Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 0-32259

ALIGN TECHNOLOGY, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 94-3267295 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

881 Martin Avenue

Santa Clara, California 95050

(Address of principal executive offices)

(408) 470-1000

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | x | Accelerated filer | ¨ | |||||

| Non-accelerated filer | ¨ | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | ||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The number of shares outstanding of the registrant’s Common Stock, $0.0001 par value, as of April 30, 2010 was 75,677,254.

Table of Contents

| PART I | FINANCIAL INFORMATION | 3 | ||

| ITEM 1. | FINANCIAL STATEMENTS (UNAUDITED): | 3 | ||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OFOPERATIONS | 15 | ||

| ITEM 3. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 22 | ||

| ITEM 4. | CONTROLS AND PROCEDURES | 22 | ||

| PART II | OTHER INFORMATION | 23 | ||

| ITEM 1. | LEGAL PROCEEDINGS | 23 | ||

| ITEM 1A. | RISK FACTORS | 24 | ||

| ITEM 2. | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | 33 | ||

| ITEM 3. | DEFAULTS UPON SENIOR SECURITIES | 33 | ||

| ITEM 4. | REMOVED AND RESERVED | 33 | ||

| ITEM 5. | OTHER INFORMATION | 33 | ||

| ITEM 6. | EXHIBITS | 33 | ||

| 34 | ||||

Invisalign, Align, ClinCheck, Invisalign Assist, Invisalign Teen and Vivera, amongst others, are trademarks belonging to Align Technology, Inc. and are pending or registered in the United States and other countries.

2

Table of Contents

ALIGN TECHNOLOGY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(unaudited)

| Three Months Ended March 31, | |||||||

| 2010 | 2009 | ||||||

Net revenues: | |||||||

Invisalign | $ | 85,422 | $ | 66,270 | |||

Non-case | 4,668 | 3,862 | |||||

Total net revenues | 90,090 | 70,132 | |||||

Cost of revenues | |||||||

Invisalign | 18,607 | 15,391 | |||||

Non-case | 1,773 | 2,034 | |||||

Total cost of revenues | 20,380 | 17,425 | |||||

Gross profit | 69,710 | 52,707 | |||||

Operating expenses: | |||||||

Sales and marketing | 27,946 | 27,854 | |||||

General and administrative | 14,951 | 13,468 | |||||

Research and development | 6,116 | 5,191 | |||||

Restructurings | — | 910 | |||||

Total operating expenses | 49,013 | 47,423 | |||||

Profit from operations | 20,697 | 5,284 | |||||

Interest and other income (expense), net | (553 | ) | 148 | ||||

Net profit before provision for income taxes | 20,144 | 5,432 | |||||

Provision for income taxes | 5,214 | 2,796 | |||||

Net profit | $ | 14,930 | $ | 2,636 | |||

Net profit per share: | |||||||

Basic | $ | 0.20 | $ | 0.04 | |||

Diluted | $ | 0.19 | $ | 0.04 | |||

Shares used in computing net profit per share: | |||||||

Basic | 75,166 | 65,983 | |||||

Diluted | 77,597 | 66,447 | |||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

3

Table of Contents

ALIGN TECHNOLOGY, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except per share data)

(unaudited)

| March 31, 2010 | December 31, 2009 | |||||||

ASSETS | ||||||||

Current assets: | ||||||||

Cash and cash equivalents | $ | 190,407 | $ | 166,487 | ||||

Marketable securities, short-term | 14,991 | 19,978 | ||||||

Accounts receivable, net of allowance for doubtful accounts of $589 and $1,033, respectively | 58,801 | 54,537 | ||||||

Inventories | 2,356 | 2,046 | ||||||

Prepaid expenses and other current assets | 18,055 | 18,251 | ||||||

Total current assets | 284,610 | 261,299 | ||||||

Property and equipment, net | 25,418 | 24,971 | ||||||

Goodwill | 478 | 478 | ||||||

Intangible assets, net | 4,288 | 4,988 | ||||||

Deferred tax asset | 56,560 | 61,535 | ||||||

Other assets | 2,198 | 1,969 | ||||||

Total assets | $ | 373,552 | $ | 355,240 | ||||

LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

Current liabilities: | ||||||||

Accounts payable | $ | 4,513 | $ | 6,122 | ||||

Accrued liabilities | 34,690 | 42,822 | ||||||

Deferred revenues | 37,047 | 32,299 | ||||||

Total current liabilities | 76,250 | 81,243 | ||||||

Other long-term liabilities | 946 | 961 | ||||||

Total liabilities | 77,196 | 82,204 | ||||||

Commitments and contingencies (Notes 5 and 8) | ||||||||

Stockholders’ equity: | ||||||||

Preferred stock, $0.0001 par value (5,000 shares authorized; none issued) | — | — | ||||||

Common stock, $0.0001 par value (200,000 shares authorized; 75,608 and 74,568 shares issued, respectively; 75,608 and 74,568 shares outstanding, respectively) | 8 | 7 | ||||||

Additional paid-in capital | 533,808 | 525,073 | ||||||

Accumulated other comprehensive income, net | 109 | 455 | ||||||

Accumulated deficit | (237,569 | ) | (252,499 | ) | ||||

Total stockholders’ equity | 296,356 | 273,036 | ||||||

Total liabilities and stockholders’ equity | $ | 373,552 | $ | 355,240 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

4

Table of Contents

ALIGN TECHNOLOGY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| Three Months Ended, March 31, | ||||||||

| 2010 | 2009 | |||||||

Cash Flows from Operating Activities: | ||||||||

Net profit | $ | 14,930 | $ | 2,636 | ||||

Adjustments to reconcile net profit to net cash provided by operating activities: | ||||||||

Deferred income taxes | 4,975 | 563 | ||||||

Depreciation and amortization | 2,938 | 2,443 | ||||||

Amortization of intangibles | 700 | 700 | ||||||

Stock-based compensation | 3,473 | 3,715 | ||||||

Amortization of prepaid royalties | 827 | — | ||||||

Provision for doubtful accounts | (200 | ) | 201 | |||||

Loss on retirement and disposal of fixed assets | 6 | 6 | ||||||

Changes in assets and liabilities: | ||||||||

Accounts receivable | (4,857 | ) | (81 | ) | ||||

Inventories | (319 | ) | (117 | ) | ||||

Prepaid expenses and other current assets | (738 | ) | (1,267 | ) | ||||

Accounts payable | (271 | ) | 738 | |||||

Accrued and other long-term liabilities | (7,927 | ) | (2,038 | ) | ||||

Deferred revenues | 5,108 | 3,104 | ||||||

Net cash provided by operating activities | 18,645 | 10,603 | ||||||

Cash Flows from Investing Activities: | ||||||||

Purchase of property and equipment | (4,530 | ) | (1,886 | ) | ||||

Purchases of marketable securities | — | (13,977 | ) | |||||

Maturities of marketable securities | 4,988 | 12,293 | ||||||

Other assets | (246 | ) | 36 | |||||

Net cash provided by (used in) investing activities | 212 | (3,534 | ) | |||||

Cash Flows from Financing Activities: | ||||||||

Proceeds from issuance of common stock | 6,016 | 3,252 | ||||||

Payments on short-term obligations | — | (136 | ) | |||||

Employees’ taxes paid upon the vesting of restricted stock units | (755 | ) | (107 | ) | ||||

Net cash provided by financing activities | 5,261 | 3,009 | ||||||

Effect of foreign exchange rate changes on cash and cash equivalents | (198 | ) | (127 | ) | ||||

Net increase in cash and cash equivalents | 23,920 | 9,951 | ||||||

Cash and cash equivalents at beginning of period | 166,487 | 87,100 | ||||||

Cash and cash equivalents at end of period | $ | 190,407 | $ | 97,051 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

5

Table of Contents

ALIGN TECHNOLOGY, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

Note 1. Summary of Significant Accounting Policies

Basis of presentation

The accompanying unaudited Condensed Consolidated Financial Statements have been prepared by Align Technology, Inc. (“we” or “our”) in accordance with the rules and regulations of the Securities and Exchange Commission (SEC) and contain all adjustments, including normal recurring adjustments, necessary to present fairly our financial position as of March 31, 2010, our results of operations for the three months ended March 31, 2010 and 2009, and our cash flows for the three months ended March 31, 2010 and 2009. The Condensed Consolidated Balance Sheet as of December 31, 2009 was derived from the December 31, 2009 audited financial statements. Revenues and cost of revenues in prior period amounts have been reclassified to conform with the current period presentation. These reclassifications had no impact on previously reported gross profit or financial position.

The results of operations for the three months ended March 31, 2010 are not necessarily indicative of the results that may be expected for the year ending December 31, 2010 or any other future period, and we make no representations related thereto. The information included in this Quarterly Report on Form 10-Q should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Quantitative and Qualitative Disclosures About Market Risk” and the Consolidated Financial Statements and notes thereto included in Items 7, 7A and 8, respectively, of the our Annual Report on Form 10-K for the year ended December 31, 2009.

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the amounts reported in our Condensed Consolidated Financial Statements and accompanying notes. Actual results could differ materially from those estimates.

Recent Accounting Pronouncements

In September 2009, the Financial Accounting Standards Board (FASB) amended the Accounting Standards Codification (ASC) as summarized in Accounting Standards Update (ASU) 2009-13, “Revenue Recognition (ASC 605): Multiple-Deliverable Revenue Arrangements.” Guidance in ASC 605-25 on revenue arrangements with multiple deliverables has been amended to require an entity to allocate revenue to deliverables in an arrangement using its best estimate of selling prices if the vendor does not have vendor-specific objective evidence or third-party evidence of selling prices, and to eliminate the use of the residual method and require the entity to allocate revenue using the relative selling price method. The new guidance also requires expanded quantitative and qualitative disclosures about revenue from arrangements with multiple deliverables. The update is effective for fiscal years beginning on or after June 15, 2010, with early adoption permitted. Adoption may either be on a prospective basis for new revenue arrangements entered into after adoption of the update, or by retrospective application. We are assessing the potential impact of the update on our consolidated financial statements and are planning to adopt the update effective January 1, 2011.

In January 2010, the FASB issued ASU 2010-06, “Fair Value Measurements and Disclosures (ASC 820): Improving Disclosures about Fair Value Measurements.” This update will require (1) an entity to disclose separately the amounts of significant transfers in and out of Levels 1 and 2 fair value measurements and to describe the reasons for the transfers; and (2) information about purchases, sales, issuances and settlements to be presented separately (i.e. present the activity on a gross basis rather than net) in the reconciliation for fair value measurements using significant unobservable inputs (Level 3 inputs). This guidance clarifies existing disclosure requirements for the level of disaggregation used for classes of assets and liabilities measured at fair value and requires disclosures about the valuation techniques and inputs used to measure fair value for both recurring and nonrecurring fair value measurements using Level 2 and Level 3 inputs. The new disclosures and clarifications of existing disclosure are effective for fiscal years beginning after December 15, 2009, except for the disclosure requirements for related to the purchases, sales, issuances and settlements in the rollforward activity of Level 3 fair value measurements. Those disclosure requirements are effective for fiscal years ending after December 31, 2010. We are still assessing the impact of this guidance and do not believe the adoption of this guidance will have a material impact to our consolidated financial statements.

On February 24, 2010, FASB issued ASU 2010-09, “Subsequent Events (ASC 855): Amendments to Certain Recognition and Disclosure Requirements.” The amendments in the ASU remove the requirement for a Securities and Exchange Commission (SEC) filer to disclose a date through which subsequent events have been evaluated in both issued and revised financial statements. Revised financial statements include financial statements revised as a result of either correction of an error or retrospective application of U.S. GAAP. The FASB also clarified that if the financial statements have been revised, then an entity that is not an SEC filer

6

Table of Contents

ALIGN TECHNOLOGY, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(unaudited)

should disclose both the date that the financial statements were issued or available to be issued and the date the revised financial statements were issued or available to be issued. We have adopted this guidance for the period ended March 31, 2010.

On March 5, 2010, FASB issued ASU 2010-11, “Derivatives and Hedging (ASC 815): Scope Exception Related to Embedded Credit Derivatives.” The FASB believes this ASU clarifies the type of embedded credit derivative that is exempt from embedded derivative bifurcation requirements. Specifically, only one form of embedded credit derivative qualifies for the exemption—one that is related only to the subordination of one financial instrument to another. As a result, entities that have contracts containing an embedded credit derivative feature in a form other than such subordination may need to separately account for the embedded credit derivative feature. The amendments in the ASU are effective for each reporting entity at the beginning of its first fiscal quarter beginning after June 15, 2010. We are still assessing the impact of this guidance and do not believe the adoption of this guidance will have a material impact to our consolidated financial statements.

Other recent accounting pronouncements issued by the FASB (including its Emerging Issues Task Force), the American Institute of Certified Public Accountants and the SEC did not or are not believed by management to have a material impact on our present or future consolidated financial statements.

Note 2. Marketable Securities and Fair Value Measurements

Our short-term marketable securities as of March 31, 2010 and December 31, 2009 are as follows (in thousands):

March 31, 2010 | Amortized Costs | Gross Unrealized Gains | Fair Value | |||||||||

U.S. government notes and bonds | $ | 14,984 | $ | 7 | $ | 14,991 | ||||||

December 31, 2009 | Amortized Costs | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | ||||||||

U.S. government notes and bonds | $ | 18,972 | $ | 6 | $ | — | $ | 18,978 | ||||

Corporate bonds | 1,000 | — | — | 1,000 | ||||||||

Total | $ | 19,972 | $ | 6 | $ | — | $ | 19,978 | ||||

As of March 31, 2010, all short-term investments have maturity dates of less than one year. For the three months ended March 31, 2010 and 2009, no significant gains or losses were realized on the sale of marketable securities.

Fair Value Measurements

We measure the fair value of our cash equivalents and marketable securities as the price that would be received from selling an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. We use the GAAP fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. This hierarchy requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The three levels of inputs that may be used to measure fair value:

Level 1—Quoted (unadjusted) prices in active markets for identical assets or liabilities.

Our Level 1 assets consist of U.S. government debt securities and money market funds. We did not hold any Level 1 liabilities as of March 31, 2010.

Level 2—Observable inputs other than quoted prices included in Level 1, such as quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the asset or liability.

We did not hold any Level 2 assets or liabilities as of March 31, 2010.

Level 3—Unobservable inputs to the valuation methodology that are supported by little or no market activity and that are significant to the measurement of the fair value of the assets or liabilities. Level 3 assets and liabilities include those whose fair value measurements are determined using pricing models, discounted cash flow methodologies or similar valuation techniques, as well as

7

Table of Contents

ALIGN TECHNOLOGY, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(unaudited)

significant management judgment or estimation.

We did not hold any Level 3 assets or liabilities during the quarter ended March 31, 2010.

The following table summarizes our financial assets measured at fair value on a recurring basis as of March 31, 2010 (in thousands):

Description | Balance as of March 31, 2010 | Quoted Prices in Active Markets for Identical Assets (Level 1) | ||||

Cash equivalents: | ||||||

Money market funds | $ | 122,085 | $ | 122,085 | ||

Short-term investments: | ||||||

U.S. government debt securities | 14,991 | 14,991 | ||||

| $ | 137,076 | $ | 137,076 | |||

Note 3. Balance Sheet Components

Inventories are comprised of (in thousands):

| March 31, 2010 | December 31, 2009 | |||||

Raw materials | $ | 1,161 | $ | 1,079 | ||

Work in process | 977 | 746 | ||||

Finished goods | 218 | 221 | ||||

| $ | 2,356 | $ | 2,046 | |||

Work in process includes costs to produce the Invisalign product. Finished goods primarily represent ancillary products that support the Invisalign system.

Accrued liabilities consist of the following (in thousands):

| March 31, 2010 | December 31, 2009 | |||||

Accrued payroll and benefits | $ | 16,750 | $ | 25,847 | ||

Accrued income taxes | 2,866 | 2,920 | ||||

Accrued sales rebate | 2,895 | 2,610 | ||||

Accrued sales tax and value added tax | 2,376 | 2,392 | ||||

Accrued warranty | 2,463 | 2,376 | ||||

Accrued sales and marketing expenses | 1,978 | 1,954 | ||||

Other | 5,362 | 4,723 | ||||

| $ | 34,690 | $ | 42,822 | |||

Note 4. Intangible Assets

The intangible assets represent non-compete agreements received in conjunction with the October 2006 OrthoClear Agreement at gross value of $14 million. These assets are amortized on a straight-line basis over the expected useful life of five years. As of March 31, 2010 and December 31, 2009, the net carrying value of these non-compete agreements was $4.3 million (net of $9.7 million of accumulated amortization) and $5.0 million (net of $9.0 million of accumulated amortization), respectively.

We perform an impairment test whenever events or changes in circumstances indicate that the carrying value of such assets may not be recoverable. Examples of such events or circumstances include significant underperformance relative to historical or projected future operating results, significant changes in the manner of use of acquired assets or the strategy for its business, significant negative industry or economic trends, and/or a significant decline in our stock price for a sustained period. Impairments

8

Table of Contents

ALIGN TECHNOLOGY, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(unaudited)

are recognized based on the difference between the fair value of the asset and its carrying value, and fair value is generally measured based on discounted cash flow analyses. There were no impairments of intangible assets during the periods presented.

The total estimated annual future amortization expense for these intangible assets as of March 31, 2010 is as follows (in thousands):

Fiscal Year | |||

2010 (for the remaining 9 months) | $ | 2,100 | |

2011 | 2,188 | ||

Total | $ | 4,288 | |

Note 5. Legal Proceedings

Consumer Class Action

On May 18, 2007, Debra A. Weber filed a consumer class action lawsuit against us, OrthoClear, Inc. and OrthoClear Holdings, Inc. (d/b/a OrthoClear, Inc.) in Syracuse, New York, U.S. District Court. The complaint alleges two causes of action against the OrthoClear defendants and one cause of action against us for breach of contract. The cause of action against us titled “Breach of Third Party Benefit Contract” references our agreement to make Invisalign treatment available to OrthoClear patients, alleging that we failed “to provide the promised treatment to Plaintiff or any of the class members”.

On July 3, 2007, we filed an answer to the complaint and asserted 17 affirmative defenses. On July 20, 2007, we filed a motion for summary judgment on the Third Cause of Action (the only cause of action alleged against us). On August 24, 2007, Weber filed a motion for class certification. On October 1, 2007, we filed an opposition to the motion for class certification and it is currently awaiting rulings from the Court. OrthoClear has filed a motion to dismiss. The initial case management conference and all discovery has been stayed pending the Court’s decision on the motion for class certification, OrthoClear’s motion to dismiss and our motion for summary judgment. We believe the lawsuit to be without merit and we intend to vigorously defend ourselves. Accordingly, we believe there is not sufficient evidence to conclude that a reasonable possibility exists that a loss had been incurred as of March 31, 2010.

Securities Litigation

In August 2009, Plaintiff Charles Wozniak filed a lawsuit against us and our Chief Executive Officer and President, Thomas M. Prescott (“Mr. Prescott”), in District Court for the Northern District of California on behalf of a claimed class consisting of all persons or entities who purchased our common stock between January 30, 2007 and October 24, 2007. The complaint alleges that we and Mr. Prescott violated Section 10(b) of the Securities Exchange Act of 1934 and that Mr. Prescott violated Section 20(a) of the Securities Exchange Act of 1934. Specifically, the complaint alleges that during the class period, we failed to disclose that we had shifted the focus of our sales force to clearing backlog, causing a significant decrease in the number of new case starts. On November 13, 2009, the Court appointed Plumbers and Pipefitters National Pension Fund as lead plaintiff (“Lead Plaintiff”). Lead Plaintiff filed an amended complaint on January 29, 2010. The amended complaint alleges that we and Mr. Prescott issued a number of purportedly false and misleading statements throughout the class period concerning the Patients First program, our production capacity, a purported backlog, and the focus of our sales force. On March 26, 2010, we and Mr. Prescott filed a motion to dismiss the amended complaint. The motion is currently scheduled to be heard by the Court on July 9, 2010. We believe the lawsuit to be without merit and intend to vigorously defend ourselves. Accordingly, we believe there is not sufficient evidence to conclude that a reasonable possibility exists that a loss had been incurred as of March 31, 2010.

Note 6. Ormco Litigation Settlement

On August 16, 2009, we entered into three agreements with Ormco Corporation (“Ormco”), an affiliate of Danaher Corporation (“Danaher”): a Settlement Agreement, a Stock Purchase Agreement, and a Joint Development, Marketing and Sales agreement (“Collaboration Agreement”). The Settlement Agreement ended all pending litigations between the parties, and we agreed to (1) make a cash payment of $13.2 million upon the execution of the agreement and (2) issue a total of 7.6 million non-assessable shares of common stock pursuant to the Stock Purchase Agreement. Under the Collaboration Agreement, we and Ormco agreed to jointly develop and market an orthodontic product for the most complex orthodontic cases that combine the Invisalign system with Ormco’s orthodontic brackets and arch wire systems over the next seven years. Because we entered into several agreements with Ormco on the same date, the guidance related to multiple element arrangements was considered in determining the allocation of the total settlement amount to the various elements of this arrangement.

9

Table of Contents

ALIGN TECHNOLOGY, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(unaudited)

In accordance with the Collaboration Agreement, each party will retain ownership of its pre-existing intellectual property, and each party will be granted intellectual property licenses in their respective field for jointly-developed combination products. The Collaboration Agreement, among other things, ensures mutual and equal participation, and equal share of the risks, costs, and benefits associated with developing the combination product. With the assistance of a third party valuation firm, we concluded there was no value on the execution date of this agreement, as we have not contributed any assets or tendered any consideration. In addition, as part of its long-term strategic plan, we had the intention of collaborating with other orthodontic industry leaders to offer Invisalign in combination with traditional wires and brackets therapy, and we believe that the terms of such an agreement would have been similar to those we reached with Ormco.

Upon execution of the Settlement Agreement, 5.6 million shares were issued to Danaher and the remaining 2.0 million shares were issued upon the expiration of the waiting period under the provisions of the Hart-Scott-Rodino Antitrust Improvements Act, which occurred on September 21, 2009. In addition to other provisions of the Settlement Agreement, these shares may not be resold except pursuant to an effective registration statement under the Securities Act or an available exemption from registration. We are not obligated to affect any such registration prior to the one year anniversary of this agreement. The fair value of the shares should reflect the value that market participants would demand because of the risk relating to the inability to access a public market for these securities for the specified period. The fair value of the unregistered shares was determined as of the market closing price on the dates the shares were issued less a 25% non-marketability discount, for a total value of $76.7 million, including the cash payment.

We have concluded that 25% is an appropriate discount based primarily on an analysis utilizing the Black-Scholes model to value a hypothetical put option to approximate the cost of hedging the restricted stock over the expected period of non-marketability. This approach calculates the amount required to buy the right to sell the presently restricted stock at the then-current market price on the date the holder can count on the shares becoming saleable on the public exchange. The assumptions input into the Black-Scholes option pricing model were based on the stock price on the dates of the share issuances, an expected term of 1 year, expected volatility of 70%, risk-free interest rate of 4.38% to 4.90% and no expected dividends.

We corroborated the conclusion indicated by the Black-Scholes model by assessing that the discount was generally consistent with the ranges noted from published restricted stock studies and comparable to discounts on restricted stock transactions completed by other companies operating in similar industries.

In accordance with the Settlement Agreement, Ormco released us from any and all past and future claims of infringement for the period September 9, 2003 through the expiration of the patent on January 19, 2010 (“infringement period”). In order to determine how to allocate the settlement value between past infringement and the future use of the patent, we considered both past and estimated future case shipment volumes during the infringement period, and allocated the total settlement value across all case shipments. We attributed $69.7 million to past infringement claims, based on case shipments from September 9, 2003 through August 16, 2009. This was recorded as litigation settlement costs and included in operating expenses during the period ended September 30, 2009. Additional royalty costs based on case shipments between August 17, 2009 through January 19, 2010 totaling $7.0 million were recorded as prepaid royalties. We amortized $6.2 million of the prepaid royalties to cost of sales for the year ended December 31, 2009 and the remaining $0.8 million was amortized during first quarter of 2010.

Note 7. Credit Facilities

On December 5, 2008, we renegotiated and amended our existing credit facility with Comerica Bank. Under this revolving line of credit, we have $25.0 million of available borrowings with a maturity date of December 31, 2010. This credit facility requires a quick ratio covenant and also requires us to maintain a minimum unrestricted cash balance of $10.0 million. The interest rate on borrowings will range from Libor plus 1.5% to 2.0% depending upon the amount of unrestricted cash we maintain at Comerica Bank above the $10.0 million minimum.

As of March 31, 2010, we had no outstanding borrowings under this credit facility and are in compliance with the financial covenants.

Note 8. Commitments and Contingencies

Leases

As of March 31, 2010, minimum future lease payments for non-cancelable leases are as follow (in thousands):

10

Table of Contents

ALIGN TECHNOLOGY, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(unaudited)

Fiscal Year | |||

2010 (for the remaining 9 months) | $ | 3,349 | |

2011 | 3,960 | ||

2012 | 3,374 | ||

2013 | 2,752 | ||

2014 and thereafter | 7,101 | ||

Total | $ | 20,536 | |

On January 26, 2010, we entered into an agreement to lease new corporate headquarters of approximately 129,024 square feet in San Jose, California. The lease agreement commences on the earlier of August 1, 2010 or the date we first commence conducting business in the premises, which is expected to be on or about June 28, 2010, and will continue for an initial term of seven years and two months. Our agreement for the current corporate headquarters in Santa Clara, California, expires on June 30, 2010.

Warranty

We warrant our products against material defects until the Invisalign case is completed. We accrue for warranty costs in cost of revenues upon shipment of products. The amount of accrued estimated warranty costs is primarily based on historical experience as to product failures as well as current information on replacement costs. We regularly review the accrued balances and update these balances based on historical warranty trends. Actual warranty costs incurred have not materially differed from those accrued. However, future actual warranty costs could differ from the estimated amounts.

The following table reflects the change in our warranty accrual during the three months ended March 31, 2010 and 2009, respectively (in thousands):

| Three Months Ended March 31, | ||||||||

| 2010 | 2009 | |||||||

Balance at beginning of period | $ | 2,376 | $ | 2,031 | ||||

Charged to cost of revenues | 788 | 623 | ||||||

Actual warranty expenses | (701 | ) | (659 | ) | ||||

Balance at end of period | $ | 2,463 | $ | 1,995 | ||||

Note 9. Stock-based Compensation

Summary of stock-based compensation expense

The following table summarizes stock-based compensation expense related to all of our stock-based options and employee stock purchases for the three months ended March 31, 2010 and 2009 (in thousands):

| Three Months Ended March 31, | ||||||

| 2010 | 2009 | |||||

Cost of revenues | $ | 435 | $ | 386 | ||

Sales and marketing | 847 | 951 | ||||

General and administrative | 1,813 | 1,954 | ||||

Research and development | 378 | 424 | ||||

Total stock-based compensation expense | $ | 3,473 | $ | 3,715 | ||

The fair value of stock options granted was estimated at the grant date using the Black-Scholes option pricing model with the following weighted average assumptions:

11

Table of Contents

ALIGN TECHNOLOGY, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(unaudited)

| Three Months Ended March 31, | ||||||||

| 2010 | 2009 | |||||||

Stock Options: | ||||||||

Expected term (in years) | 4.4 | 4.4 | ||||||

Expected volatility | 63.3 | % | 61.4 | % | ||||

Risk-free interest rate | 2.0 | % | 1.6 | % | ||||

Expected dividend | — | — | ||||||

Weighted average fair value per share at grant date | $ | 9.26 | $ | 3.90 | ||||

Options

Stock option activity for the three months ended March 31, 2010 under the stock incentive plans is set forth below:

| Total Shares Underlying Stock Options | |||||||||||

| Number of Shares Underlying Stock Options (in thousands) | Weighted Average Exercise Price | Weighted Average Remaining Contractual Term (in years) | Aggregate Intrinsic Value (in thousands) | ||||||||

Outstanding as of December 31, 2009 | 7,488 | $ | 11.49 | ||||||||

Granted | 1,221 | 17.97 | |||||||||

Cancelled or expired | (132 | ) | 13.83 | ||||||||

Exercised | (560 | ) | 7.04 | ||||||||

Outstanding as of March 31, 2010 | 8,017 | $ | 12.75 | 6.45 | $ | 53,327 | |||||

Vested and expected to vest at March 31, 2010 | 7,711 | $ | 12.67 | 6.40 | $ | 51,920 | |||||

Exercisable at March 31, 2010 | 4,908 | $ | 11.78 | 5.59 | $ | 37,494 | |||||

As of March 31, 2010, we expect to recognize $20.3 million of total unamortized compensation cost related to stock options over a weighted average period of 2.7 years.

Restricted Stock Units

A summary of the nonvested shares for the three months ended March 31, 2010 is as follows:

| Number of Shares Underlying RSUs (in thousands) | Weighted Average Remaining Contractual Term (in years) | Aggregate Intrinsic Value (in thousands) | ||||||

Nonvested as of December 31, 2009 | 876 | |||||||

Granted | 340 | |||||||

Vested and released | (225 | ) | ||||||

Forfeited | (38 | ) | ||||||

Nonvested as of March 31, 2010 | 953 | 1.71 | $ | 18,433 | ||||

As of March 31, 2010 the total unamortized compensation cost related to restricted stock units was $11.3 million, which we expect to recognize over a weighted average period of 2.6 years.

Employee Stock Purchase Plan

The fair value of the option component of the Purchase Plan shares was estimated at the grant date using the Black-Scholes options pricing model with the following weighted average assumptions:

12

Table of Contents

ALIGN TECHNOLOGY, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(unaudited)

| Three Months Ended March 31, | ||||||||

| 2010 | 2009 | |||||||

Employee Stock Purchase Plan: | ||||||||

Expected term (in years) | 1.3 | 1.3 | ||||||

Expected volatility | 58.3 | % | 74.7 | % | ||||

Risk-free interest rate | 0.5 | % | 0.6 | % | ||||

Expected dividend | — | — | ||||||

Weighted average fair value per share at grant date | $ | 7.57 | $ | 3.72 | ||||

As of March 31, 2010, we expect to recognize $1.3 million of the total unamortized compensation cost related to employee purchases over a weighted average period of 0.3 years.

Note 10. Accounting for Income Taxes

The financial statement recognition of the benefit for an uncertain tax position is dependent upon the benefit being more-likely-than-not to be sustainable upon audit by the applicable taxing authority. If this threshold is met, the tax benefit is then measured and recognized at the largest amount that is greater than 50 percent likely of being realized upon ultimate settlement.

During the first quarter of fiscal 2010, the amount of unrecognized tax benefits was increased by approximately $0.8 million. The total amount of unrecognized tax benefits was $6.7 million as of March 31, 2010, which would impact our effective tax rate if recognized. We recognize interest and penalties related to unrecognized tax benefits as a component of income taxes. Interest and penalties are immaterial and are included in the unrecognized tax benefits.

We are subject to taxation in the U.S. and various states and foreign jurisdictions. All of our tax years will be open to examination by the U.S. federal and most state tax authorities due to our net operating loss and overall credit carryforward position. With few exceptions, we are no longer subject to examination by foreign tax authorities for years before 2005.

Note 11. Net Profit Per Share

Basic net profit per share is computed using the weighted average number of shares of common stock outstanding during the period. Diluted net profit per share is computed using the weighted average number of shares of common stock, adjusted for the dilutive effect of potential common stock. Potential common stock, computed using the treasury stock method, include options, restricted stock units, and the dilutive component of Purchase Plan shares.

The following table sets forth the computation of basic and diluted net profit per share attributable to common stock (in thousands, except per share amounts):

| Three Months Ended March 31, | ||||||

| 2010 | 2009 | |||||

Net profit | $ | 14,930 | $ | 2,636 | ||

Weighted-average common shares outstanding, basic | 75,166 | 65,983 | ||||

Effect of potential dilutive common shares | 2,431 | 464 | ||||

Total shares, diluted | 77,597 | 66,447 | ||||

Basic net profit per share | $ | 0.20 | $ | 0.04 | ||

Diluted net profit per share | $ | 0.19 | $ | 0.04 | ||

For the three months ended March 31, 2010 and 2009, stock options and restricted stock units totaling 2.1 million and 5.9 million, respectively, were excluded from diluted net profit per share because of their anti-dilutive effect.

13

Table of Contents

ALIGN TECHNOLOGY, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(unaudited)

Note 12. Comprehensive Income

Comprehensive income includes net profit, foreign currency translation adjustments and unrealized gains on available-for-sale securities. The components of comprehensive income are as follows (in thousands):

| Three Months Ended March 31, | ||||||||

| 2010 | 2009 | |||||||

Net profit | $ | 14,930 | $ | 2,636 | ||||

Foreign currency translation adjustments | (347 | ) | (357 | ) | ||||

Change in unrealized gain on available-for-sale securities | 1 | 20 | ||||||

Comprehensive income | $ | 14,584 | $ | 2,299 | ||||

Note 13. Segments and Geographical Information

Segment

We report segment data based on the internal reporting that is used by management for making operating decisions and assessing performance. During all periods presented, we operated as a single business segment.

Geographical Information

Net revenues and long-lived assets are presented below by geographic area (in thousands):

| Three Months Ended March 31, | ||||||

| 2010 | 2009 | |||||

Net revenues: | ||||||

North America | $ | 68,854 | $ | 55,293 | ||

Europe | 20,378 | 14,352 | ||||

Other international | 858 | 487 | ||||

Total net revenues | $ | 90,090 | $ | 70,132 | ||

| As of March 31, 2010 | As of December 31, 2009 | |||||

Long-lived assets: | ||||||

North America | $ | 86,700 | $ | 91,548 | ||

Europe | 819 | 1,018 | ||||

Other international | 1,423 | 1,375 | ||||

Total long-lived assets | $ | 88,942 | $ | 93,941 | ||

Note 14. Restructuring

In July and October 2008, we announced restructuring plans to increase efficiencies across the organization and lower the overall cost structure. The July 2008 plan reduced full time headcount primarily through a phased-consolidation of order acquisition operations from our corporate headquarters in Santa Clara, California to Juarez, Mexico, which was completed by the end of 2008. In addition to headcount reductions, the October restructuring plan included the phased relocation of our shared services organizations from Santa Clara, California to our facility in Costa Rica, which was completed during the second quarter of 2009.

In 2009, we incurred approximately $1.3 million of costs related to severance and termination benefits, of which $0.9 million were in the first quarter of 2009. There were no costs incurred relating to the restructuring plans during the first quarter of 2010.

14

Table of Contents

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

In addition to historical information, this quarterly report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements include, among other things, our expectations regarding the Proficiency Requirements and its impact on our case volume and revenues, the anticipated impact of our new products and product enhancements will have on doctor utilization and our market share, our expectations regarding product mix and product adoption, our expectations regarding the existence and impact of seasonality, our expectations regarding the continued growth of our international markets, our expectations regarding the impact of increased consumer marketing programs in Europe, the anticipated level of our gross margins, and other factors beyond our control, as well as other statements regarding our future operations, financial condition and prospects and business strategies. These statements may contain words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates,” or other words indicating future results. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in Item 2 “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, and in particular, the risks discussed below in Part II, Item 1A “Risk Factors”. We undertake no obligation to revise or update these forward-looking statements. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

The following discussion and analysis of our financial condition and results of operations should be read together with our Condensed Consolidated Financial Statements and related notes included elsewhere in this Quarterly Report on Form 10-Q.

We design, manufacture and market the Invisalign system, a proprietary method for treating malocclusion, or the misalignment of teeth. Invisalign corrects malocclusion using a series of clear, nearly invisible, removable appliances that gently move teeth to a desired final position. Because it does not rely on the use of metal or ceramic brackets and wires, Invisalign significantly reduces the aesthetic and other limitations associated with metal arch wires and brackets, commonly referred to as braces. We received the United States Food and Drug Administration (“FDA”) clearance to market Invisalign in 1998. The Invisalign system is regulated by the FDA as a Class II medical device.

We distribute the vast majority of our products directly to our customers: the orthodontist and the general practitioner dentist, or GP. Orthodontists and GPs must complete an initial Invisalign training course in order to begin providing the Invisalign treatment solution to their patients. The Invisalign system is sold in North America, Europe, Asia Pacific, Latin America and Japan. We use a distributor model for the sale of our products in parts of the Asia Pacific, Latin American and EMEA (Europe, Middle East and Africa) regions.

Each Invisalign treatment plan is unique to the individual patient. Our Invisalign Full treatment consists of as many aligners as indicated by ClinCheck in order to achieve the doctors’ treatment goals. Our Invisalign Express is a dual arch orthodontic treatment for cases that meet certain predetermined clinical criteria and consist of up to ten sets of aligners. Invisalign Express treatment is intended to assist dental professionals to treat a broader range of patients by providing a lower-cost option for adult relapse cases, for minor crowding and spacing, or as a pre-cursor to restorative or cosmetic treatments such as veneers. Invisalign Teen is designed to meet the specific needs of the non-adult comprehensive or teen treatment market. Invisalign Assist is intended to help newly-trained and lower volume Invisalign GPs accelerate the adoption and frequency of use of Invisalign into their practice. Upon completion of an Invisalign or non-Invisalign treatment, the patient may be prescribed our traditional retainer product, or our Vivera retainers, a clear aligner set designed for ongoing retention. Our goal is to establish Invisalign as the standard method for treating malocclusion ultimately driving increased product adoption by dental professionals by focusing on the four key objectives: driving product innovation and clinical effectiveness, enhancing the customer experience, generating consumer demand and expanding into international markets. Each of these four key objectives is described more fully inItem I—Business—Business Strategy of our 2009 Annual Report on Form 10-K. In addition to the successful execution of our business strategy, a number of other factors may affect our results in 2010 and beyond, the most important of which are set forth in our Annual Report in Form 10-K as updated below.

| • | Proficiency Program. Our success depends upon increasing acceptance and frequency of use of the Invisalign system by dental professionals (what we refer to as utilization). We have a large number of low volume doctors that make up a large portion of our customer base. We want every Invisalign provider to be one we can comfortably direct a prospective patient to with an expectation of knowledgeable treatment and a great outcome. On April 22, 2010, we announced a significant change to the Invisalign Product Proficiency Requirements (or the proficiency program) launched in North America in June 2009. Under the modified proficiency program, doctors will no longer be required to have 10 Invisalign case starts (measured by ClinCheck acceptance) in each calendar year to maintain their active provider status. We will continue to emphasize the importance of Invisalign professional education in treatment success by requiring the annual ten Invisalign continuing education (CE) hour requirements. Doctors who do not complete a minimum of 10 Invisalign CE hours in a calendar year will have their Invisalign account temporarily suspended until they complete the minimum |

15

Table of Contents

CE hours. In addition, we will continue to promote the benefits of Invisalign Preferred Provider status for doctors who start ten or more cases each year. |

Approximately 22,000 doctors in North America either achieved the proficiency requirements in 2009 or qualified for the additional six month qualification period and will have until December 31, 2010 to meet the new proficiency program requirements. With the elimination of the minimum case requirements we expect that a greater number of doctors will meet the requirements of the proficiency program and will continue to be Invisalign providers in 2010 and beyond, however, it is uncertain how case volumes, particularly for lower volume doctors, will be impacted. We expect to experience variability in customer activity over the next several quarters as doctors adjust to the changes to the proficiency program requirements. In addition, if GPs and Orthos do not attend our continuing dental education courses in sufficient numbers for any reason, we may have to suspend the accounts of more doctors in 2011 than we currently anticipate and our revenue may fail to grow as expected.

| • | Number of new doctors trained. Prior to 2009, we historically have trained at least 5,000 new doctors per year in North America. With the introduction of the proficiency program and a renewed focus on attracting the right kind of customer, we trained approximately 2,825 new doctors in North America in 2009 and 390 in the first quarter of 2010. Our new doctor training in North America is evolving to identify and focus on practices that are interested in gaining the skills and experience necessary to be successful with Invisalign. As a result, we expect that the number of new doctors trained in North America will be relatively comparable to 2009. |

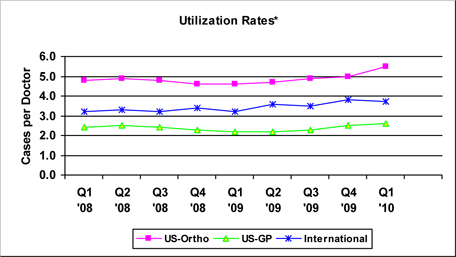

| • | Utilization Rates. Our goal is to establish Invisalign as the treatment of choice for treating malocclusion ultimately driving increased product adoption and frequency of use by dental professionals, or utilization. Our quarterly utilization rates for the previous nine quarters are as follows: |

| * | Utilization rates = # of cases shipped divided by # of doctors cases were shipped to |

Although utilization rates in the first quarter of 2010 for each of our Ortho, GP, and International channels were higher than the same quarter last year mainly due to fewer numbers of North American doctor submitters and higher international shipments, we do expect to continue to see fluctuation in our utilization rates as practices adjust to the proficiency program and our customer base evolves throughout the year. As a result of eliminating the annual case requirements, we expect that the number of doctors we ship to over the next several quarters will fluctuate. We therefore believe that quarter-to-quarter comparisons of utilization rates may not be as meaningful in 2010.

| • | Impact of product mix on deferred revenue. Many of our products launched in 2008 (Vivera retainers, Invisalign Teen, Invisalign Assist) include features of staged delivery or the option to receive replacement aligners during the course of treatment. As a result of these features, these products have a significantly higher amount of deferred revenue as a percentage of their average selling prices compared to Invisalign Full. Vivera retainers are delivered in four shipments over the course of a year, and revenue is initially deferred and then recognized as each shipment occurs. Invisalign Teen which includes up to six replacement aligners, is delivered in a single shipment except for the replacement aligners. Currently, the revenue for the six replacement aligners is 100 percent deferred based on the fair market value |

16

Table of Contents

and recognized as the replacement aligners are used or when the case is completed. Although Invisalign Teen has been available since July 2008, we do not have sufficient evidence to support a usage rate less than 100 percent for the six replacement aligners at this time, however, we are continually gathering and evaluating our historical experience. If and when we gather sufficient historical experience to support a usage rate for the six replacement aligners less than 100 percent, we would adjust our deferred revenue balance to the estimated usage rate and prospectively apply this rate to future Invisalign Teen shipments. For Invisalign Assist, when the progress tracking feature is selected, aligners are shipped every nine stages. As a result, revenue for these cases is deferred upon the first shipment and will be recognized upon the final shipment. Depending on customers’ adoption of these products, our mix of products may continue to gradually shift towards these products, which will result in an increase in deferred revenue on our balance sheet. |

| • | Seasonal fluctuations. Seasonal fluctuations in the number of doctors in their offices and available to take appointments have affected, and are likely to continue to affect our business. Specifically, our customers often take vacation during the summer months and therefore tend to start fewer cases, especially in Europe. In addition, summer is typically the busiest season for orthodontists with practices that have a high percentage of adolescent and teenage patients. Many parents want to get their teens started in treatment before the start of the school year. As a result, adult appointments, including adult Invisalign patient starts, are often pushed further into late summer or early fall. In 2009, we did not experience the normal seasonality in our business and had sequential case growth in the North American orthodontic from second quarter to the third quarter. With the availability of Invisalign Teen, 2009 was the first summer we were able to actively compete for a share of teen patient starts and believe that Invisalign Teen may have helped moderate the historical downward trend we have typically seen for our North American orthodontic customers during the summer months. However, there can be no assurance that our historical seasonal trends will not continue to cause, fluctuations in our quarterly results, including fluctuations in sequential revenue growth rates. |

| • | Foreign Exchange Rates. Although the U.S. dollar is our reporting currency, a portion of our revenues and profits are generated in foreign currencies. Revenues and profits generated by subsidiaries operating outside of the United States are translated into U.S. dollars using exchange rates effective during the respective period and as a result are affected by changes in exchange rates. We have generally accepted the exposure to exchange rate movements without using derivative financial instruments to manage this risk. Therefore, both positive and negative movements in currency exchanges rates against the U.S. dollar will continue to affect the reported amount of revenues and profits in our consolidated financial statements. |

| • | Gross margin. In the second quarter of 2010 we will introduce a consumer rebate program that will run through the end of the quarter, as well as an additional volume rebate for our highest volume customers. These programs are expected to have a negative impact on revenue and gross margin during the second quarter compared to the first quarter of 2010. |

Results of Operations

Net revenues and case volume by channel and product:

Invisalign product revenues by channel and other non-case revenues, which represents training, retainer and ancillary products, for the three months ended March 31, 2010 and 2009 are as follows (in millions):

| Three Months Ended March 31, | ||||||||||||

| Net | ||||||||||||

Net revenues | 2010 | 2009 | Change | % Change | ||||||||

North America: | ||||||||||||

Ortho | $ | 28.2 | $ | 21.0 | $ | 7.2 | 34.3 | % | ||||

GP | 37.2 | 30.9 | 6.3 | 20.4 | % | |||||||

Total North American Invisalign | 65.4 | 51.9 | 13.5 | 26.0 | % | |||||||

International Invisalign | 20.0 | 14.3 | 5.7 | 39.9 | % | |||||||

Total Invisalign revenues | 85.4 | 66.2 | 19.2 | 29.0 | % | |||||||

Non-case revenues | 4.7 | 3.9 | 0.8 | 20.5 | % | |||||||

Total net revenues | $ | 90.1 | $ | 70.1 | $ | 20.0 | 28.5 | % | ||||

Case volume data which represents Invisalign case shipments by channel, for the three months ended March 31, 2010 and 2009 are as follows (in thousands):

17

Table of Contents

| Three Months Ended March 31, | |||||||||

Invisalign case volume | 2010 | 2009 | Net Change | % Change | |||||

North America: | |||||||||

Ortho | 22.1 | 16.9 | 5.2 | 30.8 | % | ||||

GP | 28.5 | 23.3 | 5.2 | 22.3 | % | ||||

Total North American Invisalign | 50.6 | 40.2 | 10.4 | 25.9 | % | ||||

International Invisalign | 13.0 | 9.9 | 3.1 | 31.3 | % | ||||

Total Invisalign case volume | 63.6 | 50.1 | 13.5 | 26.9 | % | ||||

Invisalign revenues by product and other non-case revenues, which represents training, retainer and ancillary products, for the three months ended March 31, 2010 and 2009 are as follows (in millions):

| Three Months Ended March 31, | ||||||||||||

Net revenues | 2010 | 2009 | Net Change | % Change | ||||||||

Invisalign Full | $ | 65.7 | $ | 55.3 | $ | 10.4 | 18.8 | % | ||||

Invisalign Express | 8.6 | 6.8 | 1.8 | 26.5 | % | |||||||

Invisalign Teen | 8.2 | 3.5 | 4.7 | 134.3 | % | |||||||

Invisalign Assist | 2.9 | 0.6 | 2.3 | 383.3 | % | |||||||

Other non-case revenues | 4.7 | 3.9 | 0.8 | 20.5 | % | |||||||

Total net revenues | $ | 90.1 | $ | 70.1 | $ | 20.0 | 28.5 | % | ||||

Case volume data which represents Invisalign case shipments by product, for the three months ended March 31, 2010 and 2009 are as follows (in thousands):

| Three Months Ended March 31, | |||||||||

Invisalign case volume | 2010 | 2009 | Net Change | % Change | |||||

Invisalign Full | 43.7 | 37.3 | 6.4 | 17.2 | % | ||||

Invisalign Express | 9.2 | 8.0 | 1.2 | 15.0 | % | ||||

Invisalign Teen | 7.4 | 3.9 | 3.5 | 89.7 | % | ||||

Invisalign Assist | 3.3 | 0.9 | 2.4 | 266.7 | % | ||||

Total Invisalign case volume | 63.6 | 50.1 | 13.5 | 26.9 | % | ||||

Total net revenues increased for the three months ended March 31, 2010 compared to the same period in 2009 as a result of worldwide volume growth across all of our customer channels and products. We believe the United States economic downturn adversely impacted consumer spending habits in 2009, and doctors tended to focus on more traditional dental procedures. As a result, sales of Invisalign were negatively impacted in 2009. In the first quarter of 2010, the North America channel grew approximately 26% in revenue and case volume compared to the same period of 2009. However, as Invisalign Teen and Assist grow as a percentage of our overall volume, revenues may not increase in a similar proportion, as these products have higher amounts of deferred revenue. Our International Invisalign also increased for the three months ended March 31, 2010 compared to the same period in 2009 due to 31.3% higher case volumes supplemented by favorable exchange rates of the Euro against the U.S. dollar.

Other non-case revenues, consisting of training fees and sales of ancillary products, were higher for the three months ended March 31, 2010 compared to March 31, 2009 primarily due to increased sales of our Vivera and retainer products.

Cost of revenues and gross profit (in millions):

| Three Months Ended March 31, | |||||||||||

| 2010 | 2009 | Change | |||||||||

Cost of revenues | $ | 20.4 | $ | 17.4 | $ | 3.0 | |||||

% of net revenues | 22.6 | % | 24.8 | % | |||||||

Gross profit | $ | 69.7 | $ | 52.7 | $ | 17.0 | |||||

Gross margin | 77.4 | % | 75.2 | % | |||||||

18

Table of Contents

Cost of revenues includes salaries for staff involved in the production process, the cost of materials, packaging, shipping costs, depreciation on capital equipment used in the production process, training costs and stock-based compensation expense. Cost of revenues also includes the cost of the third party shelter service provider, we utilized in Juarez, Mexico until April 2009.

Gross margin improved for the three months ended March 31, 2010 compared to the same period in 2009 primarily due to increased cost absorption due to higher production volumes along with continued improvement in operating efficiencies as well as cost savings from the commencement of direct fabrication of our aligners. These savings were partially offset by Ormco royalties of $0.8 million and net training costs associated with continuing education courses of approximately $0.5 million that were historically charged to sales and marketing, however, as a result of finalizing the educational requirements for the Proficiency Program, these costs are included in gross margin starting January 1, 2010.

Sales and marketing (in millions):

| Three Months Ended March 31, | |||||||||||

| 2010 | 2009 | Change | |||||||||

Sales and marketing | $ | 27.9 | $ | 27.9 | $ | — | |||||

% of net revenues | 31.0 | % | 39.7 | % | |||||||

Sales and marketing expense includes sales force compensation (including travel-related costs), marketing personnel-related costs, media and advertising, clinical education, product marketing and stock-based compensation expense.

Our sales and marketing expense for the three months ended March 31, 2010 was comparable to the same period in 2009. The first quarter of 2010 reflects a $1.1 million increase in marketing, media, and advertising expenses, which was partially offset by a $1.0 million decrease in clinical education costs, of which $0.5 million was included in gross margin as a result of finalizing the educational requirements for the Proficiency Program.

General and administrative (in millions):

| Three Months Ended March 31, | |||||||||||

| 2010 | 2009 | Change | |||||||||

General and administrative | $ | 15.0 | $ | 13.5 | $ | 1.5 | |||||

% of net revenues | 16.6 | % | 20.3 | % | |||||||

General and administrative expense includes salaries for administrative personnel, outside consulting services, legal expenses and stock-based compensation expense.

General and administrative expenses increased in the three months ended March 31, 2010 as compared to the same period in 2009 primarily due to proceeds from an insurance reimbursement of $1.5 million that we received in March 2009 relating to the OrthoClear settlement. The reimbursement was partially offset by higher legal expenses which were related to the Ormco litigation during the first quarter of 2009.

Research and development (in millions):

| Three Months Ended March 31, | |||||||||||

| 2010 | 2009 | Change | |||||||||

Research and development | $ | 6.1 | $ | 5.2 | $ | 0.9 | |||||

% of net revenues | 6.8 | % | 7.4 | % | |||||||

Research and development expense includes the personnel-related costs and outside consulting expenses associated with the research and development of new products and enhancements to existing products, conducting clinical and post-marketing trials and stock-based compensation expense.

19

Table of Contents

Research and development expenses were slightly higher during the three months ended March 31, 2010 compared to the same period in 2009 primarily due to $0.5 million of costs related to higher payroll-related and temporary contractor expenses during the first quarter of 2010.

Restructuring (in millions):

| Three Months Ended March 31, | ||||||||||||

| 2010 | 2009 | Change | ||||||||||

Restructuring | $ | — | $ | 0.9 | $ | (0.9 | ) | |||||

% of net revenues | 0.0 | % | 1.3 | % | ||||||||

During 2008, we announced restructuring plans in July and October to increase efficiencies across the organization and with the expectation of lowering the overall cost structure by approximately $3.5 million per quarter. We incurred approximately $0.9 million during the first quarter of 2009 of cost related to severance and termination benefits. There were no restructuring costs during the first quarter of 2010.

Interest and other income, net (in millions):

| Three Months Ended March 31, | ||||||||||||

| 2010 | 2009 | Change | ||||||||||

Interest income | $ | 0.1 | $ | 0.2 | $ | (0.1 | ) | |||||

Other (expense), net | (0.7 | ) | (0.1 | ) | (0.6 | ) | ||||||

Total interest income and other (expense), net | $ | (0.6 | ) | $ | 0.1 | $ | (0.7 | ) | ||||

Interest and other income (expense), net, include interest income earned on cash balances, interest expense, foreign currency translation gains and losses and other miscellaneous charges.

Interest income, net for the three months ended March 31, 2010 decreased slightly compared to the same period in 2009 primarily due to lower returns on our investments as we shifted into more conservative US government securities and money market funds which bear lower interest rates.

Other expense, net for the three months ended March 31, 2010 increased as compared with the same period in 2009 reflecting increases in foreign exchange losses during the first quarter of 2010.

Income tax (in millions):

| Three Months Ended March 31, | |||||||||

| 2010 | 2009 | Change | |||||||

Provision for (benefit) from income taxes | $ | 5.2 | $ | 2.8 | $ | 2.4 | |||

We recorded an income tax provision of $5.2 million and $2.8 million for the three months ended March 31, 2010 and 2009, respectively, representing effective tax rates of 25.9% and 51.5%. Our effective tax rate for the remainder of 2010 may fluctuate based upon our operating results for each taxable jurisdiction in which we operate and the amount of statutory tax that we incur in each jurisdiction.

We exercised significant judgment in regards to estimates of future market growth, forecasted earnings and projected taxable income, in determining the provision for income taxes, and for purposes of assessing our ability to utilize any future benefit from deferred tax assets. As of March 31, 2010, we have recorded a valuation allowance of approximately $6.2 million related to capital loss and foreign loss carryforwards because we cannot forecast sufficient future capital gains or foreign source income to realize these deferred tax assets. These net operating loss and capital loss carryforwards will result in an income tax benefit if and when we conclude it is more likely than not that the related deferred tax assets will be realized.

20

Table of Contents

In February 2009, the California 2009-2010 budget legislation was signed into law. One of the major components of this legislation is the ability to elect to apply a single sales factor apportionment for years beginning after January 1, 2011. As a result of our anticipated election of the single sales factor, we are required to re-measure our deferred taxes taking into account the reversal pattern and the expected California tax rate under the elective single sales factor. We have determined that by electing a single sales factor apportionment, our deferred tax assets will decrease by approximately $0.6 million (net of federal benefit). The tax impact of $0.6 million has been recorded as a discrete item in the first quarter of fiscal year 2009.

Liquidity and Capital Resources

We fund our operations from product sales and proceeds from the sale of common stock. As of March 31, 2010 and December 31, 2009 we had the following cash and cash equivalents, and short-term marketable securities (in thousands):

| March 31, 2010 | December 31, 2009 | |||||

Cash and cash equivalents | $ | 190,407 | $ | 166,487 | ||

Marketable securities, short-term | 14,991 | 19,978 | ||||

Total | $ | 205,398 | $ | 186,465 | ||

Net cash provided by operating activities was $18.6 million for the three months ended March 31, 2010 resulting primarily from our net profit of $14.9 million adjusted for non-cash items largely from depreciation, amortization of intangibles and royalties, deferred taxes of $9.4 million and $3.5 million of stock-based compensation expenses. Additionally, cash flows from operating activities increased due to a $5.1 million increase in deferred revenues, which were partially offset by an increase in accounts receivable of $4.9 million and decreases in accrued liabilities, prepaids, and other assets of $9.2 million.

Net cash provided by operating activities was $10.6 million for the three months ended March 31, 2009 resulting primarily from our net profit of $2.6 million adjusted for non-cash items such as depreciation, amortization of intangibles and stock-based compensation expense totaling $6.9 million. Additionally, cash flows from operating activities increased due to a $4.4 million increase in accounts payable, deferred revenue, and deferred taxes, which were offset by a $3.5 million decrease in accrued liabilities, prepaids, and other assets.

Net cash provided by investing activities was $0.2 million for the three months ended March 31, 2010 primarily consisted of maturities of our marketable securities of $5.0 million, which were partially offset by property, plant, and equipment purchases of $4.5 million.

Net cash used in investing activities was $3.5 million for the three months ended March 31, 2009, largely consisted of $14.0 million used for the purchase of marketable securities and $1.9 million on property, plant, and equipment, which were partially offset by $12.3 million of proceeds from maturities of marketable securities.

As a result of adverse financial market conditions, investments in some financial instruments may pose risks arising from liquidity and credit concerns. Although we believe our current investment portfolio has little risk of impairment, we cannot predict future market conditions or market liquidity and can provide no assurance that our investment portfolio will remain unimpaired.

Net cash provided by financing activities was $5.3 million for the three months ended March 31, 2010 primarily resulting from $6.0 million in proceeds from the issuances of our common stock, which were partially offset by $0.7 million of taxes paid on the vesting of restricted stock units related to our employee stock plan.

Net cash provided by financing activities was $3.0 million for the three months ended March 31, 2009, which primarily resulted from $3.3 million in proceeds from the issuance of our common stock.

Contractual Obligations

On January 26, 2010, we entered into an agreement for new corporate headquarters to lease approximately 129,024 square feet in San Jose, California. The lease agreement commences on the earlier of August 1, 2010 or the date we first commence conducting business in the premises, which is expected to be on or about June 28, 2010 and will continue for an initial term of seven years and two months. The lease agreement for our current office headquarters in Santa Clara, California, expires on June 30, 2010.

21

Table of Contents

There were no other material changes to our contractual obligations outside the ordinary course of business from those disclosed in our Annual Report on Form 10-K for the year ended December 31, 2009.

We believe that our current cash and cash equivalents combined with our existing borrowing capacity will be sufficient to fund our operations for at least the next 12 months. If we are unable to generate adequate operating cash flows, we may need to seek additional sources of capital through equity or debt financing, collaborative or other arrangements with other companies, bank financing and other sources in order to realize our objectives and to continue our operations. There can be no assurance that we will be able to obtain additional debt or equity financing on terms acceptable to us, or at all. If adequate funds are not available, we may need to make business decisions that could adversely affect our operating results such as modifications to our pricing policy, business structure or operations. Accordingly, the failure to obtain sufficient funds on acceptable terms when needed could have a material adverse effect on our business, results of operations and financial condition.

Critical Accounting Policies

Management’s discussion and analysis of our financial condition and results of operations is based upon our Condensed Consolidated Financial Statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of financial statements requires our management to make estimates and judgments that affect the reported amounts of assets and liabilities, revenues and expenses and disclosures at the date of the financial statements. We evaluate our estimates on an on-going basis, including those related to revenue recognition, accounts receivable, legal contingencies and income taxes. We use authoritative pronouncements, historical experience and other assumptions as the basis for making estimates. Actual results could differ from those estimates.

We believe the following critical accounting policies reflect our most significant estimates, judgments and assumptions used in the preparation of our consolidated financial statements. These critical accounting policies and related disclosures appear in our Annual Report on Form 10-K for the year ended December 31, 2009.

| • | Revenue recognition; |

| • | Stock-based compensation expense; |

| • | Long-lived assets, including finite lived purchased intangible assets; |

| • | Deferred tax valuation allowance. |

There have been no significant changes in our critical accounting policies during the three months ended March 31, 2010 compared to what was previously disclosed in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations included in our Annual Report on Form 10-K for the year ended December 31, 2009.

Recent Accounting Pronouncements

See Note 1 “Summary of Significant Accounting Policies” of the Notes to Condensed Consolidated Financial Statements for a discussion of recent accounting pronouncements.

| ITEM 3. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

For quantitative and qualitative disclosures about market risk affecting us, see Item 7A, “Quantitative and Qualitative Disclosures About Market Risk,” in our Annual Report on Form 10-K for the year ended December 31, 2009, which is incorporated herein by reference. Our exposure to market risk has not changed materially since December 31, 2009.

| ITEM 4. | CONTROLS AND PROCEDURES |

Evaluation of disclosure controls and procedures.

Under the supervision and with the participation of our management, including our Chief Executive Officer and our Chief Financial Officer, we have evaluated the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act) as of the end of the period covered by this Quarterly Report on Form 10-Q. Based upon that evaluation, our Chief Executive Officer and our Chief Financial Officer have concluded that our disclosure controls and procedures are effective as of March 31, 2010 to provide reasonable assurance that information required to be

22

Table of Contents

disclosed by us in the reports that we file or submit under the Exchange Act is accumulated and communicated to our management, including our Chief Executive Officer and our Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure, and that such information is recorded, processed, summarized and reported within the time periods specified in the SEC rules and forms.

Changes in internal control over financial reporting.

There was no change in our internal control over financial reporting that occurred during the period covered by this Quarterly Report on Form 10-Q that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

| ITEM 1. | LEGAL PROCEEDINGS |

Consumer Class Action