June 26, 2006

Via EDGAR and Overnight Delivery

Don Hunt

U.S. Securities and Exchange Commission

100 F Street, N.W.

Mail Stop 6010

Washington, DC 20549

| Re: | SenoRx, Inc. |

| Registration Statement on Form S-1 |

| File No. 333-134466 |

Dear Mr. Hunt:

On behalf of SenoRx, Inc. (“SenoRx” or the “Company”), we are responding to the Staff’s letter dated June 21, 2006 (the “Comment Letter”), relating to the above-referenced Registration Statement on Form S-1 (the “Registration Statement”). In response to the comments set forth in the Comment Letter, the Registration Statement has been amended and SenoRx is filing pre-effective Amendment No. 1 to the Registration Statement (“Amendment No. 1”) with this response letter. For your convenience, we have repeated the Staff’s comments below in bold face type before each of our responses below. The numbered paragraphs of this letter correspond to the numbered paragraphs of the Comment Letter. References to “we,” “our” or “us” mean the Company or its advisors, as the context may require.

Amendment No. 1 reflects the adjustment of capitalization numbers previously reported in the Registration Statement to reflect the effect of a reverse stock split that has been approved by the Company’s board of directors and stockholders. Upon the completion of the offering, all outstanding shares of the Company’s preferred stock will convert into shares of the Company’s common stock at the then applicable conversion ratio, as adjusted to reflect the 1-for-3.5 reverse stock split of the Company’s common stock.

While we have submitted with our filing several additional exhibits, Exhibit 23.1 (consent of accountants) is not included with Amendment No. 1. The report contained in this filing is a draft, unsigned report. The accountants will deliver their Exhibit 23.1 consent in any filing that contains an executed report.

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 2

Additionally, in response to Staff comment number 30, below, we are supplementally providing the Staff with a “back-up binder” of source material data included in the Registration Statement.

General

| 1. | Please confirm that any preliminary prospectus you circulate will include all non-Rule 430A information. This includes the price range and related information based on abona fide estimate of the public offering within that range. Also, in the next amendment, please fill in the blanks throughout the filing, and note that we may have additional comments after you do so. |

In response to the Staff’s comment, we confirm that all non-Rule 430A information will be included in its preliminary prospectus once a price range for the public offering is determined. We have filled in blanks not dependent upon establishing a price range.

Prospectus Cover Art

| 2. | Please advise us in your response letter whether the features listed on the table describe all of the significant features of both your and your competitor’s biopsy systems. For example, are there other features of you competitor’s products that are not shared by your products? We may have further comment. |

In response to the Staff’s comments, we have revised the artwork to eliminate comparison to the competitor. Instead we have simply listed the significant features of the Company’s Encor System, which reflects key features as described under our “EnCor Breast Biopsy System” on page 51.

Summary, page 1

Our Business, page 1

| 3. | Tell us why you state here and elsewhere in your prospectus that you currently manufacture and sell devices for the treatment of breast cancer. It appears from your disclosure that you have not yet commercialized any of your product candidates that treat breast cancer. |

In response to the Staff’s comment, we have eliminated here and elsewhere in our prospectus statements that we currently manufacture and sell devices for the treatment of breast cancer.

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 3

Recent Developments, page 3

| 4. | Please revise your disclosure to provide greater details as to what is meant by the phrase “we have not fully transitioned to the redesigned cutter.” Also confirm in your response letter that such modification does not require a new clearance from the FDA. |

In response to the Staff’s comment, we have eliminated the statement that “we have not fully transitioned to the redesigned cutter.” Because the Company has completed the redesign and has begun to manufacture the redesigned cutter in commercial quantities, and because the Company has indicated in the Registration Statement that its failure to comply with the requirements in the settlement would lead to refiling of the lawsuit, the statement is unnecessary. We confirm that the Company does not believe that the EnCor cutter modification requires a new clearance from FDA, since, as indicated in the prospectus, “we do not believe that the modification affects the operation or intended use of the device.”

Market Data, page 4

| 5. | Please revise to eliminate your statement in the last sentence of this paragraph that “the accuracy or completeness” of the market data and industry forecasts included in the prospectus “is not guaranteed,” as investors are entitled rely on statements made in the prospectus. If you question the accuracy or completeness of any data prepared by third parties, you should omit it from the prospectus. |

In response to the Staff’s comment, we have eliminated the statement in the last sentence of the paragraph that “the accuracy or completeness” of the market data and industry forecasts included in the prospectus “is not guaranteed.”

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 4

The Offering, page 5

| 6. | Revise the second bullet point to quantify the number of shares of common stock into which your preferred stock and convertible promissory notes will convert. |

In response to the Staff’s comment, we have revised this disclosure to quantify the number of shares of common stock issuable upon the conversion of the preferred stock, which is 7,109,570. However, because neither the offering price range nor the offering price per share has yet been determined, and the convertible promissory notes convert into shares of common stock at a 20% discount to the public offering price, we are unable to calculate the number of shares of common stock issuable upon the conversion of the convertible promissory notes at this time. The pricing information and the number of shares of common stock into which the convertible promissory notes will convert will be included in the Registration Statement that includes the price range for this offering.

| 7. | Please respond to the following comments: |

| • | Please reconcile the number of common shares outstanding as of March 31, 2006 of 33,073,663 with the number of common shares outstanding as of March 31, 2006 of 8,190,037 on page F-27. |

We respectfully advise the Staff that the 33,073,663 shares (or 9,449,486 shares as reported in Amendment No. 1 to reflect the reverse stock split) of common stock reported on page 5 includes 8,190,037 shares (2,339,916 shares post-split) of common stock outstanding as of March 31, 2006 and, as indicated by the second bullet point, assumes the conversion of an aggregate of 24,384,939 shares of the outstanding preferred stock into an aggregate of 24,883,626 shares (7,109,570 shares post-split) of the common stock pursuant to the Company’s certificate of incorporation. By contrast, the 8,190,037 shares (2,339,916 shares post-split) of common stock reported on page F-27 is based on the actual number of shares of common stock outstanding as of March 31, 2006 and does not assume the conversion of the preferred stock, which outstanding shares as of March 31, 2006 are listed out separately by series on page F-27.

| • | Please reconcile your disclosure that all of the information in the prospectus assumes the conversion of your convertible promissory notes with your disclosure that the number of shares of common stock outstanding after the offering excludes the common shares issuable upon conversion of the convertible promissory notes. |

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 5

In response to the Staff’s comment, we have revised the Registration Statement to delete from the second bullet point on page 5 the statement that the information in the prospectus assumes the conversion of the Company’s convertible promissory notes.

Please tell us why you have excluded the number of shares of common stock issuable upon conversion of the convertible promissory notes from the number of common shares to be outstanding after the offering. On page F-36 you disclose that the notes automatically convert into common shares upon the closing of your IPO.

We respectfully advise the Staff that, as indicated above in response to Staff comment number 6, the number of shares of common stock that are reported as outstanding after the offering is based on shares outstanding as of March 31, 2006. Shares issuable upon the conversion of the convertible promissory notes were excluded from this computation because we have not yet included pricing information from which we could calculate an assumed number of shares into which the convertible promissory notes would convert.

Summary Financial Data, page 6

| 8. | Please remove the term “(unaudited)” from the column headings for the three months ended March 31, 2006 and 2005 and as of March 31, 2005 to avoid giving the impression that the other periods are audited. Please similarly revise page 26. |

In response to the Staff’s comment, we have revised the column headings to delete the reference to “(unaudited)” financial statements here and in other similar summary and selected presentations of financial data.

| 9. | We note that you include the following transactions related to your notes with the pro forma impact of your offering: (a) the effects of a fair value adjustment and (b) the conversion of the notes into common stock. Please revise your pro forma presentation to separately present the pro forma effects of the offering. Please similarly revise your pro forma presentations on pages 22 and 27. |

In response to the Staff’s comment, we have made the requested revisions to our disclosure here and in the pro forma presentations on pages 22 and 27.

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 6

Risk Factors, page 8

| 10. | We note that you have entered into multiple amendments to your loan agreement with Silicon Valley Bank. Please discuss the risks of default, if material, because of your failure to comply with the covenants in that agreement. |

We respectfully advise the Staff that the risk of default under the loan agreement with Silicon Valley Bank is not material. Following the completion of this offering and the additional funds to be raised pursuant hereto, the Company expects that it will continue to remain in compliance with all covenants under the SVB Agreement eliminating any material risk of default. The Company has borrowed an aggregate amount of $3.5 million under the SVB Agreement and, following the completion of this offering, will have capital resources to repay this financing instrument, if it so chooses, without disrupting its expected use of proceeds.

Use of Proceeds, page 21

| 11. | We note that you intend to use some of the offering’s proceeds to repay interest owing on the May 2006 convertible promissory notes. It appears from the form of such notes filed as part of Exhibit 10.10 that any accrued and unpaid interest is due and payable along with the principal upon each note’s maturity. Please supplement this section to provide the disclosure required by Instruction 4 to Item 504 of Regulation S-K. |

In response to the Staff’s comments, we have added the requested disclosure, including interest rate, maturity date, and the use of proceeds of such indebtedness.

Dilution, page 24

| 12. | Please respond to the following comments: |

| • | Please tell us and disclose how the dilution information reflects the conversion of the preferred shares to common shares upon the IPO. |

| • | We note that you include the following transactions related to your notes with the pro forma impact of your offerings: (a) the effects of a fair value adjustment |

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 7

and (b) the conversion of the notes into common stock. Please revise your pro forma presentation to separately present the pro forma effects of the offering. |

In response to the Staff’s comments, we have revised the contents of the Dilution table on page 24 to clarify that the Existing Stockholders at March 31, 2006 includes the actual common shares outstanding in addition to the number of common shares that the outstanding preferred shares will convert into upon the completion of this offering. We also note that, as in our response to Staff comment number 9 above, we have revised our pro forma presentation to separately present the pro forma effects of the offering.

| 13. | We note that the amount of total consideration for existing stockholders is $47.9 million. It appears that this amount assumes conversion of the preferred stock. Please tell us how you calculated the amount of total consideration and reconcile with pages F-18 and F-27. |

In response to the Staff’s comment, the total consideration for existing stockholders of $47.9 million on the Dilution table on page 24 has been revised to clarify that this includes proceeds received from the issuance of common stock and preferred stock, which consists of total proceeds raised from the sale of preferred stock of $46.8 million, as indicated on pages F-18 and F-27, and an additional $1.1 million received from the exercise of common stock options.

| 14. | With respect to your table at the bottom of page 24, please disclose how the conversion of the convertible debt upon the IPO will impact the percentage of shares purchased and the total consideration percentage paid by the new investors and existing stockholders. Please also revise your current disclosure on page 25 with respect to the options and warrants to include the impact of the conversion of this debt. |

In response to the Staff’s comment, we have revised the contents of the Dilution table and the following discussion to include the impact of the conversion of the convertible debt.

Management’s Discussion and Analysis, page 28

| 15. | We note your disclosure on page 14 and 58 that the shearing off in patients’ breasts of the tip of one of your marker products was recurring problem. Please tell us in your response letter whether any litigation related to this problem has ensued. |

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 8

Supplement your disclosure to identify any known trends and uncertainties related to this recurring problem to the extent that such events would result in or are reasonably likely to result in your liquidity increasing or decreasing in any material way. Disclosure of such trend, demand, commitment, event or uncertainty is required unless you are able to conclude either that it is not reasonably likely that the trend , uncertainty or other event will occur or come to fruition, or that a material effect on your liquidity, capital resources or results of operations is not reasonably likely to occur. See Item 303(a)(1) of Regulation S-K and Section III.B.3 of SEC Release 33-8350. |

In response to the Staff’s comments, we have modified the disclosure on pages 14 and 58 to make clear that the shearing off of the tip in patients’ breasts was a historical occurrence. As we have disclosed, the FDA’s action related to the process by which we validated the design changes that we implemented to remedy the problem. Following the design changes, the Company has not experienced a material number of tip shear events. No litigation related to this problem has ensued.

Recent Developments, page 28

| 16. | Please correct your cross-reference to your description of your convertible promissory notes. |

In response to the Staff’s comment, we have corrected the cross-reference to our description of the convertible promissory notes.

Results of Operation, page 30

Three Months Ended March 31, 2006 Compared to Three Months Ended March, 31, 2005

| 17. | Please reconcile the decrease in sales of SenoCor 360 of $0.2 million with the table on page F-33. We note that biopsy capital equipment product sales decreased 13%. Please tell us and disclose why these sales and the sales of SenCor 360 are declining. Refer to Item 303(b)(2) of Regulation S-K and the instructions thereto, SAB Topic 13.B, and Release 33-8350. |

In response to the Staff’s comment, we have modified the disclosure on page 30 to reconcile the decrease in sales of SenoCor products with the table on page F-33. We

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 9

respectfully advise the Staff and have disclosed that the decrease is attributable to our shift in sales focus onto our EnCor products.

| 18. | Please quantify the impact of the “increased costs associated with scrapping obsolete component inventory” on your gross profit. Refer to FRC 501.04. |

In response to the Staff’s comment, we have expanded the discussion to include the dollar amounts related to the “increased costs of associated with scrapping obsolete component inventory.”

Year ended December 31, 2005 compared to year ended December 31, 2004, page 31

| 19. | We note that the increase in net revenues was primarily attributable to a $5.6 million increase in sales of EnCor disposable probes and consoles. Please tell us and disclose the underlying reasons for the increase, especially considering the full commercial launch did not occur until November 2005. Refer to Item 303(1)(3)(iii) of Regulation S-K, SAB Topic 13.B, and Release 33-8350. |

We respectfully advise the Staff that while full commercial launch occurred in November 2005, the increase in net revenues for the year ended December 31, 2005 reflects the limited release of the Company’s EnCor products following regulatory clearance in late 2004. We have revised the applicable disclosure accordingly and have made additional responsive disclosure in our MD&A overview.

| 20. | Please reconcile the increase in sales of Encor disposable probes and consoles of $5.6 million and the decrease in sales of SenoCor 360 of $0.5 million with the table on page F-25. We note that adjunct and other product sales decreased 20%. Please tell us and disclose why these sales are declining. Refer to Item 303(1)(3)(iii) of Regulation S-K, SAB Topic 13.B, and Release 33-8350. |

We respectfully advise the Staff that the net $5.2 million increase in sales of Encor and SenoCor 360 disposable probes and consoles, after rounding, is equal to the difference between 2005 and 2004 for the combined biopsy disposable products and biopsy capital equipment products on page F-25.

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 10

The decrease in sales of adjunct and other products during the three months ended March 31, 2006 from the same period in 2005 is the decrease in sales of our Gamma Finder product.

In response to the Staff’s comment, we have added to the table on page F-33 a description of the products included in each of the major product classes. Additionally, we have made certain revisions to the MD&A discussion to conform with the product classes as presented on page F-25.

Year ended December 31, 2004 compared to year ended December 31, 2003, page 31

| 21. | Please reconcile the increase in sales of EnCor disposable probes and consoles of $1.5 million, an increase of $1.3 million in tissue marker sales, an increase of $1.3 million in Gamma Finder sales and a $0.4 million decrease in sales of SenoCor 360 with your disclosure on page F-25. On Page F-25 we note that biopsy disposable product sales increased $1.9 million, while biopsy capital equipment sales decreased $1.2 million. We also note that marker product sales increased $6.7 million and adjunct and other product sales decreased $4.1 million. Please tell us and disclose in MD&A the reasons for the significant changes in your sales shown by the table on page F-25. Refer to Item 303(a)(3)(iii) of Regulation S-K, SAB Topic 13.B, and Release 33-8350. |

In response to the Staff’s comment, and in order to reconcile the MD&A disclosure, the page F-25 disclosure and the page F-33 disclosure, we have revised the description of the products included in each of the major product classes and have revised the classification of certain products for 2003 to conform with the product classes presented for 2004 and 2005.

Liquidity and Capital Resources, page 33

| 22. | Please reconcile (a) the cumulative gross profit from the sale of your products of $25.0 million with the same amount derived from pages F-5 and F-28 and (b) the cumulative net proceeds from the issuance of preferred stock of $46.8 million with the same amount derived from page F-27. |

In response to the Staff’s comment, we have corrected the second sentence of Liquidity and Capital Resources to reflect the period “From inception to March 31, 2006” in place

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 11

of the period originally presented as “From 2003 through March 31, 2006.” We respectfully advise the Staff that the $46.8 million in cumulative net proceeds from the issuance of preferred stock referenced on page 33 is, after rounding, equal to the cumulative net Series A, Series B, and Series C amounts on page F-27.

| 23. | Please discuss material changes in the underlying drivers of your working capital changes (e.g. cash receipts from the sale of goods and services and cash payments to acquire materials for manufacture or goods for resale), rather than merely describing items identified on the face of the statement of cash flows to provide a sufficient basis for a reader to analyze the change. Refer to Item 303(a)(1) of Regulation S-K and Release 33-8350. |

In response to the Staff’s comments, we have revised the disclosure to include the underlying drivers related to changes in working capital.

| 24. | Please revise your contractual obligations table to include other long-term liabilities reflected in your balance sheet under GAAP, or tell us why the current disclosure complies with Item 303(a)(5) of Regulation S-K. |

We respectfully advise the Staff that the other long-term liabilities on the balance sheet is comprised solely of the back-end interest payment due in October 2007 to the holder of the Subordinated Note as described in Note 5 – Long-Term Debt on page F-16. As we have noted in footnote 1 to the Contractual Obligations table on page 35, interest on Long-Term Debt has been excluded.

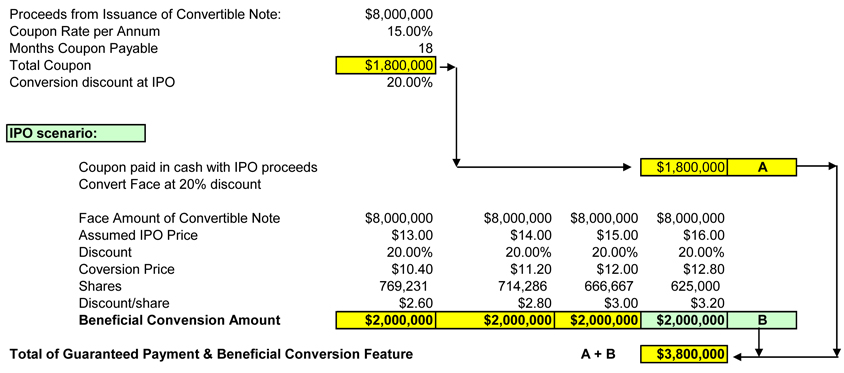

| 25. | Please tell us how you calculated the $2.0 million of discount value on the 2006 convertible notes. Refer to the fourth paragraph on page 36. |

In response to the Staff’s comment, we have included Attachment 25-A hereto, which provides support for calculation of the $2.0 million of discount value on the 2006 convertible notes. The noteholders will receive $10.0 million in shares of common stock in cancellation of their $8.0 million in notes, based upon the offering price, whatever that price may be.

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 12

Critical Accounting Policies, page 37

| 26. | Please disclose the aggregate intrinsic value of all outstanding vested and unvested options as of March 31, 2006 based on the midpoint of the estimated IPO price range. |

In response to the Staff’s comment, we have revised our disclosure of “Stock Based Compensation” to include the requested information in format only at this time. The values will be completed upon subsequent amendment when an offering price range is included.

| 27. | We note your reference to a third-party estimate. Please note that if you elect to continue to make such a reference, you will be required to identify the appraisal firm under “Experts” and include their consent in the Registration Statement. Alternatively, we encourage you to instead clearly disclose that management is primarily responsible for estimating fair value for impairment purposes. We will not object if you wish to state, in revised disclosure, that management considered a number of factors, including valuations or appraisals, when estimating fair value. Regardless of your decision, your disclosure should clearly indicate that management is responsible for the valuation. See Securities Act Rule 436. |

In response to the Staff’s comments, we have revised the disclosure to remove reference to the third party and have attributed the valuation analysis to management and the board of directors.

Business, page 43

Overview, page 43.

| 28. | Revise your disclosure in the third sentence of the first paragraph and in the summary section to clarify that you will need to seek and receive regulatory approval prior to commercializing your therapeutic products. |

In response to the Staff’s comment, we have revised the disclosure to clarify that we will need to seek and receive regulatory approval prior to commercializing our therapeutic products.

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 13

| 29. | We note your disclosure here and elsewhere in the prospectus that you “expect to seek and obtain FDA 510(k) clearance” at specified future times. Please disclose the basis for your expectation that you will be able to seek and obtain FDA clearance for your product candidates. |

In response to the Staff’s comment, we have eliminated “and obtained” from the disclosure in the Overview and elsewhere in the prospectus that the statement appears.

Industry Overview, page 43

Breast Cancer, page 43

| 30. | Please provide us with reports containing data cited throughout the prospectus, clearly marking the relevant sections. For example, in the first two paragraphs you provide data regarding the rate and number of incidences of breast cancer in the United States, in the final full paragraph on page 44 you provide data regarding the number of breast biopsies performed annually in the United States and you cite estimates by Millennium Research Group in the final paragraph on page 45. Please also disclose the source of your quoted data. In addition, please tell us whether the sources of the cited statistics have consented to your use of their data and whether any reports were prepared specifically for your use. |

In response to the Staff’s comment, we are supplementally providing the Staff with representative sources (in most cases, duplicative data is available from multiple sources) of data found throughout the prospectus, along with a marked copy of the prospectus, highlighting corresponding sections. We have obtained Millennium Research Group’s consent to the use of their data cited in the final paragraph on page 45. We have not identified sources of data where the source is neither cited nor quoted and the data is publicly available, nor have we sought any third party consent to this data. No reports were prepared specifically for our use.

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 14

Evolution of Breast Biopsy Procedures, page 44

Surgical Biopsy, page 44

| 31. | We note your statement that “the accuracy of a diagnosis using the surgical method is close to 100%.” Please disclose the accuracy rate for alternative biopsy methods, including needle biopsy and vacuum-assisted biopsy. |

In response to the Staff’s comment, we have eliminated this statement and modified the corresponding disclosure.

Vacuum-Assisted Biopsy, page 45

| 32. | Please revise to disclose the comparative advantages and disadvantages of open and closed systems referenced in the final sentence. |

In response to the Staff’s comment, we have revised the disclosure to eliminate this statement, though we have also provided disclosure of comparative advantages and disadvantages of open and closed systems.

Our Solution, page 48

| 33. | Please tell us why you believe it is appropriate at this time to state that you “have developed a broad product line” when it appears from your disclosure that you have not yet fully developed your product candidates for excising, treatment and reconstruction. |

In response to the Staff’s comment, we have revised our disclosure to indicate that we are in the process of “developing” a broad product line, rather than having “developed” it already.

| 34. | We note your disclosure that your Vacuum Radiation Balloon is designed to “provide uniform radiation dosing.” We further note your disclosure on page 46 that “delivering a uniform radiation dose remains an obstacle” for radiation balloon brachytherapy. Please clarify how your product candidate is able to overcome this obstacle; if it is solely through its use in conjunction with the Single Step device, so state. |

In response to the Staff’s comment, we have revised the disclosure to clarify that this product candidate is able to overcome the obstacle when used in conjunction with the Single Step device.

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 15

Our Products, page 50

| 35. | Please tell us why you believe it is appropriate to make references to your “products” when referring to product candidates that have not yet been commercially sold. |

In response to the Staff’s comment, we have revised the disclosure here and elsewhere, when referring to product candidates, to characterize these not as “products,” but as “products under development.”

Manufacturing, page 55

| 36. | Please revise your disclosure to identify the manufacturer that provides you with subassembly services in Thailand and file any material agreement required by Item 601(b) of Regulation S-K. |

In response to the Staff’s comment, we have revised the disclosure to identify Infus Medical as the Company’s subassembly service provider. To date, the Company has no material agreement with Infus. The Company has only purchased products from Infus on a purchase order basis.

| 37. | Please revise your disclosure to identify the single source suppliers referenced in the second sentence of the fourth full paragraph on page 56. |

In response to the Staff’s comment, we have revised the disclosure to identify the sole source suppliers referenced on page 56.

Patents and Proprietary Technology, page 60

| 38. | Please disclose the duration and scope of all material patents. |

In response to the Staff’s comment, we have revised the disclosure to identify the duration and scope of all material patents.

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 16

Related Party Transactions, page 75

Debt, page 75

| 39. | Disclose all material terms of your May 2006 Note Purchase Agreement and related agreements, including the identities of the parties, their relationships to you, conversion terms, etc., as applicable. This disclosure should appear in narrative form in the text of your prospectus, not solely in a footnote. |

In response to the Staff’s comment, we have revised the disclosure to identify the material terms of the May 2006 Note Purchase Agreement in narrative form and have deleted the redundant footnotes.

| 40. | Using an assumed initial public offering price, please disclose the number of shares and effective price per share paid for the common stock the noteholders will receive upon conversion of the notes at closing your offering. This calculation should include the $1,800,000 interest payment due to noteholders within 60 days of the closing. |

In response to the Staff’s comment, we will disclose the number of shares and effective price per share paid for the common stock by the noteholders upon conversion of the notes with our filing that includes a price range, calculated based upon the midpoint of the range. The table already discloses information regarding the interest payment, which will be due in cash.

Corporate Finance, page 75

| 41. | Please disclose all the material terms of the Series C preferred stock offerings listed here, including when each such offering took place. |

In response to the Staff’s comment, we have revised the disclosure to add that shares of Series C preferred stock were sold as part of the Company’s Series C preferred stock financing between June 2003 and August 2005, which sales occurred on 12 separate

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 17

closing dates. We have also inserted a cross-reference to the section titled, “Description of Capital Stock,” which discusses the material terms of the preferred stock.

| 42. | Disclose how each of the named entities is affiliated with your officers or directors, if at all. We note, for example, your disclosure in footnote 6 on page 78 regarding the relationship between Mr. Dotzler and De Novo Ventures. |

In response to the Staff’s comment, we have revised the disclosure to describe the affiliations between the Company’s officers and directors, if any, with the entities named in this section.

Principal Stockholders, page 77

| 43. | Identify all natural persons who beneficially own the shares held by each of the entities named in the Principal Stockholders table. |

In response to the Staff’s comment, we have revised the disclosure to identify the natural persons who beneficially own the shares held by each of the entities named in the Principal Stockholders table.

Shares Eligible for Future Sale, page 82

Lock-Up Agreements, page 82

| 44. | Please quantify the number of shares of common stock subject to lock-ups. |

In response to the Staff’s comment, we have revised the disclosure to quantify the numbers of shares of common stock subject to lock-up restrictions, which numbers are 9,449,486 shares of common stock, 255,304 shares of common stock issuable upon the exercise of outstanding warrants and all shares of common stock to be issued upon the conversion of the Century Medical convertible subordinated note and the May 2006 convertible promissory notes.

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 18

Financial Statements, page F-1

Statements of Stockholders’ Equity, page F-6

| 45. | Please tell us why a portion of the warrants issued during the year ended December 31, 2004 was applied to deferred compensation and how this amount was determined. Please disclose the nature of this transaction in the notes to the financial statements. |

We respectfully advise the Staff that the warrants issued in 2004 which were applied to deferred compensation were issued to our CEO, Lloyd Malchow. This transaction is described in Note 8-Warrants on page F-22. The $294,500 value of the warrants was the intrinsic value.

Statements of Cash Flows, page F-7

| 46. | Please reconcile the amount of net proceeds from issuance of common stock and stock option exercises for the year ended December 31, 2004 to the amount recorded on the statement of stockholders’ equity. |

We respectfully advise the Staff that the net proceeds from the issuance of common stock on the Statement of Stockholders’ Equity on page F-6 is correct. The amount shown as net proceeds from the issuance of common stock on the Statement of Cash Flows is understated by $7,292, due to a misclassification. Management has concluded that the misclassification is immaterial and has therefore not revised the 2004 Statement of Cash Flows.

Note 1. General and Significant Accounting Policies, page F-8

Revenue Recognition and Deferred Revenue, page F-10

| 47. | Please clarity the point at which title transfers. |

In response to the Staff’s comment, we have added a sentence which states that “The Company’s terms of sales specify that title transfers at the time of shipment by the Company.”

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 19

| 48. | In a related matter, please expand your disclosure in the last paragraph of this section to describe what happens to the title to the equipment and amortized cost of the equipment if the customer doesn’t purchase a minimum number or disposable devices at the end of the contract. |

In response to the Staff’s comments, we have added expanded disclosure to describe what happens if minimum requirements are not met.

| 49. | We note that you entered into an arrangement with Century Medical in 2002. Please tell us and disclose all of the significant terms of that agreement, including the circumstances under which you may be obligated to refund the advances. Please provide us with a rollforward of the deferred revenue amount from the inception of the agreement through March 31, 2006. Explain why the amount of deferred revenue is increasing each period. Please tell us in more detail how you determine the current and long-term portions of the deferred revenue. We note that the current portion is $287,133 as of December 31, 2005, while total sales from 2002 through March 31, 2006 have been only $46,000. |

In response to the Staff’s comment, we have disclosed all of the significant terms of the Century Medical arrangement in MD&A. The agreement provides Century with exclusive distribution rights to the Company’s products in Japan. Under the agreement, Century is required to seek and obtain, at their cost, approvals from the Japanese regulatory authorities, after which it has a five year term with an automatic five year renewal provided that Century has met minimum annual purchase targets. The agreement required Century to make two advance payments of $500,000 each, one in December 2002 and one in December 2003, related to the Company’s successful completion of milestones related to products covered under the distribution agreement. The advance payments are reduced by purchases made by Century. As of March 31, 2006, Century has ordered and the Company has delivered $47,000 in products covered under the agreement which have been offset against the aggregate $1.0 million in prepayments.

In response to the Staff’s request for additional information regarding the period-over-period increase of the long-term portions calculation, we are providing the Staff with additional information in Attachment 49-A hereto.

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 20

Note 6. Stockholders’ Equity, page F-17

| 50. | We note that you issued 961,849 shares of common stock in 2005 at $0.27 per share. On page F-21 it appears that the fair value of your common stock was above $1.00 during 2005. Please tell us how you accounted for the issuance of these shares and why. Tell us the nature of the purchasers and whether they are related parties. |

We respectfully advise the Staff that all shares of common stock issued in 2005 resulted from common stock option exercises by employees and consultants. The per share value that results on the Statement of Stockholders’ Equity on page F-6 is the original exercise price of the options. To clarify this matter, we have revised the captions on page F-6 to note that the issuance of common stock in each year is from stock option exercises.

Note 7. Stock Option Plans, page F-20

| 51. | Please note that we are deferring any final evaluation of stock compensation recognized until the estimated offering price is specified, and we may have further comments in that regard when you file the amendment containing that information. |

We acknowledge the Staff’s comment.

| 52. | Please give us a schedule showing in chronological order, the date of grant, optionee, number of options or warrants granted, exercise price and the deemed fair value of the underlying shares of common stock for the options or warrants issued within the year preceding the contemplated IPO. Also, provide a similar schedule for issuances of common stock. Tell us the objective evidence and analysis which supports your determination of the fair value at each grant and stock issuance date. Discuss the nature of any events which occurred between the dates the options were granted and the date the Registration Statement was filed. Quantify the effect on the fair value in order to support a valuation below the IPO price. |

In response to the Staff’s comment, please see Attachment 52-A to this letter, which provides in chronological order the dates of grant, optionee by nature of their relationship to the Company, the number of options granted to each optionee, the exercise price and the deemed fair value of the options granted for all option grants from June 2005 through May 2006. All options were granted for common stock. The Company has not transacted any direct sales of common shares.

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 21

With respect to warrants, Footnote 8 - Warrants on page F-22 provides a recap of a warrant that was issued in June 2005 to Silicon Valley Bank in conjunction with a renewal of our debt facilities.

In connection with the preparation of the financial statements necessary for the initial public offering, the Company engaged an independent valuation advisory firm to retrospectively assist management in its calculations of valuations of its common stock for option grants at the grant dates in 2005 and to assist the Company’s board of directors in determining fair market value for the option grants in February 2006 and May 2006, and also valuations of the Company’s preferred stock at the same points in time. The valuation used by management used a probability-weighted combination of both an income approach and a market based approach. The valuation included a probability-weighting giving consideration to a potential strategic merger and/or acquisition scenarios as well as an initial public offering, reflecting the Company’s potential liquidity pathways.

The market-based approach was based upon the stock prices of companies in the medical device field and whose stock is traded in the public market. We believe there are no companies directly comparable to the Company, because it is the only company focusing on the full continuum of developing, selling and manufacturing medical devices for the diagnosis and treatment of breast cancer.

The income method involved applying appropriate discount rates to estimated future cash flows that were based on our forecasts of revenues and costs. The Company’s revenue forecasts were based on its estimates of expected annual growth rates of existing products, as well as products it intends to bring to commercial launch in future years. Operating expenses were based upon its internal assumptions, including anticipated growth of expenditures to support the growth of the organization for research and development, sales and marketing and general and administrative expenses.

Management supplied to the independent valuation advisory firm monthly financial statements, internally prepared financial projections, managements’ assessment of liquidity pathways and internal information summarized below influencing positively and negatively the fair value assigned to the option grants as of the specific grants dates reflected on the chart which summarizes the stock option grants for 2005 and through May 2006 on page 39 of the Registration Statement:

| • | In February 2005, the Company was awarded a large contract from a major healthcare organization. The agreement provided the potential to facilitate gaining further critical mass in the placement of the EnCor systems with influential healthcare institutions and clinicians. |

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 22

| • | In February 2005, Suros Surgical Systems named the Company in a patent infringement lawsuit involving its flagship EnCor product. Although the Company believed that the EnCor product did not infringe the Suros patent named in the litigation, potential risks related to customer and investor reaction to the suit, as well as the unpredictable nature of litigation generally, were considered. |

| • | During the second and third quarters of fiscal 2005, the Company implemented design modifications and delayed the full commercial launch of its flagship EnCor product due to delays in implementation of certain product enhancements and shortages of key console components. |

| • | The Company’s sales during Q2 2005 and Q3 2005 were lower than expected, and lower than in Q1 2005. |

| • | In July 2005, the FDA issued a warning letter against the Company. |

| • | In July 2005, the Company closed a $5.7 million equity fund-raise to improve its low cash position. |

| • | In September 2005, knowledge of the FDA the warning letter caused concern with customers, future investors or potential acquirers of the Company. Sales volumes continued at or below the March 2005 levels, and the cost of the Suros litigation defense negatively impact projected cash needs. |

| • | In October 2005, the Company began evaluating additional debt financing packages to ensure that it remained in compliance with its bank’s quick ratio covenant. Several large companies engaged the Company in strategic partnership discussions, including a potential acquisition. |

| • | In November and December 2005, the Company’s cash liquidity remained constrained. As a result, the Company had to seek waivers from its bank on the non-compliance with quick ratio requirements. |

| • | In December 2005 and January 2006, based upon feedback from several potential larger strategic and acquisition partners, the Company believed that certain key |

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 23

strategic assets might not be fully valued in such strategic partnerships, so management began exploration of other alternatives to raise additional capital. |

| • | In February 2006, the Company had not yet secured additional debt or equity financing. |

| • | In late February 2006, the Company’s board of directors agreed to invite select investment bankers to present informal presentations and evaluations of a potential for an initial public offering. This led to selection of a syndicate and an initial organization meeting in early March 2006 as the Company began the process of preparing for an IPO. |

| • | In early March 2006, the Company began the negotiation of two competing debt packages to provide working capital and to bring its financial position into compliance with bank requirements. |

| • | In April 2006, the Company continued with the IPO process and secured commitments for the $8.0 million convertible debt instrument. |

| • | On May 4, 2006, the Company funded the $8.0 million convertible debt offering and regained compliance with its bank covenants. The preferred stockholders agreed to remove the minimum IPO price per share conversion requirement in the investors’ rights agreement and agreed to convert their preferred stock into common stock at the closing of the IPO. |

| • | On May 24, 2006, the Company reached a settlement agreement with Suros Surgical Systems, thereby removing the risk of outstanding patent litigation that could impact the offering. |

| • | On May 25, 2006, the Company filed its Registration Statement |

The detailed events described above led to the decrease in the fair value per share from $7.07 in February 2005 to $4.24 by the end of the second quarter of 2005, and then a modest increase to $4.83 by the end of the third quarter of 2005. The Company’s cash and financing situation then drove the subsequent decrease to $3.71 per share by the close of fiscal 2005. In the first quarter of fiscal 2006, as the Company was working out financing alternatives and began the process of the initial public offering, the per share value increased to $7.95 per share. The significant positive events in second fiscal quarter of 2006, including the May 2006 note financing and the progression of the Company’s IPO efforts, as well as the settlement of the outstanding litigation, increased the price to $12.25 per share.

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 24

The Company believes that it has used reasonable methodologies, approaches and assumptions consistent with the guidelines set forth in the American Institute of Certified Public Accountants Practice Guide,Valuation of Privately-Held-Company Equity Securities Issued as Compensationto determine the fair value of its common stock and that deferred compensation and related amortization have been recorded properly for accounting purposes.

| 53. | For equity instruments granted during the twelve months prior to the date of the most recent balance sheet, please disclose the following in the notes to your financial statements: |

| • | For each grant date, the number of options or shares granted, the exercise price, the fair value of your common stock, and the intrinsic value (if any) per option. |

| • | Whether the valuation was contemporaneous or retrospective. |

| • | If the valuation specialist was a related party, please disclose that fact. |

| • | Please note that when you refer to an independent valuation you should also disclose the name of the expert and include the consent of the expert if the reference is made in a 1933 Act filing. |

In response to the Staff’s comments, the Company has revised the disclosure of common stock option grants on pages F-21 and F-35 to include additional detail of the grants during the period. In accordance with Staff comment number 27 above, we have revised the disclosure to state that the valuation analysis is the responsibility of management and the board of directors, assisted by a third-party valuation.

Note 11. Segment Information, page F-24

| 54. | Please disclose the nature of the products included in each of the five product categories so that the information can be reconciled to your discussion in MD&A. Refer to paragraph 37 of SFAS 131. |

In response to the Staff’s comment, we have revised our disclosure of the Company’s five product classes in Note 11 to include product names.

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 25

Interim Financial Statements

Note 6. Subsequent Events, page F-36

| 55. | With respect to the 2006 convertible notes, please address the following: |

| • | Please provide us with your analysis of the conversion feature under SFAS 133 and EITF 00-19. We note that the conversion price is 80% of the IPO price. It appears that as a result you would not be able to conclude that you have sufficient authorized and unissued shares. This conclusion, if true, would also cause a similar problem under any other outstanding non-employee convertible instruments. |

| • | We note that you did not identify the interest rate as a derivative even though it is equal to 22.5% of the principal amount of the notes. Please provide us with your analysis of this feature under SFAS 133, including paragraphs 12 and 13. |

| • | On page F-13 you state that you expect to record a fair value adjustment of $3.8 million. Please tell us how you calculated this amount and when you expect to record it. Tell us whether you plan to record the instrument at fair value as of June 30, 2006 and make any associated fair value adjustments. |

In response to the Staff’s comments, our analysis of the 2006 convertible notes under FASB 133 and EITF 00-19 is as follows:

Paragraph 12 of FASB 133 requires that all three of the following criteria be met before bifurcation of an embedded derivative is required:

| a. | The economic characteristics and risks of the embedded derivative instrument are not clearly and closely related to the economic characteristics and risks of the host contract. |

| b. | The contract (“the hybrid instrument”) that embodies both the embedded derivative instrument and the host contract is not remeasured at fair value under otherwise applicable generally accepted accounting principles with changes in fair value reported in earnings as they occur. |

| c. | A separate instrument with the same terms as the embedded derivative instrument would, pursuant to paragraphs 6–11, be a derivative instrument subject to the |

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 26

requirements of this Statement. (The initial net investment for the hybrid instrument shall not be considered to be the initial net investment for the embedded derivative.) However, this criterion is not met if the separate instrument with the same terms as the embedded derivative instrument would be classified as a liability (or an asset in some circumstances) under the provisions of Statement 150 but would be classified in stockholders’ equity absent the provisions in Statement 150. |

The following discusses the application of each of the three criteria in paragraph 12 of FASB 133 to the embedded feature in the 2006 convertible notes:

Paragraph 12(a) – Clearly and Closely Related

In order to determine whether the economic characteristics and risks of an embedded feature are clearly and closely related to the economic characteristics and risks of the host contract, the Company must determine the nature of the host contract.

At the March 15, 2001 DIG meeting, the DIG members and the FASB staff tentatively concluded that, for an investor in debt or equity securities, the host contract under FASB 133 should be the same as the classification of the security under FASB 115 (see DIG Agenda Item 15-5). Although paragraph 60 of FASB 133 requires an evaluation of the hybrid, the DIG members and certain FASB staff members believed that symmetry between FASB 115 and FASB 133 accounting was the most appropriate and consistent method for evaluating instruments with multiple embedded derivatives.

In Agenda Item 15-5, the DIG addressed only the investor’s identification of the host contract, since at the time it was expected that the EITF may be addressing the issuer’s accounting. The Company, however, believes that its identification should be similar to the investor’s identification.

The glossary to FASB Statement No. 115,Accounting for Certain Investments in Debt and Equity Securities (FASB 115) defines a debt security as follows:

Any security representing a creditor relationship with an enterprise. It also includes (a) preferred stock that by its terms either must be redeemed by the issuing enterprise or is redeemable at the option of the investor … [Emphasis added]

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 27

Since the 2006 convertible note has been issued in the form of debt, it provides the investor with creditor’s rights. Therefore, it represents a creditor relationship with SenoRx and is considered a debt security under FASB 115. Accordingly, the Company determined the host contract should be considered debt-like.

The embedded feature provides the holder a fixed pay-off payable in common stock upon the occurrence of an IPO. Please refer to our response to Staff comment number 25 as to the calculation of the $2 million associated with the discount value of the notes. The Company does not believe the economic characteristics of this feature are clearly and closely related to a debt host contract because this embedded feature does not provide the holder with any creditor rights and the pay-off is merely indexed or dependent on the Company’s ability to complete an IPO within 18 months. The Company also considered the guidance in paragraph 13 of FASB 133, but concluded that such guidance is not relevant because the underlying embedded feature is not an interest rate index.

Accordingly, the Company concluded that the economic characteristics and risks of the embedded feature are not clearly and closely related to the debt host and therefore criterion (a) of paragraph 12 of FASB 133 has been met.

Paragraph 12(b) – Hybrid Remeasured at Fair Value

The hybrid instrument would not require remeasurement at fair value under otherwise applicable generally accepted accounting principles with changes in fair value reported in earnings as they occur. Since this is a debt security, the guidance in FASB Statement No. 150,Accounting for Certain Financial Instruments with Characteristics of both Liabilities and Equity (FASB 150) does not apply to the hybrid. Accordingly, the hybrid would not be remeasured at fair value. Rather, accounting pronouncements related to convertible debt, such as APB Opinion No. 14,Accounting for Convertible Debt and Debt Issued with Stock Purchase Warrants (APB 14), EITF Issue No. 85-29,Convertible Bonds with a “Premium Put” (EITF 85-29), EITF Issue No. 98-5,Accounting for Convertible Securities with Beneficial Conversion Features or Contingently Adjustable Conversion Ratios (EITF 98-5) and EITF Issue No. 00-27,Application of Issue No. 98-5 to Certain Convertible Instruments (EITF 00-27), should be followed. None of these pronouncements require remeasurement at fair value. Therefore, the Company determined that criterion (b) of paragraph 12 of FASB 133 has been met.

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 28

Paragraph 12(c) – Separate instrument with the same terms as the embedded derivative instrument would, pursuant to paragraphs 6–11, be a derivative instrument

The Company evaluated whether the embedded feature has all the characteristics of a derivative described in paragraph 6 of FASB 133. The following table lists the characteristics of a derivative as outlined in paragraph 6 of FASB 133 and the application to the embedded feature:

| Paragraph 6 Characteristics | Application to the Embedded Feature | |

(a) It has (1) one or more underlyings and (2) one or more notional amounts or payment provisions or both. Those terms determine the amount of the settlement or settlements, and, in some cases, whether or not a settlement is required | The embedded feature has an underlying (the occurrence or non-occurrence of an IPO), as well as a payment provision as described in paragraph 7 of FASB 133 (a fixed payment of 20 percent discount, or $2.0 million.) | |

(b) It requires no initial net investment or an initial net investment that is smaller than would be required for other types of contracts that would be expected to have a similar response to changes in market factors | Paragraph 12(c) of FASB 133 states that “the initial net investment for the hybrid instrument shall not be considered to be the initial net investment for the embedded derivative.” Accordingly, there is no initial net investment for the embedded feature. | |

(c) Its terms require or permit net settlement, it can readily be settled net by a means outside the contract, or it provides for delivery of an asset that puts the recipient in a position not substantially different from net settlement. | As discussed in DIG Issue No. A17,Definition of a Derivative: Contracts That Provide for Net Share Settlement (DIG A17), the embedded feature should be considered net settleable irrespective of the fact that currently the shares are not readily convertible into cash. That is, the embedded feature may be settled by issuance of a net number of shares with a fair value of $2.0 million. Therefore, the instrument contains an explicit net settlement feature. | |

Additionally, the embedded feature does not qualify for any of the scope exceptions in paragraphs 10 and 11 of FASB 133. Specifically, the feature does not qualify for the scope exception in paragraph 11(a) of FASB 133, because it is not indexed to the

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 29

Company’s own stock. Rather it provides a fixed pay-off of $2.0 million, payable in a net number of shares. Therefore, a separate instrument with the same terms as the embedded feature would be considered a derivative instrument pursuant to paragraphs 6 though 11 of FASB 133. Accordingly, we have determined the criteria in paragraph 12(c) of FASB 133 have been met.

In summary, all three criteria of paragraph 12 of FASB 133 have been met. Additionally, the Company has determined that the scope exception set forth in paragraph 11(a) of FASB 133 are not met, and therefore the 2006 convertible notes should be accounted for in accordance with FASB 133 as a liability. The Company did not consider the provisions of EITF 00-19 as part of evaluating the conversion feature under FASB 133 because it concluded that the conversion feature is not indexed to its stock, as defined in EITF Issue No. 01-6,The Meaning of “Indexed to a Company’s Own Stock.” The Company does, however, agree with the Staff’s comment that all other instruments that are subject to EITF 00-19 would most likely require liability classification because the Company may be required to issue an unlimited number of shares under the 2006 convertible notes. However, the Company does not have any instruments that are subject to EITF 00-19, with the exception of the conversion features of its preferred stock. This conversion feature does not require bifurcation, as it does not require net settlement under paragraph 6(c) of FASB 133. In the event that the Company issues financial instruments subject to EITF 00-19, the Company will evaluate the impact of the 2006 convertible notes upon the classification of such newly issued instruments.

Once the Company concluded that the conversion feature requires bifurcation under FASB 133, the Company elected to apply the provisions of FASB 155 to the 2006 convertible notes, and recognize the entire instrument, including all potential embedded derivatives, at fair value. Therefore, it does not need to separately evaluate embedded interest rate derivatives for bifurcation under paragraphs 12 and 13 of FASB 133.

The fair value adjustment of $3.8 million disclosed on page F-13 is comprised of the $1.8 million of aggregate interest payable under the terms of the 2006 convertible notes and the $2.0 million discount to the IPO price described above. In the event an IPO is completed, the holders of the 2006 convertible notes will receive common stock with a fair value of $10.0 million, as well as a cash payment of $1.8 million. That is, the holders will receive a payment with a fair value of $11.8 million upon completion of the IPO. Therefore, the fair value of the 2006 convertible notes will be $11.8 million upon completion of the IPO. Accordingly, the Company will be required to recognize the

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 30

difference between the initial fair value of the 2006 convertible notes of $8.0 million and the fair value upon an IPO of $11.8 million as a fair value adjustment through earnings in the period leading up to the IPO. For reporting periods prior to the completion of the IPO, the Company will engage a third-party independent valuation firm to assist management in determining the fair value of the 2006 convertible notes at the end of each reporting period.

We have revised the Registration Statement to clarify the components of the aggregate fair value adjustments and the timing of recording such adjustments.

Part II

Recent Sales of Unregistered Securities – Page II-2

| 56. | Rather than describing unrelated transactions on a group basis, please revise your disclosure in paragraphs 2. and 3. to include all of the information required by Item 701 of Regulation S-K foreach individual transaction that was not part of a series of transactions. |

In response to the Staff’s comment, we have revised the disclosure in paragraph 2 and 3 as requested. Additional disclosure has been added to paragraph 2 regarding the sale of shares of the Series C preferred stock on 12 separate closing dates between June 2003 and August 2005 at a purchase price of $1.96 per share in connection with the Company’s Series C preferred stock financings. We respectfully advise the Staff that we believe each closing to be a part of a larger transaction and that as such, separate disclosure for each closing is not required. Paragraph 3 has been revised to include all of the information required by Item 701 of Regulation S-K for each warrant issuance during the last three years.

Item 17. Undertakings, page II-4

| 57. | Please provide the undertakings contained in Items 512(a)(5)(ii) and 512(a)(6) of Regulation S-K. |

In response to the Staff’s comment, we have revised the undertakings to comply with Regulation S-K.

Don Hunt

U.S. Securities and Exchange Commission

June 26, 2006

Page 31

Signatures

| 58. | Please provide signatures of all the parties required to execute the Registration Statement, including your principal financial officer. See Instruction 1 to the Form S-1 signature page. |

We acknowledge the Staff’s comment, and will provide signatures of all the parties required to execute the Registration Statement.

Exhibits

| 59. | Please file all other required exhibits to allow sufficient time for staff review. |

We acknowledge the Staff’s comment, are filing additional exhibits with this amendment, and will be filing other exhibits upon further amendment of the Registration Statement.

| 60. | We note that you have requested confidential treatment for portions of exhibits 10.11 and 10.13. We will review and provide any comments on your request separately. Comments regarding your request must be resolved before we will accelerate the effectiveness of this Registration Statement. |

We acknowledge the Staff’s comment.

We would very much appreciate the Staff’s prompt review of Amendment No. 1. Should you have any follow-up questions, please call me at (650) 320-4872.

Sincerely, |

WILSON SONSINI GOODRICH & ROSATI |

Professional Corporation |

|

David J. Saul |

SenoRx, Inc. - Attachment 25-A

Analysis of Convertible Note Conversion Features

The following scenario exhibits the various components for the note under an IPO:

A: At IPO the $8,000,000 Aggregate Note will convert into common shares at a 20% discount to the IPO price.

B: In addition, the Company will make a payment to the note holder an amount equal to 22.5% of the face value of the notes 60 days after the completion of the IPO.

SenoRx, Inc. - Attachment 49-A

Deferred Revenue Rollforward

Century Medical, Gamma Finder, EnCor & SenoCor

| December 31, | |||||||||||||||||||||||

| 2001 | 2002 | 2003 | 2004 | 2005 | Mar-06 | ||||||||||||||||||

Total | |||||||||||||||||||||||

Century Medical | $ | — | $ | 468,839 | $ | 958,354 | $ | 954,411 | $ | 953,014 | $ | 953,014 | |||||||||||

Gamma Finders | — | — | 9,500 | 54,600 | 54,108 | 61,866 | |||||||||||||||||

EnCor | — | — | — | 13,200 | 53,025 | 87,436 | |||||||||||||||||

SenoCor | — | — | — | 2,500 | 5,000 | 3,770 | |||||||||||||||||

Grand Total | $ | — | $ | 468,839 | $ | 967,854 | $ | 1,024,711 | $ | 1,065,147 | $ | 1,106,086 | |||||||||||

Current | |||||||||||||||||||||||

Century Medical | $ | — | $ | — | $ | — | $ | — | $ | 175,000 | $ | 175,000 | (B) | ||||||||||

Gamma Finders | — | — | 9,500 | 54,600 | 54,108 | 61,866 | (A) | ||||||||||||||||

EnCor | — | — | — | 13,200 | 53,025 | 87,436 | (A) | ||||||||||||||||

SenoCor | — | — | — | 2,500 | 5,000 | 3,770 | (A) | ||||||||||||||||

Total Current | $ | — | $ | — | $ | 9,500 | $ | 70,300 | $ | 287,133 | $ | 328,072 | |||||||||||

Non-Current | |||||||||||||||||||||||

Century Medical | $ | — | $ | 468,839 | $ | 958,354 | $ | 954,411 | $ | 778,014 | $ | 778,014 | (B) | ||||||||||

Gamma Finders | — | — | — | — | — | — | |||||||||||||||||

EnCor | — | — | — | — | — | — | |||||||||||||||||

SenoCor | — | — | — | — | — | — | |||||||||||||||||

Total - Non-Current | $ | — | $ | 468,839 | $ | 958,354 | $ | 954,411 | $ | 778,014 | $ | 778,014 | |||||||||||

Century Activity Rollforward | |||||||||||||||||||||||

Beginning Balance | $ | — | $ | — | $ | 468,839 | $ | 958,354 | $ | 954,411 | $ | 953,014 | |||||||||||

Prepayments | — | 500,000 | 500,000 | — | — | — | |||||||||||||||||

Purchases Offset | — | (31,161 | ) | (10,485 | ) | (3,943 | ) | (1,397 | ) | — | |||||||||||||

Ending Deferred Revenue | $ | — | $ | 468,839 | $ | 958,354 | $ | 954,411 | $ | 953,014 | $ | 953,014 | |||||||||||

| (A) | Represents payments for extended warranties and are amortized to income as earned. |

| (B) | Allocation of $175,000 as current deferred revenue is management’s estimate of the amount that Century Medical will order and that the Company will ship within the next twelve months. |

SenoRx, Inc. - Attachment 52-A

Option Grants - June 2005 thru May 2006

| Date of Grant | Name | Option Type | Shares Granted | Exercise Price Per Share | “Fair Value” | |||||||

| 6/30/2005 | Employee | ISO | 1,428 | $ | 2.63 | $ | 4.24 | |||||

| 6/30/2005 | Employee | ISO | 1,428 | $ | 2.63 | $ | 4.24 | |||||

| 6/30/2005 | Employee | ISO | 1,428 | $ | 2.63 | $ | 4.24 | |||||

| 6/30/2005 | Employee | ISO | 1,428 | $ | 2.63 | $ | 4.24 | |||||

| 6/30/2005 | Employee | ISO | 285 | $ | 2.63 | $ | 4.24 | |||||

| 6/30/2005 | Employee | ISO | 4,285 | $ | 2.63 | $ | 4.24 | |||||

| 6/30/2005 | Employee | ISO | 1,428 | $ | 2.63 | $ | 4.24 | |||||

| 6/30/2005 | Employee | ISO | 285 | $ | 2.63 | $ | 4.24 | |||||

| 6/30/2005 | Employee | ISO | 285 | $ | 2.63 | $ | 4.24 | |||||

| 6/30/2005 | Employee | ISO | 1,428 | $ | 2.63 | $ | 4.24 | |||||

| 6/30/2005 | Employee | ISO | 1,428 | $ | 2.63 | $ | 4.24 | |||||

| 6/30/2005 | Employee | ISO | 1,428 | $ | 2.63 | $ | 4.24 | |||||

| 6/30/2005 | Employee | ISO | 2,857 | $ | 2.63 | $ | 4.24 | |||||

| 6/30/2005 | Employee | ISO | 285 | $ | 2.63 | $ | 4.24 | |||||

| 6/30/2005 | Employee | ISO | 285 | $ | 2.63 | $ | 4.24 | |||||

| Subtotal | 19,991 | |||||||||||

| 9/21/2005 | Employee | ISO | 1,142 | $ | 2.63 | $ | 4.83 | |||||

| 9/21/2005 | Employee | ISO | 1,428 | $ | 2.63 | $ | 4.83 | |||||

| 9/21/2005 | Employee | ISO | 2,857 | $ | 2.63 | $ | 4.83 | |||||

| 9/21/2005 | Employee | ISO | 2,857 | $ | 2.63 | $ | 4.83 | |||||

| 9/21/2005 | Employee | ISO | 2,857 | $ | 2.63 | $ | 4.83 | |||||

| 9/21/2005 | Employee | ISO | 1,428 | $ | 2.63 | $ | 4.83 | |||||

| 9/21/2005 | Employee | ISO | 714 | $ | 2.63 | $ | 4.83 | |||||

| 9/21/2005 | Consultant | NSO | 4,285 | $ | 2.63 | $ | 4.83 | |||||

| 9/21/2005 | Employee | ISO | 71 | $ | 2.63 | $ | 4.83 | |||||

| 9/21/2005 | Employee | ISO | 2,857 | $ | 2.63 | $ | 4.83 | |||||

| 9/21/2005 | Employee | ISO | 71 | $ | 2.63 | $ | 4.83 | |||||

| 9/21/2005 | Employee | ISO | 285 | $ | 2.63 | $ | 4.83 | |||||

| 9/21/2005 | Employee | ISO | 285 | $ | 2.63 | $ | 4.83 | |||||

| 9/21/2005 | Employee | ISO | 2,857 | $ | 2.63 | $ | 4.83 | |||||

| 9/21/2005 | Employee | ISO | 1,428 | $ | 2.63 | $ | 4.83 | |||||

| 9/21/2005 | Employee | ISO | 71 | $ | 2.63 | $ | 4.83 | |||||

| Subtotal | 25,493 | |||||||||||

| 12/16/2005 | Employee | ISO | 428 | $ | 4.03 | $ | 3.71 | |||||

| 12/16/2005 | Employee | ISO | 1,428 | $ | 4.03 | $ | 3.71 | |||||

| 12/16/2005 | Employee | ISO | 14,285 | $ | 4.03 | $ | 3.71 | |||||

| 12/16/2005 | Employee | ISO | 428 | $ | 4.03 | $ | 3.71 | |||||

| 12/16/2005 | Employee | ISO | 2,857 | $ | 4.03 | $ | 3.71 | |||||

| 12/16/2005 | Employee | ISO | 428 | $ | 4.03 | $ | 3.71 | |||||

| 12/16/2005 | Employee | ISO | 1,714 | $ | 4.03 | $ | 3.71 | |||||

| 12/16/2005 | Employee | ISO | 10,000 | $ | 4.03 | $ | 3.71 | |||||

| 12/16/2005 | Employee | ISO | 1,428 | $ | 4.03 | $ | 3.71 | |||||

| Subtotal | 32,996 | |||||||||||

| 2/17/2006 | Employee | ISO | 2,142 | $ | 3.71 | $ | 7.95 | |||||

| 2/17/2006 | Employee | ISO | 4,285 | $ | 3.71 | $ | 7.95 | |||||

| 2/17/2006 | Employee | ISO | 5,714 | $ | 3.71 | $ | 7.95 | |||||

| 2/17/2006 | Employee | ISO | 1,000 | $ | 3.71 | $ | 7.95 | |||||

| 2/17/2006 | Employee | ISO | 10,000 | $ | 3.71 | $ | 7.95 | |||||

| 2/17/2006 | Employee | ISO | 42,857 | $ | 3.71 | $ | 7.95 | |||||

| 2/17/2006 | Employee | ISO | 1,428 | $ | 3.71 | $ | 7.95 | |||||

| 2/17/2006 | Employee | ISO | 2,857 | $ | 3.71 | $ | 7.95 | |||||

| 2/17/2006 | Employee | ISO | 10,000 | $ | 3.71 | $ | 7.95 | |||||

SenoRx, Inc. - Attachment 52-A

Option Grants - June 2005 thru May 2006

| Date of Grant | Name | Option Type | Shares Granted | Exercise Price Per Share | “Fair Value” | |||||||

| 2/17/2006 | Employee | ISO | 2,142 | $ | 3.71 | $ | 7.95 | |||||

| 2/17/2006 | Employee | ISO | 10,000 | $ | 3.71 | $ | 7.95 | |||||

| 2/17/2006 | Employee | ISO | 2,142 | $ | 3.71 | $ | 7.95 | |||||

| 2/17/2006 | Employee | ISO | 2,142 | $ | 3.71 | $ | 7.95 | |||||

| Subtotal | 96,709 | |||||||||||

| 5/9/2006 | Employee | ISO | 1,428 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Employee | ISO | 2,857 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Employee | ISO | 428 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Employee | ISO | 5,714 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Employee | ISO | 2,142 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Employee | ISO | 2,857 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Employee | ISO | 2,142 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Employee | ISO | 1,428 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Employee | ISO | 2,142 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Employee | ISO | 2,142 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Employee | ISO | 2,142 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Employee | ISO | 2,142 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Consultant | NSO | 2,857 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Consultant | NSO | 714 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Employee | ISO | 285 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Employee | ISO | 428 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Employee | ISO | 1,428 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Employee | ISO | 714 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Employee | ISO | 714 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Employee | ISO | 71 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Employee | ISO | 2,857 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Employee | ISO | 2,142 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Employee | ISO | 1,428 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Consultant | NSO | 2,142 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Employee | ISO | 3,571 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Employee | ISO | 714 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Employee | ISO | 11,428 | $ | 7.95 | $ | 12.25 | |||||

| 5/9/2006 | Employee | ISO | 428 | $ | 7.95 | $ | 12.25 | |||||

| Subtotal | 59,485 | |||||||||||

| Total | 234,674 | |||||||||||