per share (HK$) | Lowest price paid per share (HK$) | Total price paid (HK$) | ||||

November 2007 | 1,249,000 | 1.64 | 1.57 | 1,996,670 | ||||

December 2007 | 2,859,000 | 1.61 | 1.52 | 4,477,130 | ||||

| 4,108,000 | 6,473,800 | |||||||

The above repurchases were made for the purpose of achieving an increase in the consolidated net asset value and/or earnings per share of the Company.

Save as disclosed above, neither the Company nor any of its subsidiaries has purchased, sold or redeemed any listed securities of the Company during the financial year.

AUDITORS

The Financial Statements now presented have been audited by KPMG, Certified Public Accountants, who retire and being eligible, offer themselves for re-appointment.

By Order of the Board

Wilson W. S. Chan

Company Secretary

Hong Kong, March 10, 2008

| i-CABLE Communications Limited Annual Report 2007 33 |

Report of the Directors(continued)

SUPPLEMENTARY CORPORATE INFORMATION

| (A) | BIOGRAPHICAL DETAILS OF DIRECTORS AND SENIOR MANAGERS ETC. |

| (I) | Directors |

Stephen T. H. Ng, Chairman and Chief Executive Officer (Age: 55)

Mr. Ng became Chairman of the Company in August 2001. He has been Director and Chief Executive Officer since 1999 and formerly was the Deputy Chairman of the Company. He is also the deputy chairman and managing director of the Company’s holding company, namely, The Wharf (Holdings) Limited (“Wharf”), the deputy chairman of Wheelock and Company Limited (“Wheelock”), a director of Joyce Boutique Holdings Limited and became its chairman since 2007, the chairman of Modern Terminals Limited, and the chairman and chief executive officer of Wharf T&T Limited (“WTT”). He serves as a member of the General Committee of the Hong Kong General Chamber of Commerce.

William J. H. Kwan, Director and Chief Financial Officer (Age: 44)

Mr. Kwan was appointed a Director of the Company in February 2007. He joined Hong Kong Cable Television Limited (“HKC”) in January 1994 and had been Director – Corporate Development of HKC since 2002. He was appointed Chief Financial Officer of the Company effective from January 1, 2006.

Peter S. O. Mak, Director (Age: 59)

Mr. Mak has been a Director of the Company since August 2006. He is an executive director of Wharf Limited, responsible for overseeing the corporate management functions including corporate planning, investor relations, legal, group accounts, audit and insurance of Wharf. He is also a director of Modern Terminals Limited, which is a major subsidiary of Wharf, a director of WTT, and certain other subsidiaries of Wharf. Prior to joining Wharf, Mr. Mak held directorship in CITIC Pacific Limited, a Hang Seng Index constituent company. His experience includes managing large-scale capital and infrastructure portfolios, real estate investments, shipping and leasing. Mr. Mak holds a Bachelor of Arts degree from The University of Hong Kong.

Dennis T. L. Sun, BBS, JP, Director (Age: 57)

Dr. Sun has been an independent Non-executive Director of the Company since 2001. He also serves as a member and the chairman of the Company’s Related Party Transactions Committee and a member of each of the Audit Committee and Compensation Committee. He is the chairman and managing director of publicly-listed China Hong Kong Photo Products Holdings Limited. Furthermore, he is the deputy chairman of the Hong Kong Management Association and a council member of The City University of Hong Kong. He was also the vice patron of the Community Chest of Hong Kong from 1999 to 2007. He is the honorary chairman of the Hong Kong Photo Marketing Association, the life honorary advisor of the Photographic Society of Hong Kong and the foundation member of the China Charity Foundation. He was awarded the Bronze Bauhinia Star in 1999 and appointed as a Justice of the Peace in 2002.

Dr. Sun holds a Bachelor’s degree in Pharmacy from University of Oklahoma, USA and a Degree of Doctor of Philosophy in Business Administration from Southern California University for Professional Studies.

Patrick Y. W. Wu, Director (Age: 55)

Mr. Wu was appointed as an independent Non-executive Director of the Company in May 2007. He also serves as a member of each of the Company’s Audit Committee and Related Party Transactions Committee. Mr. Wu is a vice president of American Appraisal Associates, Inc. (“AAA”) and the president & managing director of American Appraisal China Limited, AAA’s key operation in Asia. Mr. Wu has worked both in industry as a senior executive with extensive management experience and in private practice as a lawyer. Prior to joining AAA, he was a partner of an international law firm with particular responsibility for China trade advice. Mr. Wu was educated in Hong Kong and the United Kingdom. He graduated from the University of London in 1974 with a Bachelor’s Degree in Science, and obtained his Master of Business Administration Degree from the Cass Business School, City University in London in 1976. Mr. Wu is also an active member of various professional organisations, chambers of commerce and the business community in Hong Kong.

| 34 | i-CABLE Communications Limited Annual Report 2007 |

SUPPLEMENTARY CORPORATE INFORMATION(continued)

| (A) | BIOGRAPHICAL DETAILS OF DIRECTORS AND SENIOR MANAGERS ETC.(continued) |

| (I) | Directors(continued) |

Gordon Y. S. Wu, GBS, KCMG, FICE, Director (Age: 72)

Sir Gordon Wu has been an independent Non-executive Director of the Company since 2001. He is the chairman as well as the founder of publicly-listed Hopewell Holdings Limited. He is also the chairman of publicly-listed Hopewell Highway Infrastructure Limited. He is active in civic and community services, and has received many awards and honours which include, inter alia, membership of Chinese People’s Political Consultative Conference, The People’s Republic of China since 1983, and Great Pearl River Delta Business Council since 2004.

Sir Gordon is also a stalwart supporter of his alma mater Princeton University, USA where he earned his Bachelor of Science in Engineering degree in 1958. He received Honorary Doctorate Degrees from Hong Kong Polytechnic University, University of Strathclyde, UK and University of Edinburgh, UK. He is a Fellow of The Institute of Civil Engineers and Honorary Fellow of Australian Society of Certified Practising Accountants. He has been appointed the Honorary Consul of The Republic of Croatia in the Hong Kong SAR. He was awarded the Gold Bauhinia Star in 2004.

Anthony K. K. Yeung, JP, Director (Age: 62)

Mr. Yeung has been an independent Non-executive Director of the Company since 2004. He also serves as a member and the chairman of each of the Company’s Audit Committee and Compensation Committee and a member of the Related Party Transactions Committee. He is the chairman of K K Yeung Management Consultants Ltd. and Wall Street Resources Ltd. Furthermore, he is a managing partner of K K Yeung Partnership, Certified Public Accountants (Practising). Mr. Yeung is also appointed as chairman of CityU Professional Services Limited.

Mr. Yeung is a Practising Certified Public Accountant in Hong Kong and senior member of the accountancy professions, i.e. Fellow, Chartered Institute of Management Accountants; Fellow, Chartered Association of Certified Accountants; Fellow, Chartered Institute of Secretaries and Administrators; Fellow, Hong Kong Institute of Certified Public Accountants and Taxation Institute of Hong Kong.

Mr. Yeung is the vice chairman of the Hong Kong General Chamber of Commerce and the chairman of the Management Consultancies Association of Hong Kong.

Mr. Yeung is also a council member of the Hong Kong Trade Development Council.

Furthermore, Mr. Yeung is a member of the Rehabilitation Advisory Committee, the Professional Services Development Assistance Scheme Vetting Committee and the Manpower Development Committee appointed by the Chief Executive of the Government of the HKSAR. Mr. Yeung is also a member of the Trade and Industry Advisory Board appointed by the Secretary for Commerce, Industry and Technology and a member of the Innovation and Technology Fund General Support Programme Vetting Committee appointed by the Secretary for Commerce, Industry and Technology.

Mr. Yeung is the chairman of the Hong Kong Trade and Industry Department’s Customer Liaison Group for Small and Medium Enterprises appointed by the Director-General of Trade and Industry.

Mr. Yeung is also a member of the Election Committee of the Government of the HKSAR.

In January 2005, Mr. Yeung was conferred “Grade of Knight of the Crown” by King Albert II of Belgians.

| Notes: | (1) Wheelock, Wharf and Wharf Communications Limited (“Wharf Communications”) (of which Mr. S. T. H. Ng is director) have interests in the share capital of the Company discloseable to the Company under the provisions of Divisions 2 and 3 of Part XV of the Securities and Futures Ordinance (the “SFO”). | |

(2) The Company confirms that it has received written confirmation from each of the Independent Non-executive Directors confirming their independence pursuant to Rule 3.13 of the Rules Governing the Listing of Securities (the “Listing Rules”) on the Stock Exchange, and considers them independent. | ||

| i-CABLE Communications Limited Annual Report 2007 35 |

Report of the Directors(continued)

SUPPLEMENTARY CORPORATE INFORMATION(continued)

| (A) | BIOGRAPHICAL DETAILS OF DIRECTORS AND SENIOR MANAGERS ETC.(continued) |

| (II) | Senior management |

Stephen T. H. Ng, Chairman and Chief Executive Officer (Age: 55)

William J. H. Kwan, Director and Chief Financial Officer (Age: 44)

Ronald Y. C. Chiu, Executive Director – i-CABLE News Limited and i-CABLE Sports Limited (Age: 55)

Mr. Chiu joined Wharf Communications in 1991 as a member of the pre-licence consultant team. When HKC was awarded the licence in June 1993, Mr. Chiu was appointed Assistant News Controller and was instrumental in the launch of the first 24-hour Cantonese language News Channel in the world. Mr. Chiu was promoted to News Controller in 1994 and appointed as Vice President, News & Sports in 2002. He became an executive director of i-CABLE News Limited and i-CABLE Sports Limited in September 2005. Mr. Chiu is now responsible for operating channels of the Sports and News platform. Prior to joining HKC, Mr. Chiu held various senior news positions in the television industry. His experience spans from reporting, editing, news anchoring, to planning and execution of news coverage as well as management of news operation.

Vincent T. Y. Lam, Executive Director – i-CABLE Network Limited (Age: 57)

Mr. Lam joined Wharf Communications in 1992 as Vice President – Planning. In 1995, Mr. Lam was appointed chief operating officer of i-CABLE Network Limited (“iNL”) responsible for the rollout and deployment of cable network infrastructure in Hong Kong. In 2006, Mr. Lam became an executive director of iNL and HKC, responsible for strategic development and engineering, including technologies, services and regulatory development. Mr. Lam has over 20 years of experience in the telecommunications industry in the United States and Asia. Prior to joining Wharf Communications, Mr. Lam was general manager of business development in Asia for U.S. West International.

Benjamin W. S. Tong, Executive Director – HKC (Age: 58)

Mr. Tong joined HKC in 1995 to manage the Marketing and Sales Department in the Cable Operations Division. He was appointed Cable Multimedia Services Director in August 1999 to lead the development of the Group’s high-speed Internet access service. He became an executive director of HKC in 2006 to take overall charge of the company’s Pay TV and Broadband subscription services. Mr. Tong has over 20 years of marketing and sales experience in Hong Kong, Mainland China and Taiwan. Prior to joining HKC, Mr. Tong was marketing and sales director in Taiwan for American Express.

Siuming Y. M. Tsui (alias: Siuming Tsui), Executive Director – i-CABLE Entertainment Limited; Chief Operating Officer –i-CABLE Satellite Television Limited; President – Sundream Motion Pictures Limited (Age: 54)

Mr. Tsui joined HKC in July 2001 as Chief Operating Officer of i-CABLE Satellite Television Limited to develop satellite television business and programme production in Mainland China. Mr. Tsui was an executive director, Programming Services of HKC from 2003 to 2005. He became an executive director of i-CABLE Entertainment Limited in September 2005. Mr. Tsui was principally responsible for programme development, production, distribution and transmission of channels of entertainment platform. Mr. Tsui has extensive managerial and production experience in the media industry. Prior to joining HKC, he was chief executive officer of Sun TV Cyberworks Holdings Limited, senior vice president of Asia Television Limited and chief executive officer of Emperor Movie Group Limited.

Samuel C. C. Tsang, General Manager – Hong Kong Cable Enterprises Limited (Age: 51)

Mr. Tsang joined Wharf Communications in 1992 as marketing consultant to bid for the cable television licence in Hong Kong. In 1995, he was appointed Enterprises Director to take charge of international programme licensing and advertising sales for the station. He became chief operating officer of Hong Kong Cable Enterprises Limited (“HKCE”) when it was set up in 2000 to take over advertising sales of HKC. He became General Manager of both HKCE and Hong Kong Cable News Express Limited on March 1, 2005. Mr. Tsang has extensive experience in media and marketing, specialising in new business establishment in Mainland China and Hong Kong.

Simon K. K. Yu, Vice President, i-CABLE Network Operations Limited (Age: 53)

Mr. Yu joined the Wharf Group in 1987 and has held various administration and audit positions in the Wharf Group. He was appointed corporate controller-operations of Wharf Communications in 1992, responsible for operations, accounting, finance, control, administration and personnel. In 1996, Mr. Yu was appointed Administration and Audit Director of HKC. He became Vice President – i-CABLE Network Operations Limited (formerly known as i-CABLE WebServe Limited) in 2006 to take charge of operations of the company’s HFC & MMDS networks.

| 36 | i-CABLE Communications Limited Annual Report 2007 |

SUPPLEMENTARY CORPORATE INFORMATION(continued)

| (A) | BIOGRAPHICAL DETAILS OF DIRECTORS AND SENIOR MANAGERS ETC.(continued) |

| (II) | Senior management(continued) |

Garmen K. Y. Chan, Vice President – External Affairs (Age: 54)

Mr. Chan joined HKC in 1995 as external affairs director. He is responsible for formulating and implementing regulatory and external affairs strategies and action plans for the Group. Mr. Chan came from a diverse media background in Hong Kong, having held key positions in English newspapers and local television stations. Mr. Chan was a media consultant prior to joining HKC.

David C. T. Wong, Vice President – i-CABLE Enterprises Limited (Age: 54)

Mr. Wong joined the Group in May 2004 as Vice President of i-CABLE Enterprises Limited. He is responsible for formulating and implementing strategies for the Group in opening up cross-media business opportunities. Mr. Wong had over 20 years of journalistic experience and held various senior editorial and managerial positions in the Sing Tao Newspapers Group. Prior to joining the Group, Mr. Wong was Director-General of the Hong Kong Press Council – a self-regulatory body to promote professional ethics of the newspaper industry.

Felix W. K. Yip, Vice President – Human Resources & Administration (Age: 49)

Mr. Yip joined the Group in February 2005 as Vice President – Human Resources, Administration and Audit. He has a successful track record in Human Resources and Administration. He started his professional career with the Dairy Farm Group of companies. He next spent ten years in various positions with San Miguel Brewing International Limited, where he last held the position of General Manager – Human Resources & Administration, China Business Operations.

| (B) | DIRECTORS’ INTERESTS IN SHARES |

At December 31, 2007, Directors of the Company had the following beneficial interests, all being long positions, in the ordinary shares of the Company, of its parent company, namely, Wharf, and Wharf’s parent company, namely, Wheelock, and the percentages which the shares represented to the issued share capitals of the Company, Wheelock and Wharf respectively are also set out below:

| No. of shares (Percentage of issued capital) | Nature of interest | |||

The Company Mr. Stephen T. H. Ng | 1,065,005 (0.0528)% | Personal interest | ||

Wheelock Mr. Stephen T. H. Ng | 300,000 (0.0148)% | Personal interest | ||

Wharf Mr. Stephen T. H. Ng(Note) | 650,057 (0.0266)% | Personal interest | ||

| Note: | Subsequent to the financial year end, Mr. Stephen T. H. Ng fully subscribed for his pro rata rights entitlements under a 1-for-8 rights issue by Wharf and he was accordingly allotted 81,257 shares of Wharf on January 16, 2008. Consequently, Mr. Ng was interested in 731,314 shares of Wharf following such allotment. |

| i-CABLE Communications Limited Annual Report 2007 37 |

Report of the Directors(continued)

SUPPLEMENTARY CORPORATE INFORMATION(continued)

| (B) | DIRECTORS’ INTERESTS IN SHARES(continued) |

Set out below are particulars of interests (all being personal interests) in options to subscribe for ordinary shares of the Company granted under the Share Option Scheme of the Company held by Directors of the Company during the financial year (no movement in such options recorded during the year):

Name of Director | Date granted (Day/Month/Year) | No. of ordinary shares represented by unexercised options outstanding throughout the year | Period during which rights exercisable (Day/Month/Year) | Price per share to be paid on exercise of options (HK$) | Consideration paid for the options granted (HK$) | |||||

Mr. Stephen T. H. Ng | 08/02/2000 | 1,500,000 | 01/04/2001 to 31/12/2009 | 10.49 | 10 | |||||

Mr. William J. H. Kwan | 08/02/2000 | 260,000 | 01/04/2001 to 31/12/2009 | 10.49 | 10 | |||||

Except as disclosed above, as recorded in the register kept by the Company under section 352 of the SFO in respect of information required to be notified to the Company and the Stock Exchange by the Directors and/or Chief Executive of the Company pursuant to the SFO or to the Model Code for Securities Transactions by Directors of Listed Issuers (the “Model Code”), there were no interests, both long and short positions, held during the financial year by any of the Directors or Chief Executive of the Company in shares, underlying shares or debentures of the Company and its associated corporations (within the meaning of Part XV of the SFO), nor had there been any exercises during the financial year of any rights to subscribe for any shares, underlying shares or debentures of the Company.

| (C) | SUBSTANTIAL SHAREHOLDERS’ INTERESTS |

Given below are the names of all parties which were, directly or indirectly, interested in 5% or more of the nominal value of any class of share capital of the Company as at December 31, 2007, the respective relevant numbers of shares in which they were, and/or were deemed to be, interested as at that date as recorded in the register kept by the Company under section 336 of the SFO (the “Register”) and the percentages which the shares represented to the issued share capital of the Company:

Names | No. of ordinary shares (Percentage of issued capital) | |

(i) Wharf Communications Limited | 1,480,505,171 (73.41)% | |

(ii) The Wharf (Holdings) Limited | 1,480,505,171 (73.41)% | |

(iii) WF Investment Partners Limited | 1,480,505,171 (73.41)% | |

(iv) Wheelock and Company Limited | 1,481,442,626 (73.46)% | |

(v) HSBC Trustee (Guernsey) Limited | 1,481,442,626 (73.46)% | |

(vi) Marathon Asset Management Limited | 121,332,000 (6.02)% | |

(vii) Matthews International Capital Management, LLC | 141,739,000 (7.03)% |

| Note: | For the avoidance of doubt and double counting, it should be noted that duplication occurs in respect of the shareholdings stated against parties (i) to (v) above to the extent that the shareholding stated against party (i) above was entirely duplicated or included in that against party (ii) above, with the same duplication of the shareholdings in respect of (ii) in (iii), (iii) in (iv) and (iv) in (v). |

All the interests stated above represented long positions and as at December 31, 2007, there were no short position interests recorded in the Register.